Attached files

| file | filename |

|---|---|

| 8-K - BENIHANA INC 8-K 8-22-2011 - BENIHANA INC | form8k.htm |

Exhibit 99.1

Discussion Materials

August 2011

Filed by Benihana Inc.

Pursuant to Rule 425 under the Securities Act of

1933 and deemed filed pursuant to Rule 14a-6 of

the Securities Exchange Act of 1934

1933 and deemed filed pursuant to Rule 14a-6 of

the Securities Exchange Act of 1934

Subject Company: Benihana Inc.

Registration Statement File No.: 333-174815

[1]

Notice

These discussion materials are based on publicly available information. Neither the Company nor its advisors has

assumed any responsibility for independently verifying the information herein or makes any representation or warranty

as to the accuracy or completeness of the information herein.

assumed any responsibility for independently verifying the information herein or makes any representation or warranty

as to the accuracy or completeness of the information herein.

[2]

Benihana Safe Harbor Statement

Except for the historical matters contained herein, statements in this document are forward-looking and are made

pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that

forward-looking statements involve risks and uncertainties that may affect the business and prospects of Benihana,

including, without limitation: risks related to Benihana's business strategy, including the Renewal Program and marketing

programs; risks related to Benihana's ability to operate successfully in the current challenging economic environment; risks

related to Benihana's efforts to strengthen its Benihana Teppanyaki concept and build its RA Sushi and Haru brands; and

other risks and uncertainties that may cause results to differ materially from those set forth in the forward-looking

statements. Past performance may not be indicative of future results. Although Benihana believes the expectations

reflected in such forward-looking statements are based upon reasonable assumptions, there can be no assurance that its

expectations will be realized. In addition to the risks and uncertainties set forth above, investors should consider the risks

and uncertainties discussed in Benihana's filings with the Securities and Exchange Commission, including, without

limitation, the risks and uncertainties discussed under the heading "Risk Factors" in such filings. Benihana does not

undertake any obligation to publicly update any forward-looking statement to reflect events or circumstances after the

date on which any such statement is made or to reflect the occurrence of unanticipated events.

pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that

forward-looking statements involve risks and uncertainties that may affect the business and prospects of Benihana,

including, without limitation: risks related to Benihana's business strategy, including the Renewal Program and marketing

programs; risks related to Benihana's ability to operate successfully in the current challenging economic environment; risks

related to Benihana's efforts to strengthen its Benihana Teppanyaki concept and build its RA Sushi and Haru brands; and

other risks and uncertainties that may cause results to differ materially from those set forth in the forward-looking

statements. Past performance may not be indicative of future results. Although Benihana believes the expectations

reflected in such forward-looking statements are based upon reasonable assumptions, there can be no assurance that its

expectations will be realized. In addition to the risks and uncertainties set forth above, investors should consider the risks

and uncertainties discussed in Benihana's filings with the Securities and Exchange Commission, including, without

limitation, the risks and uncertainties discussed under the heading "Risk Factors" in such filings. Benihana does not

undertake any obligation to publicly update any forward-looking statement to reflect events or circumstances after the

date on which any such statement is made or to reflect the occurrence of unanticipated events.

Benihana Additional Information

On June 9, 2011, Benihana filed with the Securities and Exchange Commission a Registration Statement on Form S-4,

which has since been declared effective by the Securities and Exchange Commission. The Registration Statement on Form

S-4 contains a proxy statement/prospectus which describes the proposed reclassification. Stockholders of Benihana are

advised to read the proxy statement/prospectus, because it contains important information. Such proxy

statement/prospectus and other relevant documents may be obtained, free of charge, on the Securities and Exchange

Commission's website (http://www.sec.gov) or from Benihana at the Investor Relations section of

www.benihana.com/about or by contacting the Company by telephone at (305) 593-6770 (Attention: General Counsel).

which has since been declared effective by the Securities and Exchange Commission. The Registration Statement on Form

S-4 contains a proxy statement/prospectus which describes the proposed reclassification. Stockholders of Benihana are

advised to read the proxy statement/prospectus, because it contains important information. Such proxy

statement/prospectus and other relevant documents may be obtained, free of charge, on the Securities and Exchange

Commission's website (http://www.sec.gov) or from Benihana at the Investor Relations section of

www.benihana.com/about or by contacting the Company by telephone at (305) 593-6770 (Attention: General Counsel).

