Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K MAIN BODY - CENTERLINE HOLDING CO | f8k_june2011-clnh.htm |

| EX-99.1 - PRESS RELEASE - CENTERLINE HOLDING CO | exhibit99-1.htm |

Centerline Holding Company

Financial Overview

2Q11 | June 30, 2011

CENTERLINE CAPITAL GROUP

Table of Contents

Centerline Corporate Overview pg 3

Equity Ownership Summary pg 7

Supplemental Financial Information pg 9

Glossary pg 22

Corporate Office

625 Madison Avenue

New York, NY 10022

Phone: 212-317-5700

Fax: 212-751-3550

www.centerline.com

OTC Symbol: CLNH

Investor Contacts

Rob Levy

President, CFO and COO

212-317-5700

Denise Bernstein

Investor Relations

212-521-6451

Centerline Corporate Overview pg 3

Equity Ownership Summary pg 7

Supplemental Financial Information pg 9

Glossary pg 22

Corporate Office

625 Madison Avenue

New York, NY 10022

Phone: 212-317-5700

Fax: 212-751-3550

www.centerline.com

OTC Symbol: CLNH

Investor Contacts

Rob Levy

President, CFO and COO

212-317-5700

Denise Bernstein

Investor Relations

212-521-6451

This presentation contains forward-looking statements about

Centerline Holding Company. Certain statements in this document

may constitute forward-looking statements within the meaning of

the "safe harbor" provisions of the Private Securities Litigation

Reform Act of 1995. Except for historical information, the matters

discussed in this presentation are forward-looking statements

subject to certain risks and uncertainties. These statements are

based on management's current expectations and beliefs and are

subject to a number of factors and uncertainties that could cause

actual results to differ materially from those described in the

forward-looking statements. These risks and uncertainties are

detailed in Centerline Holding Company's most recent Annual

Report on Form 10-K and the Quarterly Reports on Form 10-Q for

the first, second and third quarters of 2010 filed with the Securities

and Exchange Commission, and include, among others, business

limitations caused by adverse changes in real estate and credit

markets and general economic and business conditions; our ability

to generate new income sources, raise capital for investment funds

and maintain business relationships with providers and users of

capital; changes in applicable laws and regulations; our tax

treatment, the tax treatment of our subsidiaries and the tax

treatment of our investments; risk of allocations of income to our

shareholders without corresponding cash distributions; possible

adverse effects of a future issuance of shares or a reverse share

split; possible deterioration in cash flows generated by material

investments, such as the Freddie Mac B-Certificate; competition

with other companies; risk of loss under mortgage banking loss

sharing agreements; and risks associated with providing credit

intermediation. Words such as "anticipates", "expects", "intends",

"plans", "believes", "seeks", "estimates" and similar expressions are

intended to identify forward-looking statements. Such forward-

looking statements speak only as of the date of this document.

Centerline Holding Company expressly disclaims any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change

in Centerline Holding Company's expectations with regard thereto

or change in events, conditions, or circumstances on which any

such statement is based.

Centerline Holding Company. Certain statements in this document

may constitute forward-looking statements within the meaning of

the "safe harbor" provisions of the Private Securities Litigation

Reform Act of 1995. Except for historical information, the matters

discussed in this presentation are forward-looking statements

subject to certain risks and uncertainties. These statements are

based on management's current expectations and beliefs and are

subject to a number of factors and uncertainties that could cause

actual results to differ materially from those described in the

forward-looking statements. These risks and uncertainties are

detailed in Centerline Holding Company's most recent Annual

Report on Form 10-K and the Quarterly Reports on Form 10-Q for

the first, second and third quarters of 2010 filed with the Securities

and Exchange Commission, and include, among others, business

limitations caused by adverse changes in real estate and credit

markets and general economic and business conditions; our ability

to generate new income sources, raise capital for investment funds

and maintain business relationships with providers and users of

capital; changes in applicable laws and regulations; our tax

treatment, the tax treatment of our subsidiaries and the tax

treatment of our investments; risk of allocations of income to our

shareholders without corresponding cash distributions; possible

adverse effects of a future issuance of shares or a reverse share

split; possible deterioration in cash flows generated by material

investments, such as the Freddie Mac B-Certificate; competition

with other companies; risk of loss under mortgage banking loss

sharing agreements; and risks associated with providing credit

intermediation. Words such as "anticipates", "expects", "intends",

"plans", "believes", "seeks", "estimates" and similar expressions are

intended to identify forward-looking statements. Such forward-

looking statements speak only as of the date of this document.

Centerline Holding Company expressly disclaims any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change

in Centerline Holding Company's expectations with regard thereto

or change in events, conditions, or circumstances on which any

such statement is based.

