Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - ANAREN INC | ex21.htm |

| EX-32.1 - EXHIBIT 32.1 - ANAREN INC | ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - ANAREN INC | ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - ANAREN INC | ex31-2.htm |

| EX-23.1 - EXHIBIT 23.1 - ANAREN INC | ex23-1.htm |

| EX-32.2 - EXHIBIT 32.2 - ANAREN INC | ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended June 30, 2011

OR

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ____________________ to ____________________

Commission File Number 0-6620

|

New York

|

16-0928561

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

6635 Kirkville Road, East Syracuse, New York 13057

|

|

(Address of principal executive offices) (Zip Code)

|

|

Registrant's telephone number, including area code(315) 432-8909

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

Common Stock, $0.01 par value

|

Name of each exchange on which registered

The NASDAQ Stock Market LLC

(NASDAQ Global Market)

|

Securities registered pursuant to Section 12(g) of the Act:

|

None

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. oYes xNo

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. oYes xNo

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. xYes oNo

1

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

xYes oNo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229,405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule12b-2 of the Exchange Act. (Check One):

|

Large accelerated filer o

|

Accelerated filer x

|

| Non-accelerated filer o (Do not checkif a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). oYes xNo

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant, based on the closing sale price of the common stock on December 31, 2010, as reported on the NASDAQ Global Market, was approximately $287,116,760.

The number of shares of the registrant’s common stock, par value $0.01 per share, outstanding on August 8, 2011 was 15,010,463 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement to be filed with the Securities and Exchange Commission in connection with its 2011 Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

2

|

PART I

|

||

|

Item 1.

|

Business

|

|

|

Item 1A.

|

Risk Factors

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

|

Item 2.

|

Properties

|

|

|

Item 3.

|

Legal Proceedings

|

|

|

Item 4.

|

Removed and Reserved

|

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

|

Item 6.

|

Selected Financial Data

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

|

|

Item 9A.

|

Controls and Procedures

|

|

|

Item 9B.

|

Other Information

|

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

|

|

Item 11.

|

Executive Compensation

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

|

|

Item 14.

|

Principal Accountant Fees and Services

|

|

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

3

PART I

Item 1. Business

Company Overview

Unless the context otherwise requires, all references in this Annual Report on Form 10-K to the “Company”, “Anaren”, “we”, “our” and “us” refers to Anaren, Inc., a New York corporation, incorporated in 1967, and its consolidated subsidiaries. Our executive offices are located at 6635 Kirkville Road, East Syracuse, New York 13057. Our telephone number is (315) 432-8909.

Anaren is a leading provider of microelectronics, and microwave components and assemblies for the wireless and space and defense electronics markets. Our distinctive engineering, manufacturing and packaging techniques enable us to cost-effectively produce compact, lightweight microwave products for use in wireless communication and space and defense systems covering a broad range of frequencies (from 100 MHz to more than 30 GHz) and power levels (small signal to more than 500 watts).

Using our focused research and development efforts, we design components and subsystems for wireless communication systems including wireless infrastructure, wireless consumer and medical applications, as well as advanced radar, beam-forming, jamming, motion control and receiver applications for the space and defense markets.

We conduct our business in two business segments: The Wireless Group and The Space & Defense Group.

The financial statements included in this Annual Report provide additional information relating to these segments for each of the Company's last three fiscal years. See “Note (15) Segment and Related Information" and “Management's Discussion and Analysis of Financial Condition and Results of Operations” for financial information about our operating segments, including net sales outside the United States.

Our common stock is listed on The NASDAQ Global Market under the symbol “ANEN.”

Distribution of Company Information

We maintain a website at www.anaren.com. We make available, free of charge on our website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, current reports on Form 8-K, our proxy statement and amendments to those reports or statements filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file those reports with, or furnish them to, the Securities and Exchange Commission, or the SEC. The SEC’s website, www.sec.gov, contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The content on any website referred to in this Form 10-K is not incorporated by reference into this Annual Report on Form 10-K unless specifically noted.

4

Wireless Group

Industry Overview

The Company’s wireless products are used primarily in communication systems, either in user equipment, such as wireless local area network (WLAN), cellular handsets and Bluetooth devices, or satellite television reception applications, or on the network infrastructure side such as cellular telephone base stations or television broadcast equipment applications.

A typical wireless communications network is comprised of a geographic region containing a number of cells, each of which contains one or more base stations, which are linked in a network to form a service provider's coverage area. Each base station is comprised of the equipment that receives and transmits telephone calls and data traffic to the wireless users within the cell. A base station can process a fixed number of radio channels through the use of multiple transceivers, power amplifiers, filters, and combiners - along with one or more antennas to transmit and receive signals to and from the wireless user.

GSM has been the predominant second generation (2G) wireless network. Third generation networks (3G) were introduced with higher data rates to support greater mobile applications under standards such as UMTS or WCDMA. Enhanced 3G networks have been implemented under umbrellas such as LTE (Long-Term Evolution) which include GSM/EDGE. Presently, there is a move to Advanced LTE which will provide data rates close to the minimum requirements for the true fourth-generation (4G) standard, and are often marketed as such. In the years to come, it is expected that needs for higher data rates and greater bandwidth will continue to put pressure on wireless networks and drive the need for new equipment.

Strategy

The Company's strategy for the Wireless Group is to continue to use its microwave expertise, proprietary technologies, extensive microwave design libraries and low cost manufacturing capabilities to further expand its penetration in the wireless industry. Key components of the Company's strategy include the following:

Pursue Large Addressable Markets. The Company has successfully penetrated the mobile wireless infrastructure market and is using its market position to pursue other wireless industrial markets such as wireless data transmission, mobile handsets, Bluetooth, satellite television, low power wireless, medical and other consumer electronics markets. This is enabled by advances made in the Company’s design and manufacturing of sub miniature Multi-Layer Stripline components.

Focus on value added products. The Company continues to expand its component offerings to enable the Company to increase the number of products addressing each wireless application. In addition, with its Multi-Layer Stripline, and thick film ceramic manufacturing technologies, the Company will continue to increase the functionality of its products, thereby enabling its wireless customers to reduce the size and cost of their platforms.

Strengthen and Expand Customer Relationships. Today, a limited number of large original equipment manufacturers (OEMs) drive the wireless market. The Company has developed, and plans to continue to expand, customer relationships with many of these manufacturers including Ericsson, Huawei, Nokia Siemens Networks, ZTE and Samsung. The Company intends to further strengthen its customer relationships by offering complete outsourcing solutions, from research and development to product design and production, thereby increasing the customers' reliance on the Company.

Pursue Price Leadership Position. The Company aspires to use its technological leadership, low cost manufacturing, and sourcing capabilities to be one of the lowest cost provider of components and higher level assemblies for the wireless markets.

Pursue Strategic Acquisitions. The Company intends to continue to pursue opportunistic acquisitions of companies, product lines and technologies. The Company will focus on acquisitions that compliment its technical expertise and business development resources and provide a competitive advantage for its targeted markets.

Products and Technologies

The Company provides components and assemblies to leading OEMs in the wireless industry. These products range from standard sub-miniature components for consumer electronics to custom assemblies for high power wireless infrastructure applications. Over the last three years, the Company has focused its research and development investments on its standard component product lines and those products now make up more than 80% of the Wireless Group net sales.

