Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bristow Group Inc | d8k.htm |

First Quarter FY 2012

Earnings Presentation

Bristow Group Inc.

August 9, 2011

Exhibit 99.1 |

2

First quarter earnings call agenda

Introduction

CEO remarks and operational highlights

Current and future financial performance

-

FY12 Q1 Financial discussion

-

Introduction of Client Promise,

LACE rate and BVA

Closing remarks

Questions and answers

Linda McNeill, Director Investor Relations

Bill Chiles, President and CEO

Jonathan Baliff, SVP and CFO

Bill Chiles, President and CEO |

3

Forward-looking statements

This presentation may contain “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Forward-looking statements include

statements about our future business, operations, capital expenditures, fleet composition,

capabilities and results; modeling information, earnings guidance, expected operating margins

and other financial projections; future dividends; plans, strategies and objectives of our

management, including our plans and strategies to grow earnings and our business, our general

strategy going forward and our business model; expected actions by us and by third parties, including

our customers, competitors and regulators; our use of excess cash; the valuation of our company and

its valuation relative to relevant financial indices; assumptions underlying or relating to any

of the foregoing, including assumptions regarding factors impacting our business, financial

results and industry; and other matters. Our forward-looking statements reflect our views

and assumptions on the date of this presentation regarding future events and operating

performance. They involve known and unknown risks, uncertainties and other factors, many of

which may be beyond our control, that may cause actual results to differ materially from any

future results, performance or achievements expressed or implied by the forward-looking statements.

These risks, uncertainties and other factors include those discussed under the captions “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended

March 31, 2011 and our Quarterly Report on Form 10-Q for the quarter ended June 30,

2011. We do not undertake any obligation, other than as required by law, to update or

revise any forward-looking statements, whether as a result of new information, future events or

