Attached files

| file | filename |

|---|---|

| EX-23 - Westpoint Energy, Inc. | forms1a2090811ex23-1.htm |

As filed with the Securities and Exchange Commission on September 13 , 2011

Registration No. 333-_________

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 2 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WESTPOINT ENERGY, INC.

(Exact name of Registrant as specified in its charter)

|

Nevada

|

1381

|

27-4251960

|

||

|

(State or other jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification Code)

|

(I.R.S. Employer Identification No.)

|

Westpoint Energy, Inc.

871 Coronado Center Drive, Suite 200

Henderson, Nevada 89052

Telephone: (702) 940-2333

(Address, including zip code, and telephone number,

including area code, of registrant's principal executive offices)

Jarnail Dhaddey

Westpoint Energy, Inc.

871 Coronado Center Drive, Suite 200

Henderson, Nevada 89052

Telephone: (702) 940-2333

Facsimile: (702) 952-0400

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies of all correspondence to:

|

David Lubin, Esq.

David Lubin & Associates, PLLC

10 Union Avenue, Suite 5

Lynbrook, New York 11563

Telephone: (516) 887-8200

Facsimile: (516) 887-8250

|

1

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box: [x]

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. □

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. □

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. □

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

|

Large accelerated filer

|

□

|

Accelerated filer

|

□

|

|

|

Non-accelerated filer

|

□

|

Smaller reporting company

|

x

|

2

Calculation of Registration Fee

|

Title of Class of Securities to be Registered

|

Amount to be Registered

|

Proposed Maximum Aggregate Price Per Share

|

Proposed Maximum Aggregate Offering Price

|

Amount of Registration Fee

|

|

Common Stock, $0.0001 per share(1)

|

5,740,000

|

$0.10(2)

|

$574,000

|

$40.93 (3)

|

|

Total

|

5,740,000

|

$0.102)

|

$574,000

|

$40.93 (3)

|

|

(1)

|

Represents common shares currently outstanding to be sold by the selling security holders.

|

|

(2)

|

The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o). Our common stock is not traded on any national exchange and in accordance with Rule 457, the offering price was determined by the price shares were sold to the selling security holders in private placement transactions. The selling shareholders may sell shares of our common stock at a fixed price of $0.10 per share until our shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. The fixed price of $0.10 has been arbitrarily determined as the selling price. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority (“FINRA”), which operates the OTC Electronic Bulletin Board, nor can there be any assurance that such an application for quotation will be approved. We have agreed to bear the expenses relating to the registration of the shares for the selling security holders.

|

|

(3)

|

In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended.

|

|

(4)

|

Previously paid.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED ______ __, 2011

3

WESTPOINT ENERGY, INC.

5,740,000 Shares of Common Stock

This prospectus relates to the resale of 5,740,000 shares of common stock, par value $0.0001, of Westpoint Energy, Inc., which are issued and outstanding and held by persons who are our shareholders.

Our common stock is presently not traded on any market or securities exchange. The shares of our common stock can be sold by selling security holders at a fixed price of $0.10 per share until our shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. The fixed price of $0.10 has been arbitrarily determined as the selling price. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with FINRA, for our common stock to be eligible for trading on the Over the Counter Bulletin Board. We do not yet have a market maker who has agreed to file such application.

INVESTING IN OUR SECURITIES INVOLVES SIGNIFICANT RISKS. SEE “RISK FACTORS” BEGINNING ON PAGE 3.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The information in this prospectus is not complete and may be changed. This prospectus is included in the registration statement that was filed by us with the Securities and Exchange Commission. The selling security holders may not sell these securities until the registration statement becomes effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is __________, 2011

4

Table of Contents

|

Page

|

|

|

Prospectus Summary

|

6 |

|

Risk Factors

|

15 |

|

The Offering

|

27 |

|

Use of Proceeds

|

27 |

|

Dilution

|

|

|

Determination of Offering Price

|

28 |

|

Forward Looking Statements

|

28 |

|

Selling Security holders

|

28 |

|

Plan of Distribution

|

30 |

|

Description of Securities

|

33 |

|

Interest of Named Experts and Counsel

|

33 |

|

Description of Business

|

34 |

|

Description of Property

|

37 |

|

Legal Proceedings

|

42 |

|

Market for Common Equity and Related Stockholder Matters

|

42 |

|

Dividend Policy

|

42 |

|

Share Capital

|

42 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

43 |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

|

|

Directors, Executive Officers, Promoters, and Control Persons

|

47 |

|

Director Independence

|

48 |

|

Executive Compensation

|

48 |

|

Security Ownership of Certain Beneficial Owners and Management

|

49 |

|

Certain Relationships and Related Transactions

|

50 |

|

Expenses of Issuance and Distribution

|

50 |

|

Legal Matters

|

50 |

|

Indemnification for Securities Act Liabilities

|

51 |

|

Experts

|

51 |

|

Where You Can Find More Information

|

51 |

|

Financial Statements

|

52

|

|

Information not Required in Prospectus

|

75 |

5

PROSPECTUS SUMMARY

As used in this prospectus, references to the “Company,” “we,” “our,” “us,” or “Westpoint” refer to Westpoint Energy, Inc., unless the context otherwise indicates.

The following summary highlights selected information contained in this prospectus. Before making an investment decision, you should read the entire prospectus carefully, including the “Risk Factors” section, the financial statements and the notes to the financial statements.

