Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE RE: 2011 Q2 EARNINGS RELEASE - AutoWeb, Inc. | ex99_1.htm |

| 8-K - FORM 8-K RE: 2011 Q2 EARNINGS RELEASE - AutoWeb, Inc. | form8k_080411.htm |

Exhibit 99.2

Autobytel Inc

Moderator: Jeffrey Coats

August 4, 2011

5:00 p.m. ET

|

Operator:

|

Good day, ladies and gentlemen, and thank you for standing by, and welcome to Autobytel Announces Second Quarter Earnings Results for fiscal Year 2011. At this time, all participants are in a listen-only mode. Later, we'll conduct a question-and-answer session, and instructions will follow at that time. If anyone should require assistance during the program, you may press star then zero on your touchtone telephone. As a reminder, this conference is being recorded. And now I'll turn the program over to Roger Pondel, Investor Relations for Autobytel. Sir, the floor is yours.

|

|

Roger Pondel:

|

Thank you, Operator. Hello, everyone, and welcome to Autobytel’s 2011 Second Quarter Conference Call. I am joined today by Jeffrey Coats, President and Chief Executive Officer, and Curt DeWalt, Senior Vice President and Chief Financial Officer.

Before we begin, I'd like to remind you that during today’s call, including the Q&A session, any projections and forward-looking statements made regarding future events and Autobytel’s future financial performance are covered by the safe harbor statements contained in today’s press release and in the Company’s filings with the SEC. Actual events and results may differ materially from those forward-looking statements.

Specifically, please refer to the Company’s Form 10-K for the year ended 2010, the Form 10-Q for the quarter ended June 30, 2011, which is expected to be filed tomorrow, and other filings with the SEC. These filings identify factors that could cause results to differ materially from those forward-looking statements.

|

Autobytel Inc

Moderator: Jeffrey Coats

08-04-11/5:00 p.m. ET

Confirmation # 83132993

Page 2

|

Jeffrey Coats:

|

Slides are also included with today’s presentation to help illustrate some of the points being made and discussed during the call. You can access the slides by clicking on the link in today’s press release or by going to Autobytel’s website at www.autobytel.com. When you’re there, go to “Investor Relations” and then click “Events and Presentations.”

Also, please note that during this call, we will be discussing adjusted operating expenses, EBITDA and cash flow, which are non-GAAP financial measures as defined by SEC Reg G. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure are included in the slides for this call that are posted on Autobytel’s website

With that, I’m happy to turn the call over to Jeff.

Thank you, Roger, and good afternoon everyone. Thank you for joining us today.

Obviously, we are very pleased to be speaking with you today and to confirm that Autobytel has achieved GAAP net income for the second quarter of 2011. And, although we cannot provide any assurances, based upon current information and assuming no further auto industry and/or macroeconomic deterioration, we believe at this time that we will remain profitable and cash flow positive for the third quarter of 2011 as well. Looking further out, while market conditions remain subject to volatility, we anticipate sustained profitability and positive cash flow for the remainder of the year.

Getting to this stage has been a key objective since I became CEO at the end of 2008. Since then, among other initiatives and achievements, including a game-changing acquisition, I told you that we would right-size the company by significantly reducing costs and restructuring our operations. Over the last eleven quarters, during the most difficult period in U.S. auto retailing history, total operating expenses have fallen by nearly two-thirds from $15.3 million, or 107% of revenues, to $6.1 million, or 40% of revenues. At the same time, gross margin has improved to nearly 42% from the low 30% range.

I also said that we would refocus our efforts on automotive purchase requests, which, as our core business, established the Autobytel brand in the auto industry.

|

Autobytel Inc

Moderator: Jeffrey Coats

08-04-11/5:00 p.m. ET

Confirmation # 83132993

Page 3

|

Curt DeWalt:

|

We continue to internally generate 60% to 70% of purchase requests from our family of websites. While internally generated volume percentages will fluctuate, Autobytel’s principal focus is always on optimizing ROI from our internal resources, while supplementing our offerings, where necessary, from high quality affiliate suppliers.

Additionally, I committed to reinvigorating Autobytel.com, our flagship website, to bring a new online automotive experience to consumers. In June, we launched the first of a multiphase redesign of the site to serve an increasing number of consumers and to make Autoybtel.com more relevant throughout the entire automotive lifecycle, not just when consumers are in the buying mode. The newly designed site has updated graphics, rich vehicle images, user friendly navigation and innovative tools that allow consumers to personalize their online car shopping, buying and ownership experience.

While it has taken many months of dedicated hard work, tough decisions and the fortitude to remain patient in a very challenging market, I’m happy to say that we have finally begun to reap the benefits of our actions. Perhaps more importantly, I believe we are poised to capitalize on additional growth opportunities by becoming even more strategically nimble as the auto industry recovers.

