Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNICO INC /AZ/ | unico_8k.htm |

Integrity Metals and Mining, LLC

2360 Corporate Circle, Suite 400

Henderson, NV 89074

HIGHLY CONFIDENTIAL

August 26, 2011

Deer Trail Mining Company, LLC

14260 Garden Road, Suite A604, Poway, CA 92064

Mail: P.O. Box 503228, San Diego, CA 92150

For the attention of: Mark Lopez, CEO

Ed Winders, Chairman of the Board Deer Trail Mining company LLC (858) 837-0428 mlopez.unico@gmail.com

Re: Letter of Intent Regarding Sale of Assets or Stock Purchase of Deer Trail Mining Company. LLC

Dear Sirs:

WHEREAS Deer Trail Mining Company, LLC, a Nevada limited liability company ("DTM"), is engaged in the business of the exploration, development and production of gold, silver, lead, zinc, copper and other metals,

WHEREAS DTM owns the patented and unpatented mining claims as well as certain real property, equipment and other assets,

WHEREAS DTM is seeking to sell all of its assets, including its mineral rights, equipment, real property and all other assets, tangible and intangible, to Integrity Metals & Mining LLC ("IMM") as set forth below and subject to the conditions described herein,

WHEREAS the Board of Directors of Unico, Inc., the parent company and sole equity holder in DTM, has approved this Agreement and is hereby committed and obligated to closing the transactions described below, subject only to the satisfaction of the closing conditions set forth below, and

WHEREAS, the Board of Directors of IMM has approved this Agreement and is hereby committed and obligated to closing the transactions described below, subject only to the satisfaction of the closing conditions set forth below

This binding Agreement confirms the understanding, subject only to the conditions set forth below, between DTM and IMM (collectively referred to herein as the "Parties") with respect to (i) the sale of the DTM assets to IMM for $10 million as set forth below

|

1.

|

Representations of Integrity Metals & Mining LLC

|

Integrity Metals & Mining ("IMM") represents to Unico and DTM as follows:

|

(a)

|

IMM is a Nevada corporation and is qualified and authorized to enter into this Agreement,

|

|

(b)

|

IMM is a sophisticated investor, is able to evaluate the merits and risks associated with entering into this Agreement and the transactions described herein, and has had access to all of the information necessary or desirable to complete its due diligence, and

|

|

(c)

|

IMM has all requisite power and authority to execute, deliver and perform this Agreement.

|

|

(d)

|

IMM will show Proof of Funds, upon execution of this agreement exhibiting the ability to close this transaction in the time set forth by the Purchase Agreement

|

|

2.

|

Representations of Unico and DTM

|

Unico and DTM represent to IMM as follows:

|

(a)

|

Unico is an Arizona corporation and Unico and/or its subsidiaries, including DTM, are qualified to do business in all of the states in which they operate and conduct business and are in good standing in each of these jurisdictions; the common stock of Unico is registered under Section 12 of the Securities Exchange Act of 1934, as amended and has filed all past quarterly reports and annual reports with the U.S. Securities and Exchange Commission (other than the quarterly reports for the period ended August 31, 2010, November 30, 2010 and May 31, 2011 on Form 10-Q, and the annual report for the period ended February 28, 2011 on Form 10-K); the common stock of Unico is listed on the "Pink Sheets" under the

symbol "UNCO.PK",

|

|

(b)

|

DTM's assets are located at 1000 Deer Trail Mine, Marysvale, Utah,

|

|

(c)

|

DTM is the legal and beneficial owner of the real property, patented claims and unpatented mineral claims (the "Mineral Property") located near Marysvale, Utah and as described in Exhibit "A";

|

|

(d)

|

DTM holds all subsurface mineral rights to the Mineral Property and surface rights to the patented claims free of any liens, royalties, charges or encumbrances except as described in Exhibit "B"; there is no known impediment or restriction that would prevent conducting exploration or that would prevent ongoing mining operations or permitting of mine and milling operations on the Mineral Property,

|

|

(e)

|

No creditor or other third party holds any interest, royalty obligation, lien or other encumbrance on any of the Company's assets except for the existing royalty claim by Crown Mining

|

|

(f)

|

Both Unico and DTM have all requisite power and authority to execute, deliver and perform this Agreement.

|

|

3.

