Attached files

| file | filename |

|---|---|

| EX-23.2 - CONSENT OF DELOITTE & TOUCHE LLP - Mascoma Corp | d230618dex232.htm |

| EX-23.1 - CONSENT OF DELOITTE & TOUCHE LLP - Mascoma Corp | d230618dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on September 16, 2011.

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MASCOMA CORPORATION

(Exact Name of Registrant As Specified in Its Charter)

| Delaware | 2869 | 20-3639247 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

67 Etna Road, Suite 300

Lebanon, New Hampshire 03766

(603) 676-3320

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

William J. Brady

President and Chief Executive Officer

Mascoma Corporation

67 Etna Road, Suite 300

Lebanon, New Hampshire 03766

(603) 676-3320

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Jocelyn M. Arel, Esq. Michael J. Minahan, Esq. William J. Schnoor, Jr., Esq. Goodwin Procter LLP Exchange Place Boston, Massachusetts 02109 (617) 570-1000 |

Deanna L. Kirkpatrick, Esq. Richard D. Truesdell, Jr., Esq. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ¨ | Accelerated Filer ¨ | |||

| Non-Accelerated Filer x(Do not check if a smaller reporting company) | Smaller Reporting Company ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to Be Registered |

Proposed Maximum Aggregate |

Amount of Registration Fee | ||

| Common Stock, par value $0.001 per share |

$100,000,000 | $11,610 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933. |

| (2) | Includes additional shares of Common Stock that the underwriters have an option to purchase. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued , 2011

Shares

COMMON STOCK

Mascoma Corporation is offering shares of its common stock. This is our initial public offering and no public market exists for our shares. We anticipate that the initial public offering price will be between $ and $ per share.

We have applied to list our common stock on the under the symbol “ .”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 11 .

PRICE $ A SHARE

| Price to |

Underwriting |

Proceeds to | ||||

| Per Share |

$ | $ | $ | |||

| Total |

$ | $ | $ |

We have granted the underwriters the right to purchase up to an additional shares of common stock.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on , 2011.

| MORGAN STANLEY | UBS INVESTMENT BANK | CREDIT SUISSE |

| BAIRD | CANACCORD GENUITY |

, 2011

Table of Contents

We and the underwriters have not authorized anyone to provide you with additional or different information from that contained in this prospectus or any free writing prospectus. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date on the front cover of this prospectus, or other earlier date stated in this prospectus or in such free-writing prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

For investors outside of the United States: Neither we nor any of the underwriters has done anything that would permit this offering outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, and those which we intend to target, is based on information from various sources (including industry publications, surveys and forecasts and our internal research), on assumptions that we have made, which we believe to be reasonable, based on that data and other similar sources and on our knowledge of those markets. In most cases, our internal research has not been verified by any independent source. While we believe the industry information included in this prospectus is generally reliable, such information is inherently based on a number of assumptions and limitations and is therefore imprecise. In addition, projections, assumptions and estimates of our future performance and the future performance of the industries in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors” and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

Mascoma, MGT, the Mascoma logo and other trademarks or service marks of Mascoma appearing in this prospectus are the property of Mascoma. This prospectus contains additional tradenames, trademarks and service marks of other companies.

Until and including, , 2011 (25 days after commencement of this offering), all dealers that buy, sell, or trade shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes included elsewhere in this prospectus. You should also consider, among other things, the matters described in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in each case appearing elsewhere in this prospectus. Unless otherwise stated, all references to “us,” “our,” “Mascoma,” “we,” the “Company” and similar designations in this prospectus refer to Mascoma Corporation and its subsidiaries. In addition, all references to “our hardwood CBP facilities” refer to the first two hardwood CBP facilities that will be built, owned and operated by our collaborators in Kinross, Michigan and Drayton Valley, Alberta and to which we intend to license our technology.

Mascoma Corporation

Overview

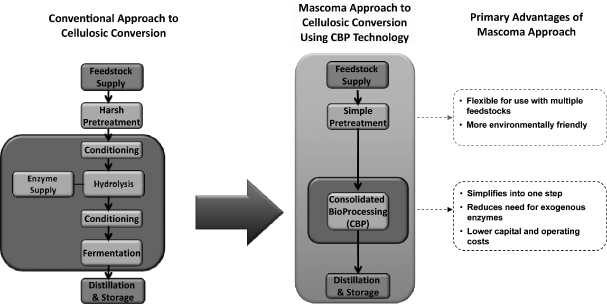

We are a renewable fuels company that has developed innovative technology for the low-cost conversion of abundant biomass. Our highly adaptable technology has also been demonstrated to convert biomass to renewable chemicals. Using our proprietary consolidated bioprocessing, or CBP, technology platform, we have developed genetically-modified yeasts and other microorganisms to reduce costs and improve yields in the production of renewable fuels and chemicals. Our CBP technology provides us with the ability to use a variety of feedstocks to produce multiple renewable fuel and chemical end-products. We plan to initially target the large and established first generation corn ethanol industry with our proprietary Mascoma Grain Technology, or MGT, yeast product. We are also working with leading industry participants to develop and construct commercial scale facilities to convert hardwood feedstocks into cellulosic ethanol. We believe that these facilities will offer compelling economic value to us and our collaborators based on the expected operating costs of these facilities and today’s market prices for fuel and feedstocks. In the future, we plan to expand the application of our CBP technology to develop advanced biorefineries that produce multiple high-value end-products, such as advanced fuels and chemicals, from many different feedstocks.

Conversion of cellulosic biomass typically involves a difficult process of breaking down the complex sugars found in plant material into simple, easy-to-process sugars and then converting these simple sugars into end-products. Our proprietary microorganisms, and our methodology for producing them, allow us to streamline the biomass conversion process and alleviate the need to purchase most of the expensive enzymes used in the process. Our microorganisms have been demonstrated to convert different types of plant material into fuel and chemical end-products in industrial processing conditions. We have built on decades of research to develop and acquire intellectual property related to biomass conversion technologies, including in the fields of pretreatment, hydrolysis, metabolic pathway engineering, enzyme expression and processes for biomass conversion. As of September 1, 2011, we owned or had licensed rights to approximately 75 distinct patent families in the United States, Canada and various other foreign jurisdictions covering our products, technologies and processes, which included approximately 9 issued patents and approximately 205 pending patent applications in the United States and various foreign jurisdictions.

