SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

July 29, 2011

Date of Report (Date of earliest event reported)

NDB Energy, Inc.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation)

333-52040

(Commission File Number)

98-0195748

(I.R.S. Employer Identification No.)

1200 G Street

NW Suite 800

Washington, DC 20005

(Address of principal executive offices)

(800) 676-1006

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SECTION 1. Registrant’s Business and Operations

Item 1.01 Entry into a Material Definitive Agreement.

Effective as of July 29, 2011, NDB Energy, Inc. (the “Company”) entered into an Asset Purchase Agreement with Mr. James Cerna, Jr. (“Mr. Cerna”) and Acqua Ventures, Inc., pursuant to which the Company acquired the lease to approximately 300 acres of undeveloped land in Gonzales County, Texas for total compensation of one million eight hundred thousand (1,800,000) shares of the Company’s common stock (the “GC APA”).

Effective as of July 29, 2011, the Company entered into an Asset Purchase Agreement with Mr. Cerna pursuant to which the Company acquired two leases totaling approximately 120 contiguous acres of land and fourteen wells in Young County, Texas for total cash compensation of $128,500 (the “YC APA”). Pursuant to the YC APA, the property acquired is subject to an operating agreement with Baron Energy, Inc., an independent oil and gas production, exploitation, and exploration company headquartered in New Braunfels, Texas, with producing assets in the prolific oil producing Permian Basin of West Texas and North Central Texas (“Baron”), pursuant to which Baron operates the wells located on the property and receives a 25% working interest and a 20.3125% net revenue interest.

Effective as of July 29, 2011, the Company entered into an at-will employment agreement with Mr. Cerna (the “JC Employment Agreement”), pursuant to which Mr. Cerna has been appointed to serve as the Company’s Chief Executive Officer on an at-will basis and will be paid an annual salary of $180,000 in 24 equal bi-monthly payments, and will be granted stock options and other executive compensation subject to Board of Directors approval; for further information see Item 5.02 below.

SECTION 2. Financial Information

Item 2.01 Completion of Acquisition or Disposition of Assets

Effective as of July 29, 2011, the Company completed the acquisition of a lease for approximately 300 acres of land in Gonzales County, Texas pursuant to the GC APA. For additional information see Item 1.01 above.

Effective as of July 29, 2011, , the Company completed the acquisition of two leases totaling approximately 120 acres of land and fourteen wells in Young County, Texas pursuant to the YC APA. For additional information see Item 1.01 above.

Unless the context requires otherwise, references to the “Company,” “NDB Energy,” “we,” “our,” and “us,” refer to NDB Energy, Inc. and its wholly-owned subsidiaries.

About Us and Our Business

We were incorporated under the laws of the State of Nevada on November 6, 1998, under the name “e.Deal.net, Inc.” for the purpose of providing a platform for automotive information to, and connecting, buyers and sellers of pre-owned automobiles through the Internet. We were not successful in our efforts and ceased providing online automotive information in November 2006.

During 2005, as we started winding down our online automotive business activities, we amended our Articles of Incorporation to effect a change of name to “International Energy, Inc.,” to reflect our entry into the energy industry although we continued to provide automotive information until November of 2006; initially, through International Energy Corp., our wholly owned subsidiary (“IEC”), we commenced operations as an oil and gas exploration company. On June 27, 2011, we changed our name to NDB Energy, Inc.

2

Oil and gas exploration was our primary focus from November 2006 through September of 2007. Although we acquired exploration rights under land leases located in the State of Utah, we were unable to successfully implement our proposed exploration program due to our inability to secure adequate drilling rigs and equipment as well as qualified personnel.

Our management decided that while our primary focus should remain on energy, our interests and those of our shareholders would be best served by redirecting our focus from oil and gas exploration to the acquisition, development and commercialization of alternative renewable energy technologies. Subsequently, on September 17, 2007, we commenced the development and acquisition of these technologies through our wholly owned subsidiary, IEC, by entering into a Research Agreement with The Regents of the University of California (the “Research Agreement”) in the area of algal biochemistry and photosynthesis (the “Research Project”). The goal of the Research Project was to develop protocols for the growth of microalgal cultures and for the generation of long chain liquid hydrocarbons. These hydrocarbons are derived directly from the photosynthesis of the green microalgae.

Beginning with our Form 10-Q for the period ending September 30, 2010, through our entry into the asset purchase agreements effective as of July 29, 2011, pursuant to which we acquired the lease for approximately 300 acres of land in Gonzales County, Texas (the “GC Property”) and two leases totaling approximately 120 contiguous acres of land and fourteen wells in Young County, Texas (the “YC Property”), we have been considered a “shell company,” as that term is defined in Rule 405 of the Securities Act of 1933, as amended, and Rule 12b-2 of the Securities Exchange Act of 1934, as amended. As a result of these acquisitions, further described below and elsewhere is this Current Report on Form 8-K, the Company believes that it is no longer a “shell company.”

We are an emerging independent oil and gas company that explores for, develops, produces and markets crude oil and natural gas from various known prolific and productive geological formations, primarily in Gonzales and Young Counties. Our goal is to become a profitable organization focused in the development and production of crude oil and natural gas in established domestic oil fields.

We are focused on building and developing a portfolio of oil and gas assets by acquiring what we believe are undervalued, underdeveloped and underperforming properties, and for which we believe we can increase production economically and profitably. At this time, we are considering onshore, domestic, proven areas for our portfolio.

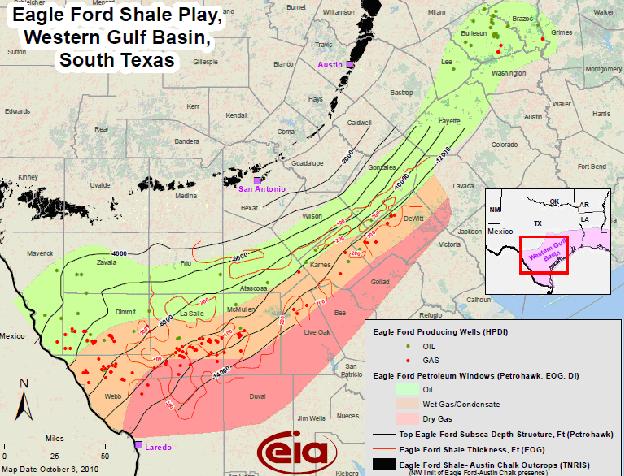

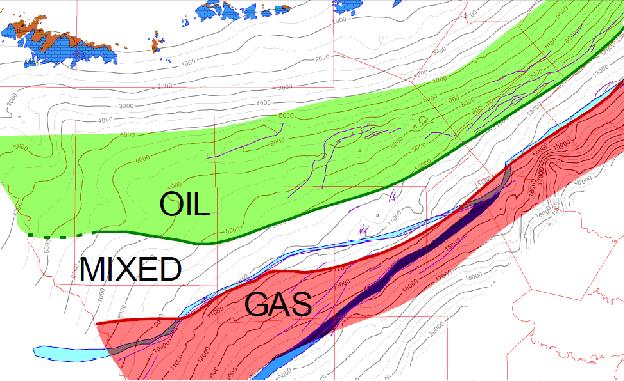

We intend to explore the GC Property to determine whether any oil and/or gas reserves exist. We do not know if an economically viable oil and gas reserve exists on the GC Property and there is no assurance that we will discover one. Initial due diligence indicates that the property is located in the prolific “Eagle Ford Shale” geologic formation, but a great deal of exploration will be required before a final evaluation as to the economic, environmental and legal feasibility for our future exploration is determined. Our plan of operation is to conduct exploration work on the GC Property in order to ascertain whether it possesses commercially exploitable quantities of oil and gas reserves.

