Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Fortune Brands Home & Security, Inc. | d8k.htm |

Fortune Brands Home and Security

Investor Presentation

September 2011

Exhibit 99.1 |

2

Disclaimer

Please note that the information included in this presentation contains

statements relating to future results, which are forward-looking

statements. We caution you that these forward-looking statements

speak only as of the date hereof, and we have no obligation to update

them. Actual results may differ materially from those projected as a

result of certain risks and uncertainties, including the risks described in

our Registration Statement on Form 10, as amended. There can be no

assurance that the spin-off of Fortune Brands Home & Security, Inc. will

be completed as anticipated or at all. |

3

Distribution Date

Distributing Company

Transaction Overview

Distributed Company

Distributed Securities

Dividend Policy

Fortune Brands, Inc. (NYSE: FO), to be renamed Beam Inc. (NYSE: BEAM) after

distribution Fortune Brands Home & Security, Inc. (NYSE: FBHS)

100% of outstanding shares of Fortune Brands Home & Security common

stock Distribution Ratio

One

share

of

Fortune

Brands

Home

&

Security

common

stock

for

one

share

of Fortune Brands common stock

Recapitalization of

FBHS / Dividend to FO

Initially,

Fortune

Brands

Home

&

Security

does

not

intend

to

pay

a

dividend

on

its

common

stock

Fortune Brands Home & Security has entered into a $1.0 billion of credit

facility and will dividend $500 million to Fortune Brands prior to

spin-off Fortune Brands Home & Security is expected to have

approximately $520 million of debt immediately following spin-off

Record Date

September 20, 2011

October 3, 2011 |

4

Today’s Presenters

Chris Klein

Chief Executive Officer

Lee Wyatt

Chief Financial Officer |

5

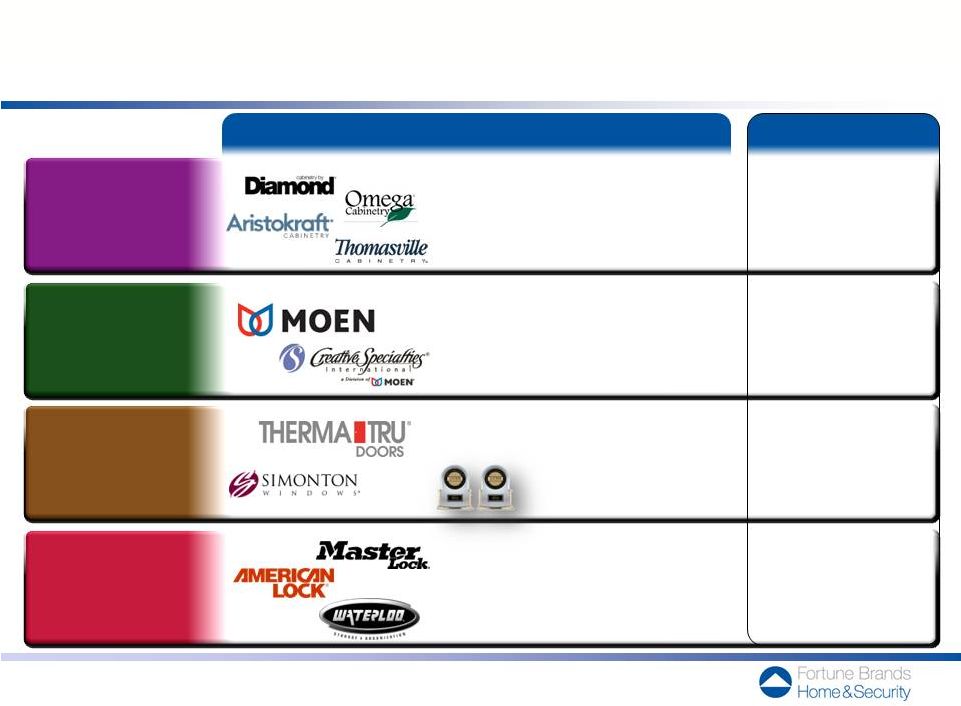

FBHS has multiple brands that appeal to consumers and the

trade focused in home products, security and storage.

Our Partners

Our Brands |

6

Our Mission

At Fortune Brands Home & Security, our

Mission is to create products

and services that help fulfill

the dreams of homeowners

and help people feel more secure |

7

Winning New

Business

Expanding in

Adjacent Categories

and

International Markets

Using Cash Flow

to Maximize

Shareholder Value

An Outperforming Industry Leader Well-Positioned

to Accelerate Growth and Create Value

Attractive Home

& Security Product

Categories & Positions

Consumer

& Customer Focus

Operational

& Management

Excellence

Demonstrated Ability

to Outperform

the Market

Benefits of

Being Independent

Strong Cash Flow

& Flexible Capital

Structure

Front-end of

Housing Market

Recovery

Consistent, Focused

Strategy & Execution

Benefits & Timing

of Spin-off

Exceptional Growth

& Value Creation

Opportunities |

8

An Outperforming Industry Leader Well-Positioned

to Accelerate Growth and Create Value

Attractive Home

& Security Product

Categories & Positions

Consumer

& Customer Focus

Operational

& Management

Excellence

Demonstrated Ability

to Outperform

the Market |

9

FBHS has a strong foundation built on systematic innovation, strong brands,

excellent customer service and balanced channels of distribution. We believe

this foundation can be leveraged to create attractive growth and

returns.

Solid Business Foundation

Strong branding opportunities

–

To consumer and/or to trade

–

Underpins channel strength

Strong

innovation

opportunities

–

Functionality

–

Fashion/finish

–

Material conversion

Excellent customer service

Balance

across

end

markets

–

New Construction and Repair & Remodel

–

Retail and Wholesale

…

and Opportunities

for Leveraged Returns

Operating leverage

—

Scale efficiencies

and global supply chains

Complexity

—

Ability to add value and/or service

Strong channel mix

—

Ability to deliver products/services

across a balance of channels

Growth opportunities

—

Share gains, substantial adjacency

opportunities and potential

add-on acquisitions |

10

Brand Leadership

Position

Leading Brands and Differentiated Positions in Each Category

Fully integrated platform,

poised to leverage scale

across multiple brands,

channels and price points

Powerful engine

for consistent growth

and profitability

Leaders poised

to leverage the

market recovery

Exceptional brand with

growth potential well

beyond padlocks;

more stable market not

tied to housing cycle

Kitchen & bath

cabinet manufacturer

in North America

Faucet brand

in North America

Fiberglass residential

entry door brand in U.S.

