Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - CHINACAST EDUCATION CORP | v233789_ex23-1.htm |

| EX-10.27 - EXHIBIT 10.27 - CHINACAST EDUCATION CORP | v233789_ex10-27.htm |

| EX-31.1 - EXHIBIT 31.1 - CHINACAST EDUCATION CORP | v233789_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - CHINACAST EDUCATION CORP | v233789_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - CHINACAST EDUCATION CORP | v233789_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-K/A

Amendment No. 1

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For The Fiscal Year Ended: December 31, 2010

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Transition Period From to

Commission File No. 001-33771

CHINACAST EDUCATION CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

20-178991

|

|

(State or other Jurisdiction of

Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

Suite 08, 20/F, One International Financial Centre, 1 Harbour View Street,

Central, Hong Kong

(Address of Principal Executive Offices) (Zip Code)

(852) 3960-6506

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

$0.0001 Common Stock

|

NASDAQ Global Select Market

|

|

Title of each class

|

Name of each exchange on which registered

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer x

|

|

|

Non-accelerated filer ¨

|

Smaller reporting company ¨

|

|

|

(Do not check if a smaller reporting company)

|

||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the voting stock on June 30, 2010 held by non-affiliates of the registrant was approximately $232,235,034 based on the reported last sale price of common stock on the NASDAQ Stock Market LLC on June 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter.

The number of shares outstanding of the registrant’s common stock at $.0001 par value as of March 11, 2011 was 49,778,952

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

This amendment on Form 10-K/A (the “Amendment”) amends the Annual Report on Form 10-K for ChinaCast Education Corporation (the “Company”), as initially filed with the Securities and Exchange Commission (“SEC”) on March 16, 2011 (the “Original Report”). The Company is filing this Amendment for the purpose of amending and supplementing Part I, Item 1, “Business” and Item 1A “Risk Factors,” Part II, Item 7 “Management’s Discussion and Analysis Of Financial Condition and Results Of Operation,” Item 8 “ITEM 8. Financial Statements and Supplementary Data” and Item 9A “Controls and Procedures,” Part III, Item 11. “Executive Compensation “ and Item 13. “Certain Relationships and Related Transactions, and Director Independence” and Part IV, Item 15. “Exhibits, Financial Statement Schedules.” of the Original Report. All other items presented in the Original Report are unchanged. This Amendment does not reflect events occurring after the date of the Original Report or modify or update any of the other disclosures contained therein in any way other than the amendments referred to above. Accordingly, this Amendment should be read in conjunction with the Original Report and the Company’s other filings with the SEC.

In addition, as required by Rule 12b-15 of the Securities Exchange Act of 1934, this Amendment contains new certifications by our Principal Executive Officer and our Principal Financial Officer, filed as exhibits hereto.

i

CHINACAST EDUCATION CORPORATION

Annual Report on Form 10-K for the Year Ended December 31, 2010

TABLE OF CONTENTS

|

PART I

|

2

|

|

ITEM 1. BUSINESS

|

2

|

|

ITEM 1A. RISK FACTORS

|

12

|

|

ITEM 1B. UNRESOLVED STAFF COMMENTS

|

24

|

|

PART II

|

25 |

|

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

25

|

|

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

36

|

|

ITEM 9A. CONTROLS AND PROCEDURES

|

37

|

|

PART III

|

41 |

|

ITEM 11. EXECUTIVE COMPENSATION

|

41

|

|

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

52

|

|

PART IV

|

54 |

|

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

54

|

|

EX-10.27

|

|

|

EX-23.1

|

|

|

EX-31.1

|

|

|

EX-31.2

|

|

|

EX-32.1

|

ii

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements relate to future events or our future financial performance. We have attempted to identify forward-looking statements by terminology including “anticipates”, “believes”, “expects”, “can”, “continue”, “could”, “estimates”, “expects”, “intends”, “may”, “plans”, “potential”, “predict”, “should” or “will” or the negative of these terms or other comparable terminology. These statements are only predictions. Uncertainties and other factors, including the risks outlined under Risk Factors contained in Item 1A of this Form 10-K, may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels or activity, performance or achievements expressed or implied by these forward-looking statements.

A variety of factors, some of which are outside our control, may cause our operating results to fluctuate significantly. They include:

|

|

•

|

the availability and cost of products from our suppliers ;

|

|

|

•

|

general and cyclical economic and business conditions, domestic or foreign;

|

|

|

•

|

the rate of introduction of new products by our customers;

|

|

|

•

|

the rate of introduction of enabling technologies by our suppliers;

|

|

|

•

|

changes in our pricing policies or the pricing policies of our competitors or suppliers;

|

|

|

•

|

our ability to compete effectively with our current and future competitors;

|

|

|

•

|

our ability to manage our growth effectively, including possible growth through acquisitions;

|

|

|

•

|

our ability to enter into and renew key corporate and strategic relationships with our customers and suppliers;

|

|

|

•

|

our implementation of share-based compensation plans;

|

|

|

•

|

changes in the favorable tax incentives enjoyed by our PRC operating companies;

|

|

|

•

|

foreign currency exchange rates fluctuations;

|

|

|

•

|

adverse changes in the securities markets; and

|

|

|

•

|

legislative or regulatory changes in China.

|

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Our expectations are as of the date this Form 10-K is filed, and we do not intend to update any of the forward-looking statements after the filing date to conform these statements to actual results, unless required by law.

1

PART I.

ITEM 1. BUSINESS

General

ChinaCast Education Corporation is a leading post-secondary education and e-Learning services provider in China. The Company provides post-secondary degree and diploma programs through its three universities in China: The Foreign Trade and Business College of Chongqing Normal University, the Lijiang College of Guangxi Normal University and the Hubei Industrial University Business College. These universities offer fully accredited, career-oriented bachelor's degree and diploma programs in business, economics, law, IT/computer engineering, hospitality and tourism management, advertising, language studies, art and music. The Company provides its e-Learning services to post-secondary institutions, K-12 schools, government agencies and corporate enterprises via its nationwide satellite/fiber broadband network. These services include interactive distance learning applications, multimedia education content delivery, and vocational training courses. The Company is listed on NASDAQ Global Select Market with the ticker symbol CAST.

Our History and Current Business

We were formed as Great Wall Acquisition Corporation on August 20, 2003 as a blank check company. On December 22, 2007, we completed the acquisition of 51.22% of the outstanding shares of ChinaCast Communication Holdings Limited (“CCH”), a company listed on the Stock Exchange of Singapore (“SGX”) and subsequently changed its name to ChinaCast Education Corporation. During 2007, we acquired 100% of CCH and terminated our SGX listing.

CCH was incorporated under the laws of Bermuda on November 20, 2003 as an exempted company with limited liability, and as the holding company for a public flotation in Singapore of CCH’s business.

CCH’s principal subsidiary, ChinaCast Technology (BVI) Limited (“CCT BVI”), was founded in 1999 to provide funding for its satellite broadband Internet services through ChinaCast Company Ltd. (“CCL”) - Beijing Branch (“CCLBJ”) and ChinaCast Li Xiang Co. Ltd. (“CCLX”) through various contract agreements.

In late 2000, CCH identified demand for its services in the education industry. Given the limited resources of its tertiary institutions (i.e., university/college), and to meet the fast-growing population of its university students, the PRC Ministry of Education ( “MOE” ) granted licenses to approximately 30 (subsequently increased to 68) universities to conduct undergraduate and post-graduate courses by distance learning.

