Attached files

Table of Contents

As filed with the Securities and Exchange Commission on August 16, 2011

Registration No. 333-173154

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 6

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Insys Therapeutics, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware |

2834 |

51-0327886 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

10220 South 51st Street, Suite 2

Phoenix, AZ 85044-5231

(602) 910-2617

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Michael L. Babich

President and Chief Executive Officer

Insys Therapeutics, Inc.

10220 South 51st Street, Suite 2

Phoenix, AZ 85044-5231

(602) 910-2617

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| Matthew T. Browne, Esq. Charles S. Kim, Esq. Sean M. Clayton, Esq. Cooley LLP 4401 Eastgate Mall San Diego, CA 92121 (858) 550-6000 |

Cheston J. Larson, Esq. Divakar Gupta, Esq. Matthew T. Bush, Esq. Latham & Watkins LLP 12636 High Bluff Drive, Suite 400 San Diego, CA 92130 (858) 523-5400 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer |

x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each class of securities to be registered | Proposed maximum aggregate |

Amount of registration fee | ||

| Common Stock, $0.0002145 par value per share |

$55,000,000 | $6,386(2) | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act. Includes the offering price of shares that the underwriters have the option to purchase to cover over-allotments, if any. |

| (2) | Previously paid. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

| PROSPECTUS | SUBJECT TO COMPLETION, DATED AUGUST 16, 2011 |

Shares

Common Stock

This is an initial public offering of Insys Therapeutics, Inc. We are offering shares of common stock. We currently estimate that the initial public offering price of our common stock will be between $ and $ per share.

We have filed an application for our common stock to be listed on the Nasdaq Global Market under the symbol “INRX.”

Investing in our common stock involves risk. See “Risk Factors” beginning on page 11.

| Per Share | Total | |||||||

| Initial price to public |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds, before expenses, to Insys Therapeutics, Inc. |

$ | $ | ||||||

We have granted to the underwriters an option to purchase up to additional shares of common stock to cover over-allotments, if any, exercisable at any time until 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about , 2011.

| Wells Fargo Securities | JMP Securities |

Oppenheimer & Co.

Prospectus dated , 2011.

Table of Contents

| Page | ||||

| 1 | ||||

| 11 | ||||

| 50 | ||||

| 52 | ||||

| 52 | ||||

| 53 | ||||

| 55 | ||||

| Unaudited Pro Forma Condensed Consolidated Financial Information |

57 | |||

| 64 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

66 | |||

| 86 | ||||

| 115 | ||||

| 122 | ||||

| 145 | ||||

| 151 | ||||

| 153 | ||||

| 157 | ||||

| Material U.S. Federal Income Tax Consequences to Non-U.S. Holders of Our Common Stock |

159 | |||

| 163 | ||||

| 169 | ||||

| 169 | ||||

| 169 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus and in any free writing prospectus that we may provide to you in connection with this offering. Neither we nor any of the underwriters has authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or any such free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor any of the underwriters is making an offer to sell or seeking offers to buy these securities in any jurisdiction where or to any person to whom the offer or sale is not permitted. The information in this prospectus is accurate only as of the date on the front cover of this prospectus and the information in any free writing prospectus that we may provide you in connection with this offering is accurate only as of the date of that free writing prospectus. Our business, financial condition, results of operations and future growth prospects may have changed since those dates.

For investors outside the United States: neither we nor any of the underwriters has done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside of the United States.

i

Table of Contents

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, especially “Risk Factors” and our financial statements and the notes to these financial statements, before deciding to buy shares of our common stock.

Overview

We are a specialty pharmaceutical company that develops and seeks to commercialize innovative pharmaceutical products that target the unmet needs of cancer patients, with an initial focus on cancer-supportive care. We have assembled a product pipeline targeting cancer-supportive care and cancer therapy that we believe can be developed cost efficiently and, if approved, commercialized through a targeted commercial organization. Our supportive care product candidates include Subsys, a proprietary, fast-acting sublingual fentanyl spray for the treatment of breakthrough cancer pain, or BTCP, and our family of dronabinol product candidates for the treatment of chemotherapy-induced nausea and vomiting, or CINV, and appetite stimulation in AIDS patients. Subsys and our generic Dronabinol SG Capsule product candidates are both under review for marketing approval by the U.S. Food and Drug Administration, or FDA. We are also developing proprietary cancer therapeutics, the most advanced of which is LEP-ETU, an improved formulation of paclitaxel, the active ingredient in the cancer drugs Taxol and Abraxane.

We focus our research and development efforts on product candidates that utilize innovative formulations to address the clinical shortcomings of existing commercial pharmaceutical products. We intend to build a capital-efficient commercial organization to market Subsys and our other proprietary products, if approved. We expect to utilize an incentive-based sales model similar to that employed by Sciele Pharma, Inc. and other companies previously led by members of our board, including our founder and Executive Chairman.

The National Cancer Institute estimates that as of January 1, 2008, there were approximately 12.0 million people in the United States who had been previously diagnosed or were living with cancer. Debilitating side effects and symptoms such as pain, nausea and vomiting are prevalent in cancer patients and generally are caused by their disease as well as the radiation or chemotherapy treatment regimens intended to eradicate or inhibit the progression of the cancer. These side effects, among others, can impact a patient’s quality of life and ability to tolerate cancer treatment regimens. We believe effective supportive care is an important component in the treatment of cancer that is not adequately addressed by existing marketed therapies. By focusing on supportive care products, we believe we can contribute to the improvement of cancer patient outcomes and survival rates.

We are led by a management team and board of directors with substantial experience founding and managing pharmaceutical and related companies. Our founder and Executive Chairman, Dr. John N. Kapoor, has held executive management and board positions at Sciele Pharma and OptionCare, Inc., among others. Dr. Kapoor has also had significant experience with cancer-supportive care products, including Marinol, while he was Chairman of Unimed Pharmaceuticals, Inc. Our President and Chief Executive Officer, Michael L. Babich, has board and management experience at Alliant Pharmaceuticals, Inc. and EJ Financial Enterprises, Inc. Our Director of Scientific Development, Dr. Daniel D. Von Hoff, is a renowned oncologist and a founder of ILEX Oncology, Inc. Dr. Von Hoff previously led the development of several approved cancer and cancer-supportive care therapies including drugs such as Campath, Camptosar and Clofarabine. Our Chief Medical Officer, Dr. Larry Dillaha, previously served as the Chief Medical Officer of Sciele Pharma. We intend to leverage the

1

Table of Contents

experience of our management team to build Insys into a leading specialty pharmaceutical company focused on commercializing innovative therapies that address unmet medical needs of cancer patients.

