Attached files

| file | filename |

|---|---|

| EX-99.2 - PRESS RELEASE - Copano Energy, L.L.C. | ex99-2.htm |

| 8-K - COPANO ENERGY, L.L.C. FORM 8-K - Copano Energy, L.L.C. | form8-k.htm |

Exhibit 99.1

2011 Citigroup One-on-One

MLP/Midstream Infrastructure

Conference

August 24 - 25, 2011

MLP/Midstream Infrastructure

Conference

August 24 - 25, 2011

NASDAQ: CPNO

Disclaimer

This presentation includes “forward-looking statements,” as defined in the federal securities laws.

Statements that address activities or events that Copano believes will or may occur in the future are

forward-looking statements. These statements include, but are not limited to, statements about future

producer activity and Copano’s total distributable cash flow and distribution coverage. These statements

are based on management’s experience and perception of historical trends, current conditions, expected

future developments and other factors management believes are reasonable.

Statements that address activities or events that Copano believes will or may occur in the future are

forward-looking statements. These statements include, but are not limited to, statements about future

producer activity and Copano’s total distributable cash flow and distribution coverage. These statements

are based on management’s experience and perception of historical trends, current conditions, expected

future developments and other factors management believes are reasonable.

Important factors that could cause actual results to differ materially from those in the forward-looking

statements include the following risks and uncertainties, many of which are beyond Copano’s control:

the volatility of prices and market demand for natural gas and natural gas liquids; Copano’s ability to

continue to obtain new sources of natural gas supply and retain its key customers; the impact on

volumes and resulting cash flow of technological, economic and other uncertainties inherent in

estimating future production, producers’ ability to drill and successfully complete and attach new natural

gas supplies and the availability of downstream transportation systems and other facilities for natural

gas and NGLs; higher construction costs or project delays due to inflation, limited availability of required

resources, or the effects of environmental, legal or other uncertainties; general economic conditions;

the effects of government regulations and policies; and other financial, operational and legal risks and

uncertainties detailed from time to time in Copano’s quarterly and annual reports filed with the

Securities and Exchange Commission.

statements include the following risks and uncertainties, many of which are beyond Copano’s control:

the volatility of prices and market demand for natural gas and natural gas liquids; Copano’s ability to

continue to obtain new sources of natural gas supply and retain its key customers; the impact on

volumes and resulting cash flow of technological, economic and other uncertainties inherent in

estimating future production, producers’ ability to drill and successfully complete and attach new natural

gas supplies and the availability of downstream transportation systems and other facilities for natural

gas and NGLs; higher construction costs or project delays due to inflation, limited availability of required

resources, or the effects of environmental, legal or other uncertainties; general economic conditions;

the effects of government regulations and policies; and other financial, operational and legal risks and

uncertainties detailed from time to time in Copano’s quarterly and annual reports filed with the

Securities and Exchange Commission.

Copano undertakes no obligation to update any forward-looking statements, whether as a result of new

information or future events.

information or future events.

2

Introduction to Copano

Independent midstream company founded in 1992

■ Producer focused

■ Entrepreneurial approach

■ Focus on long-term accretive growth

■ Publicly traded LLC

● No general partner or incentive distribution rights

● Tax benefits similar to MLPs, but with corporate governance of a C-corp

Service throughput volumes approximate 1,500,000 MMBtu/d of

natural gas(1)

natural gas(1)

Approximately 6,700 miles of active pipelines

10 natural gas processing plants with over 1.2 Bcf/d of combined

processing capacity

processing capacity

One NGL fractionation facility with total capacity of 22,000 Bbls/d

■ Expansion underway to increase total capacity to 44,000 Bbls/d

3

(1) Based on 2Q 2011 results. Includes unconsolidated affiliates.