We have reached an important milestone, but we must be relentless in our strategic focus and actions in light of evolving market conditions. That said, I believe we are entering this next phase with a renewed sense of optimism for what we can truly achieve. When Curt completes his financial review, I will return to discuss some of our key initiatives. Curt

Thanks, Jeff. First, a reminder that the slides we’re referring to on today’s call can be found on the Autobytel website under “Investor Relations” and then “Events and Presentations.”

On slide 3, you will see the total revenue for the 2011 second quarter grew 26% to $15.2 million from $12.1 million last year. On a sequential basis, revenue was down from $16.0 million even as a result of the disruption in the marketplace caused primarily by the March earthquake and tsunami in Japan.

|

Autobytel Inc

Moderator: Jeffrey Coats

08-04-11/5:00 p.m. ET

Confirmation # 83132993

Page 4

|

|

The improvement from last year principally reflects contributions from the Cyber Ventures acquisition. During the quarter, the situation in Japan adversely impacted many manufacturers, large dealer groups and third party online automotive lead suppliers, which, in turn, had an affect on Autobytel. However, we are slowly beginning to see some improvement as the Japanese automakers in particular are returning to full production more quickly than originally anticipated.

On slide 5, you’ll see our quarterly revenue broken out by source. For the 2011 second quarter, total automotive purchase request revenue grew 30% over last year’s second quarter, which included a 94% revenue increase in the OEM and other wholesale channels, compared with last year’s second quarter, largely due to the acquisition.

On a sequential basis, auto purchase request revenue declined 7%, with 8% decrease in OEM and other wholesale revenue, compared with the first quarter of 2011. Again, this is primarily related to the impacts of the events in Japan.

We delivered approximately 908,000 purchase requests in the second quarter of 2011, up 38% from last year’s second quarter, but down 11% on a sequential basis from the first quarter of this year. As Jeff mentioned, 60% to 70% of our purchase requests are being internally generated, giving us a significant competitive advantage when coupled with our strong dealer distribution network, and therefore, driving higher gross margins.

Increasing credit availability has positively impacted our finance request business, with revenue growing 10% when compared with the second quarter of 2010, and more than 6% from 2011 first quarter. Although revenue was up as a result of product mix and better monetization of purchase requests, the number of finance requests we delivered was down slightly. We delivered approximately 111,000 finance requests in Q2 2011, compared with 117,000 the same quarter last year and 112,000 in the 2011 first quarter.

Advertising revenue grew approximately 14% versus last year’s second quarter but decreased approximately 1% on a sequential basis as we saw a slight constriction in the spending from certain Japanese manufacturers. With regard to the advertisers, we are receiving very positive and enthusiastic feedback from both the OEMs and

|

Autobytel Inc

Moderator: Jeffrey Coats

08-04-11/5:00 p.m. ET

Confirmation # 83132993

Page 5

|

|

advertising agencies as we have taken them through the all new, redesigned Autobytel.com. As the site evolves, we are looking to expand and further innovate advertising offerings, thus maximizing the ability to monetize the site.

As seen on slide 6, our dealer network comprised 2,426 new car dealers, up 9% from the prior year, but down 2% on a sequential basis. Used car dealers totaled 1,162, up 12% from last year, and up 11% from the first quarter of this year. In addition, we attracted 307 dealers through new or enhanced product offerings that did not exist a year ago. We also had 295 finance dealers in our network at the end of the 2011 second quarter, up 13% from last year’s second quarter, and up 9% sequentially. This is due to the thawing of available credit and dealerships moving more heavily into near prime and subprime markets.

Gross profit increased 50% to $6.4 million for the 2011 second quarter when compared with last year’s second quarter of $4.2 million, while gross margin improved to 41.7% from 35.0% last year and 38.4% for the first quarter of this year. The improvements were principally due to the larger number of internally generated purchase requests as well as search engine optimization initiatives. We believe that margins should continue to grow assuming ongoing optimization efforts and increases in the number of purchase request generated from Autobytel’s network of websites.

On slide 7 you’ll see our cost structure on an adjusted basis. As you know, by having streamlined the company, we believe our cost structure is more appropriately aligned with the current revenue and business conditions.

|

|

|

Total operating expenses for the 2011 second quarter were reduced by approximately 20% to $6.1 million, from $7.5 million in last year’s second quarter, which had included $425,000 in severance and related expenses. Total operating expenses also fell by more than 8% on a sequential basis.

