Attached files

As filed with the Securities and Exchange Commission on August 17, 2011

Registration No. 333-175572

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

(AMENDMENT NO. 1)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

XFONE, INC.

(Exact name of Registrant as specified in its charter)

|

Nevada

|

|

(State or other jurisdiction

of incorporation)

|

| 4899 |

|

(Primary Standard Industrial

Classification Code Number)

|

|

11-3618510

|

|

(I.R.S. Employer

Identification No.)

|

5307 W. Loop 289

Lubbock, Texas 79414

Telephone number: (806) 771-5212

__________________________________________________________

__________________________________________________________

(Address, including zip code, and telephone number, including area code,

of Registrant’s principal executive offices)

InCorp Services, Inc.

2360 Corporate Circle, Suite 400

Henderson, NV 89074-7722, USA

Telephone number: (702) 866-2500

________________________________________________

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies of all correspondence to:

Gersten Savage LLP

Arthur S. Marcus, Esq.

David A. Latimer, Esq.

600 Lexington Avenue

New York, NY 10022-6018

Telephone number: (212) 752-9700

Facsimile number: (212) 980-5192

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box: þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer (Do not check if smaller reporting company) o

|

Smaller reporting companyþ

|

|

CALCULATION OF REGISTRATION FEE

|

||||||||||||

|

Title of Each Class of

Securities to be Registered (1)

|

Amount to be

Registered

|

Proposed

Maximum

Offering Price

per Share

|

Proposed

Maximum

Aggregate

Offering Price

|

Amount of

Registration Fee

|

||||||||

|

common stock, par value $0.001 per share

|

21,119,488

|

$

|

0.30

|

$

|

6,335,846.40 (2)

|

$

|

735.59 (3)

|

|||||

|

rights to purchase common stock, par value $0.001 per share (3)

|

21,119,488

|

N/A

|

N/A

|

$ |

0.00 (4)

|

|||||||

|

(1)

|

This registration statement relates to shares of our common stock, par value $0.001 per share, deliverable upon the exercise of the subscription rights.

|

|

(2)

|

Represents the gross proceeds from the sale of shares of our common stock assuming the exercise of all non-transferable subscription rights to be distributed and additional oversubscriptions up to the maximum amount contemplated in this registration statement.

|

|

(3)

|

Evidencing the rights to subscribe for 21,119,488 shares of common stock, par value $0.001 per share.

|

|

(4)

|

The rights are being issued for no consideration. Pursuant to Rule 457(g)(3) under the Securities Act of 1933, as amended, no separate registration fee is payable.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the U.S. Securities and Exchange Commission (the “SEC” or “Commission”), acting pursuant to said Section 8(a), may determine.

-1-

|

The information in this Prospectus is not complete and may be amended. These securities may not be sold until the Registration Statement filed with the U.S. Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

SUBJECT TO COMPLETION, DATED AUGUST 17, 2011

PRELIMINARY PROSPECTUS

Up to

21,119,488 Shares of common stock Issuable Upon Exercise of Rights to Subscribe for Such Shares at $0.30 per Share

We are distributing, at no charge, to holders of shares of our common stock non-transferable and non-tradable subscription rights to purchase up to 21,119,488 shares of our common stock, par value $0.001 per share. We refer to this offering as the “Rights Offering”. In this Rights Offering, you will receive one subscription right for every one share of common stock owned at 5:00 p.m., New York time (midnight, Israel time), on ______, 2011, the “Record Date”.

Each whole subscription right will entitle you to purchase one share of our common stock at a subscription price of $0.30 per share (the “Subscription Price”), which we refer to as the “Basic Subscription Privilege”. The per share subscription price was determined by our board of directors after taking in consideration the factors described below under the “Determination Of Subscription Price” section beginning on page 21 of this Prospectus. We will not issue fractional shares of common stock in the Rights Offering, and holders will only be entitled to purchase a whole number of shares of common stock, rounded up to the nearest whole number a holder would otherwise be entitled to purchase. We understand that some members of the Tel Aviv Stock Exchange Ltd., which we refer to as the “TASE”, may record fractional securities for the accounts of their clients pursuant to their internal policies.

If you fully exercise your Basic Subscription Privilege and other shareholders do not fully exercise their Basic Subscription Privileges, you may also exercise an “Oversubscription Privilege” to purchase on a pro rata basis a portion of the unsubscribed shares at the same subscription price of $0.30 per share, subject to certain limitations as more fully described below. To the extent you exercise your Oversubscription Privilege for an amount of shares that exceeds the number of the unsubscribed shares available to you, any excess subscription payment received by the U.S. Subscription Agent will be returned promptly, without interest or penalty. If all of the rights are exercised, the total purchase price of the shares offered in the Rights Offering would be $6,335,846. The net proceeds to the Company, after deducting offering expenses of $199,027, would be $6,136,819.

If you choose not to exercise your subscription rights you can still retain your current number of shares of common stock of the Company. However, the percentage of the shares of common stock of the Company that you own will decrease and your voting rights and other rights will be diluted if and to the extent that other shareholders exercise their subscription rights. For more information see “DILUTION” beginning on page 22 of this Prospectus.

This is not an underwritten offering. The shares of common stock are being offered directly by us without the services of an underwriter or selling agent. We are not entering into any standby purchase agreement or similar agreement with respect to the purchase of any shares of our common stock not subscribed for through the Basic Subscription Privilege or the Oversubscription Privilege. Therefore, there is no certainty that any shares will be purchased pursuant to the Rights Offering and there is no minimum purchase requirement as a condition to accepting subscriptions.

The subscription rights will expire void and worthless if they are not exercised by 5:00 p.m., New York time (midnight, Israel time), on ______, 2011 unless we extend the Rights Offering period. If you hold your rights through an Israeli brokerage company that holds the rights through our Israeli Nominee Company (Mizrahi Tefahot Nominee Company Ltd.), you must notify your Israeli brokerage company of your election to exercise your rights on or before ________, 2011, at such time (Israel time) as determined by the applicable Israeli brokerage company. The last date for clients of TASE members to deliver their exercise instructions to their respective nominees will be ________, 2011. Any rights not exercised at or before ________, 2011 will expire without any payment to the holders for those unexercised rights.

The issuance of our shares of common stock purchased in the Rights Offering will be made by ________, 2011. The U.S Subscription Agent will mail certificates representing the shares of common stock purchased in the Rights Offering to record holders registered on our shareholder register maintained by it promptly after such date. Beneficial owners of our shares of common stock whose shares are held by a nominee, such as a broker, dealer, bank, trustee or depository (including Mizrahi Tefahot Nominee Company Ltd.), rather than in their own name, will have any shares of common stock acquired in the Rights Offering credited to the account of such nominee on such date. Our Board of Directors reserves the right to change the Subscription Price prior to the effective date of this Prospectus, or to terminate the Rights Offering at any time, for any reason. If the Rights Offering is terminated, all subscription payments received by the U.S. Subscription Agent will be returned promptly, without interest or penalty.

Our shares of common stock are traded on the NYSE Amex LLC (the “Amex”) and the TASE under the symbol “XFN”. As of August 15, 2011, the closing price of our shares of common stock was $0.71 (Amex) / NIS 2.45 (TASE). We urge you to obtain a current market price for the shares of our common stock before making any determination with respect to the exercise of your rights. The TASE has informed us that it will reduce the opening price of our shares of common stock on the trading day following the Record Date, to reflect the imputed economic benefit of the subscription rights at such time. No such adjustment will be effected by the Amex.

