Attached files

| file | filename |

|---|---|

| EX-31.1 - Continental Resources Group, Inc. | q1100111_ex31-1.htm |

| EX-32.1 - Continental Resources Group, Inc. | q1100111_ex32-1.htm |

| EX-31.2 - Continental Resources Group, Inc. | q1100111_ex31-2.htm |

| EX-32.2 - Continental Resources Group, Inc. | q1100111_ex32-2.htm |

| EX-21.1 - Continental Resources Group, Inc. | q1100111_ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2011

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from_______to_______

Commission file number 333-152023

CONTINENTAL RESOURCES GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

26-1657084

|

|||

|

(State or other jurisdiction of incorporation or

organization)

|

(I.R.S. Employer Identification No.)

|

|||

|

3266 W. Galveston Drive #101

Apache Junction, AZ

|

85120

|

|||

|

(Address of principal executive offices)

|

(Zip Code)

|

|||

Registrant's telephone number, including area code (480) 288-6530

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). o Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated file, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of the Company’s most recently completed second fiscal quarter was approximately $36,026,474.

As of August 12, 2011, there were 95,119,018 shares of Common Stock, par value $0.0001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

CONTINENTAL RESOURCES GROUP, INC.

|

Page

|

|||

|

PART I

|

|||

|

Item 1.

|

Business.

|

1 | |

|

Item 1A.

|

Risk Factors.

|

1 | |

|

Item 1B.

|

Unresolved Staff Comments.

|

1 | |

|

Item 2.

|

Properties.

|

1 | |

|

Item 3.

|

Legal Proceedings.

|

1 | |

|

Item 4.

|

(Removed and Reserved)

|

1 | |

|

PART II

|

|||

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

1 | |

|

Item 6.

|

Selected Financial Data.

|

1 | |

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition or Plan of Operation

|

1 | |

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

1 | |

|

Item 8.

|

Financial Statements and Supplementary Data.

|

1 | |

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

|

1 | |

|

Item 9A.

|

Controls and Procedures.

|

1 | |

|

Item 9B.

|

Other Information.

|

1 | |

|

PART III

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

1 | |

|

Item 11.

|

Executive Compensation.

|

1 | |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

1 | |

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

1 | |

|

Item 14.

|

Principal Accountant Fees and Services.

|

1 | |

|

PART IV

|

1 | ||

|

Item 15.

|

Exhibits and Financial Statement Schedules.

|

1 |

PART I

Forward-Looking Statements

Forward-looking statements in this report, including without limitation, statements related to Continental Resources Group, Inc.’s plans, strategies, objectives, expectations, intentions and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such forward-looking statements involve risks and uncertainties including without limitation the following: (i) Continental Resources Group, Inc.’s plans, strategies, objectives, expectations and intentions are subject to change at any time at the discretion of Continental Resources Group, Inc.; (ii) Continental Resources Group, Inc.’s plans and results of operations will be affected by Continental Resources Group, Inc.’s ability to manage growth; and (iii) other risks and uncertainties indicated from time to time in Continental Resources Group, Inc.’s filings with the Securities and Exchange Commission.

In some cases, you can identify forward-looking statements by terminology such as ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘could,’’ ‘‘expects,’’ ‘‘plans,’’ ‘‘intends,’’ ‘‘anticipates,’’ ‘‘believes,’’ ‘‘estimates,’’ ‘‘predicts,’’ ‘‘potential,’’ or ‘‘continue’’ or the negative of such terms or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of such statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We are under no duty to update any of the forward-looking statements after the date of this report.

Item 1. Business.

Corporate History

We were organized as Sienna Resources, Inc. in the State of Delaware on July 20, 2007 to engage in the acquisition, exploration and development of natural resource properties. We were an exploration stage company with no revenues or operating history. On December 21, 2009, we filed an Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware in order to, among other things, changed our name to “American Energy Fields, Inc.”. On June 28, 2011, we changed our name to “Continental Resources Group, Inc.” by merging a newly-formed, wholly owned subsidiary of the Company with and into the Company, with the Company as the surviving corporation in the merger.

On December 24, 2009, we entered into an Exchange Agreement with Green Energy Fields, Inc., and the shareholders of Green Energy. Upon closing of the transaction contemplated under the Exchange Agreement, on December 24, 2009, the shareholders of Green Energy transferred all of the issued and outstanding capital stock of Green Energy to us in exchange for 28,788,252 shares of our common stock. Such exchange caused Green Energy to become our wholly-owned subsidiary. Following the closing of the Exchange, we issued an aggregate of 9,300,000 shares of our common stock and two-year warrants to purchase an additional 4,650,000 shares of common stock exercisable at $0.40 per share, in a private placement to 16 investors for $1,395,000. Immediately following the closing of the foregoing, we transferred all of our pre-Exchange assets and liabilities to our wholly-owned subsidiary, Sienna Resources Holdings, Inc. Thereafter, we transferred all of the outstanding capital stock of Sienna Resources Holdings, Inc. to Julie Carter, our prior sole officer and director, in exchange for the cancellation of 15,250,000 shares of our common stock that she owned. Following the Exchange and the split-off transaction, we discontinued our former business and succeeded to the business of Green Energy as our sole line of business. Therefore, all discussions regarding (1) our financial statements and (2) our business relate to the business of Green Energy operating as our wholly-owned subsidiary.

Our principal executive offices are located at 3266 W. Galveston Drive, Suite 101 Apache Junction, Arizona 85120. Our telephone number is 480-288-6530.

General

We are primarily engaged in the acquisition and exploration of properties that may contain uranium mineralization in the United States. Our target properties are those that have been the subject of historical exploration. We have acquired State Leases and Federal unpatented mining claims in the states of California and Arizona for the purpose of exploration and potential development of uranium minerals on a total of approximately 7,200 acres.

1

Recent Developments

On July 22, 2011, the Company, Sagebrush Gold Ltd (“Sage”) and Continental Resources Acquisition Sub, Inc., Sage’s wholly owned subsidiary (“Acquisition Sub”), entered into an asset purchase agreement the (“Agreement”) pursuant to which Acquisition Sub purchased substantially all of the assets of the Company (the “Asset Sale”) in consideration for (i) shares of Sage’s common stock (the “Shares”) which shall be equal to eight (8) Shares for every ten (10) shares of the Company’s common stock outstanding; (ii) the assumption of the outstanding warrants to purchase shares of the Company’s common stock such that Sage shall deliver to the holders of the Company’s warrants, warrants to purchase shares of Sage’s common stock (the “Warrants”) which shall be equal to one Warrant to purchase eight (8) shares of Sage’s common stock for every warrant to purchase ten (10) shares the Company’s common stock outstanding at an exercise price equal to such amount as is required pursuant to the terms of the outstanding warrants, and (iii) the assumption of the Company’s 2010 Equity Incentive Plan and all options granted and issued thereunder such that Sage shall deliver to the Company’s option holders, options (the “Options”) to purchase an aggregate of such number of shares of Sage’s common stock issuable under Sage’s equity incentive plan which shall be equal to one option to purchase eight (8) shares of Sage’s common stock for every option to purchase ten (10) shares of the Company’s common stock outstanding with a strike price equal to such amount as is required pursuant to the terms of the outstanding option. The exercise price of the Warrants and the strike price and Options shall be determined and certified by an officer of Sage. Upon the closing of the Asset Sale, Acquisition Sub will assume the certain liabilities of the Company. The Asset Sale is intended to be tax-free for federal income tax purposes and constitutes a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended, and the regulations promulgated thereunder.

