Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - HCA Healthcare, Inc. | d231012dex991.htm |

| 8-K - FORM 8-K - HCA Healthcare, Inc. | d231012d8k.htm |

Second Quarter

2011 Review September 12, 2011

Exhibit 99.2 |

1

Forward Looking Statements

This presentation may contain certain forward-looking statements provided by Company

management. These statements are intended to be covered by the safe-harbor provisions

of the Private Securities Litigation Reform Act of 1995. Forward-looking statements

include all statements that do not relate solely to historical or current facts,

including statements regarding future operations, financial results and projections, cash flows,

costs and cost management initiatives, capital structure management, growth rates, market

share, and operational and strategic initiatives, compliance efforts and results of

compliance audits, and future impact of changes in Medicare case mix index, and can also

be identified by the use of words like “may,” “believe,” “will,” “expect,” “project,” “estimate,”

“anticipate,” “intend,” “plan,” “initiative,”

“continue” or words or phrases of similar meaning. These forward- looking

statements speak only as of the date hereof and are based on our current plans and expectations and are

subject to a number of known and unknown uncertainties and risks, many of which are beyond our

control. These risks and uncertainties are described in headings such as “Risk

Factors” in our annual report on Form 10-K for the year ended December 31, 2010,

and other reports filed with the Securities and Exchange Commission. As a consequence,

current plans, anticipated actions and future financial position and results of operations may differ

significantly from those expressed in any forward-looking statements in today’s

presentation. You are cautioned not to unduly rely on such forward-looking statements

when evaluating the information presented and we do not intend to update any of these

forward-looking statements.

The presentation may contain certain non-GAAP financial measures. The Company’s

earnings release for the quarter and six months ended June 30, 2011, located on the

Company’s investor relations page at www.hcahealthcare.com, includes a

reconciliation of the difference between certain non-GAAP financial measures with the

most directly comparable financial measure calculated in accordance with GAAP. These non-GAAP

financial measures should not be considered an alternative to the GAAP financial

measures. References to

“Company” used herein refer to HCA Holdings, Inc. and its affiliates, unless otherwise stated or

indicated by context.

|

2

Introduction

•

Purpose of this presentation is to summarize the supplemental analysis

performed and findings reached on our second quarter

•

Medicare revenue growth in second quarter fell short of expectations and

was inconsistent with historical trends

•

Medicare revenue declined in second quarter due to several factors,

including a decline in Medicare case mix index (CMI)

•

Based on information available to us at this time, including this analysis and

preliminary results for July and August, we are confirming 2011 guidance of 3

to 5% growth in adjusted EBITDA for the full year, assuming we substantially

meet HITECH reimbursement parameters |

3

2011

Annual

Medicare

IPPS

Updates

3.4%

(4Q’06)

3.3%

3.6%

1.9%

(0.55%)

2007

2008

2009

2010

$93

$50

$67

$116

$154

$145

$115

$126

$127

$191

$190

$141

$111

$112

$71

$131

$147

($4)

