Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - SHAMIKA 2 GOLD, INC. | Financial_Report.xls |

| EX-31.1 - SHAMIKA 2 GOLD, INC. | v232425_ex31-1.htm |

| EX-32.1 - SHAMIKA 2 GOLD, INC. | v232425_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q/A

(Amendment No. 1)

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

for the quarterly period ended June 30, 2011

|

|

o

|

TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD ________TO ________

|

Commission File Number: 000-52689

SHAMIKA 2 GOLD, INC.

(formerly known as Aultra Gold, Inc.)

(Exact name of small business issuer as specified in its charter)

|

Nevada

|

98-0448154

|

|

(State or other jurisdiction of

incorporation or organization)

|

(IRS Employer

Identification No.)

|

1350 Broadway, 11th Floor

New York, New York 10018

(Address of principal executive offices)

(Registrant's telephone number, including area code (212) 216-8000

Indicate by check mark whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

||

|

Non-accelerated filer o

|

Smaller Reporting Company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No þ

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date: As of June 30, 2011, the Issuer had 66,261,046 shares of common stock, par value $0.00001 per share, issued and outstanding.

Explanatory Note: The sole purpose of this Amendment No. 1 to Shamika 2 Gold, Inc.’s Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2011, filed with the Securities and Exchange Commission on August 11, 2011 (the “Form 10-Q”), is to provide the consolidated financial statements and related notes from the Form 10-Q formatted in XBRL (eXtensible Business Reporting Language).

TABLE OF CONTENTS

|

Page

|

|||||

|

PART I. FINANCIAL INFORMATION

|

|||||

|

ITEM 1.

|

Condensed Consolidated Financial Statements (unaudited)

|

3 | |||

|

Condensed Consolidated Balance Sheets as of June 30, 2011 and December 31, 2010 (unaudited)

|

F-1 | ||||

|

Condensed Consolidated Statements of Operations for the three and six months ended June 30, 2011 and for the three months ended June 30, 2010 and for the period from inception (January 13, 2010) through June 30, 2010 (unaudited)

|

F-2 | ||||

|

Condensed Consolidated Statements of Cash Flows for the six months ended June 30, 2011 and for the period from inception (January 13, 2010) through June 30, 2010

|

F-3 | ||||

|

Notes to Condensed Consolidated Financial Statements (unaudited)

|

F-4 – F-18 | ||||

|

ITEM 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

4 | |||

|

ITEM 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

13 | |||

|

ITEM 4.

|

Controls and Procedures

|

13 | |||

|

Legal Proceedings

|

17 | ||||

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

17 | ||||

|

Defaults Upon Senior Securities

|

18 | ||||

|

(Removed and Reserved)

|

18 | ||||

|

Other Information

|

18 | ||||

|

Exhibits

|

18 | ||||

|

Signatures

|

19 | ||||

2

PART I - FINANCIAL INFORMATION

| ITEM 1. FINANCIAL STATEMENTS. |

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and Item 310(b) of Regulation S-B, and, therefore, do not include all information and footnotes necessary for a complete presentation of financial position, results of operations, cash flows, and stockholders' equity in conformity with generally accepted accounting principles. In the opinion of management, all adjustments considered necessary for a fair presentation of the results of operations and financial position have been included and all such adjustments are of a normal recurring nature. Operating results for the six months ended June 30, 2011 are not necessarily indicative of the results that can be expected for the year ending December 31, 2011.

As used in this Quarterly Report on Form 10-Q (the “Quarterly Report”), the terms "we", "us", "our", the “Company” and mean Shamika 2 Gold. Inc., unless otherwise indicated. All dollar amounts in this Quarterly Report are in U.S. dollars unless otherwise stated.

3

Shamika 2 Gold, Inc.

An Exploration Stage Company

Condensed Consolidated Balance Sheets

(unaudited)

|

June 30,

2011

|

December 31,

2010

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets

|

||||||||

|

Deferred financing costs

|

$ | 25,786 | $ | $7,995 | ||||

|

Prepaid expenses

|

30,333 | - | ||||||

|

Assets of discontinued operations

|

- | 500,002 | ||||||

|

Total Current Assets

|

56,119 | 507,997 | ||||||

|

Long-term Assets

|

||||||||

|

Mineral property

|

350,000 | - | ||||||

|

Total Assets

|

$ | 406,119 | $ | 507,997 | ||||

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts payable, notes payable and other accrued liabilities

|

$ | 261,797 | $ | 200,551 | ||||

|

Accounts payable related party (note 5)

|

91,422 | 9,613 | ||||||

|

Liabilities of discontinued operations

|

- | 503,499 | ||||||

|

Convertible notes payable, net of discounts of $159,034 and $53,526, respectively

|

196,466 | 24,974 | ||||||

|

Accrued interest

|

7,408 | 276 | ||||||

|

Total Liabilities

|

557,093 | 738,913 | ||||||

|

Commitments and Contingencies

|

||||||||

|

Stockholders’ Deficit

|

||||||||

|

Preferred stock, $0.00001 par value, 10,000,000 shares authorized: none issued or outstanding

|

||||||||

|

Common stock, $0.00001 par value, 300,000,000 shares authorized: 66,261,046 and 50,333,336 shares issued and outstanding, respectively (note 6)

|

662 | 503 | ||||||

|

Additional paid-in capital

|

2,854,199 | 156,842 | ||||||

|

Deficit accumulated during exploration stage

|

(3,005,835 | ) | (388,261 | ) | ||||

|

Total Stockholders’ Deficit

|

(150,974 | ) | (230,916 | ) | ||||

|

Total Liabilities and Stockholders’ Deficit

|

$ | 406,119 | $ | 507,997 | ||||

See Notes to Condensed Consolidated Financial Statements

F-1

Shamika 2 Gold Inc.

An Exploration Stage Company

Condensed Consolidated Statements of Operations

(unaudited)

|

For the three months ended

June 30, 2011

|

For the three months ended

June 30, 2010

|

For the six months ended

June 30, 2011

|

From inception

January 13,

2010 through

June 30, 2010

|

From inception

January 13,

2010 through

June 30, 2011

|

||||||||||||||||

|

REVENUE

|

$ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||

|

Operational Expenses

|

||||||||||||||||||||

|

Consulting fees

|

1,753,250 | - | 1,753,250 | - | 1,753,250 | |||||||||||||||

|

Legal & Professional fees

|

85,221 | 30,424 | 120,098 | 59,924 | 238,925 | |||||||||||||||

|

Investor relations

|

18,594 | - | 18,594 | - | 18,594 | |||||||||||||||

|

Management fee – related party (note 5)

|

278,310 | - | 468,811 | - | 508,811 | |||||||||||||||

|

Exploration costs

|

25,700 | 28,724 | 25,700 | 29,239 | 34,250 | |||||||||||||||

|

Other operational expenses

|

6,361 | 26,660 | 15,838 | 30,160 | 41,879 | |||||||||||||||

|

Operating loss

|

2,167,436 | 85,808 | 2,402,291 | 119,323 | 2,595,709 | |||||||||||||||

|

Other expenses

|

||||||||||||||||||||

|

Interest expense

|

120,210 | - | 192,780 | - | 197,374 | |||||||||||||||

|

Organization expense

|

- | - | - | 500 | 86,750 | |||||||||||||||

|

Net loss from continuing operations

|

2,287,646 | 85,808 | 2,595,071 | 119,823 | 2,879,833 | |||||||||||||||

|

(Gain) Loss from discontinued operations (Note 4)

|

(3,497 | ) | - | 22,503 | - | 126,002 | ||||||||||||||

|

Net loss

|

$ | 2,284,149 | $ | 85,808 | $ | 2,617,574 | $ | 119,823 | $ | 3,005,835 | ||||||||||

|

Loss per share from continuing operations – basic and diluted

|

$ | 0.04 | $ | 0.00 | $ | 0.05 | $ | 0.00 | $ | 0.06 | ||||||||||

|

Loss per share from discontinued operations – basic and diluted

|

$ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||

|

Loss per share

|

$ | 0.04 | $ | 0.00 | $ | 0.05 | $ | 0.00 | $ | 0.06 | ||||||||||

|

Weighted Average Number of Shares Outstanding

|

56,665,591 | 50,000,000 | 53,675,854 | 50,000,000 | 51,270,145 | |||||||||||||||

See Notes to Condensed Consolidated Financial Statements

F-2

Shamika 2 Gold Inc.