Benihana and certain persons may be deemed to be participants in the solicitation of proxies relating to the proposed

reclassification. The participants in such solicitation may include Benihana's executive officers and directors. Further

information regarding persons who may be deemed participants is available in Benihana's proxy statement/prospectus.

reclassification. The participants in such solicitation may include Benihana's executive officers and directors. Further

information regarding persons who may be deemed participants is available in Benihana's proxy statement/prospectus.

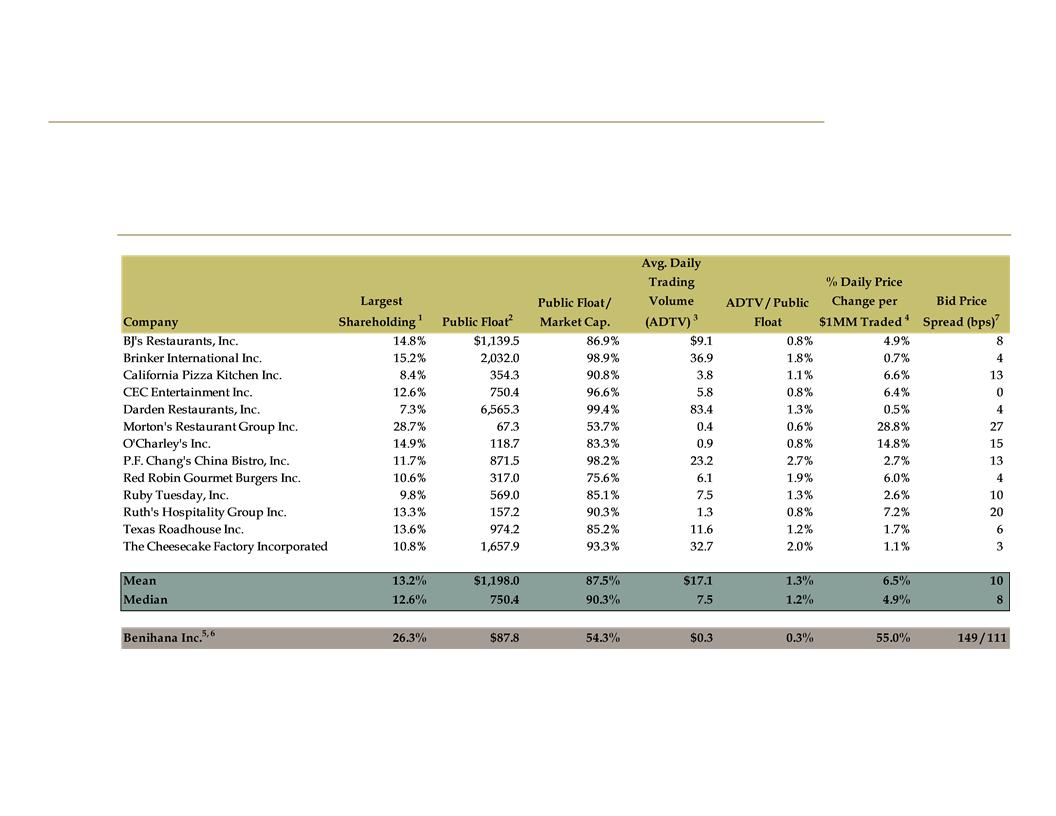

Improved Trading Liquidity:

Control and Marketability Benchmarking

Control and Marketability Benchmarking

SELECTED PUBLIC RESTAURANT COMPANY TRADING LIQUIDITY SUMMARY ($ IN MILLIONS)

Source: Capital IQ, Market data as of 5/6/11

1. Based on voting interest

2. Defined as shares outstanding less shares held by company employees, strategic corporate investors, VC/PE firms, hedge funds with a greater than 5% stake

3. Based on twelve months ended May 6, 2011; based on shares of Class A and Common Stock for Benihana

4. Calculated as the median of ((daily absolute price change / $ value of daily trading volume)*($1.0 million)); based on last twelve months

5. As of May 6, 2011, Benihana’s 2 largest shareholders together represented 45.7% of the total voting power of Benihana’s outstanding capital stock

