Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Dex Liquidating Co. | ex23-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Dex Liquidating Co. | ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Dex Liquidating Co. | ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Dex Liquidating Co. | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 10-K

|

R

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended June 30, 2011

|

|

|

£

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number: 000-51772

CARDICA, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

94-3287832

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

Incorporation or Organization)

|

Identification No.)

|

900 Saginaw Drive

Redwood City, California 94063

(650) 364-9975

(Address, including zip code, and telephone number, including area code, of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value per share

|

The NASDAQ Stock Market LLC

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes £ No R

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes £ No R

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes £ No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. R

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer £

|

Accelerated filer R

|

Non-accelerated filer £

|

Smaller reporting company R

|

|

(Do not check if a smaller reporting company)

|

|||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes £ No R

The aggregate market value of the voting stock held by non-affiliates of the registrant as of December 31, 2010 was approximately $83,673,637 (based on the closing sales price of the registrant’s common stock as reported by the NASDAQ Global Market, on December 31, 2010).

The number of shares of common stock outstanding as of September 9, 2011 was 26,968,559.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for its 2011 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission within 120 days after the registrant’s fiscal year ended June 30, 2011 are incorporated by reference in Part III, Items 10-14 of this Annual Report on Form 10-K.

Cardica, inc.

ANNUAL REPORT ON FORM 10-K

For the Year Ended June 30, 2011

TABLE OF CONTENTS

|

|

Page

|

|

PART I

|

|

|

Item 1. Business

|

1

|

|

Item 1A. Risk Factors

|

21

|

|

Item 1B. Unresolved Staff Comments

|

38

|

|

Item 2. Properties

|

39

|

|

Item 3. Legal Proceedings

|

39

|

|

Item 4. (Removed and Reserved)

|

39

|

|

PART II

|

|

|

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

39

|

|

Item 6. Selected Financial Data

|

40

|

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

41

|

|

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

|

49

|

|

Item 8. Financial Statements and Supplementary Data

|

49

|

|

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

50

|

|

Item 9A. Controls and Procedures

|

50

|

|

Item 9B. Other Information

|

52

|

|

PART III

|

|

|

Item 10. Directors, Executive Officers and Corporate Governance

|

52

|

|

Item 11. Executive Compensation

|

52

|

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

52

|

|

Item 13. Certain Relationships and Related Transactions, and Director Independence

|

53

|

|

Item 14. Principal Accounting Fees and Services

|

53

|

|

PART IV

|

|

|

Item 15. Exhibits, Financial Statement Schedules

|

53

|

|

Signatures

|

78

|

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. Forward-looking statements are based on our management’s beliefs and assumptions and on

information currently available to our management. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential” and similar expressions intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other

factors which may cause our actual results, performance, time frames or achievements to be materially different from any future results, performance, time frames or achievements expressed or implied by the forward-looking statements. We discuss many of these risks, uncertainties and other factors in this Annual Report on Form 10-K in greater detail under the heading “Risk Factors.” Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking

statements. Also, these forward-looking statements represent our estimates and assumptions only as of the date of this filing. You should read this Annual Report on Form 10-K completely and with the understanding that our actual future results may be materially different from what we expect. We hereby qualify our forward-looking statements by our cautionary statements. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual

results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

PART I

Item 1. Business

Overview

Historically, our business focused on the design, manufacture and marketing of proprietary automated anastomotic systems used by cardiac surgeons to perform coronary bypass surgery. We have re-focused our business on the development of an endoscopic microcutter product line intended for use by thoracic, bariatric, colorectal and general surgeons.

The first product that we are developing in our planned microcutter product line is the Microcutter XPRESS™ 30, the first true multi-fire endolinear microcutter device based on our proprietary “staple-on-a-strip” technology, which would expand our commercial opportunity into additional surgical markets. In addition, we are developing the Microcutter XPRESS™ 45, a planned multi-fire endolinear microcutter device with a 45 millimeter staple line, the Microcutter XCHANGE™ 30, a planned cartridge based

microcutter device with a 5 millimeter shaft diameter and a 30 millimeter staple line, the Microcutter FLEXCHANGE™ 30, a planned cartridge based microcutter device with a flexible shaft to facilitate endoscopic procedures requiring cutting and stapling, and the Microcutter XPRESS™ 60, a planned cutting and stapling device specifically designed for the bariatric and thoracic surgery markets. We estimate these planned devices expand our commercial opportunity to approximately 1.4 million additional procedures involving, we estimate, over 4 million staple cartridge deployments 3 million of which, we believe are deployed in laparoscopic procedures. We initiated

first-in-man use of the current version of the Microcutter XPRESS 30, with the Conformité Européenne, or CE Mark, in Europe in July 2011, and we are continuing to refine the product prior to commercial launch in Europe.

Our C-Port® Distal Anastomosis Systems, or C-Port systems, are sold in the United States and Europe. The C-Port systems are used to perform a distal anastomosis, which is the connection between a bypass graft vessel and the target coronary artery. As of June 30, 2011, more than 12,100 C-Port systems had been sold in the United States and Europe. We also currently sell our PAS-Port® Proximal Anastomosis System, or PAS-Port system, in the United States, Europe and Japan. The PAS-Port system is used to perform a proximal anastomosis, which is the connection of a bypass graft vessel to the aorta or other source of blood. As of June 30, 2011, more than 24,100 PAS-Port systems

had been sold in the United States, Europe and Japan. We use independent distributors and manufacturers’ representatives to augment a small core direct sales team for our C-Port and PAS-Port systems in the United States to contain sales costs while continuing to serve our customers and potential customers for our automated anastomosis product line.

Our Strategy

Our goals are to develop and market endoscopic microcutter products intended for use by thoracic, bariatric, colorectal and general surgeons and to increase adoption of automated anastomotic systems for coronary artery bypass grafting, or CABG, procedures and closure devices for other surgical procedures. Other existing technologies either do not enable or are less compatible with less invasive and minimally invasive surgery. Because less invasive surgery has many advantages relative to patient outcomes, our strategy involves developing and, ultimately, marketing and selling devices that enable or facilitate less invasive and minimally invasive procedures, which in turn may help enlarge the

market for these types of surgeries.

1

The principal elements of our strategy to achieve our vision and goals include:

|

●

|

Commercializing our microcutters.

We plan to commence commercializing our Microcutter XPRESS 30 initially in Europe, following application of the CE Mark to the current version of the Microcutter XPRESS 30 in July

2011. We plan to initially focus on developing relationships with leading clinicians who are considered to be “thought leaders” in their institutions and surgical specialties. We intend to work closely with a limited number of targeted clinical sites to achieve routine clinical adoption of our planned microcutter products in a select group of thoracic, bariatric, colorectal and general surgical procedures in which we believe the key features of the planned microcutter products are most differentiated from existing devices. We plan to leverage the lessons learned from this initial experience and the clinical experience of these key opinion leaders with the microcutter devices to bring credibility to a broader

launch. As we are able to apply the CE Mark to additional products in our microcutter product line and are able to gain more adoption of our products, we would plan to introduce these additional products in a similar manner. Similarly, we plan to use this same approach to commence commercialization in the United States provided we obtain clearance of one or more of our microcutter products from the U.S. Food and Drug Administration, or FDA. We recently signed a distribution agreement

with Century Medical, Inc., or Century, with respect to distribution of our planned microcutter products in Japan.

|

|

|

|

●

|

Leveraging the Microcutter XPRESS 30 technology to develop a broad range of surgical stapling devices.