Padlock brand

in North America

#1

#1

#1

#1

Winner of two consumer

and five builder awards

from JD Power

Kitchen

& Bath

Cabinetry

Plumbing

&

Accessories

Advanced Material

Windows & Door

Systems

Security

&

Storage |

11

Channel Positioning

Deep and Broad Channel Strength

Specialized distribution for

specific channel/customer needs

Broad channel presence across

price points and demographics

Provides distinct value to retail chains

Deep builder relationships

Halo effect on wholesale channel

Global momentum

in key international markets

Exclusive arrangements

with strong two-step distributors

Strong trade brand fosters loyal

distributor/customer relationships

Considerable strength in locksmith channel

Widespread distribution across retail channels

Commercial market / Channel momentum

Home

centers

Dealers

&

Showrooms

Wholesale

2-Step

Other

Retail

Builders

Kitchen

& Bath

Cabinetry

Plumbing

&

Accessories

Advanced Material

Windows & Door

Systems

Security

&

Storage |

12

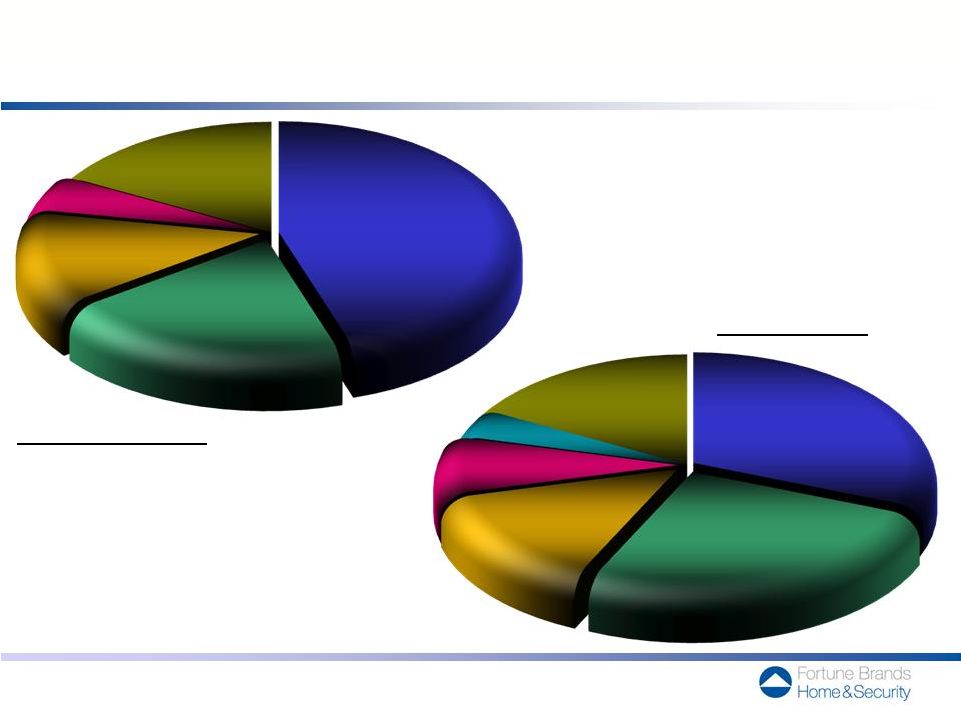

Well-Balanced Business Mix

by

End

Market*

by

Channel*

* Source: Company internal estimates for year ended December 31, 2010

Repair & Remodel

45%

New Construction

20%

Security & Storage

13%

Commercial

5%

International

17%

Wholesale

31%

Home Centers

26%

Dealer

14%

Other Retail 8%

International

17%

Builder Direct

4% |

13

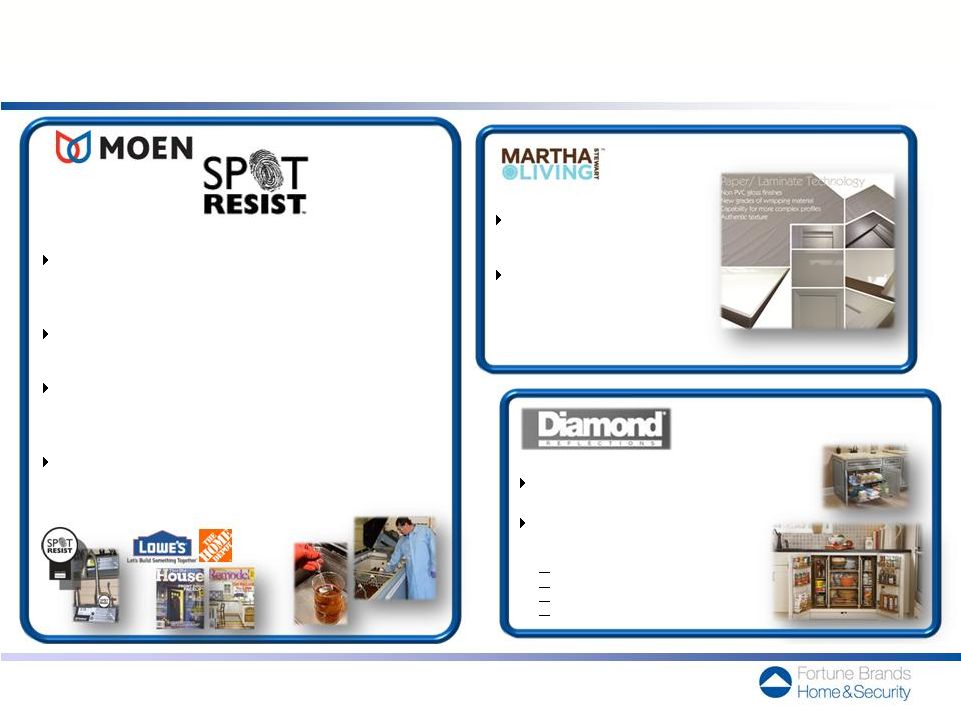