|

|

|

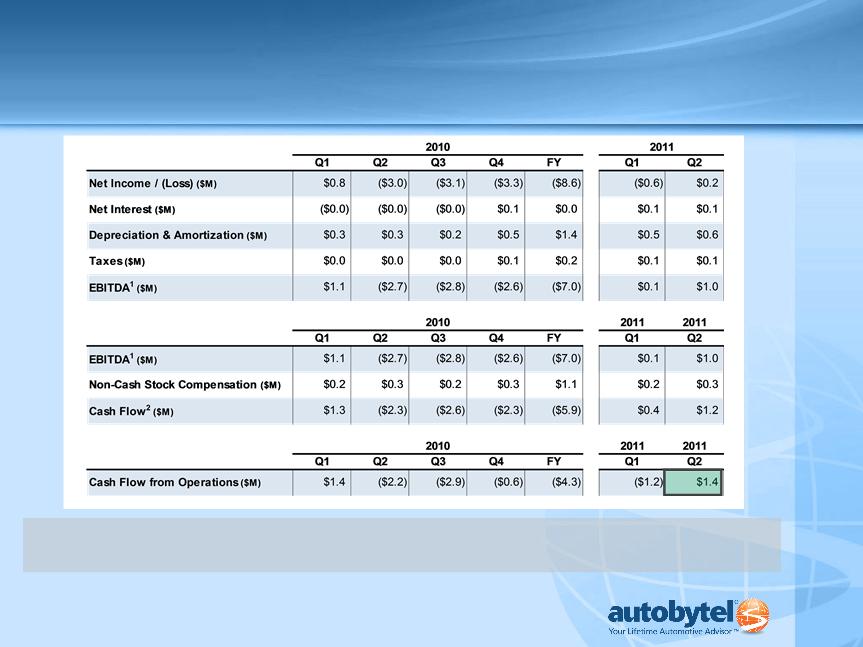

As you’ll see on slide 4, non-cash stock-based compensation for the second quarter of 2011 was $273,000, versus $330,000 for the second quarter of 2010. Depreciation and amortization was $566,000 for the most recent second quarter, compared with $321,000 in the second quarter a year ago. This increase was principally due to the depreciation of acquired assets.

|

Autobytel Inc

Moderator: Jeffrey Coats

08-04-11/5:00 p.m. ET

Confirmation # 83132993

Page 6

|

Jeffrey Coats:

|

This brings EBITDA to $1 million for the second quarter of 2011, compared with a negative $2.7 million in the second quarter of 2010, and approximately $144,000 in the first quarter of 2011.

The biggest news of the quarter is that we generated a net income of $199,000, or breakeven per diluted share, compared with a net loss of $3.0 million, or $0.07 per share, in last year’s second quarter and a net loss of $571,000, or $0.01 per share, in the first quarter of this year.

Cash flow provided by operations was also positive, coming in at $1.4 million for the second quarter, compared with cash flow used in operations of $2.2 million for last year’s second quarter and $1.2 million used in operations for this year’s first quarter.

At the end of June 2011, the company had cash and cash equivalents of $8.6 million, compared with $8.8 million at the end of December 2010, and up from $7.5 million at the end of March 2011. We are carrying a $5 million convertible note from the acquisition, which pays simple interest at the rate of 6% per year.

You will find our year-to-date results in the press release we released earlier. And as a reminder, we plan to file our second quarter Form 10-Q tomorrow.

With that, I’ll turn the call back to Jeff.

Thanks, Curt.

During the quarter, the auto industry, Autobytel included, was adversely impacted by the disruption from the March earthquake and tsunami in Japan. Despite these conditions, we were still able to achieve the favorable results outlined for you here today. Fortunately, many Japanese manufacturers are coming back online more quickly than originally anticipated, which should help the industry regain some of the momentum it had begun to gather earlier this year.

As you can see on slide 8, July SAAR was 12.2 million units, up from 11.8 million in May and 11.4 million in June. Although there was a progressive uptick in annualized units from May through July, current full year 2011 SAAR forecasts continue to range from 12.5 million to 12.9 million units.

|

Autobytel Inc

Moderator: Jeffrey Coats

08-04-11/5:00 p.m. ET

Confirmation # 83132993

Page 7

|

|

While no one is exactly sure how the scenario will play out, this week’s Automotive News reports that as Japanese vehicle volume returns to normal levels, U.S. car dealers believe automakers will spend hundreds of millions of dollars more on incentives and advertising in the remainder of the year. Automotive News went on to say that important fall vehicle launches, particularly the redesigned Toyota Camry, will drive a battle for market share and a fourth quarter surge in vehicle sales. This is further echoed by Auto Nation’s CEO, Mike Jackson, who this week stated that consumers are waiting for specific vehicle inventory and/or incentives, which he believes will bring those consumers into the market. Given this observation, Jackson predicts that for December we will see an annual selling rate close to 14 million units.

|

|

|

These favorable market projections make us even more excited to have launched the first phase of a major upgrade to Autobytel.com in June, which you can see highlighted on slide 10. After extensive research and consumer input, the site’s new design provides consumers with innovative content and tools to make it easier to research new and used vehicles. We are also giving consumers the opportunity to explore various buying or leasing options, receive tips for selling or trading in a vehicle, as well as evaluate their insurance needs – all in addition to connecting them with our large network of dealers to complete their purchase process.

|

|

|

As Curt mentioned, we continue to receive very positive feedback from advertisers about the new site, particularly the MyGarage® section which gives consumers the opportunity to register their existing vehicles to receive service and recall updates, tools to diagnose a problem and/or the option of direct access to a mechanic to ask specific questions. And, in response to one of the things consumers echoed time and again during our pre-design research, we now give our visitors the ability to share opinions, photos, articles and experiences with other consumers on the site and with friends and family through a plethora of social media links directly from Autobytel.com.