Even if we complete our proposed exploration program and we are successful in identifying an oil and gas reserve, we will have to spend substantial funds on further drilling and engineering studies before we will know whether we have a commercially viable oil and/or gas reserve.

The YC Property currently produces approximately 4 to 5 barrels of oil per day. For the remainder of 2011, we intend to conduct repairs on the wells and further develop the YC Property, including performing acid jobs on all the wells and increase the volume of fluids in the injection wells in an attempt to increase production. There is no guarantee that any efforts we undertake to increase production will prove to be effective.

3

Reverse Stock Split

On June 12, 2011, our shareholders, pursuant to a written consent in lieu of a special meeting signed by the shareholders owning a majority of the Company’s issued and outstanding shares, authorized the Company’s officers to file the necessary documentation with the Secretary of State of Nevada to effect a one-for-five reverse stock split, whereby owners of five shares of our common stock prior to the reverse stock split received one share of our common stock after the reverse stock split, with all fractional shares being rounded to the nearest whole share (the “Reverse Split”). The record date for the Reverse Split was set as of one business day prior to the effective date and the effective date for the Reverse Split was set for June 27, 2011.

The Reverse Split was declared effective by FINRA on June 29, 2011. All shares and share prices have been retroactively changed to reflect the Reverse Split.

Private Placement

On April 17, 2008, we completed the sale of an aggregate of 800,000 units (the “Units”) at a price of $3.00 per Unit for gross proceeds of $2,400,000. Each Unit consisted of one share of our common stock (collectively, the “Private Placement Shares”) and one Series B Non-redeemable Warrant (the “Series B Warrants”) to purchase an additional share of our common stock (the “Warrant Shares”), at $3.00 per share for a period of two years from the date of issuance (the “2008 Private Placement”), pursuant to the terms of Subscription Agreements having an effective date of April 17, 2008, between ourselves and certain institutional and other accredited investors (the “Investors”), as defined in Rule 501 of Regulation D promulgated under the Securities Act. The net proceeds of the Private Placement were used for working capital purposes. In connection with the Private Placement, we paid a commission of 20,000 Units (the “Commission Units”) to one registered broker dealer.

The shares issued in the Private Placement comprised approximately 11% (without giving effect to the exercise of any of the Series B Warrants) of our issued and outstanding shares as of April 17, 2008, the date on which the Private Placement was consummated.

Risk Factors

Investing in our common stock involves a high degree of risk. Before investing in our common stock you should carefully consider the following risks, together with the financial and other information contained in this prospectus. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be adversely affected. In that case, the trading price of our common stock would likely decline and you may lose all or a part of your investment.

4

Risks Relating To Our Business and the Oil and Gas Industry

We have a history of operating losses and expect to continue suffering losses for the foreseeable future.

We have incurred losses since our company was organized in November 6, 1998. Moreover, in each of the fiscal years ended March 31, 2011 and 2010, we recorded net losses of $183,666 and $261,758, respectively. From inception (November 6, 1998) through June 30, 2011, we recorded a cumulative net loss of $3,64,579. We cannot anticipate when, if ever, our operations will become profitable.

We are a development stage company with a limited operating history, which may hinder our ability to successfully meet our objectives.

We are a development stage company with only a limited operating history upon which to base an evaluation of our current business and future prospects. We have only begun engaging in the oil and gas exploration and development business and we do not have an established history of locating and developing properties that have oil and gas reserves. As a result, the revenue and income potential of our business is unproven. In addition, because of our limited operating history, we have limited insight into trends that may emerge and affect our business. Errors may be made in predicting and reacting to relevant business trends and we will be subject to the risks, uncertainties and difficulties frequently encountered by early-stage companies in evolving markets. We may not be able to successfully address any or all of these risks and uncertainties. Failure to adequately do so could cause our business, results of operations and financial condition to suffer.

Market conditions or operation impediments may hinder our access to oil and gas markets or delay our potential production.

The marketability of potential production from our properties depends in part upon the availability, proximity and capacity of pipelines, natural gas gathering systems and processing facilities. This dependence is heightened where this infrastructure is less developed. Therefore, even if drilling results are positive in certain areas of our oil and gas properties, a new gathering system may need to be built to handle the potential volume of oil and gas produced. We might be required to shut in wells, at least temporarily, for lack of a market or because of the inadequacy or unavailability of transportation facilities. If that were to occur, we would be unable to realize revenue from those wells until arrangements were made to deliver production to market.

Even if we are able to establish any oil or gas reserves on our properties, our ability to produce and market oil and gas is affected and also may be harmed by:

|

·

|

inadequate pipeline transmission facilities or carrying capacity;

|

|

·

|

government regulation of natural gas and oil production;

|

|

·

|

government transportation, tax and energy policies;

|

|

·

|

changes in supply and demand; and

|

|

·

|

general economic conditions.

|

5

Our future performance is dependent upon our ability to identify, acquire and develop oil and gas properties, the failure of which could result in under use of capital and losses.

Our future performance depends upon our ability to identify, acquire and develop oil and gas reserves that are economically recoverable. Our success will depend upon our ability to acquire working and revenue interests in properties upon which oil and gas reserves are ultimately discovered in commercial quantities, and our ability to develop prospects that contain proven oil and gas reserves to the point of production. Without successful acquisition and exploration activities, we will not be able to develop oil and gas reserves or generate revenues. We cannot provide you with any assurance that we will be able to identify and acquire oil and gas reserves, on acceptable terms, or that oil and gas deposits will be discovered in sufficient quantities to enable us to recover our exploration and development costs or sustain our business.

The successful acquisition and development of oil and gas properties requires an assessment of recoverable reserves, future oil and gas prices and operating costs, potential environmental and other liabilities, and other factors. Such assessments are necessarily inexact and their accuracy is inherently uncertain. In addition, no assurance can be given that our exploration and development activities will result in the discovery of any reserves.

We have a very small management team and the loss of any member of our team may prevent us from implementing our business plan in a timely manner.

We currently have one executive officer and a limited number of consultants upon whom our success largely depends. We do not maintain key person life insurance policies on our executive officers or consultants, the loss of which could seriously harm our business, financial condition and results of operations. In such an event, we may not be able to recruit personnel to replace our executive officers or consultants in a timely manner, or at all, on acceptable terms.

