|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 10, 2011

CENTRAL VERMONT PUBLIC SERVICE CORPORATION

(Exact name of registrant as specified in its charter)

|

|

Vermont

(State or other jurisdiction

of incorporation)

|

1-8222

(Commission

File Number)

|

03-0111290

(IRS Employer

Identification No.)

|

|

77 Grove Street, Rutland, Vermont 05701

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (800) 649-2877

N/A

(Former name or former address, if changed since last report)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 7.01.

|

Regulation FD Disclosure.

|

This presentation will be conducted at the Boston Harbor Hotel in Boston, Massachusetts before an audience of electric industry analysts and industry professionals on August 10, 2011.

Central Vermont Public Service Corporation

Williams Capital East Coast Seminar

August 10, 2011

Larry Reilly, President and CEO

Pam Keefe, Senior Vice President, CFO and Treasurer

Safe Harbor Statement

Statements contained in this presentation that are not historical fact are forward-looking statements within the meaning of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. Whenever used in this presentation, the words “estimate,” “expect,” “believe,” or similar expressions are intended to identify such forward-looking statements. Forward-looking statements involve estimates, assumptions, risks and uncertainties that could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. Actual results will depend upon, among other things, the actions of regulators, performance of the Vermont Yankee nuclear power plant, effects of and changes in weather and economic conditions, volatility in wholesale power markets, our ability to maintain our current credit ratings, performance of our unregulated business, and other considerations such as the operations of ISO-New England, changes in the cost or availability of capital, authoritative accounting guidance, and the effect of the volatility in the equity markets on pension benefit and other costs. We cannot predict the outcome of any of these matters; accordingly, there can be no assurance that such indicated results will be realized. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

|

•

|

This communication does not constitute a solicitation of any vote or approval. This communication is being made in respect of the proposed merger transaction involving CVPS. The proposed merger will be submitted to the stockholders of CVPS for their consideration. In connection therewith, CVPS has filed a preliminary proxy statement and will file a definitive proxy statement with the Securities and Exchange Commission (the “SEC”). CVPS also plans to file other documents with the SEC regarding the proposed transaction. CVPS URGES INVESTORS AND SECURITY HOLDERS OF CVPS TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The definitive proxy statement will be mailed or delivered to CVPS’s stockholders. In addition, stockholders will be able to obtain the proxy statement and other relevant documents filed by CVPS with the SEC free of charge at the SEC’s website at www.sec.gov, or at CVPS’s website at www.cvps.com by clicking on the link “SEC Filings.”

|

|

•

|

Participants in the Solicitation

|

|

|

CVPS and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of CVPS in connection with the proposed transaction. Information about CVPS and its directors and executive officers, and their ownership of CVPS’s securities, is set forth in the proxy statement for the annual meeting of stockholders of CVPS held on May 3, 2011, which was filed with the SEC on March 24, 2011 and which can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement relating to the proposed merger and other relevant materials to be filed with the SEC when they become available.

|

Investor Contact Information

Pamela J. Keefe

Sr. Vice President, CFO & Treasurer

(802) 747-5435

e-mail: pkeefe@cvps.com

CVPS Profile

-

Vermont's largest integrated electric utility

-

CVPS serves approximately 160,000 customers in a territory covering hald of the area of Vermont

-

Rural service territory of 19 customers per mile of line

|

Credit Ratings

|

Moody’s

|

|

Corporate Credit Rating

|

Baa3/Stable

|

|

First Mortgage Bonds

|

Baa1

|

|

Preferred Stock

|

Ba2

|

COMMON STOCK PROFILE (NYSE: CV)