By the end of 2002, CCH had signed with over 15 universities in the PRC to use its satellite interactive distance learning network, serving over 50,000 students nationwide. In July 2003, it raised additional funding to upgrade its satellite technology to the Hughes Network Systems DirecWay satellite broadband network, and thereafter expanded its distance learning business by signing additional K-12, IT and management training customers.

In February 2008, the Company signed a definitive agreement with the owner of the Foreign Trade Business College of Chongqing Normal University (“FTBC”) to acquire 80% of the holding company of FTBC for a consideration of RMB480 million.

On September 18, 2009, the Company entered an agreement with all the shareholders of Chongqing Chaosheng Education and Investment Co., Ltd. (“Chaosheng”) to acquire the 100% equity interest in Chaosheng for a total consideration of RMB135 million. Chaosheng held the remaining 20% equity interest in Hai Lai. Chaosheng has no operating business and it only serves to hold the 20% interest in Hai Lai. After the completion of the acquisition of Chaosheng, the Company holds 100% of the equity interest of Hai Lai.

On October 5, 2009, the Company completed the acquisition of East Achieve Limited (“East Achieve”), the holding company which beneficially owns 100% of Lijiang College of Guangxi Normal University (“Lijiang” or “LJC”). LJC is an independent, for profit, private university affiliated with Guangxi Normal University. LJC offers four-year bachelor’s degree programs in tourism, hospitality, language studies, computer engineering, economics, law, music, art and physical education, all of which are fully accredited by the Ministry of Education. The total consideration was RMB365 million, of which RMB295 million has been paid and the remaining contingent consideration of RMB70 million was to be paid within 30 days of August 31, 2010. Subsequently RMB20.54 million out of the RMB70 million was paid due to LJC’s performance shortfall in the 2009/2010 academic year.

On August 23, 2010 the Company completed the acquisition of Wintown Enterprises Limited (“Wintown”), the holding company which beneficially owns 100% of Hubei Industrial University Business College (“HIUBC”). The total consideration was RMB450 million, of which RMB360 million has been paid and the remaining contingent consideration of RMB90 million will need to be paid within 30 days of August 31, 2011.

2

Since our acquisition of Hai Lai in April 2008, we have organized as two business segments, the E-learning and training service group (the “ELG”), encompassing all of the Company’s business before the acquisition, and the Traditional University Group (the “TUG”), offering bachelor and diploma programs to students in China.

The ELG offers products and services to customers under three principal business lines:

|

|

•

|

Post Secondary Education Distance Learning Services — We enable universities and other higher learning institutions to provide nationwide real-time distance learning services. Our “turn-key” packages include all the hardware, software and broadband satellite network services necessary to allow university students located at remote classrooms around the country to interactively participate in live lectures broadcast from a main campus. The Company currently services 15 universities with over 143,000 students in over 300 remote classrooms. For example, Beijing Aeronautical and Aeronautics University (Beihang), consistently ranked among the top ten Universities in China by the Ministry of Education, launched its distance learning network in cooperation with CCH in 2002. By 2010, the number of distance learning students of Beihang reached 25,000, at over 120 remote learning centers in China. In return for the turn-key distance learning services, we receive from the University a percentage of each remote student’s tuition.

|

|

|

•

|

K-12 Educational Services — We currently broadcast multimedia educational content to 6,500 primary, middle and high schools throughout the PRC in partnership with leading educational content companies, and renowned educational institutions. The educational content packages assist teachers in preparing and teaching course content. Each school pays us a monthly subscription fee for this service and a one-time charge for equipment used to provide the service.

|

|

|

•

|

Vocational/Career Training Services — In partnership with various government departments and corporate enterprises, we have deployed several hundred training centers throughout China providing job-skills training to recent graduates, employees of state-owned enterprises, and corporate employees.

|

The TUG offers products and services to customers under one principal business line:

|

|

•

|

Universities — FTBC, LJC and HIUBC are independent private residential universities affiliated with Chongqing Normal University,Guangxi Normal University and Hubei Industrial University respectively. With a total of over 30,000 on campus students, our three universities offer four-year bachelor’s degree and three-year diploma programs in finance, economics, trade, tourism, advertising, IT, music, foreign languages, tourism, hospitality, computer engineering, law and art, all of which are fully accredited by the Ministry of Education.

|

The China Education Market

According to the PRC Ministry of Education (MOE), the Chinese government plans to increase spending on public education significantly, from the budget allocation of 2.8% of GDP (US$212 billion) in 2005 to 4.0% (US$392 billion) by 2010. Even after this increase, the target level will still be less than in developed countries, which typically spend an average of over 5% of GDP on education services and education spending per capita in China is less than 10% of the level in the United States, implying significant upside.

In terms of number of enrollments, China has the largest market in the world. Compounded annual growth rate for 2004 to 2010 was 13% in China compared to less than 2% in the US. Despite its current size, we expect the number of post-secondary enrollments will continue to grow. The MOE plans to double the current number of seats in post-secondary education to over 40 million by 2020. The percentage of post-secondary students enrolled in universities as a percentage of the age group (18-22 year olds) is only 22% which is significantly less than other developed countries which is above 60%. The percentage of population in China with a four year college degree is even lower, at less than 5%.

We have identified four key drivers that will drive the growth in the Chinese education market. First, PRC government statistics suggest that Chinese consumers recognize education to be crucial to a better life. According to the China State Bureau of Statistics, the average family plans to spend roughly 7% of its disposable income on education. This spending is highly concentrated as most households have only one child. Second, the demographic trend in China will drive the demand for postsecondary education seats over the next 10 years as the percentage population at college age swells. Third, the expected financial reward after gaining an accredited college degree is much more than in the more mature countries such as the US. And fourth, the job market in China is becoming very competitive and a post secondary education is essential to get a good job.

3

The MOE has been very active in reforming the post-secondary education sector in China. They have granted distance learning licenses to 68 of the country’s top colleges and universities, allowing them to offer degrees programs off-campus. Prior to that, all college education was residential. The MOE has also allowed the development of over 600 privately invested post-secondary colleges some of which are allowed to offer accredited degrees and diplomas. For K-12, the MOE launched the “All Schools Connected” project to equip all of China’s primary, middle and high schools with e-learning systems by 2010. The market for online vocational training and certification exam preparation is also developing rapidly.

The Company strives to tailor its education services to address China’s task of educating its rapidly growing post-secondary, vocational training and K-12 education sectors.

Business Strategy

The Company believes that the combination of its traditional bricks and mortar universities, its proprietary e-learning products and services, ownership of a nationwide broadband content delivery network and its ability to develop new educational content are essential to its long-term growth. In our TUG business, we develop our own teaching content for the instruction of the students. For our ELG business, the faculty members of the partnering universities develop the teaching content and the partnering universities own such content. We also purchase standard educational materials for our K-12 business from suppliers from which we develop the content in multimedia format, and then broadcast the content through our network for the use by K-12 schools. We do not publish/distribute any content on our websites and accordingly we do not need an internet content provider license. For the TUG business, all of our universities are granted an education license by the Ministry of Education, which allows the universities to teach and provide educational content to their students. For the ELG business, we distribute the content over our VSAT network. CCLX was granted by the Ministry of Industry and Information Technology to operate a VSAT network and currently, no other entity in the CEC corporate structure holds a VSAT license other than CCLX.

The Company seeks to achieve brand recognition in targeted high growth, high margin market segments, such as domestic and international post-secondary education and vocational/career training. It strives to maximize customer loyalty and increase margins by offering additional services not offered by traditional service providers. The Company’s growth strategy is to continue to develop new services via internal development and to complement organic growth by mergers and acquisitions to further expand its educational service offerings.

