Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - Renewable Energy Group, Inc. | d200494dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on September 19, 2011

Registration No. 333-175627

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

Form S-1

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

RENEWABLE ENERGY GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2860 | 26-4785427 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

416 South Bell Avenue

Ames, Iowa 50010

(515) 239-8000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jeffrey Stroburg

Chief Executive Officer

416 South Bell Avenue

Ames, Iowa 50010

(515) 239-8000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Blair W. White, Esq. Heidi E. Mayon, Esq. Pillsbury Winthrop Shaw Pittman LLP 50 Fremont Street San Francisco, California 94105 (415) 983-1000 |

Michael J. Zeidel, Esq. Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information contained in this prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | Subject to Completion | , 2011 |

Shares

Common Stock

This is the initial public offering of our Common Stock. No public market currently exists for our Common Stock. We are offering shares of our Common Stock and the selling stockholders identified in this prospectus are selling shares of our Common Stock offered by this prospectus. We will not receive any of the proceeds from the Common Stock sold by the selling stockholders. We expect the public offering price to be between $ and $ per share.

Following this offering, we will have two classes of authorized common stock, Common Stock and Class A Common Stock. The rights of the Common Stock and Class A Common Stock are identical, including rights with respect to voting and dividends. However, the Class A Common Stock will not be listed for trading on any stock exchange. Shares of Class A Common Stock will automatically convert into shares of Common Stock upon expiration of the underwriter lock-up agreements described herein.

We have applied to list our Common Stock on the Nasdaq Global Market, under the symbol “REGI.”

Investing in our Common Stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our Common Stock in “Risk factors” beginning on page 9 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||

| Public offering price | $ | $ | ||

| Underwriting discounts and commissions | $ | $ | ||

| Proceeds, before expenses, to Renewable Energy Group, Inc. | $ | $ | ||

| Proceeds, before expenses, to the selling stockholders | $ | $ |

The underwriters may also purchase up to an additional shares of our Common Stock from us at the public offering price, less underwriting discounts and commissions, to cover over-allotments, if any, within 30 days from the date of this prospectus. If the underwriters exercise this option in full, the total underwriting discounts and commissions will be $ . Our total proceeds, after underwriting discounts and commissions but before expenses, will be $ based on a public offering price of $ , the midpoint of the price range set forth above.

The underwriters are offering the Common Stock as set forth under “Underwriting.” Delivery of the shares will be made on or about , 2011.

| UBS Investment Bank | Piper Jaffray |

| Stifel Nicolaus Weisel | Canaccord Genuity |

Table of Contents

You should rely only on the information contained in this prospectus and any free writing prospectus we may specifically authorize to be delivered or made available to you. We, the selling stockholders and the underwriters have not authorized anyone to provide you with additional or different information. The information contained in this prospectus or any free writing prospectus is accurate only as of its date, regardless of its time of delivery or of any sale of shares of our Common Stock. Our business, financial condition, results of operations and prospects may have changed since that date.

| 1 | ||||

| 5 | ||||

| 7 | ||||

| 9 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 36 | ||||

| 38 | ||||

| Management’s discussion and analysis of financial condition and results of operations |

40 | |||

| 77 | ||||

| 88 |

| 102 | ||||

| 110 | ||||

| 115 | ||||

| 121 | ||||

| 124 | ||||

| 133 | ||||

| Material United States federal income and estate tax considerations to non-United States holders |

136 | |||

| 140 | ||||

| 148 | ||||

| 148 | ||||

| 148 | ||||

| F-1 |

This prospectus is an offer to sell only the shares offered hereby but only under circumstances and in jurisdictions where it is lawful to do so.

i

Table of Contents

Conventions That Apply to this Prospectus

Prior to February 26, 2010, the “Company,” “we,” “us,” “our” and similar references refer to the business, results of operations and cash flows of REG Biofuels, Inc., formerly Renewable Energy Group, Inc., which is considered the accounting predecessor to Renewable Energy Group, Inc., formerly REG Newco, Inc. On or after February 26, 2010, such references refer to the business, results of operations and cash flows of Renewable Energy Group, Inc. and its consolidated subsidiaries.

In this prospectus:

“ASTM” refers to the American Society for Testing and Materials International, an organization that develops and delivers international voluntary consensus standards, including United States standards for fuel.

“ASTM D6751” refers to the ASTM specification for pure biodiesel, or B100, in the United States.

“ASTM D7467” refers to the ASTM specification for biodiesel blends in the United States from 6% to 20% biodiesel.

“ASTM D975” refers to the ASTM specification for diesel fuel in the United States, which includes up to 5% biodiesel.

“B2, B5, B6, B10, B11, B99.9 and B100” each refer to blends of biodiesel with petroleum-based diesel. The number represents the biodiesel percentage of the blend. For instance, a blend of 5% biodiesel and 95% petroleum-based diesel would be represented as B5.

“blender’s tax credit” refers to the federal excise tax credit of $1.00 per gallon of biodiesel that is available to the person who blends biodiesel with petroleum-based diesel.

“BQ-9000” refers to a cooperative and voluntary program for the accreditation of biodiesel producers and marketers. The program combines the ASTM standard for B100, ASTM D6751, and a quality systems program that includes storage, sampling, testing, blending, shipping, distribution and fuel management practices.

“CBOT” refers to the Chicago Board of Trade.

“Distillate fuel”, as defined by the Energy Information Association, involves two products: low-sulfur distillate, which is used as a transportation fuel (diesel) for on-highway vehicles, and high-sulfur distillate, which is used for space heating (heating oil) in the residential and commercial sectors and as a fuel for other stationary (nontransportation) applications in the commercial, industrial, and electricity generation sectors.

“mmgy” refers to million gallons per year.

“nameplate production capacity” refers to the production capacity of a particular facility based on the expected annual throughput in gallons based upon producing at 100% of design capacity for approximately 330 days per year using a particular feedstock.

“NBB” refers to the National Biodiesel Board which is a national trade association representing the biodiesel industry, of which we are one of its largest members.

“Obligated Parties” refers to petroleum refiners and petroleum fuel importers in the 48 contiguous states and Hawaii that have annual renewable fuel volume obligations to use biofuels under RFS2.

“OPIS” refers to the Oil Price Information Service.

ii

Table of Contents

“REG-9000” refers to the brand that we use to market our biodiesel.

“RFS” refers to the renewable fuel standard created under the Energy Policy Act of 2005, which established the first renewable fuel volume requirement in the United States.

“RFS2” refers to the expanded renewable fuel standard that became effective July 1, 2010 requiring for the first time that a specific portion of the diesel fuel consumed in the United States annually be renewable.

“RIN” refers to a renewable identification number, which is generated in connection with the production or importation of renewable fuel and is assigned to a gallon of renewable fuel. RINs are primarily used by Obligated Parties to demonstrate compliance with the use of the specific volumes of renewable fuels mandated by RFS2. For a more detailed discussion of RINs, see the section entitled “Industry overview—Government Programs Favoring Biodiesel Production and Use—Renewable Identification Numbers.”

“RVO” refers to a renewable volume obligation, the annual renewable fuel volume requirement for an Obligated Party under RFS2.

“Tolling arrangements” refer to agreements under which a biodiesel facility produces biodiesel for a third party using such third party’s feedstock.

“ULSD” refers to ultra low sulfur diesel, which is diesel fuel containing 15 parts per million or less of sulfur, which is the current United States standard for on-road diesel fuel.

III

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our Common Stock. You should read this entire prospectus carefully, including our consolidated financial statements and the related notes and the information set forth under the headings “Risk factors” and “Management’s discussion and analysis of financial condition and results of operations,” in each case included elsewhere in this prospectus.

