Attached files

| file | filename |

|---|---|

| 8-K - UIL FORM 8-K DATED AUGUST 9, 2011 - UIL HOLDINGS CORP | uil_form8kdated08102011.htm |

| EX-99 - UIL EXHIBIT 99 - PRESS RELEASE - UIL HOLDINGS CORP | uil_exh99.htm |

1

Williams Capital Group

East Coast Seminar

August 10, 2011

Exhibit 99.1

2

James P. Torgerson

President and Chief Executive Officer

Safe Harbor Provision

Certain statements contained herein, regarding matters that are not historical facts, are forward-looking statements (as defined in the

Private Securities Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs,

expectations or forecasts for the future. Such forward-looking statements are based on UIL Holdings’ expectations and involve risks and

uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements. Such risks and

uncertainties include, but are not limited to, general economic conditions, legislative and regulatory changes, changes in demand for

electricity, gas and other products and services, unanticipated weather conditions, changes in accounting principles, policies or

guidelines, and other economic, competitive, governmental, and technological factors affecting the operations, markets, products and

services of UIL Holdings’ subsidiaries, The United Illuminating Company, The Southern Connecticut Gas Company, Connecticut

Natural Gas Corporation and The Berkshire Gas Company. Such risks and uncertainties with respect to UIL Holdings’ recent acquisition

of The Southern Connecticut Gas Company, Connecticut Natural Gas Corporation and The Berkshire Gas Company include, but are not

limited to, the possibility that the expected benefits will not be realized, or will not be realized within the expected time period. The

foregoing and other factors are discussed and should be reviewed in UIL Holdings’ most recent Annual Report on Form 10-K and other

subsequent periodic filings with the Securities and Exchange Commission. Forward-looking statements included herein speak only as of

the date hereof and UIL Holdings undertakes no obligation to revise or update such statements to reflect events or circumstances after the

date hereof or to reflect the occurrence of unanticipated events or circumstances.

Note to Investors

3

UIL - Corporate Structure, Service Areas

› Service territory: 335 sq

miles

miles

› ~325,000 customers

› 1,095 employees

› Allowed Distribution ROE

of 8.75%

of 8.75%

› Earned ’10 Transmission

ROE (composite) of 12.5%

ROE (composite) of 12.5%

› 50% interest in GenConn

Energy LLC

Energy LLC

The United Illuminating

Company (UI)

Company (UI)

UIL Holdings

Corporation

Corporation

Service Area Key

SCG

CNG

UI

Berkshire

Overlapping Territory

› Service territory: 716 sq

miles - Greater Hartford-

New Britain & Greenwich

miles - Greater Hartford-

New Britain & Greenwich

› ~160,000 customers

› 319 employees

› 2,011 miles of mains with

~124,000 services

~124,000 services

› 2011 settlement allowed

ROE of 9.41%

ROE of 9.41%

Connecticut Natural Gas

(CNG)

(CNG)

› Service territory: 738 sq

miles in Western MA

including Pittsfield and

North Adams

miles in Western MA

including Pittsfield and

North Adams

› ~36,000 customers

› 120 employees

› 738 miles of mains

› Allowed ROE of 10.50%

Berkshire Gas Company

(Berkshire)

(Berkshire)

› Service territory: 512 sq

miles from Westport, CT to

Old Saybrook, CT

miles from Westport, CT to

Old Saybrook, CT

› ~178,000 customers

› 290 employees

› 2,273 miles of mains with

~131,000 services

~131,000 services

Southern Connecticut Gas

(SCG)

(SCG)

4

Investment Highlights

Transmission Focus

(FERC Regulated)

› 2011 estimated overall allowed weighted-average ROE of 12.3%-12.5%

› Identified future investment opportunities reaching beyond service territory

› Reviewing FERC Order 1000: Transmission Planning & Cost Allocation

Attractive Regulated

Electric and Gas

Utility

Electric and Gas

Utility

› Proven ability to earn allowed electric & gas rate of returns

› Average ROEs as of 6/30/11: D& CTA 10.13%, preliminary SCG 9.00-9.10%, CNG 10.55

-10.65%

-10.65%

› GenConn - 9.75%

Notes: (1) As of November 2010. The annual long-term capital spending will be updated in the Fall of 2011.