On April 11, 2008, the Company completed the acquisition of 80% of Hai Lai, which holds 100% of the Foreign Trade and Business College of Chongqing Normal University (“FTBC”). FTBC is an independent, for profit, private university affiliated with Chongqing Normal University. FTBC offers four-year bachelor’s degree and three-year diploma programs in finance, economics, trade, tourism, advertising, IT, music and foreign languages, all of which are fully accredited by the Ministry of Education. The Company subsequently acquired the remaining 20% interest of Hai Lai in September 2009.

On October 5, 2009, the Company completed the acquisition of East Achieve Limited (“East Achieve”), the holding company which beneficially owns 100% of Lijiang College of Guangxi Normal University (“Lijiang or LJC”). LJC is an independent, for profit, private university affiliated with Guangxi Normal University. LJC offers four-year bachelor’s degree programs in tourism, hospitality, language studies, computer engineering, economics, law, music, art and physical education, all of which are fully accredited by the Ministry of Education.

On August 23, 2010 the Company completed the acquisition of Wintown Enterprises Limited (“Wintown”), the holding company which beneficially owns 100% of Hubei Industrial University Business College (“HIUBC”). The total consideration was RMB450 million, of which RMB360 million has been paid and the remaining contingent consideration of RMB90 million, fair valued at RMB78 million, will need to be paid wthin 30 days of August 31, 2011.

The Company completed all the procedures required by the State Administration of Industry and Commerce (SAIC) relating to the above acquisitions. In addition, prior to each acquisition, we consulted with the Ministry of Education to confirm that the annual reviews of the education licenses of the universities will not be affected as a result of the ownership change. Subsequent to such acquisitions, the universities have passed all the annual reviews by the Ministry.

Sales and Marketing

To reach its customers, the Company utilizes a direct sales force, distributors, resellers, internet marketing and joint marketing efforts with strategic allies, seeking to market its products and services efficiently with minimal capital while fostering profitable customer relationships. In addition, our bricks and mortar universities work on an annual basis with the PRC MOE to recruit our new university students.

The Company’s sales and marketing team of professional and supporting personnel, located in Beijing and Shanghai, has responsibility for relationship building, performing customer requirements analysis, preparing product presentations, conducting demonstrations, implementing projects and coordinating after-sales support. To reach new customers, the Company pursues various marketing activities, including direct marketing to potential clients and existing customers and strategic joint marketing activities with key partners and government departments such as the MOE and the Ministry of Labor.

4

Competitive Strengths

• Proven track record in successful acquisition of bricks and mortar universities

The Company acquired FTBC in April 2008, LJC in October 2009 and HIUBC in August 2010. The three universities collectively serve over 32,000 on-campus students offering fully accredited bachelor’s degree and diploma programs. The Company was the first US publicly listed post-secondary education service company that owned fully accredited universities in China.

• E-learning first mover advantage in the PRC

Based on its general knowledge of the industry, the Company believes it is one of the first distance learning providers using satellite broadband services, and we believe that the Company is the market leader in this segment although there are no independent surveys of this segment. Currently, many broadband operators rely mainly on terrestrial networks that do not have extensive coverage, especially in less-developed areas of rural China. The Company believes its programs provide an attractive alternative for schools that wish to engage only a single company to provide all necessary satellite services, hardware, software and content.

• Highly scalable, recurring revenue business model

The Company’s E-learning business model is capital efficient, profit driven and highly scalable. Its revenue stream from shared student tuition and school subscriptions provides predictability and visibility. The Company pays close attention to market forces and profit trends, adhering to a strict financial plan that precludes unnecessary capacity or technology not required by its customers.

• CEC has an experienced and proven management team

The Company’s executive officers and directors have on average over fifteen years experience in China. They have established business relationships in the PRC; extensive experience in leading public companies in China, Hong Kong, Singapore and the United States; government regulatory know-how; and access to capital and long-term personal relationships in the industry.

Corporate Structure

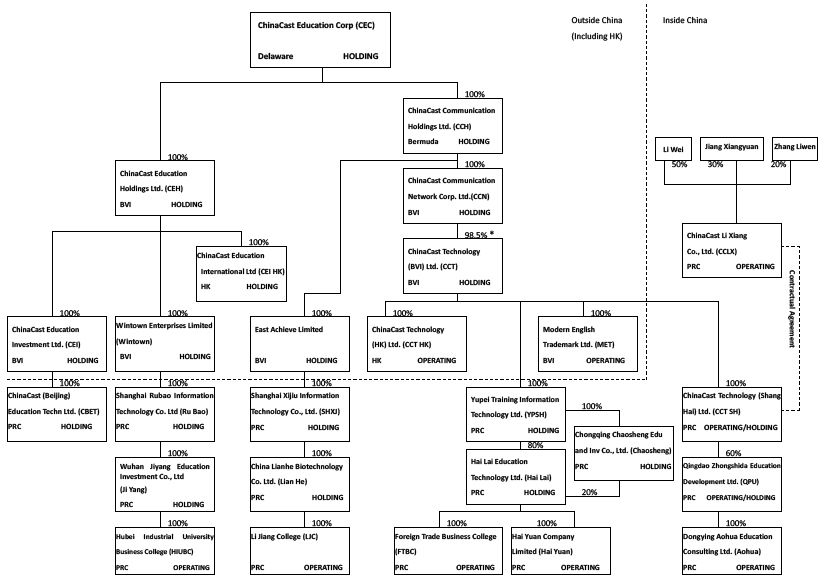

The corporate structure of CEC as of December 31, 2010, together with its contractual relationship with CCLX, is as follows.

5

|

*

|

Glander Assets Limited holds the remaining 1.5% of CCT BVI.

|

Definitions:

|

• CEC

|

ChinaCast Education Corporation

|

|

• CCH

|

ChinaCast Communication Holdings Limited

|

|

• CEH

|

ChinaCast Education Holdings Limited

|

|

• CEI HK

|

ChinaCast Education International Limited

|

|

• CEI

|

ChinaCast Education Investment Limited

|

|

• CBET

|

ChinaCast (Beijing) Education Technology Limited

|

|

• CCN

|

ChinaCast Communication Network Company Ltd.

|

|

• CCT BVI

|

ChinaCast Technology (BVI) Limited

|

|

• CCT HK

|

ChinaCast Technology (HK) Limited

|

|

• CCT Shanghai

|

ChinaCast Technology (Shanghai) Limited

|

|

• YPSH

|

Yupei Training Information Technology Co., Ltd.

|

|

• MET

|

Modern English Trademark Limited

|

|

• Chaosheng

|

Chongqing Chaosheng Education and Investment Co., Ltd.

|

|

• Hai Lai

|

Hai Lai Education Technology Limited

|

|

• FTBC

|

Foreign Trade and Business College of Chongqing Normal University

|

|

• Hai Yuan

|

Hai Yuan Company Limited

|

|

• CCLX

|

ChinaCast Li Xiang Co., Ltd.

|

|

• East Achieve

|

East Achieve Limited

|

|

• Xijiu

|

Shanghai Xijiu Information Technology Co. Limited

|

|

• Lian He

|

China Lianhe Biotechnology Co., Ltd.