|

Corporate Background

|

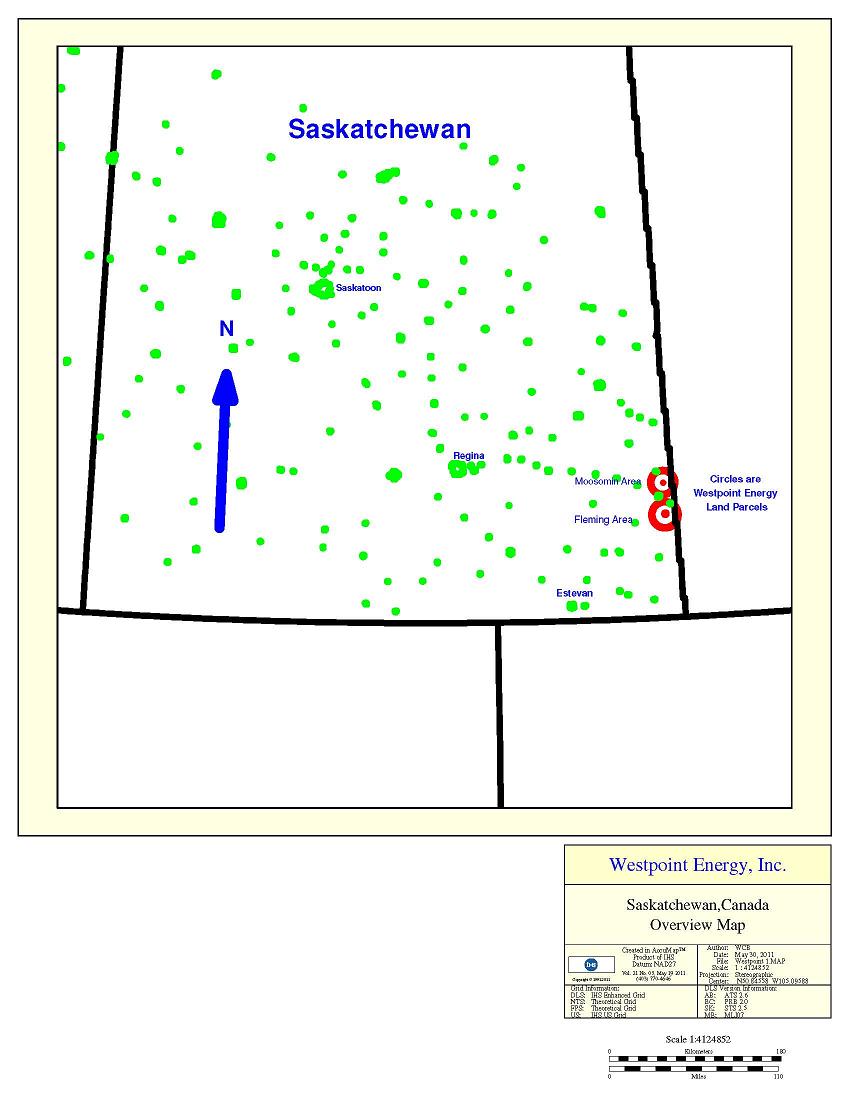

Westpoint Energy, Inc. was incorporated under the laws of the State of Nevada on December 6, 2010. Westpoint is an exploration-stage company as defined by the Securities and Exchange Commission (“SEC”) and we are in the business of exploring and if warranted, advancing certain oil and gas properties to the discovery point where we believe maximum shareholder returns can be realized. Our primary focus is in the oil and gas sector and our only properties (the "Properties") at this time consist of 2 leases located in the province of Saskatchewan, Canada.

We are dependent upon making an oil or gas discovery on the Properties. Should we be able to make an economic find on the Properties, we would then be solely dependent upon the production from the Properties for our revenue and profits, if any. Presently we do not have any known oil or gas resources or reserves. There is no drilling or production plant or equipment located within the Property boundaries. Currently, there is no power supply to the Properties. The probability that oil or gas reserves that meet SEC guidelines will be discovered on the Properties is undeterminable at this time. A great deal of work is required before a determination as to the economic and legal feasibility of an oil and gas production venture on it can be made. We have a work plan for the first year that will include a detailed review of all publicly available drill data, compilation of a list of other entities operating in the area that may present opportunities for partnering, and completion of an initial assessment of potential oil or gas-producing formations that may exist on the Properties. There is no assurance that a commercially viable deposit will be proven through the exploration efforts by us on the Properties. We cannot assure you that funds expended on our Properties or other properties that we may acquire in the future will be successful in leading to the delineation of oil or gas reserves that meet the criteria established under SEC oil and gas industry reporting guidelines.

|

6

|

Strategy

|

Our primary focus in the natural resource sector is oil and gas with an emphasis on oil. Though it is possible to take a resource property that hosts a viable oil or gas deposit into production, the costs and time frame for doing so are considerable, and the subsequent return on investment for our shareholders would be very risky. We therefore anticipate partnering or selling any oil or gas deposits that we may discover to a larger oil and gas company.

|

|

|

Acquisition of Interest

|

On February 16, 2011 the Company acquired an interest in two PN&G Leases (the “Leases”) in the province of Saskatchewan for an aggregate $15,000. The total area covered by the Leases is 132 hectares, or 528 acres. The interests in the Leases were acquired from Titan Oil & Gas, Inc. (“Titan”), an SEC reporting company. Titan disposed of its Saskatchewan leases as Titan’s other properties are located in Alberta which is Titan’s area of focus. The sole officer of Westpoint is also the sole officer of Titan. In addition, one of the directors of Titan is also a director of Westpoint. The term of each of the Leases is 5 years, requires minimum annual lease payments, and grants the Company the right to explore for potential petroleum and natural gas opportunities on the respective lease.

|

|

|

Description and Location of the Saskatchewan Properties

|

Both of the Properties are located in the Estevan area of Southeastern Saskatchewan, Canada.

|

|

|

Exploration History and Geology of the Saskatchewan Properties

|

The Bakken Formation is present over a large portion of southeastern Saskatchewan. It is subdivided into three members characterized by a middle siltstone to sandstone unit sandwiched between black organic-rich shales. In southeastern Saskatchewan, the Late Devonian to Early Mississippian Bakken Formation is conformably overlain by grey, fossiliferous limestones of the Souris Valley (Lodgepole) Formation of Mississippian (Kinderhookian) age. There have been no wells drilled on the Company’s Saskatchewan properties.

|

|

|

Current State of Exploration

|

The Company has not undertaken any exploration or drilling on its properties. There are no known resources or reserves of oil or natural gas on the Company’s properties.

|

7

|

Geological Exploration Program

|

The Province of Saskatchewan maintains a significant publicly-available database of drilling information from all wells drilled under leases issued by the provincial government. Companies who drill on government land in Saskatchewan are required to submit their drill results to the province. Therefore, previous drilling undertaken on land adjacent to the Company’s holding, or drilling on the Company’s land by companies exploring for other resources (oil sands for example) are required to submit their drill log data to the Saskatchewan government. As a result, there is a large database of drill results available to the public. Westpoint intends to make use of this publicly-available data to gain an initial understanding of the formations that may potentially exist on our Leases.

|

|

|

Competition

|

The oil and gas exploration industry is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We compete with many exploration companies that have significantly greater personnel, financial, managerial, and technical resources than we do. Competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

|

|

|

Government Regulations

|

Development, production and sale of natural gas and oil in Canada are subject to extensive laws and regulations, including environmental laws and regulations. The oil and gas properties currently leased by the Company are owned by the Province of Saskatchewan and are managed by the Department of Energy. We may be required to make large expenditures to comply with environmental and other governmental regulations. Under these laws and regulations, we could be liable for personal injuries, property damage, oil spills, discharge of hazardous materials, remediation and clean-up costs and other environmental damages.

