Attached files

| file | filename |

|---|---|

| EX-10.24 - MV Portfolios, Inc. | v231194_ex10-24.htm |

| EX-10.25 - MV Portfolios, Inc. | v231194_ex10-25.htm |

| EX-10.23 - MV Portfolios, Inc. | v231194_ex10-23.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 4, 2011

California Gold Corp.

(Exact Name of Registrant as Specified in Its Charter)

Nevada

(State or Other Jurisdiction of Incorporation)

| 333-134549 | 83-0483725 | |

| (Commission File Number) | (IRS Employer Identification No.) |

4515 Ocean View Blvd., Suite 305, La Cañada, CA 91011

(Address of Principal Executive Offices) (Zip Code)

818-542-6891

(Registrant's Telephone Number, Including Area Code)

________________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Table of Contents

|

Forward-Looking Statements

|

1

|

||

|

Item 8.01

|

Other Events

|

2

|

|

|

Explanatory Note

|

2

|

||

|

Description of Business

|

3

|

||

|

Description of Properties

|

9

|

||

|

Risk Factors

|

13

|

||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

29

|

||

|

Security Ownership of Certain Beneficial Owners and Management

|

31

|

||

|

Directors, Executive Officers, Promoters and Control Persons

|

34

|

||

|

Executive Compensation

|

36

|

||

|

Certain Relationships and Related Transactions

|

38

|

||

|

Market Price of and Dividends on Common Equity and Related Shareholder Matters

|

40

|

||

|

Recent Sales of Unregistered Securities

|

41

|

||

|

Description of Securities

|

42

|

||

|

Legal Proceedings

|

47

|

||

|

Indemnification of Directors and Officers

|

48

|

||

|

Item 9.01

|

Financial Statements and Exhibits.

|

49

|

|

|

Signatures

|

52

|

||

|

Exhibit Index

|

53

|

||

FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements.” All statements other than statements of historical facts included in this Current Report on Form 8-K, including without limitation, statements in this Management’s Discussion and Analysis of Financial Condition and Results of Operations regarding our financial position, estimated working capital, business strategy, the plans and objectives of our management for future operations and those statements preceded by, followed by or that otherwise include the words “believe”, “expects”, “anticipates”, “intends”, “estimates”, “projects”, “target”, “goal”, “plans”, “objective”, “should”, or similar expressions or variations on such expressions are forward-looking statements. We can give no assurances that the assumptions upon which the forward-looking statements are based will prove to be correct. Because forward-looking statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by the forward-looking statements. There are a number of risks, uncertainties and other important factors that could cause our actual results to differ materially from the forward-looking statements, including, but not limited to, our ability to identify appropriate corporate acquisition and/or joint venture opportunities in the rare and precious metals mining sector and to establish the technical and managerial infrastructure, and to raise the required capital, to take advantage of, and successfully participate in such opportunities; future economic conditions; political stability; and mineral prices.

Except as otherwise required by the federal securities laws, we disclaim any obligations or undertaking to publicly release any updates or revisions to any forward-looking statement contained in this Report to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

1

Item 8.01 Other Events

EXPLANATORY NOTE

California Gold Corp. (“California Gold,” the “Company,” “we,” “us,” “our” or similar terms) is an exploration stage Nevada corporation whose principal focus is the identification, acquisition and development of rare and precious metal mining properties. The Company was incorporated on April 19, 2004 as Arbutus Resources, Inc. We have changed our name a number of times (see “Description of Business – Company History” below) and most recently, on March 9, 2009, we changed our name to California Gold Corp.

Prior to the execution on February 11, 2011 of the AuroTelurio Option Agreement (defined below), we were a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended). We believe that as a result of the execution of the AuroTelurio Option Agreement and taking into account the activities we have undertaken in connection with that agreement, we have ceased to be a shell company as of February 11, 2011. The material terms of the AuroTelurio Option Agreement are discussed in our Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on February 16, 2011 and are incorporated into this Form 8-K by reference.

The information contained in this report, together with the information contained in our Annual Report on Form 10-K for the fiscal year ended January 31, 2011, and our subsequent Quarterly Report on Form 10-Q and our subsequent Current Reports on Form 8-K, as filed with the SEC, constitute the current “Form 10 information” necessary to satisfy the conditions contained in Rule 144(i)(2) under the Securities Act of 1933, as amended (the “Securities Act”).

2

DESCRIPTION OF BUSINESS

Overview

California Gold is an exploration stage mining company whose principal focus is the identification, acquisition and development of rare and precious metals mining properties in the Americas.

Our primary focus is on the exploration and development of the La Viuda Concessions comprising the AuroTelurio Property south of Moctezuma, Sonora, Mexico, where, we believe, deposits of tellurium, gold and silver may exist in economically minable quantities. We are still in the exploration stage and have not generated any revenues from our mining properties in Mexico.

The Mexivada Property Option Agreement

On February 11, 2011, we entered into a property option agreement (the “AuroTelurio Option Agreement”) with Mexivada Mining Corp. (“Mexivada”) to acquire up to an 80% interest in Mexivada’s La Viuda and La Viuda-1 concessions comprising its AuroTelurio tellurium-gold-silver property (the “La Viuda Concessions,” the “AuroTelurio Property” or, the “Property”) south of Moctezuma, Sonora, Mexico.

Under the terms of the AuroTelurio Option Agreement (which are more fully described in our Form 8-K current report filed with the SEC on February 16, 2011 and incorporated herein by reference), we will acquire up to an 80% legal and beneficial ownership interest in the AuroTelurio Property by, in addition to making certain cash payments and share issuances to Mexivada, incurring up to $3,000,000 in cumulative exploration expenditures on the Property over a four year period at an investment rate of at least $750,000 per year. We will earn a 20% vested interest in the AuroTelurio Property in the first year of the AuroTelurio Option Agreement by investing $750,000 in an exploration program (the “Exploration Program”) and up to an additional 60% interest in the Property, in blocks of 20% each, by investing an additional $750,000 in the Exploration Program in each of the following three years, or sooner, and meeting all of the other required terms of the AuroTelurio Option Agreement. Each 20% interest will vest earlier if each year’s cash and stock payments to Mexivada and $750,000 exploration expenditure investment are completed earlier than scheduled.

First Closing under the AuroTelurio Option Agreement

On August 4, 2011, we conducted the first closing (the “First Closing”) under the AuroTelurio Option Agreement. Prior to the First Closing, we had made cash payments to Mexivada totaling $20,000. On the date of the First Closing, we paid Mexivada an additional $10,000 in cash and issued to Mexivada 250,000 shares of our restricted common stock. In exchange, we received from Mexivada four fully executed title deeds, each transferring to us a twenty percent (20%) interest in the La Viuda Concessions comprising the AuroTelurio Property. We will hold these title deeds in escrow until we meet the terms of the AuroTelurio Option Agreement for the vesting of each twenty percent (20%) interest. At that time, the relevant title deed will be released to us from escrow and filed with the Ministry of Mines in Mexico, to evidence our ownership in that specific twenty percent interest in the AuroTelurio Property. If we default on our commitments under the AuroTelurio Option Agreement or otherwise determine not to proceed with the acquisition of the AuroTelurio Property, all unvested interests and related title deeds in the AuroTelurio Property will be returned to Mexivada.

