Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K/A (Amendment No. 2)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) June 30, 2011

|

China America Holdings, Inc.

|

||

|

(Exact name of registrant as specified in its charter)

|

||

|

Florida

(State or other jurisdiction of incorporation)

|

000-53874

(Commission File Number)

|

82-0326560

(IRS Employer Identification No.)

|

|

Xi Lv Biao Industrial Park, Longdu Street, Zhucheng City, Shangdong Province, China

|

262200

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant's telephone number, including area code

|

86-536-6046925

|

|

333 E. Huhua Road, Huating Economic & Development Area, Jiading District, Shanghai, China 201811

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Explanatory Note

On July 7, 2011 China America Holdings, Inc. (“we, “our”, "us” or the "Company") filed Amendment No. 1 to a Current Report on Form 8-K (the “8-K”) in connection with a transaction in which we acquired all of the issued and outstanding capital stock (the “China Ziyang Technology Shares”) of China Ziyang Technology Co., Limited, a Hong Kong company (“China Ziyang Technology”). China Ziyang Technology owns 100% of the capital stock of Ziyang Ceramic Company Limited, a Chinese company (“Ziyang Ceramic”). Ziyang Ceramic is a manufacturer and distributer of porcelain tiles used for residential and commercial flooring in the PRC,

located in Zhucheng City of Shangdong Province in the PRC. By this Amendment No. 2 to the Current Report on Form 8-K (“Amendment No. 2), we are amending the 8-K to provide additional disclosure in response to comments we received from the staff to the Securities and Exchange Commission on the 8-K and to correct an error in the English translation of the Option Agreement discussed below. This Amendment No. 2 speaks as of the original filing date of the 8-K, does not reflect events that may have occurred subsequent to the original filing date, and does not modify or update in any way disclosures made in the 8-K.

Unless otherwise noted, all share amounts give effect to a 400 for 1 reverse stock split (the “Reverse Stock Split”) we plan to implement, subject to shareholder approval, pursuant to the terms of the convertible promissory notes we issued in connection with our acquisition of China Ziyang Technology.

Our acquisition of China Ziyang Technology occurred on June 30, 2011, through an exchange with its sole shareholder Best Alliance Worldwide Investments Limited (“BAW") (the “Share Exchange”) in which we exchanged 590,350 shares of our common stock representing approximately 54.0% of our issued and outstanding shares and a Convertible Promissory Note in the principal amount of $14,739,932 which bears interest at the rate of 3% per annum and is convertible into 7,369,966 shares of our common stock ( the “BAW Convertible Note”). Upon completion of the Reverse Stock Split and the conversion of the BAW Convertible Note, we will have issued

approximately 79.6% of our issued and outstanding common stock to acquire China Ziyang Technology. The transaction was accounted for as a reverse merger and recapitalization of China Ziyang Technology whereby China Ziyang Technology is considered the acquirer for accounting purposes.

Item 1.01 Entry into a Material Definitive Agreement.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The following agreements were entered into in connection with the acquisition of China Ziyang Technology:

The Share Exchange Agreement and Related Transactions

On June 13, 2011 we entered into a consulting agreement with China Direct Investments, Inc. and its affiliate (“China Direct Investments”), a principal shareholder of our company, whereby China Direct Investments agreed to perform certain consulting services for us, including identifying and evaluating companies for possible acquisition, performance of due diligence, and coordination of legal accounting and SEC filings in connection with possible acquisition targets. These services included several different business opportunities, including China Ziyang Technology. The term of the agreement is for 180 days beginning June 13, 2011. As compensation for China Direct

Investments’ services, we agreed to pay China Direct Investments $500,000 in cash upon our receipt of the loan payment proceeds from the $1,728,340 loan receivable due us from Glodenstone Development Limited (the “Glodenstone Note”) and shares of our common stock representing up to 20% of our projected outstanding shares after giving effect to the number of shares issued to the target company after any reverse stock split that occurs as part of such acquisition. We agreed to pay China Direct Investments a portion of the amounts we expect to receive under the Glodenstone Note as we had no other cash resources to pay this portion of the consulting fees. See “Our history – Sale of Aohong Chemical” for a summary of the Sale of Aohong Chemical transaction.

On June 29, 2011, China Ziyang Technology acquired 100% of the equity interests in Ziyang Ceramic from its shareholders in exchange for its agreement to pay them RMB 50,000,000 (approximately $7,725,439).

In anticipation of the Reorganization discussed below, on June 29, 2011 BAW entered into an Option Agreement with the former shareholders of Ziyang Ceramic (the “Option Agreement” ) whereby these former shareholders have a five year right to acquire up to 7,960,000 shares of our unregistered common stock (the “Acquisition Shares”) from BAW, upon the occurrence of the conditions described below. The optionees who are parties to the Option Agreement are the 15 former shareholders of Ziyang Ceramic including Mr. Lingbo Chi and Ms. Ping Wang all of whom are senior executives or senior level employees of Ziyang Ceramic.

- 1 -

|

Condition

|

Number of Shares

which may be acquired

|

|||

|

Entry by us, China Ziyang Technology and BAW into the Share Exchange Agreement, which condition was met on June 30, 2011.

|

2,653,333

|

|||

|

Ziyang Ceramic achieving not less than $60,000,000 in Gross Revenues, as determined under US GAAP during the period from July 1, 2011 through June 30, 2013.

|

2,653,333

|

|||

|

Ziyang Ceramic achieving not less than $12,000,000 in pre-tax profits, as determined under US GAAP during the period from July 1, 2011 through June 30, 2013.

|

2,653,334

|

|||

We accounted for the Acquisition Shares as paid in capital as part of the Share Exchange Agreement discussed below and the Option Agreement has no accounting impact on us.

On June 30, 2011, we entered into a Share Exchange Agreement (the “Share Exchange Agreement”) among us, China Ziyang Technology and its shareholder BAW to acquire 100% of the outstanding shares of Ziyang Ceramic . Under the Share Exchange Agreement, we exchanged 590,035 shares of our common stock representing approximately 54.0% of our issued and outstanding shares and a Convertible Promissory Note in the principal amount of $14,739,932 (the “BAW Convertible Note”) which bears interest at the rate of 3% per annum and is convertible into 7,369,966 shares of our common stock for 100% of the outstanding shares of China Ziyang Technology (the

“Share Exchange”). Upon completion of the Reverse Stock Split and the conversion of the BAW Convertible Note, we will have issued approximately 79.6% of our issued and outstanding common stock to acquire China Ziyang Technology. The Share Exchange Agreement was approved by our Board of Directors on June 30, 2011 and no approval of our shareholders was necessary under Florida law. The transaction will be accounted for as a reverse merger and recapitalization of China Ziyang Technology whereby China Ziyang Technology is considered the acquirer for accounting purposes and the 590,035 shares of our common stock and the BAW Convertible Note were accounted for as paid in capital of the Company. As a result of the consummation of the Share Exchange, China Ziyang Technology and Ziyang Ceramic are now our wholly-owned subsidiaries.

As compensation for services under the June 13, 2011 consulting agreement we entered into with China Direct Investments, on June 30, 2011 we issued China Direct Investments a convertible promissory note in the principal amount of $11,075,206 (the “China Direct Convertible Note”). This promissory note bears interest at the rate of 3% per annum and is convertible into 1,538,223 shares of our common stock after giving effect to the Reverse Stock Split. The services China Direct Investments provided to us included an evaluation of several different business opportunities, including the acquisition of China Ziyang Technology and China Ceramic. The China Direct Convertible Note will be

accounted for as an expense of our company prior to the merger and recapitalization with China Ziyang Technology and the resulting effect in net equity was eliminated upon completion of reverse merger and recapitalization with China Ziyang Technology.