We have established a staged strategy for the commercialization of our innovative CBP technology platform in the renewable fuels and chemicals industries. Our first commercial application of CBP technology is our genetically-modified MGT yeast product that can be used by corn ethanol producers as a drop-in substitute for existing yeasts. We expect to begin selling this product in 2012. We believe this product is capable of significantly improving the economics of corn ethanol production with negligible capital expenditures and will generate near-term revenue and gross margin for our company. We intend to capture, through a license

1

Table of Contents

agreement or other arrangement, a significant portion of the incremental margin generated by our line of MGT yeast products. We plan to pursue the corn ethanol market first in order to capitalize on the size and maturity of this market, the technologically advanced nature of our MGT product compared to conventional yeasts and our ability to cost-effectively deploy our CBP technology. Our initial MGT product adds value by alleviating the need to purchase most of the expensive enzymes currently used in corn ethanol production, lowering production costs. Based on laboratory test runs and management estimates of ethanol production costs, we believe that our initial MGT product will reduce the cost of producing corn ethanol by approximately $0.01 to $0.02 per gallon. As a result, we believe that this product can create significant and immediate value to corn ethanol producers, which collectively produced over 13 billion gallons of corn ethanol in the United States in 2010. Future generations of our MGT product are also expected to improve ethanol yields, further lowering production costs and potentially increasing revenue for corn ethanol producers. Based on laboratory test runs, we believe future generations of our MGT product will be capable of ethanol yield improvements of up to 4%. Our MGT yeast products are subject to scientific review by the Center for Veterinary Medicine, or CVM, section of the Food and Drug Administration. See the section entitled “Business—Regulatory Matters” for more information about this regulatory process.

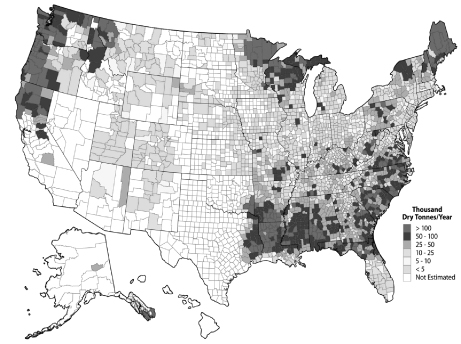

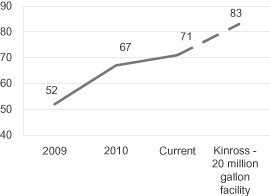

We are also working with leading industry participants to develop and construct commercial scale facilities to convert abundant and low-cost hardwood pulpwood to cellulosic ethanol. Based on pilot production runs at our demonstration facility in Rome, New York, we have achieved hardwood to ethanol conversion yields of 67 gallons per bone dry short ton of hardwood. In a laboratory setting we have achieved ethanol conversion yields of 71 gallons per bone dry short ton of hardwood and we are working to continue to improve conversion yields. At our planned 20 million gallon per year commercial-scale hardwood CBP facility in Kinross, Michigan, we expect to achieve hardwood to ethanol conversion yields of 83 gallons per bone dry short ton of hardwood with unsubsidized cash operating costs of approximately $1.77 per gallon. These estimates assume a hardwood feedstock cost of $66 per bone dry short ton of hardwood and are based on a 20 million gallon per year facility. Over the next several years we are targeting unsubsidized cash operating costs, net of revenue from the sale of co-products such as electricity, of less than $1.00 per gallon based on ethanol yields of 87 gallons per bone dry short ton of hardwood, increases in process efficiencies, economies of scale and ongoing improvements in enzyme expression and metabolic engineering in our microorganisms.

We expect that our first two hardwood CBP facilities will be built in Kinross, Michigan and Drayton Valley, Alberta. We anticipate construction of our hardwood CBP facility in Kinross, Michigan to start in the next 3 to 6 months and construction of our hardwood CBP facility in Drayton Valley, Alberta to start within 12 to 24 months. Our hardwood CBP commercialization strategy is “capital-light,” in that rather than build and operate the hardwood CBP facilities directly, we expect to collaborate with third parties to fund, build, develop and operate the facilities, while we contribute technology and receive fees and/or an equity interest in the facilities. For these two initial hardwood CBP facilities we expect to use government grants in addition to equity funding from strategic partners, but for future facilities we expect to rely primarily on financing from strategic and financial partners.

In the future, we plan to expand the application of our CBP technology to develop advanced biorefineries that produce multiple fuel and chemical end-products from a variety of feedstocks. Beyond corn and hardwood, we have already shown the flexibility of our CBP technology platform through the conversion into ethanol of a number of additional feedstocks in a laboratory setting, including corn stover, sugarcane bagasse, palm residue, softwood, miscanthus, switchgrass, paper sludge and sorghum, many of which are abundant and have limited end uses. We believe our feedstock flexibility will enable us to more effectively enter new geographic markets. In terms of end-products, we have demonstrated in a laboratory setting the production of propanol and fatty acids. These chemicals can in turn be used to create propylene and alkanes, which are the building blocks of many petrochemical replacements, and we plan to continue to expand the number of potential end-products.

2

Table of Contents

Market Opportunity

As a result of our highly adaptable CBP technology platform, we intend to operate across the renewable fuels and chemicals industries, with a near-term focus on ethanol. We believe there is a significant market need for a low-cost, more sustainable alternative to petroleum-based products that is less volatile with respect to price and supply.

First Generation Ethanol

Virtually all the ethanol produced globally today is from edible sugar and starch sources, including corn in the United States and sugarcane in Brazil. These fuels are commonly referred to as first generation biofuels. The ethanol industry has grown significantly over the past several years. According to the Renewable Fuels Association, or RFA, U.S. corn ethanol production increased from 3.6 billion gallons in 2005 to over 13 billion gallons in 2010, which represented a compound annual growth rate of over 30% for that period, and ethanol exports in 2010 hit a record high of 350 million gallons. As of 2010, over 200 ethanol plants existed in the United States. We believe this large and established industry presents a compelling market for our drop-in MGT yeast product. In addition, current ethanol producers benefit from a volumetric ethanol excise tax credit from the Internal Revenue Service of $0.45 per gallon of ethanol produced or sold domestically. With the potential expiration of this credit in the near-term, we believe corn ethanol producers will be motivated to purchase products that reduce operating costs and improve ethanol yields to support their margins.

