Attached files

| file | filename |

|---|---|

| EX-2.1 - EXHIBIT 2.1 - SaveDaily Inc | exh2_1.htm |

| EX-3.1 - EXHIBIT 3.1 - SaveDaily Inc | exh3_1.htm |

| EX-10.2 - EXHIBIT 10.2 - SaveDaily Inc | exh10_2.htm |

| EX-99.1 - EXHIBIT 99.1 - SaveDaily Inc | exh99_1.htm |

| EX-10.1 - EXHIBIT 10.1 - SaveDaily Inc | exh10_1.htm |

| EX-23.1 - EXHIBIT 23.1 - SaveDaily Inc | exh23_1.htm |

| EX-99.2 - EXHIBIT 99.2 - SaveDaily Inc | exh99_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 22, 2011

NINE MILE SOFTWARE, INC.

(Exact name of registrant as specified in Charter)

|

Nevada

|

333-143039

|

20-8006878

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File No.)

|

(IRS Employee Identification No.)

|

3020 Old Ranch Parkway, Suite 140

Seal Beach, California 90740

(Address of Principal Executive Offices)

(562) 795-7500

(Issuer Telephone number)

563 West 500 South, Suite 330, Bountiful, Utah 84010

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

1

Forward Looking Statements

This Form 8-K and other reports filed by Registrant from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, Registrant’s management as well as estimates and assumptions made by Registrant’s management. When used in the filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to Registrant or Registrant’s management identify forward-looking statements. Such statements reflect the current view of Registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) relating to Registrant’s industry, Registrant’s operations and results of operations, and any businesses that may be acquired by Registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although Registrant believes that the expectations reflected in the forward looking statements are reasonable, Registrant cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States of America, Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with Registrant’s pro forma financial statements and the related notes that will be filed herein.

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Merger with SaveDaily.com, Inc.

On August 22, 2011, Nine Mile Software, Inc., a Nevada corporation (“Nine Mile”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with SD Acquisition Inc., a California corporation and a wholly-owned subsidiary of Old Nine Mile (“Merger Sub”), and SaveDaily.com, Inc., a California corporation, pursuant to which Merger Sub would be merged (the “Merger”) into SaveDaily.com, Inc., and SaveDaily.com, Inc. would become a wholly-owned subsidiary of Nine Mile.

For purposes of this Current Report on Form 8-K, references herein to “Nine Mile” shall refer to Nine Mile prior to the closing of the Merger, references herein to “Old SaveDaily” shall refer to SaveDaily.com, Inc. prior to the Merger, and references herein to “SaveDaily” shall refer to (i) the operations of SaveDaily.com, Inc., prior to the Merger and (ii) SaveDaily, Inc., commencing on and continuing after the closing of the Merger.

The foregoing description does not purport to be a complete statement of the parties’ rights and obligations under the Merger Agreement and the above description is qualified in its entirety by reference to the Merger Agreement. A copy of the Merger Agreement is included as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Spin-Off of TradeWarrior.

In connection with the Merger, and as a part of the transactions contemplated thereby, Nine Mile entered into a Stock Purchase Agreement, that was deemed effective and closed as of August 26, 2011 (the “TradeWarrior Agreement”) with Damon Deru, the chief executive officer of Nine Mile prior to the Merger (the “Acquirer”). Pursuant to the Trade Warrior Agreement, Nine Mile agreed to sell and transfer (the “Spin-Off”) TradeWarrior, a Nevada corporation and a wholly owned subsidiary of Nine Mile (“TradeWarrior”), to the Acquirer, in consideration for the Acquirer's agreement to assume all liabilities associated with Nine Mile and Trade Warrior relating to or arising in connection with the period prior to the consummation of the Merger. Additionally, in connection with the Merger and the Spin-Off, the Acquirer agreed to return 100,000 shares of Nine Mile Common Stock to Nine Mile for cancellation.

2

The Board of Directors of Nine Mile approved the Spin-Off as part of the negotiations that led to the Merger. Although the Board of Directors believes, based upon the facts and circumstances, that the Spin-Off, the Merger and the transactions contemplated in connection with each of the Spin-Off and the Merger (the “Strategic Transactions”) should be deemed to be fair and in the best interests of Nine Mile and its shareholders, the Board of Directors of Nine Mile did not have any independent or disinterested directors who could make an independent valuation.

The foregoing description does not purport to be a complete statement of the parties’ rights and obligations under the TradeWarrior Agreement and the above description is qualified in its entirety by reference to the TradeWarrior Agreement. A copy of the TradeWarrior Agreement is included as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

Closing of Merger.

On August 22, 2011, Nine Mile entered into the Merger Agreement. The Merger was effective, on August 23, 2011 (the “Merger Date”), by the filing of an Agreement of Merger with the California Secretary of State. Pursuant to the Merger Agreement, Nine Mile issued 33,000,000 shares of Nine Mile common stock, $.001 par value per share (“Nine Mile Common Stock” or the “Company’s Common Stock”) to the stockholders of Old SaveDaily, determined as of immediately prior to the closing of the Merger (the “Old SaveDaily Stockholders”). Those persons holding shares of Old SaveDaily Common Stock, warrants and options to purchase shares of Old SaveDaily Common Stock, and certain promissory notes convertible into shares of Old SaveDaily Common Stock, received shares of Nine Mile Common Stock and warrants and options to purchase shares of Nine Mile Common Stock. As part of the Merger, SaveDaily.com, Inc. also paid $75,000 to Old Nine Mile for discharge of certain of Nine Mile obligations owed to others and $25,000 to bolster the capital of Trade Warrior.

The shares of Nine Mile Common Stock were issued to the Old SaveDaily Stockholders at a conversion ratio of 1 to 1.0812286 (the “Conversion Ratio”), whereby each share of Old SaveDaily Common Stock was converted into the right to receive 1.0812286 shares of Nine Mile Common Stock.

In addition, each outstanding option and warrant to purchase shares of Old SaveDaily Common Stock was exchanged with and/or converted into an option or warrant, respectively, to purchase that number of shares of Nine Mile Common Stock equal to (a) the number of shares of Old SaveDaily Common Stock underlying the option or warrant times (b) the Conversion Ratio. In connection therewith, there were options to purchase 140,340 shares of Old SaveDaily Common Stock that SaveDaily assumed and that are now exercisable for 151,761 shares of Nine Mile Common Stock (as determined on a post-conversion basis). Additionally, there were warrants to purchase 1,799,960 shares of Old SaveDaily Common Stock that Nine Mile assumed and that are now exercisable for 1,946,168 shares of Nine Mile Common Stock (as determined on a post-conversion basis).

3

Upon issuance of the shares of Nine Mile Common Stock to the Old SaveDaily Stockholders, there were a total of 34,574,556 shares of Nine Mile Common Stock issued and outstanding. Immediately following the closing of the Merger, the former shareholders of Nine Mile, as a group, held approximately 4.55% of the total number of outstanding shares of Nine Mile Common Stock, and the Old SaveDaily Stockholders held the balance of approximately 95.45%.

The resulting merged company will operate under the name SaveDaily, Inc. From and after the closing of the Merger, the Company’s primary operations consist of the business and operations of SaveDaily.

This Current Report on Form 8-K contains summaries of the material terms of various agreements executed in connection with the transactions described herein. The summaries of these agreements are subject to, and qualified in their entirety by, reference to these agreements, all of which are incorporated herein by reference.

BUSINESS

Overview.

SaveDaily.com, Inc., or "SaveDaily," was formed in California in May 1999 and is headquartered in Seal Beach, California.