On June 30, 2011, Lingbo Chi was appointed as a member of our Board of Directors and our Chief Executive Officer and Ping Wang as our Chief Financial Officer in connection with our acquisition of China Ziyang Technology. Shaoyin Wang resigned his positions with us as Chief Executive Officer and Chief Financial Officer on June 30, 2011. Mr. Chi and Ms. Wang are related parties to our company as they are officers and directors of our company, they are former shareholders of Ziyang Ceramic and are officers and directors of China Ziyang Technology. Mr. Chi became the sole director of BAW upon closing of the Share Exchange Agreement.

We plan to seek the approval of a majority of our shareholders in order to amend our articles of incorporation to effectuate the Reverse Stock Split as required under the Florida Business Corporation Act. If our shareholders approve the Reverse Stock Split, each four hundred (400) shares of our common stock issued and outstanding, or held as treasury shares, immediately prior to the effective date of the Reverse Stock Split, will become one (1) share of the same class of our common stock on the effective date of the Reverse Stock Split.

The Reverse Stock Split was one alternative we considered at the time we entered into the Purchase Agreement to acquire China Ziyang Technology as part of the financing for this transaction. Based on our capitalization at the time we were negotiating to acquire China Ziyang Technology, we only had approximately 236,013,800 shares (without giving effect the Reverse Stock Split), or 47.2% of our total authorized and unissued common stock available for issuance. These shares were not sufficient to complete the acquisition of China Ziyang Technology. In order to enable us to complete this acquisition on terms acceptable to China Ziyang Technology and pay the fees payable to China Direct Investments due

under our consulting agreement with that firm through the issuance of our common stock, we agreed to pay a portion of the purchase price for the acquisition, as well as the fees payable to China Direct Investments, through our issuance of the Convertible Notes.

- 2 -

The Convertible Notes provide for their automatic conversion into common stock on the effective date of a reverse stock split or an increase in the number of shares of common stock we are authorized to issue. Specifically, the BAW Convertible Note is automatically convertible into shares of our common stock at a conversion price of $2.00 per share immediately following the date on which we file Articles of Amendment to our Articles of Incorporation with the Secretary of State of Florida either increasing the number of our authorized shares of common stock or upon completion of a reverse stock split so that there are a sufficient number of shares of our common stock to permit a full conversion of the note based

upon the conversion price (the “Conversion Conditions”). The China Direct Convertible Note is also automatically convertible into shares of our common stock at a conversion price of $7.20 per share immediately following the satisfaction of at least one of the Conversion Conditions. Other than for accrued interest, the number of shares in which the Convertible Notes issued to BAW and China Direct Investments are convertible into is not subject to adjustment unless, during the time the notes are outstanding, we were to declare a stock dividend or make other distributions of our common stock or if we were to merge with or transfer our assets to an unrelated entity.

FORM 10 DISCLOSURE

Following the transaction with China Ziyang Technology, our business and operations are now those of Ziyang Ceramic Following is information on the business and operations of China Ziyang Technology and its wholly owned subsidiary Ziyang Ceramic . Unless specifically set forth to the contrary, when used in this report the terms "we"", "our", the "Company" and similar terms refer to China Ziyang Technology Co., Limited, a Hong Kong company (“China Ziyang Technology”) which owns 100% of the interests of Ziyang Ceramic Company Limited, a Chinese company (“Ziyang Ceramic ”). The information which appears on our web site at is not part of this

report.

Our Corporate Structure

Ziyang Ceramic, our principal operating subsidiary in the Peoples Republic of China (the “PRC”), was established under the laws of the PRC on January 21, 2006.

China Ziyang Technology was formed on June 29, 2011 under the laws of Hong Kong. On June 29, 2011, BAW agreed to contribute to China Ziyang Technology HK $2,500 (approximately US$193) in cash as paid in capital and lend China Ziyang Technology the sum of HK $60,166,972 (approximately US $7,725,439) in exchange for 2,500 shares of China Ziyang Technology. On June 30, 2011 , China Ziyang Technology acquired 100% of the equity interests in Ziyang Ceramic in exchange for its agreement to pay its shareholders RMB 50,000,000 (approximately $7,632,422).

- 3 -

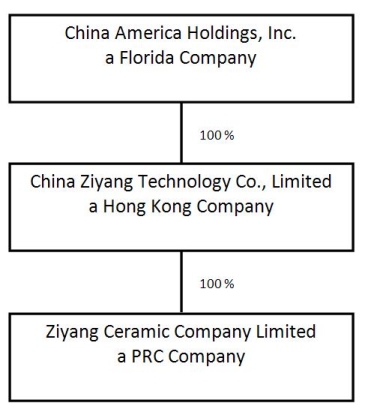

The chart below illustrates the current structure of the Company:

China America Holdings, Inc. and China Ziyang Technology are holding companies.

The Reorganization

In June 2011, the shareholders of Ziyang Ceramic (the “Ziyang Ceramic Shareholders”) and Lingbo Chi, its chief executive officer, developed a plan to position itself to acquire companies that were seeking to expand and obtain the benefits of a U.S. public company (the “Restructuring”). A key element of the Restructuring was to enter into a transaction with a public shell company in the United States by which we, the public shell company, would acquire operations based in the PRC, all in compliance with PRC law.

- 4 -

To accomplish this step, BAW formed China Ziyang Technology to acquire Ziyang Ceramic. The second step in the Restructuring was for the Ziyang Ceramic shareholders to transfer their ownership interest in Ziyang Ceramic to China Ziyang Technology. The third step was for China Ziyang Technology and BAW to enter into and complete a transaction with a U.S. public reporting company whereby that company would acquire Ziyang Ceramic.

The first step was completed in conjunction with the second step so that as Ziyang Ceramic became a subsidiary of China Ziyang Technology when it acquired Ziyang Ceramic. As part of the second step, Ziyang Ceramic entered into a Share Transfer Agreement with the Ziyang Ceramic Shareholders to purchase the company in exchange for its agreement to pay the shareholders RMB 50,000,000. As part of the third step of the Restructuring, the Ziyang Ceramic Shareholders entered into an option agreement (the “Option Agreement”) which provided them with a process under which they could purchase for a nominal amount the shares of common stock of the U.S. public reporting company held by

BAW. Thereafter China Ziyang Technology could undertake the third and final step of the Restructuring to enter into and complete a transaction with a U.S. public reporting company whereby that company would acquire China Ziyang Technology.

The Restructuring and acquisition of Ziyang Ceramic was structured to comply with the New M&A Rules discussed on page 8 of the Form 8-K – “Regulation of foreign exchange in certain onshore and offshore transactions.” Under the New M&A Rules, the acquisition of PRC companies by foreign companies that are controlled by PRC citizens who are affiliated with Ziyang Ceramic is strictly regulated and requires approval from the Ministry of Commerce, which approval is burdensome to obtain. Such restrictions however, do not apply to foreign entities which are controlled by foreign persons. These restrictions apply only at a “snapshot in time” that

occurs at the time PRC companies are acquired by a foreign entity. In our case, this was effective on June 29, 2011 when China Ziyang Technology acquired 100% of the equity interest of Ziyang Ceramic from the Ziyang Ceramic Shareholders for aggregate consideration of RMB50,000,000 (approximately $7,632,422) which was the registered and fully paid up capital of Ziyang Ceramic. At that time China Ziyang Technology was owned 100% by BAW, and BAW was owned 100% by Mau Nam Chan, a Hong Kong citizen. China Ziyang Technology Technology’s’ acquisition of Ziyang Ceramic was a cross-border transaction governed by and permitted under the New M&A Rules.