If we are unable to successfully recruit qualified managerial and field personnel having experience in oil and gas exploration, we may not be able to continue our operations.

In order to successfully implement and manage our business plan, we will depend upon, among other things, successfully recruiting qualified managerial and field personnel having experience in the oil and gas exploration business. Competition for qualified individuals is intense. We may not be able to find, attract and retain qualified personnel on acceptable terms. If we are unable to find, attract and retain qualified personnel with technical expertise, our business operations could suffer.

Future growth could strain our personnel and infrastructure resources, and if we are unable to implement appropriate controls and procedures to manage our growth, we may not be able to successfully implement our business plan.

We expect to experience rapid growth in our operations, which will place a significant strain on our management, administrative, operational and financial infrastructure. Our future success will depend in part upon the ability of our executive officers to manage growth effectively. This may require us to hire and train additional personnel to manage our expanding operations. In addition, we must continue to improve our operational, financial and management controls and our reporting systems and procedures. If we fail to successfully manage our growth, we may be unable to execute upon our business plan.

6

We will have substantial capital requirements that, if not met, may hinder our growth and operations.

Our future growth depends on our ability to make large capital expenditures for the exploration and development of our natural gas and oil properties. Future cash flows and the availability of financing will be subject to a number of variables, such as:

|

·

|

the success of our planned projects in Texas;

|

|

·

|

success in locating and producing reserves; and

|

|

·

|

prices of natural gas and oil.

|

Financing might not be available in the future, or we might not be able to obtain necessary financing on acceptable terms. If sufficient capital resources are not available, we might be forced to curtail our drilling and other activities or be forced to sell some assets on an untimely or unfavorable basis, which would have an adverse affect on our business, financial condition and results of operations.

If we obtain additional financing, our existing stockholders may suffer substantial dilution or we may not have sufficient funds to pay the interest on our current or future debt.

Additional financing sources will be required in the future to fund developmental and exploratory drilling. Issuing equity securities to satisfy our financing requirements could cause substantial dilution to our existing stockholders.

Debt financing could lead to:

|

·

|

a substantial portion of operating cash flow being dedicated to the payment of principal and interest;

|

|

·

|

being more vulnerable to competitive pressures and economic downturns; and

|

|

·

|

restrictions on our operations.

|

If we incur indebtedness, our ability to meet our debt obligations and reduce our level of indebtedness depends on future performance. General economic conditions, oil and gas prices and financial, business and other factors affect our operations and future performance. Many of these factors are beyond our control. We cannot assure you that we will be able to generate sufficient cash flow to pay the interest on our current or future debt or that future working capital, borrowings or equity financing will be available to pay or refinance such debt. Factors that will affect our ability to raise cash through an offering of our capital stock or a refinancing of our debt include financial market conditions, the value of our assets and performance at the time we need capital. We cannot assure you that we will have sufficient funds to make such payments. If we do not have sufficient funds and are otherwise unable to negotiate renewals of our borrowings or arrange additional financing, we might have to sell significant assets. Any such sale could have a material adverse effect on our business and financial results.

We may not be able to determine reserve potential or identify liabilities associated with our Texas property or any future properties. We may also not be able to obtain protection from vendors against possible liabilities, which could cause us to incur losses.

We have conducted a very limited review of our property in Texas, such review and evaluation might not necessarily reveal all existing or potential problems. This is also true for any future acquisitions made by us. Inspections may not always be performed on every well, and environmental problems, such as groundwater contamination, are not necessarily observable even when an inspection is undertaken. Even when problems are identified, a vendor may be unwilling or unable to provide effective contractual protection against all or part of those problems, and we may assume environmental and other risks and liabilities in connection with the acquired properties.

7

If we or our operators fail to maintain adequate insurance, our business could be materially and adversely affected.

Our operations are subject to risks inherent in the oil and gas industry, such as blowouts, cratering, explosions, uncontrollable flows of oil, gas or well fluids, fires, pollution, earthquakes and other environmental risks. These risks could result in substantial losses due to injury and loss of life, severe damage to and destruction of property and equipment, pollution and other environmental damage, and suspension of operations. We could be liable for environmental damages caused by us and/or previous property owners. As a result, substantial liabilities to third parties or governmental entities may be incurred, the payment of which could have a material adverse effect on our financial condition and results of operations.

Any prospective drilling contractor or operator which we hire will be required to maintain insurance of various types to cover our operations with policy limits and retention liability customary in the industry. Therefore, we do not plan to acquire our own insurance coverage for such prospects. The occurrence of a significant adverse event on such prospects that is not fully covered by insurance could result in the loss of all or part of our investment in a particular prospect which could have a material adverse effect on our financial condition and results of operations.

The oil and gas industry is highly competitive, and we may not have sufficient resources to compete effectively.

The oil and gas industry is highly competitive. We compete with oil and natural gas companies and other individual producers and operators, many of which have longer operating histories and substantially greater financial and other resources than we do, as well as companies in other industries supplying energy, fuel and other such needs to consumers. Our larger competitors, by reason of their size, operating history and relative financial strength, can more easily access capital markets than we can and may enjoy a competitive advantage in the recruitment of qualified personnel. They may be able to absorb the burden of any changes in laws and regulation in the jurisdictions in which we do business and handle longer periods of reduced prices for oil and gas more easily than we can. Our competitors may be able to pay more for oil and gas leases and properties and may be able to define, evaluate, bid for and purchase a greater number of leases and properties than we can. Further, these companies may enjoy technological advantages and may be able to implement new technologies more rapidly than we can. Our ability to acquire additional properties in the future will depend upon our ability to conduct efficient operations, evaluate and select suitable properties, implement advanced technologies and consummate transactions in a highly competitive environment.

In addition to acquiring producing properties, we may also grow our business through the acquisition and development of exploratory oil and gas prospects, which is the riskiest method of establishing oil and gas reserves.

In addition to acquiring producing properties, we may acquire, drill and develop exploratory oil and gas prospects that are profitable to produce. Developing exploratory oil and gas properties requires significant capital expenditures and involves a high degree of financial risk. The budgeted costs of drilling, completing, and operating exploratory wells are often exceeded and can increase significantly when drilling costs rise. Drilling may be unsuccessful for many reasons, including title problems, weather, cost overruns, equipment shortages, and mechanical difficulties. Moreover, the successful drilling or completion of an exploratory oil or gas well does not ensure a profit on investment. Exploratory wells bear a much greater risk of loss than development wells. We cannot assure you that our exploration, exploitation and development activities will result in profitable operations. If we are unable to successfully acquire and develop exploratory oil and gas prospects, our results of operations, financial condition and stock price will be materially adversely affected.

8

Exploration and production activities are subject to certain environmental regulations which may prevent or delay the commencement or continuance of our operations.

