Attached files

| file | filename |

|---|---|

| 8-K - STANDARD MICROSYSTEMS 8-K 8-16-2011 - STANDARD MICROSYSTEMS CORP | form8k.htm |

Exhibit 2.1

ASSIGNMENT AND ASSUMPTION OF LEASE AGREEMENT

BY AND BETWEEN:

STANDARD MICROSYSTEMS

CORPORATION,

(“Seller”)

and

REP 80 ARKAY DRIVE, LLC

(“Purchaser”)

Dated: as of August 16, 2011

|

TABLE OF CONTENTS

|

|

|

Page

|

|

|

SECTION 1: SUBJECT OF SALE

|

1

|

|

SECTION 2: DEFINITIONS

|

3

|

|

SECTION 3: TRANSFER OF PROPERTY; CLOSING

|

5

|

|

SECTION 4: DUE DILIGENCE; PROPERTY INFORMATION; ACCESS

|

6

|

|

SECTION 5: TITLE; MATTERS TO WHICH THE SALE IS SUBJECT

|

8

|

|

SECTION 6: “AS IS SALE”

|

10

|

|

SECTION 7: ADJUSTMENTS

|

12

|

|

SECTION 8: CASUALTY

|

13

|

|

SECTION 9: CONDEMNATION PENDING CLOSING

|

14

|

|

SECTION 10: SELLER’S WARRANTIES AND REPRESENTATIONS

|

14

|

|

SECTION 11: SELLER’S INSTRUMENTS AT CLOSING

|

17

|

|

SECTION 12: PURCHASER’S REPRESENTATIONS AND WARRANTIES

|

18

|

|

SECTION 13: PURCHASER’S INSTRUMENTS AT CLOSING

|

19

|

|

SECTION 14: CONTRACT PERIOD

|

19

|

|

SECTION 15: CONDITIONS PRECEDENT TO CLOSING

|

20

|

|

SECTION 16: TRANSFER TAX AND TRANSACTION COSTS

|

21

|

|

SECTION 17: NOTICES

|

22

|

|

SECTION 18: DEFAULT

|

23

|

|

SECTION 19: ASSIGNMENT

|

24

|

|

SECTION 20: COUNTERPARTS

|

25

|

|

SECTION 21: FURTHER ASSURANCES

|

25

|

|

SECTION 22: MISCELLANEOUS

|

26

|

|

SECTION 23: ESCROW AGENT

|

28

|

i

|

SECTION 24: CONFIDENTIALITY

|

29

|

|

SECTION 25: TAX PROCEEDINGS

|

30

|

|

SECTION 26: SALE BROKERAGE AGREEMENTS

|

31

|

|

SECTION 27: THIRD PARTY BENEFICIARY

|

31

|

|

SECTION 28: JURISDICTION AND SERVICE OF PROCESS

|

31

|

|

SECTION 29: WAIVER OF TRIAL BY JURY

|

32

|

|

SECTTION 30: PURCHASE MONEY FINANCING

|

32

|

|

SCHEDULES

|

|

|

Schedule 1:

|

Description of the Land

|

|

Schedule 2:

|

Seller’s Wire Instructions

|

|

Schedule 3:

|

Title Exceptions

|

|

Schedule 4:

|

Excluded Property

|

|

EXHIBITS

|

|

|

Exhibit A:

|

List of Leases

|

|

Exhibit B:

|

Form of Assignment and Assumption of IDA Lease

|

|

Exhibit C:

|

Form of Assignment Agreement

|

|

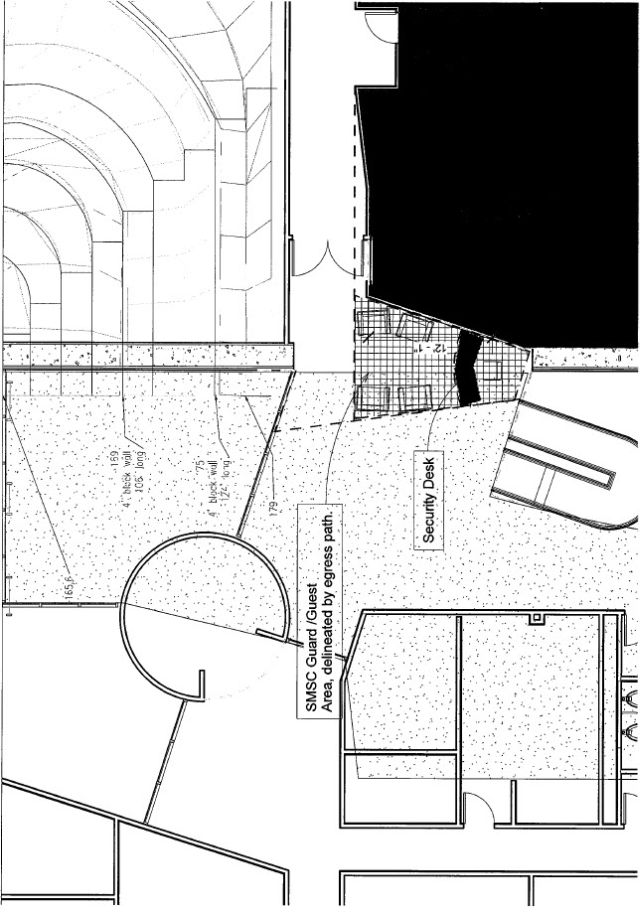

Exhibit D:

|

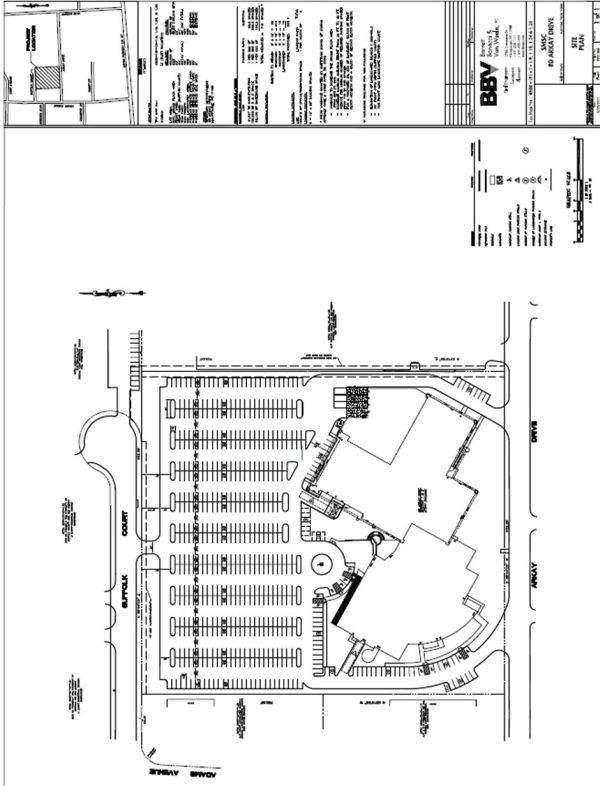

Parking Area Retrofitting/Reconfiguration

|

|

Exhibit E:

|

Form of FIRPTA Certificate

|

|

Exhibit F:

|

List of Service Contracts

|

|

Exhibit G:

