Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PATHEON INC | d230176d8k.htm |

| EX-99.1 - PRESS RELEASE - PATHEON INC | d230176dex991.htm |

Exhibit 99.2

September 2011

Patheon Fiscal 2011 Third Quarter Earnings

Forward-Looking Statements

This presentation contains forward-looking statements or information which reflect our expectations regarding possible events, conditions, our future growth, results of operations, performance, and business prospects and opportunities. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements necessarily involve significant known and unknown risks, assumptions and uncertainties that may cause our actual results in future periods to differ materially from those expressed or implied by such forward-looking statements. These risks are described in our Registration Statement on Form 10-Q and Form 10, as amended, and our other filings with the U.S. Securities and Exchange Commission and with the Canadian Securities Administrators.

Accordingly, you are cautioned not to place undue reliance on forward-looking statements.

These forward-looking statements are made as of the date hereof, and except as required by law, we assume no obligation to update or revise them to reflect new events or circumstances.

2

Third Quarter and Nine Month Highlights

3

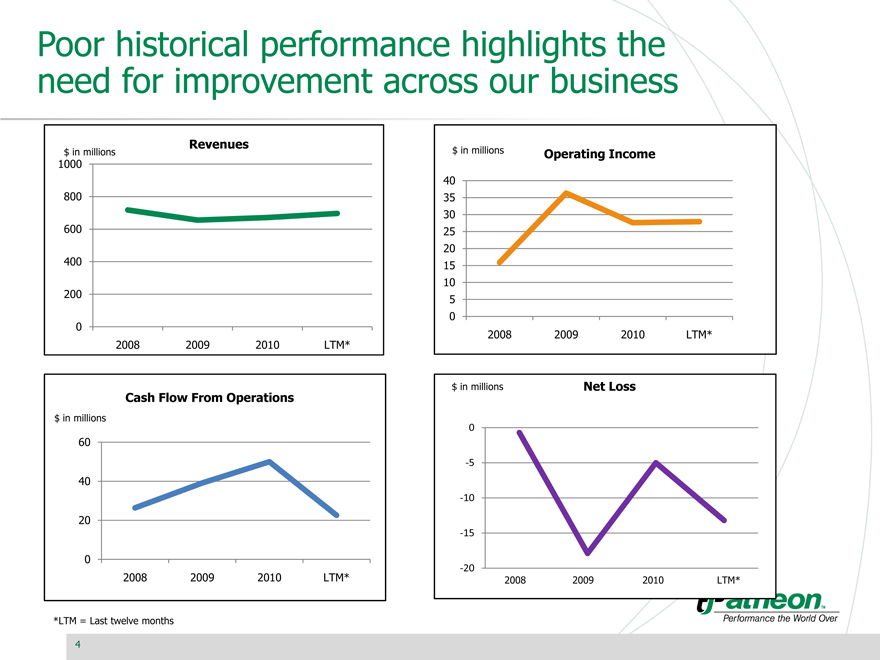

Poor historical performance highlights the need for improvement across our business

$ in millions

Revenues

1000 800 600 400 200 0

2008 2009 2010 LTM*

$ in millions

Operating Income

40 35 30 25 20 15 10 5 0

2008 2009 2010 LTM*

$ in millions

Cash Flow From Operations

60 40 20 0

2008 2009 2010 LTM*

Net Loss

$ in millions

0 -5 -10 -15 -20

2008 2009 2010 LTM*

*LTM = Last twelve months

4

Our strategy will begin with focus on strengthening our core operations

Current focus:

Strengthen core operations

Next step: Sell business differently

1. Focus our network footprint on core businesses and centers of excellence

• Site actions include Caguas, Zug, Burlington, Swindon

• Discontinuing activities in semi-solids, clinical packaging

2. Drive efficiency improvements throughout all facilities, materials, and supporting operations

• Transformation underway at Toronto and Whitby facilities with early success

• Additional OE efforts planned at Cincinnati, Monza, and Ferentino facilities

3. Increase the operational performance of the PDS business and expand its presence in early drug development services

5

Patheon enjoys a top share position, but across highly fragmented CMO and CDO markets