Since the New M&A Rules would have prohibited the Ziyang Ceramic Shareholders who were PRC citizens from immediately receiving a controlling interest in the Company in a share exchange as consideration for the sale of their interest in Ziyang Ceramic, the Ziyang Ceramic Shareholders and BAW instead agreed that they would enter into an Option Agreement to grant those Ziyang Ceramic Shareholders a right to acquire all of BAW’s interest in the Company. Because all of the Ziyang Ceramic Shareholders were PRC citizens, a majority of Ziyang Ceramic shareholders would not have been permitted to immediately receive shares in China Ziyang Technology or in the Company in exchange for their interests in

Ziyang Ceramic. However, there is no prohibition under PRC laws for those Ziyang Ceramic shareholders to earn an interest in the Company after the acquisition of Ziyang Ceramic was consummated.

As part of the first and second steps of the Restructuring, the Ziyang Ceramic Shareholders entered into an Option Agreement. The Option Agreement was succeeded by and developed in connection with the Share Exchange. These agreements taken together provided the Ziyang Ceramic Shareholders with a process under which they could purchase for a nominal amount the shares held by BAW. The Option Agreement provides for the Ziyang Ceramic Shareholders to obtain legal ownership of the Company’s shares issued to BAW in the Share Exchange.

On June 29, 2011, BAW and the Ziyang Ceramic Shareholders entered into the Option Agreement. The Option Agreement enables the Ziyang Ceramic Shareholders to purchase 7,960,000 shares (after giving effect to a planned 400 for 1 reverse stock split) of the Company (the “Option Shares”) from BAW for a nominal amount per share provided that BAW enters into a Share Exchange Agreement with the Company and it meets certain performance targets for the period July 1, 2011 through June 30, 2013. The Ziyang Ceramic Shareholders would be entitled to purchase from BAW during the five year term of the Option Agreement one-third of the Option Shares when BAW entered into the Share Exchange

Agreement with the Company, one-third of Option Shares if the Company’s gross revenues for any 12 consecutive months during the time period from July 1, 2011 through June 30, 2013 reached $60 million and one-third of the Option Shares if the Company’s pre-tax profits reached $12 million over the same time period. The number of shares which can be acquired by the Ziyang Ceramic Shareholders under the Option Agreement is in proportion to their former relative ownership interest in Ziyang Ceramic prior to its sale to China Ziyang Technology.

The Option Agreement reflects the intent and purpose of the parties in undertaking and accomplishing the Restructuring. And following completion of the third step in the Restructuring, the Option Agreement is the operative agreement for all purposes with respect to the relationship of the Ziyang Ceramic Shareholders to the Company.

Under the Option Agreement, BAW has legal title to the shares of the Company’s common stock issuable under the Share Exchange Agreement and there are no limits on its voting rights with respect to those shares. Under the Option Agreement, the Ziyang Ceramic Shareholders have the right to obtain the economic benefits of the Option Shares by purchasing them from BAW for a nominal amount upon the Company entering into the Share Exchange Agreement and it's attaining the specified financial thresholds in the agreement which trigger their purchase rights.

- 5 -

On June 30, 2011, the goal of the Restructuring was realized when the Company entered into and completed a share exchange agreement with BAW and China Ziyang Technology. At that time the Company was controlled by its public shareholders who owned approximately 49% of its common stock. Pursuant to the share exchange agreement, the Company acquired 100% of the equity of China Ziyang Technology from BAW in exchange for the issuance of an aggregate of 7,960,000 shares (590,035 on an immediate basis and 7,960,000 by way of a convertible promissory note, all such amounts giving effect to a planned 400 for 1 reverse stock split) of our common stock to BAW. As a result of this transaction, the Company is a

holding company which, through its direct ownership of China Ziyang Technology and Ziyang Ceramic, now has operations based in the PRC.

BUSINESS

Ziyang Ceramic manufactures and distributes in the PRC porcelain tiles used for interior residential and commercial flooring. Located in Zhucheng City of Shangdong Province, Ziyang Ceramic was established in January of 2006. Since its inception, Ziyang Ceramic has expanded its operations that includes two operational production lines with annual total production capacity of approximately 11 million square meters of porcelain floor tiles in more than 50 different size and color combinations. In addition, Ziyang Ceramic substantially completed construction of a new production line that is expected to provide additional annual production capacity of 80 million square feet of interior

wall porcelain tiles upon completion of testing. Ziyang Ceramic sells porcelain tiles under the “Fuyunde,” “Luckway,”and “GEF” brand names through a distribution network of approximately 150 distributors across 10 provinces concentrating on major second and third tier cities primarily in Eastern and Central China. Ziyang Ceramic owns mining rights to extract approximately 638,000 tons of white clay raw material which it plans to use for its own production and opportunistically sell to third parties. Ziyang Ceramic sales of its finished goods are exempt from a 17% value added tax and is entitled to a deduction from income taxes in an amount equal to 10% of its revenues because it recycles gas and heat and uses certain types of raw materials in the manufacture of its products. Eligibility for these tax benefits

is subject to review every two years with the next renewal date on January 1, 2013.

Our three principal product categories are: (i) patterned polished porcelain tiles, (ii) ultra bright porcelain tiles, and (iii) polycrystalline porcelain tiles launched in the fourth quarter of calendar 2010. In addition, we opportunistically sell white clay from our mines to third parties. Each of our products are available in two different sizes, 600mm X 600mm and 800mm X 800mm. The market for our products has grown at a rate of approximately 9% over the past 3 years primarily due to the increasing demand for construction materials in the PRC attributable to population growth, urbanization and the increase in standards of living. In 2010, our annual sales volume increased by 40% from 2009.

Product Description

|

|

Patterned polished porcelain tiles. These tiles are high density, high strength tiles with low water absorption characteristics. They are extremely durable and have antibacterial, high stain resistant, wear-resistant, and anti-slip qualities making them especially suitable for public and residential use.

|

|

|

Ultra bright polished porcelain tiles. The surfaces of these tiles are treated with a nano-particle based coating that forms a bacterial resistant glossy mirrored surface. These tiles are super wear-resistant, stain resistant, acid- resistant and have low water absorption and non-slip qualities. Fired under high temperature and with the use of special penetrating technology, these tiles result in soft colors and elegant surface patterns, suitable for high-end decorative residential use.

|

|

|

Polycrystalline porcelain tiles. Polycrystalline tiles have elegant, natural-looking marble like patterns. The surface is delicate, transparent, glossy, and feels like jade. This product is antibacterial and environmentally friendly. These tiles are frost resistant, thermal shock resistant, wear- resistant, and acid- resistant. This product is superior to natural granite and can be used as high-end decorative paving products for residential and commercial use.

|

- 6 -

We sell our tiles under the three brand names and registered trademarks listed in the table below. Our trademarks have been registered with the Trademark Office of the State Administration for Industry and Commerce of the Peoples Republic of China (the “SAIC"). Based on our trademark registration and applicable PRC law, we have the exclusive right to use a trademark for products and services for which the trademark has been registered with the SAIC. A trademark registration is valid for 10 years as noted in the “Validity Term" column in the table below, starting from the day the registration was approved:

|

Brand Name

|

Trademark

|

Class/Products

|

Validity Term

|

SAIC Registration No.