CENTERLINE CAPITAL GROUP

Centerline Corporate Overview

4

Corporate Overview

5

Business Groups

6

Competitive Advantages

CENTERLINE CAPITAL GROUP

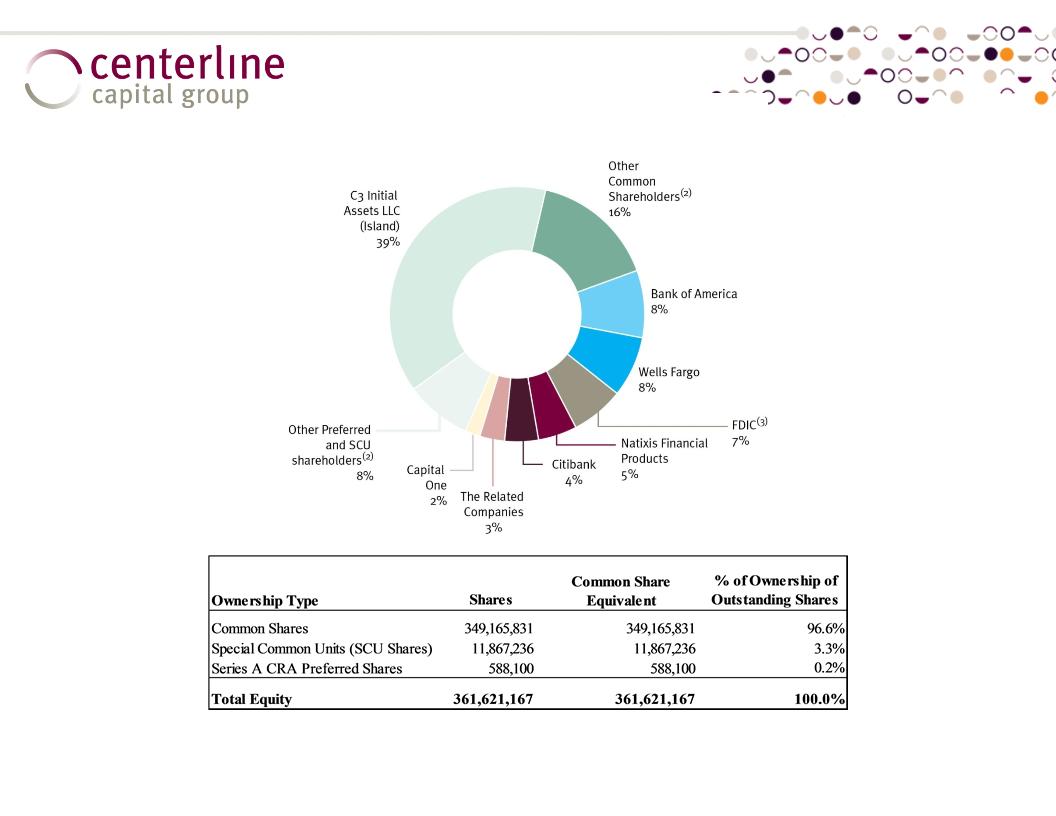

Equity Ownership Summary

8

Equity Ownership as of June 30, 2011

(1) On October 6, 2010, Centerline shareholders approved the amendment to the Company’s trust agreement that increased the number of shares authorized for issuance from

160 million shares to 800 million shares. At that time, 19.3 million of the Special Series A Shares automatically were converted into 289.9 million of common shares at 1:15 ratio.

(2) Excludes common shares owned by The Related Companies as they are shown separately.

(3) The FDIC, in its capacity as Receiver, is the record owner of common shares on behalf of the following entities: California National Bank, California Savings Bank, San Diego National Bank, Indy Mac Bank, F.S.B., North

Houston Bank, and Community Bank & Trust.

Houston Bank, and Community Bank & Trust.

(4) Shareholders are subject to Lock-Up Agreements pursuant to which they may not offer, sell, offer to sell, contract to sell, grant and option to purchase or otherwise sell or dispose of any of their Centerline equity interests.

(1)

(4)

(4)

(4)

(4)

CENTERLINE CAPITAL GROUP

Supplemental Financial Statements

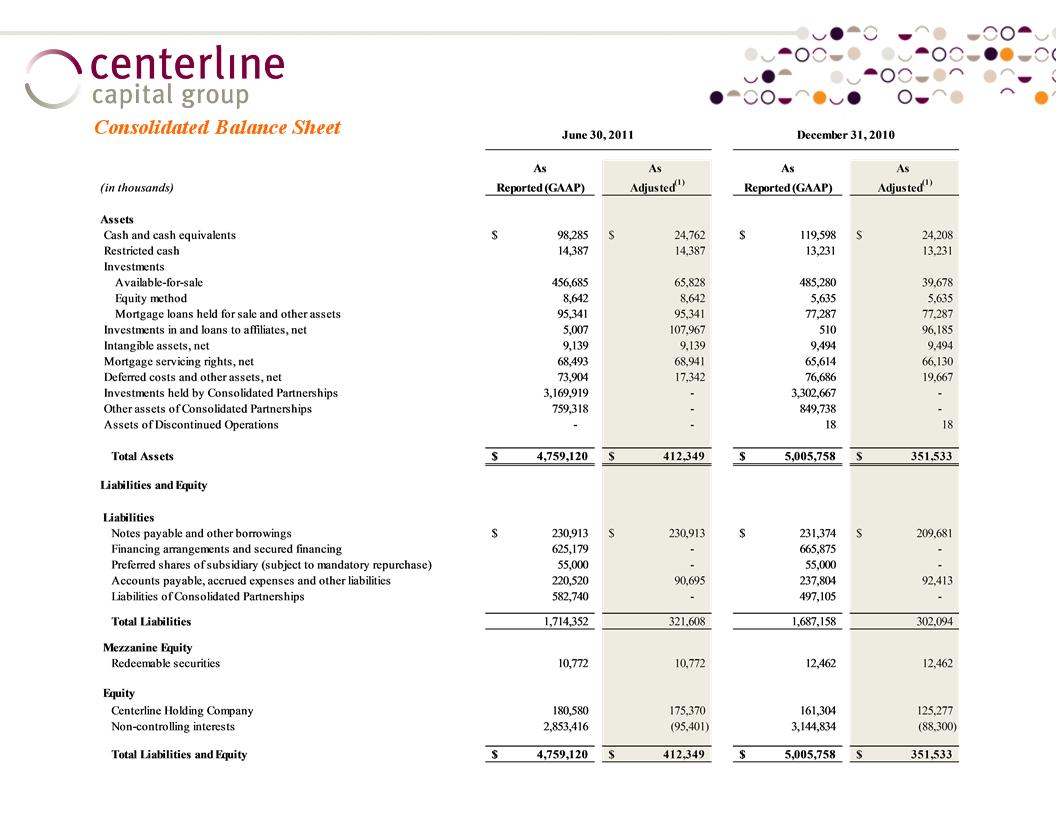

The accompanying “As Adjusted” balance sheets and statements of operations are not in accordance with

GAAP, are presented for the purpose of enhancing the understanding of the economics of our business, and may

not be comparable to figures reported by other companies.