otherwise. |

4

Chief Executive comments

Bill

Chiles,

President

and

CEO |

5

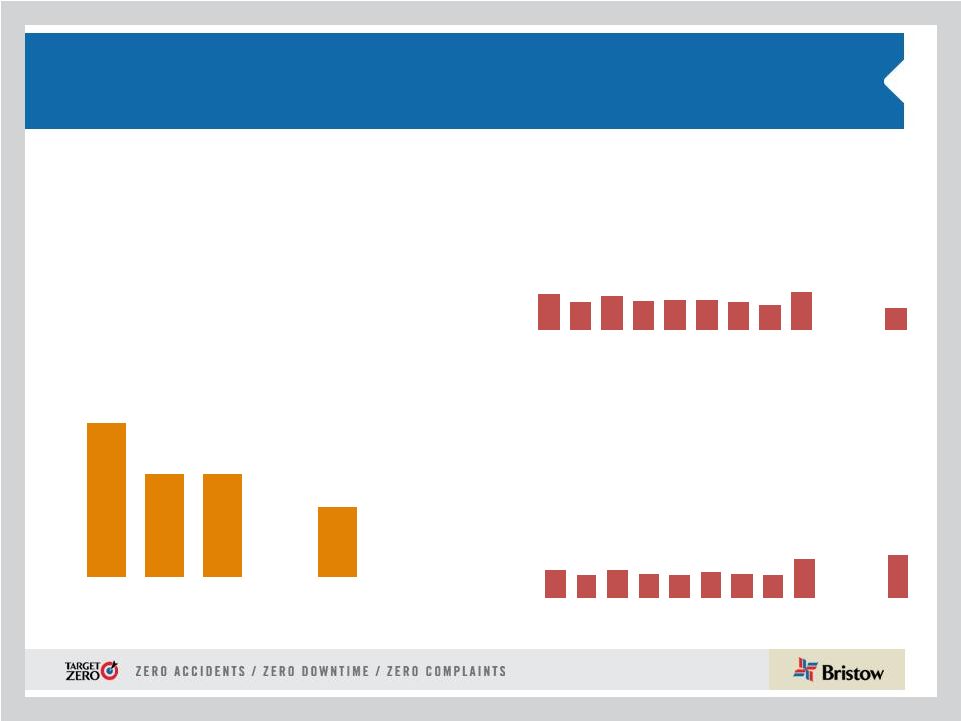

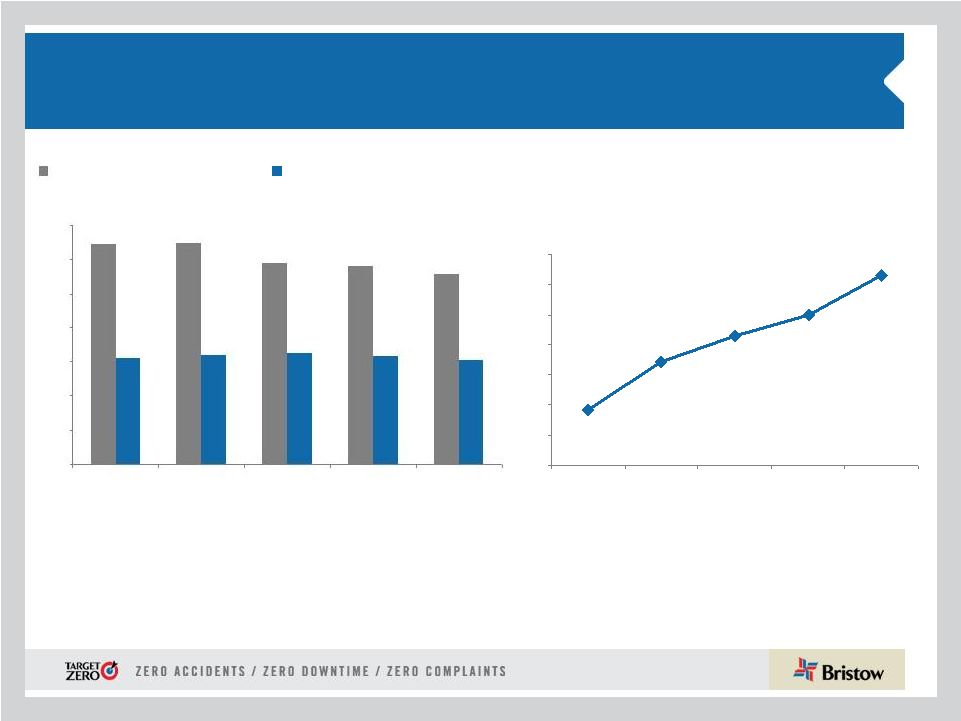

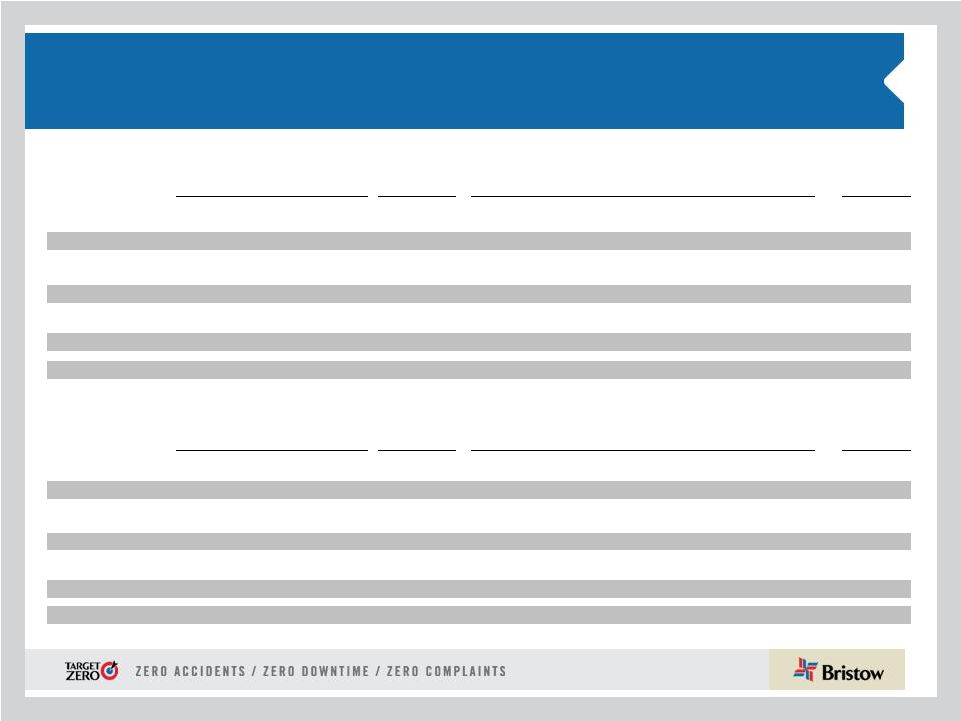

Operational safety review

0.40

0.32

0.38

0.33

0.34

0.34

0.31

0.28

0.43

0.00

0.00

0.25

0.00

0.50

1.00

J

A

S

O

N

D

J

F

M

A

M

J

1.17

0.78

0.78

0.00

0.00

0.00

0.54

0.00

1.00

2.00

2006

2007

2008

2009

2010

2011

Q1 2012

* Includes consolidated commercial operations only

0.16

0.13

0.16

0.14

0.13

0.15

0.14

0.13

0.23

0.00

0.00

0.25

0.00

0.10

0.20

0.30

0.40

0.50

J

A

S

O

N

D

J

F

M

A

M

J

Total Reportable Injury Rate per 200,000 man-

hours (cumulative)

Lost Work Case Rate per 200,000

man-hours (cumulative)

Air Accident Rate* per 100,000

Flight Hours (Fiscal Year)

FY11

FY12

FY11

FY12 |

6

Q1 FY12 highlights

•

Quarterly performance similar to Q1 FY11 and was impacted by front-

loaded costs primarily due to compensation

•

Bristow reaffirms earnings per share guidance for the full FY12 of

$3.55 to $3.90

•

FY12 LACE Rate guidance range initiated at $7.20 -

$7.50M per Large

AirCraft Equivalent (LACE) aircraft

•

Significant

Other

International

Business

Unit

(OIBU)

growth

plus

new

contracts worldwide highlight strength in FY12 and beyond

•

Q1 Operating revenue of $286.8M (5% increase from Q1 FY11, 5% increase from Q4

FY11) •

Q1 adjusted EPS * of $0.54 (same as Q1 FY11, 37% decrease from Q4 FY11)

•

Q1 GAAP EPS of $0.57 (same as Q1 FY11, 32% decrease from Q4 FY11)

•

Q1 adjusted operating income * of $35M (8% decrease from Q1 FY11, 30% decrease from

Q4 FY11) •

Q1 adjusted EBITDA * of $58.1M (same as Q1 FY11, 21% decrease from Q4 FY11)

•

Q1 Operating cash flow of $52.9M (106% increase from Q1 FY11, 47% increase from Q4

FY11) * Adjusted EPS, adjusted operating income and adjusted EBITDA

amounts exclude gains and losses on dispositions of assets and any special items during the period. See

reconciliation

of

these

items

to

GAAP

in

our

earnings

release

for

the

quarter

ended

June 30

,

2011

th |

7

•

Brent remains above $100 in the face of EIA (U.S. Energy Information

Administration) reserve release in April 2011 and the weak global

economy •

By the end of 2011, Global Exploration & Production (E&P) spending will

have reached the 2008 pre-recession level of $500 billion

•

This E&P confidence is reflected in improved helicopter tender activity,

principally for FY12/13 work and gives us a positive outlook for our

business •

More than 80 % of global E&P spending is Non-US, with Brazil, West Africa

and Southeast Asia as the front runners with a growth rate of 11%

•

55% of our fleet and 86% of our operating revenue comes from international markets

Current market environment

Source: Barclays Capital Research and PFC Energy June 2011

|

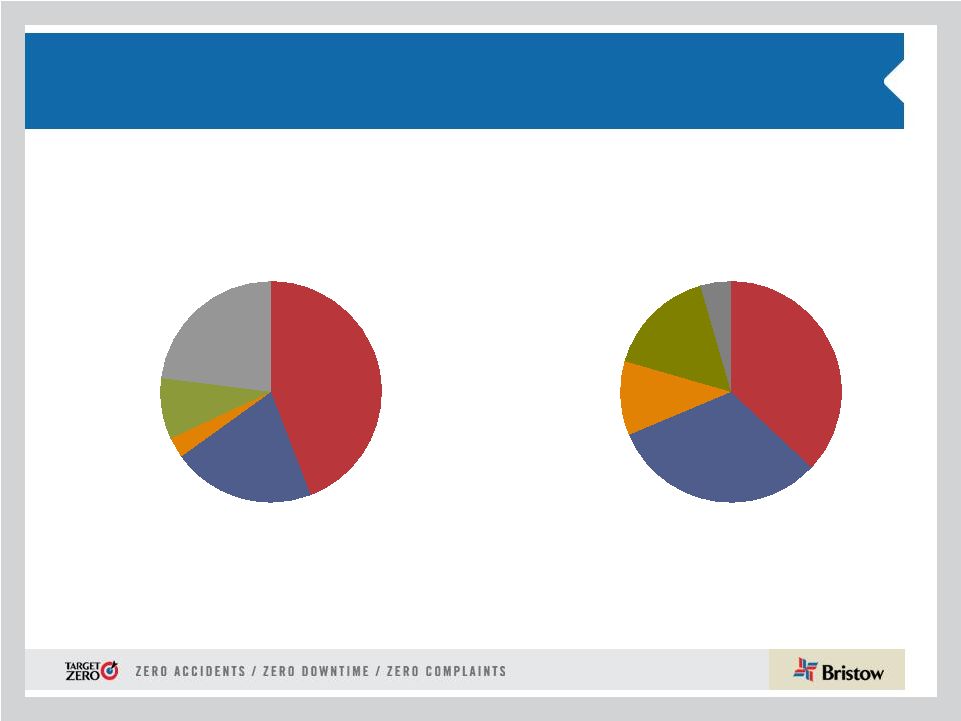

8

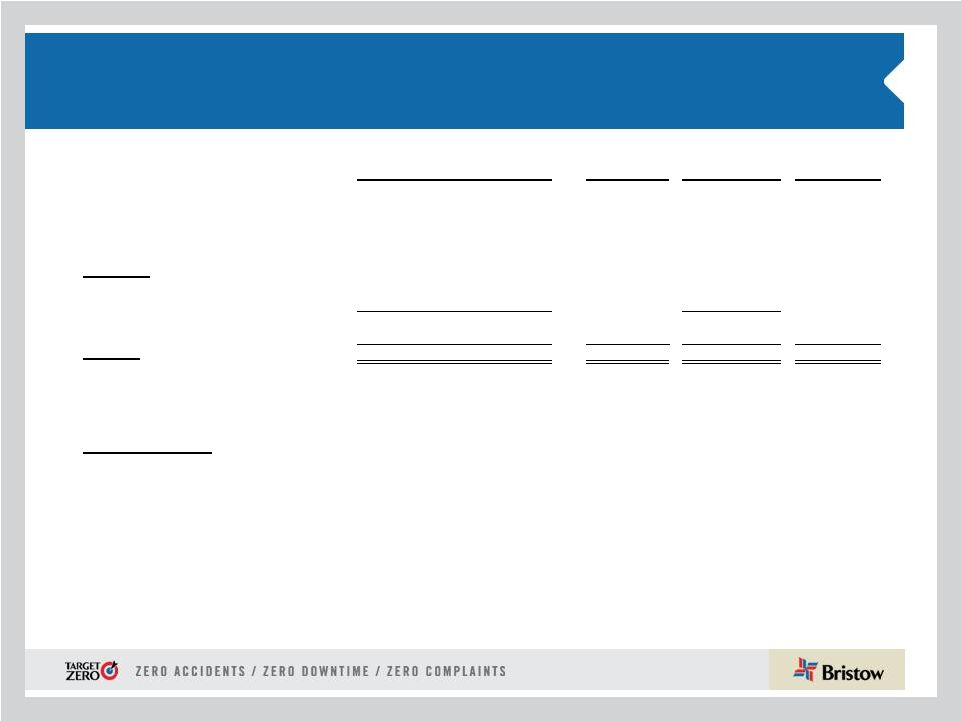

Operating Income* Q1 FY11

Australia

16%

North America

11%

West Africa

32%

Europe

37%

Other International

4%

Operating Income* Q1 FY12

North America

3%

West Africa

21%

Europe

44%

Other International

23%

Australia

9%

Quarter-over-quarter changes in Operating Income

Total Operating income for Q1 FY12 is $36.4M

Total operating income for Q1 FY11 is $39.7M

*

Excludes centralized operations, corporate, gain on disposals of assets, and Bristow Academy |

