Attached files

| file | filename |

|---|---|

| 8-K - 8K - Q2 2011 EARNINGS RELEASE AND CONFERENCE CALL - HOOPER HOLMES INC | a8kq22011earningsreleasean.htm |

| EX-99.2 - TRANSCRIPT OF CONFERENCE CALL - HOOPER HOLMES INC | exhibit99-2.htm |

News Release

For further information:

Hooper Holmes

Burt R. Wolder

Senior Vice President

(908) 953-6249

Investors: Andrew Berger

S.M. Berger & Company

(216) 464-6400

Hooper Holmes Announces Second Quarter 2011 Results

BASKING RIDGE, N.J., August 12, 2011 -- Hooper Holmes (NYSE Amex:HH) today announced financial results for the quarter ended June 30, 2011.

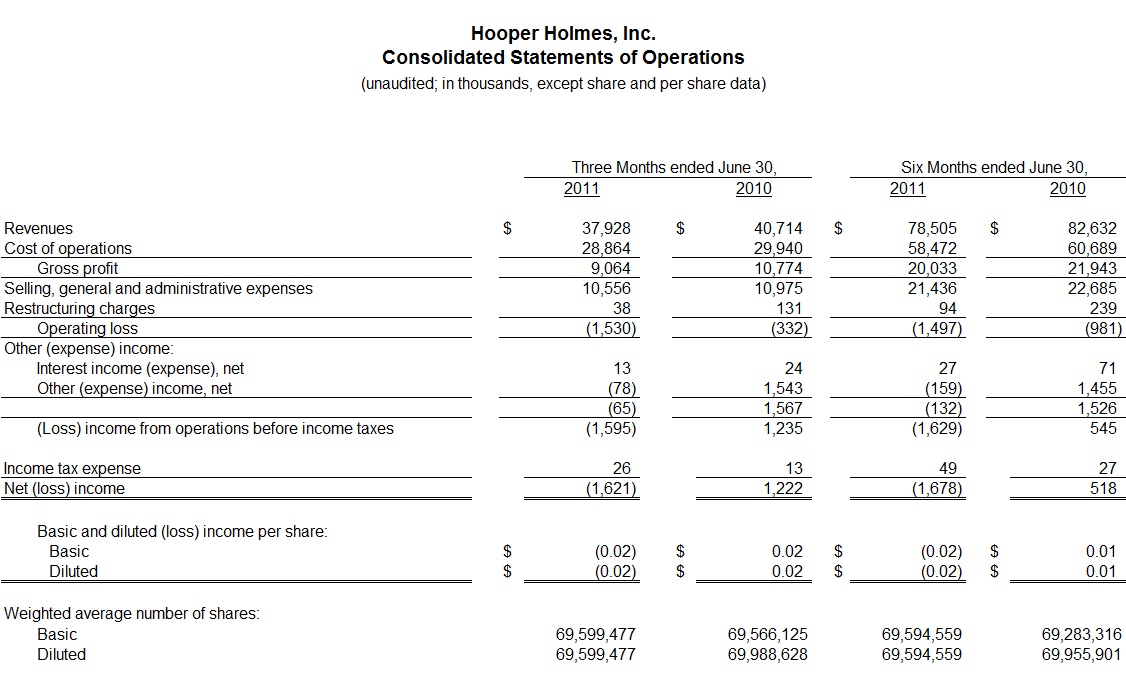

Consolidated revenues totaled $37.9 million for the second quarter of 2011, representing a 7% revenue decline from $40.7 million in the second quarter of 2010. The Company recorded a net loss of $1.6 million for the second quarter of 2011, or ($0.02) per share, compared to net income of $1.2 million, or $0.02 per share, for the second quarter of 2010. Net income for the second quarter of 2010 included a $1.6 million reduction in a previously established reserve for interest and penalties pertaining to unclaimed property.

For the six months ended June 30, 2011, consolidated revenues were $78.5 million compared to $82.6 million in the comparable period of 2010. The Company's net loss for the six months ended June 30, 2011 totaled $1.7 million, or ($0.02) per share, compared to net income of $0.5 million, or $0.01 per share, for the six months ended June 30, 2010. The results for the six months ended June 30, 2010 included a $1.6 million reduction in a previously established reserve for interest and penalties pertaining to unclaimed property.