Business Development.

Introduction

SaveDaily developed (over eight years) and owns a proprietary financial services platform, the most recent version being in production for about three years, helping financial intermediaries succeed in bringing suitable and affordable investment services to everyday savers and investors. In the view of management of SaveDaily, the mass market class is in need of affordable access to the relationships and investment strategies typically reserved only for affluent investors. SaveDaily was founded to provide people of all income levels the information and tools necessary to invest and self manage their short and long term investment goals.

The everyday saver is often under-served because the acquisition and maintenance of their accounts are often unprofitable or only marginally profitable for financial institutions and brokerage houses. SaveDaily's proven proprietary technology is a low cost, private label solution for these financial institutions designed specifically to serve the mass market - commonly referred to as the small investor and mass affluent investor, making up 90% of the investing population. Our private label platform offers mutual funds and any daily-valued product investments for both qualified and non-qualified account types.

The SaveDaily platform provides straight-through processing, record keeping and all-electronic money movement. With a complete end-to-end technological infrastructure, the financial services, defined contribution, and asset management market users gain a feature-rich, low cost, efficient, easy to use, and easy to deploy servicing platform. This open architecture, omnibus trading platform is flexible and unencumbered by laborious manual processes. Management believes that by remaining mutual fund, bank and clearing firm agnostic, SaveDaily’s platform delivers mutual funds, its feature set, and a price point our partners need to provide superior services to their investor clients at increased profit levels. Leveraging its scalable, all-electronic, sub-accounting and money movement platform, SaveDaily believes that it currently offers the industry's lowest cost, private-labeled, investment solutions to large banks, community banks, credit unions, and broker dealers. By helping these entities bring their investors completely private-labeled solutions, delivered under their respective brands, and leveraging virtually any mutual fund and virtually any third party money manager(s), investors in our service sets enjoy access to advisory services generally not readily available to this investor class.

4

By using its platform products, business partners of SaveDaily gain the ability to attract new customers, retain existing customers, lower servicing costs, and derive new revenue streams by incorporating a customizable mutual fund investing solution into their existing offerings. SaveDaily enables partner organizations to accelerate time-to-market by providing turn-key solutions and a robust Applications Programming Interface that supports tight integration between SaveDaily's investor platform and their existing infrastructure, at any back-office or consumer touch point.

By utilizing SaveDaily's proprietary platform products clients are able to initiate brokerage services with consumer-direct offerings, augment existing programs with financial advisors, more efficiently oversee portfolio management of trust funds, 401(k) Plans, 403(b) Plans, Safe Harbor IRA Rollovers, and provide for managed fund accounts. SaveDaily offers a full-service record keeping facility, providing participants with daily valuations and full-featured web access, all while maintaining compliance with pre-determined mutual fund models or approved product lists. All tax reporting, performance reporting, confirmation, and statement delivery is to be provided by SaveDaily directly to investors, or integrated into existing partner operations, for a seamless flow of regulated information to the investors

The Company

SaveDaily produces and supports proprietary record keeping and workflow software solutions in the financial services industry that market products and services to everyday savers and investors. Mass market and mass affluent savers and investors typically have investable assets of less than $100,000 and generally make up the bulk of the retail client services by the banking industry, the qualified and defined benefits industry, and the debit card industry - all of which are target markets.

SaveDaily was incorporated in May 1999 in the State of California. SaveDaily has had a history of losses and does not yet operate at break even cash flow. Since its inception, SaveDaily has received more than $14 million in equity from private sources. The first eight years were spent in development of a fully integrated platform of technology solutions, during which time components were created in conjunction with key firms within the financial services industry. It currently has 10 employees, its solutions, though continuing to evolve and be refined, are mature, and it has been actively marketing these solutions since about 2008. Deployed with partners supporting investment accounts in both the qualified and non-qualified spaces, SaveDaily’s solutions are operating successfully in its defined markets. SaveDaily offers investments and record-keeping services directly to clients via its website located at www.savedaily.com, as well as indirectly to clients of business partners through a variety of white-labeled interfaces. Through its various online portals, clients are able to find educational information, investment and account type wizards, and can open and transact mutual fund investments in individual, joint, custodial, IRA, ESA, Qualified and HSA accounts.

SaveDaily has formed strategic joint ventures to provide investment services to ethnically, religiously, and socio-economically focused communities, including African-American, Latino-American, and economically underserved and un-banked populaces. In these communities, SaveDaily is providing managed accounts of all tax types in conjunction with its strategic partners, who are themselves focused in these market places.

5

SaveDaily has partnered with UMB Bank, N.A. to provide Safe Harbor Automatic Rollover IRAs to terminated participants of qualified retirement plans, and has entered into over 1,500 agreements with retirement plan sponsors to handle their Safe Harbor Automatic Rollover IRAs.

SaveDaily also partners with third party administrators (TPAs) to create and offer a 401K/Qualified plan record-keeping platform aimed at TPAs, payroll associations and financial advisors. The platform was created to be private labeled by distribution partners, with SaveDaily providing record-keeping, trading, settlement and customer support.

SaveDaily launched an HSA investment sub-account product in 2007. This product is designed to link with existing banks and other entities that provide or manage direct deposit account support for HSAs. In September of 2007, SaveDaily was selected as the investment solution for the largest HSA provider in the country, which began deployment of the company's solution to its client base in October of 2008.

Mission:

The mission of SaveDaily is to provide advice-driven investment services to the mass market, worldwide, that are otherwise made available only to the high-net worth investor. In this pursuit, SaveDaily reaches out to small investors both through fully automated technology solutions and through the channels already being used. In partnership with the intermediaries that control these channels, SaveDaily offers its services at retail and wholesale price points which SaveDaily believes to be affordable to all.

Market:

Personal consumption, or what people do as consumers, represents about 70% of the United States Gross Domestic Product and represents the largest influence on our economic health. As larger groups of consumers age and spend more, the economy grows. When large groups in the population pass their peak stage in spending, the economy slows down. Banks see a slowdown in mortgage loans, car loans, and insurance related products, and their affluent customers tend to decrease spending and tend to adopt more conservative stances regarding investments. These factors collectively result in decreased revenues to the banks. Institutions providing retail banking services are seeking to make up this revenue in growing instances by providing additional services to their less affluent retail customers who together make up about 90% of the population in the United States. Because of the ubiquitous nature of banking in today’s electronic world, retail banking customers can change banks virtually overnight. This creates an ultra-competitive environment for banks and the financial services industry at large, resulting in an extremely price sensitive and customer service sensitive market space. Consumers of financial services through banks, credit unions, traditional financial service firms, and non-traditional financial intermediaries, expect low price points for services generally reserved for the affluent consumers of the previous generation. In order for these financial institutions and intermediaries to retain and grow their existing customer bases they must address these facts.

