Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

[X]

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended June 30, 2011

|

|

|

[ ]

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

|

|

For the transition period from _________ to ________

|

|

|

Commission file number: 333-169346

|

|

|

KINETIC RESOURCES CORP.

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

Nevada

|

27-2089124

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

Josefa Ortiz de Dominguez,

#52, Bucerias, Nayarit, Mexico

|

__________ |

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number: 775-636-6937 OR 52-329-298-3649

|

|

|

Securities registered under Section 12(b) of the Exchange Act:

|

|

|

Title of each class

|

Name of each exchange on which registered

|

|

none

|

not applicable

|

|

Securities registered under Section 12(g) of the Exchange Act:

|

|

|

Title of class

|

|

|

none

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [X] No [ ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. Not available

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 3,550,000 as of August 26, 2011.

ii

|

TABLE OF CONTENTS

|

||

|

Page

|

||

iii

PART I

Item 1. Business

Company Overview

We are an exploration stage company that intends to engage in the exploration of mineral properties. On July 28, 2010, our wholly owned subsidiary, KRC Exploration LLC, a Nevada limited liability company, (“KRC”) entered into a Property Option Agreement (the “Property Option Agreement”) with American Mining Corporation of Osburn, Idaho (“American”) to acquire an option to purchase a 100% interest in the Young America Mine group of Mineral Claims (the “YAM Claims”). Although we hold an option to the mineral exploration rights relating to the four mineral claims in the YAM Claims group, we do not own any real property interest in the YAM Claims or any other property.

The YAM Claims do not possess known mineral reserves. Exploration of it is required before a final determination as to its viability can be made. We do not currently possess sufficient funds to complete our exploration program of the YAM Claims. We will seek to fund the Phase I exploration program for the YAM Claims by obtaining capital from management and significant shareholders sufficient to fund the exploration in the ongoing operational expenses and seeking equity and/or debt financing. However we cannot provide any assurances that we will be successful in accomplishing any of these plans

Our Business

Mineral exploration is essentially a research activity that does not produce a product. Successful exploration often results in increased project value that can be realized through the optioning or selling of the claimed site to larger companies. As such, we intend to acquire properties which we believe have potential to host economic concentrations of minerals. These acquisitions have and may take the form of unpatented mining claims on federal land, or leasing claims, or private property owned by others. An unpatented mining claim is an interest that can be acquired to the mineral rights on open lands of the federally owned public domain. Claims are staked in accordance with the Mining Law of 1872, recorded with the federal government pursuant to laws and regulations established by the Bureau of Land Management (the Federal agency that administers America’s public lands), and grant the holder of the claim a possessory interest in the mineral rights, subject to the paramount title of the United States.

We plan to perform basic geological work to identify specific drill targets on the properties, and then collect subsurface samples by drilling to confirm the presence of mineralization (the presence of economic minerals in a specific area or geological formation). We may enter into joint venture agreements with other companies to fund further exploration work. By such prospects, we mean properties that may have been previously identified by third parties, including prior owners such as exploration companies, as mineral prospects with potential for economic mineralization. Often these properties have been sampled, mapped and sometimes drilled, usually with indefinite results. Accordingly, such acquired projects will either have some prior exploration history or will have strong similarity to a recognized geologic ore deposit model. Geographic emphasis will be placed on the western United States. The focus of our activity will be to acquire properties that we believe to be undervalued; including those that we believe to hold previously unrecognized mineral potential.

1

Our strategy with properties deemed to be of higher risk or those that would require very large exploration expenditures is to present them to larger companies for joint venture. Our joint venture strategy is intended to maximize the abilities and skills of the management group, conserve capital, and provide superior leverage for investors. If we present a property to a major company and they are not interested, we will continue to seek an interested partner.

Item 2. Properties

YAM Claims - Washington State, Stevens County

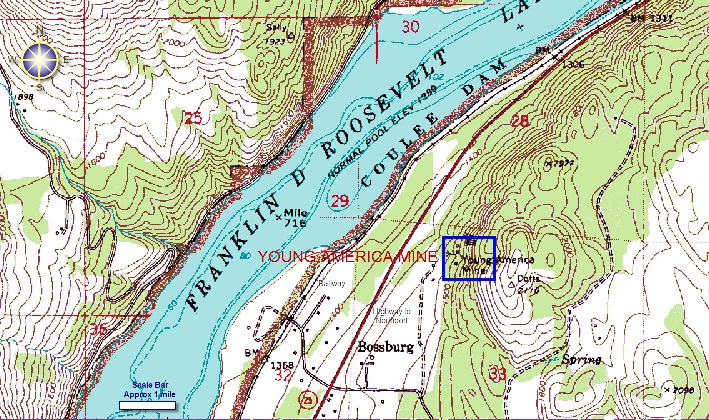

The Young American Claim Group is approximately 80 acres of lode claims 100% owned by American Mining Corporation, Inc. The property is located in northwestern Stevens County, north central Washington. Young America is 4 en bloc unpatented claims originally located in 1886 and is within the Bossburg Mining District. In February 2008 American Mining Corporation, Inc., (AMC) of Osburn, Idaho staked the four original unpatented claims that are located on Bureau of Land Management managed land. The four claims are in a portion of the SW ¼ of Section 28, and NW ¼ of Section 33, both Township 38N Range 38E, Willamette Meridian, Stevens County, Washington about 15 miles of paved highway north of Kettle Falls, Washington. Access from the highway is about ½ mile via a 2WD gravel road that crosses private property.

2

Property Topology

Item 3. Legal Proceedings

We are not a party to any pending legal proceeding. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

Item 4. (Removed and Reserved)

3

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock is currently quoted on the OTC Bulletin Board (“OTCBB”), which is sponsored by FINRA. The OTCBB is a network of security dealers who buy and sell stock. The dealers are connected by a computer network that provides information on current "bids" and "asks", as well as volume information. Our shares are quoted on the OTCBB under the symbol “KTNC”.

The following table sets forth the range of high and low bid quotations for our common stock for each of the periods indicated as reported by the OTCBB. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

|

Fiscal Year Ending June 30, 2011

|

||||

|

Quarter Ended

|

High $

|

Low $

|

||

|

June 30, 2011

|

N/A

|

N/A

|

||

|

March 31, 2011

|

N/A

|

N/A

|

||

|

December 31, 2010

|

N/A

|

N/A

|

||

|

September 30, 2010

|

N/A

|

N/A

|

||

|

Fiscal Year Ending June 30, 2010

|

||||

|

Quarter Ended

|

High $

|

Low $

|

||

|

June 30, 2010

|

N/A

|

N/A

|

||

|

March 31, 2010

|

N/A

|

N/A

|

||

|

December 31, 2009

|

N/A

|

N/A

|

||

|

September 30, 2009

|

N/A

|

N/A

|

||

Penny Stock

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

4

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

Holders of Our Common Stock

As of August 26, 2011, we had 3,550,000 shares of our common stock issued and outstanding, held by forty-two (42) shareholders of record.