OUR BUSINESS

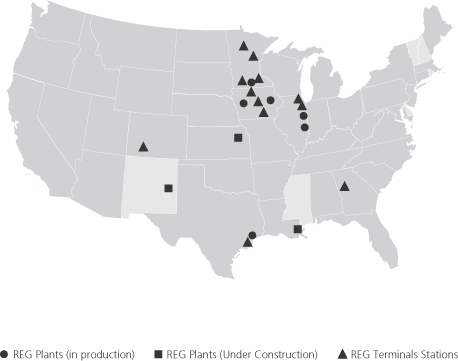

We are the largest producer of biodiesel in the United States based on gallons produced. We have played a leading role in developing the United States biodiesel industry since our inception in 1996. We market and distribute our biodiesel throughout the country to all segments of the petroleum-based distillate fuel supply chain. In 2010, we sold nearly 68 million gallons of biodiesel, representing approximately 22% of United States biodiesel production. Our strategy is to optimize and grow our core biodiesel business, to diversify into renewable chemicals and additional advanced biofuels, and to expand internationally.

We believe we have completed more acquisitions in the biodiesel industry than any of our competitors since 2006. We operate six biodiesel plants, with an aggregate nameplate production capacity of 212 million gallons per year, or mmgy, consisting of five wholly-owned facilities and one leased facility. We have acquired four of our six facilities since February 2010. Our scale allows us to quickly transfer best practices at one of our facilities to the others to maximize production volumes and cost efficiencies. We believe our fully integrated approach, which includes acquiring feedstock, managing biorefinery facility construction and upgrades, operating biorefineries and marketing renewable products, strongly positions us to capitalize on growing demand for biodiesel, renewable chemicals and other advanced biofuels.

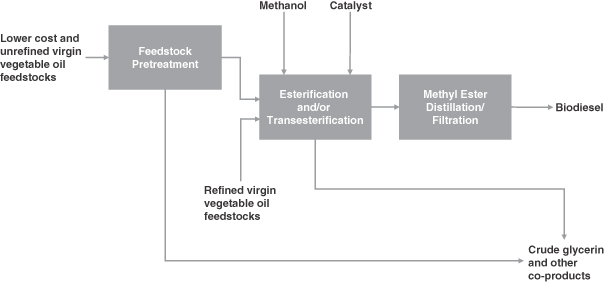

We are a low-cost biodiesel producer. We primarily produce our biodiesel from a wide variety of lower cost feedstocks, including inedible animal fat, used cooking oil and inedible corn oil. We believe our ability to process these feedstocks provides us with a cost advantage over many biodiesel producers, particularly those that rely on higher cost virgin vegetable oils, such as soybean oil. In addition, we believe our size, reputation, large and diverse feedstock supplier base and processing capabilities give us a competitive advantage over other biodiesel producers.

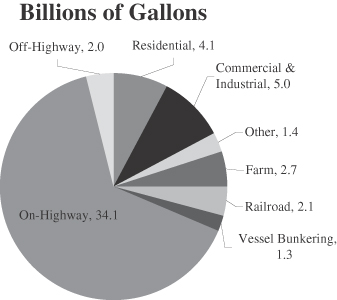

Biodiesel addresses a large existing market. According to the United States Energy Information Administration, or EIA, the market for distillate fuel, which includes biodiesel, in 2009 in the United States was 52.7 billion gallons, the latest year for which data is available.

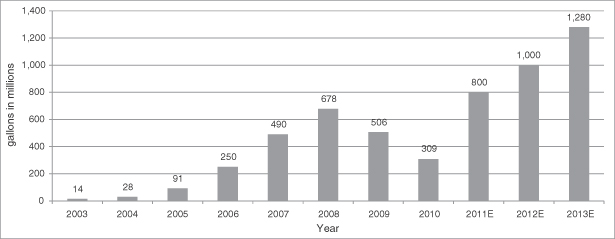

On July 1, 2010, the expanded renewable fuel standard, or RFS2, became effective, requiring for the first time that a portion of the diesel fuel consumed in the United States be renewable. RFS2 requires that Obligated Parties use 800 million gallons of biomass-based diesel in 2011, one billion gallons in 2012 and at least one billion gallons each year thereafter through 2022. Recently, the United States Environmental Protection Agency, or EPA, proposed a requirement that 1.28 billion gallons of biomass-based diesel be used in 2013. According to the National Biodiesel Board, or NBB, biodiesel is currently the only commercially significant RFS2-compliant biomass-based diesel fuel produced in the United States. As a result, demand for biodiesel has increased significantly. In the first four months of 2011, according to the EIA, 173 million gallons of biodiesel were produced in the United States, compared to 309 million gallons in all of 2010.

1

Table of Contents

OUR COMPETITIVE STRENGTHS

| Ø | Largest United States Biodiesel Producer. We believe the scale of our operations allows us to enjoy several advantages over many of our competitors. First, we offer lower cost feedstock producers consistent access to the renewable fuel industry on a scale that we believe our competitors generally cannot match. Second, our size allows us to provide our customers with larger volumes of biodiesel than our smaller competitors. Third, our larger size also generally allows us to reduce our overhead costs per gallon compared to our smaller competitors. Fourth, we are able to transfer best practices among our six operating facilities to maximize production volumes and reduce operating costs, in a manner that our competitors who do not operate multiple facilities cannot. |

| Ø | Multi-Feedstock Expertise. We utilize our proprietary technology and knowhow to efficiently convert a wide variety of lower cost feedstocks into high quality biodiesel. We believe our ability to process lower cost feedstocks at scale enables us to be a low cost producer and provides a distinct advantage against many of our competitors. Several of our competitors’ facilities are only able to process higher cost virgin vegetable oil feedstocks. Our competitors that are able to process lower cost feedstocks generally operate at a smaller scale, making it more difficult for them to reliably procure and efficiently process lower cost feedstocks. |

| Ø | Effective Acquisitions. We believe we have completed more acquisitions in the biodiesel industry than any of our competitors since 2006, acquiring six biodiesel plants and two additional biodiesel businesses since our inception. We have developed an ability to target and acquire strategic assets and quickly add value to them through upgrades and integration onto our biorefinery platform. We believe our in-house expertise will allow us to continue to acquire and effectively integrate new production facilities as we grow and complete additional acquisitions in the biodiesel industry. |

| Ø | Strategic relationships with other industry participants. We have established strategic relationships with other industry participants, particularly Bunge North America, Inc., or Bunge, ED&F Man Holdings Limited and its subsidiaries, or ED&F Man, and West Central Cooperative, or West Central, with whom we trade feedstock and biodiesel, and each of whom is also a principal stockholder. These relationships enable us to more effectively address market opportunities and provide us with an advantage over our competitors that have not been able to establish such strategic relationships. |

| Ø | Sales and Marketing Leadership. We are a leading marketer of biodiesel in the United States, marketing both biodiesel we produce as well as biodiesel produced by others. The scale of our operations, combined with our logistics capabilities, allows us to satisfy local and national customer needs in a manner that we believe most other biodiesel producers and marketers cannot match. In addition, the customer support provided by our large sales and technical teams provides us with further competitive advantages. |

| Ø | Premium Product Quality. Our REG-9000® biodiesel exceeds the ASTM D6751 biodiesel quality specification. In addition, all of our operating facilities are either certified as BQ-9000 producers or follow BQ-9000 protocols and are in the process of obtaining certification. Some larger customers require specifications stricter than ASTM D6751. The ability of our REG-9000® biodiesel to meet stricter specifications than the industry standards and our BQ-9000 accreditation enables us to sell to a broader customer base than our competitors who cannot meet these customer requirements. |

| Ø | Experienced Management Team with Significant Risk Management Expertise. Our management team has extensive experience in the biodiesel and related oleochemical and agricultural industries, with an average of 19 years of relevant experience. Our management team has enabled our company to evolve from a single biodiesel production facility in 1996 into a nationally recognized fully integrated biodiesel company. Our team also has extensive experience in managing risk related to commodity pricing, which is an essential component of effective biorefinery management. |