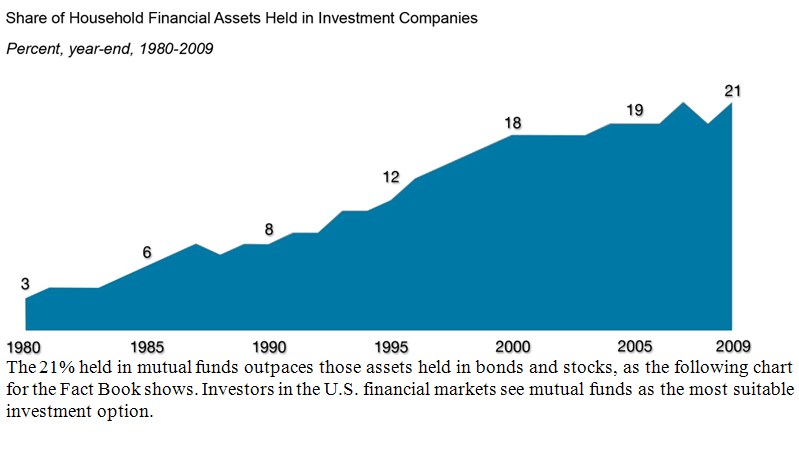

The 2010 Investment Company Fact Book (the “Fact Book”), published by the Investment Company Institute, details the characteristics of the mutual fund industry through its research into the investment companies that issue mutual funds. In its latest report, the following graph shows that 21% of household assets in the United States are made up of mutual funds.

6

Share of Household Financial Assets Held in Investment Companies Percent, year-end, 1980-2009 3 6 8 12 18 19 21 1980 1985 1990 1995 2000 2005 2009

The 21% held in mutual funds outpaces those assets held in bonds and stocks, as the following chart for the Fact Book shows. Investors in the U.S. financial markets see mutual funds as the most suitable investment option.

Household Net Investments in Funds, * Bonds, and Stocks Billions of dollars, 2000-2009 registered investment companies* directly held bonds directly held stock 481 385 193 16 183 304 399 589 774 319 308 -70 -121 61 205 226 72 512 23 196 -680 -518 -213 -125 -344 -478 -667 -951 -108 -162 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

7

Coupling this demonstrated desire to invest in mutual funds with the aforementioned price sensitivity of the demographic currently being served by the banks and the financial services industry at large, SaveDaily believes it operates in an environment where a full-service low priced mutual fund investing platform becomes extremely attractive to the 90% of the U.S. markets not considered affluent and not being served under the offerings typically made available by the financial services industry.

Services:

The Company's platform is deployed for use in multiple account types: qualified retirement plans, Health Savings Investment Accounts, Safe Harbor Automatic IRA Rollovers and the direct-to-consumer space. Through these offerings, SaveDaily delivers professionally managed mutual funds and advice driven investment allocation models. Regardless of the market space being served, SaveDaily delivers its service set for what it believes to be a low annual fee, collected monthly, quarterly, or annually, without imposing limits on the number of mutual funds within an account. SaveDaily also allows numerous transactions within those mutual funds, generally requires no minimum transaction amounts, and has no excessive trading penalties. Comparatively low asset based fees may also be levied for the use of advice driven models composed of allocations of mutual funds. This pricing approach represents one of the lowest pricing models in the industry to our partners and ultimately to the investors using these services. As an end-to-end deliverable, investors are able to enjoy a feature rich, fully regulatory compliant investing platform, trading virtually all mutual funds made available by issuers.

The core of our deliverable is an integrated library of Applications Programming Interfaces (API) that can be either integrated into our partner’s existing infrastructure or hosted as a stand-alone financial management system. SaveDaily built its API on a scalable, all-electronic, sub-accounting and money movement framework. The API allows SaveDaily to readily deliver its service set under a private-label approach to its partners. SaveDaily delivers this API to its partners, including non-traditional financial services providers, employee benefit program providers, and financial intermediaries, enabling them more efficiently to offer mutual fund products and value-added financial services to a broader spectrum of investor accounts, across a multitude of interactive consumer touch points. Features of the API include:

|

§

|

Full electronic record-keeping of financial transactions (electronic confirmations, statements, transaction histories, tax records, etc.)

|

|

§

|

Integration and compliance with all technology and regulatory requirements (SEC, security licenses, privacy practices, ACH, etc.)

|

|

§

|

Straight through processing of transactions (paperless brokerage, e-registration, etc.)

|

|

§

|

An open architecture, expandable for future services

|

|

§

|

Full integration with partner systems enabling a private-label strategy

|

|

§

|

Framed solution to facilitate small or niche marketers

|

SaveDaily augments its API with complete technology support, financial advisory and educational services, and electronic assessment and interactive asset allocation tools to create a transparent investor environment and a robust, turn-key investing and commerce platform for our partners.

8

SaveDaily’s efficient and low cost structure can result in higher margins for those partner organizations currently offering mutual fund investing to their existing customer base. In addition, the platform enables its partners to service profitably even the lowest income consumer segments with top-tier mutual fund investment securities, opening the door to entirely new markets and revenue opportunities.

Competitive Features:

SaveDaily believes that it is competitively positioned to offer mutual fund investing solutions to its partners via SaveDaily's proprietary platform. Having logged over 8 years towards development and solution refinement, invested significant financial resources and forged key strategic operational partnerships, SaveDaily has achieved "first mover" status in the industry, resulting in an array of competitive advantages:

|

§

|

New Business Processes Result in Low Cost Infrastructure for the Industry – SaveDaily built its platform with a focus on efficiency and cost-effectiveness unconstrained by legacy systems. The platform utilizes technology to reduce costs for providers in existing markets and create new market opportunities for non-traditional financial services providers.

|

|

§

|

Proprietary Sub-Accounting and Record Keeping System – SaveDaily has created an all-electronic, low cost sub-accounting system that often materially reduces the cost of administering a brokerage account.

|

|

§

|

Straight Through Processing – SaveDaily’s platform utilizes straight through processing of mutual fund transactions, connecting its partners’ investors directly to the investment product, reducing the number of steps and people involved in transaction processing.

|

|

§

|

Money Movement Technology Architecture – The platform’s multi-source/multi-destination money movement architecture is capable of receiving funds from a variety of sources and pushing funds to a variety of destinations via secure electronic networks, resulting in nearly frictionless transactions.

|

|

§

|

Completely Paperless System – The platform supports online registration, electronic transactions via the ACH network, electronic trading capabilities, electronic confirmations, electronic prospectuses and quarterly statements, and electronic tax reporting.

|

|

§

|

Micro-Investing Capability Attracts New Investors – SaveDaily’s platform enables investors the ability to invest amounts as small as $0.01 into multiple nationally known mutual funds. This capability enables partners to serve mass market and mass affluent investors, addressing an estimated 51% of domestic households that have yet to purchase mutual funds.

|

|

§

|

Breadth of Expertise – In developing and delivering the platform, SaveDaily has acquired a cross-discipline combination of re-engineered processes, innovative technology, business agreements with fund providers and banking entities, financial licenses, and a carefully designed legal and regulatory structure.

|

9

|

§

|

Customizable Private-Label Solution is Built for Integration – SaveDaily has applied the knowledge it has gained in its years of experience running a direct-to-consumer website to optimize the platform specifically for partner integration. The Application Programming Interface (API) based model, open architecture, and adherence to data transfer standards allows for transparent integration in support of our partner’s branding efforts.

|

In summary, SaveDaily's technology platform allows clients to reduce costs of managing investment accounts to price points that are consumer friendly and profitable for the service provider. The scalable design of the technology allows for rapid expansion and integration with existing programs. In management's view “SaveDaily brings the investment world of Wall Street to the savings needs of Main Street.”