Second Generation Ethanol

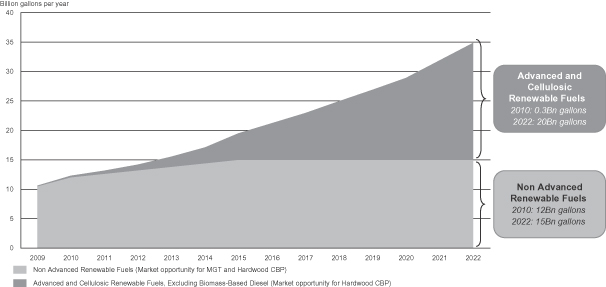

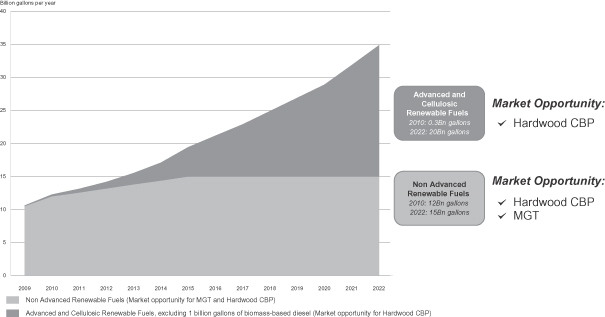

As the demand for biofuels continues to grow, we believe production will shift increasingly from food-based to non-food based sources. Fuels produced from municipal solid waste and non-food plant materials such as hardwood, bagasse, corn stover and dedicated energy crops like switchgrass and miscanthus, are commonly referred to as second generation biofuels. While corn is expected to remain the primary feedstock for ethanol production in the United States in the near-term, there is an increasing push to produce ethanol and other biofuels from non-food plant materials. The U.S. Renewable Fuel Standard Program, or RFS, was established by the U.S. Environmental Protection Agency, or EPA, in 2005 under the Energy Policy Act of 2005. As required by the Energy Independence and Security Act of 2007, the standards were revised in February 2010. We refer to these modifications as RFS2, which, among other requirements, mandate that 36 billion gallons of renewable fuels (such as biofuels) from multiple sources be blended into transportation fuels by 2022. Of the 36 billion gallons of renewable fuels mandated by 2022, 20 billion gallons are mandated to be advanced biofuels (excluding 1 billion gallons of biomass-based diesel), with at least 16 billion gallons required to be cellulosic biofuels. Biofuels are primarily produced from corn, cereal grains, sugarcane and other organic materials. Advanced biofuels are renewable fuels that produce at least 50% less greenhouse gases, or GHG, on a life cycle basis compared to GHG emissions of petroleum products as measured in 2005. Cellulosic biofuels are renewable fuels produced from wood, grasses or non-edible parts of plants that produce at least 60% less GHG on a life cycle basis compared to GHG emissions of petroleum products as measured in 2005. The vast majority of ethanol consumed in the United States today is produced from corn and does not satisfy RFS2 advanced biofuels requirements. We expect the ethanol produced at our hardwood CBP facilities will be a cellulosic biofuel and we intend to capitalize on this mandated market.

Market Challenges

The market for renewable fuels and chemicals has evolved significantly over the past several years, with many companies seeking to capitalize on the growing market potential and the environmental benefits offered by these products. However, many challenges exist and we believe that companies will need to satisfy the following criteria to succeed in this market:

| • | Demonstrated and Validated Technology. Numerous technologies have been offered as solutions for producing renewable fuels and chemicals. However, in order to become economically viable, many |

3

Table of Contents

| of these emerging technologies rely on anticipated technological improvements and future cost reductions. We believe there is a clear market demand for technologies that have been demonstrated and are expected to be cost-competitive at a commercial scale. We believe that the validation and adoption of a particular technology by independent third parties, whether as engineering, off-take or feedstock partners, are critical. |

| • | Comprehensive, Integrated Process. Many of the emerging technologies in the second generation biofuels markets are focused on just one of the steps in the biomass conversion process. These solutions rely on compatibility with, and often improvements in, other stages of the process by third parties in order to achieve economic viability. As a result, we believe there is a strong need for a comprehensive and viable biochemical solution that facilitates biomass conversion without dependence on other pending emerging technologies. |

| • | Low Cost. We believe that market participants are focused on a technology’s all-in cost, which takes into account upfront capital spending as well as ongoing operating costs. Most of the non-feedstock operating costs in current processes are related to the need to purchase most of the expensive enzymes required to make the technology work. For example, we believe enzymes may account for approximately $0.50 per gallon in operating costs for cellulosic ethanol facilities. As a result, we believe a process that eliminates or reduces enzyme and associated costs would have an advantage over other technologies. |

| • | Flexibility. Currently, the vast majority of biofuels are developed from food-based feedstocks such as corn, cereal grains and sugarcane. Given their dependence on a single feedstock, corn ethanol producers have been significantly impacted by volatility in the price of corn. It is expected that future growth in this industry will come from non-food feedstocks. The technologies utilized by producers of first generation ethanol are currently used to produce one primary end-product and are generally unable to process inputs other than their primary feedstock. We believe ethanol producers and other industry participants are looking for a flexible technology that can be applied to different feedstocks and can produce various end-products. |

Our Competitive Strengths

We believe that we benefit from the following competitive strengths:

| • | Proven CBP Technology. We have demonstrated the performance of our MGT yeast product and hardwood CBP technology as follows: |

| • | Validation of the performance of our initial MGT yeast product by ICM, Inc., the leading provider of engineering services to the ethanol industry; |

| • | Successful production runs using our hardwood CBP microorganisms, including more than 1,000 continuous hours of operating data on a fully-integrated basis at our demonstration facility in Rome, New York; |

| • | Validation of our hardwood CBP technology by independent engineers at the U.S. Department of Energy and by independent third parties; and |

| • | Proven commercial use of the core equipment used in our biomass conversion process, with the front-end pretreatment equipment traditionally used in the pulp and paper industries, and the back-end distillation equipment used in the fuels and petrochemical industries. |

| • | Comprehensive and Efficient Biochemical Solution for Biomass Conversion. We know of no other company that provides a comprehensive biochemical solution for the production of renewable fuels and chemicals from multiple feedstocks that covers the full spectrum of the biomass conversion process, including pretreatment, hydrolysis and fermentation. By controlling key aspects of our manufacturing process, we are not reliant on technological improvements or cost reductions by third parties to be |

4

Table of Contents

| cost-competitive. We believe our CBP technology platform, which converts cellulosic biomass into high-value end-products in a single step, increases our ability to reduce costs for both corn ethanol producers and producers of second generation ethanol and provides us with a competitive advantage over other technologies and processes. |

| • | Low All-in Cost Solution. CBP is distinct from other, less integrated configurations, in that it alleviates the need to purchase most of the expensive enzymes associated with most other ethanol production methods while also improving yields. In doing so, the technology enables the cost-effective conversion of cellulosic biomass into renewable fuels and chemicals, and lowers costs in first generation ethanol production. Our substantial experience with CBP technology has enabled us to develop an integrated biomass conversion solution that is differentiated by its cost-effectiveness today, without government subsidies or incentives or third-party improvements in technology or yield. In addition, we believe there will be significant future cost reduction opportunities using our CBP technology as we gain experience with commercial processing and benefit from economies of scale. |

| • | Capital-Light Path to Revenue Generation. The commercialization of our initial MGT yeast product is not dependent on any meaningful capital expenditures by us or any third parties. Our hardwood CBP commercialization strategy is “capital-light,” in that rather than build and operate the hardwood CBP facilities directly, we intend to collaborate with third parties to fund, build, develop and operate the facilities, while we contribute technology and receive fees from and/or an equity interest in each facility to provide us with a share of that facility’s profits and related cash flow. As a result, we believe our business model has the potential to generate significant financial returns while minimizing our operational and financial risk. |

| • | Feedstock Flexible and Adaptable Technology. CBP is a flexible technology that we believe can be adapted for a wide variety of potential feedstocks. As a result, we expect that we will be able to adjust our focus based on long-term changes in the market demand for particular feedstocks. Being feedstock flexible also allows us to provide a value-add product to the mature first generation ethanol market in the near-term, while, over time, adapting our technology for use in different regions based on the feedstock that is the least expensive and most abundant in the region. To date, in addition to our proven ability to convert corn and hardwood, we have also successfully demonstrated in a laboratory setting the ability to convert a number of additional feedstocks including corn stover, bagasse, palm residue, softwood, miscanthus, switchgrass, paper sludge and sorghum. In the long-term, we believe our adaptable CBP technology will also enable us to produce a variety of end-products, including advanced fuels and chemicals. |

| • | Deep Domain Expertise. We believe that our business is differentiated by our ability to leverage the deep domain expertise of an exceptional and distinguished group of executives, scientists and partners. Our management team has a strong, demonstrated record of leadership and growth in the fuel, chemical and biotechnology industries. We were founded by pioneers in consolidated bioprocessing and cellulose conversion, Dr. Lee Lynd and Dr. Charles Wyman, who, together with Dr. Michael Ladisch, are our key science officers. They possess deep domain knowledge of cellulosic biomass, biomass conversion, pretreatment, fermentation and related processes and regularly provide us with insight into important technical and engineering aspects of the conversion of cellulosic biomass into renewable fuels and chemicals. We believe that our combination of management, intellectual property, know-how and technical expertise sets us apart in the industry. |

