Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - General Motors Co | d8k.htm |

| EX-99.1 - NEWS RELEASE DATED AUGUST 9, 2011 - General Motors Co | dex991.htm |

Exhibit 99.2

FORWARD LOOKING STATEMENTS

FORWARD LOOKING STATEMENTS

In this presentation and in related comments by our management, our use of the words

“expect,” “anticipate,” “possible,” “potential,” “may,” “would,” “could,” “should,” “project,” intended to identify forward looking statements that represent our current judgment about possible future events. We believe these judgments are reasonable, but these statements are not guarantees of any events or financial results, and our actual results may differ materially due to a variety of important factors. Among other items, such factors might include: our ability to realize production efficiencies and to achieve reductions in costs as a result of our restructuring initiatives and labor modifications; our ability to maintain quality control over our vehicles and avoid material vehicle recalls; our suppliers’ such times to allow us to meet production schedules; our ability to maintain adequate liquidity and financing sources and an appropriate level of debt, including as required to fund our planned significant investment in new technology; our ability to realize successful vehicle applications of new technology; and our ability to continue to attract new customers, particularly for our new products. GM’s most recent annual report on Form 10-K and quarterly reports on Form 10-Q provides information about these and other factors, which we may revise or supplement in future reports to the SEC.

AGENDA

AGENDA

Everything Starts and Ends with Great Products DAN AKERSON Great Products Will Drive Results DAN AMMANN Engineering Complexity Reduction and MARY BARRA Productivity Improvement Material Performance and Improving Supplier Relations BOB SOCIA Low Cost Global Manufacturing Footprint / Flexibility DIANA TREMBLAY

Q&A

Break

Strengthening Brand Value JOEL EWANICK Improving Our U.S. Sales Operations DON JOHNSON

Q&A

Closing Remarks DAN AKERSON

Q&A

1. Design, Build and Sell the World’s

1. Design, Build and Sell the World’s

2. Strengthening Our Brand Value

3. Growing Profitably Around the World

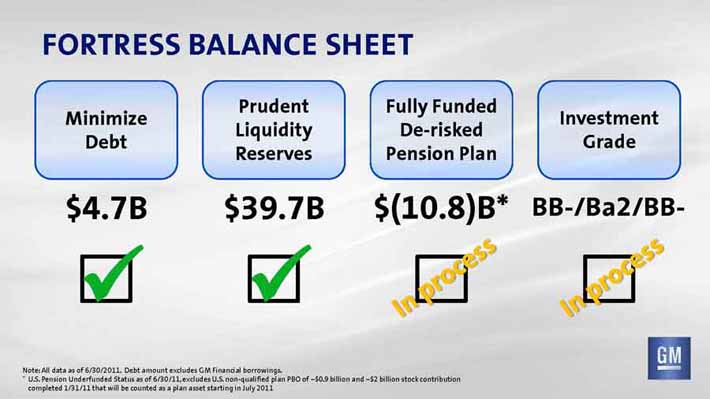

4. Maintaining a Fortress Balance Sheet

KEY MESSAGES

KEY MESSAGES

¶Long-term sustainable results

¶Path to achieve strong margins

FINANCIAL STRATEGY ENABLES LONG TERM OPPORTUNITY

FINANCIAL STRATEGY ENABLES LONG TERM OPPORTUNITY

¶ Break-even at bottom, strong margins at peak

¶ Fortress balance sheet

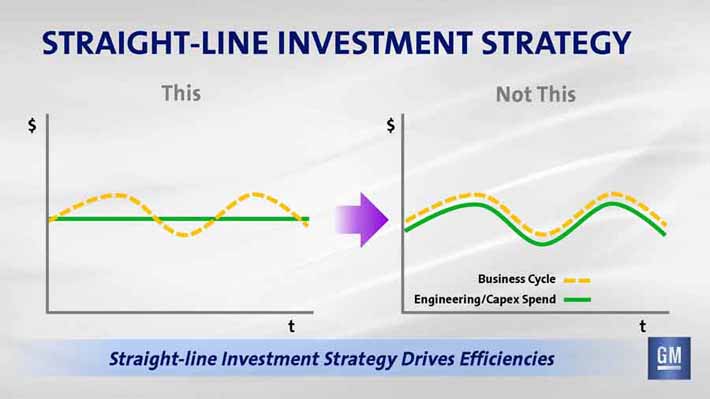

¶ “Straight-line”