Targets:

SaveDaily provides its platform to partners that have large existing customer bases with a propensity to invest, regardless of income level or experience. Through these relationships, SaveDaily is creating an extended distribution channel for low cost mutual fund investing, growing investment accounts and clients. These partners include traditional financial services providers and non-traditional intermediaries, such as affinity groups and retailers that are focused on providing services to the workplace and directly to consumers. SaveDaily enters into servicing agreements with these established partners in order to accelerate account growth. SaveDaily is targeting the following distribution markets:

|

§

|

Retail Banking Industry

|

|

§

|

Brokerage Industry

|

|

§

|

Employer Services Industry

|

|

§

|

Non-traditional Financial Services Providers

|

Benefits to the Mass Affluent and Mass Market investors:

|

§

|

Low monthly fee covers no limits on the number of funds within an account, numerous transactions within those mutual funds, no minimum balance and no minimum investment amount.

|

|

§

|

Easy to use tools geared for the everyday saver and investor (mass market and mass affluent).

|

|

§

|

Ability to invest towards core financial goals.

|

|

§

|

24/7 access.

|

|

§

|

Accessibility to virtually all available mutual funds.

|

|

§

|

Automatic Investment Plans – “out of sight/out of mind” investing.

|

|

§

|

Flexible investment and planning tools.

|

Benefits to SaveDaily’s partners:

All Target Partners:

|

§

|

Profitably service existing retail customers and expand customer base.

|

|

§

|

Low monthly fee covers no limits on the number of funds within an account, numerous transactions within those mutual funds, no minimum balance and no minimum investment amount.

|

|

§

|

Automatic allocation and rebalancing of professionally managed products.

|

|

§

|

New revenue streams and ability to have higher margins on account fees and asset based fees.

|

10

|

§

|

Retain customers and prevent erosion of captive funds to external brokerage providers.

|

|

§

|

Private-labels promote existing brands and enhances customer loyalty.

|

|

§

|

Wealth transfer tools inspire family loyalty, client retention, and asset retention.

|

|

§

|

Infrastructure based on open systems and industry standards.

|

|

§

|

All related compliance and regulatory requirements managed.

|

|

§

|

Data mining and report generation for account management/administration/review.

|

|

§

|

Improve public relations by empowering the small investor.

|

Retail Banking Industry:

Large Banks, Community Banks, and Credit Unions:

|

§

|

Allows banks to expand their asset management business to retail customer base and beyond.

|

|

§

|

Prevents erosion of captive assets to external brokerage accounts.

|

|

§

|

Represents new product and incremental fee income from existing base.

|

|

§

|

Automated account management enables high-touch/low-cost advisory services.

|

|

§

|

Increase touch points into household.

|

|

§

|

Minimizes/eliminates need for commission based personnel, reducing compliance risk.

|

|

§

|

Bring beginning investors and lower income households into the asset accumulation.

|

Brokerage Industry:

Large Wire Houses and Small-Medium Broker Dealers:

|

§

|

Rapid growth of assets under management by penetrating deeper levels of U.S. demographic.

|

|

§

|

Provides personalized client experience with reduced impact on investment advisors.

|

|

§

|

Dramatic reduction in paper for existing operations.

|

|

§

|

Dramatic reduction in costs of operations associated with mass affluent account maintenance.

|

|

§

|

Increase touch points into household.

|

Employer Services Industry:

Affinity Based Services Providers, Third Party Administrators, and Employer Groups:

|

§

|

Ability to offer non-qualified investment programs to complement qualified plan offerings.

|

|

§

|

Affordable to substantially all employees.

|

|

§

|

Support for payroll deduction and consolidated statements.

|

Non-traditional Financial Service Providers:

Existing Market Under-Defined Targets:

The Fact Book estimates that, since about the year 2000, the mutual fund industry has experienced average annual growth of over 15%, resulting in mutual fund assets growth from about $7 trillion to nearly $11 trillion by the end of 2009. At the end of 2009, there were approximately 271 million mutual fund accounts in the United States, representing 44% of U.S. households (51.6 million U.S. households or about 90.2 million investors), having an average account balance of $40,500. The market addressed by SaveDaily’s products represented nearly $5.5 billion in revenue in 2009 from account administration and servicing fees, in addition to advisory and distribution fees from assets under management.

11

Of the 271 million mutual fund accounts, the Tower Group estimated that 20% of these were serviced by third party transfer agencies and record keeping services, representing a total of about 54 million accounts. At an annual average of $48 per account for transfer agency and record-keeping services provided via the SaveDaily platform, the annual market opportunity for these services is nearly $2.5 billion.

Registered Investment Advisors typically charge investors an annual advisory fee of between 1% and 3% of assets under management for financial advice and management of their portfolio. Additionally, mutual fund companies pay out distribution fees of between 25 and 40 basis points annually on total assets under management to intermediaries who sell their mutual funds. Assuming an annual advisory fee of 50 basis points and earned distribution fees of 32.5 basis points, the annual revenue opportunity for the 20% of accounts currently serviced by third party record keeping services is approximately $18 billion.

New Market Under-Served Targets:

The platform’s low cost structure enables financial services providers to profitably serve smaller accounts than previously practical, thereby increasing the numbers of this serviceable market. This increased market opportunity could result in nearly 220 million additional accounts, representing an annual market opportunity of $2.1 billion (again based on the Tower Group estimate of 20%) in transfer agency and record-keeping services. These potential accounts are based on the estimated total number of accounts possible in the U.S. as extrapolated from existing accounts versus percent of households in the U.S. they represent (about 615 million possible accounts).

Due to the low cost structure of the platform, SaveDaily believes that it is currently one of the few companies able to profitably service this additional market of accounts.

Sales Strategy:

Rather than marketing its services directly to consumers, SaveDaily looks to partner with financial services intermediaries that currently have both small and large customer bases with a propensity to invest, regardless of income level or experience. Through these relationships, SaveDaily is creating an extended distribution channel for low cost mutual fund investing, fueling investment account growth, and reaching out to savers and investors through partners. These partners include traditional financial services providers and non-traditional intermediaries, such as affinity groups and employer service providers, that are focused on providing services to the workplace and directly to the consumer. SaveDaily delivers its technology and services to partners who wish to accelerate account growth and offload the burden and cost of customer acquisition. These partners can include large wire houses, large banks, and large broker/dealers that are currently divesting themselves of the mass market and mass affluent investors because of their high cost of operations generally associated with this consumer class. Furthermore, SaveDaily believes that it can benefit by leveraging the brand equity of our partners and the ‘trusted provider’ relationship they have with their consumers, particularly in the credit union and community bank markets, where these institutions have already expended material resources and time to build strong member relationships and wish to build reinforced, longer-term loyalty within their existing consumer bases.

12

SaveDaily is pursuing two approaches to engage in partnerships and reach consumers through those partners: (1) direct sales and (2) working through intermediaries.

Direct Sales:

SaveDaily is focusing on engaging partners directly to leverage its platform for the purpose of offering financial services to the partner’s audience. In these instances, SaveDaily works directly with each of its industry partners to design the solution, to ensure a successful deployment, and to maximize participation by the partner’s consumer base. Direct Sales resources include:

|

1.

|

Full-Time Internal Sales Professionals

|

SaveDaily’s sales professionals are focused on providing the technology solutions necessary for our partners to serve the mass market and create class leading efficiencies in its four target areas. SaveDaily’s Director of Business Development has extensive experience selling solutions into these target areas.

|

2.

|

Consultants and Subject Matter Experts

|

The Company has and will continue to establish performance-based contracts with independent consultants to capitalize on their “spheres of influence” and further penetrate its target areas.

Intermediaries:

To augment its partnering efforts in the direct channel, SaveDaily has and will continue to enter into co-brand and white label services agreements with intermediaries to increase distribution to partners in the four target areas. These intermediaries are licensed to sell value added services (based on SaveDaily’s platform) directly to partners, and will in turn pay SaveDaily an annual account fee for each Investment Account opened through the partner. For example, a Professional Employer Organization (PEO), acting as an intermediary, could offer non-qualified Investment plans to the employees of multiple client companies.

