Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Burlington Coat Factory Investments Holdings, Inc. | d8k.htm |

| EX-99.1 - PRESS RELEASE - Burlington Coat Factory Investments Holdings, Inc. | dex991.htm |

Exhibit 10.1

SECOND AMENDED AND RESTATED CREDIT AGREEMENT

dated as of

September 2, 2011

BURLINGTON COAT FACTORY WAREHOUSE CORPORATION

as Lead Borrower

for

THE BORROWERS NAMED HEREIN

THE FACILITY GUARANTORS PARTY HERETO

BANK OF AMERICA, N.A.

as Administrative Agent and Collateral Agent

WELLS FARGO CAPITAL FINANCE, LLC

JPMORGAN CHASE BANK, N.A.

as Co-Syndication Agents

SUNTRUST BANK

U.S. BANK, NATIONAL ASSOCIATION

as Co-Documentation Agents

THE LENDERS

NAMED HEREIN

MERRILL LYNCH, PIERCE, FENNER & SMITH INCORPORATED

WELLS FARGO CAPITAL FINANCE, LLC

as Joint Lead Arrangers

MERRILL LYNCH, PIERCE, FENNER & SMITH INCORPORATED

WELLS FARGO CAPITAL FINANCE, LLC

as Joint Bookrunners

TABLE OF CONTENTS

| ARTICLE I |

2 | |||||

| SECTION 1.01 |

Definitions | 2 | ||||

| SECTION 1.02 |

Terms Generally | 56 | ||||

| SECTION 1.03 |

Accounting Terms | 57 | ||||

| SECTION 1.04 |

Rounding | 58 | ||||

| SECTION 1.05 |

Times of Day | 58 | ||||

| SECTION 1.06 |

Letter of Credit Amounts | 58 | ||||

| SECTION 1.07 |

Certifications | 58 | ||||

| ARTICLE II Amount and Terms of Credit |

58 | |||||

| SECTION 2.01 |

Commitment of the Lenders | 58 | ||||

| SECTION 2.02 |

Increase in Total Commitments | 59 | ||||

| SECTION 2.03 |

Reserves; Changes to Reserves | 61 | ||||

| SECTION 2.04 |

Making of Revolving Credit Loans | 61 | ||||

| SECTION 2.05 |

Overadvances | 63 | ||||

| SECTION 2.06 |

Swingline Loans | 63 | ||||

| SECTION 2.07 |

Notes | 64 | ||||

| SECTION 2.08 |

Interest on Revolving Credit Loans | 65 | ||||

| SECTION 2.09 |

Conversion and Continuation of Revolving Credit Loans | 65 | ||||

| SECTION 2.10 |

Alternate Rate of Interest for Revolving Credit Loans | 66 | ||||

| SECTION 2.11 |

Change in Legality | 67 | ||||

| SECTION 2.12 |

Default Interest | 67 | ||||

| SECTION 2.13 |

Letters of Credit | 67 | ||||

| SECTION 2.14 |

Increased Costs | 73 | ||||

| SECTION 2.15 |

Termination or Reduction of Commitments | 74 | ||||

| SECTION 2.16 |

Optional Prepayment of Revolving Credit Loans; Reimbursement of Lenders | 75 | ||||

| SECTION 2.17 |

Mandatory Prepayment; Commitment Termination; Cash Collateral | 77 | ||||

| SECTION 2.18 |

Cash Management | 78 | ||||

| SECTION 2.19 |

Fees | 81 | ||||

| SECTION 2.20 |

Maintenance of Loan Account; Statements of Account | 83 | ||||

| SECTION 2.21 |

Payments; Sharing of Setoff | 83 | ||||

| SECTION 2.22 |

Settlement Amongst Lenders | 84 | ||||

| SECTION 2.23 |

Taxes | 85 | ||||

| SECTION 2.24 |

Mitigation Obligations; Replacement of Lenders | 89 | ||||

| SECTION 2.25 |

Designation of Lead Borrower as Borrowers’ Agent | 90 | ||||

| SECTION 2.26 |

Security Interests in Collateral | 91 | ||||

| SECTION 2.27 |

Extension of Commitments | 91 | ||||

| ARTICLE III Representations and Warranties |

95 | |||||

| SECTION 3.01 |

Organization; Powers | 95 | ||||

| SECTION 3.02 |

Authorization; Enforceability | 96 | ||||

| SECTION 3.03 |

Governmental and Other Approvals; No Conflicts | 96 | ||||

| SECTION 3.04 |

Financial Condition | 96 | ||||

| SECTION 3.05 |

Properties | 97 | ||||

| SECTION 3.06 |

Litigation and Environmental Matters | 97 | ||||

| SECTION 3.07 |

Compliance with Laws and Agreements | 98 | ||||

| SECTION 3.08 |

Investment Company Status | 99 | ||||

| SECTION 3.09 |

Taxes | 99 | ||||

| SECTION 3.10 |

ERISA | 99 | ||||

| SECTION 3.11 |

Disclosure | 99 | ||||

| SECTION 3.12 |

Subsidiaries | 99 | ||||

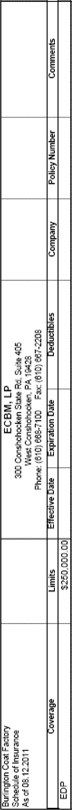

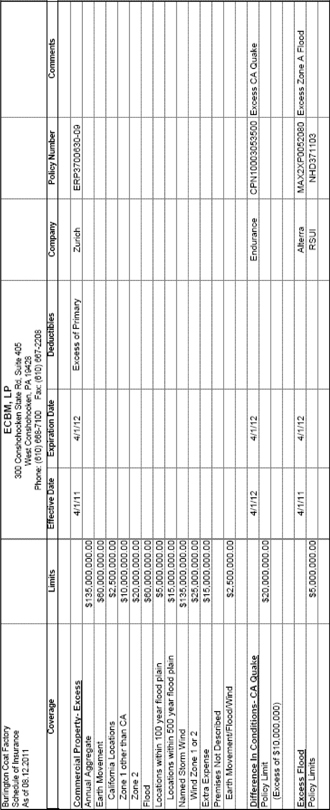

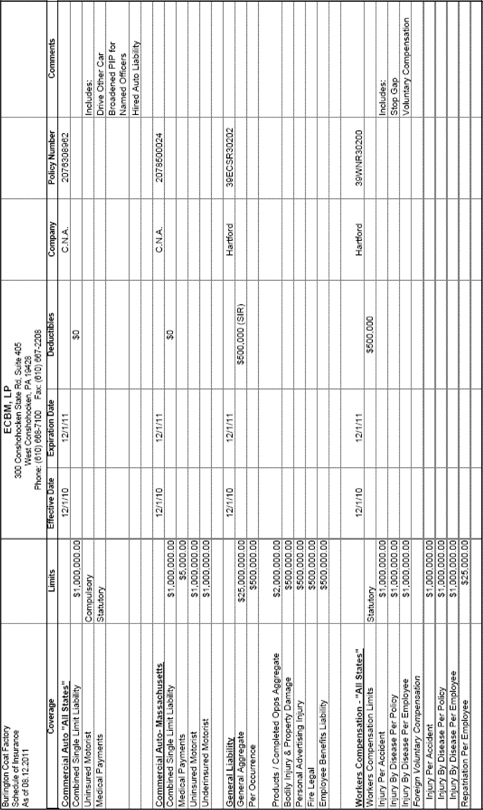

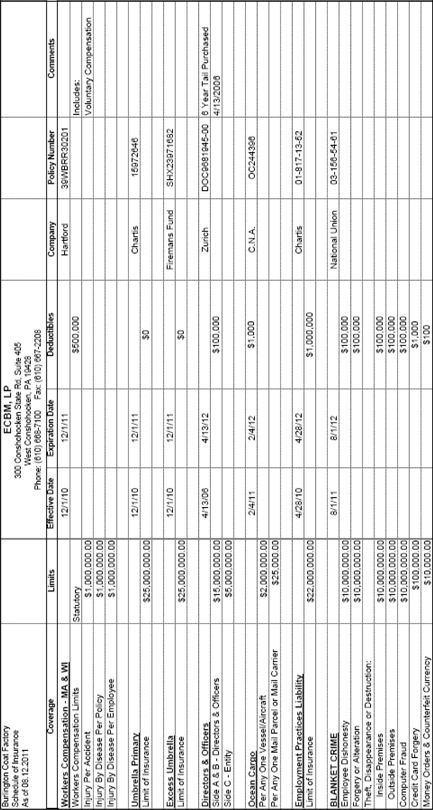

| SECTION 3.13 |

Insurance | 100 | ||||

| SECTION 3.14 |

Labor Matters | 100 | ||||

| SECTION 3.15 |

Security Documents | 100 | ||||

| SECTION 3.16 |

Federal Reserve Regulations | 101 | ||||

| SECTION 3.17 |

Solvency | 101 | ||||

| ARTICLE IV Conditions |

101 | |||||

| SECTION 4.01 |

Effective Date | 101 | ||||

| SECTION 4.02 |

Conditions Precedent to Each Revolving Credit Loan and Each Letter of Credit | 104 | ||||

| ARTICLE V Affirmative Covenants |

105 | |||||

| SECTION 5.01 |

Financial Statements and Other Information | 105 | ||||

| SECTION 5.02 |

Notices of Material Events | 109 | ||||

| SECTION 5.03 |

Information Regarding Collateral | 110 | ||||

| SECTION 5.04 |

Existence; Conduct of Business | 110 | ||||

| SECTION 5.05 |

Payment of Obligations | 110 | ||||

| SECTION 5.06 |

Maintenance of Properties | 111 | ||||

| SECTION 5.07 |

Insurance | 111 | ||||

| SECTION 5.08 |

Books and Records; Inspection and Audit Rights; Appraisals; Accountants | 112 | ||||