|

|||

|

FUYUNDE

|

|

19/Tiles; wave shape tile; non-metallic tile for construction use; non-metallic flooring tile; ceramic tiles; refractory material (wrought material);

|

From March 28, 2007 to March 27, 2017

|

4115540 | |||

|

LUCKWAY

|

|

19/Tiles; construction use inlay tiles; wave shape tile; non-metallic tile; construction use non-metallic tile; non-metallic flooring tile; glass mosaic; ceramic tiles

|

From October 28, 2008 to October 27, 2018

|

4713560 | |||

|

GEF

|

|

19/Tiles; construction use inlay tiles; wave shape tile; non-metallic tile; construction use non-metallic tile; non-metallic flooring tile; glass mosaic; ceramic tiles

|

From August 7, 2009 to August 6, 2019

|

5343316 | |||

Certifications and Awards

All of our products are manufactured under guideline GB/T19001:2008, a Chinese national standard set by Standardization Administration of China (SAC). This standard follows ISO 9001:2008 which is a standard developed and published by the International Organization for Standardization (ISO) that define, establish, and maintain an effective quality assurance system for manufacturing and service industries. In addition, our porcelain products have been tested and have passed the radioactivity test based on GB6566-2001 standards of radionuclide’s limits in building materials and have received the China Compulsory Certification (the “CCC”) for each of our product categories issued by the China

Building Materials Test and Certification Center.

Ziyang Ceramic received The Green Building Ceramic Recommended Certification of China from China Building Ceramic and Sanitary Ware Association (“China Sanitary Ware Association”) for its Fuyunde brand tiles. China Sanitary Ware Association is a non-profit organization that promotes the healthy development of the ceramics industry and is engaged in the research, design, equipment manufacturing, education, training, construction and foreign trade for this industry.

In 2008, Ziyang Ceramic received a financial incentive national energy savings award of approximately $254,000 from the Chinese central government to retrofit its furnace into an energy efficient roller kiln that utilizes advanced waste heat recycling technology and higher efficient insulation to achieve greater production efficiency and energy savings.

- 7 -

Customers

We sell our products directly to our network of approximately 150 distributors primarily in Eastern and Central China with approximately 54% of our 2010 revenues from sales within the Shandong and Henan Provinces. The end customers are typically residential developers and urban and rural residents in second and third tier cities.

In 2010, our top 10 distributors represented approximately 54% of our total revenues with each one representing less than 10% of total revenue. We have long-term relationships with our customers and our top ten customers in 2010 have purchased from us for over four years.

Sales and Marketing

We market our products directly to various distributors in China’s second and third tier cities utilizing our in-house sales team. We participate from time to time in various ceramic and porcelain products trade shows and expositions. Typically, annual open contracts are signed with our distributors and subsequently sales volume and prices are determined monthly.

More than 90% of our sales are paid for at the time of sale with credit terms of up to 3 months available to only a few of our largest customers. As a result of our restrictive payment and credit terms, we have not had any write-offs for bad debts since the inception of our business in 2006. Ziyang Ceramic does not bear any delivery costs on its sales as its distributors pickup the products they order from our warehouse in Zhucheng, Shangdong Province.

Suppliers

Clay and coal are the two main raw materials required to manufacture porcelain tiles. We have access to our own source of white clay from own mines. We purchase the coal we use to generate coke gas to heat the kilns used in firing our tiles from at least two independent suppliers. Other major sourced materials include kaolin tailings (a clay mineral) and packaging materials. We are not dependent on any one of our PRC based suppliers as we are able to source raw materials from alternative vendors should the need arise.

Our major suppliers usually deliver raw materials within one to two months after the receipt of our purchase order. Their typical credit terms for our coal suppliers are from one to two months after the raw materials have been delivered.

We have sufficient raw materials on hand to support, on average, three weeks of production at any point in time to minimize any potential production delays that could arise due to a delay in raw material delivery. We have not experienced any significant production disruptions due to supply shortages from our suppliers, nor have we had a major dispute with a supplier.

None of our officers or directors or their respective affiliates has any direct or indirect interest in any of the major suppliers.

Facility

Ziyang Ceramic occupies a 775,000 square foot production facility, a 172,222 square foot warehouse, a 19,375 square foot office building and a 22,600 square foot dormitory and dining hall facility all of which are located on a 1.8 million square foot parcel of land. The production facility houses two currently operating production lines with a combined total annual capacity of 118 million square feet of floor porcelain tiles. In addition, Ziyang Ceramic substantially completed construction of a new production line that is expected to provide additional annual production capacity of 80 million square feet of interior wall porcelain tiles upon completion of testing. In addition, this manufacturing

facility employs energy efficient and environmentally friendly capabilities that allow for the recovery and reuse of waste water, waste gas, and waste dust in its production.

- 8 -

Production Process

Our production process takes approximately 83 hours. Both of our production lines operate on a 24 hour basis annually allowing for approximately 10 days for maintenance and repair during Chinese New Year. Our production process can be categorized into the following eight main steps.

|

1.

|

Raw Material Inspection. Ensuring the quality of raw materials is essential in porcelain production as the chemical specifications of key components such as clay, feldspar, porcelain stone and other minerals can vary depending on their origin. Ziyang Ceramic’ quality control inspectors examine and test the physical and chemical specifications of each shipment of raw materials to ensure it meets specified standards. Raw materials that meet the required standards are stored and those that do not are rejected.

|

|

2.

|

Mixing. Raw materials are mixed in large vats capable of holding approximately 30 metric tons of raw materials. Electronic scales are used to achieve precise mixture ratios we developed for each product line.

|

|

3.

|

Grinding/Iron removal/Sifting. The prepared mixture is then moved into a ball mill grinder where it is ground for approximately 14 hours to achieve the desired particle size, consistency, moisture content, and flow rate. After inspection of the materials and addition of a coloring agent, a sizing agent is added to achieve the desired strength and water-repelling characteristics. A procedure to remove iron impurities that cause discoloring is performed. Finally the mixture in run through a vibrating sifter to remove large particles and impurities that may cause defects to the tile’s surface.

|

|

4.

|

Spray granulation. The material is then moved to a spray drying tower where the moisture content is reduced to form even granules at a prescribed moisture content. The granules are then stored for over 24 hours to ensure uniformity and consistency.

|

|

5.

|

Molding. The processed materials are then poured into molds through a feeder and pressed to form the desired size and shape known as a ‘bisque’.

|

|

6.

|

Drying and Firing. The bisques are dried using residual heat from the kilns at temperatures that reach 180º C in order to achieve a desired level of hardness and minimize cracking. The dried bisques are then fired in a coke gas fired, machine controlled kiln at uniform temperatures reaching 1210ºC where it goes through a series of physical and chemical reactions to reach the specifications required for each product.

|

|

7.

|

Polishing. Once cooled, the tiles are sent to polishing machines to cut and polish their surface to ensure shine and smoothness. The surface of the tiles is then coated with a layer of wax filler making them stain resistant.

|

|

8.

|

Inspection/Packaging. In the final step, the tiles examined to ensure they meet established quality standards and are sorted by grades and packaged by categories. They are then stored and ready for sale.

|

Quality Control Process

Our quality control department is involved throughout the entire manufacturing process. Raw materials go through a series of chemical tests to ensure they meet the required specifications. During each step of the production process, random samples of the materials are tested to ensure each step is processed accurately. Finished products are thoroughly examined. Based on each tile’s appearance, size, and surface smoothness, they are then sorted, packaged and sold by premium, superior, standard, and substandard grades.