(2) As of 8/5/11.

Conservative

Financial Strategy

Financial Strategy

(5.4% Yield)(2)

› Commitment to investment grade credit profile

› Consistent history of dividend payments

› Disciplined capital investment program

Visible Growth

Opportunities

Opportunities

› Significant opportunity exists to switch households to natural gas

› Conversions growth plan is in place

› Projected $2.2B (2011-2019) electric & gas capital expenditure plan

› GenConn: cost-of-service electric peaking generation is complete and operating in the ISO-

markets

markets

5

Gas Operations Integration

Closed on the acquisitions of Southern Connecticut Gas, Connecticut

Natural Gas and Berkshire Gas Company on November 16, 2010

Natural Gas and Berkshire Gas Company on November 16, 2010

Working diligently internalizing the Transition Services Agreement (TSA)

Ø Support services such as IT, Finance and Human Resources provided by

Iberdrola, USA (IUSA) with the ability to terminate any service given 90 days

notice

Iberdrola, USA (IUSA) with the ability to terminate any service given 90 days

notice

Integration activities are well underway

Ø Implementation of these initiatives is expected to continue through this year

with most completed before 2012

with most completed before 2012

2012 savings opportunities - identified & quantified

Ø IUSA 2009 allocated corporate overheads, support costs and shared services

totaled $23M

totaled $23M

› $11.6M of expected savings to be in place in 2012

6

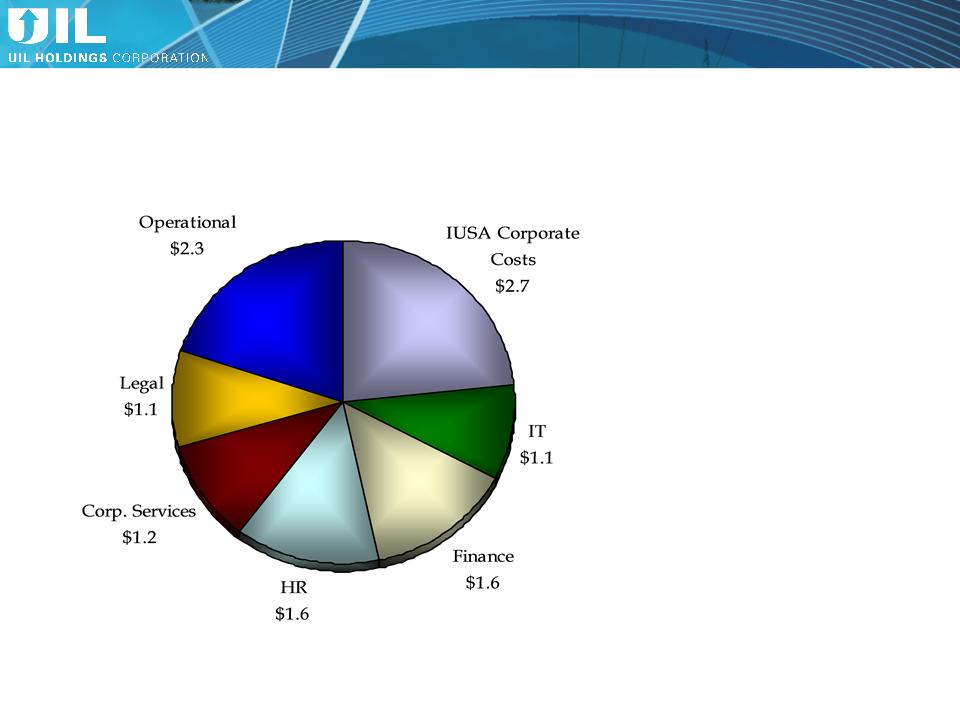

Expected $11.6M of Identified Savings

($M)