Exercising the rights and investing in our shares of common stock involves a high degree of risk. We urge you to read carefully this Prospectus, and the “Risk Factors” section beginning on page 14 of this Prospectus, and all other information included or incorporated herein by reference in this Prospectus in its entirety before you decide whether to exercise your rights.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this Prospectus is ________, 2011

-2-

TABLE OF CONTENTS

The following table of contents has been designed to help you find information contained in this Prospectus. We encourage you to read the entire Prospectus.

|

Page

|

|

|

PART I:

|

|

| 4 | |

| 10 | |

| 14 | |

| 14 | |

| 21 | |

| 21 | |

| 22 | |

| 22 | |

| 23 | |

| 31 | |

| 33 | |

| 35 | |

| 35 | |

| 37 | |

| 37 | |

| 49 | |

| 52 | |

| 53 | |

| 53 | |

| 54 | |

| 54 | |

| 54 | |

|

PART II:

|

|

| 56 | |

| 59 | |

| 60 |

-3-

QUESTIONS AND ANSWERS RELATED TO THE RIGHTS OFFERING

The following are examples of what we anticipate may be common questions about the Rights Offering. The answers are based mostly on selected information from this Prospectus. The following questions and answers do not contain all of the information that may be important to you and may not address all of the questions that you may have about the Rights Offering. This Prospectus contains more detailed descriptions of the terms and conditions of the Rights Offering and provides additional information about us and our business, including potential risks relating to the Rights Offering, our business, and our shares of common stock.

Exercising the rights and investing in our securities involves a high degree of risk. We urge you to carefully read the section entitled “Risk Factors” beginning on page 14 of this Prospectus and all other information included or incorporated by reference in this Prospectus in its entirety before you decide whether to exercise your rights.

Q: What is a Rights Offering?

A: A Rights Offering is a distribution of subscription rights on a pro rata basis to all shareholders of a company to buy a proportional number of additional securities at a given price. We are distributing to holders of shares of our common stock as of 5:00 p.m., New York time (midnight, Israel time), on ______, 2011 (the “Record Date”), at no charge, non-transferable and non-tradable subscription rights to purchase shares of our common stock. You will receive one subscription right for every share of our common stock you own on the Record Date. Each subscription right carries with it a basic subscription privilege and an oversubscription privilege (see below). The subscription rights will be evidenced by subscription rights certificates which may be physical certificates and/or electronic instruments issued through the facilities of the Depository Trust Company (the “DTC”) in the United States, and the Tel Aviv Stock Exchange Clearing House (the “TASE Clearing House”) in Israel.

Q: Why are we engaging in a Rights Offering and how will we use the proceeds from the Rights Offering?

A: The purpose of this Rights Offering is to raise equity capital in a cost-effective manner that allows all shareholders to participate and maintain their proportional ownership interest in the Company. The net proceeds from the Rights Offering will be used for general corporate purposes, including, but not limited to, capital expenditures and working capital.

Q: What will be the proceeds of the Rights Offering?

A: If we sell all the shares being offered, we will receive gross proceeds of approximately $6,335,846. We are offering shares in the Rights Offering with no minimum purchase requirement and with no standby commitment. As a result, there is no assurance that we will be able to sell all or any of the shares being offered. We also reserve the right to limit the exercise of rights by certain shareholders in order to protect against an unexpected “ownership change” for federal income tax purposes. This may affect our ability to receive gross proceeds of up to $6,335,846 in the Rights Offering.

Q: What is the basic subscription privilege?

A: A basic subscription privilege is a right to purchase one (1) share of our common stock at a subscription price of $0.30 per share for each share of common stock owned on the Record Date. A holder may exercise any number of his/her/its rights. For example, if you own 1,000 shares of our common stock on the Record Date, then you will have the right to purchase between 1 to 1,000 shares of our common stock at an aggregate price of $0.30 to $300.00, respectively. We will not issue fractional shares of common stock in the Rights Offering, and holders will only be entitled to purchase a whole number of shares of common stock, rounded up to the nearest whole number a holder would otherwise be entitled to purchase. We understand that some TASE members may record fractional securities for the accounts of their clients pursuant to their internal policies.

-4-

If you are a beneficial owner that holds your shares of common stock through a broker, dealer, bank, trustee, depository or other nominee (including Mizrahi Tefahot Nominee Company Ltd.) who uses the services of the DTC or the TASE Clearing House (each, a “Nominee”), then DTC or the TASE Clearing House, as the case may be, will credit the account of the Nominee with one (1) right for every one (1) share of common stock you own on the Record Date. Shares of common stock held through a Nominee are referred to as shares which are held in “street name”.

Q: What is the oversubscription privilege?

A: We do not expect that all of our shareholders will exercise all of their basic subscription privilege. If you fully exercise your basic subscription privilege, the oversubscription privilege entitles you to subscribe on a pro rata basis for additional shares of our common stock unclaimed by other holders of rights in this offering at the same subscription price per share. “Pro rata” means in proportion to the aggregate number of shares of our common stock that all subscription rights holders who have requested to purchase pursuant to their respective oversubscription privileges. For example, if X shareholder subscribes for 20 shares and Y shareholder subscribes for 30 shares pursuant to their oversubscription privileges, and there are only 30 shares available for oversubscription, X would receive the right to purchase 20/50 of the 30 shares available for oversubscription and Y would receive the right to purchase 30/50 of the 30 shares available for oversubscription. Payments in respect of the oversubscription privilege are due at the time payment is made for the basic subscription privilege. Any excess Subscription Price payments will be returned, without interest or deduction, promptly after the expiration date of the Rights Offering.

No holder can own, as a result of the exercise of his/her/its basic subscription privilege or the oversubscription privilege a number of shares of our common stock which would result in such holder owning, as of the consummation of the Rights Offering, in excess of 30% of our shares of common stock, on a fully-diluted basis. The U.S. Subscription Agent (as defined below) will return any excess payments by mail without interest or deduction promptly after the expiration of the subscription period.

We will not issue fractional shares of common stock in the Rights Offering, and holders will only be entitled to purchase a whole number of shares of common stock, rounded up to the nearest whole number a holder would otherwise be entitled to purchase. We understand that some TASE members may record fractional shares for the accounts of their clients pursuant to their internal policies.

Q: Who will receive subscription rights?

A: Holders of shares of our common stock will receive one non-transferable and non-tradable subscription right for each share of common stock owned by him/her as of the Record Date.

Q: May shareholders in all states participate in the Rights Offering?

A: Although we intend to distribute the rights to all shareholders, we reserve the right in some states to require shareholders, if they wish to participate, to state and agree upon exercise of their respective rights that they are acquiring the shares for investment purposes only, and that they have no present intention to resell or transfer any shares acquired. Our securities are not being offered in any jurisdiction where the offer is not permitted under applicable local laws.

Q: Am I required to subscribe in the Rights Offering?

A: No. You may exercise any number of your subscription rights, or you may choose not to exercise subscription rights at all.

Q: What happens if I choose not to exercise my subscription rights?