Consumer Driven Innovation has led to Consistently Winning

Profitable New Business

Track

Record

of

Leading

New

Product

Launches

across

all

Business

Segments

Vented Sidelites

New

Glass

Styles

Electronics Storage

Speed

Dial

Padlocks

Adding value for customers

and winning new business

Martha Stewart Living

cabinetry introduced at all

US and Canadian Home Depot

stores in 2010

In-stock cabinetry at Lowe’s

rolling out in 2011

Moen expanding in home

centers and mass retail

with new products

Waterloo rolling out Husky

Garage Organization at all US

Home Depot stores in 2011

23% of 2010 sales came from

products introduced

in the last three years

Kitchen

& Bath

Cabinetry

Plumbing

&

Accessories

Advanced Material

Windows & Door

Systems

Security

&

Storage |

14

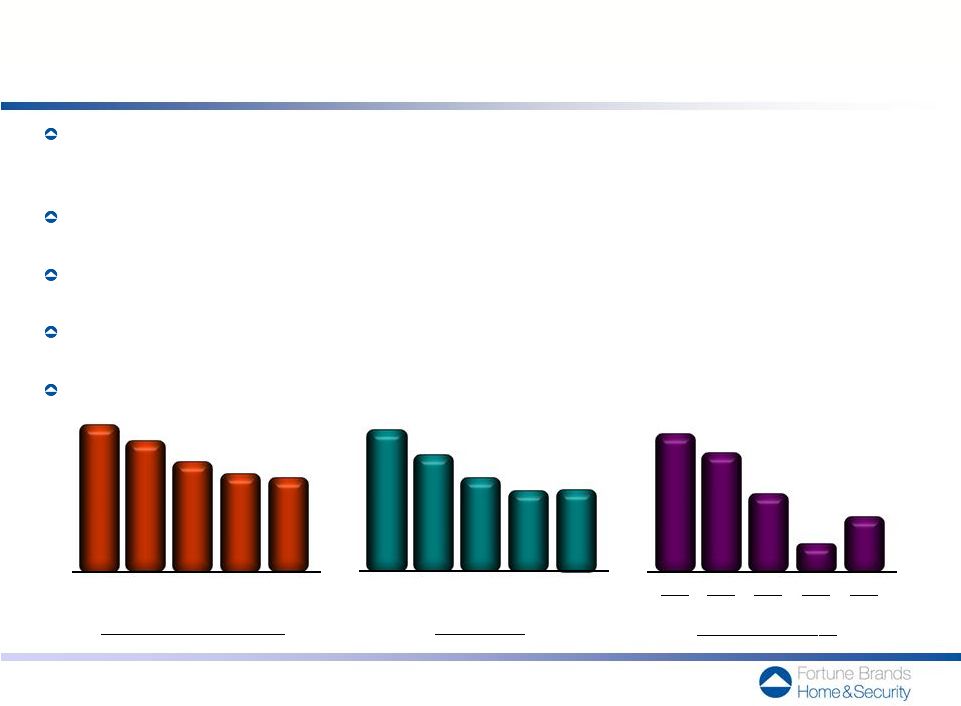

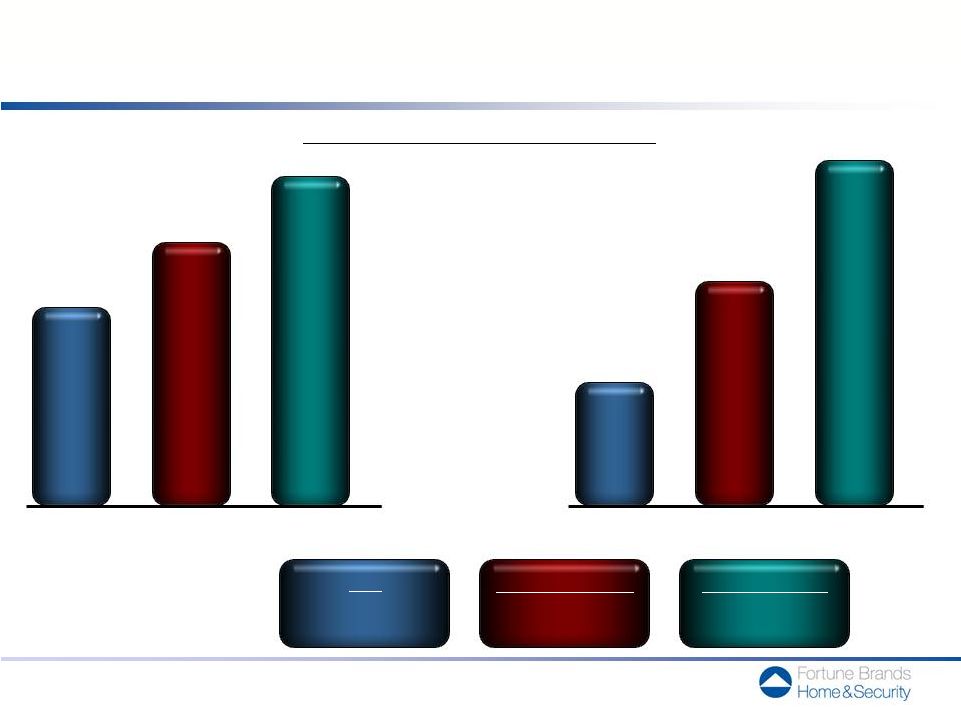

Efficient and Scalable Supply Chain / Infrastructure

Substantially improved cost structures by proactively reducing footprint nearly 40%

between 2006 –

2009 and creating more flexible supply chains

Increased productivity through continuous improvement investments

Maintaining capacity to ramp up with industry-leading service levels and lead

times Well-positioned to accelerate earnings growth as volumes grow

Can support revenue of up to $5B without capital spending above normal levels

Headcount

(000’s)

Operating Margin

Manufacturing Facilities

Sales:

1 -

Adjusted Pro Forma: before Charges / Gains, including incremental standalone

corporate expenses. 2006

2007

2008

2009

2010

2006

2007

2008

2009

2010

2006

2007

2008

2009

2010

$4.7B

$4.6B

$3.8B

$3.0B

$3.2B

27.7

64

56

47

41

40

22.8

18.4

15.8

16.1

14.2%

12.1%

8.0%

2.7%

5.6%

1 |

15

Proven Management Team Driving Continued Growth

–

Powerful Combination of Operational & Strategic Leadership

Corporate, Stategic & Financial Leadership

Operating Management

Chris Klein

CEO

Lee Wyatt

CFO

8 years

with

Fortune

Brands

including

~

3

years

with

FBHS

and

5+

years

leading

Strategy

&

Corporate

Development

at Fortune Brands; previously a Partner at McKinsey & Co. and EVP at Bank

One Recruited as CFO of FBHS; previously CFO of Hanesbrands and led

spin-off from Sara Lee, CFO at $7B Sonic Automotive and CFO of

Sealy Greg Stoner

President –

MBCI

7 years with FBHS; previously 11 years with Newell Rubbermaid and 9 years with

GE; drove rationalization efforts through the downturn in 2009; managed

MBCI as it became the #1 cabinet manufacturer in North America in

2011 David Lingafelter

President –

Moen

21 years with FBHS; managed transition from engineering-driven

to consumer-driven organization, leading marketing, brand investments

and new product development processes

David Randich

President –

Therma-Tru

Mark Savan

President –

Simonton

4 years with FBHS; previously 24 years with Armstrong; repositioned business

during downturn through channel diversification and restructuring of global

supply chain 11 years with FBHS; previously 6 years with Booz Allen; led

Simonton’s transition from a building products-focused to a

consumer-focused organization John Heppner

President –

Master Lock

& CEO –

FOSS

18 years with FBHS; grew Master Lock market share

while repositioning Waterloo

Kitchen

& Bath

Cabinetry

Plumbing

&

Accessories

Advanced Material

Windows & Door

Systems

Security

&

Storage |

16

Demonstrated growth that has exceeded the market over extended

period of time and through multiple cycles. Sales performance reflects

both organic growth and acquisitions

includes housing recessions of ‘90-’91, ‘94-’96,

‘00-’01, ‘06-’11 Sales Growth Rate

1989 2011 Projected FBHS

Organic Sales* U.S. Home Products Market

New Construction and

Replace & Remodel

FBHS

GAAP Sales

* Excludes impact from acquisitions and divestitures

4%

9%

~2%

|

17

An Outperforming Industry Leader Well-Positioned

to Accelerate Growth and Create Value

Attractive Home

& Security Product

Categories & Positions

Consumer

& Customer Focus

Operational

& Management

Excellence

Demonstrated Ability

to Outperform

the Market

Benefits of

Being Independent

Strong Cash Flow

& Flexible Capital

Structure

Front-end of

Housing Market

Recovery

+ |

18

Benefits of Being Independent

Clearer focus and alignment

on Home & Security priorities enables more nimble response

to growth and capital investment opportunities

Strong balance sheet and flexible capital structure

aligned to the needs of a growth company

Business unit performance

and management incentive

structure more tightly linked to overall company performance

“Pure

play”

equity

may

be

more

attractive

to

investors

who want to participate in the home market recovery |

19

Opportune Timing of the Spin-off Ahead of Expected

Housing Market Recovery

Long-Term Home Market Drivers

Factors

that

Enable

Recovery

Positive population

and immigration growth

Increased levels of household

formation driven by demographics

Favorable housing affordability

Aging housing stock

(average of 40 years),

particularly homes >12 years

Increasing existing home sales

New

Construction

Repair

&

Remodel

Improvements in the

broader economy

and employment

–

at the local market level

Credit availability

Stability in home prices

Improving consumer

confidence |

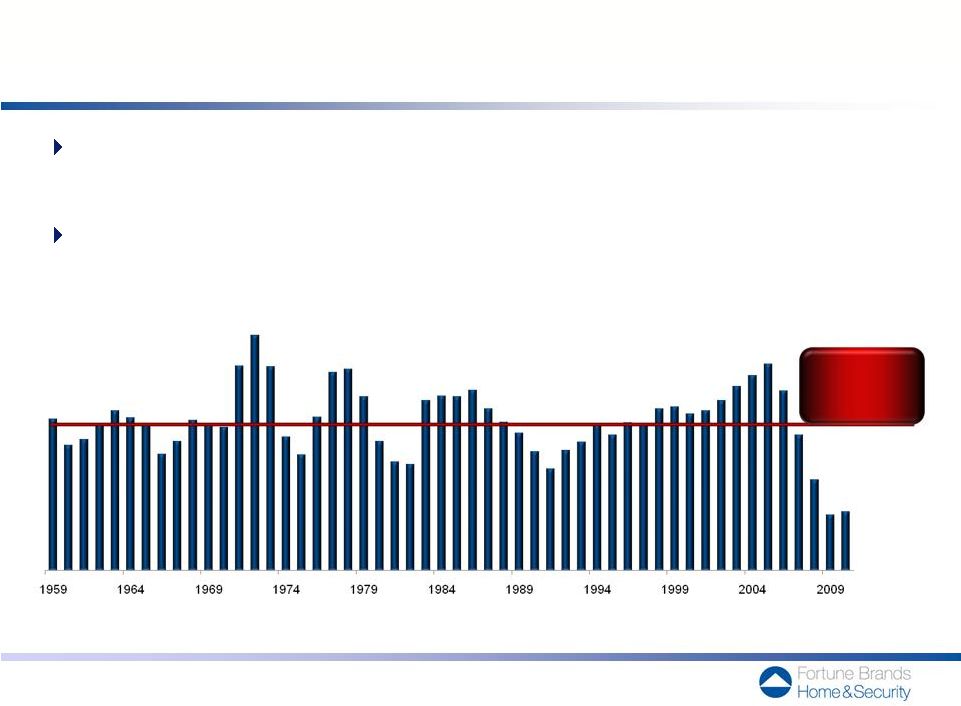

20

1959 –

2010

average:

1,497,000 starts

Long-Term Market Trends Point Towards

an Eventual Recovery in New Housing Starts

New housing starts are at a historically low level,

with just 587,000 starts in 2010

The long-term average, as well as demographic trends,

suggest a recovery is likely

Annual New Housing Starts

Source: US Census Bureau. Data reflects single and multi-family housing

starts. |

21

Winning New

Business

Expanding in

Adjacent Categories

and

International Markets

Using Cash Flow

to Maximize

Shareholder Value

An Outperforming Industry Leader Well-Positioned

to Accelerate Growth and Create Value

Attractive Home

& Security Product

Categories & Positions

Consumer

& Customer Focus

Operational

& Management

Excellence

Demonstrated Ability

to Outperform

the Market

Benefits of

Being Independent

Strong Cash Flow

& Flexible Capital

Structure

Front-end of

Housing Market

Recovery

Consistent, Focused

Strategy & Execution

Benefits & Timing

of Spin-off

Exceptional Growth

& Value Creation

Opportunities |

22

Consumers have a latent need

to maximize functional storage space

MBCI has launched hundreds

of practical functional solutions fitting

many different consumer needs

Physical challenges

Organomics / Ergonomics

Occupying the valuable toe-kick space

High density storage of "Super Cab"

