Attached files

| file | filename |

|---|---|

| EX-3.1 - ARTICLES OF INCORPORATION - Callidus Corp | callidus_ex31.htm |

| EX-5.1 - CONSENT OF COUNSEL - Callidus Corp | callidus_ex51.htm |

| EX-3.2 - BY-LAWS - Callidus Corp | callidus_ex32.htm |

| EX-23.1 - CONSENT OF EXPERTS AND COUNSEL: INDEPENDENT AUDITOR'S CONSENT BY PETER MESSINEO, C.P.A - Callidus Corp | callidus_ex231.htm |

| EX-99.2 - ESCROW AGREEMENT - Callidus Corp | callidus_ex992.htm |

| EX-99.1 - SUBSCRIPTION AGREEMENT - Callidus Corp | callidus_ex991.htm |

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

||

|

Callidus Corporation

|

||

|

(Name of registrant as specified in its charter)

|

|

Nevada

|

5190

|

27-2919616

|

||

|

(State or jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer Identification No.)

|

|

9788 Cheewall Lane

|

|

Parker, Colorado 80134

|

|

(303) 346-8384

|

|

(Address and telephone number of registrant’s principal executive offices)

|

|

Brian E. Morsch, President

Callidus Corporation

9788 Cheewall Lane

Parker, Colorado 80134

(303) 346-8384

|

|

(Name, address and telephone number of agent for service)

|

|

Copy to:

Diane Dalmy, Attorney at Law and Escrow Agent

8965 West Cornell Place

Lakewood, Colorado 80227

(303) 985-9324

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after the Registration Statement becomes effective. If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

| Large Accelerated Filer | o | Accelerated Filer | o |

| Non-Accelerated Filer | o | Smaller Reporting Company | x |

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

Amount to be Registered

|

Proposed Maximum Offering Price Per Share

|

Proposed Maximum Aggregate Offering Price

|

Amount of Registration Fee

|

||||||||||||

|

Common Stock par value $0.001

|

4,000,000 | $ | 0.01 | $ | 40,000 | $ | 4.64 | |||||||||

The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457 under the Securities Act of 1933, as amended.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

BEFORE INVESTING, YOU SHOULD CAREFULLY READ THIS PROSPECTUS AND, PARTICULARLY, THE RISK FACTORS SECTION, BEGINNING ON PAGE 7. NEITHER THE U.S. SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES DIVISION HAS APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Investing in our common stock involves a high degree of risk. A potential investor should carefully consider the factors described under the heading “Risk Factors” beginning at page 7.

Neither the Securities and Exchange Commission nor any State Securities Commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED August 16, 2011.

2

The information in this prospectus is not complete and may be changed. The securities offered by this prospectus may not be sold until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is neither an offer to sell these securities nor a solicitation of an offer to buy these securities in any state where an offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Dated August 16, 2011

Callidus Corporation

4,000,000 Shares of Common Stock

$0.01 per share

$40,000 Maximum Offering

Callidus Corporation (“Company”) is offering on a best-efforts basis a maximum of 4,000,000 shares of its common stock at a price of $0.01 per share. This is the initial offering of Common Stock of Callidus Corporation and no public market exists for the securities being offered. The Company is offering the shares on a “self-underwritten”, best-efforts, all or none basis directly through our officer and director. The shares will be offered at a fixed price of $.01 per share for a period not to exceed 180 days from the date of this prospectus. There is no minimum number of shares required to be purchased. Brian Morsch, the sole officer and director of Callidus Corporation, intends to sell the shares directly. No commission or other compensation related to the sale of the shares will be paid to our officer and director. The intended methods of communication include, without limitations, telephone, and personal contact. For more information, see the section titled “Plan of Distribution” and “Use of Proceeds” herein.

| Per Share | Total | |||||||

| Initial public offering price | $ | 0.01 | $ | 40,000 | ||||

| Underwriting discounts and commissions | $ | 0.0 | $ | 0.0 | ||||

| Proceeds, before expenses, to us | $ | 0.01 | $ | 40,000 | ||||

The proceeds from the sale of the shares in this offering will be payable to Diane D. Dalmy Trust Account, who is also our counsel. A Trust Account will hold all the subscription funds pending placement of the entire offering. This offering is on a best effort, all-or-none basis, meaning if all shares are not sold and the total offering amount is not deposited by the expiration of the offering, all monies will be promptly returned to investors, without interest or deduction. The amount of funds actually collected in the escrow account from checks that have cleared the interbank payment system as reflected in the records of the insured depository institution is the only factor assessed in determining whether the minimum offering condition has been met.

The Officer and director of the issuer and any affiliated parties thereof will not participate in this offering. The offering shall terminate on the earlier of (i) the date when the sale of all 4,000,000 shares is completed or (ii) one hundred and eighty (180) days from the date of this prospectus. Callidus Corporation will not extend the offering period beyond one hundred and eighty (180) days from the effective date of this prospectus.

Callidus Corporation is a development stage, start-up company and currently has no operations. Any investment in the shares offered herein involves a high degree of risk. You should only purchase shares if you can afford a complete loss of your investment.

BEFORE INVESTING, YOU SHOULD CAREFULLY READ THIS PROSPECTUS AND, PARTICULARLY, THE RISK FACTORS SECTION, BEGINNING ON PAGE 7. NEITHER THE U.S. SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES DIVISION HAS APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Prior to this offering, there has been no public market for Callidus Corporation’s common stock.

3

|

Page

|

||||

|

PROSPECTUS SUMMARY

|

5 | |||

|

RISK FACTORS

|

8 | |||

|

A NOTE CONCERNING FORWARD-LOOKING STATEMENTS

|

13 | |||

|

USE OF PROCEEDS

|

13 | |||

|

DETERMINATION OF OFFERING PRICE

|

14 | |||

|

DILUTION

|

14 | |||

|

SELLING SECURITY HOLDERS

|

15 | |||

|

PLAN OF DISTRIBUTION

|

16 | |||

|

DESCRIPTION OF SECURITIES

|

18 | |||

|

INTEREST OF NAMED EXPERTS AND COUNSEL

|

19 | |||

|

INFORMATION WITH RESPECT TO THE REGISTRANT

|

20 | |||

|

Description of Business

|

20 | |||

|

Description of Property

|

28 | |||

|

Legal Proceedings

|

28 | |||

|

Market Price of and Dividends on the Company’s Common Equity and Related Stockholder Matters

|

28 | |||

|

Reports to Security Holders

|

29 | |||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

29 | |||

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

32 | |||

|

Directors and Executive Officers

|

34 | |||

|

Executive Compensation

|

35 | |||

|

Security Ownership of Certain Beneficial Owners and Management

|

37 | |||

|

Transactions With Related Persons, Promoters and Certain Control Persons

|

38 | |||

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

39 | |||

|

INDEX TO FINANCIAL STATEMENTS

|

40 | |||

|

SIGNATURES

|

II-4

|

|||

4

Item 3. Prospectus Summary.