Quarter Ended June 30, 2011

|

Market Capitalization

|

$485.2M

|

|

Book Value

|

$20.41

|

|

Market-to-Book

|

1.77

|

|

52-week Range

|

$19.09-$36.36

|

|

Debt% - Equity%

|

45% - 55%

|

|

Average Daily Volume

|

128,089

|

|

Shares Outstanding

|

13.422M

|

|

Annualized Dividend Yield

|

2.54%

|

AGENDA

|

·

|

Merger Update

|

|

·

|

Vision, Recent Accomplishments and Goals Update

|

|

·

|

Power Planning

|

|

·

|

Regulatory

|

|

·

|

Financial

|

Merger Agreement

|

·

|

On July 12, 2011 CVPS and Gaz Métro Limited Partnership announced an agreement for the acquisition of CV by Gaz Métro

|

|

−

|

$35.25 per common share

|

|

−

|

All cash transaction; no financing contingency

|

|

−

|

Significant premium for CV Shareholders:

|

|

◦

|

55% over closing price on May 4th

|

|

◦

|

45% over closing price on May 27th

|

|

−

|

Allowed to continue current dividend until closing

|

|

·

|

Agreement with Gaz Métro “topped” previously announced transaction with Fortis Inc.

|

|

·

|

Transaction is subject to CV Shareholder approval, State and Federal Regulatory approvals, and typical closing conditions

|

|

−

|

Expected to close during the first half of 2012

|

About Gaz Métro

|

·

|

Quebec’s leading natural gas distributor

|

|

·

|

$3.6 billion in assets

|

|

·

|

10,000 kilometer network serving 300 municipalities

|

|

·

|

Proven track record in Vermont

|

|

−

|

Vermont Gas Systems acquired in 1986

|

|

−

|

Green Mountain Power Corporation acquired in 2007

|

Gaz Métro U.S. Operations Post-Acquisition

|

Gaz Métro L.P.

|

||||||||||

|

Northern New England Energy Corp.

|

||||||||||

|

Northern N.E. Investment Corp.

|

Vermont Gas Systems

|

Green Mountain

Power

|

Central VT

Public Service

|

|||||||

|

Portland Natural

Gas Transmission System

|

90,000 customers

|

160,000 customers

|

||||||||

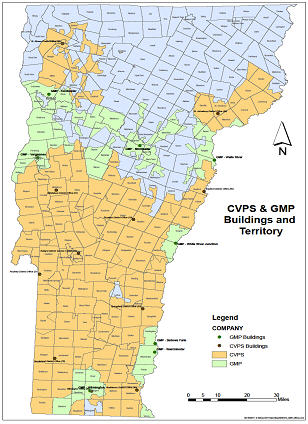

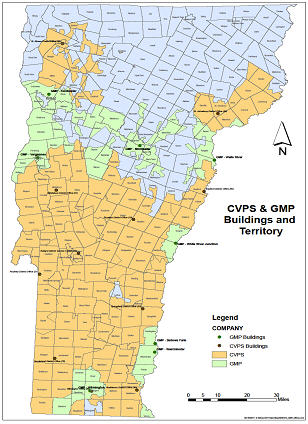

Gaz Métro U.S. Electric Distribution Business Pre- and Post-Acquisition

|

·

|

Largely contiguous territories provide significant opportunities for consolidation

|

|

CV

|

GMP

|

Combined

|

||

|

Customers Served (VT)

|

47%

|

25%

|

72%

|

|

|

Area Served (VT)

|

50%

|

13%

|

63%

|

|

|

Line Miles

|

8,900

|

3,100

|

12,000

|

|

|

In-State Hydro*

|

24 stations 66 MW

|

8 stations 37 MW

|

32 stations 103 MW

|

*for CV, includes VMPD hydros expected to be purchased Sept 1, 2011

Merger will benefit many stakeholders

|

·

|

Significant premium for investors

|

|

·

|

Significant savings for all customers

|

|

−

|

$144 million guaranteed over 10 years

|

|

·

|

Low-income customers to benefit from spin-off of 30% interest in VELCO ($8 million rate base)

|

|

·

|

Workforce reductions accomplished through normal attrition and retirements

|

|

−

|

No layoffs, other than certain executive officers

|

|

·

|

Rutland to become Headquarters for Operations and Energy Innovation

|

|

−

|

Downsizing to be proportional between CV and GMP territories

|

|

−

|

Other commitments to benefit Rutland

|

Approval Update

|

·

|

Shareholder Approval

|

|

−

|

Preliminary proxy statement filed August 1st

|

|

−

|

Assuming no review:

|

|

◦

|

Mailing late August

|

|

◦

|

Special shareholder meeting late September

|

|

−

|

SEC Review could delay process by three weeks or more

|

|

·

|

Vermont Public Service Board Approval

|

|

−

|

Critical path for all required regulatory approvals

|

|

−

|

Plan to file petition and testimony before the end of August

|

|

·

|

Other State approvals

|

|

−

|

Routine approvals needed from ME, NY, and NH

|

|

−

|

Target filing date: September 9th

|

|

·

|

Federal Approvals

|

|

−

|

Federal Energy Regulatory Commission

|

|

−

|

Nuclear Regulatory Commission

|

|

−

|

Department of Justice (Hart-Scott-Rodino)

|

|

−

|

Committee on Foreign Investment in the US

|

|

−

|

Federal Communications Commission

|

|

·

|

Filings in preparation

|

|

−

|

No significant issues identified to date

|

CVPS Vision:

The Best Small Utility in America

|

Customers

5th in East Region on JD Power

Low rates compared to others in East

68% of LCI customers are “completely satisfied”

EEI Storm Response 3 time winner

CVPS SmartPower® Plan approved

|

Shareholders

Rated Baa3 by Moody’s

Recognized by Forbes as Trustworthy

|

|

|

Community

Gift of Life Marathon holds record for most pints collected

Corporate Citizenship ranked 2nd in the East Region among

midsize companies by JD Power Survey |

Employees

91% of Employees would recommend CVPS as a great place to work

Performed well in Denison Culture Survey

Safety culture strong according to an independent audit

|

Key Measures of Success

|

·

|

Maximize Value in the Regulated Business

|

|

−

|

Address gaps between earned and allowed ROE

|

|

−

|

Close pending acquisitions

|

|

·

|

Further Diversify Power Sources

|

|

·

|

Regulatory Collaboration

|

|

·

|

CVPS SmartPower® Program Execution

|

|

·

|

Maintain or Improve Credit Rating

|

J.D. Power East Region Overall CSI

|

Southern Maryland Electric

|

686

|

|

|

Central Maine Power

|

638

|

|

|

PPL Electric Utilities

|

636

|

|

|

Penn Power

|

636

|

|

|

Central Vermont Public Service

|

623

|

|

|

New York State Electric & Gas

|

621

|

|

|

Rochester Gas & Electric

|

620

|

|

|

Penelec

|

618

|

|

|

PECO Energy

|

617

|

|

|

NSTAR

|

617

|

|

|

WMECO

|

617

|

|

|

Met-Ed

|

615

|

|

|

Allegheny Power

|

614

|

|

|

Baltimore Gas and Electric

|

611

|

|

|

ConEd NY

|

610

|

|

|

Public Service Electric and Gas

|

607

|

|

|

East Region Average

|

606

|

|

|

Public Service of New Hampshire

|

605

|

|

|

Delmarva Power

|

604

|

|

|

Jersey Central Power & Light

|

603

|

|

|

National Grid

|

602

|

|

|

Duquesne Light

|

595

|

|

|

Atlantic City Electric

|

594

|

|

|

Central Hudson Gas & Electric

|

593

|

|

|

Connecticut Light & Power

|

588

|

|

|

Orange & Rockland

|

587

|

|

|

United Illuminating

|

586

|

|

|

Long Island Power Authority

|

582

|

|

|

Appalachian Power

|

570

|

|

|

Pepco

|

556

|

CVPS ranked 5th in the East Region, and 2nd among New England and New York utilities, for overall CSI.

CVPS Customer Service ranks 6th nationally out of 124 companies.

