Attached files

| file | filename |

|---|---|

| EX-5.1 - EXHIBIT 5.1 - INTEGRATED ENERGY SOLUTIONS, INC. | ex51.htm |

| EXCEL - IDEA: XBRL DOCUMENT - INTEGRATED ENERGY SOLUTIONS, INC. | Financial_Report.xls |

| EX-23.1 - EXHIBIT 23.1 - INTEGRATED ENERGY SOLUTIONS, INC. | ex231.htm |

As filed with the Securities and Exchange Commission on September 2, 2011

Registration No. 333 -

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

AMERILITHIUM CORP.

(Name of registrant in its charter)

| Nevada | 1040 | 61-16014254 | ||

| (State or other Jurisdiction | (Primary Standard Industrial | (I.R.S. Employer | ||

| of Incorporation or Organization) | Classification Code Number) | Identification No.) |

871 Coronado Center Dr.

Suite 200

Henderson, NV 89052

(702) 583-7790

(Address and telephone number of principal executive

offices and principal place of business)

Matthew Worrall, Chief Executive Officer

AMERILITHIUM CORP.

871 Coronado Center Dr.

Suite 200

Henderson, NV 89052

(702) 583-7790

(Name, address and telephone number of agent for service)

Copies to:

Thomas A. Rose, Esq.

61 Broadway, 32nd Flr.

New York, New York 10006

(212) 930-9700

(212) 930-9725 (fax)

APPROXIMATE DATE OF PROPOSED SALE TO THE PUBLIC:

From time to time after this Registration Statement ecomes effective.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

1

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See definitions of “large accelerated filer,” “accelerated filed,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o |

Accelerated filer

|

o | |

| Non-accelerated filer o |

Smaller reporting company

|

x |

(Do not check if a smaller reporting company)

2

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to Be Registered | Proposed Maximum Offering Price Per Security (1) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||||

|

Common Stock, $.0001 par value per share

|

15,000,000 | 0.18 | $ | 2,700,000 | $ | 313.47 | ||||||||||

| Total | 15,000,000 | 0.18 | $ | 2,700,000 | $ | 313.47 | ||||||||||

(1) Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(c) and Rule 457(g) under the Securities Act of 1933, using the average of the high and low price as reported on the Over-The- Counter Bulletin Board on August 30, 2011, which was $0.18 per share.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

3

The information in this prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 2, 2011

PROSPECTUS

AMERILITHIUM CORP.

15,000,000 Shares of Common Stock

This prospectus relates to the resale by the selling stockholder of up to 15,000,000 shares of our common stock issuable upon conversion of an outstanding convertible promissory note. The selling stockholder may sell common stock from time to time in the principal market on which the stock is traded at the prevailing market price or in negotiated transactions. The selling stockholder may be deemed an underwriter of the shares of common stock which they are offering. We will pay the expenses of registering these shares.

Our common stock is registered under Section 12(g) of the Securities Exchange Act of 1934 and is quoted for trading on the Over-The-Counter Bulletin Board under the symbol “AMEL”. The last reported sales price per share of our common stock as reported by the Over-The-Counter Bulletin Board on August 30, 2011, was $0.19.

The securities offered in this prospectus involve a high degree of risk. See "Risk Factors" beginning on page 8 of this prospectus to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined whether this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is _________, 2011

4

TABLE OF CONTENTS

| Page | |

|

Prospectus Summary

|

6

|

|

Risk Factors

|

8

|

|

Use of Proceeds

|

14

|

|

Market for Common Equity and Related Stockholders Matters

|

14

|

|

Management's Discussion and Analysis and Plan of Operations

|

15

|

|

Business

|

18

|

|

Description of Property

|

30

|

|

Legal Proceedings

|

30

|

|

Management

|

30

|

|

Executive Compensation

|

31

|

|

Certain Relationships and Related Transactions

|

32

|

|

Security Ownership of Certain Beneficial Owners and Management

|

32

|

|

Description of Securities

|

32

|

|

Indemnification for Securities Act Liabilities

|

32

|

|

Plan of Distribution

|

33

|

|

Selling Stockholder

|

34

|

|

Legal Matters

|

34

|

|

Experts

|

34

|

|

Available Information

|

34

|

|

Index to Financial Statements

|

F-1

|

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information that is different. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any jurisdiction where the offer or sale of these securities is not permitted. You should assume that the information contained in this prospectus is accurate as of the date on the front of this prospectus only. Our business, financial condition, results of operations and prospects may have changed since that date. This prospectus will be updated as required by law.

5

PROSPECTUS SUMMARY

The following summary highlights selected information contained in this prospectus. This summary does not contain all the information you should consider before investing in the securities. Before making an investment decision, you should read the entire prospectus carefully, including the “risk factors” section, the financial statements and the notes to the financial statements.

References to “the Company,” “we,” “us,” “our” and similar words refer to Amerilithium Corp.

AMERILITHIUM CORP.

We are a mineral exploration company. We intend to pursue an exploration program to continue the exploration and development of our mineral claims described herein with a view to establish sufficient mineral-bearing reserves.

We have not earned any revenues to date. We do not anticipate earning revenues until such time as we enter into commercial production of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that commercially viable mineral deposits exist on our mineral claims or that we will discover commercially exploitable levels of mineral resources on our properties, or if such deposits are discovered, that we will enter into further substantial exploration programs. Further exploration is required before a final evaluation as to the economic and legal feasibility is required to determine whether our mineral claims possess commercially exploitable mineral deposits.

6

The Offering

|

Common stock offered by selling stockholder

|

Up to 15,000,000 shares of our common stock issuable upon conversion of a currently outstanding promissory note.

|

|

Share outstanding prior to the offering

|

68,409,104 shares as of August 30, 2011.

|

|

|

|

|

Shares to be outstanding after the offering

|

83,409,104 shares.

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of the common stock.

|

Related Transactions

June 2011 Financing

On June 29, 2011, we entered into Note Purchase Agreements with JMJ Financial pursuant to which the Company issued and sold, and JMJ Financial purchased a series of convertible promissory notes of the Company in the principal amount of $2,390,000. The Notes are convertible into shares of the Company’s common stock based on 80% of the average of the lowest trade price in the 25 trading days previous to the conversion. The Notes each bear an 8% one-time interest charge, payable on issuance.

The initial note provides for $1,700,000 in the form of cash payments to be made to us. The funds will be paid according to the following schedule:

● $370,000 paid to us within 3 business days of execution and closing of the Note Purchase Agreement, and $60,000 paid to our counsel.

● $70,000 paid to us within 10 business days of filing of this registration statement; provided that such filing occurs within 40 days of the date of the Note Purchase Agreement and that there are no outstanding comments from the SEC on our previously filed Form 10-K.

● $400,000 paid to us within 10 business days of notice of effective registration statement, and that registration statement must be effective no later than 120 days from the date of the Note Purchase Agreement.

● $200,000 paid to us within 120 business days of notice of effective registration statement.

● $300,000 paid to us within 150 business days of notice of effective registration statement.

7

● $300,000 paid to us within 180 business days of notice of effective registration statement.

● At each of the foregoing funding dates, the funding of such amount is conditioned on the following:

● The calculated conversion price shall be equal to or greater than $0.1665;

● Adequate registered shares must be available for issuance;

● The total dollar trading volume of our stock for the 23 days prior to the date of conversion must be equal to or greater than $1,000,000 and

● No event of default shall exist.