6. Benihana’s % daily price change per $1mm traded reflects Class A only; would be 337% for Common Stock

7. Bid Price Spread (bps) calculated as Ask Price less Bid Price, divided by Bid Price, as of 5/6/11; 149bps and 111bps for Benihana Class A and Common Stock,

respectively

respectively

§ The following companies represent an indicative sample of Benihana’s competitors in the “casual dining” and “upscale casual”

segments of the restaurant industry

segments of the restaurant industry

Based on various metrics, Benihana has significantly less trading liquidity than that of its peers

[3]

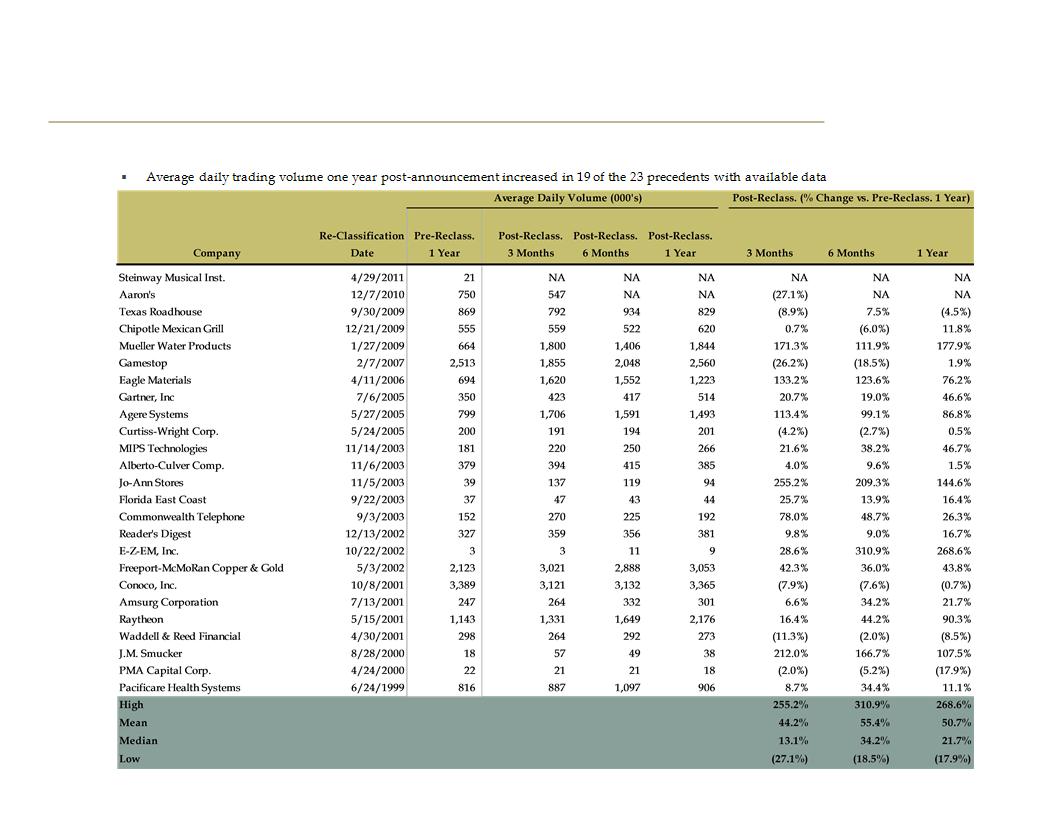

Improved Trading Liquidity:

Precedent Reclassifications Trading Liquidity

Precedent Reclassifications Trading Liquidity

Source: Capital IQ, Bloomberg, public filings

Looking at an indicative sample of reclassification transactions1, the median and mean of the change in average daily trading

volume of these precedents post-announcement reflected a 21.7% and 50.7% increase, respectively

volume of these precedents post-announcement reflected a 21.7% and 50.7% increase, respectively

1. See Appendix

[4]

No Premium Paid to High Vote Shares (Common):