Exit from transition services agreement is on schedule

Ø Successful, major SAP system cut

over from IUSA to UIL occurred

on 8/1/11

over from IUSA to UIL occurred

on 8/1/11

› Finance

› Human Resources

› Supply Chain

› Work Management

Integration

7

American Community Survey’s selected housing characteristics estimates show a large percentage of

households in Connecticut do not use natural gas for heating

households in Connecticut do not use natural gas for heating

Potential for Gas Heating in CT

Litchfield

62%

13%

16%

4%

5%

Fairfield

47%

35%

15%

2%

1%

Connecticut

50%

31%

15%

2%

1%

New Haven

46%

35%

16%

2%

2%

Middlesex

63%

11%

18%

4%

3%

New London

63%

11%

19%

3%

4%

Windham

68%

9%

11%

8%

4%

Tolland

67%

9%

13%

5%

4%

Hartford

41%

42%

13%

1%

2%

Fuel oil, kerosene

Electricity

Utility gas

Bottled, tank or LP gas

Other¹

Source: U.S. Census Bureau; Average data for 2005-2009

1 Other includes coal or coke, wood, solar, no fuel used and other

# Occupied

housing units:

1,327,482

housing units:

1,327,482

73,704

339,516

52,993

42,653

104,468

65,476

322,752

325,920

(0)

(17)

(2)

(12)

(0)

(0)

(4)

(9)

The # in parentheses represents

the number of cities or towns in

that county that are served by a

UIL gas company.

UIL gas company.

Approximately 37% of businesses & households on UIL gas mains are not currently natural gas customers

8

Gas Operations

Ø Capitalize on the competitive advantage of natural gas heating use as the

economical, abundant and environmentally friendly fuel of choice for

customers

economical, abundant and environmentally friendly fuel of choice for

customers

Ø Aggressively pursue new gas heating customers

Ø Generate incremental revenue to support infrastructure expansion and

replacement

replacement

Ø 2011 multi-media campaign - launched in April

› Cost savings associated with natural gas heating use compared to other energy sources

› Momentum of interest in conversions - even in off-peak heating season

9

Gas Operations

Ø Historical customer additions(1) 2009 2010

Heating conversions 5,535 5,728

New construction 901 1,071

Total 6,436 6,799

Ø Targeting 30,000-35,000 additional gas heating customers over the next 3 years

› ’11 - 25% increase over ‘10 levels

› ’12 - 50% increase over ’10 levels

Ø Conversions are 9% ahead of 2010 levels

› 3,190 conversions through June ‘11

› On track to achieve ’11 goal

Ø New customers are anticipated to generate approximately $280-$315 dollars of

distribution net operating income per customer

distribution net operating income per customer

Ø Approx. capital spending (2012-2015) associated with customer additions

› Base - $54M

› Incremental - $52M

(1) Businesses & households

10

*2010 Gas distribution capex reflects the full year amount; UIL ownership was for 6 weeks effective with the closing on the acquisition.

** Updated - February 23, 2011

*** Information as of November 2010, except for Gas distribution

Amounts may not add due to rounding.

