Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - American Standard Energy Corp. | v232383_8k.htm |

1 !!!! AMERICAN STANDARD ENERGY CORP. INVESTOR PRESENTATION – Q3 2011

2 FORWARD -LOOKING STATEMENTS Statements made by representatives of American Standard Energy Corp. (“ASEN” or the “Company”) during the course of this presentation that are not historical facts are “forward ‐ looking statements” within the meaning of federal securities laws. These statements are based on certain assumptions and expectations made by the Company which reflect management’s experience, estimates and perception of historical trends, current conditions, anticipated future developments and other factors believed to be appropriate . No assurances can be given that such assumptions and expectations will occur as anticipated and actual results may differ materially from those implied or anticipated in the forward looking statements . Such statements are subject to a number of risks and uncertainties, many of which are beyond the control of the Company, and which include risks relating to the global financial crisis, our ability to obtain additional capital needed to implement our business plan, declines in prices and demand for gas, oil and natural gas liquids, our minimal operating history, loss of key personnel, lack of business diversification, reliance on strategic, third‐ party relationships, ability to obtain rights to explore and develop oil and gas reserves, financial performance and results, our ability to replace reserves and efficiently develop our current reserves, our ability to make acquisitions on economically acceptable terms, and other important factors. ASEN undertakes no obligation to publicly update any forward ‐ looking statements, whether as a result of new information or future events. Ticker: ASEN (OTC BB)

3 COMPANY SNAPSHOT • Formation – ASEN was previously a privately ‐ held oil exploration and production company . ASEN was incorporated in Nevada on April 2, 2010 for the purposes of acquiring certain oil and gas properties from Geronimo Holding Corporation (“Geronimo”), XOG Operating, LLC (“XOG”) and CLW South Texas 2008, LP (“CLW”) (collectively, the "XOG Group") . – On October 1, 2010, Famous Uncle Al’s Hot Dogs & Grille, Inc. (“FDOG”) entered into a Share Exchange Agreement (the “Share Exchange Agreement”), dated October 1, 2010, between its then controlling shareholder and American Standard Energy Corp., a Nevada Corporation (“ASEN”) . • Market Capitalization ~$250 million • Total Debt Zero • 90 day average trading volume ~20,000 • Total Shares Outstanding 1 ~40.0 million • Management/Director Ownership ~58% • Company Management Scott Feldhacker, CEO Richard MacQueen, President Scott Mahoney, CFO • Key Partners Audit: BDO Engineering: DeGolyer and MacNaughton Legal: Blank Rome 1) Shares outstanding as of July 31, 2011. The number of shares outstanding does not include shares issuable upon the exercise of warrants or outstanding stock options. Ticker: ASEN (OTC BB)

4 COMPANY OVERVIEW • American Standard Energy Corp. (“ASEN” or the “Company”) was formed for the purpose of leveraging a strategic relationship with a large private oil and gas company to accumulate and develop select oil and gas properties within highly desirable areas of the United States. • To date, Company has executed 7 acquisitions to accumulate more than 40,000 acres in the Williston Basin in North Dakota, the Permian Basin in West Texas and the Eagle Ford shale formation in South Texas. • ASEN’s “non‐ operated plus” model employs a largely 100% working interest focus in the Permian, with a complimentary minority interest focus in the Williston Basin and Eagle Ford shale formation . • ASEN’s strategy is to build a position of scale in each of its core operating areas. ASEN intends to continue to acquire acreage and production at attractive relative values in each of these three basins for the foreseeable future. Ticker: ASEN (OTC BB)

