Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BEAM INC | d8k.htm |

VERSION 08/10/11

PRIMED TO ACCELERATE

PROFITABLE GROWTH

September 7, 2011

Exhibit 99.1 |

2

Disclaimer

Please note that the information included in this presentation contains

statements relating to future results, which are forward-looking statements

as that term is defined in the Private Securities Litigation Reform Act of

1995. We caution you that these forward-looking statements speak only

as of the date hereof and we have no obligation to update them. Actual

results may differ materially from those projected as a result of certain risks

and uncertainties, including the risks described under the headings “Risk

Factors”

and “Forward-looking Statements”

in our securities filings. There

can be no assurance that any of the projected results will be achieved as

anticipated or at all. Beam does not endorse or adopt the analyst

estimates in this presentation. This presentation includes measures not

derived in accordance with generally accepted accounting principles

(“GAAP”), such as adjusted pro forma diluted earnings per share,

adjusted pro forma operating income, adjusted pro forma return on

invested capital before charges/gains, and ratio of net debt/EBITDA.

These measures should not be considered as substitutes for GAAP

measures and may be inconsistent with similar measures presented

by

other companies. |

3

Presenters

Matt Shattock

President & Chief Executive Officer

Bob Probst

Chief Financial Officer |

4

Beam Is A Pure-Play Spirits Industry Leader With Compelling

Growth Prospects

1.

Leader With The Scale And Agility To Outperform

2.

Strong Positions In An Attractive Industry

3.

Focused Strategy And Investments

4.

Driving Momentum In The Marketplace

5.

Primed To Deliver Long-Term Shareholder Value |

5

Beam Is The Future Of Fortune Brands

•

Golf sold and net proceeds of $1.1B used to pay down debt

•

Home & Security, Inc. to be spun off tax-free to shareholders

-

$500MM tax-free dividend to Beam to pay down debt

•

FO to become pure-play spirits company

-

NYSE “BEAM”

on October 4, 2011 with “when-

issued”

trading beginning

on or about September 16, 2011

•

Fortune Brands separating businesses to maximize shareholder value

•

Creating a leading global pure-play spirits company

Pre-Separation

Pre-Separation

Post-Separation

Post-Separation

Shareholders

Golf

Spirits

Home & Security

FO

Shareholders

Beam Inc.

(RemainCo)

Fortune Brands

Home & Security, Inc.

(SpinCo) |

6

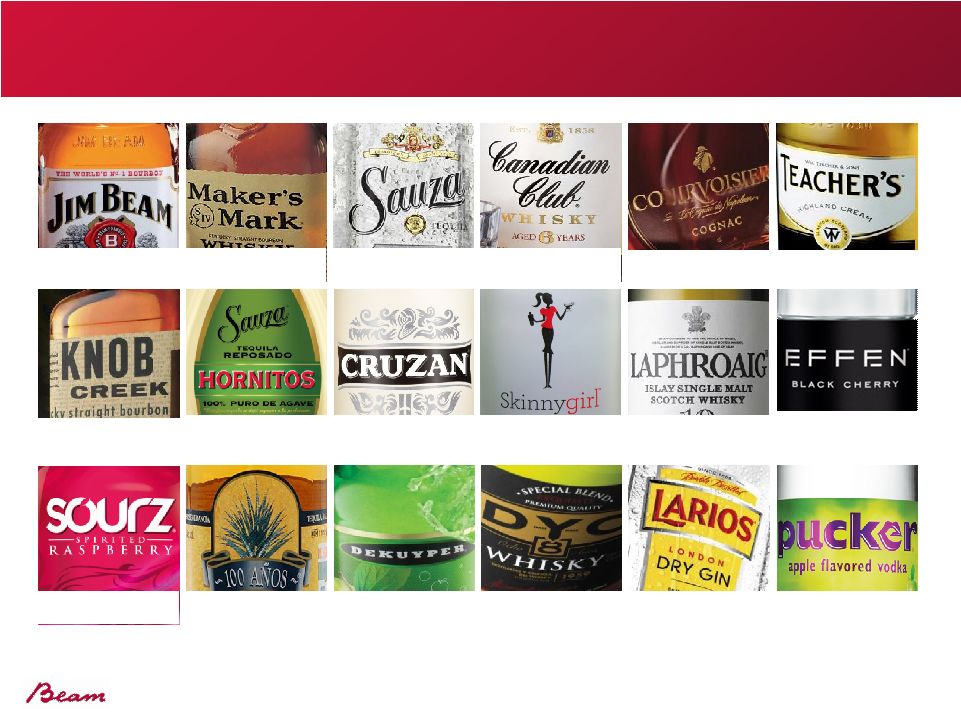

Beam Is The World’s 4th Largest Premium Spirits Company

Successful flavored

vodka launch

#1 Bourbon worldwide

#1 super-premium

Bourbon worldwide

#2 Tequila worldwide

#3 Canadian Whiskey

worldwide

#1 Scotch in India;

#2 in Brazil

#1 Cognac in UK;

#3 in US

#1 Single-Malt Islay

Scotch worldwide

Impact Top 100

premium spirit

#1 small batch Bourbon

Fast growing super-

premium Tequila

Top 5 super-premium

Vodka in US

Fast growing premium

Rum

Fastest growing spirits

brand in US

#1 Liqueur in US

Impact Top 100

premium spirit

#1 Liqueur in UK

on-trade

Fast growing

Tequila in US |

7

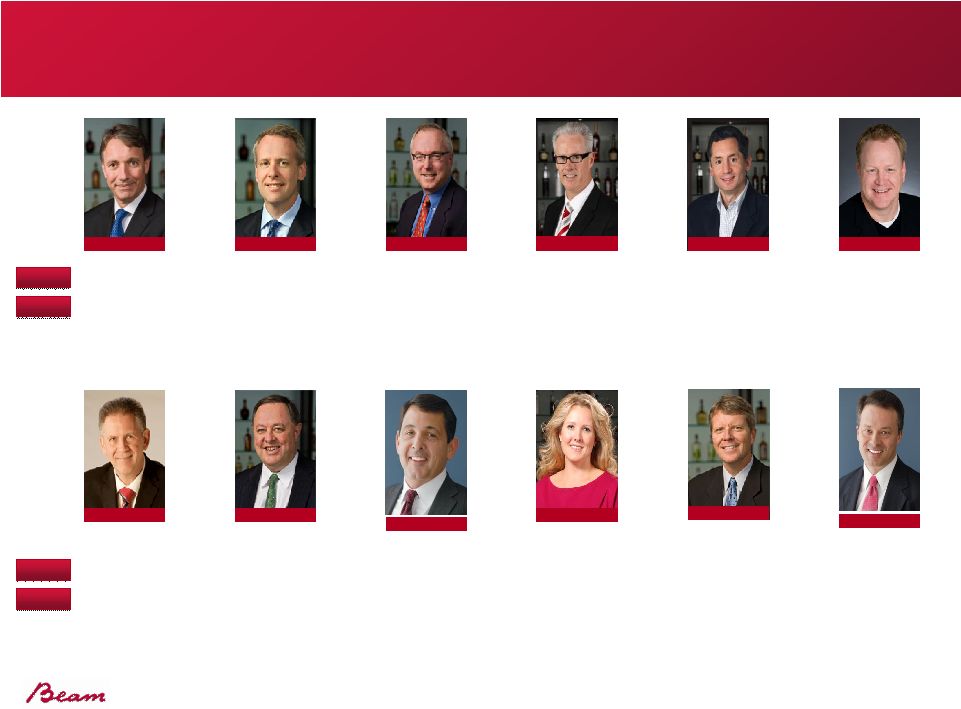

Experienced Leadership Team Drawn From Spirits And CPG

At Beam

At Beam

Prior

Prior

2 years

Led key

businesses for

Cadbury and

Unilever

3 years

Led financial

operations

inside Baxter

and Diageo

9 years

Sales and GM

business builder at

Allied Domecq,

Wine.com and

LVMH

12 years

Developed and

emerging markets

GM formerly with

Coca-Cola Amatil

1 year

International

GM at Yum!

