Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NAVISTAR INTERNATIONAL CORP | d8k.htm |

Jefferies Annual Global Industrials

August 10th, 2011

Exhibit 99.1

1

NYSE: NAV

For more than 175 years

we’ve been helping people from every corner of the world

move the goods that move the welfare of entire nations.

|

2

2

Safe Harbor

Statement &

Other Cautionary Notes

Information provided and statements contained in this presentation that are not purely historical are

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995. Such forward-looking statements only speak as of

the date of this presentation and the Company assumes no obligation to update the information

included in this presentation. Such forward-looking statements include information concerning our possible or

assumed future results of operations, including descriptions of our business strategy. These

statements often include words such as “believe,” “expect,”

“anticipate,” “intend,” “plan,” “estimate,” or similar expressions. These statements are

not guarantees of performance or results and they involve risks, uncertainties, and assumptions. For a

further description of these factors, see Item 1A,

Risk Factors

, included within our Form 10-K for the year ended October 31, 2010, which

was filed on December 21, 2010. Although we believe that these forward-looking statements

are based on reasonable assumptions, there are many factors that could affect our actual

financial results or results of operations and could cause actual results to differ materially

from those in the forward-looking statements. All future written and oral forward-looking

statements by us or persons acting on our behalf are expressly qualified in their entirety by the

cautionary statements contained or referred to above. Except for our ongoing obligations to

disclose material information as required by the federal securities laws, we do not have any

obligations or intention to release publicly any revisions to any forward-looking statements

to reflect events or circumstances in the future or to reflect the occurrence of unanticipated events.

The financial information herein contains audited and unaudited information and has been prepared by

management in good faith and based on data currently available to the Company.

Certain Non-GAAP measures are used in this presentation to assist the reader in understanding our

core manufacturing business. We believe this information is useful and relevant to assess and

measure the performance of our core manufacturing business as it illustrates manufacturing

performance without regard to selected historical legacy costs (i.e. pension and other

postretirement costs). It also excludes financial services and other expenses that may not be related to

the core manufacturing business or underlying results. Management often uses this information to

assess and measure the performance of our operating segments. A reconciliation to the most

