Attached files

| file | filename |

|---|---|

| EX-23.1.2 - China United Insurance Service, Inc. | v230318_ex23-12.htm |

| EX-23.1.1 - China United Insurance Service, Inc. | v230318_ex23-11.htm |

| EX-23.1.3 - China United Insurance Service, Inc. | v230318_ex23-13.htm |

| EX-23.1.4 - China United Insurance Service, Inc. | v230318_ex23-14.htm |

WASHINGTON, D.C. 20549

AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHINA UNITED INSURANCE SERVICE, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

6411

|

98-6088870

|

||

|

(State or other jurisdiction of

|

(Primary Standard Industrial

|

(I.R.S. Employer

|

||

|

incorporation or organization)

|

Classification Code Number)

|

Identification Number)

|

Building 4F, Hesheng Plaza No. 26 Yousheng S Rd.

Jinshui District, Zhengzhou, Henan

People’s Republic of China

+86371-63976529

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Lo Chung Mei

President and Chief Executive Officer

Building 4F, Hesheng Plaza No. 26 Yousheng S Rd.

Jinshui District, Zhengzhou, Henan

People’s Republic of China

+86371-63976529

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Mark E. Crone

The Crone Law Group

101 Montgomery Street, Suite 2650

San Francisco, CA 94104

(415) 955-8900

(415) 955-8910 FAX

Approximate Date of Commencement of Proposed Sale to the Public: from time to time after the effective date of this Registration Statement as determined by market conditions and other factors.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

x

|

|

(Do not check if a smaller reporting company)

|

|||

CALCULATION OF REGISTRATION FEE

|

Title Of Each

Class of Securities

To be Registered

|

|

Amount To

Be Registered

|

|

|

Proposed

Maximum

Offering Price

Per Share

|

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

|

Amount of

Registration Fee

|

|

||||

|

Common Stock, par value $0.00001

|

1,000,000

|

$

|

0.015

|

$

|

15,000

|

$

|

1.75*

|

|||||||||

* Previously paid

The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(c). Our common stock is not traded on any national exchange and in accordance with Rule 457, the offering price was determined by the price of the shares that were recently sold to our shareholders. The price of $0.015 is a fixed price at which the selling security holders may sell their shares until our common stock is quoted on the OTC Bulletin Board at which time the shares may be sold at prevailing market prices or privately negotiated prices.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the securities act of 1933 or until the registration statement shall become effective on such date as the commission, acting pursuant to said section 8(a), may determine.

2

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS

Subject to completion, dated August 5, 2011

1,000,000 shares of Common Stock

CHINA UNITED INSURANCE SERVICE, INC.

The selling stockholders named in this prospectus are offering all of the shares of common stock offered through this prospectus. Our common stock is presently not traded on any market or securities exchange. The 1,000,000 shares of our common stock can be sold by selling security holders at a fixed price of $0.015 per share until our shares are quoted on the OTC Bulletin Board (“OTCBB”) and thereafter at prevailing market prices or privately negotiated prices. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority (“FINRA”), which operates the OTCBB, nor can there be any assurance that such an application for quotation will be approved. We have agreed to bear the expenses relating to the registration of the shares of the selling security holders. We will receive no proceeds from the sale or other disposition of the shares, or interests therein, by the selling stockholders.

An investment in shares of our common stock involves a high degree of risk. We urge you to carefully consider the Risk Factors beginning on page 10.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Date of this Prospectus is _______________.

3

TABLE OF CONTENTS

|

PROSPECTUS SUMMARY

|

5 | |

|

RISK FACTORS

|

10 | |

|

FORWARD LOOKING STATEMENTS

|

26 | |

|

USE OF PROCEEDS

|

26 | |

|

DIVIDEND POLICY

|

26 | |

| DETERMINATION OF OFFERING PRICE | 27 | |

| DILUTION | 27 | |

| PENNY STOCK CONSIDERATIONS | 27 | |

|

MARKET FOR OUR COMMON STOCK

|

27 | |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

28 | |

|

BUSINESS

|

42 | |

|

MANAGEMENT

|

56 | |

|

SECURITY OWNERSHIP

|

61 | |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

62 | |

|

DESCRIPTION OF SECURITIES

|

64 | |

|

SELLING STOCKHOLDERS

|

65 | |

|

PLAN OF DISTRIBUTION

|

66 | |

|

LEGAL MATTERS

|

66 | |

|

EXPERTS

|

66 | |

|

AVAILABLE INFORMATION

|

67 | |

|

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

68 |

4

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the common stock. You should carefully read the entire prospectus, including “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements, before making an investment decision.