Several of the innovative features that we plan to incorporate into our microcutter product line are: the ability to deploy multiple

successive rows of staples without replacing cartridges, significantly reduced tool shaft diameter and increased amount of articulation of the end-effector. The Microcutter XPRESS 30, the first true multi-fire endolinear microcutter device based on our proprietary “staple-on-a-strip” technology, is the first product we are developing for commercialization in our planned product line of microcutter devices. We believe that our technology for the Microcutter XPRESS 30 can be adapted for a variety of surgical stapling devices, including the

Microcutter XCHANGE™, a planned cartridge based device with a rigid shaft, and the Microcutter FLEXCHANGE™, a planned cartridge based device with a flexible shaft, to facilitate endoscopic procedures requiring cutting and stapling. The product applications of our technology that we plan to develop include stapling devices that have incremental benefits, such as smaller size, a flexible instrument shaft, greater degrees of articulation and potentially larger staples. By leveraging our technology, we believe we will expand our commercial

opportunity into additional surgical markets.

|

|

●

|

Obtaining U.S. regulatory clearance of the Microcutter XPRESS 30. We plan to seek U.S. regulatory approval from the FDA for our microcutter products under the 510(k) process, providing clinical data as required by the FDA. We are seeking to work with the FDA to obtain further guidance as to the

clinical data that the FDA will require for clearance of our planned 510(k) submission. We plan to commence a single-arm clinical trial of the Microcutter XPRESS 30 in Europe during this calendar year to obtain the clinical data that we plan to include in our 510(k) submission. We anticipate that the results of this clinical trial conducted under our currently planned protocol will be available within approximately six months of trial commencement.

|

|

|

|

●

|

Driving market adoption of the C-Port and PAS-Port systems. We intend to drive commercial adoption of our C-Port systems and our PAS-Port system by marketing them as integrated anastomotic tools for use in both on- and off-pump CABG procedures and in robot assisted bypass surgeries, known as totally endoscopic coronary artery bypass, or TECAB, procedures.

|

|

●

|

Establishing a strong proprietary position. As of June 30, 2011, we had 93 issued U.S. patents, 74 additional patent applications in the United States, seven issued foreign patents and another six patent applications filed in selected international markets. We plan to continue to invest in building our intellectual property portfolio.

|

2

Microcutter Industry Background

Evolution of surgical techniques

Open surgery has been the most common form of surgery for many decades. Using open surgical techniques, a surgeon generally creates an incision large enough to allow a direct view of the operating field and inserts the instruments necessary to manipulate the patient's tissues. The large incisions and significant tissue manipulation involved in open surgery create trauma to the patient, resulting in extended hospitalization and recovery times, increased hospital costs, and additional pain and suffering.

Over the past thirty years, technological innovations such as enhanced imaging and instrumentation have facilitated visualization and surgical access through smaller and smaller incisions. These improvements have enabled surgeons to reduce patient trauma, hospital stays and morbidity, while improving recovery times and cosmetic results. This evolution has both been enabled by, and created opportunities for, the development of new categories of surgical devices.

Minimally invasive or laparoscopic surgery replaces the large incision typically required for open surgery with several small abdominal openings and ports that provide access to the organs on which the surgeon needs to operate. The surgeon uses an endoscope to view the anatomy and inserts specialized instruments through the ports to carry out the procedure. The advantages of laparoscopic surgery include shorter post-operative recovery periods with less pain, shorter lengths of stay in the hospital, decreases in post-operative complications and a quicker return to routine activities compared to traditional open surgical procedures.

Laparoscopic surgery was originally used by gynecologists for the diagnosis and treatment of diseases of the ovary and uterus. Removal of the gall bladder by laparoscopic techniques was introduced in the late 1980s. Since that time, many of the procedures that were performed in the past utilizing traditional open surgical techniques have transitioned to minimally invasive surgical approaches including procedures on the appendix, stomach, lungs, colon, uterus and other organs.

More recently, minimally invasive surgeons are using fewer and fewer abdominal openings or ports, including single incision surgery, in which the surgeon operates almost exclusively through a single entry point, typically the patient’s navel. Unlike a traditional multi-port laparoscopic approach, single port surgery leaves only a single small scar. Single incision surgery has been used to perform many types of surgery, including removal of the appendix, gall bladder and portions of the lung or colon, as well as bariatric surgeries including gastric bypass and sleeve gastrectomy.

We believe the realization of the full potential of minimally invasive surgery will depend upon the availability of surgical instruments and devices that address the unique challenges of these procedures by offering advanced capabilities, including smaller instrument shaft diameters, increased end-effector articulation, flexible shaft instruments, better ergonomics and greater ease of use than are provided by currently available devices.

Market

The use of disposable devices for closing and/or cutting in both traditional and laparoscopic surgical procedures has been broadly adopted clinically in a number of surgical specialties including colorectal, bariatric, gynecologic, urologic and thoracic surgery. The worldwide laparoscopic surgery products market is estimated at $3.6 billion, with the cutter and stapler segment representing approximately $1.3 billion. Based on a 2010 Millennium Research Group report, 55-70% of the worldwide laparoscopic stapling-cutting closure product revenue is generated in the United States market.

We estimate there are approximately 1.4 million surgical procedures per year in the United States involving bariatric and general, thoracic, gynecologic and urologic surgery, involving, we estimate, over 4 million staple cartridge deployments, 3 million of which we believe are deployed in laparoscopic procedures.

Current Devices for Surgical Stapling

Current, conventional surgical stapling technology generally involves:

|

●

|

individually placing sets of staples in reloadable cartridges, designed for single use;

|

|

●

|

using a deployment tool, consisting of a handle and shaft (with a minimum diameter of 12 millimeters), that is reusable within a single surgical procedure;

|

|

●

|

using cartridges that can be loaded, following each deployment, into a receptacle at the end of the deployment tool;

|

|

●

|

deploying multiple U-shaped wires against a deforming surface, called an anvil, to reshape the wires into B-shaped wires and thereby connecting or sealing tissue; and

|

|

●

|

deploying multiple rows of staples, usually two to three rows per side, with a tissue dividing cut between the rows.

|

3

Unlike many other surgical instruments and devices, there have been few significant innovations in surgical stapling technology over the past ten years.