Our Product Candidates

The following table summarizes certain information regarding our most advanced product candidates:

| Franchise |

Product Candidate |

Regulatory Pathway |

Indication |

Status | ||||||

| Spray | Subsys |

505(b)(2) | BTCP in Opioid-Tolerant Patients |

NDA Accepted; PDUFA goal date January 4, 2012 | ||||||

| Dronabinol |

Dronabinol SG Capsule | ANDA | CINV and Appetite Stimulation in Patients with AIDS |

ANDA Submitted3 | ||||||

| Dronabinol RT Capsule

|

sANDA1 | } | Pending4 | |||||||

| Dronabinol Oral Solution | 505(b)(2)1 | CINV and Appetite Stimulation in Patients with AIDS2 |

Pre-Phase 35 | |||||||

| Dronabinol Inhalation Device

|

505(b)(2)1 | Preclinical | ||||||||

| Dronabinol IV Solution | 505(b)(2)1 | Preclinical | ||||||||

| Oncology |

LEP-ETU | TBD | Metastatic Breast Cancer2 | Phase 2 | ||||||

| 1 | Anticipated regulatory pathway |

| 2 | Initial targeted indication |

| 3 | Abbreviated New Drug Application, or ANDA, under expedited review |

| 4 | Supplemental ANDA, or sANDA, expected to be filed in the first quarter of 2012, assuming approval of Dronabinol SG Capsule ANDA in the third quarter of 2011 |

| 5 | End-of-Phase 2 meeting completed; planning to initiate pivotal bioequivalence study |

Subsys

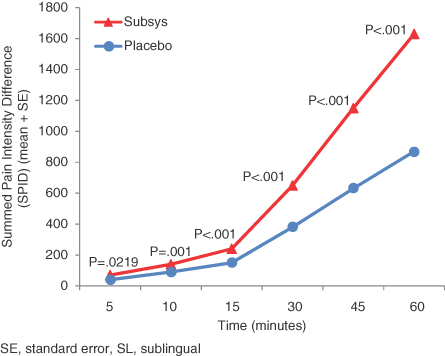

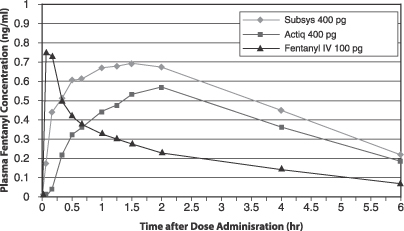

Subsys is a proprietary, single-use product that delivers fentanyl, an opioid analgesic, in seconds for transmucosal absorption underneath the tongue. In March 2011, we submitted a New Drug Application, or NDA, to the FDA for Subsys for the treatment of BTCP in opioid-tolerant patients. The FDA notified us in May 2011 that it had accepted the NDA for review and initially assigned a Prescription Drug User Fee Act, or PDUFA, goal date of January 4, 2012 for its review of the NDA. BTCP is characterized by sudden, often unpredictable, episodes of intense pain which can peak in severity at three to five minutes despite background pain medication. Subsys is the only transmucosal product to show statistically significant pain relief when measuring the sum of pain intensity difference at five minutes in a Phase 3 BTCP clinical trial using fentanyl. We believe this product is further differentiated by ease and speed of administration relative to the most widely-prescribed treatment alternatives. BTCP occurs in 50 to 90% of patients with cancer pain based on industry publications. According to IMS Health, transmucosal immediate-release fentanyl, or TIRF, products generated $440 million in U.S. sales in 2010. We believe this market has the potential to expand if faster-acting and more convenient products such as Subsys are approved by the FDA and this product class is more effectively promoted to oncologists and pain specialists. We currently plan to market Subsys in the United States, if approved, through a targeted sales force of approximately 50 to 75 representatives.

Dronabinol Product Family

We are developing a portfolio of dronabinol product candidates for the treatment of CINV and appetite stimulation in patients with AIDS, as well as other indications where dronabinol could have

2

Table of Contents

potential therapeutic benefits. Dronabinol, the active ingredient in Marinol, is a synthetic cannabinoid whose chemical name is delta-9-tetrahydrocannabinol, or THC. In 2010, dronabinol products generated approximately $142 million in U.S. sales. Our portfolio consists of two product candidates intended to be generic equivalents to Marinol in addition to three proprietary formulations, including Dronabinol Oral Solution. We believe our family of dronabinol products, if approved, has the potential to capture a broader share of the CINV market, which, according to IMS Health, generated $1.9 billion in U.S. sales in 2010.

We produce dronabinol active pharmaceutical ingredient, or API, for our product candidates at our U.S.-based, state-of-the-art manufacturing facility, which we believe provides us with a significant competitive advantage. We believe that this facility has the capacity to supply sufficient commercial quantities of the API for our dronabinol product candidates for the foreseeable future. In May 2011, we entered into a supply and distribution agreement with Mylan Pharmaceuticals Inc., or Mylan, for the distribution of Dronabinol SG and RT Capsules within a defined geographic area.

Dronabinol SG Capsule. Dronabinol SG Capsule, the most advanced product candidate in our dronabinol family, is a dronabinol soft gelatin capsule intended to be a generic equivalent to Marinol. In June 2010, we submitted an amendment to our ANDA to the FDA for this product candidate. If approved, we intend to commercialize Dronabinol SG Capsule with the aim of generating near-term cash flows to help fund the commercialization of Subsys and the development of our proprietary dronabinol and other product candidates, as well as validating our dronabinol supply chain and internal manufacturing capabilities.

Dronabinol RT Capsule. Dronabinol RT Capsule is a proprietary dronabinol soft gel capsule that is stable at room temperature. We intend to submit an sANDA to the FDA for Dronabinol RT Capsule following the approval of Dronabinol SG Capsule. We believe Dronabinol RT Capsule, if approved, would offer convenience advantages to distributors, pharmacies and patients, as product labeling for Marinol requires storage at refrigerated temperatures.

Dronabinol Oral Solution. Dronabinol Oral Solution is a proprietary synthetic THC in an oral liquid formulation which may offer advantages, including more consistent bioavailability, faster onset of action and more flexible dose titration. We have completed an end-of-Phase 2 meeting with the FDA and plan to initiate a pivotal bioequivalence study for this product candidate in the second half of 2011. Marinol is characterized by a highly variable bioavailability and an onset of action that ranges from 30 minutes to one hour. In our Phase 1 clinical trial, Dronabinol Oral Solution demonstrated a more reliable absorption profile and rapid onset of action as compared to Marinol. We believe these product attributes, coupled with increased acceptance of THC as a therapeutic alternative, could result in Dronabinol Oral Solution capturing market share and potentially expanding the market for dronabinol-based products.

Cancer Therapeutics

In addition to our cancer-supportive care products, we intend to develop proprietary cancer therapeutics targeting limitations of existing commercial products.

LEP-ETU. LEP-ETU, our most advanced proprietary cancer therapeutic, is a proprietary NeoLipid liposomal, or microscopic membrane-like structure created from lipids, formulation that incorporates paclitaxel. LEP-ETU recently completed a successful Phase 2 clinical trial of 70 patients with metastatic breast cancer. We are developing this product candidate to improve efficacy and reduce paclitaxel-related side effects. According to IMS Health, paclitaxel products generated $393 million in U.S. sales in 2010.