|

Form of Letter of Credit

|

|

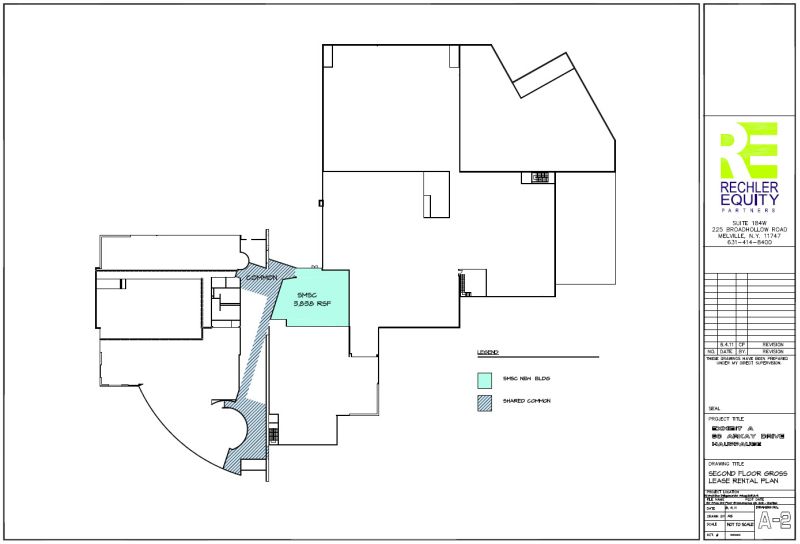

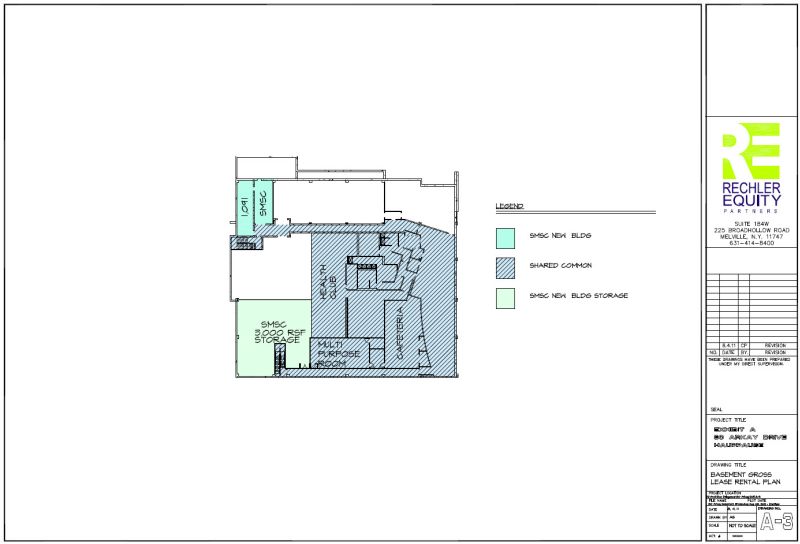

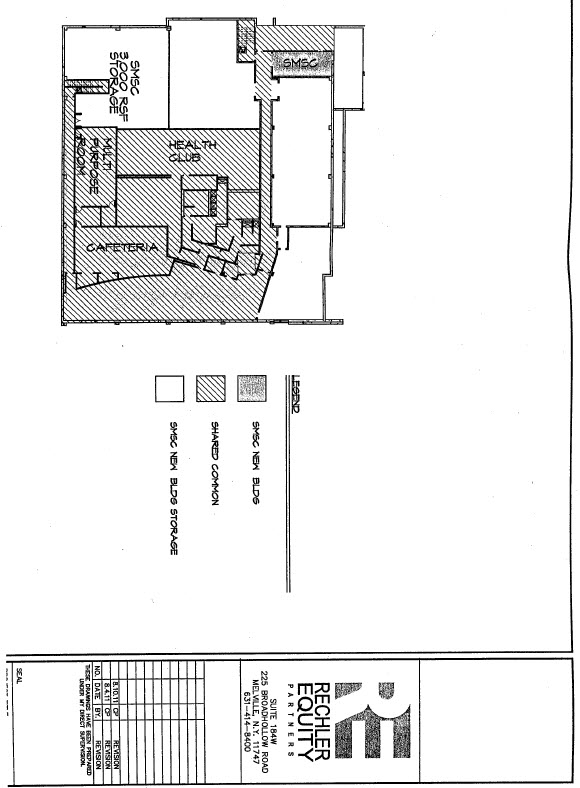

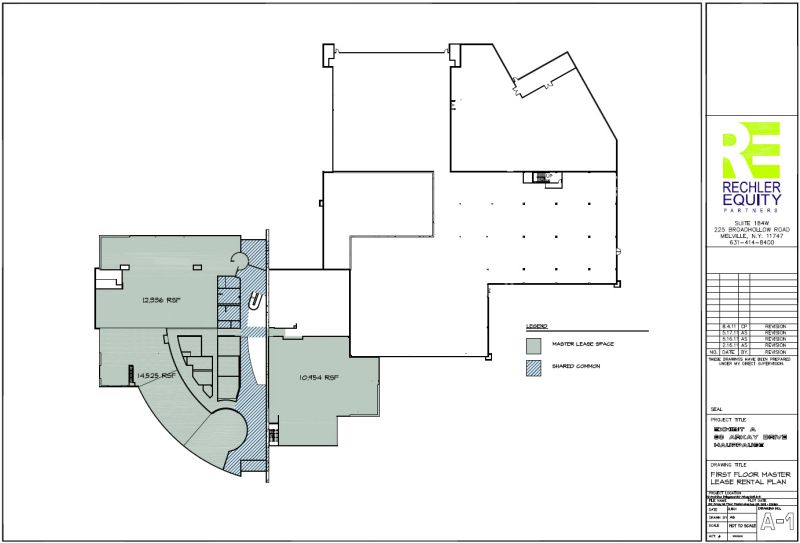

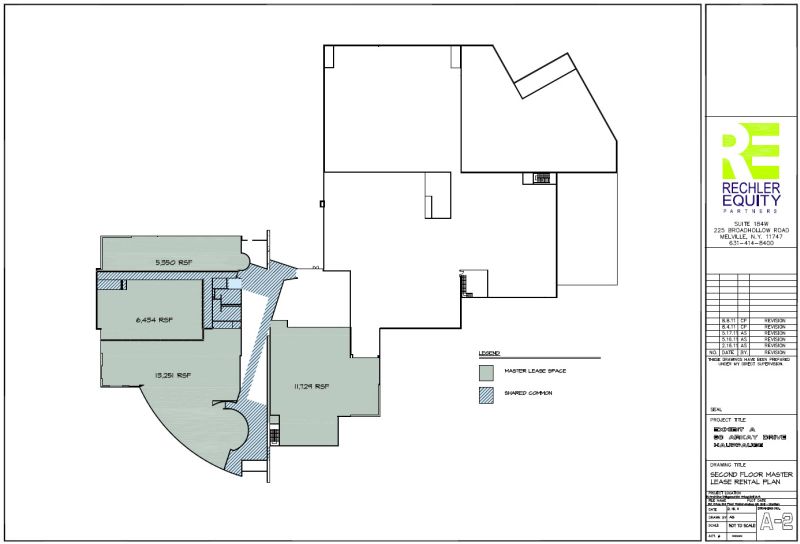

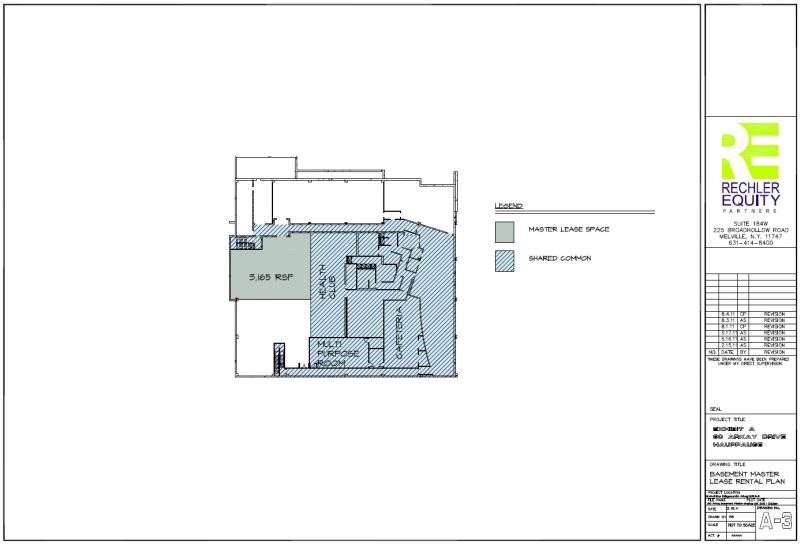

Exhibit H-1:

|

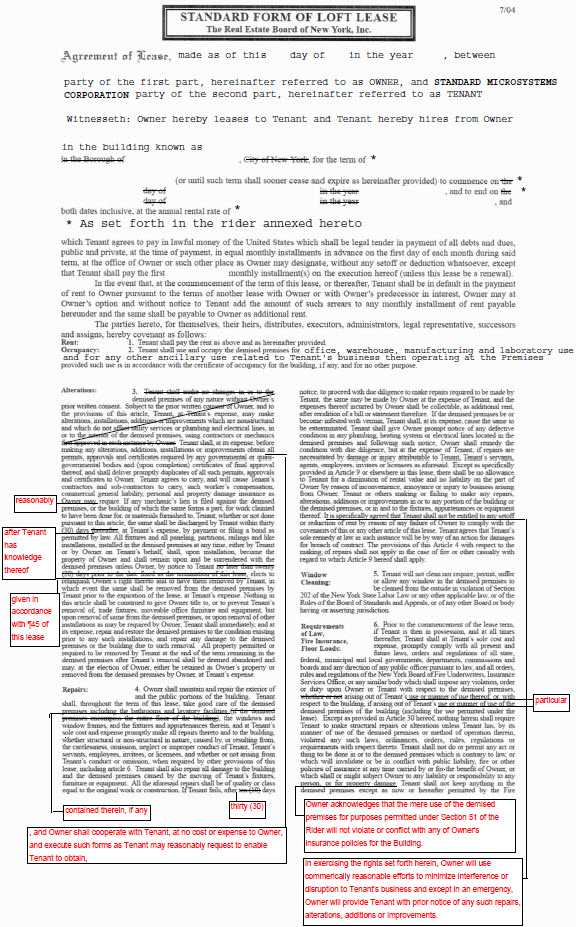

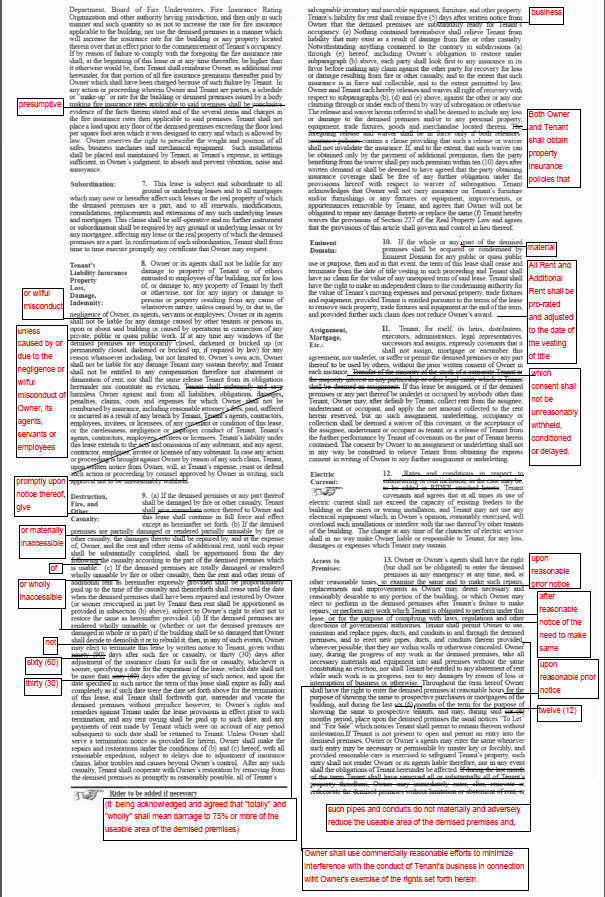

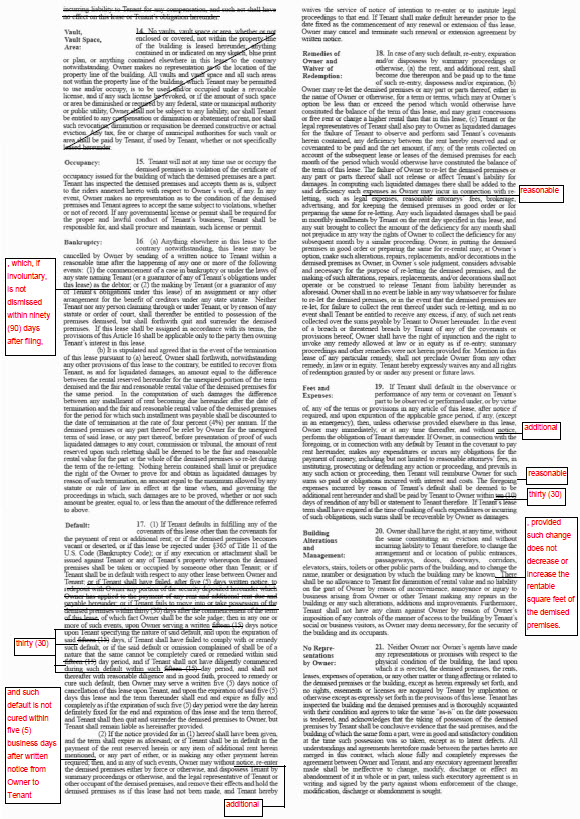

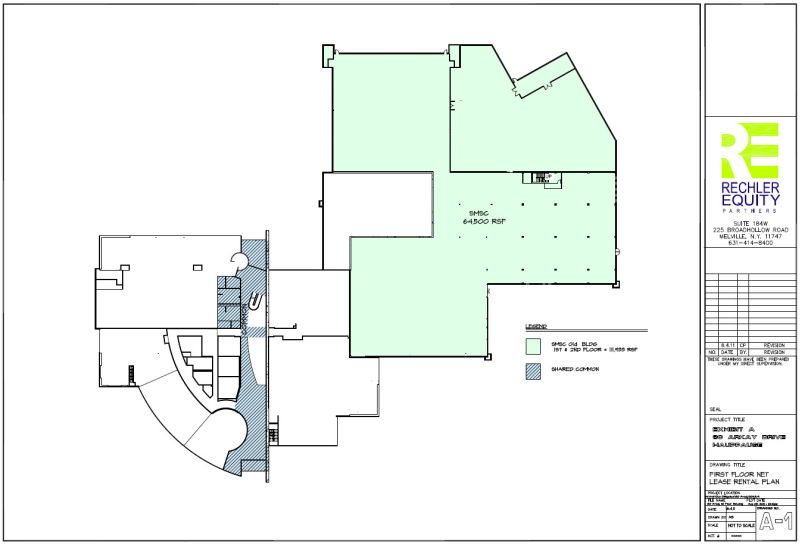

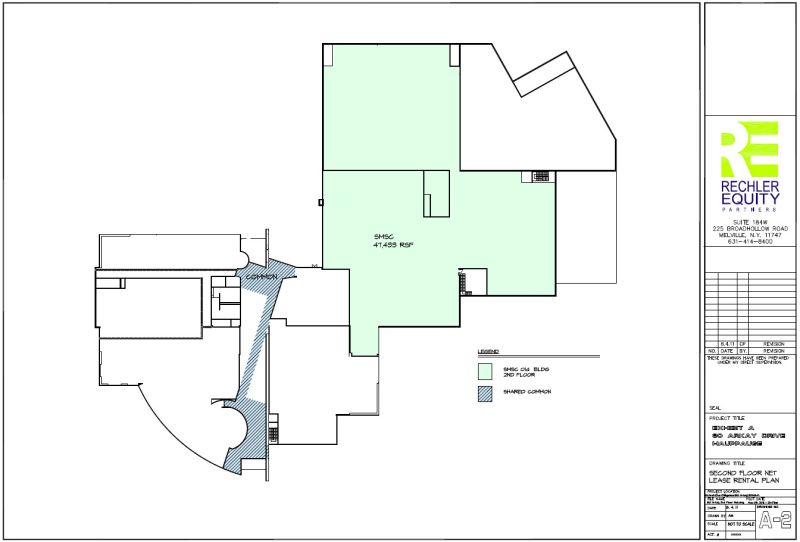

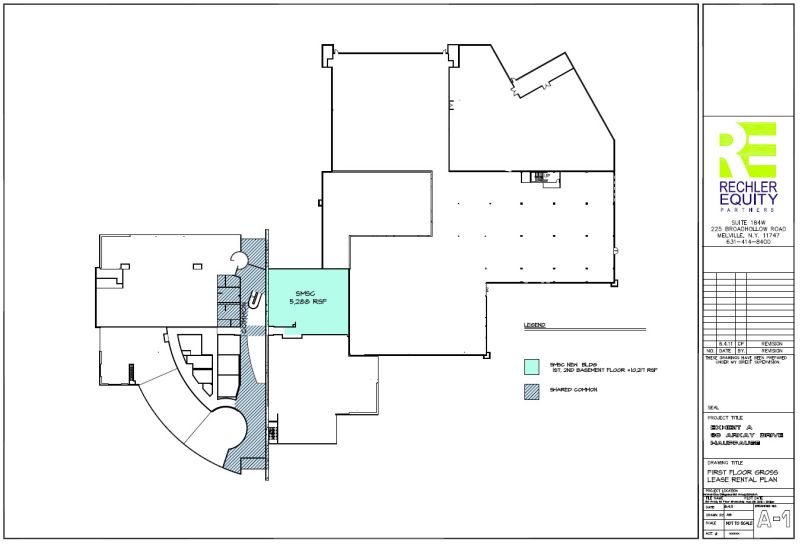

111,933 square foot Lease

|

|

Exhibit H-2:

|

10,217 square foot Lease

|

|

Exhibit H-3:

|

77,744 square foot Lease

|

|

Exhibit I-1:

|

Form of Note

|

|

Exhibit I-2:

|

Form of Mortgage

|

|

Exhibit I-3:

|

Form of Assignment

|

|

Exhibit I-4:

|

Form of Guaranty

|

ii

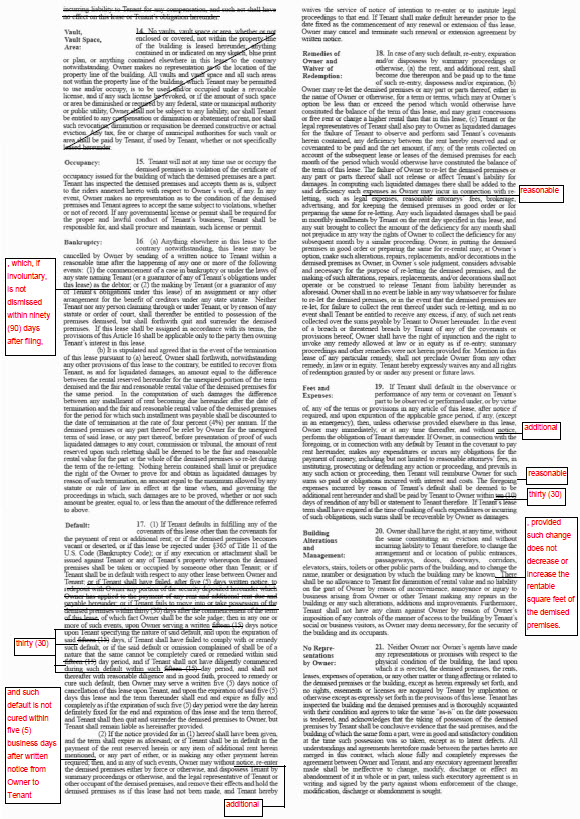

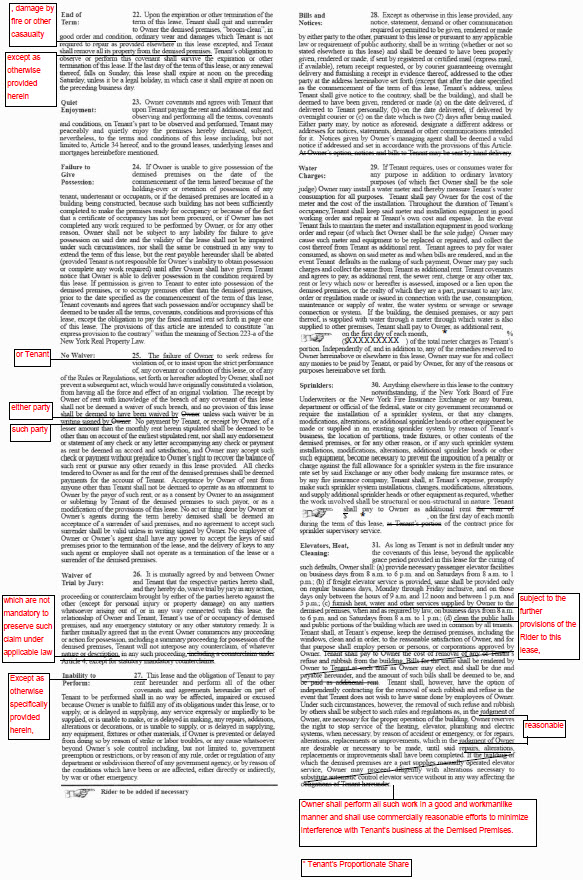

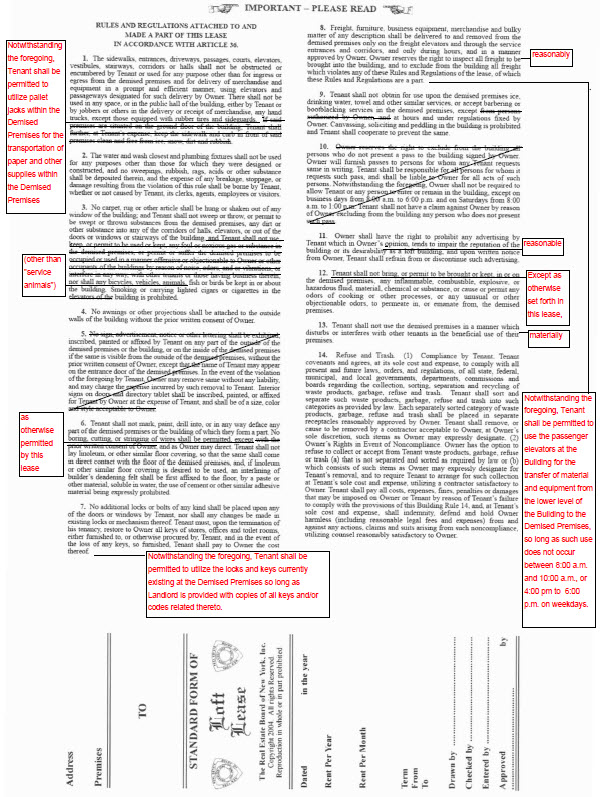

ASSIGNMENT AND ASSUMPTION AGREEMENT

THIS ASSIGNMENT AND ASSUMPTION AGREEMENT (this “Agreement”) made as of the 16th day of August, 2011, by and between STANDARD MICROSYSTEMS CORPORATION, as assignor, having an address at 80 Arkay Drive, Hauppauge, New York

11788, (“Seller”), and REP 80 ARKAY DRIVE, LLC, as assignee, having an address at c/o Rechler Equity Partners, 225 Broadhollow Road, Melville, New York 11747 (“Purchaser”).

RECITALS

WHEREAS, Seller is the lessee under that certain Lease Agreement (the “IDA Lease”) dated March 1, 2005, with the Suffolk County Industrial Development Agency, as lessor (the “Agency”) for the Real Property (as hereinafter defined), pursuant to which Seller is entitled to certain tax benefits (the “IDA Benefits”).

WHEREAS Purchaser desires to purchase Seller’s leasehold interest the Property (as hereinafter defined), and Seller desires to sell the same to Purchaser, upon and pursuant to the terms of this Agreement.

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein contained, and of other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally bound hereby, do hereby agree as follows:

SECTION 1: SUBJECT OF SALE

Section 1.01. Subject to and in accordance with the terms and conditions of this Agreement, Seller shall sell, assign, and convey to Purchaser all of Seller’s leasehold right, title and interest in, to, and under the following, under the IDA Lease:

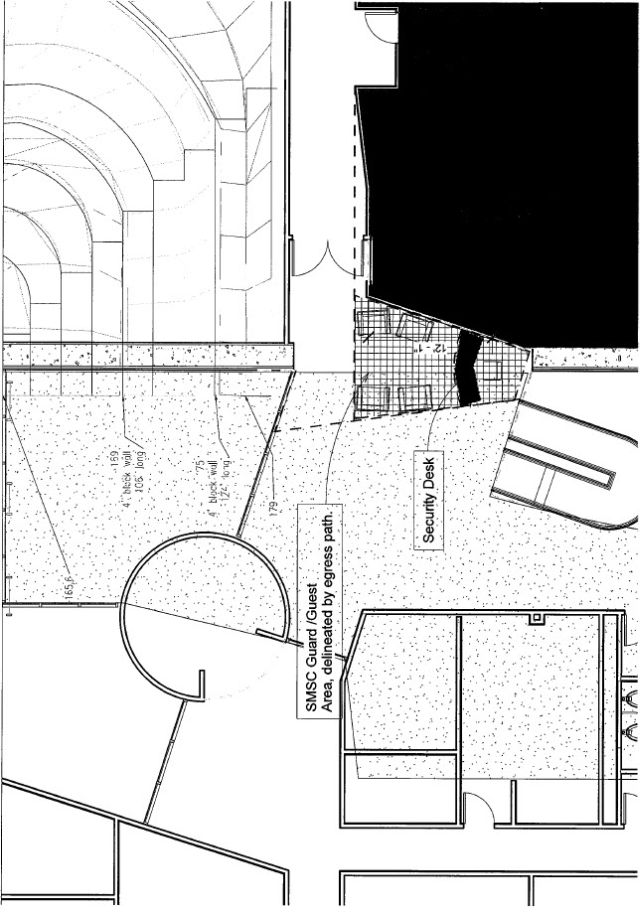

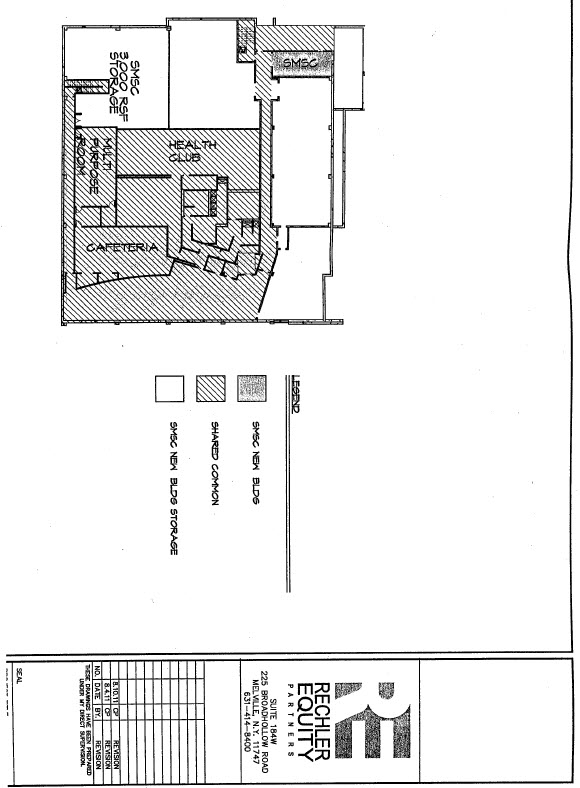

(a) (i) that certain parcel of real property situate, lying, and being in the Town of Smithtown, County of Suffolk, State of New York, and located at 80 Arkay Drive, Hauppauge, New York, as more particularly described on Schedule 1 attached hereto (the “Land”), and (ii) all of the improvements located on the Land (individually, a “Building” and, collectively, the “Improvements”);

(b) all rights, privileges, grants and easements appurtenant to the Land and the Improvements, including, without limitation, all of Seller’s right, title, and interest in and to the Land lying in the bed of any public street, road or alley, all mineral and water rights, and all easements, licenses, covenants and rights-of-way or other appurtenances used in connection with the beneficial use and enjoyment of the Land and the Improvements (the Land and the Improvements, and all such rights, privileges, easements, grants and appurtenances are sometimes

referred to herein collectively as the “Real Property”);

(c) intentionally omitted;

(d) all leases, licenses and other agreements (other than subleases or sublicenses) with respect to the use and occupancy of the Real Property, together with all amendments and modifications thereto and any guaranties provided thereunder, in effect as of the Closing Date (individually, a “Lease” and, collectively, the “Leases”);

(e) all governmental permits, licenses, approvals, and certificates, to the extent transferable, relating to the Real Property (collectively, the “Permits and Licenses”), and all of Seller’s right, title and interest in and to those contracts set forth on

Exhibit F with respect to the servicing, maintenance, repair, management, leasing or operation of the Real Property, in effect on the Closing Date to the extent Purchaser hasn’t elected for Seller to terminate same (individually, a “Service Contract” and, collectively, the “Service Contracts”);

(f) all guaranties and warranties, to the extent transferable, owned by Seller received in connection with any construction, repair or maintenance services performed with respect to the Real Property (collectively, the “Warranties”); and

(g) all other rights, privileges, and appurtenances owned by Seller, if any, to the extent transferable and directly related to the leasehold ownership, use or operation of the Real Property, including, without limitation but subject to the terms and conditions of Section 25 of this Agreement, any real estate tax refunds relating to the Property (collectively, the “Intangible Rights”).