5

The Company has developed its product offerings to enable its customers to reduce the size and cost, while enhancing the performance of their equipment. The Company continually invests capital and human resources to enhance existing products and develop new products to address current and future market demands. The Company has developed and continues to market a full line of standard products as well as limited custom products to wireless OEMs. A brief description of the Company's major product categories is as follows:

Passive Surface Mount Components. The Company's Xinger® line of products consists of off-the-shelf surface mount microwave components which provide passive microwave signal distribution functions. These products were developed to provide a low-cost high performance signal distribution component, which could be placed on standard printed circuit boards with automated production equipment. The primary applications of these products are in equipment for cellular base stations and in WLAN, Bluetooth, and satellite television.

In cellular base stations, the Company’s Xinger® surface mount products are utilized in radio frequency (RF) power amplifiers, and are also found in low-noise amplifiers and radios. Based on its research, the Company believes it is currently the market leader in this product area, supplying industry leading OEMs and leading power amplifier manufacturers. The Company continues to invest in the expansion of this product line as well as its addressable market. The Company’s surface mount product line offers significantly improved RF performance and power handling in a package that supports the latest global environmentally friendly initiatives.

The Company also has several products specifically designed to address WLAN, cellular telephone handsets and Bluetooth applications. These innovative products are 1/100th the size of our typical Xinger® type of products and offer performance and cost advantages over traditional consumer electronic components.

Resistive Products. The Company's resistive product line includes resistors, power terminations, and attenuators for use in high power wireless, industrial, and medical applications. These products range from very small components for implantable medical devices to high power products used in power amplifiers. The Company’s resistive products are frequently used in conjunction with our Xinger® surface mount components.

Custom Assembled Products. In addition to the large array of standard component product offerings, the Company has traditionally developed a portfolio of custom splitting and combining products for distribution of signals in wireless base station applications. They have included splitting of signals from the receive antennas to the radios, combining of amplifiers prior to the transmit antennas, and splitting/combining of signals internal to power amplifiers. These assemblies include RF backplanes which incorporate direct current power and digital signal distribution, ferrite based power combiners, low-power radio receive splitter assemblies, and custom ferrite components. The Company’s strategy is to continue to support legacy products and customer platforms as needed, but generally not pursue new opportunities. This is due in large part to the trend towards smaller base stations with limited splitting/combining requirements, and the fact that these products generally do not meet the Company’s gross margin targets. In fiscal year 2011, custom assembled products represented less than 3.2% of the Wireless Group revenue.

Customers

The Company believes that the strength of its customer support and depth of its customer relationships provide the Company a competitive advantage. To this end, the Company endeavors to become an integral part of its key customers’ operations by working closely with them through the entire development and production process. The Company assigns a dedicated multi-disciplined team including project engineering, design engineering and customer service to each customer to ensure a high level of responsiveness and customer service. This team assists the customer from the conceptual design stages through the development and manufacturing process. By maintaining close contact with the customers' design engineering, manufacturing, purchasing and project management personnel, the Company can better understand their needs, rapidly develop customer-specific solutions, and more effectively design the Company's solutions into the customers' systems and networks.

The Company sells its standard line of Xinger® components, custom products and resistive components to leading OEMs in the wireless industry and to a broad range of other wireless equipment contract manufacturers in the industry. In general, customers have purchased the Company’s products directly from the Company or through distributors or sales representatives. During the fiscal year ended June 30, 2011, the Wireless Group accounted for approximately 37% of the Company’s total revenues. There were no Wireless Group customers that accounted for more than 10% of the Company’s fiscal 2011 net sales. The following is a list of customers who generated $3 million or more in net sales for the Company in the fiscal year ended June 30, 2011:

|

● Avnet Electronics

|

● Motorola Solutions

|

|

● EG Components

|

● Nokia-Siemens Networks

|

|

● Huawei Technologies Co., Ltd.

|

● Richardson Electronics, Ltd.

|

6

Competition

The microwave component and assembly industry continues to be highly competitive. Direct competitors of the Company in the wireless market include Aeroflex, Smith Industries, SDP, and Soshin Electric Co. As a direct supplier to OEMs, the Company also faces significant competition from the in-house capabilities of its customers. However, the current trend in the wireless marketplace has been for the OEMs to outsource more of their design and production work.

The principal competitive factors in both the foreign and domestic markets are technical performance, reliability, ability to produce in volume, on-time delivery and most critically, price. It is anticipated that this pricing pressure will continue indefinitely. Based on these factors, the Company believes that it competes favorably within its markets in the wireless industry. The Company believes that it is particularly strong in the area of technical performance in the wireless marketplace. With its manufacturing capability in Suzhou, China, and innovative design techniques, the Company believes that it also competes favorably on price.

Backlog

The Company's backlog of orders for the Wireless Group was $15.2 million as of June 30, 2011, versus $10.5 million as of June 30, 2010, resulting primarily from stronger demand for the Company’s wireless infrastructure components. The backlog for the Wireless Group primarily represents firm orders for component products and signed purchase orders (i.e. orders for specific custom sub-assemblies) for custom components due to ship within eight to twelve weeks. The Company’s backlog as of June 30, 2011 is expected to be shipped within the current year. The Company does not believe that its wireless backlog as of any particular date is representative of actual sales for any succeeding period. Typically, large OEMs including Ericsson, Huawei, and Nokia-Siemens Networks, who use the Company's component and custom products, negotiate set prices for estimated annual volumes. The Company then receives a firm delivery commitment prior to shipment. The Company does not recognize backlog until it has received a firm order.

As part of the Company's close working relationships with major wireless communications customers, the customers expect the Company to respond quickly to changes in the volume and delivery schedule of their orders and, if necessary, to inventory products at its facilities for just-in-time delivery. Therefore, although contracts with these customers typically specify aggregate dollar volumes of products to be purchased over an extended time period, these contracts also provide for delivery flexibility, on short notice. In addition, these customers may cancel orders with some financial penalty or defer orders without significant penalty.

Space & Defense Group

Products and Technology

Our Space & Defense Group principally designs and manufactures advanced microwave-based hardware for use in advanced radar systems, advanced jamming systems, smart munitions, electronic surveillance systems and satellite and ground based communication systems.

Radar Countermeasure Subsystems. Defense radar countermeasure subsystems digitally measure, locate and counter enemy radar systems. Our Digital Radio Frequency Measurement (DRFM) devices are used for storing and retrieving RF signals as part of military aircraft self protection systems. Our Digital Frequency Discriminators (DFD) are employed in electronic warfare (EW) systems to detect and measure the RF signals emitted by enemy radar systems. We also manufacture a suite of electronic subassemblies designed to process radar signals detected by a receiver. This technology is a major component of Electronic Support Measure (ESM) systems used on helicopters and fixed winged aircraft to detect, locate, and identify enemy radar. This technology is called a Passive Ranging Subsystem.

Beamformers. Beamformers determine the number, size and quality of beams that are produced from an antenna array. The Company supplies passive and active beamformers and has a unique expertise in designing and manufacturing high performance beamformers in industry leading small size packages. Passive beamformers produce fixed beam locations while active beamformers allow for real-time reconfiguration of the beam pattern. Beamforming technology is implemented on military and commercial phased array communication systems and radar systems.

