Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DELCATH SYSTEMS, INC. | form8-k.htm |

Investor Presentation

(NASDAQ: DCTH)

(NASDAQ: DCTH)

August 2011

2 DELCATH SYSTEMS, INC

Forward-looking Statements

This presentation contains forward-looking statements, within the meaning of federal securities laws,

related to future events and future financial performance which include statements about our

expectations, beliefs, plans, objectives, intentions, goals, strategies, assumptions and other statements

that are not historical facts. Forward-looking statements are subject to known and unknown risks and

uncertainties and are based on potentially inaccurate assumptions, which could cause actual results to

differ materially from expected results, performance or achievements expressed or implied by

statements made herein. Our actual results could differ materially from those anticipated in forward-

looking statements for many reasons, including; uncertainties relating to the time required to build

inventory and establish commercial operations in Europe, adoption, use and resulting sales, if any, for

the chemosaturation delivery system in the EEA, our ability to successfully commercialize the

chemosaturation system and the potential of the system as a treatment for patients with cancer in the

liver, availability of melphalan in the EEA, acceptability of the Phase III clinical trial data by the FDA, our

ability to address the issues raised in the Refusal to File letter received from the FDA and the timing of

our re-submission of our NDA, re-submission and acceptance of the Company’s NDA by the FDA,

approval of the Company’s NDA for the treatment of metastatic melanoma to the liver, adoption, use and

resulting sales, if any, in the United States, approval of the current or future chemosaturation system for

other indications or the same indication in other foreign markets, actions by the FDA or other foreign

regulatory agencies, our ability to successfully enter into distribution and strategic partnership

agreements in foreign markets and the corresponding revenue associated with such foreign markets,

our ability to secure reimbursement for the chemosaturation system, progress of our research and

development programs and future clinical trials, uncertainties regarding our ability to obtain financial

and other resources for any research, development and commercialization activities, overall economic

conditions and other factors described in the section entitled ‘‘Risk Factors’’ in our most recent Annual

Report on Form 10-K and the Quarterly Reports on Form 10-Q that we file with the Securities and

Exchange Commission.

related to future events and future financial performance which include statements about our

expectations, beliefs, plans, objectives, intentions, goals, strategies, assumptions and other statements

that are not historical facts. Forward-looking statements are subject to known and unknown risks and

uncertainties and are based on potentially inaccurate assumptions, which could cause actual results to

differ materially from expected results, performance or achievements expressed or implied by

statements made herein. Our actual results could differ materially from those anticipated in forward-

looking statements for many reasons, including; uncertainties relating to the time required to build

inventory and establish commercial operations in Europe, adoption, use and resulting sales, if any, for

the chemosaturation delivery system in the EEA, our ability to successfully commercialize the

chemosaturation system and the potential of the system as a treatment for patients with cancer in the

liver, availability of melphalan in the EEA, acceptability of the Phase III clinical trial data by the FDA, our

ability to address the issues raised in the Refusal to File letter received from the FDA and the timing of

our re-submission of our NDA, re-submission and acceptance of the Company’s NDA by the FDA,

approval of the Company’s NDA for the treatment of metastatic melanoma to the liver, adoption, use and

resulting sales, if any, in the United States, approval of the current or future chemosaturation system for

other indications or the same indication in other foreign markets, actions by the FDA or other foreign

regulatory agencies, our ability to successfully enter into distribution and strategic partnership

agreements in foreign markets and the corresponding revenue associated with such foreign markets,

our ability to secure reimbursement for the chemosaturation system, progress of our research and

development programs and future clinical trials, uncertainties regarding our ability to obtain financial

and other resources for any research, development and commercialization activities, overall economic

conditions and other factors described in the section entitled ‘‘Risk Factors’’ in our most recent Annual

Report on Form 10-K and the Quarterly Reports on Form 10-Q that we file with the Securities and

Exchange Commission.

3 DELCATH SYSTEMS, INC

Company Highlights

• Making established chemotherapeutic drugs work better in target organs

• Initial focus is high dose chemotherapy for improved disease control in the liver

• Successful and highly statistically significant Phase III trial results reported

• Received CE Mark approval for Class III medical device on April 13, 2011

• Positioned to address potential $3.0 billion European labeled market opportunity

