Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Transocean Ltd. | d8k.htm |

| EX-99.2 - PRESS RELEASE - Transocean Ltd. | dex992.htm |

| EX-99.1 - PRESS RELEASE - Transocean Ltd. | dex991.htm |

Transocean

Ltd. August-September 2011

Exhibit 99.3 |

2

Legal Disclaimer

Legal Disclaimer

The statements described in this presentation that are not historical facts are

forward-looking statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking

statements which could be made include, but are not limited to, statements involving

prospects for the company, expected revenues, capital expenditures, costs and results

of operations and contingencies and other factors discussed in the company's most

recent Form 10-K for the year ended December 31, 2010 and in the company's other filings

with the SEC,

which

are

available

free

of

charge

on

the

SEC's

website

at

www.sec.gov.

Should

one

or

more

of

these risks or uncertainties materialize, or should underlying assumptions prove incorrect,

actual results may

vary

materially

from

those

indicated.

All

subsequent

written

and

oral

forward-looking

statements

attributable to the company or to persons acting on our behalf are expressly qualified in

their entirety by reference to these risks and uncertainties. You should not place

undue reliance on forward-looking statements. Each forward-looking statement

speaks only as of the date of the particular statement, and we undertake no obligation

to publicly update or revise any forward-looking statements. All non-GAAP

financial measure reconciliations to the most comparative GAAP measure are displayed in

quantitative schedules

on

the

company’s

web

site

at

www.deepwater.com.

This presentation does not constitute an offer to sell, or a solicitation of an offer

to buy, any securities, and it does not constitute an offering prospectus within the

meaning of article 652a or article 1156 of the

Swiss

Code

of

Obligations

or

a

listing

prospectus

within

the

meaning

of

the

listing

rules

of

the

SIX

Swiss Exchange. Investors must rely on their own evaluation of Transocean Ltd. and its

securities, including the merits and risks involved. Nothing contained herein is, or

shall be relied on as, a promise or representation as to the future performance of

Transocean Ltd. |

3

Transocean is the Industry Leader

Transocean is the Industry Leader

•

World’s largest offshore contract driller

–

Largest fleet in all asset classes

–

Operate in all markets worldwide

–

Significant relationships across the

customer spectrum

•

Positioned to lead

–

Premier position in ultra-deepwater

market segment

–

Size and technical capabilities create

reinvestment opportunities |

4

Key Investment Highlights

Key Investment Highlights

•

Industry leader committed to customers, employees, and shareholders

•

Visibility and stability due to solid backlog

•

Financial flexibility

•

Improving our fleet in accordance with strategy

•

Leveraged to global opportunities in an improving market

•

Committed to returning excess cash

–

Dividends

Standard

Jackups

High-Spec

Jackups

Midwater

Deepwater

Ultra-

Deepwater

Percent on

Contract

(1)

55%

89%

75%

72%

100% |

Strategy to Lead

in Offshore Resource Development Strategy to Lead in Offshore Resource Development