An Exploration Stage Company

Condensed Consolidated Statements of Cash Flows

(unaudited)

|

For the six months ended

June 30, 2011

|

From inception

January 13,

2010 through

June 30, 2010

|

From inception

January 13,

2010 through

June 30, 2011

|

||||||||||

|

Operating activities

|

||||||||||||

|

Net loss

|

$ | (2,617,574 | ) | $ | (119,823 | ) | $ | (3,005,835 | ) | |||

|

Adjustments to reconcile net loss to cash used by operating activities

|

||||||||||||

|

Amortization of financing costs

|

34,642 | - | 35,641 | |||||||||

|

Amortization of debt discount

|

150,368 | - | 153,687 | |||||||||

|

Loss from discontinued operations

|

22,503 | - | 126,002 | |||||||||

|

Shares issued for services

|

1,822,500 | - | 1,822,500 | |||||||||

|

Changes in:

|

||||||||||||

|

Deferred financing costs

|

(34,931 | ) | - | (43,926 | ) | |||||||

|

Prepaid expenses

|

(30,333 | ) | - | (30,333 | ) | |||||||

|

Accrued interest

|

10,546 | - | 10,822 | |||||||||

|

Accounts payable and accrued liabilities

|

60,970 | 119,823 | 261,521 | |||||||||

|

Accounts payable - related party

|

81,809 | - | 170,421 | |||||||||

|

Net cash used in operating activities of continuing operations

|

(499,500 | ) | - | (499,500 | ) | |||||||

|

Net cash used in operating activities of discontinued operations

|

(26,000 | ) | - | (26,000 | ) | |||||||

|

Net cash used in operating activities

|

$ | (525,500 | ) | $ | - | $ | (525,500 | ) | ||||

|

Financing activities

|

||||||||||||

|

Proceeds from sale of common stock under subscription agreement

|

175,000 | - | 175,000 | |||||||||

|

Proceeds from convertible notes

|

350,500 | - | 350,500 | |||||||||

|

Net cash provided by financing activities

|

525,500 | - | 525,500 | |||||||||

|

Total change in cash for period

|

||||||||||||

|

Cash at beginning of period

|

- | - | - | |||||||||

|

Cash at end of period

|

- | - | - | |||||||||

| $ | - | $ | - | $ | - | |||||||

|

Non-Cash Investing Activities

|

||||||||||||

|

Shares issued to acquire mineral property

|

$ | 350,000 | $ | - | $ | 350,000 | ||||||

|

Mining permits acquired in exchange for notes payable

|

- | 500,002 | 500,002 | |||||||||

|

Non-cash Financing Activities

|

||||||||||||

|

Shares issued for satisfaction of note payable and accrued interest

|

$ | 78,500 | $ | - | $ | 78,500 | ||||||

See Notes to Condensed Consolidated Financial Statements

F-3

Shamika 2 Gold, Inc.

An Exploration Stage Company

Notes to Condensed Consolidated Financial Statements

June 30, 2011

(unaudited)

| 1. Nature of Operations |

| a) Organization and Change of Business |

Aultra Gold Inc. (" Aultra") was incorporated under the laws of the State of Nevada on January 26, 2005 and was primarily engaged in the acquisition and exploration of mining properties until April 2006. On April 26, 2006, there was a change in management and direction and Aultra engaged in the acquisition and licensing of online gaming technologies. In 2008 and 2009, Aultra changed strategy to focus on exploration and mining and had acquired interests in certain mining properties in Nevada, Oregon, and Montana.

On January 6, 2010, pursuant to a Stock Purchase Agreement, Dutch Gold Resources, Inc. (“Dutch Gold”) acquired 6.4 million shares of Aultra common stock which was a 67% controlling interest of Aultra for a purchase price of one million newly-issued shares of Dutch Gold’s common stock. On January 6, 2010, Aultra entered into an Asset Purchase Agreement (the “Agreement”) with Dutch Gold in which Aultra sold substantially all of its assets to Dutch Gold. As consideration for these assets, Dutch Gold issued 9,614,667 shares of its common stock, par value $0.001 per share, to the Aultra shareholders. In accordance with the transaction, Dutch Gold acquired substantially all of the assets related to Aultra’s gold and mineral business, including mineral rights, inventory, accounts receivable, certain supply and distribution and other vendor contracts, good will and other various assets and intangibles.

On January 13, 2010, Aultra entered into an Agreement and Plan of Share Exchange (the “Exchange”) with Shamika Gold Inc. ("SGI") and the shareholders of SGI pursuant to which Aultra acquired all of the outstanding shares of SGI. For accounting purposes, this is a reverse acquisition with SGI the accounting acquirer of Aultra. For legal purposes Aultra issued shares to the SGI shareholders followed by a merger and recapitalization of Aultra whereby SGI shares were cancelled and Aultra is the surviving entity.

SGI was a Canadian private corporation created by Articles of incorporation on January 13, 2010. SGI primary business activity consists of mining property acquisition, mineral exploration and development.

As a result of the transaction, 50 million shares were outstanding with 25.5 million (approximately 51%) held by the SGI shareholders, 23.5 million issued to settle liabilities and obligations of Aultra and approximately 1 million held by the former Aultra shareholders.

Upon consummation of the Exchange, the business plan of SGI was adopted and Aultra changed its name to Shamika 2 Gold, Inc. (the “Company”).

| b) Going Concern |

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. The Company’s financial statements are prepared using generally accepted accounting principles applicable to a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business.

F-4

Shamika 2 Gold, Inc.

An Exploration Stage Company

Notes to Condensed Consolidated Financial Statements

June 30, 2011

(unaudited)

| b) Going Concern – continued |

As shown in the accompanying financial statements, the Company has incurred a net loss of $2,617,574 for the six month period ended June 30, 2011. The future of the Company is dependent upon its ability to obtain financing and upon future profitable operations from the development of acquisitions. Management has plans to seek additional capital through a private placement and public offering of its common stock. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the Company cannot continue in existence.

| 2. Significant Accounting Policies |

| a) Basis of Accounting |

These consolidated financial statements are prepared in accordance with generally accepted accounting principles (“GAAP”) in the United States of America and include our accounts and the accounts of our majority-owned or controlled subsidiary. As the Company has not generated any revenues from its principal intended activity of mining operations, the Company is considered to be in the exploration stage. The Company currently operates in one reportable segment. Summarized below are those policies considered particularly significant to the Company.

| b) Use of Estimates |

The preparation of financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of any contingent assets and liabilities as of the date of the financial statements, as well as the reported amounts of revenues earned and expenses incurred during the period. Actual results could differ from those estimates.

| c) Financial Instruments and Financial Risk |

The Company’s financial instruments consists of cash, prepaid expenses, accounts payable and accrued liabilities, the fair values of which approximate their carrying amounts due to the short-term nature of these instruments. The fair value of the Company’s debt instruments are calculated based upon the availability of debt instruments with similar terms, rates, privileges and credit quality.

F-5

Shamika 2 Gold, Inc.

An Exploration Stage Company

Notes to Condensed Consolidated Financial Statements

June 30, 2011

(unaudited)

| d) Cash and Concentrations |

Financial instruments, which could potentially subject the Company to credit risk, consist primarily of cash. Cash is managed for the Company by a related party, Shamika Resources Inc. The Company is at risk of loss to the extent that the related party does not uphold its obligations to the Company.