A: If you choose not to exercise your subscription rights you can still retain your current number of shares of common stock of the Company. However, the percentage of the shares of common stock of the Company that you own will decrease and your voting rights and other rights will be diluted if and to the extent that other shareholders exercise their subscription rights. For more information see “DILUTION” beginning on page 22 of this Prospectus.

Q: May I transfer or trade my subscription rights if I do not want to purchase any shares?

A: No. The rights are non-transferable. Should you choose not to exercise your rights, you may not sell, give away or otherwise transfer your rights except by operation of law, for example, upon the death of the holder. The rights are also non-tradable. There will be no “trading day” on the Amex or the TASE (or any other stock market) for the subscription rights.

-5-

Q: How can I transfer the shares of common stock I purchase in the Rights Offering between the AMEX and the TASE?

A: If your shares of common stock are listed on the Amex or the TASE on the Record Date, then the shares of common stock that you acquire in the Rights Offering will be listed on the same stock exchange. At the request of your Nominee made to the DTC or the TASE Clearing House, as applicable, any shares of common stock can be readily transferred between the Amex and the TASE by way of the DTC account of the TASE Clearing House.

Q: How do I exercise my subscription rights?

A: As soon as practicable after the Record Date we will send a subscription rights certificate to each holder of our shares of common stock that on the Record Date is registered in our shareholder register maintained by Transfer Online, Inc., the U.S. transfer agent of our shares of common stock, which is also acting as the U.S. Subscription Agent for the Rights Offering (the “U.S. Subscription Agent”). The subscription rights certificate will evidence the number of rights issued to each holder and will be accompanied by a copy of this Prospectus.

If you are a registered shareholder, you may exercise your subscription rights by properly completing and executing your subscription rights certificate and delivering it, together with the full Subscription Price for each share of common stock you subscribe for, to the U.S. Subscription Agent on or prior to the expiration date.

If you choose to exercise your oversubscription privilege, as well as your basic subscription privilege, you must: (i) indicate that on the back side of your subscription rights certificate; and (ii) make payment in respect of the oversubscription privilege at the same time payment is made for the basic subscription privilege.

If you use the mail, we recommend that you use insured, registered mail, return receipt requested. If you cannot deliver your subscription rights certificate to the U.S. Subscription Agent on time, you may follow the guaranteed delivery procedures described under “The Rights Offering - Guaranteed Delivery Procedures” beginning on page 28 of this Prospectus.

If you are a beneficial owner of our shares of common stock and hold them through a Nominee rather than in your own name, we will ask such Nominee to notify you of the Rights Offering. To indicate your decision, you should complete and return to your Nominee the form entitled “Beneficial Owner Election Form” sufficiently in advance of the expiration of the subscription period in order to ensure timely delivery of a subscription rights certificate reflecting your exercise of the basic subscription privilege and the oversubscription privilege. Clients of TASE Clearing House members must deliver their completed subscription rights certificates to the applicable member by ________, 2011, or at the time determined by the applicable member. See also “The Rights Offering- Subscription by Beneficial Owners” and “The Rights Offering- Procedures Applicable to Holders of Shares Through our Israeli Nominee Company” beginning on page 25 of this Prospectus.

Q: To whom should I send my forms and payment?

A: If your shares are held by your Nominee, then you should send your subscription documents, subscription rights certificate and payment to that Nominee. If you are a registered holder, then you should send your subscription documents, subscription rights certificate and payment by hand delivery, first class mail or courier service to the U.S. Subscription Agent for the Rights Offering. The address for delivery to the U.S. Subscription Agent is as follows:

-6-

Delivery by Hand/Mail/Overnight Courier to:

Attn: Mr. Mark Knight

Transfer Online, Inc.

512 SE Salmon Street

Portland, OR 97214, USA

(503) 227-2950

Your delivery other than in the manner or to the address listed above will not constitute valid delivery.

If you are a record holder that resides in Israel, rather than exercising via the U.S. Subscription Agent, you may, at your option, exercise your subscription rights by delivering your executed subscription rights certificate to our offices in Israel, accompanied by evidence of a wire transfer or a bank check drawn on a bank located in Israel payable to Xfone, Inc. Payment to us may be denominated in U.S. dollars or in NIS, at the representative rate of exchange most recently published by the Bank of Israel at the time of payment. The subscription rights certificate, together with full payment of the Subscription Price, must be received by us on or prior to the expiration date of the Rights Offering.

If you are a client of a TASE member, please see “The Rights Offering- Procedures Applicable to Holders of Shares Through our Israeli Nominee Company” beginning on page 25 of this Prospectus.

Please note that payment in respect of the oversubscription privilege is due at the same time payment is made for the basic subscription privilege.

Q: After I exercise my rights, can I change my mind and cancel or change my purchase?

A: No. Once you exercise and send in your subscription rights certificate and payment you cannot revoke or change the exercise of your subscription rights, even if you later learn information about the Company that you consider to be materially unfavorable and even if the market price of our shares of common stock falls below the Subscription Price. You should not exercise your subscription rights unless you are certain that you wish to purchase additional shares of our common stock at a price of $0.30 per share. Any rights not exercised at or before the expiration date of the Rights Offering will expire as worthless without any payment to the holders for those unexercised rights. See “The Rights Offering - No Revocation or Change” beginning on page 24 of this Prospectus.

Q: Are there any conditions to my right to exercise my subscription rights?

A: Yes. The Rights Offering is subject to certain limited conditions. Please see “The Rights Offering - Conditions to the Rights Offering” beginning on page 24 of this Prospectus.

Q: If I exercise my subscription rights, when will I receive the shares of common stock that I purchased in the Rights Offering?

A: We will issue the shares of our common stock purchased in the Rights Offering by our registered shareholders by ______, 2011, after the expiration date of the Rights Offering and after allocation of all oversubscription privileges and adjustments have been completed. Beneficial owners of our shares of common stock whose shares are held by their Nominee, rather than in their own name, will have any shares of common stock acquired in the Rights Offering credited to the account of such Nominee on such date.

Q: Will the shares that I receive upon exercise of my rights be tradable on the Amex or the TASE?

A: Our shares of common stock are listed on the Amex and the TASE under the symbol “XFN”. The underlying shares to be issued in the Rights Offering will also be listed for trading on the Amex and the TASE. Such underlying shares issued to “Affiliates” of the Company will bear an appropriate restricted legend.

Q: Will I be charged a sales commission or a fee if I exercise my subscription rights?

A: We will not charge a brokerage commission to rights holders for exercising their subscription rights. However, if you exercise your subscription rights through a Nominee, you will be responsible for any fees charged by your Nominee.

-7-

Q: What are the material United States Federal income tax consequences of receiving or exercising my subscription rights?

A: A holder should not recognize income or loss for United States Federal income tax purposes in connection with the receipt or exercise of subscription rights in the Rights Offering. For a detailed discussion, see the “Material United States Federal Income Tax Consequences” section beginning on page 31 of this Prospectus. You should consult your tax advisor as to the particular consequences of the Rights Offering to you.

Q: What are the material Israeli income tax consequences of receiving or exercising my subscription rights?