Failure to comply with these laws and regulations also may result in the suspension or termination of our operations and subject us to administrative, civil and criminal penalties. Moreover, these laws and regulations could change in ways that substantially increase our costs. Accordingly, any of these liabilities, penalties, suspensions, terminations or regulatory changes could materially adversely affect our financial condition and results of operations enough to possibly force us to cease our business operations.

We believe that compliance with the laws will not adversely affect our business operations

|

|

8

|

Employees

|

We currently have no employees.

|

|

|

Property

|

The Company does not currently have physical office space but does currently maintains its executive offices on a shared basis at 871 Coronado Center Drive, Suite 200, Henderson, Nevada, 89052 and its telephone number is (702)-940-2333. We have a one year lease that commenced January 1, 2011 at a rate of $199 per month that includes mail and phone service only.

|

|

|

See “Acquisition of Interest” above.

|

||

|

The Offering

|

||

|

Securities offered:

|

5,740,000 shares of common stock

|

|

|

Offering price:

|

The selling security holders will be offering their shares of common stock at a price of $0.10 per share, which has been arbitrarily determined as the selling price. This is a fixed price at which the selling security holders may sell their shares until our common stock is quoted on the OTC Bulletin Board, at which time the shares may be sold at prevailing market prices or privately negotiated prices.

|

|

|

Shares outstanding prior to offering:

|

25,740,000 shares of common stock.

|

|

|

Shares outstanding after offering:

|

25,740,000 shares of common stock.

|

|

|

Our sole executive officer and a director currently owns 77.7% of our outstanding shares of common stock. As a result, he has substantial control over all matters submitted to our stockholders for approval.

|

||

|

Market for the common shares:

|

There has been no market for our securities. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the FINRA for our common stock to eligible for trading on the Over-The-Counter Bulletin Board. We do not yet have a market maker who has agreed to file such application.

There is no assurance that a trading market will develop, or, if developed, that it will be sustained. Consequently, a purchaser of our common stock may find it difficult to resell the securities offered herein should the purchaser desire to do so when eligible for public resale.

|

9

|

Summary of Risk Factors:

|

|||

|

RISK FACTORS RELATING TO OUR COMPANY

|

|||

|

Our independent auditor has issued a going concern opinion after reviewing our financial statements; our ability to continue is dependent on our ability to raise additional capital and our operations could be curtailed if we are unable to obtain required additional funding when needed.

|

|||

|

We are an exploration stage company, have generated no revenues to date and have a limited operating history upon which we may be evaluated.

|

|||

|

The field of oil and gas exploration is difficult to predict because of technological advancements and market factors, which factors our management may not correctly assess and it may make it difficult for investors to sell their our common shares

|

|||

|

Because we have no plan to generate revenue unless and until our exploration program is successful in finding productive wells, we will need to raise a substantial amount of additional capital in order to fund our operations for the next twelve months and in order to develop our properties and acquire and develop new properties. If the prospects for our properties are not favorable or the capital markets are tight, we would not be able to raise the necessary capital and we will not be able to pursue our business plan, which would likely cause our common shares to become worthless.

|

|||

|

Even if we discover crude oil or gas on our properties, a great deal more effort has to be put into extracting the resource from the property. Accordingly, we will require substantial additional capital to fund our operations and should we fail to do so, we will not be able to pursue our business plan, which would likely cause our common shares to become worthless.

|

|||

|

If we do not maintain the property lease payments on our properties, we will lose our interests in the properties as well as losing all monies incurred in connection with the properties.

|

|||

|

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

|

|||

|

The loss of our sole executive officer or the failure to hire qualified employees or consultants would damage our business.

|

|||

10

|

Since our officer and directors work for Titan, another natural resource exploration company, their other activities for that company may involve a conflict of interest. Mr. Adams also works for Ranger Survey Systems but Ranger Survey Systems is a drilling supply and service business that does not compete with Westpoint in the property acquisition aspect of the oil and gas business.

|

||

|

We are heavily dependent on contracted third parties. The inability to identify and obtain the services of third party contractors would harm our ability to execute our business plan and continue our operations until we found a suitable replacement.

|

||

|

Because of the speculative nature of exploration and development, there is a substantial risk that our business will fail.

|

||

|

We expect losses to continue in the next 12 months because we have no oil or gas reserves and, consequently, no revenue to offset losses.

|

||

|

We may not be able to compete with current and potential exploration companies, some of whom have greater resources and experience than we do in locating and commercializing oil and natural gas reserves and, as a result, we may fail in our ability to maintain or expand our business.

|

||

|

Volatility of oil and gas prices and markets, over which we have no control, could make it difficult for us to achieve profitability and investors are likely to lose their investment in our common shares.

|

||

|

Drilling wells is speculative, often involving significant costs that are difficult to project and may be more than our estimates, unsuccessful drilling of wells or successful drilling of wells that are, nonetheless, unprofitable, any one of which is likely to reduce the profitability of our business and negatively affect our results of operations.

|

||

|

The natural gas and oil business involves numerous uncertainties and operating risks that can prevent us from realizing profits and can cause substantial losses.

|

||

11

|

If we commence drilling, and we do not currently have any contracts with equipment providers, we may face the unavailability or high cost of drilling rigs, equipment, supplies, personnel and other services which could adversely affect our ability to execute on a timely basis our development, exploitation and exploration plans within our budget and, as a result, negatively impact our financial condition and results of operations.

|

|||

|

We are subject to complex laws and regulations, including environmental regulations, which can significantly increase our costs and possibly force our operations to cease.