• Objective is to re-file 505(b)(2) NDA to FDA for orphan drug and delivery

apparatus by end of 2011

apparatus by end of 2011

• Potential $675 million US labeled market opportunity

• Issued patents and orphan drug designations create competitive barriers

• Deep and experienced management team

Concentrating the Power of Chemotherapy to Improve Disease Control in the Liver

4 DELCATH SYSTEMS, INC

Potential $3.75 Billion Labeled Market Opportunity*

Transparent Areas

Represent Potential

Additional Indications

Represent Potential

Additional Indications

13,505**

101,563

355,712

• CE Mark in EU for delivery of melphalan

to the liver permits physician use on a

broad range of liver cancers

to the liver permits physician use on a

broad range of liver cancers

• Potential $3 Billion Long term EU Market

Opportunity*

Opportunity*

• Leverage CE Mark to gain regulatory

approvals in Asia, America’s (EX US),

MEA, and Australia

approvals in Asia, America’s (EX US),

MEA, and Australia

• Potential $8 Billion Asia/Australia Market

Opportunity*

Opportunity*

• Seeking initial indication for melanoma

mets in U.S., a potential $670 million **

market opportunity

mets in U.S., a potential $670 million **

market opportunity

• Significant potential label expansion

possible is U.S. with additional studies

possible is U.S. with additional studies

5 DELCATH SYSTEMS, INC

Spectrum of Liver Cancer Treatments

Existing Treatments Involve Significant Limitations

|

Type of Treatment

|

Advantages

|

Disadvantages

|

|

Systemic

|

o Non-invasive

o Repeatable

|

– Systemic toxicities

– Limited efficacy in liver

|

|

Regional (e.g., IHP)

|

o Therapeutic effect

o Targeted

|

– Invasive/limited repeatability

– Multiple treatments are

required |

|

Focal

|

o Isolated removal of tumor

|

– 90% unresectable

– Invasive and/or limited

repeatability |

6 DELCATH SYSTEMS, INC

Open Surgical IHP - Where It All Began

Isolated Hepatic Perfusion: Proof of Concept, but High Morbidity and Non-Repeatable

7 DELCATH SYSTEMS, INC

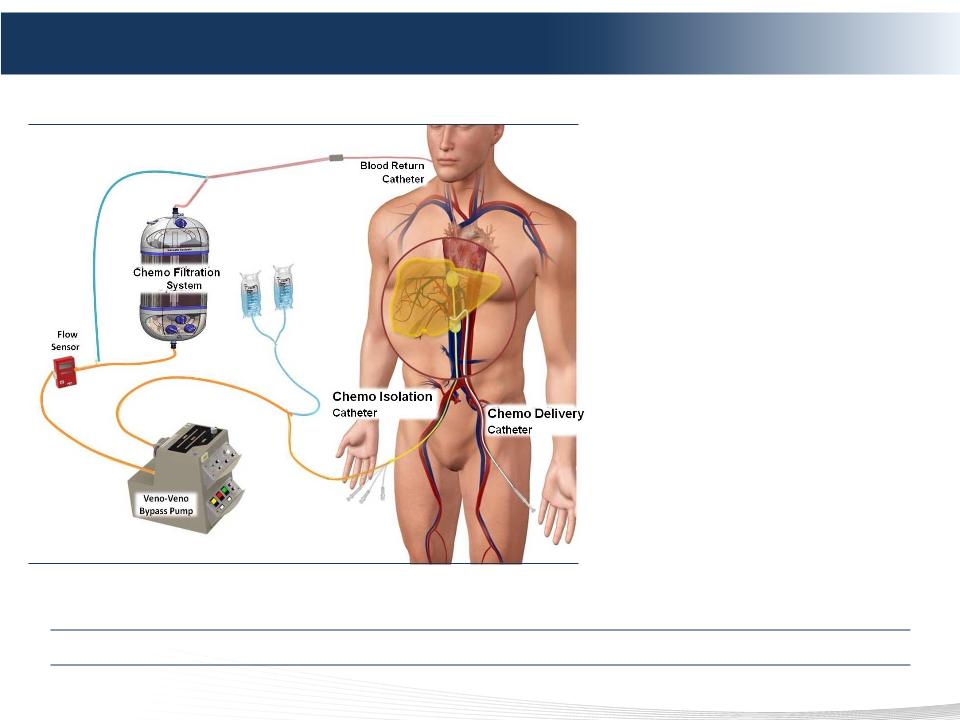

The Delcath Chemosaturation System

Three Steps of Chemosaturation

1) ISOLATION

2) SATURATION

3) FILTRATION

Advantages of Chemosaturation

• Improved disease control in the

liver

liver

• Treats entire liver

• Allows for ~ 100x effective dose

escalation of drug agents at

tumor site

escalation of drug agents at

tumor site

• Controls systemic toxicities

• Repeatable

• Complements systemic therapy

Minimally Invasive, Repeatable Liver Procedure That Could Complement Systemic Therapy

Note: Image not to scale.