|

|

|

Most importantly, we are committed to further strengthening our editorial voice through our fresh and distinct tone with exclusive articles, new car sneak peeks, breaking industry news and detailed automotive reviews, all to ensure a more robust and useful experience for our consumers.

|

Autobytel Inc

Moderator: Jeffrey Coats

08-04-11/5:00 p.m. ET

Confirmation # 83132993

Page 8

|

Operator:

|

A perfect example of this approach is in our ever growing What's Hot Now section where you’ll find everything from a first look at a very surprising interior for the new Chevy Malibu, to our editor’s spy photos capturing a convoy of not yet unveiled Mercedes, to a piece on “How to Satisfy Your Inner Racer."

I invite you to visit the new site to even better understand our positioning as “Your Lifetime Automotive Advisor” – a consumer proposition that we believe expands our ability to attract and compel and maintain consumers within the Autobytel brand while providing new avenues for revenue generation.

Over the coming months, we will launch additional content to make sure we are attracting and satisfying the largest number of consumers possible. We believe that the new Autobytel.com is bringing excitement and fun back to the online car buying experience, and we are committed to making that experience as useful and simple as possible.

As you know, we also launched the industry’s newest job site, DealershipJobs.com, during the first quarter of this year. The site now has more than 7,000 job postings covering a wide range of dealership related positions. Over time, we will continue to add new functionality to benefit job seekers as well as dealers.

With the new Autobytel.com up and running and internally-generated purchase requests driving improved results, we feel very good about our current position and ability to build upon our business from here. We also continue to believe that the market is well suited for additional consolidation, and from our strengthened position, we feel confident that Autobytel will be a key player in this consolidation.

Operator, we are now ready to take questions.

Yes sir. Ladies and gentlemen, if you would like to ask a question, please press star then one on your touchtone phone. If your question has been answered or you wish to remove yourself from the queue, you may press the pound key. Again, to queue up for a question, please press star then one. One moment for questioners to queue.

Our first questioner in queue is Steve Dyer with Craig-Hallum. Your line is now open.

|

Autobytel Inc

Moderator: Jeffrey Coats

08-04-11/5:00 p.m. ET

Confirmation # 83132993

Page 9

|

Steve Dyer:

|

Thanks. Good afternoon, guys. Congratulations on the profitability, that’s a great achievement in what was not exactly a great auto sales quarter, so well done there.

Curt, a couple questions that I think I missed – housekeeping questions. What was the CapEx in the quarter?

|

|

Curt DeWalt:

|

$344,000.

|

|

Steve Dyer:

|

And the total D&A? I missed that, and I know you said it.

|

|

Curt DeWalt:

|

$566,000.

|

|

Steve Dyer:

|

OK. You guys have done a great job kind of bringing costs down, certainly to eke out the profitability. How should we think about both gross margins and operating costs going forward? Is this kind of a good level to use for operating costs, or is there more you can wring out? What’s the thought process there?

|

|

Jeffrey Coats:

|

Operating costs are probably at a pretty good level right now. They may fluctuate a tad up, and we may be able to move them a little bit down as we continue to move forward, but this level is probably a pretty good level to consider us at.

|

|

Steve Dyer:

|

OK, and then what about gross margin? Is there room for that to improve as things go?

|

|

Curt DeWalt:

|

Yes. We feel pretty good about additional gross margin expansion. We’re getting smarter about the way we’re generating our internal leads. As you know from the launch of the new Autobytel.com, as we optimize that site and grow it and really start achieving more pure organic traffic, we will generate an increasing number of leads and other revenue from the site, and of course, that will help boost our gross margin along the way. We have not had a lot of boost from our sites for those kind of opportunities over the last couple of years, so we see some good upside as we move ahead and we further optimize.

|

|

Steve Dyer:

|

And I noticed, speaking of organic leads, you went from 70% to 60% to 70%. Is there anything to read into that, or is that just a function of, given the whole Japan thing, there was just a dearth of good organic traffic this quarter?

|

Autobytel Inc

Moderator: Jeffrey Coats

08-04-11/5:00 p.m. ET

Confirmation # 83132993

Page 10

|

Jeffrey Coats:

|

I wouldn’t read anything into it. It’s just a fluctuation. We moved up pretty quickly to 70% as a result of the acquisition. We’ve really been, as you and I have discussed previously, pulling the levers and turning the knobs to really understand better how to optimize our margins and our returns out of that, so we think this is a pretty good level. We’ve also done a lot of good work over the last couple of years of really narrowly focusing our outside lead suppliers. We feel like we’re doing business with a lot of good quality suppliers now, so we kind of look at the tradeoffs in that on a regular basis. So I really wouldn't read anything into it.