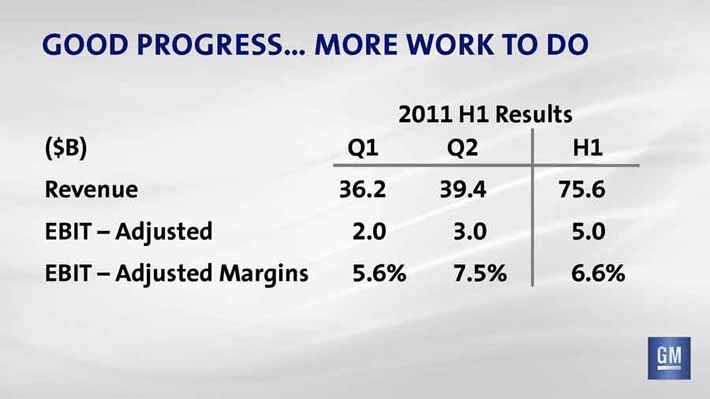

GOOD PROGRESS… MORE

GOOD PROGRESS… MORE

2011 H1 Results

($B) Q1 Q2 H1 Revenue 36.2 39.4 75.6 EBIT – Adjusted 2.0 3.0 5.0 EBIT – Adjusted Margins 5.6% 7.5% 6.6%

CREATE AND SUSTAIN OPERATING LEVERAGE

CREATE AND SUSTAIN OPERATING LEVERAGE

¶ Develop great products

¶ Increase engineering and capital efficiency

¶ Optimize purchasing and supply chain

¶ Improve capacity utilization

¶ Implement global brand strategy

¶ Optimize go-to-market execution

KEY MESSAGES

KEY MESSAGES

¶Long-term sustainable results

¶Path to achieve strong margins

CHURN IMPACT

CHURN IMPACT

¶ Historically, the following practices have contributed to

Product Development’s

– Stop/start projects

– Project cancellations

– Late scope changes

– Change in lead engineering center

¶ A consistent investment will minimize churn

Cost of Churn for Capital is Estimated at ~$1B Annually

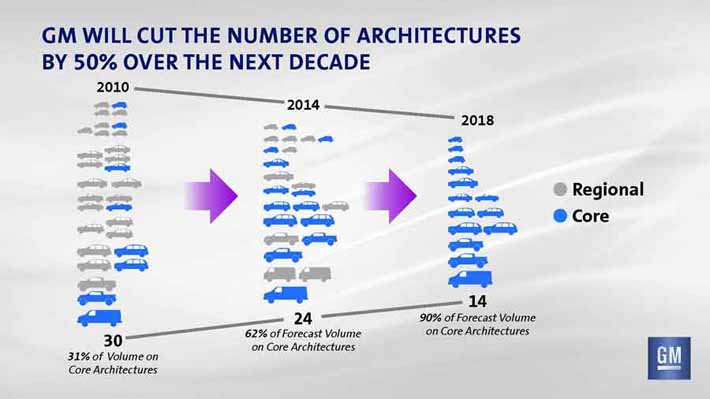

IMPACT OF REDUCING VEHICLE ARCHITECTURES AND ENGINE PLATFORMS

IMPACT OF REDUCING VEHICLE ARCHITECTURES AND ENGINE PLATFORMS

Major Benefits Include:

¶ Engineering expense ¶ Capital

– Fewer mouths to feed – Shared tooling

– More robust architectures/platforms – Leverage tooling design

– Reduce prototype material/tooling

¶ Other

¶ Material cost – More new products to market quicker

– Volume leverage

– Improved quality/warranty

GREAT PRODUCTS DEVELOPED MORE EFFICIENTLY

GREAT PRODUCTS DEVELOPED MORE EFFICIENTLY

¶ Consistent investment strategy/stable product plan

–Reduce portfolio changes

–Reduce program churn

¶ Leverage core architectures

–50% reduction in architectures

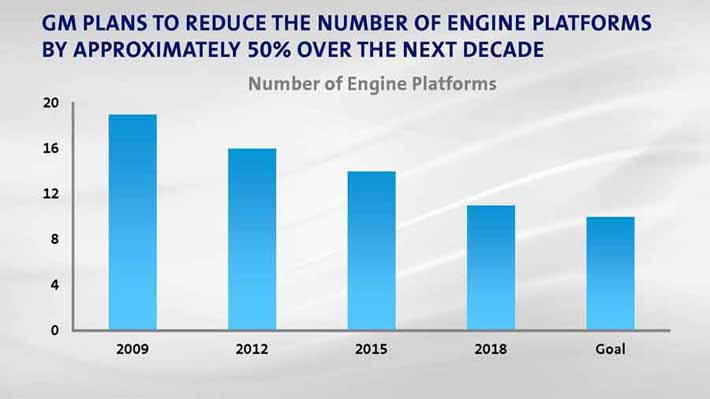

¶ Reduce engine platforms

–50% reduction

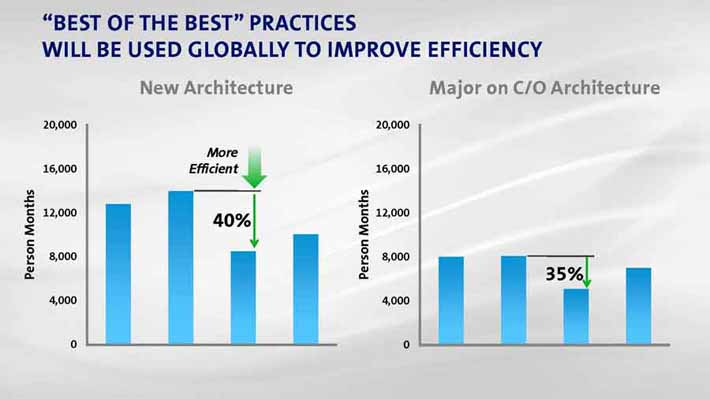

¶ Enhanced productivity

–Standardize Best Practices across Centers

–Reduce development time

–Reduce staff not performing direct engineering tasks

–Improve quality

Global Product Development Provides a Significant Opportunity to Improve Margins Going Forward

GLOBAL PURCHASING & SUPPLY CHAIN

GLOBAL PURCHASING & SUPPLY CHAIN

2011 Global Snapshot

# of Suppliers Approximately 3,200 Direct Suppliers # of Creativity Teams 76 Global/30 Regional # of Countries People Located in 35 Countries

# of Part Numbers Approximately 191,000 Direct Part Numbers Vehicle Forecast 9.6M Vehicles (including JVs) $ Material Purchases $77B Direct Material Purchases Logistics/Indirect Spend $7B Logistics/$9B Indirect

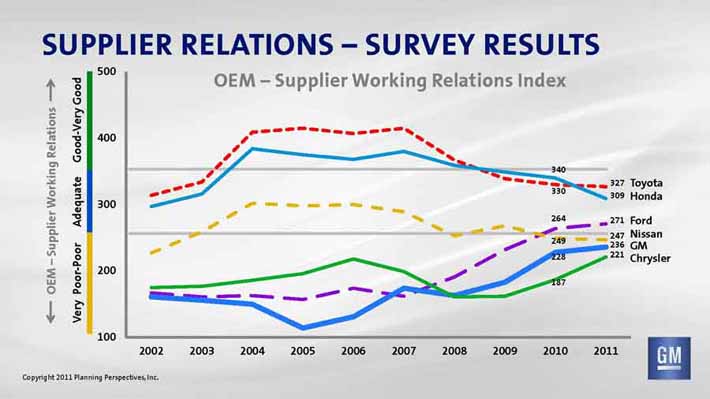

SUPPLIER RELATIONS

SUPPLIER RELATIONS

Where We What We Have Done Have Been and What We Are Doing

Issues Identified Current Actions

¶ Communication ¶ Enhance supplier meetings & GM

Supply Power

¶ Conflicting objectives with ¶ Co-location and realignment with Engineering Engineering