3

Table of Contents

Our Strategy

Our goal is to become a leading specialty pharmaceutical company focused on commercializing and developing innovative therapies that address unmet medical needs of cancer patients. Key elements of our strategy are to:

| • | Obtain FDA approval of Subsys. |

| • | Build a capital-efficient commercial organization to market Subsys and complementary products. |

| • | Obtain FDA approval of Dronabinol SG Capsule and Dronabinol RT Capsule, and commercialize these products through our May 2011 distribution agreement with Mylan. |

| • | Develop innovative dronabinol formulations to expand usage of synthetic THC for CINV and appetite stimulation in AIDS patients, as well as other indications. |

| • | Advance clinical development of LEP-ETU for the treatment of cancer. |

| • | Add commercial products or product candidates to our portfolio that complement our core competencies. |

Risks Associated with Our Business

Our business and our ability to execute our business strategy are subject to a number of risks that you should be aware of before you decide to buy our common stock. In particular, you should consider the following risks, which are discussed more fully in “Risk Factors:”

| • | We have not had commercial sales of any of our product candidates and may never become profitable. |

| • | We are highly dependent on the success of Subsys, Dronabinol SG Capsule and our other product candidates, and we cannot give any assurance that any of these product candidates will receive regulatory approval or acceptable Drug Enforcement Administration, or DEA, classification, or be successfully commercialized. |

| • | We face significant competition from both branded and generic products, and our operating results will suffer if we fail to compete effectively. |

| • | We are subject to numerous complex regulations and failure to comply with these regulations, or the cost of compliance with these regulations, may harm our business. |

| • | The anticipated development of a Risk Evaluation and Mitigation Strategies, or REMS, program for Subsys could cause significant delays in the approval process and would add additional layers of regulatory requirements that could significantly impact our ability to commercialize Subsys and dramatically reduce its market potential. |

| • | We have recently taken a number of significant actions aimed at growing our business and will need to further increase the size and complexity of our organization in the future, and we may experience difficulties in managing our growth and executing our growth strategy. |

| • | If we are unable to establish sales and marketing capabilities or execute on our sales and marketing strategy, including through our distribution agreement with Mylan, we may not be able to effectively market and sell any of our products, if approved, and generate product revenue. |

| • | We produce our dronabinol API internally and may encounter manufacturing failures that could delay the preclinical and clinical development or regulatory approval of our dronabinol product candidates, or their commercial production if approved. |

4

Table of Contents

| • | We rely on third parties to manufacture our product candidates, supply API and conduct our clinical trials. |

| • | If we fail to attract and keep management and other key personnel, as well as our board members, we may be unable to successfully develop or commercialize our product candidates and implement our business plan. |

| • | We may not be able to obtain and enforce patent rights or other intellectual property rights that cover our product candidates and are of sufficient breadth to prevent third parties from competing against us. |

| • | Our founder, Executive Chairman and principal stockholder can individually control our direction and policies, and his interests may be adverse to the interests of our stockholders. |

Corporate Information

We were incorporated as Oncomed Inc. in Delaware in June 1990, and subsequently changed our name to NeoPharm, Inc. On October 29, 2010, we entered into an Agreement and Plan of Merger with Insys Therapeutics, Inc., a Delaware corporation, and ITNI Merger Sub Inc., our wholly-owned subsidiary and a Delaware corporation. On November 8, 2010, pursuant to the Agreement and Plan of Merger, ITNI Merger Sub Inc. merged with and into Insys Therapeutics, Inc., and Insys Therapeutics, Inc. survived as our wholly-owned subsidiary. We refer to this transaction herein as the Merger. Following the Merger, our wholly-owned subsidiary, Insys Therapeutics, Inc., changed its name to Insys Pharma, Inc. and we changed our name to Insys Therapeutics, Inc. In connection with the Merger, all of the outstanding shares of common stock of Insys Pharma prior to the Merger were exchanged for 319,667 shares of our common stock and 14,864,607 shares of our newly-created convertible preferred stock. Each share of our convertible preferred stock is convertible into 0.57 shares of our common stock. As a result of the Merger, 95% of our common stock on an as-converted basis was held by the then-existing stockholders of Insys Pharma.

Our principal executive offices are located at 10220 South 51st Street, Suite 2, Phoenix, Arizona and our telephone number is (602) 910-2617. Our corporate website address is www.insysrx.com. We do not incorporate the information contained on, or accessible through, our website into this prospectus, and you should not consider it part of this prospectus.

For convenience in this prospectus, “Insys,” “we,” “us,” and “our” refer to Insys Therapeutics, Inc. and its subsidiaries taken as a whole, unless otherwise noted. We have applied for registration of the trademark “Insys Therapeutics, Inc.” in logo format, along with the trademarks “Insys” and “Subsys” with the United States Patent and Trademark Office. The trademark “Insys Therapeutics, Inc” in logo format is officially registered on the Principal Register of the United States Patent and Trademark Office. The trademark “Subsys” is allowed and will be eligible for registration on the Principal Register after it is used in commerce. This prospectus also contains trademarks and tradenames of other companies, and those trademarks and tradenames are the property of their respective owners.

5

Table of Contents

The Offering

| Common stock offered |

shares (or shares if the underwriters’ over-allotment option is exercised in full) |

| Common stock to be outstanding after this offering |

shares (or shares if the underwriters’ over-allotment option is exercised in full) |

| Use of proceeds from this offering |

We intend to use the net proceeds from this offering to fund the commercialization of Subsys and Dronabinol SG Capsule, if approved; to fund the development of Dronabinol RT Capsule, Dronabinol Oral Solution, Dronabinol Inhalation Device, LEP-ETU and our other early-stage product candidates; for potential product licensing and acquisitions; and for working capital and for other general corporate purposes. Please see the section entitled “Use of Proceeds.” |

| Risk factors |

You should read the “Risk Factors” section of this prospectus for a discussion of certain of the factors to consider carefully before deciding to purchase any shares of our common stock. |

| Proposed Nasdaq Global Market symbol |

INRX |

The number of shares of our common stock that will be outstanding after this offering is based on shares outstanding as of June 30, 2011 (after giving effect to the conversion of our convertible preferred stock outstanding as of such date into an aggregate of 8,528,860 shares of our common stock and the conversion of $ million in aggregate principal amount of notes and accrued interest thereon owed to trusts controlled by our Executive Chairman and principal stockholder into shares of common stock, assuming a conversion date of , 2011 and an initial public offering price of $ per share, the mid-point of the price range set forth on the cover page of this prospectus, both of which will occur automatically immediately prior to the closing of this offering), and excludes:

| • | 540,102 shares of our common stock issuable upon the exercise of outstanding options as of June 30, 2011 under our equity incentive plans, with a weighted average exercise price of $9.76 per share; |

| • | 1,079,133 shares of our common stock issuable upon the exercise of outstanding options as of June 30, 2011 under the Insys Pharma, Inc. equity incentive plan, with a weighted average exercise price of $1.83 per share; and |

| • | 3,000,000 shares of our common stock reserved for future issuance under our 2011 equity incentive plan, 2011 non-employee directors’ stock award plan and 2011 employee stock purchase plan, each of which will become effective upon the signing of the underwriting agreement for this offering. |

Unless otherwise stated, all information contained in this prospectus assumes:

| • | the conversion of all of our outstanding convertible preferred stock into an aggregate of 8,528,860 shares of common stock automatically immediately prior to the closing of this offering; |

| • | the conversion of $ million in aggregate principal amount of notes and accrued interest thereon owed to trusts controlled by our Executive Chairman and principal stockholder into shares of common stock, assuming a conversion date of , 2011 and an initial |

6

Table of Contents

| public offering price of $ per share, the mid-point of the price range set forth on the cover page of this prospectus, immediately prior to the closing of this offering; |

| • | the filing of our amended and restated certificate of incorporation and adoption of our amended and restated bylaws, which will occur upon the closing of this offering; and |

| • | no exercise of the underwriters’ over-allotment option to purchase additional shares. |

The information in this prospectus also reflects a 1-for-61 reverse stock split of our common stock that was effected on July 14, 2011.