|

|

Steve Dyer:

|

OK. And then just kind of wondering, since you guys kind of get real time lead data obviously, I’m wondering how you see sort of the cadence of leads and therefore sales going? A lot of the automakers in July said around the 4th was a good time. It was pretty soft in the middle of the month, and then it picked up toward the end of the month. How have you sort of seen things progress since the kind of early days with Japan, early in the quarter?

|

|

Jeffrey Coats:

|

Early in the quarter we were still seeing some benefit from – in April – still seeing some benefit from more optimism in the market. We did begin seeing it fall off, people coming online, configuring cars, submitting leads. We did begin to see it coming down probably earlier than most people began talking about it. Moving into July things were pretty soft, in May they continued, through June, early July was pretty much the same way. We’ve been seeing a pickup – a pronounced pickup – since about the middle of July. It’s softened a little bit as we moved into August, but it’s still running well better than we had been seeing in May and June.

|

|

Steve Dyer:

|

OK. Great. And then last question, just curious for an update on your aperture service. Any traction there? I think the whole Japan thing kind of hurt that for a little bit there, but anything more to report there?

|

|

Jeffrey Coats:

|

Not really. That has come online at a much slower pace than we had originally expected. It was certainly affected by the pullback of what’s happened as a result of the Japanese situation. We are working on a couple of other data related opportunities as well, so we do expect to see some pickup in data revenue this year, but it doesn’t look like it’s going to come through for us as well for this year as we had originally thought it would.

|

Autobytel Inc

Moderator: Jeffrey Coats

08-04-11/5:00 p.m. ET

Confirmation # 83132993

Page 11

|

Steve Dyer:

|

OK. And then last question, same thing with MyGarage®. Is that – are people using it? Is it well received? What are you seeing there early on? I know at one point in time you talked about maybe being able to parlay that into service leads, that sort of thing. What are you seeing there?

|

|

Jeffrey Coats:

|

It does seem to be very well received. We had an early version up before we launched the new site that was pretty simple. We are just now beginning to work on driving traffic to MyGarage®. We got a lot of positive feedback from the manufacturers and their advertising agencies as part of the discussions on the new site – a lot of interest in that from an advertising standpoint.

I do think – and we have talked to some other folks—I do think we’re going to be able to develop a service leads business out of that. It’s not our top priority right now. We’re basically trying to get more consumers into it. And the way it really works is, when you come to Autobytel.com now, as part of comparing vehicles or configuring a vehicle or reading articles that you want to save, you register, and that registration actually registers you for a garage. So when you’re saving comparisons, when you’re saving a vehicle you configure, if you’re saving a lead you submitted or articles you want to keep, you’re actually saving them in the MyGarage® section. We have not registered consumers on the site historically, so again, this is all about us reconnecting with the consumer and maintaining more of an ongoing relationship with them.

So we think we’re going to be able to move people into that section through a variety of means, both through some of our partners as well as just people coming to the site and through some of our own traffic acquisition opportunities.

|

|

Steve Dyer:

|

OK, great. Thanks for taking my questions.

|

|

Operator:

|

Thank you, sir. Our next questioner in queue is George Santana with Ascendiant. Please go ahead.

|

|

George Santana:

|

Seconding the comments before, congratulations on a great quarter. In a difficult operating environment, that’s really impressive. Just a housekeeping. Did I hear you say the leads were 70% generated organically?

|

Autobytel Inc

Moderator: Jeffrey Coats

08-04-11/5:00 p.m. ET

Confirmation # 83132993

Page 12

|

Jeffrey Coats:

|

The actual number is between 60% and 70%. It fluctuates on a daily basis depending upon, again, how we’re generating it and where we’re able to maximize our ROI, and it’s also crossed with leads that are available to us from some of our outside suppliers, so it will fluctuate. That volume is going to fluctuate between the 60% and 70%.

|

|

George Santana:

|

OK. And since you’re out there in the market, can you just discuss at least briefly the competitive landscape – what you’re seeing out there?

|

|

Jeffrey Coats:

|

In which competitive landscape? Across the manufacturers, in our own business?

|

|

George Santana:

|

No, your own business.

|

|

Jeffrey Coats:

|

We are aware that other players in our business have seen some of the same issues that we have. There’s definitely been a falloff in people coming online to configure vehicles during the second quarter and even early in July. We see some of our suppliers having issues with providing volume at a level that we would like to achieve with them. So there’s definitely been a pronounced falloff across the whole market as a result of the Japanese earthquake and tsunami.

|

|

George Santana:

|

Keep up the good work, guys. Thanks.

|

|

Operator:

|

Thank you, sir. Again, ladies and gentlemen, if you would like to ask a question, please press star then one on your touchtone phone. Again, to ask a question, please press star then one.