appropriate GAAP number is included in the appendix of this presentation. |

3

3

Agenda

•

Driving shareholder value

•

Three pillar strategy

–

Great products

–

Competitive cost structure

–

Profitable growth

•

2011 Update

–

Operations

–

Financial guidance |

4

4

Driving Shareholder Value

Note: This slide contains non-GAAP information, please see the REG

G in appendix for a detailed reconciliation. 2011 FY Guidance

does not include the impact of Engineering Integration; Valuation

Allowance release; restructuring of Chatham, Workhorse and

Monaco and impairment charges. |

5

5

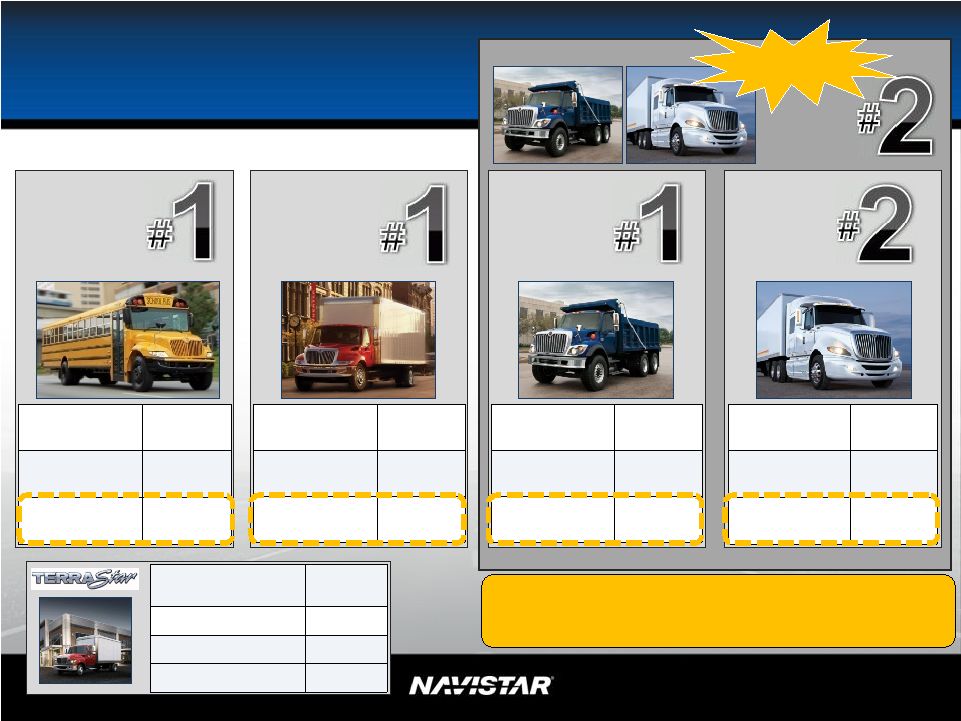

Purchased Engines

9900

SCHOOL BUS

9200 / 9400

Global Powertrain

7.2L

9.3L

4.8L

Leader in Products, Technology and

Innovation

2007 Product Offerings

2011 Product Offerings –

Well Positioned For the Future |

6

6

Leader in Products, Technology and

Innovation

2011 Product Offerings –

Well Positioned For the Future

What’s Next:

Global Class 8 Truck

Global Powertrain

7.2L

9.3L

4.8L |

7

7

At $15 to $20+ Billion Company

(Normal Industry)

At $7 to $8 Billion Company

Competitive Cost Structure

Leveraging Assets/Controlling Destiny

Scale 1-2-3

13L/15L Cost

Total (‘01 –

’05)

$1,423M

Total (‘06 –

’10)

$1,103M

*Capital expenditures excluding equity investments |

8

8

•

Moving from focused facilities to

flexible manufacturing to minimize

logistics cost

•

School bus: All assembly in Tulsa

•

Huntsville: Ability to produce

V8/I6/DT engines on same line

•

Labor agreement

Competitive Cost Structure

Completed Actions

Next Steps to increase Shareholder Value

•

Leveraging assets

•

Integrated Product Development

Center

•

Truck Plants: Chatham, Monaco &

Workhorse

NYSE: NAV

GAP

CAP

SAP

TBP

HEP

CBP

MPP

EAP |

Medium

Truck

Great Products –

Market Share

Severe Service

Truck

Heavy

Truck

FY09

61%

FY10

59%

JuneYTD11

47%

FY09

35%

FY10

38%

JuneYTD11

39%

FY09

34%

FY10

33%

JuneYTD11

33%

FY09

25%

FY10

24%

JuneYTD11

16%

Combined Class 8

School

Bus

(U.S. & Canada)

Class 4-5

JuneYTD

11

Industry

23K

Navistar

900

Market Share

~4%

9

20% Market Share

JuneYTD11

NYSE: NAV

School Bus & Combined Class 6-8 Market Share –

FY09:

34%;

34%;

FY10:

33%;

33%;

JuneYTD11:

27%

27% |

10

10

35%

43%

19%

22%

0%

10%

20%

30%

40%

50%

60%

Nov-Mar

Apr-Jun

Nov-Mar

Apr-Jun

Great Products –

Growing Market Share

with Increased Customer Experience

(U.S. & Canada)

Class 6-7

Combined Class 8

Class 8 Strategy

What We’ve Said

•

Convert to

proprietary U.S. and

Canada diesel

engine

•

Transition industry

from 15L to 13L

•

Customer

experience during

transition will drive

increased second

half momentum |

11

11

U.S. and Canada Heavy Strategy –

Launch of Derivative Products

Severe Service

Heavy

ProStar

®

with

MaxxForce

®

15

Sloped Nose

WorkStar

®

PayStar

®

with

MaxxForce

®

15

LoneStar

®

with

500HP MaxxForce

®

13

9900 with

MaxxForce

®

15

CAT CT660

Available now

Expected Q1 2012

Continue to Broaden Product Offering

Combined

Class 8 |

12

12

Navistar Defense

•

Era of efficiency

–

Government will look to industry

for:

•

Higher quality

•

Lower cost

•

Quicker development

•

Sustainment of existing vehicle

fleets will continue (increase)