In general, our exploration and production activities are subject to certain federal, state and local laws and regulations relating to environmental quality and pollution control. Such laws and regulations increase the costs of these activities and may prevent or delay the commencement or continuance of a given operation. Specifically, we are subject to legislation regarding emissions into the environment, water discharges and storage and disposition of hazardous wastes. In addition, legislation has been enacted which requires well and facility sites to be abandoned and reclaimed to the satisfaction of state authorities. However, such laws and regulations are frequently changed and any such changes may have material adverse effects on our activities. We are unable to predict the ultimate cost of compliance with such laws and regulations. Generally, environmental requirements do not appear to affect us any differently or to any greater or lesser extent than other companies in our industry. To date we have not been required to spend any material amount on compliance with environmental regulations. However, we may be required to do so in future and this may affect our ability to expand or maintain our operations.

Any change to government regulation/administrative practices may have a negative impact on our ability to operate and our profitability.

The business of oil and gas exploration and development is subject to substantial regulation under federal, state, local and foreign laws relating to the exploration for, and the development, upgrading, marketing, pricing, taxation, and transportation of oil and gas and related products and other matters. Amendments to current laws and regulations governing operations and activities of oil and gas exploration and development operations could have a material adverse impact on our business. In addition, there can be no assurance that income tax laws, royalty regulations and government incentive programs related to our oil and gas properties and the oil and gas industry generally, will not be changed in a manner which may adversely affect our progress and cause delays, inability to explore and develop or abandonment of these interests.

Permits, leases, licenses and approvals are required from a variety of regulatory authorities at various stages of exploration and development. There can be no assurance that the various government permits, leases, licenses and approvals sought will be granted in respect of our activities or, if granted, will not be cancelled or will be renewed upon expiry. There is no assurance that such permits, leases, licenses and approvals will not contain terms and provisions which may adversely affect our exploration and development activities.

Any future operations will involve many risks and we may become liable for pollution or other liabilities which may have an adverse effect on our financial position.

In the course of the exploration, acquisition and development of mineral properties, several risks and, in particular, unexpected or unusual geological or operating conditions may occur. Drilling operations generally involve a high degree of risk. Hazards such as unusual or unexpected geological formations, power outages, labor disruptions, blow-outs, sour gas leakage, fire, inability to obtain suitable or adequate machinery, equipment or labor, and other risks are involved. We may become subject to liability for pollution. It is not always possible to fully insure against such risks, and we do not currently have any insurance against such risks nor do we intend to obtain such insurance in the near future due to high costs of insurance. Should such liabilities arise, they could reduce or eliminate any future profitability and result in an increase in costs and a decline in value of the securities of our company.

9

We are not insured against most environmental risks. Insurance against environmental risks (including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production) has not been generally available to companies within the industry. We will periodically evaluate the cost and coverage of such insurance. If we became subject to environmental liabilities and do not have insurance against such liabilities, the payment of such liabilities would reduce or eliminate our available funds and may result in bankruptcy. Should we be unable to fully fund the remedial cost of an environmental problem, we might be required to enter into interim compliance measures pending completion of the required remedy.

Resource exploration involves many risks, regardless of the experience, knowledge and careful evaluation of the property by our company. These hazards include unusual or unexpected formations, formation pressures, fires, power outages, labor disruptions, flooding, explosions and the inability to obtain suitable or adequate machinery, equipment or labor.

Operations in which we will have a direct or indirect interest will be subject to all the hazards and risks normally incidental to the exploration, development and production of resource properties, any of which could result in damage to or destruction of producing facilities, damage to life and property, environmental damage and possible legal liability for any or all damage. We do not currently maintain liability insurance and may not obtain such insurance in the future. The nature of these risks is such that liabilities could represent a significant cost to our company, and may ultimately force our company to become bankrupt and cease operations.

Shortages of rigs, equipment, supplies and personnel could delay or otherwise adversely affect our cost of operations or our ability to operate according to our business plans.

If drilling activity increases in Texas, and/or other locations we operate in, a shortage of drilling and completion rigs, field equipment and qualified personnel could develop. These costs have recently increased sharply and could continue to do so. The demand for, and wage rates of, qualified drilling rig crews generally rise in response to the increasing number of active rigs in service and could increase sharply in the event of a shortage. Shortages of drilling and completion rigs, field equipment or qualified personnel could delay, restrict or curtail our exploration and development operations, which could in turn harm our operating results.

Unless we find new oil and gas reserves, our reserves and production will decline, which would materially and adversely affect our business, financial condition and results of operations.

Producing oil and gas reservoirs generally are characterized by declining production rates that vary depending upon reservoir characteristics and other factors. Therefore, our future oil and gas reserves and production and, therefore, our cash flow and revenue are highly dependent on our success in efficiently obtaining reserves and acquiring additional recoverable reserves. We may not be able to develop, find or acquire reserves to replace our current and future production at costs or other terms acceptable to us, or at all, in which case our business, financial condition and results of operations would be materially and adversely affected.

10

To the extent that we establish oil and gas reserves, we will be required to replace, maintain or expand our oil and gas reserves in order to prevent our reserves and production from declining, which would adversely affect cash flows and income.

In general, production from oil and gas properties declines over time as reserves are depleted, with the rate of decline depending on reservoir characteristics. If we establish reserves, of which there is no assurance, and we are not successful in our subsequent exploration and development activities or in subsequently acquiring properties containing proved reserves, our proved reserves will decline as the oil and gas contained in the reserves are produced. Our future oil and gas production is highly dependent upon our ability to economically find, develop or acquire reserves in commercial quantities.

To the extent cash flow from operations is reduced, either by a decrease in prevailing prices for oil and gas or an increase in finding and development costs, and external sources of capital become limited or unavailable, our ability to make the necessary capital investment to maintain or expand our asset base of oil and gas reserves would be impaired. Even with sufficient available capital, our future exploration and development activities may not result in additional proved reserves, and we might not be able to drill productive wells at acceptable costs.

The locations of both of our properties are in Texas, which subjects us to an increased risk of loss of revenue or curtailment of production from factors affecting those areas.

The locations of both of our properties are in Texas, which means that our properties could be affected by the same event should the region experience:

|

·

|

severe weather;

|

|

·

|

delays or decreases in production, the availability of equipment, facilities or services;

|

|

·

|

delays or decreases in the availability of capacity to transport, gather or process production; or

|

|

·

|

changes in the regulatory environment.

|

The oil and gas exploration and production industry is historically a cyclical industry and market fluctuations in the prices of oil and gas could adversely affect our business.

