Attached files

As filed with the Securities and Exchange Commission on August 15, 2011

Registration No. 333-[_______]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BRS GROUP, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

5050

|

80-06453328

|

||

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

No. 1307, Building 5, Sunshine Apartment, East Shui Shang Liang Li Road,

Nankai District, Tianjin Province,

People’s Republic of China 300381

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

BRS Group, Inc.

c/o Harvard Business Services, Inc.

16192 Coastal Highway

Lewes, Delaware 19958

(302) 645-7400

(Name, Address Including Zip Code and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

|

Evan L. Greebel, Esq.

Howard S. Jacobs, Esq.

Yue Cao, Esq.

Katten Muchin Rosenman LLP

575 Madison Avenue

New York, New York 10022

(212) 940-8800

|

Approximate date of Commencement of Proposed Sale to the Public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer (Do not check if a smaller reporting company) x

|

Smaller reporting company ¨

|

CALCULATION OF REGISTRATION FEE

|

Title of each class of

securities to be registered

|

Amount

to be

registered (1)

|

Proposed

maximum

offering price

per share (2)

|

Proposed

maximum

aggregate

offering price (2)

|

Amount of

registration

Fee

|

||||||||||||

|

Common stock, par value $.001 per share

|

6,848,115 | $ | 11.15 | $ | 76,356,482.25 | $ | 8,864.99 | |||||||||

|

Common stock, par value $.001 per share, underlying warrants held by certain selling stockholders (3)

|

72,000 | $ | 11.15 | $ | 802,800.00 | $ | 93.21 | |||||||||

|

TOTAL

|

6,920,115 | $ | 77,159,282.25 | $ | 8,958.19 | |||||||||||

|

(1)

|

Pursuant to Rule 416 of the Securities Act of 1933, also registered hereby are such additional and indeterminable number of shares as may be issuable due to adjustment for changes resulting from stock dividends, stock splits and similar transactions as well as additional shares that may be issuable pursuant to anti-dilution provisions contained in the warrants.

|

|

(2)

|

The proposed maximum offering price is estimated solely for the purpose of calculating the amount of registration fee pursuant to Rule 457 under the Securities Act of 1933, as amended (the “Securities Act”). Our common stock is not traded on any national exchange. In accordance with Rule 457, the offering price was determined by the price at which 16,140 shares were sold to certain of our selling stockholders in a private placement in reliance on Regulation D under the Securities Act on July 29, 2011.

|

|

(3)

|

Consists of $72,000 shares of common stock being registered for resale that are issuable upon exercise of common stock purchase warrants issued on July 29, 2011.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

|

PROSPECTUS

|

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell, nor does it seek an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 15, 2011

6,920,115 Shares

BRS Group, Inc.

Common Stock

This prospectus relates to the resale of up to a total of 6,920,115 shares of common stock, par value $.001 per share, of BRS Group, Inc., a Delaware corporation, that may be sold from time to time by the selling stockholders named in this prospectus and their successors and assigns. The shares of common stock subject to this prospectus include (i) 6,848,115 issued and outstanding shares of our common stock held by certain selling stockholders and (ii) 72,000 shares of our common stock issuable upon exercise of warrants held by certain selling stockholders.

The selling stockholders may sell all or a portion of their shares through public or private transactions at prevailing market prices or at privately negotiated prices. Information regarding the selling stockholders and the times and manner in which they may offer and sell the shares under this prospectus is provided under “Selling Stockholders” and “Plan of Distribution” in this prospectus. We have agreed to pay all the costs and expenses of this registration.

Prior to this offering, there has been no public market for our common stock and, as of the date of this prospectus, we have not applied for listing or quotation of our common stock on any securities exchange or inter-dealer quotation system.

We will not receive any of the proceeds from the sale of shares by the selling stockholders. However, upon any exercise of the warrants, we would receive cash in the amount of the exercise price of $11.15 per share of common stock, or an aggregate of $802,000 if the warrants are exercised in full, subject to any adjustments.

An investment in our securities is highly speculative, involves a high degree of risk and should be considered only by persons who can afford the loss of their entire investment. See “Risk Factors” beginning on page 6 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2011.

TABLE OF CONTENTS

|

1

|

|

|

6

|

|

|

23

|

|

|

25

|

|

|

26

|

|

|

27

|

|

|

28

|

|

|

29

|

|

|

39

|

|

|

53

|

|

|

55

|

|

|

58

|

|

|

61

|

|

|

65

|

|

|

66

|

|

|

68

|

|

|

69

|

|

|

72

|

|

|

73

|

|

|

73

|

|

|

73

|

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission (the “SEC”). You should rely only upon the information contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell or a solicitation of offers to buy any securities other than the common stock offered by this prospectus. This prospectus does not constitute an offer to sell or solicitation of offers to buy securities in any jurisdiction where, or in any circumstances in which, such offer or solicitation is unlawful.

You should assume the information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of common stock. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create an implication that there has been no change in our affairs since the date of this prospectus or that the information contained by reference to this prospectus is correct as of any time after its date. Our business, financial condition, results of operations and prospects may have changed since date of this prospectus. The rules of the SEC may require us to update this prospectus in the future.

PROSPECTUS SUMMARY

The following summary highlights selected information about our business and our common stock being sold in this offering, but does not contain all of the information that may be important to you. For a more complete understanding of our business and our common stock being sold in this offering, you should read this entire prospectus, including the section entitled “Risk Factors” and the Consolidated Financial Statements and related notes.

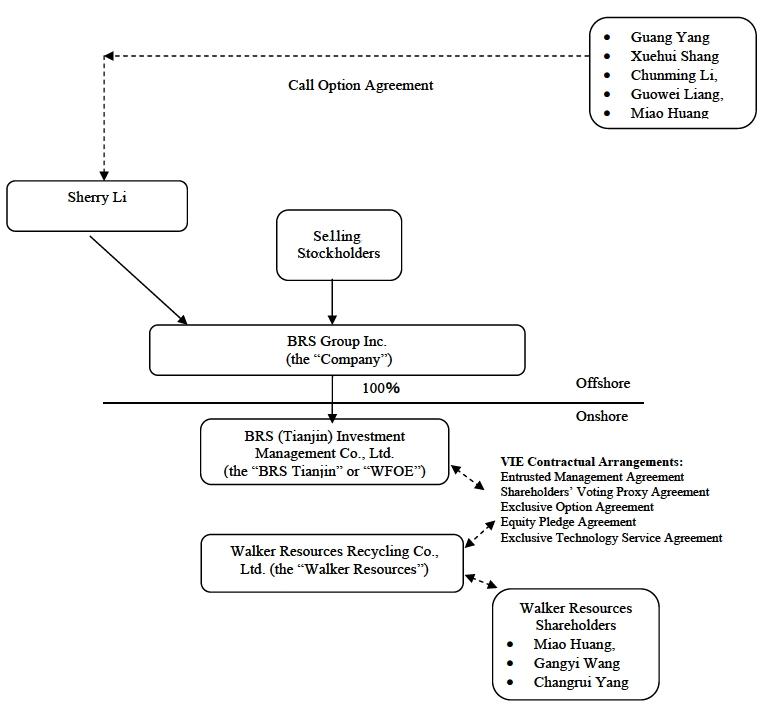

In this prospectus, unless the context requires otherwise, the terms “we”, “our”, “us” and the “Company” refer to BRS Group, Inc., a Delaware corporation, as well as our direct and indirect subsidiaries, and our principal operating business, Walker Resources Recycling Co., Ltd. (“Walker Resources”), a company organized under the laws of the People’s Republic of China (“China” or the “PRC”), which we control via a series of variable interest entity contractual agreements (the “VIE Agreements”) more fully described below.