Under the terms of the Agreement, Sage purchased from the Company substantially all of the Company’s assets, including, but not limited to, 100% of the outstanding shares of common stock of the Company’s wholly-owned subsidiaries (CPX Uranium, Inc., Green Energy Fields, Inc., and ND Energy, Inc.). The acquired assets include approximately $13 million of cash. Under the terms of the Agreement Sage acquired:

|

(i)

|

state leases and federal unpatented mining claims and other rights to exploration, as owned as of the date hereof; all stock in subsidiaries, membership, joint venture, partnership and similar interests and claims, all royalty rights and claims, and all deposits, prepayments and refunds;

|

|

(ii)

|

all contracts;

|

|

(iii)

|

all cash and cash equivalents;

|

|

(iv)

|

all accounts or notes receivable held by the Company;

|

|

(v)

|

all books and records, including, but not limited to, books of account, ledgers and general, financial and accounting records, price lists, distribution lists, supplier lists, sales material and records;

|

|

(vi)

|

all furniture, fixtures, equipment, machinery, tools, office equipment, supplies, computers and other tangible personal property;

|

|

(vii)

|

all rights, claims and causes of action against third parties resulting from or relating to the operation of the Company’s business and the assets purchased under the Agreement prior to the date of closing, including without limitation, any rights, claims and causes of actions arising under warranties from vendors, patent or trademark infringement claims, insurance and other third parties and the proceeds thereof; and

|

|

(viii)

|

all Intellectual Property, goodwill associated therewith, licenses and sublicenses granted and obtained with respect thereto, and rights thereunder, remedies against past, present, and future infringements thereof, and rights to protection of past, present, and future interests therein under the laws of all jurisdictions

|

The closing of the Asset Sale is subject to various closing conditions, including receipt by Sage of advice that the receipt of the Shares by the Company’s stockholders upon liquidation is likely to be treated as tax free for United States income tax purposes and approval of a majority of the stockholders of the Company. A majority of the stockholders of the Company approved the Agreement by written consent on or about July 21, 2011. There can be no assurance that the transaction will be tax free to any particular stockholder or the ability or timing of receipt of all approvals necessary to liquidate. The Agreement constitutes a plan of reorganization within the meaning of Treasury Regulations Section 1.368-2(g) and constitutes a plan of liquidation of the Company. The Company is expected to liquidate on or prior to July 1, 2012. Sage has agreed to file a registration statement under the Securities Act of 1933, as amended (the “Securities Act”) in connection with liquidation of the Company no later than thirty (30) days following the later of the closing date of the Asset Sale or such date that the Company delivers to Sage its audited financial statements for the fiscal year ended March 31, 2011. The Company will subsequently distribute the registered Shares to its shareholders as part of its liquidation. Sage agreed to use its best efforts to cause such registration to be declared effective within twelve months following the closing date of the Asset Sale. Sage has agree to pay liquidated damages of 1% per month, up to a maximum of 5%, in the event that Sage fails to file or is unable to cause the registration statement to be declared effective.

2

COSO

The Coso property is located in Inyo County, California on the western margin of the Coso Mountains, 32 miles (51 km) south by road of Lone Pine in Inyo County, California, 150 miles (241 km) northeast by road to Bakersfield, CA, 187 miles (300 km) north by road of Los Angeles, CA, and 283 miles (455 km) west by road of Las Vegas, Nevada. The Coso Project is accessible from U.S. highway 395 by taking the Cactus Flat road, an unimproved road for about 3 to 4 miles east of the highway, and climbing approximately 500 to 1200 feet above the floor of Owens Valley.

On December 24, 2009, as a result of the Exchange, we acquired a 100% working interest and 97% net revenue interest in the Coso property. Prior to our acquisition, Green Energy acquired the project on November 30, 2009 from NPX Metals, Inc., a Nevada Corporation. The 97% net revenue interest is the result of the Agreement of Conveyance, Transfer and Assignment of Assets and Assumption of Obligations, dated as of November 30, 2009. Under the terms of the agreement, NPX Metals, Inc. retained a 3% net smelter return royalty interest in the Coso Property, leaving a 97% net revenue interest to Green Energy.

The Coso property consists of 169 Federal unpatented lode mining claims on Bureau of Land Management ("BLM") land totaling 3,380 acres, and 800 State leased acres, in Inyo County, California. The unpatented mining claims overlie portions of sections 12, 13, 24, 25, 26, 35, and 36 of Township 20 South, Range 37 East (Mount Diablo Base & Meridian), sections 13, 24, and 25 of Township 20 South, Range 37 1/2 East (Mount Diablo Base & Meridian), sections 1 and 12 of Township 21 South, Range 37 East (Mount Diablo Base & Meridian), and sections 6 and 7 of Township 21 South, Range 37 1/2 East (Mount Diablo Base & Meridian). The state lease covers portions of section 6 of Township 20 South, Range 37 East (Mount Diablo Base & Meridian) and section 36 of Township 20 South, Range 37 1/2 East (Mount Diablo Base & Meridian). To maintain the Coso mining claims in good standing, we must make annual maintenance fee payments to the BLM, in lieu of annual assessment work. These claim fees are $140.00 per claim per year, plus a recording cost of approximately $50 to Inyo County where the claims are located. With regard to the unpatented lode mining claims, future exploration drilling at the Coso Project will require us to either file a Notice of Intent or a Plan of Operations with the BLM , depending upon the amount of new surface disturbance that is planned. A Notice of Intent is for planned surface activities that anticipate less than 5.0 acres of surface disturbance, and usually can be obtained within a 30 to 60-day time period. A Plan of Operations will be required if there is greater than 5.0 acres of new surface disturbance involved with the planned exploration work. A Plan of Operations can take several months to be approved, depending on the nature of the intended work, the level of reclamation bonding required, the need for archeological surveys, and other factors as may be determined by the BLM.

The Coso property and the surrounding region is located in an arid environment in the rain shadow of the Sierra Nevada mountains. The property is located near the western margin of the Basin and Range province, a large geologic province in western North America characterized by generally north-south trending fault block mountain ranges separated by broad alluvial basins. The geology of the area includes late- Jurassic granite bedrock overlain by the Coso Formation, which consists of interfingered gravels, arkosic sandstone, and rhyolitic tuff. The Coso Formation is overlain by a series of lakebed deposits and volcanic tuffs.

Uranium mineralization at the Coso Property occurs primarily as disseminated deposits in the lower arkosic sandstone/fanglomerate member of the Coso Formation and along silicified fractures and faults within the granite. Uranium mineralization appears to have been deposited by hydrothermal fluids moving along fractures in the granite and the overlying Coso Formation. Mineralization is often accompanied by hematite staining, silicification, and dark staining from sulfides. Autinite is the only positively identified uranium mineral in the area. The main uranium anomalies are found within the basal arkose of the lower Coso Formation and the immediately adjacent granitic rocks.

Uranium exploration has been occurring in the area since the 1950s by a number of mining companies including Coso Uranium, Inc., Ontario Minerals Company, Western Nuclear, Pioneer Nuclear, Federal Resources Corp., and Union Pacific / Rocky Mountain Energy Corp. Previous uranium exploration and prospecting on the Coso property includes geologic mapping, pitting, adits, radon cup surveys, airborne geophysics and drilling. Our preliminary field observations of the geology and historical working appear to corroborate the historical literature. These historical exploration programs have identified specific exploration targets on the property. All previous work has been exploratory in nature, and no mineral extraction or processing facilities have been constructed. The exploration activities have resulted in over 400 known exploration holes, downhole gamma log data on the drill holes, chemical assay data, and airborne radiometric surveys, and metallurgical testing to determine amenability to leaching.