|

DTM Asset/Stock Purchase Acquisition of Deer Trail Mining Company , LLC

|

Subject to the Asset Closing Conditions set forth below, IMM shall either purchase 100% of DTM's assets, including all patented and unpatented mining claims, real property, equipment and other assets, tangible and intangible (including but not limited to various water rights), for an amount equal to $10 million (ten million U.S. dollars) In addition, at the Asset Closing OR acquisition of the Deer Trail Mining Company LLC with the full understanding that all liabilities will be deducted at time of closing, monies escrowed in case of any outstanding judgments and or any other outstanding liabilities and that Unico will indemnify IMM in the result of any

pre-existing liabilities. Purchase price amount equal to $10 million (ten million U.S. Dollars)

IMM will decide within 10 days of execution of this agreement if it will be an asset purchase or acquisition of Deer Trail Mining Company, LLC. Unico shall pay in full the brokerage fees due Real Service Realty LLC as set forth in Exhibit F attached hereto.

|

4.

|

DTM Outstanding payables

|

(a) IMM will assist DTM in the negotiation of the immediate outstanding payables with the vendors.

|

5.

|

IMM Exclusivity Period

|

The Parties agree to use their best efforts to negotiate and consummate an Investment Transaction as soon as practical, which Investment Transaction shall be subject to approval by the respective boards of directors of the Parties. Unico and DTM shall be prohibited from entering into a competing transaction with any party other than IMM for a period of 30 days after the execution of this agreement.

|

6.

|

Asset/Stock Closing and Asset/Stock Closing Conditions

|

The Parties agree to use their best efforts to cause the sale of DTM's assets to IMM to close as soon as practical and in no case later than 30 days from the date of execution of the Sales and Purchase agreement. At the Asset/Stock Closing, the following conditions shall be satisfied:

|

(a)

|

IMM shall have completed its due diligence of DTM and its assets to its complete satisfaction,

|

|

(b)

|

DTM and IMM shall have entered into a definitive asset purchase agreement setting forth the terms and conditions of the transaction ,

|

|

(c)

|

The Boards of Directors of each of Unico and IMM shall each have approved the Purchase Agreement.

|

|

7.

|

Purchase to include

|

All assets of Deer Trail Mining or all the stock of Deer Trail Mining LLC Indemnification

Unico and IMM each agree, to the extent allowed under governing law, to indemnify and hold the other party harmless from any losses, claims, damages, suit, or liability (including attorney's fees and reasonable expenses incurred in connection with such claims and damages) which the indemnified party may sustain as a result of the indemnifying party breaching its representations, warranties or covenants described herein, provided however that such indemnification shall not be available to the extent that such losses, claims, damages, suit, liabilities or expenses are judicially determined to have resulted primarily from the bad faith, willful misconduct or negligence of the party seeking indemnification. As a

condition precedent to asserting a right of indemnity, the party seeking indemnification shall have given the indemnifying party timely written notice of the assertion of the claim to which the right of indemnification is claimed to exist.

|

9.

|

Governing Law

|

This Agreement will be governed by and construed in accordance with the applicable governing law of the State of Utah. If a court or other tribunal of competent jurisdiction holds any of the provisions of this Agreement to be illegal, invalid or unenforceable in whole or in part, such provisions will be limited or eliminated to the minimum extent necessary so that this Agreement will otherwise remain in full force and effect.

|

10.

|

Complete Agreement

|

Except as otherwise provided herein, this Agreement supersedes any and all prior negotiations, agreements and discussions between the parties, whether oral or written, covering the subject matter contained herein. This Agreement may not be amended or modified except as agreed to in writing by the Parties hereto.

|

11.

|

Miscellaneous

|

This Agreement will inure to the benefit of and be binding on the respective successors and assigns of the parties to this Agreement. Neither party may assign the Agreement without the prior written consent of the other party. This Agreement may be executed in one or more counterparts, each of which so executed shall constitute an original and all of which together shall constitute one and the same Agreement.