We conduct our business through our subsidiaries, principally our wholly-owned subsidiary BRS (Tianjin) Investment Management Co., Ltd. (“BRS Tianjin” or the “WFOE”), a wholly foreign owned enterprise incorporated as a limited liability company under the laws of the People’s Republic of China (“PRC” or “China”). The Company operates and controls Walker Resources through BRS Tianjin and in connection with the VIE Agreements.

In this prospectus, “RMB” and “Renminbi” refer to the legal currency of China and “$”, “US dollar” and “US$” refer to the legal currency of the United States. For convenience, certain amounts in Chinese Renminbi (“RMB”) have been converted to United States dollars at an exchange rate in effect at the date of the related financial statements. Assets and liabilities are translated at the exchange rate as of balance sheet date. Income and expenditures are translated at the average exchange rate of the period.

Overview of our Business

Through our operating business, Walker Resources, we believe we are one of a limited number of authorized Chinese importers of electrolytic and scrap copper into China. In 2010, we imported approximately 39,200 metric tons, or Tonnes, of electrolytic and scrap copper from worldwide copper suppliers. The copper we import into China is distributed to copper processing and fabrication companies as well as manufacturers who serve customers in a variety of Chinese industries, including the commercial construction, infrastructure, and manufacturing industries. We believe there is a substantial disparity between the large and growing demand for copper products in China and the available supply. Having obtained a combination of seven licenses, permits and approvals necessary to import electrolytic copper in addition to scrap copper, we believe that we are well positioned to use such disparity to maximize our profits and margins on the goods that we import.

Background and Corporate Structure

We were incorporated on September 15, 2010 under the laws of the State of Delaware. We own 100% of the issued and outstanding capital stock of BRS Tianjin, a wholly foreign owned entity recently incorporated in China. In December 2010, BRS Tianjin entered into a series of variable interest entity contractual agreements, or VIE Agreements, with Walker Resources and Walker Resources’ three shareholders, Miao Huang, Gangyi Wang and Changrui Yang, whom we refer to as the “Walker Resources Shareholders”. Pursuant to the VIE Agreements, BRS Tianjin does not directly own the equity of Walker Resources, our operating business, but rather effectively assumed management and control of the business activities of Walker Resources and has the right to appoint all of the directors, executive officers and senior management personnel of Walker Resources.

VIE Agreements

The VIE Agreements are comprised of a series of agreements, including an Entrusted Management Agreement, Shareholders’ Voting Proxy Agreement, Exclusive Technology Service Agreement and Share Equity Pledge Agreement through which BRS Tianjin has the right and responsibility to advise, consult with, manage, operate and control and provide exclusive technology services to Walker Resources. The Entrusted Management Agreement provides, among other things, that BRS Tianjin is entitled to all profits (and will bear all losses) arising from Walker Resources operations. Additionally, the Walker Resources Shareholders pledged their rights, titles and equity interest in Walker Resources to BRS Tianjin in order to secure the performance of the Walker Resources Shareholders’ obligations under the VIE Agreements, through an Equity Pledge Agreement. In order to further reinforce BRS Tianjin’s rights to control and operate Walker Resources, the Walker Resources Shareholders granted BRS Tianjin an exclusive right and option to acquire all of their equity interests in Walker Resources through an Exclusive Option Agreement. Accordingly, we have consolidated Walker Resources’ historical financial results in our financial statements as a variable interest entity pursuant to U.S. GAAP following the date of the agreements and combined such results prior to the date of the agreements.

“Slow Walk” Arrangement and Call Option Agreement

On July 21, 2011, Mr. Guang Yang, Ms. Xuehui Shang, Mr. Chunming Li, Mr. Guowei Liang, and Ms. Miao Huang, each of whom is a member of Walker Resources’ senior management and whom we refer to collectively as the “Option Holders”, entered into an Amended and Restated Call Option Agreement, or the “Call Option Agreement”, with Sherry Li, the “Grantor”, then the sole officer and director of the Company and the holder of record of a majority of our outstanding common stock.

Pursuant to the Call Option Agreement the Grantor agreed to transfer an aggregate of 15,120,000 shares of our common stock, which we refer to as the “Option Shares”, to the Option Holders as further described below. The options granted pursuant to the Call Option Agreements will be exercisable for $.0001 per share and may be exercised, (i) with respect to 40% of the Option Shares, at any time on or after December 31, 2012; (ii) with respect to 30% of the Option Shares on or after December 31, 2013; and (iii) with respect to 30% of the Option Shares, on or after December 31, 2014. If such options are exercised in full, the Option Holders will own approximately 68.8% of our common stock, based on the number of shares of our common stock currently outstanding and assuming we do not issue any common stock between the date of this prospectus and the date the options are exercised in full. The Call Option Agreement provides that the Grantor will not dispose any of the Option Shares without the Option Holders’ prior written consent. The Option Holders have indicated they intend to exercise their rights under the Call Option Agreements when they are permitted to do so. For additional information regarding the Call Option Agreements and the beneficial owners of the Option Shares, see “Description of Business—Recent Event—Slow Walk Arrangement and Call Option Agreement” and “Security Ownership of Certain Beneficial Owners and Management”.

Private Placements

On May 11 2011, we sold an aggregate of 5,391,064 shares of our common stock to four foreign purchasers for an aggregate purchase price of $60,000,000, or $11.13 per share, in a private placement, or the “May 2011 Private Placement”, pursuant to Regulation S under the Securities Act of 1933, as amended, or the “Securities Act”. The purchasers in the Private Placement were Best Investment Management Co., Ltd., Rebecca Investment Management Co., Ltd., Lotus Investment Management Co., Ltd and Worker Investment Management Co., Ltd (collectively the “May 2011 Purchasers”), each of which is identified as a selling stockholder in this prospectus. Each of the May 2011 Purchasers is organized under the laws of the PRC.