5 ASSET SUMMARY • Permian Basin – Wolfberry, Wolfcamp Shale, Avalon (100% WI Positions) – 6,500 net acres under lease, actively acquiring more acreage – Announced new 100% WI drilling program in Andrew County in July 2011 – Currently have 2 Rigs drilling full time for ASEN, actively looking to add 2 more rigs in 2011 – 2 Wells spud in July, 1 in August, expect to drill 10+ net wells in 2011, 30+ net wells in 2012 – ~$2.0 million to drill and complete a Wolfberry well • South Texas – Eagle Ford Shale Formation (Minority, Non‐ Op WI Strategy) – 1,200 net acres under lease, actively acquiring more acreage – Participated in 8 gross (0.8 net) wells YTD 2011 – Expect to participate in 15 gross (1.5 net) wells by year end 2011, 15 gross (1.5 net) wells in 2012 – ~$7.5 million to drill and complete an Eagle Ford well – Currently running two rigs full time in the basin • Williston Basin – Bakken / Three Forks Formation (Non‐ Op, Minority WI Model) – 32,300 net acres under lease, actively acquiring more acreage – Participated in 80+ gross (1.0 net) wells through Q1 2011, expect to participate in approximately 100+ gross (2‐ 3 net) wells in 2011 – Will also look to execute asset swaps for ASEN controlling interest acreage positions . – ~$8.5 million to drill and complete a 1,280 acre Bakken well Ticker: ASEN (OTC BB)

6 PERMIAN BASIN OVERVIEW • Highlights ASEN Permian Basin Acreage Map – ~6,500 net acres – 19 – 100% WI Permian wells – 500+ BOEPD early Q3 – $1.75 million average D&C cost • Drilling Activity – Completed 2 net wells in Q4 2010 – Currently producing from 45 gross (24.2 net) wells (1Q2011) – Anticipate participating in 10+ net wells in 2011 • Growth Strategy – Actively acquire more acreage ASEN currently has over 135+ Permian Basin PUD – Utilize best in class arrangements to Sites with a 100% WI for Self-Directed Drilling* accelerate development *Assumes 40 acre spacing Ticker: ASEN (OTC BB)

7 PERMIAN BASIN OVERVIEW Permian Basin Operators Permian Basin Average Monthly Rig Count 425 4% 400 0% 375 6% 1% Apache 350 6% Chevron - 325 1% 2% Texaco Clark 300 0% 275 Nearburg 250 Pits 225 Raw O&G 200 175 Reliance Energy 150 80% Trilogy 125 XOG 100 Ap J ul Ja Fe Ap Jan- 10 Feb- 1 r - 10 May- 10 - 10 Aug- 10 Nov- n- 11 b- r - 11 May- 0 Mar- 10 10 Jun- 10 Sep- 10 Oct- 10 Dec- 10 11 Mar- 11 11 80% of ASEN’s Permian wells are majority WI Source: Baker Hughes with 100% controlled drilling and production Ticker: ASEN (OTC BB)

8 PERMIAN BASIN OPPORTUNITY • ASEN continues to evaluate the most efficient transition of Permian acreage into the Company . – Targeting ~25,000 to 50,000 net acres for transfer into ASEN in 2011. Majority of the acreage under review holds both traditional and shale play development potential . – Focus on self‐ directed drilling program in the Permian, with a focus on controlling high working interest development in the Wolfberry, Wolfcamp shale formation, Wolffork shale formation and other highly desirable formations . – ASEN will also look to add to its non‐ operated position in New Mexico in the Avalon, Bone Springs, and Wolfbone shale formations . – 2 Rigs drilling full time for ASEN now, with the intent to source additional rigs in Q4 2011. Ticker: ASEN (OTC BB)

9 WOLFBERRY WELL ECONOMICS Well Economics Wolfberry Economics (140 MBOE EUR) 50% $1.65 million • Gross EUR / Well ~100‐ 150 Mboe 45% $1.75 million $1.85 million 40% • Well Cost ~$2.0 Million 35% IRR BT • Net Revenue Interest ~75.0% 30% 25% • PV‐ 10 Value per Well ~$2.0 Million 20% 15% • Well economics assume $90.00 oil / $6.00 natgas 60 65 70 75 80 85 90 95 100 105 110 115 120 Source: Cannacord Genuity $/bbl Ticker: ASEN (OTC BB)