Prices for oil and gas tend to fluctuate significantly in response to factors beyond our control. These factors include:

|

·

|

weather conditions in the United States and wherever our property interests are located;

|

|

·

|

economic conditions, including demand for petroleum-based products, in the United States and the rest of the world;

|

|

·

|

actions by OPEC, the Organization of Petroleum Exporting Countries;

|

|

·

|

political instability in the Middle East and other major oil and gas producing regions;

|

|

·

|

governmental regulations, both domestic and foreign;

|

|

·

|

domestic and foreign tax policy;

|

|

·

|

the pace adopted by foreign governments for the exploration, development, and production of their national reserves;

|

|

·

|

the price of foreign imports of oil and gas;

|

|

·

|

the cost of exploring for, producing and delivering oil and gas;

|

|

·

|

the discovery rate of new oil and gas reserves;

|

|

·

|

the rate of decline of existing and new oil and gas reserves;

|

|

·

|

available pipeline and other oil and gas transportation capacity;

|

|

·

|

the ability of oil and gas companies to raise capital;

|

11

|

·

|

the overall supply and demand for oil and gas; and

|

|

·

|

the availability of alternate fuel sources.

|

Changes in commodity prices may significantly affect our capital resources, liquidity and expected operating results. Price changes will directly affect revenues and can indirectly impact expected production by changing the amount of funds available to reinvest in exploration and development activities. Reductions in oil and gas prices not only reduce revenues and profits, but could also reduce the quantities of reserves that are commercially recoverable. Significant declines in prices could result in non-cash charges to earnings due to impairment.

Changes in commodity prices may also significantly affect our ability to estimate the value of producing properties for acquisition and divestiture and often cause disruption in the market for oil and gas producing properties, as buyers and sellers have difficulty agreeing on the value of the properties. Price volatility also makes it difficult to budget for and project the return on acquisitions and the development and exploitation of projects. We expect that commodity prices will continue to fluctuate significantly in the future.

Exploratory drilling involves many risks that are outside our control which may result in a material adverse effect on our business, financial condition or results of operations.

The business of exploring for and producing oil and gas involves a substantial risk of investment loss. Drilling oil and gas wells involves the risk that the wells may be unproductive or that, although productive, the wells may not produce oil or gas in economic quantities. Other hazards, such as unusual or unexpected geological formations, pressures, fires, blowouts, power outages, sour gas leakage, loss of circulation of drilling fluids or other conditions may substantially delay or prevent completion of any well. Adverse weather conditions can also hinder drilling operations. A productive well may become uneconomic if water or other deleterious substances are encountered that impair or prevent the production of oil or gas from the well. In addition, production from any well may be unmarketable if it is impregnated with water or other deleterious substances. There can be no assurance that oil and gas will be produced from the properties in which we have interests.

Crude oil and natural gas development, re-completion of wells from one reservoir to another reservoir, restoring wells to production and drilling and completing new wells are speculative activities and involve numerous risks and substantial and uncertain costs.

Our growth will be materially dependent upon the success of our future development program. Drilling for crude oil and natural gas and reworking existing wells involves numerous risks, including the risk that no commercially productive crude oil or natural gas reservoirs will be encountered. The cost of drilling, completing and operating wells is substantial and uncertain, and drilling operations may be curtailed, delayed or cancelled as a result of a variety of factors beyond our control, including: unexpected drilling conditions; pressure or irregularities in formations; equipment failures or accidents; inability to obtain leases on economic terms, where applicable; adverse weather conditions and natural disasters; compliance with governmental requirements; and shortages or delays in the availability of drilling rigs or crews and the delivery of equipment.

Drilling or reworking is a highly speculative activity. Even when fully and correctly utilized, modern well completion techniques such as hydraulic fracturing and horizontal drilling do not guarantee that we will find crude oil and/or natural gas in our wells. Hydraulic fracturing involves pumping a fluid with or without particulates into a formation at high pressure, thereby creating fractures in the rock and leaving the particulates in the fractures to ensure that the fractures remain open, thereby potentially increasing the ability of the reservoir to produce oil or gas. Horizontal drilling involves drilling horizontally out from an existing vertical well bore, thereby potentially increasing the area and reach of the well bore that is in contact with the reservoir. Our future drilling activities may not be successful and, if unsuccessful, such failure would have an adverse effect on our future results of operations and financial condition. We cannot assure you that our overall drilling success rate or our drilling success rate for activities within a particular geographic area will not decline. We may identify and develop prospects through a number of methods, some of which do not include lateral drilling or hydraulic fracturing, and some of which may be unproven. The drilling and results for these prospects may be particularly uncertain. Our drilling schedule may vary from our capital budget. The final determination with respect to the drilling of any scheduled or budgeted prospects will be dependent on a number of factors, including, but not limited to: the results of previous development efforts and the acquisition, review and analysis of data; the availability of sufficient capital resources to us and the other participants, if any, for the drilling of the prospects; the approval of the prospects by other participants, if any, after additional data has been compiled; economic and industry conditions at the time of drilling, including prevailing and anticipated prices for crude oil and natural gas and the availability of drilling rigs and crews; our financial resources and results; the availability of leases and permits on reasonable terms for the prospects; and the success of our drilling technology.

12

We are dependent upon the efforts of various third parties that we do not control and, as a result, we may not be able to control the timing of development efforts, associated costs, or the rate of production of reserves, if any.

The success of our business depends upon the efforts of various third parties that we do not control. Presently, we do not plan to serve as the operator for our projects. As a result, we may have limited ability to exercise influence over the operations of the properties or their associated costs. Our dependence on the operator and, where applicable, other working interest owners for these projects and our limited ability to influence operations and associated costs could prevent the realization of our targeted returns on capital in drilling or acquisition activities. The success and timing of development and exploitation activities on properties operated by others depend upon a number of factors that will be largely outside of our control, including:

|

·

|

the timing and amount of capital expenditures;

|

|

·

|

the operator’s expertise and financial resources;

|

|

·

|

approval of other participants in drilling wells;

|

|

·

|

selection of technology;

|

|

·

|

the rate of production of the reserves; and

|

|

·

|

the availability of suitable drilling rigs, drilling equipment, production and transportation infrastructure, and qualified operating personnel.

|

We will rely upon various companies to provide us with technical assistance and services. We will also rely upon the services of geologists, geophysicists, chemists, engineers and other scientists to explore and analyze oil and gas prospects to determine a method in which the oil and gas prospects may be developed in a cost-effective manner. Although our management has relationships with a number of third-party service providers, we cannot assure you that we will be able to continue to rely on such persons. If any of these relationships with third-party service providers are terminated or are unavailable on commercially acceptable terms, we may not be able to execute our business plan.

13

We may be unable to retain our leases or licenses and working interests in our leases or licenses, which would result in significant financial losses to our company.

In general, our properties are held under oil and gas leases or licenses. If we fail to meet the specific requirements of each lease or license, such lease or license may terminate or expire. We cannot assure you that any of the obligations required to maintain each lease or license will be met. The termination or expiration of our leases or licenses will harm our business. Our property interests will terminate unless we fulfill certain obligations under the terms of our leases or licenses and other agreements related to such properties. If we are unable to satisfy these conditions on a timely basis, we may lose our rights in these properties. The termination of our interests in these properties will harm our business. In addition, we will need significant funds to meet capital requirements for the exploration activities that we intend to conduct on our properties.

Title deficiencies could render our leases worthless, which could have adverse effects on our financial condition or results of operations.

