Attached files

| file | filename |

|---|---|

| 8-K - Midway Gold Corp | midwaygold8k_06272011.htm |

| EX-99.3 - PRESS RELEASE DATED AUGUST 11, 2011 - Midway Gold Corp | ex99_3.htm |

| EX-99.1 - PRESS RELEASE DATED JUNE 27, 2011 - Midway Gold Corp | ex99_1.htm |

EXHIBIT 99.2

Midway Reports Long Gold Intercepts at Spring Valley Project, Nevada

July 13, 2011

Denver, Colorado– Midway Gold Corp. ("Midway" or the "Company") (MDW:TSX-V; MDW:NYSE-AMEX) announces results calculated from data provided by Barrick Gold Exploration Inc. (“Barrick”), who is earning into Midway’s Spring Valley Project, Nevada. Highlights include metallic screen assays with gold intercepts of 166 meters of 1.48 grams per tonne (gpt) gold, including 23 meters of 2.15 gpt gold in SV10-510, and 218 meters of 2.7 gpt gold including 41 meters of 12.3 gpt in SV10-511c.

2010 Drilling

On the north end of the known resource, metallic screen assays for drill hole SV10-510 report 166 meters of 1.48 gpt gold, which includes 23 meters of 2.15 gpt gold, and hole SV10-511ccontains218 meters of 2.7 gpt gold, which also includes 41 meters of 12.3 gpt gold. This northern zone appears to remain open to the north, and additional infill drilling will be required to include this zone with the currently defined gold resource.

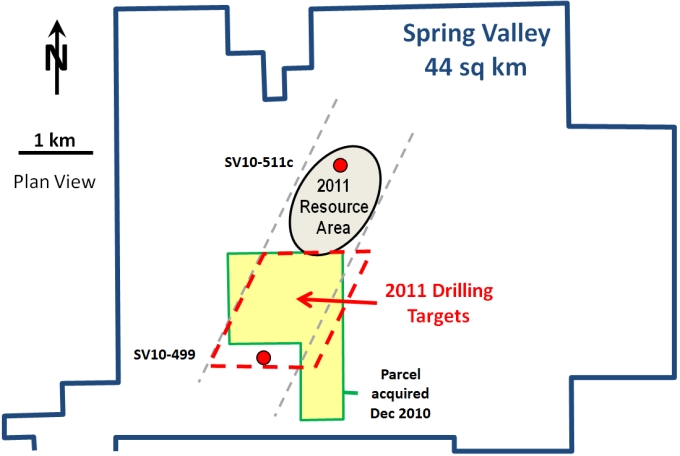

South of the existing resource (see map below), metallic screen assays for drill hole SV10-499 confirm the presence of a 205-meter-thick zone of anomalous mineralization averaging 0.24 gpt gold. This thick anomalous gold zone, only1,800 meters from the known resource area, suggests that the intervening ground is ideally located for on-going exploration and resource expansion. Additional reverse circulation (RC) and core drillingwill test this zone and its continuity with the known gold resource.

Final metallic screen assay results have been received for 12 holes drilled in 2010. Assays are pending for two 2010 core drill holes. Highlights of the first quarter drill results as calculated by Midway are summarized in the table below. These new metallic screen assays include some intervals that Midway considers significantly better than previously reported intercepts based on fire assays (Midway press release dated February 24, 2011).Metallic screen assaysanalyze a larger quantity of the sample and are more reliable when coarse gold is present.

2011 Drilling

The 2011 drilling program commenced in early April, and two RC rigs and one core rig are currently operating. The 2011 drill plan is focused on expanding the resource and evaluating property acquirednear the end of 2010south of the current resource area. In addition to drilling, cultural and biological surveys, hydrogeologic studies and trace element analyses are underway to support future permit applications.