8 DELCATH SYSTEMS, INC

Melphalan Dosing & Background

• Well understood, dose dependant, tumor preferential, alkylating cytotoxic agent that

demonstrates no hepatic toxicity

demonstrates no hepatic toxicity

• Manageable systemic toxicities associated with Neutropenia and Cytopenia

• Drug dosing over 10x higher than FDA-approved dose via systemic IV chemotherapy

• Dose delivered to tumor is approximately 100x higher than that of systemic IV

chemotherapy

chemotherapy

|

Type

|

Dosing (mg/kg)

|

|

Multiple Myeloma (label)

|

0.25

|

|

Chemoembolization

|

0.62

|

|

Surgical Isolated Hepatic Perfusion (IHP)

|

1.50

|

|

Myeloablation

|

2.50-3.50

|

|

Chemosaturation (PHP)

|

3.00

|

A Promising Drug For Liver Cancer Therapy

9 DELCATH SYSTEMS, INC

What Chemosaturation Offers

Patients:

o Significant improvement in disease control in the liver compared to

standard of care in patients with unresectable hepatic melanoma mets

standard of care in patients with unresectable hepatic melanoma mets

o Manageable systemic toxicities

o Time, so that primary cancers can continue to be treated

Physicians:

o Novel, targeted liver directed treatment to complement other

cancer therapies

cancer therapies

o Repeatable, percutaneous procedure

o Ability to treat the entire liver, including both visible and micro tumors

o Ability to continue treating patients for extra-hepatic disease

Attractive Clinical and Economic Proposition For Patient and Providers

10 DELCATH SYSTEMS, INC

Interventional

Radiologist

Patient

Primary

Care

Medical

Oncologist

Offers systemic therapy to

treat Cancer

treat Cancer

Surgical

Oncologist

Offers resection or other focal therapy

to treat cancer in Liver

to treat cancer in Liver

Transferred for

chemosaturation

chemosaturation

Diagnosis

of Cancer

of Cancer

Identification of liver

involvement

involvement

with no improvement from

systemic therapy

systemic therapy

When liver disease is

controlled, patients return to the

Medical Oncologist for

additional systemic therapy

controlled, patients return to the

Medical Oncologist for

additional systemic therapy

11DELCATH SYSTEMS, INC

Summary of Phase III Results

• Primary endpoint exceeded, p value = 0.001, hazard ratio of .301

o Treatment arm shows 5x median hepatic progression free (hPFS) survival compared to control

arm

arm

o CS/PHP median hPFS of 245 days compared to 49 days for BAC

o 86% overall clinical benefit (CR + PR + SD)

• Secondary endpoints support results

o OS Secondary endpoint - No difference in Kaplan-Meier curves due to cross over treatment

response (298 days compared to 301 days)

response (298 days compared to 301 days)

• OS cohort analysis favorable

o Median survival of 298 days for treatment arm compared to 124 in non-crossover BAC patients

o 14 treatment patients (6 treatment, 8 crossover) and 3 BAC patients still alive at 12/31/2010

• Safety profile - expected and consistent with currently approved labeling

for melphalan

for melphalan

o Treatment related Deaths: 3/40 patients (7.5%) 3/116 procedures (2.6%)

o Neutropenic Sepsis (n=2) 5%, Hepatic Failure (n=1) 2.5% (95% tumor burden)

Trial Outcomes Favorable and Consistent with Special Protocol Assessment

12 DELCATH SYSTEMS, INC

Phase I/II NCI Trials - Neuroendocrine

Pre-CS

(Baseline)

Post-CS #2

(+4 Months)

Post-CS #1

(+6 Weeks)

Promising Initial Response Rate in Attractive Market

|

Neuroendocrine Tumor Trial Results (n=23)*

|

|

|

|

Number (n)

|

|

Primary Tumor Histology

|

|

|

Carcinoid

|

3

|

|

Pancreatic Islet Cell

|

17

|

|

Response

|

|

|

Not Evaluable (Toxicity, Incomplete Treatment, Orthotopic Liver

Transplantation) |

4

|

|

Progressive Disease

|

1

|

|

Minor Response / Stable Disease

|

3

|

|

Partial Response (30.0% - 99.0% Tumor Reduction)

|

13

|

|

Complete Response (No Evidence of Disease)

|

2

|

|

Objective Tumor Response

|

15

|

|

Objective Tumor Response Rate

|

79%

|

|

|

Duration (months)

|

|

Median Hepatic PFS

|

39

|

|

Overall Survival After CS

|

40

|

*Presentation at American Hepato-Pancreo-Biliary Association 2008 annual meeting

13 DELCATH SYSTEMS, INC

High Efficiency (HE) Filter Media Development

STATUS:

o Melphalan - Achieved consistent in-vitro first pass removal

efficiency of 98% or better

efficiency of 98% or better

o Internal development project

o Developed trade secret manufacturing process to create new filter

medium

medium

EXPECTED BENEFITS:

o Reduced systemic toxicity for improved safety profile

o Concomitant Therapy (complements systemic therapies)

o Increased utility in a wider range of patients

HE Filter Expected to Significantly Enhance Procedure and Market Opportunity

14 DELCATH SYSTEMS, INC

Product Development Pipeline

• Melanoma liver mets

• Proprietary drug-melphalan &

apparatus

apparatus

• EAP - melphalan

• All liver cancers - melphalan

• Class III device

• 3rd party melphalan

• Leverage strong data in

melanoma and NET liver mets

melanoma and NET liver mets

• Additional drugs

• Other organs

• HCC and CRC liver mets global

clinical trials - melphalan

clinical trials - melphalan

• Apparatus improvements

Initial Opportunity

Near Term (< 5 years)

