Attached files

| file | filename |

|---|---|

| EX-10.1 - REAL HIP-HOP NETWORK, INC | aaxii8kex101_8152011.htm |

| EX-10.2 - REAL HIP-HOP NETWORK, INC | aaxii8kex991_7182011.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 15, 2011

Accelerated Acquisitions XII, Inc

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

000-54062

|

27-2787118

|

||

|

(State or Other Jurisdiction of

Incorporation)

|

(Commission File No.)

|

(I.R.S. Employer

Identification No.)

|

|

1840 Gateway Drive, Suite 200, Foster City, CA

|

94404

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (650) 283-2653

|

|

Email: aj@rhn.tv

atonn@rhn.tv

tneher@accelvp.com

|

_____________________________________________

(Former name or former address, if changed since last report)

(Address of Principal Offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

r

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

r

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

r

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

r

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

- 1 -

TABLE OF CONTENTS

|

Item 1.01 Entry into a Material Definitive Agreement

|

3

|

|

|

Item 5.06 Change in Shell Company Status

|

4

|

|

|

Item 9.01 Financial Statements and Exhibits

|

35

|

|

|

SIGNATURES

|

35

|

|

|

EXHIBIT INDEX

|

36

|

- 2 -

Item 1.01 Entry into a Material Definitive Agreement

On August 15, 2011, Accelerated Acquisitions XII (the “Company”) entered into a Licensing Agreement (“Licensing Agreement”) with Real Hip-Hop Network Broadcast Corporation (“Licensor”) pursuant to which the Company was granted an exclusive, non-transferrable worldwide license for certain first run movies, live concerts, break-dance battles, rhyme competitions, documentaries, news, DJ competitions and interviews (“media content”), TV Network, Website, digital, radio, broadband (“distribution platforms”), distribution contracts, patents, intellectual property, know-how, trade secret information to provide intelligent, family-appropriate Hip-Hop content to a multi-racial/multi-generational demographic. The Company is currently evaluating all licensors distribution contracts and will not take assignment of any contact liabilities until the evaluation is completed and the Company has completed its financing objectives outlined in the “Overview” and “Plan of Operations” sections below.

Except for the rights granted under the License Agreement, Licensor retains all rights, title and interest to the media content and any additions thereto—although the License includes the Company’s right to utilize such additions.

The term of the License commences on the date of the Licensing Agreement and continues for thirty (30) years, provided that the Licensee is not in breach or default of any of the terms or conditions contained in this Agreement. In addition to other requirements, the continuation of the License is conditioned on the Company generating net revenues in the normal course of operations or the funding by the Company of specified amounts for qualifying distribution and commercialization expenses related to the media content. In addition, the Company is required to fund certain specified expenses related to the distribution of the media content as specified in the License Agreement. The license is terminated upon the occurrence of events of default specified in the License Agreement and outlined as followed:

If any of the Parties are in breach or default of the terms or conditions contained in this Agreement and do not rectify or remedy that breach or default within 90 days from the date of receipt of notice by the other party requiring that default or breach to be remedied, then the other party may give to the party in default a notice in writing terminating this Agreement.

Licensee may, at its option, terminate this Agreement at anytime by doing the following:

By ceasing to use the media content and distribution platforms facilitated by any Licensed Products in their entirety. Giving sixty (60) days prior written notice to Licensor of such cessation and of Licensee’s intent to terminate, and upon receipt of such notice, Licensor may immediately begin negotiations with other potential licensees and all other obligations of Licensee under this Agreement will continue to be in effect until the date of termination. By tendering payment of all accrued royalties and other payments due to Licensor as of the date of the notice of termination and evidencing to the Licensor that provision has been made for any prospective royalties and other payments to which Licensor may be entitled after the date of termination.

Licensor may terminate the License Agreement if Licensee is in breach or default of the terms or conditions contained in this Agreement and does not rectify or remedy that breach or default within 90 days from the date of receipt of notice by Licensor requiring that default or breach to be remedied, then Licensor, may alter License granted by this Agreement with regards to its exclusivity, its territorial application and restrictions on its application.

Licensor may terminate the License Agreement if Licensee is in breach or default of the terms or conditions contained in this Agreement and does not rectify or remedy that breach or default within 90 days from the date of receipt of notice by Licensor requiring that default or breach to be remedied, then Licensor, may alter License granted by this Agreement with regards to its exclusivity, its territorial application and restrictions on its application. The License Agreement attached as Exhibit 10.1.

Item 2.01 Completion of Acquisition or Disposition of Assets.

On August 15, 2011, Accelerated Acquisitions XII (the “Company”) entered into a Licensing Agreement (“Licensing Agreement”) with Real Hip-Hop Network Broadcast Corporation (“Licensor”) pursuant to which the Company was granted an exclusive, non-transferrable worldwide license for certain media content, distribution contracts, distribution platforms, patents, intellectual property, know-how, trade secret information to provide intelligent, family-appropriate Hip-Hop content to a multi-racial/multi-generational demographic.

The Company acquired the media content and distribution platform rights from the Licensor, a company based in Washington D.C. that will continue its business of media content development and be a third party media content supplier to the Company, Atonn Muhammad is the founder and President of Licensor and has been President, Chief Executive Officer (CEO) and director of the Company since July 16, 2011. Mr. Muhammad is also the President and CEO and shareholder of SSM Media Ventures, Inc. that owns 22,350,000 shares of the Company’s outstanding common stock, representing an 88.2% ownership interest in the Company. SSM Media Ventures purchased its shares in the Company on July 16, 2011 as disclosed in a Form 8-K filed on July 19, 2011. There were no other agreements between the Company and SSM Media Ventures prior to the Share Purchase Agreement entered into on July 16, 2011.

- 3 -

Mr. Timothy Neher, the Company’s Chief Executive Officer prior to July 16, 2011, controls Accelerated Venture Partners, LLC (“AVP”), an entity which has agreed to provide financial advisory services to the Company. AVP owns 3,000,000 shares of the Company’s outstanding common stock, representing an 11.8% ownership interest in the Company (collectively, SSM Media Ventures and AVP own 100% of the Company as there are no other stockholders). Up to 1,500,000 of AVP’s shares can be repurchased by the Company for $0.0001 per share under certain circumstances. AVP is entitled to receive specified cash compensation if the Company achieves certain financial milestones as outlined in the “Our Business” section below and as described in Exhibit 10.4 to the Current Report on Form 8-K filed on July 19, 2011.

Aside from the Licensor, SSM Media Ventures, Mr. Muhammad, AVP and Mr. Neher, no other parties have an interest related to the Share Purchase Agreement or the Licensing Transaction. The parties were introduced by direct contact from Mr. Muhammad to AVP.

Under the terms of the Licensing Agreement, the Company has agreed to pay the Licensor one percent (1%) of any royalties received if the Company grants any third parties royalty-bearing licenses to the content or distribution platforms. In addition, the Company has agreed to pay Licensor a royalty of one quarter of one percent (0.25%) of all gross revenue resulting from use of the content or distribution platforms by the Company. In order to retain its rights, the Company must receive revenues or fund a minimum of $2 million in qualified Content distribution and commercialization expenses before the third anniversary of the Licensing Agreement (at least $0.5 million of which must be before the first anniversary of the Licensing Agreement and at least $1 million of which must be before the second anniversary of the Licensing Agreement). There are additional customary commercialization requirements in the Licensing Agreement, and this description is qualified by the terms of the Licensing Agreement attached as Exhibit 10.1.