Brands,

PepsiCo and

P&G

SVP, Global Operations

& Supply Chain

SVP, Human Resources

At Beam

At Beam

Prior

Prior

2 years

Brand marketer

and GM at

Unilever and

Seagram

16 years

Supply chain

expert at Allied

Domecq and

Bass Brewers

2 years

International

HR leader at

Campbell’s

and WalMart

SVP, CFO

Bob Probst

President & CEO

Matt Shattock

President, NA

Bill Newlands

President, APAC/SA

Phil Baldock

President, EMEA

Albert Baladi

SVP Global CMO

Kevin George

Ian Gourlay

VP, Investor Relations

19 years

Experienced IR and

value-based

planning at Fortune

Brands, Marakon

and Bain &

Company

Tony Diaz

Mindy Mackenzie

SVP, Corporate

Development

8 years

International

business

developer and

GM at

Seagram and

PWC

Donard Gaynor

SVP, General Counsel

25 years

Experienced

General

Counsel of

Beam, formerly

with Fortune

Brands

Kent Rose

SVP, Communications

& Public Affairs

13 years

Communications/

public affairs

leader at Fortune

Brands and

former U.S.

Senate

Leadership aide

Clarkson Hine |

8

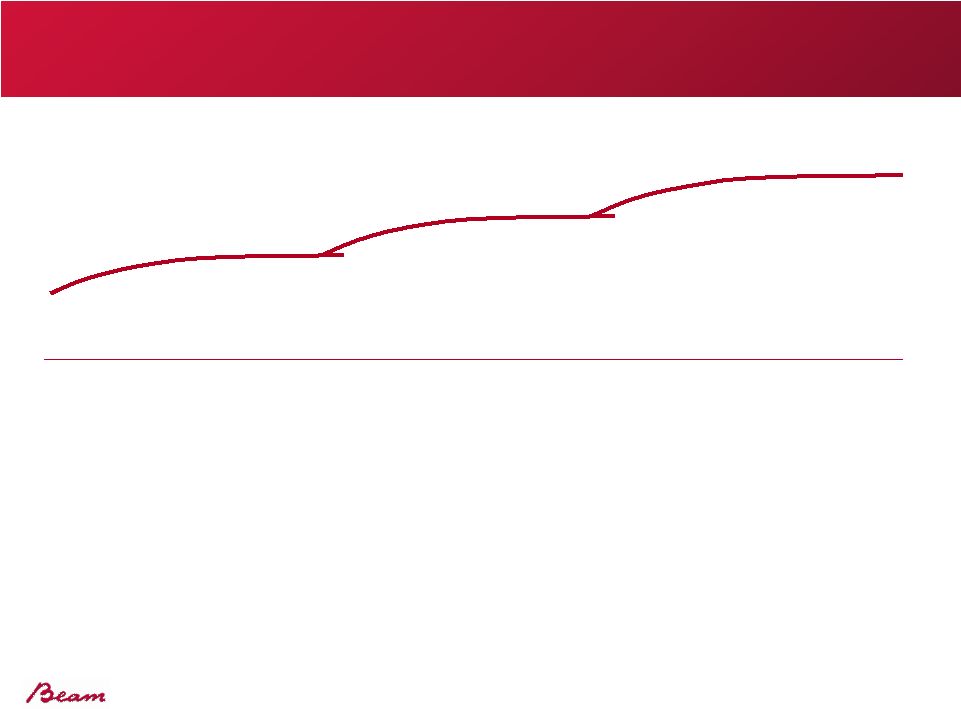

A Series Of Strategic Investments Has Transformed Beam From

A Solid Performer To An Outperforming Industry Leader

Portfolio

Transformation

Enhanced

Routes To Market

Focused

Brand Investment

•

Transformational ~$5B

Allied Domecq

acquisition

•

International from

~25% to ~50%

•

11 of top 14 brands

added in past six years

•

Sold lower return wine

business for ~$1B

•

Direct control from 8% to

75+% of worldwide sales

•

~$60M investment

•

Strategically aligned

distributors; intimacy

with customers

•

~$50M incremental brand

investment over past two

years

•

Impactful communication

building brand equity

•

Record setting innovation

2005-2007

2008-2009

2010-2011 |

9

Our Unique Combination Of Scale With Agility Is A

Competitive Advantage

Scale

from

leading portfolio

of brands and

market positions

•

Robust portfolio in

key categories

•

10 of the world’s

top 100 premium

brands

•

Strength around

the world

Agility

from high

performance

organization that’s

simple, smart, and

fast

•

Closer to customers

and consumers

•

Empowered teams

and entrepreneurial

culture

•

CPG brand builders,

innovators and

thought leaders

These advantages, combined with our strategy,

will position us to outperform our industry

Scale

Scale

Agility

Source: IMPACT |

10

One Of The Most Profitable Spirits Companies Built To Create

Shareholder Value

Strong sales

growth and

momentum

Strong sales

growth and

momentum

Competitive

EBITDA

margins

Competitive

EBITDA

margins

High cash

conversion

rate

High cash

conversion

rate

+

+

Sustainable

profitable growth

and strong

shareholder

value creation

Sustainable

profitable growth

and strong

shareholder

value creation

= |

11

Beam Is A Pure-Play Spirits Industry Leader With Compelling

Growth Prospects

1.

Leader With The Scale And Agility To Outperform

2.

Strong Positions In An Attractive Industry

3.

Focused Strategy And Investments

4.

Driving Momentum In The Marketplace

5.

Primed To Deliver Long-Term Shareholder Value |

12

Spirits Is One Of The Most Attractive Global Consumer

Categories

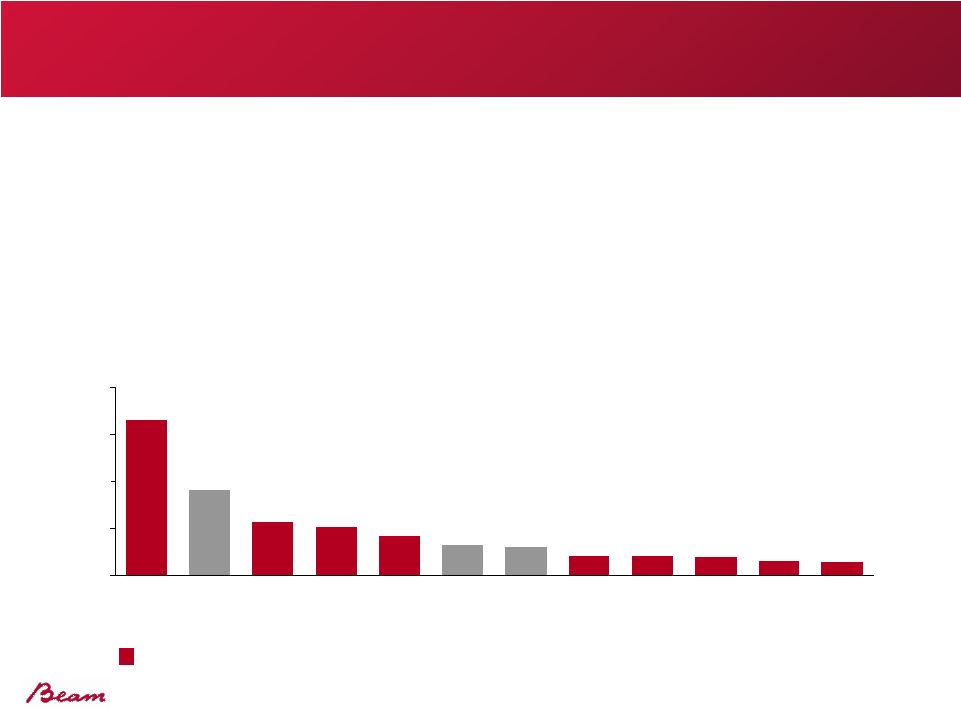

Global

Value

–

Western-Style

Spirits

($B)