If the foregoing is in accordance with your understanding of our agreements, please sign where indicated below.

| Yours truly, | |||

|

UNICO, INCORPORATED

|

|||

|

By:

|

|

||

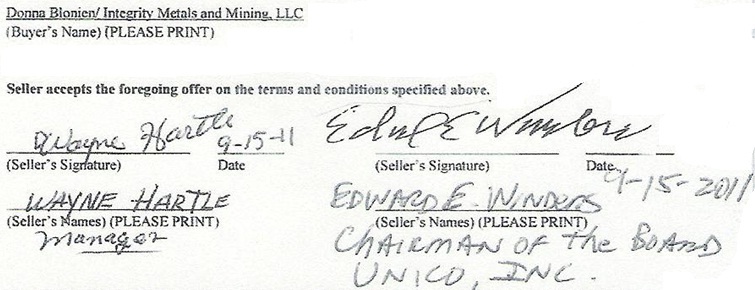

| Name: Edward E. Winders | |||

| Title: Chairman of the Board | |||

|

DEER TRAIL MINING COMPANY, LLC

|

|||

|

By:

|

|

||

| Name: | |||

| Title: Manager | |||

| AGREED AND CONFIRMED | |||

| INTEGRITY METALS & MINING LLC | |||

| By: |  |

||

| Name: Donna Blonien | |||

| Title: Managing Member | |||

Integrity Metals and Mining, LLC

2360 Corporate Circle, Suite 400

Henderson, NV 89074

REAL ESTATE PURCHASE CONTRACT FOR DEER TRAIL MINE

This is a legally binding Real Estate Purchase Contract ("REPC").

OFFER TO PURCHASE

On this 15th day of September, 2011, Integrity Metals and Mining, LLC ("IMM" or "Buyer") offers to purchase, , 100% of the assets of Deer Trail Mining Company, LLC ("DTM" or "Seller"), a wholly-owned subsidiary of Unico, Inc. ("Unico").

"Reference Date" shall be September 15, 2011.

OTHER PROVISIONS

|

1.

|

PROPERTY:

|

Deer Trail Mine to include patented and unpatented mining claims as well as certain real property, equipment and other assets.

Subject to the Closing Conditions and other terms and conditions set forth below, IMM shall purchase from DTM 100% of DTM's assets (the "DTM Asset Purchase"), including all patented and unpatented mining claims, real property, equipment and other assets, tangible and intangible (including but not limited to various water rights), for an amount of cash paid at Closing equal to $10,050,000 (ten million fifty thousand U.S. dollars), free and clear of all liens and encumbrances other than the royalty agreement in favor of Crown Mines, L.L.C. ("Crown Mines") as may be amended as to be mutually agreed to by Buyer and Seller..

Seller shall at the Closing pay in full the brokerage fees due Real Service Realty LLC pursuant to the terms of the real estate commission agreement between DTM and Real Service Realty LLC dated August 18, 2011.

|

2.

|

PURCHASE PRICE:

|

The Purchase Price for the Property, including amounts for the payment of certain claims fees, is: Ten Million Fifty Thousand Dollars, US ($10,050,000) cash at closing.

Buyer has provided and Seller has received the proof of funds sent to "DTM" for the purchase of Deer Trail Mine.

|

3.

|

SETTLEMENT AND CLOSING:

|

3.1 Settlement. Settlement shall take place no later than the Settlement Deadline referenced in Section 24(d), or as otherwise mutually agreed by Buyer and Seller in writing. This REPC and the obligations of Buyer and Seller described herein shall be null and void if the Settlement shall not have taken place by the close of business on the Settlement Deadline as referenced in Section 24(d) below. "Settlement" shall occur only when all of the following conditions (the "Closing Conditions") have been satisfied: (a) Buyer and Seller have signed and delivered to each other all documents required by the REPC, by the title insurance and escrow/closing offices, by written escrow

instructions (including any split closing instructions, if applicable), or by applicable law; (b) any monies required to be paid by Buyer or Seller under these documents have been delivered by Buyer or Seller to the other party, or to the escrow/closing office, in the form of cash, wire transfer, cashier's check, or other form acceptable to the escrow/closing office, (c) DTM shall have compiled fully with its obligations to Crown Mines pursuant to the Right of First Refusal ("ROFR") held by Crown Mines, and Crown Mines shall not have given Notice during the Offer Period of its acceptance of the Offer (the preceding words in italics

refer to the defined terms as set forth in the ROFR between Crown Mines and DTM, a copy of which has been provided to Buyer) and (d) Unico's Board of Directors shall have received a satisfactory fairness opinion from Moody Capital LLC.