3

In addition to the cash payment and stock issuance made at the First Closing, assuming we exercise our right to acquire each of the four twenty percent (20%) interests in the AuroTelurio Property, we will pay Mexivada an additional $40,000 upon the first anniversary of the First Closing, $50,000 upon the second anniversary of the First Closing, $70,000 upon the third anniversary of the First Closing and $100,000 upon the fourth anniversary of the First Closing, for an aggregate total of $290,000. We will also issue to Mexivada 250,000 additional shares of our restricted common stock upon the first anniversary of the First Closing, 300,000 additional shares upon the second anniversary of the First Closing, 350,000 additional shares upon the third anniversary of the First Closing and 500,000 additional shares upon the fourth anniversary of the First Closing, for an aggregate total of 1,650,000 shares.

The La Viuda Concessions

The La Viuda Concessions (discussed in greater detail below), which cover approximately 18,840 acres (7,624 hectares) south of Moctezuma, Sonora Mexico, comprise two exploration concessions granted by the Mexican government to Compania Minera Mexivada, S.A. de C.V., a wholly owned subsidiary of Mexivada. The La Viuda 1 concession surrounds a number of other mining concessions, including the La Viuda concession and a concession where the La Bambolla mine (“La Bambolla Concession”) is located.

La Bambolla

The La Bambolla Concession is owned by Minera Teloro, S.A. de C.V., a Mexican company reported in the past to be a subsidiary of First Solar, Inc. (“First Solar”). First Solar is a U.S. based company that manufactures and sells photovoltaic (PV) solar power systems and solar modules based on a thin film technology using cadmium telluride (CdTe) as a semiconductor. Cadmium telluride is a compound made up of cadmium (Cd) and tellurium (Te).

A report in the Sonora Geological-Mining Monograph published by the Consejo de Recursos Minerales ("CRM") describes the La Bambolla vein system as being a 2-meter thick quartz-pyrite-hematite-gold system that averages 4.0 g/ton gold and 5 g/ton silver, respectively.

The La Bambolla mine on the La Bambolla concession was active during the 1960s. We have obtained geological and assay data from channel samples taken in the La Bambolla underground workings in 1986. More than 500 channel samples taken in the underground workings of the La Bambolla mine show the presence of gold and tellurium. The gold grades are in the 0.03 to 4.90 oz/ton range, and average about 0.46 oz/ton Au. The tellurium grades range from 0.01% to 3.26%, and average 0.25% Te. The tellurium content of these samples in parts per million (ppm) ranges from 100 to 32,600 ppm, and averages 2,500 ppm. These samples were not assayed for silver. Reportedly, the La Bambolla mine dumps also contain visible native tellurium as well as tellurite and sonoraite, which are secondary tellurium minerals.

4

Tellurium

Tellurium is a relatively rare element in the same chemical family as oxygen, sulfur, selenium, and polonium. Of these, oxygen and sulfur are nonmetals, polonium is a metal, and selenium and tellurium are semiconductors (i.e., their electrical properties are between those of a metal and an insulator). Nevertheless, tellurium, as well as selenium, is often referred to as a metal when in elemental form. Tellurium production is mainly a by-product of copper processing. The 1960's brought growth in thermoelectric applications for tellurium, as well as its use in free-machining steel, which became the dominant use. Tellurium has been increasingly used in the production of cadmium-tellurium-based solar cells. Some of the highest efficiencies for electric power generation have been obtained by using this material1. The average price for tellurium in US dollars per kilogram increased from $89 in 2006 to $210 in 20102. This increase in price is attributed to an increase in the production of thin film semiconductor solar cells.

In 2008, approximately 450 to 500 metric tons of refined tellurium were produced as a result of mining and processing ores derived from primary sources. Japan and Belgium have been the leading producers of these metals, which are recovered from copper concentrates and residues purchased primarily from mining operations in Africa, Asia, Australia, and South America. China is also a large purchaser from these regions and also produces the metals from domestic mining operations. Although some of the tellurium metal is recovered from a few gold and silver deposits with anomalously high levels of tellurium content, nearly all the world’s tellurium metal produced from ore deposits depends on profitable recovery from residues (slimes) produced during the refining of copper to copper cathode. This copper cathode is derived from the mining of copper sulfide ore from polymetallic ore bodies (for example, the Sudbury nickel district), and from lead and zinc operations. The content of tellurium metal in copper concentrate is generally below 100 ppm. The metal is commercially profitable to recover only when concentrated in residues collected from copper refineries and treated for the recovery of other metals of value, which generally include antimony and precious metals such as gold, palladium, platinum, and silver3.

According to the U.S. Geological Survey, more than 90% of tellurium is produced from anode slimes collected from electrolytic copper refining, and the remainder is derived from skimmings at lead refineries and from flue dusts and gases generated during the smelting of bismuth, copper, and lead ores. In copper production, tellurium is recovered only from the electrolytic refining of smelted copper. Increasing use of the leaching solvent extraction-electrowinning processes for copper extraction, which does not capture tellurium, has limited the projected future supply of tellurium from certain types of copper deposits. This expected decrease in these sources of tellurium supply has led to the exploration for other sources of tellurium, including deposits containing pure concentrations of tellurium and concentrations combined with gold and silver such as those indicated in the historical data from the La Bambolla Concession and those believed to be present in the La Viuda Concessions as well.

1 US Geological Survey, Mineral Commodity Summaries, January 2011.

2 For 2006, the price listed was the average price published by Mining Journal for United Kingdom lump and powder, 99.95% tellurium. In 2010, the price listed was the average price published by Metal-Pages for 99.95% tellurium.

3 This paragraph has been reproduced, in relevant part, from Bleiwas, D.I., 2010, Byproduct mineral commodities used for the production of photovoltaic cells: U.S. Geological Survey Circular 1365, 10 p., available at http://pubs.usgs.gov/circ/1365/.

5

The AuroTelurio Property Exploration Program

In order to earn each 20% interest in the La Viuda Concessions comprising the AuroTelurio Property, we will be required to invest a minimum of US $750,000 per year in a four (4) year exploration program for the AuroTelurio Property. To this end, we have contracted the services of a geologist familiar with the characteristics of gold-tellurium deposits. This geologist has prepared a preliminary, nine-month Phase 1 exploration program for the AuroTelurio Property that includes geological mapping, geophysical surveying, drill site location, drilling, sampling, and assaying of surface and drill core samples. He will also prepare a NI 43-101 compliant technical report. Timetables for these exploration activities are being developed and costs for the recommended exploration program are currently being determined.