| SECTION 5.09 |

Physical Inventories | 114 | ||||

| SECTION 5.10 |

Compliance with Laws | 114 | ||||

| SECTION 5.11 |

Use of Proceeds and Letters of Credit | 115 | ||||

| SECTION 5.12 |

Additional Subsidiaries | 115 | ||||

| SECTION 5.13 |

Further Assurances | 115 | ||||

| ARTICLE VI Negative Covenants |

116 | |||||

| SECTION 6.01 |

Indebtedness and Other Obligations | 116 | ||||

| SECTION 6.02 |

Liens | 116 | ||||

| SECTION 6.03 |

Fundamental Changes | 116 | ||||

| SECTION 6.04 |

Investments, Revolving Credit Loans, Advances, Guarantees and Acquisitions | 117 | ||||

| SECTION 6.05 |

Asset Sales | 117 | ||||

| SECTION 6.06 |

Restricted Payments; Certain Payments of Indebtedness | 117 | ||||

| SECTION 6.07 |

Transactions with Affiliates | 119 | ||||

| SECTION 6.08 |

Restrictive Agreements | 120 | ||||

| SECTION 6.09 |

Amendment of Material Documents | 120 | ||||

| SECTION 6.10 |

Consolidated Fixed Charge Coverage Ratio | 121 | ||||

| SECTION 6.11 |

Fiscal Year | 121 | ||||

| ARTICLE VII Events of Default |

121 | |||||

| SECTION 7.01 |

Events of Default | 121 | ||||

| SECTION 7.02 |

Remedies on Default | 125 | ||||

| SECTION 7.03 |

Application of Proceeds | 126 | ||||

| ARTICLE VIII The Agents |

127 | |||||

| SECTION 8.01 |

Appointment and Administration by Administrative Agent | 127 | ||||

| SECTION 8.02 |

Appointment of Collateral Agent | 127 | ||||

| SECTION 8.03 |

Sharing of Excess Payments | 127 | ||||

| SECTION 8.04 |

Agreement of Applicable Lenders | 128 | ||||

| SECTION 8.05 |

Liability of Agents | 128 | ||||

| SECTION 8.06 |

Notice of Default | 129 | ||||

| SECTION 8.07 |

Credit Decisions | 130 | ||||

| SECTION 8.08 |

Reimbursement and Indemnification | 130 | ||||

| SECTION 8.09 |

Rights of Agents | 131 | ||||

| SECTION 8.10 |

Notice of Transfer | 131 | ||||

| SECTION 8.11 |

Successor Agents | 131 | ||||

| SECTION 8.12 |

Relation Among the Lenders | 132 | ||||

| SECTION 8.13 |

Reports and Financial Statements | 132 | ||||

| SECTION 8.14 |

Agency for Perfection | 133 | ||||

| SECTION 8.15 |

Delinquent Lender | 133 | ||||

| SECTION 8.16 |

Collateral Matters | 134 | ||||

| SECTION 8.17 |

Co-Syndication Agents, Co-Documentation Agents and Arrangers | 135 | ||||

| ARTICLE IX Miscellaneous |

135 | |||||

| SECTION 9.01 |

Notices | 135 | ||||

| SECTION 9.02 |

Waivers; Amendments | 136 | ||||

| SECTION 9.03 |

Expenses; Indemnity; Damage Waiver | 140 | ||||

| SECTION 9.04 |

Successors and Assigns | 141 | ||||

| SECTION 9.05 |

Survival | 145 | ||||

| SECTION 9.06 |

Counterparts; Integration; Effectiveness | 145 | ||||

| SECTION 9.07 |

Severability | 146 | ||||

| SECTION 9.08 |

Right of Setoff | 146 | ||||

| SECTION 9.09 |

Governing Law; Jurisdiction; Consent to Service of Process | 146 | ||||

| SECTION 9.10 |

WAIVER OF JURY TRIAL | 147 | ||||

| SECTION 9.11 |

Press Releases and Related Matters | 147 | ||||

| SECTION 9.12 |

Headings | 148 | ||||

| SECTION 9.13 |

Interest Rate Limitation | 148 | ||||

| SECTION 9.14 |

Additional Waivers | 148 | ||||

| SECTION 9.15 |

Confidentiality | 151 | ||||

| SECTION 9.16 |

No Advisory or Fiduciary Responsibility | 152 | ||||

| SECTION 9.17 |

Patriot Act | 153 | ||||

| SECTION 9.18 |

Foreign Asset Control Regulations | 153 | ||||

| SECTION 9.19 |

Intercreditor Agreement | 153 | ||||

| SECTION 9.20 |

Florida Tax Provisions | 153 | ||||

| SECTION 9.21 |

Existing Credit Agreement Amended and Restated | 154 |

EXHIBITS

| Exhibit A: |

Form of Assignment and Acceptance | |

| Exhibit B: |

Form of Customs Broker Agreement | |

| Exhibit C: |

Notice of Borrowing | |

| Exhibit D: |

Form of Revolving Credit Note | |

| Exhibit E: |

Form of Swingline Note | |

| Exhibit F: |

Form of Joinder | |

| Exhibit G: |

Form of Credit Card Notification | |

| Exhibit H: |

Form of Compliance Certificate | |

| Exhibit I: |

Form of Consolidated Fixed Charge Coverage Ratio Calculation | |

| Exhibit J: |

Form of Borrowing Base Certificate | |

| Exhibit K: |

Closing Agenda | |

| Exhibit L: |

Intercreditor Agreement (including the letter agreement executed on February 24, 2011) | |

| Exhibit M-1: |

Form of Tax Status Certificate (Foreign Lenders that are not Partnerships) | |

| Exhibit M-2: |

Form of Tax Status Certificate (Foreign Lenders that are Partnerships) | |

| Exhibit M-3: |

Form of Tax Status Certificate (Foreign Participants that are not Partnerships) | |

| Exhibit M-4: |

Form of Tax Status Certificate (Foreign Participants that are Partnerships) |

SCHEDULES

| Schedule 1.1(a): |

Lenders and Commitments | |

| Schedule 1.1(b): |

Business Segments | |

| Schedule 1.1(c): |

Pending Real Estate Dispositions | |

| Schedule 2.18(b): |

Credit Card Arrangements | |

| Schedule 2.18(c): |

Blocked Accounts | |

| Schedule 3.01: |

Organization Information | |

| Schedule 3.05(a): |

Title Exceptions | |

| Schedule 3.05(b): |

Intellectual Property | |

| Schedule 3.05(c)(i): |

Owned Real Estate | |

| Schedule 3.05(c)(ii): |

Leased Real Estate | |

| Schedule 3.06(a): |

Disclosed Matters | |

| Schedule 3.06(b): |

Environmental Matters | |

| Schedule 3.06(c): |

Superfund Sites | |

| Schedule 3.06(d): |

Real Estate Liens | |

| Schedule 3.10: |

ERISA Matters | |

| Schedule 3.12: |

Subsidiaries; Joint Ventures | |

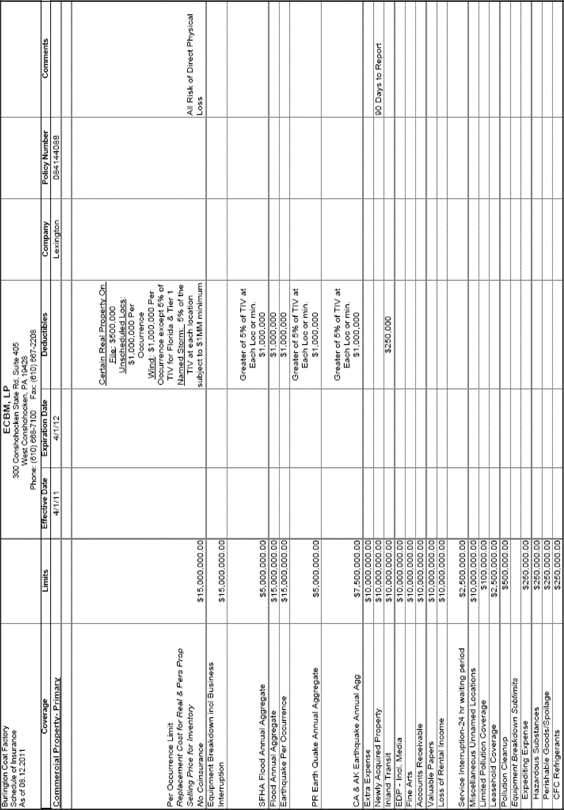

| Schedule 3.13: |

Insurance | |

| Schedule 3.14: |

Collective Bargaining Agreements | |

| Schedule 6.01: |

Existing Indebtedness | |

| Schedule 6.02: |

Existing Encumbrances | |

| Schedule 6.04: |

Existing Investments | |

| Schedule 6.05: |

Asset Sales | |

| Schedule 6.07: |

Affiliate Transactions |

SECOND AMENDED AND RESTATED CREDIT AGREEMENT dated as of September 2, 2011 among:

BURLINGTON COAT FACTORY WAREHOUSE CORPORATION (in such capacity, the “Lead Borrower”), a corporation organized under the laws of the State of Delaware, with its principal executive offices at 1830 Route 130, Burlington, New Jersey 08016, for itself and as agent for the Borrowers and the Other Borrowers; and

THE BORROWERS AND THE FACILITY GUARANTORS from time to time party hereto; and

BANK OF AMERICA, N.A., a national banking association, having a place of business at 100 Federal Street, Boston, Massachusetts 02110, as administrative agent (in such capacity, the “Administrative Agent”), and as collateral agent (in such capacity, the “Collateral Agent”), for its own benefit and the benefit of the other Secured Parties;

The LENDERS party hereto;

WELLS FARGO CAPITAL FINANCE, LLC and JPMORGAN CHASE BANK, N.A., as Co-Syndication Agents; and

SUNTRUST BANK and U.S. BANK, NATIONAL ASSOCIATION, as Co-Documentation Agents;

in consideration of the mutual covenants herein contained and benefits to be derived herefrom, the parties hereto agree as follows:

W I T N E S S E T H:

WHEREAS, the Borrowers and the Facility Guarantors have entered into a Credit Agreement, dated as of April 13, 2006, as amended and restated by that certain Amended and Restated Credit Agreement, dated as of January 15, 2010 (as amended and in effect on and prior to the date hereof, collectively, the “Existing Credit Agreement”), among such Borrowers and Facility Guarantors, the “Lenders” as defined therein, Bank of America, N.A. as “Administrative Agent” and “Collateral Agent”, Wells Fargo Retail Finance, LLC and Regions Bank, as “Co-Syndication Agents”, J.P. Morgan Securities Inc. and UBS Securities LLC, as “Co-Documentation Agents”, and General Electric Capital Corporation, U.S. Bank, National Association and Suntrust Bank, as “Senior Managing Agents”; and

WHEREAS, in accordance with SECTION 9.02 of the Existing Credit Agreement, the Borrowers, the Facility Guarantors, the Lenders and the Agents desire to amend and restate the Existing Credit Agreement as provided herein.