Switch Matrices. Switch matrices route RF signals from a single location to one or multiple end user locations. These products allow system operators to allocate capacity as required.

Radar Feed Networks. Radar feed networks distribute RF energy to the antenna elements of the radar. Radar Feed Networks are integrated into radar platforms for airborne, ship borne, ground base radars and missile guidance applications.

7

Analog Hybrid Modules. Analog Hybrid Modules are used in the electronic control and power supply systems for commercial and military aircraft, satellites, communication systems and sensor platforms. Analog components are used to accurately control the movement of flight surfaces on aircraft and missiles, steer antennas for communication systems and provide highly accurate regulated voltages for on board power systems. The product portfolio consists of motor controllers, amplifiers, and power supply components.

Mixed Signal Printed Circuit Boards. Mixed signal printed circuit boards are essential to the operation of all commercial and military aircraft, satellite systems, communication systems and sensor platforms. Mixed signal printed circuits route RF, analog, digital and power signals to mission critical components and systems.

Industry Overview

The US Department of Defense (DOD) and major US Defense OEMs are committed to ensuring a high state of military readiness. The DOD funding priorities focus on the safety and effectiveness of US troops, national defense, homeland security, and battlefield command and communication systems. Advanced radar systems, jamming systems, smart munitions, electronic surveillance and communication systems are important DOD capabilities. The Company’s products and technologies are well positioned to support these critical DOD systems.

Strategy

The Company's strategy for the Space & Defense Group is the continued use of its microwave expertise, proprietary design libraries, technologies, and manufacturing capabilities to continually expand its customer penetration. Key components of the Company's strategy include the following:

Strengthen and Expand Strategic Customer Relationships. Today, a limited number of large OEMs drive the Space & Defense Group’s business. The Company has developed, and plans to continue to expand customer relationships with many of these OEMs including, Raytheon, Lockheed Martin, Northrop Grumman, ITT, Harris, Rockwell, Thales, SRCTec, and Boeing. The Company intends to further strengthen its customer relationships by offering complete solutions, from research and development to product design and manufacturing.

Focus on value added products. The Company will continue to expand its product and technology offerings to increase the added value for next generation space and defense systems. The Company will continue leveraging investments in advanced microwave packaging technologies to meet the demands of our customers for increased levels of integration and functionality.

Pursue Strategic Acquisitions. The Company will continue to pursue opportunistic acquisitions of companies (similar to M. S. Kennedy Corp. (MSK) and Unicircuit, Inc. (Unicircuit) which were acquired in fiscal 2009), as well as product lines and technologies that provide synergistic opportunities for its Space & Defense Group. The Company will focus on acquisitions that compliment its technical expertise and business development resources and provide a competitive advantage for its targeted markets.

Customers

The Company currently sells passive components and electronic subsystems to prime contractors serving the United States and foreign governments. During the fiscal year ended June 30, 2011, the Space & Defense Group accounted for approximately 63% of the Company’s revenues. Lockheed Martin accounted for 14.6% and Raytheon Company accounted for 12.7% of the Company’s net sales. The following is a list of Space & Defense customers who generated $3 million or more in revenues in the fiscal year ended June 30, 2011:

|

● ITT Corporation

|

● Northrop Grumman Corporation

|

|

● Lockheed Martin Corporation

|

● Raytheon Company

|

|

● The Boeing Company

|

● Welking Electronics

|

Competition

As a direct supplier to large defense contractors, the Company faces significant competition from the in-house capabilities of its customers. In some cases, we are approached to supply a solution in parallel with an internal effort as a form of risk mitigation.

8

Direct competitors of the Company in the space and defense market include EMS Technologies, Cobham, Inc., Kratos, KOR Electronics, Smith Industries, TTM Technologies, Crane International Rectifier and Aeroflex.

Backlog

Order backlog for the Space & Defense Group was $90.6 million as of June 30, 2011, versus $89.6 million as of June 30, 2010 due to stronger customer demand. Approximately 75% of the Company’s backlog is expected to be shipped within the current fiscal year. All of the orders included in the Space & Defense Group backlog are covered by signed contracts or purchase orders. However, backlog is not necessarily indicative of future sales. Accordingly, the Company does not believe that its backlog as of any particular date is an indicator of actual sales for any succeeding period.

Government Contracts

The Company’s Space & Defense Group has contracts that are subject to termination at the election of the U.S. Government. However, in the event of termination, the Company would be entitled to a termination fee to recover certain costs incurred. No material contracts were subject to renegotiation of profits at the election of the U.S. government.

Company Operations

Sales and Marketing

The Company markets its products worldwide to OEMs and other industry participants in the wireless and space and defense markets primarily through a sales and marketing force of 45 people as of June 30, 2011. The Company has regional sales offices located in Sacramento, California; Waterlooville, England; and Suzhou and Shenzen, China. In addition, as of June 30, 2011, the Company had contracts with 4 major distributors, with 14 manufacturers' representatives in the United States and Canada, and with 9 international representatives located in Western Europe, the Middle East and Asia. As part of its marketing efforts, the Company advertises in major trade publications and attends major industry shows. The Company has invested significantly in its Internet website which contains an electronic version of its entire catalog. In addition, the website enables users to download important device parameter files. These files contain the performance information for catalog components in a format that is compatible with commonly used computer aided design/computer aided modeling, or CAD/CAM equipment. The Company also provides mechanical drawings and applications notes for proper use of the parts. This service allows designers to get the information they require and to easily incorporate the Company's parts into their designs.

After identifying key potential customers, the Company makes sales calls with its own sales, management and engineering personnel and with manufacturers' representatives. To promote widespread acceptance of the Company's products and provide customers with support for their technical and commercial needs, the Company’s sales and engineering teams work closely with the customers to develop solutions tailored for their particular requirements. The Company believes that its engineering team, comprised of 200 design and engineering professionals as of June 30, 2011, provides the Company with a key competitive advantage.

The Company uses distributors for its standard products, most notably its Xinger® surface mount components. Richardson Electronics is a worldwide distributor of Anaren products. Avnet distributes components in Asia; meanwhile, ACAL Technology ( formerly BFI Optilus) distributes the Company’s products in Europe. The Scandinavian countries are serviced by E.G. Components, Inc., a subsidiary of Elektronikgruppen. Additionally, Anaren's new AIR product line is distributed globally by Arrow and Mouser while Avnet distributes this line in North and South America. Using independent distributors to market and sell its products has become an important part of the Company's sales efforts by providing the Company with a larger sales force to promote its catalog product offerings.

Employees

As of June 30, 2011, the Company employed 1,032 people. Of these employees, 200 were members of the engineering staff, 721 were in manufacturing positions, 45 were in sales and marketing positions, and 66 were in management and support functions. None of these employees are represented by a labor union, and the Company has not experienced any work stoppages. The Company considers its employee relations to be excellent.