Microcutter Product Development

Based upon much of the technology we developed for our cardiac surgery anastomosis products, we are developing a new product line, referred to as our microcutter product lines, of multi-fire endolinear stapling devices. We believe that our endoscopic microcutter design potentially will address many of the limitations in currently available stapling products and would provide surgeons with a smaller and more effective stapling and cutting device for more minimally invasive surgical procedures. Key features of our planned product line include:

|

●

|

Staple Design and Formation. Our microcutter would utilize our innovative three dimensional, or 3D, staple design, which we engineered in connection with our vascular anastomotic products, that in vascular applications allows single rows of staples to effectively prevent blood leakage at physiological blood pressures. These 3D staples allow for a large contact surface between staple and tissue, which dramatically improves sealing while significantly reducing the likelihood of the staple cutting through tissue. These 3D staples are guided into their final shape by the anvil rather than forced to buckle as is the case with U-shaped wire

staples, which reduces the forming forces and helps to eliminate malformed staples. The 3D design with a rectangular cross-section significantly increases staple stiffness compared to round wire, resulting in a much stronger final form that is significantly more resistant to opening or yielding.

|

|

●

|

Device Size. By changing the technology used to form the staple, we are able to design our microcutter products to have a smaller-sized end-effector and tool shaft. Depending upon the chosen staple line length and staple height, the microcutter’s outer diameter could be as small as five millimeters. Due to its smaller size, our microcutter should enable procedures requiring minimal access, such as robot-assisted surgery and the rapidly emerging area of single incision laparoscopic surgery.

|

|

●

|

“Staple-On-A-Strip” Technology. We have further advanced our 3D staple technology in connection with the microcutter product line by introducing an innovative design in which 3D staples are stamped from sheet metal and left connected to a metal band that is then loaded into the device. This differs from conventional technology where individual staples are typically loaded into cartridge bays. We believe that our “staple-on-a-strip” technology will enable tighter spacing between individual staples, which improves sealing performance.

|

|

●

|

True Multi-Fire Capability. Our “staple-on-a-strip” technology is being designed to allow the surgeon to fire multiple deployments within a single procedure, without the need to remove the stapler from the tissue site or having to replace the staple cartridge. Conventional stapling technology requires a tedious, repetitive 13-step process after each deployment in which the stapler is first clamped and then removed from the body cavity. Our true multi-fire capability would reduce this multi-step process to one simple step: following a deployment the device is reset by activating a simple slider.

|

|

●

|

Improved Staple Formation. We are designing our microcutter products to deploy staples with significantly lower deployment forces. Reduced deployment forces potentially gives the user more control during deployment. Additionally, our compact staple mechanism would allow more design space to be dedicated to the anvil, which helps to ensure favorable tissue compression. These features combine to result in excellent staple formation.

|

|

●

|

Articulation, Rotation and Handling. End-effector articulation and rotation clearly improve tissue access and ease of use, and both are expected by surgeons in stapling devices. Our microcutter products’ designs incorporate end-effectors that in one product format we are planning would be angled up to 80 degrees, as compared to the 45 degrees of maximum articulation achieved with the vast majority of currently marketed linear stapling technologies. In addition, all of our microcutter products are being designed to enable 360-degree rotation of the end-effector. Our

microcutter would be a truly single-hand operated device: 360 degree rotation and up to 80 degree articulation would be accomplished with two articulation buttons integrated into a single knob at the end of the handle.

|

4

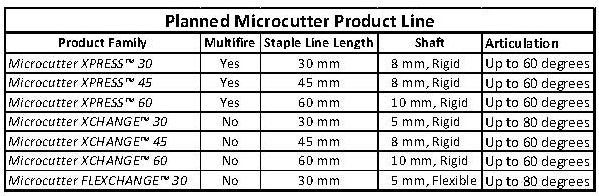

Microcutter Products

We intend to launch a full range of surgical stapling devices that cover the needs of thoracic, bariatric, colorectal and general surgeons as shown in the table below. These products would provide staple line lengths from 30 to 60 millimeters, come in shaft diameters ranging from five to ten millimeters, accommodate staple heights from 2.0 to 5.3 millimeters and articulate up to 80 degrees. Depending upon the specific product application, we anticipate that some of these products will have true multi-fire capability, while others will be cartridge based. In all instances the true multi-fire or cartridge design would be combined with our unique staple design, including the

“staple-on-a-strip” technology. In the true multi-fire design, we anticipate that each device will provide a number of deployments that is a function of shaft length and desired staple line length, ranging from six to twelve deployments in one device. In addition, we plan to expand the microcutter product line by introducing products with flexible shafts to facilitate minimally invasive procedures.

Microcutter XPRESS Product Family

The Microcutter XPRESS name refers to the group of microcutter products that is planned to have the first and only true multi-fire endolinear microcutter device on the market based on our proprietary “staple-on-a-strip” technology. This product is planned in 30, 45, and 60 mm staple line lengths, with either an 8 or 10 mm rigid shaft and articulation up to 60 degrees. These devices are planned to include a variety of staple heights from 2.0 to 5.3

mm.

The first of these products that we plan to commercially launch is the Microcutter XPRESS 30. We have received CE Mark certification for our microcutter design and manufacturing processes and have completed the internal design verification process necessary to apply the CE Mark to the Microcutter XPRESS 30 for commercial use in Europe. We initiated first-in-man use of the current version of the Microcutter XPRESS 30, with the CE Mark, in Europe in July 2011, and we continue to refine the product prior to commercial launch in Europe. Before we begin a commercial launch of the Microcutter XPRESS 30, we plan to add

several features to the initial version of the device currently being used to gain clinical experience. These include articulation, an increase in the number of available deployment per device from the currently available two to a maximum of eight deployments and an increase in the available staple sizes from the one size currently available to three sizes.

We have been advised by the FDA that the FDA would require clinical data with respect to the staple design used in the planned microcutter product line as part of a 510(k) submission to the FDA with respect to potential clearance of the Microcutter XPRESS 30 and other products in the planned microcutter product line for marketing and sale in the United States. We plan to commence a single-arm clinical trial of the Microcutter XPRESS 30 in Europe during this calendar year to obtain the clinical data that we plan to include in our 510(k) submission. Our planned clinical trial will be focused on use of the Microcutter XPRESS 30 in

gastrointestinal surgical procedures. We are seeking to work with the FDA to obtain further guidance as to the clinical data that the FDA will require for clearance of our planned 510(k) submission, but we cannot predict the outcome of these discussions or whether we will be able to obtain further guidance prior to commencement of the trial or our 501(k) submission. We anticipate that the results of the clinical trial conducted under our currently planned protocol will be available within approximately six months of trial commencement.

Microcutter XCHANGE Product Family

The Microcutter XCHANGE name refers to the planned group of cartridge based microcutter products with rigid shafts that will also include our proprietary “staple-on-a-strip” technology. The first product that is planned in this family would be the Microcutter XCHANGE 30 with a 30 mm staple line length. This product would be the first and only 5 mm stapling device available on the market and is being developed with up to 80 degrees of

articulation. Subsequently, the Microcutter XCHANGE 45 and Microcutter XCHANGE 60, with 45mm and 60mm staple line lengths, respectively, are planned to provide cartridge based capability when multi-fire capability is not required. These devices are also planned to include a variety of staple heights from 2.0 to 5.3 mm.

Microcutter FLEXCHANGE Product Family

The Microcutter FLEXCHANGE name refers to the planned group of cartridge based microcutter products with flexible shafts that will also include our proprietary “staple-on-a-strip” technology. The first product that is planned in this family would be the Microcutter FLEXCHANGE 30 with a 30 mm staple line length. This product would be the first and only 5 mm stapling device available on the market with a flexible shaft and is being developed with up to 80 degrees of articulation. These devices are planned to facilitate endoscopic

procedures requiring cutting and stapling and are also planned to include a variety of staple heights from 2.0 to 3.5 mm.