|

|

• LJC

|

Lijiang College of Guangxi Normal University

|

|

• Wintown

|

Wintown Enterprises Limited

|

|

• Rubao

|

Shanghai Rubao Information Technology Co. Limited

|

|

• Jiyang

|

Wuhan Jiyang Education Investment Limited

|

|

• HIUBC

|

Hubei Industrial University Business College

|

|

• QPU

|

Qingdao Zhongshida Education Development Limited

|

|

• Aohua

|

Dongying Aohua Education Consulting Limited

|

6

CEC’s Holding Company Structure

CEC was incorporated on August 20, 2003 to serve as a vehicle to effect a merger, capital stock exchange, asset acquisition or other similar business combination with a company having its primary operations in the PRC. On December 22, 2006, we completed the voluntary conditional offer made in Singapore by DBS Bank, for and on our behalf, to acquire all of the outstanding ordinary shares of CCH, pursuant to which we acquired 51.22% of the outstanding ordinary shares of CCH. On January 18, 2007, at the end of the offer period, total shares acquired was 80.27% (the “Acquisition”). Since CEC was not an operating company and the shareholders of CCH control the combined company after the Acquisition, the Acquisition was accounted for as a recapitalization in which CCH was the accounting acquirer. The cash consideration paid as part of the offer was accounted for as a capital distribution. For purposes of the preparation of the consolidated financial statements, the remaining 19.73% outstanding ordinary shares of CCH not acquired by CEC were reported as minority interest for the financial year 2005 and 2006.

Subsequent to the Acquisition, as of February 12, 2007, CEC acquired additional shares and increased its holdings to 93.73% of the outstanding ordinary shares of CCH. On April 10, 2007, CEC acquired 20,265,000 additional shares by the issuance of 951,853 CEC common shares and increased its holdings to 98.06% of the outstanding ordinary shares of CCH. On July 11, 2007, CEC acquired additional shares and increased its holdings to 100% of the outstanding ordinary shares of CCH. The following is a discussion of CCH’s business.

CEC’s wholly owned subsidiary, CCH, was incorporated in Bermuda on November 20, 2003 as an investment holding company to acquire the entire share capital of CCN in preparation for listing. CCH was subsequently listed in Singapore on May 14, 2004. CCN was established on April 8, 2003 to acquire the capital of CCT BVI to accommodate certain of its former investors. Before the establishment of CCN, CCT BVI was the entity holding the investment in the satellite businesses through its WFOE, CCT Shanghai. CCT Shanghai does not perform any activities or have any operations outside the scope of these arrangements. However, some of its former investors were not satisfied with the existing corporate governance structure of CCT BVI and were unable to obtain unanimous agreement to revise the Memorandum and Articles of Association ("MAA") of CCT BVI. As a way to accommodate these investors, CCN was established with a new corporate governance structure and a new MAA. Through a series of share swaps, CCN eventually acquired a 98.5% controlling interest of CCT BVI, and the new corporate governance structure and MAA of CCN was eventually adopted. Glander Assets Limited holds the remaining 1.5%.

Prior to its public offering of securities on the Mainboard of the Singapore Exchange, CCH and its subsidiaries, CCT BVI, CCT HK and CCT Shanghai, engaged in a series of share exchanges pursuant to which shareholders of CCT BVI exchanged substantially all of their shares in that entity for CCH ordinary shares. At the same time, CCH engaged in a restructuring of its subsidiaries’ relationship with CCL and CCLX.

In 2010, CEC set up a new fully owned subsidiary CEH as a step towards simplifying the corporate structure of the Group. CEH is one of the intermediate off shore holding company. Through its fully owned subsidiary, CEI, a WFOE, Han Yang has been set up to eventually hold the university investment companies and other future acquisitions.

CEC’s Contractual Arrangements with CCLX

To operate in the PRC satellite communication market, a company needs a Very Small Aperture Terminals (VSAT) license. Such license is issued by the Ministry of Industry and Information Technology, and needs to be inspected and renewed annually. Foreign ownership is forbidden for companies holding a VSAT license.

CEC provided its satellite related services through the CCLX and CCLBJ in the past through various contractual arrangements. Prior to December 2010, CC LX was owned by Li Wei (10%) and CCL (90%). Then, after our ex-chairman, Mr. Yin Jian Ping resigned and disposed of his stake in the Company, Mr. Yin, wanted his company, CCL, to focus on its own development. Accordingly, CCL terminated its arrangements with us and at our direction transferred its legal ownership in CCLX in December 2010 to the following employees of the Company who then became the legal owners of record of CCL: 40% to Li Wei, 30% to Jiang Xiang Yuan and 20% to Zhang Li Wen (the “CCLX Shareholders”) Accordingly, after such transfer by CCL , CCLX was held 50% by Li Wei, 30% by Jiang Xiang Yuan and 20% by Zhang Li Wen.

After CCL transferred the ownership of its 90% stake in CCLX to the CCLX Shareholders and terminated various contractual arrangements with CEC, CEC entered into new contractual arrangements with the CCLX Shareholders and CCLX. . Both before and after this transfer, the Company enjoyed all of the economic benefits of CCLX through the relevant contractual arrangements which enabled us to consolidate the results of CCLX into the Company’s financial statements. . As discussed below, the CCLX Shareholders are parties to a series of agreements dated December 31, 2010, which are legally enforceable by the Company. There are no specific additional incentives for the CCLX Shareholders to perform their obligations under these agreements, but all the CCLX Shareholders are also employees of the Company and consequently have a common interest with the Company in ensuring that these contracts are honored.

The following describes contractual arrangements between CEC and its subsidiaries, CCLX and the CCLX Shareholders.

7

● Benefits and Obligations under the Agreements that transfer economic benefits to CCT Shanghai

Technical Services Agreement between CCLX and CCT Shanghai

Before CCL transferred the beneficial ownership of its 90% stake in CCLX to the CCLX Shareholders and terminated the various contractual arrangements with CCT Shanghai and CCLX, the Company provided its services and products to end customers in the PRC through CCLX under the terms of a technical services agreement, dated August 11, 2003, between CCT Shanghai, CCL, Li Wei and CCLX, as amended on March 29, 2004 (the “Old Technical Services Agreement”). In addition, prior to such transfer, CCT Shanghai also entered into a Novation Deed to enable CCLX to assume the position of CCL and continue its obligations under another technical services agreement, dated November 15, 2000, among CCT Shanghai and CCL and its stockholders. The Novation Deed was entered into on September 11, 2003 among CCT Shanghai, CCLX, Li Wei, CCL and the shareholders of CCL. Under the Novation Deed, CCT Shanghai undertook to provide to CCLX the technical services described in the Old Technical Service Agreement and CCLX undertook to perform the duties, including the payment of technical service fee to CCT Shanghai, as described in the Old Technical Service Agreement between CCL and CCT Shanghai. CCT Shanghai does not perform any activities or have any operations outside the scope of these arrangements.

On December 31, 2010, CCLX and CCT Shanghai terminated the 2003 Technical Service Agreement and entered into a new technical service agreement for a term of 10 years (the “New Technical Service Agreement”) with terms similar to the old ones. CCT Shanghai is the exclusive services provider to CCLX with complete technical support, business support, financial support and related consulting services during the term of the agreement. CCLX prepares an annual budget for its business which is submitted to CCT Shanghai for approval. As consideration for its services, CCT Shanghai is entitled to change CCLX monthly service fees equal to the total revenue earned by CCLX less operating expenses reasonably incurred in the course of conducting the business. All the technical service fees of CCLX for the past three years have been paid to CCT Shanghai. CCT Shanghai did not remit the fees to CEC and was not obligated to do so. CCT Shanghai has the right to inspect and/or procure its auditor to inspect any records kept by CCLX. During the term of the agreement, unless CCT Shanghai commits gross negligence, or a fraudulent act against CCLX, CCLX may not terminate the agreement prior to its expiration date. CCT Shanghai can terminate the agreement upon 30 days’ prior written notice to CCLX at any time.