CMO Market

400+ Others 54%

Patheon 5%

Vetter 4%

Baxter 4%

Famar 3%

Aenova 3%

Fareva 3%

Haupt 3%

DPT 2%

Recipharm 2%

Hospira 2%

Nextpharma 2%

Catalent 13%

CDO Market

Patheon, $126

Catalent, $35

Lancaster Labs, $100

Aptuit $75

AAI, $75

Almac, $100

PPD $100

100+ Others, $690

Source: PharmSource (2011)

6

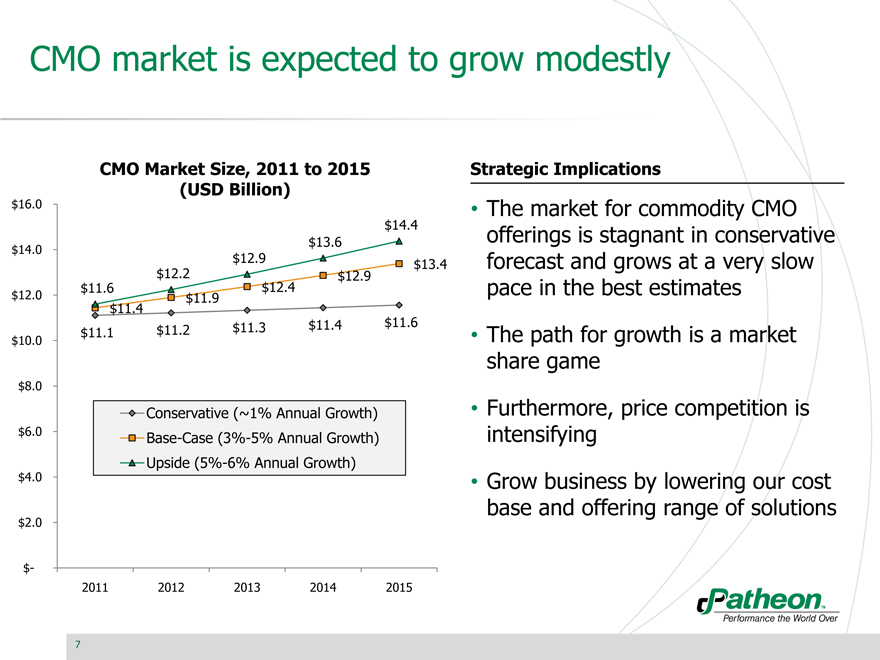

CMO market is expected to grow modestly

CMO Market Size, 2011 to 2015 (USD Billion)

$16.0 $14.0 $12.0 $10.0 $8.0 $6.0 $4.0 $2.0 $-

2011 2012 2013 2014 2015

$11.6 $12.2 $12.9 $13.6 $14.4

$11.4 $11.9 $12.4 $12.9 $13.4

$11.1 $11.2 $11.3 $11.4 $11.6

Conservative (~1% Annual Growth)

Base-Case (3%-5% Annual Growth)

Upside (5%-6% Annual Growth)

Strategic Implications

• The market for commodity CMO offerings is stagnant in conservative forecast and grows at a very slow pace in the best estimates

