Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENCORE CAPITAL GROUP INC | d8k.htm |

Encore

Capital Group Investor Presentation August 2011

Exhibit 99.1 |

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

2

FORWARD-LOOKING STATEMENTS

The statements in this presentation that are not historical facts, including, most

importantly, those statements preceded by, or that include, the words “may,”

“believe,” “projects,” “expects,” “anticipates” or the

negation thereof, or similar expressions, constitute “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform

Act”). These statements may include, but are not limited to, statements regarding

our future operating results and growth. For all “forward-looking

statements,” the Company claims the protection of the safe harbor for forward-looking

statements contained in the Reform Act. Such forward-looking statements involve

risks, uncertainties and other factors which may cause actual results, performance or

achievements of the Company and its subsidiaries to be materially different from any future

results, performance or achievements expressed or implied by such forward-looking

statements. These risks, uncertainties and other factors are discussed in the reports

filed by the Company with the Securities and Exchange Commission, including the

most recent reports on Forms 10-K, 10-Q and 8-K, each as it may be amended from

time to time. The Company disclaims any intent or obligation to update these

forward-looking statements. |

INVESTMENT HIGHLIGHTS

3

•

Favorable supply and demand dynamics have existed since

2008, with

a few credible, large buyers

•

Strong performance is expected to continue

•

Operational and financial leverage is increasing, largely due to

the

success of our operating center in India

•

Analytic insights inform our valuation and operating strategies

and allow for a closer partnership with consumers |

ENCORE

IS A LEADING PLAYER IN THE CONSUMER DEBT BUYING AND RECOVERY INDUSTRY

4

Revenue Composition

As of June 30, 2011

Global Capabilities

Debt Purchasing & Collections

Bankruptcy Servicing

•

Purchase and collection

of

charged-off unsecured

consumer receivables

(primarily credit card)

•

Robust business model

emphasizing consumer

intelligence and

operational

specialization

•

Invested ~$2.0 billion to

acquire receivables with a face

value of ~$61 billion

•

Acquired ~36 million consumer

accounts since

inception

•

Process secured consumer bankruptcy accounts for leading

auto

lenders and other financial institutions

•

Proprietary software dedicated to bankruptcy servicing

•

Operational platform that integrates lenders, trustees,

and

consumers

Debt Purchasing & Collections

Bankruptcy Servicing

St Cloud, MN

Arlington, TX

Phoenix, AZ

Delhi, India

Call Center /

Technology Site

Call Center Site

Ascension

Call Center Site

San Diego, CA

Headquarters/

Call Center Site |

STRATEGIC DECISIONS MADE OVER THE PAST DECADE

DEMONSTRATE OUR ABILITY TO FORESEE, AND ADAPT TO, CHANGES

5

•

Hired first statisticians

•

Created first and second generation

forecasting models

•

Created 1 generation operational

models

(mail channel and call center)

•

In late 2005, we established a call center in

India. We believe it is the only late-stage

collections platform in India, at

approximately 1/3 the cost of our U.S.

operations

•

Between 2005 and 2007 we remained

disciplined and avoided high priced

portfolios

that did not meet internal hurdle

rates

•

In 2008 we built and implemented the industry’s

first known ability-to-pay (capability) model

•

In 2009, we ramped up

purchasing

to take

advantage of the favorable

market environment

•

In February 2010, we entered

into a new $327.5 million

revolving credit facility which

was subsequently increased

to $410.5 million, and added

$75 million in two private

placement transactions with

Prudential

Emerging Market

2001

2003

Overconfidence and

Irrational Pricing

2005

2007

Attractive Opportunity

2011

2009

2002

2004

2006

2008

2010

Demand

Supply

st |

THESE

DECISIONS ARE DRIVING STRONG RESULTS 6

2010

2009

YOY Growth

Annual Variance

$604,609

$116,817

24%

$487,792

Collections

$381,308

$64,889

21%

$316,419

Revenue

$346,656

$82,051

31%

$264,605

Adjusted EBITDA*

$361,957

$105,325

41%

$256,632

Purchases

$1.95

$0.58

42%

$1.37

EPS

($000s, except EPS and ratios)