3.2 Proration's. All proration's, including, but not limited to, property taxes for the current year, and interest on assumed obligations, if any, shall be made as of the Settlement Deadline referenced in Section 24(d), unless otherwise agreed to in writing by the parties. Such writing could include the settlement statement. The provisions of this Section 3.2 shall survive Closing.

3.3 Greenbelt. If any portion of the Property is presently assessed as "Greenbelt" the payment of any roll-back taxes assessed against the Property shall be paid for by Seller.

3.4 Fees/Costs/Payment Obligations. Unless otherwise agreed to in writing, Seller shall pay the fee charged by the escrow/closing office for its services in the settlement/closing process. Buyer agrees to be responsible for private and public utility service transfer fees, if any, and all utilities and other services provided to the Property after the Settlement Deadline. The escrow/closing office is authorized and directed to withhold from Seller's proceeds at Closing, sufficient funds to pay off on Seller's behalf all mortgages, trust deeds, judgments, mechanic's liens, tax liens and warrants. The provisions of this Section 3.4 shall

survive Closing.

3.5 Closing. For purposes of the REPC, "Closing" means that: (a) Settlement has been completed; (b) the applicable Closing documents have been recorded in the office of the county recorder. The actions described in

3.5 (b) and (c) shall be completed within four calendar days after Settlement.

|

4.

|

POSSESSION:

|

Upon the execution of this REPC and prior to Closing, Buyer shall be entitled to physically store, at its own cost ore, similar material, equipment or other physical assets (the "Buyer's Materials") on Seller's property in a quantity, location and manner as shall be determined by Seller in its sole discretion. Buyer shall be solely responsible for determining that the storage of the Buyer's Materials does not violate any local, State of Utah or Federal laws, rules or regulations and shall be responsible for any loss or damages suffered by or caused by the Buyer's Materials while on Seller's property. If the Closing does not occur within the time periods set forth in Section 24 below, Seller is entitled to require

Buyer to remove the Buyer's Materials from Seller's property and to restore the property on which such material was stored at Buyer's cost. If the Buyer does not remove the Buyer's Materials within 60 days then such Buyer's Materials shall become the property of the Seller and Buyer shall have no rights to such Buyer's Materials. Upon execution of this agreement Seller shall also allow Buyer access to the Seller property for due diligence or for other purposes as Seller shall agree to in its sole discretion, provided (i) Buyer shall notify Seller in advance of when it seeks access to the property, (ii) Seller shall have the right to limit access to the property to periods when Seller's representatives can accompany Buyer on the property, (iii) prior to the Closing, Buyer shall have no right to operate any Seller equipment without approval of Seller and must be accompanied in doing so by

Seller's representatives, and (iv) Buyer shall be responsible for any damages to or losses suffered by Seller or any of Seller's property as a result of Buyer's conduct on or access to Seller's property.

Seller agrees to deliver the Property to Buyer in the same general condition it was in when Buyer inspected the property on September 6, 2011. The provisions of this Section 4 shall survive Closing.

|

5.

|

CONFIRMATION OF AGENCY DISCLOSURE:

|

Buyer and Seller acknowledge prior written receipt of agency disclosure provided by their respective agent that has disclosed the agency relationships confirmed below. At the signing of the REPC:

Seller's and Buyer's Agent: Dan Kennedy, Real Service Realty LLC

|

6.

|

TITLE & TITLE INSURANCE:

|

6.1 Title to Property. Seller represents that Seller has fee title to the Property and will convey marketable title to the Property to Buyer at Closing by general warranty deed. Title for all non-real estate assets shall be conveyed from Seller to Buyer at Closing by assignment. Buyer does agree to accept title to the Property subject to the contents of the Commitment for Title Insurance (the "Commitment") provided by Seller under Section 7, and as reviewed and approved by Buyer under Section 8. The provisions of this Section 6.1 shall survive Closing.

6.2 Title Insurance. At Settlement, Seller agrees to pay for and cause to be issued in favor of Buyer, through the Title insurance agency that issued the Commitment, the most current version of an ALTA standard coverage owner's policy of title insurance. Any additional title insurance coverage desired by Buyer shall be at Buyer's expense.