This summary highlights certain information contained elsewhere in this prospectus. You should read the following summary together with the more detailed information regarding Callidus Corporation (“Us,” “We,” “Our,” “Callidus,” “ the Company,” or “the Corporation”) and our financial statements and the related notes appearing elsewhere in this prospectus.

|

The Company

Our Business

|

Callidus Corporation was incorporated in the State of Nevada on September 28, 2010. Callidus Corporation is a development stage company with a principal business objective of selling protective screens for all flat panel televisions and computers. The company plans to have its initial screens consist of sizes ranging between 19”-52” for all flat panel televisions and an Apple computer monitor screen of 24”. Our goal is to provide aesthetically pleasing and affordable screen protectors for all business and households to protect their investment. Callidus plans to provide its first initial offerings through Amazon and eBay as well as direct ordering through their retail website.

Callidus Corporation is a development stage company that has not commenced its planned principal operations. Callidus operations to date have been devoted primarily to start-up and development activities. Our President, Brian Morsch, has performed all of the development activities to date, which include the following:

1. Formation of the Company;

2. Development of the Callidus Corporation business plan;

3. Initiated final screen designs, materials and a manufacturer to produce the product

4. Conducted research on competition, specifically two competitors

5. Formulated product development and marketing strategies for product lines to include:

- Flat panel televisions

- Apple computer monitors

6. Researched largest TV providers in the commercial space which include:

- Sports Bars, Restaurants, Health Clubs and Airports

7. Secured web site domain www.calliduscorp.com;

8. Conducted research on flat panel television sales nation and worldwide.

Callidus Corporation is attempting to become operational and anticipates sales to begin during the third quarter of operations following the completion of our offering. In order to generate revenues, Callidus must address the following areas:

1. Finalize and implement our long-term marketing plan: In order to effectively penetrate our targeted market, Callidus will use a multi-faceted marketing plan that includes a high-end web site, Amazon, eBay, targeted retail outlets, and target specific distribution channels using independent representatives. We anticipate using independent commissioned sales representatives to work as middlemen between Callidus and the retailers. Their responsibilities would include approaching any/all appropriate retailers, work on creative marketing techniques to attract business from companies that sell televisions/flat screens to their customers. The Company currently does not have any engagements, agreements, or contracts with independent commissioned sales representatives.

2. Tailor our website: Callidus Corporation has secured the web domain located at www.calliduscorp.com. The site is currently under construction and we plan to incorporate this site with strategic vertical market e-commerce retailers. We have budgeted the necessary funding to develop a quality site.

3. Constantly monitor our market: We plan to constantly monitor our target market and adapt to consumers needs, wants and desires. To be successful we plan to evolve and diversify our product lines to satisfy the consumer. Our product will be like no other on the market which our competitors currently provide.

4. Run our Company ethically and responsibly. Conduct our business and ourselves ethically and responsibly.

|

|

Our Statement of Organization:

|

We were incorporated in Nevada on September 28, 2010, as Callidus Corporation. Our principal executive offices are located at 9788 Cheewall Lane, Parker, CO 80134. Our phone number is (303) 346-8384.

|

5

|

The Offering

|

|

|

The following is a brief summary of this offering. Please see the “Plan of Distribution” section for a more detailed description of the terms of the offering.

|

|

|

Number of Shares Being Offered:

|

The Company is offering 4,000,000 shares of common stock, par value $0.001

|

|

Offering Price per share

|

$0.01

|

|

Offering Period:

|

The shares are being offered for a period not to exceed 180 days. In the event we do not sell all of the shares before the expiration date of the offering, all funds raised will be promptly returned from the escrow account and returned to the investors, without interest or deduction.

|

|

Escrow Account:

|

The subscription proceeds from the sale of the shares in this offering will be payable to Diane D. Dalmy Trust Account and will be deposited in a non-interest bearing law office trust bank account until all offering proceeds are raised. All subscription agreements and checks should be delivered to Diane Dalmy. Failure to do so will result in checks being returned to the investor who submitted the check. Callidus Corporation’s escrow agent, Diane Dalmy acts as legal counsel for Callidus Corporation and is therefore not an independent third party.

|

|

Gross Proceeds to Company:

|

$40,000

|

|

Use of Proceeds:

|

We intend to use the proceeds to expand our business operations.

|

|

Number of Shares Outstanding Before the Offering:

|

10,000,000 common shares

|

|

Number of Shares Outstanding After the Offering:

|

14,000,000 common shares

|

The offering price of the common stock bears no relationship to any objective criterion of value and has been arbitrarily determined. The price does not bear any relationship to Callidus Corporation assets, book value, historical earnings, or net worth.

Callidus Corporation will apply the proceeds from the offering to pay for accounting fees, legal and professional fees, equipment, office supplies, salaries/contractors, sales and marketing, and general working capital.

The Company has not presently secured an independent stock transfer agent. Callidus Corporation has identified several agents to retain that will facilitate the processing of the certificates upon closing of the offering.

The purchase of the common stock in this offering involves a high degree of risk. The common stock offered in this prospectus is for investment purposes only and currently no market for Callidus Corporation common stock exists. Please refer to the sections herein titled “Risk Factors” and “Dilution” before making an investment in this stock.

SUMMARY FINANCIAL INFORMATION

The following table sets forth summary financial data derived from Callidus Corporation financial statements. The accompanying notes are an integral part of these financial statements and should be read in conjunction with financial statements, related notes and other financial information included in this prospectus.

6

|

Callidus Corporation

(A Development Stage Company)

Statement of Operations

For the Three Month Period Ended June 30, 2011 and

for the period from September 28, 2010 (date of inception) through March 31, 2011.

|

|

For the Three Months Ended June 30, 2011

|

For the Period from Sept. 28, 2010 (date of inception) through March 31, 2011

|

|||||||

|

(unaudited)

|

(audited)

|

|||||||

|

Revenues:

|

$ | -- | $ | -- | ||||

|

Expenses:

|

||||||||

|

Operating Expenses:

|

||||||||

|

Marketing and sales

|

-- | -- | ||||||

|

Compensation

|

-- | -- | ||||||

|

Professional

|

2,250 | -- | ||||||

|

General and administrative

|

675 | 555 | ||||||

|

Research and development

|

-- | -- | ||||||

|

Depreciation and amortization

|

-- | -- | ||||||

|

Total operating expenses

|

2,925 | 555 | ||||||

|

Net loss from operations

|

(2,925 | ) | (555 | ) | ||||

|

Other income (expense)

|

||||||||

|

Interest income

|

-- | -- | ||||||

|

Interest expense

|

-- | -- | ||||||

|

Loss before income taxes

|

(2,925 | ) | (555 | ) | ||||

|

Income tax benefit (provision)

|

-- | -- | ||||||

|

Net Loss

|

$ | (2,925 | ) | $ | (555 | ) | ||

|

Basic and diluted loss per common share

|

$ | 0.00 | $ | 0.00 | ||||

|

Basic and diluted weighted average common shares outstanding

|

10,000,000 | 10,000,000 | ||||||

The accompanying notes are an integral part of the financial statements.

7

RISK FACTORS

Before you invest in our common stock, you should be aware that there are risks, as described below. You should carefully consider these risk factors together with all of the other information included in this prospectus before you decide to purchase shares of our common stock. Any of the following risks could adversely affect our business, financial conditions and results of operations.

Risks Related To the Company

(1) Our Auditor Has Expressed Substantial Doubt About Our Ability To Continue As A Going Concern.

These financial statements included with this registration statement have been prepared on a going concern basis. We may not be able to generate profitable operations in the future and/or obtain the necessary financing to meet our obligations and repay liabilities arising from normal business operations when they come due. The outcome of these matters cannot be predicted with any certainty at this time. These factors raise substantial doubt that we will be able to continue as a going concern. Management plans to continue to provide for its capital needs through related party advances. Our financial statements do not include any adjustments to the amounts and classification of assets and liabilities that may be necessary should the Company be unable to continue as a going concern.