On May 16, 2011, we signed a surface rights agreement with the land owner where the AuroTelurio Property is located. We will pay this land owner $14,400 per year for the right to conduct our exploration of the La Viuda Concessions on the AuroTelurio Property.

We have begun our exploration program and we are currently conducting mapping, trenching and sampling programs at the AuroTelurio Property. These activities will be followed by planned gravity and magnetic geophysical surveys in preparation for an initial 3,000-meter drilling program that is planned for implementation by this fall.

Historical data suggest that tellurium-gold mineralization at the adjoining La Bambolla mine occurs along a regional structural system with an average S 70 degrees E trend where a swarm of relatively narrow, sub-parallel, silica-rich mineralized veins are present. At La Bambolla, these veins are either vertical, or have steep dips, and range from 0.14 to 2.60 meters in width. Based on analytical results of more than 500 underground channel samples taken at La Bambolla in the 1980's, the grades in the mine range from 0.01 to 3.26 % tellurium and 0.03 to 4.90 oz/ton gold, respectively.

Geologic mapping and sampling has thus far confirmed that the regional structure hosting the tellurium-gold vein system at La Bambolla extends easterly onto our AuroTelurio Property. Zones of fracture-controlled silicification, strikingly similar to those described at La Bambolla, have been mapped in our grounds to the east-southeast.

The current interpretation is that these features could be spatially located at a higher level than similar alteration-mineralization features found at La Bambolla. This interpretation, furthermore, appears to support our initial geologic model that a series of essentially north trending, post-mineral faults have down-dropped segments of the original mineralized system to the east. Our current belief, based on projections from the existing data, is that ore-grade tellurium-gold mineralization is highly likely to exist at depth within our La Viuda Concessions.

6

Competition

We are a mineral resource exploration company. We compete with other mineral resource exploration companies for financing, personnel and equipment and for the acquisition of mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and/or development. This competition could adversely impact our ability to finance further exploration and to achieve the financing necessary to develop our mineral properties.

Compliance with Government Regulation

We are committed to complying with and are, to our knowledge, in compliance with all governmental and environmental regulations applicable to our Company and our properties. Permits from a variety of regulatory authorities are required for many aspects of mine operation and reclamation. We cannot predict the extent to which these requirements will affect our Company or our properties if we identify the existence of minerals in commercially exploitable quantities. In addition, future legislation and regulation could cause additional expense, capital expenditure, restrictions and delays in the exploration of our properties.

Company History

We were incorporated on April 19, 2004, as Arbutus Resources Inc. under the laws of the state of Nevada. We were organized to be engaged in the acquisition and exploration of mineral properties. We acquired a 100% undivided right, title and interest in and to twenty cells, known collectively as the Green Energy Claims, located 61 km southwest of the City of Williams Lake in South Central British Columbia, Canada. By April 30, 2007, we had not earned any revenues, and, not having sufficient funds to commence exploration on our Green Energy Claims, we determined to seek a joint venture partner or other business option to continue operating as a viable public company.

On July 11, 2007, we merged with Cromwell Uranium Holdings, Inc. (“Holdings,” the “Cromwell Merger”), a uranium exploration mining company, having changed our name on June 15, 2007 to Cromwell Uranium Corp. in anticipation of this merger. Pursuant to the Cromwell Merger, Holdings became our wholly owned subsidiary. At the closing of the Cromwell Merger, we transferred the Green Energy Claims to a newly formed subsidiary and sold all of the capital stock of that subsidiary to our former directors. As a result of developments in the public capital markets as well as conditions in the mining industry, among other factors, effective August 8, 2007, we and the principals of Holdings unwound the Cromwell Merger and on August 9, 2007, we changed our name to US Uranium Inc.

7

Since that unwinding, we have been searching for an appropriate business opportunity in the precious metals mining sector. On March 9, 2009, we changed our name to California Gold Corp.

Research and Development Expenditures

We have incurred no research and development expenditures over the last fiscal year and do not anticipate significant future research and development expenditures.

Employees

We currently have no employees. Our Chief Executive Officer and Chief Operating Officer each provide their services to us on an independent contractor basis. We have also contracted with Incorporated Communications Services, a California administrative services and communications corporation, which provides certain administrative services to us.

Additionally, we engage contractors from time to time to consult with us on specific corporate affairs or to perform specific tasks in connection with our exploration programs.

Subsidiaries

We currently have one subsidiary, CalGold de Mexico, S. de R.L. de C.V., through which we will hold our interests in the La Viuda Concessions and manage our business affairs in Mexico.

Intellectual Property

We do not own, either legally or beneficially, any patent, trademark or material license, and are not dependent on any such rights.

8

DESCRIPTION OF PROPERTIES

General

Our corporate headquarters are located at 4515 Ocean View Blvd., Suite 305, La Cañada, California 91011, at the offices of Incorporated Communications Services (“ICS”), a company that provides administrative services to us. George Duggan, our Chief Operations Officer, is the Vice President of ICS.

The La Viuda Concessions

Property Mineral Rights

On February 11, 2011, we entered into the AuroTelurio Option Agreement with Mexivada to acquire up to an 80% interest in Mexivada’s La Viuda Concessions south of Moctezuma, Sonora, Mexico. Under the terms of the AuroTelurio Option Agreement, we will acquire up to an 80% legal and beneficial ownership interest in the Property by incurring up to $3,000,000 in cumulative exploration expenditures on the Property over a four year period at an investment rate of at least $750,000 per year, and by making certain cash payments and share issuances to Mexivada, as discussed in greater detail elsewhere in this report.

The La Viuda Concessions comprise two exploration concessions granted by the Mexican government to Compania Minera Mexivada, S.A. de C.V., a wholly owned subsidiary of Mexivada. The La Viuda Concessions, details of which are set forth below, cover approximately 7,624 hectares, or 18,839.31 acres.

|

Concession

|

Status

|

File No.

|

Legal Title #

|

Title Grant Date

|

Title Expiry Date

|

Surface

Area (Ha.)

|

|||||||||||

|

La Viuda

|

Granted

|

082/323550 | 232498 |

August 18, 2008

|

August 18, 2058

|

44 | |||||||||||

|

La Viuda 1

|

Granted

|

082/32407 | 232859 |

October 29, 2008

|

October 29, 2058

|

7,580.79 | |||||||||||

9

Property Location

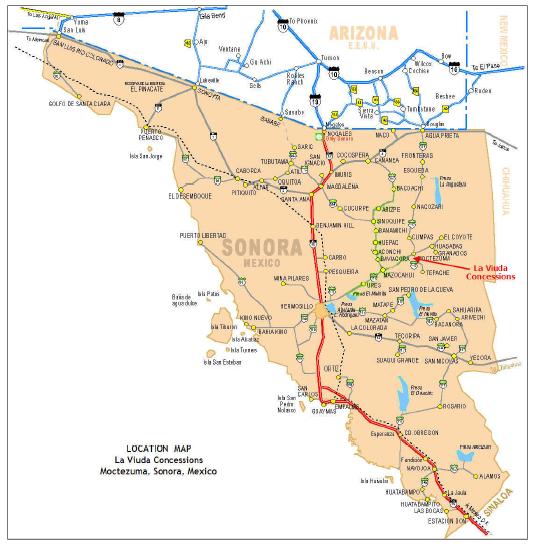

The La Viuda Concessions are located in the northeastern portion of the State of Sonora, Mexico, near the Chihuahua border and just south of the town of Moctezuma. The property is approximately 280 miles southeast of Tucson, Arizona. The following map shows the approximate location of the concessions:

Figure 1 – Location map of the La Viuda Concessions in Sonora, Mexico.