Research and Development

Ziyang Ceramic engages in new product development and improvement both through our internal research and development staff and in partnership with industry consultants from time to time. We are currently developing natural stone powder tiles, glazed and crystallized tiles, ultra-thin tiles, permeable pavement tiles and sanitary ware products. We expect to release our natural stone powder line of tiles in the second half of 2011.

- 9 -

Industry

The PRC is the largest ceramic tile producer providing approximately 70% of the world’s supply. It is also the world’s largest exporter of ceramic tiles. According to data compiled by the Italian Ceramic Manufacturers Association, worldwide demand for ceramic tile is rising by 3%-5% per year since 2009, while demand in Europe and within the PRC is expected to rise in future years by 9% per year. According to the Chinese Ministry of Construction, it is estimated that from 2009 to 2014, the PRC’s new construction will cover 7.4 million acres.

The development of the PRC’s ceramic tiles industry is closely related to the overall national economic development, especially with the unprecedented urbanization in China. In 2010, the PRC’s gross domestic product (GDP) reached approximately $5.87 trillion. Construction and real estate investment and related industries continue to be one of the main drivers of GDP growth, representing approximately 20% of its GDP. However, since 2010, the Chinese government has taken a series of tightening measures in an effort to slow economic growth and inflation. As a result, we believe that commercial and residential real estate development in the tier one cities such as Beijing and Shanghai may decline. The

prospects for future growth in domestic demand for ceramic tile products depends on the following economic factors and government policies intended to influence the construction and real estate development sections of the Chinese economy.

Urbanization: The urbanization trend in the PRC over the past 20 years is expected to continue with estimates of nearly 400 million new urban residents by 2030 (an increase of 47% of the total population to more than 64%) exceeding the population of the United States. These increases are expected to benefit the construction industry for many years to come. Additionally, the construction materials industry in the PRC is expected to benefit from two other trends associated with urbanization: population growth and increasing standards of living reflected in the demand for larger living space. It is estimated that the PRC’s urban population will expand

from 572 million in 2005 to 926 million in 2025 and reach one billion by 2030. As a result, we believe that commercial and residential construction will continue to expand which we expect to support the continued growth in the demand of our products.

Growth of Tier II/Tier III cities: Tier II and Tier III cities are major cities with populations exceeding 1 million that in many cases live in homes that do not meet modern standards. China's Tier-II cities account for in excess of 88% of the country's GDP and have experienced rapid increases in household disposable income per capita and retail sales. Economic activities from these cities are estimated to continue to drive the PRC’s GDP growth. Continuing growth of these cities will demand residential and commercial construction and renovation projects generating growing demand for our products.

Rural Development: Rural areas will be one of the major growth developments for the ceramic industry in the coming decade thanks in part to the subsidies for rural housing renovation from central and local governments. We expect to see continued growth in this market for our products in the near future.

Social welfare housing: the PRC is aggressively promoting social welfare housing construction programs nationwide. The program is expected to produce approximately 3.0 million new social welfare housing units and 2.8 million new public rental housing units. This program is expect to create demand for 2 to 2.4 billion square meters of ceramic tiles, approximately 20-25% of anticipated total output in 2011. In 2010, the central government committed approximately RMB63.2 billion ($9.8 billion) in financing representing approximately 40%-50% of the total construction costs with the remaining covered by real estate developers. We believe that the PRC central

government’s push for social welfare housing will further increase the demand of our products.

Our Competitive Advantages

We believe the following competitive advantages will support our continued growth and profitability:

|

1.

|

Control of main raw materials (white clay). Ziyang Ceramic has mining rights for white clay that result in stable reduced raw material costs and a stable source of supply.

|

|

2.

|

Favorable tax treatment. Ziyang Ceramic sales of its finished goods are exempt from the 17% value added tax and is entitled to receives a deduction from its income taxes an amount equal to 10% of its revenues because it recycles gas and heat and uses certain types of raw materials in the manufacture of its products. Eligibility for these tax benefits is subject to review every two years with the next renewal date on January 1, 2013.

|

- 10 -

|

3.

|

Loyal customer base and a strong sales network. We sell our products mainly through our network of over 150 distributors throughout Eastern and Central China, including Heilongjiang, Guangdong, and Fujian provinces. Many of our distributors have been our customer since our inception in 2006.

|

|

4.

|

Strategic location in Zhucheng City of Shandong Province. Zhucheng City is an established ceramic and construction materials hub in the PRC. The development of ceramic related products is supported by the local government. Distributors and direct customers often come to this area to procure construction materials for construction projects and exports, providing us with a regular flow of customers. The centralized industry location allows us to respond quickly to customer demands and react rapidly to emerging market trends. In addition, significant deposits of the white clay which is a key raw material in the manufacture of porcelain tiles and which we own

mining rights are located nearby Zhucheng City.

|

|

5.

|

Strong Management Team. Ziyang Ceramic' growth and development has been a result of its executive management team’s considerable operational experience in the porcelain tile industry.

|

Growth Strategy

Our growth strategies include the following:

|

1.

|

Launch of New Products. Development of a line of interior wall tiles and completed the expansion of our manufacturing facility to accommodate production of these tiles. We expect to begin offering interior wall tiles along with a natural stone powder line of tiles in the second half of calendar 2011.

|

|

|

2.

|

Expand Sales of Recently Launched Products. Expand sales of our recently launched high-end polycrystalline porcelain tiles series by offering additional sizes and styles.

|

|

3.

|

Increase Sales Network. Development of an online sales enabled website to expand sales of our products directly to end customers.

|

|

|

4.

|

International Distribution. Development of an international distribution network to expand our sales outside of the PRC.

|

|

5.

|

Acquisition of Additional Manufacturing Facilities. Acquisition of additional ceramics manufacturing facilities.

|

Competition

The Chinese ceramic tiles industry is fragmented and highly competitive. Led by a few flagship ceramic tiles manufacturers in Eastern China especially in the provinces of Guangdong, Fujian and Shandong, there are numerous smaller producers scattered throughout the PRC. We face intense competition from existing competitors and new market entrants. Most of our competitors are privately owned enterprises that are located throughout the PRC. We compete primarily based on product quality, brand recognition, and our extensive distributor network.

GOVERNMENT REGULATION

General Regulatory Environment

We operate our business in the PRC under a legal regime consisting of the State Council, which is the highest authority of the executive branch of the PRC central government, and several ministries and agencies under its authority, including the State Administration for Industry and Commerce, or SAIC, the Ministry of Commerce, or MOFCOM, the State Administration of Foreign Exchange, or SAFE, and their respective authorized local counterparts.

- 11 -

Environmental Protection Regulations

In accordance with the China Environmental Protection Law adopted on December 26, 1989, the Administration Supervisory Department of Environmental Protection of the State Council sets the national guidelines for the discharge of pollutants. The PRC’s provincial governments, autonomous regions and municipalities may also set their own guidelines for the discharge of pollutants within their own provinces or districts in the event that the national guidelines are inadequate. A company which causes environmental pollution and discharges other polluting materials which endanger the public should implement environmental protection methods and procedures into their business operations. This may be achieved by setting

up a system of accountability within the company’s business structure for environmental protection, adopting effective procedures to prevent environmental hazards such as waste gases, water and residues, dust powder, radioactive materials and noise arising from production, construction and other activities from polluting and endangering the environment. The environmental protection system and procedures should be implemented simultaneously with the commencement of and during the operation of construction, production and other activities undertaken by the company. Any company which discharges environmental pollutants should report and register such discharge with the Administration Supervisory Department of Environmental Protection and pay any fines imposed for the discharge. A fee may also be imposed on the company for the cost of any work required to restore the environment to

its original state. Companies which have caused severe pollution to the environment are required to restore the environment or remedy the effects of the pollution within a prescribed time limit. If a company fails to report and/or register the environmental pollution it caused, it will receive a warning or be penalized. Companies that fail to restore the environment or remedy the effects of the pollution within the prescribed time will be penalized or have their business licenses terminated. Companies that have polluted and endangered the environment must bear the responsibility for remedying the danger and effects of the pollution, as well as to compensate any losses or damages suffered as a result of such environmental pollution.