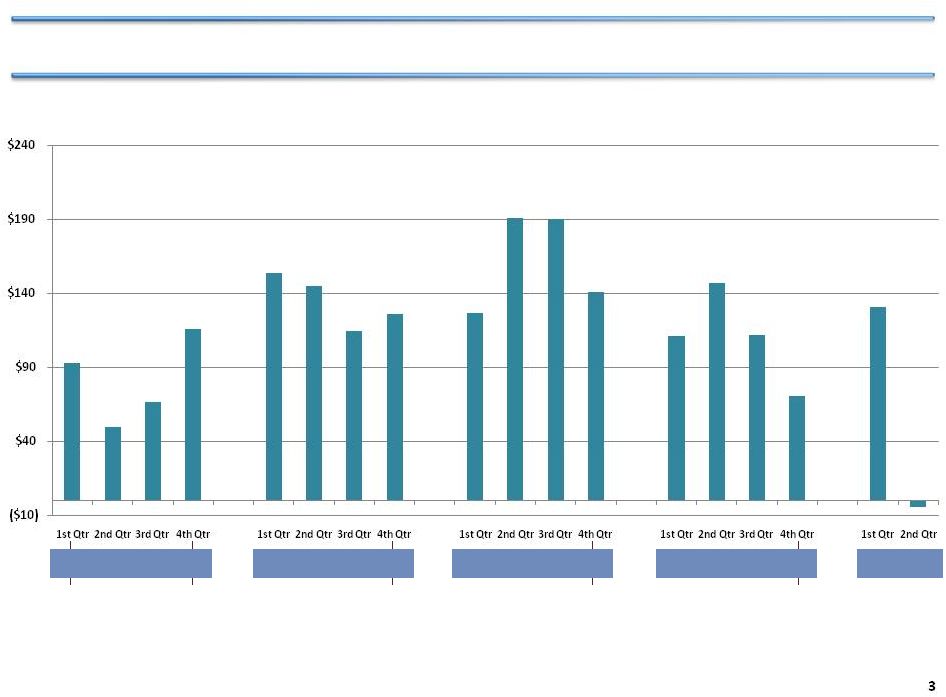

Medicare revenue growth in 2

nd

Quarter 2011 declined unexpectedly

Medicare (Traditional & Managed) Revenue Growth, numbers show year over year change Consolidated

Domestic Ops Same Facility - Hospital Only, Inpatient and Outpatient ($ in millions) |

Traditional Medicare

Managed Medicare

4

Medicare case mix decline in 2

Quarter 2011 was unexpected

Trend of Medicare CMI

1.4000

1.4500

1.5000

1.5500

1.6000

1.6500

1.7000

2007

2008

2009

2010

2011

nd |

5

Additional analysis of Q2 included three major areas

•

Data Integrity Review

•

Regulatory and Past Period Adjustments Review

•

Case Mix Review |

6

Supplemental data integrity review disclosed no issues

Findings

Analysis

HCA has a robust compliance effort in all areas of compliance risk, including

DRG coding

•

No changes in coding process,

and no significant differences

in historical coding results

•

Confirmed data flow operated

correctly

•

DRG coding audit conducted,

with independent review, of

both shared services and

hospital DRG coding

•

Reviewed systems that involve

flow of data from coding to

billing

|

7

Regulatory

changes

&

prior

year

cost

reports

and

claims

affected

Medicare

revenue

Analysis

•

•

•

•

Regulatory changes include the

72 hour

rule

(effective

6/30/10),

with adverse impact of $21

million in Q2 (no year over year

impact going forward); and CT scan

reimbursement

(effective

1/1/11) with adverse impact of

$7 million in Q2 (similar impact

anticipated in Q3 and Q4)

Findings

Prior year cost report and

claims revenue was $18 million

less in 2Q/2011 compared with

2Q/2010 (smaller expected

impact in Q3 and Q4)