The Real Property, the Leases, the Permits and Licenses, the Service Contracts, the Warranties, the Intangible Rights and all other property interests described in this Section 1 being conveyed hereunder are hereinafter collectively referred to as the “Property”.

Section 1.02. Notwithstanding anything to the contrary contained herein, it is expressly agreed by the parties hereto that any fixtures, furniture, furnishings, equipment or other personal property (including, without limitation, trade fixtures in, on, around or affixed to the Building) owned or leased by any Tenant, contractor or employee at the Building (collectively, the “Excluded Property,” as more fully set forth on the annexed Schedule 4) is not included in the Property to be sold to Purchaser hereunder.

Section 1.03. The parties hereto acknowledge and agree that no part of the Purchase Price is allocable to Personal Property (as defined herein). Although it is not anticipated that any sales tax shall be due and payable, Purchaser agrees that Purchaser shall pay any and all sales and/or compensating use taxes imposed upon by or due to the state or town in which the Property is located in connection with the transactions contemplated hereunder. Purchaser shall file all necessary tax returns with respect to all such taxes and, to the extent required by applicable law, Seller will join in the execution of any such tax returns.

Section 1.04. The parties hereto agree that they will endeavor to timely obtain Agency consent to the transactions contemplated herein (including both the assignment and assumption of the IDA Lease and the Purchase Money Financing), and will each cooperate with requests made by the Agency in connection therewith. In the event the Agency denies its consent of the transactions contemplated herein, the parties shall jointly direct the Escrow Agent to deliver the Downpayment to Purchaser, whereupon Escrow Agent shall deliver the Downpayment to

Purchaser and this Agreement shall terminate and be of no further force or effect and the parties hereto shall be released from all obligations and liabilities hereunder except those that expressly survive the termination of this Agreement. Notwithstanding anything to the contrary contained herein, in the event the Agency notifies Seller and/or Purchaser that it will not continue the IDA Benefits to Seller, as occupant of the Property, then Seller may terminate this Agreement on written notice to Purchaser and Escrow Agent, whereupon Escrow Agent shall deliver the Downpayment to Purchaser and this Agreement shall terminate and be of no further force or effect and the parties hereto shall be released from all obligations and liabilities hereunder except those that expressly survive the termination of

this Agreement.

2

SECTION 2: DEFINITIONS

Section 2.01. For all purposes of this Agreement, except as otherwise expressly provided or unless the context clearly indicates a contrary intent:

(i) the capitalized terms defined in this Section have the meanings assigned to them in this Section, and include the plural as well as the singular; and

(ii) the words “herein”, “hereof”, and “hereunder” and other words of similar import refer to this Agreement as a whole and not to any particular Section or other subdivision.

“Assignment Agreement” shall mean the Assignment Agreement in the form of Exhibit

C attached hereto and made a part hereof.

“Assignment and Assumption of IDA

Lease” shall mean the Assignment and Assumption of IDA Lease in the form of Exhibit B attached hereto and made a part hereof.

“Basket Amount” shall have the meaning set forth in Section 15 hereof.

“Building” shall have the meaning set forth in Section 1.01(a)(ii) hereof.

“Business Day” shall mean any day other than (i) a Saturday or Sunday, (ii) all days observed by the federal or State of New York government as legal holidays, and (iii) all days on which commercial banks in the State of New York are required by law to be closed.

“Closing” shall mean the closing of the transactions contemplated by this Agreement.

“Closing Date” shall mean the actual date on which the Closing occurs.

“Closing Date Representations” shall mean all of the representations and warranties set forth in Section 10.01.

“Code” shall have the meaning set forth in Section 10.01(d) hereof.

“Confidential Information” shall have the meaning set forth in Section 24.01.

3

“Contract Period” shall mean the period commencing on the date of this Agreement and ending on the Closing Date.

“Downpayment” shall mean the downpayment set forth in Section 3.01(a), together with any interest thereon.

“Escrow Agent” shall mean Moritt Hock & Hamroff, LLP.

“Excluded Property” shall have the meaning set forth in Section 1.02 hereof.

“Improvements” shall have the meaning set forth in Section 1.01(a)(ii) hereof.

“Intangible Rights” shall have the meaning set forth in Section 1.01(g) hereof.

“Land” shall have the meaning set forth in Section 1.01(a)(i) hereof.

“Leases” shall have the meaning set forth in Section 1.01(d) hereof.

“Loss” or “Losses” shall mean the actual damage, loss, cost or expense (including reasonable costs of investigation incurred in defending against and/or settling such damage, loss, cost or expense or claim therefor and any amounts paid in settlement thereof), if any, imposed on, or incurred by, Purchaser because a representation made by Seller in Section 10.01 of this Agreement is untrue or incorrect. In no event shall any “Loss” or

“Losses” include any indirect, consequential or punitive damages.

“Maximum Credit Amount” shall have the meaning set forth in Section 15 hereof.

“Permits and Licenses” shall have the meaning set forth in Section 1.01(e) hereof.

“Permitted Encumbrances” shall have the meaning set forth in Section 5.01 hereof.

“Person” shall mean any individual, estate, partnership, limited liability company, corporation, trust, governmental entity or any other legal entity and any unincorporated association

“Personal Property” shall have the fixtures, machinery, equipment, and other items of personal property owned by Seller and located upon and used in connection with the leasehold ownership or operation of the Real Property.

“Property” shall have the meaning set forth in Section 1.01 hereof.

“Purchase Price” shall have the meaning set forth in Section 3.01 hereof.

“Purchaser’s Loss Notice” shall have the meaning set forth in Section 10.03 hereof.

‘Purchase Money Financing” shall have the meaning set froth in Section 30.01 hereof.

“Qualified Intermediary” shall have the meaning set forth in Section 19.02 hereof.

4

“Real Estate Taxes” shall mean real estate taxes and any general or special assessments imposed upon the Real Property, including but not limited to any general or special assessments of any governmental or municipal authority or tax district, including, without limitation, any assessments levied for public benefits to the Real Property, but shall specifically exclude federal, state or local income taxes, franchise, gift, transfer, excise, capital stock, estate or inheritance taxes, and penalties and/or interest for late payment of Real Estate Taxes.

“Real Property” shall have the meaning set forth in Section 1.01(b) hereof.

“Review Period” shall have the meaning set forth in Section 4.01 hereof.

“Representatives” shall have the meaning set forth in Section 24.01 hereof.

“Scheduled Closing Date” shall have the meaning set forth in Section 3.02 hereof.

“Service Contracts” shall have the meaning set forth in Section 1.01(e) hereof.

“Survival Period” shall mean the period of time commencing on the Closing Date and terminating six (6) months subsequent to the Closing Date.

“Title Insurer” shall mean any reputable title company licensed to do business in the

State of New York.

“Warranties” shall have the meaning set forth in Section 1.01(f) hereof.

SECTION 3: TRANSFER OF PROPERTY; CLOSING

Section 3.01. Seller agrees to assign to Purchaser, and Purchaser agrees to assume from Seller, subject to and in accordance with the terms, provisions, covenants and conditions set forth in this Agreement, all of Seller’s leasehold right, title and interest in and to the Property for a purchase price of Eighteen Million and 00/100 Dollars ($18,000,000.00) (the “Purchase Price”), subject to

adjustments to be made pursuant to the terms of this Agreement, including, without limitation, as provided in Section 7 hereof. The Purchase Price to be paid by Purchaser shall be paid as follows:

(a) Five Hundred Thousand and 00/100 Dollars ($500,000.00) by delivery of a clean, irrevocable and unconditional letter of credit (in the form annexed hereto as Exhibit G) to the Escrow Agent on the signing of this Agreement as the Downpayment. The Downpayment shall be held by the Escrow Agent in accordance with Section 23 hereof.

(b) Sixteen Million Two Hundred Thousand and 00/100 ($16,200,000.00) Dollars by way of Purchase Money Financing from Seller to Purchaser, as set forth more fully in Section 30.01 of this Agreement.

(c) One Million Three Hundred Thousand and 00/100 ($1,300,000.00) Dollars, subject to any adjustments as provided herein, in U.S. dollars at the Closing, to be delivered to Seller (or its designees) at Closing by (i) wire transfer in accordance with the wire instructions set forth on Schedule 2 attached hereto, or (ii) certified check of Purchaser, to the

order of Seller, drawn on any bank, savings bank, trust company or savings and loan association having a banking office in the State of New York, or by (iii) official bank checks, to the order of Seller, drawn by any such banking institution.

5

(i) Notwithstanding the foregoing, at Closing, Purchaser shall have the right to substitute the letter of credit being held as the Downpayment with a cash Downpayment, in which event at Closing, Purchaser shall pay to Seller (or its designees) One Million Eight Hundred Thousand and 00/100 ($1,800,000.00) Dollars, subject to any adjustments as provided herein, in U.S. dollars, by (i) wire transfer in accordance with the wire instructions set forth

onSchedule 2 attached hereto, or (ii) certified check of Purchaser, to the order of Seller, drawn on any bank, savings bank, trust company or savings and loan association having a banking office in the State of New York, or by (iii) official bank checks, to the order of Seller, drawn by any such banking institution, and the Escrow Agent will simultaneously return the letter of credit to Purchaser.

Section 3.02. Subject to the satisfaction of Section 15 hereof, the Closing shall occur on or about twenty (20) Business Days following the later of (i) expiration of the Review Period or (ii) Seller’s obtaining the Parking Variance (as hereinafter defined) as set forth in Section 22.01 hereof (the “Scheduled Closing Date”), at the offices of Seller’s

attorney. Notwithstanding the foregoing provisions of this Section 3.02, Seller and Purchaser shall each have the right to unilaterally set a final closing date, time being of the essence, upon thirty (30) days written notice delivered to the other party on or after the Scheduled Closing Date (as such Scheduled Closing Date may be extended pursuant to Section 5.02 hereof).