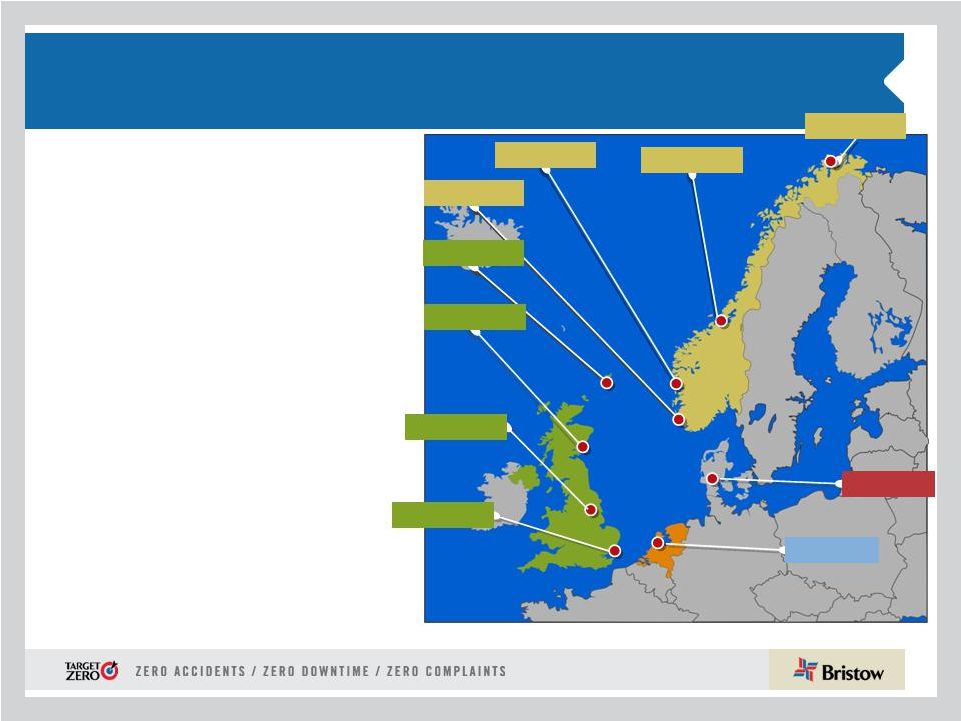

9

•

Europe represents 38% of total operating revenue

in Q1 FY12 and 44% of operating income

•

Operating margin of 21.5% vs 21.4% in prior year

quarter

•

European oil and gas continues to grow

with new entrants, despite experts

predictions that a rapid decline would

set in

•

Front-loaded compensation costs

•

Salary costs in Norway and labor costs

associated with hard landing in NNS

Outlook:

•

New incremental work

•

UK Gap SAR and SARH

•

Norway SAR

•

FBH contracts

Operating margin expected for FY12 to be ~ low

twenties

Europe (EBU)

UK

Netherlands

Norway

Norwich

Aberdeen

Scasta

Stavanger

Den Helder

Bergen

Hammerfest

Esbjerg

Humberside

Kristiansund |

10

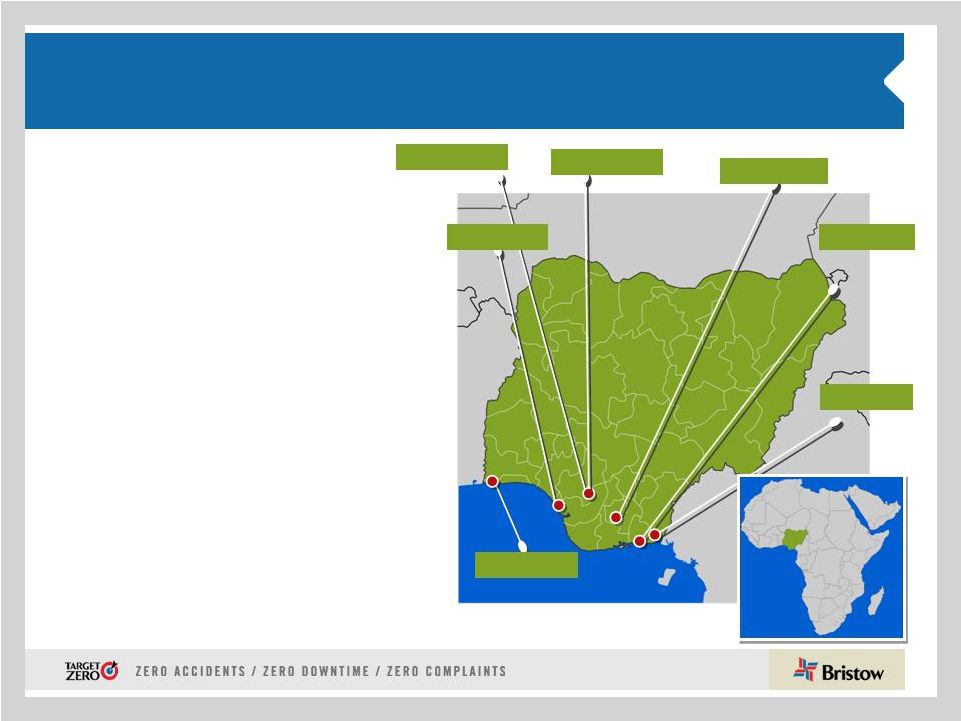

West Africa (WASBU)

Nigeria

Lagos

Escravos

Port Harcourt

Warri Osubi

Eket

Calabar

•

Nigeria represents 18% of total operating

revenue in Q1 FY12 and 21% of operating

income

•

Operating revenue of $52.3M decreased from

$57.7M in Q1 FY11

•

Operating income decreased to $11.2M from

$15.6M

•

Operating margin of 21.5% vs 27.1% in prior

year quarter

•

Increased operating expense in Q1

FY12 related to compensation, new

a/c

depreciation, and other expenses.