The annual long-term capital spending will be updated in the Fall of 2011

$M

UIL 2010-2019 CapEx Profile

11

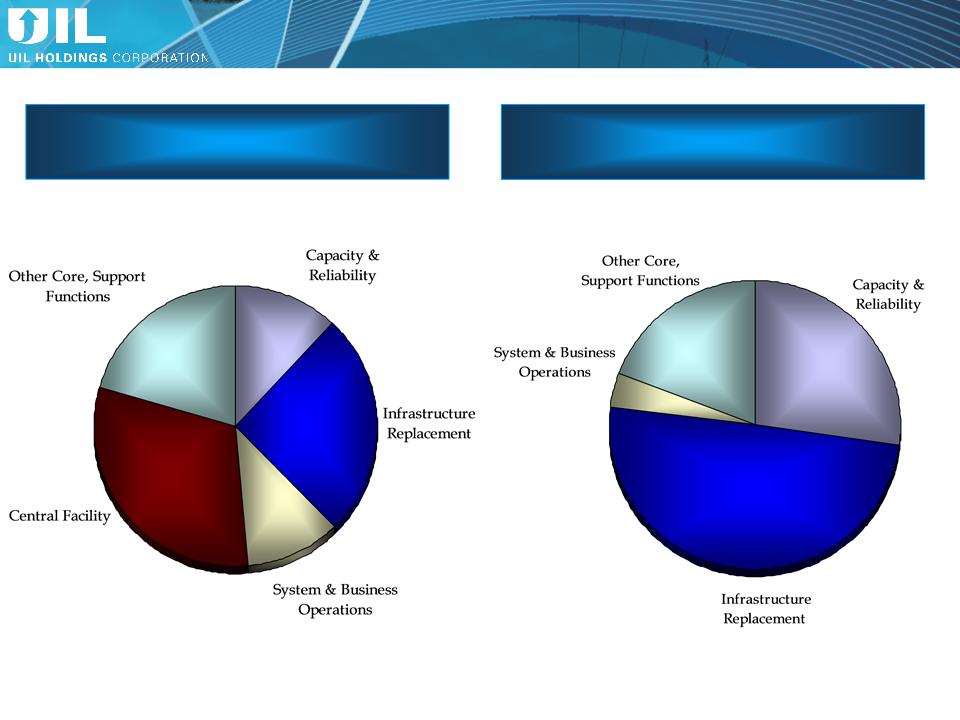

Electric transmission investments

Electric distribution investments

31%

12%

26%

11%

50%

19%

27%

4%

20%

2011 Electric Distribution & Transmission CapEx Detail

12

Gas distribution investments

47%

22%

12%

8%

8%

3%

2011 Gas Distribution CapEx Detail

13

Central Facility - UI Office &

Operations Building

Operations Building

Splice Chamber Remediation

Paper Insulated Lead Cable (PILC)

Replacement

Replacement

Distribution Transformer Replacement

Program

Program

› Consolidate all UI “Work Centers” onto a single

site referred to as the Central Facility

site referred to as the Central Facility

› Under construction

› Planned in-service

2012

2012

~ $115M*

› Rebuild deteriorated underground splicing chambers

› Under construction

› Annual program

over 10 years

over 10 years

~ $7M per year

› Under construction

› Annual program

over 10 years

over 10 years

~ $3M per year

› Infrastructure program to replace transformers due

to poor physical condition, inadequate capacity,

and/or contain unacceptable levels of PCB's

to poor physical condition, inadequate capacity,

and/or contain unacceptable levels of PCB's

› Under construction

› Annual program over

10 years

10 years

~ $7M per year

* Dollars shown are rounded/approximate expected total project capex (generally including both spend to date and future expected spend).

Examples of Current Distribution Projects

14

Grand Avenue 115 kV Switching

Station Rebuild

Station Rebuild

New Shelton 115/ 13.8 kV

Substation

Substation

New Union Avenue 115/ 26.4 kV

Substation

Substation

East Shore 115 kV Substation Upgrades

› Addresses short circuit capability issues and

aged/obsolete infrastructure

aged/obsolete infrastructure

› Under construction

› Planned in-service

2012

2012

~ $60M*

› Meets Greater Shelton area load growth

› In Planning

› Planned in-service

2015

2015

~ $20M*

› In engineering

› Planned in-service

2012

2012

~ $15M*

› Addresses infrastructure condition, maintenance

short circuit capability concerns

short circuit capability concerns

› Phased upgrades,

in engineering and

construction

in engineering and

construction

› Planned in-service

2011-2013

2011-2013

~ $25M*

* Dollars shown are rounded/approximate expected total project capex (generally including both spend to date and future expected spend); excluding AFUDC.