Item 5.06 Change in Shell Company Status.

Prior to the Company’s entry into the business of media content distribution and commercialization of media content distribution platforms through the execution of the License Agreement as described in Item 1.01 above, the Company was a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended). As a result of entering into this agreement and undertaking efforts into the distribution of media content, we ceased to be a shell company.

None of the Company’s securities are registered for resale with the Securities and Exchange Commission. The outstanding shares of common stock may only be resold through registration under the Securities Act of 1933, or under an applicable exemption from registration

OTHER PERTINENT INFORMATION

Unless specifically set forth to the contrary, when used herein, the terms “Accelerated Acquisitions XII, Inc.”, "we", "our", the "Company" and similar terms refer to Accelerated Acquisitions XII, Inc., a Delaware corporation.

FORM 10 DISCLOSURE

Item 2.01(f) of Form 8-K states that if the registrant was a shell company, like our company, the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10. Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements were based on various factors and were derived utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to our ability to develop our operations, our ability to satisfy our obligations, our ability to consummate the acquisition of additional assets, our ability to generate revenues and pay our operating expenses, our ability to raise capital as necessary, economic, political and market conditions and fluctuations, government and industry regulation, interest rate risk, U.S. and global competition, and other factors. Most of these factors are difficult to predict accurately and are generally beyond our control. You should consider the areas of risk described in connection with any forward-looking statements that may be made herein. Readers are cautioned not to place undue reliance on these forward-looking statements and readers should carefully review this report in its entirety, including the risks described in "Risk Factors" and the risk factors described in our other filings with the Securities and Exchange Commission. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

- 4 -

OUR BUSINESS

From inception May 4, 2010, Accelerated Acquisitions XII, Inc. was organized as a vehicle to investigate and, if such investigation warrants, acquire a target company or business seeking the perceived advantages of being a publicly held corporation. Our principal business objectives were to achieve long-term growth potential through a combination with a business rather than immediate, short-term earnings. The Company has not restricted our potential candidate target companies to any specific business, industry or geographical location and, thus, may acquire any type of business.

On May 4, 2010, the Registrant sold 5,000,000 shares of Common Stock to Accelerated Venture Partners, LLC for an aggregate investment of $2,000.00. The Registrant sold these shares of Common Stock under the exemption from registration provided by Section 4(2) of the Securities Act.

On July 16, 2011, SSM Media Ventures, Inc (“Purchaser”) agreed to acquire 22,350,000 shares of the Company’s common stock par value $0.0001 for a price of $0.0001 per share. At the same time, Accelerated Venture Partners, LLC agreed to tender 3,500,000 of their 5,000,000 shares of the Company’s common stock par value $0.0001 for cancellation. Following these transactions, SSM Media Ventures owned approximately 94% of the Company’s 23,850,000 issued and outstanding shares of common stock par value $0.0001 and the interest of Accelerated Venture Partners, LLC was reduced to approximately 6% of the total issued and outstanding shares. Simultaneously with the share purchase, Timothy Neher resigned from the Company’s Board of Directors and Atonn Muhammad was simultaneously appointed to the Company’s Board of Directors. Such action represents a change of control of the Company.

The Purchaser used their working capital to acquire the Shares. The Purchaser did not borrow any funds to acquire the Shares. Prior to the purchase of the shares, the Purchaser was not affiliated with the Company. However, the Purchaser will be deemed an affiliate of the Company after the share purchase as a result of their stock ownership interest in the Company. The purchase of the shares by the Purchaser was completed pursuant to written Subscription Agreements with the Company. The purchase was not subject to any other terms and conditions other than the sale of the shares in exchange for the cash payment. The Company intends to file a Certificate of Amendment to its Certificate of Incorporation with the Secretary of State of Delaware in order to change its name to “Real Hip-Hop Network, Inc.”.

On July 18, 2011, the Company entered into a Consulting Services Agreement with Accelerated Venture Partners LLC (“AVP”), a company controlled by Timothy J. Neher. The agreement requires AVP to provide the Company with certain advisory services that include reviewing the Company’s business plan, identifying and introducing prospective financial and business partners, and providing general business advice regarding the Company’s operations and business strategy in consideration of (a) an option granted by the Company to AVP to purchase 1,500,000 shares of the Company’s common stock at a price of $0.0001 per share (the “AVP Option”) (which was immediately exercised by the holder) subject to a repurchase option granted to the Company to repurchase the shares at a price of $0.0001 per share in the event the Company fails to complete funding as detailed in the agreement subject to the following milestones:

.

|

● Milestone 1 -

|

Company’s right of repurchase will lapse with respect to 60% of the shares upon securing $10 million in available cash from funding;

|

|

● Milestone 2 -

|

Company’s right of repurchase will lapse with respect to 20% of the Shares upon securing $20 million in available cash (inclusive of any amounts attributable to Milestone 1);

|

|

● Milestone 3 -

|

Company’s right of repurchase will lapse with respect to 20% of the Shares upon securing $30 million in available cash (inclusive of any amounts attributable to Milestone 2);

|

and (b) cash compensation at a rate of $66,667 per month. The payment of such compensation is subject to Company’s achievement of certain designated milestones, specifically, cash compensation of $800,000 is due consultant upon the achievement of Milestone 1, $800,000 upon the achievement of Milestone 2 and $800,000 upon the achievement of Milestone 3. Upon achieving each Milestone, the cash compensation is to be paid to consultant in the amount then due at the rate of $66,667 per month. The total cash compensation to be received by the consultant is not to exceed $2,400,000 unless the Company receives an amount of funding in excess of the amount specified in Milestone 3. If the Company receives equity or debt financing that is an amount less than Milestone 1, in between any of the above Milestones or greater than the above Milestones, the cash compensation earned by the Consultant under this Agreement will be prorated according to the above Milestones. The Company also has the option to make a lump sum payment to AVP in lieu of all amounts payable thereunder.

On August 15, 2011, Accelerated Acquisitions XII (the “Company”) entered into a Licensing Agreement (“Licensing Agreement”) with Real Hip-Hop Network Broadcast Corporation (“Licensor”) pursuant to which the Company was granted an exclusive, non-transferrable worldwide license for certain first run movies, live concerts, break-dance battles, rhyme competitions, documentaries, news, DJ competitions and interviews (“media content”), distribution platforms, patents, intellectual property, know-how, trade secret information to provide intelligent, family-appropriate Hip-Hop content to a multi-racial/multi-generational demographic. The Company is currently evaluating all licensors distribution contracts and will not take assignment of any contact liabilities until the evaluation is completed and the Company has completed its financing objectives outlined in the “Overview” and “Plan of Operations” sections below.

- 5 -

Except for the rights granted under the License Agreement, Licensor retains all rights, title and interest to the content and any additions thereto—although the License includes the Company’s right to utilize such additions.