The property is undeveloped, and there are no facilities or structures. There are a number of adits and trenches from previous exploration activities, as well as more than 400 exploration drillholes.

The last major exploration activities on the Coso Property occurred during a drilling campaign in the mid-1970s. As of March 31, 2011 we have conducted field reconnaissance and mineral sampling on the property, but have not conducted any drilling or geophysical surveys. We plan to locate and identify the uranium anomalies targeted by previous exploration for further evaluation. If feasible, old drill holes in prospective areas will be re-entered and logged by down-hole radiometric probes to identify zones and grades of subsurface uranium mineralization. We are currently developing a detailed exploration plan for the Coso Property, together with budgets and timetables.

Power is available from the Mono Power Company transmission lines, which parallel U.S. highway 395. To date, the water source had not yet been determined.

With regard to the state mineral prospecting permit, we are currently authorized to locate on the ground past drill holes, adits, trenches and pits, complete a scintilometer survey, and conduct a sampling program including a bulk sample of 1,000 pounds for leach test. The Company is not currently authorized to conduct exploration drilling on the state mineral prospecting permit. Future drilling on the state mineral prospecting permit will require the Company to file environmental documentation under the California Environmental Quality Act.

3

The Coso Property does not currently have any reserves. All activities undertaken and currently proposed at the Coso Property are exploratory in nature.

4

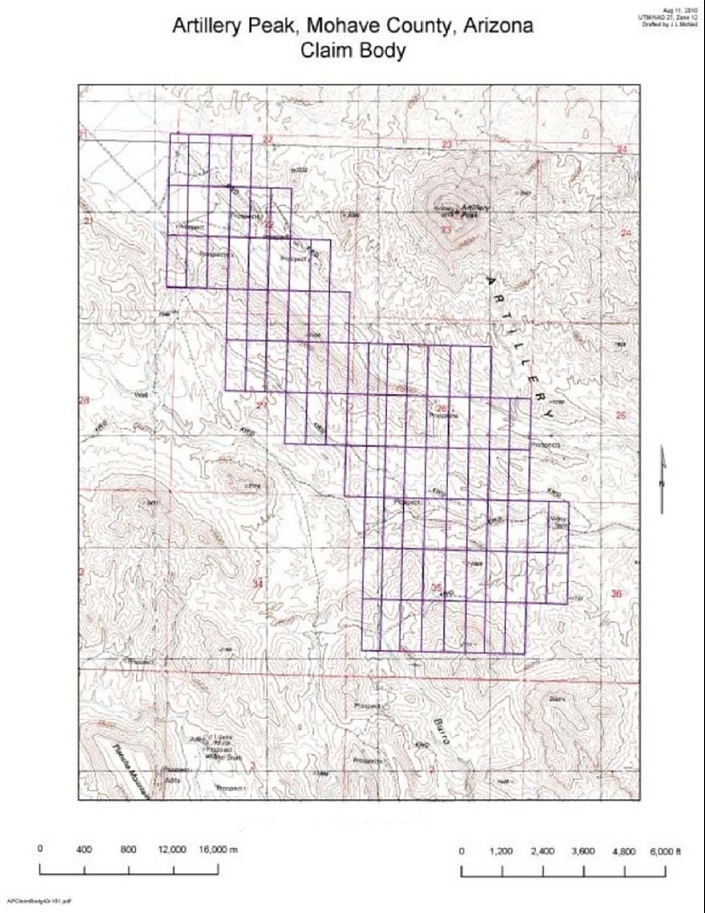

ARTILLERY PEAK

The Artillery Peak Property is located in western north-central Arizona near the southern edge of Mohave County. The Company’s claim group is composed of a total of 86 unpatented contiguous mining claims in Sections 22, 26, 27, 35, and 36 of Township 12 North, Range 13 West, Gila & Salt River Base & Meridian covering 1,720 acres of land managed by the BLM.

On April 26, 2010, the Company acquired a 100% interest (minus a 4% net smelter royalty interest) in 86 unpatented lode mining claims, located in Mohave county, Arizona for $65,000 in cash and 200,000 shares of common stock.

To maintain the Artillery Peak mining claims in good standing, we must make annual maintenance fee payments to the BLM, in lieu of annual assessment work. These claim fees are $140.00 per claim per year, plus minimal per claims cost of approximately $10 to $15 per claim recording fees to Mohave County where the claims are located.

The Artillery Peak Property is subject to an agreement to pay a net smelter return royalty interest of 4%. To date, there has been no production on the Property, and no royalties are owed. The claims are not subject to any other royalties or encumbrances.

The Artillery Peak Property lies within the Date Creek Basin, which is a region well known for significant uranium occurrence. Uranium exploration has been occurring in the Artillery Peak region since the 1950’s by a number of exploration and mining entities. Radioactivity was first discovered in the Date Creek Basin area by the U.S. Atomic Energy Commission in 1955 when a regional airborne radiometric survey was flown over the area. The Artillery Peak Property was first acquired by Jacquays Mining and first drilled in 1957. Subsequently the Property was acquired by Hecla Mining (1967), Getty Oil (1976) with a joint venture with Public Service Co of Oklahoma, Hometake Mining (1976) on adjacent properties to the south, Santa Fe Minerals (also around 1976), and Universal Uranium Limited in 2007. As of 2007, a total of 443 exploration holes were drilled into the Artillery Peak Property area.

The Artillery Peak uranium occurrences lie in the northwest part of the Miocene-age Date Creek Basin, which extends from the east to the west in a west-southwest direction, and includes the Anderson Uranium Mine. The uranium anomalies are found primarily within a lacustrine rock unit known as the Artillery Peak Formation. The uranium bearing sediments are typically greenish in color and are thin-bedded to laminated, well-sorted, sandstone, siltstone and limestone.

The Company released a technical report on October 12, 2010 formatted according to Canadian National Instrument 43-101 standards prepared by Dr. Karen Wenrich, an expert on uranium mineralization in the southwestern United States, and Allen Wells, who performed a mineral resource estimate (as defined by the Canadian Institute of Mining, Metallurgy and Petroleum) based on historical data and the recent 2007 data. As recommended in the technical report, the Company expects to develop plans to conduct exploration drilling to further delineate the extent and nature of the uranium mineralization at the Artillery Peak Property. We are currently developing a detailed exploration plan for the Artillery Peak Property, together with budgets and timetables.

Access to the property is either southeast from Kingman or northwest from Wickenburg along U.S. Highway 93, then following the Signal Mountain Road (dirt) for 30 miles toward Artillery Peak. Road access within the claim block is on unimproved dirt roads that currently are in good condition. The property is undeveloped, and there are no facilities or structures.

A power line runs northeast to southwest approximately 2 miles to the northwest of the Artillery Peak Property, and power for the Property will be tied to the national power grid. Other than that, no utilities exist on or near the Artillery Peak Project area. The transmission power line runs northwest to southeast along U.S. Highway 93, approximately 30 miles to the east. The water supply may be provided by drilling in the thick alluvial fill and located only 2-7 miles from the perennial Big Sandy River.