5

Table of Contents

Our Strategy

We have a staged approach for the commercialization of our CBP technology. We intend to go to market first with our genetically-modified MGT yeast product while also working with leading industry participants to develop and construct commercial scale facilities to convert hardwood feedstocks into cellulosic ethanol. Our long-term goal is to provide the leading technology to advanced biorefineries for the conversion of biomass from non-food plants to fuels and chemicals.

| • | Deploy our Proprietary MGT Product to the Large and Established Corn Ethanol Market. Our first commercial application of CBP technology is our proprietary MGT product, which is a genetically-modified yeast product that can be used by corn ethanol producers as a drop-in substitute for conventional fermenting yeast. Following the completion of CVM review and approval, we intend to market this product to the more than 200 corn ethanol plants that, according to the RFA, produced over 13 billion gallons of ethanol in the United States in 2010. We believe our initial MGT product is capable of significantly improving the economics for corn ethanol producers and will generate near-term revenue and gross margin for our company and requires negligible capital expenditures. Based on laboratory test runs, we believe future generations of our MGT product will be capable of ethanol yield improvements in commercial-scale ethanol production of up to 4%. We believe this compelling value proposition will drive rapid adoption of our MGT products among first generation ethanol producers, solidify our technology leadership position and help establish our credibility in the larger fuel market. |

| • | Convert Hardwood Pulpwood into Cellulosic Ethanol on a Commercial Scale. We believe that converting hardwood to cellulosic ethanol is the best entry point into the advanced biofuels market given the abundant supply and low cost of hardwood feedstock. We are working with leading industry participants to develop and construct our first two hardwood CBP facilities in Kinross, Michigan and Drayton Valley, Alberta. We expect construction of our hardwood CBP facility in Kinross, Michigan to start in the next 3 to 6 months and construction of our hardwood CBP facility in Drayton Valley, Alberta to start within 12 to 24 months. We believe that our hardwood CBP facilities will serve as the foundation for our expansion into new feedstocks and end-products and that the success of our initial hardwood CBP facilities may facilitate the use of traditional project financing for future facilities. |

| • | Expand into New Geographies and Different Feedstocks. Upon successful commercial application of our CBP technology platform to hardwood feedstocks in North America, we believe we will be able to apply this highly adaptable technology to different feedstocks and enter new geographic markets. For example, we believe there is significant market opportunity to adapt our CBP technology through the development of microorganisms to convert sugarcane bagasse and cane trash into ethanol, which are abundant and low-cost feedstocks in Brazil and other geographies. We are also exploring the application of our technology in other countries including Canada, China, India and South Africa. |

| • | Enable Advanced Biorefineries. Our long-term goal is to enable the development of advanced biorefineries that utilize multiple feedstocks to produce a wide variety of high-value fuels and chemicals. The biorefinery concept is analogous to petroleum refineries that currently produce a wide spectrum of fuels and chemicals from petroleum. However, unlike petroleum refineries, a biorefinery utilizing our technology could be adapted for a different feedstock or end-product without significant changes to its installed infrastructure. Through a biorefinery approach, we intend to expand into the industrial chemicals market through conversion of biomass feedstock into higher-value chemicals such as ethylene and propylene derivatives by adding on to existing hardwood CBP facilities and by developing dedicated biomass-to-chemical refineries. The markets for these chemicals are global, growing and significant, and we believe that in the future we will be able to access these markets with our technology platform. |

6

Table of Contents

Risk Factors

Our business is subject to many risks and uncertainties, as more fully described in the section entitled “Risk Factors” in this prospectus, of which you should be aware before investing in our common stock. For example:

| • | We have a limited operating history, a history of losses and the expectation of continuing losses. |

| • | We may not achieve or sustain positive cash flow and we may be unable to obtain additional financing to grow our business, develop or enhance our products or respond to competitive pressures. |

| • | In order to sell any of our MGT yeast products to corn ethanol producers we must obtain regulatory approval, and any delays in receiving approval could have a material adverse effect on our business, financial condition and results of operations. |

| • | Our MGT yeast products may not perform as expected or be accepted by ethanol producers. |

| • | We will rely on third parties to manufacture, validate and commercialize our MGT yeast product, and actions by these third parties may adversely affect the commercialization and market acceptance of our MGT products. |

| • | We have no experience applying our CBP technology to the production of renewable fuels or chemicals at commercial scale and our management has limited experience in the renewable fuels and chemicals business, and as a result, we may not be successful in commercializing our hardwood CBP technology. |

| • | We will rely on third parties to commercialize our hardwood CBP technology and as a result the successful implementation of our technology will be dependent on these parties performing satisfactorily. |

| • | We and our collaborators may encounter unforeseen operational and financial difficulties in constructing our hardwood CBP facilities in Kinross, Michigan and Drayton Valley, Alberta. |

| • | The government grants and awards that we receive are subject to certain conditions and obligations and if we fail to meet our obligations the research funded by these grants and the construction of our initial commercial-scale hardwood CBP facilities may be materially delayed. |

| • | Our hardwood CBP commercialization strategy relies heavily on our ability to negotiate and execute definitive agreements with third parties. |

| • | The market for renewable fuels and chemicals may not develop as anticipated. |

Our Corporate Information

We were incorporated in the state of Delaware on October 14, 2005. Our principal executive offices are located at 67 Etna Road, Suite 300, Lebanon, New Hampshire 03766 and our telephone number is (603) 676-3320. Our website address is www.mascoma.com. We do not incorporate the information on or accessible through our website into this prospectus, and you should not consider any information on, or that can be accessed through, our website as part of this prospectus.