The term of the License commences on the date of the Licensing Agreement and continues for thirty (30) years, provided that the Licensee is not in breach or default of any of the terms or conditions contained in this Agreement. In addition to other requirements, the continuation of the License is conditioned on the Company generating net revenues in the normal course of operations or the funding by the Company of specified amounts for qualifying distribution and commercialization expenses related to the media content. In addition, the Company is required to fund certain specified expenses related to the distribution of the media content as specified in the License Agreement. The license is terminated upon the occurrence of events of default specified in the License Agreement and outlined as followed: If any of the Parties are in breach or default of the terms or conditions contained in this Agreement and do not rectify or remedy that breach or default within 90 days from the date of receipt of notice by the other party requiring that default or breach to be remedied, then the other party may give to the party in default a notice in writing terminating this Agreement.

Licensee may, at its option, terminate this Agreement at anytime by doing the following: By ceasing to use the media content and distribution platforms facilitated by any Licensed Products. Giving sixty (60) days prior written notice to Licensor of such cessation and of Licensee’s intent to terminate, and upon receipt of such notice, Licensor may immediately begin negotiations with other potential licensees and all other obligations of Licensee under this Agreement will continue to be in effect until the date of termination. By tendering payment of all accrued royalties and other payments due to Licensor as of the date of the notice of termination and evidencing to the Licensor that provision has been made for any prospective royalties and other payments to which Licensor may be entitled after the date of termination.

Licensor may terminate the License Agreement if Licensee is in breach or default of the terms or conditions contained in this Agreement and does not rectify or remedy that breach or default within 90 days from the date of receipt of notice by Licensor requiring that default or breach to be remedied, then Licensor, may alter License granted by this Agreement with regards to its exclusivity, its territorial application and restrictions on its application.

Licensor may terminate the License Agreement if Licensee is in breach or default of the terms or conditions contained in this Agreement and does not rectify or remedy that breach or default within 90 days from the date of receipt of notice by Licensor requiring that default or breach to be remedied, then Licensor, may alter License granted by this Agreement with regards to its exclusivity, its territorial application and restrictions on its application. The License Agreement attached as Exhibit 10.1.

The Company is an emerging growth company that has licensed media content and distribution platforms to entry into a unique business of providing intelligent, family-appropriate Hip-Hop content to a multi-racial/multi-generational demographic. We will continue to acquire media content as well as internally develop content with the goal of informing and enriching our young adult audience and encouraging their participation across platforms. The Company will operate a television network, The Real Hip-Hop Network (“RHN”), a website, RHN.TV, and RHN Mobile that will distribute media content to mobile devices.

OVERVIEW

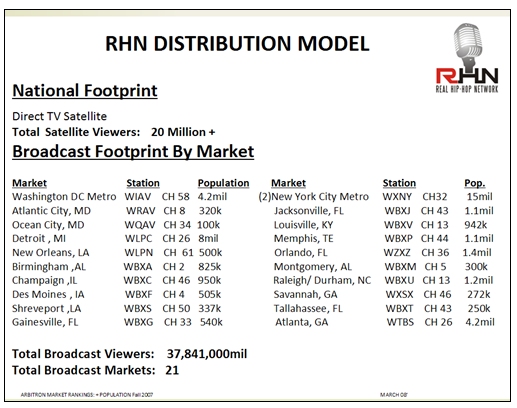

The Company licensed all right to RHN media content and distribution platforms that include a cable channel that provides intelligent, family-appropriate Hip-Hop content to a multi-racial/multi-generational 18-34 year-old audience demographic. RHN’s website RHN.TV is designed to be the Internet destination for the Company’s target audiences. RHN Mobile delivers music, gaming, and video content to the target audiences on wireless devices across wireless service providers. The Company also intends use its broadband and digital platforms to deliver video streaming content to gaming systems that include: X-BOX 360, NINTENDO Wii, and PLAYSTATION 3. RHN has beta tested the delivery of live streaming version of its video content online and on RHN.TV. RHN has also beta tested its content to over 164,000,000 households in Africa, Europe, and the Middle East through an informal available time brokerage agreement with Ethiopian Broadcast System (EBS). The RHN will continue to beta test in the United States (“US”) with an estimated audience of 3 million households until the Company can launch commercially hrough national subscription TV that is estimated to be the fall of 2011. RHN assigned the Company a distribution term sheet with DirecTV, which could allow the Company to launch to a viewership of an estimated 18 million subscribers (attached as Exhibit A of the License Agreement Exhibit 10.1). RHN has also assigned a term sheets to the Company to launch on the DISH Network which could give access to another estimated 14 million subscribers (attached as Exhibit B of the License Agreement Exhibit 10.1). In addition, RHN has identified and negotiated Local Marketing Agreements (LMA) to carry the network with additional Low Power Television Stations in (21) major and secondary markets outlined in the distribution and marketing section below which could add an additional 37 million households. The Company is evaluating all of the licensors distribution agreements and will not take assignment of any agreements until the Company is ready to commercially launch and has accomplished is financing objectives outlined below.

- 6 -

The Company intends to motivate its audiences to make a difference in their lives and communities with a broad and impactful pro-social agenda. In addition to providing a mix of approximately 45% music video-based entertainment, approximately 55% of RHN’s lineup includes original programming revolving around the Hip-Hop lifestyle, culture and pro-social programs, such as first run movies, live concerts, break-dance battles, rhyme competitions, documentaries, news, DJ competitions, interviews and exciting original content. We are currently evaluating all our options to commercialize our licensed content and platforms. The Company’s concept and content has been beta tested and has not been deployed for commercial sale anywhere in the world. Each country has different requirements for deployment, so the commercialization process is likely to be lengthy and complex. The Company may employ different strategies in different areas of the world, such as sublicensing deployment and commercialization rights for some territories while retaining rights for other territories.

Our primary sources of revenue are affiliate fees and advertising. Affiliate fees are derived from long-term distribution agreements with cable, satellite and telecommunications operators who pay us a monthly fee for each subscriber household that receives RHN content.

The Company will not be able to commercialize either its media content or distribution platforms without additional capital, if we do not raise additional funds of at least $2 million for the advancement of its content distribution over the next three years we will lose our rights to the media content and distribution platforms. The Company will require significant additional financing in order to meet the milestones and requirements of its Business Plan and avoid discontinuation of the License. Funding would be required for staffing, marketing, public relations and the necessary distribution to expanding the scope of its offering to include the global market. The Company intends to seek at an aggregate of $50,000,000 in 2011 and 2012 through the sale of equity or convertible debt securities, the issuance of these securities could dilute existing shareholders. The Company’s funding plans include selling additional capital stock and/or borrowing to fund the aforementioned expenses. The Company intends to approach Hedge Funds, Venture Capital Groups, Private Investment Groups and other Institutional Investment Groups in its efforts to achieve future funding. It is estimated that $7,626,649 will be used for management, sales and marketing, $25,860,155 will be used for the TV network fees, an estimated $5,717,918 will be spent on finance closing, legal, accounting, rent and other payables and $7,179,041 will be spent on production and programming leaving $3,616,237 in reserve for increased working capital.