Dividends

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

|

1.

|

we would not be able to pay our debts as they become due in the usual course of business, or;

|

|

2.

|

our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution.

|

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Item 6. Selected Financial Data

A smaller reporting company is not required to provide the information required by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements.” These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

5

Plan of Operation

We are an exploration stage company that intends to engage in the exploration of mineral properties. On July 28, 2010, our wholly owned subsidiary, KRC Exploration LLC, a Nevada limited liability company, (“KRC”) entered into a Property Option Agreement (the “Property Option Agreement”) with American Mining Corporation of Osburn, Idaho (“American”) to acquire an option to purchase a 100% interest in the Young America Mine group of Mineral Claims (the “YAM Claims”). Although we hold an option to the mineral exploration rights relating to the four mineral claims in the YAM Claims group, we do not own any real property interest in the YAM Claims or any other property.

The YAM Claims do not possess known mineral reserves. Exploration of it is required before a final determination as to its viability can be made. We do not currently possess sufficient funds to complete our exploration program of the YAM Claims. We will seek to fund the Phase I exploration program for the YAM Claims by obtaining capital from management and significant shareholders sufficient to fund the exploration in the ongoing operational expenses and seeking equity and/or debt financing. However we cannot provide any assurances that we will be successful in accomplishing any of these plans.

YAM Claims

The YAM claims consist of 4 en bloc unpatented lode claims totaling 80 acres. Each claim is approximately 1500 feet by 600 feet.

Location and Means of Access to YAM Claims

The mine is located on BLM-managed land on SR 25 about 2000 feet northeast of and 400 feet above the ghost town of Bossburg, Wash., a small settlement on the east bank of Lake Roosevelt. Bossburg is situated about 15 miles north of Kettle Falls and about 20 miles south of Northport.

A two-wheel-drive gravel road, crossing private property, leads directly to the No. 1 adit. The mill ruins are located on private property below and adjacent to the west shoulder of SR 25 directly west of the mine.

Power and rail facilities are available immediately adjacent to the mine. Supplies and services would be obtained from Northport or from Spokane.

Title to YAM Claims

The YAM Claims are 4 adjoining unpatented claims originally located in 1886. In 2008 American staked the four original unpatented claims that are located on BLM managed land. At present, the claims are beneficially owned by American.

The YAM Claims are on BLM managed land. The annual claim payments for Bureau of Land Management managed land are $140. American is responsible for making these payments.

Previous Operations and Work Completed on the YAM Claims.

We have not performed any work on the property. American has not performed any recent work on the property and there has been no known recent exploration on the property. There has been past exploration on the property, including work by American over 50 years ago.

Present Condition of YAM Claims.

At present, the property does not have any plant, buildings, equipment or mining assets. The condition of the workings is unknown and may not be safe for entry.

6

Proposed and Current State of Exploration and Development on the Southern Beardmore Claims.

There is not currently any exploration on the property. We retained Mr. Barry Price, Master of Science in Geology and Professional Geoscientist to conduct a study and produce a report on the exploration potential of the property. He had the following recommendation:

|

|

·

|

Phase I

|

|

|

o

|

Phase I of the recommended geological program will cost a total of approximately $17,000. Phase I consists of on-site surface reconnaissance, mapping, surface sampling, and geochemical analyses. If we are able to secure additional capital, we would like to initiate this phase prior to the end of the 2011 calendar year.

|

|

|

·

|

Phase II

|

|

|

o

|

Phase II would entail underground examination, further sampling and geochemical analyses based on the outcome of the Phase I exploration program. The Phase II program will cost approximately $35,000. If we are able to secure additional capital, then we would like to commence this phase two years after Phase I is initiated.

|

|

|

·

|

Phase III

|

|

|

o

|

The budget for Phase III of our exploration program is tentative in nature as the actual exploration program to be undertaken will depend upon the outcomes of the Phase I and Phase II exploration programs. Phase III of our exploration program, if undertaken, may commence one year after Phase II is initiated, and will consist of diamond drilling and drill core sampling of approximately 3,000 feet of drilling at several locations on the YAM mineral claims. It is currently estimated that Phase III will cost approximately $135,000.

|

The cumulative cost of the phases of this program is $185,000, which would be expended as follows:

Phase I

|

DESCRIPTION

|

DETAILS

|

COST US$

|

|||

|

Geological Inspection GPS survey claims, workings

|

4 man days @ $750/day

|

$ | 3,000 | ||

|

Helper

|

4 man days

|

$ | 1,200 | ||

|

Food and accommodation Vehicle costs

|

4 days

|

$ | 800 | ||

|

Acquire old reports and data, topographic maps

|

$ | 5,000 | |||

|

Sample assays

|

$ | 500 | |||

|

Preparation of Base Maps and reports, additional claim staking if required

|

$ | 5,000 | |||

|

Subtotal

|

$ | 15,500 | |||

|

Contingency

|

$ | 1,500 | |||

|

TOTAL EXPENSES

|

$ | 17,000 | |||

7

Phase II

Phase II of exploration would be contingent on favorable results in the initial phase.

|

DESCRIPTION

|

DETAILS

|

COST US$

|

|||

|

Geological supervision and underground examination

|

$ | 10,000 | |||

|

IP survey and/or Gravity survey

|

$ | 22,000 | |||

|

Subtotal

|

$ | 32,000 | |||

|

Contingency

|

$ | 3,000 | |||

|

TOTAL EXPENSES

|

$ | 35,000 | |||

Phase III

Phase three, diamond drilling; contingent on results from the initial phases would logically be diamond drilling, estimated at 1000 meters costing $135/meter (all inclusive of Geological supervision and sample assays), total $135,000

While we have not yet commenced the field work phase of our initial exploration program, we intend to proceed with the initial exploratory work as recommended. We would like to commence the field work of Phase I by the end of the 2011 calendar year. Upon our review of the results, we will assess whether the results are sufficiently positive to warrant additional phases of the exploration program. We will make the decision to proceed with any further programs based upon our consulting geologist’s review of the results and recommendations. If we do decide to proceed with Phase II, then in order to complete significant additional exploration beyond the currently planned Phase I we will need to raise additional capital.