(2) The Company’s Needs Could Exceed The Amount Of Time Or Level Of Experience That Our Sole Officer And Director May Have.

Our business plan does not provide for the hiring of any additional employees until sales will support the expense, which is estimated to be the third quarter of operations. Until that time, the responsibility of developing the company's business, the offering and selling of the shares through this prospectus and fulfilling the reporting requirements of a public company all fall upon Brian Morsch. While Brian Morsch has business experience including 13 years Sr. Management and Sales in a publicly traded technology company, he does not have extensive experience in a public company setting, including serving as a principal accounting officer or principal Executive officer. Nor does Mr. Morsch have any experience running a technical production company. Mr. Morsch has Sr. Executive level sales and management experience in selling into fortune 500 companies and Enterprise level accounts. Mr. Morsch has also held Sr. level roles in product test, support and architecture design for a 40 million dollar a year software application at a high tech company.

Brian Morsch plans to spend at least ten (10) hours per week on the Company’s needs, or about twenty-five (25) percent of his time.

We have not formulated a plan to resolve any possible conflict of interest with his other business activities. In the event he is unable to fulfill any aspect of his duties to the company we may experience a shortfall or complete lack of sales resulting in little or no profits and eventual closure of the business.

(3) Since We Are A Development Stage Company, The Company Has Generated No Revenues And Does Not Have An Operating History.

The Company was incorporated on September 28, 2010; we have not yet commenced our business operations; and we have not yet realized any revenues. We have no operating history upon which an evaluation of our future prospects can be made. Based upon current plans, we expect to incur operating losses in future periods as we incurred significant expenses associated with the initial startup of our business. Further, we cannot guarantee that we will be successful in realizing revenues or in achieving or sustaining positive cash flow at any time in the future. Any such failure could result in the possible closure of our business or force us to seek additional capital through loans or additional sales of our equity securities to continue business operations, which would dilute the value of any shares you purchase in this offering.

8

(4) We Don’t Have Any Substantial Assets And Are Totally Dependent Upon The Proceeds Of This Offering To Fully Fund Our Business. If We Do Not Sell The Shares In This Offering We Will Have To Seek Alternative Financing To Complete Our Business Plans Or Abandon Them.

Callidus Corporation has limited capital resources. To date, the Company has funded its operations from limited funding and has not generated any cash from operations to be profitable. Unless Callidus Corporation begins to generate sufficient revenues to finance operations as a going concern, Callidus Corporation may experience liquidity and solvency problems. Such liquidity and solvency problems may force Callidus Corporation to cease operations if additional financing is not available. No known alternative resources of funds are available to Callidus Corporation in the event it does not have adequate proceeds from this offering. However, Callidus Corporation believes that the net proceeds of the Offering will be sufficient to satisfy the start-up and operating requirements for the next twelve months.

(5) We Cannot Predict When Or If We Will Produce Revenues, Which Could Result In A Total Loss Of Your Investment If We Are Unsuccessful In Our Business Plans.

We have not sold any Protective Screens to date and have not yet generated any revenues from operations. In order for us to continue with our plans and open our business, we must raise our initial capital through this offering. The timing of the completion of the milestones needed to commence operations and generate revenues is contingent on the success of this offering. There can be no assurance that we will generate revenues or that revenues will be sufficient to maintain our business. As a result, you could lose all of your investment if you decide to purchase shares in this offering and we are not successful in our proposed business plans.

(6) Our Continued Operations Depend On The Public’s Acceptance Of Our Products.

The ability to develop a robust product that the market finds desirable and willing to purchase is critically important to our success. We cannot be certain that the TV protective screens we offer will be appealing to the market and as a result there may not be any demand and our sales could be limited and we may never realize any revenues. In addition, there are no assurances that if we alter, or develop new protective screens in the future that the market’s demand for these will develop and this could adversely affect our business and any possible revenues.

(7) We depend on strategic marketing relationships.

We expect our future marketing efforts will focus in part on developing business relationships with companies that seek to augment their businesses by offering our products to their customers. Our inability to enter into and retain strategic relationships, or the inability of such companies to effectively market our products, could materially and adversely affect our business, operating results and financial condition.

(8) We Are Dependent On The Services Of A Certain Key Employee And The Loss Of His Services Could Harm Our Business.

Our success largely depends on the continuing services of our Chairman and Chief Executive Officer, Brian Morsch. His past experience in Sales and Executive management makes the Company dependent on his abilities. Our continued success also depends on our ability to attract and retain qualified personnel. We believe that Mr. Morsch possesses valuable industry and business development knowledge, experience and leadership abilities that would be difficult in the short term to replicate. The loss of him as a key employee could harm our operations, business plans and cash flows.

9

(9) Rapidly changing technology and substantial competition may adversely affect our business.

Our business is subject to rapid changes in technology. We can provide no assurances that research and development by competitors will not render our technology obsolete or uncompetitive. We compete with a number of protective screen companies that have technologies and products similar to those offered by us and have greater resources, including more extensive research and development, marketing and capital than us. We can provide no assurances that we will be successful in marketing our existing products and developing and marketing new products in such a manner as to be effective against our competition. If our technology is rendered obsolete or we are unable to compete effectively, our business, operating results and financial condition will be materially and adversely affected.

(10) Our Growth May Require Additional Capital, Which May Not Be Available.

Callidus Corporation has limited capital resources. Unless Callidus Corporation begins to generate sufficient revenues to finance operations as a going concern, we may experience liquidity and solvency problems. Such liquidity and solvency problems may force Callidus Corporation to cease operations if additional financing is not available. No known alternative resources of funds are available to the Company in the event it does not have adequate proceeds from this offering. However, Callidus Corporation believes the net proceeds of the Offering will be sufficient to satisfy the start-up and operating requirements for the next twelve months.

(11) The Screen Protection Industry Is Highly Competitive. If We Cannot Develop And Market Desirable Products That The Public Is Willing To Purchase, We Will Not Be Able To Compete Successfully. Our Business May Be Adversely Affected And We May Not Be Able To Generate Any Revenues.

Callidus Corporation has many potential competitors in the screen protection industry. We consider the competition is competent, experienced, and they have greater financial and marketing resources than we do at the present. Our ability to compete effectively may be adversely affected by the ability of these competitors to devote greater resources to the development, sales, and marketing of their products than are available to us.

Some of the Company’s competitors also offer a wider range of screen protection products; have greater name recognition and more extensive customer bases than the Company. These competitors may be able to respond more quickly to new or changing opportunities, customer desires, as well as undertake more extensive promotional activities, offer terms that are more attractive to customers and adopt more aggressive pricing policies than the Company. Moreover, current and potential competitors have established or may establish cooperative relationships among themselves or with third parties to enhance their visibility. The Company expects that new competitors or alliances among competitors have the potential to emerge and may acquire significant market share. Competition by existing and future competitors could result in an inability to secure adequate market share sufficient to support Callidus’ endeavors. We cannot be assured that we will be able to compete successfully against present or future competitors or that the competitive pressure we may face will not force us to cease operations. As a result, you may never be able to liquidate or sell any shares you purchase in this offering.