Spring Valley is a large, porphyry-hosted gold system. A May, 2011 updated resource estimate reported 2.16 million ounces of gold in the combined Measured and Indicated categories at a cut-off grade of 0.14 gpt. There is an additional Inferred resource of 1.97 million ounces of gold at the same cut-off grade. The Measured resource is 0.93 million ounces contained within 59.0 million tonnes grading 0.49 gpt, the Indicated resource is 1.23 million ounces contained within 85.8 million tonnes grading 0.45 gpt, and the Inferred resource is contained within 103.9 million tonnes grading 0.59 gpt. The estimate was prepared for Midway by Gustavson Associates, LLC of Lakewood, Colorado (Midway press release dated May 2, 2011).

Under the terms of a March 9, 2009 agreement between Midway and Barrick, Barrick will earn a 60% interest in the project by completing work expenditures totaling US$30 million before December 31, 2013. Barrick has informed Midway that it intends to conduct and fund the minimum required program of US$7 million in 2011, resulting in cumulative expenditures of US$16 million by December 31, 2011.

Significant Metallic Screen Assay Intercepts, Spring Valley Project, Nevada

calculated by Midway from data provided by Barrick

|

Hole ID

|

From (m)

|

To (m)

|

Interval (m)

|

Gold (gpt)

|

|

SV10-497C

|

105.2

|

112.8

|

9.1

|

1.35

|

|

129.5

|

134.1

|

6.1

|

0.94

|

|

|

395.8

|

400.0

|

5.2

|

0.94

|

|

|

SV10-498

|

169.1

|

182.9

|

13.7

|

1.70

|

|

169.2

|

173.7

|

4.6

|

0.70

|

|

|

SV10-499

|

97.5

|

128.0

|

30.5

|

0.43

|

2

|

Hole ID

|

From (m)

|

To (m)

|

Interval (m)

|

Gold (gpt)