Differentiation is an

aspiration for consumers

By engaging advanced

technology and High-Tech

Materials, we are able to

bring fashionable color to

consumers at an affordable price

Started with the key insight that Consumers want

faucets that are easier to clean and don’t show

water spots or fingerprints

Moen developed an innovative new finish that virtually

eliminates water spotting and finger printing

Moen activated the market using a broad range

of traditional media, on-line techniques and strong

in-store point of purchase support from our partners

The

new

finish

increased

sell

through

by

10%

-

25%

generating significant increases for Moen and our key

partners

Our Systematic, Consumer Driven Innovation Processes Result

in New Products Consumers Love

Purestyle Technologies

Logix Storage & Organization |

23

International

Markets

In Addition to Winning New Business, Potential for Expansion

in Adjacent Categories and International Markets

(Examples)

Commercial

China

India

Europe

Automotive

Latin America

Bath

Accessories

Sinks

Commercial

Safety

Electronic Security

Storage Security

Bath Vanities

China

$25B

$25B

$7B

China

Market

Opportunity

Adjacent

Categories

1

2

3

1 – N. America & China Residential & Commercial Fashion Plumbing Market includes fixtures

(bathtub/shower, toilets, sinks, other) and fittings (lavatory, bathtub/shower, kitchen/other

sink, other) ; source – Freedonia, company analysis 2 – North American Security Products (mechanical & electronic access control) and Services;

source – Freedonia, company analysis

3 – US Residential Wood Kitchen and Bath Cabinet Market; source – Freedonia, company

analysis |

24

We will use Cash Flow to Maximize Shareholder Value

in Multiple Ways

Continue to invest in current businesses

–

products, markets, brands, supply chains

Pay down debt

Pursue accretive acquisitions or return cash to

shareholders

–

share buybacks or dividends |

25

Target Criteria

Illustrative Past Acquisitions

Fit within our market

Primary focus

Ability to leverage existing

Good companies to be made

New home & security

Truly differentiated leader

with a capable management team

Clear path for organic growth

Acquisition Opportunities Can Accelerate Growth

in Both Home and Security Markets

What We Acquired:

Strong commercial brand

Heavy-duty commercial products

What We Did:

Leveraged combined strengths to

Maintained market facing teams

Fully integrated supply chain

What We Acquired:

Position in higher-end of dealer channel

Custom kitchen products and capabilities

What We Did:

Leveraged brand across broader dealer channel

Maintained market facing teams

Fully integrated supply chain & back office

What We Acquired:

Strong trade brand

#1 position in U.S. fiberglass

What We Did:

Grew in R&R market

Streamlined supply chain

Increased productivity

solidify #1 padlock share in N.A.

& back office

residential entry doors

attractiveness criteria

on core categories

capabilities, market positions

and structure

great, not turnarounds

categories under two conditions: |

26

Security Market Offers Attractive Opportunities for Growth

Growing ~$25B North American Security

market

Historically stable demand

in core padlock market segment

Technology is an enabler to solve

security issues that customers value

Exploring opportunities in Electronic

Access control and monitoring

Unparalleled brand and channel

strength, particularly with distributors

and locksmiths

Existing commercial channel market

position

Solution focused innovation to meet

unmet security needs

Master Lock

has Strong Assets to Leverage

The Security Market is Attractive |

27

FBHS Corporate Governance Structure is consistent with Fortune

Brands but supplemented with additional defenses to protect new

company

Board of Directors

•

Initially 7 members (6 independent from Fortune Brands plus Chris Klein)

•

David Thomas –

non-executive chairman

Auditors

•

External auditors –

PriceWaterhouseCoopers

•

Internal audit function and people transferring from Fortune Brands

Structural Defenses

•

Shareholder

rights

plan

–

one

year

plan

with

a

15%

trigger

•

Other appropriate protections such as classified board, no cumulative

voting, no shareholder right to call for special meetings or remove

directors other than for cause and advance notice of director

nominations |

28

Confidence in the Fortune Brands Home & Security Opportunity

Strong belief in our strong brands and attractive categories

Well positioned, having restructured early and made substantial

strategic investments in long-term growth

Strong historical performance versus market and demonstrated operating

leverage in 2010, off the 2009 low

Long-term demographics in place to drive eventual housing market recovery

|

29

While the housing market slump has significantly reduced sales and

profit, we believe the business is positioned to return to previous

levels when the housing market recovers

$ millions

* Adjusted Pro Forma: before Charges / Gains, including incremental standalone

corporate expenses. Net Sales

$4,694

$4,551

$3,759

$3,007

$3,234

% Growth

13%

(3%)

(17%)

(20%)

8%

Operating Income*

$668

$553

$301

$81

$180

% Operating Margin*

14%

12%

8%

3%

6%

EBITDA*

$816

$703

$435

$195

$288

% EBITDA Margin*

17%

15%

12%

6%

9%

Unlevered Free Cash Flow*

$464

$393

$325

$280

$146

Fiscal Year ending December 31

2006

2007

2008

2009

2010

adjusted Pro Forma |

30

2011 First-half results reflect overall market decline, negative impact of 2010

home buyers credit and commodity inflation, but FBHS continued to invest in the

business and out-perform the market. Second-half expectations assume a

flat market and negative impact of 2010 energy credit, but FBHS expects to

continue to benefit from price increases, invest in the business and out-perform the market

*Assumes second half improvement in consumer confidence and overall

employment. Market

Market declined -

Assuming Market flat* -

FBHS Sales

FBHS grew 2%

We believe FBHS could grow

mid-single digits

Prior Year

New home buyer credit

Energy credit

benefited 2010

benefited 2010

Commodity Inflation

Higher costs;

Higher costs;

price increases initiated

price increases in place

Investment in Business

FBHS continued to invest

FBHS continues to invest

Competitive Promotions

Heavy in cabinets

On-going

Operating Costs

Continued cost reductions

Continuing cost reductions

1

Half

2011

Observations

2

Half

2011

Expectations

st

nd |

31

Flexible capital structure following spin-off with strong balance sheet and cash

flow to fuel growth opportunities. Bank financing in place with strong bank

leadership group.

1.

Peer leverage metrics per Moody’s.

2.

Peers include Armstrong, Lennox, Masco, Mohawk, Owens Corning, Stanley Black &

Decker and Whirlpool. 3.

