Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CRAWFORD & CO | d8k.htm |

Keefe, Bruyette

& Woods 2011 Insurance Conference

September 8, 2011

Exhibit 99.1 |

Forward-looking Statements,

Segment Operating Earnings and non-GAAP Financial Information

Forward Looking Statements and Interim Results:

This presentation contains forward-looking statements, including statements

about the future financial condition, results of operations and earnings

outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not

statements

of

historical

fact

may

be

“forward-looking”

statements

as

defined

in

the

Private

Securities

Litigation

Reform

Act of 1995 and other securities laws. Forward-looking statements involve

a number of risks and uncertainties that could cause actual results to

differ materially from historical experience or Crawford & Company’s present expectations.

Accordingly, no one should place undue reliance on forward-looking statements,

which speak only as of the date on which they are made. Crawford &

Company does not undertake to update forward-looking statements to reflect the

impact of circumstances or events that may arise or not arise after the date the

forward-looking statements are made. Results for any interim period

presented herein are not necessarily indicative of results to be expected for the full year or

for any other future period. For further information regarding Crawford &

Company, and the risks and uncertainties involved in forward-looking

statements, please read Crawford & Company’s reports filed with the United States

Securities

and

Exchange

Commission

and

available

at

www.sec.gov

or

in

the

Investor

Relations

section

of

Crawford

&

Company’s website at www.crawfordandcompany.com.

Segment Operating Earnings:

Under the Financial Accounting Standards Board’s Accounting Standards

Codification Topic 280, “Segment Reporting,” the Company has

defined segment operating earnings as the primary measure used by the Company to evaluate the

results of each of its four operating segments. Segment operating earnings exclude

income taxes, interest expense, amortization of customer-relationship

intangible assets, stock option expense, earnings or loss attributable to non-

controlling interests, certain unallocated corporate and shared costs, and certain

other nonrecurring gains and expenses.

Non-GAAP Financial Information:

For additional information about certain non-GAAP financial information

presented herein, see the Appendix following this presentation.

2 |

Market-Leading

Global Businesses The world’s largest fully-integrated independent

provider of global claims management solutions.

EMEA-A/P

Americas

Broadspire

Legal Settlement

Administration

Serves the U.K., European,

Middle Eastern, African and

Asia Pacific markets

Serves the U.S., Canadian,

Caribbean and Latin American

markets

Serves large national

accounts, carriers and self-

insured entities

Provides administration for

class action settlements and

bankruptcy matters

3 |

4

Crawford’s Award-Winning Performance

Service Provider of the Year

Crawford & Company

With an unprecedented level of natural catastrophes

across the world in 2010 and 2011, Crawford seized the

opportunity to prove its global capabilities and has been

recognized as Service Provider of the Year for its efforts.