It’s estimated that the minimum amount of capital the Company needs to raise over the next twelve months is $2 million to continue operations. There is no guarantee that the Company will be able to raise this or any amount of additional capital and a failure to do so would have a significant adverse effect on the Company’s ability, or would cause significant delays in its ability to address the market for content delivery and achieve its Business Plan. Neither the Company nor any of its advisors or consultants has significant experience in raising funds similar to the $50,000,000 estimated to be required.

INDUSTRY BACKGROUND

The ways in which young adults consume media and engage with news, information and lifestyle content are undergoing profound changes. We believe the dynamic preferences and consumption patterns of young adults are not being adequately addressed by traditional media outlets. At the same time, technology is transforming the way media is created, expanding the universe of content creators, altering the cost structure of content production and distribution, and enabling delivery across multiple platforms. The packaging and programming of content is also evolving, enabling new means of distribution capable of rapidly adapting to changing consumer preferences. As the way young adults engage with news, information and lifestyle content changes, it presents new challenges to networks and advertisers who target the 18-34 year-old audience demographic. These challenges include:

|

·

|

Evolution in the media preferences and consumption patterns of young adults. Young adults want to engage with programming related to news, information and lifestyle, but their consumption patterns have evolved faster than traditional television programming, leaving their needs underserved.

|

|

·

|

Changes in media programming and production. Digital media tools enable scalable production with relatively low overhead, open systems and small teams, which has changed the way content can be processed, organized and delivered.

|

|

·

|

Evolution in content creation. Changes in the means and cost structure of content production and distribution have significantly expanded the universe of potential content creators. As a result, programming can be a conversation between viewers and a network, offering freedom from one-way communication and resulting in unprecedented engagement and participation.

|

|

·

|

Changes in advertising models that drive the media industry. Advertisers devote the largest portion of their media spending to television. However, the traditional TV advertising model is becoming less effective with young adults, who are changing their viewing patterns.

|

- 7 -

MARKET OPPORTUNITY

We believe there is a significant gap between what is being delivered by traditional sources of TV and what is demanded by young adults. Young adults need and want news and information about what is going on in their world; however, they have not had a news and information source on TV that speaks to them. Young adults increasingly are turning to other platforms, especially the Internet, for news and information.

As a result, there is a large market opportunity to develop an integrated media platform capable of cost-effectively engaging young adults around news, information and lifestyle entertainment, and to build a brand premised on communicating what is going on in the lives of this young-adult generation. There is demand from both young adults and the advertisers who target them for a media platform that engages 18-34 year-olds in their own voices and from their own perspectives, and whose content is defined by what is most important in their lives: from pop culture to politics, careers to relationships.

We believe our media platform will motivate its audiences to make a difference in their lives and communities with a broad and impactful pro-social agenda. In addition, providing a mix of approximately 45% music video-based entertainment, approximately 55% of RHN’s lineup includes original programming revolving around the Hip-Hop lifestyle, culture and pro-social programs, such as first run movies, live concerts, break-dance battles, rhyme competitions, documentaries, news, DJ competitions, interviews and exciting original content provides a compelling way to capture this opportunity.

HIP-HOP MARKET

Originating an estimated 30 years ago as an “underground” urban music genre popular in a few large U.S. cities, Hip-Hop has evolved and expanded into a broadly popular global entertainment and cultural medium. Business Week reported as early as 2005 that there were an estimated 100 million Hip-Hop fans worldwide, including 50 million in the U.S. alone. The following discussion highlights what the Company believes is distinctive appeal of the Hip-Hop market, focusing on the characteristics that make it ideally suited to support the Company’s dedicated programming network. Specifically:

|

·

|

While it has grown far beyond its music roots, Hip-Hop is fundamentally a media-based industry targeting a media-centric audience. It is estimated that Hip-Hop is the second largest selling music category, trailing only Country (for which, by comparison, there are already three dedicated cable networks). There are at least two Hip-Hop radio stations ranked among the top 10 (based on listenership) in nine of the ten largest U.S. markets.

|

|

·

|

Hip-Hop music and culture have broad appeal to a large cross-section of the U.S. teen and young adult population (i.e., individuals aged 12-34). While Hip-Hop retains its popularity and cultural draw in the urban market, the majority of Hip-Hop consumers are Caucasian suburbanites – reflecting the significant (and growing) urban influence on suburban culture. Hip-Hop’s broad appeal has made the genre extremely important and attractive to major advertisers seeking to connect with this difficult to reach young audience.

|

|

·

|

Leading Hip-Hop entertainers have emerged as “One Man Brands,” achieving enormous success in marketing apparel, footwear, video games, etc. – as well as endorsing products and “crossing over” into television and film acting careers.

|

|

·

|

Finally, entertainment and “reality” television programming with Hip-Hop themes is increasingly prevalent and popular, while Hip-Hop videos are estimated to be the most popular genre in the MTV Network’s music menu as well as the most popular programming category on the Black Entertainment Television (“BET”)

|

The entrepreneurial spirit and savvy of leading Hip-Hop artists initially transformed the marketing landscape by establishing the “One Man Brand.” More recently, Hip-Hop entrepreneurs have increasingly intertwined their own initiatives with the activities of major advertisers and Fortune 500 companies.

PROGRAMMING STRATEGY

Programming is anticipated to be the company’s fundamental strength and the factor that most distinguishes the network from competitors. We will provide 2-5 times the number of hours devoted to Hip-Hop music videos than existing mainstream music channels. The Company will not only devote more time to current and past Hip-Hop “stars,” but will also devote much more time to emerging artists in the field. In addition, the number of hours of programming the company will devote to news, magazine, lifestyle and reality shows about and/or featuring Hip-Hop artists will be extremely difficult to duplicate by other networks because our network will initially be built with essentially “no cost” music videos which will form the basis of much of its programming schedule, RHN’s programming strategy allows for greater ability to manage investment, as the business scales.

- 8 -

Programming Themes and Concepts

The Company intends to be flexible with its programming mix and content to respond to its target market. However, the network’s plan is to establish a programming schedule consisting of approximately 45% music video-based entertainment, and about 55% original programming revolving around the Hip-Hop lifestyle and culture. More than half of the original programming is expected to be studio-based shows, magazine shows and documentaries/reality shows produced by the Company (e.g., generally modest cost, hosted shows with interviews and some live performances), while the remaining half of original programming is expected to be acquired and/or bartered from independent producers.