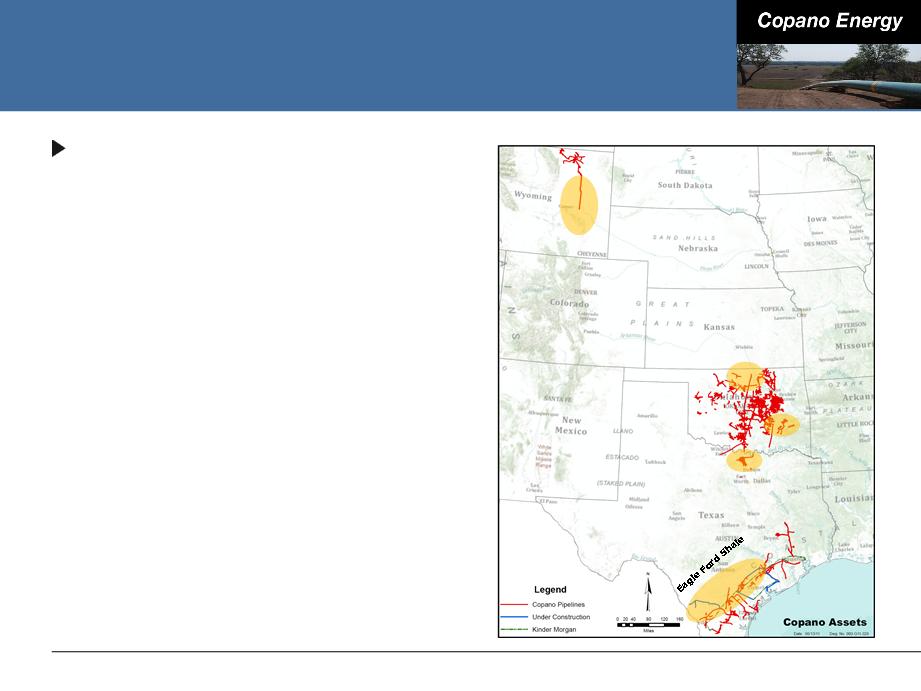

Operating Segments

Operating segments

■ Texas

■ Oklahoma

■ Rocky Mountains

■ Copano currently has assets in five

active U.S. resource plays

active U.S. resource plays

● Eagle Ford Shale

● North Barnett Shale Combo

● Woodford Shale

● Mississippi Lime

● Powder River Basin Niobrara

4

Powder River

Basin Niobrara

Basin Niobrara

Woodford

Shale

Shale

Mississippi

Lime

Lime

North Barnett

Shale Combo

Shale Combo

Executing On Our Business Strategy

Eagle Ford Shale, North Barnett Shale Combo, Woodford

Shale and Mississippi Lime

Shale and Mississippi Lime

Acquisition of the Harrah and Davenport plants

5

Organic Growth and

Bolt-on Acquisitions

Bolt-on Acquisitions

Maintaining Strong

Balance Sheet

Balance Sheet

Reduce Sensitivity

to Commodity

Prices

to Commodity

Prices

Flexibility in

Operations

Operations

Long-term, fee-based contracts - also reduce hedging

requirements

requirements

Access to multiple NGL markets

Ability to fractionate and produce y-grade product

Multiple plant residue alternatives

March 2010 equity offering

TPG Capital preferred equity investment

Senior notes refinancing

Extended maturity of revolver to 2016

Expand Midstream

Services Menu

Services Menu

Fractionation and NGL marketing services

Purity ethane and propane pipeline service

Y-grade service through the Liberty pipeline

Condensate and crude oil gathering project in planning phase

Agenda

6

|

Eagle Ford Shale

Growth Projects |

Business Segment

Outlook |

|

Financing and

Commodity Price Sensitivity |

Conclusions

|

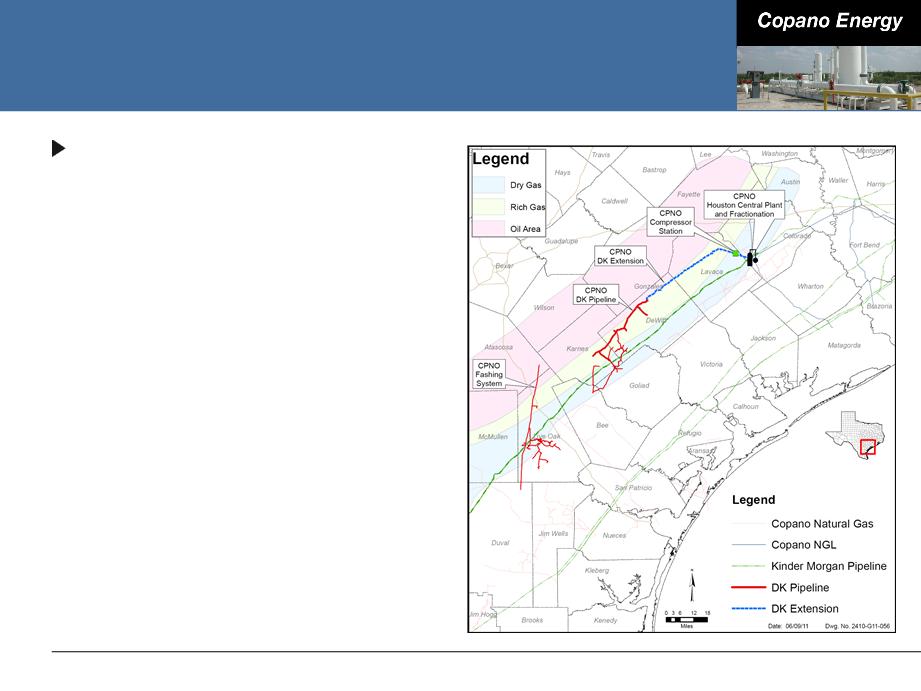

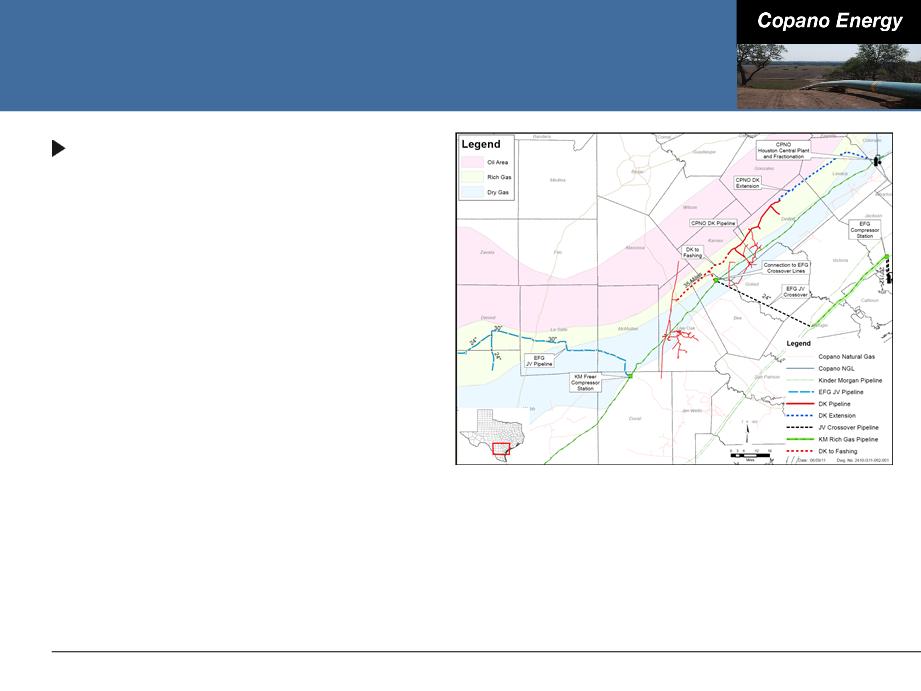

DK Pipeline and Extension

DK extension

■ Key producer contracts with

Abraxas, GeoSouthern, Petrohawk,

Pioneer, Riley and others

Abraxas, GeoSouthern, Petrohawk,

Pioneer, Riley and others

■ Announced February 2011

● 58 miles of 24” pipe

● Construction approximately 25%

complete

complete

■ Loops Kinder Morgan’s Index 50

pipeline, effectively boosting

pipeline capacity to Houston Central

complex

pipeline, effectively boosting

pipeline capacity to Houston Central

complex

■ Extension to Houston Central

complex will increase DK pipeline

capacity to 350,000 MMBtu/d from

225,000 MMBtu/d

complex will increase DK pipeline

capacity to 350,000 MMBtu/d from

225,000 MMBtu/d

■ Estimated capital investment of

$100 million

$100 million

7

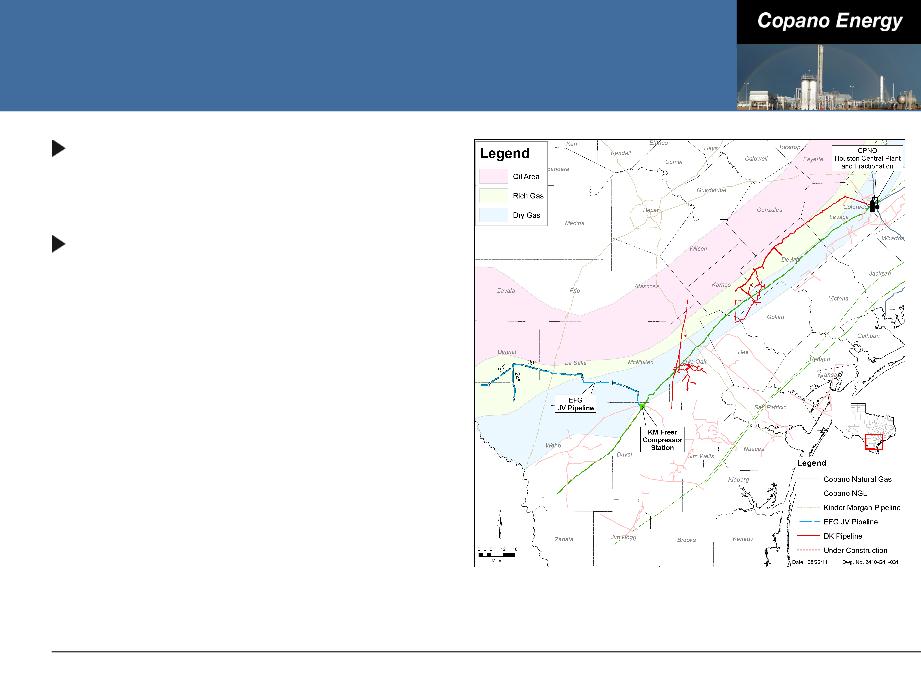

Southern Eagle Ford Shale

Eagle Ford Gathering (EFG)

■ 50/50 JV with Kinder Morgan

EFG Mainline

■ 117 miles of 30” and 24” pipe -

nearing completion

nearing completion

■ 30” pipeline now accepting

interruptible gas with full service

expected early October

interruptible gas with full service

expected early October

■ Nominal capacity of 600,000

MMBtu/d - expandable with

compression

MMBtu/d - expandable with

compression

■ Long-term, fee-based contracts with

volume commitments for 91% of

nominal capacity

volume commitments for 91% of

nominal capacity

● Newly added contacts with Rosetta

and Petrohawk

and Petrohawk

■ Estimated capital investment of

$87.5 million

$87.5 million

8

EFG Crossover

9

Allows for full utilization of EFG

Mainline pipeline

Mainline pipeline

66 miles of 24” and 20” pipe

connecting Kinder Morgan’s

Index 50 and Tejas 30”

pipelines to Formosa

connecting Kinder Morgan’s

Index 50 and Tejas 30”

pipelines to Formosa

■ Approximately 50% of 24” line

constructed

constructed

■ Estimated capital investment of $50

million

million

7 miles of 20” pipe connecting

Kinder Morgan’s Tejas 30”

pipeline to Williams Partners’

Markham plant

Kinder Morgan’s Tejas 30”

pipeline to Williams Partners’

Markham plant

■ Anticipate early October access to

Markham plant

Markham plant

■ Estimated capital investment of

$13.5 million

$13.5 million

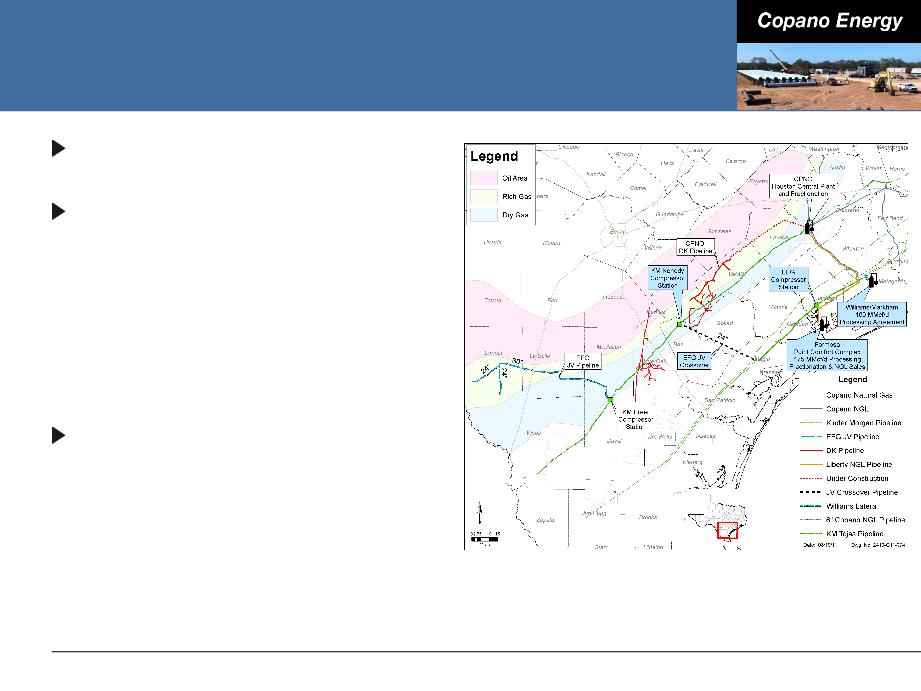

EFG Crossover (cont’d)