Within 21 days of the date of the Purchase Agreement, we are required to file a registration statement to register 15,000,000 of the shares issuable upon conversion of the initial Note. If not filed within 21 days, a $50,000 penalty will be waived until such time as this registration statement is declared effective. If the registration statement is declared effective within 90 days from the date of the financing, the penalty will be forgiven. IUf not, the penalty amount will be added to the balance of the Note.

The principal sum of the other Note is $540,000, secured and collateralized by JMJ Financial, with $500,000 being received as consideration.

The issuance of the Notes were made pursuant to Section 4(2) of the Securities Act of 1933 and/or Regulation D promulgated thereunder since, among other things, the transaction did not involve a public offering, the Investor was an accredited investor, the Investor took the securities for investment and not resale, and the Company took appropriate measures to restrict the transfer of the securities.

RISK FACTORS

This investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and the other information in this prospectus. If any of the following risks actually occur, our business, operating results and financial condition could be harmed and the value of our stock could go down. This means you could lose all or a part of your investment.

Risks Relating to Our Business

None of the properties in which we have an interest or the right to earn an interest has any known reserves.

None of the properties in which we have an interest or the right to earn an interest has any reserves. To date, we have engaged in only limited preliminary exploration activities on the properties. Accordingly, in which we do not have sufficient information upon which to assess the ultimate success of our exploration efforts. If we do not establish reserves, we may be required to curtail or suspend our operations, in which case the market value of our common stock may decline, and you may lose all or a portion of your investment.

8

Our current cash will not be sufficient to fund our business as currently planned for the next 12 months. We will need additional funding, either through equity or debt financings or partnering arrangements, that could negatively affect us and our stock price.

We will need significant additional funds to continue operations, which we may not be able to obtain. We estimate that we must raise approximately $2 million over the next 12 months to fund our anticipated capital requirements and obligations. Although we have entered into agreement with JMJ Financial which may provide a substantial portion of the funds needed, there is no assurance that all of such funds will be available when needed for our operations.

We have historically satisfied our working capital requirements through the private issuances of equity securities and convertible notes. We will continue to seek additional funds through such channels and from collaboration and other arrangements with corporate partners. However, we may not be able to obtain adequate funds when needed or funding that is on terms acceptable to us. If we fail to obtain sufficient funds, we may need to delay, scale back or terminate some or all of our mining exploration programs.

We are an exploration stage company, and based on our negative cash flows from operating activities there is uncertainty as to our ability to continue as a going concern, as noted by our auditors.

From inception, we have generated no revenues and have experienced negative cash flows from operating losses. We anticipate continuing to incur such operating losses and negative cash flows for the foreseeable future, and to accumulate increasing deficits as we increase our expenditures for exploration and mining of minerals, infrastructure, research and development and general corporate purposes. Any increases in our operating expenses will require us to achieve significant revenue before we can attain profitability.

Our history of operating losses and negative cash flows from operating activities will result in our continued dependence on external financing arrangements. In the event that we are unable to achieve or sustain profitability or are otherwise unable to secure additional external financing, we may not be able to meet our obligations as they come due, raising substantial doubts as to our ability to continue as a going concern. Any such inability to continue as a going concern may result in our security holders losing their entire investment. There is no guaranty that we will generate revenues or secure additional external financing. Our financial statements, which have been prepared in accordance with the United States Generally Accepted Accounting Principles, contemplate that we will continue as a going concern and do not contain any adjustments that might result if we were unable to continue as a going concern. Changes in our operating plans, our existing and anticipated working capital needs, the acceleration or modification of our expansion plans, lower than anticipated revenues, increased expenses, potential acquisitions or other events will all affect our ability to continue as a going concern.

The report of independent auditors of our consolidated financial statements dated April 1, 2011 contains an explanatory paragraph which note our recurring operating losses since inception and our lack of capital, and that these conditions give rise to substantial doubt about our ability to continue as a going concern. In the event that we are unable to successfully achieve future profitable operations and obtain additional sources of financing to sustain our operations, we may be unable to continue as a going concern.

We have not generated any revenues to date. We incurred losses of approximately $240,976 for the three months ended June 30, 2011 and $1,066,066 and $82,765 respectively, for the fiscal years ended December 31, 2010 and 2009. We have accumulated losses since inception of approximately $1,699,023. We anticipate that losses will continue until such time when revenue from operations is sufficient to offset our operating costs, if ever. If we are unable to increase our revenues or to increase them significantly enough to cover our costs, our financial condition will worsen and you could lose some or all of your investment.

9

Because we do not have sufficient capital, we may have limited our exploration activity, which may result in a loss of your investment.

Because we are small and do not have much capital, we have limited our exploration activity. As such, we may not be able to complete exploration programs as planned. In that event, an existing ore body may go undiscovered. Without an ore body, we cannot generate revenues, in which case, you will lose your investment.

Because of the speculative nature of mineral property exploration, there is substantial risk that no commercially exploitable minerals will be found and our business will fail.

Exploration for minerals is a speculative venture involving substantial risk. We cannot provide investors with any assurance that our claims and properties contain commercially exploitable reserves. The exploration work that we intend to conduct on our claims or properties may not result in the discovery of commercial quantities of minerals. Problems such as unusual and unexpected rock formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, our business may fail.

Joint ventures and other partnerships in relation to our properties may expose us to risks.

In the future we may enter into joint ventures or other partnership arrangements with other parties in relation to the exploration, development and production of the properties in which we have an interest. Joint ventures can often require unanimous approval of the parties to the joint venture or their representatives for certain fundamental decisions such as an increase or reduction of registered capital, merger, division, dissolution, amendments of constating documents, and the pledge of joint venture assets, which means that each joint venture party may have a veto right with respect to such decisions which would lead to deadlock in the operations of the joint venture or partnership. Further, we may be unable to exert control over strategic decision made in respect of such properties. Any failure of such other companies to meet their obligations to us or to third parties, or any disputes with respect to the parties’ respective rights and obligations, could have a material adverse effect on the joint ventures or their properties and, therefore, could have a material adverse effect on our results of operations, financial performance, cash flows and share price.

As of August 30, 2011, Matthew Worrall, our President and Chief Executive Officer, owned beneficially approximately 26.7% of our outstanding common stock. Mr. Worrall is able to influence all matters requiring stockholder approval, including election of directors and approval of significant corporate transactions. This concentration of ownership, which is not subject to any voting restrictions, could limit the price that investors might be willing to pay for our common stock. In addition, Mr. Worrall is in a position to impede transactions that may be desirable for other shareholders. He could, for example, make it more difficult for anyone to take control of us.

Risks relating to the industry in general

Planned exploration, and if warranted, development and mining activities involve a high degree of risk.

We cannot assure you of the success of our planned operations. Exploration costs are not fixed, and resources cannot be reliably identified until substantial development has taken place, which entails high exploration and development costs. The costs of mining, processing, development and exploitation activities are subject to numerous variables which could result in substantial cost overruns. Mining for silver and other base or precious metals may involve unprofitable efforts, not only rom dry properties, but from properties that are productive but do not produce sufficient net revenues to return a profit after accounting for mining, operating and other costs.

Our operations may be curtailed, delayed or cancelled as a result of numerous factors, many of which are beyond our control, including economic conditions, mechanical problems, title problems, weather conditions, compliance with governmental requirements and shortages or delays of equipment and services. If our drilling activities are not successful, we will experience a material adverse effect on our future results of operations and financial condition.

There is a substantial risk that the properties that we drill will not eventually be productive or may decline in productivity over time. We do not insure against all risks associated with our business because insurance is either unavailable or its cost of coverage is prohibitive. The occurrence of an event that is not covered by insurance could have a material adverse effect on our financial condition.