¶ Critical capacity management ¶ 18-24 months visibility globally

¶ Limited schedule visibility & stability ¶ Improve scheduling stability

¶ Ineffective processes ¶ ~400 Process ideas submitted and completed

Goal: OEM of Choice

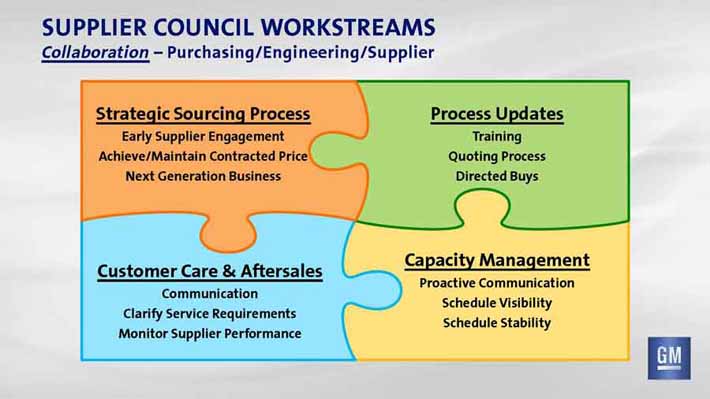

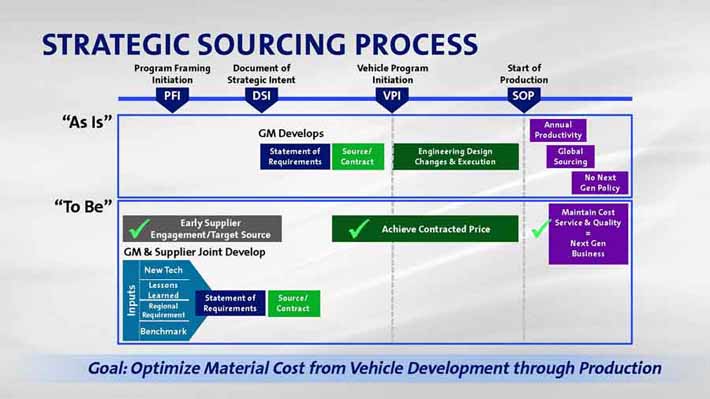

SUPPLIER COUNCIL WORKSTREAMS

SUPPLIER COUNCIL WORKSTREAMS

Collaboration –Purchasing/Engineering/Supplier

Strategic Sourcing Process Process Updates

Early Supplier Engagement Training Achieve/Maintain Contracted Price Quoting Process Next Generation Business Directed Buys

Capacity Management Customer Care & Aftersales

Proactive Communication Communication Schedule Visibility Clarify Service Requirements Schedule Stability Monitor Supplier Performance