Manufacturing

The Company currently maintains manufacturing locations in East Syracuse, New York; Salem, New Hampshire; Liverpool, New York; Littleton, Colorado and Suzhou, China. MSK currently occupies a 43,000 square foot facility in Liverpool, New York, and Unicircuit in Littleton, Colorado, owns 31,000 square feet and leases 18,000 square feet of manufacturing space. The Company’s China subsidiary currently leases a 76,000 square foot facility in Suzhou, China, which is expected to be taken over by the Chinese government sometime in fiscal 2012. The Company’s Suzhou operations have been in the process of working with the landlord to move into a new 107,000 square foot facility. The move to the new facility is expected to take place during fiscal year 2012. The 156,000 square foot, East Syracuse facility houses the Company’s legacy Wireless Group and Space & Defense Group’s manufacturing and engineering areas to support current and future growth. The Company’s 65,000 square foot facility located in Salem, New Hampshire, houses its wholly owned subsidiary, Anaren Ceramics, Inc. This facility includes significantly more space for future expansion and a state-of-the-art Class 10,000 clean room for manufacturing.

9

The Company continues to develop capability and capacity to produce highly engineered, complex microwave subassemblies to support its Space & Defense business. The fiscal 2009 acquisition of MSK added high-reliability hybrid module manufacturing to the Company’s manufacturing capabilities. The Company expects to leverage the capability with the Company’s existing RF design expertise to provide highly integrated multi-function RF and microwave modules to the major space and defense OEMs. The addition of Unicircuit provides the Company with state-of-the art RF and Microwave printed circuit board capability supporting design to print manufacturing for direct OEM business as well as design to specification capability when combined with the Company’s existing RF design expertise.

The Company is committed to providing the lowest cost manufacturing solutions. Part of this strategy has evolved with the continued investment in its Suzhou, China operation. Most high volume, labor intensive wireless product lines from the Syracuse and the Salem operations have been successfully transitioned to Suzhou over the past three years. The Company has also successfully implemented a material sourcing function in Suzhou, facilitating the identification, qualification, and procurement of lower cost raw materials to support the wireless infrastructure products being manufactured in Suzhou.

All of the Company's operational manufacturing facilities (East Syracuse, New York; Salem, New Hampshire; Liverpool, New York; Littleton, Colorado; and Suzhou, China) are ISO 9001 certified.

The Company manufactures its products from standard components, as well as from items which are manufactured by vendors to its specifications. The raw materials utilized in the Company’s various product areas are generally accessible and common to both of the Company's business segments. The Company purchases most of its raw materials from a variety of vendors and most of these raw materials are available from a number of sources. During fiscal year 2011, the Company had no single vendor from which it purchased more than 10% of its total raw materials, and the Company believes that alternate sources of supply are generally available for all raw materials supplied by all Company vendors.

Research and Development

The Company's research and development efforts are focused on the design, development and engineering of both products and manufacturing processes. The Company’s current development efforts include:

|

|

●

|

products for use in mobile and fixed wireless infrastructure applications;

|

|

|

●

|

low power transceiver products for wireless data transmission;

|

|

|

●

|

advanced manufacturing technologies to produce high density microwave structures for next generation military radars, communication and sensor systems;

|

|

|

●

|

thick-film substrates capable of replacing higher cost thick-film circuits;

|

|

|

●

|

miniature components for wireless networking, subscriber and broadcast applications; and

|

|

|

●

|

high performance analog microelectronics including custom hybrids, power hybrids, and multi-chip modules.

|

These activities include customer-funded design and development, as well as efforts funded directly by the Company. Research and development expenses funded by the Company were $16.8 million in fiscal 2011, $14.8 million in fiscal 2010 and $13.0 million in fiscal 2009. Research and development costs are charged to expense as incurred.

Environmental Matters

The Company is subject to increasingly stringent environmental laws and regulations, including those relating to air emissions, wastewater discharges, chemical and hazardous waste management and disposal. Some of these environmental laws hold owners or operators of land or businesses liable for their own and for previous owners’ or operators’ releases of hazardous or toxic substances or wastes. Other environmental laws and regulations require the obtainment and compliance with environmental permits. To date, costs of complying with environmental, health and safety requirements have not been material. The nature of the Company’s operations and its long history of manufacturing activities at certain of its current facilities, as well as those acquired could potentially result in material environmental liabilities.

10

While the Company must comply with existing and pending climate change legislation, regulation, international treaties or accords, current laws and regulations do not have a material impact on its business, capital expenditures or financial position. Future events, including those relating to climate change or greenhouse gas regulation could require the Company to incur expenses related to the medication or curtailment of operations, installation of pollution control equipment, or investigation and cleanup of contaminated sites.

Intellectual Property

The Company's success depends to a significant degree upon the preservation and protection of its proprietary product and manufacturing process designs and other proprietary technology. To protect its proprietary technology and processes, the Company generally limits access to its processes and technology, treats portions of such processes and technology as trade secrets, and obtains confidentiality or non-disclosure agreements from persons with access to such proprietary processes and technology. The Company enters into agreements with its employees prohibiting them from disclosing any confidential information, technology developments and business practices, and from disclosing any confidential information entrusted to the Company by other parties. Consultants engaged by the Company who have access to confidential information generally sign an agreement requiring them to keep confidential and not disclose any non-public confidential information.

The Company currently has 16 active patents and 13 other patent applications that are currently pending before the United States Patent and Trademark Office to protect both the construction and design of its products. The Company also has registered trademarks covering certain products; most notably is the Wireless Group’s Xinger® product family. Anaren®, Xinger®, and What’ll We Think Of Next® are registered trademarks of Anaren, Inc. All rights reserved.

By agreement, Company employees who initiate or contribute to a patentable design or process are obligated to assign their interest in any patent or potential patent to the Company.

Government Regulation

The Company's products are incorporated into wireless communications systems that are subject to regulation domestically by the Federal Communications Commission and internationally by other foreign government agencies. In addition, because of its participation in the defense industry, the Company is subject to audit from time to time for compliance with government contract regulations by various governmental agencies. The Company is also subject to a variety of local, state and federal government regulations relating to environmental laws, as they relate to toxic or other hazardous substances used to manufacture the Company's products. The Company believes that it operates its business in compliance with applicable laws and regulations, however, any failure to comply with existing or future laws or regulations could have a material adverse effect on the Company's business, financial condition and results of operations.

Seasonal Trends

The Company historically has not experienced material seasonality in its business.

Item 1A. Risk Factors

In an effort to provide investors a balanced view of our current condition and future growth opportunities, this Annual Report on Form 10-K includes comments by our management about future performance. These statements which are not historical information, are "forward-looking statements" pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These, and other forward-looking statements are not guarantees of future performance, but rather, are subject to business and economic risks and uncertainties that could cause actual results to differ materially from those discussed. The risks and uncertainties described below are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that are currently deemed immaterial may also impair our business operations. If any of the following risks actually occur, our business could be adversely affected, and the trading price of our common stock could decline, and you may lose all or part of your investment. You are encouraged to review our 2011 Annual Report, this Form 10-K for the fiscal year ended June 30, 2011 and exhibits hereto filed with the Securities and Exchange Commission, to learn more about the various risks and uncertainties facing our business and their potential impact on our revenue, earnings and stock price. Unless required by law, we disclaim any obligation to update or revise any forward-looking statement.

11

We depend on a small number of suppliers for many of our component parts and services.