A: An Israeli holder will likely not recognize any income, gain or loss for Israeli income tax purposes in connection with the receipt or exercise of the subscription rights. However, no tax ruling from the Israeli Income Tax Authority will be sought for the Rights Offering. See “Certain Israeli Income Tax Consequences” beginning on page 33 of this Prospectus. You should consult your tax advisor as to the particular consequences of the Rights Offering to you.

Q: Is exercising my subscription rights risky?

A: The exercise of your subscription rights involves a high degree of risk. Exercising your rights means buying additional shares of our common stock and should be considered as carefully as you would consider any other equity investment. Among other things, you should carefully consider the risks described under the “Risk Factors” section of this Prospectus and all other information included in this Prospectus before deciding to exercise your subscription rights.

Q: Has the Board of Directors made a recommendation regarding the Rights Offering?

A: Neither we, nor our Board of Directors, the U.S. Subscription Agent, our Israeli Nominee Company, Mizrahi Tefahot Nominee Company Ltd. (the “Israeli Nominee Company”) or the Information Agent is making any recommendation as to whether or not you should exercise your subscription rights. You are urged to make your decision based on your own assessment of our business and the Rights Offering, after considering all of the information herein, including the “Risk Factors” section of this Prospectus.

Q: May the Officers, Directors and Significant Shareholders of the Company participate in the Rights Offering?

A: Our Officers, Directors and greater than 5% beneficial shareholders may participate in the Rights Offering, but none of them are obligated to so participate. Such shares issued to “Affiliates” of the Company will be issued with the appropriate restrictive legends and will be subject to the “short swing profit” provisions of Section 16 the Securities and Exchange Act of 1934, as amended.

Q: Does the Company need to achieve a certain participation level in order to complete the Rights Offering?

A: No. We may choose to consummate the Rights Offering regardless of the number of shares actually purchased.

Q: When will the Rights Offering expire?

A: The subscription rights will expire and have no value if they are not exercised prior to 5:00 p.m., New York City time (midnight, Israel time), on _______, 2011, unless we decide to extend the Rights Offering expiration date until a later time. See “The Rights Offering - Expiration of the Rights Offering and Extensions, Amendments and Termination” beginning on page 24 of this Prospectus. The U.S. Subscription Agent must actually receive all required documents and payments before the expiration date.

If you hold your rights through an Israeli brokerage company that holds the rights through our Israeli Nominee Company, you must notify your Israeli brokerage company of your election to exercise your rights on or before ______, 2011, at such time (Israel time) as determined by the applicable Israeli brokerage company. The related payment will be collected from the clients of TASE members and will be transferred to the Company on ______, 2011. Any rights not exercised at or before ______, 2011 will expire without any payment to the holders for those unexercised rights. See “The Rights Offering - Expiration of the Rights Offering and Extensions, Amendments and Termination” beginning on page 24 of this Prospectus.

If you hold your shares through a Nominee, you will be required to comply with the procedural requirements of such Nominee, including the procedures relating to the last time by which you may be required to provide notice of your intention to exercise your rights. For further information see “The Rights Offering-Subscription by Beneficial Owners” and “The Rights Offering-Procedures Applicable to Holders of Shares Through our Israeli Nominee Company” beginning on page 25 of this Prospectus.

If you do not timely exercise your rights in accordance with the procedures applicable to you, your ability to exercise the rights and purchase the shares of common stock will expire and you will lose your rights under the Rights Offering.

-8-

Q: How many shares will be outstanding after the Rights Offering?

A: The number of shares of common stock that will be outstanding after the Rights Offering will depend on the number of shares that are purchased in the Rights Offering. If we sell all of the shares being offered, then we will issue additional 21,119,488 shares of common stock. In that case, we will have 42,238,976 shares of common stock outstanding after the Rights Offering. This would represent an increase of 100% in the number of outstanding shares of common stock. However, we do not expect that all of the subscription rights will be exercised.

Q. How will this Rights Offering affect the price of our shares on the Amex and the TASE?

A. You should not assume or expect that after the completion of the Rights Offering our shares of common stock will trade at or above the Subscription Price in any given time period. The market price of our shares of common stock may decline during or after the Rights Offering, and you may not be able to sell the shares purchased in the Rights Offering at a price equal to or higher than the Subscription Price.

Amex will not reduce the opening price of our shares of common stock at the opening of trading on the Amex Ex-day, which is the first day that our shares of common stock will trade on Amex without entitlement to receive the rights . The Amex Ex-day for the Rights Offering will be the first trading day on Amex following the Record Date.

The TASE will reduce the opening price of our shares of common stock at the opening of trading on the TASE Ex-day, which is the first day that our shares of common stock will trade on the TASE without entitlement to receive the ri ghts. The TASE Ex-day for the Rights Offering will be the first trading day on the TASE following the Record Date.

Q: How was the Subscription Price established?

A: Our Board of Directors determined that the Subscription Price should be designed to, among other things, provide an incentive to our current shareholders to exercise their rights. Other factors considered in setting the Subscription Price included the amount of proceeds desired, our need for equity capital, alternatives available to us for raising equity capital, the historic and current market price and liquidity of our shares of common stock, the pricing of similar transactions, the historic volatility of the market price of our shares of common stock, the historic trading volume of our shares of common stock, our business prospects, our recent and anticipated operating results and general conditions in the securities market. The Subscription Price does not necessarily bear any relationship to the book value of our assets, net worth, past operations, cash flows, losses, financial condition, or any other established criteria for valuing the Company. You should not consider the Subscription Price as an indication of the value of the Company or our shares of common stock.

Q: Can the Board of Directors terminate, amend, or extend the Rights Offering?

A: Yes. We have the option to extend the Rights Offering and the period for exercising your subscription rights, although we do not presently intend to do so. Our Board of Directors may terminate or amend the Rights Offering at any time and for any reason. If our Board of Directors terminates, amends or extends the Rights Offering, we will issue a press release notifying our shareholders of the termination, and any money received from subscribing shareholders will be promptly returned, without interest or deduction. If we terminate the Rights Offering, the adjustment made by the TASE to the opening price of our shares of common stock at the opening of trading on the TASE Ex-day (which is the first day that our shares of common stock will trade on the TASE without entitlement to receive the rights) will not be reversed. Our Board of Directors / Special Committee reserve the right to amend or modify the terms of the Rights Offering, including the Subscription Price, at any time prior to the effective date of this Prospectus. See “The Rights Offering - Expiration of the Rights Offering and Extensions, Amendments and Termination” beginning on page 24 of this Prospectus.

Q: What if I have other questions?

A: If you have other questions about the Rights Offering, please contact our Information Agent, Institutional Marketing Services (IMS), by telephone at (203) 972-9200 or, if you are located in Israel, you may also contact Alon Reisser, our General Counsel and Secretary, at 08-6229583, during their respective normal business hours.

FOR A MORE COMPLETE DESCRIPTION OF THE RIGHTS OFFERING, SEE “THE RIGHTS OFFERING” BEGINNING ON PAGE 23 OF THIS PROSPECTUS.