Intermediate Term (> 5 years)

• HCC and CRC liver mets global

clinical trials - melphalan

clinical trials - melphalan

• Drug-melphalan & apparatus

• HCC and CRC livers met global

clinical trials

clinical trials

• Apparatus improvements

• Additional drugs

• Other organs

• Additional drugs

• Other organs

Robust Development Program Planned

• Leverage CE Mark approval

• Leverage strong data in

melanoma and NET liver mets

melanoma and NET liver mets

• 3rd party melphalan

15 DELCATH SYSTEMS, INC

Clinical Data Development Plans

• Utilize High Efficiency (HE) Filter

o Concomitant therapy to complement standard of care treatments

o Increase safety (reduce systemic side effects) of procedure

o Small Pk study commencing in Q4 in Australia

• Enroll clinical trials in 2012 to expand data and enhance commercial

adoption

adoption

o Expanded Access Program (EAP) in U.S. for metastatic melanoma at 4-5 centers

o 2 L HCC: randomized, Global Phase 3 of Chemosaturation vs BSC for sorafenib

refractory patients (registration study for expanded labeling of melphalan)

refractory patients (registration study for expanded labeling of melphalan)

o 1L HCC: randomized, Global Phase 4 sorafenib vs Chemosaturation in first line setting

o Metastatic colorectal (mCRC): Phase 2, single arm for patients refractory to1L therapy

• Future possibilities may include: use in adjuvant setting in melanoma, combination

therapy with ipilimumab, combination with SOC in mCRC, combination with resection

therapy with ipilimumab, combination with SOC in mCRC, combination with resection

Goal Of Establishing Chemosaturation As Standard of Care For Disease Control In The Liver

16 DELCATH SYSTEMS, INC

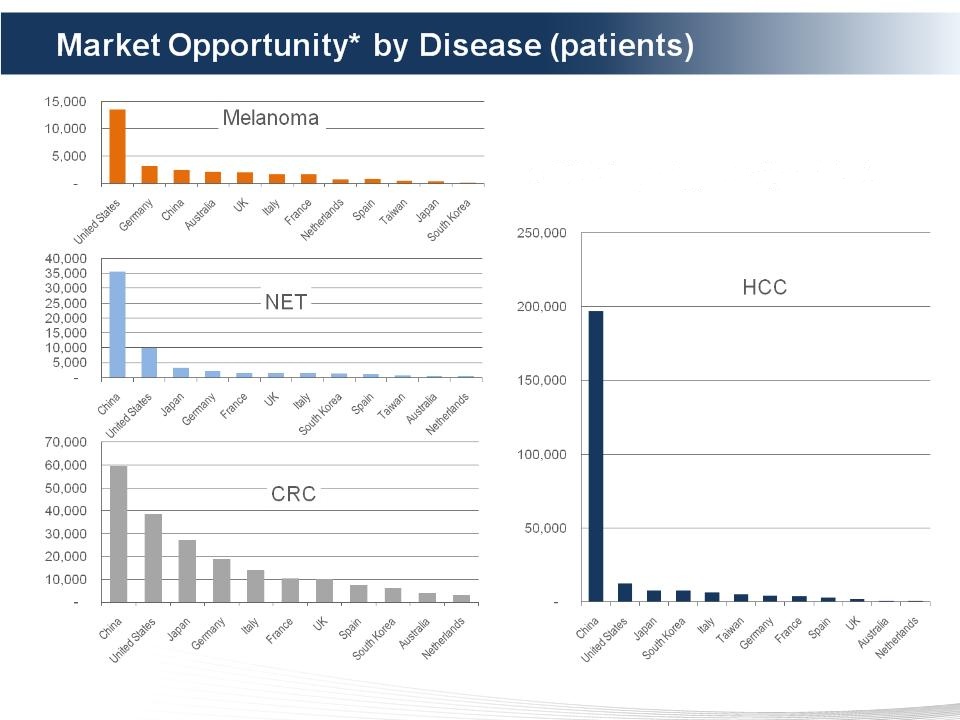

• US - largest opportunity for Melanoma

• China- largest opportunity for HCC

• CRC - largest opportunity worldwide

*TPM Total Potential Market

17 DELCATH SYSTEMS, INC

EEA Landscape

• CE Mark device approval covers 30 countries in the European

Economic Area (EEA)

Economic Area (EEA)

• Indication is for “intra-arterial delivery of chemotherapeutic agent

(melphalan hydrochloride) to the liver”

(melphalan hydrochloride) to the liver”