5

Microcutter Technology License Agreement

On August 16, 2010, we entered into a license agreement with Intuitive Surgical Operations, Inc., or Intuitive Surgical, pursuant to which we granted to Intuitive Surgical a worldwide, sublicenseable, exclusive license to use our intellectual property in the robotics field in diagnostic or therapeutic medical procedures, excluding vascular anastomosis applications, referred to as the License Agreement. In consideration for this license, we received an

up-front license fee of $9.0 million. We are also eligible to receive a contingent payment related to achieving a certain sales volume. Receipt of the contingent payment is substantively at risk given the uncertainties surrounding the development and sale of any products incorporating our patent rights. Each party has the right to terminate the License Agreement in the event of the other party’s uncured material breach or bankruptcy. Following any termination of the License Agreement, the licenses granted to Intuitive Surgical will continue, and, except in the case of termination for our or Intuitive Surgical’s uncured material breach or insolvency, Intuitive Surgical’s payment obligations will continue as well. Under the License Agreement, Intuitive Surgical has rights to improvements in our

technology and intellectual property over a specified period of time.

Microcutter Product Sales and Marketing

United States

Our sales and marketing approach in the United States is planned to commence with a strategy focused on influential thoracic, bariatric, colorectal and general surgeons. We are currently gaining feedback on our initial planned products from these surgeons in prominent institutions around the United States, which will assist us in deciding which institutions and cities to target initially.

Provided we receive clearance from the FDA under the 510(k) process, we plan to initially launch the Microcutter XPRESS 30 to a limited number of targeted clinical sites. We plan to learn from these sites the time and training required to achieve routine clinical adoption of the Microcutter XPRESS 30. To support this strategy, we are planning to start with a small group of top performing and experienced direct sales representatives that have extensive backgrounds in stapling products and laparoscopic procedures and existing relationships with key surgeons and decision makers.

We would base a broader launch of the Microcutter XPRESS 30 on our experience from this initial product introduction. Over subsequent quarters, our plan would be to add additional sales representatives in new markets with a similar hiring profile as our first sales representatives.

International

We plan to commence commercializing our Microcutter XPRESS 30 initially in Europe, following application of the CE Mark to the current version of the Microcutter XPRESS 30 in July 2011. We plan to initially focus on developing relationships with leading clinicians who are considered to be “thought leaders” in their institutions and surgical

specialties. We intend to work closely with a limited number of targeted clinical sites to achieve routine clinical adoption of our planned microcutter products in a select group of thoracic, bariatric, colorectal and general surgical procedures in which we believe the key features of the planned microcutter products are most differentiated from existing devices. We plan to leverage the lessons learned from this initial experience and the clinical experience of these key opinion leaders with the microcutter devices to bring credibility to a broader launch. As we are able to apply the CE Mark to additional products in our microcutter product line and are able to gain more adoption of our products, we would plan to introduce these additional products in a similar

manner. We recently signed a distribution agreement with Century with respect to distribution of our planned microcutter products in Japan.

Under the terms of a secured note purchase agreement, Century has agreed to loan us an aggregate of up to $4.0 million at a 5% annual interest rate, with principal due five years after the first draw by us under the agreement, subject to certain conditions. Century’s obligation to provide the loan to us is subject to the successful deployment, in Century’s sole discretion, of certain of our microcutter products in clinical and wet lab environments, before specified dates, or at such other date as mutually agreed upon between the parties. We

expect to complete these deployments within the next several months. In return for the loan commitment, we granted Century distribution rights to our planned microcutter product line in Japan and a right of first negotiation for distribution rights in Japan to future products. Century will be responsible for securing regulatory approval from the Ministry of Health in Japan. After approval for marketing in Japan, we would sell microcutter units to Century, who would then sell the microcutter devices to their customers in Japan.

Competition

The Microcutter XPRESS 30 and other planned products in the microcutter product line, if they receive regulatory clearance and are successfully launched, would compete in the market for stapling and cutting devices within laparoscopic stapling and sealing devices currently marketed around the world. We believe the principal competitive factors in the market for laparascopic staplers include:

|

•

|

reduced product size;

|

|

•

|

ease of use;

|

|

•

|

product quality and reliability;

|

|

•

|

multi-fire capability;

|

|

•

|

device cost-effectiveness;

|

|

•

|

degree of articulation;

|

|

•

|

surgeon relationships; and

|

|

•

|

sales and marketing capabilities.

|

6

Two large competitors, Ethicon Endo-Surgery, part of Johnson & Johnson, and Covidien currently control over 80% of this market. Other large competitors in the laparoscopic device market include Stryker Endoscopy and Olympus, which acquired another competitor, Gyrus Medical. Ethicon Endo-Surgery and Covidien, which acquired a small competitor, Power Medical, each have large direct sales forces in the United States and have been the largest participants in the market for single use disposable laparoscopic stapling devices for many years. Competing against large established competitors with significant resources

may make establishing a market for any products that we develop difficult which would have a material adverse effect on our business.

Cardiac Industry Background

Coronary Artery Disease

According to the American Heart Association, approximately 17.6 million people in the United States have coronary artery disease, and approximately 425,400 people in the United States die each year as a result of the disease. Coronary artery disease, sometimes referred to as atherosclerosis, is a degenerative disease resulting from the deposit of cholesterol and other fatty materials on the interior walls of blood vessels, forming a build-up known as plaque. The accumulation of plaque, usually over decades, causes the vessel to become inelastic and progressively narrows the interior of the artery, impairing its ability to supply blood and oxygen to the heart muscle. When there is insufficient

blood flow to the heart muscle, an injury may occur, often resulting in chest pain, or angina, a heart attack or even death. Coronary artery disease is caused by aging and is exacerbated by dietary and environmental factors, as well as by genetic predisposition. As a patient ages, the disease will typically advance and become more diffuse, compromising the coronary artery system more globally and occluding more small-diameter vessels.

Current Treatment Alternatives for Coronary Artery Disease

Physicians and patients may select among a variety of treatments to address coronary artery disease, with the selection often depending upon the stage and severity of the disease and the age of the patient. In addition to changes in patient lifestyle, such as smoking cessation, weight reduction, diet changes and exercise programs, the principal existing treatments for coronary artery disease include the following:

Medical Treatment with Pharmaceuticals

Before the advent of interventional cardiology or bypass surgery, medical treatment with pharmaceuticals was the only form of therapy available to patients with coronary artery disease. In patients with less severe disease, pharmaceuticals remain the primary treatment approach and include drugs such as platelet adhesion inhibitors or drugs that reduce the blood cholesterol or triglyceride levels. The objective for medical treatment with pharmaceutical agents is to reduce the incidence, progression or exacerbation of coronary artery disease and its associated symptoms. For more serious disease, however, pharmacological therapy alone is often inadequate.

Interventional Cardiology Techniques

Coronary Angioplasty. Percutaneous transluminal coronary angioplasty, commonly referred to as balloon angioplasty, is a surgical procedure that involves the dilation of the obstructed artery with a balloon catheter. To perform an angioplasty, the surgeon maneuvers a flexible balloon catheter to the site of the blockage in the coronary artery, inflates the balloon, compressing the plaque and stretching the artery wall to create a larger channel for blood flow. The balloon is then deflated and removed. Angioplasty is generally successful in increasing immediate blood flow and, relative to current surgical procedures, offers the benefits of

shorter periods of hospitalization, quicker recovery times, reduced patient discomfort and lower cost. However, angioplasty does not always provide prolonged efficacy: independent studies indicate that 25% to 40% of vessels treated with balloon angioplasty return to their pre-treatment, narrowed size, a process known as restenosis, within six months following the procedure. Restenosis is primarily the result of cell proliferation in response to the “injury” caused by the angioplasty procedure.