SaveDaily has and will continue to establish co-marketing arrangements; whereby an intermediary can initiate the interest of a partner and introduce SaveDaily to an opportunity. In these cases, SaveDaily would share a portion of the resulting revenues with the intermediary. Establishing an intermediary channel allows SaveDaily to expand distribution and reach of its solutions without incurring a proportionate expense.

Distribution Approach

SaveDaily delivers its platform to its distribution partners as either a private-labeled or co-branded solution in a completely turn-key package or as a fully customizable package, which includes the following features and services:

|

§

|

An Application Programming Interface (API) set and a complete set of back-end services.

|

|

§

|

A platform is built specifically for partner integration and based on open standards.

|

|

§

|

Partners are free to manage the consumer-facing touch points as they desire.

|

|

§

|

Investors access their investment accounts via the partner’s interfaces.

|

|

§

|

Partner pages are subject to our compliance oversight.

|

13

SaveDaily generally requires its partners to pay SaveDaily a setup fee depending on the number of interfaces they are deploying. This fee is paid at contract execution to ensure that the resources needed for customization, partner integration, and deployment of the SaveDaily platform is funded prior to full deployment. Partners are thereafter charged a recurring annual fee per account, which can be collected monthly, quarterly, or annually. The flexibility of the SaveDaily fee engine, built into the platform, accommodates its partners’ varying business models, including any existing fee structures they have in place. Banks may, for instance, prefer to charge a monthly fee, rather than an annual, or may prefer to institute a transaction-based fee. SaveDaily’s platform permits clients to levy their preferred fee structures on its partners' behalf and remand those fees directly to those partners.

Sales Cycle:

Steps in the SaveDaily sales cycle typically include:

|

1.

|

Develop lead lists based on criteria outlined for each target area.

|

|

2.

|

Engage partner existing contact network – no "cold calling" of end user customer or clients of intermediaries.

|

|

3.

|

Qualify a potential partner and identify decision maker(s) for that partner.

|

|

4.

|

Provide preliminary sales materials to potential partner and/or conduct conference calls/demonstrations as appropriate.

|

|

5.

|

Gather program requirements and generate proposals/statements of work.

|

|

6.

|

Prepare rollouts/implementation plan(s) (pilot if necessary) and negotiate contract.

|

|

7.

|

Execute Contract.

|

|

8.

|

Ensure satisfactory implementation and launch.

|

|

9.

|

Market additional services as needed or appropriate.

|

The following is an estimation of the duration of sales cycles by target area:

|

Target Area

|

Minimum Cycles

|

Maximum Cycles

|

|

Banking

|

6 Months

|

15 Months

|

|

Brokerage

|

6 Months

|

12 Months

|

|

Employer Services

|

4 Months

|

12 Months

|

|

Non-traditional Providers

|

2 Months

|

9 Months

|

In general, non-traditional financial service providers will have the shortest sales cycle due to their focus on revenue generation, propensity towards technology-enabled services, customer focus and need to increase value-added service offerings, and their willingness to let SaveDaily manage compliance and regulatory issues.

14

Current Competitors:

Although SaveDaily currently services about 40,000 customers it has had a history of losses and does not yet operate at break-even cash flow. SaveDaily believes that it has the ability to compete successfully based on:

|

§

|

Its market penetration/presence with financial institutions and related scale advantages.

|

|

§

|

The reliability, security, speed and capacity of its technical infrastructure.

|

|

§

|

The comprehensiveness, scalability, ease of use and service level of its products and services.

|

|

§

|

Its ability to interface with vendors of data processing software and services.

|

|

§

|

Its pricing policies and the pricing policies of our competitors and suppliers.

|

|

§

|

The timing of introductions of new products and services by the company and its competitors.

|

|

§

|

Its ability to support unique customer requirements.

|

|

§

|

Its understanding of and attention to the complex regulatory environment related to provision of financial services.

|

|

§

|

Business acumen of management team to bring together financial services industry with profitable technology solutions for the mass market investor.

|

SaveDaily views direct competitors as product and service providers who are targeting the same market with similar products and services. By this definition, SaveDaily believes that its principal current, direct competitor is ShareBuilder, currently a subsidiary of ING Direct.

ShareBuilder focuses on fractional share equity (stock) trading, an industry segment SaveDaily believes is ill-suited for the mass markets and the emerging investor markets. Mutual funds are generally viewed as a more sound alternative for the emerging investor because they are professionally managed and their inherent diversification is believed to result in less risk and volatility than individual stocks.

ShareBuilder’s revenue model differs significantly from SaveDaily’s. ShareBuilder’s solution is either offered as a transaction fee based model ($19.95 per trade) or a monthly subscription model ($12 plus $7.95 per trade). In either case, the pricing structure for partners and their end users is currently higher than SaveDaily’s basic pricing structure of $5.95 per month for multiple positions, numerous transactions, and no minimums. SaveDaily’s low cost structure can result in a more profitable model for partners and is a more affordable model for the end-user. This model allows the end-user to make changes to their holdings at any time without worrying about associated costs of doing so, e.g., the costs of one or more trades. Additionally, the revenue generated for partners offering ShareBuilder is not as favorable when compared to the revenue potential related to SaveDaily’s platform.

ShareBuilder’s co-branded solution is not intended to integrate into partners’ existing web infrastructures. The ShareBuilder solution is offered primarily as a separate product linked from the partner site, in contrast to the integration offered by the SaveDaily platform. SaveDaily’s ASP design promotes a private-label strategy that is a better fit for intermediaries that have committed a significant amount of resources in building brand equity. When a customer chooses to participate in a co-branded ShareBuilder program, the end-user is taken to the ShareBuilder site to open an account and conduct all transactions. From a SaveDaily perspective this solution does not preserve brand-equity and does not provide a transparent and seamless solution to partners. Further, end-user accounts become the accounts of ShareBuilder. End-user accounts with SaveDaily are jointly owned by SaveDaily and its partners, which SaveDaily believes will prove more attractive to potential partners.

15

Devenir provides strategic financial solutions to individuals and corporations and designed to meet wealth management and corporate services needs, including customized wealth management for high net worth individuals, families, corporations, trusts and foundations and dedicated corporate services to banks, corporations, executives and third party administrators. Providing investment advisory services, Devenir works off a fee only basis. Devenir has begun to operate in the HSA arena, which competes directly with a SaveDaily market. However, we believe that the solution that SaveDaily offers to its clients is more fully developed and operational at a lower cost to institutional partners.

SaveDaily’s focus on the small investor, which is presently not that of Devenir.

Broadridge is a provider of transaction processing systems, desktop productivity applications and investor communication services to the financial services industry worldwide. Their services encompass an array of services - from account opening and securities transaction processing to document management and investor communications as well as full operational staff outsourcing. Broadridge offers global banks, retail, institutional and discount brokerage firms, and correspondent clearing firms, multi-entity, multi-currency securities processing solutions. Focusing upon back-office data center operations the Broadridge platform supports real-time processing of North American and international equities, options, mutual funds, fixed income securities and more.

Broadridge employs a combination of best-of-breed products and technologies. Their pricing model with large startup costs might make it difficult for smaller institutions to initiate investment services or transition back room outsourcing. We believe that SaveDaily’s proprietary platform provides much lower start up costs and the investment advisory services available through SaveDaily as an RIA offer the means of attracting investor clients, not just managing their accounts in the back room.

