Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K 11-8-30 - MIDSOUTH BANCORP INC | form_8k.htm |

| EX-99.2 - MIDSOUTH PRESS RELEASE DATED 11-8-30 - MIDSOUTH BANCORP INC | ex99_2.htm |

First Louisiana National Bank

Acquisition

Acquisition

August 30, 2011

Transaction Summary

Description: Purchase of substantially all of the assets and liabilities of First Louisiana

National Bank

National Bank

Seller: First Bankshares of St. Martin, LTD and First Louisiana National Bank

Expected Closing December 31, 2011

Purchase Price: $11.5 million in cash

725,000 MSL restricted common shares

725,000 MSL restricted common shares

Assets Purchased: Estimated $115.0 million

Bank Equity: $11.0 million

Branch Locations: Breaux Bridge, LA, Lafayette, LA, St. Martinville, LA

Transaction Expenses: $500,000 pretax (25% professional fees, 75% conversion costs)

Cost Savings: Approx. 60% cost reductions based on a net one branch increase after

closing two branches

closing two branches

Earnings Accretion: 2012E - $0.20

2013E - $0.25

2013E - $0.25

2

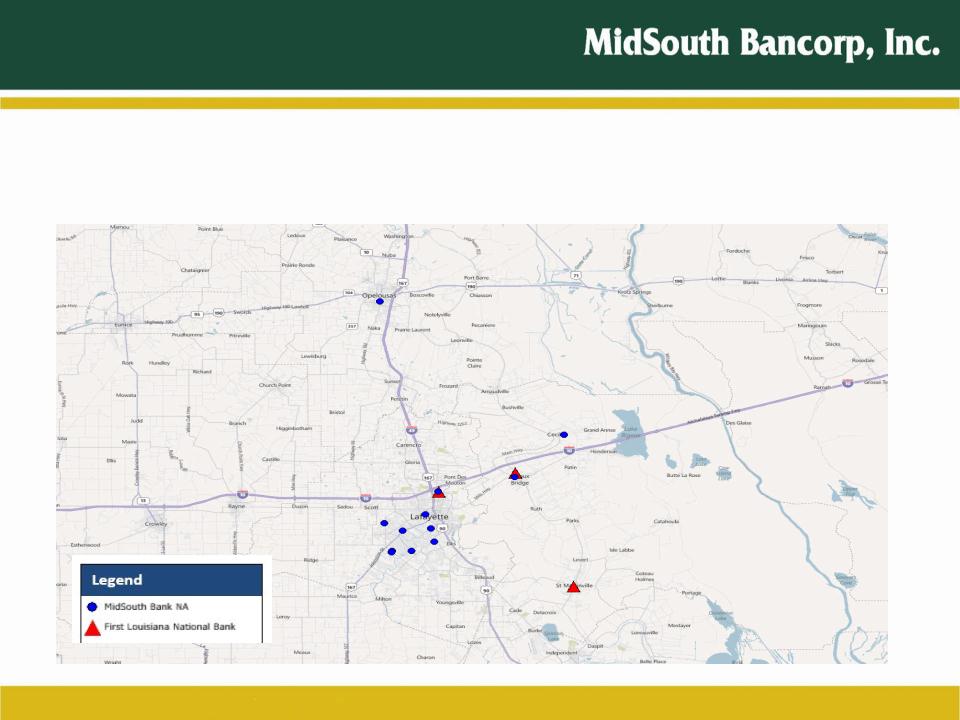

First Louisiana Branch Locations

Branch Consolidation Plans

• Breaux Bridge

– Close and consolidate MSL branch into FLNB branch

– Allows for future expansion of MSL operations center, which

shares former MSL branch location, to support LA and TX

growth

shares former MSL branch location, to support LA and TX

growth

• Lafayette

– Close and consolidate FLNB branch into MSL branch

• St. Martinville

– FLNB Branch remains open

Investor Considerations

• In-market acquisition with significant integration savings, closing

two branches for a net gain of one branch

two branches for a net gain of one branch

• Opportunity to leverage First Louisiana National consumer

based operations with MSL commercial expertise, larger lending

limit, increased branch network and stronger operating bank

platform.

based operations with MSL commercial expertise, larger lending

limit, increased branch network and stronger operating bank

platform.