The existence of a material title deficiency can render our lease worthless and can result in a large expense to our business. It is our practice in acquiring oil and gas leases or undivided interests in oil and gas leases to forgo the expense of retaining lawyers to examine the title to the oil or gas interest to be placed under lease or already placed under lease. Instead, we rely upon the judgment of oil and gas landmen who perform the field work in examining records in the appropriate governmental office before attempting to place under lease a specific oil or gas interest. We do not anticipate that we, or the person or company acting as operator of the wells located on the properties that we lease or may lease in the future, will obtain counsel to examine title to the lease until the well is about to be drilled. As a result, we may be unaware of deficiencies in the marketability of the title to the lease. Such deficiencies may render the lease worthless.

Risks Relating to Our Common Stock

The value and transferability of your shares may be adversely impacted by the limited trading market for our stock on the OTC Markets Group, Inc. OTCQBTM tier (the “OTCQB”), which is a quotation system, not an issuer listing service, market or exchange. Because buying and selling stock on the OTCQB is not as efficient as buying and selling stock through an exchange, it may be difficult for you to sell your shares or you may not be able to sell your shares for an optimum trading price.

The OTCQB is a regulated quotation service that displays real-time quotes, last sale prices and volume limitations in over-the-counter securities.

When fewer shares of a security are being traded on the OTCQB, volatility of prices may increase and price movement may outpace the ability to deliver accurate quote information. Lower trading volumes in a security may result in a lower likelihood of an individual’s orders being executed, and current prices may differ significantly from the price one was quoted by the OTCQB at the time of the order entry. The dealer’s spread (the difference between the bid and ask prices) may be large and may result in substantial losses to the seller of securities on the OTCQB if the common stock or other security must be sold immediately.

14

The trading price of our common stock historically has been volatile and may not reflect its value.

The trading price of our common stock has, from time to time, fluctuated widely and in the future may be subject to similar fluctuations. From April 1, 2009 through March 31, 2011, our stock has traded at a low of $0.20 and a high of $1.90. The trading price may be affected by a number of factors including the risk factors set forth herein, as well as our operating results, financial condition, general economic conditions, market demand for our common stock, and various other events or factors both in and out of our control. In addition, the sale of our common stock into the public market upon the effectiveness of this registration statement could put downward pressure on the trading price of our common stock. In recent years, broad stock market indices, in general, and smaller capitalization companies, in particular, have experienced substantial price fluctuations. In a volatile market, we may experience wide fluctuations in the market price of our common stock. These fluctuations may have a negative effect on the market price of our common stock.

Kalen Capital Corporation, a private corporation solely owned by Mr. Harmel S. Rayat, our former chief financial officer, director and controlling shareholder, owns approximately 32% of our issued and outstanding stock. This ownership interest may preclude you from influencing significant corporate decisions.

Kalen Capital Corporation, a private corporation the sole shareholder of which is Harmel S. Rayat, our former chief financial officer, director and controlling shareholder, owns in the aggregate, 3,275,834 shares or approximately 32% of our outstanding common stock. As a result, Mr. Rayat may be able to exercise a controlling influence over matters requiring shareholder approval, including the election of directors and approval of significant corporate transactions, and may have significant control over our management and policies. Mr. Rayat’s interests may at times be different from yours. For example, he may support proposals and actions with which you may disagree or which are not in your interests. The concentration of ownership could delay or prevent a change in control of our company or otherwise discourage a potential acquirer from attempting to obtain control of our company, which in turn could reduce the price of our common stock. In addition, Mr. Rayat could use his voting influence to maintain our existing management and directors in office, delay or prevent changes of control of our company, or support or reject other management and Board of Director (“Board”) proposals that are subject to shareholder approval, such as amendments to our employee stock plans and approvals of significant financing transactions.

We may compete for the time and efforts of our officers and directors.

Certain of our officers and directors are also officers, directors, and employees of other companies. Except for Mr. Cerna, none of our officers or directors anticipate devoting more than approximately five (5%) percent of their time to our matters. Except for Mr. Cerna, we currently have no consulting or employment agreements with any of our officers and directors imposing any specific condition on our officers and directors regarding their continued employment by us.

A new business opportunity may raise potential conflicts of interests between certain of our officers and directors and us.

Certain of our directors are or may become directors and employees of other companies and, to the extent that such other companies may participate in ventures in which we may participate, our directors may have a conflict of interest in negotiating and concluding terms regarding the extent of such participation by us and such other companies. In addition, directors may present potential prospects to such other companies rather than presenting the opportunities to us or be affiliated with companies developing technologies which may compete with our technologies. We have not established any mechanisms regarding the resolution of any such conflict if it were to arise; accordingly, there is no assurance that any such conflict will be resolved in a manner that would not be adverse to our interest.

15

We have a large number of restricted shares outstanding, a portion of which may be sold under Rule 144 which may reduce the market price of our shares.

Of the 10,249,839 shares of our common stock issued and outstanding as of August 15, 2011, a total of 7,012,170 shares (inclusive of the 3,275,834 shares beneficially owned by Kalen Capital Corporation) are deemed “restricted securities,” within the meaning of Rule 144. Absent registration under the Securities Act, the sale of such shares is subject to Rule 144, as promulgated under the Securities Act.

In general, subject to the satisfaction of certain conditions, Rule 144 permits a person who presently is not and who has not been an affiliate of ours for at least three months immediately preceding the sale and who has beneficially owned the shares of common stock for at least six months to sell such shares without regard to any of the volume limitations set forth in Rule 144. This provision may apply as early as October 18, 2008, with respect to the shares issued in connection with the Private Placement, assuming that at such time the relevant criteria of Rule 144 is satisfied by both the selling shareholders owning the restricted shares and ourselves.

Under Rule 144, subject to the satisfaction of certain other conditions, a person deemed to be one of our affiliates, who has beneficially owned restricted shares of our common stock for at least one year is permitted to sell in a brokerage transaction, within any three-month period, a number of shares that does not exceed the greater of 1% of the total number of outstanding shares of the same class, or, if our common stock is quoted on a stock exchange, the average weekly trading volume during the four calendar weeks preceding the sale, if greater. This provision currently may apply to the shares owned by Kalen Capital Corporation). Accordingly, assuming all of the conditions of Rule 144 is satisfied by both Kalen Capital Corporation) and us at the time of any proposed sale, Kalen Capital Corporation may sell, approximately every three months pursuant to Rule 144, a number of shares equal to 1% of our then issued and outstanding shares of our common stock.

The possibility that substantial amounts of our common stock may be sold under Rule 144 into the public market may adversely affect prevailing market prices for the common stock and could impair our ability to raise capital in the future through the sale of equity securities.

There are options to purchase shares of our common stock currently outstanding.

As of August 15, 2011, we have options outstanding to purchase an aggregate of 20,000 shares of our common stock to various persons and entities. The exercise prices of these options are as follows: 10,000 stock options at $4.15 per share and 10,000 stock options at $2.00 per share. If issued, the shares underlying these options would increase the number of shares of our common stock currently outstanding and will dilute the holdings and voting rights of our then-existing shareholders.

We have the ability to issue additional shares of our common stock without asking for shareholder approval, which could cause your investment to be diluted.