The shares sold in the May 2011 Private Placement were sold pursuant to a Common Stock Purchase Agreement, or the “May 2011 Purchase Agreement”, among the Company and each of the four May 2011 Purchasers. Pursuant to the May 2011 Purchase Agreement, we granted the May 2011 Purchasers the right to include the shares acquired in the May 2011 Private Placement in any registration statement that we file to register any of our securities after the closing date of the May 2011 Private Placement. Pursuant to the May 2011 Purchase Agreement, we also granted the May 2011 Purchasers a right of first refusal to participate in any subsequent funding by the Company on a pro rata basis at 100% of the offering price. For a period of 60 months from the closing of the May 2011 Private Placement, we are prohibited from effecting, or agreeing to effect, a subsequent financing involving (i) the issuance of any securities that are convertible, exchangeable or exercisable for common stock at a conversion or exchange rate or an exercise price based on trading prices following the date of such issuance or subject to being reset following the initial issuance based on events related to the our business or the market for our common stock or (ii) a transaction that allows us to issue securities to subsequent investors providing the right to receive additional shares of common stock with terms more favorable than those provided to the May 2011 Purchasers in the May 2011 Private Placement.

On July 29, 2011, we sold an aggregate of 16,140 shares of our common stock and common stock purchase warrants, or the “Warrants”, entitling the holders to purchase up to an aggregate of 72,000 shares of our common stock to four accredited investors for an aggregate purchase price of $179,961, or $11.15 per share in a private placement, or the “July 2011 Private Placement”, pursuant to Regulation D under the Securities Act. The purchasers in the July 2011 Private Placement were T Squared Investments LLC, T Squared China Fund LLC, Silver Rock II Ltd. and Valuegrowth Consulting LLC (collectively the “July 2011 Purchasers”), each of which is identified as a selling stockholder in this prospectus. We refer to the July 2011 Purchasers and the May 2011 Purchasers collectively as the “Private Placement Investors”.

The shares and Warrants sold in the July 2011 Private Placement were sold pursuant to a Common Stock Purchase Agreement, or the “July 2011 Purchase Agreement”, among the Company and each of the four July 2011 Purchasers. Pursuant to the July 2011 Purchase Agreement, we granted the July 2011 Purchasers the right to include the shares acquired, and the shares underlying the Warrants acquired, in the July 2011 Private Placement in any registration statement that we file to register any of our securities after the closing date of the July 2011 Private Placement. Pursuant to the July 2011 Purchase Agreement, we also agreed, among other things, not to issue preferred stock or convertible debt for a period of three years from the completion of the July 2011 Private Placement, to list our common stock on a U.S. securities exchange within twelve months following the closing of the July 2011 Private Placement, to appoint a majority of independent directors to our board and to establish audit and compensation committees consisting of independent directors. We also agreed, for a period of two years following the July 2011 Private Placement, not to borrow amounts in excess of three times our earnings before interest, taxes, depreciation and amortization from recurring operations. For additional information regarding the July 2011 Private Placement and the terms of the July 2011 Purchase Agreement, see “Description of Business—Recent Events—Private Placements”.

The Warrants are exercisable for $11.15 per share until the second anniversary of our initial public offering. In the event that the shares underlying the Warrants, or the “Warrant Shares”, are not registered within one year following the closing of the July 2011 Private Placement, the Warrants may be exercised on a cashless basis. The Warrants may not be exercised on a cashless basis so long as a registration statement with respect to the Warrant Shares is effective. The exercise price of the Warrants is subject to adjustment to reflect any stock splits, stock dividends, share combinations, reclassifications or recapitalizations affecting the number of outstanding shares of our common stock or securities. In addition, in the event of a merger, consolidation or similar reorganization in which we will not be the surviving entity, holders of the Warrants will be entitled to receive, in lieu of the Warrant Shares, the stock, securities or other property (including cash) to which such holders would have been entitled if the Warrants had been exercised immediately prior to the reorganization transaction.

The following illustration depicts our corporate structure following the events described above:

The Offering

|

Common stock outstanding immediately before this offering:

|

21,968,115 shares

|

|

Common stock offered by the selling stockholders:

|

6,920,115 shares, including 72,000 shares underlying the Warrants

|

|

Common stock outstanding immediately after this offering:

|

22,040,115 shares, assuming the exercise in full of the Warrants

|

|

Trading Market:

|

No active market for our common stock presently exists. We have not applied for listing or quotation of our common stock on any securities exchange or inter-dealer quotation system.

|

|

Use of proceeds:

|

We will not receive any proceeds from the sale of the common stock offered hereby. However, upon any exercise of the warrants, we would receive cash in the amount of the exercise price of $11.15 per share of common stock, or an aggregate of $802,000, if the warrants are exercised for cash in full, subject to any adjustments. No assurances can be given that the Warrants will be exercised in full or at all.

|

|

Risk Factors:

|

Investing in our securities involves a high degree of risk. As an investor you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the section of this prospectus entitled “Risk Factors.”

|

RISK FACTORS

You should carefully consider the risks described below, as well as other information and data included in this prospectus, before deciding whether to invest in our common stock. Any of the following risks could materially adversely affect our business, financial condition or results of operations, which may result in your loss of all or part of your original investment.

Risks Related to Our Business and Industry

We are highly dependent on our status as one of a limited number of authorized importers of electrolytic and scrap copper.

Under Chinese law, the importation of electrolytic and scrap copper requires a combination of several licenses, permits and other authorizations issued by various regulatory authorities at the national and local level. We are currently one of only a few companies that have all of the licenses required to import electrolytic copper into China. If the Chinese government were to authorize other companies to import electrolytic and scrap copper, or significantly reduce the burdens associated with obtaining such authorization, we would face increased competition. The importation of copper into China has historically been subject to strict regulation by the Chinese Government, which has limited foreign competitors’ access to the Chinese copper market as well as the end markets that we serve. Since China’s entry into the World Trade Organization, the Chinese government has lifted many of its barriers to foreign competition. To the extent that the Chinese government continues to ease restrictions on foreign participation in Chinese copper markets and the end markets that we serve, we anticipate that the environment in our markets will become increasingly competitive. If China’s domestic economy continues to expand, more competitors, many of which may have greater resources than us, may seek to enter the Chinese market. Increases in future levels of imported copper could negatively impact future market prices and the demand levels for our services.

If our existing licenses, permits or other approvals are revoked, or if the applicable regulatory authorities fail to renew our existing licenses, permits and approvals, our business would be materially and adversely affected.

Our regulatory approvals authorizing our operations and activities are subject to periodic review, reassessment and renewal by Chinese authorities. Standards of compliance necessary to pass such reviews change from time to time and differ from jurisdiction to jurisdiction, leading to a degree of uncertainty. If our licenses and permits are revoked, substantially modified or not renewed or if additional permits, business licenses or approvals that may become necessary in connection with our business are not granted or are delayed, we may suffer adverse consequences.

Our business is dependent on five customers.

During the year ended September 30, 2010, we derived approximately 30.64%, 25.89% and 23.04% of our consolidated sales revenue from our top three customers, and all of our consolidated sales revenue from five customers. If any one of our customers were to significantly reduce its purchases from us, or if we were unable to sell to them on terms as favorable to us as the terms under our current agreements, our financial condition and results of operations would likely suffer materially.