7

Table of Contents

Summary Financial Data

The following tables set forth our summary financial data. The summary financial data for the years ended December 31, 2010, 2009 and 2008 are derived from our audited financial statements appearing elsewhere in this prospectus. The statement of operations data for the six months ended June 30, 2011 and 2010 and the selected balance sheet data as of June 30, 2011 have been derived from our unaudited consolidated financial statements appearing elsewhere in this prospectus. The unaudited financial statements have been prepared on a basis consistent with our audited financial statements included in this prospectus and include, in our opinion, all adjustments, consisting only of normal recurring adjustments, necessary to state fairly our financial position as of June 30, 2011 and results of operations for the six months ended June 30, 2011 and 2010. You should read this summary financial data in conjunction with the financial statements and related notes and the information under the headings “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Unaudited Pro Forma Condensed Consolidated Financial Information” appearing elsewhere in this prospectus. Our historical results are not necessarily indicative of our future results.

On October 29, 2010, we entered into an Agreement and Plan of Merger with Insys Therapeutics, Inc., a Delaware corporation, and ITNI Merger Sub Inc., our wholly-owned subsidiary and a Delaware corporation. On November 8, 2010, pursuant to the Agreement and Plan of Merger, ITNI Merger Sub Inc. merged with and into Insys Therapeutics, Inc., and Insys Therapeutics, Inc. survived as our wholly-owned subsidiary. We refer to this transaction as the Merger. Following the Merger, our wholly-owned subsidiary, Insys Therapeutics, Inc., changed its name to Insys Pharma, Inc. and we changed our name to Insys Therapeutics, Inc. In connection with the Merger, all of the outstanding shares of common stock of Insys Pharma prior to the Merger were exchanged for 319,667 shares of our common stock and 14,864,607 shares of our newly-created convertible preferred stock. Each share of our convertible preferred stock is convertible into 0.57 shares of our common stock. As a result of the Merger, 95% of our common stock on an as-converted basis was held by the then-existing stockholders of Insys Pharma. Since Insys Pharma is the acquiring entity for accounting purposes, the financial statements for all periods up to and including the November 8, 2010 Merger date are the financial statements of the entity that is now our subsidiary, Insys Pharma. The financial statements for all periods subsequent to the November 8, 2010 Merger date are the consolidated financial statements of Insys Therapeutics, Inc. and Insys Pharma. However, for all periods, the financial statements are labeled “Insys Therapeutics, Inc.” financial statements. In addition, the audited financial statements of NeoPharm for the years ended December 31, 2009 and 2008 and the unaudited financial statements for the nine months ended September 30, 2010 and 2009 are also included in this prospectus.

The summary unaudited pro forma condensed consolidated statement of operations data for the six months ended June 30, 2011 and for the year ended December 31, 2010 below is based on the historical consolidated statements of operations of Insys Therapeutics, Inc. and NeoPharm, giving effect to the Merger, the conversion of our convertible preferred stock outstanding as of June 30, 2011 and December 31, 2010 into 8,528,860 shares of our common stock, the issuance after each period presented of additional notes payable to trusts controlled by our Executive Chairman and principal stockholder, and the conversion of the resulting $ million in aggregate principal amount of notes and actual accrued interest thereon through , 2011 owed to trusts controlled by our Executive Chairman and principal stockholder into shares of common stock, assuming an initial public offering price of $ per share, the mid-point of the price range set forth on the cover page of this prospectus, as if such transactions had occurred on January 1, 2010. The unaudited pro forma condensed consolidated statement of operations data is based on the estimates and assumptions set forth in the notes to the unaudited pro forma condensed consolidated financial statements. Please see the section entitled “Unaudited Pro Forma Condensed Consolidated Financial Information.” These estimates and assumptions are preliminary and subject to change, and have been made solely for the

8

Table of Contents

purposes of developing such pro forma information. The summary unaudited pro forma condensed consolidated statement of operations data is not necessarily indicative of the combined results of operations to be expected in any future period or the results that actually would have been realized had the entities been a single entity during the period presented.

| Pro Forma | Actual | Pro Forma | Actual | |||||||||||||||||||||||||

| Six Months Ended June 30, | Year Ended December 31, | |||||||||||||||||||||||||||

| 2011 |

2011 | 2010 | 2010 |

2010 | 2009 | 2008 | ||||||||||||||||||||||

| (In thousands, except share and per share data) |

||||||||||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||||||||||

| Revenues |

$ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||

| Operating expenses: |

||||||||||||||||||||||||||||

| Research and development |

3,807 | 3,807 | 5,240 | 13,244 | 10,428 | 8,982 | 14,729 | |||||||||||||||||||||

| General and administrative |

4,595 | 4,595 | 2,015 | 5,265 | 3,539 | 4,504 | 10,221 | |||||||||||||||||||||

| Loss on settlement of vendor dispute |

— | — | — | — | — | — | 1,104 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total operating expenses |

8,402 | 8,402 | 7,255 | 18,509 | 13,967 | 13,486 | 26,054 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Loss from operations: |

(8,402 | ) | (8,402 | ) | (7,255 | ) | (18,509 | ) | (13,967 | ) | (13,486 | ) | (26,054 | ) | ||||||||||||||

| Other income |

102 | 102 | 26 | 1,532 | 797 | 31 | 780 | |||||||||||||||||||||

| Interest income (expense), net. |

— | (888 | ) | (473 | ) | 57 | (1,148 | ) | (999 | ) | (1,913 | ) | ||||||||||||||||

| Income tax benefit |

— | — | — | — | 575 | — | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net loss |

(8,300 | ) | (9,188 | ) | (7,702 | ) | (16,920 | ) | (13,743 | ) | (14,454 | ) | (27,187 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net loss allocable to preferred stockholders |

— | 8,414 | 7,425 | — | 13,144 | 13,932 | 26,205 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net loss allocable to common stockholders |

$ | (8,300 | ) | $ | (774 | ) | $ | (277 | ) | $ | (16,920 | ) | $ | (599 | ) | $ | (522 | ) | $ | (982 | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Basic and diluted net loss per common share |

$ | $ | (0.99 | ) | $ | (0.87 | ) | $ | $ | (1.54 | ) | $ | (7.05 | ) | $ | (19.09 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Weighted average common shares outstanding, basic and diluted(1) |

784,020 | 319,423 | 388,449 | 74,063 | 51,438 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | Please see Note 2 to our audited financial statements appearing elsewhere in this prospectus for an explanation of the method used to calculate the net loss per common share and the number of common shares used in the computation of historical per share amounts. |

9

Table of Contents

| As of June 30, 2011 | ||||||||||||

| Actual | Pro Forma | Pro Forma As Adjusted(1) |

||||||||||

| (Unaudited) | ||||||||||||

| (In thousands) | ||||||||||||

| Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 17 | $ | $ | ||||||||

| Total current assets |

1,524 | |||||||||||

| Total assets |

14,644 | |||||||||||

| Total current liabilities |

46,381 | |||||||||||

| Total liabilities |

48,779 | |||||||||||

| Total stockholders’ equity (deficit) |

(34,135 | ) | ||||||||||

| (1) | A $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the mid-point of the price range set forth on the cover page of this prospectus, would increase (decrease) each of cash and cash equivalents, total current assets, total assets and total stockholders’ equity by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