NOW, THEREFORE, in consideration of the mutual conditions and agreements set forth in this Agreement, and for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the undersigned hereby agree that the Existing Credit Agreement shall be amended and restated in its entirety to read as follows (it being agreed that this Agreement

1

shall not be deemed to evidence or result in a novation or repayment and reborrowing of the Obligations under the Existing Credit Agreement):

ARTICLE I

SECTION 1.01 Definitions.

As used in this Agreement, the following terms have the meanings specified below:

“2011 Dividend” means that certain dividend, a portion of which in the amount of $298,090,547.23 was paid in cash to the stockholders of the Parent prior to April 30, 2011, and a portion of which in the amount of $1,909,452.77 may be made on or before May 31, 2012.

“ABL Borrowings Amount” means, as of any date (the “Reference Date”), an amount equal to (a) the sum of the aggregate amount of Revolving Credit Loans of the Borrowers outstanding as of the Reference Date and the last day of each of the eleven months ending immediately prior to the Reference Date divided by (b) twelve.

“ABL Priority Collateral” has the meaning set forth in the Intercreditor Agreement.

“ACH” means automated clearing house transfers.

“Accommodation Payment” has the meaning provided in SECTION 9.14(d).

“Account(s)” means “accounts” as defined in the UCC, and also means a right to payment of a monetary obligation, whether or not earned by performance, (a) for property that has been or is to be sold, leased, licensed, assigned, or otherwise disposed of, (b) for services rendered or to be rendered, or (c) arising out of the use of a credit or charge card or information contained on or for use with the card. The term “Account” does not include (a) rights to payment evidenced by chattel paper or an instrument, (b) commercial tort claims, (c) deposit accounts, (d) investment property, or (e) letter-of-credit rights or letters of credit.

“Acquired EBITDA” means, with respect to any entity or business acquired in a Permitted Acquisition (any of the foregoing, an “Acquired Entity”), for any period, the amount of Consolidated EBITDA of such Acquired Entity for such period (determined as if references to the Parent and its Subsidiaries in the definition of Consolidated EBITDA were to such Acquired Entity and its Subsidiaries), all as determined on a Consolidated basis for such Acquired Entity in accordance with GAAP.

“Acquired Entity” has the meaning provided in the definition of “Acquired EBITDA.”

“Acquisition” means, with respect to a specified Person, (a) an Investment in or a purchase of a 50% or greater interest in the Capital Stock of any other Person, (b) a purchase or acquisition of all or substantially all of the assets of any other Person, (c) a purchase or acquisition of a Real Estate portfolio or Stores from any other Person, or (d) any merger or consolidation of such Person with any other Person or other transaction or series of transactions resulting in the acquisition of all or substantially all of the assets, or a 50% or greater interest in

2

the Capital Stock of, any Person, in each case in any transaction or group of transactions which are part of a common plan.

“Act” has the meaning provided in SECTION 9.17.

“Additional Commitment Lender” has the meaning provided in SECTION 2.02(a).

“Adjusted LIBOR Rate” means, with respect to any LIBOR Borrowing for any Interest Period, an interest rate per annum (rounded upwards, if necessary, to the next 1/100 of one percent) equal to (a) the LIBOR Rate for such Interest Period multiplied by (b) the Statutory Reserve Rate. The Adjusted LIBOR Rate will be adjusted automatically as to all LIBOR Borrowings then outstanding as of the effective date of any change in the Statutory Reserve Rate.

“Administrative Agent” has the meaning provided in the preamble to this Agreement.

“Advisory Agreement” means the Advisory Agreement dated as of April 13, 2006 by and among Burlington Coat Factory Holdings, Inc., a Delaware corporation, Burlington Coat Factory Warehouse Corporation, a Delaware corporation and Bain Capital Partners, LLC, a Delaware limited liability company, as amended and in effect from time to time in a manner not prohibited hereunder.

“Advisory Fees” means annual advisory fees, closing fees and transaction fees and related expenses payable by the Loan Parties pursuant to the Advisory Agreement, but not to exceed the amounts payable thereunder as in effect on the Effective Date.

“Affiliate” means, with respect to a specified Person, any other Person that directly or indirectly through one or more intermediaries Controls, is Controlled by or is under common Control with the Person specified.

“Agents” means collectively, the Administrative Agent and the Collateral Agent.

“Agreement” means this Second Amended and Restated Credit Agreement, as modified, amended, supplemented or restated, and in effect from time to time.

“Agreement Value” means, for each Hedge Agreement, on any date of determination, an amount equal to:

(a) In the case of a Hedge Agreement documented pursuant to an ISDA Master Agreement, the amount, if any, that would be payable by any Loan Party to its counterparty to such Hedge Agreement, as if (i) such Hedge Agreement was being terminated early on such date of determination and (ii) such Loan Party was the sole “Affected Party” (as therein defined);

(b) In the case of a Hedge Agreement traded on an exchange, the mark-to-market value of such Hedge Agreement, which will be the unrealized loss, if any, on such Hedge Agreement to the Loan Party which is party to such Hedge Agreement, based on the settlement price of such Hedge Agreement on such date of determination; or

3

(c) In all other cases, the mark-to-market value of such Hedge Agreement, which will be the unrealized loss, if any, on such Hedge Agreement to the Loan Party that is party to such Hedge Agreement as the amount, if any, by which (i) the present value of the future cash flows to be paid by such Loan Party exceeds (ii) the present value of the future cash flows to be received by such Loan Party, in each case pursuant to such Hedge Agreement.

“Applicable Law” means as to any Person: (a) all laws, statutes, rules, regulations, orders, codes, ordinances or other requirements having the force of law; and (b) all court orders, decrees, judgments, injunctions, enforceable notices, binding agreements and/or rulings, in each case of or by any Governmental Authority which has jurisdiction over such Person, or any property of such Person.

“Applicable Lenders” means the Required Lenders or all Lenders, as applicable.

“Applicable Margin” means:

(a) From and after the Effective Date until November 27, 2011, the percentages set forth in Level II of the pricing grid below; and

(b) (x) On November 27, 2011, and (y) thereafter on the first day of each Fiscal Quarter (each, an “Adjustment Date”), commencing with the Fiscal Quarter beginning on January 28, 2012, the Applicable Margin shall be determined from such pricing grid based upon average daily Availability (i) with respect to clause (x) above, for the period from the Effective Date through November 26, 2011, and (ii) with respect to clause (y) above, for the most recently ended Fiscal Quarter immediately preceding such Adjustment Date; provided, however, that until November 27, 2011, the Applicable Margin shall not be established at Level I (even if the Availability requirements for Level I have been met).

| Level |

Average Daily Availability |

LIBOR Applicable Margin |

Prime Rate Applicable Margin |

|||||||

| I |

Equal to or greater than 40% of the Loan Cap | 1.75 | % | 0.75 | % | |||||

| II |

Less than 40% of the Loan Cap, but equal to or greater than 20% of the Loan Cap | 2.00 | % | 1.00 | % | |||||

| III |

Less than 20% of the Loan Cap | 2.25 | % | 1.25 | % | |||||

“Appraised Value” means the net appraised recovery value of the Borrowers’ Inventory as set forth in the Borrowers’ stock ledger (expressed as a percentage of the Cost of such Inventory) as reasonably determined from time to time by reference to the most recent appraisal received by the Agents conducted by an independent appraiser reasonably satisfactory to the Agents.

4

“Approved Fund” means any Fund that is administered or managed by (a) a Credit Party, (b) an Affiliate of a Credit Party, (c) an entity or an Affiliate of an entity that administers or manages a Credit Party, or (d) the same investment advisor or an advisor under common control with such Credit Party or advisor, as applicable.

“Arrangers” means, collectively, Merrill Lynch, Pierce, Fenner & Smith Incorporated and Wells Fargo Capital Finance, LLC.

“Assignment and Acceptance” means an assignment and acceptance entered into by a Lender and an assignee (with the consent of any party whose consent is required by SECTION 9.04), and accepted by the Administrative Agent, in substantially the form of Exhibit A or any other form approved by the Administrative Agent.

“Availability” means the lesser of (a) or (b), where:

(a) is the result of:

(i) The Total Commitments,

Minus

(ii) The Total Outstandings;

(b) is the result of:

(i) The Borrowing Base, as determined from the most recent Borrowing Base Certificate (delivered by the Lead Borrower to the Administrative Agent pursuant to SECTION 5.01(F) hereof (as may be adjusted from time to time pursuant to SECTION 2.03 hereof));

Minus

(ii) The Total Outstandings.