THE COMPANY

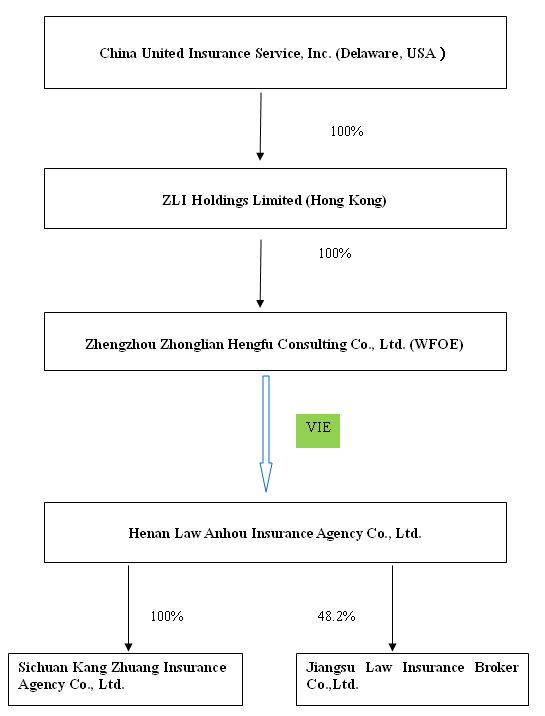

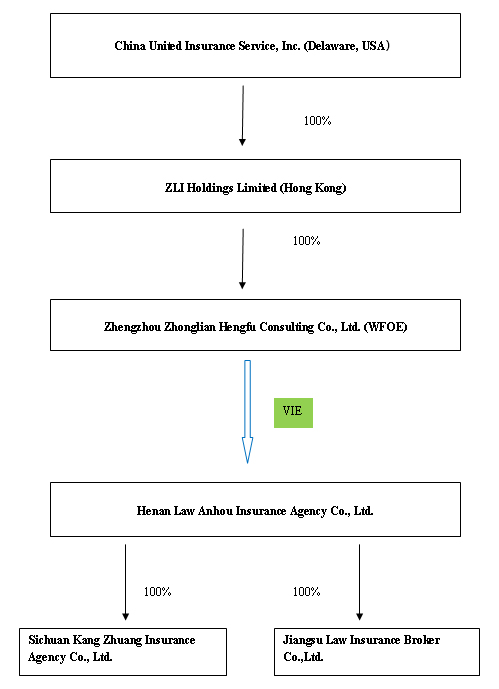

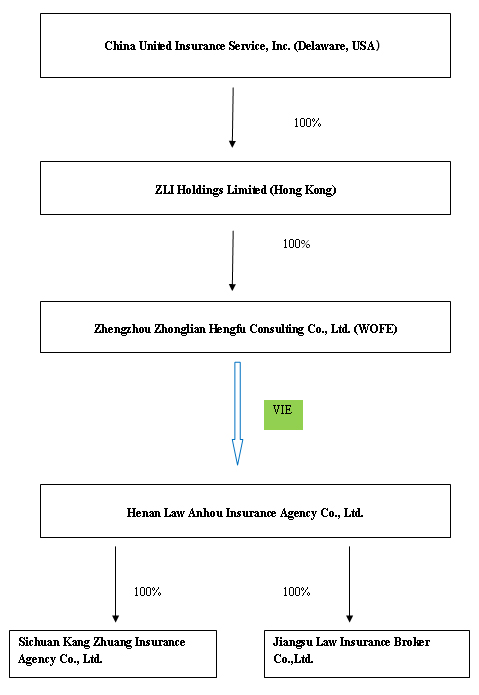

Company Structure

China United Insurance Service, Inc. (“China United” or the “Company”) is a Delaware corporation organized on June 4, 2010 by Mao Yi Hsiao, a Taiwanese citizen, as a listing vehicle for ZLI Holdings Limited (“CU Hong Kong”) to be quoted on the OTCBB. CU Hong Kong, a wholly owned Hong Kong-based subsidiary of China United, was originally founded by China United, on July 12, 2010 under Hong Kong laws.

Henan Law Anhou Insurance Agency Co., Ltd. (“Henan Anhou”, formerly known as Zhengzhou Anhou Insurance Agency Co., Ltd.) was founded in Henan province of the People’s Republic of China (the “PRC”) on October 9, 2003. Henan Anhou provides insurance agency services in the PRC.

Henan Anhou’s wholly owned subsidiary Sichuan Kangzhuang Insurance Agency Co., Ltd. (“Sichuan Kangzhuang”) was founded on September 4, 2006 in Sichuan province of the PRC, and it provides insurance agency services in the PRC. On August 23, 2010, at Sichuan Kangzhuang’s general meeting of shareholders, its shareholders voted for transferring all of their equity interests in Sichuan Kangzhuang to Henan Anhou for RMB532,622 ($78,318). On September 6, 2010, the equity transfer agreements were signed between Henan Anhou and each shareholder of Sichuan Kangzhuang.

Jiangsu Law Insurance Broker Co., Ltd. (“Jiangsu Law”) was founded on September 19, 2005 in Jiangsu Province of the PRC. Jiangsu Law is allowed to provide insurance brokerage services. On August 12, 2010, at Jiangsu Law’s general meeting of shareholders, its shareholders voted for transferring all of their shareholding to Henan Anhou for RMB518,000 ($75,475). On September 28, 2010, the equity transfer agreements were signed between Henan Anhou and each individual shareholder of Jiangsu Law. On February 11, 2011, Henan Anhou has invested RMB4.82 million in Jiangsu Law to increase the registered capital to RMB10 million. The said share transfer is currently under the registration and reporting process with local Administration of Industry and Commerce, or AIC, and CIRC. Jiangsu Law expects to complete the government registration or reporting process with respect to the equity interests by the end of September 2011, subsequent to which Henan Anhou shall have complied with all of the applicable laws and regulations with respect to its holding 100% equity interests in Jiangsu Law.

On January 16, 2011, we issued a total of 20,000,000 shares of our common stock, $0.00001 par value per share, to several non U.S. persons in consideration for their previous investment of $300,000 in the Company’s subsidiaries, which has been contributed to the capital account of Zhengzhou Zhonglian Hengfu Business Consulting Limited (“CU WFOE”), a wholly owned subsidiary of CU Hong Kong. Pursuant to the PRC laws and regulations, CU WFOE is a wholly foreign owned enterprise. The issuance was made pursuant to an exemption from registration contained in Regulation S under the Securities Act of 1933, as amended.

On January 17, 2010, CU WFOE and Henan Anhou and its shareholders entered into a series of agreements known as variable interest agreements (the “VIE Agreements”) pursuant to which CU WFOE has executed effective control over Henan Anhou through these contractual arrangements. The VIE Agreements included:

5

(1) An Exclusive Business Cooperation Agreement through which CU WFOE has the right to advise, consult, manage and operate Henan Anhou and collect and own all 90% of the net profits of Henan Anhou;

(2) a Power of Attorney under which the shareholders of Henan Anhou have vested their collective voting control over Henan Anhou to CU WFOE;

(3) an Option Agreement under which the shareholders of Henan Anhou have granted to CU WFOE the irrevocable right and option to acquire all of their equity interests in Henan Anhou, subject to applicable PRC laws and regulations; and

(4) a Share Pledge Agreement under which the owners of Henan Anhou have pledged all of their equity interests in Henan Anhou to CU WFOE to guarantee Henan Anhou’s performance of its obligations under the Exclusive Business Cooperation Agreement.

The foregoing description of the terms of the Exclusive Business Cooperation Agreement, the Power of Attorney, the Option Agreement and the Share Pledge Agreement is qualified in its entirety by reference to the provisions of the agreements filed as Exhibits 10.2 – 10.14 to this report, which are incorporated by reference herein.

See “Related Party Transactions” for further information on our contractual arrangements with these parties.