2

Table of Contents

OUR STRATEGY

Our strategy is to optimize and grow our core biodiesel business, to diversify our biorefinery assets to produce renewable chemicals, additional advanced biofuels and next generation feedstocks, and to expand internationally.

| Ø | Optimize and expand our fully integrated biodiesel offering. We intend to enhance the capabilities and increase the production capacity of our existing plants by investing in high-value processing upgrades to further improve yields and optimize the range of usable lower cost feedstocks at our production facilities. We also plan to continue to consolidate the biodiesel industry and expand our existing biorefinery platform by continuing to strategically acquire biodiesel plants. |

| Ø | Diversify into the production of renewable chemicals, additional advanced biofuels and related products. Our track record of successfully commercializing new biorefinery technologies positions us well to diversify into the production of renewable chemicals and additional advanced biofuels, such as renewable diesel and jet fuel. We also plan to vertically integrate by producing next generation feedstocks, such as algae oil. |

| Ø | Grow our business internationally. We intend to expand into select international markets, which may include Europe, South America and Asia, where we believe we can leverage our existing fully integrated biorefinery platform or leverage our existing strategic relationships with industry participants operating in such markets. In addition, we plan to acquire or invest in biodiesel, renewable chemicals or other advanced biofuel production and distribution assets targeting large end-user or large feedstock generating markets. |

| Ø | Expand our intellectual property base. We intend to build upon our existing intellectual property portfolio and develop and acquire additional intellectual property to support our business and to expand into renewable chemicals, additional advanced biofuels, next generation feedstocks and related renewable products. |

RISKS ASSOCIATED WITH OUR BUSINESS

Our business is subject to numerous risks. Before you invest in our Common Stock, you should carefully consider all the information in this prospectus, including matters set forth under the heading “Risk factors” beginning on page 9 of this prospectus. These risks include, among others, that:

| Ø | a loss or reduction of governmental requirements for the use of biofuels could have a material adverse affect on our revenues and operating margins; |

| Ø | our gross margins are dependent on the spread between feedstock costs and biodiesel prices; |

| Ø | the costs of raw materials that we use as feedstocks are volatile and our results of operations could fluctuate substantially as a result; |

| Ø | we have limited working capital and a recent history of unprofitable operations, and these working capital constraints may limit our growth and may cause us to curtail our operations or forgo sales; |

| Ø | we and certain subsidiaries have substantial indebtedness, which subjects us to potential defaults, and could adversely affect our ability to raise additional capital to fund our operations and could limit our ability to react to changes in the economy or the biodiesel industry; |

| Ø | a loss or reductions of tax incentives for biodiesel production or consumption could have a material adverse affect on our revenues and operating margins; |

| Ø | despite our current debt levels, we and our subsidiaries may incur substantially more debt. This could exacerbate the risks associated with our substantial indebtedness; |

3

Table of Contents

| Ø | our success depends on our ability to manage our growing and changing operations; |

| Ø | risk management transactions could significantly increase our operating costs and working capital requirements if we incorrectly estimate our feedstock demands and biodiesel sales as compared to market conditions; |

| Ø | one customer accounted for a meaningful percentage of revenues and a loss of this customer could have an adverse impact on our total revenues; and |

| Ø | insiders have substantial control over us and will continue to be able to exercise influence over corporate matters following this offering. |

CORPORATE INFORMATION

Our predecessor, REG Biofuels, Inc., formerly named Renewable Energy Group, Inc., was formed under the laws of the State of Delaware in August 2006 upon acquiring the assets and operations of the biodiesel division of West Central and two of West Central’s affiliated companies, InterWest, L.C. and REG, LLC. We were incorporated in Delaware in April 2009.

Our principal executive offices are located at 416 South Bell Avenue, Ames, Iowa 50010. Our telephone number at that location is (515) 239-8000. Our website address is www.REGI.com. Information on our website is not part of this prospectus and should not be relied upon in determining whether to make an investment decision.

Renewable Energy Group, REG, the REG logo, and REG-9000® referenced in this prospectus are our trademarks or service marks or registered trademarks or service marks. All other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

4

Table of Contents

| Common Stock offered by us |

shares (or shares if the underwriters exercise their over-allotment option in full) |

| Common Stock offered by the selling stockholders |

shares |

| Common Stock to be outstanding after this offering |

shares (or shares if the underwriters exercise their over-allotment option in full) |

| Class A Common Stock to be outstanding after this offering |

shares |

| Total Common Stock and Class A Common Stock to be outstanding after this offering |

shares (or shares if the underwriters exercise their over-allotment option in full) |

| Over-allotment option |

The underwriters have an option to purchase a maximum of additional shares of Common Stock from us to cover over-allotments. The underwriters could exercise this option at any time within 30 days from the date of the prospectus. |

| Use of proceeds |

We intend to use approximately $12.0 million of the net proceeds received by us from this offering to exercise the option we hold to acquire our facility in Seneca, Illinois, which we currently lease, with the remaining proceeds to be used for working capital, capital expenditures related to improvements of production processes and logistics, investments in new biofuel businesses, production technologies or other assets, and in opportunities to extend our biorefinery platform to the production of renewable chemicals and feedstocks. If the underwriters exercise their over-allotment option, the first $15.0 million of net proceeds, or such lesser amount if the net proceeds are less than $15.0 million, will be used for certain payments to the former holders of the Series A preferred stock. We intend to use any net proceeds from the exercise of the over-allotment option in excess of $15.0 million as described in the first sentence above. See “Use of proceeds” on page 31. We will not receive any of the proceeds from the sale of Common Stock by the selling stockholders. |

5

Table of Contents

| Risk factors |

See “Risk factors” beginning on page 9 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our Common Stock. |

| Proposed Nasdaq Global Market symbol |

“REGI” |

The total number of shares of our Common Stock and Class A Common Stock outstanding after this offering is based on no shares of our Common Stock and shares of our Class A Common Stock outstanding (after giving pro forma effect to the reclassification of our existing common stock into an equivalent number of shares of Class A Common Stock), as of June 30, 2011 and:

| Ø | Includes shares of Class A Common Stock that will be issued as part of the conversion of our outstanding Series A preferred stock and exchange of existing warrants to purchase shares of our common stock; |

| Ø | Excludes up to shares of Common Stock issuable upon the conversion of the Series B preferred stock issuable upon conversion of our outstanding Series A preferred stock; |

| Ø | Excludes shares of Class A Common Stock issuable upon the exercise of warrants to purchase Class A Common Stock that will remain outstanding following this offering; |

| Ø | Excludes shares of Class A Common Stock issuable upon the exercise of outstanding restricted stock units, or RSUs; |

| Ø | Excludes shares of Class A Common Stock issuable upon the exercise of outstanding options, at a weighted average exercise price of $ per share; and |

| Ø | Excludes shares of Class A Common Stock reserved for future issuance under our 2009 Stock Incentive Plan. |

Unless otherwise indicated, all information in this prospectus assumes:

| Ø | The reclassification of our existing common stock into an equivalent number of shares of our Class A Common Stock and the authorization of our Common Stock; |

| Ø | That our third amended and restated certificate of incorporation, which we will file in connection with the completion of this offering, is in effect; |

| Ø | Except for the financial statements and notes thereto, the conversion, effective immediately prior to the completion of this offering, of all outstanding shares of our Series A preferred stock for an aggregate of shares of Class A Common Stock and 3,000,000 shares of Series B preferred stock, which number includes up to 400,000 shares of Series B preferred stock, issuable upon expiration of the underwriters’ over-allotment option, to be reduced proportionately if the net proceeds from that exercise are greater than $5.0 million and less than $15.0 million, as described under “Use of proceeds”; and |

| Ø | No exercise by the underwriters of their over-allotment option to purchase up to additional shares of Common Stock from us. |

All references in this prospectus to common stock include our existing common stock, our Common Stock and our Class A Common Stock. As set forth in the section entitled “Description of capital stock,” all shares of Class A Common Stock outstanding following this offering will automatically convert into shares of Common Stock upon expiration of the underwriters lock-up described in the section entitled “Underwriting.”