* Adjusted EBITDA is a non-GAAP number. The Company considers Adjusted EBITDA

to be a meaningful indicator of operating performance and uses it as a measure to

assess the operating performance of the Company. See Reconciliation of Adjusted

EBITDA to GAAP Net Income at the end of this presentation. Q2 11

$195,081

$115,830

$116,484

$93,701

$0.58

Q2 10

$156,789

$96,231

$90,458

$83,337

$0.47 |

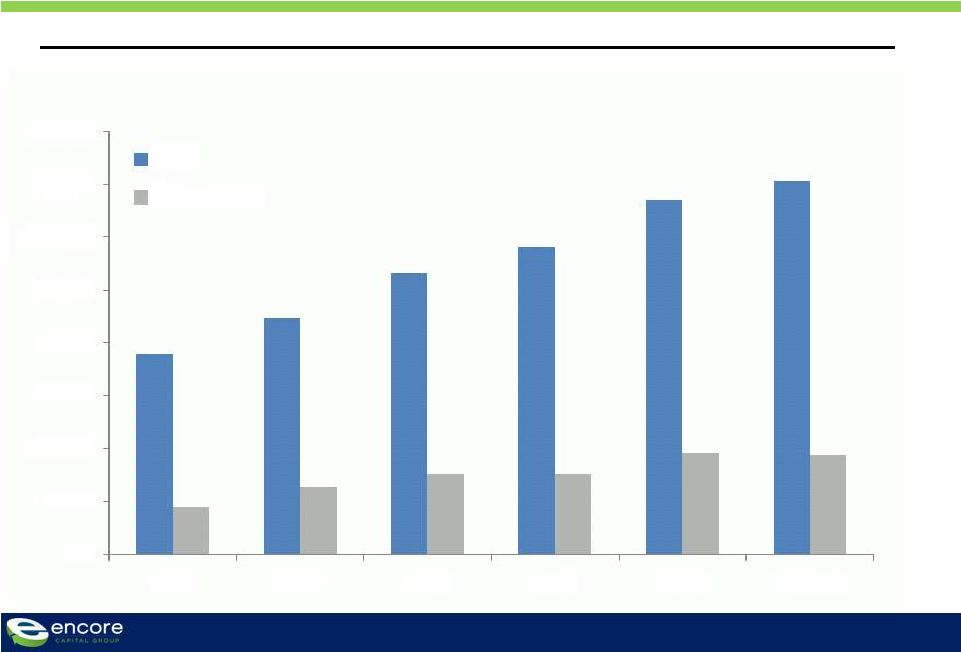

WE HAVE

SIGNIFICANTLY INCREASED BOTH OPERATING CASH FLOW (ADJUSTED EBITDA) AND CASH

COLLECTIONS 7

($ millions)

*

Adjusted EBITDA is a non-GAAP number. The Company considers Adjusted EBITDA to

be a meaningful indicator of operating performance and uses it as a measure to

assess the operating performance of the Company. See Reconciliation of Adjusted

EBITDA to GAAP Net Income at the end of this presentation **

LTM data as of 06/30/2011

Adjusted EBITDA* and Gross Collections by year

$150

$250

$350

$450

$550

$650

2007

2008

2009

2010

LTM**

Gross Collections

Adjusted EBITDA |

WHILE

ENHANCING THE FUTURE VALUE OF THE COMPANY 8

Annual Estimated Remaining Gross Collection (ERC) and Total Debt

($ millions, at end of period)

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

2006

2007

2008

2009

2010

Q2 2011

ERC

Total Debt |

WE

BELIEVE THAT OUR CURRENT ESTIMATE OF REMAINING COLLECTIONS IS CONSERVATIVE

GIVEN OUR HISTORY 9

Cumulative collections (initial expectation vs. actual)

($

millions,

March

01

–

June

11)

Actual cash

collections

Initial

projections

$-

$250

$500

$750

$1,000

$1,250

$1,500

$1,750

$2,000

$2,250

$2,500

$2,750

$3,000

$3,250

$3,500 |

MARKET

DYNAMICS CONTINUE TO BE IN OUR FAVOR, WHILE THE REGULATORY ENVIRONMENT REMAINS

CHALLENGING 10

Charge-offs

remain

elevated

Consumer

credit continues

to experience

losses at near

record levels

Supply more

closely

managed by

the issuers

Demand

increasing, albeit

slowly

Few players with

access to

significant

amounts of capital

Continued exit of

large players, but

others starting to

gain traction

Consumer

performance

remains predictable

Our models continue

to predict consumer

behavior with a high

degree of accuracy

Significant

regulatory and

legislative scrutiny

Both in our industry

and in the financial

services sector at

large |

OUR

CONSUMERS HAVE SHOWN THAT THEY ARE RESILIENT DESPITE THE MACROECONOMIC

ENVIRONMENT 11

Overall payer rate for all active inventory

2008

0.8%

0.9%

1.0%

1.1%

1.2%

1.3%

1.4%

1.5%

1.6%

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2009

2010

2011 |

AS A

RESULT, WE HAVE BEEN ABLE TO ACCELERATE OUR ABILITY TO HELP CONSUMERS MOVE

TOWARD FINANCIAL RECOVERY 12

Consumers with whom we have partnered to retire their debt (cumulative)