The Company’s operations are all related to the minerals and mining industry. A reduction in mineral prices, political unrest in the countries in which the Company operates or other disturbances in the minerals market could have an adverse effect on the Company’s operations.

| e) Environmental Costs |

Environmental expenditures that relate to current operations are charged to operations or capitalized as appropriate. Expenditures that relate to an existing condition caused by past operations, and which do not contribute to current or future revenue generation, are charged to operations. Liabilities are recorded when environmental assessments and/or remedial efforts are probable, and the cost can be reasonably estimated. Generally, the timing of these accruals coincides with the earlier of completion of a feasibility study or the Company’s commitments to plan of action based on the then known facts. Management has determined that recording a liability pertaining to environmental contingencies or expenditures as of June 30, 2011 is not needed.

| f) Per Share Data |

Basic loss per share is computed by dividing net loss by the weighted average number of common shares outstanding for the year. Diluted loss per share is computed by dividing net loss by the weighted average number of common shares outstanding plus common stock equivalents (if dilutive) related to warrants and convertible notes.

The Company has excluded all common equivalent shares outstanding for warrants and convertible notes from the calculation of diluted net loss per share because all such securities are anti-dilutive for the periods presented.

| g) Income Taxes |

Deferred taxes are provided on a liability method whereby deferred tax assets are recognized for deductible temporary differences and operating loss carry-forwards and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment. ASC 740 also requires that uncertain tax positions are evaluated in a two-step process, whereby (1) it is determined whether it is more likely than not that the tax positions will be sustained based on the technical merits of the position and (2) for those tax positions that meet the more-likely-than-not recognition threshold, the largest amount of tax benefit that is greater than fifty percent likely of being realized upon ultimate settlement with the related tax authority would be recognized.

F-6

Shamika 2 Gold, Inc.

An Exploration Stage Company

Notes to Condensed Consolidated Financial Statements

June 30, 2011

(unaudited)

| 2. Significant Accounting Policies (continued) |

| h) Revenue Recognition |

The Company plans to recognize revenue from the sale of product when an agreement of sale exists, product delivery has occurred, title has transferred to the customer and collection is reasonably assured. The price to be received is based upon terms of a sales contract. The Company has not generated revenue activity for the periods presented in the consolidated financial statements.

| i) Stock Based Compensation |

The Company measures the compensation cost of stock options and other stock-based awards to employees and directors at fair value at the grant date and recognizes compensation expense over the requisite service period for awards expected to vest. The Company issued 200,000 and 1,800,000 shares of the Company’s common stock to Frederic Clement de la Forge, a Director of the Company, in two separate grants on April 14, 2011 and May 24, 2011, respectively. The shares vested immediately and the value of the share grants were $52,000 and $234,000, respectively, based upon the market price on the grant date. On April 14, 2011, the Company issued 1,000,000 shares of the Company’s common stock to Terence S. Ortslan, a Director of the Company. The shares vested immediately and the value of this share grant is $260,000, based upon the market price on the grant date.

The Company periodically issues stock for payment of compensation and certain other expenses and these stock issuances are expensed based on the market value of the stock on the date granted. The Company expensed this compensation at the time of stock issuance as the stock issuance date approximates the date the services are performed. On June 6, 2011 the Company issued 957,565 shares of the Company’s Common stock as compensation to consultants. The market price on the grant date, June 6, 2011, was $0.1305 per share, resulting in a value of this share grant of $125,000.

| j) Asset Retirement Obligation |

The Company follows ASC 410-20, which addresses financial accounting and reporting for obligations associated with the retirement of tangible long-lived assets and the associated retirement costs. The standard applies to legal obligations associated with the retirement of long-lived assets that result from the acquisition, construction, development and normal use of the asset.

ASC 410-20 requires that the fair value of a liability for an asset retirement obligation be recognized in the period in which it is incurred if a reasonable estimate of fair value can be made. The fair value of the liability is added to the carrying amount of the associated asset and this additional carrying amount is depreciated over the life of the asset. The liability is accreted at the end of each period through charges to operating expense. If the obligation is settled for other than the carrying amount of the liability, the Company will recognize a gain or loss on settlement. The Company has no mining projects in production as of June 30, 2011, and the asset retirement obligations are usually created as part of the production process. Accordingly, at June 30, 2011, the Company had no asset retirement obligations.

F-7

Shamika 2 Gold, Inc.

An Exploration Stage Company

Notes to Condensed Consolidated Financial Statements

June 30, 2011

(unaudited)

| k) Mineral Properties, Mineral Claim Payments and Exploration Expenses |

The Company capitalizes costs related to the acquisition of mineral properties. Costs related to the maintenance and exploration of unproven mineral properties to which it has secured exploration rights are expensed as incurred. If and when proven and probable reserves are determined for a property and a feasibility study is completed, then subsequent development costs of the property are capitalized. Once capitalized, such costs will be amortized using the units-of-production method over the estimated life of the probable reserves. To date, excluding the mineral properties in the Democratic Republic of Congo which were discontinued (see note 4), the Company had not established the commercial feasibility of its exploration prospects, therefore all maintenance and exploration costs have been expensed. At June 30, 2011, in connection with the acquisition of the Montclerg property mineral rights (see Note 6), the Company had capitalized $350,000 of acquisition costs related to mineral properties.

The Company assesses the carrying costs for impairment under ASC 930 Extractive Activities – Mining (ASC 930) annually. Impairment is recognized when the sum of the expected undiscounted future cash flows is less than the carrying amount of the mineral property. Impairment losses, if any, are measured as the excess of the carrying amount of the mineral property over its estimated fair value. If mineral properties are subsequently abandoned or impaired, any capitalized costs will be charged to operations.

| l) Convertible Instruments |

The Company reviews the terms of convertible debt and equity instruments to determine whether there are conversion features or embedded derivative instruments including embedded conversion options that are required to be bifurcated and accounted for separately as a derivative financial instrument. In circumstances where the convertible instrument contains more than one embedded derivative instrument, including conversion options that are required to be bifurcated, the bifurcated derivative instruments are accounted for as a single compound instrument. Also, in connection with the sale of convertible debt and equity instruments, the Company may issue free standing warrants that may, depending on their terms, be accounted for as derivative instrument liabilities, rather than as equity. When convertible debt or equity instruments contain embedded derivative instruments that are to be bifurcated and accounted for separately, the total proceeds allocated to the convertible host instruments are first allocated to the fair value of all the bifurcated derivative instruments. The remaining proceeds, if any, are then allocated to the convertible instruments themselves, usually resulting in those instruments being recorded at a discount from their face amount. When the Company issues debt securities, which bear interest at rates that are lower than market rates, the Company recognizes a discount, which is offset against the carrying value of the debt. Such discount from the face value of the debt, together with the stated interest on the instrument, is amortized over the life of the instrument through periodic charges to income.

In addition, certain conversion features are recognized as beneficial conversion features to the extent the conversion price as defined in the convertible note is less than the closing stock price on the issuance of the convertible notes.

Fees incurred in the placement of the convertible notes are deferred and recognized over the life of the debt agreement as an adjustment to interest expense using the interest method.

F-8

Shamika 2 Gold, Inc.

An Exploration Stage Company

Notes to Condensed Consolidated Financial Statements

June 30, 2011

(unaudited)

| m) Recent Accounting Pronouncements |

Fair Value Measurements and Disclosures ASC 820, Improving Disclosures about Fair Value Measurements: In January 2010, the Financial Accounting Standards Board (FASB) issued accounting guidance intended to improve disclosures related to fair value measurements. This guidance requires significant transfers in and out of Level 1 and Level 2 fair value measurements to be disclosed separately along with the reasons for the transfers. Additionally, in the reconciliation for the fair value measurements using significant unobservable inputs (Level 3), information about purchases, sales, issuances and settlements must be presented separately (cannot net as one number). This guidance also provides clarification for existing disclosures on (i) level of disaggregation and (ii) inputs and valuation techniques. In addition, this guidance includes conforming amendments for employers’ disclosure of postretirement benefit plan assets. This guidance was effective for interim and annual reporting periods beginning after December 15, 2009, except for the disclosures about purchases, sales, issuances and settlements in the roll-forward of activity in Level 3 fair value measurements. Those disclosures are required for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years. The adoption of ASC 820 did not have a material impact on the Company’s consolidated results of operations or financial position.

| 3. Business Acquisitions |

Prior to the reverse acquisition discussed herein, Aultra Gold Inc. was an exploration and mining company with certain claims and permits and limited operational activity.