1

Large and Growing Market

Favorable Dynamics:

Beam Has #4 Global Position

2010

Global

Volume

–

Western-Style

Spirits

(M

9-L

Cases)

1

Growing Middle Class

in Emerging Markets

Consumers Responsive

to Innovation

Trend Towards

Premiumization

High Brand Loyalty

Stable Cash Flows &

Recession Resilience

San

Miguel

Brown-

Forman

UB

Group

Beam

Bacardi

Pernod

Ricard

Diageo

La

Martin-

iquaise

The

Edrington

Group

William

Grants

Heaven

Hill

Sazerac

100M

80

60

40

20

0

Cuervo

Campari

Tand-

uay

Top 15 companies = ~66% share of

Western-style spirits market

$100B

80

60

40

20

0

2015E

2014E

2013E

2011E

2010

2009

2008

2012E

2005

2006

2007

Consistent

low-to-mid

single digit

growth

(1)

Western-style spirits exclude local distilled spirits, economy brandy, and

economy vodka in Eastern Europe Source: Euromonitor, IWSR, internal

analysis |

13

Beam Has A Balanced Global Business Focused On The

Industry’s Current And Future Profit Pools

•

#2 portfolio in US –

world’s most profitable spirits market

•

#2 portfolio and #1 brand in Australia –

second largest Bourbon market

•

#2 Tequila in North America

•

#1 Cognac in UK with opportunity in emerging markets

•

#1 Scotch in India and #2 in Brazil

•

Emerging markets drive ~15% of sales and increasing

2010-2015

Projected

Global

Value

Growth

–

Western-Style

Spirits

($B)

1

Beam Top 11 Market

(1)

Western-style spirits exclude local distilled spirits, economy brandy, and

economy vodka in Eastern Europe Source: Euromonitor, IWSR, internal

analysis 1

0

GER

CAN

MEX

AUS

BRA

FRA

VEN

RUS

UK

IND

CHI

USA

2

$4B

3 |

14

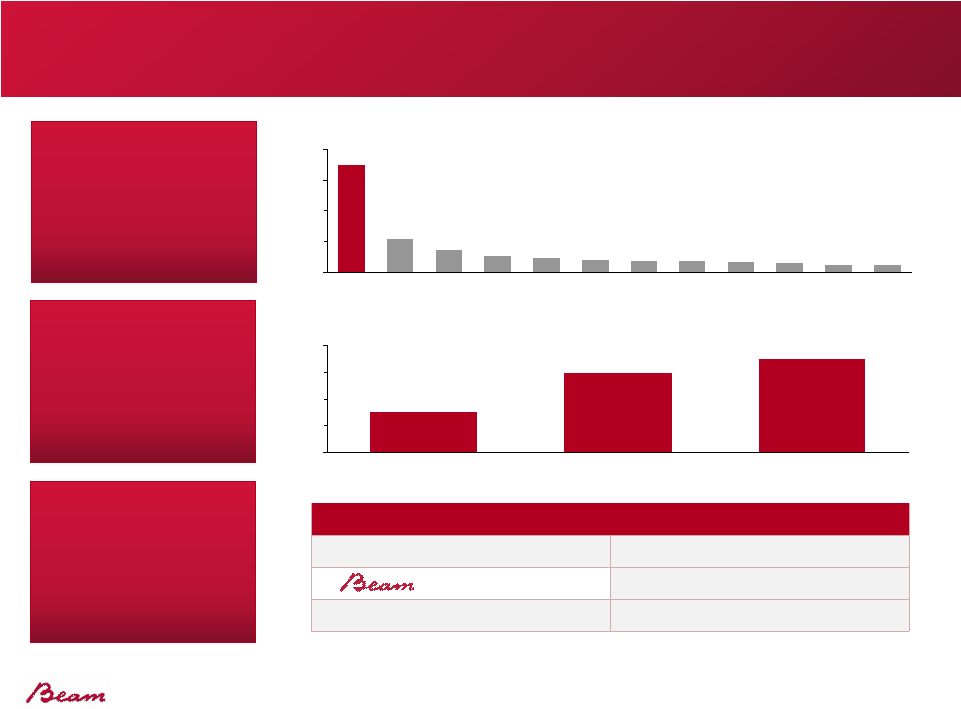

The #2

Spirits Supplier

in the US

Beam Enjoys An Advantaged Position In The US,

The Single Largest Profit Pool

2010

Global

Value

–

Western-Style

Spirits

($B)

1

US Spirits Category Revenue Share of Total Alcohol Category

US Spirits Volume Rank (9-L Cases)

1. Diageo

4. Bacardi

2.

5. Pernod Ricard

3. Sazerac

6. Brown-Forman

Spirits Taking Share in

US Alcohol Beverage

Market

US is Larger Than

Next Five Markets

Combined

(1)