No Known Presence of Reserves on the YAM Claims.

The proposed program is exploratory in nature and there are no known reserves on the property.

Rock Formations and Mineralization of Existing or Potential Economic Significance on the YAM Claims.

All development at the Young America mine was in the lower unit of the Middle Cambrian Metaline Limestone, a dense, fine-grained, bluish-gray dolomitic limestone that strikes N20°E and dips 12–20°E. In the immediate vicinity of the mine, the host rock is highly brecciated and silicified. Production came from two relatively flat-lying mineralized zones parallel to each other but separated by about 30 feet in elevation. These two zones transgressed bedding planes and have been mined up-dip about 60 feet in elevation to a point 240 feet distant from adits in the cliff face where a post-ore, calcite-rich shear zone was encountered.

The ore lenses range in thickness from a few inches to 6 feet. Primary sulphide minerals consist of an intimate mixture of sphalerite, argentiferous galena, and pyrargyrite. In addition, the upper ore horizon carried a significant concentration of geocronite, a lead–antimony mineral. Some tetrahedrite and chalcopyrite inclusions appeared in the galena. Prior reports indicated that a sample of primary sulphides from the upper mineralized zone contained 1000 ppm tin, probably from the mineral stannite. Prior reports also identified the presence of stibiconite, a hydrated antimony oxide. In addition to identifying stibiconite var. schulzite, prior reports have identified microscopic inclusions of cobaltite in euhedral grains of pyrite. The carbonates of lead and zinc, cerussite and smithsonite, were mined from a narrow high-grade zone of oxidation prior to 1905. Although hand-picked specimens are reported in anecdotal accounts as containing bonanza-type assays of lead, zinc, and silver, a 350-pound sample taken by the USBM from the cliff stope is probably the best representation of the kinds of values contained in the sulphide vein material: Prior reports discuss a 350 pound sample taken by the USBM from the cliff stope is probably typical of the main sulphide vein material.

8

|

Zn

|

Pb

|

Cu

|

Fe

|

Sb

|

Ag

|

Au.

|

||||||||||||||

| 10.9 | % | 5.9 | % | 0.09 | % | 1.2 | % | 0.07 | % |

10.6 opt

|

.011 opt

|

|||||||||

The gangue minerals are pyrite, quartz, calcite, and siderite. The primary mineralization shows some characteristics of a replacement-type deposit and some characteristics of open-space filling as indicated by observations made by different investigators. It is possible that both processes have taken place at separate times on one or more occasions. On the basis of thin-section studies, prior reports postulated eight different stages of mineralization at the Young America, beginning with pre-ore fracturing, followed by deposition of sulphides, quartz, calcite, and siderite in different episodes, and ending with post-mineral movement on the calcite-rich shear zone described above.

Results of Operations for the Year Ended June 30, 2011, from Inception (March 4, 2010) to June 30, 2010 and the period from Inception (March 4, 2010) to June 30, 2011

We have had no revenue for the year ended June 30, 2011, from Inception (March 4, 2010) to June 30, 2010, and during the period from Inception (March 4, 2010) through June 30, 2011. Our operating expenses for the year ended June 30, 2011, from Inception (March 4, 2010) to June 30, 2010 and for the period from Inception (March 4, 2010) through June 30, 2011, were $67,390, $7,077 and $74,467, respectively.

The primary expenses for the year ended June 30, 2011 were legal fees of $32,411, audit and accounting fees of $17,370 and office expenses of $6,100. The primary expense for the period from Inception (March 4, 2010) to June 30, 2010 were legal fees of $5,999. The primary expenses for the period from Inception (March 4, 2010) through June 30, 2011 were legal fees of $38,410, audit and accounting fees of $17,370 and office expenses of $6,606.

We recorded a net loss of $68,721 for the year ended June 30, 2011, $7,077 from Inception (March 4, 2010) to June 30, 2010 and $75,798 from Inception (March 4, 2010) through June 30, 2011.

Liquidity and Capital Resources

As of June 30, 2011, we had total current assets of $5,958. Our total current liabilities as of June 30, 2011 were $2,612. We had a working capital surplus of $3,346 as of June 30, 2011.

Operating activities used $71,855 in net cash from Inception (March 4, 2010) through June 30, 2011. Our net loss of $75,798 from Inception (March 4, 2010) through June 30, 2011 was the primary negative component of our operating cash flow. Financing activities generated net cash of $77,813 during this same period consisting of $50,000 of proceeds from related parties payables and $27,813 in proceeds from the issuance of common stock.

Off Balance Sheet Arrangements

As of June 30, 2011, there were no off balance sheet arrangements.

Going Concern

We have yet to achieve profitable operations, have accumulated losses of $75,798 since our inception and expect to incur further losses in the development of its business, all of which casts substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent upon our ability to generate future profitable operations and/or to obtain the necessary financing from shareholders or other sources to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management has no formal plan in place to address this concern but considers that we will be able to obtain additional funds by equity financing and/or related party advances, however there is no assurance of additional funding being available or on acceptable terms, if at all.

9

Critical Accounting Policies

In December 2001, the SEC requested that all registrants list their most “critical accounting polices” in the Management Discussion and Analysis. The SEC indicated that a “critical accounting policy” is one which is both important to the portrayal of a company’s financial condition and results, and requires management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain. At this time, management does not believe that any of our accounting policies fit this definition.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

A smaller reporting company is not required to provide the information required by this Item.

10

Item 8. Financial Statements and Supplementary Data

Index to Financial Statements Required by Article 8 of Regulation S-X:

|

Audited Financial Statements:

|

|

11

KINETIC RESOURCES CORP.

(An Exploration Stage Company)

CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2011 and 2010

(Stated in US Dollars)

12

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders

Kinetic Resources Corp.

We have audited the accompanying balance sheets of Kinetic Resources Corp. (An Exploration Stage Company) as of June 30, 2011 and 2010 and the related statements of operations, stockholder’s equity (deficit) and cash flows for the year ended June 30, 2011, from inception (March 4, 2010) through June 30, 2010, and for the period from inception (March 4, 2010) through June 30, 2011. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Kinetic Resources Corp. (An Exploration Stage Company) as of June 30, 2011 and 2010 and the results of its operations and cash flows for the year ended June 30, 2011, from inception (March 4, 2010) through June 30, 2010, and for the period from inception (March 4, 2010) through June 30, 2011 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered losses from operations, which raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ De Joya Griffith & Company, LLC

Henderson, Nevada

August 19, 2011

2580 Anthem Village Dr., Henderson, NV 89052

Telephone (702) 563-1600 ● Facsimile (702) 920-8049

F-1

13

KINETIC RESOURCES CORP.