Pursuant to a Stock Purchase Agreement, on January 6, 2010 Dutch Gold Resources Inc. (Dutch Gold) acquired 6,442,500 shares of Aultra which comprised a 67% controlling interest in Aultra after giving effect to a 1 for 10 reverse stock split completed by Aultra just prior to the transaction. Dutch Gold issued one million shares of Dutch Gold’s common stock with a fair value at date of closing of $135,000 as consideration for the purchase.

On January 6, 2010, Dutch Gold also entered into an Asset Purchase Agreement with Aultra pursuant to which, Dutch Gold acquired all of Aultra’s assets which at the time consisted of mining property rights to several parcels in Montana, Nevada and Oregon. As consideration for these assets, Dutch Gold issued 9,614,667 shares of Dutch Gold common stock, par value $0.001 per share, to Aultra's shareholders at a total value of $1,297,980.

As a result of the January 6, 2010 transactions with Dutch Gold, Aultra was 67% owed by Dutch Gold, and was a publically traded company with no assets, approximately $900,000 in carry over liabilities and no means of generating any future revenues.

On March 26, 2010, Aultra Gold, Inc. entered into an Agreement and Plan of Share Exchange with SGI. Pursuant to the agreement Aultra Gold, Inc. acquired all of the outstanding SGI shares from the SGI shareholders in exchange for an aggregate of 25,500,000 newly issued shares of Aultra’s common stock, par value $0.00001 per share resulting in, SGI and its 99.9% owned subsidiary Shamika Gold Mining Sprl., a Congolese limited partnership became subsidiaries of Aultra. Aultra shares were issued to the SGI shareholders on a pro rata basis, on the basis of the shares held by such SGI shareholders at the time of the transaction. In addition, Aultra issued 23,547,067 shares of its common stock to various former Aultra Shareholders to satisfy certain liabilities at the time of the transaction in the amount of $301,000 and of this amount Dutch Gold receiving 4,950,000 shares. Upon completion of the transaction, there were 50,000,000 shares of Aultra outstanding including 952,933 shares retained by the former Aultra shareholders.

F-9

Shamika 2 Gold, Inc.

An Exploration Stage Company

Notes to Condensed Consolidated Financial Statements

June 30, 2011

(unaudited)

| 3. Business Acquisitions - continued |

This transaction represents a reverse acquisition with SGI being the acquirer. The business purpose of this transaction was for SGI to be a publically traded company and have access to capital markets in the United States.

As Aultra had no operations subsequent to the Asset Purchase Agreement noted above, issuing shares that would result in SGI having a controlling interest allowed Aultra shareholders an exit strategy or investment return.

As a result of the acquisition by SGI, Dutch Gold assumed the remaining Aultra liabilities of $616,154 which represents amounts owed to a related party officer (Rauno Perttu) at the time of the transaction.

At the effective time of the acquisition, Aultra’s board of directors and officers was reconstituted by the resignation of: Rauno Perttu from his role as President, Secretary and director, Daniel Hollis from his role as Chief Financial Officer and director, and the appointment of Robert Vivian as President and Chief Executive Officer and Terence Ortslan as Secretary and Director. Therefore, subsequent to the acquisition, Dutch Gold no longer has a controlling interest in Aultra.

Subsequent to the transaction, Aultra changed its name to Shamika 2 Gold, Inc and adopted the business plan of the Company.

On January 13, 2010, Shamika Gold Mining SPRL, a subsidiary was contributed as initial capital to the Company. During 2010 the Company spent resources on permits to develop the Congo claims including the Lubutu project which consists in 72 mining blocks controlled, covering 61 km2 located on lands in Lubutu, Pting the province of Maniema. This location is in the heart of the Kibara Metallogenic Belt approximately 300 kilometres northwest of Lake Kivu. The claims and expenditures also included the Poko project which consists of an exploration permit located on lands in the Kilo-Moto Greenstone belt area in Congo’s Eastern region covering an area of 120 mining blocks and 101 km2.

F-10

Shamika 2 Gold, Inc.

An Exploration Stage Company

Notes to Condensed Consolidated Financial Statements

June 30, 2011

(unaudited)

| 4. Discontinued Operations |

During fourth quarter 2010, the Company reallocated its resources to find other projects and to focus efforts on the Cambodia project (see note 6), ceased expenditures and further, the Company decided to abandon its efforts on the Congo properties. On April 6, 2011 the Company assigned all rights and interests in the assets and liabilities of Shamika Gold Mining SPRL to a related company, Shamika Congo Kahele SPRL. The Company has no continuing involvement in Shamika Gold Mining SPRL. The Company accounted for the subsidiary disposal as discontinued operations. The value of the identifiable assets and liabilities of Shamika Gold Mining SPRL was as follows as of December 31, 2010:

|

Assets

|

||||

|

Mining rights and licences

|

$

|

500,002

|

||

|

Liabilities

|

||||

|

Note payable

|

459,000

|

|||

|

Accounts payable – related party

|

44,499

|

|||

|

503,499

|

||||

|

Net liabilities of discontinued operations

|

$

|

3,497

|

||

|

There were no amounts reflected on the June 30, 2011 balance sheet related to discontinued operations as the assets and liabilities were disposed of on April 6, 2011.

The following table shows the results of operations of the disposal subsidiary for the three and six month period ended June 30, 2011:

|

|

3 Month

Period

|

6 Month

Period

|

|||||||

|

Revenues

|

$ | - | $ | - | ||||

|

Permits & Licences

|

20,000 | |||||||

|

Other administrative costs

|

6,000 | |||||||

|

Gain on disposal

|

(3,497 | ) | (3,497 | ) | ||||

|

Net Loss

|

$ | (3,497 | ) | $ | 22,503 | |||

No tax benefits were recorded on results of discontinued operations as realization of such does not meet recognition criteria.

F-11

Shamika 2 Gold, Inc.

An Exploration Stage Company

Notes to Condensed Consolidated Financial Statements

June 30, 2011

(unaudited)

| 5. Management Fees to Related Party |

The Company operates under a management agreement with a related party Shamika Resources, Inc, which is controlled by the Company's CEO, Robert Vivian. The Company has no employees or office expenses as such are provided by Shamika Resources Inc. through the management agreement. During 2011 the agreement was informal and $468,811 was expensed as management fees to Shamika Resources, Inc. under the agreement. The Company does not maintain any cash or bank accounts but relies upon advances from and payables to Shamika Resources, Inc, under the management agreement, which holds any cash the Company has raised as a result of debt or equity issuances and makes payments for services on the Company's behalf. Related party payables are recorded at their cost, are non-interest bearing, unsecured and have no specific terms for repayment. As of June 30, 2011, the Company owes $91,422 to Shamika Resources Inc. under the agreement.

| 6. Share Capital |

During 2010, the Company sold capital units (Units) using a subscription agreement. Each Unit consisted of 83,334 shares of common stock and 41,667 warrants. The warrants have a three year expiration period. The warrants also are subject to a mandatory exercise provision which will require the holder of the warrants to exercise the warrants when the average closing price of the Company’s Common Stock has been equal to or greater than $0.75 for ten consecutive trading days.

As a result of a subscription agreement that was executed with Dutch Gold on November 16, 2010, the Company received $100,000 in payments from Dutch Gold for 4 units. The Company issued 333,336 Common Stock of the Company, par value $0.00001 per share and166,668 warrants with a $0.50 exercise strike price.