6

SECTION 4: DUE DILIGENCE; PROPERTY INFORMATION; ACCESS

Section 4.01. (a) Purchaser and its agents, representatives, employees or contractors shall have from the date upon which this Agreement is fully executed and delivered to Purchaser’s attorney until thirty (30) days following such date (i.e., September 15,

2011) (the “Review Period”) the right to access the Property to conduct such inspection and investigation of and at the Property as it determines to be necessary or appropriate with respect to the Property, including, without limitation, mechanical and engineering inspections, title inspections, surveying and structural, geographical and environmental testing such as Phase I environmental assessment (collectively, the “Inspections”), to determine whether all

matters relating to the Property are acceptable. Promptly following the full execution and delivery of this Agreement, Seller shall provide to Purchaser all reasonably requested due diligence materials in Seller’s possession and/or reasonable control, including without limitation, soil and environmental reports, engineering studies, feasibility studies, title reports, surveys, site plans, and other information which may reasonably assist Purchaser in evaluating the Property. In the event a Phase II environmental assessment of the Property is recommended by Purchaser’s environmental consultant(s), Purchaser shall notify Seller of same in writing and the Review Period shall be extended for a reasonable period of time in order to accommodate such additional Inspections. Notwithstanding anything to the contrary contained herein, Purchaser agrees to give

Seller reasonable advance notice prior to its performing a Phase I and/or Phase II environmental assessment of the Property to enable Seller’s environmental consultants to be present and perform similar inspections on a “shadow” basis. If Purchaser is dissatisfied with the Premises as a result of the Inspections, then on or before the expiration of the Review Period (as same may have been extended for the performance of a Phase II assessment),

time being of the essence, Purchaser shall notify Seller in writing

(“Purchaser’s Concern(s) Notice”) of Purchaser’s specific engineering or environmental concern(s) (the “Concerns”). Purchaser’s failure to timely deliver a Purchaser’s Concern(s) Notice shall be deemed a waiver of Purchaser’s right to object to Concern(s), and this Agreement shall continue in full force and effect without any

abatement of or credit against the Purchase Price. If the repair or remediation of the Concern(s) will cost $360,000 (the “Threshold Amount”) or less, neither Purchaser nor Seller shall have any right to terminate this Agreement and Seller shall, in its sole discretion, either (i) give Purchaser a credit against the Purchase Price in the amount necessary to repair or remediate the Concern(s), not to exceed the Threshold Amount, or (ii) agree to repair or remediate the Concern(s); provided if the repair or remediation cannot be completed prior to Closing, Seller shall deposit with the Escrow Agent an amount equal to 110% of the cost estimate to

complete the repair or remediation of the Concern. In either event, Seller shall provide Purchaser with written notice of its election within ten (10) days after receipt of Purchaser’s Concern(s) Notice and should Seller elect to have the work performed as provided in clause (ii) above, Purchaser shall commence such work within ten (10) days after Seller’s notice (unless a permit is needed to perform such work, then within 10 days of permit issuance). If the repair or remediation of the Concern(s) will cost in excess of the Threshold Amount, Seller shall, in its sole discretion, either (x) give Purchaser a credit against the Purchase Price in an amount not to exceed the Threshold Amount, or (y) terminate this Agreement as provided above. Seller shall provide Purchaser with written notice of its election within ten (10) days after receipt of Purchaser’s Concern(s)

Notice. Should Seller elect to proceed with the Agreement and give Purchaser a credit against the Purchase Price as provided in clause (x) above, Purchaser shall have the right to terminate this Agreement by written notice to Seller given within five (5) days after Seller’s credit notice, time being of the essence. Should Seller elect to terminate this

Agreement as provided in clause (y) above, Purchaser shall have the right to reject such termination by notifying Seller in writing within five (5) days after Seller’s termination notice, time being of the essence, that it elects to proceed under this

Agreement with a credit against the Purchase Price in an amount up to the Threshold Amount. (b) Purchaser shall further have the right during the Review Period to confirm that the Property may be used as a multi-tenant commercial office building. So long as the Property may be used as a multi-tenant office building, Purchaser may not terminate this Agreement. If the Property may not be used as a multi-tenant office building, Purchaser’s sole right shall be to terminate this Agreement. Purchaser acknowledges and agrees that the right to use the Property as a multi tenant office building may be subject to obtaining of the Parking Variance (as hereinafter defined) and in such event Purchaser may not terminate this Agreement during the Review Period. (c) If Purchaser is entitled, under either (a) or (b) above, to terminate this Agreement as above,

Purchaser’s sole right shall be to terminate this Agreement by written notice to Seller and Escrow Agent on or before the date on which the Review Period expires or a Purchaser notice is required below (whichever is later), whereupon, Escrow Agent shall deliver the Downpayment to Purchaser and this Agreement shall terminate and be of no further force or effect and the parties hereto shall be released from all obligations and liabilities hereunder except those that expressly survive termination of this Agreement. If Purchaser is entitled to terminate this Agreement under this Section 4.01 and does not so terminate on a timely basis (time being of the essence to all such dates and notices), Purchaser shall no longer be entitled to terminate this Agreement under this Section 4.01.

7

Section 4.02. Seller shall use reasonable efforts to permit Purchaser and its Representatives access to the Property during the Review Period, during normal business hours and upon prior reasonable notice to Seller, for the purpose of performing the Inspections (but Purchaser shall not have the right to drill on the Property or conduct any other invasive procedures) unless same are recommended in the Phase I report delivered by Purchaser’s environmental consultants, in which event such invasive testing and procedures shall be subject

to Seller’s prior approval (not to be unreasonably withheld, conditioned or delayed), and Seller or its representatives shall have the right to be present during such Inspections. Purchaser shall deliver to Seller, promptly upon Purchaser’s receipt thereof and at no cost to Seller, copies of all tests, reports and inspections of the Property made and conducted by Purchaser or its Representatives or for Purchaser’s benefit. Purchaser’s right to inspect the Property shall be conditioned upon Purchaser obtaining property damage and comprehensive general liability insurance, in form and amounts reasonably acceptable to Seller and naming Seller and its managing agent as additional insureds, and furnishing to Seller policies or a certificate or certificates of insurance evidencing such coverage, prior thereto.

Section 4.03. In conducting any Inspections of the Property, Purchaser shall at all times comply with all laws and regulations of all applicable governmental authorities, and neither Purchaser nor any of its Representatives shall (a) contact or have any discussions with any of Seller’s employees, agents or representatives, or with any contractors providing services to, the Property, unless in each case Purchaser obtains the prior written consent of Seller, which consent

shall not be unreasonably withheld, conditioned or delayed, (b) interfere with the use or operation of the Property by Seller, or (c) damage the Property. Seller may from time to time establish reasonable rules of conduct for Purchaser and its Representatives in furtherance of the foregoing. Purchaser agrees to pay to Seller on demand the reasonable, out-of-pocket cost of repairing and restoring any damage or disturbance which Purchaser or any of its Representatives shall cause to the Property in connection with such Inspections.

Section 4.04. Purchaser shall indemnify, defend and hold harmless Seller and its direct and indirect shareholders, officers, directors, partners, principals, members, employees, agents and contractors, and any successors or assigns of the foregoing, from and against any and all losses, costs, liabilities, damages and expenses, including, but not limited to, penalties, fines, court costs, disbursements and reasonable attorney’s fees incurred as a direct result or directly arising from injuries to persons or damage to property caused by Purchaser’s and/or its Representatives’ access to, or inspection of the Property, or any tests, inspections or other due diligence conducted by or

on behalf of Purchaser. The indemnity provisions of this Section 4.04 shall be binding upon Purchaser regardless of whether or not the transactions contemplated hereby are consummated and shall survive the termination of this Agreement or the Closing, as applicable.

SECTION 5: TITLE; MATTERS TO WHICH THE SALE IS SUBJECT

Section 5.01. Seller shall assign and convey or cause to be assigned and conveyed to Purchaser good and valid insurable leasehold title to the Property free and clear of any and all mortgages, liens, leases, encumbrances and easements, except the following (collectively, the “Permitted Encumbrances”):

8

(a) Subject to the provisions of Section 7, all Real Estate Taxes, water meter and water charges and sewer rents, accrued or unaccrued, fixed or not fixed, becoming due and payable after the Closing Date;

(b) All zoning laws and building ordinances, resolutions, regulations and orders of all boards, bureaus, commissions and bodies of any municipal, county, state or federal government, and all notes or notices of violations thereof noted or issued with respect to the Property prior to the Closing Date;

(c) All covenants, restrictions and rights and all easements and agreements for the erection and/or maintenance of water, gas, steam, electric, telephone, sewer or other utility pipelines, poles, wires, conduits or other like facilities, and appurtenances thereto, over, across and under the Property;

(d) The standard conditions and exceptions to title contained in Purchaser’s title policy or any “marked-up” commitment issued by the Title Insurer to Purchaser;

(e) Any state of facts which would be shown on or by an accurate survey of the Property, provided same do not render title unmarketable and/or uninsurable;

(f) De-minimus variations between tax lot lines and lines of record title;

(g) All violations of building, fire, sanitary, environmental, housing and similar laws and regulations whether or not noted or issued at the date hereof or the Closing Date; and

(h) All of the restrictions, encumbrances, covenants, agreements, easements and all other matters affecting title to the Property (other than any mortgage) set forth in the title report for the Property issued by Excalibur Title Agency, as agent for Old Republic National Title Insurance Company and attached hereto as Schedule 3.

Notwithstanding that the Assignment and Assumption of IDA Lease for the Property does not so state, Seller’s leasehold interest in the Property shall be deemed conveyed to Purchaser subject to the exceptions set forth in items (a) through (h). This provision shall survive the Closing.

9

Section 5.02. Prior to the expiration of the Review Period, Purchaser shall obtain a survey (“Survey”) and title commitment (“Title Commitment”) with respect to the assignment and assumption of Seller’s leasehold interest in the Property

(“Title Commitment”) from the Title Insurer, to be delivered simultaneously to Purchaser’s and Seller’s attorneys. No later than the end of the Review Period, Purchaser shall notify Seller of such objections, except for any Permitted Encumbrances set forth in Section 5.01 above, as Purchaser may have to anything contained in the Title Commitment or on the Survey (collectively, the

“Title Objections”). If there are Title Objections by Purchaser, Seller shall have the option, at its sole discretion, to satisfy them prior to the Scheduled Closing Date. If Seller elects to attempt to satisfy the Title Objections, Seller shall so notify Purchaser within ten (10) days after receipt of such Title Objections and shall use commercially reasonable efforts to attempt to cure such Title Objections prior to Closing, and the Scheduled Closing Date may be reasonably extended for up to sixty (60) days, at Seller's option, in order to attempt to cure such Title

Objections. If Seller elects not to satisfy such Title Objections, then Seller shall so notify Purchaser and Purchaser shall thereupon have a period of ten (10) days after receipt of Seller's notice that Seller elects not to cure such Title Objections to either (i) waive the Title Objections and accept such title as Seller is able to convey, without abatement or reduction of the Purchase Price or any credit or allowance on account thereof (except as may otherwise be expressly set forth herein), and by such waiver of the Title Objections, Purchaser shall be deemed to have waived any and all claims and/or causes of action against Seller for

damages or any other remedies for any and all defects in and/or exceptions to title to the Property, or (ii) terminate this Agreement by giving notice to Seller on or before the end of such ten (10) day period, in which event the Downpayment shall be returned to Purchaser and the parties hereto shall be released from further liability hereunder except as expressly otherwise provided herein. In no event shall Seller have any obligation to commence litigation or to expend money to cure or remove any Title Objections (other than removal of

mortgages, liens or violations against the Property which may be cleared by payment of a finite sum). Purchaser's failure to exercise the right to terminate within the ten (10) day period shall constitute a waiver of Purchaser’s right to terminate with respect to such title matters. Notwithstanding anything contained herein to the contrary, in the event that the Title Insurer selected by Purchaser can not insure good and valid leasehold title to the Property in accordance with an ALTA form of Leasehold policy, Seller shall have the option, but not the obligation, upon notice to Purchaser, to select a Title Insurer that will insure leasehold title to the Property in accordance with an ALTA form of Leasehold policy, subject to the Permitted Encumbrances.

Section 5.03. The existence of mortgages, liens and encumbrances shall not be Title Objections provided that properly executed instruments in recordable form necessary to satisfy, discharge or remove the same (as the case may be) are delivered to the Purchaser at the Closing, together with applicable recording and/or filing fees, and provided that the Title Insurer shall omit any such mortgage, lien or encumbrance from its title insurance policy. Such mortgages, liens and encumbrance may be paid by Seller from the Purchase Price. Purchaser, if request is made not less than two (2) business days prior to the Closing, agrees to provide at the Closing separate certified or cashier's checks as requested,

aggregating not more than the balance (as adjusted, pursuant to the provisions of Section 3 hereof) of the Purchase Price, to facilitate the satisfaction of any such mortgages, liens and encumbrances. Notwithstanding anything contained herein to the contrary, Seller shall be required to remove any Title Objections which are mortgages placed on the Property by Seller. If, after delivery of the Title Commitment to Seller, but prior to the Scheduled Closing Date, a new Title Objection is disclosed by an updated endorsement to the Title Commitment, the same rights and obligations of both parties as set forth above shall be applicable. Notwithstanding anything to the contrary contained herein, Seller agrees to execute and deliver to the Title Insurer any documents reasonably requested by the Title Insurer with respect to any of the restrictions, encumbrances, covenants,

agreements and easements affecting the Property set forth in the annexed Schedule 3.