2008

2009

2010

2011+

> $2B

> $2B

> $2B

~$1.9B |

13

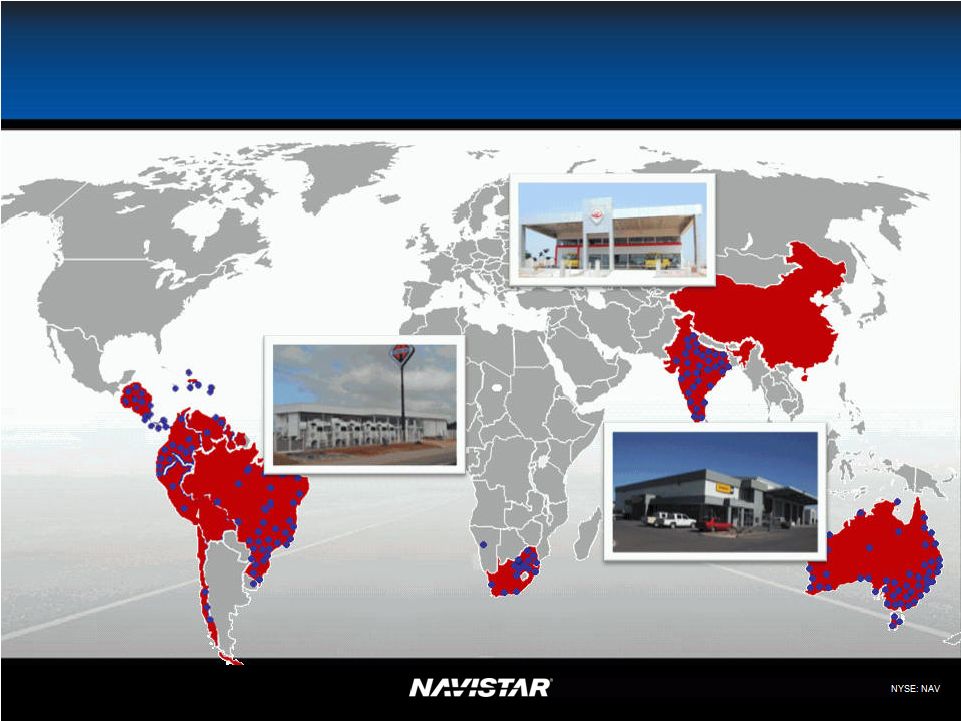

13

Differentiated Global Distribution

Currently 410 branded sales or service points |

14

14

Results –

Vehicle Integration Drives

Profitable Growth

(U.S., Canada, Mexico, excludes Military)

North American Parts Sales

$0

$500

$1,000

$1,500

$2,000

2009

2010

2011 Fcst |

15

15

Actual

Annualizing

Industry

YTD June

YTD June

School Bus

16,500

18,000

11,700

17,500

15,000

18,000

Class 6-7 - Medium

52,500

58,000

40,900

61,300

60,000

67,000

Combined Class 8 (Heavy & Severe Service)

171,000

184,000

108,300

162,400

165,000

175,000

Total Industry Demand

240,000

260,000

160,900

241,200

240,000

260,000

FY 11

FY 11

Historical Information

United States and Canadian Class 6-8 Truck Industry - Retail Sales Volume

Original Guidance

Revised Guidance

2011 Update

Position Us For When Market Returns:

Industry Landscape –

Investing in Our Future

100,000

200,000

300,000

400,000

500,000

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

U.S. and Canada Class 6-8 Retail Industry

2011 Drivers:

•Differentiation and leadership

•Deliver customer value

Fuel economy with EGR

Convert 15L to 13L

Strength of dealer network

•Focus on cost structure

Flexible manufacturing

Integrated product development

•Invest in global growth |

16

16

3,000

4,300

0

2,000

4,000

6,000

8,000

10,000

12,000

FY 2010

FY 2011 YTD June

FY 2011 FCST

Maximize Profit While Protecting Markets

Balance needs of customers with supplier capacity

As reported on 6/7/2011

in Q2 presentation:

Updated

Outlook:

Combined

Class 8

FY2011

Revised FY2011

Industry

171K -

184K

165K -

175K

Navistar

42K -

46K

38K -

40K

Market Share

~25%

~23% -

24%

Global Truck: Latin America & Caribbean

U.S. and Canada Combined Class 8 Retail Sales

ProStar

®

10,000 –

12,000

TranStar

®

WorkStar

®

Mixer

(This represents retail deliveries)

12.5%

18.0%

YTD FY2010

YTD FY2011

Market Share |

17

2011 Analyst Day

2011 Analyst Day

Today

Today

2011 Business Drivers

2011 Business Drivers

•

Industry

recovering

(240K

–

260K)

•

Industry (240K –

260K) Heavy

, Class 6-7

•

Maintain

Market

Share

–

Back-end

loaded

•

Maintain Market Share –

Back-end loaded

•

Military

$1.5B

-

$2.0B Revenue

•

Military –

~$1.9B Revenue

•

Global

Investing to profitable

•

“Total”