-9-

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus contains forward-looking statements and information relating to our business that are based on our beliefs as well as assumptions made by us or based upon information currently available to us. These statements reflect our current views and assumptions with respect to future events and are subject to risks and uncertainties. No forward-looking statement can be guaranteed, and actual results may vary materially from those anticipated in any forward-looking statement. Forward-looking statements are often identified by words like: “believe,” “expect,” “estimate,” “anticipate,” “intend,” “project” and similar expressions or words which, by their nature, refer to future events. In some cases, you can also identify forward-looking statements by terminology such as “may,” “will,” “should,” “plans,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” beginning on page 14 of this Prospectus, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In addition, you are directed to factors discussed in the “Management’s Discussion and Analysis of Financial Condition and Results of Operation” section incorporated herein by reference, and the section entitled “Description of Business” beginning on page 41 of this Prospectus, as well as those discussed elsewhere in this Prospectus.

The aforementioned factors do not represent an all-inclusive list. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained in this Prospectus. In particular, this Prospectus sets forth important factors that could cause actual results to differ materially from our forward-looking statements. These and other factors, including general economic factors, business strategies, the state of capital markets, regulatory conditions, and other factors not currently known to us, may be significant, now or in the future, and the factors set forth in this Prospectus may affect us to a greater extent than indicated. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth in this Prospectus and in other documents that we have filed with the U.S. Securities and Exchange Commission including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

These forward-looking statements speak only as of the date of this Prospectus. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, or achievements. Except as required by applicable law, including the securities laws of the United States, we expressly disclaim any obligation or undertaking to disseminate any update or revisions of any of the forward-looking statements to reflect any change in our expectations with regard thereto or to conform these statements to actual results.

We prepare our financial statements in United States dollars and in accordance with generally accepted accounting principles as applied in the United States, referred to as U.S. GAAP. In this Prospectus, references to “$” and “dollars” are to United States dollars and references to “NIS” and “shekels” are to New Israeli Shekels.

-10-

PROSPECTUS SUMMARY

You should read the following summary together with the more detailed information elsewhere in this Prospectus, including the section entitled “Risks Factors”, regarding us and the shares of common stock being offered for sale by means of this Prospectus.

As used in this Prospectus, references to “the Company”, “we”, “our”, “ours” and “us” refer to Xfone, Inc. and its consolidated subsidiaries, unless otherwise indicated. References to “Xfone” refer to Xfone, Inc. In addition, references to our “financial statements” are to our consolidated financial statements except as the context otherwise requires.

About us

Xfone was incorporated in the State of Nevada, U.S.A. in September 2000. We are a holding and managing company providing, through our subsidiaries, integrated communications services which include voice, video and data over our Fiber-To-The-Premise (“FTTP”) and other networks. We used to have operations in Israel and the United Kingdom. Our Board of Directors made a strategic decision to concentrate our operations in the U.S.; accordingly, in the summer of 2010 we disposed of our U.K. and Israeli operations. We currently have operations in Texas, Mississippi and Louisiana and we also serve customers in Arizona, Colorado, Kansas, New Mexico, and Oklahoma.

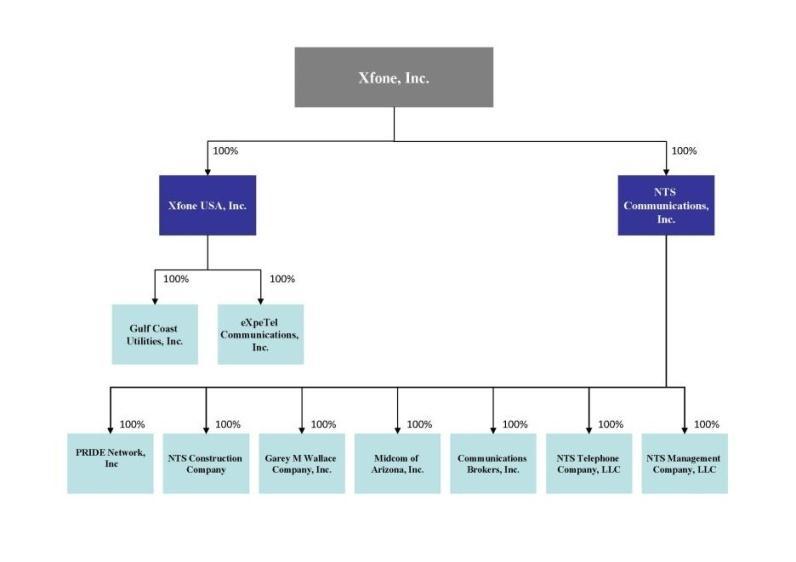

Following the sale of our U.K. and Israeli operations, we have two wholly owned subsidiaries in the United States. These subsidiaries, and their consolidated subsidiaries, are shown in the following diagram.

-11-

Where you can find us

Our principal executive offices are located at 5307 W. Loop 289, Lubbock, Texas 79414 and our telephone number is (806) 771-5212.

Our offices in Israel are located at 11 Rabbi Akiva Street, Modi'in Illit, 71919 and our telephone number there is + 972 08-6229582.

Our corporate website

For our corporate website please visit www.xfone.com. Our website is not part of this Prospectus.

Summary of the Offering

|

The following summary describes the principal terms of the Rights Offering, but is not intended to be complete. See the information in the section entitled “The Rights Offering” beginning on page 23 in this Prospectus for a more detailed description of the terms and conditions of the Rights Offering.

|

|

Rights Granted

|

We will distribute to each shareholder of record on the Record Date, at no charge, one non-transferable and non-tradable subscription right for each share of our common stock then owned. The rights will be evidenced by subscription rights certificates. If and to the extent that our shareholders exercise their right to purchase our shares of common stock we will issue up to 21,119,488 shares and receive gross proceeds of up to $6,335,846 in the Rights Offering.

|

|

|

Basic Subscription Privilege

|

Each basic subscription privilege will entitle the holder to purchase one (1) share of our common stock for the Subscription Price, which shall be paid in immediately available funds.

|

|

|

Oversubscription Privilege

|

We do not expect that all of our shareholders will exercise all of their basic subscription privileges. If you fully exercise your basic subscription privilege, the oversubscription privilege entitles you to subscribe on a pro rata basis for additional shares of our common stock unclaimed by other holders of rights in this offering at the same subscription price per share. “Pro rata” means in proportion to the aggregate number of shares of our common stock that all subscription rights holders who have requested to purchase pursuant to their respective oversubscription privileges. No holder can own, as a result of the exercise of his/her/its basic subscription privileges or the oversubscription privileges, a number of shares of our common stock which would result in such holder owning, as of the consummation of the Rights Offering, in excess of 30% of our shares of common stock, on a fully-diluted basis. The U.S. Subscription Agent will return any excess payments by mail without interest or deduction promptly after the expiration of the subscription period.

|

|

|

Subscription Price

|

$0.30 per share, which shall be paid in immediately available funds.

|

|

|

Record Date

|

5:00 p.m., New York time (midnight, Israel time), on ________, 2011

|

|

|

Commencement Date of Subscription Period.

|

After 5:00 p.m., New York City time (midnight, Israel time) on ________, 2011

|

|

|

Expiration Date of Subscription Period

|

5:00 p.m., New York City time (midnight, Israel time), on ________, 2011, subject to extension or earlier termination. If you hold your rights through an Israeli brokerage company that holds the rights through our Israeli Nominee Company (Mizrahi Tefahot Nominee Company Ltd.), you must notify your Israeli brokerage company of your election to exercise your rights on or before ________, 2011 at such time (Israel time) as determined by the applicable Israeli brokerage company. Any rights not exercised at or before ________ ,2011 will have no value and expire without any payment to the holders for those unexercised rights. | |

|

Non-Transferability of Rights

|

The subscription rights are not transferable, other than by operation of law.