Stents. High rates of restenosis following treatment by balloon angioplasty led to the introduction of stents, mesh-like metallic tubes that are placed within the narrowed portion of the coronary vessel to hold the vessel open after the angioplasty balloon has been removed. Although clinical outcomes for procedures using stents reflect an improvement over balloon angioplasty alone, the effectiveness of stents is still limited by restenosis, which for bare metal stents occurs in about 10% to 35% of cases within six months of the procedure.

Some manufacturers have introduced drug-eluting stents, which incorporate, on the surface of the stent, specially formulated, slow-release drugs designed to prevent restenosis. According to published studies, currently marketed drug-eluting stents have been shown in clinical trials to reduce the rate of restenosis, within the first nine months after placement, to less than 10%. Market adoption of drug-eluting stents has been rapid, and industry observers had predicted that drug-eluting stents would capture approximately 90% of the stent market within three years. However, some studies have been presented that associate drug-eluting stents with late stage thrombosis, or clotting, which can be an

adverse event. Drug-eluting stents are still widely used, with a current market share relative to total stent usage in the range of 70-80%.

7

Despite the advancements and market success of drug-eluting stents and angioplasty therapies, these interventional procedures may be less effective than CABG procedures in addressing diffuse progressive coronary artery disease. In this advanced stage of coronary artery disease, intervention is required for multiple vessels, many of which are less than two millimeters in internal diameter, a diameter currently unsuited for angioplasty and stenting. In addition, stents have been shown to be difficult to place in patients with coronary lesions in sections with vessel branches and in patients with narrowings in the left main coronary artery.

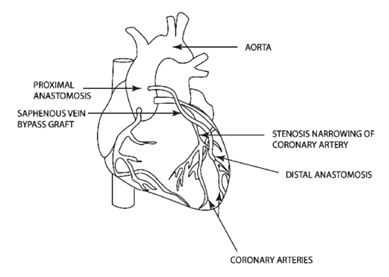

Bypass Surgery. CABG involves the construction of an alternative path to bypass a narrowed or occluded coronary artery and restore blood flow from the aorta to an area past the occlusion. This procedure can be accomplished using either veins or arteries as bypass grafts. Veins are typically harvested from the patient’s leg (saphenous vein), while arteries are taken from either the patient’s arm (radial artery) or chest wall (mammary artery). For vein grafts and radial arteries, one end of the harvested vessel is then generally attached to the aorta for blood inflow, and the opposite end is attached to the target coronary

vessel. If a mammary artery is used as the bypass graft, it must be dissected from the chest wall, leaving one end in place, while the opposite end is attached to the target vessel, providing uninterrupted blood flow from the arterial circulation. Once in place, these grafts provide sufficient blood flow to bypass the narrowed or occluded portion of the coronary artery. (See Figure Below).

Although CABG surgery is generally a highly invasive and even traumatic procedure, an independent study comparing CABG and implantation of conventional stents has shown that CABG is the more effective treatment for coronary artery disease, achieving the best long-term patient outcomes as measured by survival rate and need for intervention. Studies have shown that following CABG, grafts can remain patent, or open, and functional for as long as 10 years in approximately 50% of venous grafts and approximately 90% of arterial grafts. In addition, CABG procedures can be used to treat diffuse, end-stage coronary artery disease states that are often not amenable to treatment by angioplasty or

stents.

According to an independent analysis by Medtech Insight, a division of Windhover Information, entitled “U.S. Surgical Procedure Volumes,” dated February 2007, an estimated 257,000 CABG procedures were performed in 2007 in the United States, as compared to approximately 260,000 procedures in 2006. We believe that the decrease in CABG procedures is primarily attributable to the increase in other interventional cardiology procedures, including the increased use of drug-eluting stents. The average CABG surgery requires approximately three bypass grafts per patient, and a majority of grafts require an anastomotic connection at both ends of the graft. Assuming an average of approximately

five anastomoses per CABG procedure, we estimate that approximately 1.8 million of these blood vessel connections are performed in connection with CABG procedures annually in the United States. We believe approximately two-thirds of the procedures are performed using veins as the bypass graft. A similar number of CABG procedures with similar grafting frequency are performed outside of the United States.

8

Types of CABG Procedures

There are currently three types of CABG procedures, two of which are commonly performed:

Conventional On-Pump CABG Procedures. Conventional on-pump CABG procedures are particularly invasive and traumatic to the patient, typically requiring the surgeon to open the patient’s chest cavity by splitting the sternum and to place the patient on a pump to circulate the blood throughout the body. Redirecting the blood flow to a pump enables the surgeon to clamp the aorta and stop the heart, which results in a motionless and bloodless field in which the surgeon can perform the difficult and tedious task of manually suturing the small vessels to one another. The absence of blood flow and motion are important factors in ensuring

precision and providing positive clinical outcomes; however, the use of a pump for circulation exposes the patient’s blood to foreign surfaces, which has been shown to increase the incidence of bleeding and short-term neurocognitive defects. Additionally, stopping the heart may result in impairment or damage to the heart muscle. Moreover, clamping of the aorta has been shown in clinical studies to cause the release of particles into the blood stream that may produce blockages in other parts of the body, such as the brain. Blockages in the brain can lead to neurological damage, including strokes. Clamping the aorta also carries the risk of injury to the vessel wall with later bleeding complications. Notwithstanding these potential problems, the majority of CABG procedures performed today use this on-pump technique.

Off-Pump CABG Procedures. In 1995, a new method of performing CABG procedures was introduced that avoids the use of external pumps, requiring the surgeon to perform the anastomosis while the heart is beating. The clinical literature suggests that this procedure, termed off-pump coronary artery bypass, or OPCAB, offers several benefits as compared to on-pump CABG procedures, including reductions in bleeding, kidney dysfunction, short-term neurocognitive dysfunction and length of hospital stay. OPCAB procedures currently represent approximately 25% of all CABG procedures performed in the United States.

Notwithstanding these advantages, the technical challenges inherent in OPCAB have impeded its widespread adoption. Because the patient’s heart is beating during the procedure, the surgeon is required to perform the delicate anastomosis on a target vessel, which could be as small as one millimeter in internal diameter, while the vessel is moving with each heart contraction. The technical demands of the procedure, together with the longer learning curve required to achieve surgical proficiency, may also initially adversely affect long-term graft patency and completion of revascularization. In addition, surgeons will still typically be required to place a partially occluding clamp on the

ascending aorta to hand suture the proximal vein graft anastomosis. As a result, even in OPCAB procedures, patients still face the risk of the serious adverse effects associated with the application of aortic clamps.