6

Table of Contents

Summary consolidated financial data

The summary consolidated statements of operations data for each of the three years in the period ended December 31, 2010 have been derived from our audited consolidated financial statements that are included elsewhere in this prospectus. The summary consolidated balance sheet data as of June 30, 2011 and the summary consolidated statements of operations data for each of the six months ended June 30, 2011 and 2010 have been derived from our unaudited condensed consolidated financial statements that are included elsewhere in this prospectus. You should read this information together with the consolidated financial statements and related notes, unaudited pro forma as adjusted financial information and other information under “Management’s discussion and analysis of financial condition and results of operations” included elsewhere in this prospectus. Operating results for the six months ended June 30, 2011 are not necessarily indicative of the results that may be expected for the year ended December 31, 2011.

| Year ended December 31, | Six months ended June 30, |

|||||||||||||||||||

| Consolidated Statement of Operations Data: | 2010(1) | 2009 | 2008(2) | 2011 | 2010 | |||||||||||||||

| (in thousands, except share and per share amounts) | ||||||||||||||||||||

| Revenues: |

||||||||||||||||||||

| Biodiesel sales |

$ | 207,902 | $ | 109,027 | $ | 69,509 | $ | 284,421 | $ | 79,144 | ||||||||||

| Biodiesel government incentives |

7,240 | 19,465 | 6,564 | 16,266 | 3,674 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total biodiesel |

215,142 | 128,492 | 76,073 | 300,687 | 82,818 | |||||||||||||||

| Services |

1,313 | 3,009 | 9,379 | 60 | 1,008 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

216,455 | 131,501 | 85,452 | 300,747 | 83,826 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Costs of goods sold: |

||||||||||||||||||||

| Biodiesel |

194,016 | 127,373 | 78,736 | 262,084 | 75,949 | |||||||||||||||

| Services |

807 | 1,177 | 4,470 | 42 | 533 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total costs of goods sold |

194,823 | 128,550 | 83,206 | 262,126 | 76,482 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

21,632 | 2,951 | 2,246 | 38,621 | 7,344 | |||||||||||||||

| Total operating expenses |

29,681 | 24,144 | 24,208 | 14,090 | 10,958 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from operations |

(8,049 | ) | (21,193 | ) | (21,962 | ) | 24,531 | (3,614 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total other income (expense), net |

(16,102 | ) | (1,364 | ) | (2,318 | ) | (21,596 | ) | 2,956 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income tax benefit (expense) and loss from equity investments |

(24,151 | ) | (22,557 | ) | (24,280 | ) | 2,935 | (658 | ) | |||||||||||

| Income tax benefit (expense) |

3,252 | (45,212 | ) | 9,414 | — | 3,728 | ||||||||||||||

| Loss from equity investments |

(689 | ) | (1,089 | ) | (1,013 | ) | (148 | ) | (381 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

(21,588 | ) | (68,858 | ) | (15,879 | ) | 2,787 | 2,689 | ||||||||||||

| Less: Net loss attributable to noncontrolling interests |

— | 7,953 | 2,788 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) attributable to the company |

(21,588 | ) | (60,905 | ) | (13,091 | ) | 2,787 | 2,689 | ||||||||||||

| Effects of recapitalization |

8,521 | — | — | — | 8,521 | |||||||||||||||

| Less: accretion of preferred stock to redemption value |

(27,239 | ) | (44,181 | ) | (26,692 | ) | (12,076 | ) | (16,246 | ) | ||||||||||

| Less: undistributed dividends allocated to preferred stockholders |

(10,027 | ) | (14,036 | ) | (11,145 | ) | (6,246 | ) | (4,073 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss attributable to the company’s common stockholders |

$ | (50,333 | ) | $ | (119,122 | ) | $ | (50,928 | ) | $ | (15,535 | ) | $ | (9,109 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss per share attributable to common stockholders: |

||||||||||||||||||||

| Basic |

$ | (1.71 | ) | $ | (6.14 | ) | $ | (3.07 | ) | $ | (0.47 | ) | $ | (0.34 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted (3) |

$ | (1.71 | ) | $ | (6.14 | ) | $ | (3.07 | ) | $ | (0.47 | ) | $ | (0.34 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

7

Table of Contents

| Year ended December 31, | Six months ended June 30, |

|||||||||||||||||||

| Consolidated Statement of Operations Data: | 2010(1) | 2009 | 2008(2) | 2011 | 2010 | |||||||||||||||

| (in thousands, except share and per share amounts) |

||||||||||||||||||||

| Weighted-average shares used to compute net loss per share attributable to common stockholders: |

||||||||||||||||||||

| Basic |

29,427,120 | 19,407,227 | 16,593,555 | 31,171,531 | 26,686,936 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted(3) |

29,427,120 | 19,407,227 | 16,593,555 | 31,171,531 | 26,686,936 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pro forma net loss per share attributable to common stockholders(4): |

||||||||||||||||||||

| Basic |

$ | $ | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Diluted |

$ | $ | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Pro forma weighted-average shares used to compute net loss per share attributable to common stockholders(4): |

||||||||||||||||||||

| Basic |

||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Diluted |

||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| (1) | Reflects the deconsolidation of Blackhawk Biofuels, LLC, or Blackhawk, as of January 1, 2010, the acquisition of Blackhawk as of February 26, 2010, the acquisition of Central Iowa Energy, LLC, or CIE, as of March 8, 2010, the consolidation of Seneca Landlord, LLC, or Landlord, as of April 8, 2010, the acquisition of Tellurian Biodiesel, Inc., or Tellurian, and American BDF, LLC, or ABDF, as of July 16, 2010, and the acquisition of Clovis Biodiesel, LLC, as of September 21, 2010. |

| (2) | Reflects the consolidation of Blackhawk as of May 9, 2008 and the acquisition of U.S. Biodiesel Group, Inc., or USBG, as of June 26, 2008. |

| (3) | Certain potentially dilutive securities were excluded from the calculation of diluted net loss per share attributable to common stockholders during the periods presented as the effect was anti-dilutive. |

| (4) | The pro forma per share amounts give effect to (i) the filing of our second amended and restated certificate of incorporation, (ii) the automatic conversion of all outstanding shares of Series A preferred stock and the reclassification of our existing common stock into an aggregate of shares of Class A Common Stock and 3,000,000 shares of Series B preferred stock in the recapitalization transactions that will occur in connection with this offering, (iii) the issuance of 500,000 shares of Class A Common Stock to USRG Holdco IX, LLC immediately prior to the completion of this offering in connection with the termination of the Glycerin Option Agreement dated as of April 8, 2010, between us and USRG Holdco IX, LLC and (iv) the issuance of shares of Class A Common Stock in exchange for existing warrants to purchase shares of Class A Common Stock, as if such actions had occurred on the first day of the applicable period. |

| As of June 30, 2011 | ||||||||

| Consolidated Balance Sheet Data: | Actual | Pro Forma(1) | Pro Forma as Adjusted(2) | |||||