(12) We Are Selling This Offering Without An Underwriter And May Be Unable To Sell Any Shares. Unless We Are Successful In Selling All Of The Shares And Receiving The Proceeds From This Offering, We May Have To Seek Alternative Financing To Implement Our Business Plans And You Would Receive A Return Of Your Entire Investment.

This offering is self-underwritten, that is, we are not going to engage the services of an underwriter to sell the shares; we intend to sell them through our officer and director, who will receive no commissions. He will offer the shares to friends, relatives, acquaintances and business associates; however, there is no guarantee that he will be able to sell any of the shares. In the event we do not sell all of the shares before the expiration date of the offering, all funds raised will be promptly returned to the investors, without interest or deduction.

10

(13) Due To The Lack Of A Trading Market For Our Securities, You May Have Difficulty Selling Any Shares You Purchase In This Offering.

There is presently no demand for our common stock and no public market exists for the shares being offered in this prospectus. We plan to contact a market maker immediately following the effectiveness of this Registration Statement and apply to have the shares quoted on the OTC Electronic Bulletin Board (OTCBB). The OTCBB is a regulated quotation service that displays real-time quotes, last sale prices and volume information in over-the-counter (OTC) securities. The OTCBB is not an issuer listing service, market or exchange. Although the OTCBB does not have any listing requirements per se, to be eligible for quotation on the OTCBB, issuers must remain current in their filings with the SEC or applicable regulatory authority. Market Makers are not permitted to begin quotation of a security whose issuer does not meet this filing requirement. Securities already quoted on the OTCBB that become delinquent in their required filings will be removed following a 30 or 60 day grace period if they do not make their required filing during that time. We cannot guarantee that our application will be accepted or approved and our stock listed and quoted for sale. As of the date of this filing, there have been no discussions or understandings between Callidus Corpration or anyone acting on our behalf with any market maker regarding participation in a future trading market for our securities. If no market is ever developed for our common stock, it will be difficult for you to sell any shares you purchase in this offering. In such a case, you may find that you are unable to achieve any benefit from your investment or liquidate your shares without considerable delay, if at all. In addition, if we fail to have our common stock quoted on a public trading market, your common stock will not have a quantifiable value and it may be difficult, if not impossible, to ever resell your shares, resulting in an inability to realize any value from your investment.

(14) Investors In This Offering Will Bear A Substantial Risk Of Loss Due To Immediate And Substantial Dilution.

The principal shareholder of Callidus Corporation is Brian Morsch who also serves as its Director, President, Secretary, and Treasurer. Mr. Morsch acquired 10,000,000 restricted shares of Callidus Corporation common stock at a price per share of $0.001 for a $10,000 equity investment. Upon the sale of the common stock offered hereby, the investors in this offering will experience an immediate and substantial “dilution.” Therefore, the investors in this offering will bear a substantial portion of the risk of loss. Additional sales of our common stock in the future could result in further dilution. Please refer to the section titled “Dilution” herein.

(15) Purchasers In This Offering Will Have Limited Control Over Decision Making Because Brian Morsch, Callidus Corporation Officer, Director, And Shareholder Controls All Of Callidus Corporation’s Issued And Outstanding Common Stock.

Presently, Brian Morsch, Callidus Corporation Director, President, Secretary, and Treasurer beneficially owns 100% of the outstanding common stock. Because of such ownership, investors in this offering will have limited control over matters requiring approval by Callidus Corporation’s security holders, including the election of directors. Mr. Morsch would retain 74.1% ownership in Callidus Corporation common stock assuming the maximum offering is attained. Such concentrated control may also make it difficult for Callidus Corporation stockholders to receive a premium for their shares of common stock in the event Callidus Corporation enters into transactions, which require stockholder approval. In addition, certain provisions of Nevada law could have the effect of making it more difficult or more expensive for a third party to acquire, or of discouraging a third party from attempting to acquire, control of Callidus Corporation. Nevada law provides that not less than two-thirds vote of the stockholders is required to remove a director for cause, which could make it more difficult for a third party to gain control of the Board of Directors. This concentration of ownership limits the power to exercise control by the minority shareholders.

(16) We Will Incur Ongoing Costs And Expenses For SEC Reporting And Compliance. Without Revenue We May Not Be Able To Remain In Compliance, Making It Difficult For Investors To Sell Their Shares, If At All.

Our business plan allows for the estimated $5,500 cost of this Registration Statement to be paid from our cash on hand. We plan to contact a market maker immediately following the effectiveness of this Registration Statement and apply to have the shares quoted on the OTC Electronic Bulletin Board. To be eligible for quotation on the OTCBB, issuers must remain current in their filings with the SEC. Market Makers are not permitted to begin quotation of a security whose issuer does not meet this filing requirement. Securities already quoted on the OTCBB that become delinquent in their required filings will be removed following a 30 or 60 day grace period if they do not make their required filing during that time. In order for us to remain in compliance we will require future revenues to cover the cost of these filings, which could comprise a substantial portion of our available cash resources. If we are unable to generate sufficient revenues to remain in compliance it may be difficult for you to resell any shares you may purchase, if at all.

11

(17) There Has Been No Independent Valuation of the Stock, Which Means That the Stock May Be Worth Less Than the Purchase Price.

The per share purchase price has been arbitrarily determined by us without independent valuation of the shares. The price per share in the recent sale of our stock to our founder, Brian Morsch, was at par value ($0.001), and was not based on perceived market value, book value, or other established criteria and bears no relationship the price per share in this offering. We did not obtain an independent appraisal opinion on the valuation of the shares. Accordingly, the shares may have a value significantly less than the offering price and the shares may never obtain a value equal to or greater than the offering price.

(18) Our CEO, Mr. Morsch, has no experience as an officer or director of a technical production business and may not be able implement our business plan or generate any revenue from sales of our products.

Mr. Morsch does not have experience running a technical production and/or retail company and has never been an officer or director of a publicly traded company. Accordingly, Mr. Morsch may not be able to implement our plan or generate any revenue from the sale of our intended products. There can be no assurance that we will be able to attract and hire officers or directors with experience in the our industry to implement the business plan in the event that Mr. Morsch is otherwise unsuccessful in doing so.

(19) We are not a fully reporting company under the Exchange Act of 1934, as amended, and thus subject only to the reporting requirements of Section 15(d).

Until our common stock is registered under the Exchange Act of 1934, as amended (the “Exchange Act”), we will be subject only to the reporting obligations imposed by Section 15(d) of the Exchange Act. Section 15(d) of the Exchange Act requires issuers to file periodic reporting with the Securities and Exchange Commission when they have issued any class of securities for which a registration statement was filed and became effective pursuant to the Securities Act of 1933, as amended. The purpose of Section 15(d) is to ensure that investor who buy securities in registered offering are provided with the same information on an ongoing basis that they would receive if the securities they purchased were listed on a securities exchange or the issuer were otherwise subject to periodic reporting obligations i.e, under Section 13 of the Exchange Act.

The reporting obligations under Section 15(d) are automatically suspended when: (i) any class of securities of the issuer reporting under Section 15(d) is registered under Section 12 of the Exchange Act; or (ii) at the beginning of the issuer’s fiscal year, the class of securities covered by the registration statement is held of record by fewer than 300 persons. In the latter case, the Company would no longer be subject to periodic reporting obligations so long as the number of holders remains below 300 unless we file a registration statement with the Securities and Exchange Commission under Section 12 of the Securities Act. Our management, however, fully intends to file on an ongoing basis all periodic reports required under the Exchange Act.