6.3 It is understood and agreed to by the parties: "IMM" will be having a survey done on the property and due to time constraints for closing, the survey may or may not be completed before closing. "DTM" understands and that any encroachments or discrepancies will be covered by the title insurance to be provided by seller.

|

7.

|

SELLER DISCLOSURES:

|

To be provided by the Seller to the Buyer within five (5) calendar days after the Buyer and the Seller fully sign this REPC. Sellers Disclosures, shall include: (a) a written Seller Property Condition Disclosure (Land) for the property, completed, signed and dated by the Sellers as provided in Section 10.2; (b) Commitment for Title Insurance as referenced in Section 6.1; (c) a copy of any restrictive covenants, rules and/or regulations affecting the Property; (d) a copy of any lease, rental, and property management agreements affecting the Property not expiring prior to Closing. (e) evidence of any water rights and/or water shares in any way related to the property (f) written notice of any claims and/or

conditions known to Seller relating to environmental problems; and violation of any federal, state or local laws, and building or zoning code violations.

Seller has disclosed to and provided Buyer with a copy of the binding agreement between DTM and Crown Mines, L.L.C., a Texas limited liability company ("Crown Mines"), dated May 31, 2007, pursuant to which DTM purchased certain mineral claims from Crown Mines and Crown Mines retained a perpetual royalty interest on the DTM mineral claims and right of access to and across the surface of DTM's mineral claims (the "Crown Mines Obligations"). Buyer will handle negotiations with Crown Mines

Seller shall use its best efforts to allow Buyer to inspect its property, assets, financial books and records related to DTM, geological maps and reports, and other any other reports which Buyer may reasonably request upon execution of this REPC. Buyer shall pay in advance any direct or indirect costs which Seller may incur in allowing Buyer to inspect such material. Upon Closing, all of these materials shall become the property of the Buyer.

|

8.

|

BUYER'S CONDITIONS OF PURCHASE:

|

8.1 DUE DILIGENCE CONDITION. Buyer's obligation to purchase the Property is conditioned upon Buyer's Due Diligence as defined in this Section 8.1(a) below. This condition is referred to as the "Due Diligence Condition."

(a) Due Diligence Items. Buyer's Due Diligence shall consist of Buyer's review and approval of the contents of the Seller Disclosures referenced in Section 7, and any other tests, evaluations and verifications of the Property deemed necessary or appropriate by Buyer, such as: the physical condition of the Property; the existence of any hazardous substances, environmental issues or geologic conditions; the square footage or acreage of the Property; the costs and availability of flood insurance, if applicable; water source, availability and quality; the

location of property lines; regulatory use restrictions or violations; fees for services such as municipal services, and utility costs; and any other matters deemed material to Buyer in making a decision to purchase the Property. Unless otherwise provided in the REPC, all of Buyer's Due Diligence shall be paid for by Buyer and shall be conducted by individuals or entities of Buyer's choice. Seller agrees to cooperate with Buyer's Due Diligence. Buyer agrees to pay for any damage to the Property resulting from any such inspections or tests during the Due Diligence. In addition, the Buyer agrees to indemnify and hold Seller harmless from any injuries which might occur during Due Diligence or other inspections by Buyer or Buyer's agents.

(b) Buyer's Right to Cancel or Resolve Objections. If Buyer determines, in Buyer's sole discretion, that the results of the Due Diligence are unacceptable, Buyer may either: (i) no later than the Due Diligence Deadline referenced in Section 24(b), cancel the REPC by providing written notice to Seller or (ii) no later than the Due Diligence Deadline referenced in Section 24(b), resolve in writing with Seller any objections Buyer has arising from Buyer's Due Diligence.

(c) Failure to Cancel or Resolve Objections. If Buyer fails to cancel the REPC or fails to resolve in writing any objections Buyer has arising from Buyer's Due Diligence, as provided in Section 8.1(b), Buyer shall be deemed to have waived the Due Diligence Condition.

8.2 APPRAISAL CONDITION. Buyer's obligation to purchase the Property is not conditioned upon the Property appraising for not less than the Purchase Price.