• Hospitals procure melphalan separately from existing sources

• Melphalan for injection approved in 14 countries, but

commercially available in remaining EEA countries

commercially available in remaining EEA countries

• Estimate potentially applicable to ~100,000 patients annually

• 6 top countries (DE, UK, FR, IT, SP, NL) represent ~70% of total

patient population

patient population

Large European Market Opportunity Concentrated in Six Countries

18 DELCATH SYSTEMS, INC

European Commercialization Plans

Objective: broad commercial adoption

Major Assumptions:

• HE filter available for full commercial launch ( Q3 2012)

• 6-8 Centers of Excellence for training

• Initiate test market in 2011 for 6 months to validate assumptions and finalize model

• Full commercialization in 2012

Tactics & Execution:

• Market to medical oncologists via contract sales organization (CSO) to create “Push”

• Sell to hospital-based interventional radiologists and surgeons with combination of direct sales and

distributors to create “Pull”

distributors to create “Pull”

• Establish European patient education & awareness programs (PR, website)

• Leverage existing new technology reimbursement channels, while pursuing permanent procedure

reimbursement via Health Technology Assessment (HTA)

reimbursement via Health Technology Assessment (HTA)

• New clinical trials to generate additional data for HCC & mCRC

Strategy and Tactics to Address All Key Constituents

19 DELCATH SYSTEMS, INC

European Marketing Considerations

Reimbursement:

o No centralized EEA device reimbursement body - regional and national systems

o Devices typically reimbursed under DRG as part of a procedure

o Immediate reimbursement plans:

• Utilize existing codes where permitted until permanent reimbursement established (e.g. Italy)

• Apply for funding under new technology programs (e.g. NUB in Germany and HAS in France)

• Other oncology therapies currently reimbursed, despite lacking randomized data

o Retained reimbursement experts to obtain new procedure specific coding and payment

o Developing Health Technology Assessment (HTA)

o Focused on highlighting clinical value proposition and demonstrating cost effectiveness

Melphalan:

o Delcath approved in the EEA for the intra-arterial administration of melphalan to the liver

o Physicians will continue to procure melphalan independently

o Clinical experience in EEA and publications support use of melphalan for disease control in the liver

Clinical Data:

o Delcath Phase 3 and Phase 2 data supplements extensive surgical IHP data with melphalan

o Expect to initiate additional studies with Standard of Care (SOC) in 2012 with availability of HE filter in

HCC, and metastatic CRC

HCC, and metastatic CRC

o Marketing to medical oncologists will be data driven

Required Elements In Place To Support Commercial Launch

20 DELCATH SYSTEMS, INC

European Interim New Technology Reimbursement Programs

Interim New Technology Payment Programs Already Exist in Major European Markets

21 DELCATH SYSTEMS, INC

Market by Disease - EEA Device Only

|

|

Germany

(Direct)

|

UK

(Direct)

|

France

(Indirect)

|

Italy

(Indirect)

|

Spain

(Indirect)

|

Netherlands

(Direct)

|

Total

Potential (patients)

|

Potential

Market ($ millions)1,2,3

|

|

|

||||||||

|

Total Potential Market #Patients

|

||||||||

|

Ocular Melanoma

|

403

|

296

|

294

|

284

|

197

|

79

|

1,553

|

$46.6

|

|

Cutaneous

Melanoma |

2,834

|

1,735

|

1,314

|

1,398

|

628

|

662

|

8.571

|

$257.1

|

|

CRC

|

18,978

|

10,155

|

10,490

|

13,952

|

7,694

|

3,151

|

64,420

|

$1,932.6

|

|

HCC (Primary)

|

3,941

|

1,734

|

3,645

|

6,253

|

2,616

|

197

|

18,386

|

$551.6

|

|

NET

|

2,168

|

1,624

|

1,645

|

1,579

|

1,185

|

438

|

8,639

|

$259.2

|

|

TOTAL

|

25,087

|

13,513

|

15,780

|

21,784

|

11,495

|

3,786

|

91,445

|

$3,047.1

|

Europe is Potential $3.0 Billion Market Opportunity for Device Only

1. Assumes 2.5 treatments per patient

2. Assumes ASP of $12K (device only)

3. Assumes mix of direct sales and distributors

22 DELCATH SYSTEMS, INC

U.S. FDA Regulatory Status

• On February 22, 2011, received Refusal to File (RTF) letter from the FDA

§ Manufacturing plant inspection timing

§ Product and sterilization validation

§ Additional statistical analysis clarification

§ Additional safety data

o RTF stated that safety information provided was insufficient to allow FDA to

accept our application and review the overall risk/benefit profile

accept our application and review the overall risk/benefit profile

o FDA & SPA approved CRF’s did not collect all hospitalization data in the

patient records in an effective manner

patient records in an effective manner

• Follow-up meeting with FDA held in April 2011 to review proposed plan

of action which includes:

o Collection of all available safety information in new CRF for all 186 patients in

the Phase I, II and III clinical trials

the Phase I, II and III clinical trials

• No additional studies or generation of new data requested

Intend to Submit Revised NDA By End of 2011

23 DELCATH SYSTEMS, INC

Market by Disease* - USA

|

Liver Metastasis

|

Potential Market

# Patients

|

Potential Market

# Procedures

(Avg 2.5/patient)

|

Potential Market ($MM)