Ziyang Ceramic believes its operations in the PRC comply with the current environmental protection requirements and will continue to evaluate the proposed environmental regulation. Ziyang Ceramic is not subject to any admonition, penalty, investigations or inquiries imposed by the environmental regulators, nor are they subject to any claims or legal proceedings to which it was named as a defendant for violation of any environmental laws and regulations.

Regulation of foreign exchange.

The PRC government imposes restrictions on the convertibility of the RMB and on the collection and use of foreign currency by PRC entities. Under current regulations, the RMB is convertible for current account transactions, which include dividend distributions, and the import and export of goods and services. Conversion of RMB into foreign currency and foreign currency into RMB for capital account transactions, such as direct investment, portfolio investment and loans, however, is still generally subject to the prior approval of or registration with SAFE.

Under current PRC regulations, foreign-invested enterprises such as our PRC subsidiaries are required to apply to SAFE for a Foreign Exchange Registration Certificate for Foreign-Invested Enterprise. With such a certificate (which is subject to review and renewal by SAFE on an annual basis), a foreign-invested enterprise may open foreign exchange bank accounts at banks authorized to conduct foreign exchange business by SAFE and may buy, sell and remit foreign exchange through such banks, subject to documentation and approval requirements. Foreign-invested enterprises are required to open and maintain separate foreign exchange accounts for capital account transactions and current account transactions. In addition,

there are restrictions on the amount of foreign currency that foreign-invested enterprises may retain in such accounts.

Regulation of foreign exchange in certain onshore and offshore transactions.

In October 2005, SAFE issued the Notice on Issues Relating to the Administration of Foreign Exchange in Fund-Raising and Return Investment Activities of Domestic Residents Conducted via Offshore Special Purpose Companies, or SAFE Circular 75, which became effective as of November 1, 2005. According to SAFE Circular 75, prior to establishing or assuming control of an offshore company for the purpose of financing that offshore company with assets or equity interests in an onshore enterprise in the PRC, each PRC resident, whether a natural or legal person, must complete certain overseas investment foreign exchange registration procedures with the relevant local SAFE branch. An amendment to the

registration with the local SAFE branch is required to be filed by any PRC resident that directly or indirectly holds interests in that offshore company upon either (i) the injection of equity interests or assets of an onshore enterprise to the offshore company or (ii) the completion of any overseas fund-raising by such offshore company. An amendment to the registration with the local SAFE branch is also required to be filed by such PRC resident when there is any material change involving a change in the capital of the offshore company, such as (i) an increase or decrease in its capital, (ii) a transfer or swap of shares, (iii) a merger or division, (iv) a long-term equity or debt investment or (v) the creation of any security interests.

- 12 -

SAFE Circular 75 applies retroactively. As a result, PRC residents who established or acquired control of offshore companies that made onshore investments in the PRC in the past were required to complete the relevant overseas investment foreign exchange registration procedures by March 31, 2006. Under SAFE Circular 75, failure to comply with the registration procedures may result in restrictions on the relevant onshore entity, including restrictions on the payment of dividends and other distributions to its offshore parent or affiliate and restrictions on the capital inflow from the offshore entity, and may also subject relevant PRC residents to penalties under the PRC foreign exchange administration

regulations.

As a U.S. company, we are considered a foreign entity in the PRC. If we purchase the assets or equity interests of a PRC company owned by PRC residents in exchange for our equity interests, such PRC residents will be subject to the registration procedures described in SAFE Circular 75. Moreover, PRC residents who are beneficial holders of our shares are required to register with SAFE in connection with their investment in us.

In addition, on August 8, 2006, six PRC regulatory authorities, including the Ministry of Commerce, the State Assets Supervision and Administration Commission, the State Administration for Taxation, the State Administration for Industry and Commerce, the CSRC and SAFE, jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the New M&A Rules, which became effective on September 8, 2006. This regulation, among other things, includes provisions that purport to require that an offshore special purpose vehicle formed for purposes of overseas listing of equity interests in PRC companies and controlled directly or indirectly by PRC companies or individuals

obtain the approval of the CSRC prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange. On September 21, 2006, the CSRC published on its official website procedures regarding its approval of overseas listings by special purpose vehicles. The CSRC approval procedures require the filing of a number of documents with the CSRC and it would take several months to complete the approval process.

Regulations on dividend distribution

The principal regulations governing dividend distributions by wholly foreign-owned enterprises and Sino-foreign equity joint ventures include:

|

·

|

Wholly Foreign-Owned Enterprise Law (1986), as amended;

|

|

·

|

Wholly Foreign-Owned Enterprise Law Implementing Rules (1990), as amended;

|

|

·

|

Sino-foreign Equity Joint Venture Enterprise Law (1979), as amended; and

|

|

·

|

Sino-foreign Equity Joint Venture Enterprise Law Implementing Rules (1983), as amended.

|

Under these regulations, wholly foreign-owned enterprises and Sino-foreign equity joint ventures in the PRC may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. Additionally, these foreign-invested enterprises are required to set aside certain amounts of their accumulated profits each year, if any, to fund certain reserve funds. These reserves are not distributable as cash dividends.

Regulation of overseas listings

On August 8, 2006, six PRC regulatory agencies, including the China Securities Regulatory Commission (“CSRC”), promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, which became effective on September 8, 2006 and was amended by the MOFCOM on June 22, 2009. This regulation, among other things, has certain provisions that require offshore special purpose vehicles, or SPVs, formed for the purpose of acquiring PRC domestic companies and controlled by PRC individuals, to obtain the approval of the CSRC prior to listing their securities on an overseas stock exchange. On September 21, 2006, the CSRC published on its official website a notice specifying

the documents and materials that are required to be submitted for obtaining CSRC approval.

There remains some uncertainty as to how this regulation will be interpreted or implemented in the context of an overseas offering. If the CSRC or another PRC regulatory agency subsequently determines that the CSRC’s approval is required in connection with our acquisition of Shaoxing High School, we may face sanctions by the CSRC or another PRC regulatory agency. If this happens, these regulatory agencies may impose fines and penalties on our operations in the PRC, limit our operating privileges in the PRC, restrict or prohibit payment or remittance of dividends by our PRC subsidiaries to us or take other actions that could have a material adverse effect on our business, financial condition, results of

operations, reputation and prospects, as well as the trading price of our common stock.

- 13 -

SAFE regulations on employee share options.