Vermont Marble, Readsboro purchases

|

·

|

PSB approved Vermont Marble and Readsboro acquisitions

|

|

−

|

Closed the Readsboro purchase August 1, 2011, adding 320 customers

|

|

−

|

Vermont Marble purchase headed toward September 1 closing

|

|

◦

|

Will add 900 customers, including Omya, which will become CVPS’s single-largest customer

|

|

◦

|

Purchase includes 18 MW of hydro, which will be upgraded to 21 MW

|

CVPS SmartPower®

|

·

|

A Smart grid program being rolled out to all CVPS customers

|

|

−

|

$62 million capex; 50% of this funded by DOE

|

|

·

|

Similar programs being implemented by other VT utilities

|

|

·

|

GMP and CVPS finalized agreement with VTel, state’s independent telephone company, for smart-grid communications backbone

|

|

−

|

Will help expand broadband statewide

|

|

−

|

Agreement lauded by Governor Shumlin

|

|

−

|

Deal expected to help make Vermont first state with full smart grid and broadband

|

|

·

|

On track to go live in late 2012

|

CVPS Power Supply Among Cleanest

|

2010 CVPS ENERGY SOURCES

|

|

|

Nuclear

|

50.1%

|

|

Hydro

|

40.3%

|

|

Oil

|

0.1%

|

|

Wood

|

3.9%

|

|

CVPS Cow Power

|

0.1%

|

|

Other

|

5.5%

|

|

2010 U.S. ENERGY SOURCES*

|

|

|

Coal

|

45%

|

|

Gas

|

24%

|

|

Nuclear

|

20%

|

|

Hydro

|

6%

|

|

Renewables

|

4%

|

|

Oil

|

1%

|

|

Other

|

0%

|

*Source: Energy Information Administration (2010), rounded whole percent

Vermont Yankee

|

·

|

Status of Vermont Yankee

|

|

−

|

Existing 175 MW VT Yankee contract expires March 21, 2012, at expiration of initial license term

|

|

−

|

NRC has granted Entergy a 20-year license extension; but the State of Vermont is opposed to continued operation of the plant

|

|

−

|

Entergy and Vermont are engaged in federal litigation

|

|

◦

|

As a future power supply the role of VY is unclear but manageable

|

|

−

|

We have a revenue sharing agreement with Entergy that serves as a price hedge should the plant continue to operate after our contract expires

|

|

·

|

Court rejected Entergy’s request for preliminary injunction sought against state of Vermont

|

|

−

|

Trial is set for September 12

|

|

−

|

Entergy has ordered replacement fuel despite uncertainty around plant’s future

|

New power supply contracts signed

|

·

|

Contracts will cover VY refueling outage and needs in 2012

|

|

−

|

Conducted highly structured Internet auction on July 27

|

|

−

|

Average price of $47.50 per mWh

|

|

−

|

Some periods are as low as $39 per mWh

|

|

−

|

Expect to continue to use auctions for short-term purchases as we evaluate long-term contracts

|

Regulatory update

|

·

|

State Energy Planning

|

|

−

|

DPS to update state plan by Fall 2011

|

|

−

|

Provided model to help balance environmental and economic objectives

|

|

−

|

New initiatives expected next Legislative session

|

|

·

|

EEU Role Changing

|

|

−

|

Vermont’s “Energy Efficiency Utility” is changing from being a contractor of the PSB for energy efficiency services to being an entity subject to appointment, with more accountability and performance metrics, and responsible for program design and delivery

|

|

−

|

EEU receives revenue from surcharge on utility customer bills and from payments for supplying demand reduction to the region’s capacity market

|

|

−

|

EEU supports and incents consumer investment in high-efficiency equipment

|

|

−

|

CVPS supports the EEU as a partner

|

|

·

|

Other regulatory collaboration

|

|

−

|

CVPS SmartPower® supports Vermont’s statewide broadband and cell coverage goals

|

|

−

|

CVPS power purchases fulfill VT’s renewable, sustainable power resource goals

|

|

−

|

CVPS supports VT’s goals in the state and regional transmission planning process

|

|

·

|

Extended Alternative Regulation Plan through 2013

|

|

−

|

Maintains earnings and power cost adjustment mechanisms

|

|

−

|

Provides for cost recovery for “new initiatives” – primarily CVPS SmartPower® and integration of VT Marble acquisition