8.3 FINANCING CONDITION. Buyer's obligation to purchase the property is not conditioned upon Buyer obtaining a loan for the purchase.

|

9.

|

ADDENDA:

|

The terms of any addenda are incorporated into the REPC only upon the full endorsement of Buyer and Sellers.

|

10.

|

"AS-IS" CONDITION OF PROPERTY:

|

10.1 Condition of Property/Buyer Acknowledgements. Buyer acknowledges and agrees that in reference to the physical condition of the Property: (a) Buyer is purchasing the Property in its "As-Is" condition without expressed or implied warranties of any kind; (b) Buyer shall have, during Buyer's Due Diligence as referenced in Section 8.1, an opportunity to completely inspect and evaluate the condition of the Property; and (c) if based on the Buyer's Due Diligence, Buyer elects to proceed with the purchase of the Property, Buyer is relying wholly on Buyer's own judgment and that of any

contractors or inspectors engaged by Buyer to review, evaluate and inspect the Property.

10.2 Condition of Property/Seller Acknowledgements. Seller acknowledges and agrees that in reference to the physical condition of the Property, Seller agrees to: (a) disclose in writing to Buyer defects in the Property known to Seller that materially affect the value of the Property that cannot be discovered by a reasonable inspection by an ordinary prudent Buyer; (b) carefully review, complete, and provide to Buyer a written Seller Property Condition Disclosure (Land) as stated in Section 7(a); and (c)

deliver the Property to Buyer in substantially the same general condition as it when Buyer inspected the property on September 6, 2011. The provisions of Sections 10.1 and 10.2 shall survive Closing.

|

11.

|

NON-COMPETE:

|

For a period of ten years after the Closing, Unico (i) shall not acquire or seek to acquire any mineral claims, mining property or other real property located within a 20 mile radius of DTM, including but not limited to any properties owned by Crown Mines within such designated area, and (ii) shall not enter into any mining operations in any capacity within the 20 mile radius of DTM.

|

12.

|

CHANGES DURING TRANSACTION:

|

Seller agrees that from the date of Acceptance until the date of Closing, none of the following shall occur without the prior written consent of Buyer: (a) no changes in any leases, rental or property management agreements shall be made; (b) no new lease, rental or property management agreements shall be entered into; (c) no substantial alterations or improvements to the Property shall be made or undertaken; (d) no further financial encumbrances to the Property shall be made, and (e) no changes in the legal title to the Property shall be made.

|

13.

|

AUTHORITY OF SIGNERS:

|

If Buyer or Seller is a corporation, partnership, trust, estate, Limited Liability Company or other entity, the person signing the REPC on its behalf warrants his or her authority to do so and to bind Buyer and Seller.

|

14.

|

COMPLETE CONTRACT:

|

The REPC together with its addenda, any attached exhibits, and Seller Disclosures (collectively referred to as the "REPC"), constitutes the entire contract between the parties and supersedes and replaces any and all prior negotiations, representations, warranties, understandings or contracts between the parties whether verbal or otherwise. The REPC cannot be changed except by written agreement of the parties.

|

15.

|

MEDIATION:

|

Any dispute relating to the REPC arising prior to or after Closing shall first be submitted to mediation, however in no event shall any mediation be cause or postpone the Closing date. Mediation is a process in which the parties meet with an impartial person who helps to resolve the dispute informally and confidentially. Mediators cannot impose binding decisions. The parties to the dispute must agree before any settlement is binding. The parties will jointly appoint an acceptable mediator and share equally in the cost of such mediation. If mediation fails, the other procedures and remedies available under the REPC shall apply. Nothing in this Section 15 prohibits any party from seeking emergency legal or equitable

relief, pending mediation. The provisions of this Section 15 shall survive Closing.

|

16.

|

DEFAULT:

|

16.1 Buyer Default. If Buyer defaults, Seller may elect one of the following remedies: (a) cancel the REPC and pursue any other remedies available at law.

16.2 Seller Default. If Seller defaults, Buyer may elect one of the following remedies: (a) cancel the REPC and pursue any other remedies available at law

|

17.

|

ATTORNEY FEES AND COSTS/GOVERNING LAW:

|

In the event of litigation or binding arbitration to enforce the REPC, the prevailing party shall be entitled to costs and reasonable attorney fees. However, attorney fees shall not be awarded for participation in mediation under Section 15. This contract shall be governed by and construed in accordance with the laws of the State of Utah. The provisions of this Section 17 shall survive Closing.

|

18.

|

NOTICES:

|

Except as provided in Section 23, all notices required under the REPC must be: (a) in writing; (b) signed by the Buyer or Seller giving notice; and (c) received by the Buyer or the Seller, or their respective agent, or by the brokerage firm representing the Buyer or Seller, no later than the applicable date referenced in the REPC.