“Availability Reserves” means, without duplication of any other Reserves or items that are otherwise addressed or excluded through eligibility criteria, such reserves as the Administrative Agent from time to time determines in its reasonable commercial discretion from the perspective of an asset-based lender exercised in good faith as being appropriate (a) to reflect the impediments to the Agent’s ability to realize upon the Collateral included in the Borrowing Base, (b) to reflect claims and liabilities that the Administrative Agent determines will need to be satisfied in connection with the realization upon the Collateral, (c) to reflect criteria, events, conditions, contingencies or risks which adversely affect the Borrowing Base and the aggregate value of the Collateral or the validity or enforceability of this Agreement and the other Loan Documents or the material rights and remedies of the Secured Parties hereunder or thereunder, or (d) to reflect any restrictions in the Senior Note Documents or the Term Loan Agreement on the incurrence of Indebtedness by the Loan Parties, but only to the extent that such restrictions reduce, or with the passage of time could reduce, the amounts available to be borrowed hereunder (including, without limitation as a result of the Loan Parties’ receipt of net proceeds

5

from asset sales) in order for the Loan Parties to comply with the Senior Note Documents or the Term Loan Agreement, as applicable. Availability Reserves shall include, without limitation, Cash Management Reserves and Bank Product Reserves.

“Bank of America” means Bank of America, N.A., a national banking association, and its Subsidiaries and Affiliates.

“Bank Products” means any services or facilities provided to any Loan Party by any Lender or any of its Affiliates (other than Cash Management Services), on account of (a) leasing arrangements and (b) Hedge Agreements.

“Bank Product Reserves” means such reserves as the Administrative Agent, from time to time after the occurrence and during the continuation of a Cash Dominion Event, determines in its reasonable commercial discretion exercised in good faith as being appropriate to reflect the reasonably anticipated liabilities and obligations of the Loan Parties with respect to Bank Products then provided or outstanding.

“Bankruptcy Code” means Title 11, U.S.C., as now or hereafter in effect, or any successor thereto.

“Blocked Account” has the meaning provided in SECTION 2.18(c).

“Blocked Account Agreement” has the meaning provided in SECTION 2.18(c).

“Blocked Account Banks” means the banks with whom deposit accounts are maintained in which material amounts (as reasonably determined by the Administrative Agent) of funds of any of the Loan Parties from one or more DDAs are concentrated and with whom a Blocked Account Agreement has been, or is required to be, executed in accordance with the terms hereof.

“Board” means the Board of Governors of the Federal Reserve System of the United States of America.

“Borrowers” means, collectively, the Lead Borrower, the Borrowers identified on the signature pages hereto and each Other Borrower who becomes a Borrower hereunder in accordance with the terms of this Agreement.

“Borrowing” means (a) the incurrence of Revolving Credit Loans of a single Type, on a single date and having, in the case of LIBOR Rate Loans, a single Interest Period, or (b) the incurrence of a Swingline Loan.

“Borrowing Base” means, at any time of calculation, an amount equal to:

(a) 90% of the face amount of Eligible Credit Card Receivables of the Borrowers;

plus

6

(b) the Cost of Eligible Inventory of the Borrowers, net of Inventory Reserves, multiplied by the Inventory Advance Rate multiplied by the Appraised Value of Eligible Inventory of the Borrowers;

plus

(c) with respect to any Eligible Letter of Credit, without duplication of any Eligible In-Transit Inventory, the Cost of the Inventory supported by such Eligible Letter of Credit when completed, net of Inventory Reserves, multiplied by the Inventory Advance Rate multiplied by the Appraised Value of such Inventory of the Borrowers;

minus

(d) the then amount of all Availability Reserves.

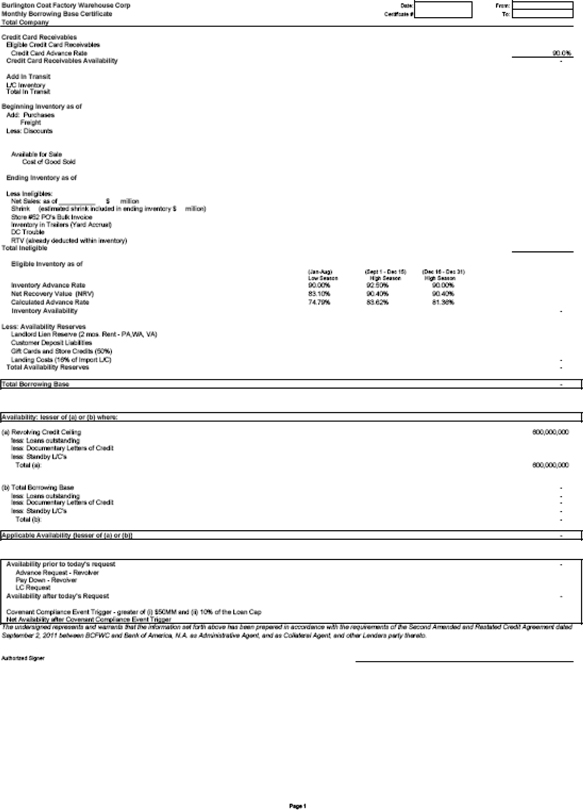

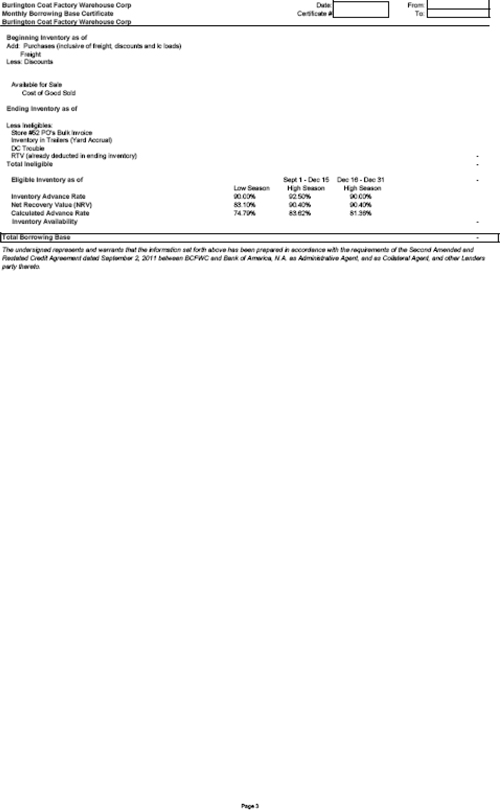

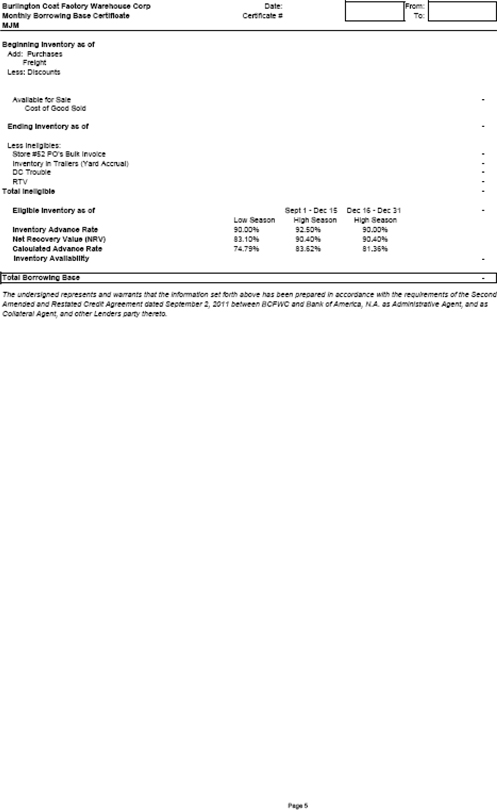

“Borrowing Base Certificate” has the meaning provided in SECTION 5.01(F).

“Borrowing Request” means a request by the Lead Borrower on behalf of any of the Borrowers for a Borrowing in accordance with SECTION 2.04.

“Breakage Costs” has the meaning provided in SECTION 2.16(b).

“Business Day” means any day that is not a Saturday, Sunday or other day on which commercial banks in Boston, Massachusetts are authorized or required by law to remain closed; provided, however, that when used in connection with a LIBOR Rate Loan, the term “Business Day” shall also exclude any day on which banks are not open for dealings in dollar deposits in the London interbank market.

“Capital Expenditures” means, with respect to the Loan Parties for any period, the additions to property, plant and equipment and other capital expenditures of the Loan Parties that are (or would be) set forth in a Consolidated statement of cash flows of the Loan Parties for such period prepared in accordance with GAAP; provided that “Capital Expenditures” shall not include (i) any additions to property, plant and equipment and other capital expenditures made with (A) the proceeds of any equity securities issued or capital contributions received by any Loan Party or any Subsidiary in connection with such capital expenditures, (B) the proceeds from any casualty insurance or condemnation or eminent domain, to the extent that the proceeds therefrom are utilized for capital expenditures within twelve months of the receipt of such proceeds, (C) the proceeds or consideration received from any sale, trade in or other disposition of any Loan Party’s assets (other than assets constituting Collateral consisting of Inventory and Accounts), to the extent that the proceeds and/or consideration therefrom are utilized for capital expenditures within twelve months of the receipt of such proceeds (or, in the case of any disposition of Real Estate the proceeds of which will be used to reinvest in Real Estate, within eighteen (18) months of receipt of such proceeds if a letter of intent or other binding commitment to reinvest such proceeds is entered into within twelve (12) months of receipt of such proceeds), (ii) any such expenditures which constitute a Permitted Acquisition, or (iii) any expenditures which are contractually required to be, and are, reimbursed to the Loan Parties in cash by a third party (including landlords) during such period of calculation.

7

“Capital Lease Obligations” means, with respect to any Person for any period, the obligations of such Person to pay rent or other amounts under any lease of (or other arrangement conveying the right to use) real or personal property, or a combination thereof, which obligations are required to be classified and accounted for as capital leases on a balance sheet of such Person under GAAP; for purposes of this Agreement, the amount of such obligations shall be the capitalized amount thereof determined in accordance with GAAP (except for temporary treatment of construction related expenditures under EITF 97-10, “The Effects of Lessee Involvement in Asset Construction” which will ultimately be treated as operating leases upon a sale-leaseback transaction).