Minimally Invasive Endoscopic Procedures. Recently, a very small number of CABG procedures have been performed using minimally invasive endoscopic procedures to reduce patient trauma. These TECAB procedures typically involve the use of Intuitive Surgical’s da Vinci surgical robot system. In this approach, the sternum is left intact and the surgery is performed through small access ports. The anastomoses are performed on selected, readily reachable vessels using special surgical instruments or the da Vinci robot system, and this procedure requires special surgical skills. Although endoscopic procedures offer the promise of faster

post-operative patient recovery times, rapid ambulation, long-term graft patency and a low incidence of adverse outcomes, in the past there were a number of challenges to wide-scale realization of that potential, including the absence of a method to enable surgeons to perform reproducible and effective anastomoses that can be rapidly deployed through small incisions. While many patients may be eligible for minimally invasive endoscopic techniques, the TECAB procedures are currently performed in less than 1% of all CABG patients.

Surgical Techniques for Anastomoses

The current method of performing anastomoses, which surgeons generally view as the most critical aspect of CABG procedures, typically employs tedious and time-consuming hand-sewn placement of individual stitches with a continuous suture to connect the bypass graft to the aorta or coronary vessels. Conventional anastomosis can require ten to 25 minutes to suture, depending upon the size and disease state of the vessels. Proper vessel alignment and suture tension among the many individually placed fine stitches are critical for optimal bypass graft blood flow and function. Furthermore, long-term clinical outcomes may be improved if the anastomosis is “compliant,” that is, if its shape

and size can adapt to changes in flow and blood pressure by placement of many single sutures rather than one continuous suture. However, most surgeons prefer the use of a continuous suture because placement of individual sutures may be more technically challenging and time-consuming. Whether the surgeon elects to operate on the patient on- or off-pump, a hand-sewn proximal anastomosis generally requires clamping of the aorta and therefore carries with it the risk of neurological damage and other serious adverse effects. Recently, new technology has been introduced that allows the surgeon to perform hand-sewn proximal anastomoses to the aorta without clamping of the aorta. These facilitating devices temporarily cover the opening in the aortic wall from the inside while the surgeon places the stitches to create the anastomosis and are removed after the anastomosis has been completed to

allow blood flow into the bypass graft. We believe these systems, in their current implementations, are not suitable for endoscopic bypass surgery.

9

The laborious and time-consuming nature of manually applied sutures and the limitations associated with their use, together with advances occurring in coronary surgical procedures, have fueled the need for easy-to-use, fast and highly reliable automated systems to expedite and standardize the performance of anastomoses in CABG procedures. Although a number of companies have attempted to develop automated systems to perform anastomoses, to date, Cardica is the only company with FDA clearance to market distal and proximal anastomosis devices in the United States, and only one other non-automated system for use in performing a proximal anastomosis is currently commercially available in the United

States.

Our Cardiac Solutions

We design, manufacture and market proprietary automated anastomotic systems used by surgeons to perform anastomoses during on- or off-pump CABG procedures. We believe that by enabling consistent and reliable anastomoses of the vessels at this most critical step in CABG surgery through a fast, automated process, our products can improve the quality and consistency of these anastomoses, which we believe will ultimately contribute to improved patient outcomes. We have designed our products to meet the needs of surgeons, including:

|

•

|

Physiological features. Our clips use medical grade stainless steel that is identical to that used in conventional coronary stents, which is known to be compatible with the human body (in the absence of allergies to certain components of medical grade stainless steel). Our products minimize trauma to both the graft and target vessel during loading and deployment, thereby reducing the risk of scar formation and associated narrowings or occlusions. Additionally, our PAS-Port system can be used without clamping the aorta, which has been shown to be a cause of adverse events, including neurological complications. In addition, our

C-Port system creates compliant anastomoses, which potentially allow the shape and size of the anastomosis to adapt to changes in flow and blood pressure.

|

|

•

|

Handling features. Our anastomotic systems can create anastomoses more rapidly than hand suturing, resulting in a surgical procedure that can be performed more quickly. For example the PAS-Port system can be set-up and deployed in approximately three minutes compared with approximately ten to 25 minutes for a hand-sewn anastomosis. In addition, the system is easy to use, typically requiring only a few hours of training to become technically proficient in the technique. The C-Port system is compatible with coronary arteries as small as 1.3 millimeters in internal diameter, which is typically the lower limit of target vessels considered

to be candidates for revascularization. The C-Port system can also be deployed at various angles, allowing access to all coronary targets during both on- and off-pump procedures. Both the C-Port system and the PAS-Port system are designed as integrated products, where all steps necessary to create an anastomosis are performed by a single tool, with one user interface. The need for target vessel preparation is minimal for the PAS-Port system, a feature that is especially important in patients undergoing a second or third coronary bypass procedure with the presence of significant scarring in and around the heart and aorta.

|

|

•

|

Standardized results. Our products enable consistent, reproducible anastomoses, largely independent of surgical technique and skill set, using a wide range in quality of graft tissues. In comparison with hand-sewn sutures, our systems offer mechanically-governed repeatability and reduced procedural complexity.

|

|

•

|

Reduced costs. Because our products can help to expedite the CABG procedure, we believe that they may contribute to reduced operating room time and a reduction in associated expenses, partially offset by the increased direct cost of our products compared to current alternatives, such as sutures. Additionally, our C-Port system creates anastomoses rapidly and does not require the interruption of blood flow. This may reduce some of the technical challenges inherent in performing anastomosis in off-pump procedures, which may advance adoption of the off-pump approach. By helping more surgeons perform off-pump CABG, the need for a costly

pump may also be reduced or eliminated, thereby potentially reducing the total direct costs of the procedure. The C-Port Flex A allows the surgeon to perform coronary revascularization through small openings in the chest wall, thereby reducing the trauma and morbidity associated with the CABG procedure, which therefore may help reduce costs by reducing the time to patient discharge. Finally, to the extent complications such as strokes or injury to the heart muscle decrease, post-operative costs of a CABG procedure may be significantly reduced.

|

Our Cardiac Products

We currently market four proprietary products to perform anastomoses, the C-Port xA system, the C-Port Flex A system, the C-Port X-CHANGE system and the PAS-Port system. The C-Port systems automate a distal anastomosis between the graft vessel and target artery. The C-Port xA system was developed to use veins and arteries as the bypass graft vessel and received regulatory clearance through the 510(k) process with the FDA in November 2006. A new generation of the C-Port xA system, the C-Port Flex A system, designed to further enable minimally invasive CABG surgery, received 510(k) clearance from the FDA in March 2007, and the C-Port X-CHANGE system, a reloadable cartridge-based system, received

510(k) clearance from the FDA in December 2007. Each of our C-Port systems has received the CE Mark for sales in Europe. As of June 30, 2011, we had sold an aggregate of nearly 12,100 units of all the versions of our C-Port systems. The PAS-Port system automates the performance of a proximal anastomosis between a graft vessel, typically a saphenous vein, and the aorta. The PAS-Port system received 510(k) clearance from the FDA in September 2008 following successful completion of a prospective, international, randomized study. Our PAS-Port system also has received the CE Mark. The PAS-Port system is cleared or approved for sale and marketed in the United States, Europe and Japan. As of June 30, 2011, over 24,100 PAS-Port systems had been sold, primarily in Japan and the United States. Total product sales of our C-Port and PAS-Port systems were $3.9 million, $3.8 million and $6.8 million

for the fiscal years ended June 30, 2011, 2010 and 2009, respectively. Total product sales represented 29%, 95% and 69% of total revenue for the fiscal years ended June 30, 2011, 2010 and 2009, respectively.