10

The impact of government regulation could adversely affect our business.

Our business is subject to applicable domestic and foreign laws and regulations, including laws and regulations on taxation, exploration, and environmental and safety matters. Many laws and regulations require drilling permits and govern the spacing of mines, rates of production, prevention of waste and other matters. These laws and regulations may increase the costs and timing of planning, designing, drilling, installing, operating and abandoning our mines and other facilities. In addition, our operations are subject to complex environmental laws and regulations adopted by domestic and foreign jurisdictions where we operate. We could incur liability to governments or third parties for any unlawful discharge of pollutants into the air, soil or water, including responsibility for remedial costs.

The submission and approval of environmental impact assessments may be required.

Environmental legislation is evolving in a manner which means stricter standards; enforcement, fines and penalties for noncompliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of operations.

Because the requirements imposed by these laws and regulations frequently change, we cannot assure you that laws and regulations enacted in the future, including changes to existing laws and regulations, will not adversely affect our business. In addition, because we acquire interests in properties that have been operated in the past by others, we may be liable for environmental damage caused by former operators.

Decline in mineral prices may make it commercially infeasible for us to develop our property and may cause our stock price to decline.

The value and price of your investment in our common shares, our financial results, and our exploration, development and mining activities may be significantly adversely affected by declines in the price of minerals and other precious metals. Mineral prices fluctuate widely and are affected by numerous factors beyond our control such as interest rates, exchange rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, and the political and economic conditions of mineral-producing countries throughout the world. The price of minerals fluctuates in response to many factors, which are beyond anyone’s prediction abilities. The prices used in making the estimates in our plans differ from daily prices quoted in the news media. Because mining occurs over a number of years, it may be prudent to continue mining for some periods during which cash flows are temporarily negative for a variety of reasons. Such reasons include a belief that the low price is temporary, and/or the expense incurred is greater when permanently closing a mine.

We may not have access to all of the supplies and materials we need to begin exploration, which could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies such as dynamite as well as certain equipment like bulldozers and excavators that we might need to conduct exploration. If we cannot obtain the necessary supplies, we will have to suspend our exploration plans until we do obtain such supplies.

Risks Relating to Our Common Stock:

If we fail to remain current on our reporting requirements, we could be removed from the OTC Bulletin Board which would limit the ability of broker-dealers to sell our securities and the ability of stockholders to sell their securities in the secondary market.

Companies quoted on the OTC Bulletin Board must be current in their reports under Section 13 of the Securities Exchange Act of 1934 (“Exchange Act”) in order to maintain price quotation privileges on the OTC Bulletin Board. The lack of resources to prepare and file our reports, including the inability to pay our auditor, could result in our failure to remain current on our reporting requirements, which could result in our being removed from the OTC Bulletin Board. As a result, the market liquidity for our securities could be severely adversely affected by limiting the ability of broker-dealers to sell our securities and the ability of stockholders to sell their securities in the secondary market. In addition, we may be unable to get re-listed on the OTC Bulletin Board, which may have an adverse material effect on our company.

11

Because the public market for shares of our common stock is limited, investors may be unable to resell their shares of common stock.

Currently there is only a limited public market for our common stock on the OTCBB in the United States. Thus investors may be unable to resell their shares of our common stock. The development of an active public trading market depends upon the existence of willing buyers and sellers who are able to sell their shares as well as market makers willing to create a market in such shares. Under these circumstances, the market bid and ask prices for the shares may be significantly influenced by the decisions of the market makers to buy or sell the shares for their own account. Such decisions of the market makers may be critical for the establishment and maintenance of a liquid public market in our common stock. Market makers are not required to maintain a continuous two-sided market and are free to withdraw firm quotations at any time. We cannot give you any assurance that an active public trading market for the shares will develop or be sustained.

The market for our common stock is highly volatile, having ranged in the last twelve months from a low of $0.13 to a high of $0.57 on the OTCBB. The trading price of our common stock on the OTCBB is subject to wide fluctuations in response to, among other things, quarterly variations in operating and financial results, and general economic and market conditions.

In addition, statements or changes in opinions, ratings, or earnings estimates made by brokerage firms or industry analysts relating to our market or relating to us could result in an immediate and adverse effect on the market price of our common stock. The highly volatile nature of our stock price may cause investment losses for our shareholders. In the past, securities class action litigation has often been brought against companies following periods of volatility in the market price of their securities. If securities class action litigation is brought against us, such litigation could result in substantial costs while diverting management’s attention and resources.

Shareholders may suffer dilution from the issuance of common stock, options, warrants and convertible notes to finance our operations.

All of our properties are in the exploration stage, and we will be required to raise additional capital, enter into joint venture relationships or find alternative means to finance placing one or more of our properties into commercial production, if warranted. On June 28, 2011, we entered into Note Purchase Agreements with JMJ Financial whereby we issued and sold, and JMJ Financial purchased a series of convertible promissory notes in the principal amount of $2,390,000. Such notes are convertible into shares of our common stock based on 80% of the average of the three lowest trade prices in the 25 trading days prior to the date of conversion.

The conversion of the foregoing notes, in addition to any other outstanding options, warrants, convertible notes, as well as potential future transactions, would result in dilution, possibly substantial, to present and prospective holders of common shares.

Our common stock is considered to be a “penny stock,” which may make it more difficult for investors to sell their shares.

Our common stock has been subject to the provisions of Section 15(g) and Rule 15g-9 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), commonly referred to as the “penny stock” rule. Section 15(g) sets forth certain requirements for transactions in penny stocks and Rule 15g-9(d)(1) incorporates the definition of penny stock as that used in Rule 3a51-1 of the Exchange Act. The Commission generally defines penny stock to be any equity security that has a market price less than US$5.00 per share, subject to certain exceptions. Rule 3a51-1 provides that any equity security is considered to be penny stock unless that security is: registered and traded on a national securities exchange meeting specified criteria set by the Commission; issued by a registered investment company; excluded from the definition on the basis of price (at least US$5.00 per share) or the registrant’s net tangible assets; or exempted from the definition by the Commission. Our common stock is considered to be a “penny stock.” The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in “penny stocks.”

As our common stock is considered to be “penny stock,” trading in our common stock will be subject to additional sales practice requirements on broker-dealers who sell penny stock to persons other than established customers and accredited investors. This may reduce the liquidity and trading volume of our shares.

12

Financial Industry Regulatory Authority, Inc. (“FINRA”) sales practice requirements may limit a shareholder’s ability to buy and sell our common shares.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

We do not intend to pay dividends.

We do not anticipate paying cash dividends on our common stock in the foreseeable future. We may not have sufficient funds to legally pay dividends. Even if funds are legally available to pay dividends, we may nevertheless decide in our sole discretion not to pay dividends. The declaration, payment and amount of any future dividends will be made at the discretion of our board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors our board of directors may consider relevant. There is no assurance that we will pay any dividends in the future, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

As a public company, we are subject to complex legal and accounting requirements that will require us to incur significant expenses and will expose us to risk of non-compliance.

As a public company, we are subject to numerous legal and accounting requirements that do not apply to private companies. The cost of compliance with many of these requirements is material, not only in absolute terms but, more importantly, in relation to the overall scope of the operations of a small company. Our relative inexperience with these requirements may increase the cost of compliance and may also increase the risk that we will fail to comply.

Failure to comply with these requirements can have numerous adverse consequences including, but not limited to, our inability to file required periodic reports on a timely basis, loss of market confidence and/or governmental or private actions against us. We cannot assure you that we will be able to comply with all of these requirements or that the cost of such compliance will not prove to be a substantial competitive disadvantage vis-à-vis our privately held and larger public competitors.