Outlook:

•

Introduction of large new technology aircraft to

market place

•

Restructuring continues

Operating margin expected in FY12 to be

back in the ~ low to mid twenties

Warri Texaco |

11

Exmouth

Learmonth

Varanus Is

Barrow Is

Australia (AUSBU)

Australia

Perth

Dongara

Essendon

Tooradin

Broome

Truscott

Darwin

BDI provide support

to the Republic of

Singapore Air Force

Oakey

•

Australia represented 14% of total operating

revenue in Q1 FY12 and 9% of operating

income

•

Operating revenue of $40.9M increased

from $33.8M primarily due to a favorable

currency exchange rate

•

Operating income decreased from $8M in

Q1 FY11 to $4.5M in Q1 FY12

•

Introduction of new a/c type

•

Increase in training and salary costs

•

Operating margin 11.1% vs 23.6% for the

prior year quarter

•

Training costs which are not expected

to recur on the same level and increase

in depreciation

Outlook:

•

Work shifted toward the second half of the

fiscal year

Operating margin expected for FY12

to be ~ low teens

Karratha |

12

Other International (OIBU)

Consolidated in OIBU

Unconsolidated Affiliate

•

OIBU represented 12% of total operating revenue and

23% of operating income for Q1 FY12

•

Operating revenue increased to $34.5M from $32.6M

•

Operating income increased to $11.9M from $2.3M

•

Operating margin increased to 34.5% vs 6.9% in the

prior year quarter

•

Significant increased revenue from

Suriname, Brazil, Ghana, Trinidad and

Russia

•

The remaining interest in Heliservicio was sold in

July but we will continue to dry lease

aircraft

Outlook:

•

Africa is flourishing market on the activity forefront

•

Potential expansion to Indonesia

•

LIDER has been officially qualified by Petrobras as

best bid on 14 medium a/c, with 7 a/c starting work

September 2011

Expect operating margin in FY12 to be

~mid twenties |

13

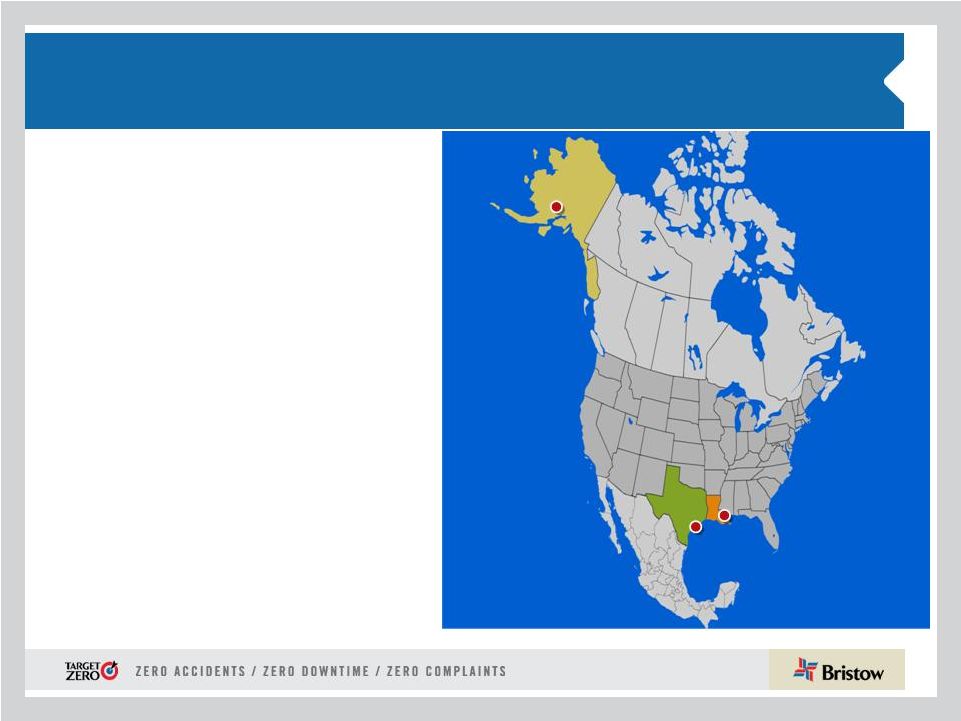

North America (NABU)

•

Operating revenue fell to $43.9M from $52.1M

and represented 15% of total operating

revenue;

•

Operating income of $1.6M vs. $5.3M in the

prior year quarter

•

Operating margin of 3.6% declined from 10.2%

in the prior year quarter

•

22% sequential flight hour increase

(from 16,741 hours in Q4 FY11 to 20,434

in Q1 FY12)

•

We achieved price increases on contract

renewals

Outlook:

•

Permits beginning to be issued resulting in

additional aircraft requests from clients

•

Large aircraft demand slowly increasing

•

Continued restructuring to bring down the fixed

costs

Expect operating margins for remainder

of FY12 to remain in the single digits |

14

Financial discussion

Jonathan

Baliff,

SVP

and

CFO |

15

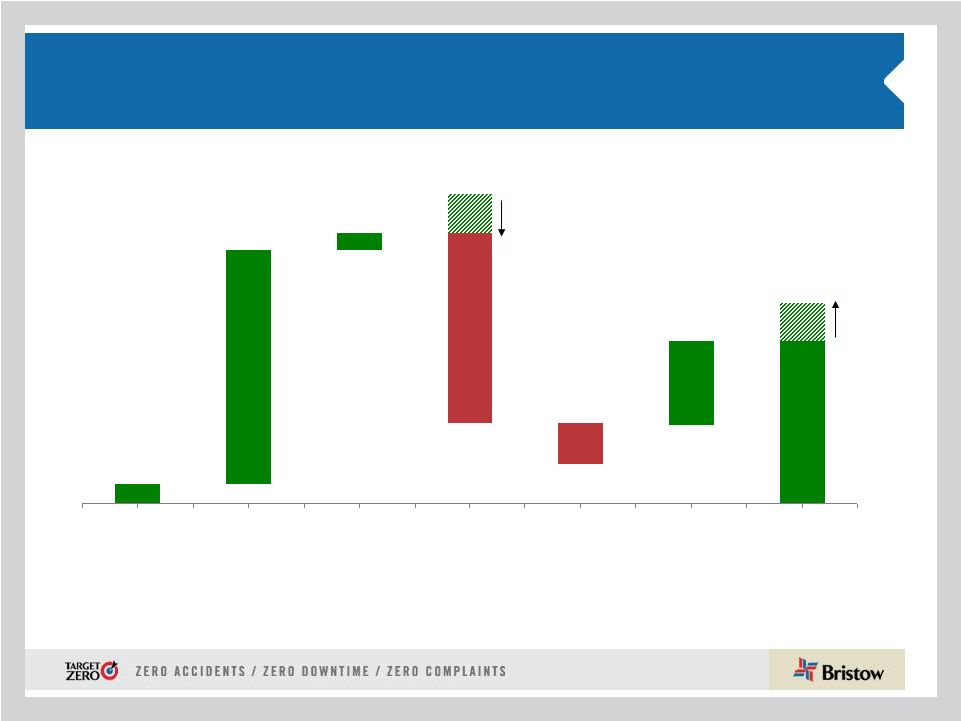

Financial highlights -

Adjusted EPS & EBITDA* Summary

Q1 FY11 to Q1 FY12 adjusted EPS bridge

Q1 FY11 to Q1 FY12 adjusted EBITDA bridge (in millions)

* Adjusted EPS, adjusted operating income and adjusted EBITDA amounts exclude gains and losses

on dispositions of assets and any special items during the period. See reconciliation