Exclusive Option Agreements

On December 31, 2010, CCT Shanghai entered into exclusive option agreements for a term of 10 years with the CCLX Shareholders, pursuant to which the CCLX Shareholders irrevocably granted CCT Shanghai an exclusive right to purchase100% of their equity interests in CCLX , for a consideration of RMB1 or the lowest price allowed by relevant laws and regulations, when it is permissible for a VSAT business to have 100% foreign investment, or CCT Shanghai’s designated party can acquire 100% of the equity interest of CCLX from the CCLX’s Shareholders at any time and from time and time.

● Agreements that provide to CCT Shanghai effective control over CCLX

Power of Attorney in favor of CCT Shanghai

Under the Power of Attorneys, the CCLX Shareholders irrevocably authorize CCT Shanghai to act on behalf of them with respect to all matters concerning their shareholdings in CCLX. The CCLX Shareholders also authorize CCT Shanghai to execute the transfer contracts stipulated in the Exclusive Option Agreement. The power of attorney remains in place so long as the CCLX Shareholders are shareholders of CCLX.

Pledge Agreements in favor of CCT Shanghai

Before CCL transferred the ownership of its 90% stake in CCLX to the CCLX Shareholders and terminated various old contractual arrangements with CCT Shanghai and CCLX, CCL and Li Wei entered into pledge agreements (the “ Old Pledge Agreements”) with CCT Shanghai and CCLX to pledge all their rights and interests associated with their stakes in CCLX, in favour of CCT Shanghai. On December 31, 2010, the Old Pledge Agreements were terminated. On the same date, the CCLX Shareholders , CCLX and CCT Shanghai entered into new pledge agreements (the “ New Pledge Agreements) with terms similar to the old one.

As collateral security for the prompt and complete payment and performance of the obligations of CCLX under the New Technical Agreements, the CCLX Shareholders have pledged to CCT Shanghai a first security interest in all of their right, title and interest, whether now owned or hereafter acquired by the CCLX Shareholders, in the equity interest of CCLX. CCT Shanghai has the right to collect dividends generated by the equity interest under the pledge. In the event CCLX fails to pay the service fee in accordance with the New Technical Service Agreement, CCT Shanghai has the right, but not the obligation, to dispose of the equity interest pledged by the CCLX Shareholders in accordance with the provisions in the agreement.

8

The pledge remains in place until all payments due under the old Technical Service Agreement have been made by CCLX. Upon the full payment of the consulting and service fees under the old Technical Service Agreement and upon termination of CCLX’s obligations under the New Technical Service Agreement, the old Pledge Agreement shall be terminated.

Acquisition of non-controlling interests of CCLX: Prior to the Termination Agreement entered into above among CCT Shanghai, CCLX and CCL, CCL had a non-controlling interest in CCLX in the amount of RMB19 million for the registered capital in CCLX. When the Termination Agreement was entered into, the Company acquired the non-controlling interest balance of RMB19million held by CCL, the fair value of which was estimated by the Company to be RMB40 million. Instead of paying cash, the Company used RMB40 million of the Non-current advances the Company provided to CCL in prior years to settle the acquisition.

Prior Arrangements with CCL

The Company entered into various contractual agreements with CCL when it was the majority equity holder of CCLX.

CCL Technical service agreements : On November 15, 2000, CCT Shanghai, CCL and the investors of CCL entered into a technical service agreement ("CCL Technical Service Agreement") pursuant to which CCT Shanghai provided CCL with certain technical services and ancillary equipment in connection with CCL's satellite communication business, which was operated by CCLBJ. Prior to January 1, 2010, CCLBJ provided equipment support service to some of the customers of the Company utilizing equipment owned by CCLBJ in exchange for a service fee. After January 1, 2010, all the services provided by CCLBJ was stopped and CCLX provided all the services required by customers since then. So in effect, CCLBJ ceased operation for 12 months as at December 31, 2010. However, CCL’s equity in CCLX was not transferred to the CCLX Shareholders until December 31, 2010.

Although technically a branch office of CCL and not a legal entity, CCLBJ was operated as a stand-alone group of businesses. CCLBJ maintains its own accounting records and bank accounts in its own name that are clearly separated from those of CCL. CCLBJ represents CCL’s Turbo 163 business, DDN Enhancement business and Cablenet business (the “Satellite Business”). The revenues and expenses of the branch office are not commingled with those of CCL. As compensation for the service, CCT Shanghai received a service fee that equaled the difference between total revenue less expenses of CCL's Beijing branch.

The Company provided CCL with interest free cash advances to finance acquisition of the related satellite equipment. CCL had undertaken that when regulation allows, the ownership of CCLX and all the relevant assets attributable to the satellite business operations in the books of CCL and its Beijing branch (collectively "Satellite Business") would be transferred to the Company, the consideration of which would be settled against the advances to CCL in the books of the Company at the sole discretion of the Company. Accordingly, the Company considered the noncurrent advances were of the nature of a deemed investment in the Satellite Business.

Equity pledge agreement : To ensure the delivery of the service pursuant to the CCL Technical Service Agreement, pursuant to the pledge agreement, the investors of CCL pledged all their rights and interests, including voting rights in CCL and, if certain events occurred, the entitlement to dividends and appropriations to CCT Shanghai.

Due to the above agreements, and the fact that CCL Beijing branch is not a legal entity separated from CCL, CCL was determined to be a variable interest entity of ChinaCast. Due to the fact that Company and its related party do not have (1) the power to direct the activities of CCL that most significantly affect CCL's economic performance, (2) the obligation to absorb losses of, or the right to receive benefits from CCL, the Company was not considered to be the primary beneficiary of CCL. Therefore CCL had never been included in the accompanying consolidated financial statements.

The CCL Technical Service Agreement and Equity Pledge agreement was terminated in 2010. On December 31, 2010, CCTSH, CCLX and CCL entered into a Service Agreement (the "Service Agreement") under which CCL will assist CCLX to renew the inter-provincial value-added telecommunication service license (the "VSAT License") for the next ten years. CCL was included as a party to the Service Agreement to minimize the risk that we would not be able to renew our VSAT license. CCL and Mr. Yin were parties responsible for the application for the existing VSAT license, and they have abundant experience with maintaining and renewing the VSAT license along with good relationships with the Ministry of Industry and Information Technology. The VSAT License is critical to the Company's E-learning and training services. Without the license, the Company is not allowed to conduct its business through satellite in China. Prior to December 31, 2010, the license was renewed each year with the assistance from CCL. In consideration of CCL's service in assisting the Company to obtain the renewal of the license, the Company shall pay an annual service fees to CCL in the amount of RMB 8.1 million during the service term of the Service Agreement and RMB60 million remaining balance of the noncurrent advances, after deducting the purchase price of NCI in CCLX, will be used as a prepayment for this service. However, the annual renewal of VSAT license needs to be approved by a government agency and the result is not under the control of neither CCL nor CCLX, and CCLX undertakes to CCL in the Service Agreement that it will not take back nor to recover any amount of the prepayment even though it subsequently does not require the service of CCL during the entire service term. As a result, the Company decided to write off the RMB60 million for the prepayment of the VSAT license renewal service. The impairment loss of RMB60 million is included in the operating income.