Near-term Electric Transmission Reliability Upgrades

15

Ø Began operating in the ISO-NE

markets in June ‘11

markets in June ‘11

50/50 Joint Venture between UI and NRG

Devon Facility

Ø Operating

Ø Contractual requirements met in

September ‘10

September ‘10

GenConn Energy

16

Near-Term Average Rate Base Profile

28%

23%

7%

30%

22%

5%

36%

2%

40%

1%

23%

38%

38%

39%

43%

22%

38%

23%

37%

40%

23%

Electric distribution

CTA

Gas distribution*

Electric transmission

UI’s 50% Share ($M)**: 2010A 2011P 2012P 2013P 2014P 2015P

Avg. GenConn RB Equivalent: $ 51 $ 148 $ 183 $ 174 $ 165 $ 157

Avg. Gen Conn Equity “Rate Base” $ 25 $ 75 $ 94 $ 89 $ 84 $ 80

Rate Base (Excluding GenConn Equity Investments):

GenConn Equity Investments:

* 2010 Gas distribution average rate base reflects the full year; UIL ownership was for 6 weeks effective with the closing on the acquisition. For comparability purposes, Gas distribution

excludes the impacts of 338(h)(10) election.

excludes the impacts of 338(h)(10) election.

** Per ’12 revenue requirement filed on 7/29/11

Amounts may not add due to rounding.

42%

$2,309

17

UI Transmission - NEEWS Investment

UI Participation in CL&P Project:

Ø UI’s portion of investment: greater of

$60M or 8.4% of CL&P’s costs for the

CT portions …

$60M or 8.4% of CL&P’s costs for the

CT portions …

› Greater Springfield Reliability

Project

Project

› Interstate Reliability Project

› Central CT Reliability Project

Ø 8.4% currently estimated at

approximately $65M*

approximately $65M*

Ø UI deposits through June ‘11 - $8.3M

› Remaining investments expected

to be made over a period of 3 to 5

years

to be made over a period of 3 to 5

years

* Previously NU had projected the cost of the Connecticut portion of these projects would be approximately $779M. UI will update its projected investment once the revised

estimate is provided by NU.

estimate is provided by NU.

18

Renewable-Enabling Transmission

Collaborative effort: UI, NU, NSTAR and NGrid …

to research / identify the most economical means of satisfying future RPS obligations

Significant Region-Wide Need:

› RPS requirement > 3x current

available renewables*

available renewables*

› CT requirement is > UI’s entire load

› Gap will be filled by renewables

remote from load

remote from load

N.E. Governors’ Blueprint:

› Significant transmission build-out

indicated

indicated

› Potential $7 to $10B range - could be

higher or lower to satisfy a 4,000 to

12,000 MW need

higher or lower to satisfy a 4,000 to

12,000 MW need

› Cost to New England likely much less

than Midwestern wind

than Midwestern wind

Potential Solutions Under Study

› Need will likely be satisfied by a portfolio

of projects

of projects

› One promising example is shown below

* From ISO-NE presentation dated 5/15/09 - driven by 2008 data.

Vast majority of

potential onshore

renewables (wind)

potential onshore

renewables (wind)

are in northern NE

North-South Interface:

80% of NE electric

load is below this line

load is below this line

19

Ø On 3/24/11, CNG, SCG & the OCC filed a motion with

the DPUC to reopen the CNG & SCG rate cases for the

purposes of reviewing and approving a settlement

agreement (DN 08-12-06RE02 & DN 08-12-07RE02)

the DPUC to reopen the CNG & SCG rate cases for the

purposes of reviewing and approving a settlement

agreement (DN 08-12-06RE02 & DN 08-12-07RE02)