Benihana 5-Year Stock Price Variance

Benihana 5-Year Stock Price Variance

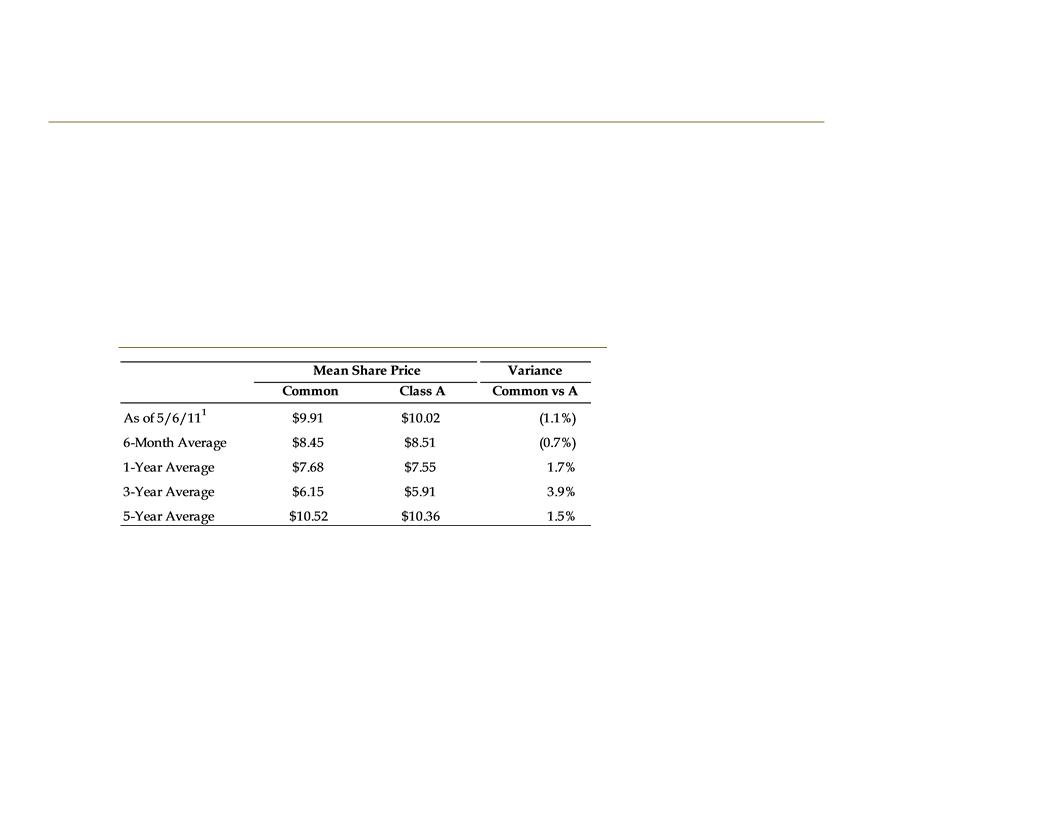

STOCK PRICE VARIANCE (COMMON STOCK VS. CLASS A)

During the six months ending May 6, 2011, Benihana Common Stock traded at a slight discount to Benihana Class A

§ Historically, the Common Stock has traded at a slight premium to the Class A (1-year, 3-year, and 5-year average

variances of 1.7%, 3.9% and 1.5%, respectively)

variances of 1.7%, 3.9% and 1.5%, respectively)

§ Most recently, as the Company’s share value has increased, the Common Stock (high vote) premium has been

modestly eclipsed by the value of the Class A (low vote) trading liquidity

modestly eclipsed by the value of the Class A (low vote) trading liquidity

Source: Capital IQ

Note: Market data as of 5/6/2011 - Reflects date around the time of the announcement of the termination of the possible sale process and proposed elimination of dual-

class common stock structure and termination of shareholder rights plan

class common stock structure and termination of shareholder rights plan

1. Since the announcement of the termination of the possible sale process and proposed elimination of dual-class common stock structure and termination of

shareholder rights plan on May 13, 2011, Common Stock has traded at a discount of (0.4%) to Class A

shareholder rights plan on May 13, 2011, Common Stock has traded at a discount of (0.4%) to Class A

[5]