We do have another questioner, Robert Setrakian with Helios. Please go ahead.

|

|

Robert Setrakian:

|

Hi, guys. Congratulations. Quick question. Obviously, good stock price, the high stock price not only keeps all of us happy, but it is good for you, the company, in terms of flexibility in terms of any strategic things that you have in mind. You mentioned the acquisitions, etc. Any upcoming investor conferences, or any efforts related to meeting new investors?

|

|

Jeffrey Coats:

|

Yes. We, as you know, I do travel pretty much every quarter to meet with new investors. We are presenting at a new conference that the Roth guys are putting together on the East Coast in September, late September. We’ve been invited to

|

Autobytel Inc

Moderator: Jeffrey Coats

08-04-11/5:00 p.m. ET

Confirmation # 83132993

Page 13

|

Robert Setrakian:

|

present at the Craig-Hallum conference in New York on October the 6th. So those are the only two scheduled conferences currently, but we are meeting with new investors and with many of the existing investors on various visits around the country, so we are trying to get the story out there a little bit more clearly. Obviously kind of hard to tell with the gyrations in the stock market the last few weeks.

I follow the stock quite closely, and it’s been crazy in that on very low volume there are no buyers, and the stock just keeps on going down and it’s ridiculous based on the performance that you have had in turning around the company and where you have gotten it to. And it must be frustrating for you guys also.

|

|

Jeffrey Coats:

|

It is very frustrating, yes.

|

|

Robert Setrakian:

|

And in terms of anything strategic, obviously the last acquisition has worked out very well. It was transformational. Anything on the horizon in the next couple of quarters before yearend perhaps, or it’s just more of the same, and we don’t have anything on the horizon.

|

|

Jeffrey Coats:

|

Well it’s always hard to gauge timing on things like that. And as you know, and as anybody listening on the call knows, I’ve been saying for 2.5 years that this market should consolidate, and we have been working behind the scenes towards that end. The Autotropolis/Cyber Ventures acquisition last year was a step down that road – a meaningful step down that road because it has been a transformational acquisition for us. I think there are opportunities for us for additional opportunities. At this point I just really can’t say anything more than that about it.

|

|

Robert Setrakian:

|

OK. Thank you very much and congratulations again.

|

|

Operator:

|

Thank you, sir. Again to ask a question, please press star then one. Presenters, I’m showing no additional questions in the queue. I’d like to turn the program back over to Mr. Jeffrey Coats.

|

|

Jeffrey Coats:

|

Thank you. Thanks again, everyone, for your ongoing support and patience. We are working diligently toward continued growth, innovation and sustained profitability for the future. Stay tuned for further progress. Thank you.

|

Autobytel Inc

Moderator: Jeffrey Coats

08-04-11/5:00 p.m. ET

Confirmation # 83132993

Page 14

|

Operator:

|

Thank you, sir. Ladies and gentlemen, this does conclude today’s program. Thank you for your participation and have a wonderful day. Attendees, you may disconnect at this time.

|

|

|

END

|

2Q 2011 Results

August 4, 2011

Welcome to Autobytel.com The

auto-centric, auto-savvy site with

comprehensive information

comprehensive information

and expert advice about

buying, selling and

maintaining

Virtually any

vehicle.

2

The statements made in the accompanying conference call or contained in this presentation that are not historical facts are forward-looking

statements under the federal securities laws. These forward-looking statements, including, but not limited to the company’s belief regarding

achievement of positive cash flow or profitability for the third quarter of 2011, are not guarantees of future performance and involve assumptions

and risks and uncertainties that are difficult to predict. Actual outcomes and results may differ materially from what is expressed in, or implied by,

these forward-looking statements. Autobytel undertakes no obligation to update publicly any forward-looking statements, whether as a result of

new information, future events or otherwise. Among the important factors that could cause actual results to differ materially from those expressed

in, or implied by, the forward-looking statements are changes in general economic conditions; the financial condition of automobile manufacturers

and dealers; changes in fuel prices; the economic impact of terrorist attacks, political revolutions or military actions; dealer attrition; pressure on

dealer fees; increased or unexpected competition; the failure of new products and services to meet expectations; failure to retain key employees

or attract and integrate new employees; actual costs and expenses exceeding charges taken by Autobytel; changes in laws and regulations; costs

of legal matters, including, defending lawsuits and undertaking investigations and related matters; and other matters disclosed in Autobytel’s filings

with the Securities and Exchange Commission. Investors are strongly encouraged to review the company’s Annual Report on Form 10-K for the

year ended December 31, 2010, and other filings with the Securities and Exchange Commission for a discussion of risks and uncertainties that

could affect the business, operating results, or financial condition of Autobytel and the market price of the company’s stock. In addition, current

year financial information could be subject to change as a result of subsequent events or the finalization of the company’s financial statement

close which culminates with the filing of the company’s Annual Report on Form 10-K for the current year.