The pro forma balance sheet data as of June 30, 2011 above gives effect to (1) the filing of our amended and restated certificate of incorporation which will occur upon the closing of this offering, (2) the conversion of our convertible preferred stock outstanding as of such date into 8,528,860 shares of our common stock, which will occur automatically immediately prior to the closing of this offering, (3) the issuance of an additional $ million in aggregate principal amount of notes payable to trusts controlled by our Executive Chairman and principal stockholder subsequent to June 30, 2011 and (4) the conversion of $ million in aggregate principal amount of notes and accrued interest thereon owed to trusts controlled by our Executive Chairman and principal stockholder into shares of common stock, assuming a conversion date of , 2011 and an initial public offering price of $ per share, the mid-point of the price range set forth on the cover page of this prospectus, immediately prior to the closing of this offering, which amount includes the $ million in aggregate principal amount of notes issued subsequent to June 30, 2011 and accrued interest on all notes payable through , 2011. The pro forma as adjusted balance sheet data as of June 30, 2011 above gives further effect to our receipt of the estimated net proceeds from the sale of shares of common stock by us in this offering at an assumed initial public offering price of $ per share, the mid-point of the price range set forth on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

10

Table of Contents

An investment in shares of our common stock involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information appearing elsewhere in this prospectus, before deciding to invest in our common stock. The occurrence of any of the following risks could have a material adverse effect on our business, financial condition, results of operations and future growth prospects. In these circumstances, the market price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Financial Position

We have not had commercial sales of any of our product candidates and may never become profitable.

We have accumulated a large deficit since inception that has primarily resulted from the significant research and development expenditures we have made. We expect that our losses will continue to be substantial for at least the short term and that our operating and general and administrative expenses will be significant and increase as we transition to a public company and in connection with our planned research and development and commercialization efforts, including our anticipated creation of a commercial organization. For the six months ended June 30, 2011 and the year ended December 31, 2010, we had a consolidated net loss of $9.2 million and $13.7 million, respectively. As of June 30, 2011, we had a consolidated accumulated deficit of $94.9 million.

Our ability to become profitable depends upon our ability to generate significant continuing revenues. To generate revenues, we must succeed, either alone or with others, in developing, obtaining regulatory approval and acceptable DEA classification for, and manufacturing, selling and marketing, our product candidates, and in particular, Subsys and Dronabinol SG Capsule.

To date, our product candidates have not generated any revenues from commercial sales, and we do not know if or when we will generate any such revenue. Our ability to generate revenue depends on a number of factors, including, but not limited to:

| • | achievement of regulatory approval and acceptable DEA classification for our product candidates, and in particular for Subsys, Dronabinol SG Capsule and Dronabinol RT Capsule; |

| • | successfully manufacturing commercial quantities of our product candidates at acceptable cost levels if regulatory approvals are obtained; |

| • | successful sales, distribution and marketing of our products, if approved, including execution on our plans to build a capital-efficient commercial organization and successful partnering with third parties; |

| • | successful completion of formulation development, preclinical studies and clinical trials for our product candidates, including Dronabinol Oral Solution, Dronabinol Inhalation Device, Dronabinol IV Solution and LEP-ETU. |

Because of the numerous risks and uncertainties associated with our development efforts and other factors, we are unable to predict when we will generate revenues or become profitable, if ever. Even if we do achieve profitability, we may not be able to sustain or increase profitability on an ongoing basis.

We have significant and increasing cash burn and may require additional funding.

Our operations have consumed substantial amounts of cash since inception. Our cash flow used for operating activities for the six months ended June 30, 2011 and the year ended December 31, 2010 was $7.7 million and $15.0 million, respectively. We expect our operating and general and administrative expenses and cash used for operations to continue to be significant and increase substantially as we transition to a public company and in connection with our planned research, development and commercialization efforts, including our anticipated creation of a commercial organization. We believe

11

Table of Contents

that the net proceeds from this offering and our existing cash and cash equivalents, together with interest thereon, will be sufficient to fund our operations through at least the next 12 months. We have based these estimates, however, on assumptions that may prove to be wrong, and we could spend our available financial resources much faster than we currently expect. Further, we may need to raise additional capital following this offering to fund our operations and continue to conduct clinical trials to support potential regulatory approval of marketing applications.

The amount and timing of our future funding requirements will depend on many factors, including, but not limited to:

| • | the timing of FDA approval and DEA classification of Subsys, Dronabinol SG Capsule and our other product candidates, if at all; |

| • | the timing and amount of revenue from sales of any of our product candidates, if approved, or revenue from grants or other sources; |

| • | the rate of progress and cost of our clinical trials and other product development programs for our dronabinol product candidates, LEP-ETU product candidate and any other product candidates that we may develop, in-license or acquire; |

| • | costs of establishing or outsourcing sales, marketing and distribution capabilities; |

| • | costs and timing of completion of outsourced commercial manufacturing supply arrangements for each product candidate; |

| • | costs of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights associated with our product candidates; |

| • | costs of operating as a public company; |

| • | the effect of competing technological and market developments; |

| • | our ability to acquire or in-license products and product candidates, technologies or businesses; |

| • | personnel, facilities and equipment requirements; and |

| • | the terms and timing of any collaborative, licensing, co-promotion or other arrangements that we may establish. |

Raising additional funds by issuing securities or through licensing or lending arrangements may cause dilution to you, restrict our operations or require us to relinquish proprietary rights.

We may need to raise additional funds to finance future cash needs through public or private equity offerings, debt financings or corporate collaboration and licensing arrangements. We cannot be certain that additional funding will be available on acceptable terms, or at all. To the extent that we raise additional capital by issuing equity securities or convertible debt, your ownership will be diluted. Any future debt financing into which we enter may impose upon us covenants that restrict our operations, including limitations on our ability to incur liens or additional debt, pay dividends, redeem our stock, make certain investments and engage in certain merger, consolidation or asset sale transactions. Any borrowings under any future debt financing will need to be repaid, which creates additional financial risk for us, particularly if our business or prevailing financial market conditions are not conducive to paying-off or refinancing our outstanding debt obligations. In addition, if we raise additional funds through corporate collaboration and licensing arrangements, it may be necessary to relinquish potentially valuable rights to our product candidates, or grant licenses on terms that are not favorable to us.

If we are unable to raise additional capital when required or on acceptable terms, we may be required to significantly delay, scale back or discontinue one or more of our product development

12

Table of Contents

programs or commercialization efforts, or other aspects of our business plan. We also may be required to relinquish, license or otherwise dispose of rights to product candidates or products that we would otherwise seek to develop or commercialize ourselves on terms that are less favorable than might otherwise be available. In addition, our ability to achieve profitability or to respond to competitive pressures would be significantly limited.

Risks Related to Our Business and Industry

We are highly dependent on the success of Subsys, Dronabinol SG Capsule and our other product candidates, and we cannot give any assurance that any of these product candidates will receive regulatory approval or acceptable DEA classification, or be successfully commercialized.