GAAP, are presented for the purpose of enhancing the understanding of the economics of our business, and may

not be comparable to figures reported by other companies.

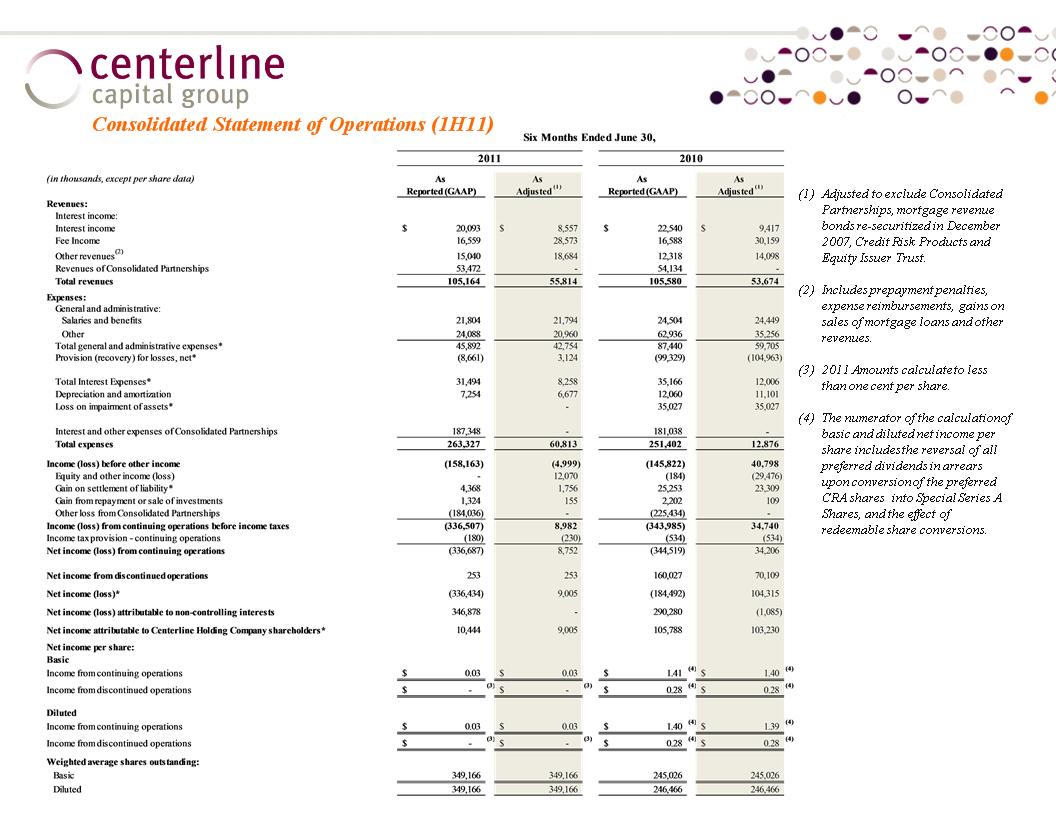

10

(1) Adjusted to exclude Consolidated Partnerships, mortgage revenue bonds re-securitized in December 2007, Credit Risk Products and Equity Issuer Trust. Refer to Pages

16-17 for further details.

16-17 for further details.