statements under the federal securities laws. These forward-looking statements, including, but not limited to the company’s belief regarding

achievement of positive cash flow or profitability for the third quarter of 2011, are not guarantees of future performance and involve assumptions

and risks and uncertainties that are difficult to predict. Actual outcomes and results may differ materially from what is expressed in, or implied by,

these forward-looking statements. Autobytel undertakes no obligation to update publicly any forward-looking statements, whether as a result of

new information, future events or otherwise. Among the important factors that could cause actual results to differ materially from those expressed

in, or implied by, the forward-looking statements are changes in general economic conditions; the financial condition of automobile manufacturers

and dealers; changes in fuel prices; the economic impact of terrorist attacks, political revolutions or military actions; dealer attrition; pressure on

dealer fees; increased or unexpected competition; the failure of new products and services to meet expectations; failure to retain key employees

or attract and integrate new employees; actual costs and expenses exceeding charges taken by Autobytel; changes in laws and regulations; costs

of legal matters, including, defending lawsuits and undertaking investigations and related matters; and other matters disclosed in Autobytel’s filings

with the Securities and Exchange Commission. Investors are strongly encouraged to review the company’s Annual Report on Form 10-K for the

year ended December 31, 2010, and other filings with the Securities and Exchange Commission for a discussion of risks and uncertainties that

could affect the business, operating results, or financial condition of Autobytel and the market price of the company’s stock. In addition, current

year financial information could be subject to change as a result of subsequent events or the finalization of the company’s financial statement

close which culminates with the filing of the company’s Annual Report on Form 10-K for the current year.

This presentation includes a discussion of "EBITDA," “Adjusted Operating Expenses,” and “Cash Flow,” which are non-GAAP financial measures.

The company defines EBITDA as net income before (i) interest income (expense); (ii) income tax provision (benefit); and (iii) depreciation and

amortization. The company defines Adjusted Operating Expenses as GAAP operating expenses adjusted for unusual, infrequent or non-recurring

items. The company defines non-GAAP Cash Flow as EBITDA plus non-cash stock compensation related to the company's grant of stock options

and other equity instruments. The company believes these non-GAAP financial measures provide important supplemental information to

management and investors. These non-GAAP financial measures reflect an additional way of viewing aspects of the company's operations that,

when viewed with the GAAP results and the accompanying reconciliations to corresponding GAAP financial measures, provide a more complete

understanding of factors and trends affecting the company's business and results of operations. These non-GAAP financial measures are used in

addition to and in conjunction with results presented in accordance with GAAP and should not be relied upon to the exclusion of GAAP financial

measures. Management strongly encourages investors to review the company's consolidated financial statements in their entirety and to not rely

on any single financial measure. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial

measures with other companies' non-GAAP financial measures having the same or similar names. In addition, the company expects to continue to

incur expenses similar to the non-GAAP adjustments described above, and exclusion of these items from the company's non-GAAP measures

should not be construed as an inference that these costs are unusual, infrequent or non-recurring.

The company defines EBITDA as net income before (i) interest income (expense); (ii) income tax provision (benefit); and (iii) depreciation and

amortization. The company defines Adjusted Operating Expenses as GAAP operating expenses adjusted for unusual, infrequent or non-recurring

items. The company defines non-GAAP Cash Flow as EBITDA plus non-cash stock compensation related to the company's grant of stock options

and other equity instruments. The company believes these non-GAAP financial measures provide important supplemental information to

management and investors. These non-GAAP financial measures reflect an additional way of viewing aspects of the company's operations that,

when viewed with the GAAP results and the accompanying reconciliations to corresponding GAAP financial measures, provide a more complete

understanding of factors and trends affecting the company's business and results of operations. These non-GAAP financial measures are used in

addition to and in conjunction with results presented in accordance with GAAP and should not be relied upon to the exclusion of GAAP financial

measures. Management strongly encourages investors to review the company's consolidated financial statements in their entirety and to not rely

on any single financial measure. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial

measures with other companies' non-GAAP financial measures having the same or similar names. In addition, the company expects to continue to

incur expenses similar to the non-GAAP adjustments described above, and exclusion of these items from the company's non-GAAP measures

should not be construed as an inference that these costs are unusual, infrequent or non-recurring.

Copyright (c) 2011 Autobytel Inc.

Safe Harbor Statement and Non-GAAP

Disclosures

Disclosures

3

Financial Overview

1 See slide 7 for Adjusted Operating Expense reconciliation

2 EBITDA is equal to Net Income plus Interest, Taxes, and Depreciation and Amortization; See slide 4 for reconciliation

3 Cash Flow is equal to EBITDA plus Non-Cash Stock Compensation; See slide 4 for reconciliation

4 Cash decreased in Q3 2010 primarily as a result of the acquisition of Cyber Ventures / Autotropolis ($9M) and a strategic investment in Driverside ($1M)

Copyright (c) 2011 Autobytel Inc.

Net Income, EBITDA, and Cash Flow POSITIVE in Q2 11

4

Copyright (c) 2011 Autobytel Inc.