|

|

|

Non-Tradability of Rights

|

The subscription rights are not tradable. There will be no “trading day” on the Amex or the TASE (or any other stock market) for the subscription rights.

|

|

|

Amendment, Extension and Termination

|

We may extend the expiration date at any time. We may amend or modify the terms of the Rights Offering. We also reserve the right to terminate the Rights Offering at any time prior to the expiration date for any reason, in which event all funds received in connection with the Rights Offering will be returned without interest or deduction to those persons who exercised their subscription rights. If the Rights Offering is terminated, all rights will expire without value and we will promptly arrange for the refund, without interest or deduction, of all funds received from holders of subscription rights. Any termination of the Rights Offering will be followed as promptly as practicable by a public announcement. If our Board of Directors terminates the Rights Offering, the adjustment made by the TASE to the opening price of our shares of common stock at the opening of trading on the TASE Ex-day (which is the first day that our shares of common stock will trade on the TASE without entitlement to receive the rights) will not be reversed.

|

|

-12-

|

Fractional Shares

|

We will not issue fractional shares, but rather will round up the aggregate number of shares of common stock you are entitled to receive to the nearest whole number. With respect to shares of our common stock registered on our shareholder register maintained by our U.S. transfer agent, Transfer Online, Inc., including those held in the name of DTC (other than those held for the account of the TASE Clearing House), such rounding will be made with respect to each record and beneficial shareholder. With respect to our shares of common stock held for the account of the TASE Clearing House or in the name of the Israeli Nominee Company (Mizrahi Tefahot Nominee Company Ltd.), such rounding will be made with respect to each nominee rather than each beneficial shareholder. We understand that some TASE members may record fractional securities for the accounts of their clients pursuant to their internal policies.

|

|

|

Procedure for Exercising Rights by Record Holders

|

You may exercise your subscription rights by properly completing and executing your subscription rights certificate and delivering it, together with the Subscription Price for each share of common stock for which you subscribe, to the U.S. Subscription Agent on or prior to the expiration date.

If you use the mail, we recommend that you use insured, registered mail, return receipt requested. If you cannot deliver your subscription rights certificate to the U.S. Subscription Agent on time, you may follow the guaranteed delivery procedures described under “The Rights Offering - Guaranteed Delivery Procedures” beginning on page 24 of this Prospectus.

If you are a record holder that resides in Israel, rather than exercising via the U.S. Subscription Agent, you may, at your option, exercise your subscription rights by delivering your executed subscription rights certificate to our offices in Israel, accompanied by evidence of a wire transfer or a bank check drawn on a bank located in Israel payable to the Company. Payment to us may be denominated in U.S. dollars or in NIS, at the representative rate of exchange most recently published by the Bank of Israel at the time of payment.

|

|

|

Procedure for Exercising Rights by Beneficial Holders

|

If you are a beneficial owner who holds our shares of common stock in street name through a Nominee, we will ask your Nominee to notify you of the Rights Offering. If you wish to exercise your rights, you will need to have your Nominee act for you. To indicate your decision, you should complete and return to your Nominee the form entitled “Beneficial Owners Election Form”. You should receive this form from your Nominee with the other Rights Offering materials. You should contact your Nominee if you believe you are entitled to participate in the Rights Offering but you have not received this form. For more information see “The Rights Offering - Subscription by Beneficial Owners” beginning on page 25 of this Prospectus.

If you hold your rights through an Israeli brokerage company that holds the rights through our Israeli Nominee Company (Mizrahi Tefahot Nominee Company Ltd.), you must notify your Israeli brokerage company of your election to exercise your rights on or before__________, 2011 at such time (Israel time) as determined by the applicable Israeli brokerage company. The related payment will be collected from the clients of TASE members and will be transferred to the Company on ______________, 2011. For more information see “The Rights Offering - Procedures Applicable to Holders of Shares Through our Israeli Nominee Company” beginning on page 25 of this Prospectus.

|

|

|

No Revocation

|

Once you submit the subscription rights certificate to exercise any subscription rights, you may not revoke or change your exercise or request a refund of monies paid. All exercises of rights are irrevocable, even if you subsequently learn information about us that you consider to be materially unfavorable.

|

|

|

Payment Adjustments

|

If you send a payment that is insufficient to purchase the number of shares requested, or if the number of shares requested is not specified in the subscription rights certificate, the payment received will be applied to exercise your subscription rights to the extent of the payment. If the payment exceeds the amount necessary for the full exercise of your subscription rights, including any oversubscription rights exercised and permitted, the excess will be returned to you as soon as practicable. You will not receive interest or a deduction on any payments refunded to you under the Rights Offering.

|

|

|

Dilution & Certain Anti-Dilution Rights and Adjustments

|

If you choose not to exercise your subscription rights you can still retain your current number of shares of common stock, however, the percentage of the shares of common stock that you own will decrease and your voting rights and other rights will be diluted if and to the extent that other shareholders exercise their subscription rights.

In conjunction with the Rights Offering, the Company will amend and/or adjust the terms of certain current warrants and options and/or issue additional warrants and options to provide the holders of such warrants and options with equal fair value after the Rights Offering as they had prior to the Rights Offering.

For more information see “DILUTION” beginning on page 22 of this Prospectus.

|

|

|

Material United States Federal Income Tax Consequences

|

A holder will not recognize income or loss for United States Federal income tax purposes in connection with the receipt or exercise of subscription rights in the Rights Offering. For a detailed discussion, see “Material United States Federal Income Tax Consequences” beginning on page 31 of this Prospectus. You should consult your tax advisor as to the particular consequences of the Rights Offering to you.

|

|

|

Material Israeli Income Tax Consequences

|

An Israeli holder will likely not recognize any income, gain or loss for Israeli income tax purposes in connection with the receipt or exercise of the subscription rights. However, no tax ruling from the Israeli Income Tax Authority will be sought for the Rights Offering. See “Certain Israeli Income Tax Consequences” beginning on page 33 of this Prospectus. You should consult your tax advisor as to the particular consequences of the Rights Offering to you.

|

|

|

Issuance of Shares of our Common Stock

|

We will issue the shares of common stock purchased in the Rights Offering by ___________, 2011

|

|

|

Conditions

|

See “The Rights Offering - Conditions to the Rights Offering” beginning on page 24 of this Prospectus.

|

|

|

No Recommendation to Rights Holders

|

An investment in shares of our common stock must be made according to your evaluation of our business and the Rights Offering and after considering all of the information herein, including the “Risk Factors” section of this Prospectus. Neither we nor our Board of Directors, U.S. Subscription Agent, Israeli Nominee Company or Information Agent are making any recommendation regarding whether you should exercise your subscription rights.

|

|

|

Use of Proceeds

|

The net proceeds from this Rights Offering are expected to be used for our working capital needs. In the event that we do not obtain all or a portion of the maximum proceeds from this Rights Offering, we may need to obtain additional financing.

|

-13-

|

U.S. Subscription Agent

|

The U.S. Subscription Agent's main role is to send this Prospectus and the ancillary offering documents to our shareholders who are eligible to participate in the Rights Offering and to collect all of the completed subscription rights certificates and related payments from such shareholders.