(20) Our attorney is also serving as our escrow agent, which may present potential conflict of interest regarding this relationship since our escrow agent is not an independent third party.

Our escrow agent is not a disinterested third party with associated impartiality. Our attorney is also serving as our escrow agent and, therefore, this relationship may present potential conflict of interest since our attorney is acting in both capacities. As our attorney, Diane Dalmy has a responsibility to carry out her duties in an honest and businesslike manner and within the scope of authority. As our escrow agent, Diane Dalmy will be entrusted with and responsible for the oversight of our assets and funds deposited into escrow. This may present certain potential conflicts of interest including, but not limited to: (i) in the event of a dispute regarding the claims by an investor of escrowed funds held by the escrow agent on our behalf; (ii) the lack of an unbiased escrow agent in the event certain issues should arise; and (iii) the potential for our escrow agent to represent our best interests above those of the investor regarding escrowed funds. Diane Dalmy, as our escrow agent and our attorney, is expected to act in the best interests of and fulfill her fiduciary duty to us and our investors.

12

A NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements about Callidus Corporation’s business, financial condition, and prospects that reflect management’s assumptions and beliefs based on information currently available. Callidus Corporation can give no assurance that the expectations indicated by such forward-looking statements will be realized. If any of Callidus Corporation’s assumptions should prove incorrect, or if any of the risks and uncertainties underlying such expectations should materialize, the actual results may differ materially from those indicated by the forward-looking statements.

The key factors that are not within Callidus Corporation’s control and that may have a direct bearing on operating results include, but are not limited to, acceptance of the products that Callidus Corporation expects to market, our ability to establish a customer base, management's ability to raise capital in the future, the retention of key employees and changes in the regulation of the industry in which Callidus Corporation functions.

There may be other risks and circumstances that management may be unable to predict to sustain operations. When used in this prospectus, words such as, “believes,” “expects,” “intends,” “plans,” “anticipates,” “estimates” and similar expressions are intended to identify and qualify forward-looking statements, although there may be certain forward-looking statements not accompanied by such expressions.

Selling all of the shares in the offering will result in $40,000 gross proceeds to Callidus Corporation. We expect to disburse the proceeds from this offering in the priority set forth below within the first 12 months after successful completion of this offering. Callidus Corporation intends to use the proceeds from this offering as follows:

|

Application of Proceeds (1)

|

% of Total

|

|||||||

|

Total Offering Proceeds

|

$ | 40,000 | 100.00 | |||||

|

Offering Expenses:

|

||||||||

|

Legal & Professional Fees

|

1,500 | 3.75 | ||||||

|

Accounting Fees

|

2,500 | 6.25 | ||||||

|

EDGAR Fees

|

700 | 1.75 | ||||||

|

Blue-sky Fees

|

800 | 2.00 | ||||||

|

Total Offering Expenses

|

$ | 5,500 | 13.75 | |||||

|

Use of Net Proceeds:

|

||||||||

|

Accounting fees

|

2,500 | 6.25 | ||||||

|

Legal and Professional Fees

|

1,000 | 2.50 | ||||||

|

Office Equipment and Furniture

|

0 | 0.00 | ||||||

|

Office Supplies

|

500 | 1.25 | ||||||

|

Product Development (2)

|

12,000 | 30.00 | ||||||

|

Wages/Contractors (3)

|

6,000 | 15.00 | ||||||

|

Sales and Marketing

|

8,000 | 20.00 | ||||||

|

Working Capital (4)

|

4,500 | 11.25 | ||||||

|

Total Use of Net Proceeds

|

$ | 34,500 | 86.25 | |||||

|

Total Use of Proceeds

|

$ | 40,000 | 100.00 | |||||

13

Note:

|

(1)

|

The above figures represent only estimated costs.

|

|

(2)

|

The category of Product Development includes, but is not limited to designing and developing protective screen covers and a retail website.

|

|

(3)

|

The category of Wages/Contractors includes, but is not limited to fees associated with contract labor such the designing and building of a website for the company. The company will not be using the funds to pay the President and CEO, Mr. Brian Morsch.

|

|

(4)

|

The category of General Working Capital may include, but is not limited to, postage, telephone services, overnight delivery services and other general operating expenses. The funds designated as working capital will also be used to pay associated costs with being a publicly reporting company. In the event insufficient funds are allocated to working capital for the payment of such expenses, we intend to obtain such funding from future private offerings of our equity or loans from related parties.

|

The offering price of the common stock has been arbitrarily determined and bears no relationship to any objective criterion of value. The price does not bear any relationship to Callidus Corporation’s assets, book value, historical earnings, or net worth. In determining the offering price, management considered such factors as the prospects, if any, for similar companies, anticipated results of operations, present financial resources and the likelihood of acceptance of this offering.

“Dilution” represents the difference between the offering price of the shares of common stock and the net book value per share of common stock immediately after completion of the offering. “Net Book Value” is the amount that results from subtracting total liabilities from total assets. In this offering, the level of dilution is increased as a result of the relatively low book value of Callidus Corporation issued and outstanding stock. This is due in part because of the common stock issued to the Callidus Corporation officer, director, and employee totaling 10,000,000 shares at par value $0.001 per share versus the current offering price of $0.01 per share. Please refer to the section titled “Certain Transactions”, herein, for more information. Callidus Corporation net book value on June 30, 2011 was $7,645. Assuming all 4,000,000 shares offered are sold, and in effect, Callidus Corporation receives the maximum estimated proceeds of this offering from shareholders, Callidus Corporation will have tangible net assets of $42,145.

Corporation net book value will be approximately $0.0030 per share. Therefore, any investor will incur an immediate and substantial dilution of approximately $0.0070 per share while the Callidus Corporation present stockholder will receive an increase of $0.0022 per share in the net tangible book value of the shares that he holds. This will result in a 71% dilution for purchasers of stock in this offering.

This table represents a comparison of the prices paid by purchasers of the common stock in this offering and the individual who purchased shares in Callidus Corporation previously:

14

|

Existing Shareholder Per Share Data based on the maximum offering

|

||||

|

Price Per Share

|

$ | 0.0010 | ||

|

Net Tangible Book Value Per Share Before the Offering

|

$ | 0.0008 | ||

|

Potential gain to existing shareholders

|

$ | 0.0022 | ||

|

Net Tangible Book Value Per Share After the Offering

|

$ | 0.0030 | ||

|

Increase in tangible book value per share to Original Shareholders

|

$ | 0.0022 | ||

|

Capital Contributions

|

$ | 10,000 | ||

|

Number of Shares outstanding before offering

|

10,000,000 | |||

|

Number of Shares after offering held by existing shareholders

|

10,000,000 | |||

|

Percentage of Ownership after offering

|

71 | % | ||

|

Purchasers Per Share Data and Ownership of Shares in this offering based on the maximum offering

|

||||

|

Price Per Share

|

$ | 0.0100 | ||

|

Dilution per share to new shareholders

|

$ | 30 | % | |

|

Net Capital Contributions

|

$ | 40,000 | ||

|

Percentage of capital Contributions (gross)

|

80 | % | ||

|

Number of shares after offering held by Public investors

|

4,000,000 | |||

|

Percentage of ownership after offering

|

29 | % | ||

15

This is a self-underwritten offering. This Prospectus is part of a Prospectus that permits our officer and director to sell the Shares directly to the public, with no commission or other remuneration payable to him for any Shares he sells. There are no plans or arrangements to enter into any contracts or agreements to sell the Shares with a broker or dealer. Brian Morsch, the sole officer and director, will sell the shares and intends to offer them to friends, family members and acquaintances. In offering the securities on our behalf, Mr. Morsch will rely on the safe harbor from broker dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934. In his endeavors to sell this offering, Mr. Morsch does not intend to use any mass-advertising methods such as the Internet or print media.