The British Insurance Awards 2011

Loss Adjuster of the Year

Crawford & Company Australia

Australia and New Zealand Insurance Industry

Best Claims Administrator

GCG

The New York Law Journal

-

Best Vendors of 2010

Risk Innovator of the Year

Risk

and

Insurance

magazine

Loss Adjuster of the Year

Crawford & Company UK

London Market Leaders Order of Merit 2010 -

Global Broker & Underwriters' Annual London

Market Readers

Survey

InfoWeek 500

2011 Award Winner Top 100

Insurance Industry Finalist

Annual listing of the nation's most

innovative users of Business Technology

InformationWeek

magazine

Loss Adjuster of the Year

Crawford & Company Australia

Australia and New Zealand Insurance Industry |

The Crawford

System of Claims Solutions SM

The Crawford System is the most comprehensive global, integrated

solution for all corporate, insurer, and re-insurer claims

administration. 5 |

Crawford is

uniquely positioned for global growth 6 |

Our Global

Strength $1 Billion Revenue Company

700 Locations

70+ Countries

8,900 Employees

7 |

Americas

•

U.S. Property and Casualty

•

Market leader

•

Technology innovation

•

Benefit from U.S. market consolidation

•

Canada

•

Strong relationships with top insurers

•

End to end solutions

•

Innovation and technology

•

Latin America & Caribbean

•

Latin American emerging markets GDP

growth on average 5%

•

Targeting markets in Brazil and Mexico

•

Focus on GTS growth

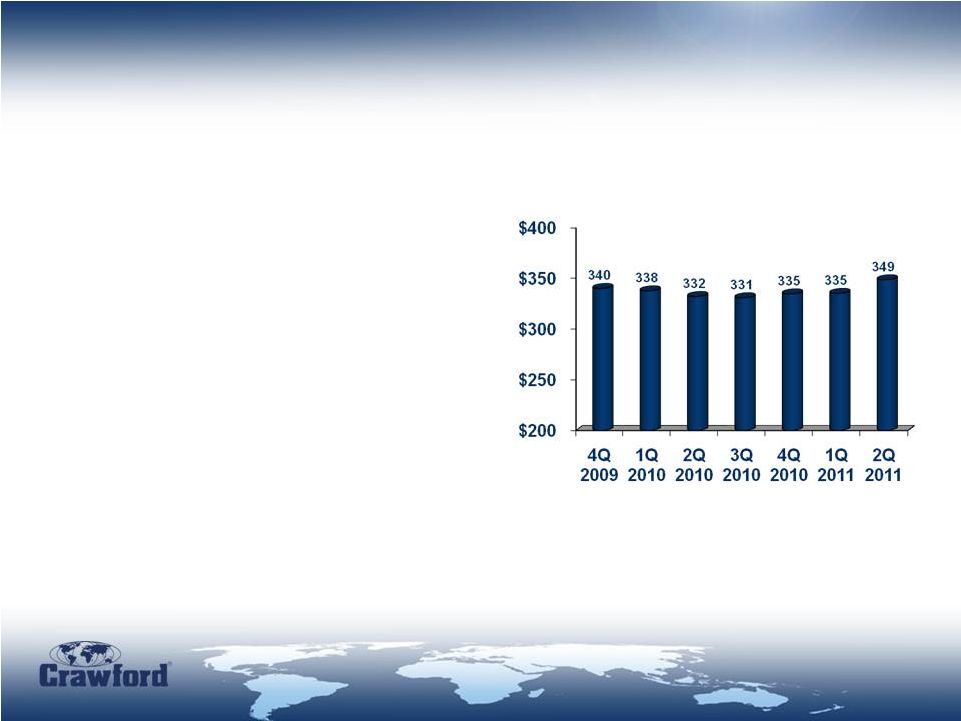

Trailing 12 Months (“TTM”) Revenues

(in $ millions)

8 |

•

United Kingdom

•

EMEA/AP’s largest market

•

Recruitment of GTS adjusters continues

•

Strong commercial presence

•

CEMEA

•

Expansion of TPA offerings

•

Claims volume increasing

•

Opportunity to grow market share

•

Asia/Pacific

•

Catastrophe revenues should continue for

the balance of this year

•

New market opportunities

TTM Revenues (in $ millions)

EMEA/AP

9 |

•

Fully integrated service model

•

Improved outcomes by teaming claims and

medical management

•

Superior outcomes measurement

•

Quantifiable measurements gauging our

performance and providing insight for

continued program improvement

•

Exceptional medical protocols

•

Shorter durations and focused strategy

drive early, successful return to work and

increased productivity

•

Technology

•

Single source claim and data management

of complete program history

•

Analytics

•

Differentiator in the market

TTM Revenues (in $ millions)

Broadspire

10

$100

$150

$200

$250

$300

4Q

2009

1Q

2010

2Q

2010

3Q

2010

4Q

2010

1Q

2011

2Q

2011

289

276

264

255

245

243

240 |

•

Core services:

•

GCG Class Action Services provides

administrative services to expedite high-volume

class action settlements

•

GCG Bankruptcy Services manages the

administration of bankruptcy cases under

Chapter 11

•

GCG Communications specializes in legal notice

programs for case administration worldwide

•

Special project pace is expected to slow

going forward but should contribute to

revenues and operating earnings

throughout 2011

•

Backlog of $75.2 million at June 30, 2011

TTM Revenues (in $ millions)