Global

–

Profitable

•

15L Launch

•

15L

Launch

–

Launched

in

March

•

Engineering

Slightly up

•

Engineering

–

Slightly

up

•

Engine segment profitability -

~$100M

(back end loaded)

•

Engine segment profitability -

~$100M

(back end loaded)

•

Adjusted EPS

-

$5.00 to $6.00

•

Adjusted EPS

-

$5.50 to $6.00

•

Manufacturing

Cash

-

$1.2B

-

$1.4B

•

Manufacturing Cash

-

$1.2B

-

$1.4B

2011 One-Time Items

2011 One-Time Items

•

Engineering Integration

•

Engineering Integration

–

on track

•

Manufacturing

•

Manufacturing

–

Chatham,

Monaco

and

Workhorse

•

Valuation Allowance

•

Valuation Allowance

What We Said:

-

Convert 15L to 13L

-

Convert all

customers to

proprietary engine

-

Implement EGR

Note: This slide contains non-GAAP information, please see the REG

G in appendix for a detailed reconciliation. 2011 FY Guidance

does not include the impact of Engineering Integration; Valuation

Allowance release; restructuring of Chatham, Workhorse and

Monaco and impairment charges. |

NYSE: NAV

18

18

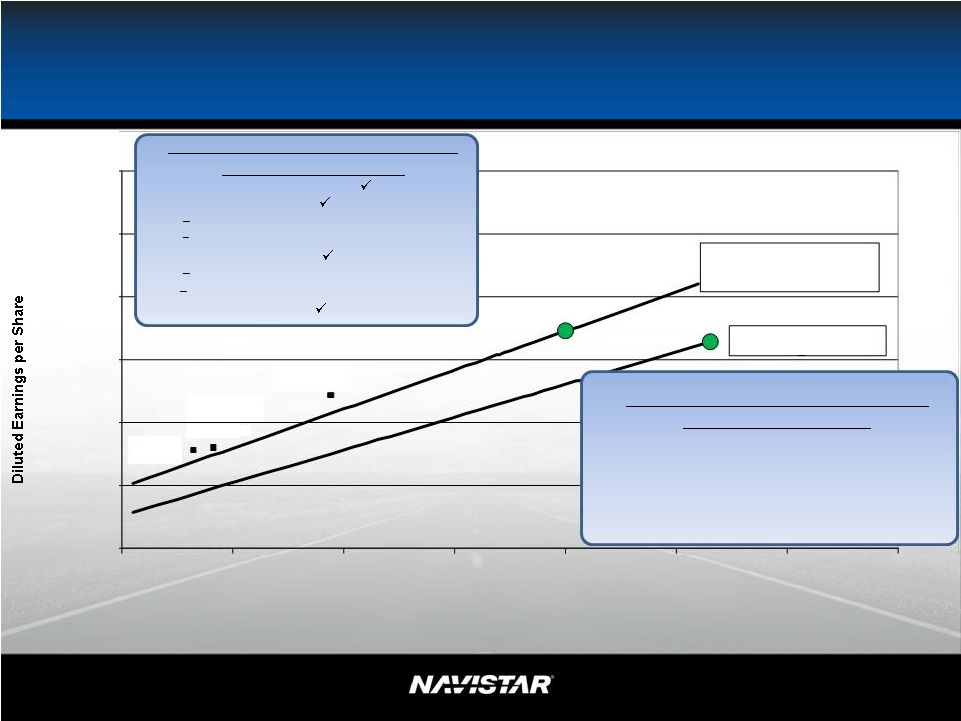

2011 Financial Guidance

•

$5.50 –

$6.00 adjusted EPS with this

being heavily weighted towards Q4

•

Q4 2011 drivers

–

Truck

•

10% increase in operating days in Q4 vs. Q3

•

Worldwide production up at > 25% from Q4

to Q3

•

Military revenues at ~$700M Q4

vs. ~$330M Q3

•

>50% increase in Latin America units vs. Q3

•

Supply base -

balance needs of customers

with supplier capacity

–

Engine

•

Big Bore engine production currently at ~800

per week and will ramp up to ~1,200 per

week by year end

•

South America –

record year

•

Cost per unit reductions

Navistar Consolidated Revenues ($ in Billions)

Navistar Adjusted Diluted EPS

Note: This slide contains non-GAAP information, please see the REG

G in appendix for a detailed reconciliation. 2011 FY Guidance

does not include the impact of Engineering Integration; Valuation

Allowance release; restructuring of Chatham, Workhorse and

Monaco and impairment charges.