of

these

items

to

GAAP

in

our

earnings

release

for

the

quarter

ended

June 30

,

2011

th

$0.54

$0.54

$0.01

$0.04

$0.05

$0.10

Q1FY2011

Operations

Corporate and Other

Taxes

FX Changes

Q1FY2012

$58.1

$58.1

$4.7

$2.1

$6.8

Q1FY2011

Operations

Corporate and Other

FX Changes

Q1FY2012 |

16

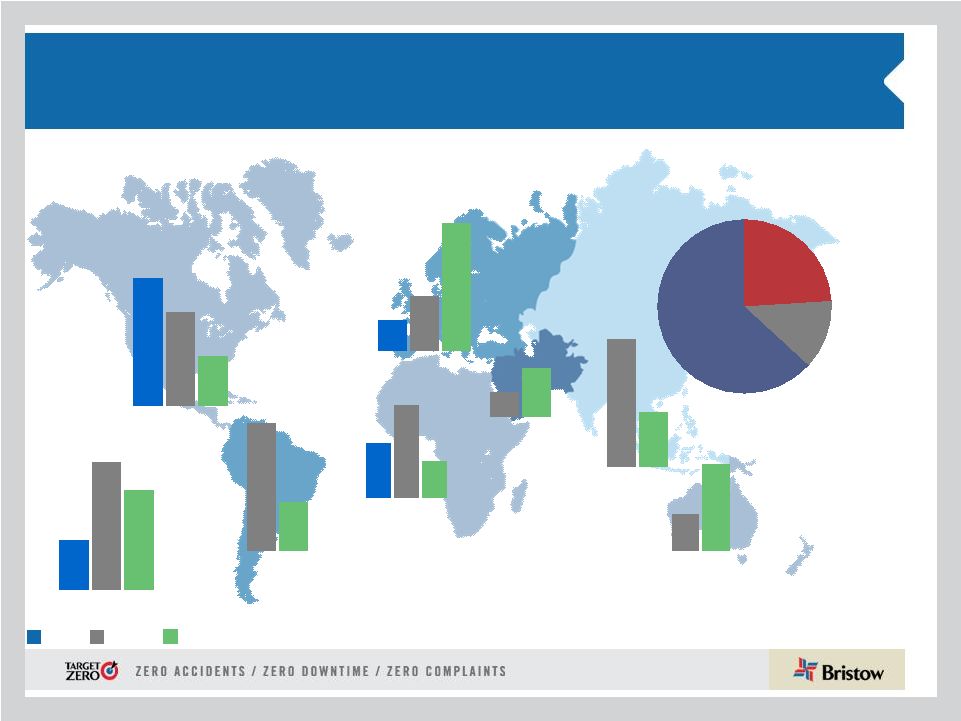

56

27

19

5

24

9

6

6

14

29

9

4

8

North America

Brazil, Colombia

Mexico,

Trinidad

Nigeria, Ghana

Equatorial Guinea

Europe

Caspian, Mid-East

Libya, East Africa

Malaysia, Thailand

Indonesia

Australia

Small

Medium

Large

Total Opportunities *

113

Wider scope of Bristow five year growth opportunities…

442 aircraft

Chart shows specific customer opportunities identified by Bristow as of May

2011 30

42

26

77

24

56

162

224

Total Aircraft Opportunities

New replacement

aircraft

Existing

aircraft

New growth

aircraft

107

56

279 |

17

Identified opportunities for the next five years while

maximizing optionality

large

medium

small

Orders*

11

0

0

Options*

24

15

0

*As of June 30, 2011

442 aircraft opportunities identified

67 built into 5

year plan

11

on

order

335 demand for New aircraft

112 expected win rate

based on market share |

18

116

497

103

1,378

238

1,121

735

FY11 balance

Operating

cash flow

Asset sales

Aircraft

purchases

Other capex

Maintain

optimal capital

structure

Available for

dividend/

growth/other

capital return

Five year cumulative cash projection with over $700 million

available for further growth and capital return

Operating

leases

Operating

leases |

19

Introduction of Client Promise, LACE & BVA

Jonathan

Baliff,

SVP

and

CFO |

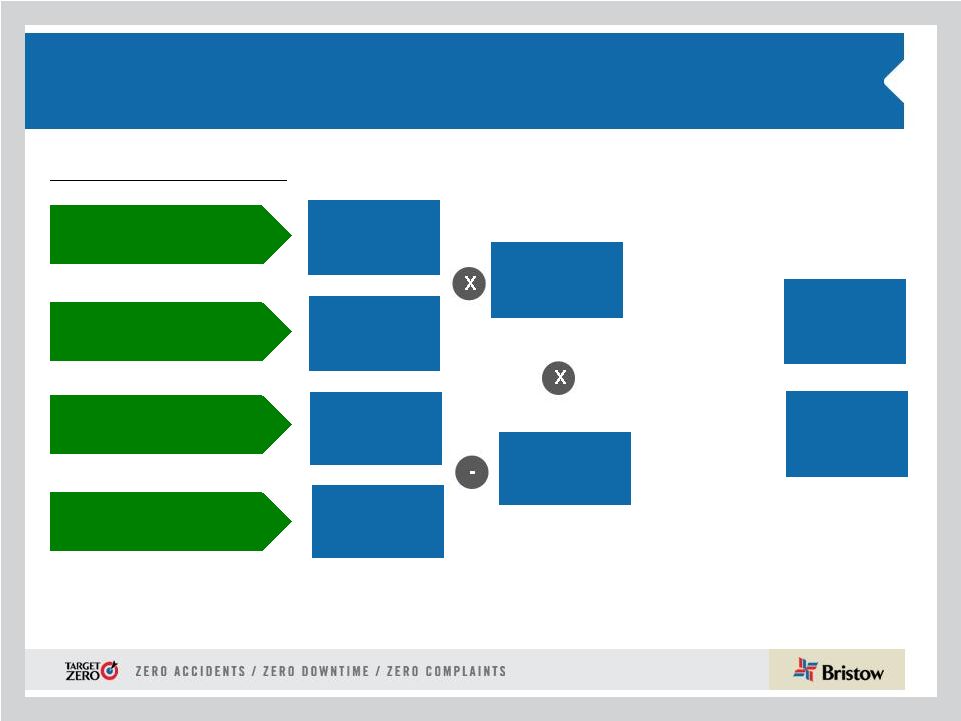

20

We Have Enhanced Our Focus on Value

Client Promise

LACE Rate

Bristow Value Added

Creating client value through

differentiation

Driving and communicating

utilization and revenue productivity

Delivering shareholder return above

our cost of capital |

21

The Client Promise: value through differentiation

Target Zero accidents, downtime and complaints

programs deliver value to operators.

More zero-accident flight hours than anyone,

more uptime than anyone,

and hassle-free service

creates confidence in flight. Worldwide.

Lowers client’s offshore operating costs

and improves productivity.

Earns us more business

to improve BVA. |

22

Introduction to LACE and the LACE Rate

–

Large

Aircraft Equivalent

(LACE)

–

“LACE”

normalizes revenue and is

functionally similar to BOE in the E&P

business

–

“LACE”

combines Large, Medium and

Small aircraft into a simple and similar

form of revenue producing asset

–

“LACE Rate”, Revenue/LACE,

will become the “Day Rate”

equivalent for our business

LACE Math

100%

per # of Large Aircraft

+50%

per # of Medium Aircraft

+25%

per # of Small Aircraft

=

Total # of LACE

Aircraft

x

LACE Rate (Revenue/LACE)

=

Revenue |

23

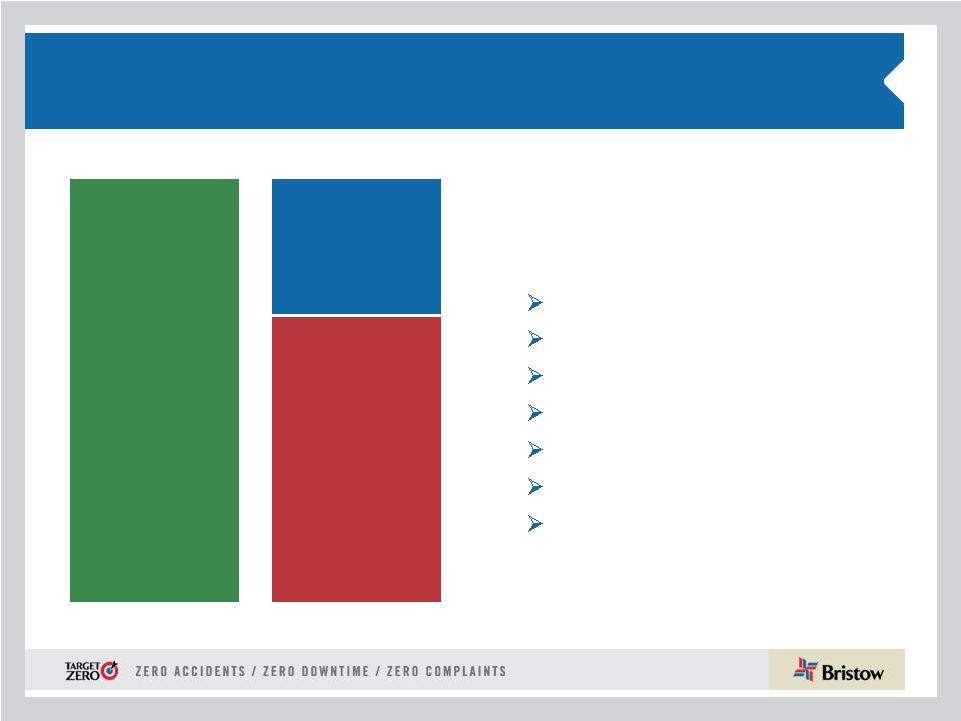

LACE and LACE Rate Historical Trends

LACE and LACE Rate excludes Bristow Academy, affiliate aircraft,

aircraft held

for sale, aircraft construction in progress, and reimbursable revenue

*LACE calculated for end of year

LACE Rate (Annual)