Ø Final decision issued on 8/3/11, approving settlement

with minor modifications

with minor modifications

› Resolves all pending issues related to the rate case

appeals

appeals

› Removal of the 10 basis point ROE penalty

› Authorized ROEs: CNG - 9.41%, SCG - 9.36%

› Terminates the SCG potential overearnings

investigation

investigation

› Companies are allowed to recover carrying charges

on the excess interim rate decrease over-credited to

customers during rate cases stay

on the excess interim rate decrease over-credited to

customers during rate cases stay

|

|

|

|

|

|

SCG Potential Overearnings

Generic ROE Proceeding

UI Electric Decoupling

SCG/CNG Rate Case Appeals

DPUC schedule has not been updated

Ø Draft decision issued on 8/1/11

› Approved decoupling credit for 2010 rate year

› Allows decoupling mechanism to continue unadjusted

until next general rate case proceeding

until next general rate case proceeding

Ø Written exceptions due 8/15/11, Oral arguments on

8/29/11, Final decision expected 8/31/11

8/29/11, Final decision expected 8/31/11

Ø Filed on 7/29/11 for 2012 revenue requirement

Ø Potential for UI to file distribution rate case for rates in effect in 2012 to reflect significant investments in

distribution infrastructure

distribution infrastructure

GenConn ’12 Revenue Requirement

Regulatory Update

20

Legislative Highlights

Session ended June 8th

Ø UIL was actively engaged in legislative process

Highlights of Public Act 11-80

Ø Department of Energy & Environmental Protection (DEEP) was created, effective

July 1

July 1

› Merged the Department of Environmental Protection and the Department of Public

Utility Control (DPUC)

Utility Control (DPUC)

4 Will result in reorganization and reassignment of existing DPUC staff

› Charged with:

4 Creating a new energy future for CT

4 Protecting CT’s environmental and natural resources

Ø Former DPUC has become the Public Utilities Regulatory Authority (PURA)

› 3 out of the 5 former DPUC commissioners are now PURA directors

Ø Allows each electric distribution company to develop and own up to 10 MW of

renewable source generation

renewable source generation

21

22

2Q ’11 vs. 2Q ’10

YTD ‘11 vs. YTD ’10

*

* 2010 - fees associated with acquisition, 2011 - interest on Oct. ’10 issuance of $450M of public debt

*

2Q & YTD ’11 Financial Results by Business

Net Income ($M)

Net Income ($M)

23

2Q & YTD ‘11 Financial Results - Details

Electric distribution, CTA, GenConn & other

Ø 18% increase in net income for the quarter & 12% increase on a YTD basis

› Increase in earnings primarily attributable to income from the investment in GenConn, partially offset

by lower CTA rate base

by lower CTA rate base

› Both GenConn Devon & Middletown are now operating in the ISO-NE markets

4 Contributed $2.6M and $4.7M on a pre-tax basis for the 2Q and first six months of ’11, respectively

Electric transmission

Ø 18% increase in net income for the quarter, 19% on a YTD basis

› Increase in income was primarily attributable to an increase in AFUDC

Gas distribution

Ø 2Q loss of $1.5M due to seasonality of earnings, YTD income of $35.9M

› Typical second quarter for gas distribution

› YTD - colder than normal winter season in New England in ‘11

Corporate

Ø After tax costs in 2Q ‘11 of $3.3M, a decrease of $1.3M compared to 2Q ‘10

› After tax costs of $7.1M on a YTD basis, an increase of $1.9M compared to ‘10

› The decrease in the quarter was primarily attributable to absence in ’11 of after-tax acquisition related

costs that occurred in 2Q ’10, partially offset by interest on the Oct. ‘10 issuance of $450M of public debt

costs that occurred in 2Q ’10, partially offset by interest on the Oct. ‘10 issuance of $450M of public debt

› YTD increase attributable to $6.3M interest expense on the $450M of public debt