$20K ASP **

|

|

Ocular

Melanoma

|

1,622

|

4,055

|

$81.1

|

|

Cutaneous

Melanoma

|

11,883

|

29,708

|

$594.2

|

|

TOTAL MELANOMA

(Initial Expected Label)

|

13,505

|

33,763

|

$675.3

|

|

CRC

|

38,423

|

96,057

|

$1,921.1

|

|

HCC (Primary)

|

12,386

|

30,964

|

$619.3

|

|

NET

|

9,986

|

24,965

|

$499.3

|

|

TOTAL OTHER

(Potential Label Expansion)

|

60,794

|

151,985

|

$3,039.7

|

*TPM Total Potential Market

** Estimated ASP

24 DELCATH SYSTEMS, INC

U.S. Commercialization Strategy

• Initial focus on leading cancer centers and referring community hospitals

• Market to Medical Oncologists via CSO

• Direct Strategy to sell to Interventional Radiologists and Surgeons: 12

Sales & Medical Science Liaison territories ultimately expanding to as

many as 60 territories as revenues ramp

Sales & Medical Science Liaison territories ultimately expanding to as

many as 60 territories as revenues ramp

• 5 Clinical Specialists initially to support site initiation and training

• Utilize top centers from Phase III trial as Centers of Excellence for training

and support

and support

Direct Sales Model Supplemented With CSO Detailing Program

25 DELCATH SYSTEMS, INC

U.S. Reimbursement Strategy

Strategy: intend to seek chemosaturation specific codes based upon value

proposition relative to other cancer therapies

proposition relative to other cancer therapies

o Physician:

• Applied for CPT Category III code

• Convert the Category III code to Category I following FDA approval

o Hospital:

• Apply for new ICD-9/10 procedure code to capture full procedure of

hepatic isolation and chemosaturation

hepatic isolation and chemosaturation

• Request new DRG based on costs above those of existing DRGs and

clinical dissimilarity to other hepatic procedures in current DRGs

clinical dissimilarity to other hepatic procedures in current DRGs

Pursuing New Specific Codes For Chemosaturation Procedure

26 DELCATH SYSTEMS, INC

Strategy For Asia, Ex US America’s, MEA and Australia

• Intend to leverage CE Mark to obtain reciprocal regulatory approvals for our

Delcath Hepatic CHEMOSAT System

Delcath Hepatic CHEMOSAT System

• Utilize existing 3rd party melphalan available to physicians

• Seek to secure strategic partners and specialty distributors

• Intend to initiate melphalan HCC trial in Taiwan with partner Chi-Fu in 2012

Combination of Direct Sales, Strategic Partnerships & Specialty Distributors

27 DELCATH SYSTEMS, INC

Market by Disease - Australia/Asia

Initial Target Markets (China, Japan, S. Korea, Taiwan, Australia)

Initial Target Markets (China, Japan, S. Korea, Taiwan, Australia)

1. Assumes 2.5 treatments per patient

2. Assumes ASP of $9K

3. Assumes mix of systems with and without Delcath branded melphalan

4. Assumes sales by distributors

|

|

China

(Drug)

|

S. Korea

(Drug)

|

Japan

(Device)

|

Taiwan

(Drug)

|

Australia

(Device)

|

Total

Potential (patients)

|

Potential

Market 1,2,3,4 |

|

|

|||||||

|

Total Potential Market #Patients

|

|||||||

|

HCC (Primary)

|

197,082

|

7,486

|

7,625

|

4,945

|

604

|

217,742

|

$4,899.2

|

|

Other

|

|||||||

|

CRC

|

59,644

|

6,219

|

27,396

|

2,762

|

3,891

|

99,912

|

$2,248.0

|

|

NET

|

35,503

|

1,275

|

3,355

|

608

|

562

|

41,303

|

$929.3

|

|

Ocular Melanoma

|

1,760

|

66

|

175

|

31

|

96

|

2,128

|

$47.9

|

|

Cutaneous

Melanoma |

667

|

74

|

238

|

429

|

1,996

|

3,404

|

$76.6

|

|

OTHER TOTAL

|

292,229

|

14,980

|

38,376

|

8,315

|

5,057

|

358,957

|

$8,201.0

|

Asia Represents Potential $8.2 Billion Market Opportunity

28 DELCATH SYSTEMS, INC

Intellectual Property

Patent Protection

• 7 issued U.S. patents, 10 foreign patents issued and 4 pending

• Primary device patent set to expire August 2016

• Up to 5 years of patent extension post FDA approval

Trade Secret Protection

• Developed High Efficiency (HE) filter media via new manufacturing processes

FDA Protection

• Orphan Drug Designation granted for melphalan in the treatment of ocular melanoma,