(in millions)

$4.92

$5.72

$6.14

$6.49

$7.15

$4.00

$4.50

$5.00

$5.50

$6.00

$6.50

$7.00

$7.50

FY07

FY08

FY09

FY10

FY11

323

324

295

290

279

156

161

164

159

153

0

50

100

150

200

250

300

350

FY07

FY08

FY09

FY10

FY11

Conslidated commercial aircraft

Large Aircraft Equivalent (LACE*) |

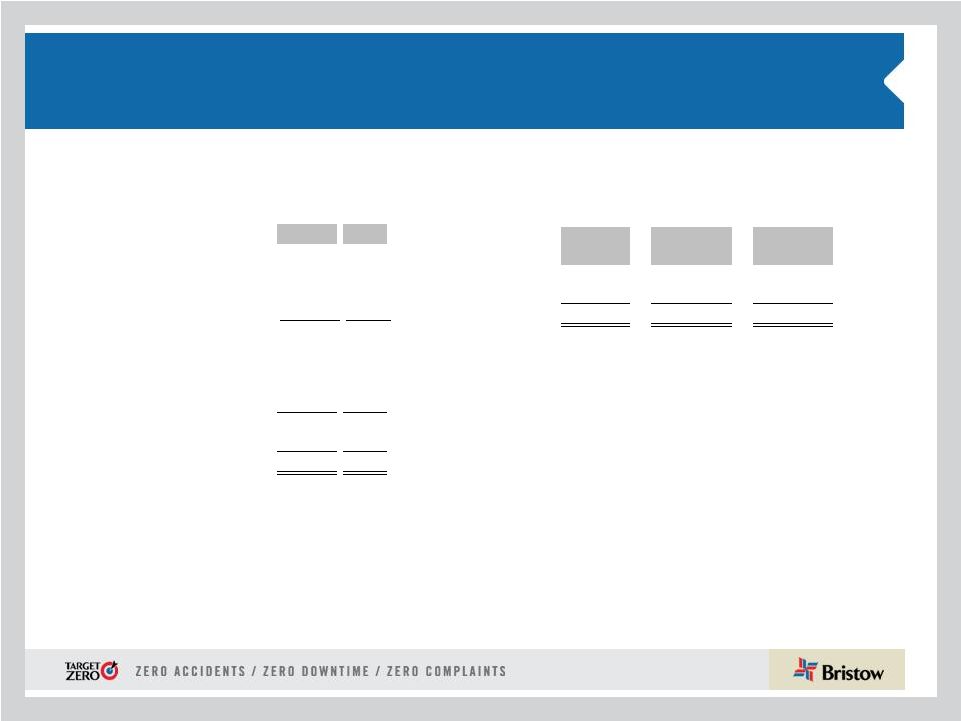

24

Phase II guidance roll out

* Guidance is for average yearly LACE and excludes Bristow Academy, A/C held for

sale, CIP, and reimbursable revenue Phase I

•

EPS guidance range (as of May 11, 2011; reaffirmed today)

$3.55 -

$3.90, excluding effects of asset dispositions and special items

•

Depreciation and amortization expense ~$85 –

$90 million

•

SG & A expense ~ $135 -

$140 million

•

Interest expense ~ $37 -

$42 million

•

Tax ~ 20% -

24 % (assuming revenue earned in same regions and

same mix)

Phase II

•

FY12 LACE* (Large Aircraft Equivalent) = 156

•

FY12 LACE Rate = Revenue/LACE* = $7.20 to $7.50 million per

LACE aircraft per year |

25

Introducing BVA, Bristow Value Added

•

BVA is the key measure to define

financial success.

•

BVA is robust enough to capture:

Revenue/Pricing

After Tax Margins

Asset Intensity

Reinvestment Rate

Differentiation

Sustainability

Risk

Gross

Cash

Flow

Adjusted After

Tax Operating

Cash Flow

Bristow

Value

Added

Capital

Charge

Gross

Operating

Assets

X

Required

Return % |

26

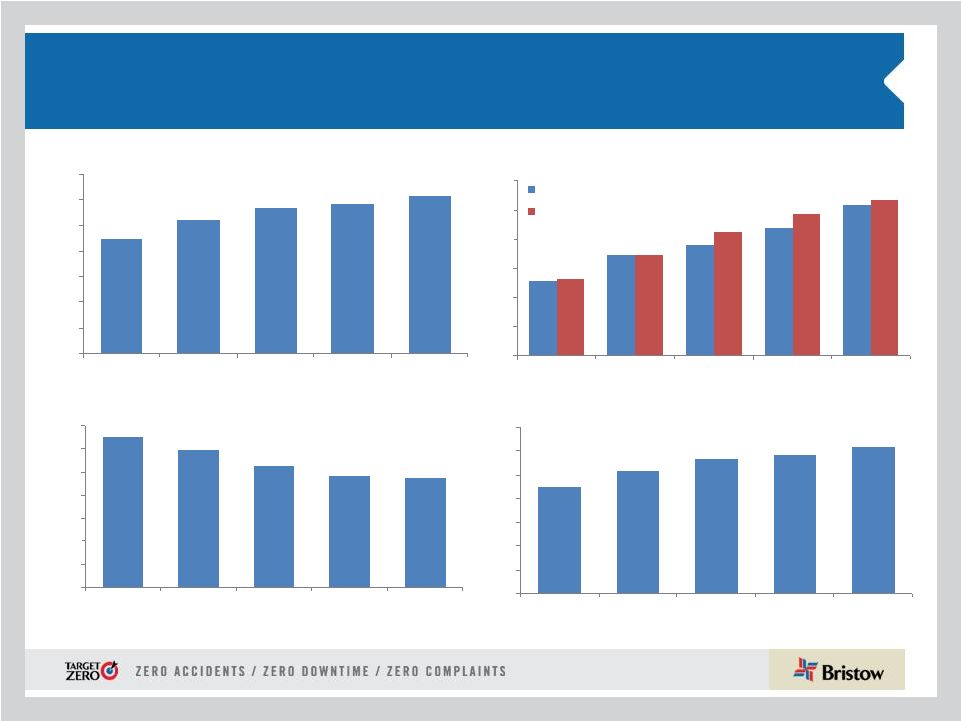

Financial Indicators and BVA Trends

Gross Operating Asset Intensity

($ of revenue/$ of asset)

0.47

0.49

0.53

0.59

0.65

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

FY07

FY08

FY09

FY10

FY11

Gross Revenue

(in millions)

$898

$1,040

$1,134

$1,168

$1,233

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

FY07

FY08

FY09

FY10

FY11

Gross Cash Flow and Capital Charge

(in millions)

$128

$174

$189

$218

$257

$132

$173

$212

$244

$267

$0

$50

$100

$150

$200

$250

$300

FY07

FY08

FY09

FY10

FY11

GCF

Capital Charge

Gross Revenue

(in millions)

$898

$1,040

$1,134

$1,168

$1,233

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

FY07

FY08

FY09

FY10

FY11

Note: BVA for Bristow Consolidated excluding the impact of Strategic Equity Investments (e.g. Lider

etc). BVA is the sum of the four fiscal quarters in each year. Presentation of gross cash

flow and gross operating asset data is in the Appendix |

27

Driving BVA…

Driving Shareholder Value

The Client Promise

Investing in Fleet

Expansion

Cost Efficiency

Capital

Productivity

Strategic Initiative

Changes in

BVA

($)