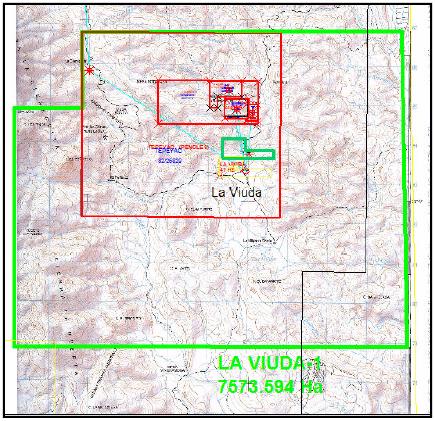

The La Viuda and La Viuda 1 concessions, shown on the map below, are the two concessions making up the Property. The La Viuda concession is approximately 47 hectares in size (116.14 acres), and is located to the south and southeast of a concession owned by Minera Teloro, S.A. de C.V., which, to our knowledge, is a subsidiary of First Solar. The La Viuda 1 is a large concession that covers an area of approximately 9 by 9 kilometers, encompassing about 7,574 hectares (18715.76 acres), and surrounds the La Viuda and other third party concessions.

10

The La Viuda Concessions are located approximately 15 miles south of Moctezuma and 7.5 miles due west of the town of Terapa. The Property is accessed from Terapa by a dirt road. The land owner who owns the land on which the Property is located has signed a surface rights agreement with us authorizing access to the La Viuda Concessions for exploration purposes.

Figure 2 – Location of the La Viuda and La Viuda 1 concessions (outlined in green).

Regional Geology

The La Viuda concessions are situated within the Sierra Madre Occidental (SMO) geologic-physiographic province. The dominant rocks are volcanics of Tertiary age, which host a number of world-class precious metal mines and deposits. In the Moctezuma region, which is where the Property is located, the dominant rock types are of Lower Cretaceous age, and they consist mostly of calcareous, argillaceous and detrital rocks. These units, in turn, are intruded by an igneous body of batholitic dimensions of Early Cretaceous to Early Tertiary age. The composition of this extensive batholith is in the granitic to granodioritic range.

The rocks of Tertiary age in this region are represented by a volcanic package that contains one or two of horizons of limestone (host rocks for base metal mineralization in the Oposura district near Moctezuma), and by a sequence of volcanic rocks consisting of pyroclastic units, whose composition varies from mafic to felsic (e.g. dacites). A plutonic intrusive body of Tertiary age, as well as hypabyssal rocks and dikes, also occurs in the district. Silicification occurs associated with some mineralized zones; this alteration-mineralization event post-dates the volcanic/intrusive sequence in the Moctezuma District.

11

Overlying the Tertiary rock sequence are continental clastic deposits capped by younger basalt flows. Lastly, alluvial and slope deposits of Quaternary age fill the valley floors and side slopes.

Local Geology

The main rock types in the district correspond to volcanic rocks of rhyolitic composition, and younger, possibly post-ore, andesites. The Arenillas formation, which has been widely studied by various entities, is of greater importance than other rock units for mineralization at the Bambolla concession. This formation consists of a package of volcaniclastic rocks that contains one or two limestone layers, which are host rocks for mineralization. The rocks present in the La Viuda Concessions are Tertiary calc-alkaline volcanics and dikes.

Plutonic rocks and dikes are also present. Tertiary sedimentary rock units, including sandstones, conglomerates, mudstones and basalts, are also evident.

Mineralization

The mineral deposits in the Oposura sector of the Moctezuma District basically consist of replacement-style, zinc-lead base metal deposits. Precious metal mineralization occurs in structurally-controlled veins, with the majority of these occurrences consisting of epithermal quartz- and quartz-carbonate veins with anomalous values of gold, silver and tellurium. A second type of structure-controlled vein type deposits occurring in the area contains base metal massive sulfides.

Structure

The La Viuda gold-mineralized structure is a WNW trending fault-controlled vein system with local exposures on the surface north of the La Viuda concession. These veins are, on the average, 0.5 to 1.0 meter in width. The vein is comprised of visible oxide minerals, mainly manganese oxides. Immediately south of La Viuda there is another vein system trending E-W to WNW and projecting to the east just south of the La Viuda concession. In this vein there is moderate sulfide mineralization along a fracture system, where stains of scorodite were observed thus suggesting that this structure could be a gold carrier.

It appears that from La Bambolla and further to the south the mineralized structures are oriented more E-W rather than NW. The main structures at the Bambolla Mine project east and west, toward the eastern Property boundaries of La Viuda 1.

Grades

The important minerals present in the Property, as documented by the Consejo de Recursos Minerales, are principally gold, silver and tellurium. However, limited surface geologic mapping and sampling work have been conducted to date to document the extent and average grades of the structures evident in the Property.

12

RISK FACTORS

An investment in shares of our common stock is highly speculative and involves a high degree of risk. We face a variety of risks that may affect our operations or financial results and many of those risks are driven by factors that we cannot control or predict. Before investing in our common stock you should carefully consider the following risks, together with the financial and other information contained in this Report. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be materially adversely affected. In that case, the trading price of our common stock would likely decline and our stockholders may lose all or a portion of their investments in us. Only those investors who can bear the risk of loss of their entire investment should consider investing in our common stock.

RISKS RELATED TO OUR BUSINESS AND FINANCIAL CONDITION

We are an exploration stage company with a limited history of operations and no current revenues. Our business plan depends on our ability to explore for and develop mineral reserves and place any such reserves into extraction. Because we have a limited operating history, it is difficult to predict our future performance.

Although we were formed in April 2004, we have been and continue to be an exploration stage company. Therefore, we have limited operating and financial history available to help potential investors evaluate our past performance and the risks of investing in us. Moreover, our limited historical financial results may not accurately predict our future performance. Companies in their initial stages of development present substantial business and financial risks and may suffer significant losses. As a result of the risks specific to our new business and those associated with new companies in general, it is possible that we may not be successful in implementing our business strategy.