EBITDA and Cash Flow

1 EBITDA is equal to Net Income plus Interest, Taxes, and Depreciation and Amortization

2 Cash Flow is equal to EBITDA plus Non-Cash Stock Compensation

3 Above financials are impacted by rounding to the nearest $0.1M

Cash Flow from Operations POSITIVE in Q2 11

5

Comments

§ Dealer revenue down 6% Y-O-Y and down 5% sequentially as a result of the impact the Japanese

earthquake and tsunami had on the Automotive Industry

earthquake and tsunami had on the Automotive Industry

§ OEM and other wholesale purchase request revenue up 94% Y-O-Y, but down 8% sequentially also

due to challenges in the overall Automotive Industry

due to challenges in the overall Automotive Industry

§ Specialty finance purchase request revenue up 10% Y-O-Y and 7% sequentially as credit markets

continue to thaw and product mix and monetization improve

continue to thaw and product mix and monetization improve

Revenue Results

Source: J.D. Power and Associates

Copyright (c) 2011 Autobytel Inc.

6

Comments

§ Retail New and Used franchises were up 10% Y-O-Y and 2% sequentially

§ Specialty Finance dealers were up 13% Y-O-Y and 9% sequentially

§ Dealers participating in other revenue products grew >50% sequentially

Dealer Base

Copyright (c) 2011 Autobytel Inc.

Total Dealer Base is the sum of Dealer franchises subscribing to our new vehicle Purchase Request programs, Dealer franchise groups and independent

Dealers subscribing to our used vehicle Purchase Request program, Dealers subscribing to our finance Purchase Request program, and Dealers subscribing

to our WebLeads+ program, with Dealers participating in more than one of these programs counted by the number of programs in which they participate.

Dealers subscribing to our used vehicle Purchase Request program, Dealers subscribing to our finance Purchase Request program, and Dealers subscribing

to our WebLeads+ program, with Dealers participating in more than one of these programs counted by the number of programs in which they participate.

7

Copyright (c) 2011 Autobytel Inc.

Operating Expenses

1 Includes all patent and other litigation settlements

2 Severance includes associated accelerated stock compensation of $(0.1) and $(0.1) for Q210 and Q410, respectively

3 Acquisition costs consist of professional fees associated with the acquisition of Cyber Ventures and Autotropolis during 2010

4 Acquisition amortization relates to acquired intangible assets from Cyber Ventures and Autotropolis during 2010

8

Comments

§ Q2 2011 was a particularly difficult quarter for SAAR US Light Vehicle sales, well below the

prior quarter average of 13.2M, and only 8% better than the prior year average of 11.2M

prior quarter average of 13.2M, and only 8% better than the prior year average of 11.2M

§ Impact from the Japan earthquake and tsunami are still unknown, however appear to have

bottomed out at 11.4M SAAR US Light Vehicle sales in June 2011

bottomed out at 11.4M SAAR US Light Vehicle sales in June 2011

§ AutoNation CEO Mike Jackson predicts a strong Q4 2011 with the SAAR as high as 14M in

December 2011

December 2011

Auto Industry Sales

Source: Automotive News

Source: J.D. Power and Associates forecasts as of June 2 and July 21, 2011

Copyright (c) 2011 Autobytel Inc.

9

Auto Industry Impact - Japan

• March 11, 2011 - Magnitude 9.0 earthquake and resulting tsunami hit Japan

• April 2011 - Japanese Automakers see production volume drop by 50-80% from prior year levels

• April 2011 - J.D. Power holds its US Light Vehicle Sales forecast at 13.0M for 2011, while IHS and AutoNation reduce

their forecasts to 12.8M and 12.5M

their forecasts to 12.8M and 12.5M

• May 2011 - Japanese Automakers see the loss of production improve to 50% of prior year levels

• June 2011 - J.D. Power reduces the US Light Vehicle Sales forecast to 12.9M for 2011

• July 2011 - Japanese Automakers at or nearing 100% of 2010 production levels

• GM and Ford will lead US market share, particularly in small, fuel efficient vehicles

• Toyota share expected to continue to languish at post recall levels

• Hyundai - Kia US market share expanding

• Japanese Automakers regain 2010 production levels by the end of Summer pushing lost production from the 1st half of

the year into the 2nd half of 2011

the year into the 2nd half of 2011

The Japan impact, while significant in Q2 11, still appears to be a

temporary setback in the automotive recovery

temporary setback in the automotive recovery

Events

Impact

Sources: Automotive News, IHS, J.D. Power and Associates

Copyright (c) 2011 Autobytel Inc.

10

The All New Autobytel.com

• Dynamic new redesign launched

June 29th 2011

June 29th 2011

• Unique consumer proposition

“Your Lifetime Automotive

Advisor”™

“Your Lifetime Automotive

Advisor”™

• Distinctive consumer content,

engagement and social dialogue

engagement and social dialogue

• What Car is Right for Me?

• MyGarage®

• Used Car Finder

• What’s Hot Now

• Intuitive Navigation to Make and Model

Pages

Pages

• Detail page features Overviews, Expert

Reviews, Pricing and Specs along with

Consumer Ratings

Reviews, Pricing and Specs along with

Consumer Ratings

• Car Comparison Tools

• Incentives & Rebates Information

Copyright (c) 2011 Autobytel Inc.

11