On March 28, 2007, SAFE promulgated the Application Procedures of Foreign Exchange Administration for Domestic Individuals Participating in Employee Share Holding Plan or Share Option Plan of Overseas Listed Company, or the Share Option Rule. The purpose of the Share Option Rule is to regulate foreign exchange administration of PRC domestic individuals who participate in employee share holding plans and share option plans of overseas listed companies. According to the Share Option Rule, if a PRC domestic individual participates in any employee share holding plan or share option plan of an overseas listed company, a PRC domestic agent or the PRC subsidiary of such overseas listed company is required to, among

others things, file, on behalf of such individual, an application with SAFE to obtain approval for an annual quota with respect to the purchase of foreign exchange in connection with share holding or share option exercises as PRC domestic individuals may not directly use overseas funds to purchase shares or exercise share options. Concurrently with the filing of such application with SAFE, the PRC subsidiary shall obtain approval from SAFE to open a special foreign exchange account at a PRC domestic bank to hold the funds required in connection with the share purchase or option exercise, any returned principal or profits from sales of shares, any dividends issued on the shares and any other income or expenditures approved by SAFE. The PRC subsidiary is also required to obtain approval from SAFE to open an overseas special foreign exchange account at an overseas bank to hold overseas

funds used in connection with any share purchase or option exercise. All proceeds obtained by PRC domestic individuals from sales of shares shall be remitted back to China after relevant overseas expenses are deducted. The foreign exchange proceeds from these sales can be converted into RMB or transferred to such individuals’ foreign exchange savings account after the proceeds have been remitted back to the special foreign exchange account opened at the PRC domestic bank. If the share option is exercised in a cashless exercise, the PRC domestic individuals are required to remit the proceeds to the special foreign exchange account.

We do not currently have any share option plans. Although further clarification is required as to how the Share Option Rule will be interpreted or implemented, we believe that if we were to adopt such a plan, we and our PRC employees who have been granted share options will be subject to the Share Option Rule when our company becomes an overseas listed company. If we or our PRC employees fail to comply with the Share Option Rule, we and/or our PRC employees may face sanctions imposed by foreign exchange authority or any other PRC government authorities.

In addition, the State Administration of Taxation has recently issued circulars concerning employee share options. Under these circulars, our employees working in the PRC who exercise share options will be subject to PRC individual income tax. Our PRC subsidiaries have obligations to file documents relating to employee share options with relevant tax authorities and withhold individual income taxes of those employees who exercise their share options. If our employees fail to pay and we fail to withhold their income taxes, we may face sanctions imposed by tax authorities or other PRC government authorities.

Employees

As of June 30, 2011, we had approximately 492 full time employees in the PRC.

Our history

We were organized in Idaho on February 5, 1968 under the name Century Silver Mines, Inc. Originally, we developed mining properties, but by 1998 we had ceased those operations. Sense Technologies was organized under the laws of the State of Florida on July 13, 1998. Sense Technologies was formed for the purpose of engaging in developing and marketing biometric devices for use in employee identification and security-related products.

In January 1999, we acquired all of the outstanding shares of Sense Technologies for a purchase price consisting of 4,026,700 of our shares of common stock issued to the former shareholders of Sense Technologies. At the time of the acquisition, Century Silver Mines had no operations and Sense Technologies was developing its proprietary biometric security systems. Immediately following the acquisition, the former shareholders of Sense Technologies owned approximately 93% of our outstanding shares. In June 1999, we changed our corporate domicile from Idaho to Florida and changed our name to Sense Holdings, Inc.

On May 31, 2001, we acquired all of the outstanding shares of Micro Sensor from UTEK Corporation and UT-Battelle LLC, the shareholders of Micro Sensor, in a stock-for-stock exchange, for total consideration of 2,000,000 shares of our common stock. Pursuant to the stock-for stock transfer, UTEK received 1,850,000 shares of our common stock and UT-Battelle LLC received 150,000 shares of our common stock.

- 14 -

On June 27, 2007 we acquired a 56.08% interest in AoHong in exchange for our commitment to contribute $3,380,000. In addition, we issued Mr. Aihua Hu, a member of AoHong?痵 board and its CEO, 12,500,000 shares of our common stock valued at $1,187,500 as additional consideration. Our commitment to AoHong required us to provide$3,380,000 between September 2007 and June 2009 to the registered capital of AoHong.

On August 31, 2007, we acquired a 60% interest in Big Tree, which together with its subsidiary Jieyang Big Tree, was a development stage company based in China that intended to operate in the toy business. In 2008 we discontinued our Toy Distribution segment and we no longer own any interest in Big Tree or Jieyang Big Tree. We do not intend to pursue any other business opportunities in the toy industry.

In November 2007, we changed the name of our company to China America Holdings, Inc. to better reflect our business and operations at that time.

In the fourth quarter of 2008, we elected to discontinue our Biometrics segment and in January 2009, we sold our historical operations related to the Biometrics segment to Mr. Perler as described earlier in this section.

Sale of Aohong Chemical. On December 23, 2010 we entered into a Membership Interest Sale Agreement with Glodenstone Development Limited, a British Virgin Islands company (“Glodenstone”), Mr. Hu and Ms. Ye to sell our 56.08% membership interest in AoHong Chemical to Glodenstone for $3,508,340, payable at closing by cancellation of a $1,780,000 debt we owed Glodenstone and Glodenstone’s issuance to us of a promissory note in the principal amount of $1,728,340. The sale of our interest in AoHong was completed June 9, 2011 following our shareholders' approval of this transaction on that

date.

China Ziyang Technology was formed on June 29, 2011 under the laws of Hong Kong. On June 29, 2011, China Ziyang Technology acquired 100% of the equity interest in Ziyang Ceramic from its shareholders in exchange for its agreement to pay them RMB 50,000,000 (approximately $7,632,422).

On June 30, 2011we acquired China Ziyang Technology as discussed in Item 1.01 of this Current Report.

RISK FACTORS

You should carefully consider the risks described below and all other information contained in this report before making an investment decision. If any of the following risks actually occur, our business, financial condition and results of operations could be materially and adversely affected. In that event, the trading price of our common stock could decline, and you may lose part or all of your investment. This report also contains forward-looking information that involves risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of many factors, including the risks described below and elsewhere in this report.

Risks related to our business and industry

Risk Factors Relating to Our Business

We may be adversely affected by factors affecting our customers’ businesses.

Factors that adversely impact our customers’ businesses may also have an adverse effect on our business, prospects, results of operations, financial condition or cash flows. These factors may include any reduction in the overall commercial and residential real estate development as a result of economic factors and government policies. Furthermore, our agreements with our major customers do not specify minimum sales volume. There is no assurance that we will continue to retain these customers or that they will continue to purchase our products at their current levels in the future. If there is any reduction or cancellation of purchase orders by these customers for any reason, including a fall in demand from the

developers who purchase our products from our customers, or a termination of the relationship with these customers, our revenues will be negatively impacted.

- 15 -

If our suppliers are unable to fulfill our orders for raw materials, we may lose business.

Our suppliers are all located in the PRC. Our purchases of raw materials is based on expected production levels, after taking into consideration, among other factors, sales forecasts and actual orders from our customers. To ensure that we are able to deliver quality products at competitive prices, we need to secure sufficient quantities of raw materials at acceptable prices and quality on a timely basis. Typically, we do not enter into any long-term supply agreements with our suppliers. There is no assurance that these suppliers will continue to supply us in the future. In the event our suppliers are unable to fulfill our orders or meet our requirements or we are unable to derive sufficient quantities of raw

materials for our own mines, we may not be able to find timely replacements at acceptable prices and quality, and this will delay the fulfillment of our customers’ orders. Consequently, our reputation may be negatively affected, leading to a loss of business and affecting our ability to attract new businesses.

Increases in the price of raw materials will negatively impact our profitability.