The U.S. Subscription Agent for the Rights Offering is our transfer agent , Transfer Online, Inc.

|

|

|

Israeli Nominee Company

|

The Israeli Nominee Company’s main role is to send this Prospectus and the ancillary offering documents to the TASE Clearing House and to collect all of the completed subscription rights certificates and related payments from the TASE Clearing House. For information regarding the process after delivery to the TASE Clearing House, see “The Rights Offering - Procedures Applicable to Holders of Shares Through Our Israeli Nominee Company” beginning on page 25 of this Prospectus.

The Israeli Nominee Company for the Rights Offering is Mizrahi Tefahot Nominee Company Ltd. (Mizrahi Tefahot Hevra Le-Rishumim B.M.)

|

|

|

Information Agent

|

The Information Agent's main role is to answer any shareholders questions and provide further information about the Rights Offering.

The Information Agent for the Right Offering is Institutional Marketing Services (IMS)

|

|

|

Amex and TASE trading symbol

|

Shares of our common stock are currently listed for quotation on Amex and TASE under the symbol “XFN”, and any shares issued to you in connection with the Rights Offering will be eligible for trading on the Amex and the TASE. If such shares are issued to “Affiliates” of the Company they will bear the appropriate restricted legends.

|

RISK FACTORS

Investing in our securities involves a high degree of risk. You should carefully consider the specific risks described below and any risks described in our other filings with the SEC, pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) before making an investment decision. See the section entitled “Where You Can Get More Information” beginning on page 54 of this Prospectus. Any of the risks we describe below or in the information incorporated herein by reference could cause our business, financial condition, results of operations or future prospects to be materially adversely affected. Our business strategy involves significant risks and could result in operating losses. The market price of our shares of common stock could decline if one or more of these risks and uncertainties develop into actual events and you could lose all or part of your investment. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition, results of operations or future prospects. Some of the statements in this section of the Prospectus are forward-looking statements. For more information about forward-looking statements, please see the section entitled “Cautionary Note Regarding Forward-Looking Statements” beginning on page 10 of this Prospectus.

An investment in our securities involves a high degree of risk. We cannot assure prospective investors that we will continue operations or make a profit in the future. No purchase of common stock should be made by any person who cannot afford a total loss of his or her investment.

In addition to the other information provided in this Prospectus, you should carefully consider the following risk factors in evaluating our business before purchasing any Common Stock. You should also consider similar information contained in any other document filed by us with the SEC after the date of this Prospectus before deciding to invest in our securities. If required, we will include in any prospectus supplement a description of those significant factors that could make the offering described therein speculative or risky.

-14-

RISKS RELATED TO OUR BUSINESS

While we act according to our licenses in the United States, if we do not comply with and continue to follow the terms of such licenses and the relevant laws and regulations, we could lose our licenses to conduct our businesses.

Not complying with, or indeed violating the conditions of our licenses and the related laws and regulations could lead to the loss of or material changes to, our licenses which could have a material adverse effect on our operations. Without such licenses we would not be able to provide any licensed services, resulting in a loss of revenues. Violations of our licenses in the U.S. could also lead to monetary penalties.

We are subject to extensive regulation in the United States which may lead us to incur increased business costs and have negative effects upon our business including revenues and potential profitability.

Regulatory changes pertaining to future regulatory classification of Internet related telephone services, otherwise known as VOIP telephony, may lead to burdensome regulatory requirements and fees, as well as additional interconnection fees to carriers and changes in access charges, universal service, and regulatory fee payments, which would affect our international and long distance services related costs and may have a material impact upon our ability to conduct business, as well as upon our revenues.

If our telecommunications infrastructure or equipment is damaged or inoperative, we may not be able to provide service to our customers.

We rely on our telecommunications equipment, including, but not limited to our switchboard and switches, to provide services to our customers. In the event that such equipment is not able to provide the services for which it is then used, we may not be able to provide services to our customers. While we have back-up for much of this equipment, if any portion of the equipment is unavailable for any extended period of time, it will be difficult to provide service to our customers, might give rise to the ability of our customers to terminate agreements with us, and would generally have a detrimental effect on retaining our customers. In addition, if we are unable to provide service, our customers in the U.S. could lose access to 911 and would not be able to access health and safety services in an emergency. This could result in potential liability for claims of property damage, personal injury, and death because a customer could not contact emergency health and safety services. This also might give rise to the ability of our customers to terminate agreements with us, and would generally have a detrimental effect on retaining our customers.

If our suppliers' telecommunications infrastructure is damaged, it could increase our expenses and we may not be able to provide service to our customers.

We rely on certain suppliers' telecommunications infrastructure in order to provide services to our customers. If their ability to supply such services to us is damaged in any way, we may be required to incur additional costs to replace such services and we may not be able to provide service to our customers.

If our information and billing systems are unable to function properly as our operations grow, we may experience system disruptions, reduced levels of customer service and a declining customer base and revenues.

Over the past years, our business operational systems handle many hundreds of thousands of transactions on a daily basis with our customers and with our interconnected networks. Accordingly, our back-office, transmission, switching, information and billing systems are under increasing stress. We use both internally developed and acquired systems to operate our services and for transaction processing, including billing and collections processing. We must continually improve all of our systems in order to meet increased usage. Furthermore, in the future, in addition to adding many thousands of new customers we may add features and functionality to our products and services using internally developed or third party licensed technologies. Our inability to add software and hardware or develop and upgrade existing technology, transaction processing systems and network infrastructure to meet increased volume through our processing systems or provide new features or functionality, may cause system disruptions, slower response times, reductions in levels of customer service, decreased quality of the user's experience, collection difficulties, delays in reporting accurate financial information, and a declining customer base, revenues and gross margin.

We serve an extremely large number of customers/users and are thus at risk for class action law suits.

Because we provide services to so many customers/users, it is possible that such customers / users may join together in a large or expensive class action to initiate an action. There is currently no class action lawsuit threatened or filed against us, however, class action lawsuits have become much more popular in the United States where we have our operations.

In connection with the sale of our former Israeli subsidiary, Xfone 018 Ltd., we undertook the full and exclusive liability for any and all amounts, payments or expenses which will be incurred by Xfone 018 as a result of a certain request to approve a claim as a class action which was filed in Israel by Eliezer Tzur and others, and is described under the “Legal Proceedings” section of our Quarterly Report on Form 10-Q for the quarter ended June 30 , 2011 filed with the SEC on August 15 , 2011 and incorporated herein by reference.

-15-

Terrorist attacks, war, or armed conflict or political economic events or upheavals may lead to a disruption in our services as well as decreased demand.

Terrorist attacks in the United States, as well as the United States involvement in Iraq and Afghanistan may negatively impact consumers' confidence in relying on alternative communication lines. Certain of our key employees, officers and directors are residents of Israel. Accordingly, armed conflicts between Israel and its neighbors, terrorism, political and economic conditions in Israel directly affect the Company's business. Any such occurrences could lead to an interruption in our services and could negatively affect our revenues and results of operations.

Natural disasters and acts of G.od may result in increased costs.