cutaneous melanoma and metastatic neuroendocrine tumors, as well as for doxorubicin

in the treatment of HCC

cutaneous melanoma and metastatic neuroendocrine tumors, as well as for doxorubicin

in the treatment of HCC

o Provides 7 years of marketing exclusivity post FDA approval

• Additional Orphan Drug applications to be filed for other drugs and indications, including melphalan

for HCC and CRC

for HCC and CRC

Multiple Levels of Protection

29DELCATH SYSTEMS, INC

Deep and Experienced Management Team

Significant Combination Product Approval and Commercialization Experience

|

Executive

|

Title

|

Prior Affiliation(s)

|

Years of

Experience |

|

Eamonn Hobbs

|

President and CEO

|

AngioDynamics, E-Z-EM

|

30

|

|

David McDonald

|

CFO

|

AngioDynamics, RBC Capital

Markets |

28

|

|

Krishna Kandarpa,

M.D., Ph.D. |

CMO and EVP, R&D

|

Harvard, MIT, Cornell, UMass

|

37

|

|

Agustin Gago

|

EVP, Global Sales & Marketing

|

AngioDynamics, E-Z-EM

|

29

|

|

Peter Graham, J.D.

|

EVP & General Counsel

|

Bracco, E-Z-EM

|

16

|

|

John Purpura

|

EVP, Regulatory Affairs &

Quality Assurance |

E-Z-EM, Sanofi-Aventis

|

27

|

|

Bill Appling

|

SVP Operations & Medical

Device R&D |

AngioDynamics

|

25

|

|

Harold Mapes

|

EVP, Global Operations

|

AngioDynamics, Mallinkrodt

|

25

|

|

Dan Johnston, Ph.D.

|

VP, Pharma R&D

|

Pfizer, Wyeth

|

10

|

FINANCIALS

31 DELCATH SYSTEMS, INC

Financial Summary

Financial & Operating Overview

• Follow On Offerings: Raised ~ $94 million since November 2009

• Burn Rate: Anticipate ~$3.0 million per month

• Cash: ~ $53 million at July 31, 2011

• Debt: None

• Shares Out: 48.0 million (54.8 million fully diluted*)

• Institutional Ownership: ~ 28% at March 31, 2011

• Market Capitalization: ~ $214 million as of July 31, 2011

• Avg. Daily Volume (3 months) ~ 815,000

Balance Sheet Strengthened Significantly in Past Two Years To Support Growth Activities

As of July 31st, 2011 fully diluted includes an additional 4.1 million options at $5.04, 2.5 million warrants at $3.51, and 174,682 unvested restricted shares.

32 DELCATH SYSTEMS, INC

Company Highlights

• Making established chemotherapeutic drugs work better in target organs

• Initial focus is high dose chemotherapy for improved disease control in the liver

• Successful and highly statistically significant Phase III trial results reported

• Received CE Mark approval for Class III medical device on April 13, 2011

• Positioned to address potential $3.0 billion European labeled market opportunity

• Objective is to re-file 505(b)(2) NDA to FDA for orphan drug and delivery

apparatus by end of 2011

apparatus by end of 2011

• Potential $675 million US labeled market opportunity

• Issued patents and orphan drug designations create competitive barriers

• Deep and experienced management team

Concentrating the Power of Chemotherapy to Improve Disease Control in the Liver

33 DELCATH SYSTEMS, INC

Appendix I. - Delcath Sources for Market Estimates

American Cancer Society. Cancer Facts & Figures 2010. Atlanta: American Cancer Society; 2010.

Alexander, Richard H., David L. Bartlett, and Steven K. Libutti. "Current Status of Isolated Hepatic Perfusion With or

Without Tumor Necrosis Factor for the Treatment of Unresectable Cancers Confined to the Liver." The Oncologist 5

(2000): 416-24.

Without Tumor Necrosis Factor for the Treatment of Unresectable Cancers Confined to the Liver." The Oncologist 5

(2000): 416-24.

Blake, Simon P., Karen Weisinger, Michael B. Atkins, and Vassilios Raptopoulos. "Liver Metastases from Melanoma:

Detection with Multiphasic Contrast Enhanced CT." Radiology 213 (1999): 92-96. Print

Detection with Multiphasic Contrast Enhanced CT." Radiology 213 (1999): 92-96. Print

Ferlay J, Shin HR, Bray F, Forman D, Mathers C and Parkin DM.

GLOBOCAN 2008, Cancer Incidence and Mortality Worldwide: IARC CancerBase No. 10 [Internet].

Lyon, France: International Agency for Research on Cancer; 2010. Available from: http://globocan.iarc.fr

GLOBOCAN 2008, Cancer Incidence and Mortality Worldwide: IARC CancerBase No. 10 [Internet].

Lyon, France: International Agency for Research on Cancer; 2010. Available from: http://globocan.iarc.fr

Nawaz Khan, Ali, Sumaira MacDonald, Ajay Pankhania and David Sherlock. "Liver, Metastases: [Print] - EMedicine

Radiology." Liver, Metastases. EMedicine - Medical Reference, 10 Feb. 2009. Web.