10

Long-term contracts with

Formosa and Williams Partners

Formosa and Williams Partners

■ Formosa - 175 MMcf/d of

processing, fractionation and

product sales

processing, fractionation and

product sales

■ Williams Partners’ Markham - 100

MMcf/d processing and associated

with fractionation, with an option to

increase to 200 MMcf/d

MMcf/d processing and associated

with fractionation, with an option to

increase to 200 MMcf/d

● Copano to construct wholly owned

8-mile, 6” NGL pipeline from

Markham plant to Liberty NGL

pipeline estimated capital

investment of $5.5 million

8-mile, 6” NGL pipeline from

Markham plant to Liberty NGL

pipeline estimated capital

investment of $5.5 million

Houston Central Complex

Fractionation expansion

■ Fractionation expansion from

22,000 Bbls/d to 44,000

Bbls/d

22,000 Bbls/d to 44,000

Bbls/d

● All ethane and propane

expected to move to Dow

through Copano purity

pipelines

expected to move to Dow

through Copano purity

pipelines

■ Estimated capital investment

of $66 million

of $66 million

● Includes fractionation

facilities and related plant

upgrades and product

pipeline expansions

facilities and related plant

upgrades and product

pipeline expansions

11

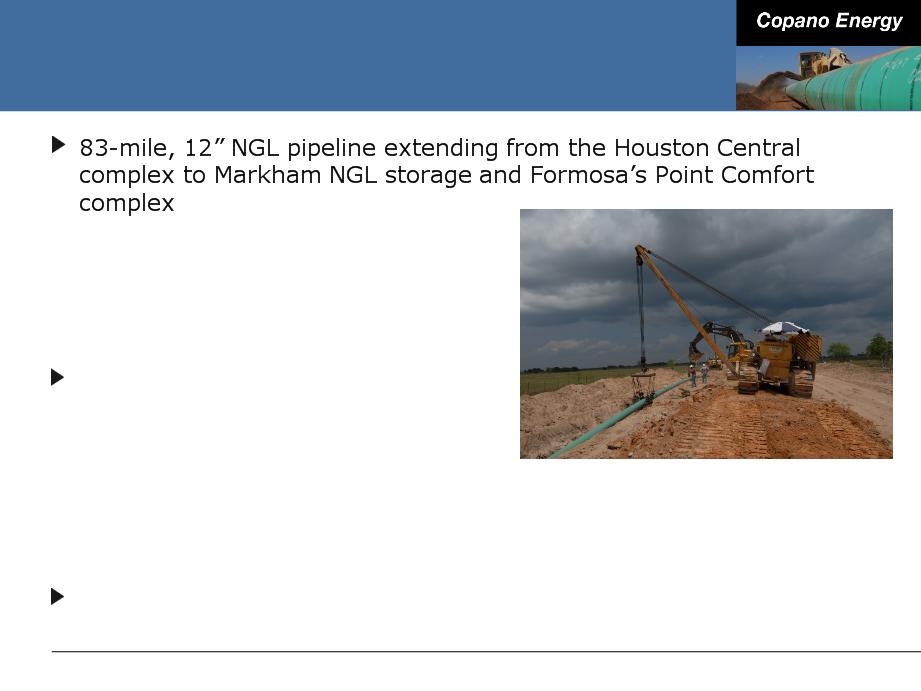

Liberty NGL Pipeline

■ Total capacity of 75,000 Bbls/d

■ Constructed through 50/50 JV

with Energy Transfer

with Energy Transfer

■ Houston Central to Clemville Storage

was placed in-service in early August

12

Long-term fractionation and product

sales agreement with Formosa on

favorable terms

sales agreement with Formosa on

favorable terms

■ Initial access to 7,000 Bbls/d

■ Upon completion of Formosa’s

fractionation expansion 1Q 2013, will

have up to 37,500 Bbls/d of firm capacity

for a 15-year term

fractionation expansion 1Q 2013, will

have up to 37,500 Bbls/d of firm capacity

for a 15-year term

Estimated capital investment of

$32.5 million

$32.5 million

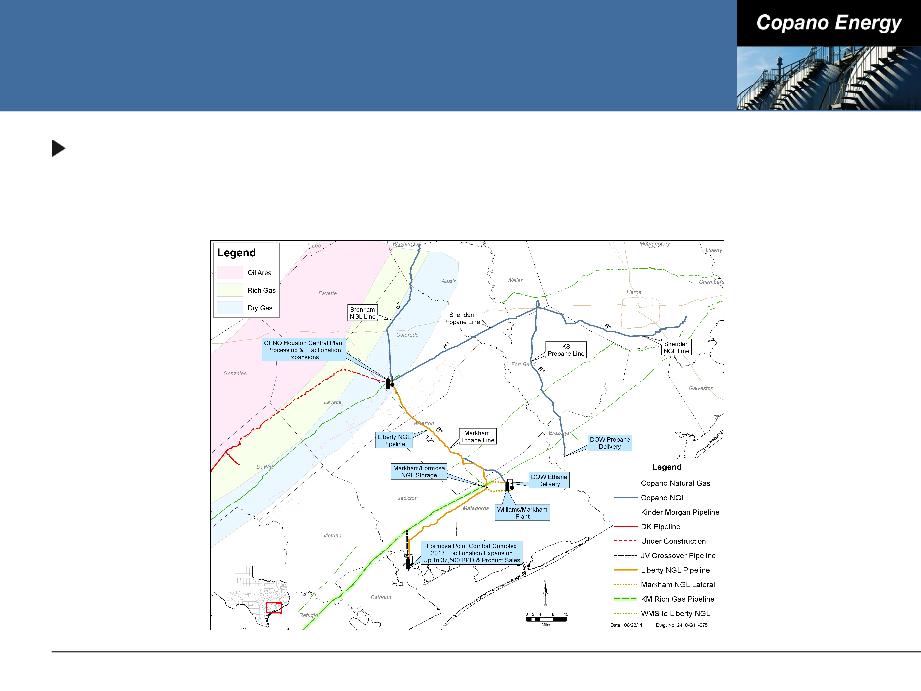

Houston Central NGL Infrastructure

13

Access to Dow and Formosa

■ Among the largest petrochemical users of NGLs in the U.S.