11

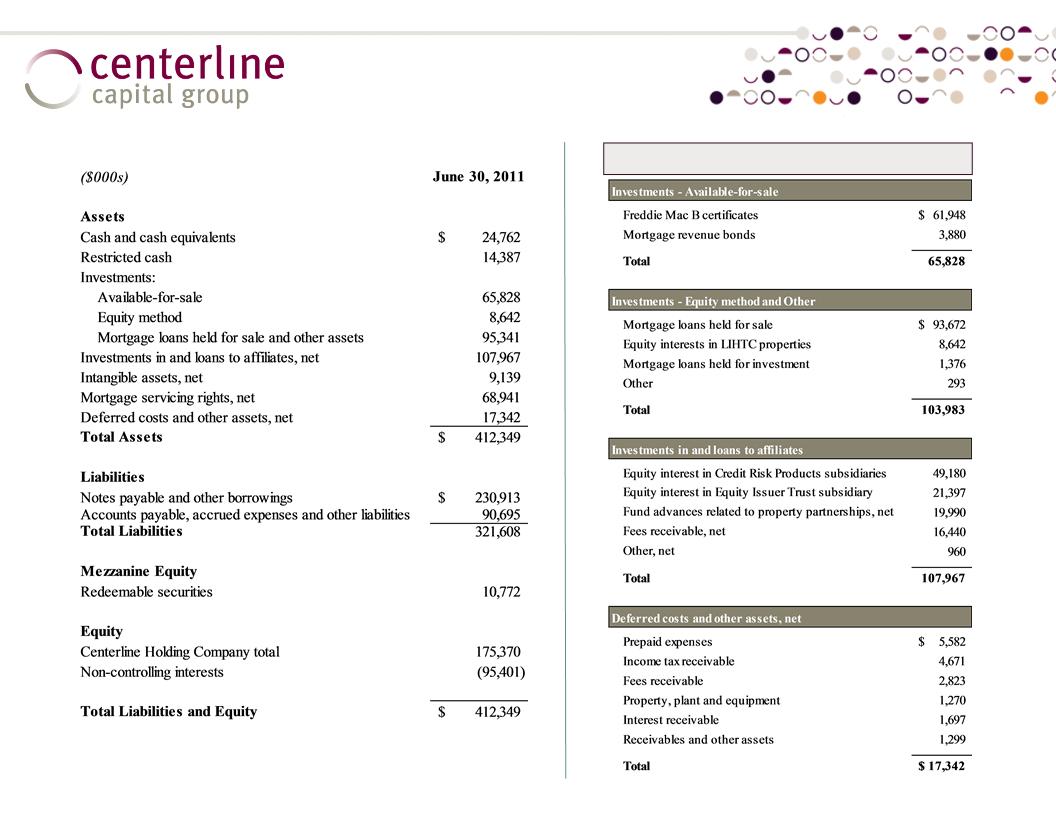

As Adjusted Balance Sheet

Asset Detail

12

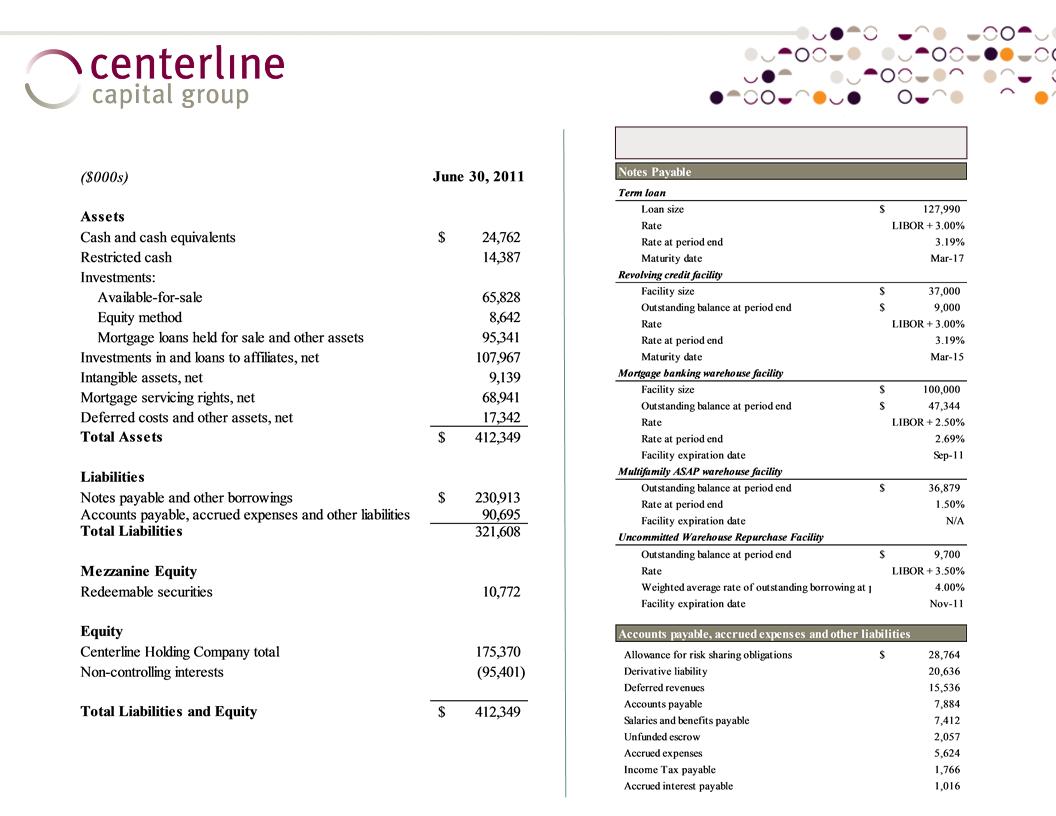

As Adjusted Balance Sheet (cont.)