Mr. Morsch will not register as a broker-dealer pursuant to Section 15 of the Securities Exchange Act of 1934, in reliance upon Rule 3a4-1, which sets forth the conditions under which a person associated with an Issuer, may participate in the offering of the Issuer's securities and not be deemed to be a broker-dealer.

| a. |

Mr. Morsch is an officer and director and is not subject to a statutory disqualification, as that term is defined in Section 3(a)(39)of the Act, at the time of his participation; and

|

| b. | Mr. Morsch is an officer and director and will not be compensated in connection with his participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; and |

| c. |

Mr. Morsch is an officer and director and is not, nor will he be at the time of his participation in the offering, an associated person of a broker-dealer; and

|

| d. | Mr. Morsch is an officer and director and meets the conditions of paragraph (a)(4)(ii) of Rule 3a4-1 of the Exchange Act, in that he (A) primarily performs, or is intended primarily to perform at the end of the offering, substantial duties for or on behalf of our company, other than in connection with transactions in securities; and (B) is not a broker or dealer, or been associated person of a broker or dealer, within the preceding twelve months; and (C) has not participated in selling and offering securities for any Issuer more than once every twelve months other than in reliance on Paragraphs (a)(4)(i) (a) (4) (iii). |

Our officer, director, control person and affiliates of same do not intend to purchase any shares in this offering.

Terms of the Offering

Callidus Corporation (“Company”) is offering on a best-efforts basis a maximum of 4,000,000 shares of its common stock at a price of $0.01 per share. This is the initial offering of Common Stock of Callidus Corporation and no public market exists for the securities being offered. The Company is offering the shares on a “self-underwritten”, best-efforts all or none basis directly through our officer and director. The shares will be offered at a fixed price of $.01 per share for a period not to exceed 180 days from the date of this prospectus. There is no minimum number of shares required to be purchased by any sole investor or organization. This offering is on a best effort, all-or-none basis, meaning if all shares are not sold and the total offering amount is not deposited by the expiration of the offering, all monies will be returned to investors, without interest or deduction. The amount of funds actually collected in the escrow account from checks that have cleared the interbank payment system as reflected in the records of the insured depository institution is the only factor assessed in determining whether the minimum offering condition has been met.

16

Brian Morsch, the sole officer and director of Callidus Corporation, intends to sell the shares directly. No commission or other compensation related to the sale of the shares will be paid to our officer and director. The intended methods of communication include, without limitations, telephone, and personal contact. For more information, see the section titled “Plan of Distribution” and “Use of Proceeds” herein.

The Officer and director of the issuer and any affiliated parties thereof will not participate in this offering.

The offering shall terminate on the earlier of (i) the date when the sale of all 4,000,000 shares is completed or (ii) one hundred and eighty (180) days from the date of this prospectus. Callidus Corporation will not extend the offering period beyond one hundred and eighty (180) days from the effective date of this prospectus.

There can be no assurance that all, or any, of the shares will be sold. As of the date of this Prospectus, Callidus Corporation has not entered into any agreements or arrangements for the sale of the shares with any broker/dealer or sales agent. However, if Callidus Corporation were to enter into such arrangements, Callidus Corporation will file a post effective amendment to disclose those arrangements because any broker/dealer participating in the offering would be acting as an underwriter and would have to be so named in the prospectus.

In order to comply with the applicable securities laws of certain states, the securities may not be offered or sold unless they have been registered or qualified for sale in such states or an exemption from such registration or qualification requirement is available and with which Callidus Corporation has complied. The purchasers in this offering and in any subsequent trading market must be residents of such states where the shares have been registered or qualified for sale or an exemption from such registration or qualification requirement is available. As of the date of this Prospectus, Callidus Corporation has not identified the specific states where the offering will be sold. Callidus Corporation will file a pre-effective amendment indicating which state(s) the securities are to be sold pursuant to this registration statement.

The proceeds from the sale of the shares in this offering will be payable to Diane D. Dalmy Trust Account (“Trust Account”) and will be deposited in a non-interest bank account until all offering proceeds are raised. A separate escrow account will be established at US Bank, N.A. on our behalf and all such proceeds from this Offering shall be deposited and remain segregated from any other funds held by our escrow agent. All subscription agreements and checks should be delivered to Diane Dalmy, 8965 West Cornell Place, Lakewood, Colorado, 80227. Failure to do so will result in checks being returned to the investor who submitted the check. All subscription funds will be held in the Trust Account pending and no funds shall be released to Callidus Corporation until such a time as the entire offering is sold. If the entire offering is not sold and proceeds received within one hundred and eighty (180) days of the date of this prospectus, all subscription funds will be returned to investors promptly without interest or deduction of fees.

Procedures and Requirements for Subscription

Prior to the effectiveness of the Registration Statement, the Issuer has not provided potential purchasers of the securities being registered herein with a copy of this prospectus. Investors can purchase common stock in this offering by completing a Subscription Agreement (attached hereto as Exhibit 99(a)) and sending it together with payment in full to Diane Dalmy, 8965 West Cornell Place, Lakewood, Colorado, 80227. All payments are required in the form of United States currency either by personal check, bank draft, or by cashier’s check. There is no minimum subscription requirement. Callidus Corporation reserves the right to either accept or reject any subscription. Any subscription rejected within this 30-day period will be returned to the subscriber within five business days of the rejection date. Furthermore, once a subscription agreement is accepted, it will be executed without reconfirmation to or from the subscriber. Once Callidus Corporation accepts a subscription, the subscriber cannot withdraw it.

17

Callidus Corporation’s authorized capital stock consists of 70,000,000 shares of common stock with a par value $0.001, and 5,000,000 shares of preferred stock with a par value $0.001 per share.

COMMON STOCK

Callidus Corporation’s authorized capital stock consists of 70,000,000 shares of common stock, with a par value of $0.001 per share.

The holders of our common stock:

1. Have equal ratable rights to dividends from funds legally available therefore, when, as and if declared by the Board of Directors;

2. Are entitled to share ratably in all of assets available for distribution to holders of common stock upon liquidation, dissolution, or winding up of corporate affairs;

3. Do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights; and

4. Are entitled to one vote per share on all matters on which stockholders may vote.

NON-CUMULATIVE VOTING

Holders of Callidus Corporation common stock do not have cumulative voting rights,which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in such event, the holders of the remaining shares will not be able to elect any of Callidus Corporation directors. After this offering is completed, and assuming all 4,000,000 shares being offered are sold, present stockholders will own approximately 71% of our outstanding shares.