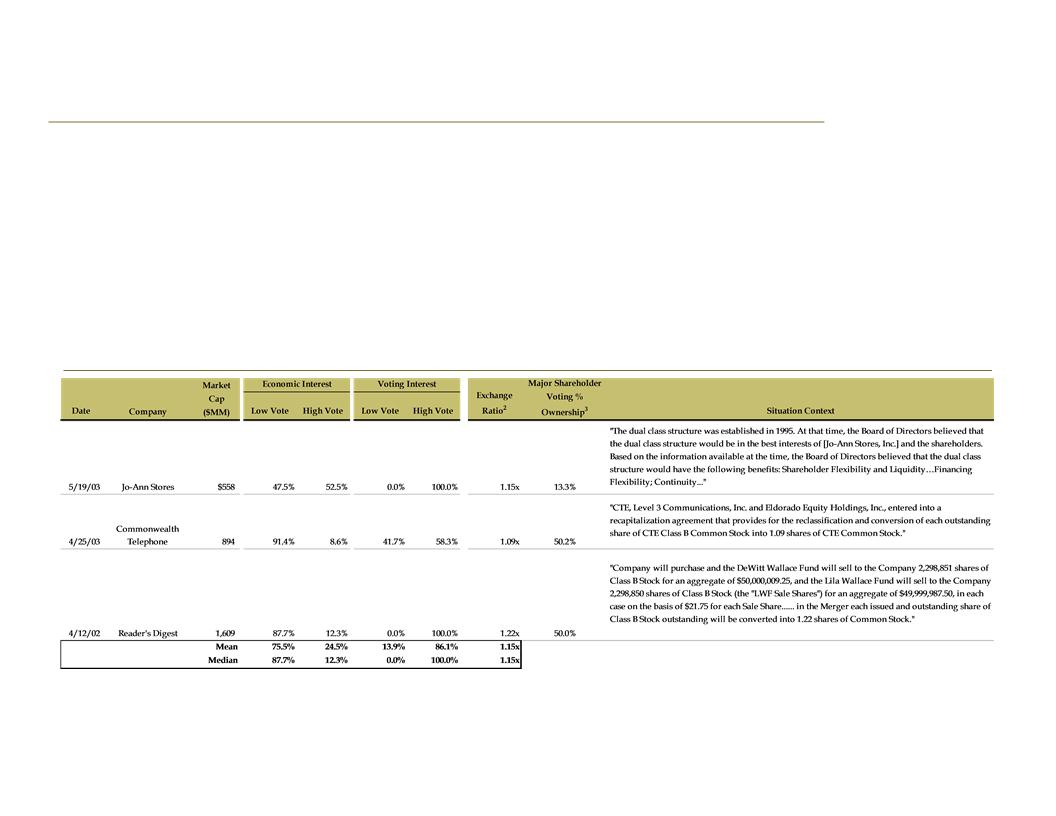

No Premium Paid to High Vote Shares:

Precedent Reclassifications Premium/Ownership Dynamics

Precedent Reclassifications Premium/Ownership Dynamics

Source: Capital IQ, public filings

1. See Appendix

2. Represents the exchange ratio used for conversion

3. Represents major shareholders % ownership of the high vote class

4. 3 members of the two founding families represent approximately 28% of high vote ownership, including the 13.3% owned by highest shareholder

Of the indicative sample of 25 reclassification transactions1, 22 companies paid no premiums to their high vote

shareholders

shareholders

§ Of the 22 precedents where there was no premium paid, there are several situations where the largest high vote shareholder

maintained below a 50% voting interest

maintained below a 50% voting interest

§ In two of the three precedents where there was a premium paid (Commonwealth Telephone, Reader’s Digest), there was the

existence of a large, 50% holder of the high vote shares

existence of a large, 50% holder of the high vote shares

§ In two of the three precedents where there was a premium paid (Commonwealth Telephone, Jo-Ann Stores), there was a share

price premium in the high vote shares to the low vote shares at the time of announcement

price premium in the high vote shares to the low vote shares at the time of announcement

− Commonwealth Telephone’s and Jo-Ann Stores’ high vote shares were trading at ~7% and ~14% premiums, respectively, to

low vote shares at the time of announcement

low vote shares at the time of announcement

RECLASSIFICATIONS - PREMIUMS PAID 1

[6]