“Capital Stock” means, as to any Person that is a corporation, the authorized shares of such Person’s capital stock, including all classes of common, preferred, voting and nonvoting capital stock, and, as to any Person that is not a corporation or an individual, the membership or other ownership interests in such Person, including, without limitation, the right to share in profits and losses, the right to receive distributions of cash and other property, and the right to receive allocations of items of income, gain, loss, deduction and credit and similar items from such Person, whether or not such interests include voting or similar rights entitling the holder thereof to exercise Control over such Person, collectively with, in any such case, all warrants, options and other rights to purchase or otherwise acquire, and all other instruments convertible into or exchangeable for, any of the foregoing.

“Cash Collateral Account” means an interest bearing account established by the Loan Parties with the Collateral Agent, for its own benefit and the benefit of the other Secured Parties, under the sole and exclusive dominion and control of the Collateral Agent, in the name of the Collateral Agent or as the Collateral Agent shall otherwise direct, in which deposits are required to be made in accordance with SECTION 2.13(j).

“Cash Dominion Event” means either (a) the occurrence and continuance of any Specified Default, or (b) the failure of the Borrowers to maintain Availability of at least the greater of (i) twelve and one-half percent (12.5%) of the Loan Cap or (ii) $60,000,000, in each case for five (5) consecutive Business Days. For purposes of this Agreement, the occurrence of a Cash Dominion Event shall be deemed continuing (unless the Arrangers otherwise agree in their reasonable discretion or the Arrangers, in their reasonable judgment, have determined that the circumstances surrounding such Specified Default cease to exist) (a) so long as such Specified Default is continuing or has not been waived, and/or (b) if the Cash Dominion Event arises as a result of the Borrowers’ failure to achieve Availability as required hereunder, until Availability has exceeded the greater of (i) twelve and one-half percent (12.5%) of the Loan Cap or (ii) $60,000,000 for thirty (30) consecutive days, in which case a Cash Dominion Event shall no longer be deemed to be continuing for purposes of this Agreement, provided, that a Cash Dominion Event may not be so cured on more than two (2) occasions in any period of 365 consecutive days.

“Cash Management Reserves” means such reserves as the Administrative Agent, from time to time after the occurrence and during the continuation of a Cash Dominion Event, determines in its reasonable commercial discretion exercised in good faith as being appropriate to reflect the reasonably anticipated liabilities and obligations of the Loan Parties with respect to Cash Management Services then provided or outstanding.

8

“Cash Management Services” means any cash management services or facilities provided to any Loan Party by any Lender or any of its Affiliates, including, without limitation: (a) ACH transactions, (b) controlled disbursement services, treasury, depository, overdraft, and electronic funds transfer services, (c) foreign exchange facilities, (d) credit card processing services, (e) purchase cards, and (f) credit or debit cards.

“Cash Receipts” has the meaning provided in SECTION 2.18(d).

“CERCLA” means the Comprehensive Environmental Response, Compensation, and Liability Act, 42 U.S.C. § 9601 et seq.

“Change in Control” means, at any time:

(a) any “change in/of control” or similar event as defined in any documents governing the Senior Notes; or

(b) after the consummation of a Qualifying IPO, any person or “group” (within the meaning of the Securities and Exchange Act of 1934, as amended), other than any one or more of the Sponsor Group, is or becomes the beneficial owner (within the meaning of Rule 13d-3 or 13d-5 of the Securities and Exchange Act of 1934, as amended, except that such person shall be deemed to have “beneficial ownership” of all Capital Stock that such person has the right to acquire, whether such right is exercisable immediately or only after the passage of time), directly or indirectly, of (i) thirty-five percent (35%) or more (on a fully diluted basis) of the total then outstanding Capital Stock of the Parent (or Holdings if the Qualifying IPO is undertaken by Holdings) entitled to vote for the election of directors of the Parent (or Holdings, if applicable), and (ii) Capital Stock of the Parent (or Holdings, if applicable) entitled to vote for the election of directors of the Parent (or Holdings, if applicable) in an amount greater than the number of shares of such Capital Stock beneficially owned by the Sponsor Group (or over which the Sponsor Group has voting control); or

(c) prior to the consummation of a Qualifying IPO, a change in the Control of the Parent such that the Loan Parties are not Controlled by any one or more of the Sponsor Group; or

(d) the Parent fails at any time to own, directly or indirectly, 100% of the Capital Stock of each Loan Party free and clear of all Liens (other than those Liens specified in clauses (a), (e), (i), (l), (r), (v) and (ee) of the definition of Permitted Encumbrances), except where such failure is as a result of a transaction permitted by the Loan Documents.

“Change in Law” means the occurrence, after the Effective Date, of any of the following: (a) the adoption or taking effect of any Applicable Law, (b) any change in any Applicable Law or in the administration, interpretation or application thereof by any Governmental Authority or (c) the making or issuance of any request, guideline or directive (whether or not having the force of law) by any Governmental Authority, provided however, for purposes of this Agreement, (i) the Dodd-Frank Wall Street Reform and Consumer Protection Act and all requests, guidelines or directives in connection therewith and (ii) all rules, guidelines

9

or directives promulgated by the Bank for International Settlements, the Basel Committee on Banking Supervision (or any successor or similar authority) or the United States or Canadian regulatory authorities, in each case pursuant to Basel III, are deemed to have gone into effect and been adopted after the Effective Date.

“Charges” has the meaning provided in SECTION 9.13.

“Charter Document” means as to any Person, its partnership agreement, certificate of incorporation, certificate of formation, operating agreement, membership agreement or similar constitutive document or agreement or its by-laws.

“Class” (a) when used with respect to commitments, refers to whether such commitment is a Commitment or an Extended Commitment of a given Extension Series or a New Extended Commitment, (b) when used with respect to Loans or a Borrowing, refers to whether such Loans, or the Loans comprising such Borrowing, are Revolving Credit Loans, Loans under Extended Commitments of a given Extension Series or Loans under New Extended Commitments, and (c) when used with respect to Lenders, refers to whether such Lenders have a Loan or commitment with respect to a particular Class of Loans or commitments.

“Closing Date” means April 13, 2006.

“Code” means the Internal Revenue Code of 1986 and the Treasury regulations promulgated thereunder, as amended from time to time.

“Co-Documentation Agents” has the meaning provided in the preamble to this Agreement.

“Co-Syndication Agents” has the meaning provided in the preamble to this Agreement.

“Collateral” means any and all “Collateral”, “Pledged Collateral” or words of similar intent as defined in any applicable Security Document.

“Collateral Access Agreement” means an agreement reasonably satisfactory in form and substance to the Collateral Agent executed by (a) a bailee or other Person in possession of Collateral, and (b) each landlord of Real Estate leased by any Loan Party, pursuant to which such Person (i) acknowledges the Collateral Agent’s Lien on the Collateral, (ii) releases or subordinates such Person’s Liens in the Collateral held by such Person or located on such Real Estate, (iii) agrees to furnish the Collateral Agent with access to the Collateral in such Person’s possession or on the Real Estate for the purposes of conducting a Liquidation, and (iv) makes such other agreements with the Collateral Agent as the Collateral Agent may reasonably require.

“Collateral Agent” has the meaning provided in the preamble to this Agreement.

“Commercial Letter of Credit” means any Letter of Credit issued for the purpose of providing the primary payment mechanism in connection with the purchase of any materials, goods or services by a Borrower in the ordinary course of business of such Borrower.

10

“Commitment” means, with respect to each Lender, the commitment of such Lender hereunder to make Credit Extensions to the Borrowers in the amount set forth opposite its name on Schedule 1.1(a) hereto or as may subsequently be set forth in the Register from time to time, as the same may be increased or reduced from time to time pursuant to SECTIONS 2.02 and 2.15 of this Agreement.

“Commitment Increase” shall have the meaning provided in SECTION 2.02(a).

“Commitment Increase Date” shall have the meaning provided in SECTION 2.02(c).

“Commitment Percentage” shall mean, with respect to each Lender, the percentage determined by dividing the Commitment of such Lender by the Commitments of all Lenders hereunder to make Credit Extensions to the Borrowers, in the amount set forth opposite such Lender’s name on Schedule 1.1(a) hereto or as may subsequently be set forth in the Register from time to time, as the same may be increased or reduced from time to time pursuant to SECTIONS 2.02 and 2.15 of this Agreement.

“Compliance Certificate” has the meaning provided in SECTION 5.01(D).

“Concentration Account” has the meaning provided in SECTION 2.18(d).

“Confirmation of Ancillary Documents” means, collectively (i) that certain Confirmation of Ancillary Documents dated as of January 15, 2010 among the Agents and the Loan Parties and (ii) that certain Confirmation of Ancillary Documents dated as of the Effective Date among the Agents and the Loan Parties.

“Consolidated” means, when used to modify a financial term, test, statement, or report of a Person, the application or preparation of such term, test, statement or report (as applicable) based upon the consolidation, in accordance with GAAP, of the financial condition or operating results of such Person and its Subsidiaries.