We may be subject to shareholder litigation, thereby diverting our resources that may have a material effect on our profitability and results of operations.

As discussed in the preceding risk factors, the market for our common shares is characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may become the target of similar litigation. Securities litigation will result in substantial costs and liabilities and will divert management’s attention and resources.

Compliance with changing regulation of corporate governance and public disclosure will result in additional expenses and pose challenges for our management.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Dodd-Frank Wall Street Reform and Consumer Protection Act, and the rules and regulations promulgated thereunder, the Sarbanes-Oxley Act and SEC regulations, have created uncertainty for public companies and significantly increased the costs and risks associated with accessing the U.S. public markets. Our management team will need to devote significant time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to compliance activities.

13

USE OF PROCEEDS

All shares of our common stock offered by this prospectus are being registered for the account of the selling security holder. We will not receive any of the proceeds from the sale of these shares.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Our common stock is quoted on the OTC Bulletin Board under the symbol “AMEL”. Our common stock was not quoted prior to March 12, 2010.

For the periods indicated, the following table sets forth the high and low bid prices per share of common stock. These prices represent inter-dealer quotations without retail markup, markdown, or commission and may not necessarily represent actual transactions.

| Fiscal Year 2010 | ||||||||

| High | Low | |||||||

| First Quarter | $ | 3.00 | $ | 0.90 | ||||

| Second Quarter | $ | 1.90 | $ | 0.50 | ||||

| Third Quarter | $ | 0.78 | $ | 0.27 | ||||

| Fourth Quarter | $ | 0.57 | $ | 0.20 | ||||

| Fiscal Year 2011 | ||||||||

| High | Low | |||||||

| First Quarter | $ | 0.53 | $ | 0.25 | ||||

| Second Quarter | $ | 0.57 | $ | 0.20 | ||||

| Third Quarter (1) | $ | 0.23 | $ | 0.13 | ||||

(1) Through August 30, 2011

Holders

As of August 30, 2011, we had approximately 68 holders of record of our common stock. This number does not include beneficial owners whose shares are held in the names of various security brokers, dealers, and registered clearing agencies.

Dividend Policy

The payment by us of dividends, if any, in the future rests within the discretion of our Board of Directors and will depend, among other things, upon our earnings, capital requirements and financial condition, as well as other relevant factors. We do not intend to pay any cash dividends in the foreseeable future, but intend to retain all earnings, if any, for use in our business.

Equity Compensation Plan Information

None.

14

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Certain statements in this registration statement contain or may contain forward- looking statements that are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These factors include, but are not limited to, our ability to raise sufficient capital to fund our ongoing operations and satisfy our obligations as they become due, our ability to implement our strategic initiatives, economic, political and market conditions and fluctuations government and industry regulation, interest rate risk, U.S. and global competition, and other factors. Most of these factors are difficult to predict any forward-looking statements that may be made herein. Readers are cautioned not to place undue reliance on these forward-looking statements and readers should carefully review this registration statement in its entirety. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this registration statement, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

Trends and Uncertainties

We are in the exploration stage, have not commenced material operations and have sustained a loss to date. The demand for our products would be negatively affected by impurities in the minerals and volume limitations.

Investing Activities

For the six months ended June 30, 2011, we did not pursue any investing activities.

For the six months ended June 30, 2010, we purchased fixed assets of $6,892 and mining rights of $7,111,000. As a result, net cash flows from investing activities for the six months ended June 30, 2011 were $7,117,892.

Financing Activities

For the six months ended June 30, 2011, we received proceeds from the sale of common stock of $327,880 and a convertible debenture, net of OID stock subscription payable of $430,000 resulting in net cash flows from financing activities of $757,800.

For the six months ended June 30, 2010, we received proceeds from the sale of common stock of $6,418,856 and stock subscriptions payable of $1,238,000. Additionally, we received advances from shareholder of $10,000 and proceeds of notes payable of $290,000. As a result, net cash flows from financing activities were $7,936,856 for the six months ended June 30, 2011.

Results of Operations

We are an exploration stage company and have not yet commenced material operations.

For the three months ended June 30, 2011 and 2010, general and administrative expenses increased from $186,527 to $240,976 due to increased operations. We paid legal and professional fees of $178,725 and $17,777 for the three months ended June 30, 2011 and 2010. The substantial increase in legal and professional fees was due to the ongoing public offering. Additionally, general and administrative expenses for the three months ended June 30, 2011 consisted of salaries of $34,500, depreciation and amortization of $279, mineral property expenditures of $24,319, marketing and advertising of $6,584, insurance of $5,934, dues and subscriptions of $2,138, tax credit of $(18,360) and other general and administrative expenses of $6,857.

Comparatively, for the three months ended June 30, 2010, in addition to the legal and professional fees described above, general and administrative expenses consisted of salaries of $49,500, depreciation and amortization of $279, marketing and advertising of $36,920 and other general and administrative costs of $10,747. The substantial increase between periods was due to increased operations.

15

For the six months ended June 30, 2011 and 2010, general and administrative expenses increased from $301,113 to $496,804 due to increased operations. We paid legal and professional fees of $211,555 and $41,735 for the six months ended June 30, 2011 and 2010. The substantial increase in legal and professional fees was due to the ongoing public offering. Additionally, general and administrative expenses for the three months ended June 30, 2011 consisted of salaries of $69,000, depreciation and amortization of $559, mineral property expenditures of $194,740, marketing and advertising of $7,744, insurance of $9,886, dues and subscriptions of $4,490, tax credit of $(18,360) and other general and administrative expenses of $17,190.

Comparatively, for the six months ended June 30, 2010, in addition to the legal and professional fees described above, general and administrative expenses consisted of salaries of $102,500, depreciation and amortization of $329, marketing and advertising of $41,735, insurance of $6,304, dues and subscriptions of $10,750 and other general and administrative costs of $9,414. The substantial increase between periods was due to increased operations.

Plan of Operation

Our ability to continue in existence is dependent on our ability to secure additional funding and comment full scale operations.

Going Concern

At June 30, 2011, we were engaged in a business and had suffered losses from development stage activities to date. In addition, we have minimal operating funds. Although management is currently attempting to identify business opportunities and is seeking additional sources of equity or debt financing, there is no assurance these activities will be successful. Accordingly, we must rely on our officers to perform essential functions without compensation until a business operation can be commenced. No amounts have been recorded in the accompanying financial statements for the value of officers' services, as it is not considered material.

These factors raise substantial doubt about the ability of the Company to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Recent Accounting Pronouncements

Recent Accounting Pronouncements In May 2008, the Accounting Standards Codification issued 944.20.15, "Accounting for Financial Guarantee Insurance Contracts-and interpretation of Accounting Standards Codification 944.20.05". Accounting Standards Codification 944.20.15 clarifies how Accounting Standards Codification 944.20.05 applies to financial guarantee insurance contracts, including the recognition and measurement of premium revenue and claims liabilities. This statement also requires expanded disclosures about financial guarantee insurance contracts.

Accounting Standards Codification 944.20.15 is effective for fiscal years beginning on or after December 15, 2008, and interim periods within those years. Accounting Standards Codification 944.20.15 has no effect on the Company's financial position, statements of operations, or cash flows at this time.

In March 2008, the Accounting Standards Codification issued 815.10.15, Disclosures about Derivative Instruments and Hedging Activities-an amendment of Accounting Standards Codification 815.10.05. This standard requires companies to provide enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and related hedged items are accounted for under 815.10.15 and its related interpretations, and (c) how derivative instruments and related hedged items affect an entity's financial position, financial performance, and cash flows.