SaveDaily views indirect competitors as product and service providers that address different markets with similar products and services. Nonetheless, they should be considered competitors because these companies could change their business strategy or augment existing lines of business to address SaveDaily’s target markets with similar products and services.

|

§

|

Private-Labeled Banking and Brokerage Service Providers:

|

Currently, there are several companies known to SaveDaily that offer outsourced private-labeled Internet banking and brokerage solutions, all with a much higher cost structure than SaveDaily would offer for these same services. In some cases, these companies offer a more robust solution, however, their cost structure can prohibit them from entering the mass markets SaveDaily services, and they currently compete in the crowded market for affluent investors. SaveDaily has a competitive proposition based on a price-performance basis versus these companies. SaveDaily addresses a specific niche of the total market and delivers a solution that cost-effectively enables our partners to serve the newly emerging markets in this niche. However, with their substantially greater capital and human resources, these private-labeled banking and brokerage solution providers have the potential to develop a product similar or even superior to SaveDaily’s. SaveDaily intends to monitor the activities of these companies and look to build relationships with them if they show interest in the emerging mass market or mass affluent market. Companies that provide outsourced Internet banking services to financial institutions include Online Resources, FundsXpress, HomeCom, Financial Fusion, NetZee, Liberty, and Virtual Financial. Also, vendors such as Corillian, Digital Insight and S1 Corporation, who primarily target the larger financial institutions, may someday decide to compete with us in our market segment. In addition, several of the vendors offering data processing services to financial institutions that offer their own Internet banking solutions, including EDS, Fiserv, Jack Henry, and Metavante, could migrate their service offerings to compete with those of SaveDaily.

|

§

|

Mutual Fund Product Providers

|

While SaveDaily distributes mutual fund products, the fund providers are capable of allowing low cost investing, by either targeting consumers directly or by going through other intermediaries. Through partnership conversations with several fund companies, it is clear that the majority of mutual fund product providers prefer to distribute through brokerages. Mutual fund companies are reluctant to go direct to consumers due to the channel conflicts this creates with existing distribution relationships. In addition, these fund providers are heavily dependent on traditional transfer agents for record keeping and transaction services, which generally maintains the current cost structures.

|

§

|

Partners/Customers with “Roll your Own” Strategy

|

SaveDaily could experience competition from its own partner financial institutions and potential partners who develop their own electronic trading solutions. Rather than purchasing products and services from third-party vendors, financial institutions could develop, implement, and maintain their own services and applications. In general, SaveDaily’s low cost structure and ability to deliver a complete solution will be compelling reasons for partners to “buy rather than build”. The ability to private label SaveDaily’s solution allows a partner to focus on its core competencies and to preserve its brand while still benefiting from SaveDaily’s low cost structure. The development and rollout expenditures of developing in-house solutions results in increased costs, decreased margins, and time-to-market issues for the intermediary. In addition, the opportunity costs to develop in-house solutions results in reallocation of internal technical resources that could be used for other projects. The ongoing maintenance costs would further decrease the value of the solution. SaveDaily believes that its blend of proprietary technology, low cost structure, relationships with fund providers and banks, and compliance with the regulatory agencies represents a cross-discipline combination of expertise that would be significant barriers to entry for most of SaveDaily’s potential partners to replicate.

16

Legal and Compliance Overview:

SaveDaily.com, Inc. is a Registered Investment Advisor. As a federally-registered investment advisor, SaveDaily is authorized to provide investment advisory services in all fifty states. SaveDaily's activities are regulated by the SEC pursuant to the Investment Advisors Act of 1940 (the "Advisors Act") and the rules promulgated by the SEC under the Advisors Act. SaveDaily, through its broker-dealer partners, makes mutual funds available to its clients. SaveDaily's broker-dealer partner is a member of the Financial Industry Regulatory Authority (FINRA) and must comply with various rules of that organization.

Opportunities For Growth

|

§

|

Large Market with Significant Opportunity. The market addressed by SaveDaily’s solution represents nearly $20.5 billion in revenue from account administration and servicing fees, in addition to advisory and distribution fees from assets under management.

|

|

§

|

Proprietary Technology Creates Additional Market Opportunities. SaveDaily designed its solution to profitably serve the small accounts in the mass markets and provide these investors with the ability to invest as little as $0.01 in the full breadth of mutual funds offered by the mutual fund industry. Due to the low cost structure of the platform, SaveDaily provides the only solution that enables partners to profitably service even the lowest income savers and investors with mutual fund investment opportunities, opening the door to entirely new markets.

|

|

§

|

Low Cost Leader in Account Processing. SaveDaily’s all-electronic, proprietary solution provides significant cost efficiencies by eliminating all printing and mailing costs associated with account opening, transaction confirmations, quarterly statements and account history. Additionally, SaveDaily’s straight through processing of mutual fund transactions drastically reduces costs associated with transaction execution to a point where, for the first time, an investor is not limited to the number of mutual funds within an account, while also allowing numerous transactions within those mutual funds, generally requiring no minimum transaction amounts, and without excessive trading penalties, thereby allowing SaveDaily to offer this to any investor class for an low monthly fee.

|

17

|

§

|

Addresses Technology and Regulatory Requirements. SaveDaily delivers its technology to partners with the necessary business agreements, regulatory filings, securities licenses, privacy practices and key relationships with financial institutions. The platform supports compliance functions, financial and tax reporting, and account processing responsibilities, including account opening, transaction processing and administration, statements and record keeping services.

|

MANAGEMENT

Appointment of New Directors

In connection with the Merger, we appointed four new directors to our Board of Directors. Furthermore, concurrent with the closing of the Merger, Mr. Damon Deru, our sole director prior to the Merger and acting Chief Executive Officer and Chief Financial Officer of Nine Mile, resigned from these positions. Immediately following the resignation of Mr. Deru, Mr. Jeffrey Mahony was appointed Chief Executive Officer, Mr. Gregory Vacca was appointed President, Ms. Pauline Schneider was appointed Chief Financial Officer and Mr. Ken Carroll was appointed Secretary, respectively, of SaveDaily, Inc.

Directors and Executive Officers

Set forth below is information regarding our current directors and executive officers. The directors are elected by the stockholders. The executive officers serve at the pleasure of the Board of Directors.

|

Name

|

Age

|

Position

|

|

Jeff Mahony

|

45

|

Director and Chief Executive Officer

|

|

Harry Dent, Jr.

|

61

|

Director and Chairman of the Board

|

|

Greg Vacca

|

61

|

Director and President

|

|

Pauline Schneider

|

55

|

Chief Financial Officer

|

|

Ken Carroll

|

46

|

Director and Secretary

|

Harry Dent Jr., Chairman of the Board Directors, Chief Strategic Officer

Harry S. Dent, Jr. is widely recognized as a leading expert on the business impact of economic, technological and demographic trends in society. A renowned investment strategist and international best-selling author, Mr. Dent also advises the AIM/Dent Demographic Trends Fund and the Van Kampen Roaring 2000s Unit Investment Trust, and manages the Dent Strategic Sector Fund. Earlier in his career, Mr. Dent was a consultant with Bain & Company, a leading international consulting firm. While at Bain, he counseled business strategy for Fortune 100 companies. He has been chief executive officer of several entrepreneurial growth companies, and currently is a member of advisory boards of several financial services companies. Mr. Dent received his MBA from Harvard Business School, where he was a Baker Scholar and an elected member of the Century Club, for leadership excellence.