(An Exploration Stage Company)

CONSOLIDATED BALANCE SHEETS

(Stated in US Dollars)

|

June 30,

|

||||||||

|

2011

|

2010

|

|||||||

|

ASSET

|

||||||||

|

Current

|

||||||||

|

Cash

|

$ | 5,958 | $ | 27,841 | ||||

|

Total current assets

|

$ | 5,958 | $ | 27,841 | ||||

|

Total assets

|

$ | 5,958 | $ | 27,841 | ||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT)

|

||||||||

|

Current

|

||||||||

|

Accounts payable

|

$ | 2,612 | $ | 6,605 | ||||

|

Due to related party – Note 4

|

- | 500 | ||||||

|

Total current liabilities

|

2,612 | 7,105 | ||||||

|

Long term liabilities

|

||||||||

|

Accrued interest

|

655 | - | ||||||

|

Notes payable, related party – Note 4

|

50,000 | - | ||||||

|

Total long term liabilities

|

50,655 | - | ||||||

|

Total liabilities

|

53,267 | 7,105 | ||||||

|

STOCKHOLDERS’ EQUITY (DEFICIT)

|

||||||||

|

Preferred stock, $0.001 par value

|

||||||||

|

10,000,000 shares authorized, none outstanding

|

- | - | ||||||

|

Common stock, $0.001 par value – Notes 4 and 5

|

||||||||

|

90,000,000 shares authorized

|

||||||||

|

3,550,000 shares issued and outstanding

|

3,550 | 3,550 | ||||||

|

Additional paid in capital

|

24,939 | 24,263 | ||||||

|

Deficit accumulated during the exploration stage

|

(75,798 | ) | (7,077 | ) | ||||

|

Total stockholders’ equity (deficit)

|

(47,309 | ) | 20,736 | |||||

|

Total liabilities and stockholders’ equity (deficit)

|

$ | 5,958 | $ | 27,841 | ||||

SEE ACCOMPANYING NOTES.

F-2

14

KINETIC RESOURCES CORP.

(An Exploration Stage Company)

CONSOLIDATED STATEMENTS OF OPERATIONS

(Stated in US Dollars)

|

From

|

From

|

|||||||||||

|

inception

|

inception

|

|||||||||||

|

(March 4

|

(March 4

|

|||||||||||

|

Year Ended

|

2010) to

|

2010) to

|

||||||||||

|

June 30

|

June 30,

|

June 30,

|

||||||||||

|

2011

|

2010

|

2011

|

||||||||||

|

Expenses

|

||||||||||||

|

Audit and accounting fees

|

$ | 17,370 | $ | - | $ | 17,370 | ||||||

|

Bank charges

|

465 | 65 | 530 | |||||||||

|

Foreign exchange gain

|

(10 | ) | 7 | (3 | ) | |||||||

|

Legal fees

|

32,411 | 5,999 | 38,410 | |||||||||

|

Management fees – Note 4

|

- | 500 | 500 | |||||||||

|

Mineral property option costs

|

4,000 | - | 4,000 | |||||||||

|

Mineral property exploration costs

|

2,500 | - | 2,500 | |||||||||

|

Office expenses

|

6,100 | 506 | 6,606 | |||||||||

|

Transfer and filing fees

|

4,554 | - | 4,554 | |||||||||

|

Operating loss

|

(67,390 | ) | (7,077 | ) | (74,467 | ) | ||||||

|

Interest expense – Note 4

|

(1,331 | ) | - | (1,331 | ) | |||||||

| - | - | |||||||||||

|

Net loss

|

$ | (68,721 | ) | $ | (7,077 | ) | $ | (75,798 | ) | |||

|

Basic loss per share

|

$ | (0.02 | ) | $ | (0.01 | ) | ||||||

|

Weighted average number of shares outstanding - basic

|

3,550,000 | 545,763 | ||||||||||

SEE ACCOMPANYING NOTES.

F-3

15

KINETIC RESOURCES CORP

(An Exploration Stage Company)

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY (DEFICIT)

for the period from inception (March 4, 2010) to June 30, 2011

(Stated in US Dollars)

|

Deficit

|

||||||||||||||||||||||||||||

|

Accumulated

|

||||||||||||||||||||||||||||

|

Additional

|

During the

|

|||||||||||||||||||||||||||

|

(Note 6)

|

Paid In

|

Exploration

|

||||||||||||||||||||||||||

|

Preferred Shares

|

Common Shares

|

Capital

|

Stage

|

Total

|

||||||||||||||||||||||||

|

Number

|

Amount

|

Number

|

Amount

|

|||||||||||||||||||||||||

|

Balance, inception (March 4, 2010)

|

- | $ | - | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||

|

Capital stock issued to founder for cash:

|

- | - | 2,000,000 | 2,000 | 13,558 | - | 15,558 | |||||||||||||||||||||

|

Capital stock issued for cash, net of commission

|

- | - | 1,550,000 | 1,550 | 10,705 | - | 12,255 | |||||||||||||||||||||

|

Net loss for the period

|

- | - | - | - | - | (7,077 | ) | (7,077 | ) | |||||||||||||||||||

|

Balance, June 30, 2010

|

- | - | 3,550,000 | 3,550 | 24,263 | (7,077 | ) | 20,736 | ||||||||||||||||||||

|

Capital contribution by president - Note 4

|

- | - | - | - | 676 | - | 676 | |||||||||||||||||||||

|

Net loss for the period

|

- | - | - | - | - | (68,721 | ) | (68,721 | ) | |||||||||||||||||||

|

Balance, June 30, 2011

|

- | - | 3,550,000 | $ | 3,550 | $ | 24,939 | $ | (75,798 | ) | $ | (47,309 | ) | |||||||||||||||

SEE ACCOMPANYING NOTES.

F-4

16

KINETIC RESOURCES CORP.