We currently have no drug products for sale and, to date, we have not successfully commercialized any products. We have expended significant time, resources and effort on the development of our product candidates, and our future results of operations depend heavily on our ability to obtain regulatory approval and acceptable DEA classification, if applicable, for and successfully commercialize our product candidates. Moreover, we do not have internal new drug discovery capabilities, and our primary focus is on developing improved formulations and delivery methods for existing FDA-approved products. In the near-term, we are highly dependent on our ability to obtain regulatory approval for Dronabinol SG Capsule and Subsys.

There can be no guarantee that the FDA will accept any of our submissions and approve any of our product candidates on our anticipated timelines, or at all, including our Dronabinol SG Capsule ANDA and NDA for Subsys. As part of PDUFA, the FDA has a goal to review and act on a percentage of all submissions in a given time frame. The general review goal for a drug application is 10 months for a standard application and six months for a priority review application. The FDA’s review goals are subject to change, and it is unknown whether the review of our NDA filing for Subsys, or a filing for any of our other product candidates, will be completed within the FDA’s review goals or will be delayed. Moreover, the duration of the FDA’s review may depend on the number and types of other NDAs that are submitted to the FDA around the same time period. In addition, the FDA may identify new or additional deficiencies related to our submissions. These deficiencies could require us to take a number of actions that could have a material adverse impact on our operations and business plan, including requiring us to undertake additional time-consuming and expensive clinical trials and manufacturing and testing activities, which could cause significant delay in the review and potential approval of our product candidates, or prevent us from receiving approval at all. Moreover, with respect to Dronabinol SG Capsule, any requirement by the FDA to produce additional test batches could result in significant increased costs and also prevent or significantly delay the potential approval of Dronabinol SG Capsule. In addition, the success of Dronabinol SG Capsule is also important in terms of generating near-term cash flows to help fund the commercialization of Subsys and the development of our proprietary dronabinol and other product candidates, validate our dronabinol supply chain and internal manufacturing capabilities, and allow us to file a supplement to our ANDA for our Dronabinol RT Capsule product candidate.

If we do not obtain regulatory approval and acceptable DEA classification, if applicable, for and successfully commercialize our product candidates, and in particular for Dronabinol SG Capsule or Subsys, on our anticipated timelines or at all, we may be unable to generate sufficient revenues to sustain and grow our business, our reputation would be harmed, our competitive position would be compromised, and our business, financial condition and results of operations will be materially adversely affected. In addition, delays in obtaining regulatory approval for any of our product candidates increases the chances that our competition will produce and obtain regulatory approval for competing products before us, which would likely have a material negative impact upon our competitive position and ability to generate revenue from sales of any approved products. This in turn could have a material adverse effect on our ability to execute on our business plan, develop our other product candidates or achieve or maintain profitability.

13

Table of Contents

With respect to Dronabinol SG Capsule, prior to 2008, the FDA issued two “major deficiency” letters citing various deficiencies relating to our ANDA for our hard gelatin capsule formulation of this product candidate. In response to the FDA’s request, we made new registration batches of soft gelatin capsules and performed a new bioequivalence study. This study was completed and data from this study along with responses to other deficiencies was submitted to the FDA in the form of a major amendment in June 2010. On October 15, 2010, we received a letter from the FDA expressing the need for clarifications related to bioequivalence and we responded to this letter on November 15, 2010. In December 2010, we received a quality deficiency “minor” letter from the FDA requesting information and clarification regarding the raw material components, composition of the three proposed dosage strengths and container closure components, to which we responded in January 2011. Separately in January 2011, we received another deficiency letter from the FDA related to labeling comments to which we also responded in January 2011. On February 10, 2011, we submitted an electronic Final Product Label in response to a request from the FDA. On March 8, 2011, we submitted a labeling amendment in response to an additional request from the FDA. The labeling comments and requests from the FDA related to revisions to our proposed labeling components for consistency with Marinol labeling and certain formatting changes. On July 7, 2011, the FDA notified us of three “telephone” deficiencies to our ANDA for Dronabinol SG Capsule. The “telephone” deficiencies we received related to the request for revised shell formulation information, a blank batch record and a filing by the holder of the Subsys drug master file. The shell formulation information had previously been submitted to the FDA by our third party manufacturer and the holder of the Subsys drug master file had previously submitted the requested filing. On July 11, 2011, we notified the FDA of the prior submissions, and we responded to the FDA’s request for the blank batch record. We believe our response has adequately addressed all the deficiencies. There can be no assurance, however, that the FDA will approve the Dronabinol SG Capsule ANDA based on our response, and the FDA may identify additional deficiencies related to our ANDA. As a general matter, amendments to ANDAs submitted in response to major deficiency letters or amendment requests are given the same review priority as original, non-reviewed ANDAs by the Office of Generic Drugs, or OGD. They are generally placed into the 180-day queue and reviewed in accordance with OGD’s first in-first reviewed procedures. In contrast, ANDA amendments submitted in response to minor FDA deficiency letters or amendment requests are generally given a higher priority review than major amendments because they often mean an ANDA is close to approval and should, therefore, be given priority. The FDA generally reviews minor amendments within 30 to 60 days. As a general matter, “telephone” deficiencies primarily relate to administrative or minor technical issues, and the FDA endeavors to review responses to “telephone” deficiencies upon receipt. Any failure to adequately respond to the FDA’s requests and deficiency notifications could delay approval of Dronabinol SG Capsule and have a material adverse effect on our business plan.

We face significant competition from both branded and generic products, and our operating results will suffer if we fail to compete effectively.

Our industry is characterized by rapidly advancing technologies, intense competition and a strong emphasis on proprietary products. We face competition from many different sources, including pharmaceutical and biotechnology companies, specialty pharmaceutical and generic drug companies, drug delivery companies, academic institutions, government agencies and private and public research institutions, many of which have significantly greater financial, technical and other resources than us.

If Subsys receives regulatory approval, it will compete against numerous branded and generic products already being marketed and potentially those which are or will be in development. In the BTCP market, physicians often treat BTCP with a variety of short-acting opioid medications, including morphine, morphine and codeine derivatives and fentanyl. Some currently marketed products against which we will likely directly compete include Cephalon, Inc.’s Fentora and Actiq, BioDelivery Sciences International’s Onsolis, Nycomed International Management GmbH’s Instanyl and ProStrakan Group plc’s Abstral. Some generic fentanyl products against which we will compete are marketed by TEVA Pharmaceuticals USA and Watson Pharmaceuticals, Inc. In addition, we are aware of numerous companies developing other treatments and technologies for rapid delivery of opioids to treat BTCP,

14

Table of Contents

including transmucosal, transdermal, nasal spray, inhaled delivery systems and sublingual delivery systems, among others. For example, Archimedes Pharma Ltd.’s Lazanda, a fentanyl nasal spray solution which has been approved in Europe and in the United States. Additionally, we are aware of companies with product candidates in late stage development for BTCP, including AcelRx Pharmaceuticals, Inc.’s ARX-02 and Akela Pharma Inc.’s Fentanyl TAIFUN, both of which are Phase 3 ready. If these treatments and technologies are successfully developed and approved, they could represent significant additional competition to Subsys. We also expect that sales and marketing efforts for other fentanyl products will increase if and when a classwide REMS program is approved by the FDA, which could make it more difficult for us to compete with a smaller and lower cost sales force.