18

Jeffrey W. Mahony, Director and Chief Executive Officer

An executive with more than 17 years experience in Internet strategy development and large scale project management for financial trading systems, Jeff Mahony is the company’s Chief Executive Officer and a founding member of SaveDaily. Prior to joining SaveDaily, Mahony served as Founder, President and Chief Executive Officer of the Jeda Group, an Internet strategy firm serving small and middle-market financial companies. He has also worked with TRW’s Space and Defense Sector to Smart Technologies, a start-up focused on financial modeling using predictive algorithms. Mr. Mahony is a graduate of the University of California, Los Angeles with a Bachelor’s Degree in Cognitive Science.

Gregory D. Vacca, Director, President and Chief Business Development Officer

Greg Vacca joined SaveDaily as the Chief Business Development Officer in May 2011. From November 2009 until May 2011 he was Vice President, Region Manager for US Bancorp Investments. From October 2007 until November 2009, Mr. Vacca was the President/CEO of WiFiMed Holdings, a company that acquired JMJ Technologies where he had been President/CEO since July 2006. Mr. Vacca’s financial services experience includes senior management positions with First Nationwide/CalFed Investments where he served as Senior Vice President Insurance/Business Banking Manager from June 1994 until January 2003. Overlapping his time with CalFed Investments, Mr. Vacca, as Principal of Vacca Insurance Services, consulted to insurance companies, broker/dealers and financial institutions for the sale of insurance and investment products between 2000 and July 2006. During that time, he was a Principal/Founder of the CoreLink Group which provided a trading platform for investment representatives in financial institutions. His industry service includes Director/President of the Financial Institutions Insurance Association (1995-2002), President/Director of the Bank Insurance and Securities Association (2002-2006) and Trustee for the National Association of Insurance and Financial Advisors (2002-2003).

He holds the designations of Certified Financial Planner, CFP® and Chartered Life Underwriter, CLU. He is a graduate of University of California, Irvine with a Bachelor's degree in Biological Sciences. He also received the Master of Divinity degree from the San Francisco Theological Seminary and is a retired Presbyterian minister and US Army Reserve Chaplain (LTC Ret.) (24 years, Desert Storm veteran). His current community service is as Trustee of the Los Ranchos Presbytery since December 2010 and Director of the Orange County Interfaith Shelter since about June 2009.

Kenneth P. Carroll, Director

Ken Carroll is a founding member of SaveDaily and served as Chief Financial Officer for SaveDaily from 1999 to June 2011. From 1997 to 1999, Mr. Carroll served as Chief Financial Officer and Vice President of Operations for BKM Total Office of California, a distribution company with $85 million in annual revenue. Prior to BKM Total Office, Mr. Carroll worked with Steelcase Inc., Peterson Consulting, LLP, in Los Angeles, and as a development consultant for Prudential Real Estate Affiliates. Mr. Carroll holds a Master’s Degree in Finance from the University of Southern California, as well as a Bachelor’s Degree in Economics from the University of California, at Irvine.

Pauline Schneider, Chief Financial Officer (Interim)

During the past twenty years, Ms. Schneider has served in an executive capacity with several private and public companies and since June 2008 has been an independent consultant to various corporations for which she provides accounting and business advisory services. From May 2007 through June 2008 she served as a management consultant for House of Taylor Jewelry, Inc where she was the Chief Financial Officer from October 2005 through April 2007. At House of Taylor Jewelry, Ms. Schneider was responsible for all accounting, administrative and financial reporting functions, including SEC compliance and listing on the Nasdaq National Market. Ms. Schneider served as Vice President of Finance for PRB Gas Transportation Inc. from June 2004 through August 2005 where she saw the company through three rounds of private financing, an initial public offering, two material acquisitions, and listing on the American Stock Exchange. Ms. Schneider was appointed SaveDaily’s interim Chief Financial Officer in June, 2011.

19

Board of Directors

Our Board of Directors is currently composed of four members. We have no independent directors. Mr. Dent, Jr. has been elected as the Chairmen of the Board of Directors. In such capacity, he is responsible for presiding at the meetings of the Board of Directors or at meetings of committees of the Board of Directors.

Board Committees

As of this date, our Board of Directors has not appointed an audit committee, compensation committee or nominating/corporate governance committee. We are not currently required to have such committees. Accordingly, we do not have an “audit committee financial expert” as such term is defined in the rules promulgated under the Securities Act and the Securities and Exchange Act of 1934, as amended (the “Exchange Act”). The functions ordinarily handled by these committees are currently handled by our entire Board of Directors. Our Board of Directors intends however to review our governance structure and institute board committees as necessary and advisable in the future, to facilitate the management of our business.

Board Meetings and Committees

Directors may be paid their expenses, if any, of attendance at a meeting of the Board of Directors, and may be paid a fixed sum for attendance at each meeting of the Board of Directors or a stated salary as director. No such payment shall preclude any director from serving SaveDaily in any other capacity and receiving compensation therefor except as otherwise provided under applicable law.

The Board of Directors may designate from among its members one or more committees. SaveDaily does not currently have an audit committee, compensation committee or nominating/corporate governance committee, but it intends to appoint such committees within 90 days after the closing of the Merger.

EXECUTIVE COMPENSATION

For purposes of the discussion contained in this section entitled “Executive Compensation,” the relevant information is presented in each instance first with respect to Nine Mile and then with respect to SaveDaily.

20

Summary Compensation

Nine Mile

Mr. Damon Deru served as the sole director, Chief Executive Officer and sole officer of Nine Mile prior to the Merger. Mr. Deru received no direct cash or non-cash compensation during the fiscal year ended December 31, 2010 from Nine Mile. In August, 2011, Nine Mile awarded 425,000 shares of Common Stock to Mr. Deru for services rendered. Effective August 26, 2011, Mr. Deru returned 100,000 shares of Common Stock to SaveDaily in connection with the TradeWarrior Spin-Off.

SaveDaily

No executive officer of SaveDaily earned more than $100,000 for the fiscal year ended April 30, 2011 other than Jeff Mahony, SaveDaily’s Chief Executive Officer, and Ken Carroll, SaveDaily’s Secretary and former Chief Financial Officer, who received a total of $256,500 and $155,834, respectively, for that period. Included in these amounts were $40,000 and $41,277 received, respectively, for deferred compensation.

Outstanding Equity Awards

Nine Mile

Mr. Deru, who served as the sole director, Chief Executive Officer and sole officer of Nine Mile prior to the Merger, did not have any option awards, unexercised options, unvested stock awards or equity incentive plan awards at December 31, 2010.

Director Compensation

Nine Mile

Prior to the Merger, Nine Mile had only one director and one officer, Mr. Deru. Mr. Deru did not receive any direct compensation for his services as a director.

SaveDaily

In connection with the Merger, Mr. Deru resigned from all of his positions with Nine Mile. Concurrent therewith, SaveDaily appointed four new directors to its board of directors; Mr. Dent, Jr., Mr. Mahony, Mr. Vacca and Mr. Carroll. Directors of SaveDaily do not receive any added compensation for serving on the Board of Directors.

Employment Agreements

All of our employees are “at-will” employees.

SECURITY OWNERSHIP AFTER CHANGE OF CONTROL

The following table sets forth certain information regarding SaveDaily Common Stock beneficially owned on August 23, 2011, for each executive officer and director, and (ii) all executive officers and directors as a group, on a pro forma basis, to reflect the closing of the Merger and post Merger transactions through August 26, 2011.