24

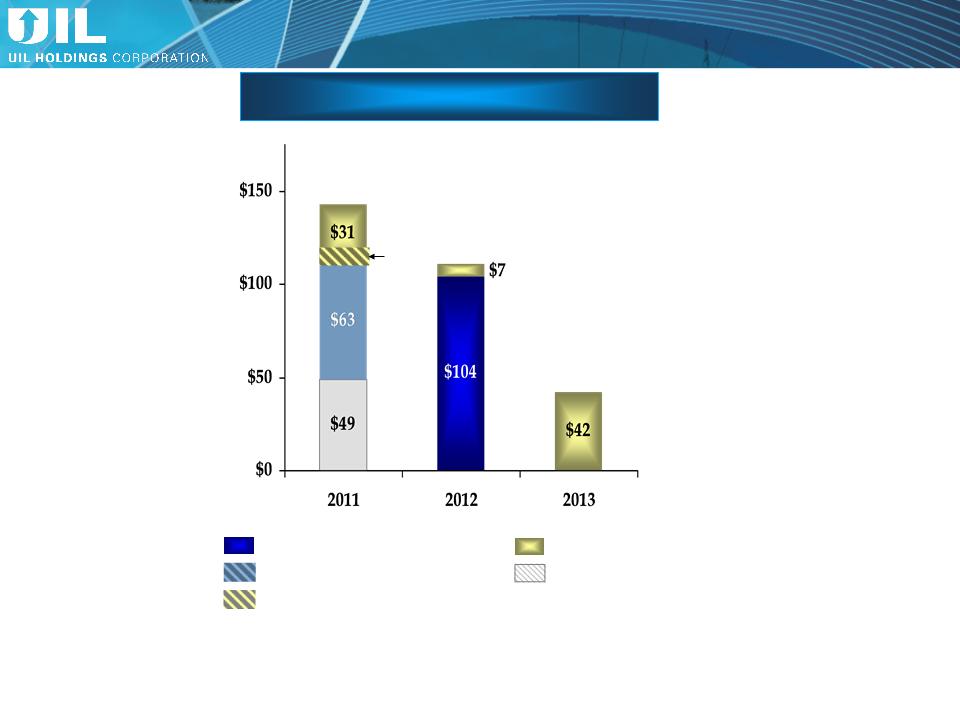

* $30M to be refinanced - in 3Q ‘11

** To be remarketed

Amounts may not add due to rounding.

Based on current plans - expect no need for external equity at least through 2013

UI Pollution Control Revenue Bonds

UI Equity Bridge Loan repaid in July

UIL Debt retired in Feb

SCG, CNG & Berkshire

Near-Term Debt Maturities

($M)

**

$3

Berkshire note repaid in May

*

Debt Maturity

25

Assumptions

› Regulated businesses are expected to earn the allowed return

on an aggregate basis

on an aggregate basis

› GenConn expected to earn $0.12-$0.14 per share

› CTA earnings are expected to decline by $0.07-$0.09 per

share from 2010 as rate base continues to be amortized

share from 2010 as rate base continues to be amortized

› Incorporates full year of gas distribution earnings

› Bonus depreciation is expected to have a net impact of ($0.03)

-($0.05) per share

-($0.05) per share

› Includes one-time costs for the transition of the gas

distribution business support services from IUSA, as well as

the on-going integration costs

distribution business support services from IUSA, as well as

the on-going integration costs

,

2011

› Integration of all of the regulated businesses with an emphasis on process integration initiatives and best practices

› Exiting the TSA by year-end for vast majority of services

› Positioned to realize half of IUSA’s ‘09 allocated corporate charges of $23M à expected savings of $11.6M in 2012

› Implementing plans for growth in gas conversions

› Execution of capital expenditure plan at each of our regulated businesses

› Continued focus on management of O&M expenses at each of our regulated businesses

