Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - CAREFUSION Corp | d230929dex311.htm |

| EX-31.2 - CERTIFICATION - CAREFUSION Corp | d230929dex312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2011

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-34273

CareFusion Corporation

(Exact name of Registrant as specified in its charter)

| Delaware | 26-4123274 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

3750 Torrey View Court

San Diego, CA 92130

Telephone: (858) 617-2000

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on which Registered | |

| Common Stock, par value $0.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ |

Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the voting common stock held by non-affiliates based on the closing stock price on December 31, 2010 was $5,720,780,345. For purposes of this computation only, all executive officers and directors have been deemed affiliates.

The number of outstanding shares of the registrant’s common stock as of August 1, 2011 was 223,610,302.

Documents Incorporated by Reference:

Portions of the registrant’s Proxy Statement to be filed for its 2011 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

Explanatory Note

This Amendment No. 1 (the “Amendment”) amends the Annual Report on Form 10-K of CareFusion Corporation (the “Company”) for the fiscal year ended June 30, 2011 (the “2011 Form 10-K”) filed with the United States Securities and Exchange Commission on August 9, 2011. The purpose of the Amendment is to amend Item 5 to furnish a corrected performance graph and related table that conforms to what will be included in the annual report to stockholders that accompanies the Company’s Proxy Statement to be filed for its 2011 Annual Meeting of Stockholders. The performance graph and related table that were included in Part II, Item 5 of the 2011 Form 10-K included inadvertent errors in certain calculations related to the cumulative total stockholder return of the S&P 500 index and S&P 500 Health Care index.

In addition, as required by Rule 12b-15, the Company’s principal executive officer and principal financial officer are providing Rule 13a-14(a) certifications in connection with this Amendment. Since financial statements are not contained in this Amendment, the Company is not furnishing Rule 13a-14(b) certifications in connection with this Amendment.

Except as described in this Explanatory Note, this Form 10-K/A does not modify, amend or update the 2011 Form 10-K or reflect events occurring after the filing of the 2011 Form 10-K.

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock is traded on the New York Stock Exchange (“NYSE”) under the symbol “CFN”. A “when-issued” trading market for our common stock began on the NYSE on August 21, 2009, and “regular way” trading of our common stock began on September 1, 2009. Prior to August 21, 2009, there was no public market for our common stock.

The price range per share of our common stock presented below represents the highest and lowest sales prices for our common stock on the NYSE during each quarter of the two most recent fiscal years.

| Fiscal 2011 | 1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter | ||||||||||||

| High |

$ | 25.35 | $ | 26.24 | $ | 28.61 | $ | 29.97 | ||||||||

| Low |

20.63 | 22.53 | 24.95 | 26.15 | ||||||||||||

| Fiscal 2010 | ||||||||||||||||

| High |

$ | 22.42 | 1 | $ | 26.99 | $ | 28.33 | $ | 30.06 | |||||||

| Low |

18.32 | 1 | 20.65 | 24.23 | 22.67 | |||||||||||

| 1 | Represents “regular way” trading activity from September 1, 2009 through September 30, 2009. |

As of August 1, 2011, there were 13,197 stockholders of record and 223,610,302 outstanding shares of common stock, and the closing price of our common stock on the NYSE was $25.49.

Dividends

We currently intend to retain any earnings to finance research and development, acquisitions and the operation and expansion of our business. We do not anticipate paying any cash dividends for the foreseeable future. The declaration and payment of any dividends in the future by us will be subject to the sole discretion of our board of directors and will depend upon many factors, including our financial condition, earnings, capital requirements of our operating subsidiaries, covenants associated with certain of our debt obligations, legal requirements, regulatory constraints and other factors deemed relevant by our board of directors. Moreover, should we pay any dividends in the future, there can be no assurance that we will continue to pay such dividends.

1

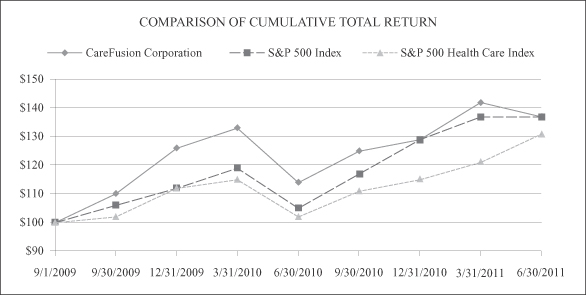

Performance Graph

This performance graph is furnished and shall not be deemed “filed” with the SEC or subject to Section 18 of the Exchange Act, nor shall it be deemed incorporated by reference in any of our filings under the Securities Act of 1933, as amended.