Western-style spirits exclude local distilled spirits, economy brandy, and

economy vodka in Eastern Europe Source: Euromonitor, DISCUS, IWSR

GER

FRA

UK

USA

15

10

5

0

MEX

RUS

JAP

CHI

AUS

CAN

VEN

SPA

$20B

28

29%

26

32%

33%

30

32

34%

2010

2005

2000 |

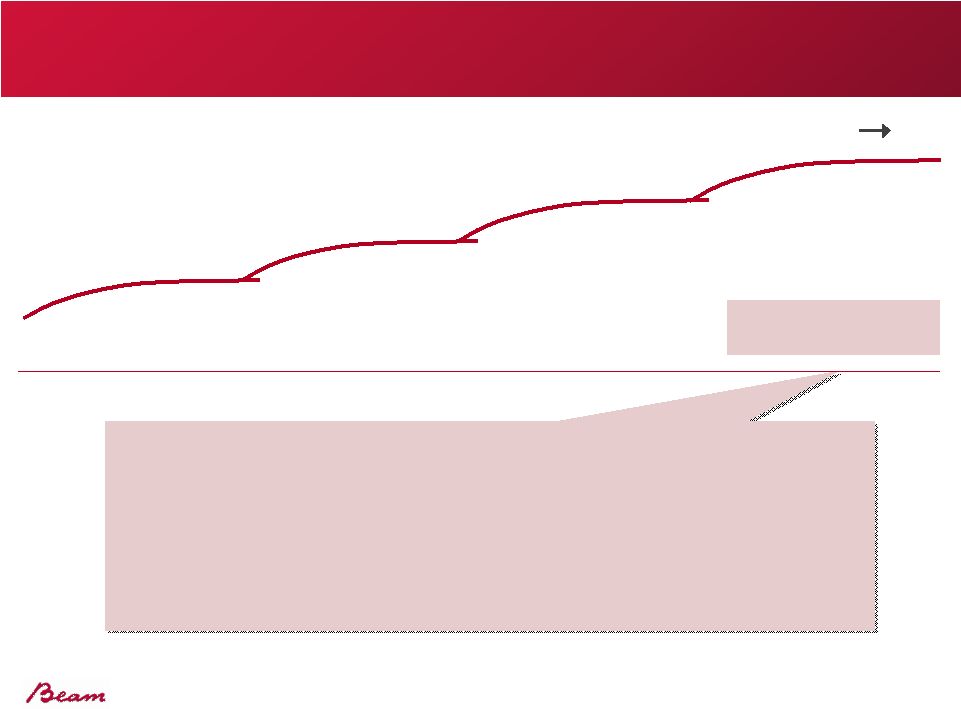

15

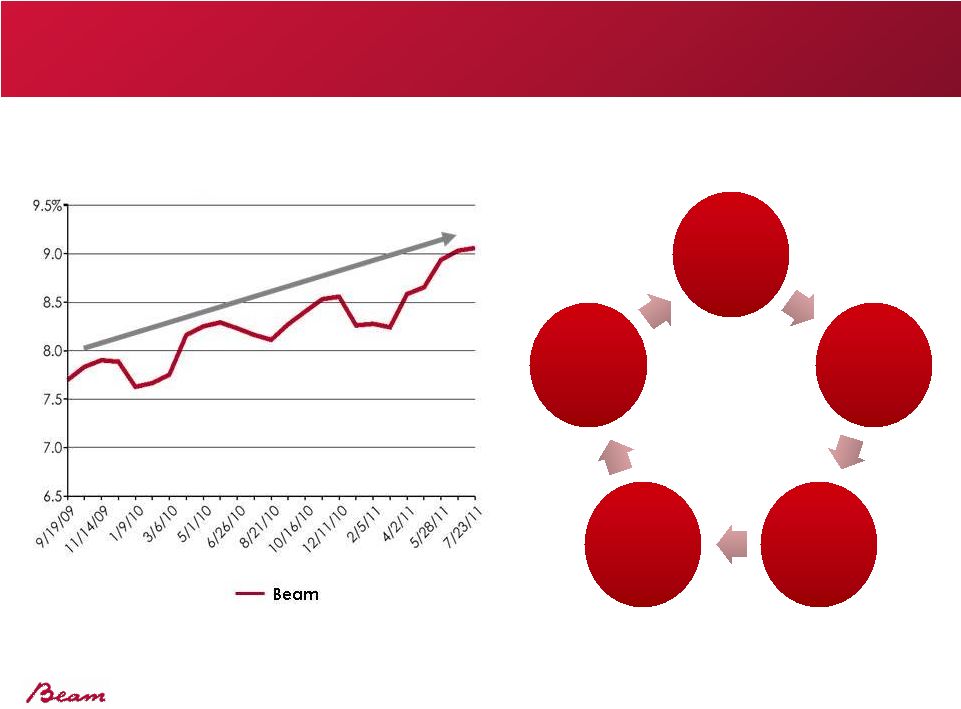

Beam Is Now The Fastest Growing Major Spirits Company In

The US

Key Growth Drivers

(1)

Rolling 13 week average Food, Drug, and Liquor Plus. Includes Skinnygirl sales

since launch in 1H 2010

Source: Nielsen

Brand

Investment

Successful

Innovation

Customer /

Distributor

Alignment

Revenue

Management

Bolt-on

Acquisition

Growing Value Market Share

1 |

16

Beam Is A Pure-Play Spirits Industry Leader With Compelling

Growth Prospects

1.

Leader With The Scale And Agility To Outperform

2.

Strong Positions In An Attractive Industry

3.

Focused Strategy And Investments

4.

Driving Momentum In The Marketplace

5.

Primed To Deliver Long-Term Shareholder Value |

17

We Are Deploying A Focused Strategy To Outperform

Our Markets

FUELING

OUR

GROWTH

CREATING

FAMOUS

BRANDS

BUILDING

WINNING

MARKETS

OUR VISION:

Crafting The Spirits That Stir The World |

18

Creating Famous Brands To Drive

Shareholder Value

Focusing on Core

Equities

Accelerating Growth

Through Innovation

Enhancing Portfolio with

Acquisitions

Creating

Famous

Brands

Building

Winning

Markets

Fueling

Our

Growth |

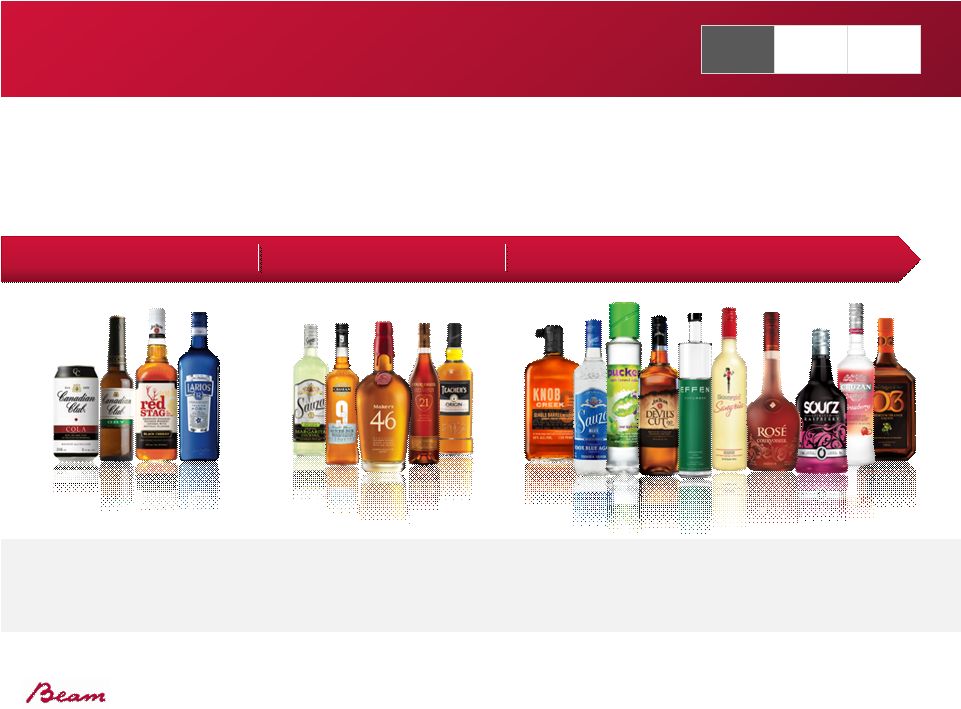

19

Focusing Investment On Our Most Powerful

And Fastest Growing Brands

Power Brands

Power Brands

Rising Stars

Rising Stars

Local Jewels

Local Jewels

Value Creators

Value Creators

(1)

% of sales based on net sales excluding excise tax

Creating

Famous

Brands

Building

Winning

Markets

Fueling

Our

Growth |

20

Increasing Consumer Advertising And

Investing Against Our Strategic Priorities

Creating

Famous

Brands

Building

Winning

Markets

Fueling

Our

Growth

100%

50

40

30

20

10

0

Digital Media

100%+

Power Brands/

Rising Stars

40%+

Consumer Advertising

50%+

Total BI

30%+

Percent Increase in Brand Investment 2009 to 2011 |

21

Industry-Leading Breadth In Bourbon And Tequila Captures

All Consumer Needs, Occasions, And Price Points

Bourbon

Bourbon

Tequila

Tequila

Spirits

$$$$

$

RTD/RTS

Creating

Famous

Brands

Building

Winning

Markets

Fueling

Our

Growth |

22

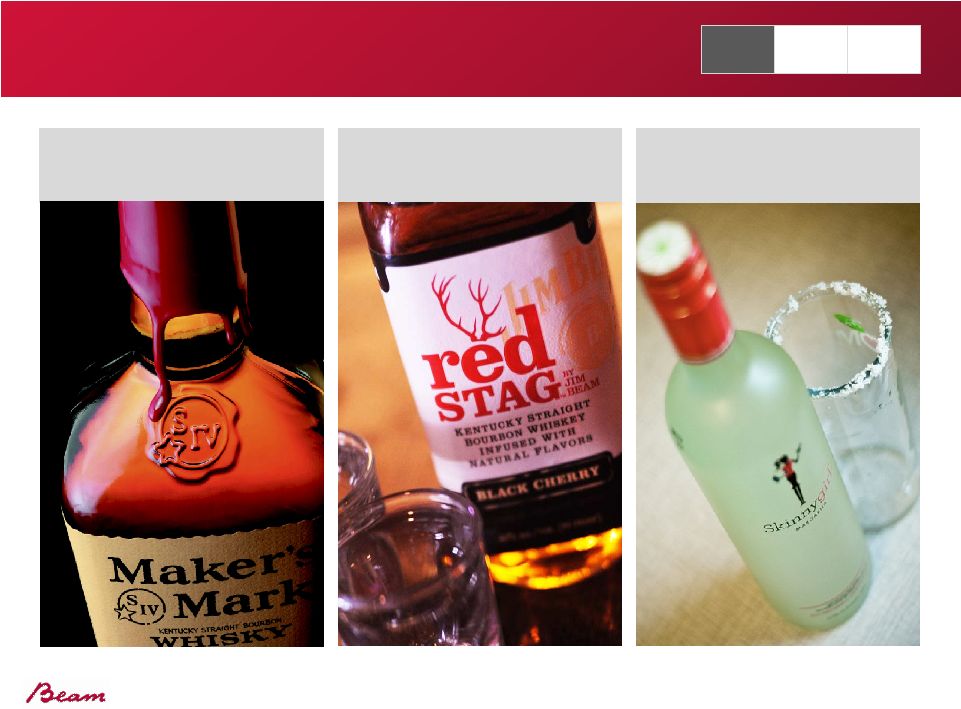

Accelerating Innovations To Turbo-Charge

Our Sales And Profit Growth

2009

2010

2011

Creating

Famous

Brands

Building

Winning

Markets

Fueling

Our

Growth

•

Innovation: “Borrow and Build”