9

CEC’s Contractual Arrangements related to FTBC, LJC and HIUBC

FTBC, LJC and HIUBC are independent, private residential universities affiliated with Chongqing Normal University and Guangxi Normal University and Hubei Industrial University respectively. The Company acquired FTBC in April 2008, LJC in October 2009 and HIUBC in August 2010. Our wholly foreign owned subsidiary, Yupei, acquired the holding company (Hai Lai) of FTBC. For LJC and HIUBC the seller re-organized the ownership of the universities to offshore holding companies of wholly foreign owned subsidiaries which became the sole respective shareholder of the holding companies of LJC (Lianhe) and HIUBC (Jiyang) . The WFOE holding FTBC is Yupei Training Information Technology Co., Ltd. The WFOE holding LJC is Shanghai Xijiu Information Technology Co., Ltd. and the WFOE holding HIUBC is Rubao.

This structure offers us effective control over FTBC, LJC and HIUBC. Another commonly accepted structure in connection with foreign investment to education is contractual control structure through a variable interest entity (VIE), similar to the structure between CCT Shanghai, CCLX and its shareholders. Compared to the VIE structure, our structure can offer us more protection and legally allow our subsidiaries to distribute dividends to us. See the risk factor on page 13 titled “The education sector, in which all of our businesses are conducted, and the telecommunication sector, upon which we are heavily reliant, each are subject to extensive regulation in China, and our ability to conduct business is highly dependent on our compliance with these regulatory frameworks” which addresses the risks involved with direct ownership.

Under the affiliation agreements between FTBC, LJC and HIUBC and their respective affiliated university, the affiliated universities are entitled to appoint directors, the aggregate voting rights of which are all under 50%, to the board of FTBC, LJC and HIUBC.Also, in the case of FTBC, the affiliated university is also entitled to supervise the following activities of FTBC:

|

|

·

|

Establishment of any major or department;

|

|

|

·

|

Daily education and administrative activities;

|

|

|

·

|

Examination and verification of qualified staffs responsible for administrative work and political work;

|

|

|

·

|

College development direction and various conditions and facilities required for running the college;

|

|

|

·

|

Administration of living service (Hou Qin), i.e., living related services, including dormitory, canteen, water supply, heating system; and

|

|

|

·

|

Student’s education administration, i.e, the administration on the student’s ideological and political education, the student’s psychological education and the student’s scholarship and subsidy.

|

Legal Advice on Group Structure

At the time of CCH listing on the Singapore Stock Exchange in 2004 it obtained legal advice that its business arrangements with CCL and CCLX, including the pledge agreements described in the previous section as well as CEC’s group structure, are in compliance with applicable PRC laws and regulations. The VIE structure of the group has been simplified since that time.

Research and Development

As most of CEC’s satellite technology is procured from various technology vendors, CEC does not conduct any research and development on the satellite technology used in its business.

Trademarks

CEC has no outstanding trademark applications.

Government Regulations

CEC’s business operations in the PRC and Hong Kong are not subject to any special legislation or regulatory controls other than those generally applicable to companies and businesses operating in the PRC. CEC has obtained all the necessary licenses and permits for its business operations in the PRC and Hong Kong, unless disclosed otherwise in this 10-K..

Pursuant to Rule 6 of the Independent College Establishment and Administrative Measures, the Ministry of Education and its local agencies (collectively, “MOE”) in Chongqing, Guangxi and Hubei are in charge of the following matters of FTBC, Lijiang College and HIUBC:

|

|

·

|

Administration of Education Permit, i.e., the issuance, updating and cancellation of the permit;

|

10

|

|

·

|

Examination of Recordation of Recruiting Prospectus and Recruiting Advertisement to determine if the recruiting prospectus and advertisements are in compliance with applicable rules;

|

|

|

·

|

Publication of relevant information of college (i.e., basic information including the name of the college, campus, departments and enrolled students;

|

|

|

·

|

Annual inspection of college;

|

|

|

·

|

Reward to college, i.e., reward certificates or bonuses to recognize a college’s research and development contribution to a specific area;

|

|

|

·

|

Investigation and Penalty of college’s illegal activities, i.e., if a college commits any inappropriate actions, MOE can investigate such activities and penalize the college if such activities are indeed in violation of laws and regulations; and

|

|

|

·

|

Other duties provided in other laws and regulations, i.e., the MOE can also exercise such powers and rights or perform such duties to supervise and administer other laws and regulations affecting the supervision and administration of independent colleges.

|

CEC provides technical services to CCLX and relies on CCLX to provide the satellite network infrastructure for its services. CCLX is licensed under PRC laws to provide value-added satellite broadband services in the PRC.

Pursuant to the “Catalogue for the Guidance of Foreign Investment Industries” effective on December 1, 2007 (Appendix II “Notes for Catalogue of Restricted Industries” 5.7), value-added services: foreign investments are permitted with the proportion of foreign investment not exceeding 50%.

Article 6 of the “Provisions on Administration of Foreign-Invested Telecommunications Enterprises” prescribed that the proportion of foreign investment in a foreign invested telecommunications enterprise providing value-added telecommunications services (including radio paging in basic telecommunications services) shall not exceed 50% in the end. The proportion of the investment made by Chinese and foreign investors to a foreign-invested telecommunications enterprise in different phases shall be determined by the competent information industry department of the State Council in accordance with the relevant provisions. Currently CCLX is a domestic limited liability company that runs the value-added telecommunication business. Subject to the approval of the relevant PRC authorities, foreign capital is allowed to own no more than 50% of the total equity interests of CCLX under current PRC regulations.

For a description of the material risks related to the impact of government regulation, See “Risk Factors.”

Competition

In its business segments, CEC competes with state-owned and private enterprises that provide IT/Telecom services as well as educational services. These include large, well-funded state owned telecom companies such as China Telecom, China Netcom, China Unicom, China Railcom, China Satcom, China Orient, Guangdong Satellite Telecom and China Educational TV, as well as private educational service companies such as ChinaEdu, Beida Online, Ambow, China Education Alliance, and China-Training.com. Not all of these companies compete directly in all e-learning and educational content sectors the Company services and may offer services that are comparable or superior to CEC’s.

Seasonality

Like many education services companies, a significant amount of the Company’s sales occur in the second and fourth quarters, coinciding with enrollment periods of educational institutions. In addition, large enterprise and government customers usually allocate their capital expenditure budgets at the beginning of their fiscal year, which often coincides with the calendar year. The typical sales cycle is six to 12 months, which often results in the customer expenditure for hardware occurring towards the end of the year. Customers often seek to expend the budgeted funds prior to the end of the year and the next budget cycle. As a result, interim results are not indicative of the results to be expected for the full year.

Employees

As of March 1, 2010, CEC had 2,300 employees of which 1,600 are full-time employees. We believe CEC’s relationship with its employees to be good.

Available Information

This Annual Report on Form 10-K for the fiscal year ended December 31, 2010 is available on our website at www.chinacasteducation.com. The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2010, excluding exhibits, and the Company’s complete audited financial statements for the fiscal year ended December 31, 2010, will be mailed without charge to any stockholder, upon written request to Secretary of the Company, ChinaCast Education Corporation, Suite 3316, 33/F, One IFC, 1 Harbour View Street, Central, Hong Kong.

11

We file annual and quarterly reports, proxy statements and other information with the SEC. Stockholders may read and copy any reports, statements or other information that we file at the SEC’s public reference room in Washington, D.C. Please call the SEC at 1-800-SEC-0330 for further information about the public reference room. Our public filings are also available from commercial document retrieval services and at the Internet Web site maintained by the SEC at www.sec.gov.