10 EAGLE FORD SHALE OVERVIEW • Opportunity: New technology application, horizontal drilling, multistage fracing • Strategy: Acquire additional HBP acreage at a discount to fair market value. Targeting 10,000 to 25,000 net acres in South Texas with Eagle Ford shale potential for acquisition in 2011 • Leasehold: LaSalle, Frio Counties, Texas • Acreage: 1,200 net acres Eagle Ford Wells Available for Drilling: 320 acre spacing = 3.8 net wells Expected down spacing to 100 acres: 100 acre spacing = 8.2 net wells Total Eagle Ford Drilling Exposure: 12 net wells • Status Completed 2 gross (0.2 net) wells in 2010 Participated in 8 gross (0.8 net) wells to date in 2011 with 2 active rigs Expect to participate in 15 gross (1.5 net) wells by year end 2011 and an additional 15 gross (1.5 net) wells 2012 Ticker: ASEN (OTC BB)

11 EAGLE FORD SHALE MAP Ticker: ASEN (OTC BB)

12 BAKKEN / THREE FORKS OVERVIEW • Opportunity: Diversification across operators, new technology application, horizontal drilling, multistage fracing • Strategy: Targeting an additional 15,000 to 25,000 net acres in the Bakken in highly desirable counties for acquisition in 2011 • Leasehold: Mountrail, McKenzie, Williams, Dunn, Divide, Stark, Burke, Billings and Golden Valley counties, North Dakota • Acreage: 32,300 net acres 4 Net Bakken Wells Available for Drilling: 320 acre spacing = 101 net wells 4 Net Three Forks Wells Available for Drilling: 320 acre spacing = 101 net wells Total Williston Basin Drilling Exposure: 202 net wells • Status Participated in 69 gross (1.25 net) wells in 2010. Currently producing ~125 BOEPD from ~0.4 net wells. Expect to participate in 150 gross (6‐ 8 net) wells in 2011. Ticker: ASEN (OTC BB)

13 ACCELERATED BAKKEN GROWTH PLAN • Recent Activity: April 12, 2011, acquired 2,725 net acres in Mountrail county at an average price of $669/acre . April 26, 2011, acquired 13,324 net acres over seven counties, including Mountrail, Stark and Williams counties, including two 100% WI positions at an average price of $1,194/acre . ASEN’s Increasing Bakken Presence: 35,000 • ASEN believes the successful 30,000 acquisition of this acreage at 25,000 attractive pricing will continue to 20,000 enhance shareholder value. 15,000 10,000 • This acreage can currently be 5,000 acquired at an average price of 0 $1,000 ‐$1,500 per acre. Sep-10 Dec-10 Mar-11 Jun-11 Ticker: ASEN (OTC BB)

14 WILLISTON BASIN OVERVIEW • The ~32,300 net acres in the Williston Basin are located primarily in Mountrail, Dunn, Billings, Burke, McKenzie, Stark and Williams counties, North Dakota • ASEN has partnered with the following operators across its Williston Basin acreage position 1% 6% 1% 3% 2% 3% 2% PetroHunt 7% 6% Hess Brigham Hess 12% Occidental Continental 17% EOG Kodiak Marathon Oasis Whiting 4% XTO Zenergy 35% Ticker: ASEN (OTC BB)

15 BAKKEN and THREE FORKS ACTIVITY • Record drilling activity has significantly intensified the pace of development in the Williston Basin Net Wells and Working Interest Outlook North Dakota Average Monthly Rig Count 180 • ASEC has paid for 80+ gross wells, for 1.0 net well 160 through Q1 2011 140 • 150+ BOEPB early in Q3 • Expect 2‐ 3 additional net wells in AFEs on existing 120 acreage in 2011 100 • ASEC will look to negotiate assets swaps with 5‐ 10 80 controlling interest positions 60 • We would look to increase net well count through asset swaps by 2‐ 3+ net wells in 2011 40 • We expect our average working interest on 20 producing wells to increase from 1‐ 2% at FYE 2010 0 to 7‐ 8% in early 2012 J a Ap J J a n- r - un 10 Aug- Oct n- 10 Feb- 10 Mar- 10 10 May- 10 - 10 Jul- 10 Sep- 10 - 10 Nov- 10 Dec- 10 11 Feb- 11 Mar- 11 Apr - 11 May- 11 Source: NDIC Department of Minerals Ticker: ASEN (OTC BB)