strategic role

•

Speed and technology a competitive advantage

Record year of innovation in 2010 –

one quarter of our growth

Continuing momentum in 2011 |

23

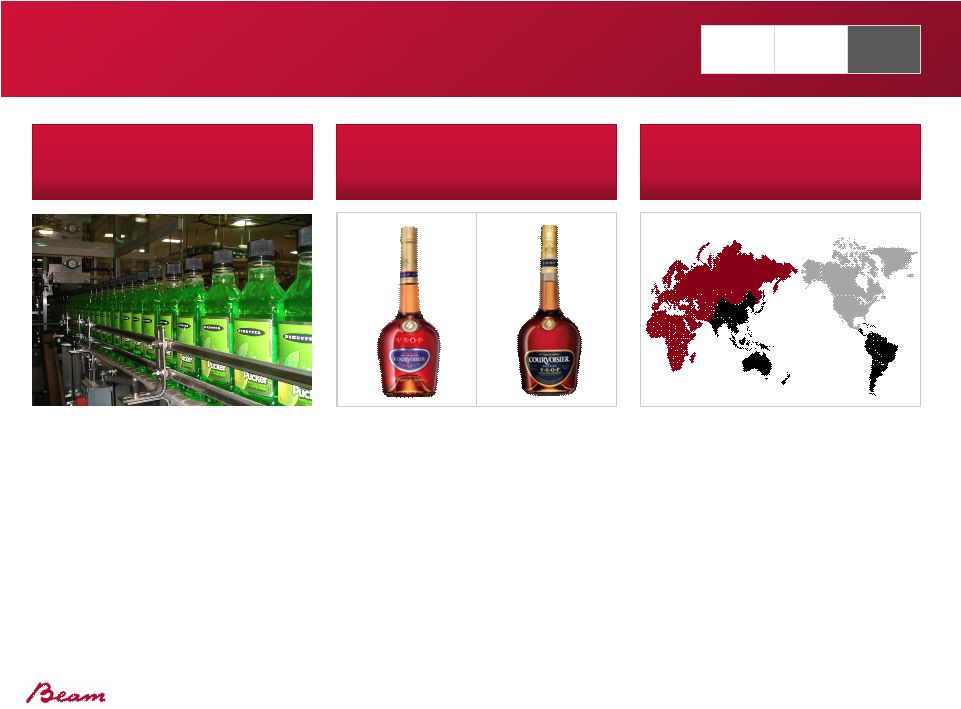

High-Return Acquisitions Enhance

Beam’s Portfolio

•

Bolt-on acquisitions have enhanced shareholder value

-

Disciplined investment in fast growing categories and segments

-

Leverage from brand building, route to market, and supply chain

2008

2009

2010

2011

Creating

Famous

Brands

Building

Winning

Markets

Fueling

Our

Growth |

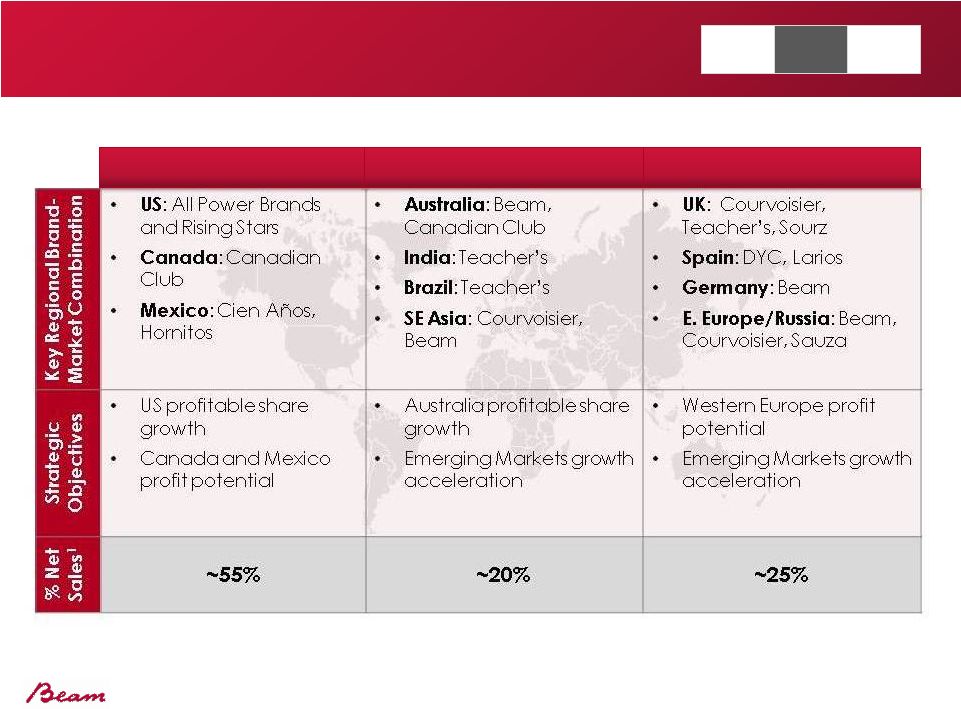

24

Building

Winning

Markets:

Three

Regions

Positioned To Deliver Sustained Profitable Growth

North America

North America

Asia Pacific / South America

Asia Pacific / South America

Europe / Middle East / Africa

Europe / Middle East / Africa

Creating

Famous

Brands

Building

Winning

Markets

Fueling

Our

Growth

(1)