Liability Detail

13

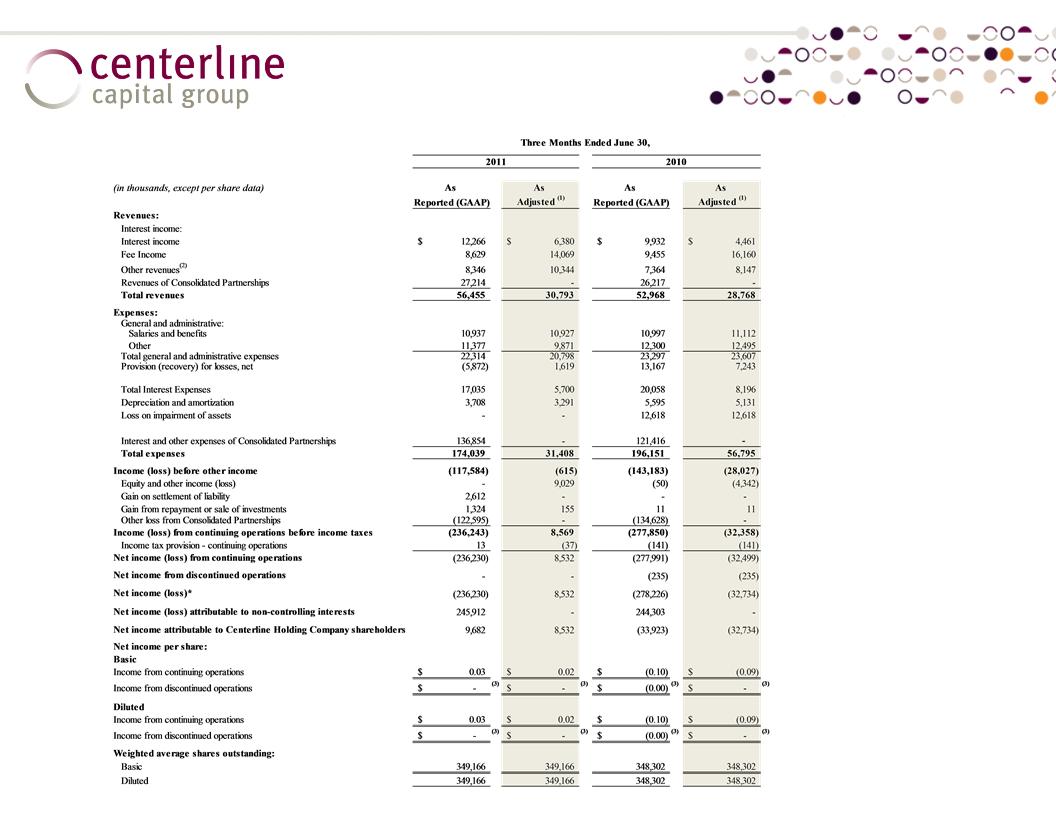

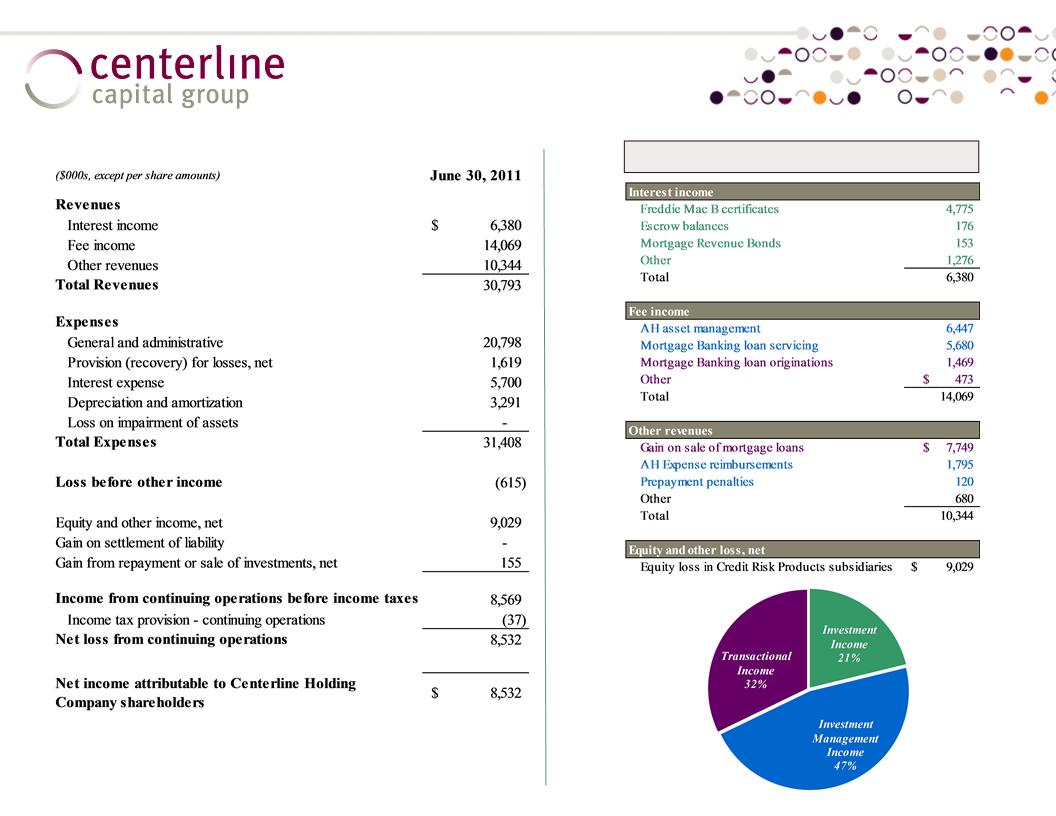

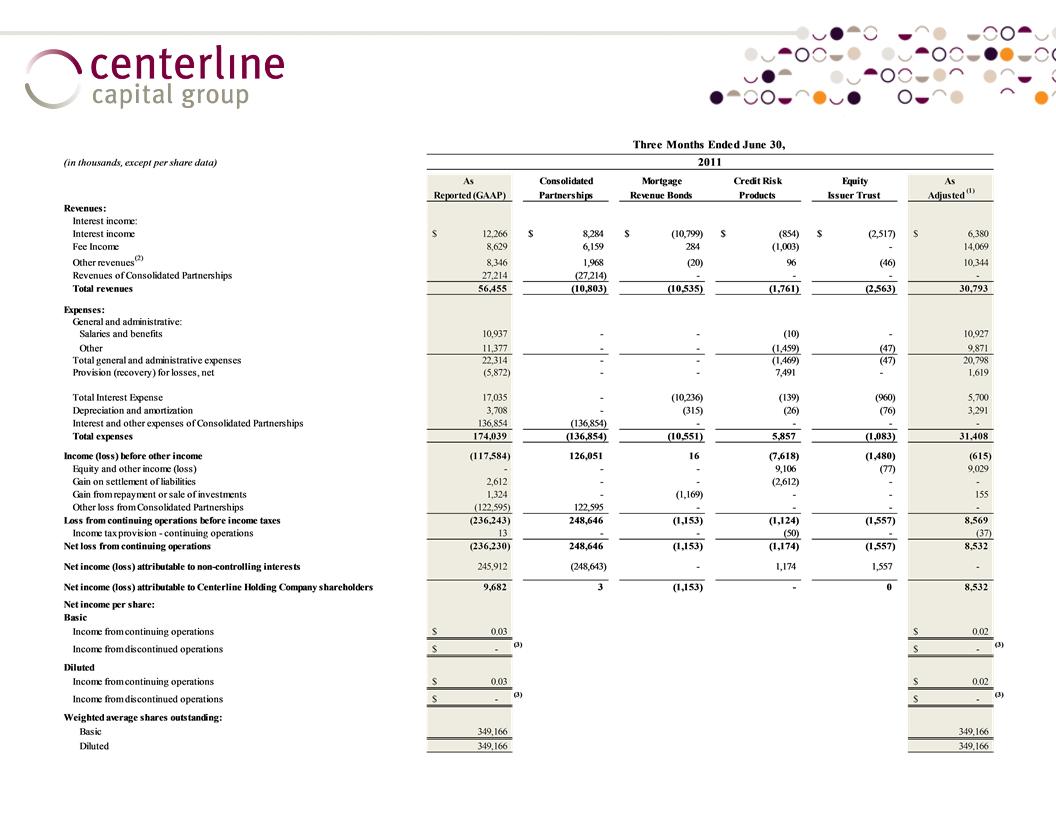

Consolidated Statement of Operations (2Q11)

(1) Adjusted to exclude Consolidated

Partnerships, mortgage revenue

bonds re-securitized in December

2007, Credit Risk Products and

Equity Issuer Trust.