On January 13, 2011, as a result of a subscription agreement that was executed with Dutch Gold on November 16, 2010, the Company received $50,000 in payments from Dutch Gold for 2 Units resulting in the issuance of 166,668 Common Stock of the Company, par value $0.00001 per share and 83,336 Warrants of the Company’s Common Stock with a $0.50 exercise strike price.

On January 19, 2011, as a result of a subscription agreement that was executed with El Oro on Ltd. November 16, 2010, the Company received $75,000 in payments from El Oro Ltd. for 3 Units resulting in the issuance of 250,002 Common Stock of the Company, par value $0.00001 per share and 125,004 Warrants of the Company’s Common Stock at the exercise price of $0.30 per share.

F-12

Shamika 2 Gold, Inc.

An Exploration Stage Company

Notes to Condensed Consolidated Financial Statements

June 30, 2011

(unaudited)

| 6. Share Capital – continued |

On February 25, 2011 the Company entered into a Securities Exchange Agreement with MIG International Mining Group, a company organized under the laws of the Republic of Mauritius (“Cambodia Project”). The Company will acquire 85% of the outstanding equity of MIG International Mining Group in exchange for an aggregate 57,000,000 newly issued common shares of the Company, par value $0.00001 per share (the “Exchange Shares”) and five hundred thousand (500,000) shares of the Company’s Series B Performing Preferred Stock, par value $0.00001 per share (the “Performing Preferred Shares”), which entitles the holder, to receive a dividend equal to forty-five percent (45%) of the net operating profit, after taxes. This Cambodia project consists of an area of approximately 140 sq miles in the Samlout/Samlaut area of Western Cambodia. The land is adjacent to Cambodia’s Pailin district, which is a producer of rubies. Following the initial closing, the holders of the newly issued shares will beneficially own approximately 51% of the outstanding shares of the Company’s Common Stock and 100% of the total outstanding shares of Performing Preferred Shares. The Performing Preferred Shares and the Exchange Shares shall be held in escrow until MIG Mauritius has received all required production licenses in Cambodia to mine approximately 240 square kilometres for gold and ruby mineralization in mining exploration rights located in Samlaut, Cambodia, (the “Mining Rights”) and has commenced commercial production for a period of at least two months (the “Release Conditions”). Following satisfactory proof of the Release Conditions, the Exchange Shares shall be released to the MIG Mauritius holders. If the Release Conditions have not been satisfied within six (6) months from the Closing, Shamika shall have the right to terminate the Agreement.

In addition, Shamika agreed to provide the project financing in the amount of $2.5 million to $5 million. Such project financing is required for the realization of the exploration and exploitation projects related to: the 254km2 property in Samlaut District, Battambang and Pailin provinces, in the Kingdom of Cambodia; the 94km2 property in Kompovpur Village, Samlaut District, in Battambang province, Kingdom of Cambodia; and other projects, subject to board approval. The project financing will be dependent upon the Company ability to successfully raise the funds from investors and will not be invested in the Cambodia Project until production and exploitation licenses have been approved by the regulatory authorities.

The acquisition of the Cambodia Project will not be considered completed or accounted for as a business combination in the financial statements until all contractual provisions are satisfied and the Company has effective control of the Cambodia Project. Such control is anticipated to occur upon the contribution of significant project financing funds once production licenses are approved and the termination provisions are no longer applicable to the Company.

On August 4, 2011, the Company received written notice from MIG International PLC ("MIG") alleging that the Company was in breach of the provisions of the Securities Exchange Agreement dated February 25, 2011 (the "Agreement") and that MIG was seeking to terminate the Agreement. The Company denies MIG's allegations.

On March 17, 2011 the Company executed a Convertible Note in the amount of $50,000 in favour of Coventry Enterprises LLC. Pursuant to the terms of the Note, the Company is required to issue the Holder 50,000 common shares, par value $0.00001 per share. The value of the shares issued is based upon the market price of the Company’s common stock on the date of issuance. The Company charged the value of the shares, $17,500, to interest expense.

F-13

Shamika 2 Gold, Inc.

An Exploration Stage Company

Notes to Condensed Consolidated Financial Statements

June 30, 2011

(unaudited)

| 6. Share Capital – continued |

On April 14, 2011, the Company issued 4,800,000 shares of the Company’s Common stock to the founders of the Company. The market value on that date was $0.26 per share, resulting in a value of this share grant of $1,248,000.

On April 19, 2011, the Company sold two capital units (Units) pursuant to a subscription agreement for a cash consideration of $50,000. Each Unit consisted of 83,334 shares of common stock and 41,667 warrants. The warrants have three year expiration. The warrants also are subject to a mandatory exercise provision which will require the holder of the warrants to exercise the warrants when the average closing price of the Company’s Common Stock has been equal to or greater than $0.75 for ten consecutive trading days.

On April 29, 2011 the Company issued 250,000 shares of the Company’s Common stock to Interactive Business Alliance, LLC, a public relations firm. The market value on that date was $0.182 per share, resulting in a value of this share grant of $45,500.

On June 6, 2011 the Company issued 957,565 shares of the Company’s Common stock to employees and consultants of Shamika Resources Inc. The market value on that date was $0.1305 per share, resulting in a value of this share grant of $125,000.

On June 14, 2011 the Company issued 1,262,819 shares of the Company’s Common stock to Centurion Private Equity, LLC. The shares represent legal costs and commitment fees pursuant to an Investment Agreement dated June 13, 2011. The market value on that date was $0.1346 per share, resulting in a value of this share grant of $170,000. As of June 14, 2011, the Company entered into an investment agreement (the “Investment Agreement”) with Centurion Private Equity, LLC (“Centurion”) to establish an equity facility pursuant to which the Company will issue registered, tradable shares of its common stock, par value $0.00001 per share (the “Common Stock”), for future financings of up to $10 million over a 36-month period. Pursuant to that certain Registration Rights Agreement (the “Registration Rights Agreement”), the Company agreed to register the shares involved in the equity facility in several tranches over the term. Any use of this equity facility will be entirely in the Company’s discretion.

Subject to an effective registration statement, the Company may draw on the $10 million facility from time to time, as and when we determine appropriate in accordance with the terms and conditions of the Investment Agreement. The maximum amount that the Company is entitled to put in any one notice is such number of shares of common stock as equals $500,000 provided that the number of shares sold in each put shall not exceed a share volume limitation equal to the lesser of: (i) a number of shares equal to the Company Designated Maximum Put Dollar Amount divided by the Company Designated Minimum Put Share Price, or (ii) 15% of the aggregate trading volume (the “Volume Limitation”) of the common stock traded on our primary exchange during any pricing period for such put excluding any days where the lowest intra-day trade price is less than the ”Trigger Price” (which is the greater of: (a) the floor price plus a fixed discount of $0.01, subject to adjustment in certain circumstances; or (b) the floor price if any set by us divided by 0.98). The offering price of the securities to Centurion will equal the lesser of: (i) 98% of the average of the lowest three daily volume weighted average price, or “VWAPs,” of our common stock during the fifteen trading day period beginning on the trading day immediately following the date Centurion receives our put notice (the “Market Price”) or (ii) the Market Price minus $0.01. However, if, on any trading day during a pricing period, the lowest intra-day trading price of the common stock is lower than the Trigger Price, then that day’s trading volume is excluded from the calculation of the Volume Limitation on the number of shares that we are entitled to sell in that put. There are put restrictions applied on days between the put notice date and the closing date with respect to that particular put. During such time, we are not entitled to deliver another put notice.

F-14

Shamika 2 Gold, Inc.

An Exploration Stage Company

Notes to Condensed Consolidated Financial Statements

June 30, 2011

(unaudited)

| 6. Share Capital – continued |

The Investment Agreement provides that the Company must deliver an advance put notice to Centurion at least five business days but no more than ten business days prior to any intended put date. The advance put notice must provide the number of shares included in the put and the put date.