With respect to our dronabinol product candidates, and in particular our generic Dronabinol SG Capsule, the market in which we will compete is challenging in part because generic products generally do not benefit from patent protection. If any of our dronabinol product candidates, and in particular Dronabinol SG Capsule, receive the requisite regulatory approval and acceptable DEA classification and are marketed, the competition from generic products which we will encounter may have an effect on our product prices, market share, revenues and profitability. We or our distributor may not be able to differentiate any products that we may market from those of our competitors, successfully develop or introduce new products that are less costly or offer better performance than those of our competitors, or offer purchasers of our products payment and other commercial terms as favorable as those offered by our competitors. In addition, there are a number of established therapies and products already commercially available and under development by other companies that treat the indications for which we are developing dronabinol products and with which our product candidates will compete if approved. If we receive regulatory approval and acceptable DEA classification for our dronabinol product candidates, these product candidates will compete against therapies and products such as Abbott Laboratories’ Marinol, Marinol generics and Valeant Pharmaceutical International Inc.’s Cesamet. Moreover, Par Pharmaceutical Companies Inc. markets an approved generic version of Marinol and we believe that other companies are pursuing regulatory approval for generic dronabinol products. We cannot give any assurance that any such other companies will not obtain regulatory approval or acceptable DEA classification for, or commercialize their generic dronabinol products on a more rapid timeline or more successfully than us.

Moreover, our products will compete with non-synthetic cannabinoid drugs, including therapies such as GW Pharmaceuticals plc’s Sativex, especially in many countries outside of the United States where non-synthetic cannabinoids are legal and in the United States if non-synthetic cannabinoids are legalized. The DEA’s proposed rule issued on November 1, 2010, if finalized, would classify naturally-derived dronabinol derived from plant material as a Schedule III controlled substance if part of an approved ANDA. In addition, literature has been published arguing the benefits of natural cannabis, or marijuana, over dronabinol, and there are a number of states that have already enacted laws legalizing medicinal marijuana. Irrespective of its potential medical applications, there is some support in the United States for legalization of marijuana. We also cannot assess the extent to which patients utilize marijuana illegally to alleviate CINV, instead of using prescribed therapies such as approved dronabinol products. Furthermore, in the treatment of CINV, physicians typically offer conventional anti-nausea drugs prior to initiating chemotherapy, such as sanofi-aventis’ Anzemet, Eisai Inc./Helsinn Group’s Aloxi, Roche Holding AG’s Kytril, MonoSol Rx’s Zuplenz and GlaxoSmithKline plc’s Zofran and its generic equivalents, as well as Neurokinin 1 receptor antagonists on the market including ProStrakan’s SANCUSO and Merck & Co., Inc.’s Emend. To the extent that our proprietary dronabinol products compete in a broader segment of the CINV market, we will also face competition from these products.

Additionally, we are aware of companies with product candidates in late stage development for CINV, including A.P. Pharma’s APF530, which has received a Complete Response Letter from the FDA, Aphios Corp.’s Zindol, which is in Phase 2/3 development, Roche Holding/Helsinn Group’s netupitant, which is in Phase 3 development, and Tesaro’s Rolapitant, which is in Phase 2 development. If these products are successfully developed and approved over the next few years, they could represent significant competition for our dronabinol family of product candidates, if any are approved.

15

Table of Contents

Our LEP-ETU product candidate, if approved for the treatment of metastatic breast cancer or other cancer indications, will compete with the leading taxanes currently on the market, including those with formulations that specifically incorporate paclitaxel as the active ingredient such as Bristol-Myers Squibb’s Taxol and its generic equivalents and Celgene Corporation’s Abraxane, as well as other taxanes, such as sanofi-aventis’ Taxotere. Furthermore, LEP-ETU could face future competition, if approved, from Cornerstone Pharmaceuticals’ new formulation of paclitaxel known as EmPac, which is undergoing preclinical studies. In addition, LEP-ETU would compete with other cytotoxic agents beyond the taxane class, including capecitabine, gemcitabine, ixabepilone and navelbine. Additionally, there are numerous biotechnology and pharmaceutical companies that currently have extensive development efforts and resources within oncology. Abbott Laboratories, Amgen Inc., AstraZeneca PLC., Bayer AG, Biogen Idec Inc., Eisai Co., Ltd., F. Hoffmann- LaRoche Ltd., Johnson and Johnson, Merck and Co., Inc., Novartis AG, Onyx Pharmaceuticals Inc., Pfizer Inc., sanofi-aventis and Takeda Pharmaceutical Co. Ltd., are among some of the leading companies researching and developing new compounds in oncology.

We will also face competition from third parties in obtaining allotments of fentanyl and dronabinol under applicable DEA annual quotas, recruiting and retaining qualified personnel, establishing clinical trial sites and enrolling patients in clinical trials, and in identifying and acquiring or in-licensing new products and product candidates.

New developments, including the development of other drug technologies and delivery methods, occur in the pharmaceutical and life sciences industries at a rapid pace. Compared to us, many of our potential competitors have substantially greater:

| • | research and development resources, including personnel and technology; |

| • | regulatory experience; |

| • | drug development, clinical trial and drug marketing and commercialization experience; |

| • | experience and expertise in intellectual property rights; |

| • | name recognition; and |

| • | capital resources. |

As a result of these and other factors, our competitors may obtain FDA approval of their products more rapidly than us or may obtain patent protection or other intellectual property rights that limit our ability to develop or commercialize our product candidates. Our competitors may also develop products that are more effective, better tolerated, subject to fewer or less severe side effects, more useful, more widely-prescribed or accepted, or less costly than ours. If we receive regulatory approvals for our products, sales and marketing efficiency are likely to be significant competitive factors. Our plan is to build a commercial organization without using third-party sales or marketing channels in the United States for most of our proprietary product candidates if approved, and there can be no assurance that we can develop these capabilities in a manner that will be capital efficient and competitive with the sales and marketing efforts of our competitors, especially since some or all of those competitors could expend greater economic resources than we do and/or employ third-party sales and marketing channels.

We are subject to numerous complex regulations and failure to comply with these regulations, or the cost of compliance with these regulations, may harm our business.

The research, testing, development, manufacturing, quality control, approval, labeling, packaging, storage, recordkeeping, promotion, advertising, marketing, distribution, possession and use of our product candidates, among other things, are subject to regulation by numerous governmental authorities in the United States and elsewhere. The FDA regulates drugs under the Federal Food, Drug and Cosmetic Act, or FDC Act, and implementing regulations. Noncompliance with any applicable regulatory requirements can result in refusal to approve products for marketing, warning letters, product recalls or seizure of products, total or partial suspension of production, prohibitions or

16

Table of Contents

limitations on the commercial sale of products or refusal to allow the entering into of federal and state supply contracts, fines, civil penalties and/or criminal prosecution. Additionally, the FDA and comparable governmental authorities have the authority to withdraw product approvals that have been previously granted. Moreover, the regulatory requirements relating to our products may change from time to time and it is impossible to predict what the impact of any such changes may be.

