Attached files

| file | filename |

|---|---|

| 8-K - FORM 8K - WEST PHARMACEUTICAL SERVICES INC | form8k.htm |

WEST PHARMACEUTICAL SERVICES, INC.

Solutions for Injectable Drug Delivery NYSE:WST www.westpharma.com

© 2011 by West Pharmaceutical Services, Inc., Lionville, PA.

All rights reserved. This material is protected by copyright. No part of it may be reproduced, stored in a retrieval system, or transmitted in any

form or by any means, electronic, mechanical, photocopying or otherwise, without written permission of West Pharmaceutical Services, Inc.. All

trademarks and registered trademarks are property of West Pharmaceutical Services, Inc., unless noted otherwise.

form or by any means, electronic, mechanical, photocopying or otherwise, without written permission of West Pharmaceutical Services, Inc.. All

trademarks and registered trademarks are property of West Pharmaceutical Services, Inc., unless noted otherwise.

CL King’s 9th Annual “Best Ideas” Conference

New York, NY

September 14, 2011

Safe Harbor Statement

2

Cautionary Statement Under the Private Securities Litigation Reform Act of 1995

This presentation and any accompanying management commentary contain “forward-looking statements”

as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include,

but are not limited to statements about expected financial results for 2011 and future years.

as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include,

but are not limited to statements about expected financial results for 2011 and future years.

Each of these estimates is based on preliminary information, and actual results could differ from these

preliminary estimates. We caution investors that the risk factors listed under “Cautionary Statement” in

our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual

Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or

supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially

from those estimated or predicted in the forward-looking statements. You should evaluate any statement

in light of these important factors. Except as required by law or regulation, we undertake no obligation to

publicly update any forward-looking statements, whether as a result of new information, future events, or

otherwise.

preliminary estimates. We caution investors that the risk factors listed under “Cautionary Statement” in

our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual

Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or

supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially

from those estimated or predicted in the forward-looking statements. You should evaluate any statement

in light of these important factors. Except as required by law or regulation, we undertake no obligation to

publicly update any forward-looking statements, whether as a result of new information, future events, or

otherwise.

Non-GAAP Financial Measures

Certain financial measures included in these presentation materials, and which may be referred to in

management’s discussion of the Company’s results and outlook, are Non-GAAP (Generally Accepted

Accounting Principles) financial measures. Please refer to the “Non-GAAP Financial Measures” and

“Notes to Non-GAAP Financial Measures” at the end of these materials for more information. Non-GAAP

financial measures should not be considered in isolation or as an alternative to such measures

determined in accordance with GAAP.

management’s discussion of the Company’s results and outlook, are Non-GAAP (Generally Accepted

Accounting Principles) financial measures. Please refer to the “Non-GAAP Financial Measures” and

“Notes to Non-GAAP Financial Measures” at the end of these materials for more information. Non-GAAP

financial measures should not be considered in isolation or as an alternative to such measures

determined in accordance with GAAP.