We do not have long-term sales contracts with our customers and our customers could at any time reduce purchases of, or entirely cease purchasing, copper from us, harming our operating results and business.

We do not have long-term volume sales contracts with our customers, and our customers are not obligated to purchase copper from us. Our customers purchase copper from us on a spot or short term contract basis. Accordingly, our customers could at any time reduce their purchases from us, demand that we sell copper at prices that are not favorable to us or cease purchasing copper from us altogether. Any negative development affecting our customers would likely harm our results of operations. For example, if any of our customers experience serious financial difficulties, it may lead to a decline in sales and write-offs of accounts receivable. A loss of order volumes from any customer, a significant reduction in their purchase orders or a decrease in the sales price could result in lower sales revenues and gross margins, increasing costs and lowering profitability.

Prices for copper are volatile and such volatility can adversely affect our business.

The price of copper can be volatile, and fluctuates based on numerous factors, many of which are beyond our control, including general economic conditions (both domestic and international), competition, production levels, customer demand levels, import duties and other trade restrictions, currency fluctuations and surcharges imposed by our suppliers. The timing and magnitude of changes in copper prices is difficult to predict and can significantly impact the volume of copper available to us, the volume and price of copper that we import and sell and our inventory levels, and could therefore adversely affect our operating results.

Our ability to respond to changing copper costs through adjustments to our sales prices is limited by competitive and other market factors. Since our customers typically do not enter into long-term purchase arrangements with us, sharp increases in the price of copper can reduce demand if customers decide to defer or limit their copper purchases. If we are unable to pass increased copper prices on to our customers for any reason, our earnings may be adversely affected. A decline in copper prices can also adversely impact our operating results. When copper prices decline, customer demand for lower prices could result in lower sale prices for our copper and, to the extent that our inventory at the time was purchased at higher costs, lower margins. Any decline in our selling prices could require us to revalue our inventory to reflect the then net realizable value, which could be below cost.

Any downturn in general economic conditions or in our customers’ specific industries could negatively impact our earnings.

We provide copper to industries that are cyclical, such as the home appliance and construction industries, that use the copper to make wires, cables and other components of their products. The demand for copper is directly related to, and significantly impacted by, demand for the goods manufactured by our customers, which may fluctuate as a result of changes in the Chinese or worldwide economy, currency exchange rates, energy prices or other factors beyond our control. If we are not able to diversify our customer base and/or increase sales of copper to customers in other industries when one or more of the cyclical industries that we serve is experiencing a decline, our revenues, gross profit and net income may be adversely affected.

If we were to lose any of our primary suppliers or otherwise be unable to obtain sufficient amounts of necessary copper on a timely basis, we may not be able to meet our customers’ needs and may suffer reduced sales.

Our business relies on our ability to obtain an adequate supply of high quality copper from a limited number of suppliers. If our suppliers experience production problems, lack of capacity or transportation disruptions, the lead times for receiving our supply of copper could be extended and the cost of our inventory may increase. If we are unable to obtain sufficient amounts of the necessary copper at competitive prices and on a timely basis from our regular suppliers, we may not be able to obtain copper from acceptable alternative sources at competitive prices to meet our delivery schedules to our customers. Even if we do find acceptable alternative suppliers, alternative sources of supply may not maintain the quality standards that are in place with our current suppliers, which could impact our ability to provide the same quality of copper to our customers that we have provided in the past, which in turn could cause our customers to move their business to our competitors. In addition, the process of locating and securing these alternatives may be disruptive to our business.

Our dependence on foreign suppliers may expose us to risks related to international trade and geopolitical events.

All of our suppliers are located outside of China. If, as a result of differences in economic conditions between foreign markets and Chinese markets, trade disputes, geopolitical events or other factors our existing sources of supply are discontinued or significantly curtailed, we may need to find sources of supply in countries with which we have not dealt previously. Dependence on sources of supply from other countries could lead to longer lead times, increased price volatility, less favorable payment terms, increased exposure to foreign currency movements and certain tariffs and duties and require greater levels of working capital.

Increased competition from Chinese copper producers may adversely affect our earnings.

The copper industry in China is dominated by five large companies, all of which have integrated operations (i.e. mining, smelting, and refining) and four additional companies that are engaged in smelting. These competitors include: Jiangxi Copper Group, Yantai Penghui Copper, Anhui Tongdu Copper (Tongling Nonferrous), Daye Nonferrous, Jinchuan Group, Yunnan Copper, Chifeng Jinjian Copper, Zhongtiaoshan Nonferrous and Baiyin Nonferrous. All of these companies are better capitalized, more experienced, and have more established relationships in the Chinese marketplace than we do.

Many factors influence our competitive position, including price, inventory availability, timely delivery, customer service, quality and cost reductions through improved efficiencies. To compete for customer sales, we may lower prices or offer increased services at a higher cost, which could reduce our earnings. An increase in competition or our inability to remain competitive could cause us to lose market share, increase expenditures, and reduce pricing, which could have an adverse effect on our results of operations and financial condition.

We are exposed to risk in our hedging arrangements.

From time to time we enter into arrangements with financial institutions to hedge our exposure to fluctuations in copper prices, mainly including futures contracts. The success of our hedging program depends on accurate forecast of copper transaction activity. We could experience adverse effects through our hedging arrangements if our forecasts are inaccurate or by limiting our ability to participate in gains from any favorable copper price fluctuations. In addition, a number of financial institutions similar to those that serve as counterparties to our hedging arrangements have recently been adversely affected by the global credit crisis. The failure of one or more counterparties to our hedging arrangements to fulfill or renew their obligations to us could adversely affect our results of operations.

Events limiting the use or productivity of our warehouse may have an adverse effect on our results of operations and financial condition.

Approximately 10% of the copper we import and distribute to our customers is stored in our warehouse facility located in Shanghai. Because our inventory capabilities are concentrated at one location, local or regional events, such as natural disasters or labor, transportation and other infrastructure disruptions, may increase costs, reduce availability of our copper inventory and limit our ability to complete customer sales orders or meet our sales goals.

We may need additional financing to provide working capital for our import business, which we may not be able to obtain on acceptable terms.

We may need to raise additional capital to carry out our plans to increase the volume of copper that we purchase and sell or increase the size of our warehouse facility. Our ability to raise capital as needed will be dependent on many factors, including credit and debt market conditions. We may not be able to raise the working capital as needed in the future on terms acceptable to us, if at all. If we do not raise capital as needed, our ability to expand our business will be limited.

Additional capital raising efforts in future periods may be dilutive to our then current stockholders or result in increased interest expense in future periods.

If we raise additional capital through the issuance of equity or convertible debt securities, the percentage ownership of our company held by existing stockholders will be reduced and those stockholders may experience significant dilution. As we will generally not be required to obtain the consent of our stockholders if we elect to purchase more copper, increase our inventory of copper, expand our warehouse facilities or otherwise grow our business, stockholders are dependent upon the judgment of our management in determining the manner of financing, including the amount of debt or the number and characteristics of stock issued to raise funds for these purposes and others.