|

|||

|

The potential profitability of oil and gas ventures depends upon various factors beyond the control of our company, which may materially affect our financial performance.

|

|||

|

Our principal stockholder, who is our sole executive officer and director, owns a controlling interest in our voting stock. Therefore investors will not have any voice in our management, which could result in decisions adverse to our general shareholders.

|

|||

|

We have no employees and our only officer and one other director each work two hours per week on our business. Consequently, we may not be able to monitor our operations and respond to matters when they arise in a prompt or timely fashion. Until we have additional capital or generate revenue, we will have to rely on consultants and service providers, which will increase our expenses and increase our losses.

|

|||

|

Our management does not reside in proximity to our two leased properties located in the Province of Saskatchewan, Canada which could result in less effective and more costly oversight of our operations.

|

|||

|

RISK FACTORS RELATING TO OUR COMMON STOCK

|

|||

|

We may, in the future, issue additional common shares, which would reduce investors’ percent of ownership and may dilute our share value.

|

|||

|

Our sole executive officer and a director owns a controlling interest in our voting stock and may take actions that are contrary to your interests, including selling their stock.

|

|||

|

The market for penny stocks has experienced numerous frauds and abuses which could adversely impact investors in our stock.

|

|||

12

|

The offering price of our common stock could be higher than the market value, causing investors to sustain a loss of their investment.

|

||

|

State securities laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell the shares offered by this prospectus.

|

||

|

Currently there is no public market for our securities, and there can be no assurances that any public market will ever develop or that our common stock will be quoted for trading and, even if quoted, it is likely to be subject to significant price fluctuations.

|

||

|

If a market develops for our shares, sales of our shares relying upon Rule 144 may depress prices in that market by a material amount.

|

||

|

We may be exposed to potential risks resulting from new requirements under Section 404 of the Sarbanes-Oxley Act of 2002.

|

||

|

Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our stockholders have limited protections against interested director transactions, conflicts of interest and similar matters.

|

||

|

The costs to meet our reporting and other requirements as a public company subject to the Exchange Act of 1934 will be substantial and may result in us having insufficient funds to expand our business or even to meet routine business obligations.

|

||

|

Use of proceeds:

|

We will not receive any proceeds from the sale of shares by the selling security holders.

|

|

13

Summary Financial Information

|

Statement of Operations Data

|

||||||||

|

For the Three

|

||||||||

|

Months

|

For the Period

|

|||||||

|

Ended

|

From December 6, 2010

|

|||||||

|

June 30,

|

(Inception) to

|

|||||||

|

2011

|

March 31, 2011

|

|||||||

|

Operating revenues

|

$ | 0 | $ | 0 | ||||

|

Income (loss) from operations

|

$ | (15,904 | ) | $ | (3,306 | ) | ||

|

Net income (loss)

|

$ | (15,904 | ) | $ | (3,306 | ) | ||

|

|

||||||||

Balance Sheet Data

|

June 30, 2011

|

March 31, 2011

|

|||||||

|

Working capital

|

$ | 68,475 | $ | 86,404 | ||||

|

Total assets

|

$ | 98,290 | $ | 102,339 | ||||

|

Total liabilities

|

$ | 12,500 | $ | 645 | ||||

|

Stockholders’ Equity

|

$ | 85,790 | $ | 101,694 | ||||

14

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following factors and other information in this prospectus before deciding to invest in our company. If any of the following risks actually occur, our business, financial condition, results of operations and prospects for growth would likely suffer. As a result, you could lose all or part of your investment.

Risk Factors Relating to Our Company

1. Our independent auditor has issued a going concern opinion after reviewing our financial statements; our ability to continue is dependent on our ability to raise additional capital and our operations could be curtailed if we are unable to obtain required additional funding when needed.

We will be required to expend substantial amounts of working capital in order to explore and develop our leased properties. We were incorporated on December 6, 2010. Our operations to date were funded entirely from capital raised from our private offering of securities from January through February 2011 (the “Offering”). Notwithstanding the proceeds from the Offering, we will continue to require additional financing to execute our business strategy. We are totally dependent on external sources of financing for the foreseeable future, of which we have no commitments. Our failure to raise additional funds in the future will adversely effect our business operations, and may require us to suspend our operations, which in turn may result in a loss to the purchasers of our common stock. We are entirely dependent on our ability to attract and receive additional funding from either the sale of securities or outside sources such as private investment or a strategic partner. We currently have no firm agreements or arrangements with respect to any such financing and there can be no assurance that any needed funds will be available to us on acceptable terms or at all. The inability to obtain sufficient funding of our operations in the future could restrict our ability to grow and reduce our ability to continue to conduct business operations. After reviewing our financial statements, our independent auditor issued a going concern opinion and our ability to continue is dependent on our ability to raise additional capital. If we are unable to obtain necessary financing, we will likely be required to curtail our development plans which could cause us to become dormant. Any additional equity financing may involve substantial dilution to our then existing stockholders.

2. We are an exploration stage company, have generated no revenues to date and have a limited operating history upon which we may be evaluated.

We were incorporated on December 6, 2010 in the State of Nevada and we have generated no revenues from operations to date. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered in establishing a business in the oil and natural gas industries. We have yet to generate any revenues from operations and have been focused on organizational, start-up, property acquisition, and fund raising activities. Since we have not generated any revenues, we will have to raise additional capital to fund our operations for the next twelve months, which we may do through loans from existing shareholders, the sale of our equity securities or strategic arrangement with a third party in order to continue our business operations. There is nothing at this time on which to base an assumption that our business operations will prove to be successful or that we will ever be able to operate profitably. We face all of the risks inherent in a new business and those risks specifically inherent in the exploration stage company, with all of the unforeseen costs, expenses, problems, and difficulties to which such ventures are subject. We cannot assure you that we will be able to generate revenues or profits from operation of our business or that we will be able to generate or sustain profitability in the future.

15

3. The field of oil and gas exploration is difficult to predict because of technological advancements and market factors, which factors our management may not correctly assess and it may make it difficult for investors to sell their our common shares.

Because the nature of our business is expected to change as a result of shifts in the market price of oil and natural gas, competition, and the development of new and improved technology, management forecasts are not necessarily indicative of future operations and should not be relied upon as an indication of future performance.