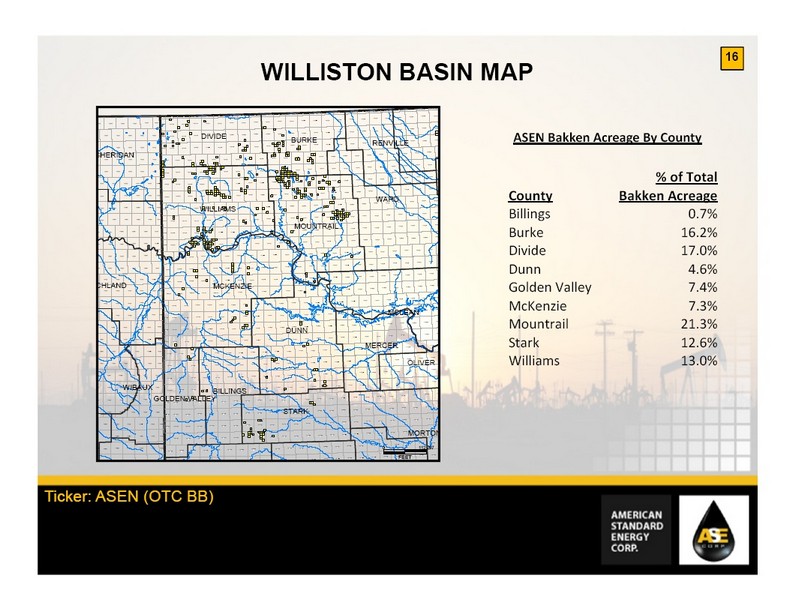

16 WILLISTON BASIN MAP DIVIDE B ASEN Bakken Acreage By County BURKE RENVILLE SHERIDAN % of Total WARD County Bakken Acreage WILLIAMS Billings 0.7% T MOUNTRAIL Burke 16.2% Divide 17.0% Dunn 4.6% CHLAND MCKENZIE Golden Valley 7.4% McKenzie 7.3% MCLEAN Mountrail 21.3% DUNN MERCER Stark 12.6% OLIVER Williams 13.0% WIBAUX BILLINGS GOLDEN VALLEY STARK MORTON 0 112,297 FEET Ticker: ASEN (OTC BB)