Partnerships, mortgage revenue

bonds re-securitized in December

2007, Credit Risk Products and

Equity Issuer Trust.

(2) Includes prepayment penalties,

expense reimbursements, gains on

sales of mortgage loans and other

revenues.

expense reimbursements, gains on

sales of mortgage loans and other

revenues.

(3) Amounts calculate to less than one

cent per share.

cent per share.

14

15

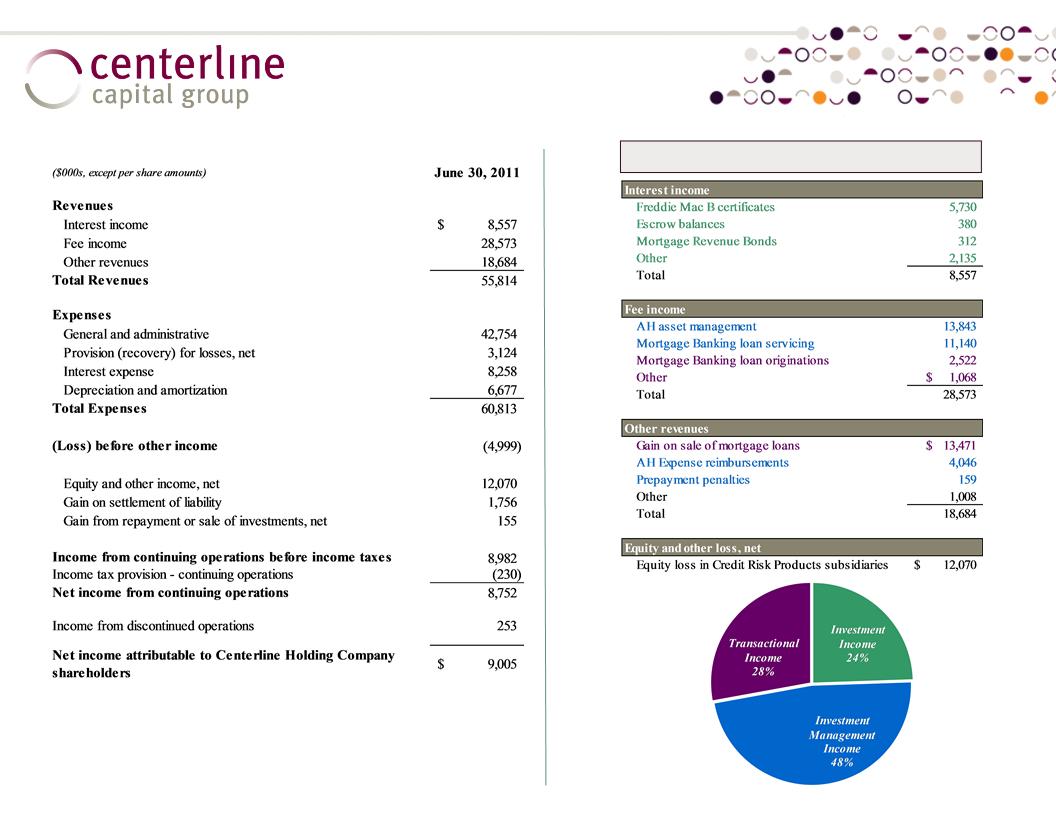

Q2 2011 As Adjusted Income Statement

Revenue & Equity Income Detail

16

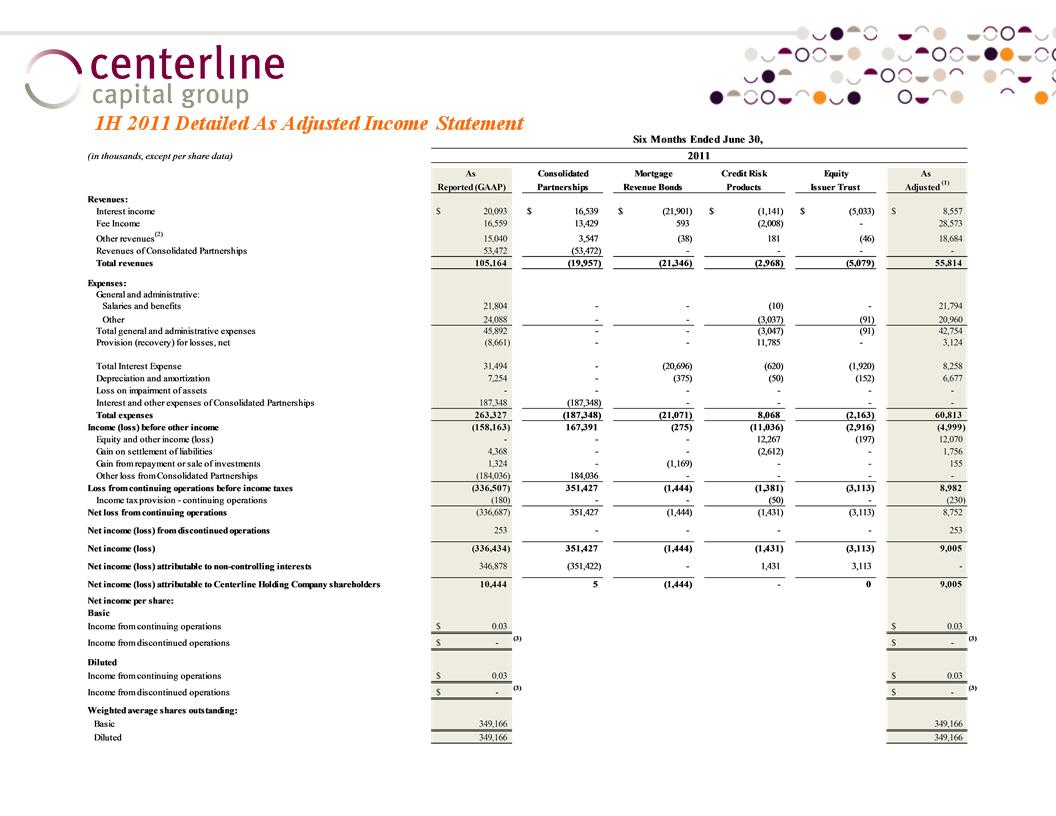

1H 2011 As Adjusted Income Statement

Revenue & Equity Income Detail

17

(1) Adjusted to exclude Consolidated Partnerships, mortgage revenue bonds re-securitized in December 2007, Credit Risk Products and Equity Issuer Trust.