16

This Statement is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008, with early application encouraged. The Company has not yet adopted the provisions of Accounting Standards Codification 815.10.15, but does not expect it to have a material impact on its consolidated financial position, results of operations or cash flows. In December 2007, the Accounting Standards Codification issued 815.10.65, Noncontrolling Interests in Consolidated Financial Statements-an amendment of Accounting Standards Codification 810.10.65. This statement amends Accounting Standards Codification 810.10.65 to establish accounting and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. It clarifies that a noncontrolling interest in a subsidiary is an ownership interest in the consolidated entity that should be reported as equity in the consolidated financial statements. Before this statement was issued, limited guidance existed for reporting noncontrolling interests. As a result, considerable diversity in practice existed. So-called minority interests were reported in the consolidated statement of financial position as liabilities or in the mezzanine section between liabilities and equity. This statement improves comparability by eliminating that diversity. This statement is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008 (that is, January 1, 2009, for entities with calendar year-ends). Earlier adoption is prohibited. The effective date of this statement is the same as that of the related Accounting Standards Codification 805.10.10 (revised 2007). The Company will adopt this Statement beginning March 1, 2009. It is not believed that this will have an impact on the Company's consolidated financial position, results of operations or cash flows.

In December 2007, the Accounting Standards Codification, issued Accounting Standards Codification 805.10.10 (revised 2007), Business Combinations.' This Statement establishes principles and requirements for how the acquirer: (a) recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree; (b) recognizes and measures the goodwill acquired in the business combination or a gain from a bargain purchase; and (c) determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of the business combination. This statement applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. An entity may not apply it before that date. The effective date of this statement is the same as that of the related Accounting Standards Codification 810.10.65, Noncontrolling Interests in Consolidated Financial Statements.

The Company will adopt this statement beginning March 1, 2009. It is not believed that this will have an impact on the Company's consolidated financial position, results of operations or cash flows.

In February 2007, the Accounting Standards Codification issued Accounting Standards Codification 810.10.65, The Fair Value Option for Financial Assets and Liabilities-Including an Amendment of Accounting Standards Codification 320.10.05. This standard permits an entity to choose to measure many financial instruments and certain other items at fair value. This option is available to all entities. Most of the provisions in Accounting Standards Codification 810.10.65 are elective; however, an amendment to Accounting Standards Codification 320.10.05 Accounting for Certain Investments in Debt and Equity Securities applies to all entities with available for sale or trading securities. Some requirements apply differently to entities that do not report net income. Accounting Standards Codification 810.10.65 is effective as of the beginning of an entity's first fiscal year that begins after November 15, 2007. Early adoption is permitted as of the beginning of the previous fiscal year provided that the entity makes that choice in the first 120 days of that fiscal year and also elects to apply the provisions of SFAS No. 157 Fair Value Measurements. The Company will adopt Accounting Standards Codification 810.10.65 beginning March 1, 2008 and is currently evaluating the potential impact the adoption of this pronouncement will have on its consolidated financial statements.

In September 2006, the Accounting Standards Codification issued Accounting Standards Codification 820.10.05, Fair Value Measurements. This statement defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), and expands disclosures about fair value measurements. This statement applies under other accounting pronouncements that require or permit fair value measurements, the Board having previously concluded in those accounting pronouncements that fair value is the relevant measurement attribute. Accordingly, this statement does not require any new fair value measurements. However, for some entities, the application of this statement will change current practice. This statement is effective for financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. Earlier application is encouraged, provided that the reporting entity has not yet issued financial statements for that fiscal year, including financial statements for an interim period within that fiscal year. The Company adopted this statement March 1, 2008, and it is not believed that this will have an impact on the Company's consolidated financial position, results of operations or cash flows.

17

BUSINESS

Corporate History

We are a mineral exploration company. We intend to pursue an exploration program to continue the exploration and development of the mineral claims described below with a view to establish sufficient mineral-bearing reserves.

We have not earned any revenues to date. We do not anticipate earning revenues until such time as we enter into commercial production of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that commercially viable mineral deposits exist on our mineral claims or that we will discover commercially exploitable levels of mineral resources on our properties, or if such deposits are discovered, that we will enter into further substantial exploration programs. Further exploration is required before a final evaluation as to the economic and legal feasibility is required to determine whether our mineral claims possess commercially exploitable mineral deposits.

On February 18, 2010, the articles of incorporation were amended to change the name of the corporation from Kodiak International, Inc. to Amerilithium Corp. and to increase the authorized common shares to 150,000,000 common shares.

Clayton Deep & Full Monty Acquisition

On April 26, 2010, we entered into a property purchase agreement with Nevada Alaska Mining Company, Inc., Robert Craig, Barbara Anne Craig and Elizabeth Dickman. The properties include Clayton Deep which is comprised of 5,280 acres and Full Monty which is comprised of 5,760 acres. Pursuant to the agreement, the sellers sold a 100% interest in certain mining claims located in the state of Nevada.

In consideration of the purchase, we paid a total of $125,000 and issued 400,000 common shares. Additionally, we granted a 2% Net Smelter Royalty to the sellers whereby 1% of the NSR is subject to buyback at any time by the Company for $500,000.

Clayton Deep and Full Monty properties have been physically examined a Registered Civil Engineer. Both Clayton Deep and Full Monty were visited by our chief executive officer and chief geologist during the period from June 17, 2010 to June 20, 2010.

On July 27, 2011 we entered into a geophysical service agreement with Magee Geophysical Services LLC Contractor. Magee agreed to conduct a gravity survey over Clayton Deep during the approximate period of August 2011. We will compensate Magee at the rate of $1,350/operator/day. The gravity survey is expected to take a maximum of 8 chargeable days including mobilization and demobilization.

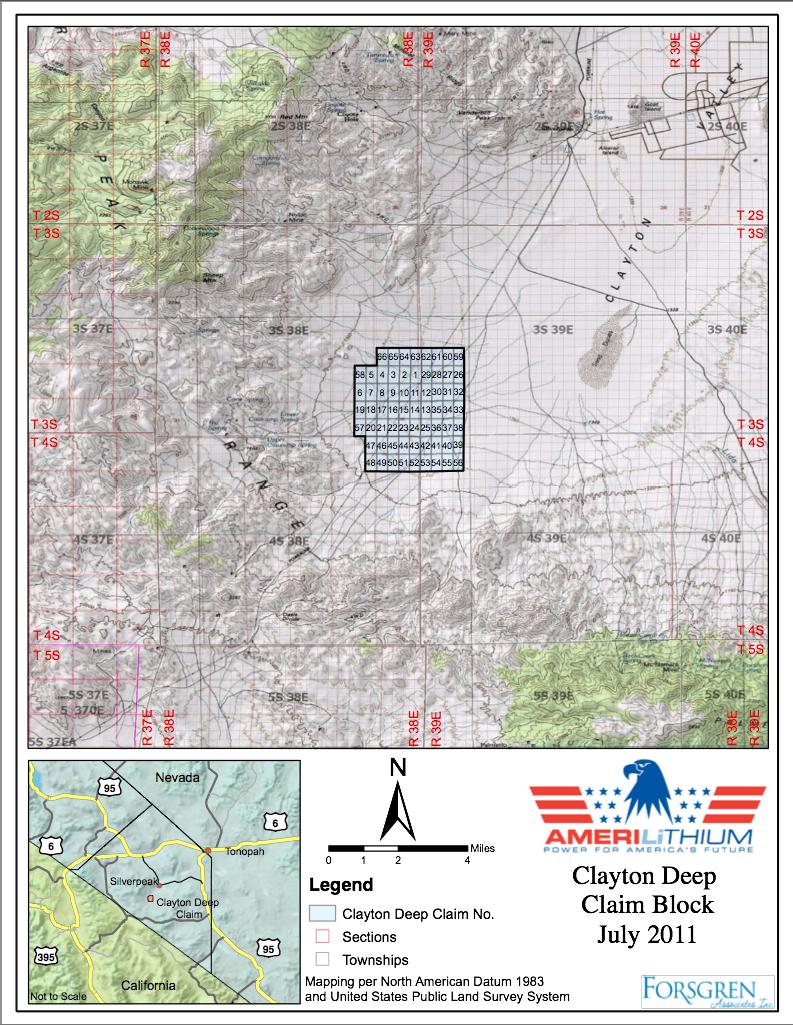

Clayton Deep covers a total area of 5,280 acres (8.25 square miles) in the southern part of Clayton Valley, Esmeralda County, Nevada, USA.