|

WE

HAVE TAKEN A LEADERSHIP STANCE BY OUTLINING OUR CORE PRINCIPLES IN AN

INDUSTRY-FIRST CONSUMER BILL OF RIGHTS 13

Clearly states what our consumers

should expect during the collection

process

Gives consumers concrete

assurances about our conduct

No interest once payments are

established if maintained

No systematic messages left

Cessation of collections under

certain circumstances

Positions Encore as a company

that governmental entities should

consult with prior to enacting

regulations that impact the industry |

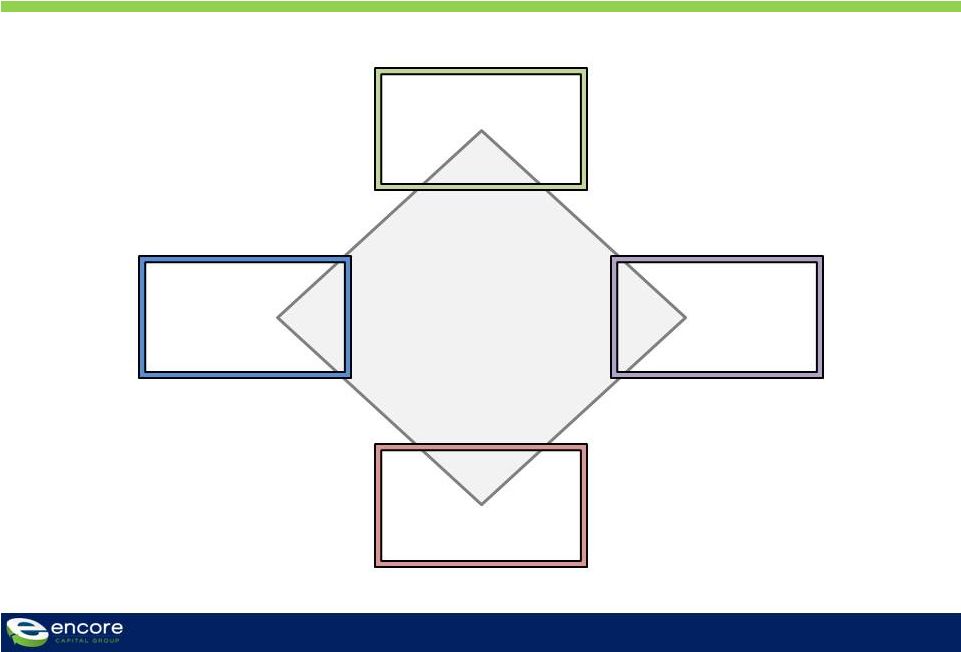

OUR

OPERATIONAL SUCCESS IS BASED UPON FOUR STRATEGIC PRIORITIES

14

ENCORE’S

STRATEGIC

PILLARS

ANALYTIC

STRENGTH

COST

LEADERSHIP

CONSUMER

INTELLIGENCE

PRINCIPLED

INTENT |

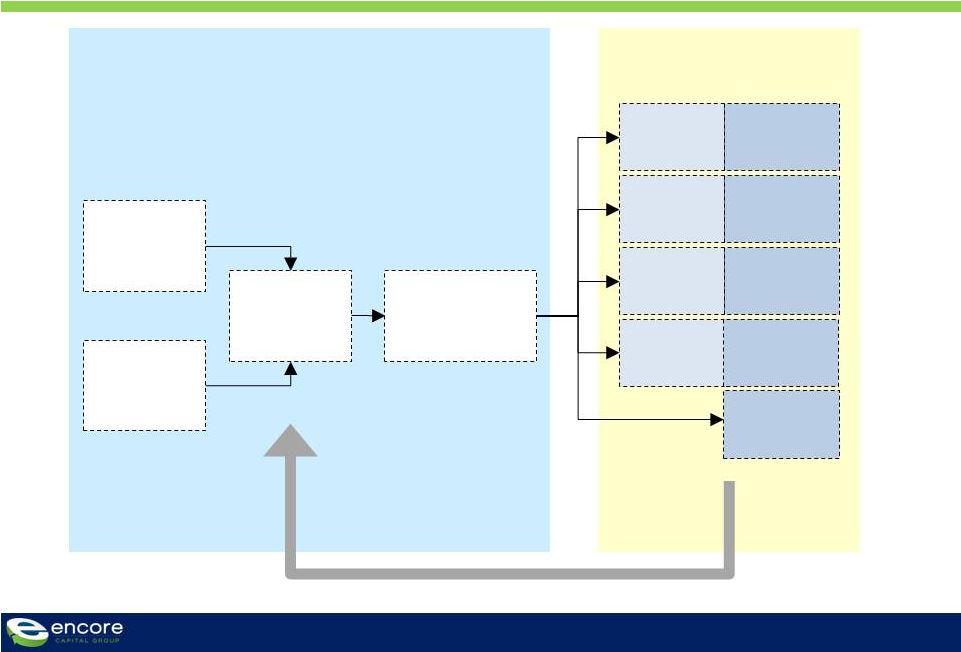

OUR

ANALYTIC REACH EXTENDS FROM PRE-PURCHASE THROUGHOUT OUR ENTIRE OWNERSHIP

PERIOD 15

No effort

Legal

Outsourcing

Legal effort

model with

Capability

Call

Centers

Call effort

model with

Capability

Direct

Mail

Letter effort

model with

Capability

Agency effort

model with

Capability

Collections operations that

optimize effort and profitability

Core competency in understanding the

payer behavior of distressed consumers

Cross-channel

coordination

and optimization

Consumer

behavior

research

Market data

and insight

Portfolio

valuation

Pre-purchase

model

Continuous feedback between

operations and valuation

Collection

Agency

Outsourcing |

WE

HAVE FUNDAMENTALLY CHANGED THE COST STRUCTURE OF THE COMPANY OVER THE PAST FOUR

YEARS… 16

Variable cost to collect *

(%)

* Represents salaries, variable compensation and employee benefits

|

DRIVEN

BY OUR ANALYTICS AND OUR INDIA CENTER, WITH THE LATTER PRODUCING HALF OF CALL

CENTER COLLECTIONS 17

Collections from all call centers

($ millions)

$126

$157

$186

$268

Percent

of Total:

10%

19%

30%

44%

~$340

50% |

SUMMARY

18

•

Strong performance is expected to continue

•

Analytic insights inform our valuation and operating strategies