“Consolidated EBITDA” means, with respect to the Loan Parties on a Consolidated basis for any period, (i) the sum (without duplication) of (a) Consolidated Net Income for such period, plus in each case without duplication and to the extent deducted in determining Consolidated Net Income for such period, (b) depreciation, amortization, and all other non-cash charges, non-cash expenses or non-cash losses, (c) provisions for Consolidated Taxes based on income, (d) Consolidated Interest Expense, (e) Advisory Fees whether accrued or paid in cash, (f) all transactional costs, expenses and charges in connection with the consummation of the amendment and restatement of the Existing Credit Agreement and this Agreement, and all transactions related thereto (including, without limitation, the payment of fees and expenses in connection therewith), and any transaction related to any Permitted Acquisition, Permitted Disposition, issuance of Permitted Indebtedness or issuance of Capital Stock (provided that any such transaction to which any Affiliate of the Loan Parties is party shall comply with SECTION 6.07 hereof), (g) to the extent not already included in Consolidated Net Income, proceeds from business interruption insurance, (h) to the extent not already included in Consolidated Net Income and actually indemnified or reimbursed, any expenses and charges that are covered by indemnification or reimbursement provisions in connection with any Permitted Acquisition or any Permitted Disposition, (i) cash receipts (or reduced cash expenditures) in respect of income

11

received in connection with subleases to the extent non-cash gains relating to such income were deducted in the calculation of Consolidated EBITDA pursuant to clause (ii)(b) below for any previous period, (j) cash charges not to exceed $25,000,000 in the aggregate after the Effective Date associated with restructuring activities, including, but not limited to, restructuring, consolidation or discontinuance of any portion of the operations, severance, recruiting, retention, relocation and other expenses of management and contract and lease termination expenses, and (k) unusual, nonrecurring or extraordinary expenses, losses or charges, minus (ii) the sum of (a) any Restricted Payment (other than any Restricted Payment made with the proceeds of any equity securities issued or capital contributions received by any Loan Party or any Subsidiary) made in cash during such period to any Person (other than a Loan Party) having an interest in any Subsidiary of a Loan Party, (b) non-cash gains for such period to the extent included in Consolidated Net Income, and (c) cash payments made during such period on account of non-cash charges added back in the calculation of Consolidated EBITDA pursuant to clause (i)(b) above for any previous period. For the avoidance of doubt, in calculating Consolidated EBITDA, Acquired EBITDA for the relevant period shall be included in such calculation.

“Consolidated Fixed Charge Coverage Ratio” means, with respect to the Loan Parties for any period, the ratio of (a) (i) Consolidated EBITDA for such period minus (ii) Unfinanced Capital Expenditures during such period, plus (iii) proceeds of any equity securities issued or capital contributions received by any Loan Party or any Subsidiary to the extent used to make payments on account of Debt Service Charges to the lenders under the Term Loan Financing Facility, to (b) the sum of (i) Debt Service Charges payable in cash during such period plus (ii) federal, state and foreign income Taxes paid in cash (net of refunds received) during such period, plus (iii) the annual management fee provided for in the Advisory Agreement, whether accrued or paid in cash during such period, all as determined on a Consolidated basis in accordance with GAAP.

“Consolidated Interest Coverage Ratio” means, on the last day of any Fiscal Quarter, the ratio of (a) Consolidated EBITDA of the Loan Parties for the period of four consecutive Fiscal Quarters most recently ended on and prior to such date, taken as one accounting period, to (b) Consolidated Interest Expense of the Loan Parties paid in cash for the period of four consecutive Fiscal Quarters most recently ended on and prior to such date, taken as one accounting period.

“Consolidated Interest Expense” means, with respect to the Loan Parties on a Consolidated basis for any period, (a) total interest expense (including that attributable to Capital Lease Obligations in accordance with GAAP but excluding any imputed interest as a result of purchase accounting) of the Loan Parties on a Consolidated basis with respect to all outstanding Indebtedness of the Loan Parties, including, without limitation, the Obligations and all commissions, discounts and other fees and charges owed with respect thereto, but excluding (i) any non-cash or deferred interest financing costs and (ii) any non-cash amortization or write-down of any deferred financing fees or bridge facility fees, all as determined on a Consolidated basis in accordance with GAAP and reduced by interest income received or receivable in cash for such period. For purposes of the foregoing, interest expense of any Loan Party shall be determined after giving effect to any net payments made or received by such Loan Party with respect to interest rate Hedge Agreements.

12

“Consolidated Net Income” means, with respect to the Loan Parties for any period, the net income (or loss) of the Loan Parties on a Consolidated basis for such period taken as a single accounting period determined in accordance with GAAP; provided, however, that there shall be excluded (a) the income (or loss) of any Person in which any Loan Party has a joint interest, except to the extent of the amount of dividends or other distributions actually paid in cash to such Loan Party during such period, and (b) the income of any direct or indirect Subsidiary of a Loan Party to the extent that the declaration or payment of dividends or similar distributions by that Subsidiary of that income is not at the time permitted by operation of the terms of its Charter Documents or any agreement, instrument, judgment, decree, order, statute, rule or governmental regulation applicable to that Subsidiary.

“Consolidated Secured Leverage Ratio” means, as of any date, the ratio of (a) the sum of (i) Consolidated Total Debt (other than any portion of such Consolidated Total Debt that is (x) attributed to Revolving Credit Loans of the Borrowers outstanding at such date or (y) not secured by any Liens on any assets of the Loan Parties) plus (ii) the ABL Borrowings Amount on such date to (b) Consolidated EBITDA of the Loan Parties for the period of four consecutive Fiscal Quarters most recently ended on or prior to such date, taken as one accounting period.

“Consolidated Taxes” means, as of any date for the applicable period ending on such date with respect to the Loan Parties on a Consolidated basis, the aggregate of all income, withholding, franchise and similar taxes and foreign withholding taxes, as determined in accordance with GAAP, to the extent the same are paid or accrued during such period.

“Consolidated Total Debt” means, at any date, the aggregate principal amount of all Indebtedness of the Loan Parties on a Consolidated basis outstanding at such date in the amount that would be reflected on a balance sheet prepared on such date in accordance with GAAP.

“Control” means the possession, directly or indirectly, of the power (a) to vote 50% or more of the securities having ordinary voting power for the election of directors (or any similar governing body) of a Person, or (b) to direct or cause the direction of the management or policies of a Person, whether through the ability to exercise voting power, by contract or otherwise. The terms “Controlling” and “Controlled” have meanings correlative thereto.

“Cost” means the cost of purchases, as reported on the Borrowers’ financial stock ledger based upon the Borrowers’ accounting practices in effect on the Effective Date or thereafter consented to by the Administrative Agent, whose consent will not be unreasonably withheld. “Cost” does not include inventory capitalization costs or other non-purchase price charges (except for freight charges with respect to all Inventory (other than unpaid freight charges for Eligible In-Transit Inventory) to the extent treated consistently with the Borrowers’ accounting practices in effect on the Effective Date) used in the Borrowers’ calculation of cost of goods sold.

“Covenant Compliance Event” means Availability at any time is less than the greater of (x) $50,000,000 or (y) 10% of the Loan Cap. For purposes hereof, the occurrence of a Covenant Compliance Event shall be deemed continuing (unless the Arrangers otherwise agree in their reasonable discretion) until such time as Availability is equal to or greater than the greater of (x) $50,000,000 or (y) 10% of the Loan Cap for thirty (30) consecutive days, in which case a

13

Covenant Compliance Event shall no longer be deemed to be continuing for purposes of this Agreement.

“Credit Card Notifications” has the meaning provided in SECTION 2.18(c).

“Credit Extensions” mean each of the following: (a) a Borrowing and (b) an L/C Credit Extension.

“Credit Party” means (a) the Lenders, (b) the Agents and their respective Affiliates and branches, (c) each Issuing Bank, (d) the Arrangers, and (e) the successors and permitted assigns of each of the foregoing.

“Credit Party Expenses” means, without limitation, all of the following to the extent incurred in connection with this Agreement and the other Loan Documents: (a) all reasonable and documented out-of-pocket expenses incurred by the Agents and Merrill Lynch, Pierce, Fenner & Smith Incorporated, including the reasonable and documented fees, charges and disbursements of one counsel for the Agents and their Affiliates (plus one local counsel in each other jurisdiction to the extent reasonably necessary), outside consultants for the Agents consisting of one inventory appraisal firm and one real estate appraisal firm, one commercial finance examination firm and one environmental engineering firm (provided that so long as the Term Loan Financing Facility has not been terminated, the Agents shall be entitled to reimbursement for no more than one environmental engineering firm acting on behalf of both the Credit Parties and the lenders under the Term Loan Financing Facility), in connection with the preparation and administration of the Loan Documents, the syndication of the credit facilities provided for herein, or any amendments, modifications or waivers requested by a Loan Party of the provisions hereof or thereof (whether or not any such amendments, modifications or waivers shall be consummated), (b) all reasonable and documented out-of-pocket expenses incurred by any Issuing Bank in connection with the issuance, amendment, renewal or extension of any Letter of Credit or any demand for payment thereunder, (c) all reasonable and documented out-of-pocket expenses incurred by the Agents and, subject to the proviso below any Lender and their respective Affiliates and branches, including the reasonable and documented fees, charges and disbursements of one counsel for the Agents and their Affiliates (plus one local counsel in each other jurisdiction to the extent reasonably necessary) and outside consultants for the Agents (including, without limitation, inventory and real estate appraisal firms, commercial finance examination firms and environmental engineering firms (provided that so long as the Term Loan Financing Facility has not been terminated, the Agents shall be entitled to reimbursement for no more than one environmental engineering firm acting on behalf of both the Credit Parties and the lenders under the Term Loan Financing Facility)), in connection with the enforcement and protection of their rights in connection with the Loan Documents, including all such reasonable and documented out-of-pocket expenses incurred during any workout, restructuring or related negotiations in respect of such Revolving Credit Loans or Letters of Credit; provided that the Lenders who are not the Agents shall be entitled to reimbursement for no more than one counsel representing all such Lenders (absent a conflict of interest in which case each group of similarly situated Lenders, taken as a whole, may engage and be reimbursed for one additional counsel to the affected party). Credit Party Expenses shall not include the allocation of any overhead expenses of any Credit Party.