Reviewed prior year cost report

and claims results

Reviewed impact of regulatory

changes |

8

Extensive review of Medicare case mix conducted

•

CMI analysis by DRG type --

identified DRGs and facilities that appeared to account for

primary CMI shifts

•

Surveyed facilities for root cause of change and outlook

•

Tested impact of CMS grouper changes implemented on October 1, 2010

|

9

Decline in Medicare case mix resulted in $28 million adverse impact

Implications for Q3 and Q4

•

Downward pressure on CMI

likely to continue, driven by

falling surgical volume

•

Difficult to predict future

medical case mix

•

Grouper change not expected

to have material impact

•

Shift in volume from

surgical to medical,

primarily in cardiovascular

service line

•

CMI decline within medical

cases, especially pulmonary

•

New CMS grouper, effective

October 2010

Drivers of CMI decline |

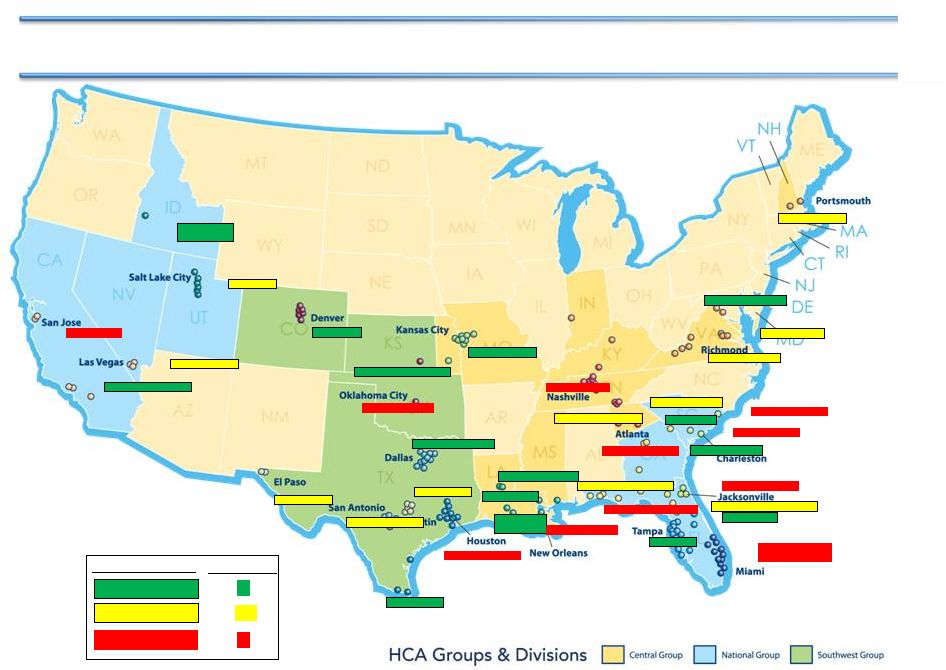

Austin -2.9%

Chattanooga -2.9%

North Central Florida -2.3%

San Antonio -2.3%

Northeast -2.2%

Panhandle West -1.9%

Utah -1.8%

Richmond -1.7%

Southwest VA -1.6%

El Paso -0.8%

Las Vegas -0.5%

Northwest Georgia -0.5%

Denver 0.1%

Dallas Ft. Worth 0.0%

Northwest 0.4%

(incl. Anchorage)

Orlando 0.6%

Valley 1.2%

Central Louisiana 1.7%

Houston 2.0%

Other Georgia 2.1%

Atlanta 3.4%

Tampa 1.3%

Southern California 4.1%

Northern Virginia 4.5%

Lafayette

4.9%

Wichita 5.5%

Oklahoma -9.1%

New Orleans -8.4%

Charleston -6.5%

Miami/Ft. Lauderdale

-3.7%

Middle Georgia -5.0%

Jacksonville -4.5%

Nashville -4.0%

San Jose -3.9%

Myrtle Beach -3.7%

Other North Florida -3.6%

Corpus Christi -3.6%

-0.1% to -2.9%

5.5 % to 0.0%

-3.0% to -9.1%

12

15

11

Markets -

38

Range of % Change

No geographical pattern to the decline in Medicare case mix in Q2

Kansas City 0.3%

10

Percent Change from Prior Year

Same Facility |

11

Losses in Medicare IP cardiovascular

surgical cases were partially offset by gains in medical

cases across multiple service lines

HCA change in number of Medicare cases

(Q2 2011 to Q2 2010)

-504

0

80

33

10

-59

93

0

-1

0

109

-769

Surgical

Total

Medicine

Neuro

Oncology

Urology

OB-GYN

Orthopedics

Gastro

Other

Pulmonary

Surgery

Cardiovascular

4,588

2,103

814

219

419

55

66

260

63

49

540

Medical

n/a

Increase

Decrease

1

2

1

3 |

12

Medicare

IP

cardiovascuar

1

surgical

cases

drove

a

decline

in

CMI

HCA change in number of Medicare cases

(Q2 2011 to Q2 2010)

0

Surgical

Other

33

Pulmonary

Surgery

109

Cardiovascular

-769

Medical

444

49

n/a

540

% of negative

CMI change

CMI Impact

Change

Drivers of CMI Impact Change:

•

Changes in cardiovascular

account for 50% of the

decline in Medicare CMI

Impact Change

•

Surgery’s negative impact

on Medicare CMI due to

fewer mechanical

ventilation cases (26

cases) which have high

weight

-1.09%

50%

-0.59%

27%

-0.31%

14%

-0.19%

9%

Total IP cardiovascular

1

surgical declined by 1,156 for all payers, with Medicare

accounting for two-thirds (769 cases) of the decline

Increase

Decrease

Sum of negative changes resulting in

net Medicare CMI change of 1.2%

-2.18%

2

3

1 Includes inpatient EP, interventional, cardiothoracic surgery, valve, and vascular surgeries

and procedures; interventional cases included in “Surgical” category

2 Surgery includes ENT, ophthalmology, and general surgery

3 Major components of “Other” includes transplant, gastro, ortho, OB/GYN,

neonatology, rehab, behavioral health, and alcohol/drug |

13

•

Overall demand for cardiovascular services has been declining about 3% per year for

several years

•

Appears to be an acceleration of this negative trend nationally that impacted HCA

markets in Q2 2011

•

In HCA, 20 hospitals across 10 divisions contributed to the majority of declines. The

primary reasons for decline were:

Physician attrition

Competitor investments, such as starting a new program

Medical management

Generally weaker demand

Cardiovascular declines were driven by several factors |

14

90

80

100

95

85

HCA

hospitals

Non-HCA

hospitals

Change

in

HCA

and

non-HCA

IP

cardiovascular

surgical

case

volume

1,2

,

all payers

’08-10

CAGR

(%)

2008

Q1

Q2

Q3

Q4

2009

Q1

Q2

Q3

Q4

2010

Q1

Q2

Q3

Q4

HCA cardiovascular IP

surgical market share:

26.7%

27.0%

27.0%

HCA has had slight growth in its share of inpatient cardiovascular surgical case volume

’08-10 share

change

~0.3%

~0%

Annual share change:

0

-2.3%

-3.2%

0.3%

1

Includes inpatient EP, interventional, cardiothoracic surgery, valve, and vascular surgeries

and procedures 2

HCA defines 29 markets based on county service areas. Analysis excluded Kansas City, Denver

and San Jose markets due to incomplete data; also excluded Augusta and N.

Virginia due to low patient volumes (<100 patients/quarter). Remaining 24 markets were used to compare HCA vs. non-HCA hospital evolution in CV IP surgical

volume

SOURCE: Intellimed |

Total Market

Discharges 4,975,899

HCA Share

Service Line

Market

HCA

Total

All SLs

4,975,899

1,193,717

0.4%

0.3%

24.0%

0.0%

Medicine

863,436

204,873

4.7%

3.6%

23.7%

(0.3%)

Women's

833,216

193,634

(4.0%)

(4.5%)

23.2%

(0.1%)

Cardiology/Cardiovascular

642,064

169,285

(3.1%)

(3.1%)

26.4%

0.0%

Neurosciences

366,760

90,604

1.4%

1.8%

24.7%

0.1%

Gen Surgery

388,670

86,680

(1.1%)

(1.6%)

22.3%

(0.1%)

Orthopedics

307,546

74,921

2.4%

3.1%

24.4%

0.2%

Behavioral

285,172

61,102

6.0%

5.9%

21.4%

0.0%

Oncology

114,781

23,249

(1.4%)

(0.9%)

20.3%

0.1%

Neonatology

100,891

22,391

(1.7%)

(2.1%)

22.2%

(0.1%)

All Other SLs

1,073,363

266,978

1.5%

2.2%

24.9%

0.2%

Market

HCA

Total

Total HCA Discharges

1,193,717

Discharges

Growth

(Over Prior 12 months)

HCA Point

Trend

15

Note 1: Statistics are based on data for the most recently available 24 month period

from 143 HCA facilities in 29 defined markets. Market shares differ from

Slide 14 because of different groupings of cases included in overall categories.

Note 2: Analysis includes data from 10 markets through Q1 ’11, 16 through Q4

’10, 1 through Q3 ’10, 1 through Q2 ’10 (KC), and 1 market through Q4

’09 (San Jose). Note 3: Source = State data via Intellimed.