6

The following flow chart illustrates our companies’ organizational structure:

7

Our Business

We are a fast-growing insurance intermediary company operating in China, with three consolidated affiliated entities primarily focusing on sales of life, property and casualty insurance products underwritten by insurance companies as well as insurance brokerage services. We have targeted our distribution and service network in provinces with most population in China, such as Henan, Jiangsu and Sichuan. As of March 31, 2011, we have 1,088 sales professionals and 73 administrative staffs operating across 35 cities within these three provinces.

Our headquarters are located in Henan, China, where we lease approximately 11,736 square feet (1092 square meters) of office space. Our subsidiaries and consolidated affiliated entities in aggregate lease approximately 30,871 square feet (2,868 square meters) of office space. In 2010, our total rental expenses were US$106,343 (RMB 720,971)

For the nine months ended March 31, 2011 and 2010, we generated revenues of $2,017,218 and $1,011,774, respectively. We generated revenues of $2,154,629 and a net loss of $150,738 for the year ended June 30, 2010. Our sales for the fiscal year ended June 30, 2009 were $1,841,008, with a net loss of $487,178.

As of March 31, 2011, the Company’s current liabilities exceeded its current assets by $384,415 and the Company’s total assets exceeded its total liabilities by $699,398. The Company generated a net loss of $174,946 for the nine months ended March 31, 2011 and the Company’s cash position on March 31, 2011 was $1,272,195.

Because all of our sales are generated in China, our business operations are subject to applicable Chinese laws and regulations. The insurance industry in the PRC is highly regulated. China Insurance Regulatory Commission (“CIRC”) is the regulatory authority responsible for the supervision of the Chinese insurance industry. Insurance activities undertaken within the PRC are primarily governed by the Insurance Law and the related rules and regulations. We operate in compliance with various applicable laws and regulations include, but not limited to, labor and employment law, taxation, environmental laws and regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central government or local governments and agencies of the jurisdictions where we operate our business may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts from us to ensure our compliance with such regulations or interpretations.

For a detailed discussion of the material regulatory framework affecting the Company, please see the discussion under the heading “Regulatory” in the “Business” section of this prospectus.

Since January 2008, China began to implement its new corporate tax rates according to which foreign-invested enterprises and domestic enterprises are subject to enterprise income tax at a uniform rate of 25%. CU WFOE is currently subject to a corporate tax rate of 25%.

As a foreign invested enterprise and subject to applicable laws and regulations, CU WFOE is permitted to remit profits offshore and such remittance does not require any prior approval from the SAFE. Pursuant to the applicable laws and regulations, a foreign invested enterprise, such as CU WFOE, cannot distribute dividends offshore if the losses of previous years have not been covered, but dividends that were not distributed in previous years may be distributed together with those of the current year. Repatriating registered capital offshore, however, is always forbidden during the term of business operation unless the relevant government authority has duly approved the reduction of the registered capital.

Summary of the Offering

The selling stockholders named in this prospectus are offering all of the shares of common stock offered through this prospectus. The selling stockholders are selling shares of common stock covered by this prospectus for their own account.

8

We will not receive any of the proceeds from the sale of these shares. The offering price of $0.015 was determined by the price for certain shares were issued to our shareholders in a private placement issuance in exchange for $300,000 investment, which has been used for the contribution into the capital account of CU WFOE. The offering price of $0.015 is a fixed price at which the selling security holders may sell their shares until our common stock is quoted on the OTCBB, at which time the shares may be sold at prevailing market prices or privately negotiated prices. We have agreed to bear the expenses relating to the registration of the shares for the selling security holders.

The offering will conclude upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) such time as all of the common stock becomes eligible for resale without volume limitations pursuant to Rule 144 under the Securities Act.

There is currently no public market for our securities and you may not be able to liquidate your investment since there is no assurance that a public market will develop for our common stock or that our common stock will ever be approved for trading on a recognized exchange. After this document is declared effective by the U.S. Securities and Exchange Commission, we intend to seek a market maker to apply for a quotation on the OTCBB in the United States. Our shares are not and have not been listed or quoted on any exchange or quotation system. We cannot assure you that a market maker will agree to file the necessary documents with the OTCBB, nor can there be any assurance that such an application for quotation will be approved or that a regular trading market will develop or that if developed, will be sustained. In the absence of a trading market, an investor may be unable to liquidate its investment.

We intend to apply for quoting of our common stock on the OTCBB, which we estimate will cost around $210,000. The breakdown of such costs is estimated as following:

|

Legal Counsel

|

$

|

100,000

|

||

|

Auditor

|

$

|

100,000

|

|

|

|

Other vendors

|

$

|

10,000

|

||

|

Total:

|

$

|

210,000

|

|

We estimate that to maintain a quoting status will cost us $100,000 to $200,000 annually which will include legal and auditing expenses.

We will rely on professional services to carry out this plan, which includes, but is not limited to, a U.S. law firm with corporate and securities practice, a PCAOB registered auditor and consultants. We have engaged the Crone Law Group as our legal counsel. We have engaged Goldman Kurland Mohidin, LLP, as our independent auditor.

To be quoted on the OTCBB, we must engage a market maker to file an application for a trading symbol on our behalf with the Financial Industry Regulatory Authority (“FINRA”). This process may take between three (3) to six (6) months. We plan to engage a market maker after our registration statement is declared effective by the U.S. Securities and Exchange Commission (the “SEC”).

The Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investments. See “Risk Factors” beginning on page 10.

Where You Can Find Us

We presently maintain our principal office at Building 4F, Hesheng Plaza No. 26 Yousheng S Rd, Jinshui District, Zhengzhou, Henan, People’s Republic of China. Our telephone number is +86371-63976529. We maintain a website at www.anhou.com.

9

RISK FACTORS

See “RISK FACTORS” for a discussion of the above factors and certain additional factors that should be considered in evaluating an investment in the common stock.