| (in thousands) | ||||||||

| Cash and cash equivalents |

$ | 9,125 | ||||||

| Working capital (deficit)(3) |

19,459 | |||||||

| Total debt(4) |

$ | 99,917 | ||||||

| Total assets |

403,949 | |||||||

| Total liabilities |

241,582 | |||||||

| Total stockholders’ equity |

27,855 | |||||||

| (1) | The pro forma column in the consolidated balance sheet data table above reflects the conversion of all outstanding shares of our Series A preferred stock into shares of Class A Common Stock and 3,000,000 shares of Series B preferred stock in recapitalization transactions that will occur in connection with this offering. |

| (2) | The pro forma as adjusted column in the consolidated balance sheet data table above reflects (i) the conversion of all outstanding shares of our Series A preferred stock into shares of Class A Common Stock and 3,000,000 shares of Series B preferred stock in the recapitalization transactions that will occur in connection with this offering, (ii) the issuance of shares of Class A Common Stock to USRG Holdco IX, LLC immediately prior to the completion of this offering in connection with the termination of the Glycerin Option Agreement dated as of April 8, 2010, between us and USRG Holdco IX, LLC, (iii) the issuance of shares of Class A Common Stock in exchange for existing warrants to purchase shares of Class A Common Stock and (iv) the issuance and sale by us of shares of our Common Stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| (3) | Includes $22.8 million term loan held by our wholly-owned subsidiary, REG Danville, LLC, or REG Danville, which matures on November 3, 2011. Working capital is defined as current assets less current liabilities. |

| (4) | In August 2011, our wholly-owned subsidiary, REG Albert Lea, LLC, or REG Albert Lea, entered into a $10.0 million note for working capital, which we have guaranteed. |

8

Table of Contents

Investing in our Common Stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including our consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision. If any of the following risks are realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the trading price of our Common Stock could decline and you could lose part or all of your investment.

RISKS ASSOCIATED WITH OUR BUSINESS

Loss or reductions of governmental requirements for the use of biofuels could have a material adverse affect on our revenues and operating margins.

The biodiesel industry relies substantially on federal requirements and state policies for use of biofuels. Since biodiesel has been more expensive to produce than petroleum-based diesel fuel over the past few years, the biodiesel industry depends on governmental programs that support a market for biodiesel that might not otherwise exist.

The most important of these government programs in the United States is RFS2, which requires that a certain volume of biomass-based diesel fuel, which includes biodiesel, be consumed. RFS2 became effective on July 1, 2010 and applies through 2022. We believe that the increase in demand for our biodiesel in 2011 is directly attributable to the implementation of RFS2. In addition, we believe that biodiesel prices in 2011 have benefited significantly from RFS2.

There can be no assurance that Congress or the EPA will not repeal, curtail or otherwise change the RFS2 program in a manner adverse to us. The petroleum industry has opposed the retroactive application of certain provisions of the rule and fundamental fairness in the implementation of policy involved in RFS2 and can be expected to continue to press for changes that eliminate or reduce its impact. Any repeal or reduction in the RFS2 requirements or reinterpretation of RFS2 resulting in our biodiesel failing to qualify as a required fuel would materially decrease the demand for and price of our product, which would materially and adversely harm our revenues and cash flows.

If Congress decides to repeal or curtail RFS2, or if the EPA is not able or willing to enforce RFS2 requirements, the demand for our product based on this program and any increases in demand that we expect due to RFS2 would be significantly reduced or eliminated and our revenues and operating margins would be materially harmed. In addition, although we believe that state requirements for the use of biofuels increase demand for our biodiesel within such states, they generally may not increase overall demand in excess of RFS2 requirements. Rather, existing demand for our biofuel from petroleum refiners and petroleum fuel importers in the 48 contiguous states or Hawaii, which are defined as “Obligated Parties” in the RFS2 regulations, in connection with federal requirements, may shift to states that have use requirements or tax incentive programs.

Our gross margins are dependent on the spread between biodiesel prices and feedstock costs.

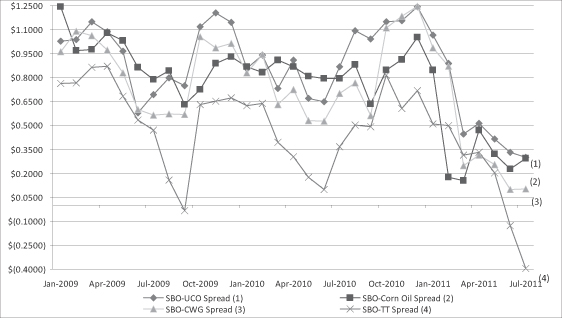

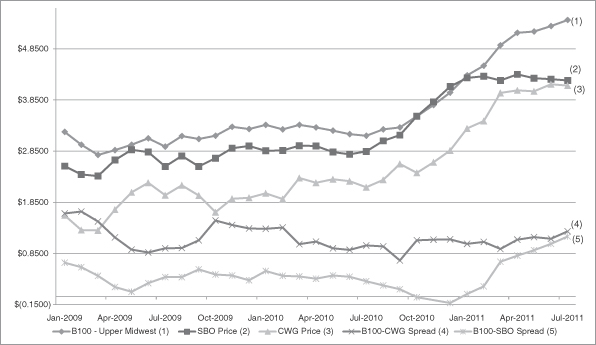

Our gross margins depend on the spread between biodiesel prices and feedstock costs. Historically, the spread between biodiesel prices and feedstock costs has varied significantly. Although actual yields vary depending on the feedstock quality, the average monthly spread between the price per gallon of 100% pure biodiesel, or B100, as reported by The Jacobsen Publishing Company, or The Jacobsen, and the

9

Table of Contents

Risk factors

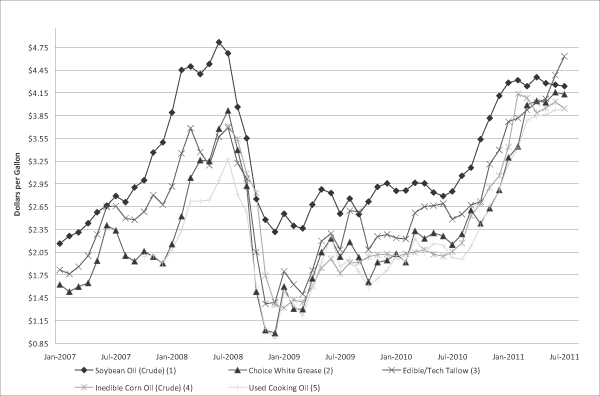

price for the amount of choice white grease, a common inedible animal fat used by us to make biodiesel, was $1.83 in 2008, $1.25 in 2009, $1.06 in 2010, and $1.08 in the first six months of 2011, assuming 8.0 pounds of choice white grease yields one gallon of biodiesel. The average monthly spread for the amount of crude soybean oil required to produce one gallon of biodiesel, based on the nearby futures contract as reported on the Chicago Board of Trade, or CBOT, was $0.61 per gallon in 2008, $0.39 in 2009, and $0.25 per gallon in 2010, and $0.62 in the first six months of 2011, assuming 7.5 pounds of soybean oil yields one gallon of biodiesel. For 2010, approximately 91% of our total feedstock usage was inedible animal fat, used cooking oil or inedible corn oil and 9% was soybean oil, compared to approximately 78% for inedible animal fat, used cooking or inedible corn oil and 22% for soybean oil in 2009.

