Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SmartStop Self Storage, Inc. | d231944d8k.htm |

September 14,

2011 Hosted By

H. MICHAEL SCHWARTZ

Chairman and CEO

2011 Third Quarter Report

Exhibit 99.1

1 |

Disclaimer

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this material, other than historical facts, may be considered

forward-looking statements within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”) and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). We intend for all such

forward looking statements to be covered by the applicable safe harbor provisions for

forward-looking statements contained in Section 27A of the Securities Act and

Section 21E of the Exchange Act, as applicable. Such statements include, in

particular, statements about our plans, strategies, and prospects and are subject to

certain risks and uncertainties, including known and unknown risks, which could cause actual

results to differ materially from those projected or anticipated. Therefore, such

statements are not intended to be a guarantee of our performance in future periods.

Such forward-looking statements can generally be identified by our use of

forward-looking

terminology

such

as

“may,”

“will,”

“expect,”

“intend,”

“anticipate,”

“estimate,”

“believe,”

“continue,”

or other similar words. Readers are cautioned not to place undue reliance on these

forward-looking statements,

which

speak

only

as

of

the

date

this

report

is

filed

with

the

Securities

and

Exchange

Commission.

We cannot guarantee the accuracy of any such forward looking statements contained in this

material, and we do not intend to publicly update or revise any forward-looking

statements, whether as a result of new information, future events, or otherwise.

Any such forward-looking statements are subject to risks, uncertainties, and other

factors and are based on a number of assumptions involving judgments with respect to,

among other things, future economic, competitive, and market conditions, all of which

are difficult or impossible to predict accurately. To the extent that our assumptions

differ from actual results, our ability to meet such forward-looking statements,

including our ability to generate positive cash flow from operations and provide

distributions to stockholders, and our ability to find suitable investment properties,

may be significantly hindered. All forward-looking statements should be read in

light of the risks identified in our prospectus and supplements. 2

|

Agenda

Second Quarter Financials

and Economies of Scale

Portfolio Growth

Adding Value

Strategic Vision

3 |

Quarterly

Financials Portfolio

Summary

(as

of

06/30/2011)