10

SECTION 6: “AS IS SALE”

Section 6.01. PURCHASER ACKNOWLEDGES AND AGREES THAT IT IS PURCHASING THE PROPERTY “AS IS, WHERE IS, WITH ALL FAULTS” AND SUBJECT TO ALL DEFECTS (PATENT AND LATENT), BASED UPON THE CONDITION (PHYSICAL OR OTHERWISE) OF THE PROPERTY AS OF THE DATE OF THIS AGREEMENT, REASONABLE WEAR AND TEAR AND, SUBJECT TO THE PROVISIONS OF SECTIONS 8 AND 9 OF THIS AGREEMENT, LOSS BY CONDEMNATION OR FIRE OR OTHER CASUALTY EXCEPTED, AND THAT NEITHER SELLER, NOR ANY PERSON ACTING ON BEHALF OF SELLER, NOR ANY PERSON WHICH PREPARED OR PROVIDED ANY OF THE MATERIALS

REVIEWED BY PURCHASER IN CONDUCTING ITS DUE DILIGENCE, NOR ANY DIRECT OR INDIRECT OFFICER, DIRECTOR, PARTNER, MEMBER, SHAREHOLDER, EMPLOYEE, AGENT, REPRESENTATIVE, ACCOUNTANT, ADVISOR, ATTORNEY, PRINCIPAL, AFFILIATE, CONSULTANT, CONTRACTOR, SUCCESSOR OR ASSIGN OF ANY OF THE FOREGOING PARTIES HAS MADE OR SHALL BE DEEMED TO HAVE MADE ANY ORAL OR WRITTEN REPRESENTATIONS OR WARRANTIES, WHETHER EXPRESSED OR IMPLIED, BY OPERATION OF LAW OR OTHERWISE, AS TO THE PRESENT, PAST OR FUTURE PHYSICAL CONDITION, ENVIRONMENTAL CONDITION, INCOME, EXPENSES, OPERATIONS, QUALITY OF CONSTRUCTION, THE PERMITTED USE OF THE PROPERTY OR THE ZONING AND OTHER LAWS, REGULATIONS AND RULES APPLICABLE THERETO OR THE COMPLIANCE BY THE PROPERTY THEREWITH, MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, OR ANY OTHER MATTER AFFECTING OR RELATED TO THE PROPERTY THE TRANSACTIONS CONTEMPLATED HEREIN, EXCEPT FOR THE

SELLER’S REPRESENTATIONS SPECIFICALLY SET FORTH IN THIS AGREEMENT. No representation, warranty or covenant made by Seller in this Agreement or any document delivered pursuant hereto shall survive the Closing, except as otherwise expressly provided in this Agreement. Purchaser has not relied upon, and Seller is not liable or bound in any manner by, any verbal or written statements, representations, real estate brokers’ “set-ups” or information pertaining to the Property furnished by any real estate broker, agent, employee, servant to other persons unless the same are expressly set forth in this Agreement. The execution and delivery of the Assignment and Assumption of IDA Lease by Seller and Purchaser shall be deemed to be the full performance and discharge of every obligation of Seller to be performed pursuant to this Agreement on or prior to the

Closing Date and the truth of every representation or warranty made by Seller in this Agreement or in any Exhibit attached hereto or in any document, certificate, affidavit or other instrument delivered by Seller or its agents at or in connection with the Closing, except for those warranties, representations and obligations of Seller which this Agreement expressly provides are to survive the Closing. Purchaser acknowledges it is acquiring the Property and is relying solely upon its own knowledge of the Property based on its investigation of the Property and its own inspection of the Property. Without limitation, Purchaser releases Seller from and against, and agrees to indemnify Seller from, any and all claims, losses, costs, liabilities, damages and expenses, including, but not limited to, penalties, fines, court costs, disbursements and reasonable

attorney’s fees arising from or related to any environmental conditions at or in respect to the Property; provided, in no event shall such release and/or indemnity be deemed to include any claim or action by a governmental body with respect to a violation of environmental laws or regulations arising prior to Closing. In addition, such waiver and indemnity shall not include any liability of Seller, in its capacity as a tenant, from and after the Closing to the extent it would otherwise be liable pursuant to a lease with Purchaser, as landlord, at the Property. The provisions of this Section 6, including, without limitation, such release and indemnity, shall survive the termination of this Agreement or the Closing, as applicable, for the Survival Period.

11

SECTION 7: ADJUSTMENTS

Section 7.01. The following items shall be apportioned between the parties on and as of the Closing Date, based upon the respective party's period of leasehold ownership of the Property:

(a) Rents payable pursuant to the Leases between Seller and Purchaser to be executed at Closing in the forms annexed hereto as Exhibits H-1, H-2, and H-3 (to the extent not apportioned pursuant to the Leases themselves);

(b) Real Estate Taxes, water charges, and sewer rents, vault charges, if any, business improvement district taxes and assessments and any other governmental taxes, charges or assessments levied or assessed against the Property, on the basis of the respective periods for which each is assessed or imposed, except that if there is a water meter at the Property, apportionment at the Closing shall be based on the last available reading, subject to adjustment after the Closing when the next reading is available (which obligation shall survive the Closing). If the Closing shall occur before a new tax rate is

fixed, the apportionment of taxes at the Closing shall be made upon the basis of the old tax rate for the preceding period applied to the latest assessed valuation of the Property;

(c) value of fuel and maintenance supplies stored on the Property, at the price then charged by Seller's supplier, including any taxes (at Closing, Seller shall deliver a statement from Seller's supplier as to such value);

(d) charges payable under Service Contracts on the basis of the period covered by such payments; provided, however, that Purchaser shall not be liable for any charges payable under any Service Contracts for a period of more than seventy five (75) days following the Closing Date;

(e) intentionally omitted;

(f) prepaid fees for licenses and other permits assigned to Purchaser at the Closing, if any;

(g) all other operating expenses with respect to the Property; and

(h) any other item which is customarily apportioned in accordance with real estate closings of commercial properties in the municipality in which the Property is located.

For the avoidance of confusion, all adjustments under this Section 7.01 shall be done as if the Seller were not leasing back portions of the Property pursuant to the Leases. Any amounts due Purchaser (as landlord) from Seller (as tenant) pursuant to such a lease shall be accounted for under such lease in a separate and distinct manner from the adjustments provided for hereunder.

Section 7.02. Intentionally omitted.

Section 7.03. Intentionally omitted.

12

Section 7.04. Charges for all electricity, steam, gas and other utility services (collectively, “Utilities”) shall be billed to Seller’s account up to the Closing Date and, from and after the Closing Date, all Utilities shall be billed to Purchaser’s account. If for any reason such changeover in billing is not practicable as of the Closing Date, as

to any Utility, such Utility shall be apportioned on the basis of actual current readings or, if such readings have not been made, on the basis of the most recent bills that are available. If any apportionment is not based on an actual current reading, then upon the taking of a subsequent actual reading, the parties shall, within ten (10) days following notice of the determination of such actual reading, readjust such apportionment and Seller shall promptly deliver to Purchaser, or Purchaser shall promptly deliver to Seller, as the case may be, the amount determined to be due upon such adjustment.

Section 7.05. Purchaser shall have no right to receive any rental insurance proceeds which relate to the period prior to the Closing Date and, if any such proceeds are delivered to Purchaser, Purchaser shall, within five (5) Business Days following receipt thereof, pay the same to Seller.

Section 7.06. If, after the Closing, an error or omission in the calculation of the apportionments set forth above is found by one of the parties, such error or omission shall be promptly corrected and the party receiving the over-payment shall pay the amount of the over- payment to the party entitled thereto. Notwithstanding the provisions of Section 7.07 the foregoing obligation to correct apportionments shall survive the Closing and continue until the expiration of the Survival Period.

Section 7.07. The provisions of this Section 7 shall survive the Closing.

Section 8.01. If, on or prior to the date of the Closing, all or a "material part" (as defined below) of the Improvements shall be damaged or destroyed by fire or other casualty, then, in any such event, Purchaser may, at its option, either (i) terminate this Agreement, whereupon, in accordance with Section 23, the Downpayment shall be returned to Purchaser and the parties hereto shall be released of all obligations and liabilities of whatsoever nature in connection with this Agreement except those that expressly survive termination of this Agreement or (ii) proceed to close the transactions contemplated by

this Agreement, in which event all of the provisions of subsection 8.01(a)(i) and subsection 8.01(a)(ii) below shall apply.

(a) If, on or prior to the date of the Closing, less than a "material part" of the Improvements shall be destroyed or damaged by fire or other casualty, then Purchaser shall nevertheless close title to the Property pursuant to all the terms and conditions of this Agreement (without any adjustment to the Purchase Price except as otherwise set forth herein), subject to the following: (i) Seller shall not (x) adjust and settle any insurance claims, or (y) enter into any construction or other contract for the repair or restoration of the Improvements, without Purchaser's

prior written consent (except no such consent shall be necessary in the event of an emergency or hazardous condition at the Property), which consent shall not be unreasonably withheld, conditioned or delayed, and (ii) at the Closing, Seller shall (1) pay over to Purchaser the amount of any insurance proceeds, to the extent collected by Seller in connection with such casualty, less the amount of the actual and reasonable unreimbursed expenses incurred by Seller in connection with collecting such proceeds and making any repairs to the Improvements occasioned by such casualty pursuant to any contract (provided that such contract was reasonably approved by Purchaser as required by this Section), and (2) assign to Purchaser in form reasonably satisfactory to Purchaser all of Seller's right, title and interest in and

to any insurance proceeds that are uncollected at the time of the Closing and that may be paid in respect of such casualty and also credit Purchaser at Closing for any deductible applicable to such insurance proceeds. Seller shall reasonably cooperate with Purchaser in the collection of such proceeds, which obligation shall survive the Closing.

13

(b) For the purpose of this Section, the phrase a "material part" of an Improvement shall mean a portion of an Improvement such that the cost of repair or restoration thereof is estimated by a reputable contractor selected by Seller and reasonably satisfactory to Purchaser, to be in excess of ten percent (10%) of the Purchase Price.

Section 8.02. The provisions of this Section 8 supersede any law applicable to the Property governing the affect of fire or other casualty in contracts for real property.

Section 9.01. If, prior to the Closing Date, condemnation or eminent domain proceedings shall be commenced by any public authority against the Improvements or any part thereof, Seller shall promptly give Purchaser written notice thereof. After notice of the commencement of any such proceedings (from Seller or otherwise) and in the event that the taking of such property is a material taking (as hereinafter defined), Purchaser shall have the right (i) to accept title to the Property subject to the proceedings, whereupon any award payable to Seller shall be paid to Purchaser and Seller shall deliver to Purchaser at the Closing all assignments and other documents reasonably requested by Purchaser to vest such

award in Purchaser, or (ii) to terminate this Agreement and upon the return of the Downpayment, this Agreement shall be null and void and neither party will have any further obligations hereunder except those that expressly survive termination of this Agreement. A taking shall be deemed to be a "material taking" if the claim for a condemnation award for such taking is estimated by an independent appraiser selected by Seller and reasonably satisfactory to Purchaser to be equal to or in excess of ten percent (10%) of the Purchase Price.

Section 9.02. In the event of a non-material taking of any part of the Improvements, Purchaser shall accept the Property subject to the proceedings and pay to Seller the full Purchase Price, whereupon any award payable to Seller shall be paid to Purchaser and Seller shall deliver to Purchaser at the Closing all assignments and other documents reasonably requested by Purchaser to vest such award in Purchaser.

Section 9.03. The provisions of this Section 9 supersede any law applicable to the Property governing the affect of condemnation in contracts for real property.

Section 10.01. To induce Purchaser to enter into this Agreement and to accept the Property from Seller, Seller makes the following representations and warranties, all of which are true in all material respects as of the date hereof and shall be true in all material respects as of the Closing Date:

14

(a) Subject to Section 22.01 hereof, the execution, delivery and performance of this Agreement and consummation of the transaction hereby contemplated in accordance with the terms of this Agreement will not violate any material contract, agreement, commitment, order, judgment or decree to which Seller is a party or by which Seller or the Property is bound and Seller has, or upon the Closing Date shall have, obtained all consents necessary (whether from a governmental authority or other third party), in order for it to consummate the transactions contemplated hereby.