|

|

−

|

PSB allowed an ROE 27 bp higher than ROE adjustment process would have otherwise determined

|

|

−

|

Will file for 2012 rates in November 2011

|

Q2 2011 Financial Results

|

All numbers in 000s except per share

|

Q2 2011 | Q2 2010 |

YTD 2011

|

YTD 2010

|

||||||||||||

|

Operating revenues:

|

||||||||||||||||

|

Retail sales

|

$ | 71,638 | $ | 67,585 | $ | 154,896 | $ | 143,647 | ||||||||

|

Resale sales

|

9,744 | 6,984 | 17,439 | 18,323 | ||||||||||||

|

Provision for rate refund

|

167 | 2,201 | 3,558 | 2,326 | ||||||||||||

|

Other

|

2,719 | 3,167 | 5,460 | 6,648 | ||||||||||||

|

Total operating revenues

|

$ | 84,268 | $ | 79,937 | $ | 181,353 | $ | 170,944 | ||||||||

|

Operating expenses:

|

||||||||||||||||

|

Purchased power

|

$ | 39,778 | $ | 37,211 | $ | 81,130 | $ | 78,929 | ||||||||

|

Other operating expenses

|

43,744 | 42,414 | 89,692 | 86,610 | ||||||||||||

|

Income tax expense (benefit)

|

(481 | ) | (791 | ) | 2,376 | 1,047 | ||||||||||

|

Total operating expense

|

$ | 83,041 | $ | 78,834 | $ | 173,198 | $ | 166,586 | ||||||||

|

Equity in Earnings in Affiliates

|

$ | 6,987 | $ | 5,115 | $ | 13,928 | $ | 10,510 | ||||||||

|

Other, net *

|

$ | (7,478 | ) | $ | (4,773 | ) | $ | (12,922 | ) | $ | (9,221 | ) | ||||

|

Net Income

|

$ | 736 | $ | 1,445 | $ | 9,161 | $ | 5,647 | ||||||||

|

Earnings per share of common stock – diluted

|

$ | 0.05 | $ | 0.11 | $ | 0.67 | $ | 0.46 | ||||||||

|

* included in this line are merger-related costs

|

$ | 3,100 | $ | -- | $ | 3,100 | $ | -- | ||||||||

Liquidity and Financing

|

Cash Flows

|

2011

|

2010

|

||||||

|

Cash and cash equivalents at beginning of period

|

$ | 2,676 | $ | 2,069 | ||||

|

Cash provided by operating activities

|

31,468 | 27,251 | ||||||

|

Cash used for investing activities

|

(8,035 | ) | (12,333 | ) | ||||

|

Cash provided (used) by financing activities

|

233 | (14,343 | ) | |||||

|

Cash and cash equivalents at end of period

|

$ | 26,342 | $ | 2,644 | ||||

|

·

|

Secured $100M ‘shelf facility’ for FMBs in 2011

|

|

−

|

Drew $40M in June 2011; $20M of this was to redeem Series SS bonds

|

|

·

|

Renewed and extended $15M credit facility

|

|

·

|

Will renew $40M facility in Q3 2011

|

|

·

|

No drawings on either LOC as of June 30, 2011

|

Merger-related items

|

·

|

Termination fee payment

|

|

−

|

In July 2011 CV paid $19.5M break fee and related expenses to Fortis, Inc.