(An Exploration Stage Company)

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Stated in US Dollars)

|

From

|

From

|

|||||||||||

|

inception

|

inception

|

|||||||||||

|

(March 4

|

(March 4

|

|||||||||||

|

2010) to

|

2010) to

|

|||||||||||

|

Year Ended

|

June 30,

|

June 30,

|

||||||||||

|

June 30

|

2010

|

2011

|

||||||||||

|

Cash Flows Used in Operating Activities

|

||||||||||||

|

Net loss

|

$ | (68,721 | ) | $ | (7,077 | ) | $ | (75,798 | ) | |||

|

Adjustments to reconcile net loss to net cash used by operating activities:

|

||||||||||||

|

Non cash interest expense – capital contribution

|

676 | - | 676 | |||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Accounts payable and accrued liabilities

|

(3,993 | ) | 6,605 | 2612 | ||||||||

|

Net cash used in operating activities

|

(71,383 | ) | (472 | ) | (71,855 | ) | ||||||

|

Cash Flows from Financing Activities

|

||||||||||||

|

Proceeds from capital stock issued

|

- | 27,813 | 27,813 | |||||||||

|

Due to related party

|

(500 | ) | 500 | - | ||||||||

|

Proceeds from notes payable, related party

|

50,000 | - | 50,000 | |||||||||

|

Net cash provided by financing activities

|

49,500 | 28,313 | 77,813 | |||||||||

|

Increase (decrease) in cash during the period

|

(21,883 | ) | 27,841 | 5,958 | ||||||||

|

Cash, beginning of the period

|

27,841 | - | - | |||||||||

|

Cash, end of the period

|

$ | 5,958 | $ | 27,841 | $ | 5,958 | ||||||

|

Supplemental information

|

||||||||||||

|

Interest and taxes paid in cash

|

$ | - | $ | - | $ | - | ||||||

SEE ACCOMPANYING NOTES.

F-5

17

KINETIC RESOURCES CORP.

(An Exploration Stage Company)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2011 and 2010

(Stated in US Dollars)

|

Note 1

|

Nature of Operations and Ability to Continue as a Going Concern

|

The Company was incorporated in the state of Nevada, United States of America on March 4, 2010. The Company is an exploration stage company and was formed for the purpose of acquiring exploration and development stage mineral properties. The Company’s year-end is June 30.

On June 4, 2010, the Company incorporated a wholly-owned subsidiary, KRC Exploration LLC in the State of Nevada, United States of America (“USA”) for the purpose of mineral exploration in the USA.

These financial statements have been prepared in accordance with generally accepted accounting principles applicable to a going concern, which assumes that the Company will be able to meet its obligations and continue its operations for its next fiscal year. Realization values may be substantially different from carrying values as shown and these financial statements do not give effect to adjustments that would be necessary to the carrying values and classification of assets and liabilities should the Company be unable to continue as a going concern. The Company has yet to achieve profitable operations, has accumulated losses of $75,798 since its inception and expects to incur further losses in the development of its business, all of which casts substantial doubt about the Company’s ability to continue as a going concern. The Company’s ability to continue as a going concern is dependent upon its ability to generate future profitable operations and/or to obtain the necessary financing from shareholders or other sources to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management has no formal plan in place to address this concern but considers that the Company will be able to obtain additional funds by equity financing and/or related party advances, however there is no assurance of additional funding being available or on acceptable terms, if at all. The financials statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the company cannot continue in existence.

|

Note 2

|

Summary of Significant Accounting Policies

|

The consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America and are stated in US dollars. Because a precise determination of many assets and liabilities is dependent upon future events, the preparation of financial statements for a period necessarily involves the use of estimates, which may have been made using careful judgment. Actual results may vary from these estimates.

The financial statements have, in management’s opinion, been properly prepared within the framework of the significant accounting policies summarized below:

F-8

18

Kinetic Resources Corp.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

June 30, 2011 and 2010

(Stated in US Dollars) – Page 2

|

Note 2

|

Summary of Significant Accounting Policies – (cont’d)

|

Principles of Consolidation

These consolidated financial statements include the accounts of the Company and KRC Exploration LLC., a wholly owned subsidiary incorporated in Nevada, USA on June 4, 2010. All significant inter-company transactions and balances have been eliminated.

Exploration Stage Company

The Company is an exploration stage company. All losses accumulated since inception have been considered as part of the Company’s exploration stage activities.

Cash and cash equivalents

The Company considers all highly liquid instruments purchased with a maturity of three months or less to be cash equivalents. There were no cash equivalents held at June 30, 2011 or June 30, 2010.

The Company minimizes its credit risk associated with cash by periodically evaluating the credit quality of its primary financial institution. The balance at times may exceed federally insured limits. At June 30, 2011 and June 30, 2010, the balance did not exceed the federally insured limit.

Mineral Property

Costs of lease, acquisition, exploration, carrying and retaining unproven mineral lease properties are expensed as incurred. The Company has chosen to expense all mineral acquisition and exploration costs as incurred given that it is still in the exploration stage. Once the Company has identified proven and probable reserves in its investigation of its properties and upon development of a plan for operating a mine, it would enter the development stage and capitalize future costs until production is established. When a property reaches the production stage, the related capitalized costs will be amortized, using the units of production method on the basis of periodic estimates of ore reserves. When the Company has capitalized mineral properties, these properties will be periodically assessed for impairment of value and any diminution in value.

Asset Retirement Obligations

Asset retirement obligations (“ARO”) associated with the retirement of a tangible long-lived asset, are recognized as liabilities in the period in which it is incurred and becomes determinable, with an offsetting increase in the carrying amount of the associated assets. The cost of tangible long-lived assets, including the initially recognized ARO, is amortized, such that the cost of the ARO is recognized over the useful life of the assets. The ARO is recorded at fair value, and accretion expense is recognized over time as the discounted fair value is accreted to the expected settlement value.

The fair value of the ARO is measured using expected future cash flow, discounted at the Company’s credit-adjusted risk-free interest rate. As at June 30, 2011, the Company has determined no provision for ARO’s is required.

F-9

19

Kinetic Resources Corp.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

June 30, 2011 and 2010

(Stated in US Dollars) – Page 3

|

Note 2

|

Summary of Significant Accounting Policies – (cont’d)

|

Impairment of Long- Lived Assets

The Company reviews and evaluates long-lived assets for impairment when events or changes in circumstances indicate that the related carrying amounts may not be recoverable. The assets are subject to impairment consideration under FASB ASC 360-10-35-17 if events or circumstances indicate that their carrying amount might not be recoverable. When the Company determines that an impairment analysis should be done, the analysis will be performed using the rules of FASB ASC 930-360-35, Asset Impairment, and 360-10 through 15-5, Impairment or Disposal of Long- Lived Assets.