Legal Settlement Administration

11 |

High Profile

Specialized Resources: Worldwide Catastrophe Response

Global Technical Services (GTS)

Contractor Connection

Garden City Group (GCG) |

Crawford’s customer response to the unprecedented number

of global catastrophes has been rapid, nimble and innovative

Earthquake, tsunami

Japan, 11 March

Earthquake

New Zealand, 22 Feb

Cyclone Yasi

Australia, 2 Feb

Landslides, flash floods

Brazil, 12-16 Jan

Floods, flash floods

Australia,

Dec 2010-Jan 2011

Severe storms, tornadoes

USA, 22–28 April

Severe storms, tornadoes

USA, 20–25 May

Wildfires

USA, May–June

Earthquake

New Zealand, 13 June

Floods

USA, April–June

Source: MR NatCatSERVICE

Yet to come:

Hurricane Irene

13 |

14

Global Technical Services

•

The definitive solution for large, complex claims, providing

the highest level of world-class talent and the industry’s

largest network to strategically manage large complex

losses anywhere on the globe

•

Combining regional and local adjusting strengths to

leverage scale and capabilities as a global provider

•

Currently tracking over 10,000 losses representing $35

billion in reserves

•

425 fully accredited International Executive General

Adjusters and Executive General Adjusters deployed in 45

countries

•

Advanced analytics based on segmentation of assignments

in 12 Industry losses, 7 product lines and 35 perils

•

Consolidated aggregation of data for trend analysis and

strategic planning

Noteworthy large

losses (reserves

values)

2011 Australia,

$1.0 billion

2010

UK,

$650 million

2010

Chile

$633 million

2011 South Africa

$213 million

2010

UK,

$180 million |

Contractor

Connection – Managed Repair Solutions

•

Dominant insurance industry leader

•

3,500 contractors in the U.S. & Canada

•

Projected $1 billion in estimate dollars

•

Average 20% revenue growth over the last five years

•

Partner with 50% of top 25 carriers

•

Expanding into consumer services, real estate, and financial

markets

•

Expansion opportunities in Australia |

–

Largest securities class action administrator in the country

•

Deep expertise in mega-case settlements

•

GCG has been entrusted with more billion dollar+ securities

settlements than all competitors combined

•

No one handled more of the top 100 securities cases than GCG

•

More than 500 associates in 12 offices nationwide

GCG

Best Claims Administrator –

2010 New York Law Journal

–

Representative engagements:

•

Antitrust:

Visa/MasterCard Settlement

•

Consumer:

Contact Lens Settlement

•

Securities:

WorldCom Securities Litigation

•

Mass Tort:

Engle Tobacco Trust Fund

•

Bankruptcy:

General Motors

•

Special Projects:

Gulf Coast Claims Facility |

Financial

Review |

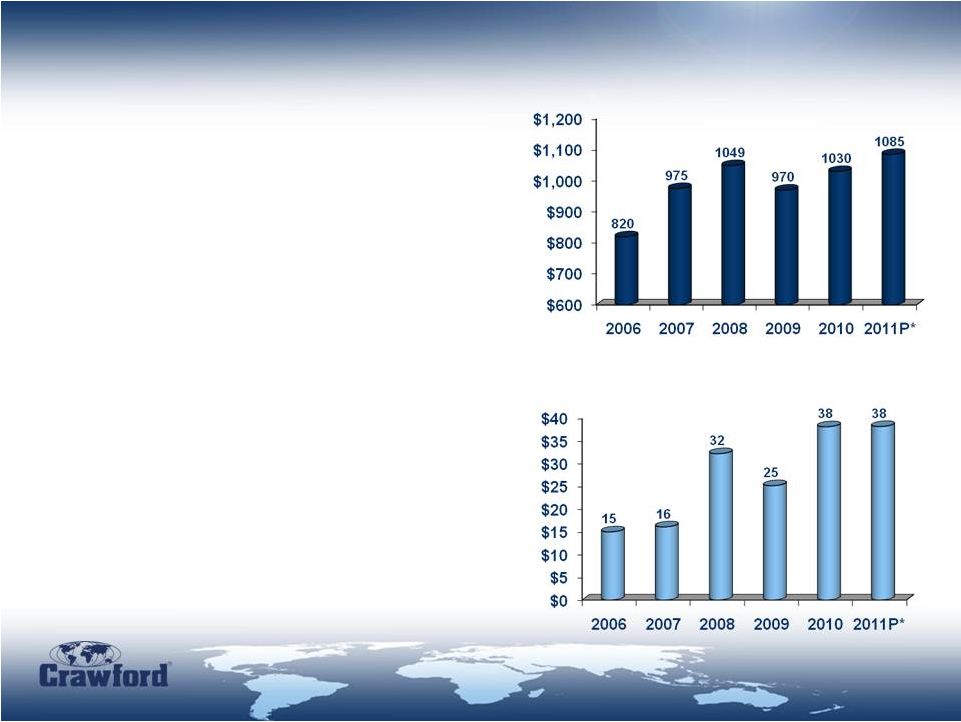

Crawford

Financial Performance •

Revenue CAGR of 5.8% from 2006 to

projected 2011

•

Strong performance in Legal Settlement

Administration, organic growth in

EMEA/AP, and acquisitions drove

revenue growth

•

Before a special credit in 2011, CAGR of

non-GAAP adjusted net income

attributable to shareholders of Crawford

& Company of 20.4% from 2006 to

projected 2011*

•

Strong cash generation from 2006 to

2010

•

Dividend reinstated in first quarter 2011

at $0.02 per share

* Based on the midpoint of the Company’s guidance as of August 8, 2011

Consolidated Revenues (in $ millions)

Non-GAAP Adjusted Net Income Attributable to

Shareholders of Crawford & Company (in $ millions)

18 |

First Half 2011

Business Drivers •

Revenues and earnings reflected

continued strong performance in Legal

Settlement Administration, due to a

special project

•

Americas’

rebound assisted by U.S.

catastrophe activity

•

Organic growth in EMEA/AP primarily due

to weather-related claims in Australia and

the U.K.

•

Group claims increased 11.7% over the

prior year period

•

Diluted earnings per share were $0.48,

compared with non-GAAP diluted

earnings per share of $0.14 in the 2010

period, excluding a goodwill impairment

charge of $0.13

Revenues (in $ millions)

Cases (in 000’s)

19 |

First Half 2011

Financials 20

Income Statement Highlights

Six months ended

2011

2010

% Change

Revenues

$576,751

$474,417

22%

Costs of Services

417,715

352,970

18%

Selling, General, and Administrative Expenses

113,159

99,378

14%

Corporate Interest Expense, Net

8,254

7,809

6%

Restructuring and Other Costs

-

4,650

nm

Goodwill Impairment Charge

-

7,303

nm

Total Costs and Expenses before Reimbursements

539,128

472,110

14%

Income Before Income Taxes

37,623

2,307

nm

Provision for Income Taxes

12,042

1,758

585%

Net Income

25,581

549

nm

Less: Net Income (Loss) Attributable to Noncontrolling Interests

(35)

22

-259%

Net Income Attributable to Shareholders of Crawford & Company

$25,616

$527

nm

Basic and Diluted Earnings Per Share

$0.48

$0.01

nm

Cash Dividends per Share:

Class A and Class B Common Stock

$0.04

--

nm

nm=not meaningful

CRAWFORD & COMPANY

Unaudited

(In Thousands, Except Earnings and Dividend Per Share Amounts and Percentages)

|

First Half 2011

Financials 21

Crawford & Company

Balance Sheet Highlights

Unaudited

As of June 30, 2011 and December 31, 2010

June 30,

December 31,

2011

2010

Change

Cash and cash equivalents

$37,206

$93,540

($56,334)