In 2009, and 2010, our cost of raw materials, which consist of clay, coal used to heat our kilns, coloring materials and glazing materials, accounted for approximately 45% and 44% of our total cost of sales, respectively. The price of clay, coal, coloring materials and glazing materials may fluctuate due to factors such as global supply and demand for such raw materials and changes in global economic conditions. Coal accounted for approximately 49% and 45% of our total raw material costs in 2009 and 2010, respectively. Although we own mining rights to approximately 638,000 tons of white clay, any shortages or interruptions in the supply of clay, coal, coloring materials or glazing materials will result in an

increase in the cost of production, thus increasing our cost of sales. If we are not able to pass on such an increase to our customers or are unable to find alternative sources of clay, coal, coloring materials, or glazing materials or appropriate substitute raw materials at comparable prices, our operations and financial performance will be adversely affected.

We are dependent on certain key personnel and the loss of these key personnel could have a material adverse effect on our business, financial condition and results of operations.

Our success is, to a large degree, attributable to Lingbo Chi, Nianzhang Zhao and Ping Wang who founded the company in 2006. Messrs. Chi and Zhao and Ms. Wang are responsible for the management, sales and marketing, and operational expertise of our PRC subsidiary and perform key functions in the operation of our business. Although we have no reason to believe that these individuals would discontinue their services with us, the loss of one or more of these key employees could have a material adverse effect upon our business, financial condition and results of operations.

Failure to compete successfully with our competitors and new entrants to the ceramics industry in the PRC may result in Ziyang Ceramic losing market share.

We operate in a competitive and fragmented industry. Given the growth potential of our industry, there is no assurance that we will not face competition from our existing competitors and new entrants into the market. We compete with a variety of companies, some of which have advantages that include: longer operating history, larger customer base, superior products, better access to capital, personnel and technology, or are better entrenched. Our competitors may be able to respond more quickly to new and emerging technologies and changes in customer requirements or succeed in developing products that are more effective or less costly than our products. Any increase in competition could have a negative impact on our

pricing (thus eroding our profit margins) and reduce our market share. If we are unable to compete effectively with our existing and future competitors and do not adapt quickly to changing market conditions, we may lose market share.

Our production facilities may be affected by power shortages which could result in a loss of business.

Our production facilities consume substantial amounts of electrical power, which, along with coal, is the principal source of energy for our manufacturing operations. Although we have an agreement with our electrical service provider to maintain a dedicated power line that services our facility, we have an on-site temporary back up source of electricity and we have not experienced power outages in the past, we may experience occasional temporary power shortages disrupting production due to government imposed power rationing, adverse weather conditions or other natural events beyond our control. Accordingly, these production disruptions could adversely impact our operations in future periods.

In the event of an interruption in the supply of electricity or coal, production at our manufacturing facilities would have to be shut down. Therefore any prolonged interruptions in the supply of energy to our manufacturing facility could result in production shutdowns.

- 16 -

Our research and development efforts may not result in marketable products.

Our research and development team has been working on the development of products which we have identified as having good potential in the market. We have not established a target date for the completion of development of these products and there is no assurance when we will release new products. There is also no assurance that the products which we are currently developing or may develop in the future will be successful or that we will be able to market these new products to our customers successfully. If our new products are unable to gain the acceptance of our customers or potential customers, we will not be able to generate future sales from our investment in research and development.

We may not be able to manage our business expansion and increasingly complicated operations effectively, which could harm our business.

We plan to expand by increasing manufacturing capacity, expansion of our product offerings, increase our sales network and development of an international distribution business. If our planned expansion is successful, it will result in substantial demands on our management and personnel and our operational, technological and other resources. To manage the expected growth of our operations, we will be required to expand our existing operational, administrative and technological systems and our financial systems, procedures and controls, and to expand, train and manage the planned growth in our employee base. We cannot assure you that our current and planned personnel, systems, procedures and controls will be

adequate to support our future operations, or that we will be able to effectively and efficiently manage the growth of our operations, and recruit and retain qualified personnel. Any failure to effectively and efficiently manage our expansion may materially and adversely affect our ability to capitalize on new business opportunities, which in turn may have a material adverse effect on our financial condition and results of operations.

We may lose revenue if our intellectual property rights are not protected and counterfeit Fuyunde, Luckway or GEF brand products are sold in the market.

We believe our intellectual property rights are important to our success and competitive position. A portion of our products are manufactured and marketed under our “Fuyunde,’ “Luckway” and “GEF” labels. We have filed our labels as trademarks in the PRC. We cannot assure you that there will not be any unauthorized usage or misuse of our trademarks or that our intellectual property rights will be adequately protected as it may be difficult and costly to monitor any infringements of our intellectual property rights in the PRC. If we cannot adequately protect our intellectual property, we may lose revenue.

In addition, we believe the branding of our products and the brand equity in our “Fuyunde,” “Luckway” and "GEF” trademarks is important to our expansion effort and the continued success of our business. Our efforts to build our brand may be undermined by the sale of counterfeit goods. The counterfeiting of our products may increase if our products become more popular.

In order to preserve and enforce our intellectual property rights, we may have to resort to litigation against the infringing or counterfeiting parties. Such litigation could result in substantial costs and diversion of management resources which may have an effect on our financial performance.

We may inadvertently infringe third-party intellectual property rights, which could negatively impact our business and financial results.

We are not aware of, nor have we received any claims from third parties for, any violations or infringements of intellectual property rights of third parties by us as of the date of this report. Nevertheless, there can be no assurance that as we develop new product designs and production methods, we would not inadvertently infringe the intellectual property rights of others or others would not assert infringement claims against us or claim that we have infringed their intellectual property rights. Claims against us, even if untrue or baseless, could result in significant costs, legal or otherwise, cause product shipment delays, require us to develop non-infringing products, enter into licensing agreements or may be

a distraction to our management. Licensing agreements, if required, may not be available on terms acceptable to us or at all. In the event of a successful claim of intellectual property rights infringement against us and our failure or inability to develop non-infringing products or to license the infringed intellectual property rights in a timely or cost-effective basis, our business and/or financial results will be negatively impacted.

- 17 -

The PRC government has recently introduced certain policy and regulatory measures to control the rapid increase in housing prices and cool down the real estate market and may adopt further measures in the future.

Our business depends on the level of business activity in the commercial and residential real estate development and construction industry that use our products in their operations in the PRC. If there is a reduction in the overall commercial and residential real estate development as a result of economic factors and government policies, the demand for construction materials, such as ceramic tiles, may consequently decrease and have a significant adverse effect on our business.

The PRC government has committed to taking steps to regulate real estate development, promote the healthy development of the real estate industry in China, and strengthen the supervision over land for real estate development purposes. For example, in his 2010 annual report to the National People’s Congress, Chinese Premier Wen Jiabao pledged to curb the rise of housing prices in certain cities to increase the availability of affordable housing. The full effect of such policies on the real estate industry and our business will depend in large part on the implementation and interpretation of the circulars by governmental agencies, local governments, and banks involved in the real estate industry. We cannot be

certain that the PRC government will not issue additional and more stringent regulations or measures or that agencies and banks will not adopt restrictive measures or practices in response to PRC governmental policies and regulations, which could negatively affect the main industries we serve in the PRC, and thereby harm our sales.

Our manufacturing activities are dependent upon availability of skilled and unskilled labor, a deficiency of which could result in a reduction in profits.

Our manufacturing activities are labor intensive and dependent on the availability of skilled and unskilled labor in large numbers. Large labor intensive operations call for good monitoring and maintenance of cordial relations. Non-availability of labor, poor labor management and/or any disputes between the labor and management may result in a reduction in profits. The scarcity or unavailability of contract laborers may affect our operations and financial performance.

We face increasing labor costs and other costs of production in the PRC, which could limit our profitability.