We are developing product candidates that are controlled substances as defined in the Controlled Substances Act of 1970, or CSA, which establishes, among other things, certain registration, production quotas, security, recordkeeping, reporting, import, export and other requirements administered by the DEA. The DEA regulates controlled substances as Schedule I, II, III, IV or V substances. Schedule I substances by definition have high potential for abuse, no currently accepted medical use in the United States and lack accepted safety for use under medical supervision, and may not be marketed or sold in the United States. Except for research and industrial purposes, a pharmaceutical product may be listed as Schedule II, III, IV or V, with Schedule II substances considered to present the highest risk of abuse and Schedule V substances the lowest relative risk of abuse among such substances. Fentanyl is listed by the DEA as a Schedule II substance under the CSA. Dronabinol in sesame oil and encapsulated in a soft gelatin capsule in the form previously approved by the FDA for the commercial sale of Marinol is currently listed by the DEA as a Schedule III substance under the CSA. Dronabinol in bulk or other product forms is currently classified by the DEA as a Schedule I substance under the CSA. If the FDA approves formulations of dronabinol which differ from Marinol, the DEA will have to make a scheduling determination and place the products in a schedule other than Schedule I in order for such products to be marketed to patients in the United States.

The manufacture, shipment, storage, sale and use, among other things, of controlled substances that are pharmaceutical products are subject to a high degree of regulation. For example, generally all Schedule II substance prescriptions, such as prescriptions for fentanyl, must be written and signed by a physician, physically presented to a pharmacist and may not be refilled without a new prescription.

The DEA also conducts periodic inspections of certain registered establishments that handle controlled substances. Facilities that conduct research, manufacture, distribute, import or export controlled substances must be registered to perform these activities and have the security, control and inventory mechanisms required by the DEA to prevent drug loss and diversion. Failure to maintain compliance, particularly non-compliance resulting in loss or diversion, can result in regulatory action that could have a material adverse effect on our business, results of operations, financial condition and prospects. The DEA may seek civil penalties, refuse to renew necessary registrations, or initiate proceedings to restrict, suspend or revoke those registrations. In certain circumstances, violations could lead to criminal proceedings.

Individual states also have controlled substances laws. Though state controlled substances laws often mirror federal law, because the states are separate jurisdictions, they may separately schedule our product candidates as well. While some states automatically schedule a drug when the DEA does so, other states schedule drugs through rulemaking or a legislative action. State scheduling may delay commercial sale of any product for which we obtain federal regulatory approval and adverse scheduling could have a material adverse effect on the commercial attractiveness of such product. We or our partners must also obtain separate state registrations, permits or licenses in order to be able to obtain, handle, and distribute controlled substances for clinical trials or commercial sale, and failure to meet applicable regulatory requirements could lead to enforcement and sanctions by the states in addition to those from the DEA or otherwise arising under federal law.

The anticipated development of a REMS program for Subsys could cause significant delays in the approval process and would add additional layers of regulatory requirements that could significantly impact our ability to commercialize Subsys and dramatically reduce its market potential.

Section 505-1 of the FDC Act permits the FDA to require sponsors to submit a proposed REMS program to ensure the safe use of the drugs in question following commercial approval. A REMS program

17

Table of Contents

is a strategic safety program that the FDA requires to ensure that the benefits of a drug continue to outweigh its risks. In determining whether a REMS program is necessary, the FDA must consider the size of the population likely to use the drug, the seriousness of the disease or condition to be treated, the expected benefit of the drug, the duration of treatment, the seriousness of known or potential adverse events, and whether the drug is a new molecular entity. A REMS program may be required to include various elements, such as a medication guide, patient package insert, a communication plan, elements to assure safe use, and an implementation system, and must include a timetable for assessment of the REMS program. Elements to assure safe use can restrict the prescribing, sale and distribution of drug products.

In September 2007 and in December 2007, the FDA issued a safety alert to healthcare professionals and consumers concerning recent reports of deaths and other adverse events in patients using approved TIRF products. The FDA has determined that TIRF products will be required to have a REMS program to ensure that the benefits of the drugs continue to outweigh the serious risks of overdose, abuse, misuse, addiction and serious complications due to medication errors. A classwide REMS program is being developed jointly by all manufacturers and IND application holders of TIRF products, and we participate actively in this program. This REMS program is expected to be a single shared program across the TIRF class of products. We expect that the FDA will approve a classwide REMS program in the second half of 2011. In addition, we continue to pursue a REMS program specific to our company as a potential alternative to the classwide REMS program.

There can be no assurance that the FDA will approve the classwide REMS program or our alternative individual REMS program that we submitted as part of our NDA submission on our anticipated timeline, or at all. Delays in the REMS program approval process could result in significant delays in the approval process for Subsys. In addition, as part of the REMS program relating to Subsys, the FDA could require significant restrictions, such as restrictions on the prescribing, distribution and patient use of the product, which could significantly impact our ability to effectively commercialize Subsys and dramatically reduce its market potential.

We have recently taken a number of significant actions aimed at growing our business and will need to further increase the size and complexity of our organization in the future, and we may experience difficulties in managing our growth and executing our growth strategy.

Our management and personnel, systems and facilities currently in place may not be adequate to support our business plan and future growth. In November 2010, we completed the Merger, which resulted in Insys Pharma becoming our wholly-owned subsidiary. Prior to the Merger, Insys Pharma in September 2009 obtained assets which have given us the ability to manufacture our supply of dronabinol API internally through our manufacturing facility in Texas. Both of these transactions have significantly increased the complexity of our business operations. We recently expanded our management team and board of directors. In addition, we grew the number of our full-time employees from 12 as of December 31, 2009 to 28 as of July 15, 2011, due in large part to the Merger and subsequent organic growth. We will need to further expand our managerial, operational, financial and other resources, and build a sales force and marketing infrastructure, in order to manage and fund our future operations and clinical trials, continue our research and development activities, and commercialize our product candidates, if approved.

Our need to effectively manage our operations, growth and various projects requires that we:

| • | continue to improve our operational, financial and management controls and reporting systems and procedures; |

| • | attract and retain sufficient numbers of talented employees; |

| • | manage our clinical trials effectively; |

| • | manage our internal dronabinol production operations effectively and in a cost effective manner; |

18

Table of Contents

| • | manage our development efforts effectively while carrying out our contractual obligations to licensors, contractors and other third parties; and |

| • | continue to improve our facilities. |

In addition, historically, we have utilized and continue to utilize the services of part-time outside consultants to perform a number of tasks for us, including tasks related to accounting and finance, clinical trial management, regulatory affairs, formulation development and other drug development functions. For example, in addition to seeking advice from our scientific advisory board, we utilize consultants for tasks such as state licensing procurement and accounting and book-keeping services. Our growth strategy may also entail expanding our use of consultants to implement these and other tasks going forward. Because we rely on consultants for certain functions of our business, we will need to be able to effectively manage these consultants to ensure that they successfully carry out their contractual obligations and meet expected deadlines. There can be no assurance that we will be able to manage our existing consultants or find other competent outside consultants, as needed, on economically reasonable terms, or at all. If we are not able to effectively expand our organization by hiring new employees and expanding our use of consultants, we may be unable to successfully implement the tasks necessary to further develop and commercialize our product candidates and, accordingly, may not achieve our research, development and commercialization goals.

If we are unable to establish sales and marketing capabilities or execute on our sales and marketing strategy, we may not be able to effectively market and sell any approved products and generate product revenue.