Accounts receivable, net

185,026

142,521

42,505

Unbilled revenues, net

136,726

122,933

13,793

Total receivables

321,752

265,454

56,298

Goodwill

129,872

125,764

4,108

Deferred revenues,

net

78,889

75,526

3,363

Pension liabilities

139,045

165,030

(25,985)

Current portion of long-term debt, capital leases

and short-term borrowings

3,426

2,891

535

Long-term debt, less current portion

217,589

220,437

(2,848)

Total debt

221,015

223,328

(2,313)

Total stockholders' equity attributable to Crawford & Company

126,317

89,516

36,801

Net debt*

183,809

129,788

54,021

Total debt/capitalization

64%

71%

*Net debt is defined by the Company as long-term debt, capital leases and short-term

borrowings, net of cash and cash equivalents. (In Thousands, except percentages)

|

2011 Focus and

Outlook |

2011 Operational

Focus •

Key account management/cross-selling through the Crawford

System of Claims Solutions

•

Continue to grow Business Process Outsourcing

•

Further expansion of Global Technical Services (GTS) and

Contractor Connection

•

International expansion of TPA offerings

•

Improve margins through cost control in all business

segments

23 |

2011

Guidance •

Full Year 2011 Guidance as of August 8, 2011 is affirmed:

–

Consolidated revenues before reimbursements between $1.07 billion

and $1.10 billion

–

Consolidated operating earnings between $75.0 million and $83.0

million

–

Consolidated cash provided by operating activities between $30.0

million and $35.0 million

–

After reflecting stock-based compensation expense, net corporate

interest expense, customer-relationship intangible asset amortization

expense, special credits, and income taxes, net income attributable to

shareholders of Crawford & Company on a GAAP basis between $41.0

million and $46.5 million, or $0.75 to $0.85 diluted earnings per share

–

Before

reflecting

the

special

credit

of

$5.8

million

net

of

tax,

or

$0.11

per share, related to an arbitration award, net income attributable to

shareholders of Crawford & Company on a non-GAAP basis between

$35.5 million and $41.0 million, or $0.65 to $0.75 diluted earnings per

share

24 |

Keefe, Bruyette

& Woods 2011 Insurance Conference

September 8, 2011 |

Appendix:

Non-GAAP Financial Information Measurements of financial performance not calculated in

accordance with GAAP should be considered as supplements to, and not substitutes

for, performance measurements calculated or derived in accordance with GAAP. Any such measures are not

necessarily comparable to other similarly-titled measurements employed by other

companies. Reimbursements for Out-of-Pocket Expenses

In the normal course of our business, we sometimes pay for certain out-of-pocket

expenses that are reimbursed by our clients. Under GAAP, these out-of-pocket

expenses and associated reimbursements are reported as revenues and expenses in our Consolidated Statements of

Operations. In this presentation, we do not believe it is informative to include the

GAAP-required gross up of our revenues and expenses for these pass-through

reimbursed expenses. The amounts of reimbursed expenses and related revenues offset each other in our Consolidated Statements

of Operations with no impact to our net income or loss. Unless noted in this presentation,

revenue and expense amounts exclude reimbursements for out-of-pocket

expenses. Net debt

Net debt is computed as the sum of long-term debt, capital leases and short-term

borrowings less cash and cash equivalents. Management believes that net debt is

useful because it provides investors with an estimate of what the Company’s debt would be if all available cash was used

to pay down the debt of the Company. The measure is not meant to imply that management

plans to use all available cash to pay down debt. Deferred Revenues, net

Deferred

Revenues,

net

is

computed

as

the

sum

of

the

current

and

noncurrent

deferred

revenues

as

reported

on

our

Consolidated

Balance

Sheets

less the sum of the current and noncurrent receivable held in trust to be released to us as

payment to service these revenues. The current portion

of

the

receivable

held

in

trust

is

reported

as

a

component

of

Accounts

Receivable

and

the

noncurrent

portion

is

reported

as

a

component

of Other Noncurrent Assets in our Consolidated Balance Sheets. The funds represented by

the amount of the receivable held in trust are released to

the

Company

over

time

to

partially

offset

the

costs

of

servicing

the

deferred

revenues.