• The path for growth is a market share game

• Furthermore, price competition is intensifying

• Grow business by lowering our cost base and offering range of solutions

7

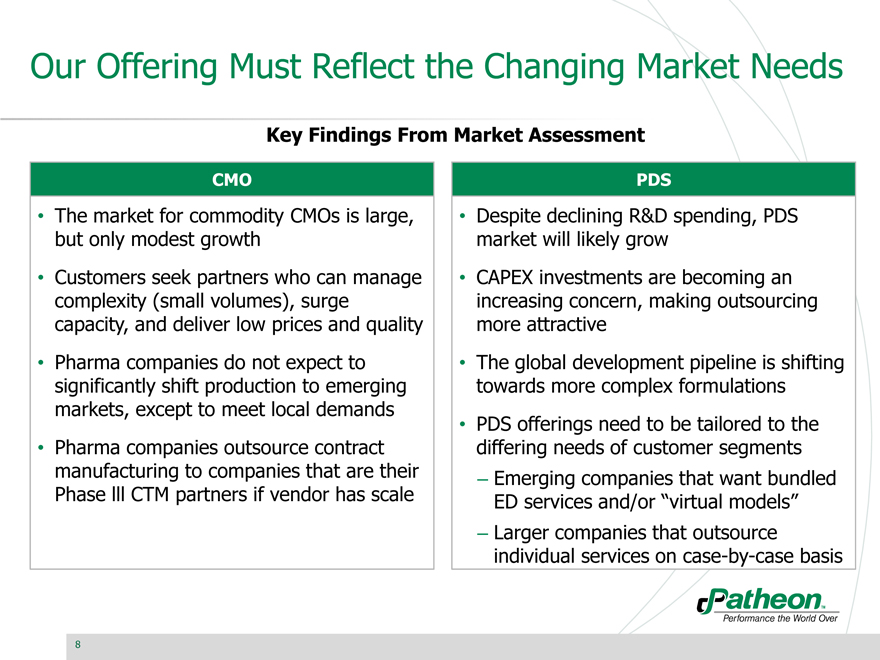

Our Offering Must Reflect the Changing Market Needs

Key Findings From Market Assessment

CMO

• The market for commodity CMOs is large, but only modest growth

• Customers seek partners who can manage complexity (small volumes), surge capacity, and deliver low prices and quality

• Pharma companies do not expect to significantly shift production to emerging markets, except to meet local demands

• Pharma companies outsource contract manufacturing to companies that are their Phase lll CTM partners if vendor has scale

PDS

• Despite declining R&D spending, PDS market will likely grow

• CAPEX investments are becoming an increasing concern, making outsourcing more attractive

• The global development pipeline is shifting towards more complex formulations

• PDS offerings need to be tailored to the differing needs of customer segments

– Emerging companies that want bundled ED services and/or “virtual models”

– Larger companies that outsource individual services on case-by-case basis

8

We Must Make Five Commitments to Transform Ourselves and The Industry

1 We will provide the industry’s leading customer experience. At all levels, places, and times our customers will have a predictably outstanding experience.

2 Our factories must be the highest quality, most flexible, and lowest cost producers in the world.

3 Our Pharmaceutical Development Services will provide the best technical and scientific solutions to solve difficult development problems and enhance product value.

4 We will create a culture of engagement, ownership and a shared commitment to excellence in all that we do.

5 We will operate our business in a disciplined, responsible, and ethical fashion such that our shareholders will appreciate superior returns over time.

9

The CMO Strategy Builds on Three Pillars

The CMO Strategy

Focus and Transform the Network

Consolidate the Network

Build New Capabilities

Set the foundation for cost competitiveness

•Focus footprint on strategic sites

•Increase overall utilization of the network

Drive for excellence

• Focus sites on center of excellence missions

• Meet customer demands for “agility/flexibility”

• Build competitive advantage through industry leading expertise and capabilities

Broaden the offering

• Add high value, generating capabilities

• Identify talent to support required capabilities

Exceed flexibility customer and requirements speed, at competitive for reliable prices quality,