We have generated no revenues to date and do not anticipate generating any revenues for the foreseeable future. Our activities to date have been limited to capital formation, organization, and development of our business. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Our success is significantly dependent on a successful exploration, mining and production program. Our operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. We may be unable to locate exploitable quantities of mineral resources or operate on a profitable basis. We are in the exploration stage and potential investors should be aware of the difficulties normally encountered by enterprises in the exploration stage. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complication, and delays frequently encountered in connection with an exploration stage business, and the competitive and regulatory environment in which we will operate, such as under-capitalization, personnel limitations, and limited revenue sources. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in us.

13

We have not generated any revenues from operations. We have a history of losses and losses are likely to continue in the future.

We have not generated any revenues from operations. Our net loss for the fiscal year ended January 31, 2011 and 2010 totaled $1,615,423 and $182,521, respectively. Cumulative losses since inception totaled $2,859,103. We have incurred significant losses in the past and we will likely continue to incur losses in the future unless our exploration program proves successful. Even if our exploration program identifies tellurium, gold, silver or other mineral reserves, there can be no assurance that we will be able to commercially exploit these resources, generate any revenues or generate sufficient revenues to operate profitably.

We have no history as a mining company.

We have no history of earnings or cash flow from mining operations. If we are able to proceed to production, commercial viability will be affected by factors that are beyond our control such as the particular attributes of the deposit, the fluctuation in metal prices, the cost of construction and operating a mine, prices and refining facilities, the availability of economic sources for energy, government regulations including regulations relating to prices, royalties, restrictions on production, quotas on exploration of minerals, as well as the costs of protection of the environment.

Exploring for rare metals such as tellurium and precious metals such as gold and silver is an inherently speculative business and there is substantial risk that our business could fail.

Exploring for rare and precious metals is a business that by its nature is very speculative. There is a strong possibility that we will not discover any tellurium (or gold or silver) which can be mined at a profit. Even if we do discover tellurium or precious metal deposits, the deposits may not be of the quality or size necessary for us to make a profit from actually mining them. Few properties that are explored are ultimately developed into producing mines. Unusual or unexpected geological formations, geological formation pressures, fires, power outages, labor disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labor are just some of the many risks involved in mineral exploration programs and the subsequent development of rare and precious metal deposits. Because of these and other factors, we can make no assurances that we will be successful in our business.

If we fail to make required payments on our mineral properties, we could lose our rights to the properties.

We have entered into the AuroTelurio Option Agreement with Mexivada to acquire up to an 80% interest in the La Viuda Concessions. To acquire each 20% block of interest, we need to make certain annual cash payments to Mexivada and invest US $750,000 each year, for four years, in an exploration program for the Property. If we fail to make these payments or investments, we may lose our right to acquire these interests in the Property.

14

We will need to obtain additional financing to fund our exploration program and the acquisition of the remaining 60% interest in the Property.

As a result of the closing of our recent private placement (discussed below), we have sufficient funds to finance the first year (US $750,000) of our La Viuda Concessions exploration program under the Mexivada AuroTelurio Option Agreement, which will trigger the vesting in us of the first 20% interest in the Property. We do not have sufficient capital, however, to fund years two through four of our exploration program as it is currently planned (US $750,000 per year), to enable us to acquire up to an additional 60% interest in the Property, or to fund the acquisition and exploration of new properties. We estimate that we will need to raise at least an additional US $4 million to pay for years two through four of our exploration program, as it is currently planned and described in this Report, and our estimated administrative expenses, lease payments and estimated claim maintenance costs. We may be unable to secure such additional financing on terms acceptable to us, or at all, at times when we need such financing. Our inability to raise additional funds on a timely basis could prevent us from achieving our business objectives and could have a negative impact on our business, financial condition, results of operations and the value of our securities. If we raise additional funds by issuing additional equity or convertible debt securities, the ownership percentages of existing stockholders will be reduced and the securities that we may issue in the future may have rights, preferences or privileges senior to those of the current holders of our Common Stock. Such securities may also be issued at a discount to the market price of our Common Stock, resulting in possible further dilution to the book value per share of Common Stock. If we raise additional funds by issuing debt, we could be subject to debt covenants that could place limitations on our operations and financial flexibility.

We do not own the land over which the La Viuda Concessions are located.

Although we are acquiring up to an 80% interest in the La Viuda Concessions from Mexivada, Mexivada does not own the land where the Property is located. We have entered into a surface rights agreement with the local landowner enabling us to begin our exploration program. If we discover meaningful quantities of minerals on the Property, however, we will need to enter into additional agreements with the landowner to enable us to mine such minerals. There can be no assurance that the landowner will agree to such further agreements or, if he does, that they will be on terms economically acceptable to us.

There are no confirmed mineral deposits on the Property from which we may derive any financial benefit.

Neither the Company nor any independent geologist has confirmed commercially viable mineable deposits of tellurium, gold, silver of other minerals on the Property, and there can be no assurances that there are such deposits on the Property.

We are uncertain as to whether our exploration for tellurium or other mineral resources on the Property will lead to meaningful results.

Resources are non-renewable and the exploration of new potential resources is crucial to a mining enterprise. Exploration of mineral resources is speculative in nature, so substantial expenses may be incurred from initial exploration to drilling to production. Tellurium is the ninth rarest element on earth and there are very few tellurium mines in operation around the world today. Although tellurium has been found on concessions adjacent to the Property and mined in the past to a limited extent, there is no assurance that exploration on the La Viuda Concessions will lead to the discovery of economically feasible quantities of tellurium (or gold or silver) or result in the mining of such elements and the generation of revenues. The exploration of the La Viuda Concessions is currently our only business. If we fail to discover economically viable quantities of tellurium (or gold or silver) on the Property, our current business plan will have failed and we may not be able to continue operations.

15

There is no assurance that we can establish the existence of any mineral reserves on the Property in commercially exploitable quantities.

We have not established that the La Viuda Concessions contain any meaningful levels of tellurium or other mineral reserves. A mineral reserve is defined by the SEC in its Industry Guide 7 (see http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. There can be no assurance that we will ever establish any mineral reserves.

We will be relying on independent analysis to evaluate the Property and structure and carry out our planned exploration activities.

We will rely on independent geologists to engage in field work at the Property, to analyze our prospects, plan and carry out our exploration program, including an exploratory drilling program, and to prepare resource reports on our La Viuda Concessions. While these geologists rely on standards established by various licensing bodies, there can be no assurance that their estimates or results will be accurate. Analyzing drilling results and estimating reserves or targeted drilling sites is not a certainty. Miscalculations and unanticipated drilling results may cause the geologists to alter their estimates. If this should happen, we may have devoted resources to areas where resources could have been better allocated, and, as a result, our business could suffer.

There is no assurance that we can establish successful mining operations.