We may not be able to sustain Walker Resources’ historic growth rates, and even if we maintain them, we are susceptible to many challenges relating to our growth.

Our limited operating history in the Chinese copper industry may not provide a sufficient basis on which to evaluate our business or future prospects. Using the funds raised from our recent private placement and the sale of our imported copper to our customers, we plan to grow sales revenues for the year ending September 30, 2011 but we may not be able to grow our consolidated sales revenues as expected and any future growth in our sales revenues may not be as high as the revenue growth Walker Resources experienced during the 2009 and 2010 fiscal years. Also, we expect that our operating expenses will increase as we expand. A significant failure to realize anticipated sales growth could result in us experiencing significant operating losses. If we are unable to manage our growth effectively, we may not be able to take advantage of market opportunities, develop new distribution channels, enhance our operational capabilities, satisfy customer requirements, execute our business plan or respond to competitive pressures. Among other things, our ability to manage our growth depends on our ability to:

|

|

·

|

Hire, train, integrate and manage additional qualified sales and other personnel;

|

|

|

·

|

Implement additional, and improve existing, administrative, financial and operations systems, procedures and controls;

|

|

|

·

|

Continue to expand and upgrade our copper importation and distribution processes;

|

|

|

·

|

Maintain, and develop new, customer relationships;

|

|

|

·

|

Protect Walker Resources’ reputation and enhance customer loyalty;

|

|

|

·

|

Manage our financial condition; and

|

|

|

·

|

Manage multiple relationships with suppliers and certain other third parties.

|

Our success also depends largely on our ability to anticipate and respond to expected changes in future demand for copper. If the timing of our expansion does not match market demand, our business strategy may need to be revised. If we over-expand and demand for copper does not increase as we may have projected, our financial results will be adversely affected. However, if we do not expand, and demand for copper increases sharply, our business could be seriously harmed because we may not be as cost-effective as our competitors due to our inability to take advantage of increased economies of scale. In addition, we may not be able to satisfy the needs of current customers or attract new customers, and we may lose credibility and our relationships with our customers may be negatively affected. Moreover, if we do not properly allocate our resources in line with future demand for copper, we may miss changing market opportunities and our business and financial results could be adversely affected. We cannot assure you that we will be able to successfully manage our growth in the future.

The loss of key personnel or the failure to attract or retain management and other personnel could impair our ability to grow our business.

We rely heavily on the services of our key employees, including Ms. Miao Huang and Mr. Guang Yang. We believe our success will depend upon our ability to retain these managers and key personnel. The loss of the services of any of key employees could have an adverse effect on our business, operations, revenues or prospects. We do not maintain key man life insurance on the lives of these individuals.

Also, we may not be successful in attracting and retaining sufficient numbers of qualified personnel to support our growth. Despite the incentives we provide, our current employees may not continue to work for us, and if additional personnel are required for our operations, we may not be able to obtain the services of additional personnel necessary for our growth. The inability to attract or retain qualified personnel could delay the development and introduction of, and have an adverse effect on our ability to sell, and control the quality of, our services, as well as our overall growth.

Because we are expanding capacity, we may be forced to make sales to customers whose creditworthiness is not known to us. We may not be able to collect receivables which are incurred by these customers .

Although we primarily sell on a cash payment basis, as we expand, our ability to receive payment for our copper and services may depend on the continued creditworthiness of our customers. In order to pay our expansion costs, we may be required to make sales to customers who are less creditworthy than our existing customers. Also, our customer base may change if our sales increase because of our added capacity, and if we are not able to collect our receivables, our revenues and profitability may be negatively affected.

We do not have insurance coverage. Any loss to our properties or assets could have an adverse effect on our financial condition and operations.

We and our subsidiaries are not covered by any insurance. As a result, any loss or damage to our properties or other assets, or personal injuries arising from our business operations could have an adverse affect on our financial condition and operations.

Risks Related to Doing Business in China

Recent scrutiny, criticism and negative publicity involving U.S. listed Chinese companies may negatively impact the market for our common stock, particularly if we become the subject of such criticism and negative publicity.

Recently, U.S. public companies that have substantially all of their operations in China have been the subject of intense scrutiny, criticism and negative publicity by investors, financial commentators and regulatory agencies, such as the SEC. Much of the scrutiny, criticism and negative publicity has centered around financial and accounting irregularities and mistakes, a lack of effective internal controls over financial accounting, inadequate corporate governance policies or a lack of adherence thereto and, in many cases, allegations of fraud. As a result of the scrutiny, criticism and negative publicity, the publicly traded stock of many U.S. listed Chinese companies has sharply decreased in value and, in some cases, has become virtually worthless. Many of these companies are now subject to shareholder lawsuits, SEC enforcement actions and are conducting internal and external investigations into the allegations. It is not clear what effect this sector-wide scrutiny, criticism and negative publicity will have on our company, our business and our stock price. If we become the subject of any unfavorable allegations, whether such allegations are proven to be true or untrue, we will have to expend significant resources to investigate such allegations and/or defend our company. This situation will be costly and time consuming and distract our management from growing our company. If such allegations are not proven to be groundless, our company and business operations would be severely damaged and your investment in our stock could be rendered worthless.

Economic, political and social conditions in China are subject to significant uncertainty and could affect our business.

All of our operations are located in China and our business is subject to political and economic uncertainties in China. The economy of China differs from the economies of most developed countries in many respects, including the level of government involvement, the level of development, control of foreign exchange, and methods for allocating resources. A substantial portion of productive assets in China are owned by the Chinese government. Changes in Chinese policies, laws and regulations, or in their interpretation or the imposition of confiscatory taxation, restrictions on currency conversion, restrictions or prohibitions on imports, restrictions or prohibitions on dividend payments to shareholders, devaluations of currency or the nationalization or other expropriation of private enterprises may occur from time to time without notice and could have an adverse effect on our business. Nationalization or expropriation could result in the total loss of our investment in China. We have no control over most of these risks and we may be unable to anticipate changes in Chinese economic and political conditions.

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities.

We are dependent on our relationship with the local government in the province in which we operate our business. The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. The Chinese central or local governments may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

If relations between the United States and China worsen, our share price may decrease and we may have difficulty accessing U.S. capital markets.

At various times during recent years, the United States and China have had disagreements over political and economic issues. Any political or trade controversies between the United States and China in the future could adversely affect the market price of our common stock and our ability to access U.S. capital markets.

We derive all of our sales from China and a slowdown or other adverse developments in the Chinese economy may adversely affect our customers, demand for copper and our business.

All of our sales are generated in China and we anticipate that sales of copper in China will continue to represent all of our total sales in the foreseeable future. The significant recent growth of China’s economy in recent years may not continue. We do not know how sensitive we are to a slowdown in economic growth or other adverse changes in the Chinese economy that may affect demand for copper. A slowdown in overall economic growth, an economic downturn or recession or other adverse economic developments in China may reduce the demand for copper and adversely affect our business. In addition, the Chinese government may take action to slow the pace of growth of the Chinese economy. A slowdown in overall economic growth, an economic downturn or recession or other adverse economic developments in China may materially reduce the demand for our products and materially and adversely affect our business.