7

Table of Contents

| Common stock offered by us |

shares |

| Common stock to be outstanding after this offering |

shares |

| Underwriter’s option to purchase additional shares |

The underwriters have an option to purchase a maximum of additional shares of common stock from us. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

| Use of proceeds |

We estimate that we will receive net proceeds from the sale of shares of our common stock in this offering of approximately $ , or $ if the underwriters fully exercise their option to purchase additional shares, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for working capital and other general corporate purposes, including for sales and marketing activities related to our MGT yeast product and for research and development activities, including those related to our next-generation MGT yeast products, the scale-up of our hardwood CBP technology and the application of our technology to other potential feedstocks and end-products, including renewable chemicals. We may also use net proceeds for possible investments in, or acquisitions of, complementary businesses, services or technologies. See the section entitled “Use of Proceeds.” |

| Risk factors |

You should read carefully the section entitled “Risk Factors” for a discussion of factors that you should consider before deciding to invest in shares of our common stock. |

The number of shares of our common stock to be outstanding after this offering is based on 54,043,199 shares of our common stock outstanding as of June 30, 2011, and excludes:

| • | 9,535,916 shares of our common stock issuable upon exercise of outstanding options as of June 30, 2011 at a weighted-average exercise price of $2.14 per share; |

| • | 4,986,648 shares of common stock issuable upon the exercise of outstanding warrants as of June 30, 2011 at a weighted-average exercise price of $3.48 per share; and |

| • | 4,513,742 shares of our common stock reserved as of June 30, 2011 for future issuance under our equity incentive plans that are not issued or subject to outstanding grants. |

Except as otherwise indicated, all information in this prospectus is as of June 30, 2011 and reflects or assumes:

| • | the filing of our amended and restated certificate of incorporation and the adoption of our amended bylaws as part of the consummation of this offering; |

| • | the conversion of the outstanding shares of our convertible preferred stock into an aggregate of 46,318,457 shares of our common stock upon the consummation of this offering; and |

| • | no exercise by the underwriters of their option to purchase up to an additional shares of our common stock in this offering. |

8

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table presents our summary consolidated financial data for the periods indicated. The summary consolidated statement of operations data for the years ended December 31, 2008, 2009 and 2010 presented below are derived from our audited consolidated financial statements that are included elsewhere in this prospectus. The summary consolidated statement of operations data for the six months ended June 30, 2010 and 2011 and the summary condensed consolidated balance sheet data as of June 30, 2011 are derived from our unaudited consolidated financial statements that are included elsewhere in this prospectus. Historical results are not necessarily indicative of the results for future periods. You should read this summary consolidated financial data in conjunction with the sections entitled “Capitalization,” “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus and our consolidated financial statements and the related notes included elsewhere in this prospectus.

| Years Ended December 31, | Six Months Ended June 30, | |||||||||||||||||||

| 2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||||||

| Consolidated statements of operations data: |

||||||||||||||||||||

| Total revenues |

$ | 3,896 | $ | 8,436 | $ | 15,492 | $ | 5,711 | $ | 6,668 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cost or product sales and operating expenses |

||||||||||||||||||||

| Cost of product sales |

— | — | 1,120 | — | 455 | |||||||||||||||

| Research and development(1) |

24,327 | 28,270 | 26,539 | 12,450 | 13,203 | |||||||||||||||

| Selling, general and administrative(1) |

9,344 | 5,059 | 10,212 | 3,947 | 5,036 | |||||||||||||||

| Loss on asset disposals and lease abandonment |

799 | 9,213 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total cost and operating expenses |

34,470 | 42,542 | 37,871 | 16,397 | 18,694 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(30,574 | ) | (34,106 | ) | (22,379 | ) | (10,686 | ) | (12,026 | ) | ||||||||||

| Other income (expense), net |

113 | (1,366 | ) | (3,407 | ) | 288 | (2,337 | ) | ||||||||||||

| Equity in loss of equity method investment |

— | — | (143 | ) | — | (173 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

(30,461 | ) | (35,472 | ) | (25,929 | ) | (10,398 | ) | (14,536 | ) | ||||||||||

| Amount attributable to redeemable noncontrolling interest |

— | (2,830 | ) | 201 | 87 | 19 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss attributable to Mascoma Corporation |

(30,461 | ) | (38,302 | ) | (25,728 | ) | (10,311 | ) | (14,517 | ) | ||||||||||

| Accretion of redeemable convertible preferred stock |

(216 | ) | (253 | ) | (205 | ) | (124 | ) | (279 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss attributable to common stockholders of Mascoma Corporation |

$ | (30,677 | ) | $ | (38,555 | ) | $ | (25,933 | ) | $ | (10,435 | ) | $ | (14,796 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss attributable to Mascoma common stockholders per share—basic and diluted |

$ | (12.25 | ) | $ | (12.61 | ) | $ | (5.39 | ) | $ | (3.15 | ) | $ | (1.92 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted-average common shares outstanding—basic and diluted |

2,505,159 | 3,058,138 | 4,813,191 | 3,315,566 | 7,724,742 | |||||||||||||||

| Pro forma net loss attributable to Mascoma common stockholders per share (unaudited)—basic and diluted(2) |

$ | (0.52 | ) | $ | (0.27 | ) | ||||||||||||||

| Pro forma weighted-average common shares outstanding (unaudited)—basic and diluted(2) |

49,798,315 | 54,043,199 | ||||||||||||||||||

9

Table of Contents

| (1) | Includes stock-based compensation expense (see the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates—Stock-Based Compensation” elsewhere in this prospectus for additional information). |

| (2) | Net loss used in computing pro forma basic and diluted net loss per share and the number of weighted-average common shares used in computing pro forma basic and diluted net loss per share give effect to the automatic conversion of all of our outstanding convertible preferred stock into 46,318,457 shares of common stock upon the completion of this offering as if such conversion had occurred at the beginning of the period. |

| As of June 30, 2011 | ||||||||||

| Actual | Pro forma(1) | Pro forma as adjusted(2) | ||||||||

| (in thousands) | ||||||||||

| Consolidated Balance Sheet Data: |

||||||||||

| Cash, cash equivalents and short-term investments |

$ | 12,092 | $ | 12,092 | ||||||

| Working capital |

6,382 | 6,382 | ||||||||

| Total assets |

85,826 | 85,826 | ||||||||

| Long-term debt (including current portion) |

10,000 | 10,000 | ||||||||

| Redeemable convertible preferred stock |

158,269 | — | ||||||||

| Redeemable common stock |

1,172 | — | ||||||||

| Warrant liabilities |

7,429 | — | ||||||||

| Stockholders’ (deficit) equity |

(118,722 | ) | 48,148 | |||||||

| (1) | The pro forma consolidated balance sheet data gives effect to (i) the conversion of all of our outstanding convertible preferred stock in connection with the completion of this offering, (ii) the termination of the put rights held by the holder of our redeemable common stock, and (iii) conversion of all of our warrants for convertible preferred stock into warrants for common stock and the related reclassification of the warrant liabilities to stockholders’ equity upon the completion of this offering. |

| (2) | The pro forma as adjusted consolidated balance sheet data gives effect to (i) the conversion of all of our outstanding convertible preferred stock in connection with the completion of this offering, (ii) the termination of the put rights held by the holder of our redeemable common stock, and (iii) conversion of all of our warrants for convertible preferred stock into warrants for common stock and the related reclassification of the warrant liabilities to stockholders’ equity upon the completion of this offering, and (iv) the sale of shares of common stock in this offering at the initial public offering price of $ per share, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

10

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the following risks and uncertainties, together with all other information in this prospectus, including our consolidated financial statements and related notes, before investing in our common stock. Any of the risk factors we describe below could adversely affect our business, financial condition or results of operations. The market price of our common stock could decline if one or more of these risks or uncertainties actually occurs, causing you to lose all or part of your investment. Certain statements below are forward-looking statements. See the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to Our Business and Our Industry

We have a limited operating history, a history of losses and the expectation of continuing losses.