|

19.

|

NO ASSIGNMENT:

|

The REPC and the rights and obligations of Buyer hereunder, are personal to Buyer. The REPC may not be assigned by Buyer without the prior written consent of Seller. Provided, however, the transfer of Buyer's interest in the REPC to any business entity in which Buyer holds a legal interest, including, but not limited to, a family partnership, family trust, limited liability company, partnership, or corporation (collectively referred to as a "Permissible Transfer"), shall not be treated as an assignment by Buyer that requires Seller's prior written consent. Furthermore, the inclusion of "and/or assigns" or similar language on the line identifying Buyer on the first page of the REPC shall constitute Seller's written

consent only to a Permissible Transfer.

|

20.

|

RISK OF LOSS:

|

If prior to Closing, any part of the Property is damaged or destroyed by fire, vandalism, flood, earthquake, or act of God, the risk of such loss or damage shall be borne by Seller except as set forth below; provided however, that if the cost of repairing such loss or damage would exceed ten percent (10%) of the Purchase Price referenced in Section 2, Buyer may elect to either: (i) cancel the REPC by providing written notice to the other party, in which instance the Earnest Money, or Deposits, if applicable, shall be returned to Buyer; or (ii) proceed to Closing, and accept the Property in its "As-Is" condition. Buyer shall bear the risk of any loss or damage to the ore or other material or equipment that it

stores on the Property prior to Closing pursuant to Section 4 above.

|

21.

|

TIME IS OF THE ESSENCE:

|

Time is of the essence regarding the dates set forth in the REPC. Extensions must be agreed to in writing by all parties. Unless otherwise explicitly stated in the REPC: (a) performance under each Section of the REPC which references a date shall absolutely be required by 5:00 PM Mountain Time on the stated date; and (b) the term "days" and "calendar days" shall mean calendar days and shall be counted beginning on the day following the event which triggers the timing requirement (e.g. Acceptance). Performance dates and times referenced herein shall not be binding upon title companies, lenders, appraisers and others not parties to the REPC, except as otherwise agreed to in writing by such non-party.

|

22.

|

ELECTRONIC TRANSMISSION AND COUNTERPARTS:

|

Electronic transmission (including email and fax) of a signed copy of the REPC, any addenda and counteroffers, and the retransmission of any signed electronic transmission shall be the same as delivery of an original. The REPC and any addenda and counteroffers may be executed in counterparts.

|

23.

|

ACCEPTANCE:

|

"Acceptance" occurs only when all of the following have occurred:

(a) Seller or Buyer has signed the offer or counteroffer where noted to indicate acceptance; and (b) Seller or Buyer or their agent has communicated to the other party or to the other party's agent that the offer or counteroffer has been signed as required.

|

24.

|

CONTRACT DEADLINES:

|

Buyer and Seller agree that the following deadlines shall apply to the REPC: If the closing of the transactions contemplated by this agreement do not occur by the Settlement Deadline (as may be extended by mutual written consent of the parties), then this agreement and the obligations of Buyer and Seller set forth herein shall be null and void.

(a) Seller Disclosure Deadline: Five (5) calendar days after Acceptance

(b) Proof of Funds: (has been provided to seller)

(c) Due Diligence Deadline: Twenty five (25) calendar days after Acceptance

(d) Settlement Deadline: Thirty (30) calendar days after Acceptance of this Purchase Agreement

|

25.

|

OFFER AND TIME FOR ACCEPTANCE:

|

It is agreed and understood by the parties: the prior signed and attached LOI shall become a legal and binding part of this purchase agreement. Should there be any discrepancies: this purchase agreement will prevail as the binding agreement. It is also understood and agreed by the parties: this agreement is to be held private between Buyer and Seller and will not be disclosed without the prior written consent of Buyer to any third party other than Crown Mines (in accordance with the terms of the ROFR between Crown Mines and Seller) or as Unico may be required to disclose, upon the advice of legal counsel, in its filings with the U.S. Securities and Exchange Commission.

Buyer offers to purchase the Property on the above terms and conditions.

|

09/15/2011 | ||

| (Buyer's Signature) | Date |

IF YOU DESIRE SPECIFIC LEGAL OR TAX ADVICE, CONSULT AN APPROPRIATE PROFESSIONAL.