A broad sampling of the specific programming themes and concepts that the network intends to feature include:

|

·

|

Music video-based programming. We intend to air a number of distinct one-hour blocks of Hip-Hop music videos – some of which will be hosted. Some of the programs will be purely music video playback, while others will include interviews, live performances and studio audiences. The legendary show, Video Juke Box, is anticipated to be aired, hosted by Ralph McDaniels, known as a pioneer who was the first to produce and host a video music show based around Hip-Hop culture and music. VR-20 (Video Request Top 20) will feature the top 20 Rap videos of the day. Hosted by VJs in front of a studio audience, this show will also feature live performances and interviews. The Real Gritty Top 20 will showcase the day’s top 20 underground Hip-Hop videos, selected by viewer request. Rap World will feature blocks of international Hip-Hop music videos. Beauty and the Beats will feature all female artists. In addition, there will be three other blocks of Hip-Hop videos daily on the network. In all, about 45% of the programming week will be devoted to blocks of exclusively Hip-Hop videos. This content will provide a springboard and a cross-promotional tool for other our original and acquired programming.

|

|

·

|

Live Concert Series. We intends to air up to six original Hip-Hop concerts per year, featuring artists ranging from the well-established to the up-and-coming and these concerts will be repeated throughout the calendar year.

|

|

·

|

News, Magazine Shows, and daily Talk Show. The Company will produce and acquire a number of topical news and magazine shows that detail relevant news and information about the Hip-Hop community. For example, One Nation Hip-Hop will be an “Entertainment Tonight”-style program providing information about the latest TV shows, movies and sitcoms featuring the biggest and hottest Hip-Hop celebrities. It will also feature current album releases and concert tour information. Analyze This will feature celebrity guests from diverse backgrounds discussing the issues and controversies behind rap lyrics, and Hip-Hop Insider will be a news show featuring politics, news and sports, hosted by RHN VJs. Mogol is a Hip-Hop business show featuring segments on record industry economics, news on the latest deals of superstar Hip-Hop recording artists, and lifestyle segments with showcases of homes, cars and travel destinations of the Hip-Hop elite. Rap Sheet is a Hip-Hop news and commentary show featuring writers from Hip-Hop’s greatest magazines, including Source, Vibe and XXL. Finally, management has plans for a nightly talk show called Hip-Hop Late Nite featuring live guests.

|

|

·

|

Documentary and “Competition” Programming. We will seek to assemble a stable of documentaries and artist profiles/features programs. Legend will chronicle the greatest Hip-Hop legends, while Behind the Platinum will showcase the backstage, behind the scenes scandals, shady deals, violence and murder that exist in the dark corners of the music industry. Dollar and Dream will document the rise of Hip-Hop’s greatest artists. In addition, Unsigned Heat will profile the hottest unsigned MC’s in the business. Competition style programming will include Technics World, a DJ competition, and Rap Wars, a nationwide MC freestyle battle competition. Rap Superstar will be an American Idol-style Rap show with celebrity guest judges. In addition, the Company has acquired and will “re-version” extensive footage and pre-produced segments that have been developed by Pseudo Entertainment and others. Much of this content is of high quality and is readily adaptable for television using low cost post-production techniques. This approach mirrors that often used by The History Channel, Biography and others, to develop quality documentary and reality programming at a modest cost.

|

|

·

|

Entertainment Programming. The Company intends to round out its programming schedule with a number of entertaining shows designed to appeal to segments of its target audience. These shows include:

|

|

§

|

Kissed or Dissed – a dating show chronicling the dates of Hip-Hop singles culminating in whether their partners will be kissed or dissed.

|

|

§

|

Beneath the World Order – a Company original animated series.

|

|

§

|

Flip Side – a reality show where two people from different worlds switch places.

|

|

§

|

Chrome – a program dedicated to Hip-Hop’s love affair with cars.

|

|

§

|

Street Skillz: Street Ball Tournament – hosted by popular former MTV hosts Ed Lover and Dr. Dre, this show offers the winner of a street basketball tournament a workout with NBA scouts.

|

|

§

|

Couture with Toni – a fashion show based on Hip-Hop fashion hosted by the Company’s personalities.

|

|

§

|

Every Woman has a Story – a show on women and their struggles.

|

- 9 -

|

§

|

Serve it Up – this show features Raz B, a former member of pop super group B2K and an actor in the movie about Hip-Hop dance “You Got Served.” The show will have top Hip-Hop dance troops compete for cash and prizes in front of celebrity judges.

|

|

§

|

The Deal – featuring The Outlawz, this show takes a behind-the-scenes look at their lives both on and off stage, as they struggle to make their own way outside the legacy of legendary artist Tupac Shakur.

|

In the event distribution and revenue proceed at a different pace than projected, the Company has the flexibility to adopt a different programming mix (e.g., exhibit more “no cost” music videos) and thereby contain costs.

Key elements of the Company’s programming model include:

|

·

|

Acquired entertainment programming/partnerships with existing niche producers. We believe that much of the acquired entertainment programming can be obtained at a modest cost. In addition, by partnering with existing niche producers for the development of certain ongoing original programming, The Company anticipates to be able to obtain distribution rights to a significant amount of content at no cash cost (i.e., on a barter basis). Our production staff will support the creation of an expanded number of programs by these partners and ensure an on-air look consistent with the network’s overall format.

|

|

·

|

Acquired and re-versioned documentary programming. By employing a combination of acquired documentary programming and utilization of post-production resources to enhance and package footage and segments obtained at little or no cost from sources we will be able to offer an appealing array of documentary-style content at a very feasible total cost.

|

|

·

|

Original studio production. A significant percentage of our original programming will be studio-based. Most shows (whether news, magazine, talk shows or hosted music video segments) will be hosted by staff VJs and will feature interviews and live performances from Hip-Hop artists looking to promote their latest work. Costs for this programming can be carefully managed. Hosted music video programs will feature wrap-around introductions and commentary produced efficiently in the studio, as well.

|

|

·

|

Opportunity for multiple airings. Much of the Company’s programming can be aired on multiple occasions, providing viewers with additional opportunities for viewing the content, while also minimizing costs. Given the network’s reliance on music videos, most of our annual programming needs will be constantly refreshed at little or no cost, as music labels/record companies will provide new releases of music videos on a continual basis. This is expected to account for about 3,600 hours of the approximate 8,000 hours of annual programming needed by the Company. The remaining programming hours will be filled with modest-cost acquired programming and no-cost bartered programming, as well as original Company productions. Acquired programming is expected to be repeated as many as ten times and original Company productions are expected to be repeated on average as many as six times.

|

DISTRIBUTION and MARKETING STRATEGY

The strategy is to provide content to its audience across all available media outlets: Broadcast TV, Broadcast Radio, Cable/Satellite, Broadband Internet, Print, mobile video, and gaming systems. In order for a media company to be competitive, it must have a multi-platform distribution strategy. Advertisers who are seeking to reach the coveted 18-34 demographic must reach beyond traditional spots and dots and cover the spectrum of all the most popular media platforms. The trend in media is portability and access to content when and where you want it. The successful new media company will be everywhere there audience is.

RHN assigned the Company a distribution term sheet with DirecTV, which could allow the Company to launch to a viewership of an estimated 18 million subscribers (attached as Exhibit A of the License Agreement Exhibit 10.1). RHN has also assigned a term sheets to the Company to launch on the DISH Network which could give access to another estimated 14 million subscribers (attached as Exhibit B of the License Agreement Exhibit 10.1). In addition, RHN has identified and negotiated Local Marketing Agreements (LMA) to carry the network with additional Low Power Television Stations in (21) major and secondary markets outlined in the distribution and marketing section below which could add an additional 37 million households. The Company is evaluating all of the licensors distribution agreements and will not take assignment of any agreements until the Company is ready to commercially launch and has accomplished is financing objectives outlined in the “Plan of Operations” section below.