Even if we do eventually discover a commercially viable tellurium or other mineral reserve on the Property, there can be no assurance that we will be able to develop the Property into producing mines and extract those resources. Both mineral exploration and development involve a high degree of risk and few properties which are explored are ultimately developed into producing mines. Furthermore, we cannot be sure that an overall exploration success rate or extraction operations within a particular area will ever come to fruition and, in any event, production rates inevitably decline over time.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the resource to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

16

We will require additional capital to develop producing mines if we find commercial quantities of minerals.

If we do discover tellurium or other mineral resources in commercially exploitable quantities on the La Viuda Concessions, we will be required to expend substantial sums of money to establish the extent of the resource, develop processes to extract it and develop extraction and processing facilities and infrastructure. Although we may derive substantial benefits from the discovery of a major deposit, there can be no assurance that such a resource will be large enough to justify commercial operations. Nor can there be any assurance that we will be able to raise the funds required for development on a timely basis, if at all.

We have raised some capital to date, including through the sale of equity securities, but we currently do not have any contracts or firm commitments for additional financing. There can be no assurance that additional financing will be available in amounts or on terms acceptable to us, if at all. An inability to obtain additional capital would restrict our ability to grow and could diminish our ability to continue to conduct our business operations. If we are unable to obtain additional financing, we will likely be required to curtail exploration and development plans and possibly cease operations. Any additional equity financing may involve substantial dilution to then existing shareholders.

It is possible investors may lose their entire investment in us.

As prospective investors, you should be aware that if we are not successful in our endeavors, your entire investment in us could become worthless. Even if we are successful, in identifying mineral reserves that can be commercially developed, there can be no assurances that we will generate any revenues and our losses will continue.

Mineral operations are subject to applicable law and government regulation which could restrict or prohibit the exploitation of any mineral resource that we might discover.

Both mineral exploration and extraction require permits from various Mexican governmental authorities, whether federal, state or local, and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral properties or for the construction and operation of a mine on the Property at economically viable costs.

We believe that we are in compliance with all material laws and regulations that currently apply to our activities, but there can be no assurance that we can continue to remain in compliance. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral properties.

17

We operate in a regulated industry and changes in regulations or violations of regulations may result in increased costs or sanctions that could reduce our revenues.

Our operations will be subject to extensive and complex federal and state laws and regulations in Mexico. If we fail to comply with the laws and regulations that are directly applicable to our business, we could suffer civil and/or criminal penalties or be subject to injunctions or cease and desist orders. While we believe that we are currently compliant with applicable rules and regulations, if there are changes in the future to such rules and regulations, there can be no assurance that we will be able to comply in the future, or that future compliance will not significantly adversely impact our operations.

Mineral exploration and development is subject to extraordinary operating risks which we do not currently insure against.

Mineral exploration, development and production involve many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our operations will be subject to all the hazards and risks inherent in the exploration for mineral resources and, if we discover a mineral resource in commercially exploitable quantity, our operations could be subject to all of the hazards and risks inherent in the development and production of resources, including liability for pollution, cave-ins or similar hazards against which we cannot insure or against which we may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. We do not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that arise from any such occurrence would have a material adverse impact on our Company.

Fluctuation in the market price of tellurium and other rare and precious metals may significantly affect the results of our operations.

If we are successful in the future in mining commercial quantities of tellurium or other precious metals, the results of our operations will be significantly affected by the market price of such metals, which are subject to substantial price fluctuations. Our earnings will be particularly sensitive to changes in the market price of tellurium, gold, and other metals that we might sell. Market prices can be affected by numerous factors beyond our control, including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, supply and demand, substitution of new or different products in critical applications, expectations with respect to the level of fossil fuel prices, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of base and precious metals, and therefore the economic viability of our exploration program, cannot accurately be predicted. If prices should decline below our cash costs of production and remain at such levels for any substantial period, we could determine at a particular point in time in the future that it might not be economically feasible to begin or continue commercial production activities.

18

Because tellurium is rare and its applications highly specific, there are no known hedging tools to utilize to protect us against price fluctuation. As such, our future ability to protect our operations against rare and precious metal price fluctuations is minimal.

The mining industry is highly competitive, and we face competition from many established domestic and foreign companies. We may not be able to compete effectively with these companies.

The markets in which we expect to operate are highly competitive. The mineral exploration, development, and production industry is largely un-integrated. We compete against numerous well-established national and foreign companies in every aspect of the mineral mining industry. Some of our competitors have longer operating histories and greater technical facilities, and significantly greater recognition in the market and financial and other resources, than we have. We may not compete effectively with other exploration companies in locating and acquiring mineral resource properties, and customers may not buy any or all of the mineral products that we expect to produce. Additionally, we may not be able to compete with competitors located in developing countries such as China, where production costs may be lower.

Because of growing demand for rare and precious metals, we may be subject to more competition in the near future.

The forecasted growth in demand for rare metals, including tellurium, which is used by the solar power industry, is expected to attract more mining companies and metal refiners into this industry and increase competition. Competition could arise from certain manufacturers, including First Solar, who use tellurium in their products and who decide to backwards integrate. We may not be able to compete with these new entrants in the market.

Compliance with environmental and other government regulations could be costly and could negatively impact production.

Our operations are subject to numerous federal, state and local laws and regulations in Mexico governing the operation of our business and the discharge of materials into the environment or otherwise relating to environmental protection. These laws and regulations may:

|

|

·

|

require that we acquire permits before commencing extraction operations;

|

|

|

·

|

restrict the substances that can be released into the environment in connection with mining and extraction activities;

|

|

|

·

|

limit or prohibit mining activities on protected areas such as wetland or wilderness areas; and

|

|

|

·

|

require remedial measures to mitigate pollution from former operations, such as dismantling abandoned production facilities.

|

Under these laws and regulations, we could be liable for personal injury and clean-up costs and other environmental and property damages, as well as administrative, civil and criminal penalties. We do not believe that insurance coverage for environmental damages that occur over time is available at a reasonable cost, and we do not maintain any such insurance. Also, we do not believe that insurance coverage for the full potential liability that could be caused by sudden and accidental environmental damages is available at a reasonable cost. Accordingly, we may be subject to liability or we may be required to cease operations including production (subsequent to any commencement) on the Property in the event of environmental damages.

19

We may have difficulty managing growth in our business.

Because of the small size of our business, growth in accordance with our long-term business plans, if achieved, will place a significant strain on our financial, technical, operational and management resources. As we increase our activities with respect to the La Viuda Concessions, there will be additional demands on our financial, technical, operational and management resources. The failure to continue to upgrade our technical, administrative, operating and financial control systems or the occurrence of unexpected expansion difficulties, including the recruitment and retention of required personnel, could have a material adverse effect on our business, financial condition, results of operations and ability to timely execute our business plan.