26

Credit Ratings

Maintenance of investment grade credit ratings is an important objective

|

Issuer

|

S&P

|

Moody’s

|

|

UIL Holdings

|

BBB

(Stable) |

Baa3

(Stable) |

|

United

Illuminating |

BBB

(Stable) |

Baa2

(Stable) |

|

SCG

|

BBB

(Stable) |

Baa2

(Stable) |

|

CNG

|

BBB

(Stable) |

Baa1

(Stable) |

|

Berkshire

|

BBB

(Stable) |

Baa2

(Stable) |

27

Investment Highlights

Transmission Focus

(FERC Regulated)

› 2011 estimated overall allowed weighted-average ROE of 12.3%-12.5%

› Identified future investment opportunities reaching beyond service territory

› Reviewing FERC Order 1000: Transmission Planning & Cost Allocation

Attractive Regulated

Electric and Gas

Utility

Electric and Gas

Utility

› Proven ability to earn allowed electric & gas rate of returns

› Average ROEs as of 6/30/11: D& CTA 10.13%, preliminary SCG 9.00-9.10%, CNG 10.55

-10.65%

-10.65%

› GenConn - 9.75%

Notes: (1) As of November 2010. The annual long-term capital spending will be updated in the Fall of 2011.

(2) As of 8/5/11.

Conservative

Financial Strategy

Financial Strategy

(5.4% Yield)(2)

› Commitment to investment grade credit profile

› Consistent history of dividend payments

› Disciplined capital investment program

Visible Growth

Opportunities

Opportunities

› Significant opportunity exists to switch households to natural gas

› Conversions growth plan is in place

› Projected $2.2B (2011-2019) electric & gas capital expenditure plan

› GenConn: cost-of-service electric peaking generation is complete and operating in the ISO-

markets

markets

28

Q&A

29

Appendix

30

* RPS = Renewable Portfolio Standard.

** From ISO-NE Presentation dated 5/15/09 - driven by 2008 data.

*** From ISO-NE Presentation dated 5/25/10 - “existing” includes RPS obligations through 2009. Total RPS Requirement excludes Vermont renewables, combined heat & power, and energy

efficiency obligations.

efficiency obligations.

Region-Wide

Compliance Gap

Compliance Gap

(v. “existing” renewable resources**)

forecasted/estimated at

~ 18,000GWh

Region-Wide RPS Obligation thru 2020:

› Unlikely to be

satisfied by

renewables currently

in the ISO-NE queue

satisfied by

renewables currently

in the ISO-NE queue

› Will require

significant additional

transmission

significant additional

transmission

Satisfaction will likely require significant new transmission in the region.

Region-Wide RPS* Obligations

31

Connecticut RPS Requirements

(Percentage of Retail Load)

Class I resources include energy derived from solar, wind, fuel cell, methane gas from landfills, ocean thermal, wave,

tidal, run-of-river hydropower (<5MW, began operation after July 1, 2003), sustainable biomass (NOx emission <0.075

lbs/MMBtu of heat input)

tidal, run-of-river hydropower (<5MW, began operation after July 1, 2003), sustainable biomass (NOx emission <0.075

lbs/MMBtu of heat input)

Class II resources include other biomass (NOx emission <0.2 lbs/MMBtu of heat input, began operation before July 1,

1998), small run-of-river hydroelectric (<5MW, began operation before July 1, 2003) and municipal solid waste trash-to-

energy facilities

1998), small run-of-river hydroelectric (<5MW, began operation before July 1, 2003) and municipal solid waste trash-to-

energy facilities

Class III include customer-sited combined heat and power (with operating efficiency >50% of facilities installed after

January 1, 2006), waste heat recovery systems (installed on or after April 1, 2007), electricity savings from conservation

and load management programs (began on or after January 1, 2006)

January 1, 2006), waste heat recovery systems (installed on or after April 1, 2007), electricity savings from conservation

and load management programs (began on or after January 1, 2006)

CT RPS Requirements