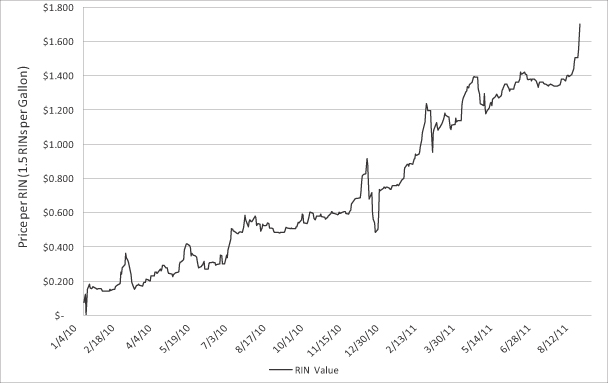

Biodiesel has traditionally been marketed primarily as an additive or alternative to petroleum-based diesel fuel and as a result biodiesel prices have been influenced by the price of petroleum-based diesel fuel, adjusted for government tax incentives supporting renewable fuels, rather than biodiesel production costs. A lack of correlation between production costs and biodiesel prices means that we may be unable to pass increased production costs on to our customers in the form of higher prices. Any decrease in the spread between biodiesel prices and feedstock costs, whether as a result of an increase in feedstock prices or a reduction in biodiesel prices, including, but not limited to, a reduction in the value of Renewable Identification Numbers, or RINs, would adversely affect our gross margins, cash flow and results of operations. For a detailed description of RINs, see “Industry overview—Government Programs Favoring Biodiesel Production and Use—Renewable Identification Numbers.”

The costs of raw materials that we use as feedstocks are volatile and our results of operations could fluctuate substantially as a result.

The cost of feedstocks is a significant uncertainty for our business. The success of our operations is dependent on the price of feedstocks and certain other raw materials that we use to produce biodiesel. A decrease in the availability or an increase in the price of feedstocks may have a material adverse effect on our financial condition and operating results. At elevated price levels, these feedstocks may be uneconomical to use, as we may be unable to pass feedstock cost increases on to our customers.

The price and availability of feedstocks and other raw materials may be influenced by general economic, market and regulatory factors. These factors include weather conditions, farming decisions, government policies and subsidies with respect to agriculture and international trade, and global supply and demand. The significance and relative impact of these factors on the price of feedstocks is difficult to predict, especially without knowing what types of feedstock materials will be optimal for use in the future, particularly at new facilities that we construct or acquire.

Since 2009, we have principally used inedible animal fats, used cooking oil and inedible corn oil as our feedstocks for the production of biodiesel. Our decision to shift to these feedstocks resulted from the reduction in profit caused by a significant increase in soybean oil prices, which rose from $0.1435 per pound in February 2001 to $0.7040 per pound in March 2008, and soybean oil having generally remained at high levels since that time. While less volatile than soybean oil, prices for these alternative feedstocks can also vary significantly based on market conditions. Since January 1, 2008, the cost per pound of choice white grease, an inedible animal fat commonly used by us in the production of biodiesel, has traded in a range of $0.0950 to $0.5250 based on the closing nearby futures prices on the CBOT. Historically, the price of animal fat has been affected by the amount of slaughter kills in the United States, as well as demand from other markets. If biodiesel production continues to increase in response to RFS2, we expect that more biodiesel producers will seek to use these lower cost feedstocks, potentially increasing our costs of production. In addition, because the market for animal fat is less developed than

10

Table of Contents

Risk factors

markets for vegetable oils such as soybean oil, we generally are unable to enter into forward contracts at fixed prices. Further, the markets for used cooking oil and inedible corn oil are in their nascent stages. The market for used cooking oil as a feedstock for biodiesel is still developing and supply is limited. While the commercial supply of inedible corn oil is growing as some ethanol producers are installing corn oil extraction technology in their ethanol plants, it is not generally available in quantities sufficient to cover all our operations. At present, there are a limited number of ethanol plants with the equipment necessary to extract inedible corn oil that can be used in biodiesel production. If more ethanol plants do not acquire and utilize corn oil extraction equipment or if ethanol plants are idled, we may not be able to obtain additional amounts of inedible corn oil for use in our production of biodiesel and may be forced to utilize higher cost feedstocks to meet increased demand, which may not be economical.

We have limited working capital and a recent history of unprofitable operations; these working capital constraints may limit our growth and may cause us to curtail our operations or forgo sales.

We have a limited amount of working capital to support our operations. We became cash flow positive during fourth quarter of 2010 and were cash flow positive in the first and second quarters of 2011, but we will need to raise additional working capital to be able to take advantage of the anticipated increased demand for biodiesel resulting from RFS2. Rising commodity prices further increase our demand for working capital, as both our feedstock production costs and costs for biodiesel we acquire from third parties and resell have increased in price, requiring more working capital to manage the same volume of sales. If additional working capital is not available, we may find it necessary to curtail operations and forgo sales, harming our revenues and profitability.

We and certain subsidiaries have substantial indebtedness, which subjects us to potential defaults, could adversely affect our ability to raise additional capital to fund our operations and limit our ability to react to changes in the economy or the biodiesel industry.

Several of our subsidiaries have a significant amount of indebtedness, some of which we have guaranteed. At June 30, 2011, our total long-term debt was $89.3 million, which includes $24.6 million of indebtedness of REG Danville that matures in November 2011. This includes consolidated long-term debt owed by our Variable Interest Entities, or VIEs, including Landlord and 416 South Bell, LLC, or Bell, LLC. At June 30, 2011, the amount borrowed by our subsidiaries under our lines of credit was $10.6 million, all of which we guaranteed. In addition, in August 2011, REG Albert Lea borrowed and we guaranteed $10.0 million that will be used for working capital at our Albert Lea facility. This REG Albert Lea debt matures in December 2011.

All of the agreements for our indebtedness contain financial covenants the breach of which would result in an event of default by us or our subsidiary obligor. At March 31, 2011, REG Danville was not in compliance with its financial covenants requiring it to meet a minimum fixed charge coverage ratio and a maximum funded debt-to-EBITDA ratio and it was necessary for us to obtain a waiver from the lender to avoid a default. At June 30, 2011, our Danville subsidiary was in compliance with its financial covenants. For a discussion of the financial covenants related to our debt agreements, see “Management discussion and analysis of financial condition and results of operations—Liquidity.”

Our level of indebtedness relative to our size could restrict our operations and make it more difficult for us to satisfy our debt obligations or obtain additional borrowings for working capital to fund operations. In connection with the Seneca facility transaction, one of our subsidiaries leases the Seneca facility from Landlord, an entity owned by certain of our large stockholders. In addition, our subsidiaries are required annually to pay a certain portion of our excess cash flow at our Danville and Newton facilities to their respective lenders, which reduces the cash flow that we receive from these facilities.

11

Table of Contents

Risk factors

Our significant amount of indebtedness could:

| Ø | require us to dedicate a substantial portion of our cash flow from operations to payments of principal, interest on, and other fees related to such indebtedness, thereby reducing the availability of our cash flow to fund working capital and capital expenditures, and for other general corporate purposes; |

| Ø | increase our vulnerability to general adverse economic and biodiesel industry conditions; |

| Ø | limit our flexibility in planning for, or reacting to, changes in our business and the biodiesel industry, which may place us at a competitive disadvantage compared to our competitors that have less debt; and |

| Ø | limit among other things, our ability to borrow additional funds. |

Loss or reductions of tax incentives for biodiesel production or consumption would have a material adverse affect on our revenues and operating margins.