- 10 -

- 11 -

Management believes that the network’s programming will attract viewership and that the network’s concept will engender strong grass roots support from Hip-Hop fans. As such, the network’s overall distribution and consumer marketing strategy is focused on the following:

|

·

|

Exposure. Marketing our network with key strategic partners, such as Fortune 500 companies, which are now recognizing the enormous size of the Hip-Hop Community. We will appoint a sales team to utilize approach on large and multiple opportunity advertisers.

|

|

·

|

Grass roots support. RHN recently completed the production of a major Hip-Hop concert event, and will continue to pursue grass roots marketing campaigns and develop launch and other promotional events that will attract Hip-Hop fans. These activities will not only contribute to the buzz and success of market-specific launches, they will also create broadened awareness of and interest in the network among Hip-Hop fans throughout the country. These fans will then be actively encouraged to support the network’s distribution efforts through follow-up targeted marketing campaigns.

|

|

·

|

Sponsorship: Promoting our services at television media industry shows as well as Hip-Hop events across the country and early stage advertising, in areas of potential viewership

|

|

·

|

Source magazine promotion. The Company will also consistently promote the Hip-Hop Network and encourage grass roots support through its widely read partners and influential Source and Vibe magazines. Source and Vibe reaches the core of the Hip-Hop fan base – and provides a very effective means for stimulating “word-of-mouth” about the Real Hip-Hop Network.

|

Radio

The Company intends to acquire Local Marketing Agreements with broadcasters in strategic markets in the United States. Broadcast affiliates have already been identified. This strategy will create a radio presence for the Real Hip-Hop Network Brand with cross promotion capability with its broadcast foot print starting in New York City, NY, Los Angeles, CA, Chicago, IL and Washington, DC.

Digital Content Delivery

The Company anticipates broad distribution through digital platforms to cross promote our brands and sell digital content subscriptions through our web and TV properties. Ringtones, Wallpaper, and Music Video Downloads may be made available for a monthly subscription fee. The Company also intends to leverage its television viewing audience to create a mobile text community. The network has a short code that will be used to get gain revenue through fee-based music video or contest voting like other television shows.

- 12 -

Smart Phone Media Distribution

According to CTIA-The Wireless Association® an international nonprofit membership organization that has represented the wireless communications industry since 1984 states that the cell phone universe has over 300 million mobile subscribers, and the number of smart phone users will exceed 70 million in the U.S. in 2011. The Company intends to have mobile applications platforms and use existing platforms to make available a mobile version of its channel to be streamed live to all smart phones.

Broadband

The web is the next frontier of the media world. RHN.TV intends to create a virtual audience build out from the channels national fan base. The network will stream its channel to the site live 24 hours a day and post popular shows on the site to be viewed on-demand. Free RHN.TV e-mail addresses will be made available to the public as well as social networking and video file sharing like youtube.com. Premium digital content will be bought and sold online. RHN.TV will use existing popular social networking platforms to create and maintain an active and growing network of RHN fans and supporters.

Web-Based Marketing

Critical to producing visibility and traffic is the use of the Web for advertising. We plan to have a campaign which will increase traffic and contribute to "brand recognition" and "brand loyalty" through a combination of search engine listings with meta-tags that produce search results in the top 10 on listings for Hip-Hop information. With the advent of WebTV, we believe that the prospect of entering more homes as a menu option delivered by a portal site like AOL or Google could enhance media exposure and visitation. The advent of broadband Internet services will be important but will not reduce our primary presence on “standard” television.

Marketing Schedule

Our final model, content, product brand and technology are all under development. We intend our initial launch will occur in the fall of 2011. We intend to place banner advertisements on our strategic partner sites which are yet to be determined. Also, we intend to have an aggressive marketing plan to solicit priority partner sponsorship from a host of providers currently serving the customers of this Hip-Hop Community. We are taking steps to a validated list of prospects for online advertising. We plan to negotiate with other Web sites to purchase our banner inventory.

AFFILIATE SALES STRATEGY

The Company understands that opportunities for new networks to secure analog and even digital basic distribution are extremely limited and often require significant launch incentive payments that substantially increase the investment associated with the network. Further, we are aware that its core audience is both highly coveted by advertisers and intensely interested in the network’s subject matter. For these reasons, the Company believes it can succeed as a service distributed via digital tiers and plans to seek inclusion in reasonably priced digital programming tiers that target a young adult audience. We may also be willing to explore ala carte distribution, if plans like those recently put in place by large networks become increasingly common.

In addition to positioning the network for tiered distribution, management intends to aggressively pursue early stage distribution by alternative video providers, most notably the major telephone companies. It is believed that securing distribution via these outlets will significantly enhance prospects for carriage among the more established cable and satellite distributors. Specifically, both Verizon and SBC have publicly announced plans to offer a range of programming choices that far exceeds anything currently available to consumers. Further, because these companies are collectively building their fiber-based distribution networks in nearly every major market in the country, widespread carriage of RHN may place pressure on cable and satellite distributors on essentially a nationwide basis with a particular emphasis on the markets where the Hip-Hop’s appeal is likely to be greatest.

The Company will focus its distribution and consumer marketing efforts on major urban markets with significant African-American population concentrations and where Hip-Hop-formatted radio stations are consistently among the leading local radio outlets.

ADVERTISING SALES STRATEGY

The Company’s advertising sales strategy centers on leveraging three primary strengths: (1) the appeal of its target audience; (2) unique cross-media packaging opportunities; and (3) the network’s expected major market concentration. The Company’s ability to capitalize on these key strengths is anticipated to be supported by strategic alliance within young adult marketing organizations.

Our advertising sales attributes are outlined in additional detail below:

Attractive audience demographics and strong appeal to major advertisers. The Hip-Hop audience is concentrated in the hard-to-reach 12-34 demographic. Major advertisers are already aligning with Hip-Hop personalities as a means for reaching this demographic with extraordinary results. As examples, sales of products including Reebok footwear, Courvoisier and Cadillac are all reported to have increased dramatically as a result of Hip-Hop marketing relationships or in some instances the mere mention of the product in a Hip-Hop song.

- 13 -

Niche appeal to selected key brands/product categories. In addition to Hip-Hop’s appeal to major advertisers, the culture/lifestyle is closely aligned with certain brands and product categories, including clothing and footwear lines designed by or for Hip-Hop artists, as well as selected other products in the automotive, beverage and retail category. The Company intends to provide a natural vehicle for these advertisers to reach a loyal and lucrative customer base. Just a few examples of industries with leading brands endorsed by Hip-Hop personalities include: Automotive, Soft Drinks, Malt Beverages, Footwear, Beauty/Hygiene and others.

Magazine partnership. We intend to partner with Hip-Hop magazines that will enable the Company to advertise in proven print media outlets that hold strong appeal and have an established market position in the Hip-Hop segment. In addition to differentiating us from competing networks, packaging may allow the Company to generate significant advertising revenues at an earlier stage than is typically possible for standalone program networks.

Concentration in major markets. It is anticipated that the Company’s initial distribution will be concentrated in the country’s largest television markets. These markets are the highest priority for major advertisers, suggesting that the Company may be able to interest larger advertisers even in its early stages of development.