The following is a small-scale map showing the location and access to our Clayton Deep property.

18

19

The project consists of 66 unpatented federal placer mining claims, granted by the United States Department of the Interior, Bureau of Land Management, Reno, Nevada.

The claims were fully recorded April 30, 2010 with the US Bureau of Land Management, Reno, Nevada. Named CD1 thru CD66, and assigned the Serial Numbers NMC 1022861-1022926.

In accordance with USA mining regulations, the Clayton Deep unpatented federal placer mining claims are in good standing until September 1, 2012. Thereafter, a maintenance fee, currently of $9,240 must be paid annually by September 1st along with a "Notice of Intent to Hold." The fees for 2011 until 2012 have been paid in full.

We are responsible for meeting the conditions above.

Full Monty covers a total area of 5,760 acres (9 square miles) in Nye County, Nevada, USA. The claims are approximately 25 miles north of Clayton Valley, Esmeralda County, Nevada, USA. The project consists of 72 unpatented federal placer mining claims, granted by the United States Department of the Interior, Bureau of Land Management, Reno, Nevada. The claims were fully recorded April 30, 2010 with the US Bureau of Land Management, Reno, Nevada. Named FM1 thru FM72, and assigned the Serial Numbers NMC 1022927-1022998.

The following is a small-scale map showing the location and access to our Full Monty property.

20

In accordance with USA mining regulations, the Full Monty unpatented federal placer mining claims are in good standing until September 1, 2012. Thereafter, a maintenance fee, currently $10,080 must be paid annually by September 1st along with a "Notice of Intent to Hold." The fees for 2011 until 2012 have been paid in full.

We are responsible for meeting the conditions above.

Clayton Deep is located in the southern part of the Clayton Valley, Nevada, USA and is approximately 45 miles from Tonopah, Nevada, USA. The property is easily accessible by car from Reno and Las Vegas, Nevada, USA along US Highway 95. Tonopah is also serviced by its own Airport.

Full Monty is located approximately 7 miles North West of Tonopah, Nevada, USA. The property is easily accessible by car from both Reno and Las Vegas, Nevada, USA along US Highway 95. Tonopah is also serviced by its own Airport.

Clayton Deep and Full Monty Claims provide surface access and mineral rights.

Rock formations and mineralization

Clayton Deep

The Clayton Valley-Montezuma Range is underlain by a thick body of tuffaceous sediments, ranging from upper Miocene to Pliocene in age. The volcanic sequence has been named the Esmeralda formation and consists of approximately 15,000 feet of lucustrine volcanic sediments which include poorly sorted conglomerates and sandstones, limestone, mudstones and tuffaceous units. Fossils suggest a relatively fresh environment of deposition.

Full Monty

Rocks immediately underlying the Full Monty property consist of a thick sequence of layered and interbedded Quaternary alluvium that was derived from the metamorphic and igneous complex that comprises the surrounding highlands. A portion of the property is occupied by a playa in which evaporites have accumulated. The thickness and nature of the sediments and playa deposits is currently unknown owing to the lack of exploration in this area.

The Full Monty claim block is situated over the intersection of the Montezuma and Big Smoky Valley structural lineaments within the northwest-southeast trending Walker Lane structural belt. The gravity low which characterizes the intersection of the two structural lineaments was identified by the United States Geological Survey during its gravity surveys of Nevada (USGS Open-File Report 80-611, 1980). Gravity lows such as the Full Monty Gravity Low are thought to be traps for lithium-bearing groundwater.

The Full Monty claims are located just west of the Hall Molybdenum Mine, a Climax-type deposit associated with a large, multi-stage Cretaceous quartz monzonite porphyry stock that was intruded into Devonian to Triassicage metasediments. The Hall porphyry is anomalous in lithium with a high geothermal gradient and may have been the source of lithium in sediments and groundwater in the vicinity of the Full Monty property. Groundwater enriched in lithium and other alkali metals may be sequestered in one or more favorable aquifer units occupying the Full Monty Gravity Low.

21

Post-Cretaceous Basin and Range faulting has tilted and displaced rocks in the area forming the existing topographic and geomorphic features.

No exploration work has been completed. We have a preliminary exploration plan developed for these two sites.

No exploration costs have been incurred to date.

From the production of exploration plans for both Clayton Deep and Full Monty, we have a combined estimated cost in the region of $2,100,000.00 USD.

Water and grid-supplied electricity are available either on site or in close proximity.

This property is currently without known reserves and the proposed property is exploratory in nature.

Power Mining Ventures Asset Purchase Agreements

On March 1, 2010, we entered into an asset purchase agreement with Power Mining Ventures, Inc. Pursuant to the agreement, Power Mining sold a 100% net revenue interest in certain mineral lease interests for the exploration of minerals in the Athena Lithium Brine Project located in Alberta, Canada. Additionally, Power Mining pledged a 2% Net Smelter Return Royalty on the property to a third party, 1% of which can be purchased for $1,000,000. The NSR will be payable upon commencement of commercial production, at which time a more formal agreement concerning NSR will be entered into. We issued 300,000 pre 8:1 forward split restricted common shares for the lease interests.

The following is a small-scale map showing the location and access to the Athena Lithium Brine Project.

22

The project covers a total area of 269,353.04 Hectares in Alberta, Canada encompassing Nampa, Berwyn, Grimshaw and Peace River. The project consists of 33 Metallic and Industrial Minerals permits, which were granted, with a commencement date of January 13, 2010

Permit numbers are sequential from and including No: 9310010413 through and including No: 9310010445 and were granted by the Coal and Mineral Development Unit of the Department of Energy.

A permit grants the exclusive right to explore for Alberta-owned metallic and industrial minerals in a specified location. Other jurisdictions in Canada use the term "mineral claim" for this type of agreement. A permit can be held for up to 14 years, and is not renewable. While there is no annual rent, permit holders are required to conduct exploration work and must report on the work every two years.

The costs to maintain the permits are as follows:

(a) during the first assessment work period, not less in the aggregate than an amount equal to $5 for each hectare in the location;

(b) during the 2nd assessment work period, not less in the aggregate than an amount equal to $10 for each hectare in the location;

(c) during the 3rd assessment work period, not less in the aggregate than an amount equal to $10 for each hectare in the location;

(d) during the 4th assessment work period, not less in the aggregate than an amount equal to $15 for each hectare in the location;

(e) during the 5th assessment work period, not less in the aggregate than an amount equal to $15 for each hectare in the location;

(f) during the 6th assessment work period, not less in the aggregate than an amount equal to $15 for each hectare in the location;

(g) during the 7th assessment work period, not less in the aggregate than an amount equal to $15 for each hectare in the location.