Our wholly owned subsidiary Xfone USA, Inc. is positioned in an environment which has a higher than average propensity to experience hurricanes. In 2005, we suffered adverse affects to our business from Hurricane Katrina. Additionally, our headquarters and those of our wholly owned subsidiaries NTS Communications, Inc. and Xfone USA, Inc. are located in Lubbock, Texas, which is a location where tornadoes are frequent. In the event of another hurricane, or tornado, the cost of rebuilding our facilities, as well as the time spent in rebuilding and organizing our infrastructure might be long and costly. There is no guarantee that we will not be negatively affected in the future by hurricanes, tornadoes, or other natural disasters or acts of G.od.

If we are unable to obtain financing as we grow our business, we may have to curtail our plans and the value of your investment may be negatively affected.

Our future business will involve substantial costs, primarily those costs associated with capital expenses associated with network deployment and upgrades, marketing, business development, and possible mergers and acquisitions. If our revenues are insufficient to fund our operations as we grow our business, we may need traditional bank financing or financing from debt or equity offerings such as this offering. However, if we are unable to obtain financing when needed, we may be forced to curtail our operations, which could negatively affect our revenues and potential profitability and the value of your investment. There can be no assurance that we will be able to obtain additional financing when needed or if available that it will be on commercially reasonable terms.

Should our agreements with our principal supplier, AT&T Inc., be cancelled, our operations will be negatively impacted.

We are dependent on AT&T Inc. which is our principal supplier. AT&T Inc. is required to provide us with services according to applicable regulations and its licenses to operate as a telecommunications provider in the United States. Should our agreements involving our principal supplier be cancelled, our operations may be negatively impacted.

We may be unable to adequately compete with our competitors.

The telecommunications business is very competitive. Our competitors may be able to adapt more quickly to changes in customer needs or to devote greater resources than we can to developing and expanding our services. Such competitors could also attempt to increase their presence in our markets by forming strategic alliances with other competitors, by offering new or improved products or services or by increasing their efforts to gain and retain market share through competitive pricing. Companies which currently view our services as complementary to their own (such as mobile network operators) may decide, where the regulatory regime permits, to change this policy and bar their customers from accessing our services or charge their customers a premium to access our services. As the market for our services matures, price competition and penetration into the market is likely to intensify. Such competition may adversely affect our gross profits, margins and results of operations. There can be no assurance that we will be able to continue to compete successfully with existing or new competitors.

Our management decisions are made by our President, Chief Executive Officer and Director, Guy Nissenson, and our Treasurer, Chief Financial Officer, Principal Accounting Officer and Director, Niv Krikov; if we lose their services, our operations will be negatively impacted.

The future success of our business is largely dependent upon the expertise of our President, Chief Executive Officer and Director, Guy Nissenson, and our Treasurer, Chief Financial Officer, Principal Accounting Officer and Director, Niv Krikov. Because Messrs. Nissenson and Krikov are essential to our operations, you must rely on their management decisions. We have not obtained any “key man” life insurance relating to Messrs. Nissenson or Krikov. There is no assurance that we would be able to hire and retain another President/Chief Executive Officer or Treasurer/Chief Financial Officer/ Principal Accounting Officer with comparable expertise. As a result, the loss of either Mr. Nissenson's or Mr. Krikov’s services could have a materially adverse affect upon our business, financial condition, and results of operation.

-16-

We are adversely affected by the devaluation of the U.S. Dollar against the New Israeli Shekel and could be adversely affected by the rate of inflation in Israel.

All of our revenues are generated in U.S. dollars. Substantially all of our long-term debt is incurred in NIS. As a result, inflation in Israel and/or the devaluation of the U.S. dollar in relation to the NIS has and may continue to have the effect of increasing the cost in U.S. dollars of financing expenses; hence, our U.S. dollar-measured results of operations are and may continue to be adversely affected. Because exchange rates between the NIS and the U.S. dollar fluctuate continuously, exchange rate fluctuations have an impact on our profitability and period-to-period comparisons of our results of operations.

Certain of our loans facilities contain a number of restrictions and obligations that may limit our financial flexibility.

Certain of our loans contain a number of restrictive covenants that limit our financial flexibility. These covenants, among other things, restrict our right to pledge our assets, make loans or give guarantees, and engage in mergers or consolidations. Our ability to continue to comply with these and other obligations depends in part on the future performance of our business. There can be no assurance that such obligations will not have a materially adverse affect on our ability to finance our future operations.

RISKS RELATED TO OUR SHARES OF COMMON STOCK

There is a limited market for our common stock, and an active trading market for our common stock may never develop, which may make it difficult to resell your shares.

Trading in our stock has been limited and has been characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. Therefore, shareholders should be aware that the lack of exposure to our stock in the investment community could consequently be reflected by a lack of market trading upon the issuance of material information that could he perceived as disappointing or very encouraging from a market point of view. This could result in an inability for shareholders to be able to dispose of their shares.

Our shares of common stock are traded on more than one market and this may result in price variations.

Our shares of common stock are currently traded on the Amex, and the TASE. Trading in our shares of common stock on these markets takes place in different currencies (dollars on the Amex, and NIS on the TASE), and at different times (resulting from different time zones, different trading days and different public holidays in the United States and Israel). The trading prices of our shares of common stock on these two markets may differ due to these and other factors. Any decrease in the trading price of our shares of common stock on one of these markets could cause a decrease in the trading price of our shares of common stock on the other market.

Future sales of our shares in the public market or issuances of additional securities could cause the market price for our shares of common stock to fall.

As of August 15 , 2011, we had 21,119,488 shares of Common Stock issued and outstanding. In addition, we have reserved 5,489,595 shares of common stock for issuance under our 2004 Stock Option Plan, 7,930,500 shares of common stock for issuance under our 2007 Stock Incentive Plan, and 4,068,474 Shares of Common Stock underlying warrants. If a large number of shares of our common stock is sold in a short period, the price of our shares of common stock would likely decrease.

RISKS RELATED TO OUR NON-CONVERTIBLE BONDS

If we are unable to make the principal or interest payments on our Bonds (as defined below) our business will be materially adversely affected.

On December 13, 2007, we issued non-convertible bonds to Israeli institutional investors, for total gross proceeds of NIS 100,382,100 (approximately $25,562,032, based on the exchange rate as of December 13, 2007). The non-convertible bonds accrue annual interest that is paid semi-annually on the 1st of June and on the 1st of December of every year from 2008 until 2015 (inclusive). The principal of the non-convertible bonds is repaid in eight equal annual payments on the 1st of December of every year from 2008 until 2015 (inclusive). The principal and interest of the non-convertible bonds are linked to the Israeli Consumer Price Index. The non-convertible bonds currently carry an interest rate of 8%. As of June 30, 2011 we had approximately $21,043,071 in principal and interest payments due on the non-convertible bonds over the next five years. If we are unable to make the principal or interest payments on the non-convertible bonds when due, then our business will be materially adversely affected.

-17-

We are a holding and managing company and our ability to meet our obligations under our non-convertible bonds largely depends upon the financial condition and indebtedness of our operating subsidiaries.

We are a holding and managing company with no significant assets other than our interest in our subsidiaries. Therefore, our ability to make interest and principal payments on our non-convertible bonds largely depends upon the future performance and the cash flow of our operating subsidiaries. In addition, our non-convertible bonds are structurally subordinated to the indebtedness of our subsidiaries.

We may not be able to make our debt payments in the future.