Adjusted

Pro

Forma:

before

Charges/

Gains,

including

incremental

standalone

corporate

expenses.

4.

As disclosed in Form 10

$ millions

~3.9x

1.8x

Peer Average

2

Debt-to-Capita

Barclays

Citibank

Credit Suisse

Wells Fargo

JPMorgan

Bank of America

Spin-off Capital Structure:

Term Loans

$350

Revolver ($650 facility)

150

Subsidiary Debt

20

Total Long-Term Debt

$520

Total Debt

520

Liabilities

1,083

Equity

2,107

2010 EBITDA

3

288

2010

Unlevered

Free

Cash

Flow³

146

Assets

$3,710

Balance Sheet Statistics:

(12/31/10 pro forma

4

)

Peer Debt/EBITDA Benchmarking

1

Strong Bank Leadership Group

3

3

20%

~ |

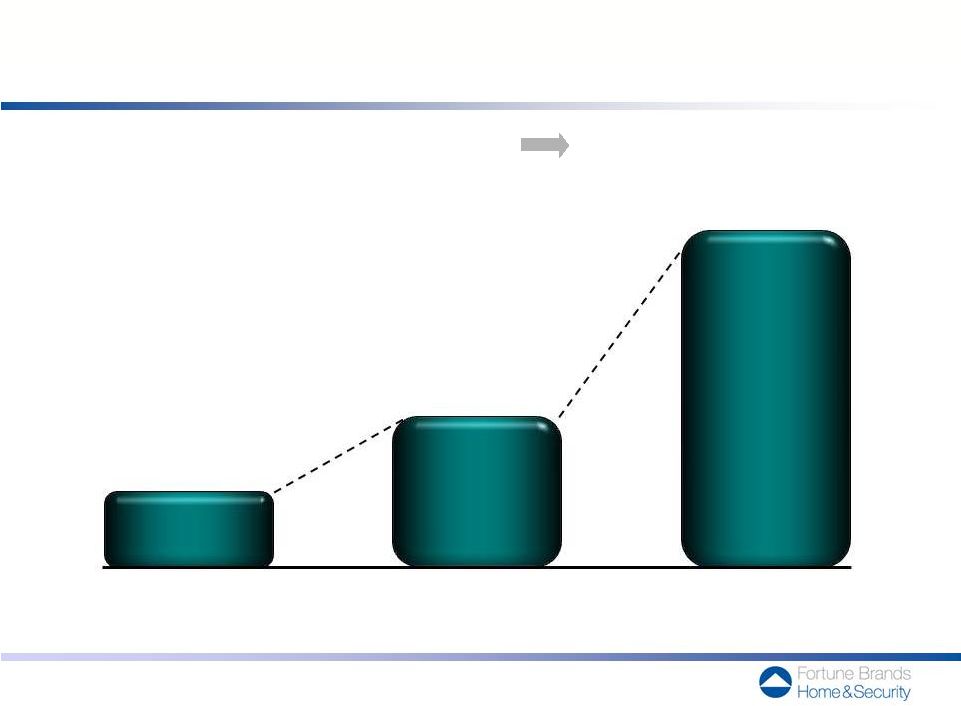

32

Our success is not dependent on rapid market recovery

for solid returns and cash flow, although returning

to “steady state”

is very attractive

Market Recovery Scenarios

Operating Income

$200

$450

$750

Sales

annual $ in B

$3

$4

$5

EBITDA

annual $ in M

$300

$550

$850

flat

~600,000

~0%

mid-recovery

~1,000,000

~2 –

3%

steady state

~1,500,000

~4 –

6%

Housing Starts

R&R Growth

1

1.

Adjusted Pro Forma: before Charges/ Gains, including incremental standalone corporate expenses. |

33

Ability to Leverage Our Business Model as the Market Recovers

Efficient supply chains allow us to profitably

serve a wide range of price points

Operations that support up to $5B in sales

without capital spending above normal levels

Industry leading brands can be leveraged

for both organic and acquisition growth

Leadership market positions to introduce new products

Proven management team can drive additional growth

Acquisition and integration experience

Invest in business growth

Fund acquisitions or return cash to shareholders

Brands

/

Market

Position

Supply

Chains

Management

Capital

Structure

and

Cash

Flow |

Thank You

Any Questions? |

Appendix |

36

$1,189

Kitchen

&

Bath

Cabinetry

–

Fully

Integrated

Business,

Scalable

and

Poised to Leverage Across Multiple Brands, Channels and Price Points

Key Brands

Market Position Summary

Why We Win

$ millions

Notes:

Market size includes residential wood cabinets sold in US in 2010

Source: Freedonia

Differentiated brands across multiple

channels and price points

Broad participation across channels

Leading design and finish innovation

Leverage global supply chain

with local assembly model

2010 Sales

Market Size |

37

Plumbing

&

Accessories

–

The

Engine

that

Provides

Consistent

Growth and Profitability

Notes:

Market

size

reflects

global

faucets

and

accessories

as

of

Dec.

2010

Source: Freedonia

$ millions

Key Brands

Market Position Summary

Why We Win

Strong consumer and trade brand

Leading market position

Sustainable and flexible supply chain

Large installed base helps replace / repair

Consistent ability to innovate

$924

2010 Sales

Market Size |

Advanced Material Windows & Door Systems

–

Ready to Leverage the Market Recovery

Notes:

Market size -

US residential windows and doors in all materials as of Dec. 2010

Source: Freedonia, Ducker, FBHS analysis

$ millions

Key Brands

Market Position Summary

Why We Win

Strong market positions

Trusted trade brands

Restructured to profitably lever

with market recovery

2010 Sales

Market Size

$601

38 |

39

Security

&

Storage

–

Strong

Brand

with

Growth

Potential

Well

Beyond

Padlocks; More Stable Market not Tied to Housing Cycle

$ millions

Key Brands

Market Position Summary

Why We Win

Large market size and room for growth

Strong brand

Ability to extend across broader

security categories

Strong channel position across retail

and commercial segments

Solution focused innovation

$520

2010 Sales

Market Size

Notes:

Market

size

reflects

North

American

security

market

as of Dec. 2010

Source: Freedonia |

40

Supply Chain Characteristics

Differentiated and Focused Supply Chains

to Best Serve Our Customers

Customizable designs and cabinet

configurations

Flexible manufacturing facilities

Distributive assembly model

Competitive Advantage

Global supply base / standard platforms

Variable cost model

Reacts quickly to change

in demand & product mix

Vertically integrated / standard platforms

Scale manufacturing drives high

efficiency for doors

Consistent rapid delivery model for windows

Global supply base

Variable cost model

Rapid response customer packaging

and keying capabilities

Reacts quickly to change in demand

& product mix

Serve multiple channels and brands

Can achieve value price points profitably

when winning new business

Significant leverage as market grows

Offer stylish solutions at affordable prices

Ramp-up innovation quickly

Significant leverage as market grows

Can meet unique customer requirement

for retail and commercial

Rapid cycle to get new product to market

Kitchen

& Bath

Cabinetry

Plumbing

&

Accessories

Advanced Material

Windows & Door

Systems

Security

&

Storage |

Appendix

Reconciliation of Non-GAAP Measures to GAAP

| FBHS Net Sales Growth Rate to FBHS Organic Sales Growth |

Page 42 | |||

| Adjusted Pro Forma Operating Income to GAAP Operating Income |

Page 43 | |||

| Adjusted Pro Forma Operating Margin to GAAP Operating Margin |

Page 44 | |||

| Adjusted Pro Forma EBITDA to GAAP Net Income |

Page 45 | |||

| Adjusted Pro Forma EBITDA margin to GAAP Net Income margin |

Page 46 | |||

| Adjusted Pro Forma Unlevered Free Cash Flow to GAAP Cash flow from Operations |

Page 47 | |||

Reconciliation of FBHS Net Sales Growth Rate to FBHS Organic Sales Growth

| Home & Security 1989-2011 Projected CAGR* |

||||

| Net sales growth (GAAP) |

9 | % | ||

| Net impact from acquisitions/divestitures |

(5 | )% | ||

|

|

|

|||

| Organic sales growth |

4 | % | ||

|

|

|

|||

| * | Compounded annual growth rate |

Organic sales growth is the rate of compounded annual net sales growth from 1989 through 2011 projected, excluding the impact of acquisitions and divestitures. Organic sales growth is not a measure derived in accordance with GAAP. Management believes this measure provides useful supplemental information regarding the underlying level of sales growth. This measure may be inconsistent with similar measures presented by other companies.

Page 42

Reconciliation of Adjusted Pro Forma Operating Income to GAAP Operating Income

(in millions)

| 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||||||||||

| Adjusted pro forma operating income |

$ | 668 | $ | 553 | $ | 301 | $ | 81 | $ | 180 | ||||||||||

| Standalone corporate expenses (1) |

20 | 20 | 20 | 20 | 20 | |||||||||||||||

| Restructuring and other charges (2) |

(26 | ) | (93 | ) | (56 | ) | (52 | ) | (12 | ) | ||||||||||

| Asset impairment charges |

— | — | (848 | ) | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| GAAP operating income |

$ | 662 | $ | 480 | $ | (583 | ) | $ | 49 | $ | 188 | |||||||||

Adjusted pro forma operating income is operating income derived in accordance with GAAP including estimated incremental standalone corporate expenses and excluding restructuring and other charges, and asset impairment charges.

Adjusted pro forma operating income is a measure not derived in accordance with GAAP. Management uses this measure to determine the returns generated by FBHS and to evaluate and identify cost-reduction initiatives. Management believes this measure provides investors with helpful supplemental information regarding the underlying performance of the company from year to year. This measure may be inconsistent with similar measures presented by other companies.

| (1) | After the separation, the Company estimates it will incur higher expenses of approximately $20 million annually associated with the incremental costs of functioning as an independent standalone public company. |

| (2) | Restructuring charges are costs incurred to implement significant cost reduction initiatives and include workforce reduction costs and asset write-downs; “other charges” represent charges directly related to restructuring initiatives that cannot be reported as restructuring under U.S. GAAP. Such costs may include losses on disposal of inventories, trade receivables allowances from exiting product lines and accelerated depreciation resulting from the closure of facilities. |

Page 43

Reconciliation of Adjusted Pro Forma Operating Margin to GAAP Operating Margin

| 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||||||||||

| Adjusted pro forma operating margin |

14.2 | % | 12.1 | % | 8.0 | % | 2.7 | % | 5.6 | % | ||||||||||

| Standalone corporate expenses (1) |

0.4 | % | 0.4 | % | 0.5 | % | 0.6 | % | 0.6 | % | ||||||||||

| Restructuring and other charges (2) |

(0.5 | )% | (2.0 | )% | (1.5 | )% | (1.7 | )% | (0.4 | )% | ||||||||||

| Asset impairment charges |

— | — | (22.5 | )% | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| GAAP Operating Margin |

14.1 | % | 10.5 | % | (15.5 | )% | 1.6 | % | 5.8 | % | ||||||||||

Adjusted pro forma operating margin is operating margin derived in accordance with GAAP including estimated incremental standalone corporate expenses and excluding restructuring and other charges, and asset impairment charges divided by GAAP net sales.

Adjusted pro forma operating margin is a measure not derived in accordance with GAAP. Management uses this measure to determine the returns generated by FBHS and to evaluate and identify cost-reduction initiatives. Management believes this measure provides investors with helpful supplemental information regarding the underlying performance of the company from year to year. This measure may be inconsistent with similar measures presented by other companies.

| (1) | After the separation, the Company estimates it will incur higher expenses of approximately $20 million annually associated with the incremental costs of functioning as an independent standalone public company. |

| (2) | Restructuring charges are costs incurred to implement significant cost reduction initiatives and include workforce reduction costs and asset write-downs; “other charges” represent charges directly related to restructuring initiatives that cannot be reported as restructuring under U.S. GAAP. Such costs may include losses on disposal of inventories, trade receivables allowances from exiting product lines and accelerated depreciation resulting from the closure of facilities. |