Foreign Currency Translation

The Company’s functional currency is the United States dollar as substantially all of the Company’s operations are in the USA. The Company uses the United States dollar as its reporting currency for consistency with registrants of the Securities and Exchange Commission (“SEC”).

Assets and liabilities denominated in a foreign currency are translated at the exchange rate in effect at the balance sheet date and capital accounts are translated at historical rates. Income statement accounts are translated at the average rates of exchange prevailing during the period. Translation adjustments from the use of different exchange rates from period to period are included in the Accumulated Other Comprehensive Income account in Stockholder’s Equity, if applicable. Transactions undertaken in currencies other than the functional currency of the entity are translated using the exchange rate in effect as of the transaction date. Any exchange gains and losses are included in the Statement of Operations.

Earnings per share

In accordance with accounting guidance now codified as FASB ASC Topic 260, “Earnings per Share,” Basic earnings per share (“EPS”) is computed by dividing net loss available to common stockholders by the weighted average number of common shares outstanding during the period, excluding the effects of any potentially dilutive securities. Diluted EPS gives effect to all dilutive potential of shares of common stock outstanding during the period including stock options or warrants, using the treasury stock method (by using the average stock price for the period to determine the number of shares assumed to be purchased from the exercise of stock options or warrants), and convertible debt or convertible preferred stock, using the if-converted method. Diluted EPS excludes all dilutive potential of shares of common stock if their effect is anti-dilutive.

Income Taxes

The Company uses the asset and liability method of accounting for income taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between the financial statements carrying amounts of existing assets and liabilities and loss carry-forwards and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled.

F-10

20

Kinetic Resources Corp.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

June 30, 2011 and 2010

(Stated in US Dollars) – Page 4

|

Note 2

|

Summary of Significant Accounting Policies – (cont’d)

|

Income Taxes – (cont’d)

The effect of a change in tax rules on deferred tax assets and liabilities is recognized in operations in the year of change. A valuation allowance is recorded when it is “more likely-than-not” that a deferred tax asset will not be realized.

Stock-based Compensation

The Company is required to record compensation expense, based on the fair value of the awards, for all awards granted after the date of the adoption.

|

Note 3

|

Financial Instruments

|

Fair value is defined as the price that would be received upon sale of an asset or paid upon transfer of a liability in an orderly transaction between market participants at the measurement date and in the principal or most advantageous market for that asset or liability. The fair value should be calculated based on assumptions that market participants would use in pricing the asset or liability, not on assumptions specific to the entity. In addition, the fair value of liabilities should include consideration of non-performance risk including our own credit risk.

In addition to defining fair value, the standard expands the disclosure requirements around fair value and establishes a fair value hierarchy for valuation inputs. The hierarchy prioritizes the inputs into three levels based on the extent to which inputs used in measuring fair value are observable in the market. Each fair value measurement is reported in one of the three levels which is determined by the lowest level input that is significant to the fair value measurement in its entirety. These levels are:

|

|

Level 1 – inputs are based upon unadjusted quoted prices for identical instruments traded in active markets.

|

|

|

Level 2 – inputs are based upon significant observable inputs other than quoted prices included in Level 1, such as quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant assumptions are observable in the market or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

|

F-11

21

Kinetic Resources Corp.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

June 30, 2011 and 2010

(Stated in US Dollars) – Page 5

|

Note 3

|

Financial Instruments

|

|

|

Level 3 – inputs are generally unobservable and typically reflect management’s estimates of assumptions that market participants would use in pricing the asset or liability. The fair values are therefore determined using model-based techniques that include option pricing models, discounted cash flow models, and similar techniques.

|

The carrying value of the Company’s financial assets and liabilities which consist of cash, accounts payable and accrued liabilities, and due to related parties in management’s opinion approximate their fair value due to the short maturity of such instruments. These financial assets and liabilities are valued using level 3 inputs, except for cash which is at level 1. Unless otherwise noted, it is management’s opinion that the Company is not exposed to significant interest, exchange or credit risks arising from these financial instruments.

|

Note 4

|

Related Party Transactions

|

The amount due to related party is due to the Company’s former president for unpaid management fees (June 30, 2010 - $500). This amount was unsecured, non-interest bearing and has no specific terms for repayment. As of June 30, 2011, this note had been paid in full.

On August 30, 2010, the Company issued a promissory note of $15,000 to the Company’s president and received $15,000 cash in exchange. The note is unsecured, non-interest bearing and matures on September 30, 2012. During the year ended June 30, 2011, the Company has recorded interest expense of $626 (2010 - $nil) and also recorded a capital contribution of $626 (2010 - $nil) in respect of the imputed interest charge on this note payable.

On February 11, 2011, the Company issued a promissory note of $25,000 to the Company’s president and received $25,000 cash in exchange. The promissory note is unsecured, bears interest at 6% per annum, and matures on February 28, 2013. During the year ended June 30, 2011, the Company accrued $571 (2010 - $nil) of interest expense in respect of this note payable.

On May 10, 2011, the Company issued a promissory note of $10,000 to the Company’s president and received $10,000 cash in exchange. The promissory note is unsecured, bears interest at 6% per annum, and matures on May 31, 2013. During the year ended June 30, 2011, the Company accrued $84 (2010 - $nil) of interest expense in respect of this note payable.

On June 4, 2010, the Company received and accepted a subscription to purchase 2,000,000 common shares at $0.00778 per share for aggregate proceeds of $15,558 from the Company’s president. The subscription agreement permitted the Company to accept 200,000 Mexican Pesos in full settlement of the share subscription. The share subscription was settled in Mexican Pesos and translated to US Dollars for financial reporting purposes.

F-12

22

Kinetic Resources Corp.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

June 30, 2011 and 2010

(Stated in US Dollars) – Page 6

|

Note 4

|

Related Party Transactions - (cont’d)

|

During the year ended June 30, 2011 the Company incurred $nil (2010 - $500) of management fees charged by the Company’s former president.

|

Note 5

|

Capital Stock

|

Issued:

On June 4, 2010, the Company issued 2,000,000 common shares to the Company’s president at $0.00778 per share for total proceeds of $15,558.