■ Long-term contracts with both Dow and Formosa

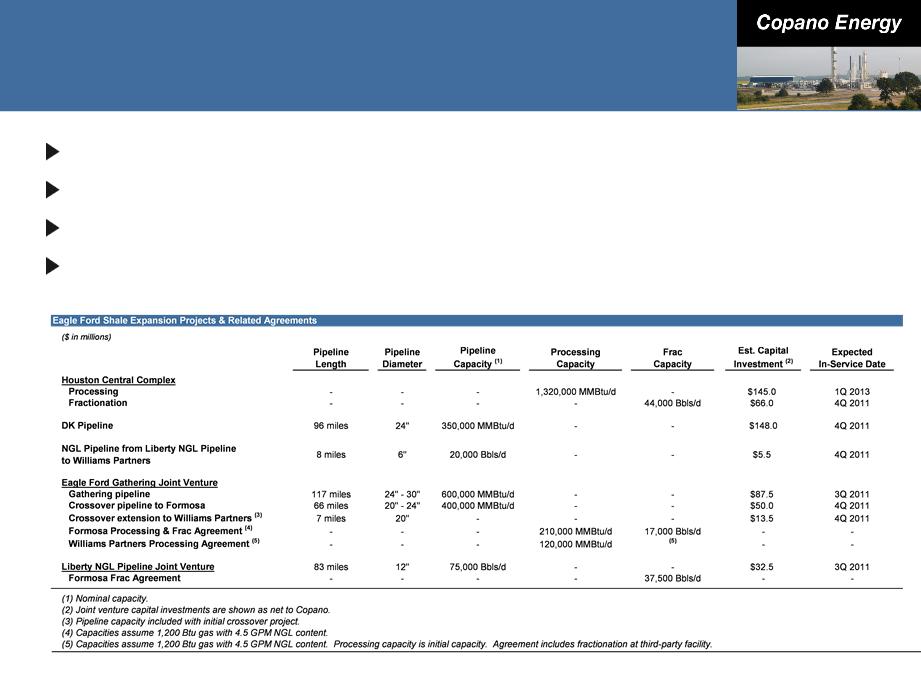

Summary of Eagle Ford Shale

Infrastructure

Infrastructure

14

Total capital investment of over $500 million

In excess of 1 Bcf/d of pipeline and processing capacity

Greater than 100,000 Bbls/d of fractionation capacity

Access to multiple markets for residue gas and NGLs

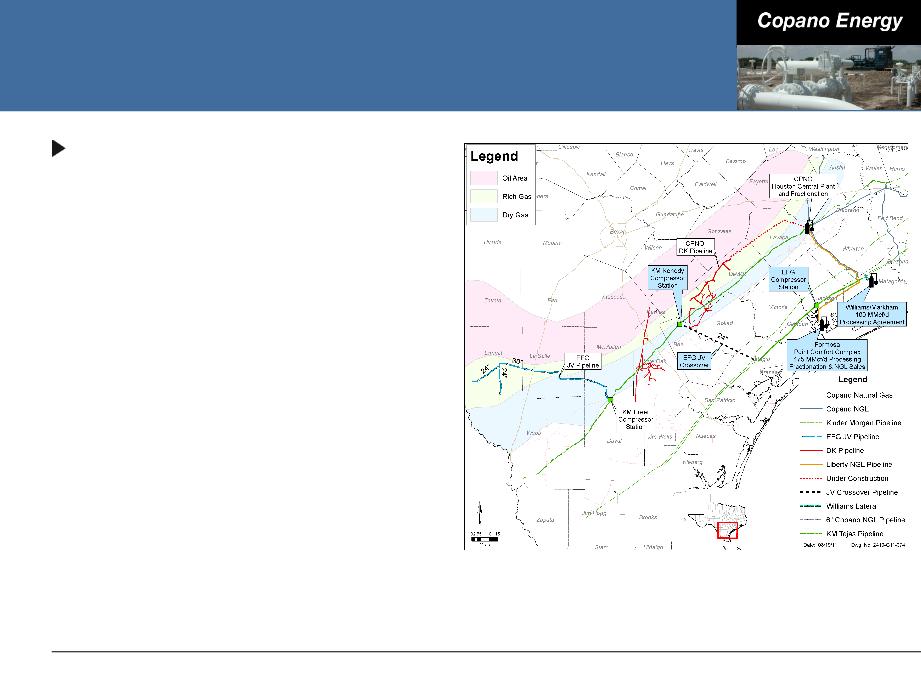

Growth Opportunities - Eagle Ford Shale

Potential extension of DK

pipeline to Fashing / Live Oak

system

pipeline to Fashing / Live Oak

system

■ Continues loop of Kinder Morgan’s

Index 50 pipeline through the

Eagle Ford Shale condensate

window

Index 50 pipeline through the

Eagle Ford Shale condensate

window

● 34 miles of 24” pipe

● Allows for gathering of

approximately 50,000 MMBtu/d

from additional Eagle Ford

Shale acreage

approximately 50,000 MMBtu/d

from additional Eagle Ford

Shale acreage

■ Ties additional existing Copano

gathering systems directly to

Houston Central complex

gathering systems directly to

Houston Central complex

■ Potential connectivity to the EFG

crossover line for DK pipeline and

Fashing / Live Oak volumes

crossover line for DK pipeline and

Fashing / Live Oak volumes

15

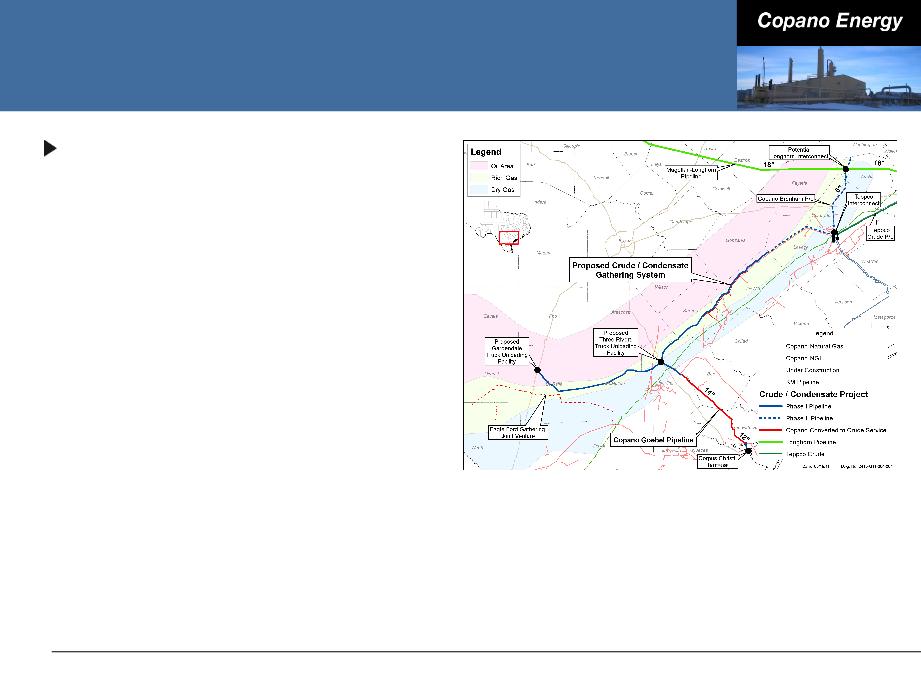

Growth Opportunities - Eagle Ford Shale

Crude oil / condensate initiative

■ 100,000 Bbls/d capacity pipeline

■ Fee-based revenue

■ Working to complete definitive JV

agreements and secure anchor

shipper by 3Q 2011

agreements and secure anchor

shipper by 3Q 2011

■ Convert existing 14” Copano

Goebel line to crude service

Goebel line to crude service

■ Tie into markets, storage and

loading docks in Corpus Christi

loading docks in Corpus Christi

■ Utilize dual-line rights of way in the

DK corridor to lay crude gathering

system

DK corridor to lay crude gathering

system

■ Proposed pipeline from Three

Rivers to Corpus Christi would

begin service in mid-2012;

remaining assets would begin 4Q

2012

Rivers to Corpus Christi would

begin service in mid-2012;

remaining assets would begin 4Q

2012

16

Business Segment Outlook

17

|

Eagle Ford Shale

Growth Projects |

Business Segment

Outlook |

|

Financing and

Commodity Price Sensitivity |

Conclusions

|

Texas Recent Developments

Saint Jo system - North Barnett Shale Combo

■ Gathering, treating and processing

■ Plant fully committed under long-term, fee-based contracts

■ System volumes have been averaging 110,000 MMBtu/d

Eagle Ford Shale

■ Copano’s total Eagle Ford Shale volumes have been averaging approximately

140,000 MMBtu/d

140,000 MMBtu/d

■ EFG 30” pipeline currently accepting interruptible gas (until Freer liquids

handling facility is operational in October)

handling facility is operational in October)

Lake Charles plant

■ Executed agreements for both natural gas receipt logistics and fractionation

and product sales

and product sales

● Equipment has been procured with expected in-service date in mid-October

■ Minimal capital investment of approximately $5 million

18

Texas Outlook

Saint Jo system

■ Copano’s largest producer has 11 rigs running in the area and expects to run 11

- 12 rigs for the remainder of the year

- 12 rigs for the remainder of the year

● On track to connect approximately 150 wells in 2011

■ Leasing activity continues

■ Evaluating opportunity to expand Saint Jo plant by 50,000 Mcf/d - 100,000

Mcf/d

Mcf/d

Eagle Ford Shale

■ Over 180 rigs currently running in the Eagle Ford Shale

■ As growth projects are completed, expect to see substantial volume increases

on both wholly owned and joint venture assets in the second half of 2011 and

beyond

on both wholly owned and joint venture assets in the second half of 2011 and

beyond

Assuming current prices continue and based on current outlook on

volumes, expect slightly higher segment gross margin in 3Q 2011

compared to 2Q 2011

volumes, expect slightly higher segment gross margin in 3Q 2011

compared to 2Q 2011

19

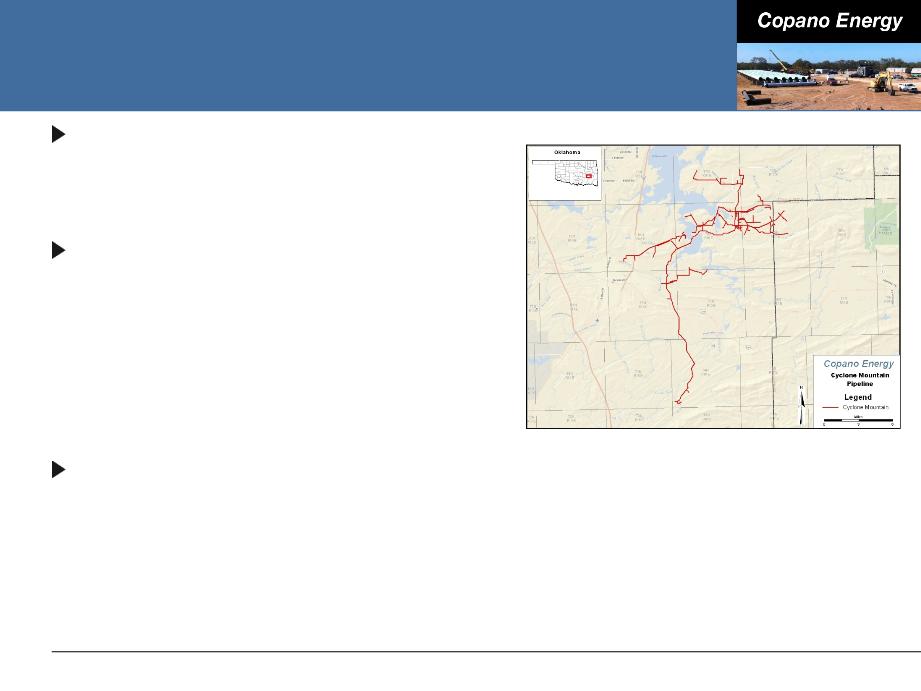

Oklahoma Recent Developments

Acquisition of Harrah plant from

Enogex (April 2011)

Enogex (April 2011)

■ Contributed $1.5 million in gross margin

in 2Q 2011

in 2Q 2011

Strong drilling activity in the

Woodford Shale around the Cyclone

Mountain system

Woodford Shale around the Cyclone

Mountain system

■ 2Q 2011 volumes increased an average

of 4,500 Mcf/d compared to 1Q 2011

of 4,500 Mcf/d compared to 1Q 2011

■ Two additional wells connected in late

July 2011 with combined rate of 14,000

Mcf/d

July 2011 with combined rate of 14,000

Mcf/d

Constructing Featherston treating

and compression station to handle

additional volumes

and compression station to handle

additional volumes

■ Capacity of 30,000 Mcf/d

■ Expect October 2011 in-service date

■ Further expansion in 2012 anticipated

20

Oklahoma Outlook

Rich gas (primarily Hunton dewatering and Mississippi Lime)