10

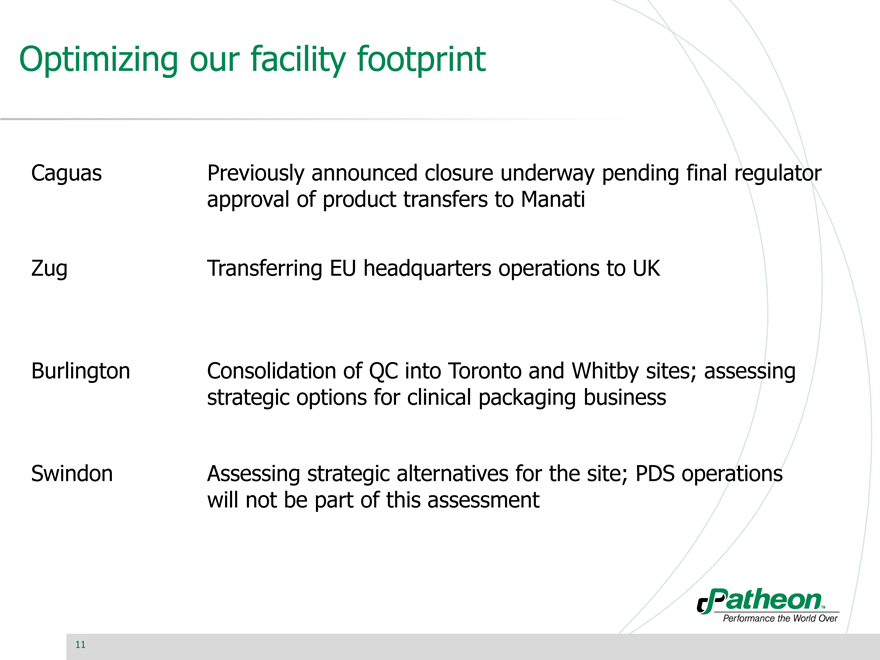

Optimizing our facility footprint

Caguas Previously announced closure underway pending final regulator approval of product transfers to Manati

Zug Transferring EU headquarters operations to UK

Burlington Consolidation of QC into Toronto and Whitby sites; assessing strategic options for clinical packaging business

Swindon Assessing strategic alternatives for the site; PDS operations will not be part of this assessment

11

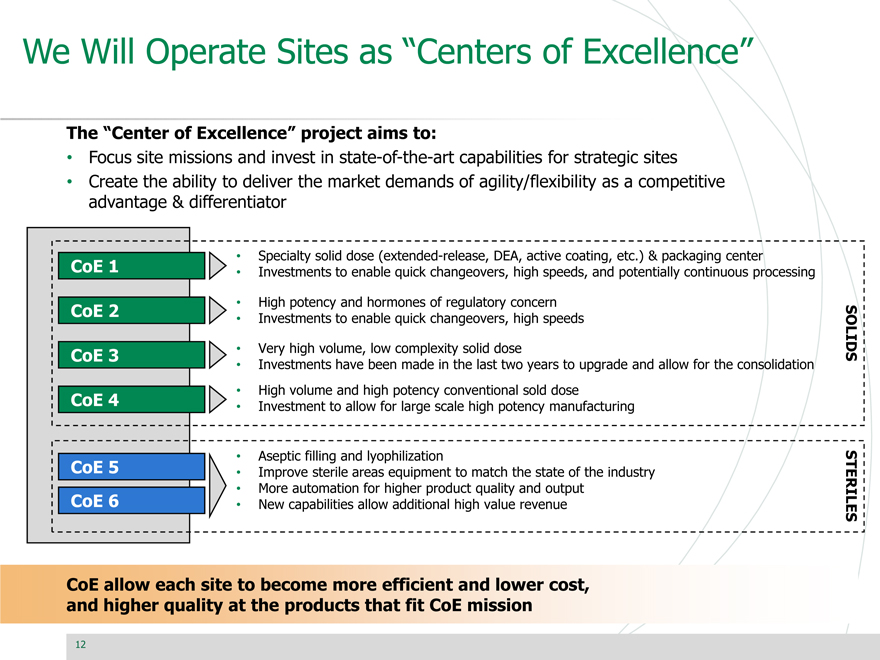

We Will Operate Sites as “Centers of Excellence”

The “Center of Excellence” project aims to:

• Focus site missions and invest in state-of-the-art capabilities for strategic sites

• Create the ability to deliver the market demands of agility/flexibility as a competitive advantage & differentiator

CoE 1 CoE 2 CoE 3 CoE 4

CoE 5 CoE 6

• Specialty solid dose (extended-release, DEA, active coating, etc.) & packaging center

• Investments to enable quick changeovers, high speeds, and potentially continuous processing