On June 22, 2010, the Company issued 1,550,000 common shares at $0.00796 per share for total proceeds of $12,335 pursuant to a private placement. The Company paid commissions of $100 for net proceeds of $12,235.

|

Note 6

|

Income Taxes

|

A reconciliation of the income tax provision computed at statutory rates to the reported tax provision is as follows:

|

Inception

|

||

|

(March 4, 2010)

|

||

|

Year Ended

|

to

|

|

|

June 30

|

June 30

|

|

|

2011

|

2010

|

|

|

Basic statutory and state income tax rate

|

35.0%

|

35.0%

|

|

Inception

|

||||||||

|

(March 4, 2010)

|

||||||||

|

Year Ended

|

to

|

|||||||

|

June 30

|

June 30

|

|||||||

|

2011

|

2010

|

|||||||

|

Approximate loss before income taxes

|

$ | 68,721 | $ | 7,077 | ||||

|

Expected approximate tax recovery on net loss, before income tax

|

$ | 24,052 | $ | 2,477 | ||||

|

Valuation allowance

|

(24,052 | ) | (2,477 | ) | ||||

|

Deferred income tax recovery

|

$ | - | $ | - | ||||

F-13

23

Kinetic Resources Corp.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

June 30, 2011 and 2010

(Stated in US Dollars) – Page 7

|

Note 6

|

Income Taxes – (cont’d)

|

Significant components of the Company’s deferred tax assets and liabilities are as follows:

|

Inception

|

||||||||

|

(March 4, 2010)

|

||||||||

|

Year Ended

|

to

|

|||||||

|

June 30

|

June 30

|

|||||||

|

2011

|

2010

|

|||||||

|

Deferred income tax assets

|

||||||||

|

Non-capital losses carried forward

|

$ | 26,529 | $ | 2,477 | ||||

|

Less: valuation allowance

|

(26,529 | ) | (2,477 | ) | ||||

|

Deferred income tax assets

|

$ | - | $ | - | ||||

At June 30, 2011, the Company has incurred accumulated net operating losses in the United States of America totalling approximately $75,798 which are available to reduce taxable income in future taxation years.

These losses expire as follows:

|

Year of Expiry

|

Amount

|

|||

|

2030

|

$ | 7,077 | ||

|

2031

|

$ | 68,721 | ||

The amount taken into income as deferred tax assets must reflect that portion of the income tax loss carryforwards that is more-likely-than-not to be realized from future operations. The Company has chosen to provide an allowance of 100% against all available income tax loss carryforwards, regardless of their time of expiry.

|

Note 7

|

Commitment

|

On July 28, 2010, our wholly owned subsidiary, KRC Exploration LLC, a Nevada limited liability company, (“KRC”) entered into a Property Option Agreement (the “Property Option Agreement”) with American Mining Corporation (“American”) to acquire an option to purchase a 100% interest in the Young America Mine group of Mineral Claims (the “YAM Claims”). Under the terms of the Property Option Agreement, the Company acquired an option to purchase a 100% interest in the YAM Claims for an initial payment of $4,000. In order to exercise the option, the Company must pay the following monies to American and make the following expenditures on the YAM Claims by the following dates:

F-14

24

Kinetic Resources Corp.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

June 30, 2011 and 2010

(Stated in US Dollars) – Page 8

|

Note 7

|

Commitment – (cont’d)

|

|

|

Payments to American

|

|

|

·

|

$4,000 on or before August 31, 2011

|

|

|

·

|

$20,000 on or before August 31, 2012

|

|

|

·

|

100,000 on or before August 31, 2013

|

Exploration Expenditures

|

|

·

|

$15,000 in aggregate exploration expenditures prior to August 31, 2012

|

|

|

·

|

$50,000 in aggregate exploration expenditures prior to August 31, 2013; and

|

|

|

·

|

$180,000 in aggregate exploration expenditures prior to August 31, 2014

|

As at June 30, 2011, the Company has incurred $2,500 of exploration expenditures.

|

Note 8

|

Subsequent Events

|

On August 22, 2011, the Company issued a promissory note of $10,000 to the Company’s president and received $10,000 cash in exchange. The promissory note is unsecured, bears interest at 6% per annum, and matures on August 31, 2013.

F-15

25

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

No events occurred requiring disclosure under Item 307 and 308 of Regulation S-K during the fiscal year ending June 30, 2011.

Item 9A. Controls and Procedures

As required by Rule 13a-15 under the Securities Exchange Act of 1934, we have carried out an evaluation of the effectiveness of our disclosure controls and procedures as of the end of the period covered by this annual report, being June 30, 2011. This evaluation was carried out under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer.

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include controls and procedures designed to ensure that information required to be disclosed in our company’s reports filed under the Securities Exchange Act of 1934 is accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure.

Based upon that evaluation, including our Chief Executive Officer and Chief Financial Officer, we have concluded that our disclosure controls and procedures were ineffective as of the end of the period covered by this annual report.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rule 13a-15(f) under the Securities Exchange Act of 1934). Management has assessed the effectiveness of our internal control over financial reporting as of June 30, 2011 based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. As a result of this assessment, management concluded that, as of June 30, 2011, our internal control over financial reporting was not effective. Our management identified the following material weaknesses in our internal control over financial reporting, which are indicative of many small companies with small staff: (i) inadequate segregation of duties and effective risk assessment; and (ii) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of both US GAAP and SEC guidelines.

We plan to take steps to enhance and improve the design of our internal control over financial reporting. During the period covered by this annual report on Form 10-K, we have not been able to remediate the material weaknesses identified above. To remediate such weaknesses, we hope to implement the following changes during our fiscal year ending June 30, 2012: (i) appoint additional qualified personnel to address inadequate segregation of duties and ineffective risk management; and (ii) adopt sufficient written policies and procedures for accounting and financial reporting. The remediation efforts set out in (i) and (ii) are largely dependent upon our securing additional financing to cover the costs of implementing the changes required. If we are unsuccessful in securing such funds, remediation efforts may be adversely affected in a material manner.

26

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to an exemption for non-accelerated filers set forth in Section 989G of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Item 9B. Other Information

None

PART III

Item 10. Directors, Executive Officers and Corporate Governance

Our sole executive officer and director and his age as of June 30, 2011 is as follows:

|

Name

|

Age

|

Position(s) and Office(s) Held

|

|||

|

Luis Antonio Delgado Gonzalez

|

38 |

President, Chief Executive Officer, Chief Financial Officer, and Director

|

|||

Set forth below is a brief description of the background and business experience of each of our current executive officers and directors.

Luis Antonio Delgado Gonzalez. Mr. Delgado is our CEO, CFO, President, Secretary, Treasurer and sole director. Mr. Delgado has been in the business of property development and management in the town of Bucerias, Nayarit, Mexico since 2004. Mr. Delgado has no specific professional experience, qualifications, or skills that led to his appointment as our sole officer and director.