$0

$2

$4

$6

$8

$10

$12

$14

$16

1st Half

2nd Half

Full Year Guidance

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

1st Half

2nd Half

Full Year Guidance

Guidance

$13.6 –

$14.3

$1.22

Guidance

$5.50 –

$6.00

Expected 2nd Half

$4.30 -

$4.80

$6.1

Expected 2nd

Half

$7.5 -

$8.2 |

19

19

Driving Shareholder Value

Note: This slide contains non-GAAP information, please see the REG

G in appendix for a detailed reconciliation. 2011 FY Guidance

does not include the impact of Engineering Integration; Valuation

Allowance release; restructuring of Chatham, Workhorse and

Monaco and impairment charges.

$(5.00)

$-

$5.00

$10.00

$15.00

$20.00

$25.00

150

200

250

300

350

400

450

500

Traditional Industry Volume (Thousands of Units)

Original

segment

profit

goal

assumed

a

share

count

of

72.5M shares and a tax rate of 25% .

2009

Actual

2010

2008

Actual

Original $1.6B Segment

Profit Goal

@ 415k

units

$1.8B Segment Profit

Goal

@ 350k

units

2011

results

and

commitment

to

earnings unchanged

•

Differentiation and leadership

•

Deliver customer value

Fuel economy with EGR

Convert 15L to 13L

•

Focus on cost structure

Flexible manufacturing

Integrated product development

•

Invest in global growth

Actual

NYSE: NAV

2012

and

Future

–

commitment

to

earnings unchanged

•

Market recovery

•

Increased product offering

•

Product differentiation

•

Military

–

$1.5B

-

$2.0B

Revenue

•

Global

Truck

–

Move

from

investing

to

profitability

•

Protect shareholder value/Maximize profitability |

NYSE: NAV

20

20

SEC Regulation G –

Non-GAAP

Reconciliation

Manufacturing

Segment

Results:

We

believe

manufacturing

segment

results,

which

includes

the

segment

results

of

our

Truck, Engine, and Parts reporting segments, provide meaningful information of our

core manufacturing business and therefore we use it to supplement our GAAP

reporting by identifying items that may not be related to the core manufacturing business.

Management often uses this information to assess and measure the

performance of our operating segments. We have chosen

to provide this supplemental information to investors, analysts and other

interested parties to enable them to perform additional analyses of

operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the

below reconciliation, and to provide an additional measure of performance.

Adjusted Net Income and Diluted Earnings Per Share Attributable To Navistar

International Corporation and Adjusted Manufacturing

Segment

Profit:

We

believe

that

adjusted

net

income,

diluted

earnings

per

share

attributable

to

Navistar

International Corporation, and adjusted manufacturing segment profit excluding

engineering integration costs, certain restructuring costs, and certain

impairment charges, which are not considered to be part of our ongoing business, improve the

comparability of year to year results and are representative of our underlying

performance. We have chosen to provide this supplemental information to

investors, analysts, and other interested parties to enable them to perform additional analyses of

operating results, to illustrate the results of operations giving effect to the

non-GAAP adjustments shown in the below reconciliations, and to provide

an additional measure of performance. The financial measures presented below are unaudited and

not in accordance with, or an alternative for, financial measures presented in accordance with

U.S. generally accepted accounting principles (GAAP). The non-GAAP financial information

presented herein should be considered supplemental to, and not as a substitute for, or superior

to, financial measures calculated in accordance with GAAP. |

21

21

SEC Regulation G –

2011

Guidance

Lower

Upper

(Dollars in Millions, except per share data)

Net income attributable to Navistar International Corporation

$ 190

$ 288

Plus: Engineering integration costs

(A)

77

77

Impairments and restructuring and related charges

(B)

160

100

Adjusted net income attributable to Navistar International Corporation

$ 427

$ 465

Diluted earnings per share attributable to Navistar International Corporation

$ 2.45

$ 3.71

Effect

of

adjustments

on

diluted

earnings

per

share

attributable

to

Navistar

International

Corporation

2.29

Adjusted diluted earnings per share attributable to Navistar International Corporation

$ 5.50

$ 6.00

Approximate diluted weighted shares outstanding

(C)

77.6

77.6

Fiscal 2011 guidance: adjusted net income and diluted earnings per share attributable to Navistar

International Corporation reconciliation:

(A)

Engineering integration costs relate to the consolidation of our truck and engine engineering

operations as well as the move of our world headquarters. We continue to develop

plans for efficient transitions related to these activities and the optimization of our operations

and management structure.