Our Management may incorrectly estimate projected occurrences and events within the timetable of our business plan, which would have an adverse effect on our results of operations and, consequently, make our common shares a less attractive investment and harm the future trading of our common shares trading on the OTC Bulletin Board. Investors may find it difficult to sell their shares on the OTC Bulletin Board should a market ever develop for our shares.

4. Because we have no plan to generate revenue unless and until our exploration program is successful in finding productive wells, we will need to raise a substantial amount of additional capital to fund our operations in the future in order to develop our properties and acquire and develop new properties. If the prospects for our properties are not favorable or the capital markets are tight, we would not be able to raise the necessary capital and we will not be able to pursue our business plan, which would likely cause our common shares to become worthless.

Cash on hand is sufficient to fund our anticipated operating needs of approximately $58,000 for the next twelve months. As we have no plan to generate revenue unless and until our exploration program is successful in finding productive wells, we will require substantial additional capital to fund our operations in the future in order to explore our leased properties which have not had any production of oil or natural gas, as well as for the future acquisition and/or development of other properties. Because we currently do not have any cash flow from operations we will need to raise additional capital, which may be in the form of loans from current shareholders and/or from public and private equity offerings. Our ability to access capital will depend on our success in participating in properties that are successful in exploring for and producing oil and gas at profitable prices. It will also be dependent upon the status of the capital markets at the time such capital is sought. Should sufficient capital not be available, the development of our business plan could be delayed and, accordingly, the implementation of our business strategy would be adversely affected. In such event it would not be likely that investors would obtain a profitable return on their investments or a return of their investments at all.

16

5. Even if we discover crude oil or gas on our properties, a great deal more effort has to be put into extracting the resource from the ground. Accordingly, we will require substantial additional capital to fund our operations and should we fail to do so, we will not be able to pursue our business plan, which would likely cause our common shares to become worthless.

Currently, we are focused primarily on exploring our properties to determine the potential for hosting crude oil or natural gas. We have no revenues, and we do not have any plan to generate revenue unless and until our exploration program is successful in finding productive wells. However, even if we discover oil or natural gas on our properties, a great deal more effort has to be put into extracting the oil or gas from the ground. Accordingly, we will require substantial additional capital to fund our future operations. Because we currently do not have any cash flow from operations, we will need to raise additional capital, which may be in the form of loans from current shareholders and/or from public and private equity offerings. Should sufficient capital not be available, the development of our business plan could be delayed and, accordingly, the implementation of our business strategy would be adversely affected. In such event it would not be likely that investors would obtain a profitable return on their investments or a return of their investments at all.

6 . If we do not maintain the property lease payments on our properties, we will lose our interests in the properties as well as losing all monies incurred in connection with the properties.

We have two Petroleum and Natural Gas (“PN&G”) leases (the “Leases”) in the province of Saskatchewan, Canada. Our Leases require annual lease payments to the Saskatchewan provincial government, which will amount to an aggregate of $407 in the next twelve months If we do not continue to make the annual lease payments, we will lose our ability to explore and develop the properties and we will not retain any kind of interest in the properties.

7 . Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. Therefore, we expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

8 . The loss of our sole executive officer or the failure to hire qualified employees or consultants would damage our business.

Because of the highly technical nature of our business, we depend greatly on attracting and retaining experienced management and highly qualified and trained personnel. We compete with other companies intensely for qualified and well trained professionals in our industry. If we cannot hire or retain, and effectively integrate, a sufficient number of qualified and experienced professionals, this will have a material adverse effect on our capacity to sustain and grow our business.

17

9 . Since our officer and directors work for Titan, another natural resource exploration company, their other activities for that other company may involve a conflict of interest.

Mr. Dhaddey, our Chief Executive Officer and President and a director and Mr. Adams, a director are not required to work exclusively for us and do not devote all of their time to our operations. In fact, Messrs. Dhaddey and Adams work for Titan, another natural resource exploration company. Mr. Adams also works for Ranger Survey Systems but Ranger Survey Systems is a drilling supply and service business that does not compete with Westpoint in the property acquisition aspect of the oil and gas business. Therefore, it is possible that a conflict of interest with regard to their time may arise based on their employment by such other company. Their other activities may prevent them from devoting full-time to our operations which could slow our operations and may reduce our financial results because of the slowdown in operations. It is expected that each of our directors will devote approximately two hours per week to our operations on an ongoing basis, and when required will devote whole days and even multiple days at a stretch when property visits are required or when extensive analysis of information is needed. Also, due to the competitive nature of the exploration business, the potential exists for conflicts of interest to occur from time to time that could adversely affect our business interests. Messrs. Dhaddey and Adams may have a conflict of interest in helping us to identify and obtain the rights to mineral properties, personnel or other business opportunities that his other natural resource exploration company may also be considering.

10 . We are heavily dependent on contracted third parties. The inability to identify and obtain the services of third party contractors would harm our ability to execute our business plan and continue our operations until we found a suitable replacement.

We are dependent on the continued contributions of third party contractors whose knowledge and technical expertise is critical for future of the Company. Our success is also heavily dependent on our ability to retain and attract experienced engineers, geoscientists and other technical and professional staff. We do not currently have any long-term consulting agreements in place with third parties under which we can ensure that we will have sufficient expertise to undertake our planned exploration program. If we were unable to obtain the services of third party contractors our ability to execute our business plan would be harmed and we may be forced to cease operations until such time as we could hire suitable contractors.

11 . We expect losses to continue in the next 12 months because we have no oil or gas reserves and, consequently, no revenue to offset losses.

Based upon the fact that we currently do not have any oil or gas reserves, we expect to incur operating losses in next 12 months. The operating losses will occur because there are expenses associated with the acquisition of, and exploration of natural gas and oil properties which do not have any income-producing reserves. Failure to generate revenues may cause us to go out of business. We will require additional funds to achieve our current business strategy and our inability to obtain additional financing will interfere with our ability to expand our current business operations.

18

12 . We may not be able to compete with current and potential exploration companies, some of whom have greater resources and experience than we do in locating and commercializing oil and natural gas reserves and, as a result, we may fail in our ability to maintain or expand our business.

The oil and natural gas market is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We compete with many exploration companies which have significantly greater personnel, financial, managerial, and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

13 . Volatility of oil and gas prices and markets, over which we have no control, could make it difficult for us to achieve profitability and investors are likely to lose their investment in our common shares.