14

“Customer Credit Liabilities” means, at any time, the aggregate remaining balance reflected on the books and records of the Parent and its Subsidiaries at such time of (a) outstanding gift certificates and gift cards of the Borrowers entitling the holder thereof to use all or a portion of the certificate or gift card to pay all or a portion of the purchase price for any Inventory, and (b) outstanding merchandise credits of the Borrowers.

“Customs Broker Agreement” means an agreement in substantially the form attached hereto as Exhibit B among a Borrower, a customs broker or other carrier, and the Collateral Agent, in which the customs broker or other carrier acknowledges that it has control over and holds the documents evidencing ownership of the subject Inventory or other property for the benefit of the Collateral Agent, and agrees, upon notice from the Collateral Agent (which notice shall be delivered only upon the occurrence and during the continuance of an Event of Default), to hold and dispose of the subject Inventory and other property solely as directed by the Collateral Agent.

“DDAs” means any checking or other demand deposit account maintained by the Loan Parties. All funds in such DDAs shall be conclusively presumed to be Collateral and proceeds of Collateral and the Agents and the Lenders shall have no duty to inquire as to the source of the amounts on deposit in the DDAs.

“Debt Service Charges” means, for any period, the sum of (a) Consolidated Interest Expense required to be paid or paid in cash, plus (b) scheduled principal payments made or required to be made (after giving effect to any prepayments paid in cash that reduce the amount of such required payments) on account of Indebtedness, including the full amount of any non-recourse Indebtedness (excluding the Obligations, but including, without limitation, Capital Lease Obligations) for such period, plus (c) scheduled mandatory payments on account of Disqualified Capital Stock (whether in the nature of dividends, redemption, repurchase or otherwise) required to be made during such period, in each case determined in accordance with GAAP.

“Default” means any event or condition described in SECTION 7.01 that constitutes an Event of Default or that upon notice, lapse of any cure period set forth in SECTION 7.01, or both, would, unless cured or waived, become an Event of Default.

“Default Rate” has the meaning provided in SECTION 2.12.

“Delinquent Lender” has the meaning provided in SECTION 8.15(a).

“Deteriorating Lender” means any Delinquent Lender or any Lender, as reasonably determined by the Administrative Agent (upon which determination the Administrative Agent will give notice thereof to the Lead Borrower) as to which (a) such Lender has defaulted in fulfilling its funding obligations under one or more other syndicated credit facilities, or (b) such Lender or a Person that Controls such Lender has been deemed insolvent or become the subject of a bankruptcy, insolvency or similar proceeding.

“Disbursement Accounts” has the meaning provided in SECTION 2.18(g).

15

“Disclosed Matters” means the actions, suits and proceedings and the environmental matters disclosed on Schedule 3.06(a) and Schedule 3.06(b).

“Disqualified Capital Stock” means any Capital Stock which, by its terms (or by the terms of any security into which it is convertible or for which it is exchangeable), or upon the happening of any event, (a) is mandatorily redeemable in whole or in part prior to the Maturity Date, pursuant to a sinking fund obligation or otherwise, or is redeemable at the option of the holder thereof, in whole or in part, (b) is convertible into or exchangeable (unless at the sole option of the issuer thereof) for Indebtedness or any Capital Stock referred to in (a) above prior to the Maturity Date, or (c) contains any mandatory repurchase obligation which comes into effect prior to the Maturity Date, provided that any Capital Stock that would not constitute Disqualified Capital Stock but for provisions thereof giving holders thereof (or the holders of any security into or for which such Capital Stock is convertible, exchangeable or exercisable) the right to require the issuer thereof to redeem such Capital Stock upon the occurrence of a Change in Control shall not constitute Disqualified Capital Stock.

“Documents” has the meaning assigned to such term in the Security Agreement.

“dollars” or “$” refers to lawful money of the United States of America.

“Earn-Out Obligations” means the maximum amount of all obligations incurred or to be incurred in connection with any Acquisition of a Person pursuant to a Permitted Acquisition under non-compete agreements, consulting agreements, earn-out agreements and similar deferred purchase agreements.

“Effective Date” means September 2, 2011.

“Eligible Assignee” means a commercial bank, insurance company, or company engaged in the business of making commercial loans or a commercial finance company, which Person, together with its Affiliates, has a combined capital and surplus in excess of $1,000,000,000, or any Affiliate of any Credit Party under common control with such Credit Party, or an Approved Fund of any Credit Party, provided that in any event, “Eligible Assignee” shall not include (x) any natural person, or (y) the Sponsor Group or any of their respective Affiliates to the extent that, after giving effect to any proposed assignment, the Sponsor Group and their respective Affiliates would hold in the aggregate more than 10% of the then Total Outstandings; provided that the Sponsor Group and each of their respective Affiliates shall be subject to the Sponsor Lender Limitations.

“Eligible Credit Card Receivables” means, as of any date of determination, Accounts due to a Loan Party from major credit card processors (including, but not limited to, VISA, Mastercard, American Express, Diners Club and DiscoverCard) as arise in the ordinary course of business and which have been earned by performance, that are not excluded as ineligible by virtue of one or more of the criteria set forth below. None of the following shall be deemed to be Eligible Credit Card Receivables:

(a) Accounts due from major credit card processors that have been outstanding for more than five (5) Business Days from the date of sale, or for such longer period(s) as may be approved by the Administrative Agent in its reasonable discretion;

16

(b) Accounts due from major credit card processors with respect to which a Loan Party does not have good, valid and marketable title thereto, free and clear of any Lien (other than Liens granted to the Collateral Agent for its own benefit and the benefit of the other Secured Parties pursuant to the Security Documents, those Liens specified in clauses (a), (e), (r) and (ee) of the definition of Permitted Encumbrances and Permitted Encumbrances having priority by operation of Applicable Law over the Lien of the Collateral Agent) (the foregoing not being intended to limit the discretion of the Administrative Agent to change, establish or eliminate any Reserves on account of any such Liens);

(c) Accounts due from major credit card processors that are not subject to a first priority (except as provided in clause (b), above) security interest in favor of the Collateral Agent for its own benefit and the benefit of the other Secured Parties;

(d) Accounts due from major credit card processors which are disputed, or with respect to which a claim, counterclaim, offset or chargeback (other than chargebacks in the ordinary course by the credit card processors) has been asserted, by the related credit card processor (but only to the extent of such dispute, counterclaim, offset or chargeback);

(e) Except as otherwise approved by the Administrative Agent, Accounts due from major credit card processors as to which the credit card processor has the right under certain circumstances to require a Loan Party to repurchase the Accounts from such credit card processor;

(f) Accounts arising from the Cohoes private label credit card receivables or any other private label credit card receivables of the Loan Parties; and

(g) Accounts due from major credit card processors (other than Visa, Mastercard, American Express, Diners Club and DiscoverCard) which the Administrative Agent determines in its commercial reasonable discretion acting in good faith to be unlikely to be collected.

“Eligible In-Transit Inventory” means, as of any date of determination, without duplication of other Eligible Inventory, Inventory (a) which has been shipped from (i) any location within the United States for receipt by a Loan Party within fifteen (15) days of the date of determination or (ii) any location outside of the United States for receipt by a Loan Party within sixty (60) days of the date of determination, but which, in either case, has not yet been received by a Loan Party, (b) for which the purchase order is in the name of a Loan Party and title has passed to a Loan Party, (c) except as otherwise agreed by the Administrative Agent, for which a Loan Party is designated as “shipper” and/or the consignor and the document of title or waybill reflects a Loan Party as consignee (along with delivery to a Loan Party or its customs broker of the documents of title, to the extent applicable, with respect thereto), (d) as to which the Collateral Agent has control over the documents of title, to the extent applicable, which evidence ownership of the subject Inventory (such as by the delivery of a Customs Broker Agreement and a control agreement with a carrier or freight forwarder), (e) which is insured in accordance with the provisions of this Agreement and the other Loan Documents, including,

17

without limitation marine cargo insurance; and (f) which otherwise is not excluded from the definition of Eligible Inventory; provided that the Administrative Agent may, in its reasonable discretion and upon prior notice to the Lead Borrower, exclude any particular Inventory from the definition of “Eligible In-Transit Inventory” in the event that the Administrative Agent reasonably determines that such Inventory is subject to any Person’s right or claim which is senior to, or pari passu with, the Lien of the Administrative Agent (such as, without limitation, a right of stoppage in transit), as applicable.

“Eligible Inventory” means, as of any date of determination, without duplication, (a) Eligible In-Transit Inventory, and (b) items of Inventory of a Loan Party that are finished goods, merchantable and readily saleable to the public in the ordinary course that are not excluded as ineligible by virtue of the one or more of the criteria set forth below. None of the following shall be deemed to be Eligible Inventory:

(a) Inventory that is not solely owned by a Loan Party, or is leased by or is on consignment to a Loan Party, or as to which the Loan Parties do not have title thereto;

(b) Inventory (other than any Eligible In-Transit Inventory) that is not located in the United States of America (or Canada, as long as the Administrative Agent shall have received or conducted appraisals of such Canadian Inventory from appraisers reasonably satisfactory to the Administrative Agent) at a location that is owned or leased by the Loan Parties except to the extent that the Loan Parties have furnished the Collateral Agent with (A) any UCC financing statements or PPSA registration statements or other filings that the Collateral Agent may reasonably determine to be necessary to perfect its security interest in such Inventory at such location, and (B) unless otherwise agreed by the Agents, a Collateral Access Agreement executed by the Person owning any such location on terms reasonably acceptable to the Collateral Agent;

(c) Inventory that is located in a distribution center leased by a Loan Party unless the applicable lessor has delivered to the Collateral Agent a Collateral Access Agreement;

(d) Inventory that represents goods which (i) are damaged, defective, “seconds,” or otherwise unmerchantable, (ii) are to be returned to the vendor, (iii) are obsolete, custom items, work in process, raw materials, or that constitute spare parts, shipping materials or supplies used or consumed in a Borrower’s business, or (iv) are bill and hold goods, including, without limitation, Inventory located at Store 52 as reflected in the Borrowers’ books and records;