We may have limited legal recourse under Chinese law if disputes arise under our contracts with third parties.

The Chinese government has enacted some laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. Their experience in implementing, interpreting and enforcing these laws and regulations is limited, and our ability to enforce commercial claims or to resolve commercial disputes is unpredictable. If our business ventures are unsuccessful, or other adverse circumstances arise from these transactions, we will face the risk that the parties to these ventures may seek ways to terminate the transactions, or, may hinder or prevent us from accessing important information regarding the financial and business operations of any company we may acquire. The resolution of these matters may be subject to the exercise of considerable discretion by agencies of the Chinese government, and forces unrelated to the legal merits of a particular matter or dispute may influence their determination. Any rights we may have to specific performance, or to seek an injunction under Chinese law, in either of these cases, are severely limited, and without a means of recourse by virtue of the Chinese legal system, may prevent us from succeeding in these situations. In addition, the inability to enforce or obtain a remedy under any of our future agreements could result in a significant loss of business, business opportunities or capital and could have an adverse impact on our operations.

Because our principal assets are located, and our directors, executive officers and employees reside outside the United States, it may be difficult for you to enforce your rights or claims against our assets, directors, officers and employees based on United States Federal securities laws or to enforce judgments of United States courts against us or them in China.

Our directors, officers and key employees reside in China. In addition, our principal operating business and all of our assets are located in China. China does not have a treaty with United States providing for the reciprocal recognition and enforcement of judgments of courts. It may therefore be difficult for investors in the United States to enforce their legal rights based on the civil liability provisions of the United States Federal securities laws against us in the courts of either the United States or China and, even if civil judgments are obtained in courts of the United States, to enforce such judgments in Chinese courts. Further, it is unclear if extradition treaties now in effect between the United States and China would permit effective enforcement against us or our officers and directors of criminal penalties, under the United States Federal securities laws or otherwise.

We may have difficulty establishing adequate management, legal and financial controls in China, which could impair our planning processes and make it difficult to provide accurate reports of our operating results.

China historically has been deficient in Western style management and financial reporting concepts and practices, as well as in modern banking, and other control systems. We may have difficulty in hiring and retaining a sufficient number of qualified employees familiar with these concepts, practices and systems to work in China. As a result of these factors, and especially given that we expect to be a publicly listed company in the U.S. and subject to regulation as such, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards.

If the Chinese Government adopts a more flexible currency policy, exchange rates between the U.S. Dollar and Chinese Renminbi may not remain stable.

Our reporting currency is the U.S. dollar and our operations in China use local currency. Substantially all of our revenue and expenses are in Chinese Renminbi. We are subject to the effects of exchange rate fluctuations with respect to either of these currencies. For example, the value of the Renminbi depends to a large extent on Chinese government policies and China’s domestic and international economic and political developments, as well as supply and demand in the local market. Since 1994, the official exchange rate for the conversion of Renminbi to the U.S. dollar had generally been stable and the Renminbi had appreciated slightly against the U.S. dollar. However, on July 21, 2005, the Chinese government changed its policy of pegging the value of Chinese Renminbi to the U.S. dollar. Under the new policy, Chinese Renminbi may fluctuate within a narrow and managed band against a basket of certain foreign currencies. It is possible that the Chinese government could adopt a more flexible currency policy, which could result in more significant fluctuation of Chinese Renminbi against the U.S. dollar. The Chinese Renminbi may not be stable against the U.S. dollar or any other foreign currency.

If Chinese Renminbi were to decline in value our revenues may be reduced in U.S. dollar terms.

Our financial statements are translated into U.S. dollars at the average exchange rates in each applicable period. To the extent the U.S. dollar strengthens against foreign currencies, the translation of these foreign currencies denominated transactions results in reduced revenue, operating expenses and net income for our international operations. Similarly, to the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions results in increased revenue, operating expenses and net income for our international operations. We are also exposed to foreign exchange rate fluctuations as we convert the financial statements of our foreign consolidated subsidiaries into U.S. dollars in consolidation. If there is a change in foreign currency exchange rates, the conversion of the foreign consolidated subsidiaries’ financial statements into U.S. dollars will lead to a translation gain or loss which is recorded as a component of other comprehensive income. In addition, we have certain assets and liabilities that are denominated in currencies other than the relevant entity’s functional currency. Changes in the functional currency value of these assets and liabilities create fluctuations that will lead to a transaction gain or loss. We have not entered into agreements or purchased instruments to hedge our exchange rate risks. The availability and effectiveness of any hedging transaction may be limited and we may not be able to hedge our exchange rate risks.

The application of Chinese regulations relating to the overseas listing of Chinese domestic companies is uncertain.

On August 8, 2006, six Chinese government agencies, namely, the Ministry of Commerce, or MOFCOM, the State Administration for Industry and Commerce, or SAIC, the China Securities Regulatory Commission, or CSRC, the State Administration of Foreign Exchange, or SAFE, the State Assets Supervision and Administration Commission, or SASAC, and the State Administration for Taxation, or SAT, jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, which we refer to as the “New M&A Rules”, which became effective on September 8, 2006. The New M&A Rules purport, among other things, to require offshore “special purpose vehicles,” that are (1) formed for the purpose of overseas listing of the equity interests of Chinese companies via acquisition and (2) are controlled directly or indirectly by Chinese companies and/or Chinese individuals, to obtain the approval of the CSRC prior to the listing and trading of their securities on overseas stock exchanges.

There are substantial uncertainties regarding the interpretation, application and enforcement of the New M&A Rules and CSRC has yet to promulgate any written provisions or formally declare or state whether the overseas listing of a China-related company structured similar to ours is subject to the approval of CSRC. Any violation of these rules could result in fines and other penalties on our operations in China, restrictions or limitations on remitting dividends outside of China, and other forms of sanctions that may cause a material and adverse effect to our business, operations and financial conditions.

Recent Chinese regulations relating to the establishment of offshore special purpose companies by Chinese residents may subject our Chinese resident shareholders or our Chinese subsidiaries to penalties, limit our ability to distribute capital to our Chinese subsidiaries, limit our Chinese subsidiaries’ ability to distribute funds to us, or otherwise adversely affect us.

The State Administration of Foreign Exchange, or “SAFE”, issued a public notice in October 2005, or the SAFE Circular No. 75, requiring Chinese residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equities of Chinese companies, referred to in the SAFE Circular No. 75 as special purpose vehicles, or SPVs. Chinese residents who are shareholders of SPVs established before November 1, 2005 were required to register with the local SAFE branch before June 30, 2006. Further, Chinese residents are required to file amendments to their registrations with the local SAFE branch if their SPVs undergo a material event involving changes in capital, such as changes in share capital, mergers and acquisitions, share transfers or exchanges, spin-off transactions or long-term equity or debt investments.