Total Properties: 72

Total Units: 47,040

Net Rentable Sq. Ft.: 5,893,200

States: 17 and 2 in Ontario, Canada

Total Assets: $423.3 Million

Leverage: 50.4%

Cash on Hand: $14.6 Million

4 |

Same Store

Results Q2 (29 properties) 2011

2010

Increase

Revenue

$5,300,379

$5,224,428

1.4%

Operating Income

$3,078,815

$3,013,907

2.1%

Properties Owned at

72

34

112%

End of Q2

Economies of Scale

5

Bringing it to the Bottom Line |

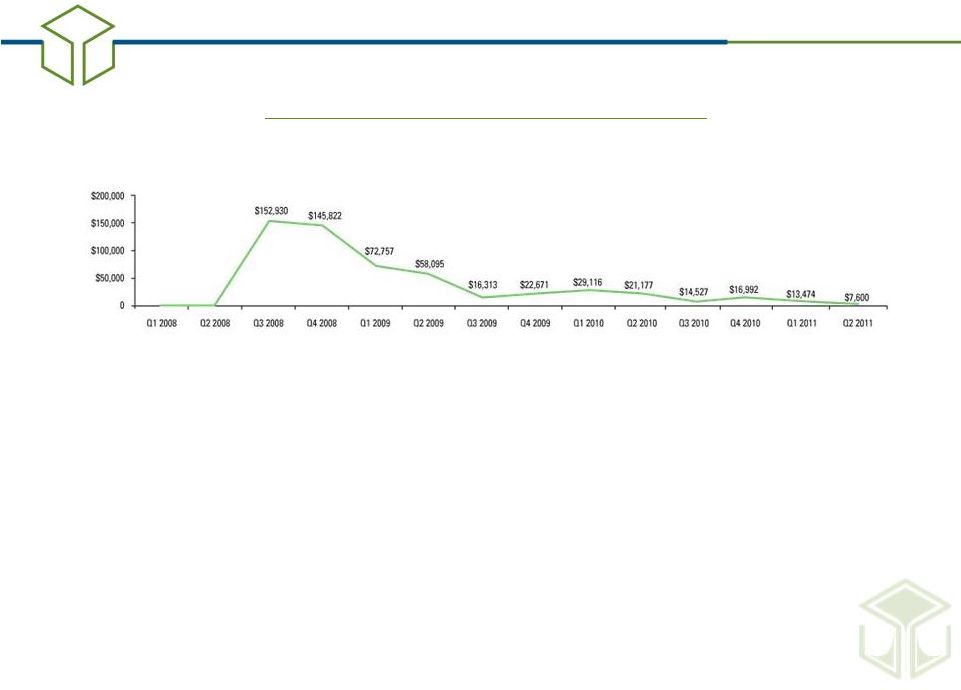

G&A Per

Property by Quarter Economies of Scale

G&A Per Property

Q2

2009

$58,095

Q2

2010

$21,177

(63.5% decrease)

Q2

2011

$7,600

(64.1% decrease)

Total G&A

Q2

2010

$720,010

Q2

2011

$547,187

(1)

(24% decrease)

(1)