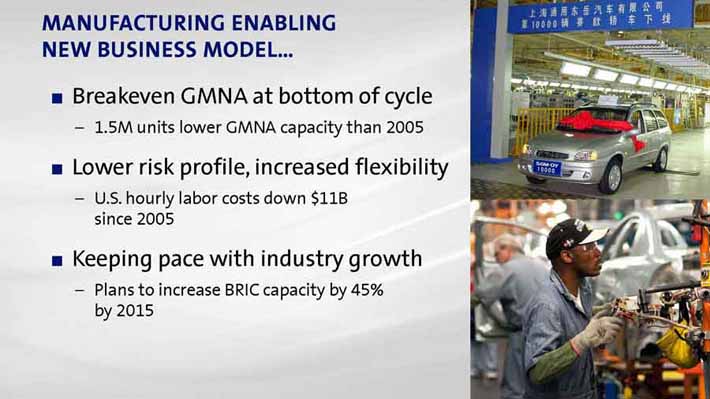

MANUFACTURING ENABLING

MANUFACTURING ENABLING

NEW BUSINESS MODEL…

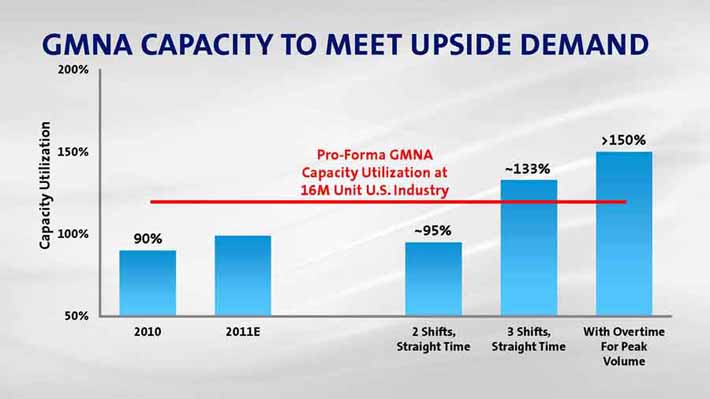

¶Breakeven GMNA at bottom of cycle

– 1.5M units lower GMNA capacity than 2005

¶Lower risk profile, increased flexibility

– U.S. hourly labor costs down $11B since 2005

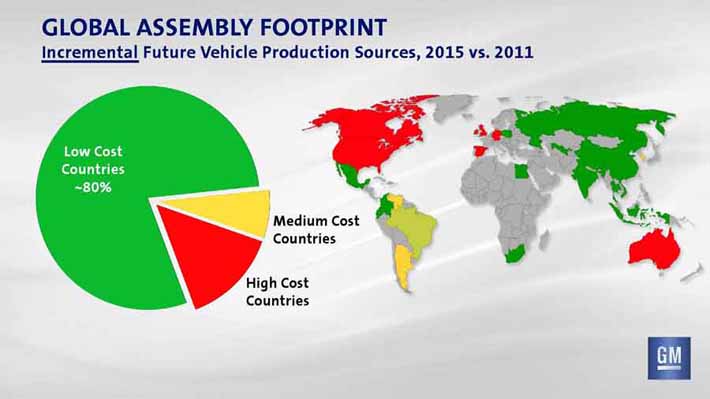

¶Keeping pace with industry growth

– Plans to increase BRIC capacity by 45% by 2015

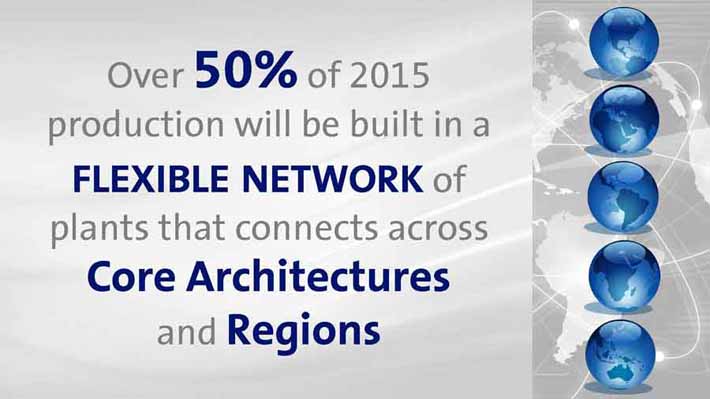

FLEXIBILITY AND CORE ARCHITECTURES

FLEXIBILITY AND CORE ARCHITECTURES

¶ Common Architectures = Faster to Market

– Buick Regal built in Rüsselsheim while Oshawa was being tooled

¶ Flexible Plants = Market Adaptability

– Chevy Volt, Malibu and Impala all to be built on same line at Detroit-Hamtramck

¶ Flexibility + Creativity = Asset Utilization

– Additional ~200K annual capacity Equinox/ Terrain with no new brick and mortar

Over 50% of 2015 production will be built in a

FLEXIBLE NETWORK of

plants that connects across

Core Architectures and Regions

GLOBAL MANUFACTURING SYSTEM

GLOBAL MANUFACTURING SYSTEM

Built-in Quality

Continuous Improvement

Standardized Work

EMPLOYEE ENGAGEMENT

Lean Material Strategies

MANUFACTURING COMPETITIVE ADVANTAGE

MANUFACTURING COMPETITIVE ADVANTAGE

Very Competitive Global Footprint

FLEXIBILITYpaying dividends

…andCAPACITY UTILIZATION

Seeking to be Quality leader in every market

“For GM, manufacturing a competitive advantage…

–Ron Harbour, Oliver Wyman

GM GLOBAL BRAND STRATEGY

GM GLOBAL BRAND STRATEGY

GM Brand Portfolio Role Core Brand Promise Area Focus

Chevrolet Global Mainstream Cars for Life’s JourneyGlobal

Cadillac Global Luxury Red-blooded Luxury Global

Buick Regional Luxury Inviting Luxury NA, China

GMC Regional Premium Professional-grade-up for the Challenge NA

Opel Regional Mainstream Forward-thinking Cars for Real Life Europe / Russia

Vauxhall Local Mainstream Forward-thinking Cars for Real Life U.K.

Holden Local Mainstream World-class cars for AustralianAustralia

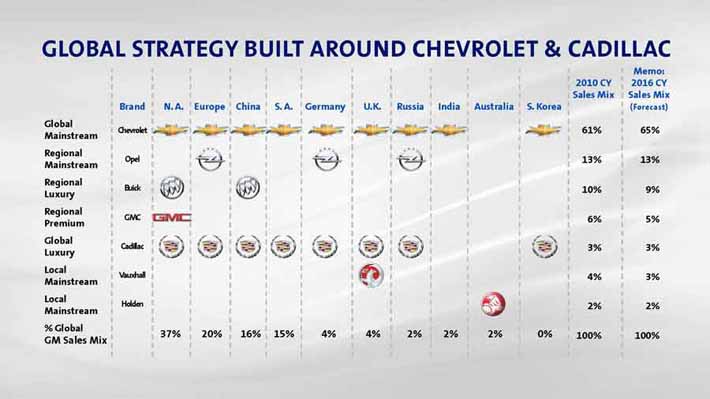

GLOBAL STRATEGY BUILT AROUND CHEVROLET & CADILLAC

GLOBAL STRATEGY BUILT AROUND CHEVROLET & CADILLAC

Memo: 2010 CY 2016 CY Sales Mix Sales Mix Brand N. A. Europe China S. A. Germany U.K. Russia India Australia S. Korea (Forecast) Global Chevrolet 61% 65% Mainstream Regional Opel 13% 13% Mainstream Regional Buick 10% 9% Luxury Regional GMC 6% 5% Premium Global Cadillac 3% 3% Luxury Local Vauxhall 4% 3% Mainstream Local Holden 2% 2% Mainstream