■ Drilling activity has increased in 3Q 2011 compared to 2Q 2011

■ 3 rigs running in the Hunton, 4 rigs in the Mississippi Lime and 13 rigs in other

rich gas areas

rich gas areas

■ Attractive processing upgrade and low geologic risk

Lean gas (primarily Woodford Shale)

■ Drilling activity remains steady in 3Q 2011 compared to 2Q 2011

■ 3 rigs running

Based on current commodity prices and volume outlook, expect

Oklahoma gross margin to be flat in 3Q 2011 compared to 2Q 2011

Oklahoma gross margin to be flat in 3Q 2011 compared to 2Q 2011

21

Rocky Mountains Outlook

Drilling and dewatering will be driven by commodity prices and

producer economics

producer economics

3Q 2011 volumes for Bighorn expected to be slightly lower vs. 2Q

2011

2011

3Q 2011 volumes for Fort Union expected to be higher vs. 2Q 2011

due to the Bison pipeline rupture

due to the Bison pipeline rupture

Second half 2011 Adjusted EBITDA expected to be slightly lower vs.

first half 2011

first half 2011

Recently approved project to connect 145 wells that have been

drilled, but not yet dewatered on the Bighorn system

drilled, but not yet dewatered on the Bighorn system

■ Volumes to flow once dewatering process is complete (12 - 18 months)

22

Financing and Commodity Price

Sensitivity

Sensitivity

23

|

Eagle Ford Shale

Growth Projects |

Business Segment

Outlook |

|

Financing and

Commodity Price Sensitivity |

Conclusions

|

Liquidity and Capitalization

At June 30, 2011:

■ $62 million cash

■ $700 million revolving credit facility

● Closed in June 2011 - added flexibility to existing financial covenants

● Approximately $360 million available

● Matures June 2016

■ $609.5 million senior notes

● $360.0 million 7.125% senior notes due 2021

● $249.5 million 7.75% senior notes due 2018

24

Shifting Contract Mix

Continued shift towards a more fee-based contract mix

■ Eagle Ford Shale, North Barnett Shale Combo and Woodford Shale volume

growth are key drivers

growth are key drivers

25

|

Contract Mix as a % of Gross Margin

|

||||||

|

|

1Q 2010

|

2Q 2010

|

3Q 2010

|

4Q 2010

|

1Q 2011

|

2Q 2011

|

|

Fee-based

|

27%

|

33%

|

37%

|

38%

|

41%

|

41%

|

|

Percentage-of-

proceeds |

39%

|

31%

|

30%

|

32%

|

32%

|

33%

|

|

Keep-

whole/Other |

36%

|

33%

|

29%

|

34%

|

39%

|

40%

|

|

Net hedging

|

-2%

|

3%

|

4%

|

-4%

|

-12%

|

-14%

|

Note: Includes Copano’s share of gross margin from unconsolidated affiliates. Approximate percentages based on Copano internal financial planning models.

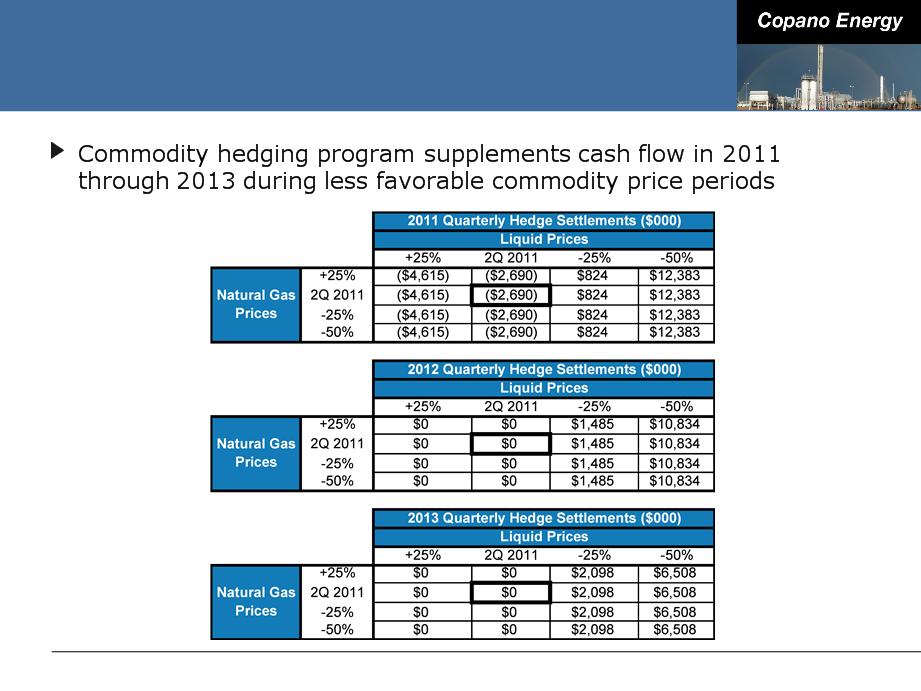

Hedging Strategy

Continued focus on option-based, product-specific hedging strategy

■ Reliance on hedging will decrease as contract mix changes over time

2011 well hedged

■ Between 70% and 90% of ethane, propane, butane, natural gasoline and

condensate exposure is hedged

condensate exposure is hedged

2012 hedged near policy limits for all products except ethane

■ 80% of propane, butane, natural gasoline and condensate exposure hedged

■ 20% of ethane exposure hedged

2013 hedging positions continue to be added

■ Between 40% and 60% of butane, natural gasoline and condensate exposure

hedged

hedged

■ 40% of propane exposure hedged

■ No ethane hedges for 2013

26

Conclusions

27

|

Eagle Ford Shale

Growth Projects |

Business Segment

Outlook |

|

Financing and

Commodity Price Sensitivity |

Conclusions

|

Copano’s Key Strengths

Founded in 1992 as an independent midstream company

Experienced operator in liquids-rich natural gas plays

Six executive management members with 166 combined years of industry experience

28

Experienced

Operator /

Operator /

Seasoned Team

Strong Balance

Sheet with

Access to

Liquidity

Sheet with

Access to

Liquidity

Strategic and

Diverse Asset

Base

Diverse Asset

Base

Significant

Organic Growth

Organic Growth

Significant position in Eagle Ford Shale and North Barnett Shale Combo

One of the largest gatherers of associated gas in Eastern Oklahoma

Large gatherer of Powder River Basin gas with access to Niobrara and Frontier gas

Upon completion of processing expansion, Houston Central complex will be largest plant

in Texas

in Texas

Approximately $440 million in 2011 growth projects (1) - majority in Eagle Ford Shale

Investments in announced growth projects target 5x multiple

Opportunities beyond traditional gathering and processing

New $700 million revolver in place

$300 million TPG Capital preferred equity

Cash flow growth expected from projects due to be completed this year

Long-term

Contracts and

Improving

Contract Mix

Contracts and

Improving

Contract Mix

DK pipeline, Eagle Ford Gathering JV and Saint Jo system approximately 80%

contracted on a combined basis

contracted on a combined basis

Average contract length for Eagle Ford Shale and North Texas Barnett Combo

approaching 9 years

approaching 9 years

Contract mix expected to be two-thirds fee-based by end of 2012

(1) Includes Copano’s net share for unconsolidated affiliates.