The Artillery Peak Property does not currently have any reserves. All activities undertaken and currently proposed at the Artillery Peak Property are exploratory in nature.

5

6

7

BLYTHE

The Blythe project is located in the southern McCoy Mountains in Riverside County, California approximately 15 miles west of the community of Blythe. It consists of 66 unpatented lode mining claims (the NPG Claims) covering 1,320 acres of BLM land.

On December 24, 2009, as a result of the Exchange, we acquired a 100% interest (minus a 3% Net Smelter Return Royalty) in the Blythe Property. Prior to our acquisition, Green Energy acquired the project on November 30, 2009.

The Blythe Property is located in an arid environment within the Basin and Range Province. The southern McCoy Mountains are composed of Precambrian metasediments, including meta-conglomerates, grits, quartzites and minor interbedded shales.

Uranium mineralization occurs along fractures, in meta-conglomerates and in breccia zones. Secondary uranium minerals occur on fracture surfaces and foliation planes adjacent to fine veinlets of pitchblende. Uranium minerals include uraninite (pitchblende), uranophane, gummite and boltwoodite. It has been reported that the uranium mineralization tends to occur in areas where finely disseminated hematite is present.

Although there are no known intrusive bodies near the property, it is believed that the uranium mineralization could be hydrothermal in origin and genetically related to an intrusive source. If such a deep-seated intrusive body underlies the property it is possible that larger concentrations of primary uranium ore may exist at depth.

A number of companies have worked on the Blythe uranium property during the 1950s through the 1980s. Several shipments of ore were reportedly shipped from the property.

Currently, we are still in the process of assessing the Blythe Property.

The Blythe Property does not currently have any reserves. All activities undertaken and currently proposed at the Coso Property are exploratory in nature.

We propose to locate and re-enter as many old drill holes as possible. These holes will be probed with geophysical instruments to determine radioactivity and uranium mineralization in the subsurface. If these results are positive, then additional drilling and down-hole probing will be proposed.

BRECCIA PIPE PROJECT

On February 15, 2011, the Company, its wholly owned subsidiary, Green Energy, and Dr. Karen Wenrich entered into an asset purchase agreement pursuant to which Green Energy has agreed to purchase certain unpatented mining claims commonly known as the “Arizona Breccia Pipes Project” located in the Coconino and Mohave counties of Arizona only upon the occurrence of certain conditions precedent. The consummation of the mining purchase will occur only in the event that certain actions taken by the BLM on July 20, 2009, which had the effect of withdrawing certain lands in the vicinity of the property from mineral location and entry, are terminated within five (5) years from the date of the Agreement leaving more than 50% of the total unpatented mining claims that comprise the property open to mineral location and entry. In the event the withdrawal termination occurs that results in fewer than 50% of the total unpatented mining claims that comprise the property opened to mineral location and entry, Green Energy will have an unrestricted option to purchase the property pursuant to the terms of the agreement (the “Purchase Option”). The Purchase Option expires 120 days from the date of the withdrawal termination.

The withdrawal is currently being studied in an Environmental Impact Statement prepared by the BLM. The withdrawal at any time may be extended in duration and scope and there can be no assurance that the withdrawal termination will occur and that the Mining Purchase will occur.

Pursuant to the terms of the agreement, in the event of the closing, Green Energy has agreed to spend an aggregate of at least $1,500,000 in exploration and related work commitments on the Property over the course of three (3) years from the date of closing with, a promised expenditure of $250,000 within the first year of closing. Green Energy will retain a right of first refusal for the sale of any additional properties, of which Dr. Wenrich becomes a majority owner, within a 30-mile radius of the property.

These breccia pipes are vertical pipe-like columns of broken rock (breccia) that formed when layers of sandstone, shale and limestone collapsed downward into underlying caverns. A typical pipe is approximately 300 feet in diameter and extends vertically as much as 3,000 feet.

The uranium-bearing breccia pipes of the northern Arizona breccia pipe district are among the highest grade uranium deposits in the United States. In addition to uranium, the breccia pipes are also known to contain rare earth metals, including neodymium, and a variety of other valuable metals, including zinc, vanadium, cadmium, copper, silver, molybdenum, cobalt, nickel, gallium, and germanium.

8

The Breccia Pipe Property does not currently have any reserves. All activities undertaken and currently proposed at the Breccia Pipe Property are exploratory in nature. Currently, we are still in the process of assessing the Breccia Pipe Property.

PROSPECT URANIUM

On March 17, 2011, the Company entered into Membership Interests Sale Agreements with Prospect Uranium Inc., a Nevada corporation and Gordon R. Haworth for the purchase of 51.35549% and 24.32225% respectively of the membership interests of Secure Energy LLC, a North Dakota limited liability company.

Secure Energy’s current assets include the following:

|

1.

|

Data package including historical exploration data including drill logs, surface samples, maps, reports and other information on various uranium prospects in North Dakota.

|

|

2.

|

Uranium Lease Agreement with Robert Petri, Jr. and Michelle Petri dated June 28, 2007. Location: Township 134 North, Range 100 West of the Fifth Principal Meridian. Sec. 30: Lots 1 (37.99), 2 (38.13), 3 (38.27), 4 (38.41) and E1/2 W1/2 and SE 1/4.

|

|

3.

|

Uranium Lease Agreement with Robert W. Petri and Dorothy Petri dated June 28, 2007. Location: Township 134 North, Range 100 West of the Fifth Principal Meridian. Sec. 30: Lots 1 (37.99), 2 (38.13), 3 (38.27), 4 (38.41) and E1/2 W1/2 and SE 1/4.

|

|

4.

|

Uranium Lease Agreement with Mark E. Schmidt dated November 23, 2007. Location: Township 134 North, Range 100 West of the Fifth Principal Meridian. Sec. 31: Lots 1 (38.50), 2 (38.54), 3 (38.58), 4 (38.62) and E1/2 W1/2, W1/2NE1/4, SE 1/4.

|

The uranium lease agreements include the rights to conduct exploration for and mine uranium, thorium, vanadium, other fissionable source materials, and all other mineral substances contained on or under the leased premises. The leased premises consist of a total of 1,027 acres located in Slope County, North Dakota.

Drill logs from the uranium leases show uranium mineralized roll fronts in sandstone, with uranium mineralization occurring within 350 feet of the surface. Additional layers of sandstone exist at deeper intervals but have not been cored or logged.

The Prospect Uranium Property does not currently have any reserves. All activities undertaken and currently proposed at the Prospect Uranium Property are exploratory in nature. Currently, we are still in the process of assessing the Prospect Uranium Property.

Competition

We do not compete directly with anyone for the exploration or removal of minerals from our property as we hold all interest and rights to the claims. Readily available commodities markets exist in the U.S. and around the world for the sale of minerals. Therefore, we will likely be able to sell minerals that we are able to recover. We will be subject to competition and unforeseen limited sources of supplies in the industry in the event spot shortages arise for supplies such as dynamite, and certain equipment such as bulldozers and excavators that we will need to conduct exploration. If we are unsuccessful in securing the products, equipment and services we need we may have to suspend our exploration plans until we are able to secure them.

Compliance with Government Regulation

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the United States generally. We will also be subject to the regulations of the Bureau of Land Management (“BLM”).

We are required to pay annual maintenance fees to the BLM to keep our Federal lode mining claims in good standing. The maintenance period begins at noon on September 1st through the following September 1st and payments are due by the first day of the maintenance period. The annual fee is $140 per claim.