The Walker Resources Shareholders who are Chinese residents are not required to file a registration with SAFE pursuant to SAFE Circular No. 75 because the Walker Resources Shareholders do not currently own any equity in the Company. Pursuant to the vesting schedule set forth in the Call Option Agreement, the Walker Resources Shareholders are permitted to exercise their options for shares of common stock in the Company. When exercising their right to acquire Option Shares, the Walker Resources Shareholders will need to file registrations with SAFE. Any failure by the Walker Resources Shareholders to file their registration with SAFE or the failure of future shareholders of our Chinese subsidiaries who are Chinese residents to comply with the registration procedures set forth in the SAFE Circular No. 75 will restrict and prohibit such individuals from transferring the proceeds from a sale of common stock to China. If such sales proceeds are transferred to China without SAFE registration, any individual in violation thereof could be subject to a fine imposed by the PRC foreign exchange control agency in an amount of approximately 30% of the sales price as well as criminal liabilities. See “Business—Government Regulation—Foreign Exchange Regulation”.

Future inflation in China may inhibit our ability to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and widely fluctuating rates of inflation. These factors have led to the adoption by the Chinese government, from time to time, of various austerity measures designed to restrict the availability of credit or regulate growth and constrain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which may inhibit economic activity in China, and thereby harm the market for copper.

We face uncertainty from the Circular on Strengthening the Administration of Enterprise Income Tax on Non-resident Enterprises' Share Transfer, or Circular 698, released in December 2009 by China's State Administration of Taxation, or the SAT, effective as of January 1, 2010.

Pursuant to the Circular 698 effective as of January 1, 2008, where a foreign investor transfers the equity interests of a Chinese resident enterprise indirectly via disposing of the equity interests of an overseas holding company, which we refer to as an Indirect Transfer, and such overseas holding company is located in a tax jurisdiction that: (i) has an effective tax rate less than 12.5% or (ii) does not tax foreign income of its residents, the foreign investor shall report such Indirect Transfer to the competent tax authority of the Chinese resident enterprise. The Chinese tax authority will examine the true nature of the Indirect Transfer, and if the tax authority considers that the foreign investor has adopted an abusive arrangement in order to avoid Chinese tax, they will disregard the existence of the overseas holding company and re-characterize the Indirect Transfer and as a result, gains derived from such Indirect Transfer may be subject to Chinese withholding tax at the rate of up to 10%. Circular 698 also provides that, where a non-Chinese resident enterprise transfers its equity interests in a Chinese resident enterprise to its related parties at a price lower than the fair market value, the competent tax authority has the power to make a reasonable adjustment to the taxable income of the transaction.

There is uncertainty as to the application of Circular 698. For example, while the term “indirectly transfer” is not defined, it is understood that the relevant PRC tax authorities have jurisdiction regarding requests for information over a wide range of foreign entities having no direct contact with China. Moreover, the relevant authority has not yet promulgated any formal provisions or formally declared or stated how to calculate the effective tax in the country or jurisdiction and to what extent and the process of the disclosure to the tax authority in charge of that Chinese resident enterprise. As a result, we may become at risk of being taxed under Circular 698 and we may be required to expend valuable resources to comply with Circular 698 or to establish that we should not be taxed under Circular 698, which could have a material adverse effect on our financial condition and results of operations.

We may be considered a resident enterprise of the PRC, and if so, the Enterprise Income Tax Law of PRC relating to PRC taxation on resident enterprise may subject us or our Shareholders to penalties.

The Enterprise Income Tax Law, or the “EIT Law”, of the PRC and its implementing rules provide that enterprises established outside China whose “de facto management bodies” are located in China are considered “resident enterprises” and subject to the uniform 25% enterprise income tax rate on global income. Our management is substantially based in the PRC and expects to be based in the PRC in the future. It is unclear and uncertain how the PRC tax authorities would interpret and implement the EIT Law and its implementing rules and it remains uncertain whether the PRC tax authorities would determine that we are a “resident enterprise” or a “non-resident enterprise”. If we are deemed as resident enterprise, we will be subject to a 25% enterprise income tax rate. If we are deemed as resident enterprise, any failure to pay the enterprise income tax may result in a fine imposed by relevant PRC tax authorities in an amount from RMB2,000 to RMB10,000, and any failure to pay the income tax within a limited period of time as requested by the PRC tax authorities may result in a fine in amount from 50% to 500% of the taxes unpaid or underpaid.

Due to various restrictions under Chinese laws on the distribution of dividends by our Chinese operating companies, we may not be able to pay dividends to our stockholders.

The Wholly-Foreign Owned Enterprise Law (1986), as amended, the Wholly-Foreign Owned Enterprise Law Implementing Rules (1990), as amended and the Company Law of China (2006) contain the principal regulations governing dividend distributions by wholly foreign-owned enterprises. Under these regulations, wholly foreign-owned enterprises may pay dividends only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. Additionally, we are required to set aside a certain amount of its accumulated profits each year, if any, to fund certain reserve funds. These reserves are not distributable as cash dividends except in the event of liquidation and cannot be used for working capital purposes. Walker Resources is required to annually transfer 10% of its net income, as determined in accordance with the PRC’s accounting rules and regulations, to a statutory surplus reserve fund until such reserve balance reaches 50% of Walker Resource’s registered capital.

The Chinese government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of China. We may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from the profits of Walker Resources. Furthermore, if our subsidiaries in China incur debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments. If we unable to receive all of the revenues from our operations through these contractual or dividend arrangements, we may be unable to pay dividends on our common stock.

The SAFE restrictions or changes in foreign exchange regulations in China may affect our ability to pay dividends in foreign currency or conduct other foreign exchange business.

We receive substantially all of our revenues in RMB, which is currently not a freely convertible currency. The restrictions on currency exchanges may limit our ability to use revenues generated in RMB to make dividends or other payments in United States dollars. The Chinese government strictly regulates conversion of RMB into foreign currencies. Over the years, foreign exchange regulations in China have significantly reduced the government’s control over routine foreign exchange transactions under current accounts. In China, SAFE regulates the conversion of the RMB into foreign currencies. Pursuant to applicable Chinese laws and regulations, foreign invested enterprises incorporated in China are required to apply for “Foreign Exchange Registration Certificates.” Currently, conversion within the scope of the “current account” (e.g. remittance of foreign currencies for payment of dividends, trade and service-related foreign exchange transactions, etc.) can be effected without requiring the approval of SAFE, instead, need to be registered with the SAFE. However, conversion of currency in the “capital account” (e.g. for capital items such as direct investments, loans, securities, etc.) still requires the approval of SAFE. In addition, failure to obtain approval from SAFE for currency conversion on the capital account may adversely impact our capital expenditure plans and our ability to expand in accordance with our desired objectives.

All of our income is derived from the profits of Walker Resources through the VIE Agreements. SAFE restrictions may delay the payment of dividends, since we have to comply with certain procedural requirements and we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from the profits of Walker Resources, and it thus may delay our payment of dividend to the equity holders.