In some cases we rely on a limited group of suppliers and vendors, particularly board fabrication and plating vendors, to provide us with services and materials necessary for the manufacture of our products. Our reliance on a limited group of suppliers involves several risks, including potential inability to timely obtain critical materials or services; potential increase in raw materials costs or production costs; potential delays in delivery of raw material or finished products; and reduced control over reliability and quality of components, and assemblies, as outsourcing continues. We do not have binding contractual commitments or other controls over our suppliers, and therefore cannot always rely upon the guaranteed availability of the materials necessary for the manufacture of our products. If we are required to seek alternative contract manufacturers or suppliers because we are unable to obtain timely deliveries of acceptable quality from existing manufacturers or suppliers, we could be forced to delay delivery of our products to our customers. In addition, if our suppliers and contract manufacturers increase their prices, we could suffer losses because we may be unable to recover these cost increases under fixed price production commitments to our customers. During fiscal 2011, we experienced continuing price increases from many suppliers impacted by rising raw material prices, particularly precious metals and rare earth elements.

Capital expenditures by Wireless service providers for infrastructure equipment are volatile.

Demand for the Company’s Wireless infrastructure equipment products continues to fluctuate and visibility remains relatively unpredictable. Despite strong sales of the Company’s standard and consumer components throughout fiscal year 2011, future decreases in capital expenditures for Wireless infrastructure equipment could significantly adversely impact the success of the Company’s Wireless business.

The Company’s results may be negatively affected by changing interest rates.

The Company is subject to market risk from exposure to changes in interest rates based on the Company’s financing activities. The Company’s $50.0 million dollar demand note agreement with Key Bank National Association (Keybank), which provided the financing for the MSK and Unicircuit acquisitions, bears interest at the Company’s choice at LIBOR, plus 100 to 450 basis points, or at Key Bank’s prime rate, minus 100 to plus 225 basis points, depending upon the Company’s EBITDA performance at the end of each quarter as measured by a defined formula. Therefore, a ten percent change in the LIBOR interest rate at June 30, 2011 would have the effect of increasing or decreasing interest expense by approximately $0.1 million annually. The Company’s current outstanding balance on the demand note stands at $30.0 million.

Changes in funding for defense procurement programs could adversely affect our ability to grow or maintain our revenues and profitability.

The demand for many of our Space & Defense products has been favorably impacted by an upward trend in United States defense spending in the last few years for, among other things, advanced radar systems, advanced jamming systems, smart munitions, electronic surveillance systems and satellite and ground based communication systems. Although the ultimate size of future United States defense budgets remains uncertain, current indications are that the total defense budget may decline over the next few years. This uncertainty could further worsen given the current debate over the United States debt crisis and extreme volatility in the world's capital markets. The specific programs in which we participate, or in which we may seek to participate in the future, must compete with other programs for consideration during the budget formulation and appropriation processes. While we believe that our products are a high priority for national defense, there remains the possibility that one or more of the programs we serve will be reduced, extended or terminated. Reductions in these existing programs, unless offset by other programs and opportunities, could adversely affect our ability to maintain and grow our revenues and profitability.

We face continuing pressure to reduce the average selling price of our Wireless products.

Many of our Wireless customers are under continuous pressure to reduce costs and, therefore, we expect to continue to experience pressure from these customers to reduce our prices. Our customers frequently negotiate volume supply arrangements well in advance of delivery dates, requiring us to commit to price reductions before we can determine whether the assumed manufacturing cost reductions or the negotiated supply volumes can be achieved. To offset declining average sale prices, we believe that we must achieve manufacturing cost reductions and increase our sales volumes. If we are unable to offset declining average selling prices, our gross margins will decline, and this decline could materially harm our business, financial condition and operating results. During fiscal year 2011, this pricing pressure intensified, affecting our component product gross margins. Component pricing pressure is expected to continue in fiscal 2012, despite the increased customer demand.

We depend on the future development of the wireless and satellite communications markets, which is difficult to predict.

We believe that our future growth depends in part on the success of the wireless and satellite communications markets. A number of the markets for our products in the wireless and satellite communications area have only recently begun to develop. It is difficult to predict the rate at which these markets will grow, if at all. Existing or potential wireless and satellite communications applications for our products may fail to develop or may erode. If the markets for our products in wireless and satellite communications fail to grow, or grow more slowly than anticipated, our business, financial condition and operating results would likely be harmed.

12

The markets which we serve are very competitive, and if we do not compete effectively in our markets, we will lose sales and have lower margins.

The markets for our products are extremely competitive and are characterized by rapid technological change, new product development and evolving industry standards. In addition, price competition is intense and significant price erosion generally occurs over the life of a product. We face competition from component manufacturers which have integration capabilities, as well as from the internal capabilities of large communications OEMs and defense prime contractors. Our future success will depend in part upon the extent to which these parties elect to purchase from outside sources rather than manufacture their own microwave components. Many of our current and potential competitors have substantially greater financial, technical, marketing, distribution and other resources than us, and have greater name recognition and market acceptance of their products and technologies. Our competitors may also develop new technologies or products that may offer superior price or performance features.

If we are unable to meet the rapid technological changes in the wireless and satellite communications markets, our existing products could become obsolete.

The markets in which we compete are characterized by rapidly changing technologies, evolving industry standards and frequent improvements in products and services. If technologies supported by our products become obsolete or fail to gain widespread acceptance, as a result of a change in the industry standards or otherwise, our business could be harmed. Our future success will depend in part on factors including our ability to enhance the functionality of our existing products in a timely and cost-effective manner, our ability to establish close working relationships with major customers for the design of their new wireless transmission systems that incorporate our products, our ability to identify, develop and achieve market acceptance of new products that address new technologies and meet customer needs in wireless communications markets, our ability to continue to apply our expertise and technologies to existing and emerging wireless and satellite communications markets, and our ability to achieve acceptable product costs on new products.

We must also continue to make significant investments in research and development efforts in order to develop necessary product enhancements, new designs and technologies. We may not be able to obtain a sufficient number of engineers, or other technical support staff, or the funds necessary to support our research and development efforts when needed. In addition, our research and development efforts may not be successful, and our new products may not achieve market acceptance. Wireless and satellite technologies are complex and new products and enhancements developed by our customers can in turn require long development periods for our new products or for enhancement or adaptation of our existing products. If we are unable to develop and introduce new products or enhancements in a timely manner in response to changing market conditions or customer requirements, or if our new products do not achieve market acceptance, our business, financial condition and operating results could suffer.

We rely on a limited number of OEMs as customers and the loss of one or more of them could harm our business.

We depend upon a small number of customers for a majority of our revenues. During fiscal 2011, we had two customers that accounted for more than 10% of our net sales (Lockheed Martin accounted for 14.6% of net sales and Raytheon Company accounted for 12.7% of net sales). We anticipate that we will continue to sell products to a relatively small group of customers. Delays in manufacturing or supply procurement or other factors, including consolidation of customers, could potentially cause cancellation, reduction or delay in orders by a significant customer or in shipments to a significant customer. Our future success depends significantly on the decision of our current customers to continue to purchase products from us, as well as the decision of prospective customers to develop and market space and defense and wireless communications systems that incorporate our products.

We must continue to attract and retain qualified engineers and other key employees to grow our business.