The following graph compares the cumulative total stockholder return on our common stock from September 1, 2009, when “regular way” trading in our common stock began on the NYSE, through June 30, 2011, with the comparable cumulative return of the S&P 500 index and S&P 500 Health Care index. The graph assumes that $100 was invested in our common stock and each index on September 1, 2009. In addition, the graph assumes the reinvestment of all dividends paid. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

The following table shows total indexed return of stock price plus reinvestments of dividends, assuming an initial investment of $100 at September 1, 2009, for the indicated periods.

| Fiscal Year 2010 | 9/1/2009 | 9/30/2009 | 12/31/2009 | 3/31/2010 | 6/30/2010 | |||||||||||||||

| CareFusion Corporation |

$ | 100 | $ | 110 | $ | 126 | $ | 133 | $ | 114 | ||||||||||

| S&P 500 Index |

100 | 106 | 112 | 119 | 105 | |||||||||||||||

| S&P 500 Health Care Index |

100 | 102 | 112 | 115 | 102 | |||||||||||||||

| Fiscal Year 2011 | 9/30/2010 | 12/31/2010 | 3/31/2011 | 6/30/2011 | ||||||||||||||

| CareFusion Corporation |

$ | 125 | $ | 129 | $ | 142 | $ | 137 | ||||||||||

| S&P 500 Index |

117 | 129 | 137 | 137 | ||||||||||||||

| S&P 500 Health Care Index |

111 | 115 | 121 | 131 | ||||||||||||||

2

Purchase of Equity Securities

The following table contains information about our company’s purchases of equity securities during the fourth quarter of fiscal year 2011:

| Issuer Purchases of Equity Securities |

||||||||||||||||

| Period | Total Number of Shares Purchased1 |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Program |

Maximum Number (or Approximate Dollar Value) of Shares that May Yet Be Purchased Under the Publicly Announced Program |

||||||||||||

| April 1 – 30, 2011 |

934 | $ | 28.51 | — | $ | — | ||||||||||

| May 1 – 31, 2011 |

659 | $ | 29.43 | — | — | |||||||||||

| June 1 – 30, 2011 |

1,433 | $ | 28.06 | — | — | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total |

3,026 | $ | 28.50 | — | $ | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 1 | Represents restricted stock awards surrendered by employees upon vesting to meet tax withholding obligations. |

3

PART IV

| ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES |

(a)(3) Exhibit Index:

| Exhibit |

Description of Exhibits | |

| 31.1 | Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. * | |

| 31.2 | Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. * | |

| * | Filed herewith. |

4

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on September 15, 2011.

| CAREFUSION CORPORATION | ||

| By: |

/s/ Kieran T. Gallahue | |

|

| ||

| Kieran T. Gallahue, Chairman and Chief Executive Officer | ||

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed on September 15, 2011 by the following persons in the capacities indicated.

| Signature |

Title |

|||

| /s/ Kieran T. Gallahue |

Chairman and Chief Executive Officer and Director (principal executive officer) |

|||

| Kieran T. Gallahue |

||||

| /s/ James F. Hinrichs |

Chief Financial Officer | |||

| James F. Hinrichs |

(principal financial officer) | |||

| /s/ Jean Maschal |

Senior Vice President, Controller and Chief Accounting Officer | |||

| Jean Maschal |

(principal accounting officer) |

|||

| * |

||||

| Philip L. Francis |

Director | |||

| * |

||||

| Robert F. Friel |

Director | |||

| * |

||||

| Jacqueline B. Kosecoff, Ph.D. |

Director | |||

| * |

||||

| J. Michael Losh |

Presiding Director | |||

| * |

||||

| Gregory T. Lucier |

Director | |||

| * |

||||

| Edward D. Miller, M.D. |

Director | |||

| * |

||||

| Michael D. O’Halleran |

Director | |||

| * |

||||

| Robert P. Wayman |

Director | |||

| * /s/ Joan Stafslien |

||||

| By: Attorney-in-Fact Joan Stafslien |

||||

5