The biodiesel industry is also substantially aided by federal and state tax incentives. Prior to RFS2, the biodiesel industry relied principally on these tax incentives to bring the price of biodiesel more in line with the price of petroleum-based diesel fuel to the end user. The most significant tax incentive program is the federal blenders’ tax credit. The blenders’ tax credit provides a $1.00 refundable tax credit per gallon of pure biodiesel, or B100, to the first blender of biodiesel with petroleum-based diesel fuel. Congress allowed the blenders’ tax credit to expire as of December 31, 2009 and then re-enacted the credit in December 2010, retroactively for all of 2010 and prospectively for 2011. The blenders’ tax credit is set to expire again on December 31, 2011. Certain ethanol tax credits have recently been proposed to be curtailed or eliminated as part of United States federal deficit reduction efforts. Unlike RFS2, the blenders’ tax credit has a direct effect on federal government spending and could be changed or eliminated as a result of changes in the federal budget policy. The absence of and uncertainty around the blenders’ tax credit during most of 2010 materially curtailed demand for biodiesel and our ability to cost effectively produce and sell biodiesel, resulting in our idling production at several of our facilities during that period. Although the blenders’ tax credit was reinstated for all of 2010, we were not able to recapture all of the tax credit we would have been able to receive because we had chosen not to blend a significant portion of our production in 2010 after the credit lapsed. It is uncertain what action, if any, Congress may take with respect to extending the blenders’ tax credit beyond 2011 or when such action might be effective. If Congress eliminates or reduces the blenders’ tax credit before its expiration on December 31, 2011, or does not extend the credit beyond 2011, demand for our biodiesel and the price we are able to charge for our product may be significantly reduced, harming revenues and profitability.

In addition, several states have enacted tax incentives for the use of biodiesel. Like the federal blenders’ tax credit, these tax incentive programs could be changed as a result of state budget considerations or otherwise. Reduction or elimination of such incentives could materially and adversely harm our revenues and profitability.

Despite our current debt levels, we and our subsidiaries may incur substantially more debt. This could exacerbate the risks associated with our substantial indebtedness.

We and our subsidiaries may incur substantial additional debt in the future, including secured debt. We and certain of our subsidiaries are not currently prohibited under the terms of our debt from incurring additional debt, pledging assets, recapitalizing our debt or taking a number of other actions that could diminish our ability to make payments thereunder. If new indebtedness is added to our current debt levels, the related risks that we and our subsidiaries now face could intensify.

12

Table of Contents

Risk factors

Our success depends on our ability to manage our growing and changing operations.

Since our formation, our business has grown significantly in size and complexity. This growth has placed, and is expected to continue to place, significant demands on our management, systems, internal controls and financial and physical resources. In addition, we expect that we will need to further develop our financial and managerial controls and reporting systems to accommodate future growth. This will require us to incur expenses related to hiring additional qualified personnel, retaining professionals to assist in developing the appropriate control systems and expanding our information technology infrastructure. Our inability to manage growth effectively could have a material adverse effect on our results of operations, financial position and cash flows.

Risk management transactions could significantly increase our operating costs and working capital requirements if we incorrectly estimate our feedstock demands and biodiesel sales as compared to market conditions.

In an attempt to partially offset the effects of volatility of feedstock costs and biodiesel fuel prices, we may enter into contracts that establish market positions in feedstocks, such as inedible animal fats and soybean oil, and related commodities, such as heating oil and ultra-low sulfur diesel, or ULSD. The financial impact of such market positions will depend on commodity prices at the time that we are required to perform our obligations under these contracts. Risk management arrangements will also expose us to the risk of financial loss in situations where the counterparty defaults on its contract or, in the case of exchange-traded or over-the-counter futures or options contracts, where there is a change in the expected differential between the underlying price in the contract and the actual prices paid or received by us. Risk management activities can themselves result in losses when a position is purchased in a declining market or a position is sold in a rising market. Changes in the value of these futures instruments are recognized in current income and may result in margin calls. We may also vary the amount of risk management strategies we undertake, or we may choose not to engage in risk management transactions at all. Further, our ability to reduce the risk of falling biodiesel prices and rising feedstock costs will be limited as currently there is no established futures market for biodiesel or the vast majority of our feedstocks, nor are fixed-price long-term contracts generally available. As a result, our results of operations and financial position may be adversely affected by increases in the price of feedstocks or decreases in the price of biodiesel that are not managed effectively.

One customer accounted for a meaningful percentage of revenues and a loss of this customer could have an adverse impact on our total revenues.

One customer, Pilot Travel Centers LLC, or Pilot, accounted for 24% and 29% of our total revenues in 2009 and 2010, respectively. During the first six months of 2011, Pilot accounted for 25% of our total revenues. Our agreements with Pilot have typically had a one-year term and our current agreement with Pilot expires December 31, 2011. In the event we lose Pilot as a customer or Pilot significantly reduces the volume of biodiesel it buys from us, it could be difficult to replace the lost revenues in the short term and potentially over an extended period, and our profitability and cash flow could be materially harmed.

Our business is primarily dependent upon one product. As a consequence, we may not be able to adapt to changing market conditions or endure any decline in the biodiesel industry.

Our business is currently focused almost entirely on the production and sale of biodiesel, with glycerin and fatty acid sales and the operations of our Services segment representing only a small portion of revenues. Our reliance on biodiesel means that we may not be able to adapt to changing market conditions or to withstand any significant decline in the biodiesel industry. For example, in 2009 and the beginning of 2010, we were required to periodically idle our plants due to insufficient demand which

13

Table of Contents

Risk factors

materially affected our revenues. If we are required to idle our plants in the future or are unable to adapt to changing market conditions, our revenues and results of operations may be materially harmed.

Technological advances and changes in production methods in the biodiesel industry could render our plants obsolete and adversely affect our ability to compete.

It is expected that technological advances in biodiesel production methods will continue to occur and new technologies for biodiesel production may develop. Advances in the process of converting oils and fats into biodiesel could allow our competitors to produce biodiesel faster and more efficiently and at a substantially lower cost. If we are unable to adapt or incorporate technological advances into our operations, our production facilities could become less competitive or obsolete. Further, it may be necessary for us to make significant expenditures to acquire any new technology and retrofit our plants in order to incorporate new technologies and remain competitive. There is no assurance that third-party licenses for any new proprietary technologies would be available to us on commercially reasonable terms or that any new technologies could be incorporated into our plants. If we are unable to obtain, implement or finance new technologies, our production facilities could be less efficient than our competitors and our results of operations could be substantially harmed.

If we are unable to respond to changes in ASTM or customer standards, our ability to sell biodiesel may be harmed.

We currently produce biodiesel to conform to or exceed standards established by ASTM. ASTM standards for biodiesel and biodiesel blends may be modified in response to new observations from the industries involved with diesel fuel. New tests or more stringent standards may require us to make additional capital investments in, or modify, plant operations to meet these standards. In addition, some biodiesel customers have developed their own biodiesel standards which are stricter than the ASTM standards. If we are unable to meet new ASTM standards or our biodiesel customers’ standards cost effectively or at all, our production technology may become obsolete, and our ability to sell biodiesel may be harmed, negatively impacting our revenues and profitability.

Increases in our transportation costs or disruptions in our transportation services could have a material adverse effect on our business.

Our business depends on transportation services to deliver our products to our customers and to deliver raw materials to us. The costs of these transportation services are affected by the volatility in fuel prices, such as those caused by recent geopolitical and economic events. We have not been in the past, and may not be in the future, able to pass along part or all of any fuel price increases to customers. If we continue to be unable to increase our prices as a result of increased fuel costs charged to us by transportation providers, our gross margins may be materially adversely affected.

If any transportation providers fail to deliver raw materials to us in a timely manner, we may be unable to manufacture products on a timely basis. Shipments of products and raw materials may be delayed due to weather conditions, strikes or other events. Any failure of a third-party transportation provider to deliver raw materials or products in a timely manner could harm our reputation, negatively affect our customer relationships and have a material adverse effect on our business, financial condition and results of operations.

We are dependent upon our key management personnel and the loss of any of these persons could adversely affect our results of operations.

We are highly dependent upon key members of our management team for the execution of our business plan. We believe that our future success is highly dependent on the contributions of these key employees.

14

Table of Contents

Risk factors

There can be no assurance that any individual will continue in his or her capacity for any particular period of time. The loss of any of these key employees could delay or prevent the achievement of our business objectives and have a material adverse effect upon our results of operations and financial position.