PREFERRED STOCK

Callidus Corporation has no current plans to either issue any preferred stock or adopt any series, preferences, or other classification of the 5,000,000 shares of preferred stock authorized with a par value $0.001 as stated in the Articles of Incorporation. The Board of Directors is authorized to (i) provide for the issuance of shares of the authorized preferred stock in series and (ii) by filing a certificate pursuant to the laws of Nevada, to establish from time to time the number of shares to be included in each such series and to fix the designation, powers, preferences and rights of the shares of each such series and the qualifications, limitations or restrictions thereof, all without any further vote or action by the stockholders. Any shares of issued preferred stock would have priority over the common stock with respect to dividend or liquidation rights. Any future issuance of preferred stock may have the effect of delaying, deferring, or preventing a change in control of the company without further action by the stockholders and may adversely affect the voting and other rights of the holders of common stock.

18

The issuance of shares of preferred stock, or the issuance of rights to purchase such shares, could be used to discourage an unsolicited acquisition proposal. For instance, the issuance of a series of preferred stock might impede a business combination by including class voting rights that would enable the holder to block such a transaction, or facilitate a business combination by including voting rights that would provide a required percentage vote of the stockholders. In addition, under certain circumstances, the issuance of preferred stock could adversely affect the voting power of the holders of the common stock. Although the Board of Directors is required to make any determination to issue such stock based on its judgment as to the best interests of stockholders, the Board of Directors could act in a manner that would discourage an acquisition attempt or other transaction that potentially some, or a majority, of the stockholders might believe to be in their best interests or in which stockholders might receive a premium for their stock over the then market price of such stock. The Board of Directors does not at present intend to seek shareholder approval prior to any issuance of currently authorized stock, unless otherwise required by law or stock exchange rules.

PREEMPTIVE RIGHTS

No holder of any shares of Callidus Corporation stock has preemptive or preferential rights to acquire or subscribe for any shares not issued of any class of stock or any unauthorized securities convertible into or carrying any right, option, or warrant to subscribe for or acquire shares of any class of stock not disclosed herein.

CASH DIVIDENDS

As of the date of this prospectus, Callidus Corporation has not paid any cash dividends to stockholders. The declaration of any future cash dividend will be at the discretion of the Board of Directors and will depend upon earnings, if any, capital requirements and financial position, general economic conditions, and other pertinent conditions. Callidus Corporation does not intend to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in business operations.

REPORTS

After this offering, Callidus Corporation will furnish its shareholders with annual financial reports certified by independent accountants, and may, at its discretion, furnish unaudited quarterly financial reports.

None of the below described experts or counsel have been hired on a contingent basis and none of them will receive a direct or indirect interest in the Company.

Our audited financial statement for the period from inception to March 31, 2011, included in this prospectus has been audited by Peter Messineo Certified Public Accountant, PCAOB Registered Auditor, 1982 Otter Way, Palm Harbor, Florida 34685. We included the financial statements and report in their capacity as authority and experts in accounting and auditing.

Diane Dalmy is counsel for our Company who has given an opinion on the validity of the securities being registered, which opinion appears elsewhere in this registration statement. Ms. Dalmy has no direct or indirect interest in us.

19

Item 11. Information with Respect to the Registrant.

General Information

Callidus Corporation was incorporated in the State of Nevada on September 28, 2010 under the same name. Since inception, Callidus Corporation has not generated any revenues and has accumulated losses in the amount of $2,355 as of June 30, 2011. Callidus Corporation has never been party to any bankruptcy, receivership or similar proceeding, nor have it undergone any material reclassification, merger, consolidation, purchase or sale of a significant amount of assets not in the ordinary course of business.

Callidus Corporation has yet to commence planned operations to any significant measure. As of the date of this Registration Statement, Callidus Corporation has had only limited start-up operations and has not generated revenues. The Company will not be profitable until it derives sufficient revenues and cash flows from protective screen sales. We believe that, if we obtain the proceeds from this offering, we will be able to implement the business plan and conduct business pursuant to the business plan for the next twelve months. Callidus Corporation's administrative office is located at 9788 Cheewall Lane, Parker, Colorado 80134. Callidus Corporation's fiscal year end is March 31.

Business Overview

Callidus Corporation is a development stage protective screen company located in Parker, Colorado. The Company intends for its initial product line to consist of protective screen covers for flat screens, including televisions and Apple monitors. The use of durable and scratch-resistant plastics that the Company intends to use to cover large screens could position the Company among larger companies in a competitive market. We plan to stay on the cutting edge of the constantly changing screen protector market and create a reputation with the consumer of providing durable and scratch-resistant screen protectors at affordable prices.

Our initial design is planned to be a protective screen cover for a 42-inch widescreen television. Consumers, especially commercial consumers such as restaurant and hotel managers, may be interested in protecting the televisions in their homes or commercial spaces from dust, moisture, UV rays, and even flying objects. Callidus intends to provide lightweight and durable plastic screen protectors for televisions and computer monitors in various sizes during the first 12 months following this offering.

In a public space, television screens are usually hung on a wall overhead and out of the reach of most people. These screens collect substantial amounts of dust and grime over time. Most television screens are highly sensitive to cleaning their surface and can scratch easily. Our protective covers are made of a high scratch resistant plastic material and can easily be cleaned with normal household cleaners. Our design also creates a seal around the screen so that dust and grime are unable to collect on the actual surface of the television screen. The screen is easily removed and can be cleaned and replaced in a matter of minutes.

The home use for our protective screens is also a large market. Our screens can provide protection against fingerprints and other accidental marks on the screen, which can be difficult to remove without harming the television. Families with children may experience this along with the accidental object thrown at the screen. Our protective screens are designed to lower the impact of flying objects and protect from the occasional fingerprint. The screens are easily removed and can be cleaned with typical household cleaners.

Our President, Mr. Morsch, is prepared to interview potential plastic manufacturers and designers to bring into the project but currently the Company has no written agreements or contracts in place with any plastic manufacturers or designers. Our target market for our initial screen covers is the hotel and restaurant industries as well as airports.

20

Current Management is comprised of Brian Morsch, CEO and President. Mr. Morsch has 13 years of experience in the software and business development industries. Mr. Morsch currently works as a software salesman (July 2009 to present) for Quantum, Corp in Denver, Colorado. Prior to that, he was a Sr. Software Architect for Quantum Corp after Quantum acquired ADIC in July of 2003. Mr. Morsch served as a Sr. Software Engineering Manager and Software Engineer with ADIC from October of 1998 until they were acquired by Quantum Corp in July 2003. Mr. Morsch has extensive experience in product design, budgeting, managing, and sales. We feel that Mr. Morsch’s experience in these business aspects makes him a valuable asset to the Company.

Acknowledging the inherent risks involved in screen protection for electronic devices, we will assess the need for any patents or trademarks on a continuing basis to protect our main applications. Once the process is initiated, applications are initially protected under the Patent Pending Process provision while completing the full patenting process. This protection will cover the United States, initially, also giving first priority to the European Community.