Transocean

5 |

6

Commitment to Drive Shareholder Value

Commitment to Drive Shareholder Value

Return Cash

to

Shareholders

Capital

Investment

Debt

Reduction

Margin

Improvement |

7

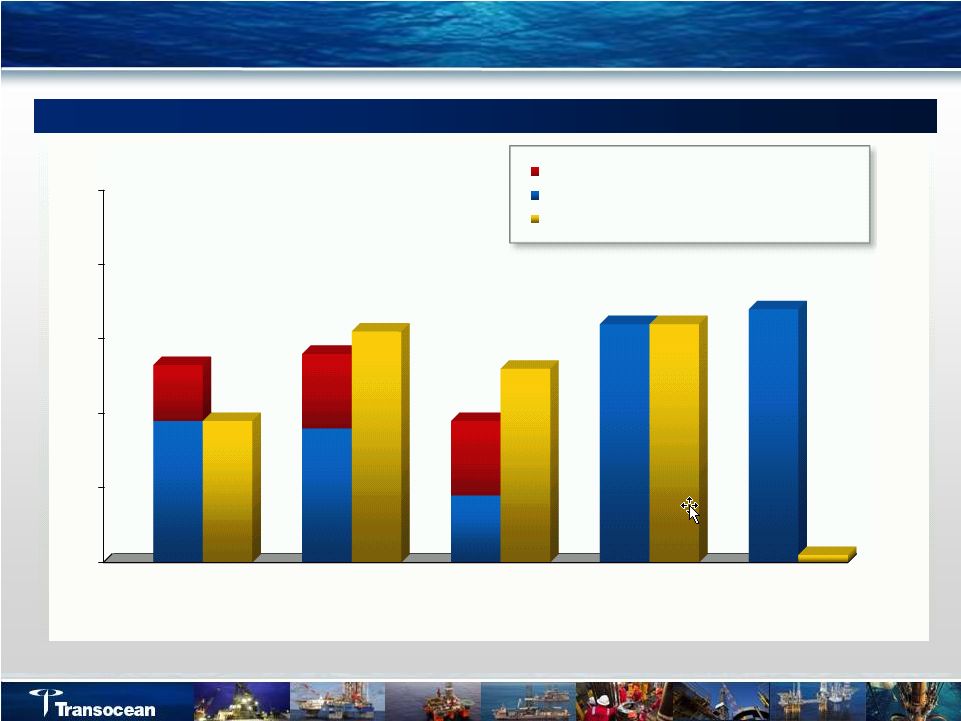

Largest Worldwide Rig Fleet

Largest Worldwide Rig Fleet

(5)

RIG

141

(2)

77

(3)

74

41

41

(4)

Pro forma

Aker Drilling

0

20

40

60

80

100

120

140

160

ESV

NE

DO

SDRL

Rigs Under Construction

Ultra-

Deepwater Floaters

Deepwater Floaters

Midwater Floaters

Jackups |

8

Diversified Revenue Source

Diversified Revenue Source

By Asset Class

(5)

By Customer

YTD June 2011 Revenues -

$4.5 billion

(1)

33%

36%

31%

Integrated

NOC

Independent

41%

14%

23%

12%

7%

3%

Ultra-Deepwater

Deepwater

Midwater

Jackups

ADTI

Other |

Strong Backlog

Creates Visibility Strong Backlog Creates Visibility

Total Contract Revenue Backlog -

$23.6 billion

(6)

4.1

(US$ billions)

7.6

5.2

3.8

2.9

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

2011

Remaining

2012

2013

2014

2015

-20

0.8

1.2

0.6

1.2

0.8

0.7

0.3

2.2

4.6

3.6

1.9

3.0

Ultra

-Deepwater Floaters

Deepwater Floaters

Midwater Floaters

Jackups

9 |

10

Substantial Free Cash Flow Backlog

Substantial Free Cash Flow Backlog

Total Free Cash Flow Backlog of $10.9 billion

(7)

(US$ billions)

2011

Remaining

2012

2013

2014-2019

2020-2038

0.0

1.0

2.0

3.0

4.0

5.0

1.9

1.9

1.8

0.9

3.2

0.75

1.0

1.0

Estimated Dividend Distribution

Scheduled Debt Maturities (Face Value)

Forecasted Free Cash Flow Backlog

3.2

3.4

2.6

1.9

3.1 |

11

Fleet Management: Create Opportunities & Drive Returns

Fleet Management: Create Opportunities & Drive Returns

2009

1.

Core

2.

Solid performers

3.

Non-core

Future

•Acquire, build,

divest and/or spin-off

•Maintain tax

efficiency for future acquisitions & divestitures

1.

Ultra-deepwater

2.

Harsh Environment

3.

High-spec Jackups

4.

High quality floaters and jackups

11

•Core, strategic

asset portfolio •Assessed and segmented fleet |

12

Newbuild Philosophy Drives Investment Decisions

Newbuild Philosophy Drives Investment Decisions

Does RIG have a suitable unit available?

Provide

Upgrade

Can a unit be upgraded?

Is an acquisition available?

Buy

Build

(To Initial Contract)

Is a newbuild appropriate?

Customer Requirements as a Starting Point |

13

Aker Drilling -

Acquisition Details

Aker Drilling -

Acquisition Details

Shareholder

Value

Financing

Strategic

Impact

•

Cash offer for 100% of the shares for NOK 26.50 per share

•

Contributes approximately $1 billion in backlog

•

Expected to be immediately accretive to RIG’s earnings

•

$1.4 billion cash component financed with:

•

Existing cash

•

Current debt facility

•

RIG assumes Aker Drilling net debt of $0.8 billion

(8)

•

Ultimately adds four high specification drilling rigs

•

Immediately enhances our position in Norway as well as

HDHE capabilities

•

Two semisubmersibles on long-term contracts |

14

•

Demand increasing

•

Continued demand growth is required to:

–

Absorb uncontracted newbuilds

–

Bring more idle jackups back to work

–

Increase dayrates for standard units

Jackup Market More Active And Evolving

Jackup Market More Active And Evolving

Jackup Type

Standard

High Spec

Utilization

Increasing

Increasing

Tendering Pace

Increasing

Increasing

Contract Term

Stable

Increasing

Dayrates

Increasing

Increasing

Key Market Drivers

Current Market Overview

Transocean Fleet

(2)