10

C-Port® Distal Anastomosis Systems

C-Port® xA Anastomosis System

Our C-Port xA Distal Anastomosis System, which may be used in either on- or off-pump CABG procedures, is designed to perform an end-to-side distal anastomosis by attaching the end of a bypass graft to a coronary artery downstream of an occlusion or narrowing. The C-Port xA system is inserted in a small incision in the coronary artery with a bypass graft vessel attached to the device. The C-Port xA system is actuated by depressing a trigger which activates a manifold powered by a cylinder of compressed carbon dioxide to provide smooth actuation. Miniature stainless steel staples are deployed to securely attach the bypass graft to the coronary artery and at the same time a miniature knife

completes an opening inside the coronary artery to complete the bypass. After deployment, the C-Port system is removed from the coronary artery and the entry incision is closed typically with a single stitch. Our C-Port xA system is effective in creating compliant anastomoses in vessels as small as 1.3 millimeters in internal diameter. In addition, the C-Port xA system has been designed to:

|

•

|

perform an end-to-side anastomosis without interruption of native coronary blood flow, which is not possible in a conventional hand-sewn anastomosis during off-pump surgery without the use of a temporarily placed vascular shunt;

|

|

•

|

achieve nearly complete alignment of the natural blood lining surfaces of the coronary artery and the bypass graft to minimize scarring and potential occlusion of the anastomosis;

|

|

•

|

minimize the amount of foreign material in the blood stream that may cause clotting and subsequent graft failure; and

|

|

•

|

be suitable for all grafts typically used in CABG procedures with wall thicknesses of less than or equal to 1.4 millimeters.

|

C-Port® Flex A Anastomosis System

The C-Port Flex A system includes modifications to the C-Port xA system that are designed to enable automated anastomoses to be performed as part of minimally invasive and robot-facilitated CABG procedures. The C-Port Flex A system includes all of the features and benefits of the C-Port xA system and has a flexible, rather than rigid, shaft. The flexible shaft is designed to allow the working end of the device that creates the anastomosis to be inserted through a 14-millimeter diameter port to access the chest cavity and heart. The device is designed to be loaded with the bypass graft vessel inside or outside the chest cavity and deployed to create the anastomosis to the coronary artery. This

product is designed to enable technology for completion of robotically assisted, including endoscopic, CABG surgery through four or five relatively small incisions between the ribs. Avoiding both the incision through the sternum and the use of the pump should significantly reduce patient trauma and accelerate post-operative recovery.

C-Port® X-CHANGE System

The C-Port X-CHANGE system, the most recent offering in the C-Port product line, is a cartridge-based reloadable C-Port system. The C-Port X-CHANGE system includes modifications to the C-Port xA system that are designed to enable multiple automated anastomoses to be performed using the same handle with up to three separate cartridges. The C-Port X-CHANGE system provides for a lower cost per deployment for multiple deployments in one CABG procedure.

PAS-Port® Proximal Anastomosis System

Our PAS-Port system is a fully automated device used to perform an end-to-side proximal anastomosis between a saphenous vein and the aorta. To complete a proximal anastomosis, the cardiac surgeon simply loads the bypass graft vessel into the PAS-Port system, places the end of the delivery device against the aorta and turns the knob on the opposite end of the delivery tool. The device first creates an opening in the aorta and subsequently securely attaches the bypass graft to the aortic wall, using a medical grade stainless steel implant that is formed into its final shape by the delivery tool. The innovative design of the PAS-Port system allows the surgeon to load the bypass graft and rapidly

complete the anastomosis, typically in approximately three minutes, with little or no injury to the bypass graft vessel or the aorta.

An important advantage of our PAS-Port system is that, in contrast to conventional hand-sewn proximal anastomoses, the vascular connections created can be performed without clamping the aorta, potentially avoiding associated risks, such as neurological complications. Surgeons use our PAS-Port system in conventional CABG procedures and in OPCAB. Similar to hand-sewn anastomosis, anastomoses completed using our PAS-Port system occasionally require additional stitches intra-operatively to obtain hemostasis (absence of bleeding in the anastomosis site). These additional stitches may be required intra-operatively in an individual anastomosis depending on the quality of the target and graft vessels,

adequacy of target site preparation and quality of the loading of the graft to the deployment cartridge.

11

Cardiac Product Sales and Marketing

United States

Our initial products focus on the needs of cardiovascular surgeons worldwide. We have a three person direct sales force, augmented by a network of independent medical device manufacturers’ representatives and distributors to sell our products domestically. We utilize manufacturers’ representatives and distributors who carry other cardiac surgery products, are clinically knowledgeable and are capable of training cardiac surgeons on the use of our products and proctoring initial cases in the operating room.

International

We currently distribute our PAS-Port system in Japan through our exclusive distributor, Century. For the fiscal years ended June 30, 2011, 2010 and 2009, sales to Century comprised approximately 7%, 22% and 10%, respectively, of our total revenue and approximately 22%, 23% and 15%, respectively, of our product sales. As of June 30, 2011, Century had trained over 300 Japanese cardiac surgeons in over 200 hospitals. Century has a direct sales organization of approximately 24 representatives who are responsible for the development of the anastomotic device market and directly contact cardiac surgeons. Century provides

clinical training and support for end-users in Japan. We provide Century with promotional support, ongoing clinical training, representation at trade shows and guidance in Century’s sales and marketing efforts. Our agreement with Century pertaining to the PAS-Port system expires in July 2014, but automatically renews for an additional five-year term if Century meets certain sales milestones. Either party may terminate this agreement if the other party defaults in performance of material obligations and such default is not cured within a specified period or if the other party becomes insolvent or subject to bankruptcy proceedings. In addition, we may terminate the agreement within 90 days following a change of control by payment of a specified termination fee. For the specifics of our revenue by geographic location please see Note 1,

Concentrations of Credit Risk and Certain Other Risks, in our Notes to Financial Statements.

Total product sales of our C-Port and PAS-Port systems were $3.9 million, $3.8 million and $6.8 million, for fiscal years ended June 30, 2011, 2010 and 2009, respectively. Total product sales represented 29%, 95% and 69% of total revenues for fiscal years ended June 30, 2011, 2010 and 2009, respectively.

We are continuing to sell to selected international customers and will continue to evaluate further opportunities to expand our distribution network in Europe and in other parts of the world where the healthcare economics are conducive to the introduction and adoption of new medical device technologies.

Competition

The market for medical devices used in the treatment of coronary artery disease is intensely competitive, subject to rapid change, and significantly affected by new product introductions and other market activities of industry participants. We believe the principal competitive factors in the market for medical devices used in the treatment of coronary artery disease include:

|

•

|

improved patient outcomes;

|

|

•

|

access to and acceptance by leading physicians;

|

|

•

|

product quality and reliability;

|

|

•

|

ease of use;

|

|

•

|

device cost-effectiveness;

|

|

•

|

training and support;

|

|

•

|

novelty;

|

|

•

|

physician relationships; and

|

|

•

|

sales and marketing capabilities.

|

There are numerous potential competitors in the medical device, biotechnology and pharmaceutical industries, such as Maquet Cardiovascular LLC, formerly the cardiac surgery division of Boston Scientific Corporation, Edwards Lifesciences Corporation, Johnson & Johnson, Inc., Abbott Laboratories, which acquired an additional division of Guidant Corporation, Medtronic, Inc. and St. Jude Medical, that are targeting the treatment of coronary artery disease broadly. Each of these companies has significantly greater financial, clinical, manufacturing, marketing, distribution and technical resources and experience than we have. In addition, new companies have been, and are likely to continue to be,

formed to pursue opportunities in our market.