Percent of sales based on net sales excluding excise tax

|

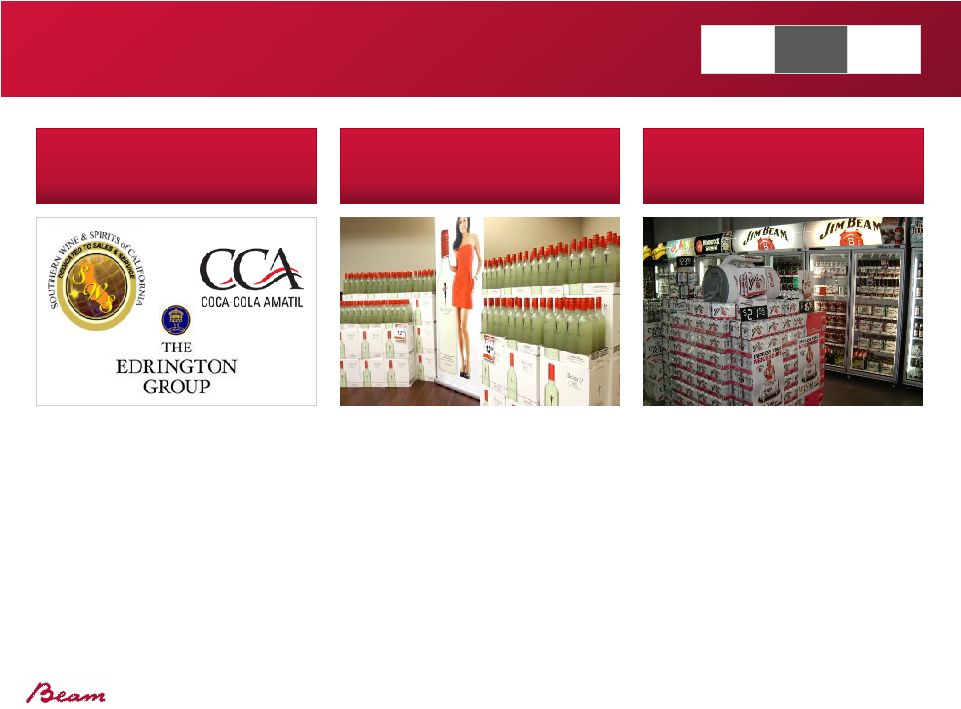

25

Our Winning Markets Strategy Is Supported

By Three Core Capabilities

Local Consumer

Activation

Local Consumer

Activation

•

Market-specific brand

activation

•

Consumer insight/media

planning

Strategic Distribution

Partnerships

Strategic Distribution

Partnerships

•

Performance-based

contracts

•

Amplify our scale

Enhanced Customer

Relationships

Enhanced Customer

Relationships

•

Closer to customers and

consumers

•

Account and category

management capability

Creating

Famous

Brands

Building

Winning

Markets

Fueling

Our

Growth |

26

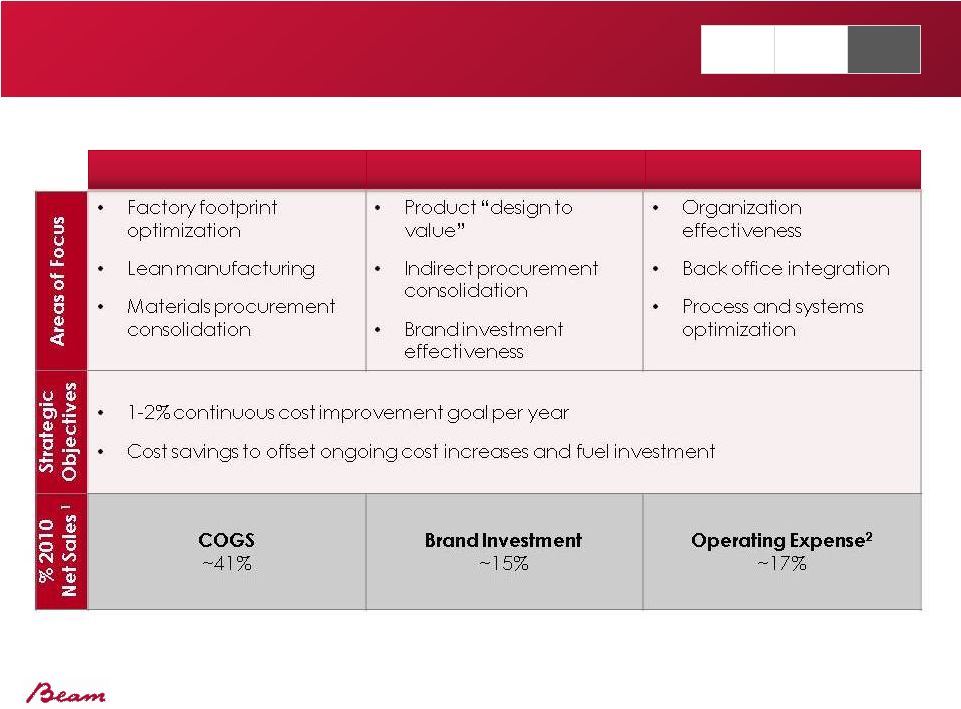

Fueling

Our

Growth

Through

Disciplined

Cost Management

Supply Chain

Supply Chain

Sales & Marketing

Sales & Marketing

Corporate Office

Corporate Office

Creating

Famous

Brands

Building

Winning

Markets

Fueling

Our

Growth

(1)

% of sales based on net sales excluding excise tax

(2)

Includes pro forma public company costs of ~$35MM |

27

Three Levers That Help Sustain High Margins

And Drive Brand Investment

Manufacturing

Optimization

Manufacturing

Optimization

Design To Value

Design To Value

Organization

Effectiveness

Organization

Effectiveness

Bottling Consolidation

•

Closing Cincinnati plant;

insourcing volume

•

Reducing overhead,

improving logistics, and

leveraging scale

Product Changes

•

Liquid and packaging

specifications

•

Reduced direct costs/

working capital without

sacrificing quality

Regional Realignment

•

Five regions down to

three; corporate

functions streamlined

•

10% workforce reduction

since 2009

Creating

Famous

Brands

Building

Winning

Markets

Fueling

Our

Growth |

28

Beam Is A Pure-Play Spirits Industry Leader With Compelling

Growth Prospects

1.

Leader With The Scale And Agility To Outperform

2.

Strong Positions In An Attractive Industry

3.

Focused Strategy And Investments

4.

Driving Momentum In The Marketplace

5.

Primed To Deliver Long-Term Shareholder Value |

29

Expanding Power Brands In Core Markets

•

Grow loyalty

•

Expand usage

•

Leverage innovation

Result:

•

Expect to surpass 1MM US

cases in 2011

•

Sustained double-digit growth

•

Impact

Hot Brand

Maker’s Mark -

US

Maker’s Mark -

US

Source: IMPACT, internal analysis |

30

Expanding Power Brands In Core Markets

Jim Beam -

Germany

Jim Beam -

Germany

•

Communicate quality

•

Access consumer passions

•

Drive trial

Result:

•

#1 whiskey in Germany

•

Double-digit sales growth YTD

•

~350,000 consumers took

“Taste Challenge”; 70%+

preference for Jim Beam

Source: Nielsen, internal analysis |

31

•

Win in premium Tequila

•

Drive awareness

•

Engage consumers

Result:

•

Double-digit increase in shipments

•

9 point increase in awareness

among target

•

24% sales growth in Plata Tequila

•

Double-digit growth in velocity

Turning Rising Stars Into Power Brands

Hornitos -

US

Hornitos -

US

Source: Nielsen, Internal analysis |

32

Driving Growth Through Innovation

Canadian Club RTD -

Australia

Canadian Club RTD -

Australia

•

Brand renovation

•

Recruitment

•

New usage

Result:

•

Fastest growing RTD in Australia

•

CC RTD up +80% YTD vs. LY

•

CC brand on track to becoming

1M RTD case brand in 2012

Source: Aztec, internal analysis |

33

Seeding Power Brands In Emerging Markets

Teacher’s -

India

Teacher’s -

India

•

Enhance premium image

•

Recruitment

•

Improve mix

Result:

•

Sales up 32% in 2010

•

In 2010, surpassed Johnnie

Walker as the #1 Scotch in India

•

35% share of Scotch category in

India; 45% share in Delhi

Source: Nielsen, Internal analysis |

34

Skinnygirl

Skinnygirl

Leveraging Bolt-On Acquisitions

•

Increase distribution

•

Grow penetration

•

Expand offering

Result:

•

Distribution up ~80 points

since the acquisition¹

•

Fastest growing spirits brand in

the US

•

#1 brand in dollar sales gains in

last 13 weeks

(1)

Based on %ACV distribution where legal for full proof spirits

Source: Nielsen, internal analysis |

35

Beam Is A Pure-Play Spirits Industry Leader With Compelling

Growth Prospects

1.

Leader With The Scale And Agility To Outperform

2.

Strong Positions In An Attractive Industry

3.

Focused Strategy And Investments

4.

Driving Momentum In The Marketplace

5.