Our continued success depends on our ability to continue to attract and retain qualified engineers, particularly microwave engineers, and management personnel. Attracting and retaining qualified engineers, including microwave engineers is challenging. If we are unable to successfully hire, train and retain qualified engineers and experienced management personnel, it could jeopardize our ability to develop new products for the wireless and space and defense markets, and could also negatively impact our ability to grow our business.

Failure to meet market expectations could impact our stock price.

The market price for our common stock is based, in part, on market expectations for our sales growth, margin improvement, earnings per share and cash flow. Failure to meet these expectations could cause the market price of our stock to decline, potentially rapidly and sharply.

The Company’s Wireless business significantly depends upon its China operations

To compete globally against low cost manufacturers who primarily operate in the Asia Pacific rim, the Company has established an assembly and test facility in Suzhou, China and also maintains a sales and marketing group based in Suzhou. Conducting operations in China could be impacted by the political environment within China and trade relations between the U.S. and Chinese governments. To the extent products manufactured in Suzhou, China are sold outside of China, the Company may be impacted by currency fluctuations and therefore to the extent the U.S. dollar continues to weaken significantly against Chinese currency, the Company’s results of operations could be adversely affected. The location of the Company’s Suzhou, China facility is in an economic development area which is currently being impacted by expansion of China’s mass transit system. Although there is currently some uncertainty over the Chinese government’s intention with respect to the Suzhou facility, the Company anticipates that it will be required to relocate the Suzhou facility to a new facility in the Suzhou Office Park sometime during fiscal year 2012. The Company’s ability to successfully transition operations to the new facility may adversely impact sales and profitability of the Company’s Wireless Group.

13

The Company could experience an impairment of goodwill or tradenames.

As the result of the acquisitions made in previous years, goodwill and other intangibles incurred as a percentage of the Company’s total assets increased. At June 30, 2011, the total assets of the Company were $252.6 million, which included $45.4 million of goodwill and tradenames. The goodwill arose primarily from the excess of the purchase price of each acquisition over the fair value of the net assets of the business acquired. The tradenames were valued separately from goodwill at the amount which an independent third party would be willing to pay for use of the MSK and Unicircuit names. The Company performs annual evaluations for potential impairment of the carrying value of goodwill and tradenames in accordance with GAAP goodwill and intangible asset accounting rules. To date, these evaluations have not resulted in the need to recognize an impairment charge. However, if the Company’s financial performance were to decline significantly, especially in the Company’s Wireless Group, the Company could incur a non-cash charge in its income statement for the impairment of goodwill or tradenames.

We have been unable to procure a new tenant for our U.K. leased facility.

We lease a 20,000 square foot building in Frimley, England which is currently not used in the Company’s operations. Annual expenditures for this facility is approximately $0.6 million and the Company is currently attempting to sublet the building. The existing lease term on this building expires in February 2014 and the Company has not yet secured a new tenant. It is unlikely that the Company will be able to secure a tenant(s) to take occupancy of the building during the remaining lease term.

Other Risks

In addition to the risks identified above, other risks we face include, but are not limited to, the following:

|

|

●

|

the effect of significant changes in monetary and fiscal policies in the U.S. and abroad, including significant income tax changes, currency fluctuations and unforeseen inflationary pressures, unforeseen intergovernmental conflicts or actions, including but not limited to military conflict and trade wars;

|

|

|

●

|

potential inability to timely ramp up to meet some of our customers', particularly Wireless Group customers increased demands;

|

|

|

●

|

order cancellations or extended postponements;

|

|

|

●

|

unanticipated delays and/or difficulties increasing procurement of raw materials in Asia through our Suzhou, China facility;

|

|

|

●

|

technological shifts away from our technologies and core competencies;

|

|

|

●

|

unanticipated impairments of assets including investment values; and

|

|

|

●

|

litigation involving mergers and acquisitions, antitrust, intellectual property, environmental, product warranty, product liability, and other issues.

|

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

The principal real estate of the Company is a 159,000 square foot building, which the Company owns, located on a 30-acre parcel in East Syracuse, New York. The Company's wholly owned subsidiary, Anaren Microwave, Inc., utilizes this facility which houses a substantial portion of the Company's marketing, manufacturing, administrative, research and development, systems design and engineering activities. The Company’s senior management team is also headquartered in this facility.

14

Anaren Ceramics, Inc., a wholly owned subsidiary of the Company, operates in a 65,000 square foot building, which is owned by the Company’s subsidiary, Anaren Properties, LLC, situated on approximately 12 acres in Salem, New Hampshire.

MSK, a wholly owned subsidiary of the Company, operates in a 43,000 square foot building which it owns, situated on approximately 5 acres in Liverpool, New York.

Unicircuit, a wholly owned subsidiary of the Company, operates in a 31,000 square foot building which it owns, situated on 3 acres in Littleton, Colorado. Additionally, Unicircuit leases 18,000 square feet in an adjacent facility which houses administrative offices and additional manufacturing space at an annual cost of $0.2 million, with a lease term through November 2011.

Anaren Communications Suzhou Co. Ltd., the Company’s wholly owned subsidiary, currently leases a 76,000 square foot facility in Suzhou, China, which houses light manufacturing and assembly activities. This facility has an annual rent of approximately $0.2 million. Although not totally certain, this facility is expected to be taken over and demolished by the Chinese government in fiscal 2012. The Company’s landlord is currently building a new facility near the current site. The move to the new facility is expected to take place during fiscal year 2012 with an annual rent of approximately $0.3 million and an initial lease term of 5 years, which is renewable for two additional 5-year terms at the Company’s option.

The Company leases a 20,000 square foot building in Frimley, England which is currently not used in its operations. Annual expenditures for this facility are approximately $0.6 million and the Company is currently attempting to sublet the building. The existing lease term on this building expires in February 2014 and the Company has not yet secured a new tenant.

Management considers the foregoing facilities, including the Suzhou, China expansion activity, adequate for the current and anticipated mid-term future requirements of the Company, and expects that suitable additional space will be available to the Company, as needed, at reasonable commercial terms.

Item 3. Legal Proceedings

There are no material legal proceedings pending against the Company.

Item 4. Removed and Reserved

Executive Officers of the Company

Executive officers of Anaren, Inc., their respective ages as of June 30, 2011, and their positions held with the Company are as follows:

|

NAME

|

AGE

|

OFFICE OR POSITION HELD

|

|

Lawrence A. Sala

|

48

|

President, Chief Executive Officer, Chairman and Director

|

|

George A. Blanton

|

50

|

Senior Vice President, Chief Financial Officer, Treasurer

|

|

Mark P. Burdick

|

53

|

President, Wireless Group

|

|

David M. Ferrara

|

56

|

Secretary and General Counsel

|

|

Carl W. Gerst, Jr

|

74

|

Chief Technical Officer, Vice Chairman and Director

|

|

Timothy P. Ross

|

52

|

President, Space & Defense Group

|

|

Amy B. Tewksbury

|

47

|

Senior Vice President, Human Resources

|

|

Gert R. Thygesen

|

56

|

Senior Vice President, Technology

|

Lawrence A. Sala joined the Company in 1984. He has served as President since May 1995, as Chief Executive Officer since September 1997, and as Chairman of the Board of Directors since November 2001. Mr. Sala became a member of the Board of Directors of the Company in 1995. He holds a Bachelor's Degree in Computer Engineering, a Master's Degree in Electrical Engineering and a Master's Degree in Business Administration, all from Syracuse University.