SUMMARY OF FINANCIAL AND OPERATING INFORMATION

The following selected financial information is derived from the Consolidated Financial Statements appearing elsewhere in this prospectus and should be read in conjunction with the Consolidated Financial Statements, including the notes thereto, appearing elsewhere in this prospectus.

|

Summary of Operations

|

Nine Months Ended

March 31, 2011

|

Nine Months Ended

March 31, 2010

|

||||||

|

(Unaudited)

|

(Unaudited)

|

|||||||

|

Revenues

|

$ | 2,017,128 | $ | 1,011,774 | ||||

|

Net loss

|

$ | (174,946 | ) | $ | (188,035 | ) | ||

|

Net loss per common share (basic and diluted)

|

$ | (0.01 | ) | $ | (0.01 | ) | ||

|

Weighted average common shares outstanding, basic and diluted

|

20,000,000 | 20,000,000 | ||||||

|

Summary of Operations

|

Year Ended

June 30, 2010

|

Year Ended

June 30, 2009

|

||||||

|

(Unaudited Pro Forma)

|

(Unaudited Pro Forma)

|

|||||||

|

Net revenue

|

$ | 2,154,629 | $ | 1,841,008 | ||||

|

Net loss

|

$ | (150,738 | ) | $ | (487,178 | ) | ||

|

Net loss per common share (basic and diluted)

|

$ | (0.01 | ) | $ | (0.02 | ) | ||

|

Weighted average common shares outstanding, basic and diluted

|

20,000,000 | 20,000,000 | ||||||

|

Statement of Financial Position

|

As of

March 31, 2011

|

As of

June 30, 2010

|

||||||

|

(Unaudited)

|

(Unaudited, Pro Forma)

|

|||||||

|

Cash and cash equivalents

|

$ | 1,272,195 | $ | 210,540 | ||||

|

Total assets

|

$ | 1,846,542 | $ | 587,429 | ||||

|

Current Liabilities

|

$ | 1,147,144 | $ | 364,512 | ||||

|

Long-term Liabilities

|

$ | 0 | $ | 0 | ||||

|

Stockholders’ equity

|

$ | 699,398 | $ | 222,917 | ||||

We plan to pay the dividends only when our net income exceeds the total amount due and when the payment will not have a significant impact on our financial position. Our Delaware corporation, China United, has not declared any dividends since its inception on June 4, 2010.

The shares of our common stock being offered for resale by the selling stockholders are highly speculative in nature, involve a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested in the common stock. Before purchasing any of the shares of common stock, you should carefully consider the following factors relating to our business and prospects. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, the trading price of our common stock could decline and you may lose all or part of your investment. This Risk Factors section has addressed all material risks that should be considered in evaluating an investment in the common stock.

10

Risks Relating to Our Business

Our limited operating history, especially our limited experience in distributing property and casualty insurance products may not provide an adequate basis to judge our future prospects and results of operations.

We have a limited operating history. We commenced our insurance intermediary business in 2003 by distributing life insurance products and expanded our offerings to other types of property and casualty insurance products in 2009. We started distributing automobile insurance business in 2010. Life insurance products accounted for 92.7% and 73.57% of our total net revenues in 2009 and 2010, respectively. Property and casualty insurance products accounted for 7.3% and 26.43% of our total net revenues in 2009 and 2010, respectively. While we regard life insurance distribution and property and casualty insurance as two major areas of our future growth strategy, we cannot assure you that our efforts to further develop these businesses will be successful. If our life insurance distribution and property and casualty insurance distribution fail to grow, our future growth will be significantly affected. In addition, our limited operating history, especially our limited experience in selling property and casualty insurance products, may not provide a meaningful basis for you to evaluate our business, financial performance and prospects.

If we fail to attract and retain productive agents, our business could suffer.

Our entire sales of property and casualty insurance products and our entire sales of life insurance products are conducted through our individual sales agents, who are not our employees. Some of these sales agents are significantly more productive than others in generating sales. If we are unable to attract and retain the core group of highly productive sales agents, our business could be materially and adversely affected. Competition for sales personnel from insurance companies and other insurance intermediaries may also force us to increase the compensation of our sales agents, which would increase operating costs and reduce our profitability.

Our business and prospects could be materially and adversely affected if we are not able to manage our growth successfully.

We commenced our insurance intermediary business in 2003 and have expanded our operations substantially in recent years. Our distribution and service networks expanded from one company in one province to two insurance agencies and one brokerage in 3 provinces as of January 31, 2011. Meanwhile, we have broadened our service offerings from the distribution of only life insurance products to cover a wide variety of property and casualty insurance and automobile insurance products. We anticipate continued growth in the future through multiple means. Our expansion has placed, and will continue to place, substantial demands on our managerial, operational, technological and other resources. To manage and support our continued growth, we must continue to improve our operational, administrative, financial and technological systems, procedures and controls, and expand, train and manage our growing employee and agent base. Furthermore, our management will be required to maintain and expand our relationships with insurance companies, other insurance intermediaries, regulators and other third parties. We cannot assure you that our current and planned personnel, systems, procedures and controls will be adequate to support our future operations. Any failure to effectively and efficiently manage our expansion could materially and adversely affect our ability to capitalize on new business opportunities, which in turn could have a material adverse effect on our results of operations.

We may be unsuccessful in identifying and acquiring suitable acquisition candidates, which could adversely affect our growth.

We expect our future growth to come from acquisitions of high-quality independent insurance agencies and brokerages as well as establishment of new insurance agencies and brokerages. There is no assurance that we can successfully identify suitable acquisition candidates, especially in those provinces where we do not yet have a presence. Even if we identify suitable candidates, we may not be able to complete an acquisition on terms that are commercially acceptable to us. In addition, we compete with other entities to acquire high-quality independent insurance agencies and brokerages. Many of our competitors may have substantially greater financial resources than we do and may be able to outbid us for these acquisition targets. If we are unable to complete acquisitions, our growth strategy may be impeded and our earnings or revenue growth may be negatively affected.

11

If we fail to integrate acquired companies efficiently, or if the acquired companies do not perform to our expectations, our business and results of operations may be adversely affected.

Even if we succeed in acquiring other insurance agencies and brokerages, our ability to integrate an acquired entity and its operations is subject to a number of factors. These factors include difficulties in the integration of acquired operations and retention of personnel, especially the sales agents who are not employees of the acquired company, entry into unfamiliar markets, unanticipated problems or legal liabilities, and tax and accounting issues. The need to address these factors may divert management’s attention from other aspects of our business and materially and adversely affect our business prospects. In addition, costs associated with integrating newly acquired companies could negatively affect our operating margins.