and allow for a closer partnership with consumers

•

Favorable supply and demand dynamics have existed since

2008, with a few credible, large buyers

•

Operational and financial leverage is increasing, largely due to

the

success of our operating center in India |

APPENDIX: RECONCILIATION OF ADJUSTED EBITDA

19

Reconciliation of Adjusted EBITDA to GAAP Net Income

(Unaudited, In Thousands)

Three Months Ended

Note:

The

periods

3/31/07

through

12/31/08

have

been

adjusted

to

reflect

the

retrospective

application

of

ASC

470-20

3/31/07

6/30/07

9/30/07

12/31/07

3/31/08

6/30/08

9/30/08

12/31/08

3/31/09

6/30/09

9/30/09

12/31/09

3/31/10

6/30/10

9/30/10

12/31/10

3/31/11

6/30/11

GAAP net income, as reported

4,991

(1,515)

4,568

4,187

6,751

6,162

3,028

(2,095)

8,997

6,641

9,004

8,405

10,861

11,730

12,290

14,171

13,679

14,775

Interest expense

4,042

4,506

4,840

5,260

5,200

4,831

5,140

5,401

4,273

3,958

3,970

3,959

4,538

4,880

4,928

5,003

5,593

5,369

Contingent interest expense

3,235

888

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Pay-off of future contingent interest

-

11,733

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Provision for income taxes

3,437

(1,031)

1,315

2,777

4,509

4,225

2,408

(1,442)

5,973

4,166

5,948

4,609

6,490

6,749

6,632

9,075

8,601

9,486

Depreciation and amortization

869

840

833

810

722

766

674

652

623

620

652

697

673

752

816

958

1,053

1,105

Amount applied to principal on receivable portfolios

28,259

29,452

26,114

29,498

40,212

35,785

35,140

46,364

42,851

48,303

49,188

47,384

58,265

64,901

63,507

53,427

85,709

83,939

Stock-based compensation expense

801

1,204

1,281

1,001

1,094

1,228

860

382

1,080

994

1,261

1,049

1,761

1,446

1,549

1,254

1,765

1,810

Adjusted EBITDA

45,634

46,077

38,951

43,533

58,488

52,997

47,250

49,262

63,797

64,682

70,023

66,103

82,588

90,458

89,722

83,888

116,400

116,484 |