Our company has only been in existence since October 2005 and we have no experience in the markets in which we intend to operate. Through June 30, 2011, we generated revenue primarily from government grants and product sales consisting of equipment for the pretreatment of biomass feedstocks. In the year ended December 31, 2010, our total revenue was $15.5 million with government grants constituting 86% of our revenue and product sales and other service agreements constituting 14% of our revenue. We have incurred substantial net losses since our inception, including net losses of $30.5 million, $35.5 million and $25.9 million for the years ended December 31, 2008, 2009 and 2010, respectively, and $14.5 million for the six months ended June 30, 2011. We expect these losses to continue. As of June 30, 2011, we had an accumulated deficit of $138.0 million. We have not yet commercialized any of our products and technologies. We intend to sell our Mascoma Grain Technology, or MGT, yeast product to corn ethanol producers but have not yet negotiated agreements for the manufacture or sale of our MGT yeast product. We also intend to participate in the development and construction of facilities in Kinross, Michigan and Drayton Valley, Alberta for the production of ethanol from hardwood feedstocks, however we and our collaborators have not yet secured financing for the development and construction of these facilities. The risks associated with our ability to commercialize our MGT yeast product and our hardwood consolidated bioprocessing, or CBP, technology are described in more detail below. We expect to continue to incur substantial costs and expenses in connection with our planned commercialization of our MGT yeast product, the planned construction and scale-up of our hardwood CBP facilities in Kinross, Michigan and Drayton Valley, Alberta and the expansion of our research and development activities. We will need to generate and sustain increased revenue levels in future periods in order to become profitable. We cannot assure you that we will ever achieve or sustain profitability on a quarterly or annual basis. Any assessments of our business and predictions you make about our future success or viability may not be as accurate as they could be if we had an operating history on which you could base your assessments and predictions, including our ability to generate revenue and execute our business plan.

We may not achieve or sustain positive cash flow and we may be unable to obtain additional financing to grow our business, develop or enhance our products or respond to competitive pressures.

We are entirely dependent on financing activities to fund our capital expenditures and working capital requirements. To develop our products and technology, we have made significant investments in research and development. Our cash used in operating activities and capital expenditures was $54.5 million, $31.7 million and $22.7 million in the years ended December 31, 2008, 2009 and 2010, respectively, and $11.1 million in the six months ended June 30, 2011. Since our inception through June 30, 2011, we have raised an aggregate of $135.3 million from private placements of equity securities and debt financing, including $105.3 million in proceeds from the sale of preferred equity securities, $10.0 million in proceeds from the sale of convertible notes, and $20.0 million in borrowings under our secured debt financing arrangements. In addition, for our two initial hardwood CBP facilities we expect to use government grants in addition to equity funding from strategic partners, and for future facilities we expect to rely primarily on financing from strategic and financial partners. We anticipate that we will continue to have negative cash flow for the next several years as we continue to incur substantial costs and expenses related to the development and expansion of our business, including our research,

11

Table of Contents

testing and development expenses. Our business will also require significant amounts of working capital to support our growth. Any required additional financing may not be available on terms acceptable to us, or at all. If we raise additional funds by issuing equity securities, you may experience significant dilution of your ownership interest, and the newly-issued securities may have rights senior to those of the holders of our common stock. If we raise additional funds by obtaining loans from third parties, our interest expense would increase. Our inability to generate positive cash flow in the future or raise additional capital on reasonable terms would materially and adversely affect our business, financial condition and results of operations.

In order to sell any of our MGT yeast products to corn ethanol producers, we must obtain regulatory approval, and any delays in receiving approval will have a material adverse effect on our business, financial condition and results of operations.

We intend to sell our proprietary MGT yeast product to corn ethanol producers. Certain by-products of the corn ethanol conversion process are used as animal feed. Our MGT products are genetically modified and are considered to be processing aids in the production of animal feed. As a result, our MGT products are subject to regulation by the U.S. Food and Drug Administration’s Center for Veterinary Medicine, or CVM, and must subsequently be approved by the American Association of Feed Control Officers, or AAFCO. The first release of our MGT product, or MGT 1.0, is currently under scientific review at CVM. Because our MGT product is a genetically modified organism, or GMO, the CVM review process may require significant time. While we expect CVM to complete its review in the fourth quarter of 2011 or early 2012, such reviews can take years, and there is no guarantee the scientific review of our MGT yeast product will result in a positive outcome. Further, approval by CVM does not guarantee approval by AAFCO. We are also developing next-generation MGT product releases that increase yields in addition to further reducing the need for exogenous enzymes, and we will also need to secure regulatory approval of these and any future MGT products used as processing aids in the production of animal feed. We have spent considerable time and resources developing our line of MGT yeast products. Other than government grants and sales of pretreatment equipment, the planned sale of our MGT product to corn ethanol producers is our only potential near-term source of revenue. Any delay in receiving regulatory clearance will slow or prevent the commercialization of these products, which will have a material adverse effect on our business, financial condition and results of operations.

Our MGT yeast products may not perform as expected or be accepted by ethanol producers.

Subject to CVM review and approval and the execution of agreements with third parties required for the manufacture and commercialization of our MGT 1.0 product, we intend to begin selling our MGT 1.0 yeast product to corn ethanol producers for use in the ethanol production process. However, the yeast products currently being used by corn ethanol producers have been used for many years and corn ethanol producers may not be willing to add, or may be skeptical of adding, a new product to their production process. We expect new customers, particularly early adopters, to conduct tests of our products and/or to initially use our products for a limited percentage of their operations in order to confirm for themselves the products’ efficacy and performance. These trials may result in a slower roll-out than expected. ICM, Inc., the leading provider of engineering services to the ethanol industry, has validated the performance of our MGT 1.0 product, however, this product has not yet been tested by a broad range of potential customers or at commercial scale. In addition, while ICM is also in the process of testing our next-generation MGT product, the expected yield increases associated with that product have not yet been validated by any third parties. There can be no assurance that the results of any future tests by ICM, potential customers or other third parties of our MGT products will be consistent with results achieved by us in a pilot or laboratory setting. There can be no assurance that these or any future generations of our MGT product will perform as expected or that the cost savings to corn ethanol producers will meet our or their expectations. Any revenue from our MGT product will be primarily based on the incremental cost savings to corn ethanol producers from using our MGT product and their actual cost savings may not meet our expectations. We intend to sell our MGT product at a higher price than corn ethanol producers currently pay for conventional fermenting yeast. To be successful, we will need to convince corn ethanol producers that the higher price of our

12

Table of Contents

product is justified by the benefits that the product provides. We cannot guarantee that our efforts to educate corn ethanol producers about the benefits of our genetically-modified MGT products will be effective. Even if effective, these efforts may take a significant amount of time and corn ethanol producers may delay large purchases of our MGT product until the benefits are demonstrated at additional test sites. Further, even if producers adopt our MGT 1.0 product, there is no assurance that they will also adopt future releases of our MGT products. Failure by us to successfully market and sell our MGT product to one or more of the corn ethanol industry’s leading participants would directly limit our market penetration and could influence the credibility of our MGT product. If corn ethanol producers do not adopt our MGT product, our business and results of operations will be materially and adversely affected.