For the three months ended June 30, 2011, the Advisor permanently waived certain

reimbursable indirect costs. 6 |

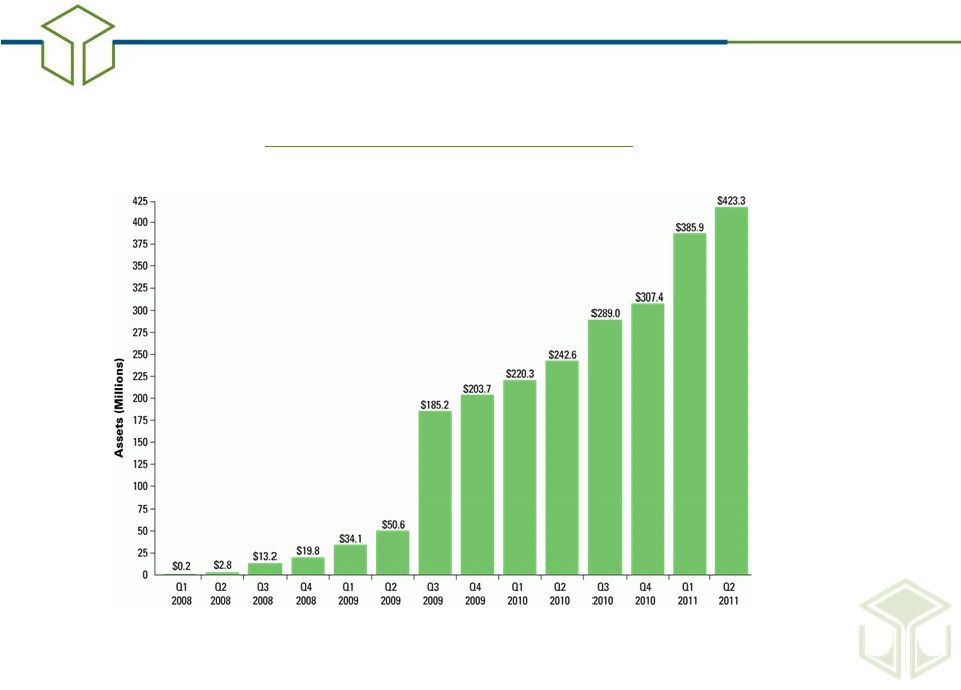

Total Assets

by Quarter Quarterly Financials

7 |

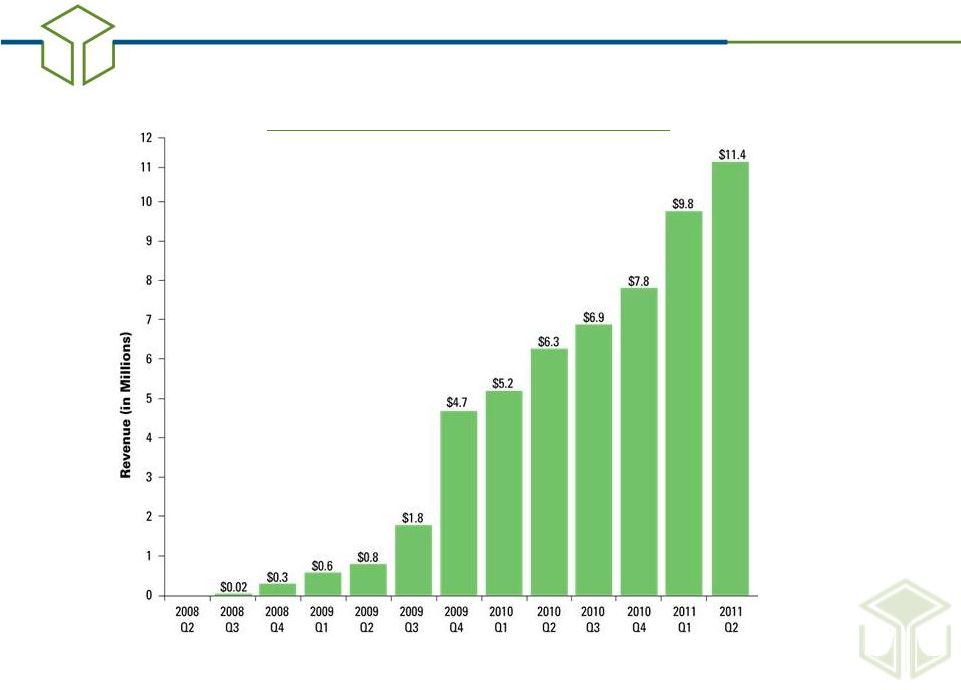

Total

Revenues by Quarter Quarterly Financials

8 |

Understanding

MFFO Net Income

+

depreciation

+

amortization

Funds From Operations (FFO)