% Global

37% 20% 16% 15% 4% 4% 2% 2% 2% 0% 100% 100% GM Sales Mix

U.S. LUXURY BRAND POSITIONING

U.S. LUXURY BRAND POSITIONING

Flank the Middle

Inviting Luxury Traditional Luxury Red-Blooded Luxury

PRODUCT Primary Competitors PRODUCT

Sculptural Beauty Provocative / Powerful Thoughtful / Alluring Best of the Best

PEOPLE PEOPLE

Quiet Confidence Ambitious / Individualistic Curious / Balanced Unmistakable Swagger

TONE TONE

Bright / Optimistic / Inviting Visceral / Energetic / Unapologetic

EUROPE BRAND POSITIONING

EUROPE BRAND POSITIONING

Luxury Traditional Luxury

Primary Competitors

Mid-Market

Primary Competitors

Mid-Market Forward-thinking

Primary Competitors Cars for Real Life

Cars for PRODUCT

Life’s Journey Accessible German Engineering Energizing / Flowing

PRODUCT

PEOPLE

Purposely Empowering

Progressive Realists Openhearted / Expressive Determined Responsible

PEOPLE

TONE

The Everyday Hero

Traditional / Familial / Innovative Hardworking

TONE

Passionate / Inspired / Genuine

Economy

CHINA BRAND POSITIONING

CHINA BRAND POSITIONING

Luxury Red-Blooded Luxury

PRODUCT Traditional Luxury Provocative / Powerful Best-of-the-Best

Primary Competitors

PEOPLE

Ambitious / Individualistic

Mid-Market Inviting Luxury Unmistakable Swagger

Primary Competitors PRODUCT TONE

Cars for Sculptural Beauty Visceral / Energetic / Thoughtful Alluring Unapologetic

Life’s Journey PEOPLE

PRODUCT Quiet Confidence Purposely Empowering Curious / Balanced Openhearted / Expressive TONE

PEOPLE Bright / Optimistic / Inviting The Everyday Hero Hardworking TONE Breadth of Packaging and Passionate / Inspired / Genuine Lower-priced Portfolio Entries

Economy

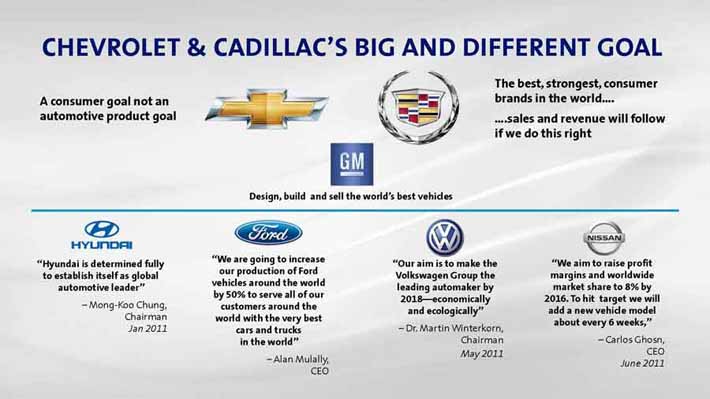

CHEVROLET & CADILLAC’S

CHEVROLET & CADILLAC’S

The best, strongest, consumer A consumer goal not an brands in the world…. automotive product goal ….salesand revenue will follow if we do this right

Design, build and sell the world’s best

We are going to increase Our aim is to make We the aim to Hyundai is determined fully our production of Ford Volkswagen Group the margins and worldwide to establish itself as global vehicles around the world leading automaker by market share to 8% by automotive leader by 50% to serve all of our 2018—economically 2016. To hit target we will –Mong-Koo Chung, customers around the and ecologically add a new vehicle model Chairman world with the very best about every 6

Jan 2011 cars and trucks –Dr. Martin Winterkorn, in the world Chairman –Carlos Ghosn,

May 2011 CEO

–Alan Mulally, June 2011 CEO

THE MOST VALUABLE GLOBAL CONSUMER BRANDS

THE MOST VALUABLE GLOBAL CONSUMER BRANDS

Country Globality Financial Brand Blended Brand of Origin Score Score Score Score