We are responsible for meeting the conditions.

During this period the holder of the permit may apply for a metallic and industrial minerals lease.

A lease grants the exclusive right to develop and mine Alberta-owned metallic and industrial minerals in a specified location. The term of a lease is 15 years, and it may be renewed. Annual rent must be paid. Royalties must be paid if any mineral production takes place on the lease.

Location and means of access

The Athena Lithium Brine Project is located in the Northern part of Alberta, encompassing Nampa, Berwyn, Grimshaw and Peace River, approximately 480 miles north of Calgary. The project is easily accessed by Car using Alberta Provincial Highways 2, 43 and 49. Peace River is also serviced by its own Airport.

The Metallic and Industrial Minerals permits that we hold are for mineral rights. Any exploration causing surface disturbance (e.g., motorized ground equipment, line cutting, drilling) will require a Metallic Mineral Exploration Approval pursuant to the Metallic and Industrial Minerals Exploration Regulation, prior to exploration. This requirement applies to public and non-public land.

Rock formations and mineralization

The large block of permits that comprise the Company’s Alberta holdings covers much of the Devonian-age sedimentary rocks that surround the large structural feature that is the Peace River Arch in northwestern Alberta. Continental brines and evaporates as well as brines associated with oil and gas pools occur in carbonate rocks of theLeduc Formation of the Woodbend Group and in the carbonate and evaporate deposits of the Devonian Beaverhill Lake Group. Formation waters in the rocks contain anomalous concentrations of lithium and other alkali metals.

23

To date, we have not completed any work or exploration on the property. We are currently in the process of developing an exploration plan. No exploration costs have been incurred to date. First stage exploration budgets will be an integral part of the exploration plan.

Water and grid-supplied electricity are available on or in close proximity to the property.

This property is currently without known reserves and the proposed program is exploratory in nature.

Our Alberta, Canada, property is highly prospective for economic deposits of lithium and other metals. Formation water samples from producing wells in the Peace River Arch area contain anomalous concentrations of lithium as reported by the Alberta Geological Survey (2010) and the Alberta Research Council (1995). Oilfield and continental brines in the area contain anomalous lithium concentrations.

Evaporite deposits similar to those from which lithium is currently produced in Clayton Valley, Nevada have also been identified and study within the boundaries of the registrant's permit holdings.

Our Alberta, Canada, property represents approximately 269,353.04 Hectares overlying a potential extension of the Leduc Formation and Beaverhill Lake Group strata/Swan Hills Formation. These two formations were identified by the Alberta Geological Survey (AGS) as containing formation waters containing potentially economic amounts of lithium.(1)

The AGS recommended further analysis of the formation waters for lithium, stating that the lithium contents are similar to those of the only US-based lithium plant in Clayton Valley, Nevada.

The AGS singled out formation waters containing high concentrations of dissolved lithium where rock porosity and permeability would allow production.

In the Leduc Formation, reef thicknesses exceed 980 feet in places (based on 88 existing wells and 3,768 core analyses), while the carbonate platform in the Beaverhill varies in thickness from over 490 feet in the south to roughly 160 feet in the northwest (based on 183 existing wells and 18,256 core analyses).(2)

AGS findings on both formations show concentrations exceeding 100 mg/l with a maximum concentration of 130 mg/l occurring in the Beaverhill Lake formation.

This property has currently not been physically examined in the field by a professional geologist or mining engineer. The Alberta claim has not been visited by either the registrant's chief geologist or chief executive officer.

On March 22, 2010, we entered into an asset purchase agreement with Power Mining Ventures, Inc. Pursuant to the agreement, Power Mining sold a 100% net revenue interest in certain mineral lease interests for the exploration of minerals in three lithium brine projects located in southwestern Australia. Additionally, Power Mining pledged a 2% Net Smelter Return Royalty on the property to a third party. 1% of which can be purchased for $1,000,000. The NSR will be payable upon commencement of commercial production, at which time a more formal agreement concerning NSR will be entered into. We issued 2,400,000 restricted common shares for the lease interests.

Bare Rocks, Hoffman Hills & Normans Lake Projects cover an area of approximately 43,000 Acres (67 square miles) in Western Australia, lose to the town of Wagin, Australia. The projects total 55 graticule blocks.

(1) Resource Estimates of Industrial Minerals in Alberta Formation Waters. Alberta Geological Survey, Jan. 31, 1995.

(2) Industrial Mineral Potential of Alberta Formation Waters. Alberta Geological Survey, 1995.

24

The following is a small-scale map showing the location and access to Bare Rocks, Hoffman Hills and Normans Lake.

25

Bare Rocks and Hoffman Hills Exploration licenses' are valid until April 18, 2016 and have a yearly rental of $1,816.00 & $1,702.50 AUD, due on April 18, every year. These licenses have a combined annual commitment of $40,000.00 AUD.

Normans Lake Project Exploration license is valid until May 24, 2016 and has a yearly rental of $2,724.00 AUD, due on the May 24, every year. This license has an annual commitment of $24,000.00 AUD.

We currently hold exploration licenses. The holder of an exploration license may in accordance with the license conditions, extract or disturb up to 1,000 tonnes of material from the ground, including overburden, and the minister may approve extraction of larger tonnages.

In order to mine economic quantities of lithium, we must obtain a mining lease. The lessee of a mining lease may work and mine the land, take and remove minerals and do all things necessary to effectually carry out mining operations in, on or under the land, subject to conditions of title. The term of a mining lease is 21 years and may be renewed for further terms. Section 67(1) of the Mining Act gives the holder of an exploration tenement an automatic right to apply for, and have granted, a mining lease, or mining leases, within the area of that exploration tenement. We are responsible for meeting the conditions.

Bare Rocks, Hoffman Hills & Normans Lake Projects are located in Western Australia, close to the town of Wagin, Australia. Wagin is accessible by state route 120 and 107, and is approximately 165 miles from Perth by road.

Rock formations and mineralization

Our projects are situated within the South West Mineral Field of Western Australia. This region includes the Wagin-Dumbleyung salt lake system which has been shown to occur at the western confluence of a very extensive surface drainage catchment area. The catchment drains an area of extensive Archaean granite of the Yilgarn Craton where the lithium may have originated from dissolution of lithium-bearing minerals occurring in trace amounts in the granitic bedrock. The three separate properties - Bear Rock, Hoffmans Hill, and Norman's Lake - within the Wagin-Dumbleyung system exhibit similar characteristics and anomalous lithium concentrations.

To date, we have not completed any work or exploration on the property. No exploration costs have been incurred to date. Water and Grid-supplied electricity are available on or in close proximity to the property.

This property is currently without known reserves and the proposed program is exploratory in nature.

This property has currently not been physically examined in the field by a professional geologist or mining engineer. Bare Rocks, Hoffman Hills & Normans Lake Projects have not been visited by the registrant's chief executive officer at this time.

Neither we nor a professional geologist or mining engineer represented by us have visited the Australia or Alberta properties covered by the mineral leases described above. There can be no assurance that the lease interests purchased pursuant to the asset purchase agreements are as represented nor that the properties will result in significant revenues.

GeoXplor Corporation

On March 12, 2010, we entered into an Asset Purchase Agreement with GeoXplor Corporation. GeoXplor has a 100% interest in and to approximately 81 claims comprising nearly 6,000 acres in the immediate Clayton Valley area, nearby the Chemetall Foot lithium brine plant at Silver Peak, Nevada.