12

The landscape of active competitors in the market for anastomotic solutions is currently limited. Several companies market systems designed to facilitate or stabilize proximal anastomoses, such as Maquet Cardiovascular’s Heartstring Aortic Occluder and Novare Surgical Systems’ Enclose anastomotic assist device. St. Jude Medical previously had a commercially available proximal anastomotic system that was marketed both in the United States and Europe; however, St. Jude Medical voluntarily withdrew this product from the market in 2004. Johnson & Johnson obtained FDA clearance for a proximal system that was developed by Bypass Inc. but has divested the division that was originally

responsible for selling this product, and this proximal anastomosis product is now not available for cardiac surgeons in the United States or abroad. Our PAS-Port system is the only commercially available automated proximal anastomosis device.

Our C-Port systems are the only automated anastomosis devices for distal anastomosis cleared for marketing in the United States. The only currently marketed facilitating device for distal anastomosis is the U-Clip, which substitutes clips for sutures, but still requires manual application of typically 12 to 14 individually placed clips per anastomosis by the surgeon.

Currently, the vast majority of anastomoses are performed with sutures and, for the foreseeable future, sutures will continue to be the principal competitor for alternative anastomotic solutions. The direct cost of sutures used for anastomoses in CABG procedures is far less expensive than the direct cost of automated anastomotic systems, and surgeons, who have been using sutures for their entire careers, have been reluctant to consider alternative technologies, despite potential advantages.

In addition, cardiovascular diseases may also be treated by other methods that do not require anastomoses, including interventional techniques such as balloon angioplasty and use of drug-eluting stents, pharmaceuticals, atherectomy catheters and lasers. Further, technological advances with other therapies for cardiovascular disease such as drugs, local gene therapy or future innovations in cardiac surgery techniques could make other methods of treating this disease safer, more effective or less expensive than CABG procedures.

Manufacturing

Our manufacturing operations, sterile products manufacturing, assembly, packaging, storage and shipping, as well as our research and development laboratories and administrative activities, all take place at our headquarters facility. We believe that our current facilities will be sufficient to meet our manufacturing needs for at least the next two years.

We believe our manufacturing operations are in compliance with regulations mandated by the FDA and the European Union, or EU. Our facility is International Standards Organization, or ISO, 13485:2003 certified. In connection with our CE mark approval and compliance with European quality standards, our facility was initially certified in June 2002 and has been inspected annually thereafter.

There are a number of critical components and sub-assemblies required for manufacturing the microcutter product line and C-Port and PAS-Port systems that we purchase from third-party suppliers. The vendors for these materials are qualified through stringent evaluation and monitoring of their performance over time. We audit our critical component manufacturers on a regular basis and at varied intervals based on the nature and complexity of the components they provide and the risk associated with the components’ failure.

We use or rely upon sole source suppliers for certain components and services used in manufacturing our products, and we utilize materials and components supplied by third parties, with which we do not have any long-term contracts. In recent years, many suppliers have ceased supplying materials for use in implantable medical devices. We cannot quickly establish additional or replacement suppliers for certain components or materials, due to both the complex nature of the manufacturing processes employed by our suppliers and the time and effort that may be required to obtain FDA clearance or other regulatory approval to use materials from alternative suppliers. Any significant supply interruption

or capacity constraints affecting our facilities or those of our suppliers would affect our ability to manufacture and distribute our products.

13

Third-Party Reimbursement

Sales of medical products are increasingly dependent in part on the availability of reimbursement from third-party payors such as government and private insurance plans. In the United States, as well as in foreign countries, government-funded or private insurance programs, commonly known as third-party payors, pay the cost of a significant portion of a patient’s medical expenses. Successful sales of our products will depend on the availability of adequate reimbursement from third-party payors. No uniform policy of coverage or reimbursement for medical technology exists among all these payors. Therefore, coverage and reimbursement can differ significantly from payor to

payor.

Hospitals and other healthcare providers that purchase medical devices, such as the ones that we manufacture, rely on third-party payors to pay for all or part of the costs and fees associated with the procedures performed with these devices. The existence of adequate reimbursement for the procedures performed with our Microcutter and cardiac surgery products by government and private insurance plans are central to acceptance of our current and future products. We may be unable to sell our products on a profitable basis if third-party payors deny coverage or reduce their current levels of payment, or if our costs of production increase faster than increases in reimbursement

levels.

Many private payors use coverage decisions and payment amounts determined by the Centers for Medicare and Medicaid Services, or CMS, which administers the Medicare program, as guidelines in setting their reimbursement policies. Future action by CMS or other government agencies may diminish payments to physicians, outpatient centers and hospitals. Those private payors that do not follow the Medicare guidelines may adopt different reimbursement policies for procedures performed with our products. For some governmental programs, such as Medicaid, reimbursement differs from state to state, and some state Medicaid programs may not pay for the procedures performed with our products in an

adequate amount, if at all.

Once a device has received approval or clearance for marketing by the FDA, there is no assurance that Medicare will cover the device and related services. In some cases, CMS may place certain restrictions on the circumstances in which coverage will be available. In making such coverage determinations, CMS considers, among other things, peer-reviewed publications concerning the effectiveness of the technology, the opinions of medical specialty societies, input from the FDA, the National Institutes of Health, and other government agencies. We cannot assure you that our microcutter products (if launched) and/or our cardiac surgery products will be covered by Medicare and other third-party

payors. Limited coverage of our products could have a material adverse effect on our business, financial condition and results of operations.

In general, Medicare makes a predetermined, fixed payment amount for its beneficiaries receiving covered inpatient services in acute care hospitals. This payment methodology is part of the inpatient prospective payment system, or IPPS. For acute care hospitals, under IPPS, payment for an inpatient stay is based on diagnosis-related groups, or DRGs, which include reimbursement for all covered medical services and medical products that are provided during a hospital stay. Additionally, a relative weight is calculated for each individual DRG which represents the average resources required to care for cases in that particular DRG relative to the average resources required to treat cases in all

DRGs. Generally, DRG relative weights are adjusted annually to reflect changes in medical practice in a budget neutral manner.

CMS has made no decisions with respect to DRG assignment when patients undergo thoracic, bariatric, colorectal, general or CABG procedures in which our microcutter or cardiac surgery products would be used, and there can be no assurance that the DRG to which such patients will be assigned will result in Medicare payment levels that are considered by hospitals to be adequate to support purchase of our products.

As is the case with other endoscopic stapling devices available in the U.S. today, we do not anticipate that our microcutter products will be reimbursed separately by third-party payors. Our cardiac surgery technologies bring added direct costs to medical providers and may not be reimbursed separately by third-party payors at rates sufficient to allow us to sell our products on a competitive and profitable basis. Many private payors look to CMS in setting their reimbursement policies and payment amounts. If CMS or other agencies limit coverage and decrease or limit reimbursement payments for hospitals and physicians, this may affect coverage and reimbursement determinations by many private payors.