Future exploration drilling on any of our properties that consist of BLM land will require us to either file a Notice of Intent or a Plan of Operations with the BLM, depending upon the amount of new surface disturbance that is planned. A Notice of Intent is for planned surface activities that anticipate less than 5.0 acres of surface disturbance, and usually can be obtained within a 30 to 60-day time period. A Plan of Operations will be required if there is greater than 5.0 acres of new surface disturbance involved with the planned exploration work. A Plan of Operations can take several months to be approved, depending on the nature of the intended work, the level of reclamation bonding required, the need for archeological surveys, and other factors as may be determined by the BLM. For the properties located in Arizona, permits to drill are also required from the Arizona Department of Water Resources (ADWR).

9

Research and Development

We have not expended funds for research and development costs since inception.

Employees

As of August 12, 2011, we had 8 full-time employees and 2 part-time employees. We believe our employee relations to be good. One employee is considered a member of the executive management.

Legal Proceedings

From time to time, we may become involved in litigation relating to claims arising out of our operations in the normal course of business. We are not currently involved in any pending legal proceeding or litigation and, to the best of our knowledge, no governmental authority is contemplating any proceeding to which we are a party or to which any of our properties is subject, which would reasonably be likely to have a material adverse effect on our business, financial condition and operating results.

Item 1A. Risk Factors.

Investing in our common stock involves a high degree of risk. Prospective investors should carefully consider the risks described below and other information contained in this annual report, including our financial statements and related notes before purchasing shares of our common stock. There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. If any of these risks actually occurs, our business, financial condition or results of operations may be materially adversely affected. In that case, the trading price of our common stock could decline and investors in our common stock could lose all or part of their investment.

Risks Relating to Our Business

WE ARE AN EXPLORATION STAGE COMPANY AND HAVE ONLY RECENTLY COMMENCED EXPLORATION ACTIVITIES ON OUR CLAIMS. WE EXPECT TO INCUR OPERATING LOSSES FOR THE FORESEEABLE FUTURE.

Our evaluation of the Coso, Artillery Peak and Blythe mining claims up to this point is primarily a result of historical exploration data. Although we have made field observations, our exploration program is just getting under way. Accordingly, we are not yet in a position to evaluate the likelihood that our business will be successful. We have not earned any revenues as of the date of this report. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from development and production of minerals from the claims, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

BECAUSE WE HAVE NOT SURVEYED OUR MINING CLAIMS, WE MAY DISCOVER MINERALIZATION ON THE CLAIMS THAT IS NOT WITHIN OUR CLAIMS BOUNDARIES.

While we have conducted mineral claim title searches, this should not be construed as a guarantee of claims boundaries. Until the claims are surveyed, the precise location of the boundaries of the claims may be in doubt. If we discover mineralization that is close to the claims boundaries, it is possible that some or all of the mineralization may occur outside the boundaries. In such a case we would not have the right to extract those minerals.

IF WE DISCOVER COMMERCIAL RESERVES OF PRECIOUS METALS ON OUR MINERAL PROPERTY, WE CAN PROVIDE NO ASSURANCE THAT WE WILL BE ABLE TO OBTAIN FINANCING TO SUCCESSFULLY ADVANCE THE MINERAL CLAIMS INTO COMMERCIAL PRODUCTION.

If our exploration program is successful in establishing ore of commercial tonnage and grade, we will require additional funds in order to advance the claims into commercial production. Obtaining additional financing would be subject to a number of factors, including the market price for the minerals, investor acceptance of our claims and general market conditions. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. The most likely source of future funds is through the sale of equity capital. Any sale of share capital will result in dilution to existing shareholders. We may be unable to obtain any such funds, or to obtain such funds on terms that we consider economically feasible and an investor may lose any investment he makes in our shares.

10

OUR INDEPENDENT AUDITOR HAS ISSUED AN AUDIT OPINION WHICH INCLUDES A STATEMENT DESCRIBING A DOUBT WHETHER WE WILL CONTINUE AS A GOING CONCERN.

As described in Note 1 of our accompanying financial statements, our lack of operations and any guaranteed sources of future capital create substantial doubt as to our ability to continue as a going concern. If our business plan does not work, we could remain as a start-up company with limited operations and revenues.

GOVERNMENT REGULATION OR OTHER LEGAL UNCERTAINTIES MAY INCREASE COSTS AND OUR BUSINESS WILL BE NEGATIVELY AFFECTED.

Laws and regulations govern the exploration, development, mining, production, importing and exporting of minerals; taxes; labor standards; occupational health; waste disposal; protection of the environment; mine safety; toxic substances; and other matters. In many cases, licenses and permits are required to conduct mining operations. Amendments to current laws and regulations governing operations and activities of mining companies or more stringent implementation thereof could have a substantial adverse impact on us. Applicable laws and regulations will require us to make certain capital and operating expenditures to initiate new operations. Under certain circumstances, we may be required to stop exploration activities, once started, until a particular problem is remedied or to undertake other remedial actions.

THE GLOBAL ECONOMIC CRISIS COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR LIQUIDITY AND CAPITAL RESOURCES.

The recent distress in the financial markets has resulted in extreme volatility in security prices and diminished liquidity and credit availability, and there can be no assurance that our liquidity will not be affected by changes in the financial markets and the global economy or that our capital resources will at all times be sufficient to satisfy our liquidity needs. In addition, the tightening of the credit markets could make it more difficult for us to access funds, enter into agreements for new debt or obtain funding through the issuance of our securities.

11

Risks Relating to Our Organization

AS A RESULT OF THE EXCHANGE, GREEN ENERGY BECAME A SUBSIDIARY OF OURS AND SINCE WE ARE SUBJECT TO THE REPORTING REQUIREMENTS OF FEDERAL SECURITIES LAWS, THIS CAN BE EXPENSIVE AND MAY DIVERT RESOURCES FROM OTHER PROJECTS, THUS IMPAIRING OUR ABILITY GROW.

As a result of the Exchange, Green Energy became a subsidiary of ours and, accordingly, is subject to the information and reporting requirements of the Exchange Act, and other federal securities laws, including compliance with the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the SEC (including reporting of the Exchange) and furnishing audited reports to stockholders will cause our expenses to be higher than they would have been if Green Energy had remained privately held and did not consummate the Exchange.

It may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We will need to hire additional financial reporting, internal controls and other finance personnel in order to develop and implement appropriate internal controls and reporting procedures. If we are unable to comply with the internal controls requirements of the Sarbanes-Oxley Act, then we may not be able to obtain the independent accountant certifications required by such act, which may preclude us from keeping our filings with the SEC current and interfere with the ability of investors to trade our securities and for our shares to continue to be quoted on the OTC Bulletin Board or to list on any national securities exchange.

OUR CERTIFICATE OF INCORPORATION ALLOWS FOR OUR BOARD TO CREATE NEW SERIES OF PREFERRED STOCK WITHOUT FURTHER APPROVAL BY OUR STOCKHOLDERS WHICH COULD ADVERSELY AFFECT THE RIGHTS OF THE HOLDERS OF OUR COMMON STOCK.

Our board of directors has the authority to fix and determine the relative rights and preferences of preferred stock. Our board of directors also has the authority to issue preferred stock without further stockholder approval. As a result, our board of directors could authorize the issuance of a series of preferred stock that would grant to such holders (i) the preferred right to our assets upon liquidation, (ii) the right to receive dividend payments before dividends are distributed to the holders of common stock and (iii) the right to the redemption of the shares, together with a premium, prior to the redemption of our common stock. In addition, our board of directors could authorize the issuance of a series of preferred stock that has greater voting power than our common stock or that is convertible into our common stock, which could decrease the relative voting power of our common stock or result in dilution to our existing common stockholders.