We will rely on third parties to manufacture, validate and commercialize our MGT yeast product, and actions by these third parties may adversely affect the commercialization and market acceptance of our MGT products.

While we have not finalized any commercial arrangements, we expect to rely on third parties for the manufacture of our MGT yeast product. Our use of third parties reduces our control over our product and exposes us to certain risks. For example, our operations could be materially disrupted if we lose one of our manufacturers or if one of our manufacturers experiences a significant interruption in its business and is unable meet our demand. If it is necessary to replace our manufacturers, either with toll manufacturers or with our internal resources, we may need to incur additional costs. If any of these manufacturers do not fulfill their contractual duties, meet expected deadlines or provide quality products, we may not be able to meet our obligations to our customers, which could result in damage to our reputation and adversely affect our business and results of operations. We may also rely on our yeast manufacturer or other third parties to assist in the sale of our MGT product to corn ethanol producers. These third parties may not be effective at selling our products. If the third parties we rely on to sell our products do not fulfill their contractual duties or perform effectively, our business, results of operations and financial condition could be materially and adversely affected. Further, if we rely on a single or small number of third parties for the manufacture of our MGT product, we will be exposed to the credit risk of those third parties.

In addition, while we have not yet entered into a definitive agreement, our commercialization strategy for our MGT product also relies in part on our relationship with ICM. ICM is an ethanol plant engineering company that has designed approximately 60% of the operating ethanol production capacity in the United States. ICM helps test and, if the results warrant, validate our MGT product. To date, ICM has provided independent validation of the performance of our initial MGT product and is currently in the process of validating our next-generation MGT product. There can be no assurance that these or future generations of our MGT products will receive validation from ICM or any other third parties on the schedule we expect or at all. We may experience difficulty commercializing these products without third party validation. We expect to rely on ICM to facilitate the adoption of the MGT product by third party corn ethanol producers in their production process. We cannot be certain that a definitive agreement with ICM with regard to the testing of our MGT product will be reached or that ICM will agree to facilitate the adoption of our products by corn ethanol producers. If we do not enter into an agreement or if our relationship with ICM is terminated for any reason or if ICM fails to validate our products, we may encounter difficulties in commercializing our products and accordingly, our business and prospects could be materially and adversely affected.

We have no experience applying our CBP technology to the production of renewable fuels or chemicals at commercial scale and our management has limited experience in the renewable fuels and chemicals business, and as a result, we may not be successful in commercializing our hardwood CBP technology.

To date, we have only produced renewable fuels at pilot scale and have only produced renewable chemicals in a laboratory setting. To successfully commercialize our CBP technology, we must be able to deploy our technology to enable the production of cellulosic ethanol on a cost-competitive basis at commercial scale. We cannot provide any assurance that we will be able to do so. Our management team has significant experience in

13

Table of Contents

our technology, however, the skills and knowledge gained in operating our demonstration facility in Rome, New York may prove insufficient to successfully scale our technology for use at a commercial-scale facility. While we have demonstrated CBP for the conversion of hardwood feedstock into cellulosic ethanol at our demonstration facility in Rome, New York, there are still significant technical, logistical and financial hurdles for us to overcome prior to commercialization. Our management has limited experience with facilities of commercial scale and as a result, we and our collaborators may not be able to resolve technological challenges associated with biomass conversion at this scale. We can provide no assurance that our technology will perform as expected when applied at commercial scale. We are working with leading industry participants to develop and construct our initial hardwood CBP facilities in Kinross, Michigan and Drayton Valley, Alberta. If constructed, these facilities will be the first of their kind in the world. As a result, we and our collaborators will not be able to benefit from the experience of others and are likely to encounter unexpected problems and challenges in the construction and operation of these facilities. The failure of our technology to perform as expected at commercial scale would have a material adverse effect on our business, financial condition and results of operations.

We will rely on third parties to commercialize our hardwood CBP technology and as a result the successful implementation of our technology will be dependent on third parties performing satisfactorily.

While we have not finalized commercial arrangements, we expect to collaborate with third parties to fund, build, develop and operate the commercial-scale hardwood CBP facilities in Kinross, Michigan and Drayton Valley, Alberta, and for future facilities. Our reliance on third parties reduces our control over the funding and construction of these facilities and the production and sale of the ethanol produced using our technology, including the operating costs of the facilities, which will expose us to certain risks. These facilities are first-of-kind projects, and we cannot assure you that our collaborators will be able to complete construction on schedule, effectively operate our CBP technology, produce cellulosic ethanol of sufficient quality or convert hardwood into ethanol at high enough yields and low enough costs to be profitable. If and when these facilities are completed, we will have limited or no control over the amount or timing of resources that our collaborators commit to our collaboration. Our collaborators may experience a change of policy or priorities or may fail to perform their obligations as expected. These collaborators may breach or terminate their agreements with us or otherwise fail to conduct their collaborative activities successfully and in a timely manner. Further, our collaborators may not devote sufficient resources to the manufacturing, marketing or sale of cellulosic ethanol produced using our CBP technology. Moreover, disagreements with a collaborator regarding strategic direction, economics of our relationship, intellectual property or other matters could develop, and any such conflict could reduce our ability to enter into future collaboration agreements and negatively impact our relationships with one or more existing strategic collaborators. In addition, our collaborators may also pursue competing technologies that may ultimately prove more compelling than ours. If any of these events occur, we may not be able to successfully commercialize our hardwood CBP technology. Additionally, our business could be negatively impacted if any of our collaborators undergo a change of control or assigns the rights or obligations under any of our agreements. If any of our collaborators were to assign these agreements to our competitors or to a third party who is not willing to work with us on the same terms or commit the same resources as the current collaborator, our business and prospects could be materially and adversely affected.

We and our collaborators may encounter unforeseen operational and financial difficulties in constructing our hardwood CBP facilities in Kinross, Michigan and Drayton Valley, Alberta.

Currently, our hardwood CBP facilities in Kinross, Michigan and Drayton Valley, Alberta are only in the planning stages and therefore we cannot assure you that these facilities will be completed on the schedules we expect or at all. If and when our collaborators complete construction of our initial-scale hardwood CBP facilities, our collaborators may not be able to process hardwood feedstocks at anticipated yields and volumes, and we and our collaborators may be unable to improve its performance. Constructing a commercial-scale biomass conversion facility of this type and size is a complex and lengthy undertaking that requires sophisticated, multi-disciplinary planning and precise execution. The successful processing of hardwood feedstocks will require integrating the multiple steps in the process into one continuous operation. The production of cellulosic ethanol

14

Table of Contents

in our hardwood CBP facility in Kinross, Michigan represents a “first of its kind” commercialization, and the complete process from sourcing the feedstock to producing ethanol has not yet been demonstrated in one contiguous operation at commercial scale.