• High potency and hormones of regulatory concern

• Investments to enable quick changeovers, high speeds

• Very high volume, low complexity solid dose SOLIDS

• Investments have been made in the last two years to upgrade and allow for the consolidation

• High volume and high potency conventional sold dose

• Investment to allow for large scale high potency manufacturing

• Aseptic filling and lyophilization

• Improve sterile areas equipment to match the state of the industry

• More automation for higher product quality and output

• New capabilities allow additional high value revenue STERILES

CoE allow each site to become more efficient and lower cost, and higher quality at the products that fit CoE mission

12

The PDS Strategy Rests on Three Pillars

The PDS Strategy

Late Development

Early Development

Growth & Transformation

Build the Brand

•Add capabilities to our portfolio so that we can provide a full solution offering to customers

•Bolster our technical reputation

•Strengthen feeder between PDS and CMO businesses

Grow the Foundation

• Secure our leading market position

• Expand the franchise in key technology areas

Scale the Business

• Globalize PDS footprint

• Optimize capabilities at each site and manages redundancy

• Identify talent to support capabilities as needed

Primary driver of reputation as a science-based solution provider

13

PDS strategy implementation

• Reorganized into global teams centered around science and technology, clinical operations, and business operations

• Operational Excellence is cornerstone of strategy and will be used to drive capacity throughout the network

• Late phase clinical operations capabilities will mirror capabilities of commercial site to better ensure seamless transition for customers

• Early phase investments for both new expertise and Early Development hubs

– Strengthen our talent base to drive into Early Development capabilities and offering

– Opening of our new San Francisco ED facility will be October 3rd

– Planning to increase our capabilities in Europe

14

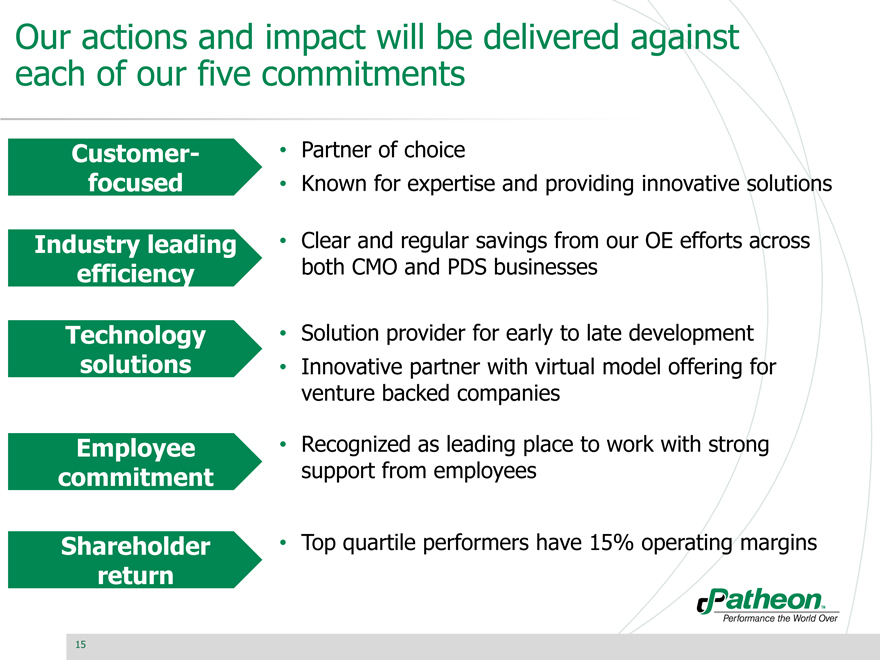

Our actions and impact will be delivered against each of our five commitments

Customer-focused

Industry leading efficiency

Technology solutions

Employee commitment

Shareholder return

Partner of choice

Known for expertise and providing innovative solutions

Clear and regular savings from our OE efforts across both CMO and PDS businesses

Solution provider for early to late development Innovative partner with virtual model offering for venture backed companies

Recognized as leading place to work with strong support from employees

Top quartile performers have 15% operating margins

15