We have partially constructed plants and planned plant upgrades that require capital that we may not be able to raise.

We have three partially constructed plants, one near New Orleans, Louisiana, one in Emporia, Kansas and one in Clovis, New Mexico, that we expect will require additional investments of approximately $130 to $140 million in the aggregate, excluding working capital requirements, before they would be able to commence production. We also have various upgrades planned for our operating facilities. In order to complete construction of these facilities or upgrade our facilities as planned, we will require additional capital. While we intend to finance certain upgrades to our existing facilities in part with a portion of the proceeds of this offering and from our cash flow from operations, we will need to raise significant capital in addition to the proceeds of this offering to complete construction of the three facilities. We continue to be in discussions with lenders in an effort to obtain financing for our facilities, however, it is uncertain when or if financing will be available. It is also likely that the terms of any project financing would include customary financial and other covenants restricting our project subsidiaries, including restrictions on the ability to make distributions, to guarantee indebtedness and to incur liens on the plants of such subsidiaries. If we are unable to obtain such capital on satisfactory terms, or if such capital is otherwise unavailable, or if we encounter cost overruns on these projects such that we have insufficient capital, we may have to postpone completion of these projects indefinitely, which may adversely affect our ability to implement our strategy and our future revenues and cash flow.

We may not successfully identify and complete acquisitions and other strategic relationships on favorable terms or achieve anticipated synergies relating to any such transactions, and integration of acquisitions may disrupt our business and management.

We regularly review domestic and international acquisitions of biodiesel production facilities and have acquired most of our facilities from third parties. However, we may be unable to identify suitable acquisition candidates in the future. Even if we identify appropriate acquisition candidates, we may be unable to complete such acquisitions on favorable terms, if at all. In addition, we may not realize the anticipated benefits of any or all of our past or future transactions and each transaction has numerous risks. These risks include:

| Ø | difficulty in integrating the operations and personnel of the acquired company; |

| Ø | difficulty in effectively integrating the acquired technologies, products or services with our current technologies, products or services; |

| Ø | disruption of our ongoing business and distraction of our management and employees from other opportunities and challenges; |

| Ø | inability to achieve the financial and strategic goals for the acquired and combined businesses; |

| Ø | incurring acquisition-related costs or amortization costs for acquired intangible assets that could impact our operating results; |

| Ø | potential failure of the due diligence processes to identify significant problems, liabilities or other shortcomings or challenges of an acquired company or technology, including but not limited to, issues with the acquired company’s intellectual property, product quality, environmental liabilities, data back-up and security, revenue recognition or other accounting practices, employee, customer or partner issues or legal and financial contingencies; |

15

Table of Contents

Risk factors

| Ø | exposure to litigation or other claims in connection with, or inheritance of claims or litigation risk as a result of, an acquisition, including but not limited to, claims from terminated employees, customers, former stockholders or other third parties; and |

| Ø | incurring significant exit charges if products or services acquired in business combinations are unsuccessful. |

In addition, one of our strategic goals is to expand our biodiesel production capabilities into international markets. In the event we expand our operations into international markets through acquisitions or otherwise, we may be exposed to additional risks, including unexpected changes in foreign laws and regulations, political and economic instability, challenges in managing foreign operations, increased costs to adapt our systems and practices to those used in foreign countries, export duties, currency restrictions, tariffs and other trade barriers, and the burdens of complying with a wide variety of foreign laws, each of which could have a material adverse effect on our business, financial condition, results of operations and liquidity.

Our business is subject to seasonal fluctuations, which are likely to cause our revenues and operating results to fluctuate.

Our operating results are influenced by seasonal fluctuations in the price of biodiesel. Our sales tend to decrease during the winter season due to perceptions that biodiesel will not perform adequately in colder weather. Colder seasonal temperatures can cause the higher cloud point biodiesel we make from inedible animal fats to become cloudy and eventually gel at a higher temperature than petroleum-based diesel or lower cloud point biodiesel made from soybean, canola or inedible corn oil. Such gelling can lead to plugged fuel filters and other fuel handling and performance problems for customers and suppliers. Reduced demand in the winter for our higher cloud point biodiesel may result in excess supply of such higher cloud point biodiesel and lower prices for such higher cloud point biodiesel. In addition, most of our production facilities are located in colder Midwestern states and our costs of shipping biodiesel to warmer climates generally increase in cold weather months. As a result of these seasonal fluctuations, comparisons of operating measures between consecutive quarters may not be as meaningful as comparisons between longer reporting periods.

Failure to comply with governmental regulations, including EPA requirements relating to RFS2, could result in the imposition of penalties, fines, or restrictions on our operations and remedial liabilities.

The biodiesel industry is subject to extensive federal, state and local laws and regulations related to the general population’s health and safety and compliance and permitting obligations, including those related to the use, storage, handling, discharge, emission and disposal of municipal solid waste and other waste, pollutants or hazardous substances, discharges, air and other emissions, as well as land use and development. Existing laws also impose obligations to clean up contaminated properties or to pay for the cost of such remediation, often upon parties that did not actually cause the contamination. Compliance with these laws, regulations and obligations could require substantial capital expenditures. Failure to comply could result in the imposition of penalties, fines or restrictions on operations and remedial liabilities. These costs and liabilities could adversely affect our operations.

Changes in environmental laws and regulations occur frequently, and any changes that result in more stringent or costly waste handling, storage, transport, disposal or cleanup requirements could require us to make significant expenditures to attain and maintain compliance and may otherwise have a material adverse effect on our business in general and on our results of operations, competitive position or financial condition. We are unable to predict the effect of additional environmental laws and regulations

16

Table of Contents

Risk factors

which may be adopted in the future, including whether any such laws or regulations would significantly increase our cost of doing business or affect our operations in any area.

Under certain environmental laws and regulations, we could be held strictly liable for the removal or remediation of previously released materials or property contamination regardless of whether we were responsible for the release or contamination, or if current or prior operations were conducted consistent with accepted standards of practice. Such liabilities can be significant and, if imposed, could have a material adverse effect on our financial condition or results of operations.

In addition to the regulations mentioned above, we are subject to various laws and regulations related to RFS2, most significantly regulations related to the generation and dissemination of RINs. These regulations are highly complex and evolving, requiring us to periodically update our compliance systems. Any violation of these regulations by us, inadvertently or otherwise, could result in significant fines and harm our customers’ confidence in the RINs we issue, either of which could have a material adverse effect on our business. For a detailed description of RINs, see “Industry overview—Government Programs Favoring Biodiesel Production and Use—Renewable Identification Numbers.”

We are a holding company and there are limitations on our ability to receive dividends and distributions from our subsidiaries.

All of our principal assets, including our biodiesel production facilities, are owned by subsidiaries and these subsidiaries are subject to loan covenants that generally restrict them from paying dividends, making distributions or making loans to us or to any other subsidiary. These limitations will restrict our ability to repay indebtedness, finance capital projects or pay dividends to stockholders from our subsidiaries cash flows from operations.

Our business may suffer if we are unable to attract or retain talented personnel.

Our success depends on the abilities, expertise, judgment, discretion, integrity, and good faith of our management and employees to manage the business and respond to economic, market and other conditions. We have a relatively small management team and employee base, and the inability to attract suitably qualified replacements or additional staff could adversely affect our business. No assurance can be given that our management team or employee base will continue their employment, or that replacement personnel with comparable skills could be found. If we are unable to attract and retain key personnel and additional employees, our business may be adversely affected.

If we fail to maintain effective internal control over financial reporting, we might not be able to report our financial results accurately or prevent fraud; in that case, our stockholders could lose confidence in our financial reporting, which would harm our business and could negatively impact the value of our stock.