(b) Seller has the full right, power and authority to bind Seller to this Agreement and to carry out Seller's obligations hereunder and Seller shall have the full right, power and authority to sell and convey its leasehold interest in the Property to Purchaser as provided herein and to take all actions required by this Agreement. The party or parties executing this Agreement on behalf of Seller have been duly authorized and are empowered to bind Seller to this Agreement and to take all actions required by this Agreement.

(c) Upon the full execution and delivery of this Agreement by Seller to Purchaser, this Agreement shall be the valid and binding obligation on Seller, enforceable against Seller in accordance with the terms hereof.

(d) Seller is not a "foreign person" as defined in Section 1445 of the Internal Revenue Code of 1986, as amended (the "Code"), and the income tax regulations thereunder.

(e) Seller is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware and is authorized to conduct business under the laws of the State of New York.

(f) No action, suit or proceeding is pending or, to Seller's knowledge, threatened against Seller which would materially adversely affect Seller's financial condition or its ability to fully perform its obligations pursuant to this Agreement.

(g) The execution and delivery of this Agreement and the performance by Seller of its obligations hereunder do not and will not conflict with or violate any law, rule, judgment, regulation, order, writ, injunction or decree of any court or governmental or quasi- governmental entity with jurisdiction over Seller, including, without limitation, the United States of America, the State of New York or any political subdivision of any of the foregoing, or any decision or ruling of any arbitrator to which Seller is a party or by which Seller is bound or affected.

(h) To Seller's actual knowledge, there are no judgments, orders or decrees of any kind against Seller unpaid or unsatisfied of record, nor any legal action, suit or other legal or administrative proceeding pending before any court or administrative agency which would adversely affect the Property, nor is Seller actually aware of any threatened legal action, suit or other legal or administrative proceeding relating to the Property.

15

(i) Seller has received no written notice that the Property is subject to any special assessments, nor has Seller received written notice of the intention of any governmental authority to impose any such special assessments.

(j) Seller has not granted any right, nor made any offer, to any third party to purchase its leasehold interest in the Property, where such right or offer remains outstanding.

(k) To Seller's actual knowledge, Seller has received no written notice of any violations or claims under or pursuant to any environmental law with respect to the Property.

(l) The IDA Lease is in full force and effect, and to Seller's actual knowledge, Seller has received no written notice of default thereunder from the Agency, nor has Seller delivered any written notice of default thereunder to the Agency.

Section 10.02. All of the representations and warranties of Seller contained in this Agreement shall survive the Closing for the Survival Period, subject, however, to the limitations on Seller's liability set forth in Section 10.03.

Section 10.03. If (a) any of the representations and warranties set forth in Section 10.01 above prove to have been false as of the date hereof or as of the Closing Date (except to the extent such representations and warranties speak as of an earlier date, they shall be true in all material respects as of such earlier date), and (b) Purchaser gives written notice thereof to Seller (a "Purchaser's Loss Notice") promptly but in no event later than the earlier to occur of (i) the Closing Date and the date that is two (2) Business Days after the aggregate amount of the Losses suffered by Purchaser prior to the

Closing Date as a result of such misrepresentation or untrue or inaccurate warranty exceeds the Basket Amount, or (ii) the last day of the Survival Period and the date that is two (2) Business Days after the aggregate amount of the Losses suffered by Purchaser during the Survival Period as a result of such misrepresentation or untrue or inaccurate warranty exceeds the Basket Amount, then Purchaser's remedies with respect to any such Loss or Losses shall be as set forth in Section 15.01(i) hereof. If Purchaser fails to timely deliver a Purchaser's Loss Notice, then Purchaser shall be deemed to have waived any remedy set forth in Section 15.01 or any other remedy provided hereunder or otherwise available with respect to any Loss. It is specifically acknowledged that (1) if any information is (or has been) disclosed to Purchaser (or its attorneys, accountants, consultants or other

professionals) on or prior to the date hereof by Seller (or its attorneys, accountants, consultants or other professionals) (or is the subject of correspondence between Seller and Purchaser) which indicates that a representation or warranty made by Seller in this Agreement is untrue or inaccurate, Seller shall have no liability with respect to such misrepresentation or untrue or inaccurate warranty and Purchaser shall not be entitled to any credit at Closing in connection therewith, and (2) if the Closing occurs, Seller shall have no liability in connection with any representations or warranties which were otherwise known by Purchaser, at Closing, to be untrue or inaccurate.

Section 10.04. Purchaser, for itself and its agents, affiliates, successors and assigns, hereby releases and forever discharges Seller, its employees, agents, affiliates, successors and assigns from any and all rights, claims and demands at law or in equity, whether known or unknown at the time of this Agreement, which Purchaser has or may have in the future, arising out of the physical, environmental, economic or legal condition of the Property, including, without limitation, any claim for indemnification or contribution arising under the Comprehensive Environmental Response, Compensation, and Liability Act (42 U.S.C. Section 9601

et seq.) or any similar federal, state or local statute, rule or ordinance relating to liability of property owners for environmental matters.

16

Section 10.05. The phrase "to Seller's knowledge" is hereby defined as the actual (as opposed to constructive or imputed) knowledge without independent inquiry or investigation of Peter Byrnes, who shall have no personal liability in regards thereto or otherwise in respect of this Agreement.

Section 11.01. Seller shall duly execute, acknowledge and/or deliver or, where applicable, cause the following to be duly executed, acknowledged and/or delivered, to Purchaser on the Closing Date the following:

(a) the Assignment and Assumption of IDA Lease substantially in the form of Exhibit B attached hereto, together with an original of the IDA Lease to the extent same is in Seller's possession;

(b) a title affidavit with respect to the Property as may be reasonably required by the Title Insurer; provided, however, that the matters and liability covered by such title affidavit shall not exceed the matters and liability of Seller with respect to its representations and warranties made under Section 10.01 hereof;

(c) real estate transfer tax forms and returns for the Property;

(d) an affidavit as required pursuant to Section 1445 of the Code substantially in the form of Exhibit E hereto;

(e) any plans with respect to the Improvements on the Property to the extent in Seller's possession or otherwise in Seller's reasonable control;

(f) such other documents, instruments, resolutions and other material with respect to the Property reasonably requested by Purchaser as may be necessary to effect the transfer of title hereunder, or as may be reasonably requested by the Title Insurer;

(g) the Assignment Agreement substantially in the form of Exhibit C attached hereto and made a part hereof, together with original executed counterparts, to the extent originals are in Seller's possession, or, if originals are not in Seller's possession, copies (to the extent that copies are in Seller's possession) of all Leases, Service Contracts, Permits and Licenses, and Warranties, if any;

(h) originals of the Parking Variance;

(i) a resolution of the Agency consenting to the transaction contemplated by this Agreement;

17

(j) a closing statement setting forth all apportionments to be made at Closing pursuant to Section 7 hereof, together with disbursement instructions for payment of the balance of the Purchase Price; and

(k) the Leases as between Purchaser and Seller, in the forms annexed hereto as Exhibits H-1, H-2 and H-3, respectively.

Section 12.01. To induce Seller to enter into this Agreement, Purchaser makes the following representations and warranties, all of which Purchaser represents are true in all material respects as of the date hereof and shall be true in all material respects as of the Closing Date and shall be deemed to be made as of that date.

(a) The execution, delivery and performance of this Agreement and consummation of the transaction hereby contemplated in accordance with the terms of this Agreement will not violate any material contract, agreement, commitment, order, judgment or decree to which Purchaser is a party or by which it is bound, and Purchaser has obtained (or will, by the Closing, have obtained) all consents necessary (whether from a governmental authority or other third party) in order for it to consummate the transactions contemplated hereby.

(b) The party or parties executing this Agreement on behalf of Purchaser have been duly authorized and are empowered to bind Purchaser to this Agreement and to take all actions required by this Agreement.

(c) Upon the full execution and delivery of this Agreement by Purchaser to Seller, this Agreement shall be the binding obligation of Purchaser, enforceable against Purchaser in accordance with the terms hereof.

(d) No action, suit or proceeding is pending or, to Purchaser's knowledge, threatened against Purchaser which would materially adversely affect Purchaser's financial condition or its ability to fully perform its obligations pursuant to this Agreement.

(e) The execution and delivery of this Agreement and the performance by Purchaser of its obligations hereunder do not and will not conflict with or violate any law, rule, judgment, regulation, order, writ, injunction or decree of any court or governmental or quasi- governmental entity with jurisdiction over Purchaser, including, without limitation, the United States of America, the State in which the Property is located or any political subdivision of any of the foregoing, or any decision or ruling of any arbitrator to which Purchaser is a party or by which Purchaser is bound or affected and no consent of

any governmental agency is required.

(f) Purchaser is a limited liability company duly organized, validly existing and in good standing under the laws of the State of New York and is authorized to conduct business under the laws of the State of New York.

All representations and warranties of Purchaser contained in this Agreement shall survive the Closing for the Survival Period.

18

SECTION 13: PURCHASER'S INSTRUMENTS AT CLOSING

Section 13.01. On the Closing Date, Purchaser shall deliver the Purchase Price, as adjusted, to, or as directed by, Seller. Additionally, on the Closing Date, Purchaser shall duly execute, acknowledge and deliver to Seller the following:

(a) the Assignment and Assumption of IDA Lease substantially in the form of Exhibit B attached hereto;

(b) real estate transfer tax forms and returns, if any, for the Property;

(c) the Assignment Agreement in the form of Exhibit C attached hereto;

(d) a closing statement setting forth all apportionments to be made at Closing, together with disbursement instructions for payment of the balance of the Purchase Price;

(e) the Leases as between Purchaser and Seller, in the forms annexed hereto as Exhibits H-1, H-2 and H-3, respectively;

(f) the documents related to the Purchase Money Financing substantially in the forms annexed hereto as Exhibits I-1, I-2, I-3 and I-4, respectively; and

(g) such other documents, instruments, resolutions and other material as may be reasonably necessary to effect the transfer of title hereunder and reasonably requested by Seller or the Title Insurer.

Section 14.01. Intentionally omitted.

Section 14.02. During the Contract Period, Seller shall continue to operate the Property in the same manner as it is currently being operated by Seller, though Seller shall not be obligated to incur any capital expenditures. Seller shall maintain replacement cost casualty insurance throughout the Contract Period. During the Contract Period, Seller shall not, without the written consent of Purchaser (which consent may be granted or withheld in Purchaser's sole discretion), enter into any new Lease or occupancy arrangement for space at the Property.

Section 14.03. During the Contract Period, Seller shall not, without the written consent of Purchaser, amend or modify (other than non-material amendments or modifications) or renew any of the Service Contracts or enter into any new Service Contracts or other agreements relating to the leasehold ownership and operation of the Property; provided, however, that Seller shall terminate all of the Service Contracts (other than those identified on Exhibit F as being non- cancelable or being assumed by Purchaser), which termination shall be effective no later than seventy five (75) days following the Closing

Date.

Section 14.04. During the Contract Period, Seller shall not allow its leasehold interest in the Property to be voluntarily liened, encumbered or transferred in such a manner that Seller may not assign its leasehold interest in the Property as set forth in Section 5 hereof.

19

Section 14.05. During the Contract Period, Seller agrees that it will not (directly or indirectly) offer to sell, or solicit any offers to purchase or negotiate for the sale or disposal of Seller's leasehold interest in the Property or otherwise market or advertise its leasehold interest in the Property for same or disposal with any party other than Purchaser.

Section 14.06. Intentionally omitted.

Section 14.07. Prior to Closing, except if consented to in writing by Seller (which consent shall not be unreasonably withheld, conditioned or delayed), Purchaser shall not communicate with any governmental or quasi-governmental agencies or authorities regarding the Property or any aspect thereof.

Section 14.08. Whenever in this Section 14 Seller is required to obtain Purchaser's approval with respect to any transaction described therein, Purchaser shall, within seven (7) Business Days after receipt of Seller's request therefor, notify Seller of its approval or disapproval of same and, if Purchaser fails to notify Seller of its disapproval within said seven (7) Business Day period, Purchaser shall be deemed to have approved same.