Our ability to achieve profitability is substantially dependent on prevailing prices for natural gas and oil. The amount of, and price obtainable for, any oil and gas production that we achieve will be affected by market factors beyond our control. If these factors are not favorable over time to our financial interests, it is likely that owners of our common shares will lose their investments. Such factors include:

|

|

• worldwide or regional demand for energy, which is affected by economic conditions;

|

|

|

• the domestic and foreign supply of natural gas and oil;

|

|

|

• weather conditions;

|

|

|

• domestic and foreign governmental regulations;

|

|

|

• political conditions in natural gas and oil producing regions;

|

|

|

• the ability of members of the Organization of Petroleum Exporting Countries to agree upon and maintain oil prices and production levels; and

|

|

|

• the price and availability of other fuels.

|

14 . Drilling wells is speculative, often involving significant costs that are difficult to project and may be more than our estimates, unsuccessful drilling of wells or successful drilling of wells that are, nonetheless, unprofitable, any one of which is likely to reduce the profitability of our business and negatively affect our results of operations.

Exploration and the development of oil and natural gas properties involves a high degree of operational and financial risk, which precludes definitive statements as to the time required and costs involved in reaching certain objectives. The budgeted costs of drilling, completing and operating wells are often exceeded and can increase significantly when drilling costs rise due to a tightening in the supply of various types of oilfield equipment and related services. Drilling may be unsuccessful for many reasons, including title problems, weather, cost overruns, equipment shortages and mechanical difficulties. Moreover, the successful drilling of a natural gas or oil well does not ensure a profit on investment. Exploratory wells bear a much greater risk of loss than development wells. A variety of factors, both geological and market-related, can cause a well to become uneconomical or only marginally economic and the results of our operations will be negatively affected as well.

19

15 . The natural gas and oil business involves numerous uncertainties and operating risks that can prevent us from realizing profits and can cause substantial losses.

Our exploration, development, and exploitation activities may be unsuccessful for many reasons, including weather, cost overruns, equipment shortages and mechanical difficulties. Moreover, the successful drilling of a natural gas and oil well does not ensure a profit on investment. A variety of factors, both geological and market-related, can cause a well to become uneconomical or only marginally economical.

The oil and natural gas business involves a variety of operating risks, including:

|

|

• fires;

|

|

|

• explosions;

|

|

|

• blow-outs and surface cratering;

|

|

|

• uncontrollable flows of oil, natural gas, and formation water;

|

|

|

• natural disasters, such as hurricanes and other adverse weather conditions;

|

|

|

• pipe, cement, or pipeline failures;

|

|

|

• casing collapses;

|

|

|

• embedded oil field drilling and service tools;

|

|

|

• abnormally pressured formations; and

|

|

|

• environmental hazards, such as natural gas leaks, oil spills, pipeline ruptures and discharges of toxic gases.

|

If we experience any of these problems, it could affect well bores, gathering systems and processing facilities, which could adversely affect our ability to conduct operations. We could also incur substantial losses as a result of:

|

|

• injury or loss of life;

|

|

|

• severe damage to and destruction of property, natural resources and equipment;

|

|

|

• pollution and other environmental damage;

|

|

|

• clean-up responsibilities;

|

|

|

• regulatory investigation and penalties;

|

|

|

• suspension of our operations; and

|

|

|

• repairs to resume operations.

|

16 . If we commence drilling, and we do not currently have any contracts with equipment providers, we may face the unavailability or high cost of drilling rigs, equipment, supplies, personnel and other services which could adversely affect our ability to execute on a timely basis our development, exploitation and exploration plans within our budget and, as a result, negatively impact our financial condition and results of operations.

If we commence drilling, shortages or an increase in cost of drilling rigs, equipment, supplies or personnel could delay or interrupt our operations, which could negatively impact our financial condition and results of operations. Drilling activity in the geographic areas in which we conduct drilling activities may increase, which would lead to increases in associated costs, including those related to drilling rigs, equipment, supplies and personnel and the services and products of other vendors to the industry. Increased drilling activity in these areas may also decrease the availability of rigs. We do not currently have any contracts with providers of drilling rigs and, consequently we may not be able to obtain drilling rigs when we need them. Therefore, our drilling and other costs may increase further and necessary equipment and services may not be available to us at economical prices.

20

17 . We are subject to complex laws and regulations, including environmental regulations, which can significantly increase our costs and possibly force our operations to cease.

If we commence drilling and experience any leakage of crude oil and/or gas from the subsurface portions of a well, our gathering system could cause degradation of fresh groundwater resources, as well as surface damage, potentially resulting in suspension of operation of a well, fines and penalties from governmental agencies, expenditures for remediation of the affected resource, and liabilities to third parties for property damages and personal injuries. In addition, any sale of residual crude oil collected as part of the drilling and recovery process could impose liability on us if the entity to which the oil was transferred fails to manage the material in accordance with applicable environmental health and safety laws.

Drilling operations generally involve a high degree of risk. Hazards such as unusual or unexpected geological formations, power outages, labor disruptions, blow-outs, sour gas leakage, fire, inability to obtain suitable or adequate machinery, equipment or labor, and other risks are involved. We may become subject to liability for pollution or hazards against which it cannot adequately insure or which it may elect not to insure. Incurring any such liability may have a material adverse effect on our financial position and operations.

Development, production and sale of natural gas and oil in Canada are subject to extensive laws and regulations, including environmental laws and regulations. We may be required to make large expenditures to comply with environmental and other governmental regulations. Matters subject to regulation include:

|

|

• location and density of wells;

|

|

|

• the handling of drilling fluids and obtaining discharge permits for drilling operations;

|

|

|

• accounting for and payment of royalties on production from state, federal and Indian lands;

|

|

|

• bonds for ownership, development and production of natural gas and oil properties;

|

|

|

• transportation of natural gas and oil by pipelines;

|

|

|

• operation of wells and reports concerning operations; and

|

|

|

• taxation.

|

Under these laws and regulations, we could be liable for personal injuries, property damage, oil spills, discharge of hazardous materials, remediation and clean-up costs and other environmental damages. Failure to comply with these laws and regulations also may result in the suspension or termination of our operations and subject us to administrative, civil and criminal penalties. Moreover, these laws and regulations could change in ways that substantially increase our costs. Accordingly, any of these liabilities, penalties, suspensions, terminations or regulatory changes could materially adversely affect our financial condition and results of operations enough to possibly force us to cease our business operations.