3

Pharmaceutical Packaging Systems

Pharmaceutical Delivery Systems

• A globally diverse manufacturer of

products used primarily in containing and

administering small-volume parenteral

drugs

products used primarily in containing and

administering small-volume parenteral

drugs

• Strong competitive position

– Substantial market shares

– Proprietary technology

– Diversified customer base

– Global footprint

– Preferred products for biologics

– Long-term customer relationships

• Stability with growth potential

• Proprietary products

• Geographic expansion

• Financial strength to invest

– Reliable operating cash flow

– Well capitalized

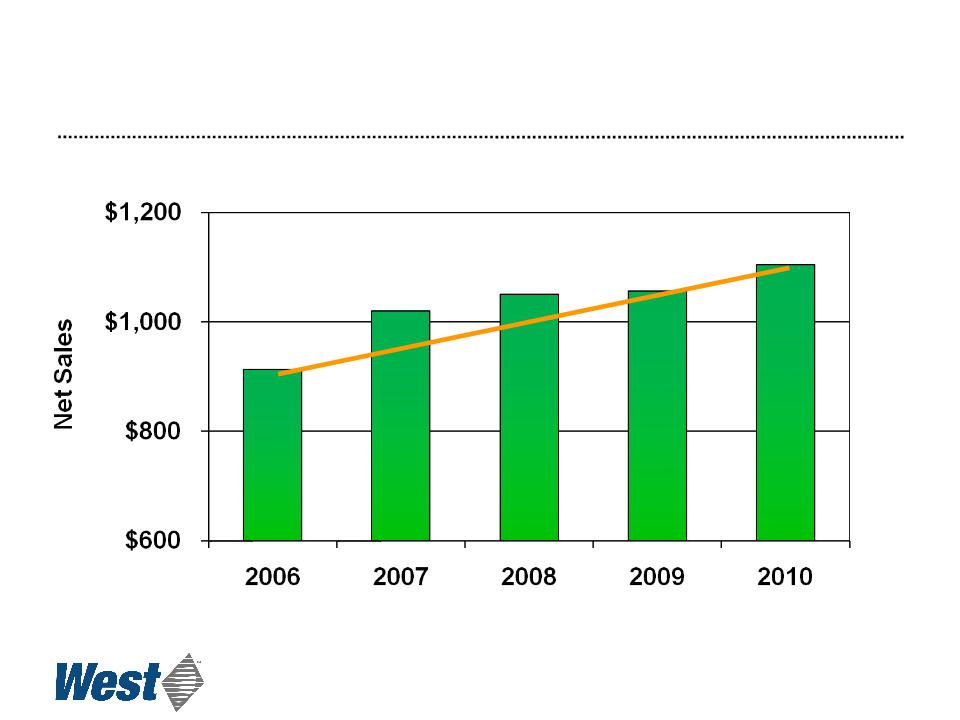

Sales

($ in millions)

($ in millions)

4

Compound annual growth rate: 4.9% (4.3% ex-currency)

Business Segments

5

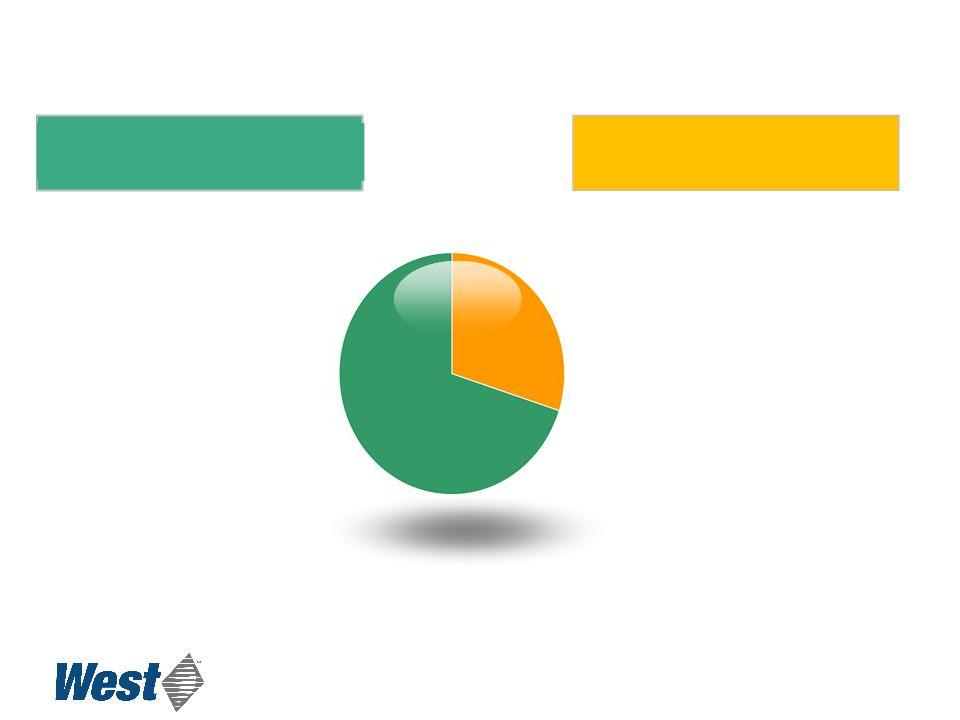

$785

$324

2010 Revenues

($ millions)