If we are unable to keep our key management personnel, then we are likely to face significant delays at a critical time in our corporate development and our business is likely to be damaged.

Our success depends upon the skills, experience and efforts of our management and other key personnel, including our Chief Executive Officer and Chief Operating Officer. As a relatively new company, much of our corporate, scientific and technical knowledge is concentrated in the hands of a few individuals. We do not have employment agreements with our Chief Executive Officer or Chief Operating Officer, only consulting agreements. Nor do we maintain key-man life insurance on these persons. The loss of the services of one or more of our present management or other key personnel could significantly delay our exploration and development activities as there could be a learning curve of several months or more for any replacement personnel. Furthermore, competition for the type of highly skilled individuals we require is intense and we may not be able to attract and retain new employees or contractors of the caliber needed to achieve our objectives. Failure to replace key personnel could have a material adverse effect on our business, financial condition and operations.

Each of our Chief Executive Officer and Chief Operating Officer has other substantial business activities that limit the amount of time that he can devote to managing our business.

Our Chief Executive Officer, James D. Davidson, and our Chief Operating Officer, George Duggan, currently serve as officers, and are involved in the running, of other companies. Accordingly, these officers are only able to devote a portion of their time to our activities. This may make it more difficult for our management to respond quickly and completely to challenges and opportunities that we may encounter, may limit our ability to timely consummate strategic relationships and may have an adverse effect on our results of operations.

There may be challenges to our title in our mining properties.

While we have conducted our own due diligence relating to Mexivada’s title to the La Viuda Concessions prior to entering into the AuroTelurio Option Agreement, mining properties, in general, may be subject to prior unregistered agreements, transfers or claims and title may be affected by undetected defects. Should any of these conditions occur, we could face significant delays, added costs and the possible loss of any investments or commitment of capital.

20

Difficult conditions in the global capital markets may significantly affect our ability to raise additional capital to continue operations.

The ongoing worldwide financial and credit upheaval may continue indefinitely. Because of reduced market liquidity, we may not be able to raise additional capital when we need it, if at all. Because the future of our business will depend on our ability to explore and develop the mineral resources on our existing properties and, possibly, the acquisition of one or more additional mineral resource properties for which, most likely, we will need additional capital, we may not be able to complete such development and acquisition projects or develop or acquire revenue producing assets. As a result, we may not be able to generate income, and to conserve capital we may be forced to curtail our current business activities or cease operations entirely.

Being a public company has increased our expenses and administrative workload.

As a public company, we must comply with various laws and regulations, including the Sarbanes-Oxley Act of 2002 and related rules of the SEC. Complying with these laws and regulations requires the time and attention of our board of directors and management, and increases our expenses. Among other things, we must:

|

|

·

|

maintain and evaluate a system of internal controls over financial reporting in compliance with the requirements of Section 404 of the Sarbanes-Oxley Act and the related rules and regulations of the SEC and the Public Company Accounting Oversight Board;

|

|

|

·

|

maintain policies relating to disclosure controls and procedures;

|

|

|

·

|

prepare and distribute periodic reports in compliance with our obligations under federal securities laws;

|

|

|

·

|

institute a more comprehensive compliance function, including with respect to corporate governance; and

|

|

|

·

|

involve to a greater degree our outside legal counsel and accountants in the above activities.

|

In addition, being a public company has made it more expensive for us to obtain director and officer liability insurance. In the future, we may be required to accept reduced coverage or incur substantially higher costs to obtain this coverage. These factors could also make it more difficult for us to attract and retain qualified executives and members of our board of directors, particularly directors willing to serve on an audit committee which we expect to establish.

21

RISKS RELATED TO DOING BUSINESS IN MEXICO

Local infrastructure may impact our exploration activities and results of operations.

Mining, processing, development and exploration activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges and power and water supplies are important determinants that affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage or government or other interference in the maintenance or provision of such infrastructure could adversely affect our activities and future profitability.

Our material property interests are in Mexico. Risks of doing business in a foreign country could adversely affect our results of operations and financial condition.

We face risks normally associated with any conduct of business in a foreign country with respect to our La Viuda Concessions in Sonora, Mexico, including various levels of political and economic risk. The occurrence of one or more of these events could have a material adverse impact on our efforts or operations which, in turn, could have a material adverse impact on our cash flows, earnings, results of operations and financial condition. These risks include the following:

|

·

|

labor disputes,

|

|

|

·

|

invalidity of governmental orders,

|

|

|

·

|

uncertain or unpredictable political, legal and economic environments,

|

|

|

·

|

war and civil disturbances,

|

|

|

·

|

changes in laws or policies,

|

|

|

·

|

taxation,

|

|

|

·

|

delays in obtaining or the inability to obtain necessary governmental permits,

|

|

|

·

|

governmental seizure of land or mining claims,

|

|

|

·

|

limitations on ownership,

|

|

|

·

|

limitations on the repatriation of earnings,

|

|

|

·

|

increased financial costs,

|

|

|

·

|

import and export regulations, including restrictions on the export of tellurium, gold and silver, and

|

|

|

·

|

foreign exchange controls.

|

These risks may limit or disrupt our business, restrict the movement of our funds or impair contract rights or result in the taking of property by nationalization or expropriation without fair compensation.

We are uncertain as to the termination and renewal of our concessions.

Under Mexican law, mineral resources belong to the Mexican state and a concession from the Mexican federal government is required to explore for or exploit mineral reserves. Mexivada’s mineral rights to the Property which we are acquiring from Mexivada derive from concessions granted by the Secretaría de Economía, formerly known as Secretaría de Comercio y Fomento Industrial (the "Secretary of Economy"), through the General Bureau of Mines pursuant to the Ley Minera (the "Mining Law") and regulations thereunder.

22

Our mining concessions may be terminated if the obligations of the concessionaires under the Mining Law, its regulations and related legal provisions are not satisfied. A concessionaire of a mining concession is obligated, among other things, to explore or exploit the relevant concession, to pay any relevant fees, to comply with all environmental and safety standards, and to provide information to the Secretary of Economy and permit inspections by the Secretary of Economy.

Our property interests in Mexico are subject to risks from instability in that country.

Our property interests in Mexico may be affected by additional foreign country risks associated with political or economic instability in that country. The risks with respect to Mexico specifically, include, but are not limited to: military repression, extreme fluctuations in currency exchange rates, criminal activity, lack of personal safety or ability to safeguard property, labor instability or militancy, mineral title irregularities and high rates of inflation. The effect of these factors cannot be accurately predicted but may adversely impact our proposed operations in Mexico.

Increasing violence between the Mexican government and drug cartels may result in additional costs of doing business in Mexico.