Distribution

The Company plans to initially focus its effort of distribution through online sales directly to the consumer. With our limited resources, the cost efficiencies involved in online sales is our targeted method for the distribution of our products. The company has secured a distinctive URL (web address) in www.calliduscorp.com. A portion of the funds raised by this offering (see “Use of Proceeds”) will go toward developing our web site. Currently, the company does not have a web site in place but desires to build a web site upon completion of this offering. We have used the Web Design Cost Calculator at www.howmuchshouldawebsitecost.com to estimate the cost of a fully functioning website with ecommerce functionality to be between $5,000 and $7,000. While it is possible that the costs for a fully functional website could greatly exceed $5,000 to $7,000, we believe that we can have a third party web development company build a website to our specifications that will generate revenues for a price in that range. Such a website would be comprised of company information, every product that we offer, and the ability to generate sales with just a few clicks of the mouse. The proposed web site would include efforts by the Company to engage in SEO (Search Engine Optimization) and cross-marketing/linking with other web sites to drive traffic to www.calliduscorp.com. At this time, no other web sites or companies have been engaged, negotiated with, or contracted to participate in cross-linking or cross-marketing with the Company with regard to web site related activities.

We believe that with the popularity and lowering costs of widescreen and HD televisions and computer monitors that there exists a substantial opportunity to provide this market with protective screen covers for these electronic devices to allow them last longer and stay in better condition. Immediate goals include the development of a protective screen cover that allows consumers such as airports, restaurants and hotels to better protect their investments in televisions and monitors.

Clearly defined goals, both short and long term, will be an intricate part of the daily decision making process within the organization. It is with these defined goals in mind that allows Callidus Corporation to feel confident with the many decisions required to maintain progressive working concepts. Within the next 12 months, Callidus Corporation plans to have all current projects designed, tested, and manufactured for online sales to direct markets.

Long term, Callidus Corporation has adopted a basic outline by which future goals will be established. As certain milestones are achieved at existing levels, new areas of design and development will be added. These new areas translate into the introduction of more products to offer our customers, including additional sizes and tinting options for our screen protectors. We will always be striving to keep up with the increasingly competitive market using new and innovative features and products. The Company’s intention is to portray itself as an innovative leader in the protective screen sectors.

21

Industry and Trend Analysis

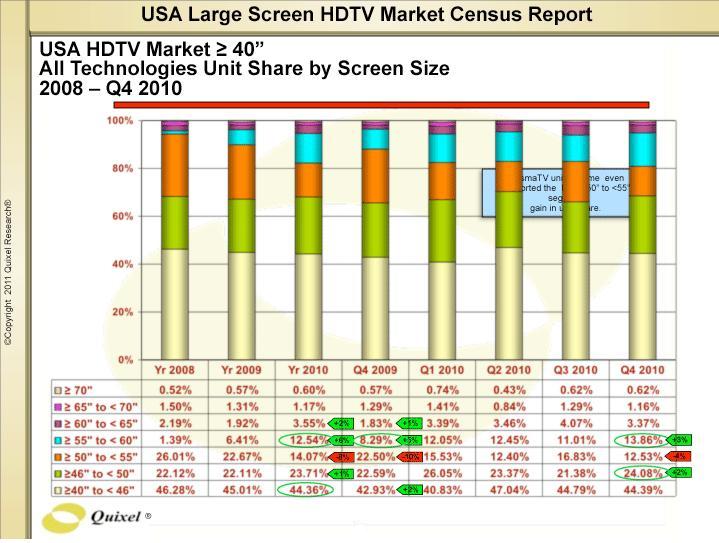

According to Quixel Research, LLC's May 12, 2010 Press Release “The overall Large Area Display category was up 7% in units year to year, with LCDTV 40”+ volumes increasing 6% for the same time period.” This increase in sales may be from the higher availablility of the screens at more affordable prices for the consumer. As you can see by the below chart, trends are moving to the larger displays which in turn create an unique opportunity for the screen protection industry for these displays.

Source www.quixelresearch.com

We see this as an opportunity to provide a service for consumers in this market. Our protective screen covers have the ability to protect against minor accidental damage and the inevitable instance of dirt, grime, oils, and other substances on the hard to clean television screens.

22

With a 40'+ display television screen being a large investment for the average family or business, the ability to protect that investment at a reasonable cost we believe will help Callidus build a successful business. Furthermore, with the obvious populartity of screen protectors for mobile devices like tablets and mobile phones, we have been unable to find a competitor that specifically targets screen protectors for television and computer monitors.

Delineation of the Market Area and Identification of Target Markets

According to Dr. Norman Herr of California State University, Northridge, 99% of American households possess at least one television with 2.24 TV sets in the average household. He goes on to advise that 66% of U.S. homes have three or more TV sets. This information was gathered from http://www.csun.edu/science/health/docs/tv&health.html. Answers.com (http://wiki.answers.com/Q/How_many_TV_sets_are_in_the_US) reports that there are 257,208,958 television sets in the United States in 2010. With so many potential television monitors to protect, we feel strongly about four specific target markets. We also have seen an increase in the number of sales of “connected” televisions, or TVs that can connect to the World Wide Web. An estimated 40 million of those were sold in 2010 and an estimated 118 million will be sold in 2014, according to WorldTVPC.com (http://www.worldtvpc.com/blog/40-million-internet-connected-televisions-rollout-2010/).

Callidus Corporation’s products can be offered worldwide and marketing them will only have one boundary, the demarcation between developed and undeveloped countries. The planned market areas will include North America, South America, Europe, Australia, and Asia. Our four specific target markets will include:

|

1.

|

Airports – Airports are large consumers of flat-panel monitors and televisions that are used to show arrivals and departures as well as news programming and sports programming throughout the airport and it airport restaurants. Airports invest largely in flat panels to keep the information visible to travelers and to entertain travelers while they wait. Also, many airports, such as our Denver International Airport, generate advertising revenue for advertisements placed in airport programming. One such company to offer that service is ProDIGIQ (http://www.prodigiq.com/account/airport_advertising).

|

|

2.

|

Restaurants and Bars/Pubs – More and more televisions are making their way into restaurants and bars than ever before. With the technology of High Definition and the lowering cost of flat panel televisions, large restaurant chains are investing in better screens to attract patrons to come to their bar or restaurant to watch sporting events. This market also should be attracted to protecting their investments, as the monitors are, by nature, more likely to be in harm’s way due to the excitement caused by sporting events and the serving of alcohol.

|

|

3.

|

Hotels and Resorts – Hotels and resorts, too, need to stay current in their accommodations to attract and retain guests. Hotel chains purchase new televisions for their rooms, event centers, lobbies, and restaurants every few years. Protecting these investments will help them to last longer as they will stay cleaner and don’t have as much risk of dust gathering on the screens. If they can keep their televisions cleaner for longer, then they may not have to replace them as frequently.

|

|

4.

|

Individual Consumers – As stated above, 99% of American households have a television and 66% have three or more televisions. These consumers will be targeted heavily on our website for individuals to protect their home television screens from debris, dust, and children.

|

23

Marketing

Our long-term marketing activities will include traditional product marketing functions such as production of both hardcopy and on-line product and company promotional material, gathering of customer input for new product features and creation of sales product demonstrations in the future. As a long-term goal, we hope to generate awareness of our company and sales leads for our products through print and web-based advertising, and consumer events such as trade shows for electronics and television monitor providers. Additionally, we plan to build and maintain an extensive web site that is used to educate our customers and prospects about our products and services.

Online Marketing

With over 40 million “connected” television monitors sold in 2010, we feel that it’s important to maximize the marketing opportunities available to us. We will place ads strategically in the most popular web sites that our target market frequents, blending our product into those who will be most interested in it. We will also employ social networking tactics of our own to spread the word about our applications on the world’s most popular sites. Properly placed and managed social media networks for the company should provide us with tools to generate revenue from online purchases with comparatively little cash outlay.