4

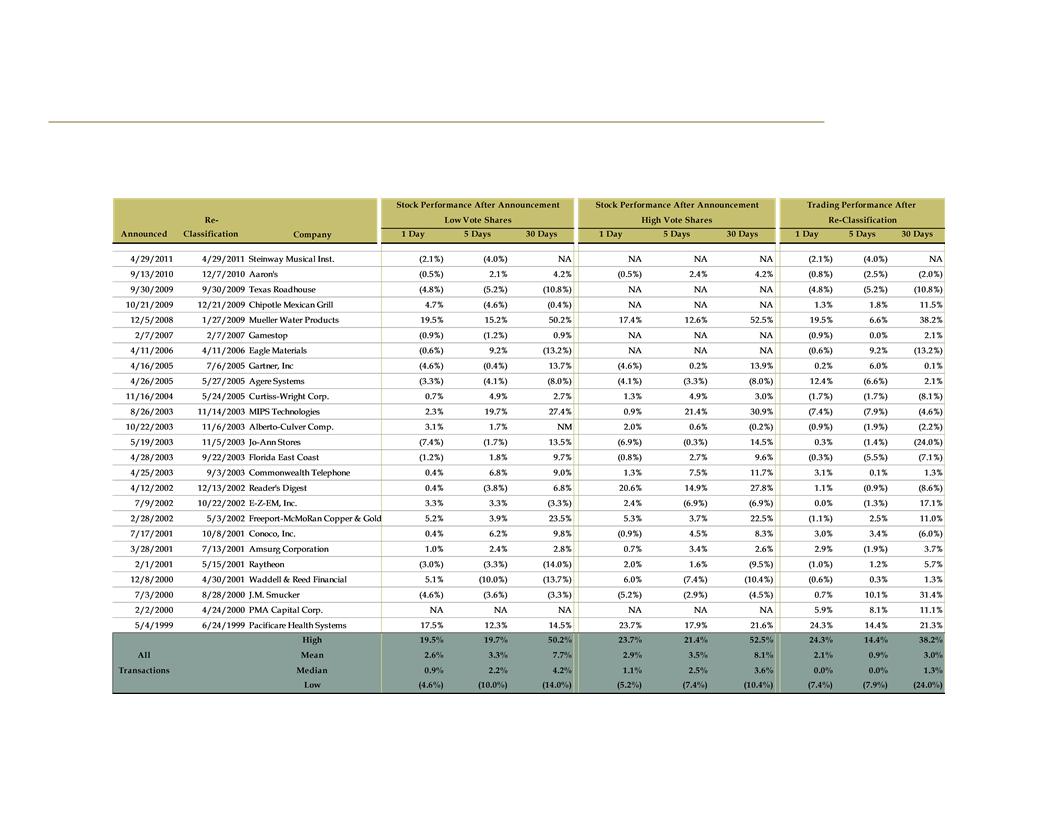

Share Price Improvement:

Precedent Reclassifications Share Price Change

Precedent Reclassifications Share Price Change

Note: Stock performance for high votes is NM in some cases due to the fact that announcement date and reclassification date is the same

1. See Appendix

2. Stock performance after announcement excludes deals without both Low and High Vote Pre-Reclassification data (Steinway Musical, Texas Roadhouse, Chipotle

Mexican Grill, Gamestop, Eagle Materials, and PMA Capital Corp) and deals where the exchange ratio between the dual classes was not 1:1 (Jo-Ann Stores,

Commonwealth Telephone, and Reader’s Digest)

Mexican Grill, Gamestop, Eagle Materials, and PMA Capital Corp) and deals where the exchange ratio between the dual classes was not 1:1 (Jo-Ann Stores,

Commonwealth Telephone, and Reader’s Digest)

Source: CapitalIQ, public filings

2

2

2

2

Looking at a sample of indicative reclassification transactions1, the mean and median in share price of these

precedents post-announcement reflected a 3.0% and 1.7% increase, respectively

precedents post-announcement reflected a 3.0% and 1.7% increase, respectively

§ Share price thirty days post-announcement was higher in 14 of the 24 precedents with available data

[7]