Section 15.01. (a) Purchaser's obligations to close title under this Agreement on the Closing Date shall be subject to the satisfaction of the following conditions precedent on or prior to the Closing Date:

(i) all of Seller's representations and warranties made in this Agreement shall be true and correct in all material respects as of the date hereof and as of the Closing Date (except to the extent such representations and warranties speak as of an earlier date, they shall be true in all material respects as of such earlier date); provided, however, that Purchaser shall be obligated to consummate the Closing without any adjustment in

the Purchase Price if the aggregate amount of Losses resulting from any misrepresentation or untrue or inaccurate warranty made by Seller in this Agreement is equal to or less than $25,000.00 (the "Basket Amount"). If the aggregate amount Losses resulting from any misrepresentation or untrue or inaccurate warranty made by Seller in this Agreement exceeds the Basket Amount, Purchaser shall be entitled to recover such Losses in excess of the Basket Amount from Seller at Closing by means of an adjustment or credit to the Purchase Price, or after Closing, as applicable, in accordance with any Purchaser's Loss Notice delivered in accordance with Section 10.03 hereof; provided, however, that in no event shall Seller's liability hereunder, and Purchaser's credit on account thereof,

exceed $250,000.00 (the "Maximum Credit Amount"). If the aggregate amount of any credits which Purchaser would otherwise be entitled to receive pursuant to this Section 15.01(a) exceeds the Maximum Credit Amount, then Purchaser shall have the right to terminate this Agreement and receive the return of the Downpayment (in which event neither party shall have any obligations or liabilities hereunder except those that expressly survive termination of this Agreement); provided, however, that Purchaser shall not be permitted to terminate this Agreement if Seller elects (it being acknowledged that Seller shall have the right but not the obligation to make such election) to grant a credit to Purchaser at Closing in the aggregate amount by which the

Losses exceeds the Basket Amount. In the event that there is a dispute as to whether Purchaser has incurred any Loss or Losses as a result of any misrepresentation or untrue or inaccurate warranty made by Seller in this Agreement, then, unless the aggregate amount thereof exceeds the Maximum Credit Amount, the Closing shall occur without adjustment regarding same; provided, however, that a portion of the Purchase Price equal to the disputed amount (up to the Maximum Credit Amount) shall be held in escrow by the Escrow Agent pending resolution of the dispute.

20

(ii) Seller shall have performed, in all material respects, all obligations and agreements undertaken by it herein to be performed on or prior to the Closing Date.

(iii) Seller obtaining, at Seller's sole cost and expense, the Parking Variance.

(b) Seller's obligations to close title under this Agreement on the Closing Date shall be subject to the satisfaction of the following conditions precedent on the Closing Date:

(i) all of Purchaser's representations and warranties made in this Agreement shall be true and correct in all respects as of the Closing Date as if they were made on that date;

(ii) Purchaser shall have timely paid to Seller or its designee(s) the Purchase Price and any other amounts required to be paid by Purchaser hereunder; and

(iii) Purchaser shall have performed, in all material respects, all other obligations and agreements undertaken by it herein to be performed on or prior to the Closing Date.

Section 16.01. At the Closing, Seller shall pay or credit to Purchaser an amount equal to any and all applicable taxes imposed by the State of New York or any other municipality or governmental authority, with respect to in connection with the conveyance of Seller's leasehold interest in the Property to Purchaser.

Section 16.02. Purchaser shall pay for (a) any and all costs and expenses associated with its due diligence, including any searches performed by the Title Insurer, (b) all costs and expenses of its legal counsel, advisors and other professionals employed by it in connection with the transfer of the Property, (c) premiums for Purchaser's and any lender's title insurance policy and all reasonably requested endorsements thereto, (d) a current survey or any update of any existing survey of the Property, (e) all costs and expenses incurred in connection with any financing obtained by Purchaser, including without limitation, mortgage recording taxes, financing costs and lender's title insurance premiums (provided,

however, Purchaser shall not be required to pay lender's legal fees in connection with the purchase money financing set forth in Section 30.01), (f) any recording fees for documentation to be recorded in connection with the transactions contemplated by this Agreement.

21

Section 16.03. The provisions of this Section 16 shall survive the Closing.

Section 17.01. All notices, requests and demands to be made hereunder to the parties hereto shall be in writing (at the addresses set forth below) and shall be given by any of the following means: (a) personal delivery (including, without limitation, overnight delivery, courier or messenger services) or (b) registered or certified, first-class United States mail, postage prepaid, return receipt requested. Notice by a party's counsel shall be deemed to be notice by such party. All notices to Seller shall be sent to the address set forth below. Such addresses may be changed by notice to the other parties given in the same manner as provided above. Any notice, demand or request sent (x) pursuant to subsection

(a) shall be deemed received upon such personal delivery, and (y) pursuant to subsection (b) shall be deemed received three (3) days following deposit in the mail.

| If to Purchaser: |

REP 80 Arkay Drive, LLC

c/o Rechler Equity Partners

225 Broadhollow Road

Melville, New York 11747

Attention: Gregg Rechler

|

| With copies to: |

Lazer, Aptheker, Rosella & Yedid, P.C.

225 Old County Road

Melville, New York 11747

Attention: Matthew C. Lamstein, Esq.

|

| To Seller: |

Standard Microsystems Corporation

80 Arkay Drive

Hauppauge, New York 11788

Attention: Walter Siegel, Esq.

|

| With copies to: |

Standard Microsystems Corporation

80 Arkay Drive

Hauppauge, New York 11788

Attention: Peter Byrnes

|

|

Standard Microsystems Corporation

80 Arkay Drive

Hauppauge, New York 11788

Attention: Kris Sennesael

|

|

|

Moritt Hock & Hamroff, LLP

400 Garden City Plaza

Garden City, New York 11530

Attention: Gary C. Hisiger, Esq

|

22

SECTION 18: DEFAULT

Section 18.01. Purchaser's Default. If Purchaser shall (a) default in the payment of the Purchase Price or if Purchaser shall default in the performance of any of its other obligations to be performed on the Closing Date or (b) default in the performance of any of its material obligations to be performed prior to the Closing Date and, with respect to any default under this clause (b) only, such default shall not be cured on or prior to the date that is five (5) Business Days after written notice to Purchaser, Purchaser's attorney and Escrow Agent, then Seller shall have the right to treat this

Agreement as having been breached by Purchaser and Seller's sole and exclusive remedy on account of such breach shall be the right to terminate this Agreement by written notice to Purchaser or Purchaser's attorney. Upon such termination (i) Purchaser shall forfeit all rights and claims with respect to the Property pursuant to this Agreement and to the Downpayment and (ii) Escrow Agent shall promptly remit the Downpayment to Seller as Seller's sole and exclusive remedy for a default by Purchaser; and thereupon neither party shall have any obligations or liabilities hereunder except those that expressly survive termination of this Agreement. Seller and Purchaser hereby agree that payment of the Downpayment to Seller shall be deemed to be fair and adequate, but not excessive, liquidated damages (and not a penalty) based upon the following considerations which Seller and Purchaser agree

would constitute damages to Seller for any default by Purchaser but which are impossible to quantify, to wit: (A) the removal of Seller's leasehold interest in the Property from the real estate market together with the uncertainty of obtaining a new purchaser at the same or greater purchase price; (B) the expenses incurred by Seller, including (but not by way of limitation) attorneys' fees, taxes, mortgage interest, and other items incidental to the maintenance of the Property until it is eventually sold; and (C) all other expenses incurred by Seller as a result of Purchaser's default. Notwithstanding the foregoing the Downpayment is not intended to cap amounts, if any, due Seller in respect of any indemnification from Purchaser that survives termination of or Closing under this Agreement, including without limitation Purchaser's indemnity under Sections 4 and 26 of this Agreement. In

the event of such termination, Purchaser shall immediately destroy or return to Seller for cancellation all due diligence materials, reports and studies delivered to Purchaser by Seller or any broker, agent, representative or employee of Seller (without Purchaser retaining copies thereof).

Section 18.02. Seller's Default. In the event Purchaser discovers, prior to the Closing Date, that (a) any of the representations and warranties set forth in Section 10.01 hereof are false as of the date hereof and Purchaser has the right to terminate this Agreement pursuant to Section 15.01(i) hereof, or (b) Seller shall default in the performance of any of its material obligations to be performed on or prior to the Closing Date, and such default shall not be cured on or prior to the earlier to occur of the date that is five (5) Business Days after written notice to Seller,

Seller's attorney and Escrow Agent or the Closing Date, then Purchaser's sole and exclusive remedy by reason thereof (in lieu of prosecuting an action for damages or proceeding with any other legal or equitable course of conduct, the right to bring such actions or proceedings being expressly and voluntarily waived by Purchaser, to the extent legally permissible, following and upon advice of its counsel) shall be to terminate this Agreement and receive the Downpayment. If, however, Seller is able to convey title to the Property to Purchaser pursuant to the terms hereof but Seller intentionally and willfully fails to do so, then Purchaser may either (1) terminate this Agreement and receive the Downpayment together with Purchaser's Transaction Costs (as hereinafter defined), or (2) seek to obtain specific

performance of Seller's obligations hereunder, provided that any action for specific performance shall be commenced within thirty (30) days after such default; it being understood and agreed that if Purchaser fails to commence an action for specific performance within thirty (30) days after such default, then this Agreement shall automatically terminate, effective as of the day immediately following such thirty-day period, and thereupon the Downpayment shall be returned to Purchaser together with Purchaser's Transaction Costs, and the parties hereto shall be released of all obligations and liabilities of whatsoever nature in connection with this Agreement except those that expressly survive termination of this Agreement. For purposes of this Section 18.02, "Transaction Costs" shall mean Purchaser's reasonable and actual costs and expenses associated with this Agreement and Purchaser's

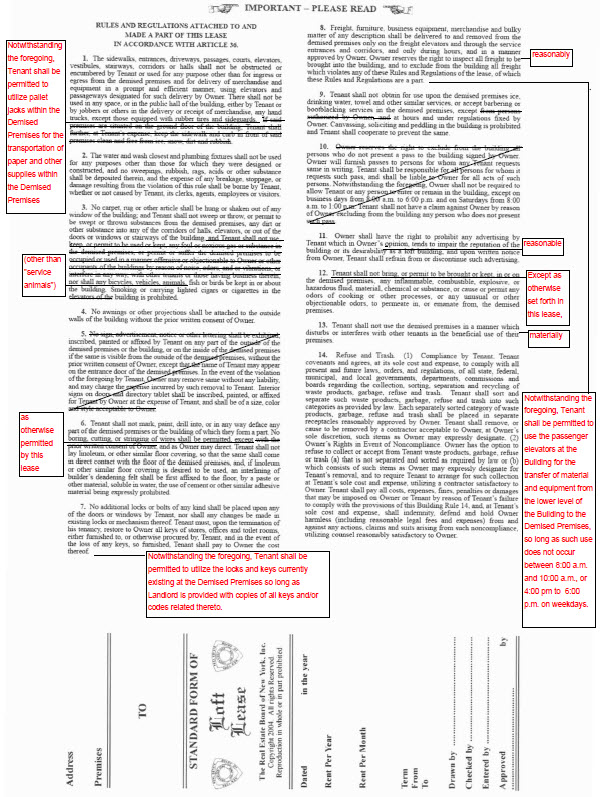

anticipated acquisition of Seller's leasehold interest in the Property including without limitation, Purchaser's reasonable counsel fees and costs, title expenses, survey costs, and other costs and expenses associated with Purchaser's due diligence, including without limitation, legal, financial and accounting due diligence, Purchaser's structural inspection of the Property and Purchaser's environmental assessment of the Property; notwithstanding the foregoing, in no event shall Purchaser's Transaction Costs exceed $250,000.00. If Purchaser elects to seek specific performance of this Agreement, then as a condition precedent to any suit for specific performance, Purchaser shall on or before the Closing Date, time being of the essence, fully perform all of its obligations hereunder which are capable of being performed (other than the payment of the Purchase Price, which shall be paid as