The Company may terminate the facility at any time for any reason during an Extended Put Period (as defined in the Investment Agreement), provided that such termination shall have no effect on the parties’ other rights and obligations under the Investment Agreement and the Registration Rights Agreement. The Investment Agreement contains customary representations and warranties of each of the Company and Centurion.

In addition, the Company executed a Registration Rights Agreement with Centurion whereby the Company agreed to register a number of shares of its Common Stock equal to the Commitment Shares, the Fee Shares, any shares of Common Stock to be issued in connection with a put and any shares resulting from a dividend, stock split, exchange, reclassification or similar distribution. The Company agreed to file a registration statement with the Securities and Exchange Statement to register such shares within 60 days and to have such registration be effective within 120-150 days and to keep such registration statement, or additional registration statements if necessary, remain effective until either all of the registered shares are sold or the shares may be sold in accordance with Rule 144 of the Securities Act of 1933, as amended.

On June 21, 2011 Asher Enterprises converted a Convertible Note, face value $78,500, into Common stock. The conversion resulted in the Company issuing 1,223,988 Common shares.

On December 20, 2010, the Company entered into the Montclerg Property- Property Sale Agreement (the “Agreement”) with Lam Chan Tho (“Tho”). Pursuant to the Agreement, the Company acquired all of the interests in certain mineral claims owned by Tho in consideration for five million shares of shares of the Company’s Common Stock, and payment of a royalty of two and one half percent of the net smelter returns, as further described in the Agreement.

On June 28, 2011, the Company issued 5,000,000 shares of Common stock to Lam Cham Tho. The shares were issued pursuant to the Purchase Agreement for the Montclerg Property. The market value on that date was $0.07 per share, resulting in a value of this share grant of $350,000.

F-15

Shamika 2 Gold, Inc.

An Exploration Stage Company

Notes to Condensed Consolidated Financial Statements

June 30, 2011

(unaudited)

| 7. Convertible Notes |

The Company had convertible promissory notes outstanding at June 30, 2011 and December 31, 2010 as follows:

|

Notes Outstanding as of

|

||||||||

|

Convertible Notes - Net of Debt Discount

|

June 30,

2011

|

December 31,

2010

|

||||||

|

Asher Enterprises #1

|

$

|

-

|

$ |

24,974

|

||||

|

Asher Enterprises #2

|

37,400

|

|||||||

|

Asher Enterprises #3

|

31,229

|

|||||||

|

Asher Enterprises #4

|

22,088

|

|||||||

|

Asher Enterprises #5

|

4,184

|

|||||||

|

War Chest

|

87,220

|

|||||||

|

Coventry

|

14,345

|

|||||||

| $ |

196,466

|

$ |

24,974

|

|||||

On January 3, 2011, the Company issued a Secured Convertible Note in the amount of $50,000 to Asher Enterprises Inc. due September 3, 2011 and bearing interest at the rate of 8% per annum. The note is convertible into common shares of the Company at any time from January 3, 2011 and ending on the complete satisfaction of the Note. The conversion price shall equal the Variable Conversion Price defined as 58% multiplied by the Market Price defined as the average of the lowest 3 Trading Prices on the OTCBB during the 10 day trading period ending one day prior to the date of Conversion Notice. In the event of default, the Note is immediately payable. The minimum amount due in default is 150% x (outstanding principal + unpaid interest). As of June 30, 2011, $12,600 in unamortized discount remained associated with the beneficial conversion feature.

On March 2, 2011 the Company issued a Secured Convertible Note in the amount of $102,500 to War Chest Capital Multi-Strategy Fund LLC., due September 2, 2011 and bearing interest at the rate of 9.875% per annum. The note is convertible into common shares of the Company at any time during the period beginning on the date of the Note and ending on the complete satisfaction of the Note. The lender has the option to convert the outstanding principal and interest of this Note into fully-paid and non-assessable shares of the Company’s Common Stock at a 30% discount to the Fair Market Value but not to exceed $0.75 per share. In the event of default, the Note is immediately payable. In the event of default, additional interest will accrue at the rate equal to the lesser of (i) 15% per annum in addition to the Interest Rate or (ii) the highest rate permitted by law, per annum until all outstanding principal, interest and fees are repaid in full. ). As of June 30, 2011, $15,280 in unamortized discount remained associated with the beneficial conversion feature.

F-16

Shamika 2 Gold, Inc.

An Exploration Stage Company

Notes to Condensed Consolidated Financial Statements

June 30, 2011

(unaudited)

| 7. Convertible Note – continued |

On March 3, 2011 the Company issued a Secured Convertible Note in the amount of $53,000 to Asher Enterprises Inc. due December 3, 2011 and bearing interest at the rate of 8% per annum. The note is convertible into common shares of the Company at any time from March 3, 2011 and ending on the complete satisfaction of the Note. The conversion price shall equal the Variable Conversion Price defined as 58% multiplied by the Market Price defined as the average of the lowest 3 Trading Prices on the OTCBB during the 10 day trading period ending one day prior to the date of Conversion Notice. In the event of default, the Note is immediately payable. The minimum amount due in default is 150% x (outstanding principal + unpaid interest). As of June 30, 2011, $21,771 in unamortized discount remained associated with the beneficial conversion feature.

On March 17, 2011 the Company executed a Convertible Note in the amount of $50,000 in favour of Coventry Enterprises LLC. Pursuant to the terms of the Note, the Company is required to issue the Holder 50,000 common shares, par value $0.00001 per share. The Conversion Price per share of Common Stock shall be the lower of $.30 or thirty five percent (35%) of the average of the three lowest prices, as defined, of the Company’s Common Stock for the fifteen trading days preceding a Conversion Date). As of June 30, 2011, $35,656 in unamortized discount remained associated with the beneficial conversion feature.

On April 28, 2011 the Company issued a Secured Convertible Note in the amount of $50,000 to Asher Enterprises Inc. due January 28, 2012 and bearing interest at the rate of 8% per annum. The note is convertible into common shares of the Company at any time from April 28, 2011 and ending on the complete satisfaction of the Note. The conversion price shall equal the Variable Conversion Price defined as 58% multiplied by the Market Price defined as the average of the lowest 3 Trading Prices on the OTCBB during the 10 day trading period ending one day prior to the date of Conversion Notice. In the event of default, the Note is immediately payable. The minimum amount due in default is 150% x (outstanding principal + unpaid interest). As of June 30, 2011, $27,912 in unamortized discount remained associated with the beneficial conversion feature.

On June 28, 2011 the Company issued a Secured Convertible Note in the amount of $50,000 to Asher Enterprises Inc. due March 27, 2012 and bearing interest at the rate of 8% per annum. The note is convertible into common shares of the Company at any time from June 28, 2011 and ending on the complete satisfaction of the Note. The conversion price shall equal the Variable Conversion Price defined as 52% multiplied by the Market Price defined as the average of the lowest 3 Trading Prices on the OTCBB during the 10 day trading period ending one day prior to the date of Conversion Notice. In the event of default, the Note is immediately payable. The minimum amount due in default is 150% x (outstanding principal + unpaid interest). As of June 30, 2011, $45,816 in unamortized discount remained associated with the beneficial conversion feature.

F-17

Shamika 2 Gold, Inc.

An Exploration Stage Company

Notes to Condensed Consolidated Financial Statements

June 30, 2011

(unaudited)

| 8. Subsequent events |

On July 13, 2011 Asher Enterprises converted a portion of Note #2 in the amount of $12,000. The conversion resulted in the issuance of 310,078 shares of the Company’s Common Stock. The remaining principal owing on Note #2 after this conversion was $38,000.

On July 14, 2011 Asher Enterprises converted a portion of Note #2 in the amount of $12,000. The conversion resulted in the issuance of 320,000 shares of the Company’s Common Stock. The remaining principal owing on Note #2 after this conversion was $26,000.