(e) Except as otherwise agreed by the Agents, Inventory that represents goods that do not conform in all material respects to the representations and warranties contained in this Agreement or any of the Security Documents;

(f) Inventory that is not subject to a perfected first priority security interest in favor of the Collateral Agent for its own benefit and the benefit of the other Secured Parties (subject only to Permitted Encumbrances having priority by operation of Applicable Law);

18

(g) Inventory which consists of samples, labels, bags, packaging materials, and other similar non-merchandise categories;

(h) Inventory as to which casualty insurance in compliance with the provisions of SECTION 5.07 hereof is not in effect;

(i) Inventory which has been sold but not yet delivered or Inventory to the extent that any Borrower has accepted a deposit therefor; and

(j) Inventory acquired in a Permitted Acquisition, unless the Administrative Agent shall have received or conducted (A) appraisals, from appraisers reasonably satisfactory to the Administrative Agent, of such Inventory to be acquired in such Acquisition and (B) such other due diligence as the Agents may reasonably require, all of the results of the foregoing to be reasonably satisfactory to the Agents. As long as the Administrative Agent has received reasonable prior notice of such Permitted Acquisition and the Loan Parties reasonably cooperate (and cause the Person being acquired to reasonably cooperate) with the Administrative Agent, the Administrative Agent shall use reasonable best efforts to complete such due diligence and a related appraisal on or prior to the closing date of such Permitted Acquisition.

“Eligible Letter of Credit” means, as of any date of determination thereof, a Commercial Letter of Credit which supports the purchase of Inventory, (i) which Inventory does not constitute Eligible In-Transit Inventory and for which no documents of title have then been issued; (ii) which Inventory when the purchase thereof is completed would otherwise constitute Eligible Inventory, (iii) which Commercial Letter of Credit has an initial expiry, subject to the proviso hereto, within 120 days after the date of initial issuance of such Commercial Letter of Credit, provided that ninety percent (90%) of the maximum Stated Amount of all such Commercial Letters of Credit shall not, at any time, have an initial expiry greater than ninety (90) days after the original date of issuance of such Commercial Letters of Credit, and (iv) which Commercial Letter of Credit provides that it may be drawn only after the Inventory is completed and after documents of title have been issued for such Inventory reflecting a Loan Party or the Collateral Agent as consignee of such Inventory, and (v) which will constitute Eligible In-Transit Inventory upon satisfaction of the requirements of clause (iv) hereof; provided that the Administrative Agent may, in its reasonable discretion and upon prior notice to the Lead Borrower, exclude any particular Inventory from the definition of “Eligible Letter of Credit” in the event the Administrative Agent reasonably determines that such Inventory is subject to any Person’s right or claim which is senior to, or pari passu with, the Lien of the Collateral Agent (such as, without limitation, a right of stoppage in transit).

“Environmental Laws” means all Applicable Laws issued, promulgated or entered into by or with any Governmental Authority, relating in any way to (a) the protection of the environment, (b) the handling, treatment, storage, disposal of Hazardous Materials, (c) exposure of any Person to Hazardous Materials, or the Release or threatened Release of any Hazardous Material to the environment, (d) the assessment or remediation of any such Release or threatened Release of any Hazardous Material to the environment or (e) occupational health or safety matters.

19

“Environmental Liability” means any liability, contingent or otherwise (including, without limitation, any liability for damages, natural resource damage, costs of environmental remediation, administrative oversight costs, fines, penalties or indemnities), of any Loan Party directly or indirectly resulting from or based upon (a) violation of any Environmental Law, (b) the generation, use, handling, transportation, storage, treatment or disposal of any Hazardous Materials, (c) exposure to any Hazardous Materials, (d) the Release or threatened Release of any Hazardous Materials into the environment or (e) any contract, agreement or other consensual arrangement pursuant to which liability is assumed or imposed with respect to any of the foregoing.

“Equipment” has the meaning set forth in the Security Documents.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended from time to time and the regulations promulgated and rulings issued thereunder.

“ERISA Affiliate” means any trade or business (whether or not incorporated) that, together with Lead Borrower, is treated as a single employer under Section 414(b) or (c) of the Code or, solely for purposes of Section 302 of ERISA and Section 412 of the Code, is treated as a single employer under Section 414 of the Code.

“ERISA Event” means: (a) any “reportable event,” as defined in Section 4043 of ERISA with respect to a Plan (other than an event for which the 30 day notice period is waived); (b) with respect to any Plan, the failure to satisfy the minimum funding standard under Section 412 of the Code or Section 302 of ERISA, whether or not waived; (c) the filing pursuant to Section 412(c) of the Code or Section 302(c) of ERISA of an application for a waiver of the minimum funding standard with respect to any Plan; (d) the incurrence by the Lead Borrower or any ERISA Affiliate of any liability under Title IV of ERISA with respect to the termination of any Plan; (e) the receipt by the Lead Borrower or any ERISA Affiliate from the PBGC or a plan administrator of any notice relating to an intention to terminate any Plan or Plans or to appoint a trustee to administer any Plan; (f) the incurrence by the Lead Borrower or any ERISA Affiliate of any liability in excess of $25,000,000 (or such lesser amount as would reasonably be expected to result in a Material Adverse Effect) with respect to the withdrawal or partial withdrawal from any Plan or Multiemployer Plan; or (g) the receipt by the Lead Borrower or any ERISA Affiliate of any notice, or the receipt by any Multiemployer Plan from the Lead Borrower or any ERISA Affiliate of any notice, concerning the imposition of Withdrawal Liability in excess of $25,000,000 (or such lesser amount as would reasonably be expected to result in a Material Adverse Effect) or a determination that a Multiemployer Plan is, or is expected to be, insolvent or in reorganization, within the meaning of Title IV of ERISA.

“Event of Default” has the meaning provided in SECTION 7.01. An “Event of Default” shall be deemed to have occurred and to be continuing unless and until that Event of Default has been duly waived in writing by the Administrative Agent in accordance with the terms of this Agreement.

“Excess Availability” means the difference between (a) the Borrowing Base and (b) the Total Outstandings.

20

“Excluded Net Proceeds” means, (i) with respect to any Net Proceeds received from a sale, transfer or disposition of any of the Term Loan Priority Collateral and/or any Qualifying Senior Collateral, or any event described in clause (b) of the definition of “Prepayment Event” with respect to any of the Term Loan Priority Collateral and/or any Qualifying Senior Collateral only, such portion of such Net Proceeds that are then required to be paid to the lenders under the Term Loan Financing Facility and/or any Qualifying Senior Secured Debt, (ii) with respect to any Net Proceeds received from any Indebtedness used to refinance the Term Loan Financing Facility and/or any Qualifying Senior Secured Debt as permitted in accordance with this Agreement, such portion of such Net Proceeds that is required to be paid to the lenders under the Term Loan Financing Facility and/or Qualifying Senior Secured Debt and (iii) with respect to any Net Proceeds received from any other Prepayment Event, if the Term Payment Availability Conditions are satisfied, and no Cash Dominion Event has occurred and is continuing or would arise therefrom, such portion of such Net Proceeds that are required to be paid to the lenders under the Term Loan Financing Facility and/or any Qualifying Senior Secured Debt.

“Excluded Subsidiary” means each Immaterial Subsidiary, Foreign Subsidiary and each Subsidiary in which substantially all of its assets consist of Capital Stock of one or more Foreign Subsidiaries.

“Excluded Taxes” means, with respect to the Agents, any Lender, any Issuing Bank or any other recipient of any payment to be made by or on account of any obligation of any Loan Party hereunder, (a) income or franchise taxes imposed on (or measured by) its gross or net income by the United States of America, or by the jurisdiction under the laws of which such recipient is organized or in which its principal office is located or, in the case of any Lender, in which its applicable lending office is located, (b) any branch profits taxes imposed by the United States of America or any similar tax imposed by any other jurisdiction in which any Loan Party or any Credit Party is located, (c) taxes imposed on any “withholdable payment” payable to such recipient as a result of the failure of such recipient to satisfy the applicable requirements as set forth in FATCA or any amended or successor version that is substantively comparable, (d) in the case of a Foreign Lender (other than an assignee pursuant to a request by a Borrower under SECTION 2.24(a)), any United States withholding tax that is imposed on amounts payable to such Foreign Lender under any law in effect at the time such Foreign Lender becomes a party to this Agreement (or designates a new lending office other than at the request of a Borrower under SECTION 2.24), except to the extent that such Foreign Lender (or its assignor, if any) was entitled, at the time of designation of a new lending office (or assignment), to receive additional amounts from the Borrowers with respect to such withholding tax pursuant to SECTION 2.23(a) and (e) any tax that is attributable to a Credit Party’s failure to comply with SECTION 2.23(e) and (i).

“Executive Order” has the meaning provided in SECTION 9.18.

“Existing Credit Agreement” has the meaning provided in the first recital to this Agreement.

“Existing Letters of Credit” means the Letters of Credit issued under the Existing Credit Agreement and outstanding as of the Effective Date.

21

“Existing Revolver Tranche” has the meaning provided in SECTION 2.27(a).

“Extended Commitments” has the meaning provided in SECTION 2.27(a).

“Extending Revolving Credit Lender” has the meaning provided in SECTION 2.27(b).

“Extension Amendment” has the meaning provided in SECTION 2.27(d).

“Extension Election” has the meaning provided in SECTION 2.27(b).

“Extension Request” has the meaning provided in SECTION 2.27(a).

“Extension Series” has the meaning provided in SECTION 2.27(a).

“Facility Guarantee” means any Guarantee of the Obligations executed by the Parent and its Subsidiaries which are or hereafter become Facility Guarantors in favor of the Agents and the other Secured Parties.

“Facility Guarantors” means any Person executing a Facility Guarantee.