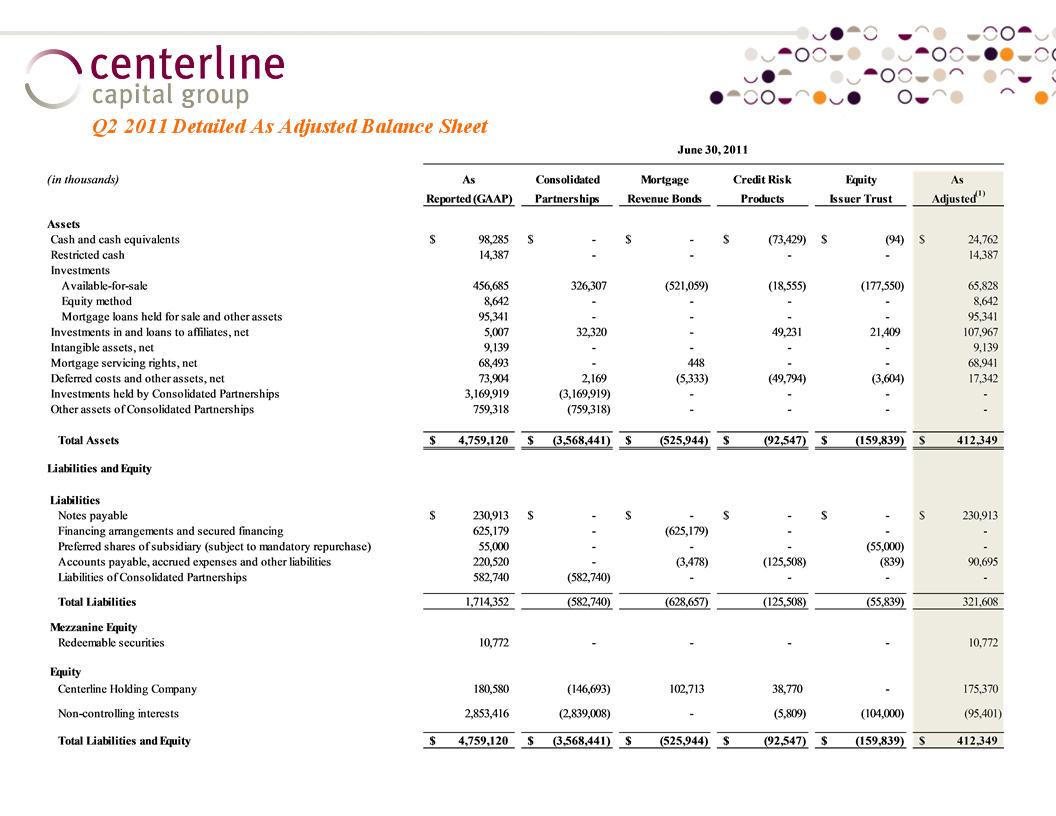

18

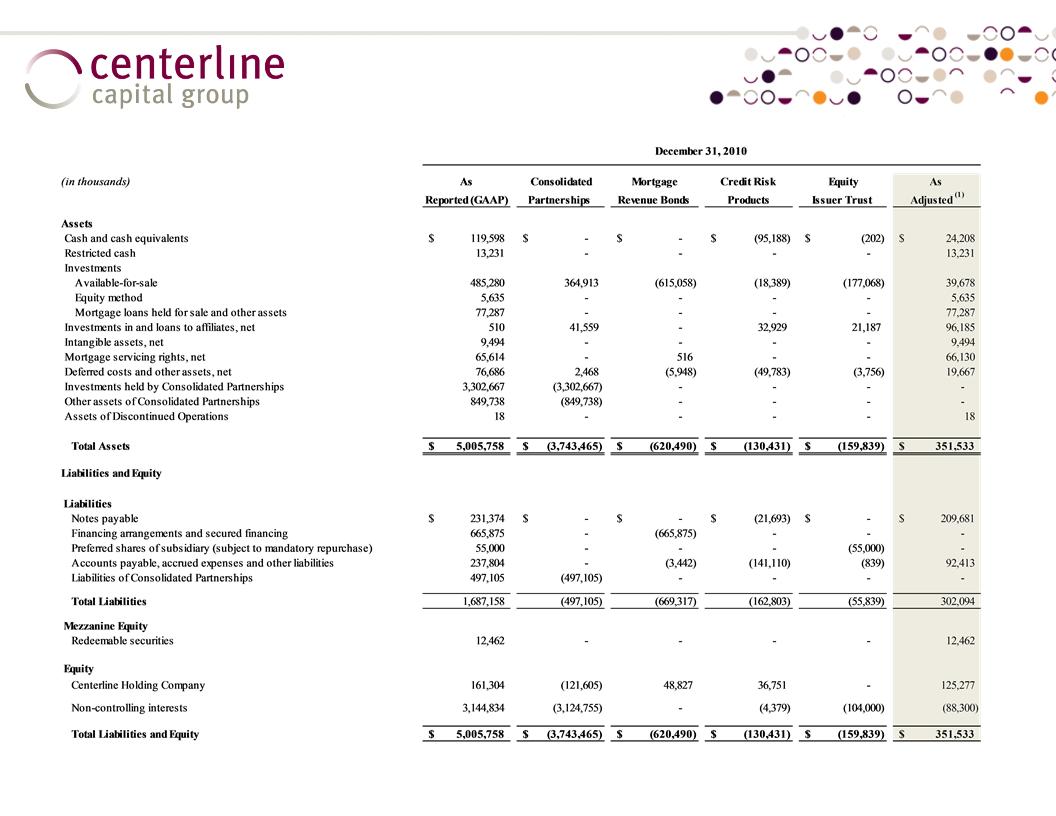

Q4 2010 Detailed As Adjusted Balance Sheet

(1) Adjusted to exclude Consolidated Partnerships, mortgage revenue bonds re-securitized in December 2007, Credit Risk Products and Equity Issuer Trust.

19

Q2 2011 Detailed As Adjusted Income Statement

(1) Refer to page 20 for further details.

(2) Includes prepayment penalties, expense reimbursements, gains on sales of mortgage loans and other revenues.

(3) 2011 Amounts calculates to less than one cent per share.

20

(1) Refer to pages 23 and 24 for further details.

(2) Includes prepayment penalties, expense reimbursements, gains on sales of mortgage loans and other revenues.

(3) The numerator of the calculation of basic and diluted net income per share includes the dividends in arrears for 2009 and for 2010 a reversal of all preferred dividends in arrears upon conversion of

the preferred CRA shares into Special Series A Shares, and the effect of redeemable share conversions.

the preferred CRA shares into Special Series A Shares, and the effect of redeemable share conversions.

21

P&L Adjustments - Details

Consolidated Partnerships

Centerline’s operating results include the results of Tax Credit Fund Partnerships that are required to be consolidated pursuant to various accounting pronouncements, as well as other

Tax Credit Fund Partnerships and Property Partnerships that Centerline controls but in which it has little or no equity interest. As Centerline has virtually no economic interest in these

partnerships, the net losses they generated were allocated almost entirely to the Partnerships' investors. The consolidation, therefore, has an insignificant impact on net income (loss),

although certain Centerline operating results are eliminated in consolidation, and operating results of the consolidated partnerships are reflected in the income statement.

Tax Credit Fund Partnerships and Property Partnerships that Centerline controls but in which it has little or no equity interest. As Centerline has virtually no economic interest in these

partnerships, the net losses they generated were allocated almost entirely to the Partnerships' investors. The consolidation, therefore, has an insignificant impact on net income (loss),

although certain Centerline operating results are eliminated in consolidation, and operating results of the consolidated partnerships are reflected in the income statement.

Given the above, the Company is presenting its operating results adjusted to exclude the impact of such partnerships’ consolidation.

Mortgage Revenue Bonds

For GAAP reporting purposes, consummation of the December 2007 Re-Securitization with Freddie Mac constituted a sale of the mortgage revenue bond investments, with the

exception of certain bonds for which our continuing involvement precluded sale treatment. The Company is presenting its operating results adjusted to reflect all mortgage revenue

bonds included in the December 2007 Re-Securitization as sold.

exception of certain bonds for which our continuing involvement precluded sale treatment. The Company is presenting its operating results adjusted to reflect all mortgage revenue