Furthermore, the acquired companies may not perform to our expectations for various reasons, including legislative or regulatory changes that affect the insurance products in which a company specializes, the loss of key clients after the acquisition closes, general economic factors that impact a company in a direct way and the cultural incompatibility of an acquired company’s management team with us. If an acquired company cannot be operated at the same profitability level as our existing operations, the acquisition would have a negative impact on our operating margin. Our inability to successfully integrate an acquired entity or its failure to perform to our expectations may materially and adversely affect our business, prospects, results of operations and financial condition.

Because the commission and fee revenue we earn on the sale of insurance products is based on premiums and commission and fee rates set by insurance companies, any decrease in these premiums or commission and fee rates may have an adverse effect on our results of operations.

We are engaged in the insurance agency and brokerage business and derive revenues primarily from commissions and fees paid by the insurance companies whose policies our customers purchase. The commission and fee rates are set by insurance companies and are based on the premiums that the insurance companies charge. Commission and fee rates and premiums can change based on the prevailing economic, regulatory, taxation-related and competitive factors that affect insurance companies. These factors, which are not within our control, include the ability of insurance companies to place new business, underwriting and non-underwriting profits of insurance companies, consumer demand for insurance products, the availability of comparable products from other insurance companies at a lower cost, the availability of alternative insurance products such as government benefits and self-insurance plans, as well as the tax deductibility of commissions and fees and the consumers themselves. In addition, premium rates for certain insurance products, such as the mandatory automobile liability insurance that each automobile owner in the PRC is legally required to purchase, are tightly regulated by China Insurance Regulatory Commission, or the CIRC.

Because we do not determine, and cannot predict, the timing or extent of premium or commission and fee rate changes, we cannot predict the effect any of these changes may have on our operations. Since China’s entry into the WTO in December 2001, intense competition among insurance companies has led to a gradual decline in premium rate levels of some property and casualty insurance products. Although such decline may stimulate demand for insurance products and increase our total sales volume, it also reduces the commissions and fees we earn on each policy sold. Any decrease in premiums or commission and fee rates may significantly affect our profitability. In addition, our budget for future acquisitions, capital expenditures and other expenditures may be disrupted by unexpected decreases in revenues caused by decreases in premiums or commission and fee rates, thereby adversely affecting our operations.

12

Competition in our industry is intense and, if we are unable to compete effectively, we may lose customers and our financial results may be negatively affected.

The insurance intermediary industry in China is highly competitive, and we expect competition to persist and intensify. In insurance product distribution, we face competition from insurance companies that use their in-house sales force and exclusive sales agents to distribute their products, and from business entities that distribute insurance products on an ancillary basis, such as commercial banks, postal offices and automobile dealerships, as well as from other professional insurance intermediaries. We compete for customers on the basis of product offerings, customer services and reputation. Many of our competitors have greater financial and marketing resources than we do and may be able to offer products and services that we do not currently offer and may not offer in the future. If we are unable to compete effectively against those competitors, we may lose customers and our financial results may be negatively affected.

Quarterly and annual variations in our commission and fee revenue may have unexpected impacts on our results of operations.

Our commission and fee revenue is subject to both quarterly and annual fluctuations as a result of the seasonality of our business, the timing of policy renewals and the net effect of new and lost business. Historically, our commission and fee revenue, particularly revenue derived from distribution of life insurance products, for the fourth quarter of any given year has been the highest among all four quarters, while our commission and fee revenue for the first quarter of any given year has been the lowest among all four quarters. The factors that cause the quarterly and annual variations are not within our control. Specifically, consumer demand for insurance products can influence the timing of renewals, new business and lost business, which generally includes policies that are not renewed, and cancellations. As a result, you may not be able to rely on quarterly or annual comparisons of our operating results as an indication of our future performance.

If our contracts with insurance companies are terminated or changed, our business and operating results could be adversely affected.

We primarily act as agents for insurance companies in distributing their products to retail customers. Our relationships with the insurance companies are governed by agreements between us and the insurance companies. See “Business—Insurance Company Partners.” These contracts establish, among other things, the scope of our authority, the pricing of the insurance products we distribute and our fee rates. These contracts typically have a term of one year and will be automatically extended for successive one-year term unless terminated earlier with at least thirty (30) days or sixty (60) days advance notice prior to its expiration.

For the year ended June 30, 2010, our top five insurance company partners, after aggregating the business conducted between our insurance agencies and brokerage firm and the various local branches of the insurance companies, were Taiping Life Insurance Co., Ltd., Sunshine Insurance Group Corporation Limited, Allianz China Life Insurance Co., Ltd., VIVA-COFCO Life Insurance Co., Ltd. and AEGON-CNOOC Life Insurance Co., Ltd. Among them, Taiping Life Insurance Co., Ltd. accounted for 41.39% of our total net revenues from commissions and fees in 2010. The termination of our contracts with insurance companies that in aggregate account for a significant portion of our business, or changes to material terms of these contracts, could adversely affect our business and operating results.

13

Our future success depends on the continuing efforts of our senior management team and other key personnel, and our business may be harmed if we lose their services.

Our future success depends heavily upon the continuing services of the members of our senior management team and other key personnel, in particular Mr. Lo Chung Me, the Chief Executive Officer, Ms. Tsai Shiu Fang, the Chief Financial Officer, Mr. Hsu Wen Yuan, the Chief Marketing Officer, Mr. Hsieh Tung Chi, Chief Operating Officer, and Mr. Chiang Te-Yun, the Chief Technology Officer. If one or more of our senior executives or other key personnel, are unable or unwilling to continue in their present positions, we may not be able to replace them easily, or at all. As such, our business may be disrupted and our financial condition and results of operations may be materially and adversely affected. Competition for senior management and key personnel is intense, the pool of qualified candidates is very limited, and we may not be able to retain the services of our senior executives or key personnel, or attract and retain high-quality senior executives or key personnel in the future. As is customary in the PRC, we do not have insurance coverage for the loss of our senior management team or other key personnel.

In addition, if any member of our senior management team or any of our other key personnel joins a competitor or forms a competing company, we may lose customers, sensitive trade information and key professionals and staff members. Each of our executive officers and key employees has entered into an employment agreement with our consolidated affiliated entities, respectively, which contains confidentiality and non-competition provisions. These agreements generally have an initial term of two years, and may be extended by mutual agreement. See “Management—Employment Agreements” for a more detailed description of the key terms of these employment agreements. If any disputes arise between any of our senior executives or key personnel and us, we cannot assure you of the extent to which any of these agreements may be enforced.