<http://emedicine.medscape.com/article/369936-print>.

Radiology." Liver, Metastases. EMedicine - Medical Reference, 10 Feb. 2009. Web.

<http://emedicine.medscape.com/article/369936-print>.

Neuroendocrine Tumors. Practice Guidelines in Oncology- v.2.2009. National Comprehensive Cancer Network

(NCCN). 2009.

(NCCN). 2009.

Pawlik, Timothy M., Daria Zorzi, Eddie K. Abdalla, Bryan M. Clary, Jeffrey E. Gershenwald, Merrick I. Ross, Thomas A.

Aloia, Steven A. Curley, Luis H. Camacho, Lorenzo Capussotti, Dominique Elias, and Jean-Nicolas Vauthey. "Hepatic

Resection for Metastatic Melanoma: Distinct Patterns of Recurrence and Prognosis for Ocular Versus Cutaneous

Disease." Annals of Surgical Oncology 13.5 (2006): 712-20.

Aloia, Steven A. Curley, Luis H. Camacho, Lorenzo Capussotti, Dominique Elias, and Jean-Nicolas Vauthey. "Hepatic

Resection for Metastatic Melanoma: Distinct Patterns of Recurrence and Prognosis for Ocular Versus Cutaneous

Disease." Annals of Surgical Oncology 13.5 (2006): 712-20.

34 DELCATH SYSTEMS, INC

Appendix II. - Phase 3 Pivotal Trial Details

35 DELCATH SYSTEMS, INC

Phase III Clinical Trial Design

Randomized to CS

92 patients: ocular

or cutaneous melanoma

CS/Melphalan

Treat every 4 weeks x 4 rounds

(responders can receive up to 6 rounds)

Cross-over

Primary Trial Endpoint

• Statistically significant difference in Hepatic Progression

Free Survival (“hPFS”): p < 0.05

Free Survival (“hPFS”): p < 0.05

• Over 80% of Oncologic drugs approved by FDA between

2005 - 2007 on endpoints other than overall survival

2005 - 2007 on endpoints other than overall survival

Modeled hPFS for Trial Success:

7.73 months (CS)

vs.

4 months (BAC)

Secondary Trial Endpoints

• Hepatic response and duration of hepatic response

• Overall response and duration of overall response

• Overall Survival - Diluted by Cross Over

• SAP calls for analysis of various patient cohorts

Pre-CS (Baseline)

Post-CS (22+ Months)

Hepatic Response - Metastatic Melanoma

Fully Powered, 93 Patient, Randomized, Multi-Center NCI Led Study

36 DELCATH SYSTEMS, INC

ASCO 2010 Presentation of Phase 3 Clinical Trial Results

• Trial results exceed primary endpoint expectations; p value = 0.001

• Treatment arm shows 5x median hPFS compared to control arm

• CS/PHP median hPFS of 245 days compared to 49 days for BAC

• Hazard Ratio = .301

• Patients failed prior therapies (radiation, chemo, immuno, image guided local)

• 90% Ocular, 10% Cutaneous - No difference in response

• Overall PFS 186 vs. 46 days for BAC

• 34% response rate for CS/PHP compared to 2% for BAC

• 52% stable disease for CS/PHP compared to 27% for BAC

• 86% overall clinical benefit (CR + PR + SD)

Strong Clinical Trial Results

37 DELCATH SYSTEMS, INC

ASCO 2010 Presentation of Phase 3 Clinical Trial (cont.)

• Majority of BAC patients crossed over and obtained similar response from treatment

• Total 93 patient trial - 10 months median OS vs. 4 months expected1 (due to cross over

provision, most patients received PHP/CS treatment)

provision, most patients received PHP/CS treatment)

• OS cohort analysis - all positive trends

a) Median survival of 298 days for treatment arm compared to 124 in non-crossover BAC patients

b) Median survival of 398 days for BAC Cross Over patients vs. 124 non-cross over BAC patients

• OS Secondary endpoint - No difference in Kaplan-Meier curves(due to cross over

treatment response)

treatment response)

• Safety profile as expected - in line with current FDA approved labeling for IV

administration of Melphalan and Phase I CS/PHP study results

administration of Melphalan and Phase I CS/PHP study results

o Treatment related Deaths: 3/40 patients (7.5%) 3/116 procedures (2.6%)

o Neutropenic Sepsis (n=2) 5%, Hepatic Failure (n=1) 2.5% (95% tumor burden)

o Current approved labeling for Melphalan - 3% to 10% mortality rate.

Encouraging Survival Data With Expected Safety Profile

1. Source: Unger et. al. Cancer 2001;91: 1148

* DELCATH SYSTEMS, INC

© 2011 DELCATH SYSTEMS, INC. ALL RIGHTS RESERVED