| 1. |

Google United States 71 93 100 75 |

2. Apple United States 74 100 73 71

3. Visa United States 73 44 68 55

4. Louis Vuitton France 83 22 71 52

5. IBM United States 74 56 43 52

6. Pampers United States 67 30 75 52

7. Coca-Cola United States 78 31 64 51

8. Nintendo Japan 98 36 39 50

9. Facebook United States 62 68 35 50

10. Shell United Kingdom 80 65 23 50

11. Moet & Chandon France 83 12 73 50 No 12. Omo United Kingdom 62 19 74 47 Automotive 13. GE United States 72 58 21 46

14. Olay United States 69 20 57 45

15. HTC Taiwan 69 41 33 44

16. ING Netherlands 37 20 80 44

17. Johnnie Walker United Kingdom 84 15 47 44

18. HSBC United Kingdom 55 58 26 44

19. Samsung South Korea 61 47 30 44

20. J.P. Morgan United States 43 61 29 43

21. McDonald’s United States 49 33 49 42

22. Wrigley’s Untied States 80 29 23 41

23. LG South Korea 58 33 36 41

24. Colgate United States 42 20 61 40

The GoalOur direct competitors are Toyota, Volkswagen, Hyundai, and Ford; however in the eyes of consumers, it’s time for Chevrolet our brand and align true global brands like Apple

OVERALL IMPLICATIONS

OVERALL IMPLICATIONS

¶ Create iconic consumer brands that transcend the automotive category and become fabric of culture

¶ Chevrolet and Cadillac set the

– Commitment for Cadillac to compete

¶ Utilize regional / local brands to bolster performance (e.g. aggressive Opel effort forces VW to focus resources / effort in Germany)

¶ Major imperatives are Organization and Brand Development

– Creation of Chevrolet and Cadillac global marketing teams

– Involves changes which are essential to initiate and sustain growth in sales, share and financial value

– Global rollout of brand ecosystem

¶ Continue building momentum for a more consumer centric culture

2011 INDUSTRY OUTLOOK

2011 INDUSTRY OUTLOOK

Economic Assumptions

¶ U.S. economy grew well below trend in H1

¶ Impacts of temporary factors on economy are abating

Downside Risk

¶ Higher oil prices

¶ Prolonged weakness in job market

¶ Consumer confidence

Upside Opportunity

¶ Stronger release of pent-up demand

¶ Faster recovery of vehicle availability and consumer’s “intend to

KEY INITIATIVES

KEY INITIATIVES

¶ Improving dealer network

–Facilities

–Dealer profitability

¶ Improving inventory management

¶ Improving vehicle financing

¶ Build on our momentum

IMPROVING DEALER NETWORK

IMPROVING DEALER NETWORK

Facilities

¶ Facility Image Program

– Create a welcoming retail shopping environment

– Increase value to our customers

– Improve brand image

¶ Dealer financial support –if all compliance requirements are met

– Facility Image Program

– Training

– Owner Retention Program

– Digital Marketing Program

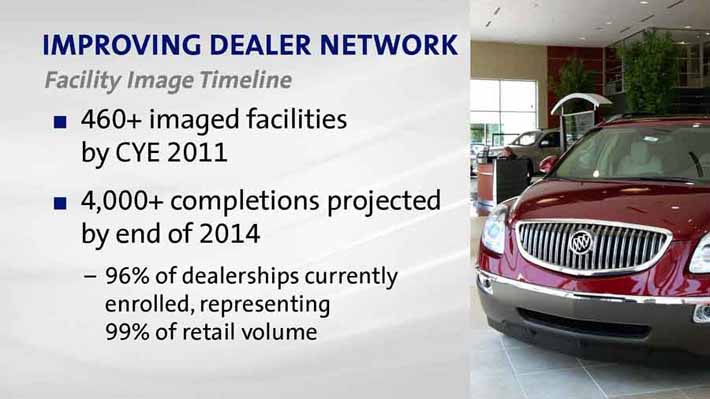

IMPROVING DEALER NETWORK

IMPROVING DEALER NETWORK

Facility Image Timeline

¶ 460+ imaged facilities by CYE 2011

¶ 4,000+ completions projected by end of 2014

–96% of dealerships currently enrolled, representing 99% of retail volume

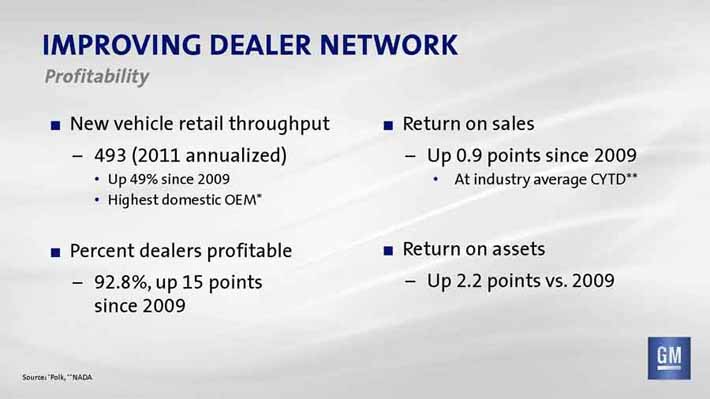

IMPROVING DEALER NETWORK

IMPROVING DEALER NETWORK

Profitability

¶ New vehicle retail throughput ¶ Return on sales

–493 (2011 annualized) –Up 0.9 points since 2009

Up 49% since 2009 At industry average CYTD** Highest domestic OEM*

¶ Percent dealers profitable ¶ Return on assets

–92.8%, up 15 points –Up 2.2 points vs. 2009 since 2009

IMPROVING INVENTORY MANAGEMENT

IMPROVING INVENTORY MANAGEMENT

Process

¶ Rigorous process that fully integrates all departments into monthly Go-To-Market planning and execution