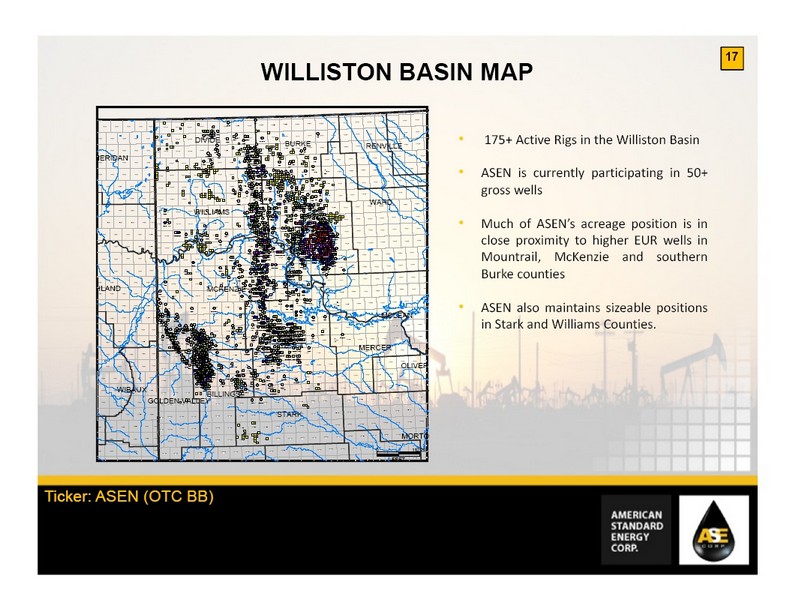

17 WILLISTON BASIN MAP DIVIDE B • 175+ Active Rigs in the Williston Basin BURKE RENVILLE HERIDAN • ASEN is currently participating in 50+ gross wells WARD WILLIAMS • Much of ASEN’s acreage position is in MOUNTRAIL close proximity to higher EUR wells in Mountrail, McKenzie and southern Burke counties HLAND MCKENZIE • ASEN also maintains sizeable positions MCLEAN in Stark and Williams Counties . DUNN MERCER OLIVER WIBAUX BILLINGS GOLDEN VALLEY STARK MORTO 0 112,297 FEET Ticker: ASEN (OTC BB)

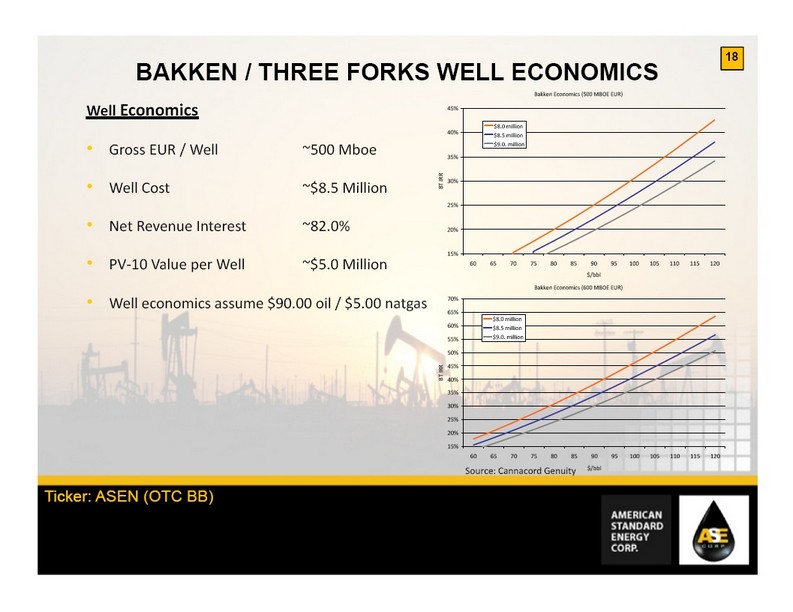

18 BAKKEN / THREE FORKS WELL ECONOMICS Bakken Economics (500 MBOE EUR) Well Economics 45% $8.0 million 40% $8.5 million • Gross EUR / Well ~500 Mboe $9.0. million 35% IRR 30% • Well Cost ~$8.5 Million BT 25% • Net Revenue Interest ~82.0% 20% 15% • PV‐ 10 Value per Well ~$5.0 Million 60 65 70 75 80 85 90 95 100 105 110 115 120 $/bbl Bakken Economics (600 MBOE EUR) • Well economics assume $90.00 oil / $5.00 natgas 70% 65% $8.0 million 60% $8.5 million 55% $9.0. million 50% IRR 45% BT 40% 35% 30% 25% 20% 15% 60 65 70 75 80 85 90 95 100 105 110 115 120 Source: Cannacord Genuity $/bbl Ticker: ASEN (OTC BB)

19 INVESTMENT HIGHLIGHTS • Non‐ operated model with drilling influence through proven operators • Participate in ~100 gross (2‐ 3 net) Bakken / Three Forks wells in 2011 • Participate in ~10‐ 15+ gross (10‐ 15+ net) Wolfberry wells in 2011 • Participate in ~12 gross (1.2 net) Eagle Ford wells in 2011 • Potential for at least 4‐ 8 wells in each Bakken / Three Forks drilling unit • Large acreage position in core areas of the Bakken and Permian with significant upside potential for additional drilling Ticker: ASEN (OTC BB)