Shareholder

Total Return

($)

LACE Rate

($ per aircraft

per year)

LACE

(aircraft)

Gross Cash

Flow Margin

(%)

Asset

Intensity

(%)

Revenue

($)

BVA Margin

($)

=

Lace

= Large A/C Equivalents

LACE Rate

= Revenue per LACE

Gross Cash Flow Margin

Asset Intensity Charge

= (EBITDAR less Tax) over Revenue

= (Required Return times Gross Operating Assets) over Revenue

|

28

Conclusions

•

Front-loaded compensation, professional, and training costs in

the first quarter masked significant growth in the Other

International Business Unit

•

Reaffirmation

of

annual

EPS

guidance

of

$3.55

-

$3.90

for

this

fiscal year

•

Dividend of $0.15 approved for payment on September 12,

2011

•

Client Promise, LACE and BVA initiatives demonstrate our

commitment and innovation with our clients and

shareholders

to create value

Analyst Day on November 10, 2011 in New York |

29

Appendix |

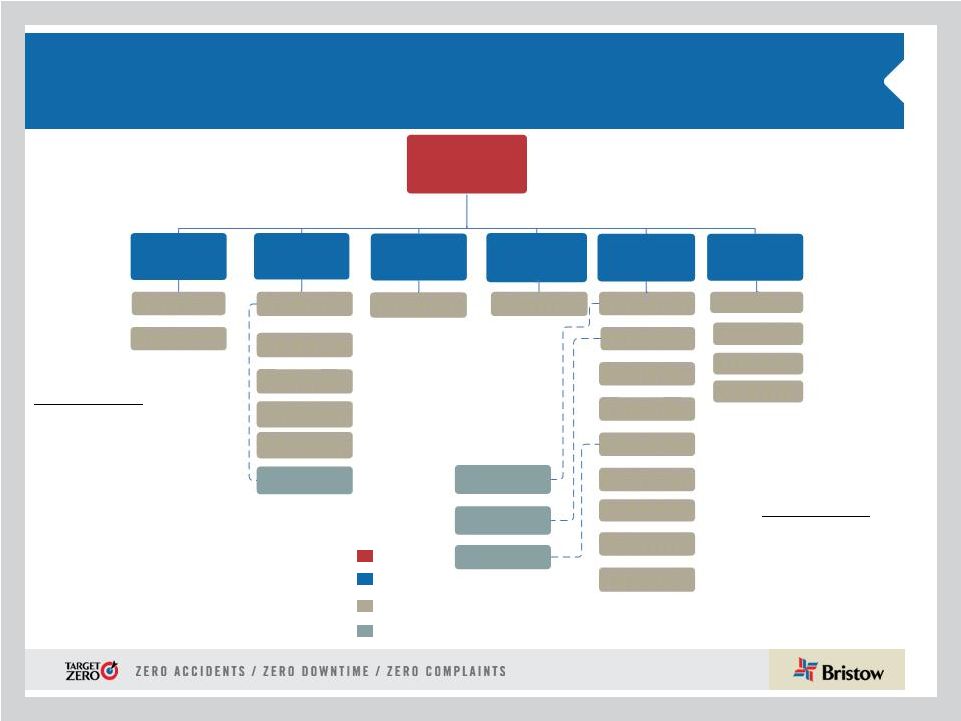

30

Organizational Chart -

as of June 30, 2011

Business Unit

Corporate

Region

Joint Venture

Key

Operated Aircraft

Bristow owns and/or operates

372 aircraft as of June 30, 2011

Bristow

NABU

15%*

AUSBU

14%

EBU

38%

WASBU

18%

OIBU

12%

BRS Academy

2%

(* % of Q1 FY12 Total Operating Revenue)

U.S. GoM –

81/7

Alaska –

14/3

UK –

35/4

Netherlands –

5/1

Norway –

14/3

Denmark –

1/1

Ireland –

1/1

FBH -

64

Nigeria –

49/7

HC -

13

Lider -

77

PAS -

45

Australia –

32/10

Mexico –

18/5

Brazil –

6/9

Trinidad –

8/1

Russia –

7/3

Egypt –

–/–

India –

1/2

Turkmenistan –

2/1

Malaysia –

5/2

Other –19/1

Florida –

52/1

Louisiana –

13/1

California –

6/1

U.K. –

3/1

Affiliated Aircraft

Bristow affiliates and joint

ventures operate 199 aircraft

as of June 30, 2011

( # of Aircraft / # of Locations)

(No. of aircraft) |

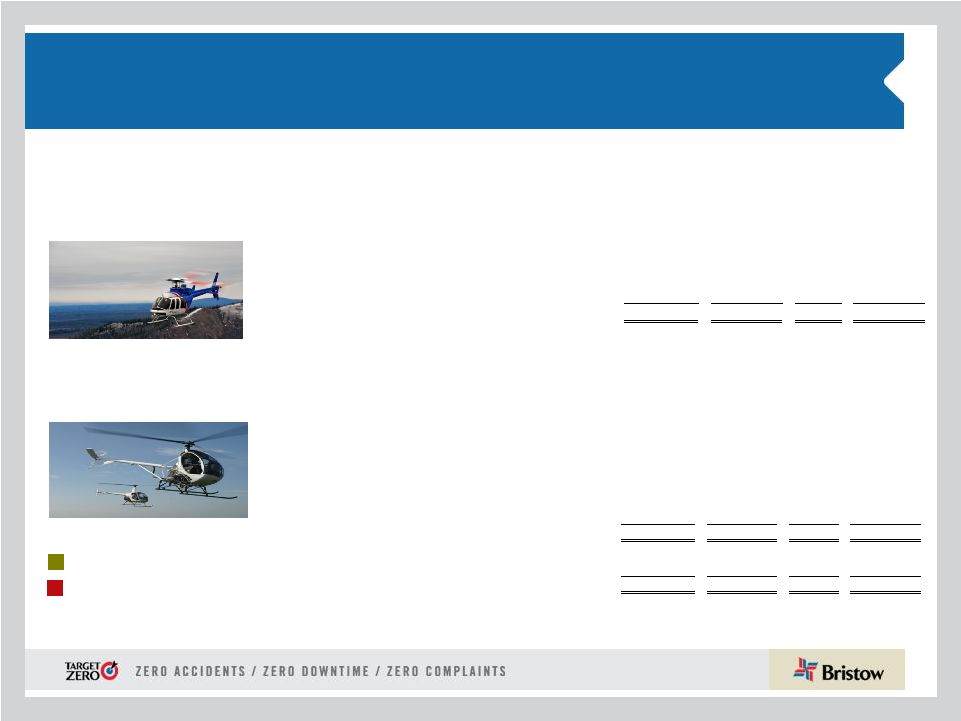

31

Aircraft Fleet –

Medium and Large

As of June 30, 2011

Next Generation Aircraft

Medium capacity 12-16 passengers

Large capacity 18-25 passengers

Mature Aircraft Models

Aircraft

Type

No. of PAX

Engine

Consl

Unconsl

Total

Ordered

Large Helicopters

AS332L Super Puma

18

Twin Turbine

30

-

30

-

Bell 214ST

18

Twin Turbine

-

-

-

-

EC225

25

Twin Turbine

17

-

17

3

Mil MI 8

20

Twin Turbine

7

-

7

-

Sikorsky S-61

18

Twin Turbine

2

-

2

-

Sikorsky S-92

19

Twin Turbine

23

1

24

8

79

1

80

11

LACE

73

Medium Helicopters

AW139

12

Twin Turbine

7

2

9

-

Bell 212

12

Twin Turbine

3

14

17

-

Bell 412

13

Twin Turbine

39

31

70

-

EC155

13

Twin Turbine

4

-

4

-

Sikorsky S-76 A/A++

12

Twin Turbine

20

7

27

-

Sikorsky S-76 C/C++

12

Twin Turbine

54

27

81

-

127

81

208

-

LACE

59 |

32

Aircraft Fleet –

Small, Training and Fixed

As of June 30, 2011 (continued)