Page 44

Reconciliation of Adjusted Pro Forma EBITDA to GAAP Net Income

(in millions)

| 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||||||||||

| Adjusted pro forma EBITDA |

$ | 816 | $ | 703 | $ | 435 | $ | 195 | $ | 288 | ||||||||||

| Depreciation (1) |

(105 | ) | (116 | ) | (108 | ) | (97 | ) | (92 | ) | ||||||||||

| Amortization of intangible assets |

(30 | ) | (35 | ) | (33 | ) | (16 | ) | (16 | ) | ||||||||||

| Restructuring and other charges (2) |

(26 | ) | (93 | ) | (56 | ) | (52 | ) | (12 | ) | ||||||||||

| Asset impairment charges |

— | — | (848 | ) | — | — | ||||||||||||||

| Related party interest expense, net |

(169 | ) | (188 | ) | (127 | ) | (85 | ) | (116 | ) | ||||||||||

| External interest expense |

(1 | ) | (0 | ) | (1 | ) | (0 | ) | (0 | ) | ||||||||||

| Standalone corporate expenses (3) |

20 | 20 | 20 | 20 | 20 | |||||||||||||||

| Income tax (provision) benefit |

(176 | ) | (137 | ) | 77 | (6 | ) | (14 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | 329 | $ | 154 | $ | (641 | ) | $ | (41 | ) | $ | 58 | ||||||||

| Noncontrolling interests |

(1 | ) | (1 | ) | (1 | ) | (1 | ) | (1 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) attributable to Home & Security |

$ | 328 | $ | 153 | $ | (642 | ) | $ | (42 | ) | $ | 57 | ||||||||

Adjusted pro forma EBITDA is net income (loss) derived in accordance with GAAP including estimated incremental standalone corporate expenses and excluding restructuring and other charges, asset impairment charges, depreciation, amortization of intangible assets, related party interest expense, net, external interest expense, and income taxes.

Adjusted pro forma EBITDA is a measure not derived in accordance with GAAP. Management uses this measure to assess returns generated by FBHS. Management believes this measure provides investors with helpful supplemental information regarding the underlying performance of the company from year to year. This measure may be inconsistent with similar measures presented by other companies.

| (1) | Depreciation excludes accelerated depreciation included in restructuring and other charges. |

| (2) | Restructuring charges are costs incurred to implement significant cost reduction initiatives and include workforce reduction costs and asset write-downs; “other charges” represent charges directly related to restructuring initiatives that cannot be reported as restructuring under U.S. GAAP. Such costs may include losses on disposal of inventories, trade receivables allowances from exiting product lines and accelerated depreciation resulting from the closure of facilities. |

| (3) | After the separation, the Company estimates it will incur higher expenses of approximately $20 million annually associated with the incremental costs of functioning as an independent standalone public company. |

Page 45

Reconciliation of Adjusted Pro Forma EBITDA margin to GAAP Net Income margin

| 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||||||||||

| Adjusted pro forma EBITDA margin |

17 | % | 15 | % | 12 | % | 6 | % | 9 | % | ||||||||||

| Depreciation (1) |

(2 | )% | (3 | )% | (3 | )% | (3 | )% | (3 | )% | ||||||||||

| Amortization of intangible assets |

(1 | )% | (1 | )% | (1 | )% | (0 | )% | (0 | )% | ||||||||||

| Restructuring and other charges (2) |

(0 | )% | (2 | )% | (1 | )% | (2 | )% | (0 | )% | ||||||||||

| Asset impairment charges |

— | — | (23 | )% | 0 | % | 0 | % | ||||||||||||

| Related party interest expense, net |

(3 | )% | (4 | )% | (3 | )% | (3 | )% | (4 | )% | ||||||||||

| External interest expense |

(0 | )% | (0 | )% | (0 | )% | (0 | )% | (0 | )% | ||||||||||

| Standalone corporate expenses (3) |

0 | % | 1 | % | 0 | % | 1 | % | 0 | % | ||||||||||

| Income tax (provision) benefit |

(4 | )% | (3 | )% | 2 | % | (0 | )% | (0 | )% | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| GAAP Net income (loss) margin |

7 | % | 3 | % | (17 | )% | (1 | )% | 2 | % | ||||||||||

Adjusted pro forma EBITDA margin is net income (loss) derived in accordance with GAAP including estimated incremental standalone corporate expenses and excluding restructuring and other charges, asset impairment charges, depreciation, amortization of intangible assets, related party interest expense, net, external interest expense, and income taxes divided by GAAP net sales.

Adjusted pro forma EBITDA is a measure not derived in accordance with GAAP. Management uses this measure to assess returns generated by FBHS. Management believes this measure provides investors with helpful supplemental information regarding the underlying performance of the company from year to year. This measure may be inconsistent with similar measures presented by other companies.

| (1) | Depreciation excludes accelerated depreciation included in restructuring and other charges. |

| (2) | Restructuring charges are costs incurred to implement significant cost reduction initiatives and include workforce reduction costs and asset write-downs; “other charges” represent charges directly related to restructuring initiatives that cannot be reported as restructuring under U.S. GAAP. Such costs may include losses on disposal of inventories, trade receivables allowances from exiting product lines and accelerated depreciation resulting from the closure of facilities. |

| (3) | After the separation, the Company estimates it will incur higher expenses of approximately $20 million annually associated with the incremental costs of functioning as an independent standalone public company. |

Page 46

Reconciliation of Adjusted Pro Forma Unlevered Free Cash Flow to GAAP Cash flow from Operations

(in millions)

| 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||||||||||

| Adjusted pro forma unlevered free cash flow |

$ | 464 | $ | 393 | $ | 325 | $ | 280 | $ | 146 | ||||||||||

| Add: |

||||||||||||||||||||

| Capital Expenditures |

128 | 75 | 57 | 43 | 58 | |||||||||||||||

| Standalone corporate expenses, net of tax |

13 | 13 | 13 | 13 | 13 | |||||||||||||||

| Less: |

||||||||||||||||||||

| Proceeds from the disposition of assets |

11 | 20 | 14 | 11 | 3 | |||||||||||||||

| Related party interest expense, net of tax |

110 | 122 | 84 | 56 | 75 | |||||||||||||||

| External interest expense, net of tax |

0 | 0 | 0 | 0 | 0 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash flow from operations |

$ | 484 | $ | 339 | $ | 297 | $ | 269 | $ | 139 | ||||||||||

Adjusted pro forma unlevered free cash flow is Cash Flow from Operations (i) less net capital expenditures (capital expenditures less proceeds from the sale of assets including property, plant and equipment) and estimated incremental standalone corporate expenses, net of tax, (ii) plus related party interest expense, net of tax, and external interest expense, net of tax. In computing unlevered free cash flow, net of tax reconciling items assume an income tax rate of 35%. Unlevered free cash flow is a measure not derived in accordance with GAAP. Management believes that Free Cash Flow provides investors with helpful supplemental information about the company's ability to fund internal growth, make acquisitions, repay debt and related interest, pay dividends, and repurchase common stock. This measure may be inconsistent with similar measures presented by other companies.

Page 47