15

Carl W. Gerst, Jr. has served as Chief Technical Officer and Vice Chairman of the Board since May 1995 and served as Treasurer from May 1992 to November 2001. Mr. Gerst previously served as Executive Vice President of the Company from its founding until May 1995, and has been a member of the Company’s Board of Directors since its founding in 1967. He holds a Bachelor's Degree from Youngstown University and a Master's Degree in Business Administration from Syracuse University.

Gert R. Thygesen joined the Company in 1981 and has served as Senior Vice President, Technology since November 2005 and served as Vice President of Technology from September 2000 until November 2005. He previously served as Vice President, Operations from April 1995 to September 2000, and as Operations Manager from 1992 until 1995. Mr. Thygesen holds a Bachelor of Science Degree and a Master's Degree in Electrical Engineering from Aalborg University Center, Denmark.

George A. Blanton joined the Company in 2008 as the Company’s Senior Vice President, Chief Financial Officer and Treasurer. Prior to his appointment, Mr. Blanton served as the Assistant General Manager of Sonic Industries, a subsidiary of Dover Corporation. From 1995 to 2006, Mr. Blanton served as the Chief Financial Officer of Sargent, a subsidiary of Dover Corporation. Mr. Blanton holds a Bachelor of Science Degree in Business Administration from University of Southern California, and a Master's Degree in Business Administration from Loyola Marymount University, Los Angeles, CA.

Mark P. Burdick has been with the Company since 1978, and up until his most recent promotion in June 2011 to President, Wireless Group, he served as Senior Vice President and General Manager since 2005 and as Vice President and General Manager from September 2000 until November 2005. He served as Vice President and General Manager, of the Company’s Wireless Group from November 1999 until September 2000, as Business Unit Manager -- Commercial Products from 1994 to 1999, and as Group Manager of Defense Radar Countermeasure Subsystems from 1991 to 1994. Mr. Burdick holds a Bachelor of Science Degree in Electrical Engineering from the Rochester Institute of Technology, and a Master's Degree of Business Administration from the University of Rochester.

Timothy P. Ross has been with the Company since 1982, and up until his most recent promotion in June 2011 to President, Space & Defense Group, he served as Senior Vice President, Business Development since November 2005 and as Vice President, Business Development from September 2000 until November 2005. He served as Vice President and General Manager, of the Company’s Space & Defense Group, from November 1999 until September 2000. Mr. Ross served as Business Unit Manager, Satellite Communications from 1995 to 1999 and as a Program Manager from 1988 to 1995. Mr. Ross holds an Associate's Degree in Engineering Science, a Bachelor of Science in Electrical Engineering from Clarkson University, and a Master's Degree in Business Administration from the University of Rochester.

Amy Tewksbury has served as Senior Vice President, Human Resources since November 2005 and joined the Company in October 2002 as Vice President, Human Resources. Prior to joining Anaren, Ms. Tewksbury was employed by Wegmans Food Markets, Inc. for 16 years. She held various positions with Wegmans including Human Resources Manager of the Syracuse Division, Corporate Human Resources Project Manager, and Store Operations. Ms. Tewksbury holds a Bachelor of Science Degree in Management from Syracuse University.

David M. Ferrara has served as the Company’s Secretary and General Counsel since February 1996, and became a part-time employee of the Company in January, 2008. Mr. Ferrara is a member of the law firm Bond Schoeneck & King, PLLC, which serves as legal counsel to the Company, and practices in the areas of labor and employment and corporate law. Mr. Ferrara holds a Bachelor’s Degree in Labor Relations from LeMoyne College, a Master’s Degree in Industrial Labor Relations from Michigan State University and a Juris Doctor Degree from Indiana University.

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

The common stock of the Company is traded on the NASDAQ Global Market under the symbol "ANEN." The following table sets forth the range of quarterly high and low sales prices reported on the NASDAQ Global Market for the Company's common stock for the fiscal quarters indicated. Sales prices listed represent prices between dealers and do not include retail mark-ups, mark-downs or commissions.

16

|

1st

Quarter

|

2nd

Quarter

|

3rd

Quarter

|

4th

Quarter

|

|||||||||||||

|

Fiscal 2011

|

||||||||||||||||

| High | $ | 17.36 | $ | 21.78 | $ | 22.67 | $ | 21.37 | ||||||||

|

Low

|

$ | 13.54 | $ | 16.12 | $ | 17.42 | $ | 15.85 | ||||||||

|

Fiscal 2010

|

||||||||||||||||

| High | $ | 18.76 | $ | 17.26 | $ | 15.34 | $ | 15.99 | ||||||||

|

Low

|

$ | 15.08 | $ | 13.38 | $ | 11.15 | $ | 13.11 | ||||||||

The Company had approximately 405 holders of record of its common stock at August 8, 2011.

The Company has never declared or paid any cash dividends on its capital stock. The Company currently intends to retain earnings, if any, to support the development of its business and does not anticipate paying cash dividends for the foreseeable future. Payment of future dividends, if any, will be at the discretion of the Board of Directors after taking into account various factors, including the Company's financial condition, operating results and current and anticipated cash needs.

Issuer Purchases of Equity Securities

On May 11, 2011, the Board of Directors increased by 1,000,000 the number of shares of common stock that the Company was authorized to repurchase in open market or privately negotiated transactions through its previously announced stock repurchase program. The program, which may be suspended at any time without notice, has no expiration date. There were on June 30, 2011, approximately 1.255 million shares remaining for purchase under the current authorization.

|

Period

|

Total Number of Shares (or Units) Purchased

|

Average Price Paid per Share (or Unit)

|

Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs

|

Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs

|

||||||||||||

|

April 2011

|

0 | 0 | 0 | 463,339 | ||||||||||||

|

May 2011

|

15,866 | $ | 17.03 | 15,866 | 1,447,473 | |||||||||||

|

June 2011

|

192,274 | $ | 16.95 | 192,274 | 1,255,199 | |||||||||||

|

Total

|

208,140 | $ | 16.95 | 208,140 | ||||||||||||

17

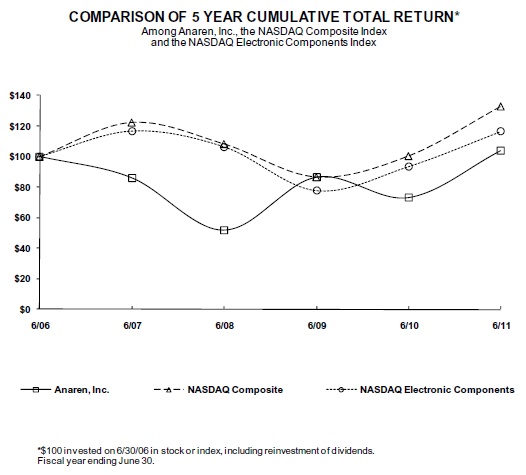

Performance Graph

The following graph presents the cumulative total shareholder return for the five years ended June 30, 2011 for our common stock, as compared to the NASDAQ Composite Index and to the NASDAQ Electronic Components Index. The starting value of each index and the investment in common stock was $100.00 on June 30, 2006.