Sales agent and employee misconduct is difficult to detect and deter and could harm our reputation or lead to regulatory sanctions or litigation costs.

Sales agent and employee misconduct could result in violations of law by us, regulatory sanctions, litigation or serious reputational or financial harm. Misconduct could include:

|

|

•

|

making misrepresentation when marketing or selling insurance products to customers;

|

|

|

•

|

hindering insurance applicants from making full and accurate mandatory disclosures or inducing applicants into make misrepresentations;

|

|

|

•

|

hiding or falsifying material information in relation to the insurance contracts;

|

|

|

•

|

fabricating or altering insurance contracts without authorization from relevant parties, selling false policies, or providing false documents on behalf of the applicants;

|

|

|

•

|

falsifying insurance agency business or fraudulently returning insurance policies to obtain commissions;

|

|

|

•

|

colluding with applicants, insured, or beneficiaries to obtain insurance benefits;

|

|

|

•

|

engaging in false claims; or

|

|

|

•

|

otherwise not complying with laws and regulations or our control policies or procedures.

|

We cannot always deter sales agent or employee misconduct, and the precautions we take to prevent and detect these activities may not be effective in all cases. We cannot assure you, therefore, that sales agent or employee misconduct will not lead to a material adverse effect on our business, results of operations or financial condition.

14

All of our personnel engaging in insurance agency or brokering are required under relevant PRC regulations to have a qualification certificate issued by the CIRC. If these qualification requirements are strictly enforced in the future, our business may be materially and adversely affected.

All of our personnel who engage in insurance agency and brokering are required under relevant PRC regulations to obtain a qualification certificate from the CIRC in order to conduct insurance agency or brokering. See “Business —Regulation.” In addition, we understand that the CIRC requires that every individual agent carry the qualification certificate and other credentials showing specific information when conducting agency business. Under the relevant PRC regulations, an insurance agency or brokerage that retains unqualified personnel to engage in insurance intermediary activities may be imposed a fine up to RMB30,000. As of March 31, 2011, approximately 80% of our sales professionals had received a qualification certificate. If more local CIRC agencies were to strictly enforce these regulations in the future, and if a substantial number of our sales forces remain unqualified, our business may be adversely affected. Moreover, we may be subject to fines and other administrative proceedings for the failure of our insurance professionals to obtain the necessary CIRC qualification certificate. Any such fines or administrative proceedings could materially and adversely affect our business, financial condition and results of operations.

Our businesses are highly regulated, and the administration, interpretation and enforcement of the laws and regulations currently applicable to us involve uncertainties, which could materially and adversely affect our business and results of operations.

We operate in a highly regulated industry. The CIRC has extensive authority to supervise and regulate the insurance industry in China. In exercising its authority, the CIRC is given wide discretion, and the administration, interpretation and enforcement of the laws and regulations applicable to us involve uncertainties that could materially and adversely affect our business and results of operations. For example, it is not clear when the CIRC will start strictly enforcing the qualification requirements for sales professionals affiliated with professional insurance intermediaries like us. Although we have not had any material violations to date, we cannot assure you that our operations will always be consistent with the interpretation and enforcement of the laws and regulations by the CIRC from time to time.

Further development of regulations in China may impose additional costs and restrictions on our activities.

China’s insurance regulatory regime is undergoing significant changes. Some of these changes and the further development of regulations applicable to us may result in additional restrictions on our activities or more intensive competition in this industry. For example, under the provisions for administration of professional insurance agencies and brokerages promulgated on September 25, 2009, insurance agencies and brokerage companies are required to increase their guaranty deposit, which generally cannot be withdrawn without the CIRC’s approval, when they open any new branches. Furthermore, pursuant to the provisions, the minimum registered capital requirements for insurance agencies and brokerages have been increased substantially. See “Business—Regulation.” Insurance agencies and brokerages that have been established before October 1, 2009 will be given a three-year phase-in period until October 1, 2012 to meet the new minimum registered capital requirement. Such increase would reduce the amount of cash available for other business purposes. In addition, according to the Insurance Law amended on February 28, 2009, sole-proprietor insurance agencies are now allowed. This change may lead to intensified competition among insurance agencies. Such development of regulations could materially and adversely affect our business and results of operations. In addition, the CIRC issued an Opinion of CIRC on Reforming and Improving the Management System of Insurance Salespersons in September 2010, which requires the insurance companies and insurance intermediaries to build up a clear legal relationship with the insurance salespersons, improve the fundamental protection rights of the insurance salespersons, and encourage the insurance companies and insurance intermediaries to actively explore new models and marketing channels for insurance sales system. As the opinion is relatively new and currently there are no implementation rules, the implementation and interpretation of this opinion may involve substantial uncertainties.

If we fail to maintain an effective system of internal controls over financial reporting, we may not be able to accurately report our financial results or prevent fraud.

After this Registration Statement is declared effective by the SEC we will be subject to reporting obligations under U.S. securities laws. Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 and the related rules adopted by the Securities and Exchange Commission, every public company is required to include a management report on the company’s internal controls over financial reporting in its annual report, which contains management’s assessment of the effectiveness of the company’s internal controls over financial reporting. These requirements will first apply to our annual report on Form 10-K for the fiscal year ending on June 30, 2012.

15

There is no assurance that we will be able to maintain effective internal controls over financial reporting in the future. If we fail to do so, we may not be able to produce reliable financial reports and prevent fraud. Moreover, if we were not able to conclude that we have effective internal controls over financial reporting, investors may lose confidence in the reliability of our financial statements, which would negatively impact the trading price of our shares. Our reporting obligations as a public company, including our efforts to comply with Section 404 of the Sarbanes-Oxley Act, will continue to place a significant strain on our management, operational and financial resources and systems for the foreseeable future.

Any significant failure in our information technology systems could have a material adverse effect on our business and profitability.

Our business is highly dependent on the ability of our information technology systems to timely process a large number of transactions across different markets and products at a time when transaction processes have become increasingly complex and the volume of such transactions is growing rapidly. The proper functioning of our financial control, accounting, customer database, customer service and other data processing systems, together with the communication systems of our various subsidiaries and consolidated affiliated entities and our main offices in Henan, is critical to our business and to our ability to compete effectively. We cannot assure you that our business activities would not be materially disrupted in the event of a partial or complete failure of any of these primary information technology or communication systems, which could be caused by, among other things, software malfunction, computer virus attacks or conversion errors due to system upgrading. In addition, a prolonged failure of our information technology system could damage our reputation and materially and adversely affect our future prospects and profitability.