(B)

Impairments and restructuring and related charges are charges relate to our plans to close our

Chatham, Ontario and Workhorse chassis plant in Union City, Indiana, and to significantly

scale back operations at its Monaco recreational vehicle headquarters and motor coach manufacturing plant in Coburg, Oregon. In addition, as a result of these

expected actions, as well as other factors, the Company concluded that there was a trigger event for

the review for impairment of various long-lived assets, including certain intangible

assets, related to these facilities. We expect most of these charges to be incurred during the third and fourth quarters of 2011, with the remainder taking place in 2012.

(C)

Approximate diluted weighted shares outstanding based on assumed average share price of

$65 per share during the period.

Note: Above reconciliation does not include the impact of the potential income tax valuation

allowance release.

3.05 |

22

SEC Regulation G –

EPS vs.

Traditional Industry

(A) Revised Target sales and revenues, net –

Projections based on $17-18B of GAAP revenue and $2-3B of Non-GAAP revenue related to

Navistar's share of non-consolidated affiliates. Original

Target

Revised

Target

U.S. & Canada Industry

414,500

350,000

Sales and Revenues, Net

(A)

$15 +

$20 +

Diluted earnings per share attributable to Navistar International

Corporation $ 11.46

$ 12.31

Approximate diluted weighted shares outstanding

~ 72.5

~ 72.5

(Dollars in Millions)

Net income (loss) attributable to Navistar International Corporation

$ 825

$ 892

Less: Financial services segment profit, Corporate and eliminations,

and income taxes (775)

(888)

Manufacturing segment profit

$ 1,600

$ 1,780 |

23

23

SEC Regulation G –

Fiscal Year

Comparison

2009

2008

(Dollars in Millions, except per share data)

Net income attributable to Navistar International Corporation

$ 320

$ 134

Plus:

Ford

settlement,

restructuring

and

related

charges

(benefits)

(A)

(157)

36

Impairment

of

property,

plant,

and

equipment

(B)

31

358

Write-off

of

debt

issuance

costs

(C)

11

-

Adjusted net income attributable to Navistar International Corporation

$ 205

$ 528

Adjusted diluted earnings per share attributable to Navistar International

Corporation $ 2.86

$ 7.21

Diluted weighted shares outstanding

71.8

73.2

Adjusted net income and diluted earnings per share attributable to Navistar

International Corporation reconciliation:

(A)

Ford settlement, restructuring and related charges (benefits) include the impact of our settlement

with Ford in 2009 as well as charges and benefits recognized related to restructuring activity

at our Indianapolis Casting Corporation and Indianapolis Engine Plant. The charges and benefits were recognized in our Engine segment with the

exception of $3 million of income tax expense and $1 million of income tax benefit related to the

settlement in 2009 and 2008 respectively. (B)

Impairment of property, plant, and equipment in 2008 are related to impairments to the asset groups

in the Engine segment’s VEE Business Unit. The 2009 impairments relate to charges

recognized by the Truck segment for impairments related to asset groups at our Chatham and Conway facilities

(C)

The write-off of debt issuance costs in 2009 relate to charges related to the Company’s

refinancing. |

24

24

SEC Regulation G –

Six Months

Ended April 30, 2011

Six Months

Ended

April 30, 2011

(Dollars in Millions, except per share data)

Net income attributable to Navistar International Corporation

$ 68

Plus:

Engineering integration costs

(A)

26

Adjusted net income attributable to Navistar International Corporation

$ 94

Diluted earnings per share attributable to Navistar International Corporation

$ 0.87

Effect

of

adjustments

on

diluted

earnings

per

share

attributable

to

Navistar

International

Corporation

0.35

Adjusted diluted earnings per share attributable to Navistar International Corporation

$ 1.22

Diluted weighted shares outstanding

77.3

Adjusted net income and diluted earnings per share attributable to Navistar International Corporation

reconciliation: (A)

Engineering integration costs relate to the consolidation of our truck and engine engineering

operations as well as the move of our world headquarters. We continue to develop plans

for efficient transitions related to these activities and the optimization of our operations and management structure.

|