WE LACK PROPER INTERNAL CONTROLS AND PROCEDURES

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our Exchange Act reports is recorded, processed, summarized, and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure based on the definition of “disclosure controls and procedures” in Rule 13a-15(e). In designing and evaluating the disclosure controls and procedures, our management recognized that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives, and management necessarily was required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures.

During the course of the preparation of our March 31, 2011 financial statements, we identified certain material weaknesses relating to our internal controls and procedures within the areas of accounting for equity transactions. Some of these internal control deficiencies may also constitute deficiencies in our disclosure and internal controls.

PUBLIC COMPANY COMPLIANCE MAY MAKE IT MORE DIFFICULT TO ATTRACT AND RETAIN OFFICERS AND DIRECTORS.

The Sarbanes-Oxley Act and rules implemented by the SEC have required changes in corporate governance practices of public companies. As a public company, we expect these rules and regulations to increase our compliance costs in 2011 and beyond and to make certain activities more time consuming and costly. As a public company, we also expect that these rules and regulations may make it more difficult and expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers, and to maintain insurance at reasonable rates, or at all.

12

Risks Relating to Our Common Stock

WE MAY FAIL TO QUALIFY FOR CONTINUED LISTING ON THE OTC BULLETIN BOARD WHICH COULD MAKE IT MORE DIFFICULT FOR INVESTORS TO SELL THEIR SHARES.

Our common stock is listed on the Over the Counter Bulletin Board (“OTCBB”). There can be no assurance that trading of our common stock on such market will be sustained or that we can meet OTCBB’s continued listing standards. In the event that our common stock fails to qualify for continued inclusion, our common stock could thereafter only be quoted on the “pink sheets.” Under such circumstances, shareholders may find it more difficult to dispose of, or to obtain accurate quotations, for our common stock, and our common stock would become substantially less attractive to certain purchasers such as financial institutions, hedge funds and other similar investors.

OUR COMMON STOCK MAY BE AFFECTED BY LIMITED TRADING VOLUME AND PRICE FLUCTUATIONS WHICH COULD ADVERSELY IMPACT THE VALUE OF OUR COMMON STOCK.

There has been limited trading in our common stock and there can be no assurance that an active trading market in our common stock will either develop or be maintained. Our common stock has experienced, and is likely to experience in the future, significant price and volume fluctuations which could adversely affect the market price of our common stock without regard to our operating performance. In addition, we believe that factors such as quarterly fluctuations in our financial results and changes in the overall economy or the condition of the financial markets could cause the price of our common stock to fluctuate substantially. These fluctuations may also cause short sellers to periodically enter the market in the belief that we will have poor results in the future. We cannot predict the actions of market participants and, therefore, can offer no assurances that the market for our common stock will be stable or appreciate over time.

OUR STOCK PRICE MAY BE VOLATILE.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including the following:

|

|

•

|

changes in our industry;

|

|

|

•

|

competitive pricing pressures;

|

||

|

•

|

our ability to obtain working capital financing;

|

||

|

•

|

additions or departures of key personnel;

|

||

|

•

|

sales of our common stock;

|

||

|

•

|

our ability to execute our business plan;

|

||

|

•

|

operating results that fall below expectations;

|

||

|

•

|

loss of any strategic relationship;

|

||

|

•

|

regulatory developments; and

|

||

|

•

|

economic and other external factors.

|

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

WE HAVE NOT PAID CASH DIVIDENDS IN THE PAST AND DO NOT EXPECT TO PAY CASH DIVIDENDS IN THE FUTURE. ANY RETURN ON AN INVESTMENT IN OUR COMMON STOCK MAY BE LIMITED TO THE VALUE OF THE COMMON STOCK.

We have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. The payment of dividends on our common stock will depend on our earnings, financial condition, and other business and economic factors as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on a shareholder’s investment will only occur if our stock price appreciates.

OFFERS OR AVAILABILITY FOR SALE OF A SUBSTANTIAL NUMBER OF SHARES OF OUR COMMON STOCK MAY CAUSE THE PRICE OF OUR COMMON STOCK TO DECLINE.

If our stockholders sell substantial amounts of our Common stock in the public market, including shares issued in the Private Placement upon the effectiveness of the registration statement of which this prospectus forms a part, or upon the expiration of any statutory holding period, under Rule 144, or issued upon the exercise of outstanding options or warrants, it could create a circumstance commonly referred to as an "overhang" and in anticipation of which the market price of our Common stock could fall. The existence of an overhang, whether or not sales have occurred or are occurring, also could make more difficult our ability to raise additional financing through the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate. The shares of common stock sold in the Private Placements will be freely tradable upon the earlier of: (i) effectiveness of a registration statement covering such shares and (ii) the date on which such shares may be sold without registration pursuant to Rule 144 (or other applicable exemption) under the Securities Act.

13

INVESTOR RELATIONS ACTIVITIES, NOMINAL “FLOAT” AND SUPPLY AND DEMAND FACTORS MAY AFFECT THE PRICE OF OUR STOCK.

We expect to utilize various techniques such as non-deal road shows and investor relations campaigns in order to create investor awareness for the Company. These campaigns may include personal, video and telephone conferences with investors and prospective investors in which our business practices are described. We may provide compensation to investor relations firms and pay for newsletters, websites, mailings and email campaigns that are produced by third-parties based upon publicly-available information concerning the Company. We will not be responsible for the content of analyst reports and other writings and communications by investor relations firms not authored by the Company or from publicly available information. We do not intend to review or approve the content of such analysts’ reports or other materials based upon analysts’ own research or methods. Investor relations firms should generally disclose when they are compensated for their efforts, but whether such disclosure is made or complete is not under our control. In addition, investors in the Company may be willing, from time to time, to encourage investor awareness through similar activities. Investor awareness activities may also be suspended or discontinued which may impact the trading market our common stock.

The SEC and FINRA enforce various statutes and regulations intended to prevent manipulative or deceptive devices in connection with the purchase or sale of any security and carefully scrutinize trading patterns and company news and other communications for false or misleading information, particularly in cases where the hallmarks of “pump and dump” activities may exist, such as rapid share price increases or decreases. We, and our shareholders may be subjected to enhanced regulatory scrutiny due to the small number of holders who initially will own the registered shares of our common stock publicly available for resale, and the limited trading markets in which such shares may be offered or sold which have often been associated with improper activities concerning penny-stocks, such as the OTC Bulletin Board or the OTCQB Marketplace (Pink OTC) or pink sheets. Until such time as the common stock sold in the Private Placement is registered and until such time as our restricted shares are registered or available for resale under Rule 144, there will continue to be a small percentage of shares held by a small number of investors, many of whom acquired such shares in privately negotiated purchase and sale transactions, that will constitute the entire available trading market. The Supreme Court has stated that manipulative action is a term of art connoting intentional or willful conduct designed to deceive or defraud investors by controlling or artificially affecting the price of securities. Often times, manipulation is associated by regulators with forces that upset the supply and demand factors that would normally determine trading prices. Since a small percentage of the outstanding common stock of the Company will initially be available for trading, held by a small number of individuals or entities, the supply of our common stock for sale will be extremely limited for an indeterminate amount of time, which could result in higher bids, asks or sales prices than would otherwise exist. Securities regulators have often cited thinly-traded markets, small numbers of holders, and awareness campaigns as components of their claims of price manipulation and other violations of law when combined with manipulative trading, such as wash sales, matched orders or other manipulative trading timed to coincide with false or touting press releases. There can be no assurance that the Company’s or third-parties’ activities, or the small number of potential sellers or small percentage of stock in the “float,” or determinations by purchasers or holders as to when or under what circumstances or at what prices they may be willing to buy or sell stock will not artificially impact (or would be claimed by regulators to have affected) the normal supply and demand factors that determine the price of the stock.