| 6/06 | 6/07 | 6/08 | 6/09 | 6/10 | 6/11 | |||||||||||||||||||

|

Anaren, Inc.

|

$ | 100.00 | $ | 85.94 | $ | 51.59 | $ | 86.29 | $ | 72.91 | $ | 103.71 | ||||||||||||

|

NASDAQ Composite

|

100.00 | 122.33 | 108.31 | 86.75 | 100.42 | 132.75 | ||||||||||||||||||

|

NASDAQ Electronic Components

|

100.00 | 116.80 | 106.44 | 77.55 | 93.33 | 116.37 |

18

Item 6. Selected Consolidated Financial Data

The selected consolidated financial data set forth below with respect to the Company’s statements of operations for each of the years in the five year period ended June 30, 2011, and with respect to the balance sheet data at June 30, 2011, 2010, and 2009 are derived from the consolidated financial statements that have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, which are included elsewhere in this Annual Report on Form 10-K, and is qualified by reference to such consolidated financial statements. For periods ended June 30, 2008 and 2007 were audited by another accounting firm. All other Selected Financial Data set forth below is derived from our audited consolidated financial statements not included in this Annual Report on Form 10-K.

The following selected financial data should be read in conjunction with the audited consolidated financial statements of the Company and the accompanying notes thereto and Management’s Discussion and Analysis of Financial Condition and Results of Operations included elsewhere in this Annual Report.

19

|

For the Years Ended

|

||||||||||||||||||||

|

Statement of Income Data:

|

June 30,

2011

|

June 30,

2010

|

June 30,

2009

|

June 30,

2008

|

June 30,

2007

|

|||||||||||||||

|

(in thousands, except per share amounts)

|

||||||||||||||||||||

|

Net sales

|

$ | 179,170 | $ | 168,789 | $ | 166,905 | $ | 131,316 | $ | 128,987 | ||||||||||

|

Cost of sales

|

111,264 | 106,512 | 112,289 | 90,838 | 83,125 | |||||||||||||||

|

Gross profit

|

67,906 | 62,277 | 54,616 | 40,478 | 45,862 | |||||||||||||||

|

Operating expenses:

|

||||||||||||||||||||

|

Marketing

|

10,592 | 9,671 | 8,967 | 7,019 | 7,416 | |||||||||||||||

|

Research and development

|

16,765 | 14,782 | 12,986 | 10,410 | 9,134 | |||||||||||||||

|

General and administrative

|

19,299 | 19,040 | 18,636 | 13,847 | 12,298 | |||||||||||||||

|

Total operating expenses

|

46,656 | 43,493 | 40,589 | 31,276 | 28,848 | |||||||||||||||

|

Operating income

|

21,250 | 18,784 | 14,027 | 9,202 | 17,014 | |||||||||||||||

|

Other income (expense):

|

||||||||||||||||||||

|

Interest expense

|

(498 | ) | (590 | ) | (1,482 | ) | (79 | ) | (24 | ) | ||||||||||

|

Other income

|

1,174 | 368 | 1,088 | 2,322 | 3,571 | |||||||||||||||

|

Total other income (expense), net

|

676 | (222 | ) | (394 | ) | 2,243 | 3,547 | |||||||||||||

|

Income from continuing operations before income tax expense

|

21,926 | 18,562 | 13,633 | 11,445 | 20,561 | |||||||||||||||

|

Income tax expense

|

5,525 | 4,850 | 3,774 | 2,982 | 5,211 | |||||||||||||||

|

Income from continuing operations

|

16,401 | 13,712 | 9,859 | 8,463 | 15,350 | |||||||||||||||

|

Discontinued operations:

|

||||||||||||||||||||

|

Income from discontinued operations of Anaren Europe

|

- | - | - | - | - | |||||||||||||||

|

Income tax benefit

|

- | - | - | 770 | - | |||||||||||||||

|

Net income from discontinued operations

|

- | - | - | 770 | - | |||||||||||||||

|

Net income

|

$ | 16,401 | $ | 13,712 | $ | 9,859 | $ | 9,233 | $ | 15,350 | ||||||||||

|

Basic earnings per share:

|

||||||||||||||||||||

|

Income from continuing operations

|

$ | 1.17 | $ | .98 | $ | .71 | $ | .57 | $ | .89 | ||||||||||

|

Income from discontinued operations

|

$ | - | $ | - | $ | - | $ | .05 | $ | - | ||||||||||

|

Net income

|

$ | 1.17 | $ | .98 | $ | .71 | $ | .62 | $ | .89 | ||||||||||

|

Diluted earnings per share:

|

||||||||||||||||||||

|

Income from continuing operations

|

$ | 1.11 | $ | .94 | $ | .70 | $ | .56 | $ | .87 | ||||||||||

|

Income from discontinued operations

|

$ | - | $ | - | $ | - | $ | .05 | $ | - | ||||||||||

|

Net income

|

$ | 1.11 | $ | .94 | $ | .70 | $ | .61 | $ | .87 | ||||||||||

|

Shares used in computing net Earnings per share:

|

||||||||||||||||||||

|

Basic

|

13,988 | 14,010 | 13,911 | 14,827 | 17,319 | |||||||||||||||

|

Diluted

|

14,746 | 14,537 | 14,179 | 15,068 | 17,721 | |||||||||||||||

|

Balance Sheet Data:

|

||||||||||||||||||||

|

Cash and cash equivalents

|

$ | 58,388 | $ | 50,521 | $ | 49,893 | $ | 10,711 | $ | 7,912 | ||||||||||

|

Working capital

|

110,099 | 89,472 | 102,212 | 71,163 | 72,858 | |||||||||||||||

|

Total assets

|

252,645 | 241,348 | 237,055 | 172,103 | 191,204 | |||||||||||||||

|

Long-term debt, less current installments

|

20,000 | 30,000 | 40,000 | - | - | |||||||||||||||

|

Stockholders’ equity

|

195,104 | 172,926 | 160,945 | 150,864 | 166,794 | |||||||||||||||

20

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following Management's Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with the consolidated financial statements and the notes thereto appearing elsewhere in this Form 10-K. The following discussion, other than historical facts, contains forward-looking statements that involve a number of risks and uncertainties. The Company's results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including factors described elsewhere in this Annual Report.

Overview

The consolidated financial statements present the financial condition of the Company as of June 30, 2011 and 2010, and the consolidated results of operations and cash flows of the Company for the years ended June 30, 2011, 2010 and 2009.

The Company designs, develops and markets microwave components and assemblies for the wireless communications, satellite communications and defense electronics markets. The Company’s distinctive manufacturing and packaging techniques enable it to cost-effectively produce compact, lightweight microwave products for use in base stations and subscriber equipment for wireless communications as well as, in satellites and in defense electronics systems. The Company is also a leading provider of high performance analog microelectronics including custom hybrids, power hybrids, and multi-chip modules. The Company sells its products to leading wireless communications equipment manufacturers such as Ericsson, Motorola Solutions, Nokia-Siemens Networks, and Huawei, and to satellite communications and defense electronics companies such as Boeing Satellite, ITT, Lockheed Martin, Northrop Grumman, and Raytheon.

Results of Operations