Delivery Systems

• Contract manufacturing base

• Multi-material

• Project management

• Automated assembly

• Regulated products

• Capabilities + IP = proprietary

delivery devices

delivery devices

• Proprietary devices are

expected to drive growth

expected to drive growth

Packaging Systems

• Established leadership

• Designed-in revenue base

• Diverse global capabilities

• High market shares

• Steady growth in base

• Increasing unit value of products

and geographic expansion are

expected to enhance growth

and geographic expansion are

expected to enhance growth

A Diverse, Stable Customer Base

(representative healthcare customers)

(representative healthcare customers)

PHARMACEUTICAL / BIOTECHNOLOGY

6

GENERIC

MEDICAL DEVICE

|

Category

|

Key Customers

|

Projected

Growth |

|

Diabetes

|

|

> 10 %

|

|

Oncology

|

|

> 10 %

|

|

Vaccines

|

|

> 10 %

|

|

Autoimmune

|

|

> 8%

|

|

Generics

|

|

>10%

|

IMS April 2010 Report; Business Insights 2009; GBI Research 2009

7

Therapeutic Category Growth Drivers

Business Environment

• Economic Recovery: Slowing or Double-dip

– Effects of weakness on private and public healthcare spending

– Implications of EU sovereign debt situation

– Developing economies growing (e.g., China, Brazil, India)

• Persistent Fx and commodity price volatility

• Trends in Pharmaceutical and Device markets:

– Thin new-product pipelines in the near-term

– Patent expirations for blockbuster products

– Pharma M&A reflects shift to large molecule products

– Global shift in product sourcing (e.g., India generic growth)

– More demanding regulatory environment

• Pre-approval demands on drugs and devices slow the rate of change

• Scrutiny of customers’ product quality creates opportunities

– Uncertain near and longer-term effects of US healthcare changes

8

• Company

– Demographics and increasing prevalence of chronic disease

– Increasing use of biologics to treat those

– Broader access to healthcare

• Packaging Systems Segment

– Growth in emerging markets

– Products and processes to satisfy escalating regulatory and quality

expectations

expectations

• Delivery Systems Segment

– Demand for combination products that promote safety, dosing accuracy,

ease of use, and deliver cost savings

ease of use, and deliver cost savings

– Drug product life cycle management

– Growing customer & regulatory awareness of glass quality issues

What Will Drive Growth?