Next Generation Aircraft

Mature Aircraft Models

Small capacity 4-7 passengers

Training capacity 2-6 passengers

Aircraft

Type

No. of PAX

Engine

Consl

Unconsl

Total

Ordered

Small Helicopters

Bell 206B

4

Turbine

2

2

4

-

Bell 206 L-3

6

Turbine

4

6

10

-

Bell 206 L-4

6

Turbine

31

2

33

-

Bell 407

6

Turbine

42

1

43

-

BK 117

7

Twin Turbine

2

-

2

-

BO-105

4

Twin Turbine

2

-

2

-

EC135

7

Twin Turbine

6

3

9

-

89

14

103

-

LACE

22

* LACE does not include held for sale, training and fixed wing helicopters

Training Helicopters

AS355

4

Twin Turbine

3

-

3

-

Bell 206B

6

Single Engine

8

-

8

-

Robinson R22

2

Piston

12

-

12

-

Robinson R44

2

Piston

2

-

2

-

Sikorsky 300CB/Cbi

2

Piston

48

-

48

-

AS350BB

4

Turbine

-

36

36

-

Agusta 109

8

Twin Turbine

-

2

2

-

AW139

12

Twin Turbine

-

3

3

-

Bell 212

12

Twin Turbine

-

8

8

-

Bell 412

13

Twin Turbine

-

15

15

-

Fixed Wing

1

-

1

-

74

64

138

-

-

Fixed Wing

3

39

42

-

Total

372

199

571

11

TOTAL LACE (Large Aircraft Equivalent)*

154

11 |

33

Consolidated Fleet Changes and Aircraft Sales for

Q1 FY12

# of A/C

Sold

Cash

Received*

Gain/ Loss*

Q1 FY 12

3

2,478

1,525

Totals

3

2,478

1,525

* Amounts stated in thousands

Q 1 FY12

Total

Fleet Count Beginning Period

373

373

Delivered

EC225

2

2

0

Total Delivered

2

2

Removed

Sales

(3)

(3)

Other*

-

Total Removed

(3)

(3)

372

372

* Includes net lease returns and commencements |

34

Gross Cash Flow Presentation

(in millions)

Gross Cash Flow Reconciliation

FY2007

FY2008

FY2009

FY2010

FY2011

Net Income

74

104

123

112

132

Depreciation and Amortization

43

54

66

75

91

Interest Expense

11

24

35

42

46

Interest Income

(9)

(13)

(6)

(1)

(1)

Rent

19

23

21

18

29

Other Income/expense-net

9

(2)

(3)

(3)

4

Earnings of Discontinued Operations

0

4

0

0

0

Gain/loss on Asset Sale

(11)

(9)

(45)

(19)

(10)

Tax Effect from Special Items

2

2

10

4

(15)

Earnings (losses) from Unconsolidated Affiliates, Net

(11)

(13)

(13)

(12)

(20)

Non-controlling Interests

1

(0)

2

1

1

Gross Cash Flow

$128

$174

$189

$218

$257 |

35

Gross Operating Asset Presentation

(in millions)

Adjusted Gross Operating Assets Reconciliation

FY2007

FY2008

FY2009

FY2010

FY2011

Total Assets

1,506

1,977

2,335

2,495

2,663

Accumulated Depreciation

300

317

351

404

446

Capitalized Operating Leases

61

63

90

97

132

Cash and Cash Equivalents

(184)

(290)

(301)

(78)

(116)

Assets from Discontinued Operations

(26)

0

0

0

0

Investment in Unconsolidated Entities

(47)

(52)

(20)

(205)

(209)

Goodwill

(7)

(16)

(45)

(32)

(32)

Prepaid Pension Cost

0

0

0

0

0

Intangibles

(3)

(3)

(10)

(9)

(7)

Assets Held for Sale: Net

(8)

(6)

(4)

(17)

(32)

Assets Held for Sale: Gross

13

11

11

39

71

Accounts Payable

(40)

(50)

(45)

(49)

(57)

Accrued Maintenance and Repairs

(12)

(13)

(10)

(11)

(16)

Other Accrued Taxes

(9)

(2)

(3)

(3)

(4)

Accrued Wages, Benefits and Related Taxes

(36)

(36)

(40)

(36)

(35)

Other Accrued Liabilities

(17)

(22)

(20)

(15)

(20)

Income Taxes Payable

(3)

(6)

0

(2)

(3)

Deferred Revenue

(16)

(15)

(18)

(19)

(10)

ST Deferred Taxes

(18)

(9)

(6)

(10)

(12)

LT Deferred Taxes

(76)

(92)

(120)

(143)

(148)

Adjusted Gross Operating Assets before Lider

$1,376

$1,757

$2,144

$2,408

$2,611 |

36

Operating margin trend

As reported in prior periods (operating income/gross revenue)

2008

2009

2012

Full Year

Full Year

Full Year

Q1

Q2

Q3

Q4

FY

Q1

EBU

23.6%

19.3%

17.0%

18.0%

18.4%

19.6%

18.8%

18.8%

17.3%

WASBU

17.9%

21.5%

28.5%

26.5%

29.5%

29.8%

24.0%

27.4%

20.6%

NABU

14.5%

12.1%

6.1%

10.1%

16.1%

4.2%

-4.0%

7.5%

3.6%

AUSBU

17.2%

5.9%

23.2%

22.5%

16.3%

17.2%

17.4%

18.2%

10.0%

OIBU

17.3%

27.0%

19.2%

6.9%

30.6%

27.7%

45.8%

28.4%

33.6%

Consolidated

16.0%

17.8%

15.5%

13.6%

17.1%

14.7%

16.1%

15.4%

11.3%

New methodology (operating income/operating revenue)

2008

2009

2012

Full Year

Full Year

Full Year

Q1

Q2

Q3

Q4

FY

Q1

EBU

29.2%

24.3%

20.8%

21.4%

22.1%

25.4%

23.6%

23.6%

21.5%

WASBU

19.4%

22.8%

29.9%

27.1%

30.5%

30.4%

26.1%

28.6%

21.5%

NABU

14.5%

12.2%

6.2%

10.2%

16.4%

4.2%

-4.0%

7.6%

3.6%

AUSBU

17.9%

6.3%

24.3%

23.6%

17.8%

18.8%

19.1%

19.8%

11.1%

OIBU

17.4%

27.3%

19.4%

6.9%

30.9%

28.2%

47.1%

28.8%

34.5%

Consolidated

17.6%

19.6%

17.0%

14.6%

18.7%

16.5%

18.2%

17.0%

12.7%

2010

2011

2010

2011 |

37

Leverage Reconciliation

*Adjusted EBITDAR exclude gains and losses on dispositions of assets

Debt

Investment

Capital

Leverage

(a)

(b)

(c) = (a) + (b)

(a) / (c)

(in millions)

As of June 30, 2011

732.4

$

1,538.7

$

2,271.1

$

32.2%

Adjust for:

Unfunded Pension Liability

98.1

98.1

NPV of GE and Norsk Lease Obligations

39.6

39.6

Adjusted

870.1

$

(d)

1,538.7

$

2,408.8

$

36.1%

Calculation of debt to adjusted EBITDAR multiple

Adjusted EBITDAR*:

FY 2012

271.9

$

(e)

Annualized

362.5

$

= (d) / (e)

3.2:1 |

38

Bristow Group Inc. (NYSE: BRS)

2000 West Sam Houston Parkway South

Suite 1700, Houston, Texas 77042

t

713.267.7600

f

713.267.7620

bristowgroup.com

Contact Us |