On July 18, 2011 Asher Enterprises converted a portion of Note #2 in the amount of $15,000. The conversion resulted in the issuance of 488,599 shares of the Company’s Common Stock. The remaining principal owing on Note #2 after this conversion was $11,000.

On July 21, 2011 Asher Enterprises converted the final portion of Note #2 in the amount of $11,000 plus accrued interest of $2,000. The conversion resulted in the issuance of 577,778 shares of the Company’s Common Stock.

On August 4, 2011, the Company received written notice from MIG International PLC ("MIG") alleging that the Company was in breach of the provisions of the Securities Exchange Agreement dated February 25, 2011 (the "Agreement") and that MIG was seeking to terminate the Agreement. The Company denies MIG's allegations.

F-18

|

ITEM 2.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

The following discussion should be read in conjunction with our Financial Statements and Notes thereto included herein beginning on page F-1.

References in this Quarterly Report on Form 10-Q (the “Quarterly Report”) to “we”, “us,” “our,” “the Company,” “Shamika” mean Shamika 2 Gold, Inc. and our subsidiaries, unless the context otherwise requires. Forward-looking statements discuss matters that are not historical facts and can be identified by the use of words such as “believes,” “expects,” “anticipates,” “intends,” “estimates,” “projects,” “can,” “could,” “may,” “will,” “would” or similar expressions.

Although these forward-looking statements reflect the good faith judgment of our management, such statements can only be based upon facts and factors currently known to us. Forward-looking statements are inherently subject to risks and uncertainties, many of which are beyond our control. As a result, our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth below under the caption “Risk Factors.” For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You should not unduly rely on these forward-looking statements, which speak only as of the date on which they were made. They give our expectations regarding the future but are not guarantees. We undertake no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by law.

Shamika 2 Gold, Inc. is engaged in the business of acquiring and exploring mining properties principally located in Cambodia and Quebec, Canada, with the objective of identifying gold and mineralized deposits economically worthy of continued production and/or subsequent development, mining or sale.

Results of Operations

During the six-month period ended June 30, 2011, the Company incurred operating expenses of $2,402,291 and interest expenses of $192,780 as compared to operating expenses of $119,323 for the period ended June 30, 2010. The operating expenses in 2011 primarily consisted of management fees of approximately $469,000 and legal and professional fees of approximately $120,000 in addition to consulting fees of approximately $1,753,000. The consulting fees were paid in shares as follows: 4,800,000 common stock issued to the founders, 1,800,000 shares issued to Frederic de La Forge, the Company’s COO, 1,262,819 issued to Centurion Equity Fund LLC for commitment and legal fees pursuant to an Equity line of credit facility and 957,565 shares issued to various consultants for services rendered.

On April 6, 2011 the Company assigned all rights and interests in the assets and liabilities of Shamika Gold Mining SPRL to a related company, Shamika Congo Kahele SPRL. The Company has no continuing involvement in Shamika Gold Mining SPRL. As a result of the decision to abandon the Congo projects, the Company accounted for the subsidiary disposal as discontinued operations. As a result of this decision, the Company incurred losses from discontinued operations of $22,503 during the six-month period ended June 30, 2011.

4

Employees

As of June 30, 2011, the Company had no full time employees as operations are provided for through a management contract with a related party. The Company anticipates that it will be conducting most of its business through agreements with consultants and third parties.

Description of S2G’s Properties

Description of Samlout, Cambodia

The Samlout project comprises a project of approximately 140 sq miles in the Samlout/Samlaut area of Western Cambodia. The land is adjacent to Cambodia’s well known Pailin district. A Survey Report by Terra Insight Services suggests that the property has potential for rubies and gold. Shamika’s business plan envisages the initiation of gold and ruby alluvial production in the second half of 2012, the completion of a 43-101 Report and a program of further exploration in accordance with the recommendations.

This property has no known reserves and the proposed program is exploratory in nature. There are no current detailed plans to conduct exploration on the property.

We plan to prepare a NI 43-101, Independent Third-Party Evaluation, in 2011. The reader is warned that a NI 43-101 study is a Canadian report, and is not compliant with U.S. SEC regulations. The report and earlier reports not compliant with current SEC regulations used terms such as “ore”, "measured," "indicated," and "inferred" "resources," which current SEC regulations strictly forbid. An effort has been made to remove such words from this document. This report will be prepared by Mr. Patrick Vualu, P.GEO. Mr. Vualu has a diploma in geology from University of Lubumbashi and has extensive experience in all aspects of mining in the DRC. He served as project manager for De Beers in DRC and was appointed chief department officer for the DRC Ministry of Mines. Mr. Vualu was president of Général de la Société Mining Consulting and Services, a firm offering geological and lithological mapping, and geological logging, analysis and testing of minerals

Description of Montclerg

This project is situated on lands close to the town of St-Augustin de Woburn in an area known as the Eastern Townships, which is approximately 200 kilometres east of Montreal, Canada. The property consists of 23 mineral claims having an area of 17.5 square kilometres. Our business plan calls for the completion of a 43-101 report and a program of further exploration to determine if proven and probable reserves exist on the property.

This property has no known reserves and the proposed program is exploratory in nature. There are no current detailed plans to conduct exploration on the property.

5

Mineralization:

Samlout Project

The project comprises an area of approximately 140 sq miles in the Samlout/Samlaut area of Western Cambodia. The land is adjacent to Cambodia’s well known Pailin district. A Survey Report by Terra Insight Services suggests that the property has potential for rubies and gold. Terra Insights Services states that in close proximity to the north and west of the license area, there are known deposits of sapphires and rubies in the province of Trat (Thailand) and Battambang (Cambodia). The most known of such deposit is Pailin: it is the main source of sapphires in Cambodia. The field is characterized by alluvial and eluvial placers that were formed during the destruction of basaltic lavas. The geologic framework is the result of a long and repeated history of sedimentation, volcanism, igneous intrusion, metamorphism, and mountain building. These processes formed ancient and recent mountain chains, folded rocks, and broad sedimentary basins throughout the region. Nonfuel mineral deposits are associated with specific geologic rock types and tectonic settings, and therefore the extensive geologic history of Asia and Pacific region has been conducive to the formation of many kinds of large and abundant mineral deposits. The geologic setting in the Asia and Pacific regions is consistent with the discovery of a number of new, important mineral belts, which may contain potential for the occurrence of undiscovered deposits. In addition, the presence of known mineral deposits suggests that well-known belts also may be areas of new discoveries. There are no infrastructures nor sources of power present on the property.

Acquisition process of mineral rights

Mineral rights are acquired through solicitation as per the mining code established by the government of the country. The basis and duration of the mineral rights relate to the rules of the mining code of the concerned countries. These mining codes are readily available to the public for detailed information as per acquisition, mineral, surface, exploration, extraction licenses and rights.

Type of claims

The concessions are essentially alluvial and elluvial deposits. They are governmental exploration mining concessions.

Mineralization:

We plan to account for probable or proven reserves as defined by the SEC section (a) of Industry Guide 7. However, we have not completed the analysis to do so. We have utilized a cutting-edge remote exploration satellite technology to determine the probable reserves and this was followed with in the field geological samples, outcrops, holes, as explained below:

Revolutionary Satellite Technology

1. Structure-metric analysis - part of the technology, which processes satellite data to identify geological and tectonic formations, as well as areas of high mineralization (including potential source deposits). Paleo-reconstruction – part of the technology, which utilizes cartographic and satellite data reconstructing the relief plasticity in order to create subsurface paleo-channel maps. Such maps assist in understanding of geomorphology and migration of geo-medium to ascertain zones of alluvial deposits’ concentration. Such channel maps help analyze attraction/focal points and geological features indicative of a mining opportunity. In relation to the Cambodian license, the relief plasticity maps helped determine likely directions and patterns of fluid flow along with estimation of locations of probable placer deposits.