-

60

Global Fleet

(9)

-

354

1

23

15 available

through 1H12

36

18

33

48

255

Contracted

Stacked

Idle

Other |

Midwater Market

Activity Improving •

No influx of newbuilds

•

Demand increasing 2H11

•

Active areas include North Sea, India, & Southeast Asia

•

Deepwater moored units may be threat in 2011

•

Short-term contract durations

•

Dayrates improving

•

Tendering activity accelerating

•

Stacked rigs likely to remain stacked, except in UK

Key Market Drivers

Current Market Overview

Transocean Fleet

(2)

-

28

Global Fleet

(9)

-

87

10 available

through 1H12

15

Contracted

Stacked

Idle

Other |

Deepwater Demand

Still Slow to Respond •

Tightening ultra-deepwater and improving midwater

•

Demand increasing 2H11

•

Dayrates remain stable

•

Moored / lower spec units seeing some idle time

•

Utilization improving

Key Market Drivers

Current Market Overview

Transocean Fleet

(2)

-

18

Global Fleet

(9)

-

56

3 available

through 1H12

16

Contracted

Stacked

Idle

Other

5

13

10

4

3

39 |

Deepwater

Opportunities Deepwater Opportunities

•

Brazil: Tendering 2+ units

•

Egypt: 2 units required

•

Australia: 3 units required

•

Angola: 2 units required

17

Egypt

Angola

Brazil

Australia |

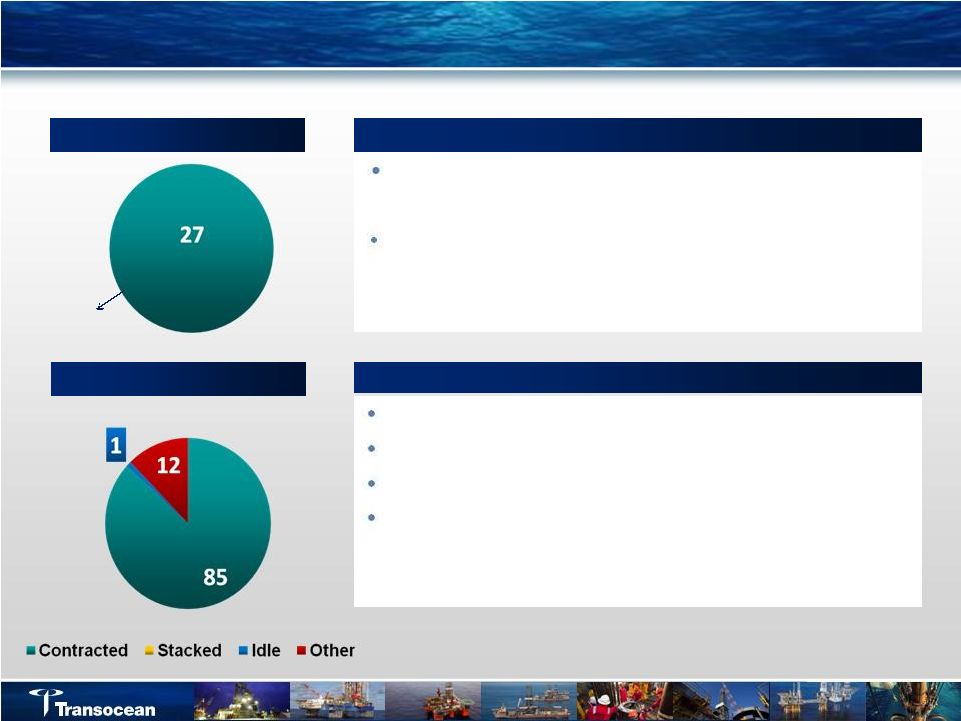

Ultra-Deepwater Strengthening

Market almost sold out in 2011

–

Petrobras has contracted four units

–

Lack of availability increases opportunity for

deepwater fleet

Market utilization over 95%

Tendering pace accelerating

Dayrates improving

Short-term availability decreasing

Key Market Drivers

Current Market Overview

Transocean Fleet

(2)

-

27

Global Fleet

(9)