If we are unable to respond in a timely and cost-effective manner to rapid technological change in the insurance intermediary industry, there may be a resulting adverse effect on business and operating results.

The insurance industry is increasingly influenced by rapid technological change, frequent new product and service introductions and evolving industry standards. For example, the insurance intermediary industry has increased use of the Internet to communicate benefits and related information to consumers and to facilitate information exchange and transactions. We believe that our future success will depend on our ability to continue to anticipate technological changes and to offer additional product and service opportunities that meet evolving standards on a timely and cost-effective basis. There is a risk that we may not successfully identify new product and service opportunities or develop and introduce these opportunities in a timely and cost-effective manner. In addition, product and service opportunities that our competitors develop or introduce may render our products and services uncompetitive. As a result, we can give no assurances that technological changes that may affect our industry in the future will not have a material adverse effect on our business and results of operations.

We face risks related to health epidemics, severe weather conditions and other catastrophes, which could materially and adversely affect our business.

Our business could be materially and adversely affected by the outbreak of avian flu, severe acute respiratory syndrome, or SARS, another health epidemic, severe weather conditions or other catastrophes. In April 2009, influenza A (H1N1), a new strain of flu virus commonly referred to as “swine flu,” was first discovered in North America and quickly spread to other parts of the world, including China. In January and February 2008, a series of severe winter storms afflicted extensive damages and significantly disrupted people’s lives in large portions of southern and central China. In May 2008, an earthquake measuring 8.0 on the Richter scale hit Sichuan province in southwestern China, causing huge casualties and property damages. Because our business operations rely heavily on the efforts of individual sales agents, any prolonged recurrence of avian flu or SARS, or the occurrence of other adverse public health developments such as influenza A (H1N1), severe weather conditions such as the massive snow storms in January and February 2008 and other catastrophes such as the Sichuan earthquake may significantly disrupt our staffing and otherwise reduce the activity level of our work force, thus causing a material and adverse effect on our business operations.

16

Risks Related to Our Corporate Structure

If the PRC government finds that the agreements that establish the structure for operating our China business do not comply with applicable PRC laws and regulations, we could be subject to severe penalties.

PRC laws and regulations place certain restrictions on foreign investment in and ownership of insurance intermediary companies. We conduct our operations in China principally through contractual arrangements among CU WFOE, our consolidated affiliated entity, Henan Law Anhou Insurance Agency Co., Ltd., or Henan Anhou, and the shareholders of Henan Anhou. Henan Anhou directly holds 100% equity interests in one PRC insurance agency and one brokerage. Henan Anhou and these wholly owned subsidiaries of Henan Anhou hold the licenses and permits necessary to conduct our insurance intermediary business in China.

Our contractual arrangements with Henan Anhou, its shareholders enable us to:

|

|

•

|

exercise effective control over Henan Anhou and its subsidiaries;

|

|

|

•

|

receive a substantial portion of the economic benefits of Henan Anhou and its subsidiaries in consideration for the services provided by our wholly-owned subsidiary in China; and

|

|

|

•

|

have an exclusive option to purchase all or part of the equity interests in Henan Anhou when and to the extent permitted by PRC law.

|

Because of these contractual arrangements, we are the primary beneficiary of Henan Anhou and its subsidiaries and have consolidated them into our consolidated financial statements. If we, our consolidated affiliated entity, Henan Anhou or any of the existing and future subsidiaries of Henan Anhou are found to be in violation of any existing or future PRC laws or regulations, or fail to obtain or maintain any of the required permits or approvals, the relevant PRC regulatory authorities, including the CIRC, will have broad discretion in dealing with such violations, including:

|

|

•

|

revoking the business and operating licenses of our PRC subsidiary and consolidated affiliated entities;

|

|

|

•

|

restricting or prohibiting any related-party transactions among our PRC subsidiary and consolidated affiliated entities;

|

|

|

•

|

imposing fines or other requirements with which we, our PRC subsidiary or our consolidated affiliated entities may not be able to comply;

|

|

|

•

|

requiring us, our PRC subsidiary or our consolidated affiliated entities to restructure the relevant ownership structure or operations; or

|

|

|

•

|

restricting or prohibiting us from providing additional funding for our business and operations in China.

|

The imposition of any of these penalties could result in a material and adverse effect on our ability to conduct our business.

17

We rely on contractual arrangements with Henan Anhou and its shareholders for our China operations, which may not be as effective in providing operational control as direct ownership.

We have relied and expect to continue to rely on contractual arrangements with our PRC consolidated affiliated entities, Henan Anhou and its subsidiaries, and its shareholders to operate our business in China. For a description of these contractual arrangements, see “Business—Organizational Structure.” These contractual arrangements may not be as effective in providing us with control over Henan Anhou and its subsidiaries as direct ownership. We have no direct or indirect equity interests in Henan Anhou or any of its subsidiaries.

If we had direct ownership of Henan Anhou and its subsidiaries, we would be able to exercise our rights as a shareholder to effect changes in the board of directors of Henan Anhou and its subsidiaries, which in turn could effect changes, subject to any applicable fiduciary obligations, at the management level. But under the current contractual arrangements, as a legal matter, if Henan Anhou or any of its subsidiaries and shareholders fails to perform its or his obligations under these contractual arrangements, we may have to incur substantial costs and other resources to enforce such arrangements and rely on legal remedies under PRC law, including seeking specific performance or injunctive relief and claiming damages, which may not be effective. For example, if the shareholders of Henan Anhou were to refuse to transfer their equity interest in Henan Anhou to us or our designee when we exercise the call option pursuant to these contractual arrangements, or if they were otherwise to act in bad faith toward us, then we may have to take legal action to compel them to fulfill their contractual obligations.

All of our contractual arrangements with Henan Anhou and its subsidiaries and shareholders are governed by PRC law and provide for the resolution of disputes through arbitration in the PRC. Accordingly, these contracts would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. The legal environment in the PRC is not as developed as in some other jurisdictions, such as the United States. As a result, uncertainties in the PRC legal system could limit our ability to enforce these contractual arrangements. In the event we are unable to enforce these contractual arrangements, we may not be able to exert effective control over our consolidated affiliated entities, and our ability to conduct our business may be negatively affected.