Management

believes

that

subtracting

the

receivable

held in trust from deferred revenues provides investors with a snapshot of what the net cash

costs will be to service the deferred revenues in the future.

Non-GAAP Adjusted Net Income Attributable to Shareholders of Crawford & Company

Non-GAAP adjusted net income attributable to shareholders of Crawford & Company

excludes Broadspire acquisition-related goodwill impairment charges and a related

credit for a purchase price arbitration award. Management believes this is useful to investors as it presents a measure that

can be more easily compared to other periods that do not have such charges.

26 |

27

Reconciliation of Non-GAAP Items

(in $000's)

2006

2007

2008

Revenues Before Reimbursements

Total Revenues

900

$

1,051

$

1,136

$

1,048

$

1,110

$

1,172

$

Reimbursements

(80)

(76)

(87)

(78)

(80)

(87)

Revenues Before Reimbursements

820

$

975

$

1,049

$

970

$

1,030

$

1,085

$

Non-GAAP Adjusted Net Income Attributable to Shareholders of

Crawford & Company Net Income (Loss) Attributable to Shareholders of

Crawford & Company 15,011

$

16,116

$

32,259

$

(115,683)

$

28,328

$

43,840

$

Goodwill Impairment Charge/(Special Credit)

140,945

$

10,788

$

(6,967)

$

Tax Impact of Goodwill Impairment Charge/(Special Credit)

-

-

-

-

140,945

(948)

9,840

1,127

(5,480)

Non-GAAP Adjusted Net Income Attributable to Shareholders of Crawford &

Company 15,011

$

16,116

$

32,259

$

25,262

$

38,168

$

38,000

$

*Midpoint of Company guidance as of August 8, 2011

2010

2011 Projected*

2009 |

28

Reconciliation of Non-GAAP Items (cont.)

Net Income

(Loss)

Attributable

Net

to Shareholders

Earnings

Income (Loss)

Tax

Income

of Crawford

(Loss) Per

Before Taxes

Expense

(Loss)

& Company

Share

As reported

2,307

$

1,758

$

549

$

527

$

0.01

$

Add:

Goodwill impairment charge

7,303

462

6,841

6,841

0.13

Non-GAAP adjusted

9,610

$

2,220

$

7,390

$

7,374

$

0.14

Crawford & Company

Reconciliation of Net Income Attributable to Shareholders of Crawford & Company

and Earnings Per Share to Non-GAAP Adjusted Net Income Attributable to

Shareholders and Earnings Per Share of Crawford & Company For the Six

Months Ended June 30, 2010 |

Reconciliation

of Non-GAAP Items 29

Crawford & Company

(in $000's)

June 30,

December 31,

2011

2010

Deferred Revenues, Net

Deferred revenues, current

51,605

$

48,198

$

Deferred

revenues, noncurrent 29,098

30,048

Total deferred revenues

80,703

78,246

Less:

Receivable held in trust included in accounts receivable

1,661

1,661

Receivable held in trust included in other noncurrent assets

153

1,059

Deferred revenues, net

78,889

$

75,526

$

Net Debt

Short-term borrowings

484

$

-

$

Current installments of long-term debt and capital leases

2,942

2,891

Long-term debt and capital leases, less current installments

217,589

220,437

Total debt

221,015

223,328

Less:

Cash and cash equivalents

37,206

93,540

Net debt

183,809

$

129,788

$

Six Months Ended

Six Months Ended

June 30,

June 30,

2011

2010

Revenues Before Reimbursements

Total Revenues

618,190

$

508,039

$

Reimbursements

(41,439)

(33,622)

Revenues Before Reimbursements

576,751

$

474,417

$

Costs of Services Before

Reimbursements Total Costs of Services

459,154

$

386,592

$

Reimbursements

(41,439)

(33,622)

Costs of Services Before Reimbursements

417,715

$

352,970

$

|