9

Pharmaceutical Packaging Systems

Packaging Components for Small Volume Parenterals

Packaging Components for Small Volume Parenterals

Plungers, Tip caps,

Needle shields for Glass

Syringes

Needle shields for Glass

Syringes

Plungers, lined seals

for Glass Cartridges

for Pens

for Glass Cartridges

for Pens

10

Primary packaging components (those that touch the drug) are typically

proprietary to West and are “designed into” customers’ drug products

proprietary to West and are “designed into” customers’ drug products

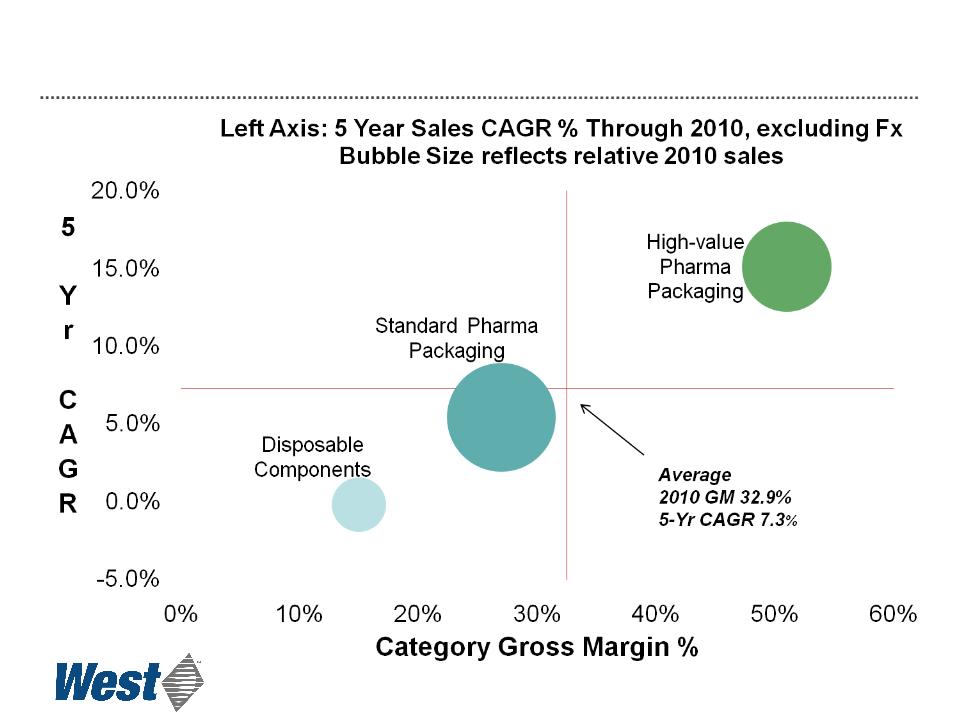

Packaging Systems Segment

• Increase per-unit value

• Continued growth of prefilled syringes

• Improve operating efficiency: lean operations

• Geographic expansion - capacity investments in Asia

• Strategic acquisitions and partnerships

Growth Strategy

11

12

Standard High-Value

Products Products

Revenue Opportunity ($ per unit)

Plungers and

sleeve stoppers

sleeve stoppers

Stoppers

Seals

RU seals

Westar® RU

Faster Growth of High-Value Products

Pharmaceutical Packaging Systems

Pharmaceutical Packaging Systems

13

Pharmaceutical Packaging Systems

Key High-value Products

Key High-value Products

• Westar® RS (ready-to-sterilize) and Westar® RU (ready-to-use)

components

components

• Barrier film coatings (FluroTec®, Teflon® coated) enhance drug-

product stability

product stability

– Key feature for biotech products

• B-2 and LyoTec® coatings for enhanced handling and machine-

ability

ability

• Envision™ 100% vision-inspected products

– Eliminate deformation, surface and embedded defects

14

Teflon® is a registered trademark of DuPont.

FluroTec® technology is licensed from Daikyo Seiko, Ltd.

FluroTec® technology is licensed from Daikyo Seiko, Ltd.

Delivery Systems

West ConfiDose®

auto-injector system

auto-injector system

Daikyo Crystal Zenith®

Life-cycle Containment Solutions

Life-cycle Containment Solutions

SmartDose® electronic

patch injector system

patch injector system

15

MixJect® and Vial2Bag®

Custom Manufacturing of

Components and Devices

Components and Devices

Proprietary Components, Devices and Systems

MixJect®, Vial2Bag® and SmartDose® are registered trademarks of Medimop Medical Projects Ltd., a West company.

Veramyst® is a registered trademark of Glaxo Group, Inc.

Veramyst® is a registered trademark of Glaxo Group, Inc.