Foreign exchange transactions by PRC operating subsidiaries under the capital account continue to be subject to significant foreign exchange controls and require the approval of and need to register with PRC government authorities, including SAFE. In particular, if Walker Resources, our PRC VIE entity, borrows foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance Walker Resources by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the Ministry of Commerce, or their respective local counterparts. These limitations could affect Walker Resources’ ability to obtain foreign exchange through debt or equity financing.

The Chinese government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining foreign currency, we may be unable to pay dividends or meet obligations that may be incurred in the future that require payment in foreign currency.

Our failure to fully comply with Chinese labor laws, including laws relating to social insurance, may expose us to potential liability and increased costs.

Companies operating in China must comply with a variety of labor laws, including the Labor Contract Law of China enacted in June 2007, or the New Labor Contract Law, and laws requiring us to make social insurance (including unemployment insurance, medical insurance, and pension) and other staff welfare-oriented payments (such as housing funds). Our failure to comply with these laws could have a material adverse effect on our business. For example, we have not paid social insurance for 44 of our full-time employees whose personal identification files cannot be transferred to us since they are not registered residents in Tianjin Province, and as an alternative we have paid these employees compensations included in their monthly salary with an amount equals to the amount of monthly social insurance that we are required to pay and the employees could pay the social insurance by themselves. We also have 35 part-time employees that we believe we are not required to pay social insurance for as these part-time employees are not legally employees of ours, but are rather independent contractors. The New Labor Contract Law, which became effective on January 1, 2008, imposes stricter obligations on employers including a requirement that employers execute written labor contracts with all of their employees. Our failure to remain in compliance with Chinese labor laws including social insurance requirements in the future could adversely impact our results of operations.

Furthermore, the New Labor Contract Law governs standard terms and conditions for employment, including termination and lay-off rights, contract requirements, compensation levels and consultation with labor unions, among other topics. In addition, the law limits non-competition agreements with senior management and other employees who have access to confidential information to two years and imposes restrictions or geographical limits. This new labor contract law will increase our labor costs, which could adversely impact our results of operations.

Failure to comply with the United States Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

We are required to comply with the United States Foreign Corrupt Practices Act, which prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some of our competitors, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in mainland China. If our competitors engage in these practices, they may receive preferential treatment from personnel of some companies, giving our competitors an advantage in securing business or from government officials who might give them priority in obtaining new licenses, which would put us at a disadvantage. We have no formal policies in place to prevent our employees or other agents from engaging in such conduct. If such conduct is undertaken, we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties, which could adversely impact our business and results of operations.

Risks Related to our Corporate Structure

The Chinese government may determine that the VIE Agreements which we utilize to operate Walker Resources are not in compliance with applicable Chinese laws, rules and regulations and that they are therefore unenforceable.

In China it is widely understood that foreign investment enterprises, or FIEs, are forbidden or restricted from engaging in certain businesses or industries which are sensitive to the economy. As we intend to centralize our management and operation in China without being restricted to conduct certain business activities which are important for our current or future business but are restricted or might be restricted in the future, we believe our VIE Agreements will be essential for our business operation. Pursuant to the terms of the VIE Agreements, almost all of our business activities in China are managed and operated by BRS Tianjin through Walker Resources and almost all economic benefits and risks arising from the business of Walker Resources are transferred to BRS Tianjin.

There are risks involved with the operation of Walker Resources under the VIE Agreements. If the Chinese government determines the VIE Agreement used to control the operating company (Walker Resources) to be unenforceable as they circumvent the Chinese restrictions relating to foreign investment restrictions, the relevant regulatory authorities would have broad discretion in dealing with such breach, including:

|

·

|

imposing economic penalties;

|

|

·

|

discontinuing or restricting the operations of BRS Tianjin or Walker Resources;

|

|

·

|

imposing conditions or requirements in respect of the VIE Agreements with which BRS Tianjin may not be able to comply;

|

|

·

|

requiring us to restructure the relevant ownership structure or operations;

|

|

·

|

taking other regulatory or enforcement actions that could adversely affect our business; and

|

|

·

|

revoking the business license and/or the licenses or certificates of BRS Tianjin or Walker Resources, and/or voiding the VIE Agreements.

|

Any of these actions could have an adverse impact on our business, financial condition and results of operations.

We depend upon the VIE Agreements in conducting our operations in China, which may not be as effective as direct ownership .

We conduct our business through our Chinese operating subsidiaries and generate the revenues through the VIE Agreements. The VIE Agreements may not be as effective in providing us with control over Walker Resources as direct ownership. The VIE Agreements are governed by Chinese laws and provide for the resolution of disputes through arbitration proceedings pursuant to Chinese laws. Accordingly, the VIE Agreements will be interpreted in accordance with Chinese laws. If Walker Resources or its shareholders fail to perform the obligations under the VIE Agreements, we may have to rely on legal remedies under Chinese laws, including seeking specific performance or injunctive relief, and claiming damages, and there is a risk that we may be unable to obtain these remedies. The legal environment in China is not as developed as in other jurisdictions. As a result, uncertainties in the Chinese legal system could limit our ability to enforce the VIE Agreements.

We conduct substantially all of our operations through our subsidiaries, and our performance will depend upon the performance of our subsidiaries.

We have no operations independent of Walker Resources. As a result, we are dependent upon the performance of Walker Resources and will be subject to the financial, business and other factors affecting such subsidiary as well as general economic and financial conditions. As substantially all of our operations are conducted through Walker Resources, we are dependent on the cash flow of Walker Resources to meet our obligations.

Because virtually all of our assets are held by our controlled VIE entity, the claims of our shareholders will be structurally subordinate to all existing and future liabilities and obligations, and trade payables of such VIE entity. In the event of our bankruptcy, liquidation or reorganization, our assets and those of our subsidiaries will be available to satisfy the rights of our shareholders only after all of Walker Resources’ liabilities and obligations have been paid in full.

The pricing arrangement under the VIE Agreements may be challenged by Chinese tax authorities.

We could face adverse tax consequences if Chinese tax authorities determine that the VIE Agreements were not entered into based on arm’s length negotiations. If the Chinese tax authorities determine that the VIE Agreements were not entered into on an arm’s length basis, they may adjust the income and expenses of our company for Chinese tax purposes which could result in higher tax liability.

Any deterioration of the relationship between BRS Tianjin and Walker Resources could adversely affect the overall business operation of our company.

Our relationship with Walker Resources is governed by the VIE Agreements, which are intended to provide us, through our direct ownership of BRS Tianjin, with effective control over the business operations of Walker Resources. Walker Resources could violate the VIE Agreements, go bankrupt, suffer from difficulties in its business, fail to renew necessary permits and certifications or otherwise become unable to perform its obligations under the VIE Agreements and, as a result, our operations, reputation, business and stock price could be severely harmed.

If BRS Tianjin exercises the purchase options over Walker Resources’ equity pursuant to the VIE Agreements, the payment of purchase prices could adversely affect our financial position.