COMPETITIVE ENVIROMENT

Competitors to what the Company is offering include:

|

·

|

MTV Networks. Following its launch as the first video music network in 1981, Viacom subsidiary Music Television (MTV) changed the television landscape and ultimately the music industry. In 2009, MTV was among the most widely distributed cable networks, available to over 98 million homes. While still effectively targeting the 12-34 demographic, MTV has substantially changed its programming format in recent years to feature reality programming such as The Real World and other series’ such as the popular Pimp My Ride.

|

|

·

|

BET Networks. Black Entertainment Television (BET) launched in 1980. In 2009, BET was available to 90 million homes worldwide. BET provides a range of programming intended to reflect African-American culture, including educational programs, sports, public affairs and music content. Further, the popularity of BET’s music programming led the organization to develop BET Jazz – which is available to approximately over 11 million homes and features jazz videos, films and documentaries.

|

|

·

|

TV One. TV One targets African American adults (i.e., the 25-54 demographic) with a mix of lifestyle programming, classic series, movies, fashion and music content. With ownership including Radio One, Comcast and DIRECTV, TV One is estimated to have attained distribution to 18 million homes in its first year of operation, and is current available to 48 million households. This network reflects the subscription TV industry’s growing interest in enhancing its appeal to the African American market.

|

|

·

|

VH1 Networks. Also owned by Viacom, the VH1 family of networks provides a range of music video and music-centered programming – geared primarily to the 25-54 demographic. In 2009, VH1 was available to 97 million households.

|

|

·

|

FUSE. Owned by Rainbow Media, FUSE promoted itself as the “only all-music, viewer-influenced television network.” FUSE programming includes music videos, artist interviews, live concerts and specials that emphasize “alternative” rock. In certain respects, FUSE is suggestive of the potential for RHN – as a truly music-centered alternative to the MTV family, with a concentrated emphasis on the 12-34 demographic and a particular, popular music-based lifestyle.

|

The Company intends to differentiate itself through a full-time focus on Hip-Hop content, the range of its coverage of the Hip-Hop culture, its unique understanding of the Hip-Hop lifestyle that emanates from direct involvement in the industry, and its focus on delivering higher-quality, family-appropriate Hip-Hop content to a multi-generational demographic.

GOVERNMENT REGULATIONS

The scope of communications regulations to which we or our distributors are subject varies from country to country. Typically, video programming regulation in each of the countries in which we or our distributors operate or plan to operate requires that domestic broadcasters and platform providers secure certain licenses from the domestic communications authority. Additionally, most nations have communications legislation and regulations that set standards regarding program content and the content and scheduling of television advertisements. Most nations also have legislation and regulations that provide that a certain portion of programming carried by broadcasters or multi-channel video programming distributors be produced domestically and to some degree be sourced from domestic production companies that are independent of the distributor. Some jurisdictions in which we plan to operate have strict censorship of content, and prohibited content may vary substantially over time.

- 14 -

In most countries, communications regulations are generally subject to periodic and ongoing governmental review and legislative initiatives that may affect the nature of programming we are able to offer and the means by which it is distributed. For example, the U.S. Federal Communications Commission, or FCC, is considering expansion of the exclusivity ban on programmers affiliated with cable operators to programmers affiliated with satellite networks. Any such restrictions, if adopted, could adversely affect our ability to negotiate with satellite programming distributors should we become subject to any such rules. In addition, some policymakers maintain that cable and satellite operators should be required to offer programming to subscribers on a network-by-network, or á la carte, basis or to provide "family friendly" program tiers. The unbundling or tiering of program services could result in reduced subscriber households and advertising revenues and increased marketing expenses. The timing, scope or outcome of these reviews and initiatives could be unfavorable to us, and any changes to current communications legislation or regulations could require adjustments to our operations.

The laws relating to the liability of providers of online services are currently unsettled both within the U.S. and abroad. Claims against other companies with online businesses similar to ours have been threatened and filed under both U.S. and foreign law for defamation, libel, invasion of privacy and other data protection, tort, unlawful activity, copyright or trademark infringement or other theories based on ads posted on a website and content generated by a website's users. Compliance with these laws is complex and may impose significant additional costs on us and restrictions on our business. Any failure to comply with these laws could subject us to significant liability.

EMPLOYEES

We currently have five full time employees. None of our employees are represented by a labor union and we consider our relationships with our employees to be good.

Before you invest in our securities, you should be aware that there are various risks. You should consider carefully these risk factors, together with all of the other information included in this annual report before you decide to purchase our securities. If any of the following risks and uncertainties develop into actual events, our business, financial condition or results of operations could be materially adversely affected.

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to continue as a going concern and our ability to obtain future financing.

In their report dated March 31, 2011, our independent auditors stated that our financial statements for the period from inception May 4, 2010 through March 31, 2011were prepared assuming that we would continue as a going concern. Our ability to continue as a going concern is an issue raised as a result of recurring losses from operations and cash flow deficiencies since our inception. We continue to experience net losses. Our ability to continue as a going concern is subject to our ability to generate a profit and/or obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities, increasing sales or obtaining loans and grants from various financial institutions where possible. If we are unable to continue as a going concern, you may lose your entire investment.

We were formed in May, 2010 and have a limited operating history and, accordingly, you will not have any basis on which to evaluate our ability to achieve our business objectives.

We are a development stage company with limited operating results to date. Since we do not have an established operating history or regular sales yet, you will have no basis upon which to evaluate our ability to achieve our business objectives.

The absence of any significant operating history for us makes forecasting our revenue and expenses difficult, and we may be unable to adjust our spending in a timely manner to compensate for unexpected revenue shortfalls or unexpected expenses.

As a result of the absence of any operating history for us, it is difficult to accurately forecast our future revenue. In addition, we have limited meaningful historical financial data upon which to base planned operating expenses. Current and future expense levels are based on our operating plans and estimates of future revenue. Revenue and operating results are difficult to forecast because they generally depend on our ability to promote and sell our services. As a result, we may be unable to adjust our spending in a timely manner to compensate for any unexpected revenue shortfall, which would result in further substantial losses. We may also be unable to expand our operations in a timely manner to adequately meet demand to the extent it exceeds expectations.

Our limited operating history does not afford investors a sufficient history on which to base an investment decision.

We are currently in the early stages of developing our business. There can be no assurance that at this time that we will operate profitably or that we will have adequate working capital to meet our obligations as they become due.

- 15 -

Investors must consider the risks and difficulties frequently encountered by early stage companies, particularly in rapidly evolving markets. Such risks include the following:

|

●

|

competition

|

|

|

●

|

ability to anticipate and adapt to a competitive market;

|

|

|

●

|

ability to effectively manage expanding operations; amount and timing of operating costs and capital expenditures relating to expansion of our business, operations, and infrastructure; and

|

|

|

●

|

dependence upon key personnel to market and sell our services and the loss of one of our key managers may adversely affect the marketing of our services.

|

We cannot be certain that our business strategy will be successful or that we will successfully address these risks. In the event that we do not successfully address these risks, our business, prospects, financial condition, and results of operations could be materially and adversely affected and we may not have the resources to continue or expand our business operations.