Appendix

29

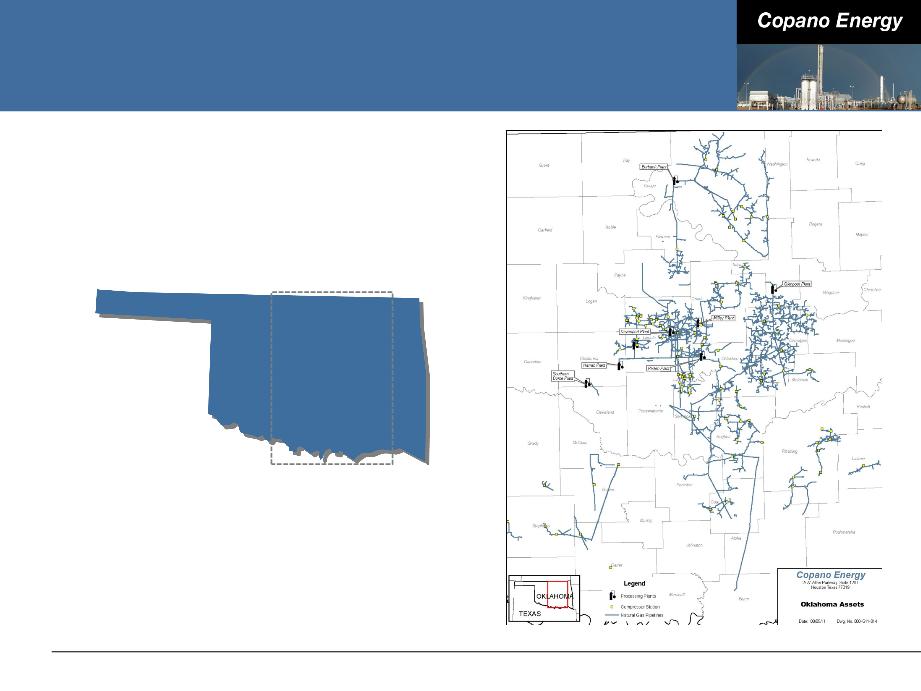

Oklahoma Assets

30

OKLAHOMA

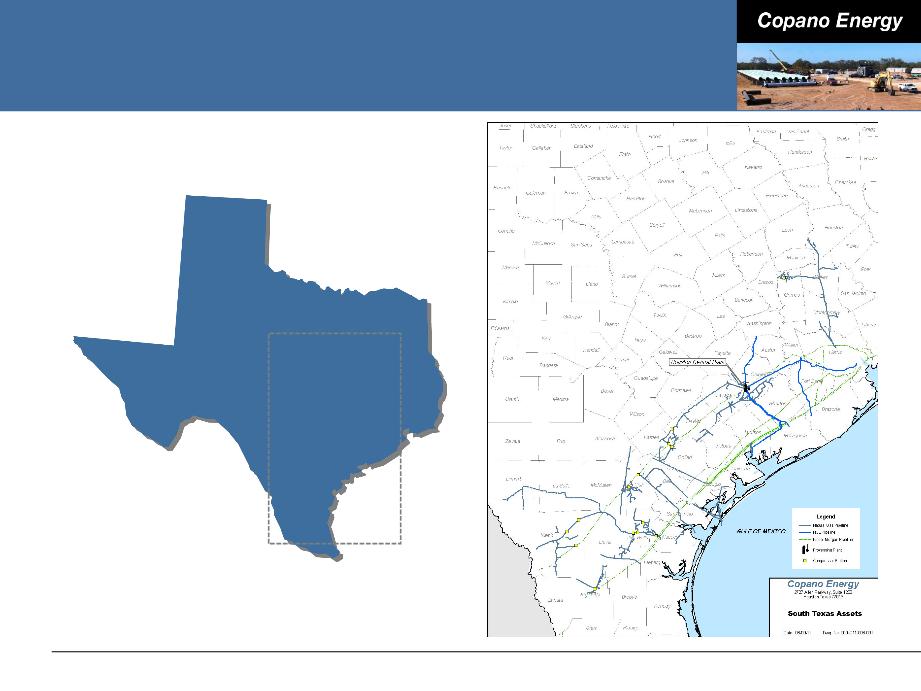

South Texas Assets

31

TEXAS

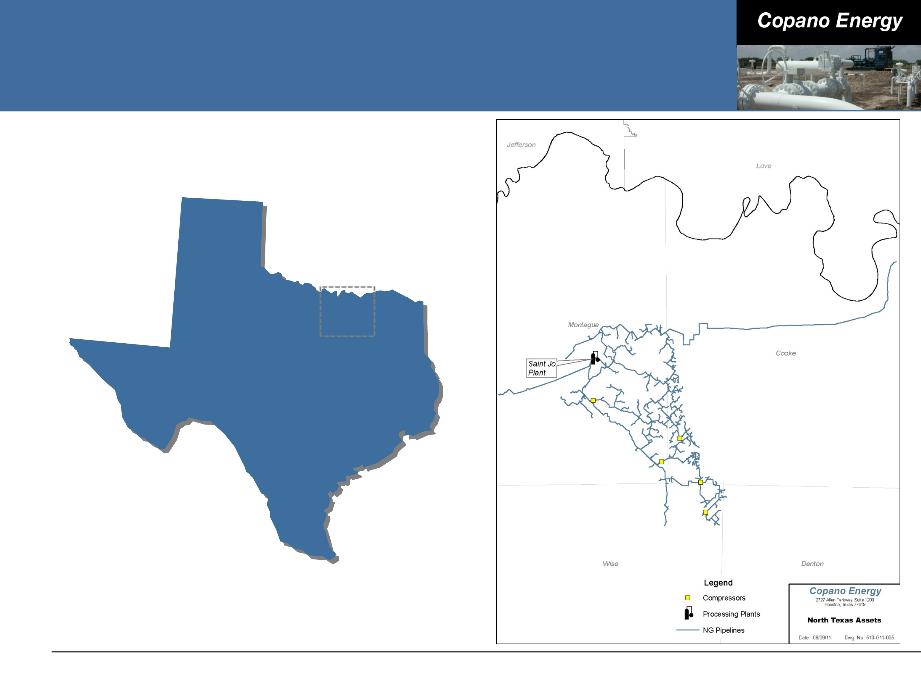

North Texas Assets

32

TEXAS

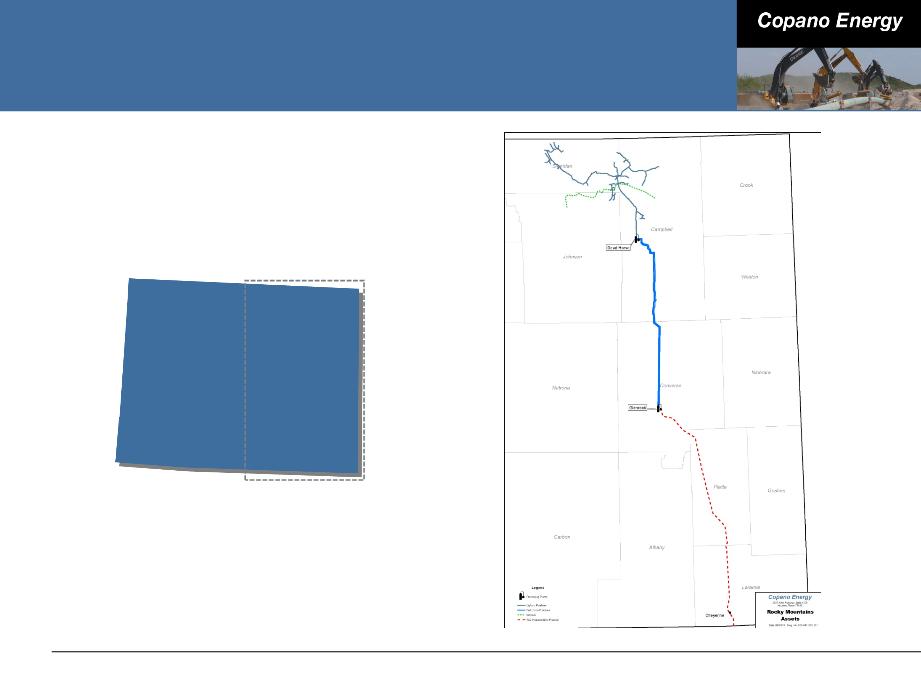

Rocky Mountains Assets

33

WYOMING

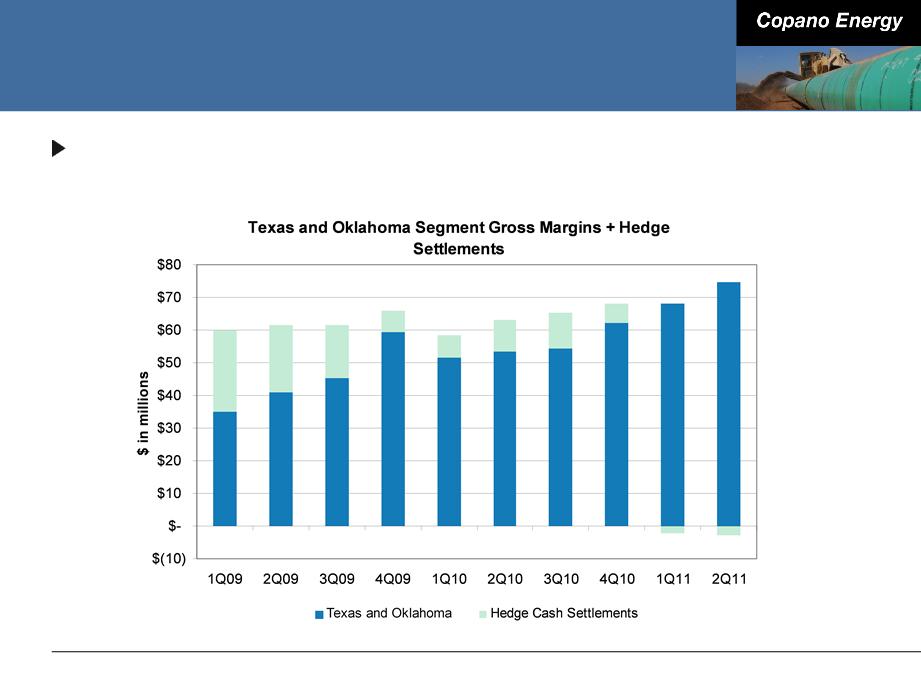

Solid Core Business Growth

34

From 1Q 2009 to 2Q 2011, Texas and Oklahoma operating

segment gross margins has increased approximately 114%

segment gross margins has increased approximately 114%

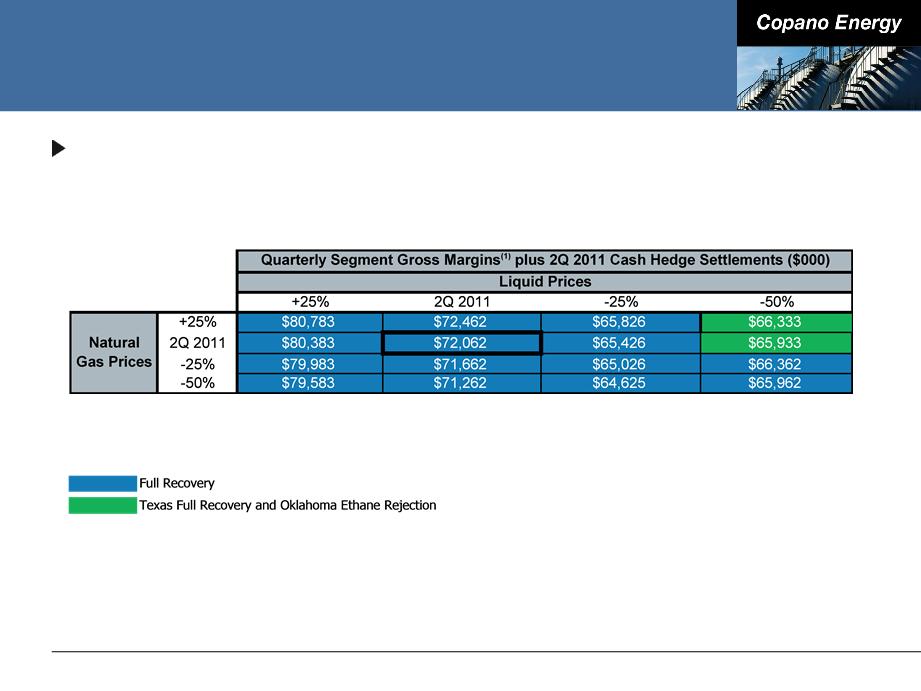

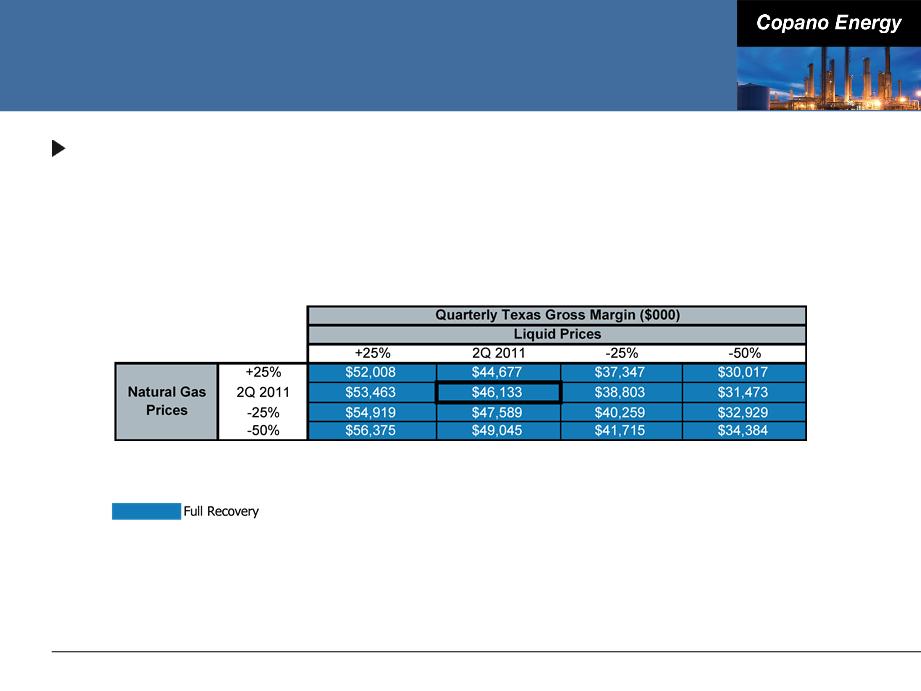

Commodity-Related Margin Sensitivities

Matrix reflects 2Q 2011 wellhead and plant inlet volumes, adjusted

using Copano’s 2011 planning model

using Copano’s 2011 planning model