• Allows for improved utilization of space for back-office

functions in one location to support anticipated growth in LA

and TX

functions in one location to support anticipated growth in LA

and TX

• The transaction is expected to be accretive to MSL earnings in

the first full fiscal year including transaction expenses, with an

anticipated IRR of 15%

the first full fiscal year including transaction expenses, with an

anticipated IRR of 15%

|

|

|

|

|

|

|

|

|

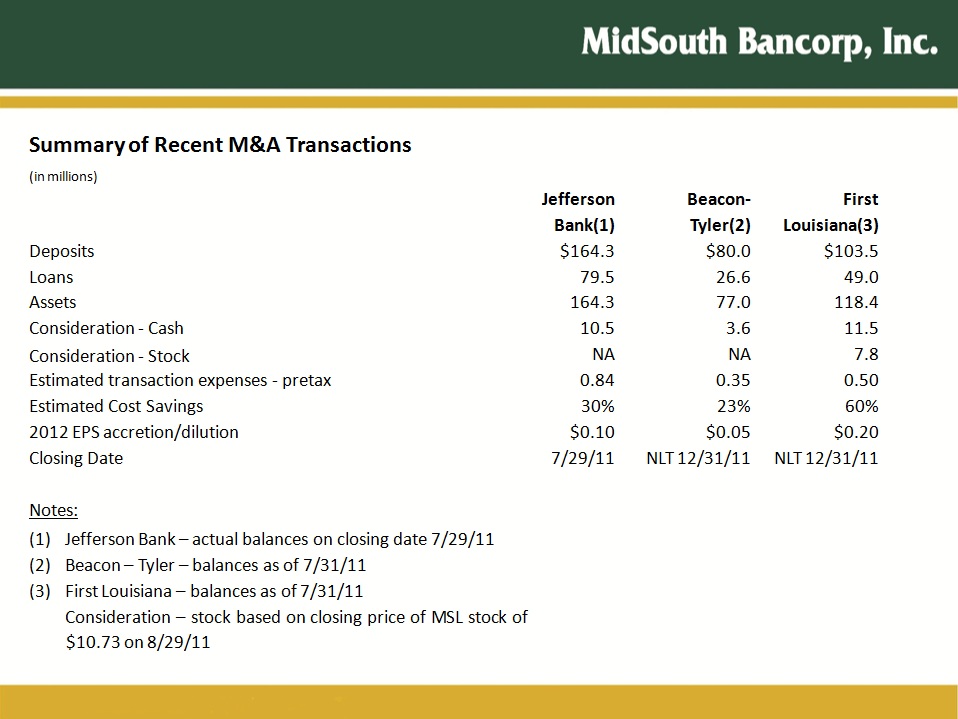

Summary of Recent M&A Transactions (in millions) Jefferson Bank(1)Beacon-Tyler(2)First Louisiana(3) Deposits $164.3 $80.0 $103.5 Loans 79.5 26.6 49.0 Assets 164.3 77.0 118.4 Consideration - Cash 10.5 3.6 11.5 Consideration - Stock NA NA 7.8 Estimated transaction expenses - pretax 0.84 0.35 0.50 Estimated Cost Savings 30% 23% 60% 2012 EPS accretion/dilution $0.10 $0.05 $0.20 Closing Date 7/29/11 NLT 12/31/11 NLT 12/31/11 Notes: (1) Jefferson Bank – actual balances on closing date 7/29/11 (2) Beacon – Tyler – balances as of 7/31/11 (3) First Louisiana – balances as of 7/31/11 Consideration – stock based on closing price of MSL stock of $10.73 on 8/29/11