-

98

1 available

through 1H12

18

Demand increasing 2H11 |

Ultra-Deepwater Opportunities

Ultra-Deepwater Opportunities

•

India: 4 units required for 3 year terms

•

Southeast Asia: Several short term tenders

•

Nigeria: 2+ units for term work

•

UK: Strong demand for summer season

•

Norway: Undersupplied –

Customers urgent to contract

•

Australia: 1+ unit

India

Southeast Asia

Australia

Nigeria

North Sea

UK

19 |

Long-Term

Ultra-Deepwater Outlook is Positive Long-Term Ultra-Deepwater Outlook is

Positive Philippines

India

China

Indonesia

Australia

Mozambique / Tanzania

Black Sea / Turkey

Israel

Gabon

Cote d’Ivoire

Ghana

Liberia

Sierra Leona

Brazil

USGOM

Mexico

20 |

21

Macondo Update

Macondo Update

•

RIG internal investigation report issued on June 22, 2011

–

Concluded the incident was the result of interrelated well design,

construction, and temporary abandonment decisions that compromised the

integrity of the well

•

BOEMRE/USCG final reports expected soon

•

Continued confidence in indemnity

–

Broad indemnity in BP-Deepwater Horizon drilling contract

–

BP’s failure to honor the indemnity obligations would significantly

alter the

E&P –

Oilfield Services operating model |

22

Key Investment Highlights -

Recap

Key Investment Highlights -

Recap

•

Industry leader committed to customers, employees, and shareholders

•

Visibility and stability due to solid backlog

•

Financial flexibility

•

Improving our fleet in accordance with strategy

•

Leveraged to global opportunities in an improving market

•

Committed to returning excess cash

–

Dividends

Standard

Jackups

High-Spec

Jackups

Midwater

Deepwater

Ultra-

Deepwater

Percent on

Contract

(1)

55%

89%

75%

72%

100% |

Transocean

Ltd. August-September 2011 |

24

Footnotes

Footnotes

(1)

Amounts have been restated to reflect the impact of discontinued operations.

(2)

Per Fleet Status Report issued July 13, 2011 & Fleet Update Summary issued August 17,

2011. Floaters classifications are by water depth as described in the Fleet Status

Report. Harsh Environment Floaters are included in the appropriate water depth classification. “Jackups”

includes High-Specification Jackups and Standard Jackups. Rig count is 134, plus 4

newbuilds, less one “other” rigs (one drilling barge). Rigs Under

Construction are inclusive of rigs to be accepted by the customer subsequent to August 17, 2011. “Idle” and “Stacked” rig

classifications are as described in the Fleet Status Report.

(3)

Excludes submersible rigs.

(4)

Excludes tender rigs.

(5)

“Jackups” includes High-Specification Jackups and Standard Jackups.

(6)

Calculated by multiplying the contracted operating dayrate by the firm contract period for

2011 and future periods as of the Fleet Status Report issued July 13, 2011. Firm

commitments are represented by signed drilling contracts or, in some cases, by other definitive

agreements awaiting contract execution. Our contract backlog is calculated by

multiplying the full contractual operating dayrate by the number of days remaining in

the firm contract period, excluding revenues for mobilization, demobilization and contract preparation or

other incentive provisions, which are not expected to be significant to our contract drilling

revenues. The contractual operating dayrate may be higher than the actual

dayrate we receive or we may receive other dayrates included in the contract, such as a waiting-on-weather

rate, repair rate, standby rate or force majeure rate. The contractual operating

dayrate may also be higher than the actual dayrate we receive because of a number of

factors, including rig downtime or suspension of operations. In certain contracts, the dayrate may be

reduced to zero if, for example, repairs extend beyond a stated period of time.

(7)

“Free Cash Flow Backlog” is defined as revenue backlog, plus firm mobilization revenue for contracts not started, less the following: operating

expenditures, overhead costs (except general and administrative costs), firm mobilization costs, cash income taxes, and firm

capital expenditures based on current contract backlog from the company’s Fleet Status

Report as of July 13, 2011. Includes the cash balance as of June 30, 2011. In

preparing the scheduled maturities of our debt, presented as of June 30, 2011 for future periods, we

assumed the noteholders exercise their options to require us to repurchase the 1.50% Series B

and 1.50% Series C Convertible Senior Notes in December 2011 and 2012, respectively.

(8)

“Net debt” is defined as the aggregate carrying amount of debt, net of (a) cash

and cash equivalents and (b) cash balances that are designated as security for certain

debt instruments. At June 30, 2011, Aker’s aggregate carrying amount of debt was $2.0 billion.

(9)

Data from ODS-Petrodata as of August 22, 2011. Analysis by Transocean. Includes

competitive rigs which have completed construction on or before August 22, 2011.

Jackups are defined as independent cantilever. “Other” includes, but is not limited to, rigs which are not under

contract and are en route, in port, in shipyard, out of service, undergoing acceptance

testing, or on standby. (10)

This presentation is unaudited.

|