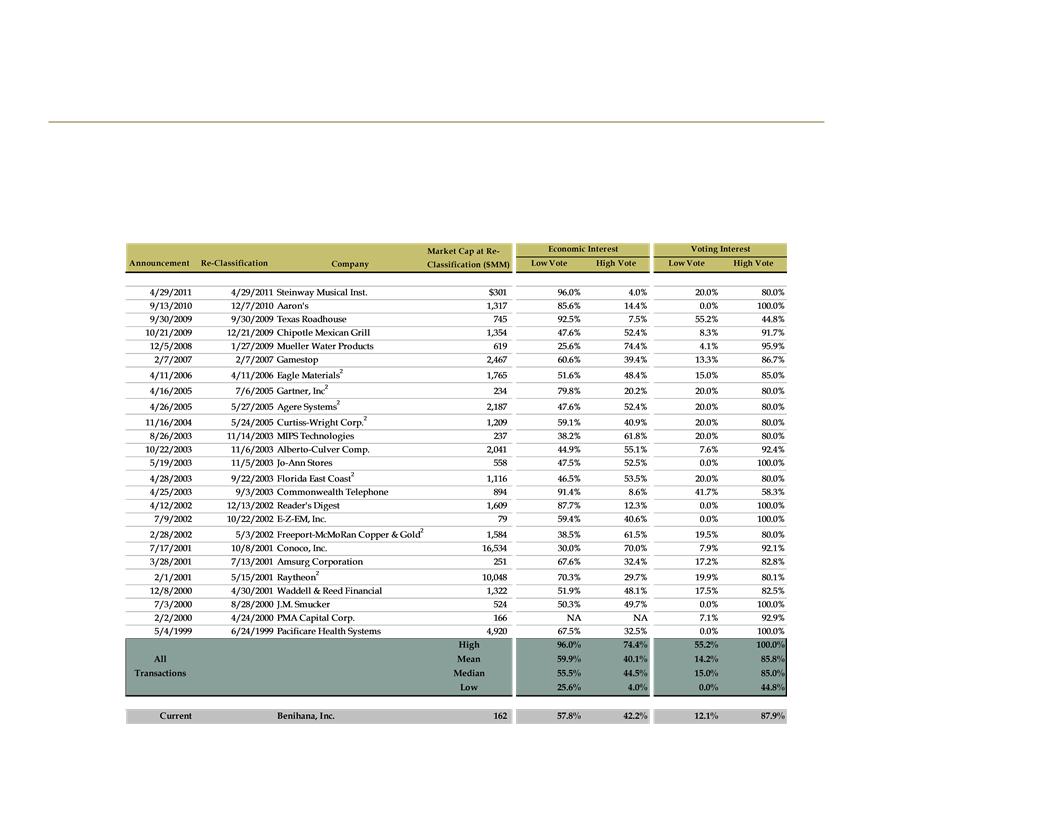

Appendix

In each “reclassification” transaction, two publicly traded classes of common stock of a single company with different voting rights

were reclassified into a single class of publicly traded common stock

were reclassified into a single class of publicly traded common stock

Historical Precedent Conversions to a Single Class Structure

§ The below list of 25 reclassification transactions was aggregated based on a general search of SEC filings and periodicals, representing

transactions for which data was readily, publicly available1

transactions for which data was readily, publicly available1

− The list is not considered to be exhaustive and examples found were not further selected in any manner, however the list is believed to

represent an indicative sample of such U.S.-based precedent transactions

represent an indicative sample of such U.S.-based precedent transactions

Source: Capital IQ, public filings

Note: Transactions represent a broad universe of companies across industries and specific situations

1. The Company reviewed the above sample of indicative reclassification transactions when proposing the elimination of the dual-class common stock structure. Subsequently, and in

conjunction with conversations with ISS regarding examples of reclassifications in which premiums were paid, in addition to the 3 of the 25 transactions where a premium was paid to high

vote shareholders detailed on page 6 of this document, the Company became aware of five other similar transactions (Continental Airlines, Dairy Mart Convenience Stores, Kaman

Corporation, Robert Mondavi and Sotheby’s Holdings). However the Company does not believe these change the conclusions herein

conjunction with conversations with ISS regarding examples of reclassifications in which premiums were paid, in addition to the 3 of the 25 transactions where a premium was paid to high

vote shareholders detailed on page 6 of this document, the Company became aware of five other similar transactions (Continental Airlines, Dairy Mart Convenience Stores, Kaman

Corporation, Robert Mondavi and Sotheby’s Holdings). However the Company does not believe these change the conclusions herein

2. High votes entitled to elect > 80% of the board

[9]