35

(1) Consists of Texas and Oklahoma Segment gross margins.

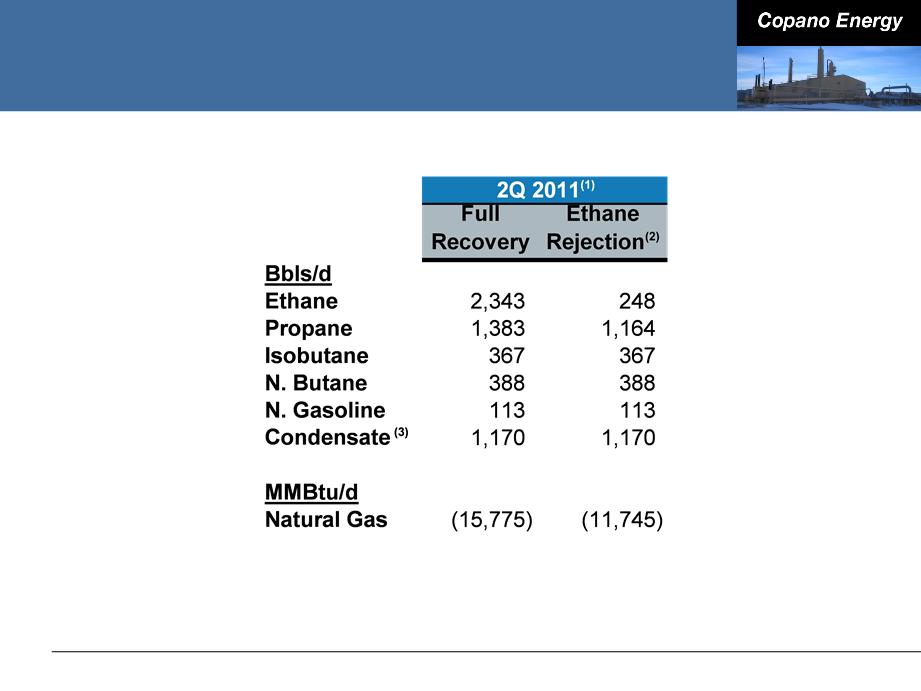

Oklahoma Net Commodity Exposure

36

Note: See explanation of processing modes in this Appendix. Values reflect rounding.

(1) Source: Copano Energy internal financial planning models.

(2) Ethane rejection at Paden plant is limited by nitrogen rejection facilities.

(3) Reflects impact of producer delivery point allocations, offset by field condensate collection and stabilization.

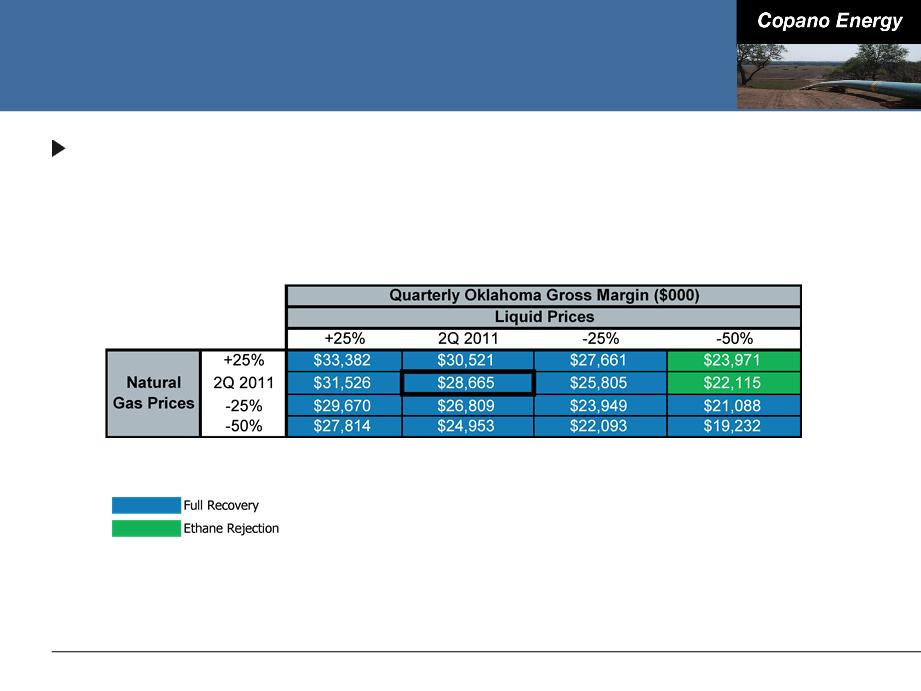

Oklahoma Commodity Price Sensitivities

Oklahoma segment gross margins excluding hedge settlements

■ Matrix reflects 2Q 2011 volumes, adjusted using Copano’s 2011 planning

model

model

37

Note: Please see this Appendix for definitions of processing modes and additional details.