Delivery Systems Segment

• Realize commercial potential of CZ

• Leverage life-cycle management opportunities

• Develop new platform opportunities - combination products

• Custom solution provider

Growth Strategy

16

17

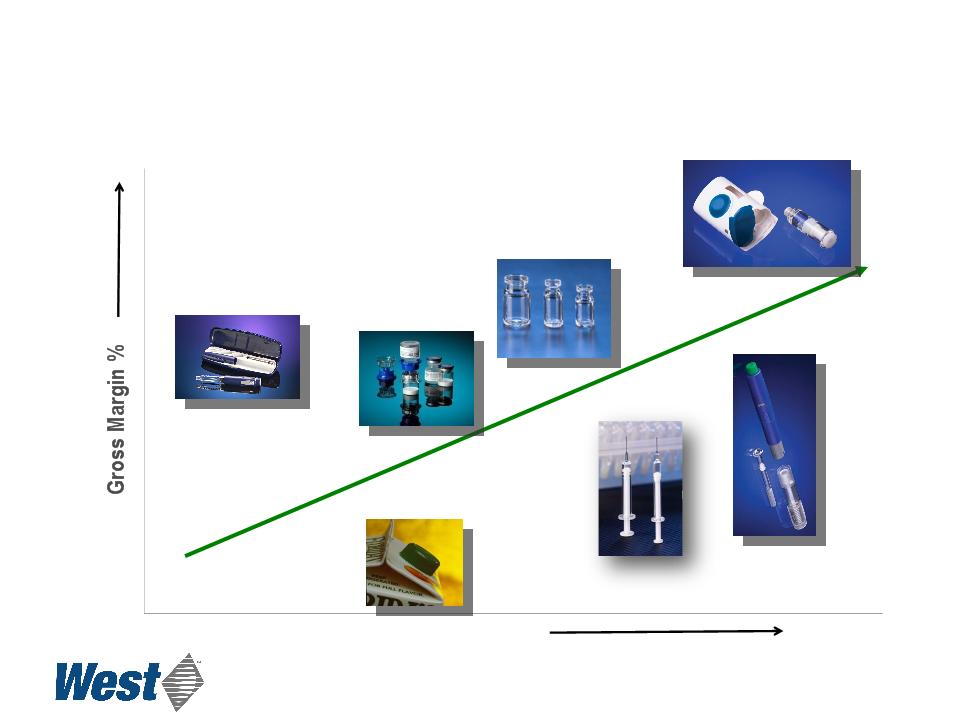

Revenue per-unit

Consumer product

manufacturing

manufacturing

Medical device

manufacturing

manufacturing

Mix2Vial®

CZ vials

CZ syringes

ConfiDose®

Effect of Increasing Proprietary Device Sales

Contract Manufacturing Proprietary Devices

Products

SmartDose®

Concerns With Glass Syringes

• Interaction with sensitive biologics

• Protein aggregation (silicone oil)

• Residual chemicals (tungsten, glue)

• Glass flakes

• Dimensional variation

• Variable silicone distribution

• High Cost of Quality

• Breakage

• In process/handling

• Within auto-injector systems

Siliconized Glass Syringe

Crystal Zenith Syringe

18

Daikyo CZ Solution

with Daikyo FluroTec®

with Daikyo FluroTec®

• Reduces:

– Drug exposure to extractables

– Risk of protein aggregation caused by silicone oil in the drug product

– Returns and in-process clean-ups caused by broken glass

– Risk of delamination and glass-particulate contamination

• Consistent piston release and travel forces without using silicone oil

19

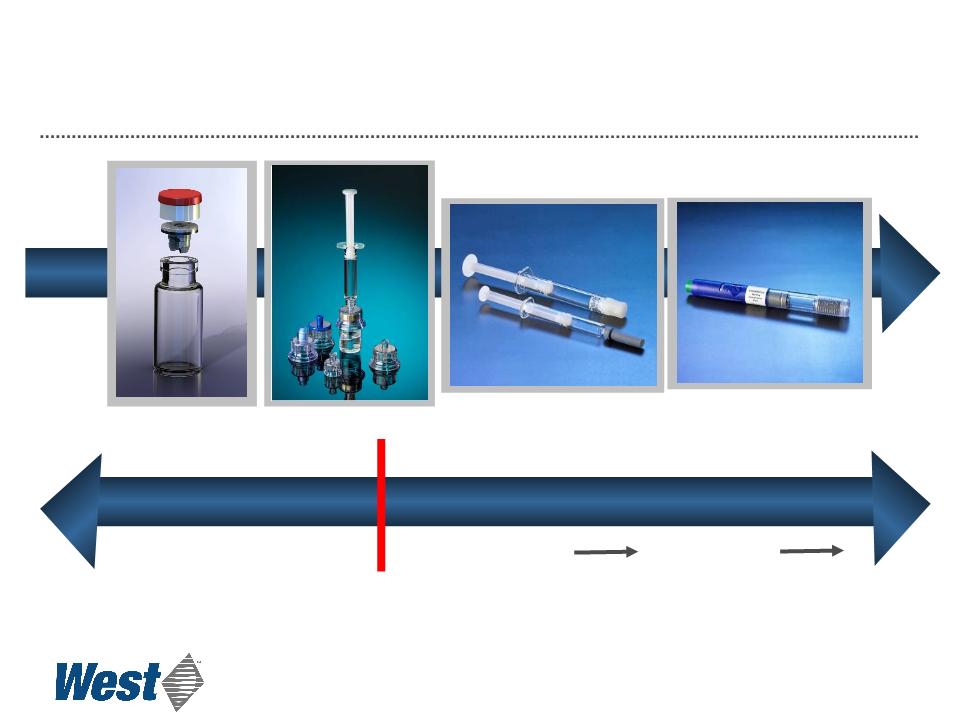

Pharma Industry Drug Life-Cycle

Management

Management

Phase I

Phase II

Phase III

Post-Market Life Cycle Management

8 - 10 years

2 - 3 years

2 - 3 years

Regulatory

Approval

Discovery

20

SmartDose®

Electronic Patch Injector

Programmed by PDA or PC

Dose may be customized

Applied and activated by patient

21

• Controlled, subcutaneous, micro-infusion delivery

of high volumes and high viscosity drugs

of high volumes and high viscosity drugs

• Prefilled cartridge, no need for user filling

• Based on Daikyo CZ cartridge

• Compact

• Hidden needle for safety

• Single push-button operation

Prototype Operation

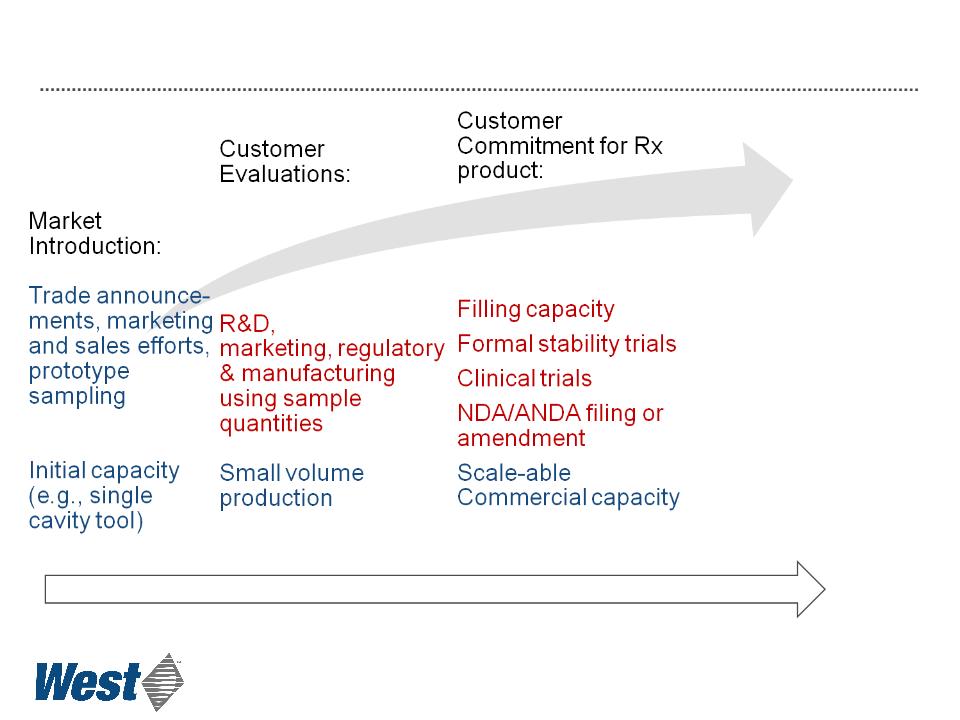

New Product Commercialization

Schematic representation of order and timing of West & Customer activities

Schematic representation of order and timing of West & Customer activities

22

Commercial Sales:

Rx Product approval

Commercial

Production

Production

1 2

4 5 6

Approximate timing (years)

Our Long-Term Focus

• Pharmaceutical Packaging Systems

– Organic growth of 3-5% per year

– Margin expansion from efficiency, product mix

– Capital investments target enhanced quality and value

• Pharmaceutical Delivery Systems

– Deliver the potential of Daikyo CZ products

– Stronger mix of healthcare-consumable contract manufacturing

– Grow proprietary safety and delivery systems

• Financial discipline

– Operating cash flow supports R&D and capital spending

– Deliver returns (ROIC) that regularly exceed cost of capital (WACC)

– Maintain quarterly dividend

– Align incentives with financial performance and value creation

23

|

($ millions)

|

June 30,

2011

|

December 31,

2010 |

|

Cash and cash equivalents

|

$110.4

|

$110.2

|

|

Debt

|

$373.5

|

$358.4

|

|

Equity

|

$696.0

|

$625.7

|

|

Net debt to total invested capital

|

27.4%

|

28.4%

|

|

Working capital

|

$317.7

|

$266.9

|

Selected Financial Information

• Balance Sheet

• Dividend

– Most recent quarter: $0.17 ($0.68 annually at current rate)

– Annual increases for 18 consecutive years

24

Summary Second Quarter Results

$ millions, except per-share data

$ millions, except per-share data

(1) These are Non-GAAP Financial Measures and exclude the effects of:

• In the 2011 period, restructuring and related pre-tax charges of $1.3, income of $0.7 from the reduction of

acquisition-related contingencies; and a pre-tax charge of $2.1 for special separation benefits.

acquisition-related contingencies; and a pre-tax charge of $2.1 for special separation benefits.

• In the 2010 period, restructuring and related pre-tax charges of $0.4, and $0.5 of tax expense from discrete items.

Further explanations of these items were included in the press release announcing the second-quarter 2011 results, which is

available through the Company’s website, www.westpharma.com, and in Form 10-Q for the second quarter of 2011.

available through the Company’s website, www.westpharma.com, and in Form 10-Q for the second quarter of 2011.

|

|

Three Months Ended

June 30,

|

|

|

2011

|

2010

|

|

|

Net Sales

|

$ 307.9

|

$ 281.8

|

|

Gross Profit

|

84.6

|

83.2

|

|

Reported Operating Profit

|

27.8

|

30.5

|

|

Adjusted Operating Profit (1)

|

30.5

|

30.9

|

|

Reported Diluted EPS

|

$ 0.57

|

$ 0.62

|

|

Adjusted Diluted EPS(1)

|

$ 0.62

|

$ 0.64

|

25

26

Pharmaceutical Packaging Systems

Pharmaceutical Delivery Systems

• Strong competitive position

– Substantial market shares

– Proprietary technology

– Diversified customer base

– Global footprint

– Preferred products for biologics

– Long-term customer

relationships

relationships

• Stability with growth potential

• Proprietary products

• Geographic expansion

• The financial strength to invest

– Reliable operating cash flow

– Well capitalized

Summary

On average, approximately 100 million components manufactured by West and

our Global Partners are used to enhance the quality of healthcare worldwide

every day.

our Global Partners are used to enhance the quality of healthcare worldwide

every day.

Global Partners with Daikyo Seiko, Ltd. and West Pharmaceutical services Mexico, S.A. de

C.V.

C.V.