Our CBP technology platform is highly complex and the specifications for the pretreatment, hydrolysis, fermentation and distillation processes may need to be adjusted to meet required feedstock, end-product or volume specifications. These adjustments may require additional resources or equipment which could increase costs and delay commercialization. For example, we may not be able to successfully integrate distinct pretreatment processes piloted at our demonstration facility in Rome, New York into a single unit at our planned hardwood CBP facilities. The volume, characteristics and purity of our products may not meet expectations and we may not achieve the economies of scale that we expect. The optimal metabolic pathways needed to reach our targeted yield levels may be patented by other companies, making it expensive or impossible for us to utilize those pathways. If any of these risks were to occur, it would impact the viability and credibility of our CBP technology. We may be unable to lower operating costs and increase our overall yields in order to produce renewable fuels and chemicals on a cost-competitive basis with existing petroleum-based fuel products without government incentives.

Our hardwood CBP facilities will have substantial capital costs, which pose significant risks to the economic viability of these facilities and may make it more difficult to attract government grants, third party investors and collaborators to fund these projects. If we fail to receive expected financing, or if we require additional financing, we may need to seek out new collaborators, which would create delays and increased costs. As described in more detail below, we and our collaborators are relying to some extent on government funding to build these facilities. If these grant agreements are terminated, our and our collaborators’ ability to complete the construction of our planned facilities could be impaired. The construction of additional facilities in the future may also be delayed by increased costs, weather delays, and the receipt of approvals and permits from various regulatory agencies, which may materially impact our business, financial condition and results of operations. Any significant delays in the timing or our commercialization strategy could materially and adversely affect our business, financial condition and results of operations.

The government grants and awards that we receive are subject to certain conditions and obligations and if we fail to meet our obligations the research funded by these grants and the construction of our initial commercial-scale hardwood CBP facilities may be materially delayed.

We are the recipient of government grants and awards, including an award from the U.S. Department of Energy, or DOE, providing for a cost share arrangement related to the construction of a hardwood CBP facility in Kinross, Michigan. The terms of this award require us to use the funds for the construction of an industrial scale fermenter system and the design, construction and operation of an integrated cellulosic ethanol plant for transforming locally grown mixed hardwoods or switchgrass into ethanol. Under this grant, the DOE will provide us with up to approximately $20.0 million, payable in phases and dependent on the results of each phase. As of June 30, 2011, we have received approximately $16.5 million under this award. We are required to make periodic progress reports on the status of our project and notify the DOE of any significant favorable or adverse events during the course of the project. If the DOE terminates this or any other grant agreements with us, our ability to complete the construction of our planned hardwood CBP facility in Kinross, Michigan could be impaired, which could harm our business.

We have also received a grant of up to $20.0 million from the Michigan Strategic Fund, or MSF, to fund our planned hardwood CBP facility in Kinross, Michigan. These funds are to be paid in installments upon certain milestones such as filing required environmental permits and finalizing commercial agreements relating to supply, construction and operation of the planned facility. As of June 30, 2011, we have received approximately $12.1 million from MSF. Our ongoing obligations under this grant agreement include providing regular progress reports on the status of the project and the milestones achieved. Unless earlier terminated for default for, among other things, the failure to meet certain milestones identified in the grant agreement, the term of this grant

15

Table of Contents

agreement lasts through December 2013. If the MSF terminates this grant, our ability to complete the construction of our planned hardwood CBP facility in Kinross, Michigan could be impaired, which could harm our business.

We have also received additional government grants, including grants from the Province of Alberta, Canada, in connection with our planned commercial hardwood CBP facility in Drayton Valley, Alberta and from the BioEnergy Science Center, or BESC, in connection with our research into CBP processing of biomass into ethanol and other end-products. As of June 30, 2011, we have received approximately $5.1 million from BESC. The loss of any of our government grants, for any reason, could materially and adversely impact our research and development efforts and our ability to execute on our staged commercialization strategy. For the year ended December 31, 2010, approximately 86% of our revenue was derived from government grants, and any termination or reduction in this funding, or ability to secure additional government funding, will materially and adversely impact our results of operations and financial condition.

Our hardwood CBP commercialization strategy relies heavily on our ability to negotiate and execute definitive agreements with third parties.

In order to commercialize our hardwood CBP technology, we need to negotiate and enter into definitive agreements with our collaborators for the financing, construction and operation of our planned hardwood CBP facilities in Kinross, Michigan and Drayton Valley, Alberta, as well as enzyme and feedstock supply agreements. We do not have any such definitive agreements in place, and we have no prior experience negotiating these types of agreements. Each of these agreements is crucial to our staged commercialization strategy and we cannot be certain of entering into definitive agreements with any of these parties. If we lose our business relationships with any of our collaborators or potential collaborators for any reason, our business and prospects could be adversely affected.

The market for renewable fuels and chemicals may not develop as anticipated.

We intend to deploy our CBP technology to convert hardwood feedstocks into renewable fuels for use in the biofuels market. However, this market may not develop as quickly as we expect or at all. The market for advanced biofuels, including cellulosic biofuels, is heavily influenced by foreign, federal, state and local government regulations and policies. If the cost of oil decreases significantly, the outlook for the long-term supply of oil to the United States improves or gasoline prices decline over extended periods of time, the perception in government and the private sector could change to our detriment. That is, a diminished belief that cheaper, more readily available energy alternatives should be developed or produced could change and thus reduce the demand for renewable fuels. Changes to existing or adoption of new domestic or foreign federal, state and local legislative initiatives that impact the production, distribution or sale of biofuels may reduce the demand for our technology. The cellulosic biofuels market is still at an early stage of development. There can be no assurance that governmental support for, and commercial interest in, this industry will continue. If the number and capacity of cellulosic biomass conversion facilities does not reach anticipated levels, there will be less demand for our cellulosic conversion technology and our business and results of operations would be adversely affected. In addition, while we utilize a biochemical process for the production of cellulosic ethanol, there are several competing technologies for producing cellulosic ethanol, including a thermochemical process, and we can provide no assurance that these other technologies will not prove to be more effective or successful than ours.

The production of cellulosic biofuels will require significant amounts of feedstock, and our collaborators may experience difficulties obtaining such feedstock.

Following the completion of our planned commercial-scale hardwood CBP facilities in Kinross, Michigan and Drayton Valley, Alberta, the successful production of cellulosic biofuels using our CBP technology will require our collaborators to acquire and process large amounts of hardwood feedstock. We cannot predict the future availability of hardwood or be sure that our collaborators’ feedstock suppliers will be able to supply it in

16

Table of Contents

sufficient quantities, at acceptable prices or in a timely manner. Feedstock availability may be adversely affected by growing-season disruptions, crop yields, increased demand by competitors, crop disease, droughts, floods, infestations, heavy rain storms, hail storms, freezing conditions, hurricanes, fires, other natural disasters, farming decisions or government policies and subsidies. These planned hardwood CBP facilities may be unable to secure access to hardwood feedstock or to secure the transportation of such feedstock on terms acceptable to our collaborators or at all. If these facilities are unable to secure cost-effective access to feedstock, the ability of our technology to produce renewable fuels and, in the long term, chemicals and our ability to execute our business plan would be adversely affected.

We and our collaborators may be unable to locate future facilities near low-cost, abundant and sustainable sources of biomass and adequate infrastructure, which may have an adverse effect on the ability to produce cost-effective renewable fuels and chemicals.