Overall market share for HCA is stable with some service line variation

|

16

Conclusion

1 Based upon decline in actual CMI change from expected CMI change

•

Relevant HCA actions are being implemented, both as to revenue opportunities and

expense control

•

Based on information available to us at this time, including this analysis and

preliminary results for July and August, we are confirming 2011 guidance of 3 to 5%

growth in adjusted EBITDA for the full year, assuming we substantially meet HITECH

reimbursement parameters

•

Medicare revenue decline in second quarter due to several factors (numbers show year

over year change, Q2 2011 to Q2 2010) and estimates of future impact refer to Q3 and

Q4 2011:

Issue

May impact future

quarters, in whole

or part

Unlikely to impact

future quarters

Not expected to

impact future

quarters

Case Mix

1

$25 Million

$3 Million

72 hour rule

$21 Million

CT Scans

$7 Million

Prior year cost reports &

claims

$5 Million

$13 Million

TOTAL

$37 Million

$16 Million

$21 Million |

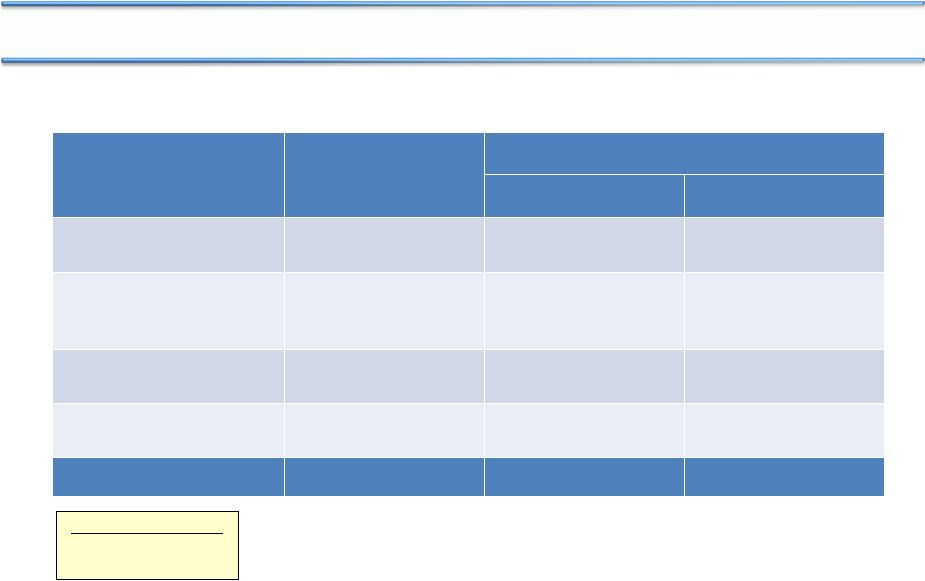

Transaction

Run Rate Annual

Interest

Savings/(Costs)

Estimated EPS Impact

2011

1

2012

2

Extended $3.0B Bank Term

Loans (May)

($36 mm)

($0.03)

($0.04)

Called all $1.0B of 2014 and

$108mm

of

2017

2

lien

notes (June) ³

$90 mm

$0.06

$0.10

Extended $4.5B of interest

rate swaps (2009-2011)

4

$190 mm

$0.03

$0.21

Refinanced $4.8B of 2016

2 lien notes (August)

$114 mm

$0.01

$0.13

TOTAL

$358 mm

$0.07

$0.40

1

Excludes losses on retirement of debt

2

Assumes effective tax rate of 38% and estimated diluted shares of 550 million

3

Funded out of revolving credit facilities

4

Commencing 11/17/11 when $7.1B of higher rate swaps expire

5

Excludes acquisition of HealthONE JV partnership interest

17

Debt/Adjusted EBITDA

12/31/2010A

4.8x

12/31/2011P

4.0x

5

One further topic:

Recent debt refinancings provide financial flexibility and enhance earnings

nd

nd |