Inputs Outputs

Economic outlook Residual management

Competitive intelligence Sales targets Production adds / cuts Incentive trends Market share targets Process Incentive spend L-T forecast Inventory levels / targets Marketing / communications S-T forecast Production / scheduling

Financial targets Marketing plans

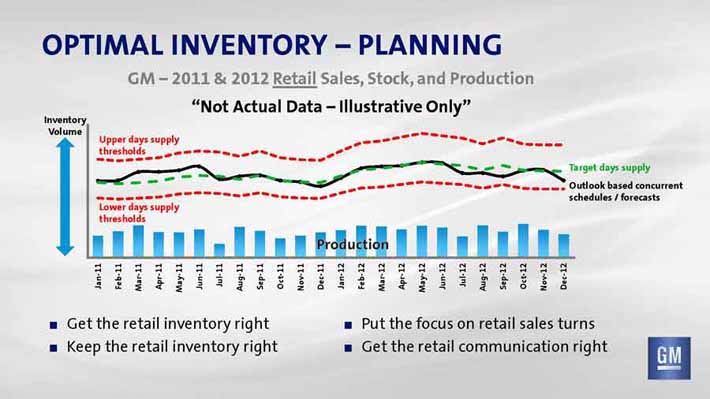

OPTIMAL INVENTORY – PLANNING

OPTIMAL INVENTORY – PLANNING

GM – 2011 & 2012 Retail Sales, Stock, and Production

Not Actual – Illustrative Data Only

¶ ¶

KeepGet Jan-11

the

Feb-11

the retail Mar-11

Apr-11

retail

May-11

Jun-11

inventory Jul-11 inventory Aug-11

right right Sep-11 Oct-11

Nov-11

Dec-11

¶ ¶ Jan-12 Feb-12 Get Put Mar-12 the the Apr-12 May-12

retail focus Jun-12

on Jul-12 Aug-12

retail Sep-12

Oct-12 sales Nov-12

communication Dec-12 right turns

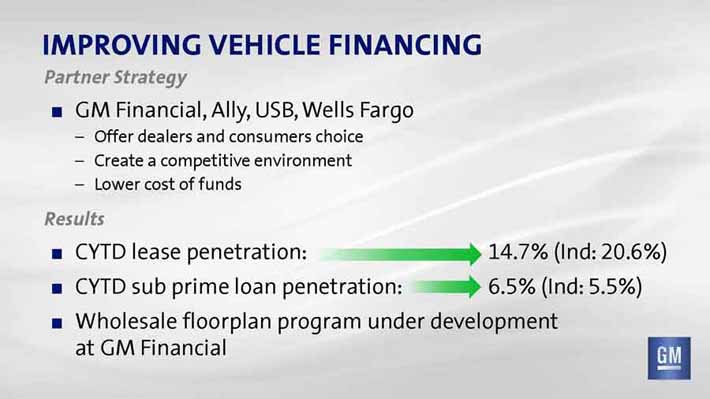

IMPROVING VEHICLE FINANCING

IMPROVING VEHICLE FINANCING

Partner Strategy

¶ GM Financial, Ally, USB, Wells Fargo

–Offer dealers and consumers choice

–Create a competitive environment

–Lower cost of funds

Results

¶ CYTD lease penetration: 14.7% (Ind: 20.6%)

¶ CYTD sub prime loan penetration: 6.5% (Ind: 5.5%)

¶ Wholesale floorplan program under development at GM Financial

BUILD ON OUR MOMENTUM –2011 ACCOMPLISHMENTS

BUILD ON OUR MOMENTUM –2011 ACCOMPLISHMENTS

U.S. Results Through July*

¶ Retail Sales 23%

¶ Total Sales 16%

¶ Retail Share 1.3 pts

¶ Total Share 0.9 pts

¶ Incentive Spending (% ATP vs. CY 2010 –JD Power PIN) 0.2 pts

¶ Residual Values (Gap to competitive set –ALG) 0.2 pts

vs. same period in 2010