18 . The potential profitability of oil and gas ventures depends upon various factors beyond the control of our company, which may materially affect our financial performance.

The potential profitability of oil and gas properties is dependent upon many factors beyond our control. For instance, world prices and markets for oil and gas are unpredictable, highly volatile, potentially subject to governmental fixing, pegging, controls, or any combination of these and other factors, and respond to changes in domestic, international, political, social, and economic environments. Additionally, due to worldwide economic uncertainty, the availability and cost of funds for production and other expenses have become increasingly difficult, if not impossible, to project. These changes and events may materially affect our financial performance.

21

19 . Our principal stockholder, who is our sole executive officer and director, owns a controlling interest in our voting stock. Therefore investors will not have any voice in our management, which could result in decisions adverse to our general shareholders.

Our principal shareholder beneficially owns approximately 77.7% of our outstanding common stock. As a result, this shareholder will have the ability to control substantially all matters submitted to our stockholders for approval including:

• election of our board of directors;

• removal of any of our directors;

• amendment of our Articles of Incorporation or bylaws; and

|

•

|

adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us.

|

As a result of his ownership and position, the principal shareholder who is also a director and our sole executive officer is able to influence all matters requiring shareholder approval, including the election of directors and approval of significant corporate transactions. In addition, the future prospect of sales of significant amounts of shares held by our principal shareholder could affect the market price of our common stock if the marketplace does not orderly adjust to the increase in shares in the market and the value of your investment in the Company may decrease. Management's stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

20 . We have no employees and our only officer and directors work two hours per week on our business. Consequently, we may not be able to monitor our operations and respond to matters when they arise in a prompt or timely fashion. Until we have additional capital or generate revenue, we will have to rely on consultants and service providers, which will increase our expenses and increase our losses.

We do not have any employees and our only officer and other director each work on our business two hours per week. With practically no personnel, we have a limited ability to monitor our operations, such as the progress of oil and gas exploration, and to respond to inquiries from third parties, such as regulatory authorities or potential business partners. Though we may rely on third party service providers, such as accountants and lawyers, to address some of our matters, until we raise additional capital or generate revenue, we will have to rely on consultants and third party service providers to monitor our operations, which will increase our expenses and have a negative effect on our results of operations.

21 . Our management does not reside in proximity to our two leased properties located in the Province of Saskatchewan, Canada which could result in less effective and more costly oversight of our operations.

Mr. Dhaddey, our Chairman, President, Chief Executive Officer and Chief Operating Officer, resides in Morgan Hill, California and Mr. Adams, our director, resides in Calgary, Alberta while our two leased properties are located in the Province of Saskatchewan in Canada. Because Messrs. Dhaddey and Adams do not reside in close proximity to the properties there may be less on-site oversight by our management in the early stages of exploration and there may be increased travel and related costs getting to such properties which may result in more difficulty executing our business plan.

22

RISK FACTORS RELATING TO OUR COMMON STOCK

22. We may, in the future, issue additional common shares, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorizes the issuance of 100,000,000 shares of common stock, par value $.0001 per share, of which 25,740,000 shares are currently issued and outstanding. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

23. Our sole executive officer and a director owns a controlling interest in our voting stock and may take actions that are contrary to your interests, including selling their stock.

Our sole executive officer, who is also a director, beneficially owns approximately 77.7% of our outstanding common stock. If and when he is able to sell his shares in the market, such sales by our sole executive officer within a short period of time could adversely affect the market price of our common stock if the marketplace does not orderly adjust to the increase in the number of shares in the market. This will result in a decrease in the value of your investment in the Company. Management's stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

24. Our common stock is subject to the "penny stock" rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The SEC has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require: (i) that a broker or dealer approve a person's account for transactions in penny stocks; and (ii) the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person's account for transactions in penny stocks, the broker or dealer must: (i) obtain financial information and investment experience objectives of the person; and (ii) make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form: (i) sets forth the basis on which the broker or dealer made the suitability determination; and (ii) that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

23

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Because we do not intend to pay any cash dividends on our shares of common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them at a price higher than that which they initially paid for such shares.

25. The market for penny stocks has experienced numerous frauds and abuses which could adversely impact investors in our stock.

We believe that the market for penny stocks has suffered from patterns of fraud and abuse. Such patterns include:

|

·

|

Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer;

|

|

·

|

Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases;

|

|

·

|

"Boiler room" practices involving high pressure sales tactics and unrealistic price projections by inexperienced sales persons;

|

|

·

|

Excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and

|

The wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses.

26. The offering price of our common stock could be higher than the market value, causing investors to sustain a loss of their investment.

The price of our common stock in this offering has not been determined by any independent financial evaluation, market mechanism or by our auditors, and is therefore, to a large extent, arbitrary. Our audit firm has not reviewed management's valuation, and therefore expresses no opinion as to the fairness of the offering price as determined by our management. As a result, the price of the common stock in this offering may not reflect the value perceived by the market. There can be no assurance that the shares offered hereby are worth the price for which they are offered and investors may therefore lose a portion or all of their investment.

24

27. State securities laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell the shares offered by this prospectus.

Secondary trading in common stock sold in this offering will not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted thus causing you to realize a loss on your investment.

28. Currently there is no public market for our securities, and there can be no assurances that any public market will ever develop or that our common stock will be quoted for trading and, even if quoted, it is likely to be subject to significant price fluctuations.

There has not been any established trading market for our common stock, and there is currently no public market whatsoever for our securities. Additionally, no public trading can occur until we file and have declared effective a registration statement with the SEC. There can be no assurances as to whether, subsequent to registration with the SEC:

|

·

|

any market for our shares will develop;

|

|

·

|

the prices at which our common stock will trade; or

|

|

·

|

the extent to which investor interest in us will lead to the development of an active, liquid trading market. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders for investors.

|

In addition, our common stock is unlikely to be followed by any market analysts, and there may be few institutions acting as market makers for our common stock. Either of these factors could adversely affect the liquidity and trading price of our common stock. Until our common stock is fully distributed and an orderly market develops in our common stock, if ever, the price at which it trades is likely to fluctuate significantly. Prices for our common stock will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity of the market for shares of our common stock, developments affecting our business, including the impact of the factors referred to elsewhere in these Risk Factors, investor perception of our company and general economic and market conditions. No assurances can be given that an orderly or liquid market will ever develop for the shares of our common stock.