21

|

Name of Beneficial Owner and Address (1)

|

Number of

Shares of

Common

Stock

Beneficially

Owned (2)

|

Percent of

Shares of

Common

Stock

Beneficially

Owned (2)

|

||||||

|

Harry Dent, Jr., Chairman

|

7,934,566 | 21.93 | % | |||||

|

Jeff Mahony, Director and Chief Executive Officer

|

6,595,494 | 18.23 | % | |||||

|

Gregory Vacca, Director and President

|

324,369 | .90 | % | |||||

|

Ken Carroll, Director and Secretary

|

3,439,190 | 9.51 | % | |||||

|

Pauline Schneider, Chief Financial Officer

|

0 | 0 | % | |||||

|

All directors and executive officers as a group (9 persons)

|

18,293,620 | 50.57 | % | |||||

|

(1)

|

Unless otherwise indicated, the address of the beneficial owner will be c/o SaveDaily, Inc., 3020 Old Ranch Parkway, Suite 140, Seal Beach, California 90740.

|

|

|

(2)

|

The amounts of beneficial ownership are based on the completion of the Merger and after giving effect to the return and cancellation of 100,000 shares of common stock in connection with the TradeWarrior Spin-Off and the issuance of 1,700,000 shares pursuant to the Consulting Agreement. After giving effect to these transactions we have 36,174,556 shares outstanding as of August 26, 2011. Amounts may vary slightly due to rounding.

|

|

DESCRIPTION OF SECURITIES

Nine Mile is currently authorized under its Articles of Incorporation to issue 50,000,000 shares of Nine Mile Common Stock and 5,000,000 shares of Nine Mile Preferred Stock. No shares of Preferred Stock have been issued or are outstanding.

Prior to the closings of the Merger, there were 1,574,556 shares of Nine Mile Common Stock issued and outstanding and no shares of Preferred Stock issued and outstanding.

Pursuant to the Merger Agreement, Nine Mile issued 33,000,000 shares of SaveDaily Common Stock to those persons holding shares of Old SaveDaily capital stock, along with warrants, options and/or rights to shares of SaveDaily Common Stock to holders of Old SaveDaily warrants, options and certain promissory notes, respectively, with each share of Old SaveDaily Common Stock outstanding immediately prior to the closing of the Merger being converted based upon the Exchange Ratio.

Additionally, each then outstanding option and warrant to purchase shares of Old SaveDaily Common Stock, whether or not exercisable, was converted into an option or warrant to purchase shares of SaveDaily Common Stock upon the same terms and conditions as the corresponding Old SaveDaily options and warrants, provided that (i) each such Old SaveDaily option and warrant related to such number of shares of SaveDaily Common Stock as was determined by multiplying the number of shares of Old SaveDaily Common Stock underlying such Old SaveDaily option or warrant by the Exchange Ratio, with the resulting product rounded down to the nearest whole number of shares, and (ii) the per share exercise price for the newly-issued SaveDaily options or warrants was determined by dividing the exercise price per share of such Old SaveDaily options or warrants by the Exchange Ratio, with the resulting quotient rounded down to the nearest whole cent.

22

At the closing of the Merger and after giving effect thereto, there were 34,574,556 shares of SaveDaily Common Stock issued and outstanding and no shares of Preferred Stock issued and outstanding.

The following descriptions of SaveDaily capital stock are only summaries and do not purport to be complete and is subject to and qualified by its Articles of Incorporation, its Bylaws, and by the provisions of applicable corporate laws of the State of Nevada. The descriptions of the SaveDaily Common Stock, reflect changes to our capital structure that occurred immediately prior to or upon the closing of the Merger:

Common Stock

Holders of SaveDaily Common Stock are entitled to one vote for each share held of record on all matters submitted to a vote of the stockholders. SaveDaily may pay dividends at such time and to the extent declared by the Board of Directors in accordance with Nevada corporate law. SaveDaily Common Stock has no preemptive or other subscription rights, and there are no conversion rights or redemption or sinking fund provisions with respect to such shares. All outstanding shares of SaveDaily Common Stock are fully paid and non-assessable. To the extent that additional shares of SaveDaily Common Stock may be issued in the future, the relative interests of the then existing stockholders may be diluted.

Preferred Stock

Preferred Stock may be divided into such number of series as the Board of Directors may determine. The Board of Directors is authorized to determine and alter the rights, preferences, privileges, and restrictions granted to or imposed upon any wholly unissued series of preferred shares, and to fix the number of shares and the designation of any series of preferred shares. The Board of Directors may increase or decrease (but not below the number of shares of such series then outstanding) the number of shares of any wholly unissued series subsequent to the issue of those shares. The rights of the holders of SaveDaily Common Stock will be subject to and may be adversely affected by the rights of the holders of any Preferred Stock that may be issued in the future. Issuance of a new series of Preferred Stock could make it more difficult for a third party to acquire, or discourage a third party from acquiring, the outstanding shares of SaveDaily Common Stock and make removal of the Board of Directors more difficult. There are no shares of Preferred Stock currently issued and outstanding, and we have no present plans to issue any shares of preferred stock.

Transfer Agent and Registrar

The transfer agent and registrar for the SaveDaily Common Stock is Standard Registrar and Transfer Company, Inc.

Dividend Policy

We do not currently intend to pay any cash dividends in the foreseeable future on SaveDaily Common Stock and, instead, intend to retain earnings, if any, for future operation and expansion. Any decision to declare and pay dividends in the future will be made at the discretion of our Board of Directors and will depend on, among other things, our results of operations, cash requirements, financial condition, contractual restrictions and other factors that our Board of Directors may deem relevant.

23

RECENT SALES OF UNREGISTERED SECURITIES

Reference is made to Item 3.02 of this Current Report on Form 8-K for a description of recent sales of unregistered securities, which is hereby incorporated by reference.

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this report that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. The list of Risk Factors below does not set forth or contain all of the information you should consider before making an investment. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of SaveDaily Common Stock could decline, and you may lose all or part of your investment.

Risks Relating to the SaveDaily Business

In this discussion of the “Risks Relating to the SaveDaily Business,” unless otherwise noted or required by the context, references to “us,” “we,” “our,” “the Company” and similar terms refers to SaveDaily, the operating business of SaveDaily, Inc. after the consummation of the Merger.

Our future operating results may fluctuate and cause the price of the Company’s Common Stock to decline.

We expect that our operating results will continue to fluctuate significantly from quarter to quarter due to various factors, many of which are beyond our control. The factors that could cause our operating results to fluctuate include, but are not limited to: (i) Our ability to obtain additional financing on satisfactory terms; (ii) Our ability to attract and retain qualified employees; (iii) Our ability to successfully expand into new markets; (iv) Our ability to manage the strain on our infrastructure caused by the growth of our business; and (v) Our ability to successfully partner with other companies in the pursuit of our business strategy. If our sales or operating results fall below the expectations of investors or securities analysts, the price of our Common Stock could significantly decline.

Our growth strategy requires us to grow our existing markets and expand our operations into new markets.

We cannot guarantee that we will be able to achieve our expansion goals or that our expansion efforts will be operated profitably. Further, we cannot assure you that any expansion of our operations will obtain similar operating results to those of our existing operations. The success of our planned expansion will be dependent upon numerous factors, many of which are beyond our control, including the following:

· Hiring, training and retention of qualified operating personnel;

· Competition in our markets; and

24

· General economic conditions.

We have a history of operating losses, and we expect our operating losses to continue for the foreseeable future. If we fail to obtain additional financing we will be unable to execute our business plan and/or we may not be able to continue as a going concern.