+

acquisition fees and expenses

+

impairments

+

marketable securities losses

+

hedging strategy losses

=

Modified FFO

Not all MFFO is created equal

{

non cash

items

9 |

Modified Funds

From Operations and The Real Story Relative Risk

Smoothing of Results

Mezzanine Loans

Sponsor Contribution

Deferred Fees

Point in Time vs. Trending

Cash Drag

Other Intangibles

10 |

Increasing

MFFO Higher Cap Rates / Higher Risk

Mezzanine Loans / Higher Risk

Deferred Maintenance and Other Expenses

11 |

Agenda

Second Quarter Financials

and Economies of Scale

Portfolio Growth

Adding Value

Strategic Vision

12 |

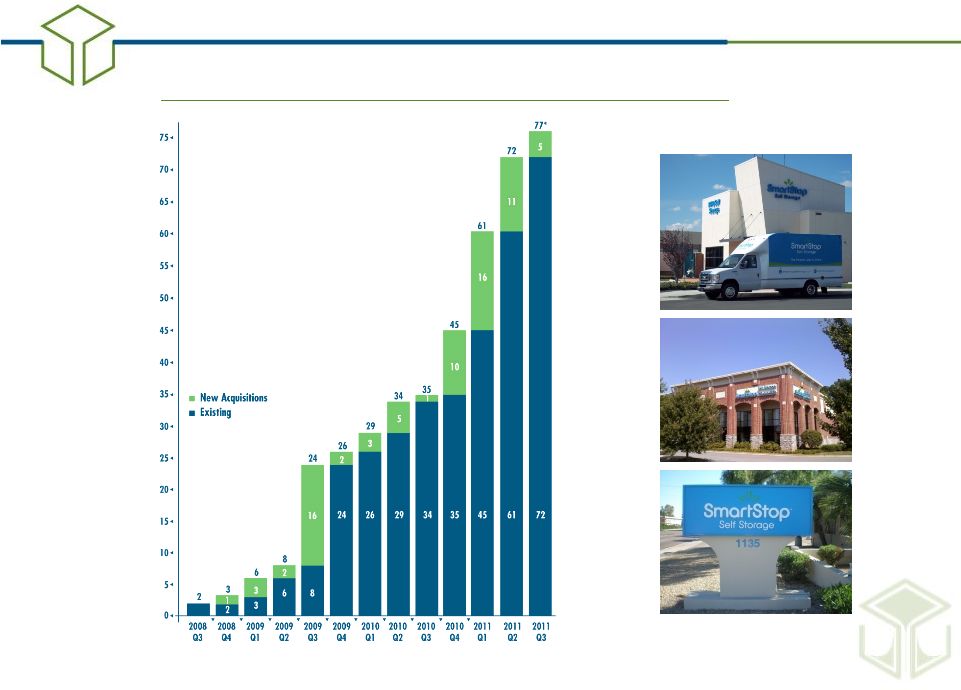

Wholly Owned

Properties by Quarter Portfolio Growth

* Through August 31, 2011

13 |

Portfolio

Growth Square

Footage

by

State

(as

of

06/30/2011)

14 |

2011 Second

Quarter Acquisitions Property

Approx. Units

Approx. Rentable Sq. Ft. (net)

1

Peachtree City -

GA

670

123,400

2

Buford -

GA

520

68,900

3

Jonesboro -

GA

730

106,400

4

Ellenwood -

GA

300

40,700

5

Marietta II -

GA

480

61,200

6

Collegeville -

PA

540

58,400

7

Skippack -

PA

390

56,300

8

Ballston Spa -

NY

690

82,800

9

Trenton -

NJ

660

85,100

10

Fredericksburg -

VA

630

59,600

11

Sandston -

VA

680

78,100

Total $44,030,000

6,290

820,900

Portfolio Growth

15 |

Subsequent

Acquisitions Property

Approx. Units

Approx. Rentable Sq. Ft. (net)

1

Ladera Ranch -

CA

980

114,000

2

SF Bay Area –

San Lorenzo -

CA

640

62,000

3

Hampton -

VA

640

70,200

4

Las Vegas V -

NV

790

88,000

5

SF Bay Area –

Gilroy -

CA

610

94,000

Total $39,680,000

3,660

428,200

(1)

Includes an adjoining parcel of vacant land, which had an acquisition price of

approximately $3.9 million. Portfolio Growth

16 |

New Store

Opening SmartStop Mississauga, Ontario Canada

Portfolio Growth

17 |

Portfolio

Growth 18 |

Potential

Acquisitions* Property

Approx. Units

Approx. Rentable Sq. Ft. (net)

1

Kennesaw -

GA

660

78,200

2

Sharpsburg -

GA

700

92,000

3

Duluth -

GA

640

81,600

4

Duluth II -

GA

700

83,300

5

Duluth III -

GA

630

82,600

6

Marietta III -

GA

640

73,400

7

Austell -

GA

590

77,700

8

Sandy Springs -

GA

890

93,800

9

Smyrna -

GA

530

65,700

10

Lawrenceville III -

GA

680

89,700

11

Jacksonville -

FL

690

82,800

12

Jacksonville II -

FL

530

71,400

Total $84,000,000

7,880

972,200

*There can be no assurance that we will complete the acquisition

of any of these properties. In some circumstances, if we fail to complete the

acquisitions, we may

forfeit

our

earnest

money.

Other

properties

may

be

identified

in

the

future

that

we

may

acquire

prior

to

or

instead

of

these

properties.