Our Articles of Incorporation authorize our Board to issue up to 100,000,000 shares of common stock and up to 1,000,000 shares of preferred stock. The power of the Board to issue shares of common stock or warrants or options to purchase shares of common stock is generally not subject to shareholder approval. Accordingly, any time the Board determines that it is in the best interests of the corporation to issue shares of its common stock, your investment will be diluted.

16

We may issue preferred stock which may have greater rights than our common stock.

We are permitted in our charter to issue up to 1,000,000 shares of preferred stock. Currently no preferred shares are issued and outstanding; however, we can issue shares of our preferred stock in one or more series and can set the terms of the preferred stock without seeking any further approval from our common stockholders. Any preferred stock that we issue may rank ahead of our common stock in terms of dividend priority or liquidation premiums and may have greater voting rights than our common stock. In addition, such preferred stock may contain provisions allowing them to be converted into shares of common stock, which could dilute the value of common stock to current stockholders and could adversely affect the market price, if any, of our common stock.

Our compliance with changing laws and rules regarding corporate governance and public disclosure may result in additional expenses to us which, in turn, may adversely affect our ability to continue our operations.

Keeping abreast of, and in compliance with, changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002, new SEC regulations and, in the event we are ever approved for listing on either NASDAQ or a registered exchange, NASDAQ and stock exchange rules, will require an increased amount of management attention and external resources. We intend to continue to invest all reasonably necessary resources to comply with evolving standards, which may result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. This could have an adverse impact on our ongoing operations.

The value and transferability of your shares may be adversely impacted by the limited trading market for our stock on the OTCQB.

There is only a limited trading market for our shares on the OTCQB. The OTCQB is not an exchange. Trading of securities on the OTCQB is often more sporadic than the trading of securities listed on an exchange or NASDAQ. You may have difficulty reselling any of the shares that you purchase from the selling stockholders. We are not certain that a more active trading market in our common stock will develop, or if such a market develops, that it will be sustained. Sales of a significant number of shares of our common stock in the public market could result in a decline in the market price of our common stock, particularly in light of the illiquidity and low trading volume in our common stock.

Our common stock is a “penny stock,” and because “penny stock” rules will apply, you may find it difficult to sell the shares of our common stock you acquired in this offering.

Our common stock is a “penny stock” as that term is defined under Rule 3a51-1 of the Securities Exchange Act of 1934. Generally, a “penny stock” is a common stock that is not listed on a securities exchange and trades for less than $5.00 a share. Prices often are not available to buyers and sellers and the market may be very limited. Penny stocks in start-up companies are among the riskiest equity investments. Broker-dealers who sell penny stocks must provide purchasers of these stocks with a standardized risk-disclosure document prepared by the U.S. Securities & Exchange Commission. The document provides information about penny stocks and the nature and level of risks involved in investing in the penny stock market. A broker must also give a purchaser, orally or in writing, bid and offer quotations and information regarding broker and salesperson compensation, make a written determination that the penny stock is a suitable investment for the purchaser, and obtain the purchaser's written agreement to the purchase. Many brokers choose not to participate in penny stock transactions. Because of the penny stock rules, there is less trading activity in penny stocks and you are likely to have difficulty selling your shares.

17

We do not intend to pay dividends for the foreseeable future.

We currently intend to retain future earnings, if any, to support the development and expansion of our business and do not anticipate paying cash dividends in the foreseeable future. Our payment of any future dividends will be at the discretion of our Board after taking into account various factors, including but not limited to our financial condition, operating results, cash needs, growth plans and the terms of any credit agreements that we may be a party to at the time. Accordingly, investors must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize their investment.

FINRA sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described below, the FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K contains forward looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward looking statements by terminology such as “may”, “should”, “intend”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “project”, “predict”, “potential”, or “continue” or the negative of these terms or other comparable terminology. These statements speak only as of the date of this Current Report on Form 8-K. In particular, this Current Report on Form 8-K contains forward looking statements pertaining to the following:

|

·

|

the quantity of potential natural gas and crude oil reserves;

|

|

·

|

potential natural gas and crude oil production levels;

|

|

·

|

capital expenditure programs;

|

|

·

|

projections of market prices and costs;

|

|

·

|

supply and demand for natural gas and crude oil;

|

|

·

|

expectations regarding our ability to raise capital and to continually add to reserves through acquisitions and development; and

|

|

·

|

treatment under governmental regulatory regimes and tax laws.

|

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks, such as:

|

·

|

our ability to establish or find reserves;

|

|

·

|

volatility in market prices for natural gas and crude oil;

|

|

·

|

liabilities inherent in natural gas and crude oil operations;

|

|

·

|

uncertainties associated with estimating natural gas reserves and crude oil;

|

18

|

·

|

competition for, among other things, capital, acquisitions of reserves, undeveloped lands and skilled personnel;

|

|

·

|

political instability or changes of laws in the countries in which we operate and risks of terrorist attacks;

|

|

·

|

incorrect assessments of the value of acquisitions;

|

|

·

|

geological, technical, drilling and processing problems; and

|

|

·

|

the uncertainty inherent in the litigation process, including the possibility of newly discovered evidence or the acceptance of novel legal theories, and the difficulties in predicting the decisions of judges and juries.

|

These risks may cause our or our industry’s actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward looking statements.

Although we believe that the expectations reflected in the forward looking statements are reasonable, we cannot guarantee future results, levels of activity or performance. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward looking statements to conform these statements to actual results.

2008 PRIVATE PLACEMENT

On April 17, 2008, we consummated the sale of an aggregate of 800,002 shares of our common stock and Series B Warrants to purchase up to an additional 800,002 shares of our common stock at a per share purchase price of $3.00 for an aggregate purchase price of $2,400,000 pursuant to the terms of a Subscription Agreement effective as of April 17, 2008, with the Investors who are signatories to the Subscription Agreement. The Investors are institutional and other accredited investors, as defined in Rule 501 of Regulation D promulgated under the Securities Act. In connection with the Private Placement we paid a commission consisting of 20,000 shares of our common stock and 20,000 Series B Warrants.

The Series B Warrants were exercisable for a period of two years at an initial exercise price of $3.00 per share beginning on April 17, 2008. The number of shares issuable upon exercise of the Series B Warrants and the exercise price of the Series B Warrants were adjustable in the event of stock splits, combinations and reclassifications, but not in the event of the issuance by us of additional securities, unless such issuance was at a price per share which was less than the then applicable exercise price of the warrants, in which event then the exercise price shall be reduced and only reduced to equal the lower issuance price and the number of shares issuable upon exercise thereof would have increased such that the aggregate exercise price payable thereunder, after taking into account the decrease in the exercise price, would have been equal to the aggregate exercise price prior to such adjustment. All remaining outstanding 576,667 Series B Warrants expired unexercised on April 17, 2010.

In connection with the 2008 Private Placement, we paid a commission of 20,000 shares of our common stock and Series B Warrants to purchase up to an additional 20,000 shares of our common stock at a per share purchase price of $3.00 to one registered broker dealer (the “Commission Units”). The Commission Units did not have any registration rights but otherwise had the same terms and conditions as the units sold to the Investors.