EXERCISE OF OPTIONS AND WARRANTS MAY HAVE A DILUTIVE EFFECT ON OUR COMMON STOCK.

If the price per share of our Common stock at the time of exercise of any options, or any other convertible securities is in excess of the various exercise or conversion prices of such convertible securities, exercise or conversion of such convertible securities would have a dilutive effect on our Common stock. As of August 12, 2011, we had (i) outstanding options to purchase 2,810,000 shares of our Common stock at an exercise price of $0.25 per share, and (ii) outstanding warrants to purchase 4,650,000 shares of our Common stock at $0.40 per share and outstanding warrants to purchase 47,308,749 shares of our Common stock at $0.50 per share. Further, any additional financing that we secure may require the granting of rights, preferences or privileges senior to those of our Common stock and result in additional dilution of the existing ownership interests of our common stockholders.

OUR COMMON STOCK MAY BE DEEMED A “PENNY STOCK,” WHICH WOULD MAKE IT MORE DIFFICULT FOR OUR INVESTORS TO SELL THEIR SHARES.

Our common stock may be subject to the “penny stock” rules adopted under Section 15(g) of the Exchange Act. The penny stock rules generally apply to companies whose common stock is not listed on The NASDAQ Stock Market or other national securities exchange and trades at less than $4.00 per share, other than companies that have had average revenue of at least $6,000,000 for the last three years or that have tangible net worth of at least $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules require, among other things, that brokers who trade penny stock to persons other than “established customers” complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. If we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market for our securities. If our securities are subject to the penny stock rules, investors will find it more difficult to dispose of our securities.

14

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties.

As of March 31, 2011, we have 169 unpatented lode mining claims on BLM land and one state lease associated with the Coso Property, 86 unpatented lode mining claims on BLM land associated with the Artillery Peak Property, and 66 unpatented lode mining claims on BLM land associated with the Blythe Property as described in detail in Item 1 above.

For a description of our Coso, Artillery Peak, Blythe, and other mineral properties, please refer to Item 1 herein, which is hereby incorporated by reference to this Item 2.

Principal Executive Office

On January 1, 2010, we entered into a sublease with NAEC for 750 square feet of office space for our principal executive offices located at 3266 W. Galveston Drive, Suite 101 Apache Junction, Arizona 85120. The rent for this office space is $1,500 per month and increased to $2,500 per month in May 2010. The term of the sublease is “month to month”. NAEC is an affiliated company whereby our CEO, Mr, Joshua Bleak is the President.

Item 3. Legal Proceedings.

There are no legal proceedings pending, and we are not aware of any material proceeding contemplated by a governmental authority, to which we are a party or any of our property is subject.

Item 4. (Removed and Reserved.)

15

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common stock is quoted on the OTC Bulletin Board under the symbol “AEFI.OB” and commenced trading on April 5, 2010. The following table sets forth the high and low bid quotation prices as reported on the OTC Bulletin Board. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not represent actual transactions. Prior to April 5, 2010, there was no active market for our Common stock. As of August 12, 2011, there were approximately 147 holders of record of our Common stock.

The following table sets forth the high and low bid prices for our Common stock for the periods indicated, as reported by the OTC Bulletin Board. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not represent actual transactions.

|

Period

|

High

|

Low

|

||||

|

January 1, 2011 through March 31, 2011

|

$

|

1.43

|

$

|

0.51

|

||

|

October 1, 2010 through December 31, 2010

|

$

|

0.98

|

$

|

0.45

|

||

|

July 1, 2010 through September 30, 2010

|

$

|

0.76

|

$

|

0.30

|

||

|

April 5, 2010 through June 30, 2010

|

$

|

1.04

|

$

|

0.18

|

||

The last reported sales price of our Common stock on the OTC Bulletin Board on August 11, 2011 was $0.36 per share.

Dividend Policy

On December 21, 2009, our board of directors declared a dividend of an additional 11.2 shares of our common stock on each share of our common stock outstanding on December 21, 2009. We have never paid cash dividends on our common stock. For the foreseeable future, we intend to retain any earnings to finance the development and expansion of our business, and we do not anticipate paying any cash dividends on our common stock. Any future determination to pay dividends will be at the discretion of our Board of Directors and will be dependent upon the existing conditions, including our financial condition and results of operations, capital requirements, contractual restrictions, business prospects, and other factors that our Board of Directors considers relevant.

Securities Authorized for Issuance under Equity Compensation Plans

On April 1, 2010, we adopted our 2010 Equity Incentive Plan which reserved 7,500,000 shares of our common stock for issuances thereunder.

Equity Compensation Plan Information

|

Number of Securities

to be Issued upon Exercise of Outstanding Options, Warrants, and Rights

|

Weighted

average exercise

price of

Outstanding

Options,

Warrants and

Rights

|

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans

|

|||||||||||

|

Equity compensation plans approved by security holders

|

2,810,000

|

$0.25

|

4,690,000

|

||||||||||

|

Equity compensation plans not approved by security holders

|

0

|

0

|

0

|

||||||||||

|

Total

|

2,810,000

|

$0.25

|

4,690,000

|

||||||||||

16

Recent Sales of Unregistered Securities

On July 20, 2007, we issued a total of 1,250,000 shares of common stock to one director for cash in the amount of $0.01 per share for a total of $12,500.

On April 13, 2009, we issued a total of 1,000,000 shares of common stock to 26 individuals for cash in the amount of $0.025 per share for a total of $25,000.

On December 21, 2009, the board of directors declared a dividend of an additional 11.2 shares of its common stock on each share of its common stock outstanding on December 21, 2009.

On December 24, 2009, we entered into the Exchange with Green Energy and its shareholders. The Green Energy shareholders transferred all of the issued and outstanding capital stock of Green Energy to us in exchange for the right to receive one share of our common stock for each share of Green Energy common stock. Accordingly, an aggregate of 28,788,252 shares of our common stock were issued to the shareholders of Green Energy.

On December 24, 2009, we issued a total of 9,300,000 shares of common stock to certain accredited investors for an aggregate purchase price of $1,395,000. In connection therewith, we also issued two year warrants to purchase an aggregate of 4,650,000 shares of our common stock at a purchase price of $0.40 per share.

On March 19, 2010, we issued to our then Chairman, Randall Reneau, an aggregate of 350,000 restricted shares of our common stock and options to purchase 750,000 shares of our common stock at an exercise price of $0.15 per share, which shall vest 150,000 shares every six months over a thirty month vesting period.

On April 26, 2010, we granted 200,000 shares of our common stock to NPX Metals, Inc. as partial consideration for the purchase of certain mining claims.