ITEM 1A. RISK FACTORS

In addition to the other information in this Form 10-K, readers should carefully consider the following important factors. These factors, among others, in some cases have affected, and in the future could affect, our financial condition and results of operations and could cause our future results to differ materially from those expressed or implied in any forward-looking statements that appear in this on Form 10-K or that we have made or will make elsewhere.

Risks Relating to our Business

Techniques Employed by Manipulative Short Sellers in Chinese Small Cap Stocks May Drive Down the Market Price of Our Common Stock

Short selling is the practice of selling securities that the seller does not own but rather has, supposedly, borrowed from a third party with the intention of buying identical securities back at a later date to return to the lender. The short seller hopes to profit from a decline in the value of the securities between the sale of the borrowed securities and the purchase of the replacement shares, as the short seller expects to pay less in that purchase than it received in the sale. As it is therefore in the short seller’s best interests for the price of the stock to decline, many short sellers (sometime known as “disclosed shorts”) publish, or arrange for the publication of, negative opinions regarding the relevant issuer and its business prospects in order to create negative market momentum and generate profits for themselves after selling a stock short. While traditionally these disclosed shorts were limited in their ability to access mainstream business media or to otherwise create negative market rumors, the rise of the Internet and technological advancements regarding document creation, videotaping and publication by weblog (“blogging”) have allowed many disclosed shorts to publicly attack a company’s credibility, strategy and veracity by means of so-called research reports that mimic the type of investment analysis performed by large Wall Street firm and independent research analysts. These short attacks have, in the past, led to selling of shares in the market, on occasion in large scale and broad base. Issuers with business operations based in China and who have limited trading volumes and are susceptible to higher volatility levels than U.S. domestic large-cap stocks, can be particularly vulnerable to such short attacks.

These short seller publications are not regulated by any governmental, self-regulatory organization or other official authority in the U.S., are not subject to the certification requirements imposed by the Securities and Exchange Commission in Regulation AC (Regulation Analyst Certification) and, accordingly, the opinions they express may be based on distortions of actual facts or, in some cases, fabrications of facts. In light of the limited risks involved in publishing such information, and the enormous profit that can be made from running just one successful short attack, unless the short sellers become subject to significant penalties, it is more likely than not that disclosed shorts will continue to issue such reports.

While we intend to strongly defend our public filings against any such short seller attacks, oftentimes we are constrained, either by principles of freedom of speech, applicable state law (often called “Anti-SLAPP statutes”), or issues of commercial confidentiality, in the manner in which we can proceed against the relevant short seller. You should be aware that in light of the relative freedom to operate that such persons enjoy – oftentimes blogging from outside the U.S. with little or no assets or identity requirements – should we be targeted for such an attack, our stock will likely suffer from a temporary, or possibly long term, decline in market price should the rumors created not be dismissed by market participants.

We have had a fairly consistent short interest of approximately 2.4 million shares for the past five weeks representing approximately 5% of our public float and we have been singled out in articles and blogs as one with a high short interest. Accordingly, the price and trading volume of our stock is vulnerable to extreme fluctuations. On February 16, 2011, February 24, 2011 and March 7, 2011 a short seller published reports with inaccurate facts and misleading allegations against the Company which continues to be disseminated through chatter on the internet. The trading volume of the Company’s stock was approximately 2 million and 1.7 million on February 16 and March 7, 2011, respectively, significantly higher than to its average daily trading volume prior to the issuance of the first report. In particular, the short seller attack focused on the circumstances surrounding the acquisition by the Company of two universities, i.e., LJC and HIUBC.The short seller questioned the location of the offices of the respective WOFE holding company of each university; the purchase price paid in connection with the acquisitions; the role certain persons who had in interest in the companies which controlled the universities prior to the acquisition; and the restructuring of the university holding structure in connection with the acquisition. The Company responded in detail to the short seller attack in letters to its shareholders and press releases included on Form 8-K filed on February 16, 17 and 22, 2011.

12

There are predictions that 2011 will bring more short seller attacks against Chinese companies. Although we will continue to educate investors that the allegations made in the reports issued on the Company were inaccurate and misleading, the price of our stock remains vulnerable to the continuing attacks by this and any other short seller.

We do not have land use rights for parcels of land occupied by HIUBC and may not be able to obtain the building ownership certificates to the buildings on the land, may be subject to fines and accordingly nay need to find alternative locations for our schools.

We do not have land use rights for parcels of land occupied by HIUBC. We may not be able to obtain the building ownership certificates to the buildings on the land because procurement of land use right is a condition precedent to obtain building ownership certificates to the buildings on the underlying land. The building ownership certificates confirm legal ownership of the buildings. Until we obtain the land use rights and building ownership certificates, we might not be able to sell the land and buildings or we might be subject to fines and penalties. Such liability might range from RMB 30,000 to RMB 300,000. If this occurs, it may disrupt our local business operation and may adversely affect our financial condition and results of operations. Alternatively, if we fail to obtain the relevant land use rights and building certificates we may be required to find alternative locations for our schools.. .

The education sector, in which all of our businesses are conducted, and the telecommunication sector, upon which we are heavily reliant, each are subject to extensive regulation in China, and our ability to conduct business is highly dependent on our compliance with these regulatory frameworks.

The Chinese government regulates all aspects of the education sector, including licensing of parties to perform various services, pricing of tuition and other fees, curriculum content, standards for the operations of schools and learning centers associated with online degree programs and foreign participation. The Chinese laws and regulations applicable to the education and telecommunication sectors are in some aspects vague and uncertain, and often lack detailed implementing regulations. These laws and regulations also are subject to change, and new laws and regulations may be adopted, some of which may have retroactive application or have a negative effect on our business. Moreover, there is considerable ongoing scrutiny of the education sector and its participants.

We must comply with China’s extensive regulations on private and foreign participation in the education and telecommunication sectors, and compliance with such restrictions has caused us to adopt complex structural arrangements with our Chinese subsidiaries and Chinese affiliated entities. If the relevant Chinese authorities decide that our structural arrangements do not comply with these restrictions, we would be precluded from conducting some or all of our current business and our financial condition, results of operations and business strategy may be materially and adversely affected.

Because our wholly-owned subsidiaries in China are considered foreign-invested, these subsidiaries may be considered ineligible to acquire the holding companies of FTBC, LJC and HIUBC and to indirectly obtain education licenses and permits in China and if they are deemed ineligible we may not be able to consolidate the financial results of our brick-and-mortar schools.

There are substantial uncertainties regarding the interpretation and application of Chinese laws and regulations, particularly as they relate to the education and telecommunications sectors. We cannot assure you that we will not be found to be in violation of any current or future Chinese laws and regulations. PRC laws and regulations currently require any foreign entity that invests in the education business in China to be an educational institution with relevant experience in providing educational services outside of China. Our Delaware holding company and our subsidiaries out of China are not educational institutions and do not provide educational services. We have acquired the holding companies of FTBC, LJC and HIUBC through our wholly owned subsidiaries in China. The WFOE holding FTBC is Yupei. The WFOE holding LJC is Xijiu. The WFOE holding HIUBC is Rubao. PRC law does not expressly prohibit a wholly foreign owned subsidiary from acquiring the holding companies of FTBC and LJC. To date, the applicable regulations on the foreign investment in education are the Regulations on Sino-Foreign Cooperative Schools, and the implementing regulations thereunder, which only provide for the ability of foreign education institutions to set up sino-foreign cooperative schools in China. Neither CCH nor its various offshore entities are qualified foreign education institutions, and accordingly, it is impractical to restructure FTBC and LJC into sino-foreign cooperative schools. Furthermore, in response to our inquiries on a no name basis with the Ministry of Education, the ability of a wholly foreign owned subsidiary to acquire a holding company of a college is not settled. We therefore have disclosed that our wholly foreign owned subsidiaries may be considered ineligible to acquire the holding companies of FTBC and LJC.