19

Market Information-the OTCQB

Our common stock is quoted on the OTCQB under the symbol “NDBE.” The OTCQB is a regulated quotation service that displays real-time quotes, last-sale prices, and volume information in over-the-counter (OTC) equity securities. The OTCQB is a quotation medium for subscribing members, not an issuer listing service, and should not be confused with The NASDAQ Stock MarketSM.

As of August 15, 2011, there were 10,849,839 shares of our common stock outstanding and held by 87 stockholders of record. As of August 15, 2011, we had 20,000 shares of common stock reserved for issuance upon exercise of outstanding stock options. We have no shares of preferred stock issued and outstanding.

Currently, there is only a limited public market for our stock on the OTCQB. You should also note that the OTCQB is not a listing service or exchange, but is instead a dealer quotation service for subscribing members. If our common stock is not quoted on the OTCQB or if a public market for our common stock does not develop, then investors may not be able to resell the shares of our common stock that they have purchased and may lose all of their investment. If we do establish a trading market for our common stock, the market price of our common stock may be significantly affected by factors such as actual or anticipated fluctuations in our operation results, general market conditions and other factors. In addition, the stock market has from time to time experienced significant price and volume fluctuations that have particularly affected the market prices for the shares of developmental stage companies, which may materially adversely affect the market price of our common stock. Accordingly, investors may find that the price for our securities may be highly volatile and may bear no relationship to our actual financial condition or results of operation.

The following table sets forth the range of high and low closing bid quotations for our common stock during our most recent two fiscal years on the Over the Counter Bulletin Board (the OTCBB), a regulated quotation service that displays real-time quotes, last-sale prices, and volume information in over-the-counter (OTC) equity securities much like the OTCQB that shares of our common stock previously traded on. The quotations represent inter-dealer prices without retail markup, markdown or commission, and may not necessarily represent actual transactions.

|

FISCAL YEAR ENDING MARCH 31, 2011

|

HIGH

|

LOW

|

||||||

|

January 1 to March 31, 2011

|

$ | 0.95 | $ | 0.30 | ||||

|

October 1 to December 31, 2010

|

$ | 0.80 | $ | 0.30 | ||||

|

July 1 to September 30, 2010

|

$ | 0.60 | $ | 0.20 | ||||

|

April 1 to June 30, 2010

|

$ | 1.20 | $ | 0.35 | ||||

|

FISCAL YEAR ENDING MARCH 31, 2010

|

HIGH

|

LOW

|

||||||

|

January 1 to March 31, 2010

|

$ | 1.20 | $ | 0.50 | ||||

|

October 1 to December 31, 2009

|

$ | 1.45 | $ | 0.60 | ||||

|

July 1 to September 30, 2009

|

$ | 1.90 | $ | 0.95 | ||||

|

April 1 to June 30, 2009

|

$ | 1.25 | $ | 0.65 | ||||

Dividend Policy

We have not paid any dividends on our common stock and our Board presently intends to continue a policy of retaining earnings, if any, for use in our operations. The declaration and payment of dividends in the future, of which there can be no assurance, will be determined by the Board in light of conditions then existing, including earnings, financial condition, capital requirements and other factors. The Nevada Revised Statutes prohibit us from declaring dividends where, if after giving effect to the distribution of the dividend:

|

·

|

We would not be able to pay our debts as they become due in the usual course of business; or

|

|

·

|

Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of stockholders who have preferential rights superior to those receiving the distribution.

|

20

Except as set forth above, there are no restrictions that currently materially limit our ability to pay dividends or which we reasonably believe are likely to limit materially the future payment of dividends on common stock.

Our Board has the right to authorize the issuance of preferred stock, without further stockholder approval, the holders of which may have preferences over the holders of the Common Stock as to payment of dividends.

Securities Authorized for Issuance Under Equity Compensation Plans

On September 30, 2002, the stockholders of the Company approved its 2002 Incentive Stock Plan (the “2002 Plan”), which has 4,000,000 shares reserved for issuance thereunder, none of which are currently registered with the SEC. The 2002 Plan provides shares available for options granted to employees, directors and others. The options granted to employees under the Company’s 2002 Plan generally vest over one to five years or as otherwise determined by the plan administrator. Options to purchase shares expire no later than ten years after the date of grant.

The following table sets forth certain information regarding the common stock that may be issued upon the exercise of options, warrants and other rights that have been or may be granted to employees, directors or consultants under all of the Company’s existing equity compensation plans, as of June 30, 2011.

|

Plan Category

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

Weighted-average exercise price of outstanding options, warrants and rights

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

|||||||||

|

(a)

|

(b)

|

(c)

|

||||||||||

|

Equity compensation plans approved by security holders (1)

|

20,000

|

$

|

3.08

|

3,970,000

|

||||||||

|

Equity compensation plans not approved by security holders

|

-

|

-

|

-

|

|||||||||

|

Total

|

20,000

|

$

|

3.08

|

3,970,000

|

||||||||

|

(1)

|

Consists of grants under the Company’s 2002 Stock Plan.

|

There were no stock options issued or exercised during the three months ended June 30, 2011.

There were no stock options exercised during the years ended March 31, 2011 or 2010. During the year ended March 31, 2011, 1,590,000 stock options with an exercise price of $0.65 per share were cancelled. These stock options were fully vested on their cancellation date and the related stock-based compensation expense was already previously recorded. At March 31, 2011, we had vested stock options to purchase 8,000 shares of our common stock at a weighted average exercise price of per share of $3.10.

21

During the years ended March 31, 2011 and 2010, stock-based compensation expense of $11,438 and $19,758, respectively, was recognized for options previously granted and vesting over time. As of March 31, 2011, we had $11,569 of total unrecognized compensation expense related to unvested stock options which is expected to be recognized over a period of 2.75 years.

The following table summarizes information about stock options outstanding and exercisable at June 30, 2011:

|

Stock Options Outstanding

|

Stock Options Exercisable

|

|||||||||||||||||||||||

|

Excercise Prices

|

Number of Options Outstanding

|

Weighted Average Remaining Contractual Life (Years)

|

Weighted Average Exercise Price

|

Number of Options Exercisable

|

Weighted Average Remaining Contractual Life (Years)

|

Weighted Average Exercise Price

|

||||||||||||||||||

| $2.00 | 10,000 | 7.3 | $ | 2.00 | 4,000 | 7.3 | $ | 2.00 | ||||||||||||||||

| 4.15 | 10,000 | 7.2 | 4.15 | 4,000 | 7.2 | 4.15 | ||||||||||||||||||

| $2.00 - $ 4.15 | 20,000 | 7.3 | $ | 3.08 | 8,000 | 7.2 | $ | 3.08 | ||||||||||||||||

Transfer Agent

The transfer agent of our common stock is Holladay Stock Transfer, Inc., 2939 North 67th Place, Scottsdale, Arizona 85251.

Penny Stock