25

29. If a market develops for our shares, sales of our shares relying upon Rule 144 may depress prices in that market by a material amount.

The majority of the outstanding shares of our common stock held by present stockholders are "restricted securities" within the meaning of Rule 144 under the Securities Act of 1933, as amended. As restricted shares, these shares may be resold only pursuant to an effective registration statement, such as this one (for the shares registered hereunder) or under the requirements of Rule 144 or other applicable exemptions from registration under the Act and as required under applicable state securities laws. On November 15, 2007, the SEC adopted changes to Rule 144, which, would shorten the holding period for sales by non-affiliates to six months (subject to extension under certain circumstances) and remove the volume limitations for such persons. The changes became effective in February 2008. Rule 144 provides in essence that an affiliate who has held restricted securities for a prescribed period may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed 1% of a company's outstanding common stock. The alternative average weekly trading volume during the four calendar weeks prior to the sale is not available to our shareholders being that the Over-the-Counter Bulletin Board (if and when listed thereon) is not an "automated quotation system" and, accordingly, market based volume limitations are not available for securities quoted only over the Over-The-Counter Bulletin Board. As a result of the revisions to Rule 144 discussed above, there is no limit on the amount of restricted securities that may be sold by a non-affiliate (i.e., a stockholder who has not been an officer, director or control person for at least 90 consecutive days) after the restricted securities have been held by the owner for a period of six months, if we have filed our required reports. A sale under Rule 144 or under any other exemption from the Act, if available, or pursuant to registration of shares of common stock of present stockholders, may have a depressive effect upon the price of our common stock in any market that may develop.

30. We may be exposed to potential risks resulting from new requirements under Section 404 of the Sarbanes-Oxley Act of 2002.

If we become registered with the SEC, we will be required, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, to include in our annual report our assessment of the effectiveness of our internal control over financial reporting We expect to incur significant continuing costs, including accounting fees and staffing costs, in order to maintain compliance with the internal control requirements of the Sarbanes-Oxley Act of 2002. Development of our business will necessitate ongoing changes to our internal control systems, processes and information systems. Currently, we have no employees, other than our sole officer and director. As we engage in the exploration of our mineral claim, hire employees and consultants , our current design for internal control over financial reporting will not be sufficient to enable management to determine that our internal controls are effective for any period, or on an ongoing basis. Accordingly, as we develop our business, such development and growth will necessitate changes to our internal control systems, processes and information systems, all of which will require additional costs and expenses.

In the future, if we fail to complete the annual Section 404 evaluation in a timely manner, we could be subject to regulatory scrutiny and a loss of public confidence in our internal controls. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations.

26

31. Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our stockholders have limited protections against interested director transactions, conflicts of interest and similar matters.

The Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the SEC, the New York and American Stock Exchanges and the Nasdaq Stock Market, as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities which are listed on those exchanges or the Nasdaq Stock Market. Because we are not presently required to comply with many of the corporate governance provisions and because we chose to avoid incurring the substantial additional costs associated with such compliance any sooner than necessary, we have not yet adopted these measures.

Because none of our directors are independent, we do not currently have independent audit or compensation committees. As a result, the directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our shareholders without protections against interested director transactions, conflicts of interest and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations.

32. The costs to meet our reporting and other requirements as a public company subject to the Exchange Act of 1934 will be substantial and may result in us having insufficient funds to expand our business or even to meet routine business obligations.

If we become a public entity, subject to the reporting requirements of the Exchange Act of 1934, we will incur ongoing expenses associated with professional fees for accounting, legal and a host of other expenses for annual reports and proxy statements. We estimate that these costs will range up to $25,000 per year for the next few years and will be higher if our business volume and activity increases but lower during the first year of being public because our overall business volume will be lower, and we will not yet be subject to the requirements of Section 404 of the Sarbanes-Oxley Act of 2002. As a result, we may not have sufficient funds to grow our operations.

THE OFFERING

This prospectus relates to the resale by certain selling security holders of the Company of up to 5,740,000 shares of our common stock. Such shares were offered and sold by us in our first private placement in January 2011 at a purchase price of $0.01 per share for 4,600,000 common shares and $0.05 for 1,140,000 common shares in our second private placement in February 2011 pursuant to the exemptions from registration under the Securities Act provided by Regulation D and Regulation S of the Securities Act. The price per share increased from one private placement to the subsequent one in the following month as a result of the agreement we executed with Titan for our Saskatchewan properties during such time.

USE OF PROCEEDS

The selling stockholders are selling shares of common stock covered by this prospectus for their own account. We will not receive any of the proceeds from the resale of these shares. We have agreed to bear the expenses relating to the registration of the shares for the selling stockholders.

27

DETERMINATION OF OFFERING PRICE

The selling stockholders will be offering the shares of common stock being covered by this prospectus at a fixed price of $0.10 per share until a market develops and thereafter at prevailing market prices or privately negotiated prices. The fixed price of $0.10 has been determined as the selling price based upon the original purchase price paid by the selling shareholders of $0.01 for 4,600,000 common shares and $0.05 for 1,140,000 common shares plus an increase based on the fact the shares will be liquid and registered.

Such offering price does not have any relationship to any established criteria of value, such as book value or earnings per share. Because we have no significant operating history, the price of our common stock is not based on past earnings, nor is the price of our common stock indicative of the current market value of the assets owned by us. No valuation or appraisal has been prepared for our business and potential business expansion. Our common stock is presently not traded on any market or securities exchange and we have not applied for listing or quotation on any public market.

This prospectus contains forward-looking statements which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors,” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

SELLING SECURITY HOLDERS

The following table sets forth the shares beneficially owned, as of September 13 , 2011, by the selling security holders prior to the offering contemplated by this prospectus, the number of shares each selling security holder is offering by this prospectus and the number of shares which each would own beneficially if all such offered shares are sold.