Due

to

the

considerable conditions to the consummation of these acquisitions, we cannot make

any assurances that the closings are probable. Portfolio Growth

19 |

Agenda

Second Quarter Financials

and Economies of Scale

Portfolio Growth

Adding Value

Strategic Vision

20 |

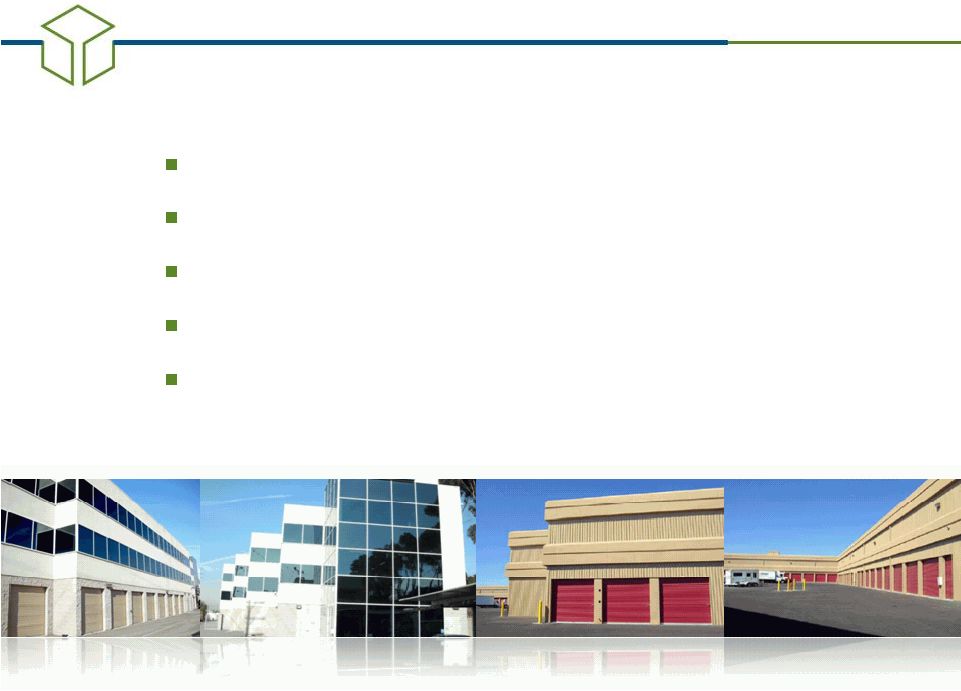

Adding

Value Increasing Revenues

Tenant Insurance

Rental Increases

Truck Rentals

Ancillary Revenues

Web Based Sales

21 |

Economies of

Scale Decreasing Expenses

Reaching Critical Mass

Property Insurance

Utility Management and Energy Conservation

Fixed vs. Variable Expenses

National Contracts

Property Management

22 |

Leveraging

Technology 156 “print”

Yellow Page campaigns and migrating into

“internet”

Yellow Page campaigns

National call center for rentals with expanded hours and

high quality agents

Salesforce.com –

Lead generation dash board management

23 |

Online

New website launched March 2011 improves customer service

Months 1-3 vs. 4-6

Visits Up +40%

Page Views +45%

Conversions +122%

First Time Visitors 61%

smartstopselfstorage.com

Leveraging Technology

24 |

New

Technology to View Updates SSTI Mobile Friendly App For

Smartphones

Available on iPad, Android and

Blackberry

Free download (search “SSTI”)

User-friendly and content-rich

Receive the latest updates

1

st

non-traded

REIT

app

on

the

iPhone, Android and Blackberry

Leveraging Technology

25 |

Strategic

Vision 26 |

Strategic

Vision $1.12

(Billion)

$631.58

(Million)

$1.89

(Billion)

$881.40

(Million)

$1.06

(Billion)

$724.22

(Million)

$20.37

(Billion)

$5,280.57

(Million)

PUBLICLY TRADED SELF STORAGE REITS

PUBLIC NON-TRADED SELF STORAGE REIT

(1) Wall Street Journal 7/28/11

(2) Wall Street Journal 12/31/10

Market

Cap

(1)

Book

Value

(2)

27 |

H. MICHAEL

SCHWARTZ Chairman and CEO

Strategic Storage Trust, Inc.

Questions and Answers

28 |

September 14,

2011 Hosted By

H. MICHAEL SCHWARTZ

Chairman and CEO

2011 Third Quarter Report

29 |