We are a development stage company and are substantially dependent on a third party

The Company is a development stage Company and is currently substantially dependent upon media content and distribution platforms licensed from The Real Hip-Hop Network Broadcast Corporation.. Moreover, since demand for our Hip-Hop content acquired has not, to the Company’s knowledge, been effectively addressed by others on a global basis, Management believes, but cannot assure, that it has an opportunity and both the capability and experience to be successful in its endeavor to generate revenues in its target markets.

We have no profitable operating history and May Never Achieve Profitability

From inception (May 4, 2010) through March 31, 2011, the Company has an accumulated deficiency during the development stage of $1,800 notwithstanding the fact that the principals of the Company have worked without salary and the Company has operated with minimal overhead. We are an early stage company and have a limited history of operations and have not generated revenues from operations since our inception. We are faced with all of the risks associated with a company in the early stages of development. Our business is subject to numerous risks associated with a relatively new, low-capitalized company engaged in our business sector. Such risks include, but are not limited to, competition from well-established and well-capitalized companies, and unanticipated difficulties regarding the marketing and sale of our services. There can be no assurance that we will ever generate significant commercial sales or achieve profitability. Should this be the case, our common stock could become worthless and investors in our common stock or other securities could lose their entire investment.

We have a need to raise additional capital

The Company will not be able to commercialize either its media content or distribution platforms without additional capital, if we do not raise additional funds of at least $2 million for the advancement of its content distribution over the next three years it will lose its rights to the media content and distribution platforms. The Company will require significant additional financing in order to meet the milestones and requirements of its Business Plan and avoid discontinuation of the License. Funding would be required for staffing, marketing, public relations and the necessary research precedent to expanding the scope of its offering to include the global market. The Company intends to seek at an aggregate of $50,000,000 in 2011 and 2012 through the sale of equity or convertible debt securities, the issuance of these securities could dilute existing shareholders. The Company’s funding plans include selling additional capital stock and/or borrowing to fund the aforementioned expenses. The Company intends to approach Hedge Funds, Venture Capital Groups, Private Investment Groups and other Institutional Investment Groups in its efforts to achieve future funding. It is estimated that $7,626,649 will be used for management, sales and marketing, $25,860,155 will be used for the TV network fees, an estimated $5,717,918 will be spent on finance closing, legal, accounting, rent and other payables and $7,179,041 will be spent on programming leaving $3,616,237 in reserve for increased working capital.

It’s estimated the minimum amount of capital the company needs to raise over the next twelve months is $2 million to continue operations. There is no guarantee that the Company will be able to raise this or any amount of additional capital and a failure to do so would have a significant adverse effect on the Company’s ability, or would cause significant delays in its ability to address the market for content delivery and achieve its Business Plan. Neither the Company nor any of its advisors or consultants has significant experience in raising funds similar to the $50,000,000 estimated to be required.

The Company’s Management and its advisors lack meaningful experience in the marketing of the Licensed Media Content

In view of the fact that the marketing of the Company’s licensed media content the content is new and there are no known comparable models in the market, the Company lacks the specific experience to implement its Business Plan. While the Company will seek to obtain resources which will support its marketing activities, there is no assurance that this lack of experience will not negatively affect the Company’s implementation of its Business Plan and prospects for growth and ultimate success.

- 16 -

Dependence on our Management, without whose services Company business operations could cease.

At this time, our management is wholly responsible for the development and execution of our business plan. Our management is under no contractual obligation to remain employed by us, although they have no present intent to leave. If our management should choose to leave us for any reason before we have hired additional personnel our operations may fail. Even if we are able to find additional personnel, it is uncertain whether we could find qualified management who could develop our business along the lines described herein or would be willing to work for compensation the Company could afford. Without such management, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

Our officers and directors devote limited time to the Company’s business and are engaged in other business activities

At this time, four officers, two of them also directors devote their full-time attention to the Company’s business. Based upon the growth of the business, we would intend to employ additional management and staff. With only four fulltime devoted officers and directors the Company’s business could adversely affect the Company’s business operations and prospects for the future. Without a full-time devoted management team, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

Concentrated control risks; shareholders could be unable to control or influence key corporate actions or effect changes in the Company’s board of directors or management.

Our current officers and directors control SSM Media Ventures who currently own 22,350,000 shares of our common stock, representing approximately 88.2% of the voting control of the Company. Our current officers and directors therefore have the power to make all major decisions regarding our affairs, including decisions regarding whether or not to issue stock and for what consideration, whether or not to sell all or substantially all of our assets and for what consideration and whether or not to authorize more stock for issuance or otherwise amend our charter or bylaws.

Lack of additional working capital may cause curtailment of any expansion plans while raising of capital through sale of equity securities would dilute existing shareholders’ percentage of ownership

Our available capital resources will not be adequate to fund our working capital requirements based upon our present level of operations for the 12-month period subsequent to March 31, 2011. A shortage of capital would affect our ability to fund our working capital requirements. If we require additional capital, funds may not be available on acceptable terms, if at all. In addition, if we raise additional capital through the sale of equity or convertible debt securities, the issuance of these securities could dilute existing shareholders. If funds are not available, we could be placed in the position of having to cease all operations.

We do not presently have a traditional credit facility with a financial institution. This absence may adversely affect our operations

We do not presently have a traditional credit facility with a financial institution. The absence of a traditional credit facility with a financial institution could adversely impact our operations. If adequate funds are not otherwise available, we may be required to delay, scale back or eliminate portions of our operations and product development efforts. Without such credit facilities, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

Our success is substantially dependent on general economic conditions and business trends, particularly in the natural products, a downturn of which could adversely affect our operations

The success of our operations depends to a significant extent upon a number of factors relating to business spending. These factors include economic conditions, activity in the financial markets, general business conditions, personnel cost, inflation, interest rates and taxation. Our business is affected by the general condition and economic stability of our customers and their continued willingness to work with us in the future. An overall decline in the demand for media content could cause a reduction in our sales and the Company could face a situation where it never achieve sales and thereby be forced to cease operations.

We will need to increase the size of our organization, and may experience difficulties in managing growth.

We are a small company four full-time employees. We expect to experience a period of significant expansion in headcount, facilities, infrastructure and overhead and anticipate that further expansion will be required to address potential growth and market opportunities. Future growth will impose significant added responsibilities on members of management, including the need to identify, recruit, maintain and integrate managers. Our future financial performance and its ability to compete effectively will depend, in part, on its ability to manage any future growth effectively.

- 17 -

We are subject to compliance with securities law, which exposes us to potential liabilities, including potential rescission rights.

We have offered and sold our common stock to investors pursuant to certain exemptions from the registration requirements of the Securities Act of 1933, as well as those of various state securities laws. The basis for relying on such exemptions is factual; that is, the applicability of such exemptions depends upon our conduct and that of those persons contacting prospective investors and making the offering. We have not received a legal opinion to the effect that any of our prior offerings were exempt from registration under any federal or state law. Instead, we have relied upon the operative facts as the basis for such exemptions, including information provided by investors themselves.