|

|

◦

|

Will be reimbursed by Gaz Métro following shareholder approval of merger agreement

|

|

−

|

Expect ~24 cents eps impact of other merger-related expenses in 2011 (legal, advisory)

|

Capex (excl. Velco Investments)

|

2005

|

$17.5

|

|

2006

|

$18.0

|

|

2007

|

$23.0

|

|

2008

|

$36.8

|

|

2009

|

$30.0

|

|

2010

|

$33.0

|

|

2011

|

$84.6

|

|

2012

|

$57.5

|

|

2013

|

$51.1

|

|

2014

|

$47.5

|

|

2015

|

$49.5

|

CVPS SmartPower® spending is net of $28M stimulus funding applied to capital

Velco investment forecast update

|

Previous forecast

|

|

|

2010

|

$22

|

|

2011

|

$12

|

|

2012

|

$30

|

|

2013

|

$0

|

|

2014

|

$27

|

|

Updated forecast

|

|

|

2010

|

$22

|

|

2011

|

$0

|

|

2012

|

$21

|

|

2013

|

$0

|

|

2014

|

$23

|

|

2015

|

$19

|

Updated forecast reflects 2010 – 2011 projects under budget as well as the deferral of PV-20 project

Rate Base Growth (Dollars in Millions)

Actual and Projected*

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

|

|

Projected Rate Base

|

$236

|

$236

|

$302

|

$344

|

$385

|

$426

|

$470

|

$507

|

$5551

|

$578

|

$619

|

Projected CAGR of 7.75% from 2010 - 2015 net of Stimulus funding

*Includes Velco investments and VT Marble acquisition

2011 Earnings Guidance and Drivers

|

·

|

2011 Earnings Guidance

|

|

−

|

$1.60 - $1.75 per diluted share previously announced (no merger-related costs)

|

|

−

|

Due to merger and uncertainty around amount and timing of merger-related costs, we are discontinuing earnings guidance

|

|

−

|

7.46% rate increase effective 1/1/11

|

|

−

|

Allowed ROE 9.45%

|

Creating value for all stakeholders

|

·

|

Merger process is proceeding well

|

|

·

|

Will remain focused on key initiatives as merger progresses

|

|

−

|

Customer service, reliability

|

|

−

|

Vermont Marble acquisition, followed by hydro investments

|

|

−

|

CVPS SmartPower®

|

Questions?

Appendix

Key Data Elements

|

−

|

Market Cap at 6/30/11: $ 485.2M

|

|

−

|

2008 Earned ROE: 8.3%

|

|

−

|

2009 Earned ROE: 9.03%

|

|

−

|

2010 Earned ROE: 8.46%

|

|

−

|

2011 Allowed ROE: 9.45%

|

|

−

|

2011 Effective Tax Rate: 36.77%

|

|

−

|

2011 Capex (ex. Transco, VT Marble; net of Stimulus): $54.9M

|

|

−

|

2011 Transco investment: NONE

|

|

−

|

~5 bp of ROE = $0.01 eps

|

|

−

|

Corp. Credit Rating (Moody’s): Baa3/ stable

|

|

−

|

2010 Peak load: 406.1 MW (July 8)

|

|

−

|

2010 Avg 12 month system capability: 516.1 MW

|

|

·

|

2010 Average Number of Customers:

|

|

−

|

136,457 Residential

|

|

−

|

22,672 Commercial

|

|

−

|

35 Industrial

|

|

·

|

2010 Revenues:

|

|

−

|

43% Residential

|

|

−

|

32% Commercial

|

|

−

|

11% Industrial

|

|

−

|

11% Resale Sales

|

|

−

|

3% Other Operating Revenue

|

Owned Generation – as of 12/31/10

|

Net Effective Capability / Entitlement (MW)

|

Generated and

Purchased mWh

|

|

|

Wholly-Owned Plants

|

||

|

Hydro

|

35.8

|

207,779

|

|

Diesel and Gas Turbine

|

22.2

|

591

|

|

Jointly-Owned Plants (1)

|

||

|

Millstone #3 (nuclear)

|

21.4

|

161,536

|

|

Wyman #4 (oil)

|

10.8

|

2,174

|

|

McNeil (various)

|

10.5

|

54,440

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CENTRAL VERMONT PUBLIC SERVICE CORPORATION

|

|

|

By

|

/s/ Pamela J. Keefe

Pamela J. Keefe

Senior Vice President, Chief Financial Officer, and Treasurer

|

|

August 10, 2011

|

|