Primed To Deliver Long-Term Shareholder Value |

36

Our Strategic Investments Position Us To Create Sustained

Shareholder Value

2010 Base

1

Long-Term Goal

$2.7B

Outperform our

low-to-mid single-digit market

$552MM

Grow faster than sales

$1.92

High-single-digit rate

2

>100%

90%+

7% / 24%

Double-digit / High-twenties

Sales

Operating Income

Diluted EPS

Earnings-to-Free-Cash-Flow

Conversion Rate

3

ROIC /

ROIC ex. Intangibles

(1)

Adjusted pro forma –

see appendix for GAAP reconciliations

(2)

Achievable without benefit of acquisitions

(3)

Defined as the quantity cash flow from operations less net capital expenditures

divided by net income |

37

Our Long-Term Profit Algorithm Is Driven By Sustainable,

Profitable, Top-Line Growth

Targeting broad, sustainable, top-line growth driven by our strategic

priorities

•

~50% of growth from Power Brands and Rising Stars in Core Markets

•

~25% of growth from expanding Power Brands in Emerging Markets

•

~25% of growth from innovation

Sharply focused on operating income growth ahead of sales growth

•

Aggressive cost reduction to offset cost headwinds

•

Sustain strong brand investment levels as mid-teens % of sales

•

Leverage fixed costs

Focused on outperforming |

38

Long-Term Performance Will Be Underpinned By A Strong

Balance Sheet And Attractive Cash Flows

Attractive Cash

Generation

Attractive Cash

Generation

Strong and

Flexible

Balance Sheet

Strong and

Flexible

Balance Sheet

•

Strong capital structure at outset

•

Investment-grade credit rating target

•

Adjusted

pro

forma

net

debt

/

EBITDA

1

of

~2.5x

•

$750mm revolver capacity

•

EBITDA at 30%+ of net sales excluding excise tax

•

Capital expenditures (including cooperage) target of 5% of net

sales excluding excise tax

•

90%+ earnings conversion to free cash flow

Disciplined,

Return-Driven

Use of Cash

Disciplined,

Return-Driven

Use of Cash

•

First priority to fund highest return internal growth

•

Evaluate high-return acquisitions versus share repurchase

•

Attractive $0.76 dividend competitive with beverage peers

(1)

Targeted year-end 2011 ratio on trailing basis; see appendix for

reconciliation. |

39

Beam Is Positioned To Drive Strong, Profitable Long-Term Growth

Attractive

Attractive

Growth

Growth

Industry

Industry

#4 Global

#4 Global

Player

Player

Driving Growth

Driving Growth

Through

Through

Investment &

Investment &

Innovation

Innovation

Strategic

Strategic

Distribution

Distribution

Partnerships

Partnerships

Talented &

Talented &

Empowered

Empowered

Organization

Organization

10 of Top 100

10 of Top 100

Global Premium

Global Premium

Brands

Brands

Category &

Category &

Geographic

Geographic

Portfolio Strength

Portfolio Strength

Strong Growth,

Strong Growth,

Cash Flows,

Cash Flows,

& Financial

& Financial

Flexibility

Flexibility

Scale

with

Agility

Driving

Shareholder Value

Creation |

40

Primed To Accelerate Profitable Growth

Portfolio

Transformation

Enhanced

Routes To Market

2005-2007

2008-2009

Focused

Brand Investment

2010-2011

Accelerate

Profitable Growth

•

Sustain our marketplace momentum

•

Grow profit faster than sales

•

Continue our strong stewardship of capital

2012 |

VERSION 08/10/11

September 7, 2011

PRIMED TO ACCELERATE

PROFITABLE GROWTH |

42

Appendix

•

Page 43 –

Beam Fact sheet

•

Page 44 -

Note on Use of Non-GAAP Financial Information

•

Page 45 -

Notes to Adjusted Pro Forma Financial Information

•

Page 46 -

Reconciliation of Adjusted Pro Forma Operating Income

•

Page 47 -

Reconciliation of Adjusted Pro Forma Diluted EPS

•

Page 48 -

Reconciliation of Adjusted Pro Forma ROIC

•

Page 49 -

Reconciliation of Adjusted Pro Forma Net Debt / EBITDA

•

Page 50 -

Schedule of Supplemental Release of Additional Beam Inc.

Adjusted Pro Forma Financial Information |

Facts

about Beam Crafting the Spirits that Stir the World

Net

Sales

(1)

(2010,

includes

$571M

excise

taxes)

$2,666 million

Operating

Income

(1)

(2010,

$112M

depreciation

&

amortization)

$552 million

Earnings

Per

Share

(1)

(2010,

diluted)

$1.92

Earnings

Conversion

to

Free

Cash

Flow

(1)

(2010,

before

dividends)

>100%

Dividend

(2)

(6/30/11,

154.5M

actual

basic

shares

&

157.5M

diluted)

$0.76

Net

Debt

(6/30/11,

net

of

$287M

cash)

$3.6B

before

$1.7B

debt

reduction

(3)

Number of Associates

3,100 worldwide

Headquarters

Deerfield, Illinois

President & CEO / Chairman

Matt Shattock / David Mackay

Stock

(effective

Oct.

4,

2011

with

“when-issued”

trading

~Sept.

16,

2011)

Traded on the New York

Stock Exchange (ticker

symbol BEAM); S&P 500 Index and

the MSCI World Index

Who We Are:

Beam is a leader in the dynamic spirits industry…with a unique combination of

scale and agility…and a focused strategy…that position us well to

outperform and consistently deliver strong, profitable, long-term

growth. •

#4 premium spirits company in the world and #2 in the U.S.

•

3 regions:

o

North

America

(~55%

of

sales

(4)

)

•

EMEA

(~25%)

•

Asia

Pacific/Latin

America

(~20%)

•

Global volumes: 33 million 9-liter cases

•

Portfolio includes 10

of the world’s top 100 premium spirits brands

o

Power

Brands:

Jim

Beam

bourbon,

Maker’s

Mark

bourbon,

Sauza

tequila,

Courvoisier

cognac, Canadian Club whisky,

Teacher’s scotch

o

Rising

Star

brands:

Skinnygirl

cocktails,

Laphroaig

single-malt

scotch,

Knob

Creek

bourbon,

Hornitos tequila, Cruzan rum, EFFEN vodka, Pucker Flavored Vodka, Sourz liqueur

o

Local

Jewels

include:

DeKuyper

cordials

(United

States)

,

Whisky

DYC

(Spain)

,

Larios

gin

(Spain)

How We Compete:

We seek to outperform with a strategy focused on three simple strategic platforms

– •

Create Famous Brands •

Build Winning Markets •

Fuel Our Growth

Our Long-term Goals:

•

Outperform our global spirits market •

Grow operating income faster than sales

•

Grow EPS at high-single-digit rate •

Convert 90%+ earnings to free cash flow •

Achieve 10%+ ROIC

(1) Adjusted pro forma, see GAAP reconciliations.

(2) Indicated annual rate.

(3) Assumed resulting from separation plan.

(4) Excluding excise taxes.

43 |

44

Note on Use of Non-GAAP Financial Information

This

presentation

includes

measures

not

derived

in

accordance

with

generally

accepted

accounting

principles

(“GAAP”),

such

as

adjusted

pro

forma

diluted

earnings

per

share,

adjusted

pro

forma

operating

income,

adjusted

pro

forma

return

on

invested

capital

before

charges/gains

and

net

debt

/

EBITDA.

These

measures

should

not

be

considered

in

isolation

or

as

a

substitute

for

any

measure

derived

in

accordance

with

GAAP,

and

may

also

be

inconsistent

with

similar

measures

presented

by

other

companies.

Management

believes

that

these

measures

are

useful

to

investors

to

reflect

Beam’s

results

and

financial

position

as

a

stand-alone

public

company.

In

addition,

these

measures

provide

investors

with

helpful

supplemental

information

regarding

the

underlying

performance

of

Beam.