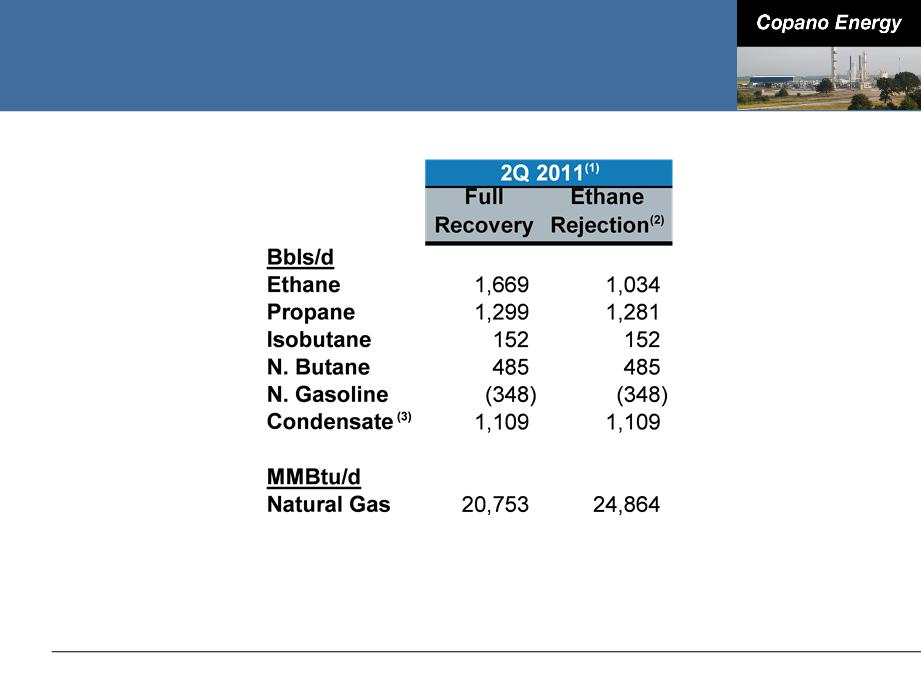

Texas Net Commodity Exposure

38

Note: See explanation of processing modes in this Appendix.

(1) Source: Copano Energy internal financial planning models. Based on 1Q 2011 daily wellhead/plant inlet volumes.

(2) Fractionation at Houston Central complex permits significant reductions in ethane recoveries in ethane rejection mode. To optimize profitability, plant

operations can also be adjusted to partial recovery mode.

operations can also be adjusted to partial recovery mode.

(3) At the Houston Central complex, pentanes+ may be sold as condensate.

Texas Commodity Price Sensitivities

Texas segment gross margins excluding hedge settlements

■ Matrix reflects 2Q 2011 volumes and operating conditions, adjusted using

Copano’s 2011 planning model

Copano’s 2011 planning model

39

Note: Please see this Appendix for definitions of processing modes and additional details.

Rocky Mountains Sensitivities

2Q 2011 Adjusted EBITDA volume sensitivity (positive or negative

impact)

impact)

■ Bighorn: 10,000 MMBtu/d = $245,000(1)

■ Fort Union: 10,000 MMBtu/d = immaterial impact until physical volumes

exceed long-term contractual volume commitments

exceed long-term contractual volume commitments

● 2Q 2011 pipeline throughput: 391,626 MMBtu/d

● 2Q 2011 revenue based on 719,520 MMBtu/d of volume commitments

40

Note: See this Appendix for reconciliation of Adjusted EBITDA. Values reflect rounding.

(1) Impact on Adjusted EBITDA based on Copano’s interest in the unconsolidated affiliate.

Hedging Impact of Commodity Price

Sensitivities

Sensitivities

41

Processing Modes

42

|

Full Recovery

|

|

|

|

Texas and Oklahoma - If the value of

recovered NGLs exceeds the fuel and gas shrinkage costs of recovering NGLs |

|

Ethane Rejection

|

|

|

|

Texas and Oklahoma - If the value of ethane

is less than the fuel and shrinkage costs to recover ethane (in Oklahoma, ethane rejection at Paden plant is limited by nitrogen rejection facilities) |

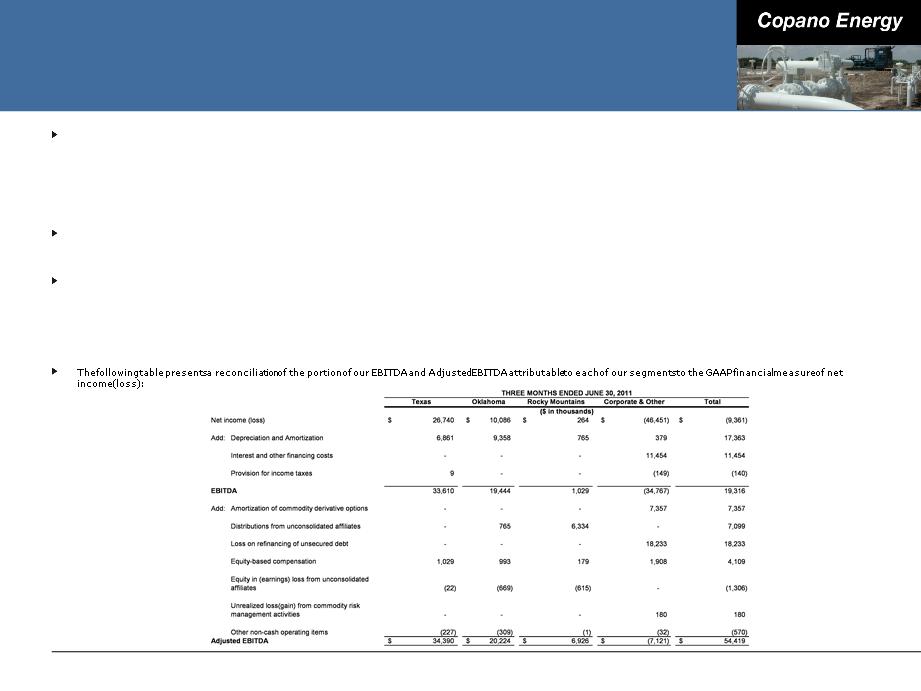

Reconciliation of Non-GAAP Financial

Measures

Measures

Adjusted EBITDA

Commencing with the second quarter of 2011, we revised our calculation of adjusted EBITDA to more closely resemble that of many of our peers in terms of measuring our

ability to generate cash. Our adjusted EBITDA (as revised) equals:

ability to generate cash. Our adjusted EBITDA (as revised) equals:

■ net income (loss);

■ plus interest and other financing costs, provision for income taxes, depreciation, amortization and impairment expense, non-cash amortization expense associated with

our commodity derivative instruments, distributions from unconsolidated affiliates, loss on refinancing of unsecured debt and equity-based compensation expense;

our commodity derivative instruments, distributions from unconsolidated affiliates, loss on refinancing of unsecured debt and equity-based compensation expense;

■ minus equity in earnings (loss) from unconsolidated affiliates and unrealized gains (losses) from commodity risk management activities; and

■ plus or minus other miscellaneous non-cash amounts affecting net income (loss) for the period.

In calculating adjusted EBITDA as revised, we no longer add to EBITDA (earnings before interest taxes depreciation and amortization our share of the depreciation,

amortization and impairment expense and interest and other financing costs embedded in our equity in earnings (loss) from unconsolidated affiliates; instead we now add to

EBITDA (i) our impairment expense, and other non-cash amounts affecting net income (loss) for the period, (ii) non-cash amortization expense associated with our

commodity derivative instruments, (iii) loss on refinancing of unsecured debt and (iv) distributions from unconsolidated affiliates.

amortization and impairment expense and interest and other financing costs embedded in our equity in earnings (loss) from unconsolidated affiliates; instead we now add to

EBITDA (i) our impairment expense, and other non-cash amounts affecting net income (loss) for the period, (ii) non-cash amortization expense associated with our

commodity derivative instruments, (iii) loss on refinancing of unsecured debt and (iv) distributions from unconsolidated affiliates.

We believe that our revised calculation of adjusted EBITDA is a more effective tool for our management in evaluating our operating performance for several reasons. Although

our historical method for calculating adjusted EBITDA was useful in assessing the performance of our assets (including our unconsolidated affiliates) without regard to

financing methods, capital structure or historical cost basis, the prior calculation was not as useful in evaluating the core performance of our assets and their ability to

generate cash because adjustments for a number of non-cash expenses and other non-cash and non-operating items were not reflected in the calculation and the impact of

cash distributions from our unconsolidated affiliates was likewise not reflected. We believe that the revised calculation of adjusted EBITDA is more consistent with the method

and presentation used by many of our peers and will allow management and analysts to better evaluate our performance relative to our peer companies. Also, we believe

that the revised calculation more effectively represents what lenders and debt holders, as well as industry analysts and many of our unitholders, have indicated is useful in

assessing our core performance and outlook and comparing us to other companies in our industry.

our historical method for calculating adjusted EBITDA was useful in assessing the performance of our assets (including our unconsolidated affiliates) without regard to

financing methods, capital structure or historical cost basis, the prior calculation was not as useful in evaluating the core performance of our assets and their ability to

generate cash because adjustments for a number of non-cash expenses and other non-cash and non-operating items were not reflected in the calculation and the impact of

cash distributions from our unconsolidated affiliates was likewise not reflected. We believe that the revised calculation of adjusted EBITDA is more consistent with the method

and presentation used by many of our peers and will allow management and analysts to better evaluate our performance relative to our peer companies. Also, we believe

that the revised calculation more effectively represents what lenders and debt holders, as well as industry analysts and many of our unitholders, have indicated is useful in

assessing our core performance and outlook and comparing us to other companies in our industry.

43