The state of Sonora where the La Viuda Concessions are located has not been adversely affected as a result of increasing violence between the Mexican government and drug cartels. We do not expect this violence to have any impact on our business operations. However, our management remains cognizant that the drug cartels may expand their operations or violence in areas in close proximity to our proposed operations. Should this occur, we may be required to hire security personnel and take other actions to protect our operations and personnel. Presently, we are not budgeting for increased security. However, if drug violence becomes a problem or, any other violence impacts our operations, the costs to protect our personnel and property will adversely impact our operations.

We may be adversely affected by the imposition of more stringent environmental regulations in Mexico that would require us to spend additional funds.

The mining and processing industries in Mexico are subject to federal and state laws and regulations (including certain industry technical standards) governing protection and remediation of the environment, mining operations, occupational health and safety and other matters. Mexican environmental regulations have become increasingly stringent over the last decade. This trend is likely to continue and may be influenced by the environmental agreement entered into by Mexico, the United States and Canada in connection with the North American Free Trade Agreement (NAFTA). Accordingly, although we believe that we will be able to comply with currently applicable environmental, mining and other laws and regulations, there can be no assurance that more stringent enforcement of existing laws and regulations or the adoption of additional laws and regulations would not have an adverse effect on our business, properties, results of operations, financial condition or prospects.

23

RISKS RELATED TO OUR COMMON STOCK

There is not now, and there may not ever be, an active market for our common stock.

There currently is a limited public market for our common stock. Further, although our common stock is currently quoted on the OTC Markets, trading of our common stock may be extremely sporadic. For example, several days may pass before any shares may be traded. As a result, an investor may find it difficult to dispose of, or to obtain accurate quotations of the price of, our common stock. Accordingly, investors must assume they may have to bear the economic risk of an investment in our common stock for an indefinite period of time. There can be no assurance that a more active market for our common stock will develop, or if one should develop, there is no assurance that it will be sustained. This severely limits the liquidity of our common stock, and would likely have a material adverse effect on the market price of our common stock and on our ability to raise additional capital.

We cannot assure you that our common stock will become liquid or that it will be listed on a securities exchange.

Until our common stock is listed on a national securities exchange such as the New York Stock Exchange or the Nasdaq National Market, we expect our common stock to remain eligible for quotation on the OTC Markets, or on another over-the-counter quotation system. In those venues, however, an investor may find it difficult to obtain accurate quotations as to the market value of our common stock. In addition, if we fail to meet the criteria set forth in SEC regulations, various requirements would be imposed by law on broker-dealers who sell our securities to persons other than established customers and accredited investors. Consequently, such regulations may deter broker-dealers from recommending or selling our common stock, which may further adversely affect the liquidity of our common stock. This would also make it more difficult for us to raise capital.

Our common stock is subject to the “penny stock” rules of the SEC and FINRA’s sales practice requirements, and the trading market in our common stock is limited, which makes transactions in our common stock cumbersome and may reduce the value of an investment in the stock.

The SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

|

|

·

|

that a broker or dealer approve a person’s account for transactions in penny stocks; and

|

|

|

·

|

the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

|

24

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

|

|

·

|

obtain financial information and investment experience objectives of the person; and

|

|

|

·

|

make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

|

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form sets forth:

|

|

·

|

the basis on which the broker or dealer made the suitability determination; and

|

|

|

·

|

that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

|

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of common stock and cause a decline in the market value of stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

In addition to the "penny stock" rules promulgated by the SEC, the Financial Industry Regulatory Authority (FINRA) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. FINRA’s requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

The price of our common stock may become volatile, which could lead to losses by investors and costly securities litigation.

The trading price of our common stock is likely to be highly volatile and could fluctuate in response to factors such as:

|

|

·

|

actual or anticipated variations in our operating results;

|

|

|

·

|

announcements of developments by us, our strategic partners or our competitors;

|

|

|

·

|

announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments;

|

25

|

|

·

|

adoption of new accounting standards affecting our industry;

|

|

|

·

|

additions or departures of key personnel;

|

|

|

·

|

sales of our common stock or other securities in the open market; and

|

|

|

·

|

other events or factors, many of which are beyond our control.

|

The stock market is subject to significant price and volume fluctuations. In the past, following periods of volatility in the market price of a company’s securities, securities class action litigation has often been initiated against such company. Litigation initiated against us, whether or not successful, could result in substantial costs and diversion of our management’s attention and resources, which could harm our business and financial condition.

Compliance with U.S. securities laws, including the Sarbanes-Oxley Act, will be costly and time-consuming.

We are a reporting company under U.S. securities laws and are obliged to comply with the provisions of applicable U.S. laws and regulations, including the Securities Act of 1933, as amended (the “Securities Act”), the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Sarbanes-Oxley Act of 2002 and the related rules of the SEC, and the rules and regulations of the relevant U.S. market, in each case, as amended from time to time. Preparing and filing annual and quarterly reports and other information with the SEC, furnishing audited reports to stockholders and other compliance with these rules and regulations will involve a material increase in regulatory, legal and accounting expenses and the attention of management, and there can be no assurance that we will be able to comply with the applicable regulations in a timely manner, if at all.

We do not anticipate dividends to be paid on our common stock, and investors may lose the entire amount of their investment.

Cash dividends have never been declared or paid on our common stock, and we do not anticipate such a declaration or payment for the foreseeable future. We expect to use future earnings, if any, to fund business growth. Therefore, stockholders will not receive any funds absent a sale of their shares. We cannot assure stockholders of a positive return on their investment when they sell their shares, nor can we assure that stockholders will not lose the entire amount of their investment.

If securities analysts do not initiate coverage or continue to cover our common stock or publish unfavorable research or reports about our business, this may have a negative impact on the market price of our common stock.

The trading market for our common stock may be affected by, among other things, the research and reports that securities analysts publish about our business and the Company. We do not have any control over these analysts. There is no guarantee that securities analysts will cover our common stock. If securities analysts do not cover our common stock, the lack of research coverage may adversely affect its market price. If we are covered by securities analysts, and our stock is the subject of an unfavorable report, our stock price and trading volume would likely decline. If one or more of these analysts ceases to cover the Company or fails to publish regular reports on the Company, we could lose visibility in the financial markets, which could cause our stock price or trading volume to decline.

26

Our common stock could be removed from quotation on the OTCBB if we fail to timely file our annual or quarterly reports. If our common stock were no longer eligible for quotation on the OTCBB, the liquidity of our stock may be further adversely impacted.

Under the rules of the SEC we are required to file our quarterly reports within 45 days from the end of the fiscal quarter and our annual report within 90 days from the end of our fiscal year. Under rules adopted by the Financial Industry Regulatory Authority (FINRA) in 2005 which is informally known as the “Three Strikes Rule”, a FINRA member is prohibited from quoting securities of an OTCBB issuer such as our Company if the issuer either fails to timely file these reports or is otherwise delinquent in the filing requirements three times in the prior two year period or if the issuer’s common stock has been removed from quotation on the OTCBB twice in that two year period.

State Blue Sky registration – potential limitations on resale of the shares.