Pursuant to the Asset Purchase Agreement, we agreed to purchase all of GeoXplor's rights, title and interest, if any, in and to the property described above. The total purchase price was $1,678,000. We will provide a work commitment for the property of up to USD $1,000,000 over three years as follows:

- USD $150,000 within one year of the closing of this definitive Agreement,

- USD $250,000 within two years of the closing of this definitive Agreement, and

- USD $600,000 within three years of the closing of this definitive Agreement.

26

We will grant GeoXplor 750,000 post-split shares of the Company as follows:

- 250,000 shares at closing of this definitive Agreement,

- 250,000 shares within six months of the closing of this definitive Agreement, and

- 250,000 shares within twelve months of the closing of this definitive Agreement.

It is also recognized that these shares may be issued in its entirety to an escrow agent upon closing, and that the shares would be released in three equal amounts at six months, twelve months and eighteen months of the closing of this definitive Agreement, respectively.

GeoXplor will retain a 3% Net Smelter Returns Royalty on the property as defined in Schedule B. The registrant is hereby granted an option to purchase up to a total of 2% of NSR by paying GeoXplor USD $1,000,000 for each 1% (1/3) at anytime. GeoXplor shall be named Operator, to perform and conduct all necessary exploration on the property to industry standards.

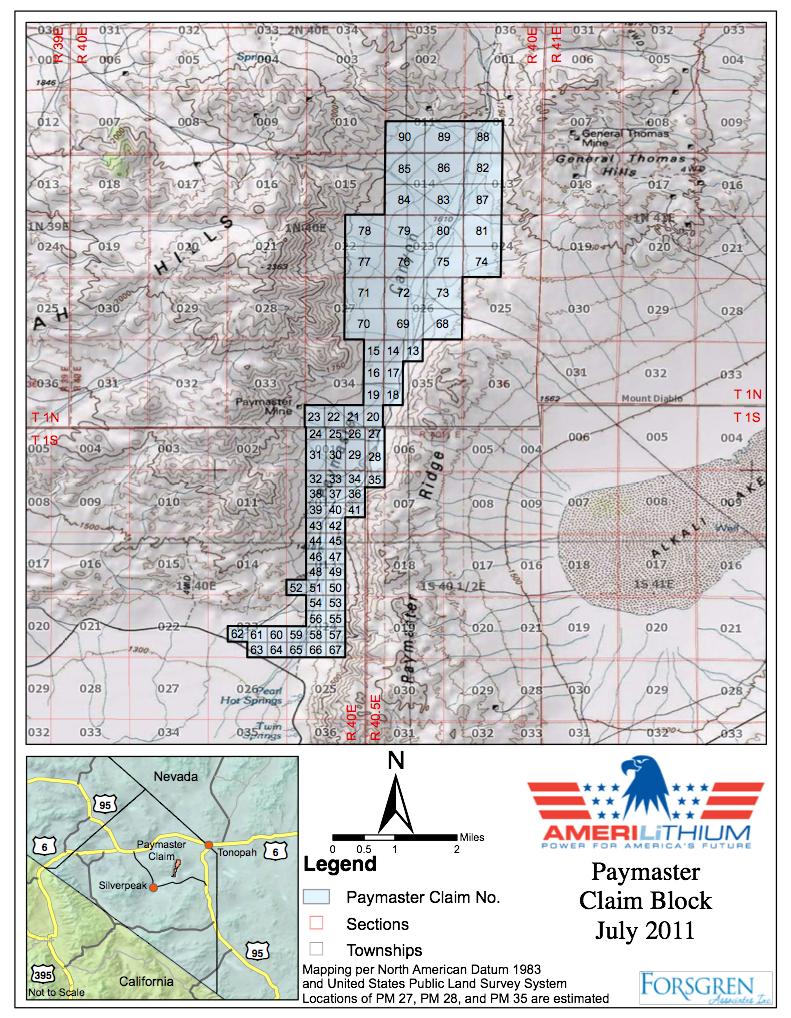

Paymaster

Paymaster covers a total area of 5,880 acres (9.19 square miles). Situated within the Paymaster Canyon, located north of the Clayton Valley playa and east of Alkali Flats playa. Clayton Valley, Esmeralda County, Nevada, USA.

The project consists of 78 unpatented federal placer claims, granted by the United States Department of the Interior, Bureau of Land Management.

The claims were fully recorded with the US Bureau of Land Management. Named PM13 thru PM90, and assigned the Serial Numbers NMC 1018759-1018836.

In accordance with USA mining regulations, the Paymaster unpatented placer mining claims are in good standing until September 1, 2012. Thereafter, a maintenance fee of $140 per claim must be paid annually by September 1st along with a "Notice of Intent to Hold" The fees for 2011 until 2012 have been paid in full.

We are responsible for meeting the conditions above.

Paymaster is located within the Paymaster Canyon, in the northern part of Clayton Valley, Nevada, USA and is approximately 20 miles from Tonopah, Nevada, USA. The property is easily accessed by car from both Reno and Las Vegas, Nevada, USA, along US Highway 95 to Goldfield, Nevada, USA, then 15 miles west on the Silver Peak County Road to the junction of the Pearl Hot Springs road, which forks into the Paymaster Canyon road that traverses the entire length of the canyon.

Paymaster claims provide surface access and mineral rights.

27

To date we have completed the following work on the property:

Geophysics - Gravity Survey

Geophysics - CSAMT/MT Survey (Controlled Source Audio Magnetotellurics/Magnetotellurics)

Drilling - Initial 3 Holes of the 8 Hole drilling program

| Paymaster Canyon | |||||

| Geophysics - Gravity | $ | 65,000 | Paid | ||

| Geophysics - CSAMT/MT | 90,000 | Paid | |||

| Phase Ia Drilling (3 holes) | 165,042 | Paid | |||

| Phase Ib Drilling (5 holes) | 375,000 | ||||

| Analytical - 1 | 31,000 | ||||

| Mapping - 2 | 50,000 | ||||

| Borehole Geophysics - 3 | 75,000 | ||||

| Preliminary Engineering - 4 | 100,000 | ||||

| Metallurgical testing - 5 | 25,000 | ||||

| Total | $ | 976,042 | |||

| Estimated Remaining | $ | 656,000 | |||

Notes:

1. geologic formation and water sample analysis by Method 6010b

2. mapping - GIS base map, exploration data overlays, topo contour mapping, isopach maps, groundwater maps, etc.

3. borehole geophysics - EM resistivity, gamma, etc.

4. process engineering, preliminary plant design parameter definition, design testing protocols, etc.

5. metallurgical testing for process definition and preliminary plant design considerations, etc.

Drilling estimated based on contractor quotes at US$75 per foot. Drillholes estimated total depth of 1000 feet each.

Water and Grid-supplied electricity are available within the Clayton Valley.

This property is currently without known reserves and the proposed program is exploratory in nature.

The following is a small-scale map showing the location and access to the Paymaster property.

28

29

Competition

Metal prices may be unstable. The mining industry in general is intensely competitive and there is no assurance that, even if commercial quantities of a mineral resource are discovered, a profitable market will exist for the sale of it. Factors beyond our control may affect the marketability of any substances discovered. The price of various metals has experienced significant movements over short periods of time, and is affected by numerous factors beyond our control, including international economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates and global or regional consumption patterns, speculative activities and increased production due to improved mining and production methods. The supply of and demand for metals are affected by various factors, including political events, economic conditions and production costs in major producing regions. There can be no assurance that the price of any metal will be such that our properties can be mined at a profit.

Government Regulations