bonds included in the December 2007 Re-Securitization as sold.

ØThe balance sheet adjustments primarily relate to cash and deposits receivable which collateralize credit intermediation agreements, outstanding under a senior credit facility

with no recourse to Centerline, loss reserves for credit intermediation agreements, deferred income, and fees payable for the restructuring of certain credit intermediation

agreements.

with no recourse to Centerline, loss reserves for credit intermediation agreements, deferred income, and fees payable for the restructuring of certain credit intermediation

agreements.

ØThe income statement adjustments primarily relate to fee income on credit intermediation agreements, provision for losses on credit intermediation agreements, fee expense

relating to certain restructured credit intermediation agreements and equity income on the investment in Credit Risk Product subsidiaries.

relating to certain restructured credit intermediation agreements and equity income on the investment in Credit Risk Product subsidiaries.

Centerline Equity Issuer Trust (“EIT”)

Centerline’s operating results include the income related to Series A-1 Freddie Mac Certificates, and expenses related to preferred shares issued by EIT, a special purpose entity. Such

preferred shares are secured by EIT’s assets, are non-recourse to Centerline and shares are fully defeased in principle and maturity by the Freddie Mac A-1 certificates. Accordingly, the

Company is presenting its operating results adjusted to exclude the impact of EIT’s consolidation.

preferred shares are secured by EIT’s assets, are non-recourse to Centerline and shares are fully defeased in principle and maturity by the Freddie Mac A-1 certificates. Accordingly, the

Company is presenting its operating results adjusted to exclude the impact of EIT’s consolidation.

Credit Risk Products

In connection with the March 2010 Restructuring, a series of transactions were entered into whereby the Company’s and its Centerline Capital Group Inc. subsidiary’s obligations

under back to back credit default swaps issued to two counterparties where assigned and assumed by certain isolated special purpose entities, relieving the Company’s assets from

exposure to potential contingent liabilities. While the credit default counterparties have significant consent rights with respect to key activities of the isolated special purpose entities,

the Company consolidates the isolated special purpose entities for GAAP purposes. The Company has adjusted its operating results to reflect such isolated special purpose entities as if

they were equity method investments.

under back to back credit default swaps issued to two counterparties where assigned and assumed by certain isolated special purpose entities, relieving the Company’s assets from

exposure to potential contingent liabilities. While the credit default counterparties have significant consent rights with respect to key activities of the isolated special purpose entities,

the Company consolidates the isolated special purpose entities for GAAP purposes. The Company has adjusted its operating results to reflect such isolated special purpose entities as if

they were equity method investments.

22

Glossary