2. Geomorphologic analysis/Lineament analysis.

3. Spectrometric analysis.

6

Methodology

1. Structure-metric Analysis of Local Stress Fields

Structure-metric analysis is conducted with the purpose of identifying and delineating areas that have high potential for bearing mineralogical deposits in liquid or solid form.

In the process of analysis and interpretation of various types of satellite images based on the geometrization of terrain attributes and using a proprietary algorithm that takes into account principals of proportionality (Harmonic Division1) and the golden ratio principle, we can:

· Accurately detect geological objects of any origin, regardless of the depth of its occurrence

· Delineate blind deposits

· Detect highly enriched areas of the ore-bearing formations

· Identify oil and natural gas bearing zones

· Solve other geological problems

Structure-metric modeling falls under the rules of fractal geometry and laws of proportional sectionalization of the golden ratio relationships are noted in many geological formations, including morpho-structural. These observations were described in the works of B.L. Lichkov, I.I. Shafronovskii and others. Fractals are the structure that consists of separate elementary particles, which are similar to the whole structure, that form a Hausdorff-Besicovitch (D) dimension set that exceeds its topological dimension (D1). Fractal geometry is a complex mathematical system, exempt from the rules of Euclidean geometry. According to the experimental and mathematical data, most objects found in nature are fractal with non-integer dimension5 . Application of these rules eliminates the subjectivity in geo-dynamic modeling during remote sensing and satellite-based analysis of selected territory.

This method was developed and perfected through the multiple studies of different ore-bearing bodies, detailed geological mapping of aero and satellite images, and geo-morphometric observations of landforms. Ultimately the method was formed into a system of universal geometric models, pertinent to all geological formations.

It has been established that any geological body (sedimentary complex, crystalline massif, mineral deposit, or hydrocarbon occurrence) lies within a strict system of geometric relations that can be shown as vector models of stress zones, comprising a complex multi-dimensional geometric form, similar in the appearance to the Calabi-Yau space. A method based on the work of O.I. Slenzaka allows delineation of local stress zones. As a result of vast amount of observation, a proprietary empirical analysis algorithm was developed based on golden section; which, by using the stress vector zones, allows identification or justification of absence of any target at any location in the surface of the Earth. It was also established that a two-dimensional satellite image carries sufficient records of all geo-dynamic interactions occurring in the Earth's crust to enable such identification.

7

Every geological setting is characterized by its own unique geological and acoustical rigidity. A geological body can only create a certain pattern of interfering stress within its hosting environment with application of tectonic forces and translate it onto the visible surface. In this case, the main characteristics are the density and elasticity properties of the studied compounds. Thus the purpose of the structure-metric analysis is to solve the inverse problem – based on the results of geometric interpretation of the elements of the terrain, with further reconstruction of paleo-structural plan of deformation within the deeply buried horizons, identify presence or absence of the targeted object.

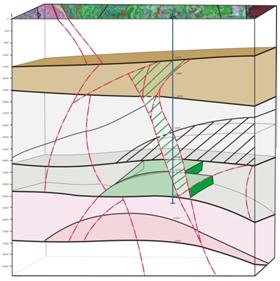

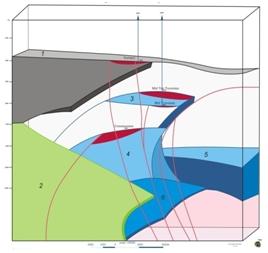

The previously mentioned algorithm enables the transformation of the original two-dimensional satellite image into a multi-dimensional vector model that carries information on all geological targets of interest, presenting themselves in the integral system of interactions. The algorithm also allows determination of the depth of target occurrence and its morphological characteristics (Figure 1).

|

|

Figure 1: Examples of three-dimensional modeling of the structure-metric scanning of geologic exploration areas, based on the analysis of stress fields

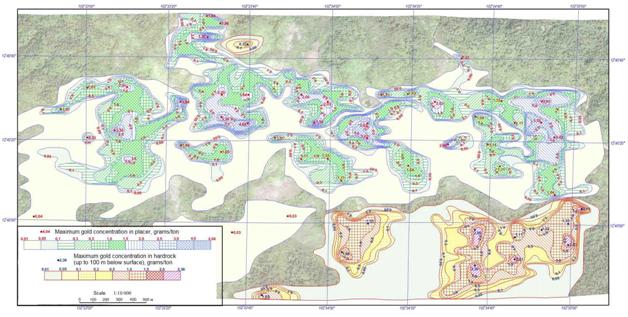

The technology allows us to determine the best outcrops concentrations showed on the isoline ore-bearing, (Figure 86) areas where for on site field detailed sampling, trenching, and holes.

8

Figure 86: isolines of gold concentration of Sector 2.

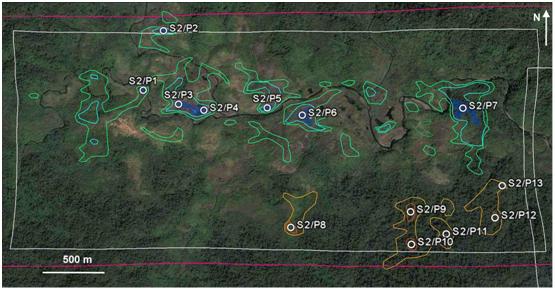

Figure 87: gold anomalies of Sector 2.

9

|

|

Field Sampling

Exploration and Exploitation programs:

|

|

1)

|

The concessions are essentially alluvial and elluvial deposits.

|

Initialize a Geological Survey or 43-101 Budget : USD $200 000 ± 10%

|

|

2)

|

Phase 1 Exploration Program could involve the following:

|

• Geoscientific compilation of available information (BRGM, data bases, maps, etc. …)

• High-definition satellite images and geo-structural interpretation

• Airborne geophysical survey and data interpretation

• Detailed characterization of the property (mapping, sampling)

• Geological and structural mapping (surface and underground)

• Preliminary surveying

• Local prospecting of known mineralised occurrences

• Geological verification of known anomalies at the site

10

Budget : USD $500,000 ± 10%

Phase 2 & 3 Exploration Program :

• Following this first phase, a field exploration program could be planned and a geological prospecting team would verify in-depth the most significant anomalies (geophysics, imagery, old sites, etc.). The main goal would be to size the property's mineralization as well as its extensions and ramifications. This portion could involve ground geophysics as well as investigation work (shafts, trenches, drilling).

• Exploration and geological mapping of the main targets (determined in phase 1), including sampling and in situ analysis with a hand analyzer, shafts, trenches and ground geophysics.

• Development: sizing and development of the Property, including definition of the mineralization boundaries by shallow drilling, detailed geology.

• Local logistics: establishment of a local geoscientific base, development of social contacts with the surrounding villages, improvement of transport infrastructure.

• Following this second phase, a third phase of more thorough investigation of the most promising targets could be undertaken, including detailed geophysics/geochemistry, definition drilling and a scoping study.

Budget : The budget of the second & third phases will be determined based on the results of phase 1 but could be estimated to be between USD $2 to 6 million depending on the required drilling program which could be between 3 to 10 000 meters of diamond core drilling.

PRODUCTION

|

|

a)

|

Capital Costs – Road Construction, Extraction Equipment, Processing & Smelter Plant

|

• A conventional ball mill processing plant could be installed to further exploit the non-alluvial Au ore present on the properties which would include a revolutionary closed loop VAT leaching process. The t/d of ore processed will have to be determined based on the estimated resources of Au and Ag present on site. It can be estimated that the process plant will have to be engineered to process between 3 000 to 5 000 tons per day of the extracted ore, open pit mine. The refinery/smelter plant will be engineered to produce doré or bullion bars.

• Budget : Can only be determined following once the complete exploration and engineering studies have been finalized. Estimation between USD $20 to 60 million.

11

Montclerg Property

This project is situated on lands close to the town of St-Augustin de Woburn in an area known as the Eastern Townships, which is approximately 200 kilometres east of Montreal. The property consists of 23 mineral claims having an area of 17.5 square kilometres. There are no infrastructures nor sources of power present on the property.