Mr. Delgado was born in Mexico and is a Mexican citizen.

Term of Office

Our Directors are appointed for a one year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

Family Relationships

There are no family relationships between or among the directors, executive officers or persons nominated or chosen by us to become directors or executive officers.

Involvement in Certain Legal Proceedings

To the best of our knowledge, during the past ten years, none of the following occurred with respect to a present or former director, executive officer, or employee: (1) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (2) any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (3) being subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his or her involvement in any type of business, securities or banking activities; and (4) being found by a court of competent jurisdiction (in a civil action), the SEC or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

27

Committees of the Board

Our company currently does not have nominating, compensation or audit committees or committees performing similar functions nor does our company have a written nominating, compensation or audit committee charter. Our directors believe that it is not necessary to have such committees, at this time, because the functions of such committees can be adequately performed by the board of directors.

Our company does not have any defined policy or procedural requirements for shareholders to submit recommendations or nominations for directors. The board of directors believes that, given the stage of our development, a specific nominating policy would be premature and of little assistance until our business operations develop to a more advanced level. Our company does not currently have any specific or minimum criteria for the election of nominees to the board of directors and we do not have any specific process or procedure for evaluating such nominees. The board of directors will assess all candidates, whether submitted by management or shareholders, and make recommendations for election or appointment.

A shareholder who wishes to communicate with our board of directors may do so by directing a written request addressed to our President, Mr. Delgado, at the address appearing on the first page of this annual report.

Code of Ethics

As of June 30, 2011, we had not adopted a Code of Ethics for Financial Executives, which would include our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

Item 11. Executive Compensation

Compensation Discussion and Analysis

Currently, the objective of the cash compensation paid by the company is to provide fair reimbursement for the time spent by our executive officer and independent directors to the extent feasible within the financial constraints faced by our developing business. The stock options granted to our executive officer and to our independent directors are intended to provide these individuals with incentives to pursue the growth and development of the company’s operations and business opportunities. Although the options awarded to our executive and directors are typically exercisable immediately, they also remain valid and exercisable for terms of several years. We believe this provides the proper balance of short-term and long-term incentives to increase the value of the company. Although an immediate increase in share price following the issuance of the options would obviously result in a profit if those options were exercised, the longer exercisable period of the options also provides an incentive to increase value over the long term and gives our executive officer and directors the opportunity to realize gains based on the sustained growth of our operations and revenues.

In addition, our sole executive officer holds substantial ownership in the company and is generally motivated by a strong entrepreneurial interest in expanding our operations and revenue base to the best of his ability.

28

Summary Compensation Table

The table below summarizes all compensation awarded to, earned by, or paid to our former or current executive officers for the fiscal years ended 2011 and 2010.

|

SUMMARY COMPENSATION TABLE

|

|||||||||||||||||||||||||||||||||

|

Name and

principal position

|

Year

|

Salary

($)

|

Bonus

($)

|

Stock Awards

($)

|

Option

Awards

($)

|

Non-Equity

Incentive Plan

Compensation

($)

|

Nonqualified

Deferred

Compensation

Earnings ($)

|

All Other

Compensation

($)

|

Total

($)

|

||||||||||||||||||||||||

|

Luis Antonio

Delgado Gonzalez,

CEO, CFO, President, Secretary-Treasurer

|

2011

|

$ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||

|

2010

|

$ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | |||||||||||||||||

|

Penny

Mendlovic former officer

|

2010

|

$ | 500 | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | 500 | ||||||||||||||||

Narrative Disclosure to the Summary Compensation Table

We have not entered into any employment agreement or consulting agreement with our executive officers. There are no arrangements or plans in which we provide pension, retirement or similar benefits for executive officers.

Although we do not currently compensate our officers, we reserve the right to provide compensation at some time in the future. Our decision to compensate officers depends on the availability of our cash resources with respect to the need for cash to further our business purposes.

Outstanding Equity Awards at Fiscal Year-End

The table below summarizes all unexercised options, stock that has not vested, and equity incentive plan awards for each named executive officer as of June 30, 2011.

|

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

|

||||||||||||||||||||||||||||||||||||

|

OPTION AWARDS

|

STOCK AWARDS

|

|||||||||||||||||||||||||||||||||||

|

Name

|

Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable

|

Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable

|

Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#)

|

Option

Exercise

Price

($)

|

Option

Expiration

Date

|

Number

of

Shares

or Shares

of

Stock That

Have

Not

Vested

(#)

|

Market

Value

of

Shares

or

Shares

of

Stock

That

Have

Not

Vested

($)

|

Equity

Incentive

Plan

Awards:

Number

of

Unearned

Shares,

Shares or

Other

Rights

That Have

Not

Vested

(#)

|

Equity

Incentive

Plan

Awards:

Market or

Payout

Value of

Unearned

Shares,

Shares or

Other

Rights

That

Have Not

Vested

(#)

|

|||||||||||||||||||||||||||

|

Luis Antonio Delgado Gonzalez

|

- | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

29

Director Compensation

The table below summarizes all compensation of our directors as of June 30, 2011.

|

DIRECTOR COMPENSATION

|

||||||||||||||||||||||||||||

|

Name

|

Fees Earned or

Paid in

Cash

|

Stock

Awards

|

Option

Awards

|

Non-Equity

Incentive

Plan

Compensation

|

Non-Qualified

Deferred

Compensation

Earnings

|

All

Other

Compensation

|

Total

|

|||||||||||||||||||||

|

Luis Antonio Delgado Gonzalez

|

- | - | - | - | - | - | - | |||||||||||||||||||||

Narrative Disclosure to the Director Compensation Table

We do not compensate our directors for their service at this time.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table sets forth, as of June 30, 2011, the beneficial ownership of our common stock by each executive officer and director, by each person known by us to beneficially own more than 5% of the our common stock and by the executive officers and directors as a group:

|

Title of class

|

Name and address of beneficial owner (1)

|

Title of Class

|

Amount of beneficial ownership

|

Percent of class*

|

||||||

|

Executive Officers & Directors:

|

||||||||||

|

Common

|

Luis Antonio Delgado Gonzalez

Josefa Ortiz de Dominique #52,

Bucerias, Nayarit

Mexico

|

2,000,000 | 56.34 | % | ||||||

|

Common

|

Total all executive officers and directors

|

2,000,000 | 56.34 | % | ||||||

|

Common

|

5% Shareholders

|

None

|

||||||||

|

(1)

|