On July 15, 2010, the Company executed an investor relations agreement, pursuant to which it is required to issue 2,000,000 shares of common stock to the consultant in consideration for certain investor relations services. The shares were issued in October of 2010. This transaction did not involve any underwriters, underwriting discounts or commissions, or any public offering and we believe was exempt from the registration requirements of the Securities Act of 1933 by virtue of Section 4(2) thereof and/or Regulation D promulgated thereunder.

On September 1, 2010, the Company entered into consulting agreements with four consultants whereby the Company agreed to issue an aggregate of 800,000 shares of its common stock (200,000 shares per consultant) in consideration for certain services related to business development, financial management and communications. This transaction did not involve any underwriters, underwriting discounts or commissions, or any public offering and we believe was exempt from the registration requirements of the Securities Act of 1933 by virtue of Section 4(2) thereof and/or Regulation D promulgated thereunder.

On October 6, 2010, the Company entered into an agreement with its newly appointed director, Bill Allred, whereby, in consideration for Mr. Allred’s services as an independent director of the Company, the Company agreed to issue an aggregate of 150,000 stock options with an exercise price of $0.25 per share, which shall vest 30,000 shares every six months for a total vesting period of thirty (30) months.

On October 15, 2010, the Company accepted subscriptions for and issued secured convertible promissory notes (the “Bridge Notes”) in the aggregate principal amount of $50,000. The Bridge Notes mature on the sixth month anniversary of the date of issuance (the “Maturity Date”) and accrue interest at an annual rate of ten percent (10%). In connection with the issuance of the Bridge Notes, the Company granted 25,000 shares of its common stock to each recipient of $50,000 Bridge Notes. The Bridge Notes are payable in full on the Maturity Date unless previously converted into shares of the Company’s common stock at an initial conversion price of $1.00 per share, as may be adjusted. Additionally, the holders of the Bridge Notes shall have the right to convert the principal and any interest due under the Bridge Notes, on a dollar-for-dollar basis, into the shares of the Company issued and sold to investors in a Qualified Financing (as that term is defined in the Bridge Notes), at a conversion price equal to that purchase price per share of the Qualified Financing securities paid by the investors in such financing.

The above transactions did not involve any underwriters, underwriting discounts or commissions, or any public offering. The issuance of these securities was deemed to be exempt from the registration requirements of the Securities Act of 1933 by virtue of Section 4(2) thereof, as a transaction by an issuer not involving a public offering.

On December 3, 2010, the Company accepted subscriptions for and issued Bridge Notes in the aggregate principal amount of $50,000 on the same terms as described above. In connection with the issuance of the Bridge Notes, the Company granted 25,000 shares of its common stock to each recipient of $50,000 Bridge Notes.

17

Between December 3, 2010 and March 4, 2011, the Company sold an aggregate of 36,140,763 of units consisting of one share of the Company’s common stock and one five year warrant to purchase one additional share of common stock at an exercise price of $0.50 per share for a per unit price of $0.50 for aggregate gross proceeds of $18,070,381.

The Units were all sold and/or issued only to “accredited investors,” as such term is defined in the Securities Act of 1933, as amended (the “Securities Act”) or pursuant to Regulation S promulgated under the Securities Act, were not registered under the Securities Act or the securities laws of any state, and were offered and sold in reliance on the exemption from registration afforded by Section 4(2) and Regulation D (Rule 506) or Rule 903 of Regulation S, under the Securities Act and corresponding provisions of state securities laws.

On March 17, 2011, the Company issued an aggregate of 3,700,000 shares of restricted common stock, subject to a 24-month lockup in consideration for membership interests of Secure Energy LLC. The shares were all sold and/or issued only to “accredited investors,” as such term is defined in the Securities Act of 1933, as amended (the “Securities Act”), were not registered under the Securities Act or the securities laws of any state, and were offered and sold in reliance on the exemption from registration afforded by Section 4(2) and Regulation D (Rule 506) and corresponding provisions of state securities laws.

On April 8, 2011, we issued an aggregate of 750,000 shares of our common stock to Geneva Asset Investment S.A. in consideration for services pursuant to a consulting agreement. The issuance of these securities was deemed to be exempt from the registration requirements of the Securities Act of 1933 by virtue of Section 4(2) thereof, as a transaction by an issuer not involving a public offering.

On December 28, 2010, we issued 600,000 shares of our common stock in consideration for consulting services pursuant to an amended consulting agreement between the Company and Marinex Media, Inc. On June 14, 2011, we appointed to the board of directors Jonathan Braun, who is the President of Marinex Media, Inc. The issuance of these securities was deemed to be exempt from the registration requirements of the Securities Act of 1933 by virtue of Section 4(2) thereof, as a transaction by an issuer not involving a public offering.

Sales by Green Energy Fields, Inc.

On November 30, 2009, Green Energy issued 2,000,000 shares of its common stock to NPX Metals, Inc. as payment for certain mining assets.

On November 30, 2009, Green Energy issued 26,788,252 shares of its common stock to certain investors for a per share purchase price of $0.0001.

We believe that the offer and sale of the securities referenced in this section were exempt from registration under the Securities Act by virtue of Section 4(2) of the Securities Act and/or Regulation D promulgated thereunder as transactions not involving any public offering. All of the purchasers of unregistered securities for which we relied on Section 4(2) and/or Regulation D represented that they were accredited investors as defined under the Securities Act, except for up to 35 non-accredited investors. The purchasers in each case represented that they intended to acquire the securities for investment only and not with a view to the distribution thereof and that they either received adequate information about the registrant or had access, through employment or other relationships, to such information; appropriate legends were affixed to the stock certificates issued in such transactions; and offers and sales of these securities were made without general solicitation or advertising.

Private Placement of Units

On December 3, 2010, we sold an aggregate of $100,000 worth of units consisting of one share of the Company’s common stock and one five year warrant to purchase one additional share of common stock at an exercise price of $0.50 per share for a per unit price of $0.50.

On December 29, 2010, we entered into subscription agreements with certain investors whereby it sold an aggregate of 4,000,000 units for an aggregate purchase price of $2,000,000. In addition, in accordance with the terms of certain Bridge Notes issued to certain investors on October 15, 2010 and December 3, 2010, in the event the Company closed an equity investment in which the Company receives gross proceeds of at least $1,250,000, the holder will have the option to convert all or a portion of the outstanding principal of and accrued interest on such Bridge Note, on a dollar-for-dollar basis, into the qualified financing. The Private Placement qualifies as a qualified financing and each holder of bridge notes was entitled to exchange the outstanding principal and interest amount of its Bridge Notes for Units sold in the Offering. Bridge notes in the aggregate principal amount of $50,000 (plus $416.50 in accrued interest) converted into 100,833 units in the Offering on December 29, 2010.

On February 18, 2011 we entered into subscription agreements with certain investors whereby we sold an aggregate of 12,159,950 units for an aggregate purchase price of $6,079,975.

On February 28, 2011, we entered into subscription agreements with certain investors whereby we sold an aggregate of 7,990,000 units for an aggregate purchase price of $3,995,000.

18

On March 4, 2011, we entered into subscription agreements with certain investors whereby we sold an aggregate of 11,689,980 units for an aggregate purchase price of $5,844,990

In connection with the foregoing, we issued warrants to the placement agents to purchase an aggregate of 7,167,986 shares of common stock, with the same terms as the warrants issued to the investors

Item 6. Selected Financial Data.

Not applicable.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

RESULTS OF OPERATIONS

Our business began on November 23, 2009, accordingly, no comparisons exist for the prior period.

We are still in our exploration stage and have generated no revenues to date.