Our wholly owned subsidiaries in China, which are considered foreign-invested, may be considered ineligible to acquire the holding companies of FTBC, LJC and HIUBC to indirectly obtain education licenses and permits in China. Moreover, if a Delaware holding company were to become an educational institution in the future, there is no assurance that the PRC Ministry of Education or any other regulator in China would retrospectively approve of an ownership of FTBC, LJC or HIUBC. If we or any of our Chinese subsidiaries or Chinese affiliated entities are found to be or to have been in violation of Chinese laws or regulations requiring foreign ownership or participation in the education sector to be by an established foreign educational institution or limiting foreign ownership or participation in the education or telecommunication sectors, the relevant regulatory authorities have broad discretion in dealing with such violation, including but not limited to:

13

|

|

·

|

levying fines and confiscating illegal income;

|

|

|

·

|

restricting or prohibiting our use of the proceeds to finance our business and operations in China;

|

|

|

·

|

requiring us to restructure the ownership structure or operations of our Chinese subsidiaries or Chinese affiliated entities;

|

|

|

·

|

requiring us to discontinue all or a portion of our business; and/or

|

|

|

·

|

revoking our business licenses.

|

Any of these or similar actions could cause significant disruption to our business operations or render us unable to conduct all or a substantial portion of our business operations, and may materially and adversely affect our business, financial condition and results of operations. For the year ended December 31, 2010, revenue attributable to Yupei and its subsidiaries accounted for 27.2% of the Group’s revenue. For the year ended December 31, 2010, revenue attributable to Xijiu and its subsidiaries accounted for 23.7% of the Group’s revenue. For the year ended December 31, 2010, the revenue attributable to Rubao and its subsidiaries accounted for 8.3% of the Group’s revenue.

The tuition charged by CCLX for certain programs, and the post-secondary and diploma programs that we provide curriculum programs to are all subject to price controls administered by the Chinese government, and our revenue is highly dependent on the level of these tuition charges.

Our revenue from e-Learning services comes primarily from service fees that are paid by customers or students and calculated as a percentage of the tuition revenue of CCLX. We provide services to these entities and the tuition charges for these programs are subject to price controls administered by various price control offices under China’s National Development and Reform Commission, or NDRC. Similarly, our revenue from the curriculum programs that we offer to post-secondary and diploma programs is also directly dependent on the tuition revenue of those schools, and those tuition charges are subject to administrative price controls. In light of the substantial increase in tuitions and other education-related fees in China in recent years, China’s price control authorities may impose stricter price control on tuition charges in the future. If the tuition charges upon which our revenue depends, particularly the tuition charges for CCLX, were to be decreased or if they were not to increase in line with increases in our costs because of the actions of China’s administrative price controls, our revenue and profitability would be adversely affected.

We have a relatively short operating history and are subject to the risks of a new enterprise, any one of which could limit growth, content and services, or market development.

Our short operating history makes it difficult to predict how our businesses will develop. In addition, while we have historically provided distance learning services, we have only recently started our post-secondary education business. Accordingly, we face all of the risks and uncertainties encountered by early-stage companies, such as:

|

|

•

|

uncertain growth in the market for, and uncertain market acceptance of, products, services and technologies;

|

|

|

•

|

the evolving nature of education and e-Learning services and content; and

|

|

|

•

|

competition, technological change or evolving customer preferences that could harm sales of services, content or solutions.

|

If we and CCLX are not able to meet the challenges of building businesses and managing growth, the likely result will be slowed growth, lower margins, additional operational costs and lower income.

We may not be able to successfully execute future acquisitions or efficiently manage the businesses we have acquired to date or may acquire in the future.

Our recent acquisitions and any future acquisitions expose us to potential risks, including risks associated with the diversion of resources from our existing businesses and the inability to generate sufficient revenue to offset the costs and expenses of acquisitions. In addition, the revenue and cost synergies that we expect to achieve from our acquisitions may not materialize. Any of these events could have an adverse effect on our business and operating results. We expect to continue to expand, in part, by acquiring complementary businesses. The success of our past acquisitions and any future acquisitions will depend upon several factors, including:

|

|

•

|

our ability to identify and acquire businesses on a cost-effective basis;

|

|

|

•

|

our ability to integrate acquired personnel, operations, products and technologies into our organization effectively;

|

14

|

|

•

|

our ability to retain and motivate key personnel and to retain the students of the acquired businesses;

|

|

|

•

|

unanticipated problems or legal liabilities of the acquired businesses; and

|

|

|

•

|

tax or accounting issues relating to the acquired businesses.

|

If we are presented with appropriate opportunities, we may acquire additional complementary companies. The integration of acquired companies diverts a great deal of management attention and dedicated staff efforts from other areas of our business. A successful integration process is important to realizing the benefits of an acquisition. If we encounter difficulty integrating our recent and future acquisitions, our business may be adversely affected. The acquisitions may not result in the expected growth or development, which may have an adverse effect on our business. We plan to continue to make strategic acquisitions, and identifying acquisition opportunities could demand substantial management time and resources. Negotiating and financing the potential acquisitions could involve significant cost and uncertainties. If we fail to continue to execute advantageous acquisitions in the future, our overall growth strategy could be impaired, and our operating results could be adversely affected. If we are unable to effectively execute our acquisition strategy or integrate any acquired business, our business, financial condition and results of operations may be materially and adversely affected. In addition, if we use our equity securities as consideration for acquisitions, the value of your common stock may be diluted.

Failure to effectively and efficiently manage the expansion of our school network may materially and adversely affect our ability to capitalize on new business opportunities.

We plan to continue to expand our operations in different geographic locations in China. This expansion has resulted, and will continue to result, in substantial demands on our management, faculty, operational, technological and other resources. Our planned expansion will also place significant demands on us to maintain the consistency of our teaching quality and our culture to ensure that our brand does not suffer as a result of any decreases, whether actual or perceived, in our teaching quality. To manage and support our growth, we must improve our existing operational, administrative and technological systems and our financial and management controls, and recruit, train and retain additional qualified teachers and management personnel as well as other administrative and sales and marketing personnel, particularly as we expand into new markets. We cannot assure you that we will be able to effectively and efficiently manage the growth of our operations, recruit and retain qualified teachers and management personnel and integrate new schools and learning centers into our operations. Any failure to effectively and efficiently manage our expansion may materially and adversely affect our ability to capitalize on new business opportunities, which in turn may have a material adverse impact on our financial condition and results of operations.

If we are unable to achieve or maintain economies of scale with respect to our various lines of business, our results of operations from these businesses may be materially and adversely affected.

Each of our lines of business involves a degree of upfront investment in the development of programs or the acquisition of contract rights to provide services to programs, and our revenue and profitability depend on the number of students in these programs. CCLX to which we provide support and services, and from which we derive a significant portion of our revenue and profits, requires considerable investments of time and resources to develop. In many cases, CCLX also requires that we make substantial investments in collaborative alliances. In the event we need to make an investment in our collaborative alliances, we can use the RMB generated by our operations in the PRC to make an equity investment, or we can choose to purchase certain assets of our collaborative alliances to complete an investment, in order to minimize the effect of SAFE restrictions. The profitability of these programs depends on the ability of the programs to attract students. If the programs or schools are unable to recruit enough students to offset the development and operating costs, our results of operations will be adversely affected.