Reconciliation

of

these

measures

to

the

most

closely

comparable

GAAP

measures,

are

presented

in

the

following slides. |

45

Notes to Adjusted Pro Forma Financial Information

The

adjusted

pro

forma

information,

which

was

derived

from

Fortune

Brands,

Inc.

consolidated

financial

statements,

is

not

intended

to

represent

what

our

operating

income

and

Diluted

EPS

would

have

been

had

the

separation

transactions

occurred

on

the

dates

set

forth

below.

The

adjusted

pro

forma

information

should

not

be

considered

indicative

of

our

future

results

of

operations

as

an

independent

spirits

company.

Adjusted

pro

forma

is

defined

as

continuing

operations

results

before

charges/gains

adjusted

to

assume

that

Beam

Inc.

was

an

independent

business

as

of

the

beginning

of

2010,

including

the

impact

of

public

company

corporate

expense,

the

business’s

underlying

tax

rate,

and

the

benefit

of

the

debt

reduction

associated

with

the

separation

plan.

It

is

also

adjusted

for

the

one-time

startup

benefit

of

the

new

Australia

spirits

distribution

agreement.

More

specifically,

the

adjusted

pro

forma

information

gives

pro

forma

effect

to

the

following:

•

The

sale

of

the

Company’s

Golf

segment

and

spin-off

of

the

Company’s

Home

&

Security

segment

as

if

both

had

occurred

on

January

1,

2010.

•

The

assumed

reduction

of

$1.7

billion

of

debt

on

January

1,

2010

using

$1.6

billion

of

proceeds

related

to

the

Golf

segment

sale

and

Home

&

Security

spin-off.

The

Company

estimates

the

annualized

interest

expense

reduction

resulting

from

this

debt

reduction

will

be

approximately

$60

million

(and

includes

the

impact

of

the

expected

settlement

of

related

interest

rate

swaps).

•

The

elimination

of

charges/gains

associated

with

(i)

restructuring

and

other

charges,

(ii)

gains/losses

on

the

sales

of

brands

and

related

assets,

(iii)

and

income

tax

related

credits

related

to

the

resolution

of

foreign

and

US

income

tax

audit

examinations.

•

The

elimination

of

non-recurring

business

separation

costs

incurred

to

implement

the

proposed

separation

of

the

Company’s

three

businesses.

•

Adjustments

to

the

Company’s

corporate

office

cost

structure

that

are

expected

to

be

made

upon

completion

of

the

separation

transactions

as

if

they

had

occurred

on

January

1,

2010.

•

The

2011

impact

of

the

Company’s

one-time

benefit

under

the

new

distribution

agreement

in

Australia.

•

An

estimated

Beam

Inc.

standalone

effective

income

tax

rate

of

approximately

25

-

26%. |

46

Reconciliation of Adjusted Pro Forma Operating Income

(Unaudited)

(in millions)

Year ended

December 31,

June 30,

June 30,

March 31,

March 31,

December 31,

September 30,

2010

2011

2010

2011

2010

2010

2010

Adjusted Pro Forma Operating Income

$552.4

$139.1

$138.6

$118.1

$110.2

$166.4

$137.2

Home & Security spin-off

222.0

70.4

82.6

5.7

22.4

44.3

72.7

Spirits restructuring and other charges

(26.0)

(1.2)

(1.0)

(6.2)

(3.7)

(2.2)

(19.1)

Loss on sales of brands and related assets

(16.0)

-

-

-

-

(7.4)

(8.6)

Spirits Australian distribution agreement

-

-

-

23.7

-

-

-

Business separation costs

(2.3)

(10.3)

-

(9.5)

-

(2.3)

-

Standalone corporate office cost

(53.5)

(10.5)

(12.0)

(14.6)

(15.6)

(15.0)

(10.9)

Operating Income (GAAP)

(1)

$676.6

$187.5

$208.2

$117.2

$113.3

$183.8

$171.3

Depreciation and Amortization (GAAP)

$99.0

$26.0

$24.9

$25.9

$23.9

$25.1

$25.1

(1)

Amount

excludes

the

Company's

Golf

segment

which

is

included

in

discontinued

operations.

For the three month period ended |

47

Reconciliation of Adjusted Pro Forma Diluted EPS

(Unaudited)

Year ended

December 31,

June 30,

June 30,

March 31,

March 31,

December 31,

September 30,

2010

2011

2010

2011

2010

2010

2010

Adjusted Pro forma Diluted EPS from

Continuing Ops

$1.92

$0.50

$0.46

$0.41

$0.36

$0.64

$0.47

Home & Security spin-off

1.03

0.28

0.38

(0.01)

0.07

0.25

0.33

Spirits restructuring and other charges

(0.11)

-

(0.01)

(0.03)

(0.02)

(0.01)

(0.08)

Loss on sales of brands and related assets

(0.12)

-

-

-

-

(0.05)

(0.08)

Spirits Australian distribution agreement

-

-

-

0.09

-

-

-

Business separation costs

(0.01)

(0.05)

-

(0.05)

-

(0.01)

-

Standalone corporate office cost

(0.22)

(0.04)

(0.05)

(0.06)

(0.06)

(0.06)

(0.04)

Debt paydown from separation

transactions

(0.19)

(0.04)

(0.04)

(0.05)

(0.05)

(0.04)

(0.05)

Income tax related credits

0.54

-

0.44

0.01

-

0.04

0.06

Effective income tax rate adjustment

(0.04)

-

(0.01)

0.03

(0.01)

(0.07)

0.04

Diluted EPS from Continuing Ops

(GAAP)

(1)

$2.80

$0.65

$1.17

$0.34

$0.29

$0.69

$0.65

(1)

Amount

excludes

the

Company's

Golf

segment

which

is

included

in

discontinued

operations.

Discontinued

operations

for

Golf

include

an

allocation

of

Fortune

Brands'

interest

expense

of

approximately

$11

million

annually.

For the three month period ended |

48

Reconciliation of Adjusted Pro Forma Return On Invested Capital (ROIC)

December 31, 2010

(unaudited)

ROIC based on GAAP Net Income attributable to Fortune Brands (1)

7%

Impact of pro forma and other adjustments

-

ROIC based on Adjusted Pro Forma Net Income (1) (2)

7%

Impact of excluding intangibles

17%

ROIC based on Adjusted Pro Forma Net Income (excluding intangibles) (1) (2)

24%

(1) ROIC is Net Income plus after-tax interest expense divided by GAAP Average Invested

Capital, which is defined as net debt (total debt less

cash) plus stockholders' equity, averaged for the periods ended

December 31, 2010 and 2009.

(2) Non-GAAP Adjusted Pro Forma Net Income and Adjusted Pro Forma Average Invested

Capital is Net Income and Average Invested

Capital, respectively, adjusted for the items described in the

Notes to the Pro Forma Financial Information slide

above. |

49

Reconciliation of Adjusted Pro Forma Net Debt / EBITDA

Year-ended

December 31,

2011

Targeted Adjusted pro forma net debt/EBITDA (1)

~2.5x

Impact of standalone corporate office cost and Australia distribution agreement

~ -

Impact of using EBITDA rather than GAAP operating cash flow

~1.5

Impact of using net debt rather than GAAP total debt (2)

~0.5

Targeted GAAP Beam debt/operating cash flow

~4.5x

(1) See the Notes to Adjusted Pro Forma Financial Information in the table above for

information related to pro forma

adjustments. (2) Net debt equals total debt less cash.

|

50

Schedule of Supplemental Release of Additional Beam Inc.

Adjusted Pro Forma Financial Information

With

Third

Quarter

Earnings

Release

in

Early

November

2011:

•

Quarterly sales, COGS, brand investment and operating expenses

1Q10 through 3Q11 as well as September YTD 2011 and 2010

•

Balance sheets: Sept. 30, 2011 and prior year as well as Dec. 31, 2010

With

Fourth

Quarter

Earnings

Release

in

Early

February

2012:

•

Full year and quarterly full income statement as well as regional

segment sales and operating income |