|

|

144.8

|

166.1

|

21.3

|

0.35

|

||

|

234.7

|

275.8

|

41.1

|

0.36

|

||

|

292.6

|

303.1

|

10.7

|

0.48

|

||

|

SV10-500C

|

318.2

|

339.8

|

21.5

|

0.57

|

|

|

418.5

|

429.5

|

11.0

|

2.70

|

||

|

includes

|

1.5

|

18.40

|

|||

|

SV10-501C

|

77.7

|

94.8

|

17.0

|

0.53

|

|

|

108.4

|

147.0

|

38.6

|

0.92

|

||

|

includes

|

2.9

|

7.25

|

|||

|

154.1

|

208.0

|

53.9

|

0.85

|

||

|

234.5

|

259.4

|

24.8

|

2.15

|

||

|

includes

|

1.0

|

50.50

|

|||

|

311.8

|

357.6

|

45.8

|

0.30

|

||

|

SV10-502C

|

184.4

|

199.6

|

15.2

|

0.64

|

|

|

394.1

|

423.1

|

29.0

|

1.08

|

||

|

includes

|

3.9

|

5.20

|

|||

|

447.4

|

463.6

|

16.2

|

1.12

|

||

|

516.0

|

678.0

|

162.0

|

0.60

|

||

|

includes

|

1.0

|

22.30

|

|||

|

SV10-505C

|

350.5

|

409.7

|

59.2

|

0.63

|

|

|

SV10-506C

|

377.3

|

393.4

|

16.1

|

0.39

|

|

|

413.9

|

458.1

|

44.2

|

0.79

|

||

|

includes

|

1.2

|

10.65

|

|||

|

SV10-507C

|

71.6

|

88.4

|

16.8

|

1.95

|

|

|

includes

|

1.5

|

6.75

|

|||

|

SV10-508

|

210.3

|

217.9

|

7.6

|

1.34

|

|

|

includes

|

1.5

|

4.65

|

|||

|

SV10-510

|

253.0

|

419.1

|

166.1

|

1.48

|

|

|

includes

|

300.2

|

323.1

|

22.9

|

2.15

|

|

|

and

|

410.0

|

414.5

|

4.6

|

26.20

|

|

|

SV10-511C

|

236.2

|

455.1

|

218.8

|

2.72

|

|

|

includes

|

275.8

|

317.0

|

41.1

|

12.29

|

|

|

with

|

1.5

|

28.40

|

|||

|

and

|

1.5

|

239.00

|

|||

|

and

|

1.5

|

19.30

|

|||

Reverse circulation drilling was conducted by Hard Rock Drilling of Elko, Nevada. Core drilling was conducted by TonaTec Exploration of Mapleton, Utah. Drill hole numbers ending with a "C" indicate core holes. Samples were assayed by ALS-Chemex Labs, in Sparks, Nevada by 30-gram fire assays (FA) or 1000-gram metallic screen assays (MS). Results reported represent thickness along the trace of the drill hole and do not necessarily represent true thickness.

3

Data providedto Midway by Barrick and disclosed in this press release have been reviewed for Midway by William S. Neal, (M.Sc., CPG), a “Qualified Person” as that term is defined in National Instrument 43-101.

ON BEHALF OF THE BOARD

“Kenneth A. Brunk”

Kenneth A. Brunk, President, COO and Director

About Midway Gold Corp.

Midway Gold Corp. is a precious metals company with a vision to explore, design, build and operate mines in a manner accountable to all stakeholders while producing an acceptable return to its shareholders. For more information about Midway, please visit our website at www.midwaygold.com or contact R.J. Smith, Vice President of Administration, at (877) 475-3642 (toll-free).

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains forward-looking statements about the Company and its business. Forward looking statements are statements that are not historical facts and include, but are not limited to, statements about the Company's intended work plans for the Spring Valley project and resource estimates. The forward-looking statements in this press release are subject to various risks, uncertainties and other factors that could cause the Company's actual results or achievements to differ materially from those expressed in or implied by forward looking statements. These risks, uncertainties and other factors include, without limitation, risks related to the timing and completion of the Company's intended work plans for the Spring Valley project, risks related to fluctuations in gold prices; uncertainties related to raising sufficient financing to fund the planned work in a timely manner and on acceptable terms; changes in planned work resulting from weather, logistical, technical or other factors; the possibility that results of work will not fulfill expectations and realize the perceived potential of the Company's properties; uncertainties involved in the interpretation of drilling results and other tests and the estimation of gold resources and reserves; the possibility that required permits may not be obtained on a timely manner or at all; the possibility that capital and operating costs may be higher than currently estimated and may preclude commercial development or render operations uneconomic; the possibility that the estimated recovery rates may not be achieved; risk of accidents, equipment breakdowns and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in the work program; and other factors identified in the Company's SEC filings and its filings with Canadian securities regulatory authorities. Forward-looking statements are based on the beliefs, opinions and expectations of the Company's management at the time they are made, and other than as required by applicable securities laws, the Company does not assume any obligation to update its forward-looking statements if those beliefs, opinions or expectations, or other circumstances, should change.

Cautionary note to U.S. investors concerning estimates of reserves and resources: This press release and the technical report referred to in this press release use the terms "resource", "reserve", "measured resources", "indicated resources" and "inferred resources", which are terms defined under Canadian National Instrument 43-101 and the Canadian Institute of Mining and Metallurgy Classification system. Estimates of mineral resources in this press release and in the technical report referred to in this press release have been prepared in accordance with NI 43-101 and such definitions differ from the definitions in U.S. Securities and Exchange Commission ("SEC") Industry Guide 7. Under SEC Industry Guide 7 standards, a "final" or "bankable" feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. Mineral resources are not mineral reserves and do not have demonstrated economic viability. We advise investors that while those terms are recognized and required by Canadian regulations, the SEC does not recognize them. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves as defined in the SEC's Guide 7. In addition, "inferred resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. U.S. investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally minable. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant "reserves" as in-place tonnage and grade without reference to unit measures. It cannot be assumed that all or any part of mineral deposits in any of the above categories will ever be upgraded to Guide 7 compliant reserves. Accordingly, disclosure in this press release and in the technical reports referred to in this press release may not be comparable to information from U.S. companies subject to the reporting and disclosure requirements of the SEC.

4