Second quarter 2011 revenues by service line:

▪ | Portamedic revenue totaled $26.8 million in the second quarter of 2011, a decline of approximately 11% compared to $30.1 million in the second quarter of 2010, primarily due to a 7% decline in paramedical exams completed during the quarter, along with a 3.5% decrease in revenue per exam. |

▪ | Heritage Labs revenue totaled $3.1 million for the second quarter of 2011, an increase of approximately 9% compared to the second quarter of 2010, primarily attributable to an increase in demand for lab kit assembly services, along with increased revenue per specimen tested. |

▪ | Hooper Holmes Services revenue totaled $5.5 million for the second quarter of 2011, basically flat in comparison to the comparable prior year period, as a result of increased demand for outsourced underwriting services, offset by reduced revenue in our tele-underwriting business. |

▪ | Health & Wellness revenue totaled $2.6 million for the second quarter of 2011, a 10% increase from the second quarter of 2010, primarily due to an increase in health screenings completed during the quarter. |

Net cash provided by operations approximated $2.6 million in the second quarter of 2011, primarily attributable to a reduction in accounts receivable during the second quarter. Capital expenditures totaled $1.0 million in the second quarter of 2011. As of June 30, 2011, cash and cash equivalents totaled $20.9 million, with no outstanding borrowings under the Company's credit facility.

“We continue to make progress towards stabilizing revenue and investing in the people and processes we need to return to sustained growth and profitability,” said Ransom J. Parker, President and CEO of Hooper Holmes. “I am pleased by the revenue growth of our Health & Wellness and Heritage Labs service lines, and I'm confident that the changes we are making in our sales organization will drive improvement in Portamedic as we look ahead to 2012.”

“The Board and management are committed to building a foundation in 2011 for the sustained performance our shareholders deserve,” commented Larry Ferguson, Chairman of the Board. “Through the first two quarters of the year, our results are consistent with our expectations, and we believe we're on the right course.”

Conference Call

The Company will host a conference call, today, August 12, 2011 at 11:00 a.m. ET to discuss second quarter 2011 results.

To participate in the conference call, please dial 877-941-2068 or internationally 480-629-9712 conference ID 4462192 five to ten minutes before the call is scheduled to begin. A live web cast will be hosted on the Company's web site located at www.hooperholmes.com. Listeners may also access a telephone replay of the conference call, available from 2:00 p.m. on August 12, 2011 until midnight on August 19, 2011, by dialing 877-870-5176 or internationally 858-384-5517. The access code for the replay is 4462192.

About Hooper Holmes

Hooper Holmes is a leader in collecting personal health data and transforming it into useful information, enabling customers to take actions that manage or reduce their risks and expenses. With a presence in hundreds of markets and a network of thousands of examiners, Hooper Holmes can arrange a medical exam anywhere in the U.S. and deliver the results to its customers.

Hooper Holmes has four service lines. Portamedic provides a wide range of medical exam services nationwide. Heritage Labs tests millions of samples annually and helps life insurers improve underwriting performance by better applying the predictive powers of today's tests. Health & Wellness provides a complete service for wellness, disease management, and managed care companies including scheduling support, fulfillment of supplies, blood collection kits, medical screenings, lab testing and data transmission. Hooper Holmes Services reduces the insurance sales cycle through integrated data collection, tele-interviewing and underwriting services.

This press release contains “forward-looking” statements, as such term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on the Company's current expectations and beliefs and are subject to a number of risks, uncertainties and assumptions. Among the important factors that could cause actual results to differ materially from those expressed in, or implied by, these forward-looking statements are our ability to successfully implement our business strategy; our working capital requirements over the next 12 to 24 months; our ability to maintain compliance with the financial covenant in our credit facility; the level of our liquidity; operating cash flows; customer and creditor concerns about our financial health; and the rate of life insurance application activity. Additional information about these and other factors that could affect the Company's business is set forth in the Company's annual report on Form 10-K for the year ended December 31, 2010, filed with the Securities and Exchange Commission on March 14, 2011. The Company undertakes no obligation to update or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this press release to reflect the occurrence of unanticipated events, except as required by law.

# # #