The new PRC Property Rights Law may affect the perfection of the pledge in our equity pledge agreements with our consolidated affiliated entity and its individual shareholders.

Under the equity pledge agreements among CU WFOE and Henan Anhou and its respective individual shareholders, the individual shareholders of Henan Anhou have pledged all of their equity interests in the entity to CU WFOE by recording the pledges on the shareholder registers of the respective entities. However, according to the PRC Property Rights Law, which became effective on October 1, 2007, a pledge is not effective without being registered with the relevant local administration for industry and commerce. The State Administration for Industry and Commerce and Henan Administration for Industry and Commerce have adopted registration procedures with respect to the registration of equity interest pledge according to the Property Rights Law. Anhou is in the process of registering the pledges of their respective equity interests, with the Henan Administration for Industry and Commerce. We cannot assure you that they will be able to register the pledges. If they are unable to do so, the pledges may be deemed ineffective under the PRC Property Rights Law. If any individual shareholder of Henan Anhou breaches his or her obligations under the agreement with CU WFOE, there is a risk that CU WFOE may not be able to successfully enforce the pledge and would need to resort to legal proceedings to enforce its contractual rights.

18

Contractual arrangements we have entered into with Henan Anhou may be subject to scrutiny by the PRC tax authorities. A finding that we owe additional taxes could substantially reduce our consolidated net income and the value of your investment.

Under PRC laws and regulations, arrangements and transactions among related parties may be subject to audit or challenge by the PRC tax authorities. We could face material and adverse tax consequences if the PRC tax authorities determine that the contractual arrangements between our PRC subsidiary and Henan Anhou are not on an arm’s-length basis and adjust the income of Henan Anhou in the form of a transfer pricing adjustment. A transfer pricing adjustment could among other things, result in a reduction, for PRC tax purposes, of expense deductions recorded by Henan Anhou, which could in turn increase their respective tax liabilities. Moreover, the PRC tax authorities may impose penalties on our consolidated affiliated entities for underpayment of taxes. Our consolidated net income may be materially and adversely affected by the occurrence of any of the foregoing.

We may have exposure to greater than anticipated tax liabilities.

We are subject to income tax, business tax and other taxes in many provinces and cities in China and our tax structure is subject to review by various local tax authorities. The determination of our provision for income tax and other tax liabilities requires significant judgment. In the ordinary course of our business, there are many transactions and calculations where the ultimate tax determination is uncertain. Although we believe our estimates are reasonable, the ultimate decisions by the relevant tax authorities may differ from the amounts recorded in our financial statements and may materially affect our financial results in the period or periods for which such determination is made.

PRC regulation of direct investment by offshore holding companies to PRC entities may delay or prevent us from making additional capital contributions to our PRC subsidiary, which could materially and adversely affect our liquidity and our ability to fund and expand our business.

We are an offshore holding company conducting our operations in China through PRC subsidiary and consolidated affiliated entities. In order to provide additional funding to our PRC subsidiary and consolidated affiliated entities, we may make additional capital contributions to our PRC subsidiary.

Any capital contributions we make to our PRC subsidiary, must be approved by the PRC Ministry of Commerce or its local counterparts, and registered with the SAFE or its local counterparts. Such applications and registrations could be time consuming and their outcomes would be uncertain.

We cannot assure you that we will be able to complete the necessary government registrations or obtain the necessary government approvals on a timely basis, if at all, with respect to future capital contributions by us to our PRC subsidiary. If we fail to complete such registrations or obtain such approvals, our ability to capitalize or otherwise fund our PRC operations may be negatively affected, which could adversely and materially affect our liquidity and our ability to fund and expand our business.

Certain acquisition by the consolidated affiliated entity and the intended capital increase are subject to registration and reporting procedures with relevant governmental authorities which involves uncertainty.

The consolidated affiliated entity, Henan Anhou, has executed the share transfer agreements for the acquisition of Jiangsu Law and intends to increase its registered capital to RMB10 million. Pursuant to applicable PRC laws and regulations, the said acquisition is still subject to registration and reporting with the local counterparts of AIC and CIRC which involves uncertainty on when or whether such registration or reporting can be completed. If such registration or reporting could not be completed on time or at all, it may have a negative impact on the operation of our company. For example, if the transfer is not completed, China United would not be able to include the financials of Jiangsu Law in the Company’s consolidated financial statements and would not be able to benefit from the performance of Jiangsu Law.

19

Risks Related to Doing Business in China

Adverse changes in economic and political policies of the PRC government could have a material adverse effect on the overall economic growth of China, which could adversely affect our business.

Substantially all of our business operations are conducted in China. Accordingly, our results of operations, financial condition and prospects are subject to a significant degree to economic, political and legal developments in China. China’s economy differs from the economies of most developed countries in many respects, including with respect to the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the PRC economy has experienced significant growth in the past 30 years or so, growth has been uneven across different regions and among various economic sectors of China. The PRC government has implemented various measures to encourage economic development and guide the allocation of resources. While some of these measures benefit the overall PRC economy, they may also have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations that are applicable to us.

Although the PRC government has implemented measures since the late 1970s emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of improved corporate governance in business enterprises, the PRC government still owns a substantial portion of productive assets in China. In addition, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. The PRC government also exercises significant control over China’s economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Actions and policies of the PRC government could materially affect our ability to operate our business.

Uncertainties with respect to the PRC legal system could adversely affect us.

We conduct our business primarily through our PRC subsidiary and consolidated affiliated entities in China. Our operations in China are governed by PRC laws and regulations. Our PRC subsidiary and consolidated affiliated entities are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to wholly foreign-owned enterprises. The PRC legal system is based on written statutes. Prior court decisions may be cited for reference but have limited precedential value.

Although, since 1979, PRC legislation and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China, China has not developed a fully integrated legal system, and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. In particular, because these laws and regulations are relatively new, and because of the limited volume of published decisions and their nonbinding nature, the interpretation and enforcement of these laws and regulations involve uncertainties. In addition, the PRC legal system is based in part on government policies and internal rules (some of which are not published on a timely basis or at all) that may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until some time after the violation. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

Governmental control of currency conversion may affect the value of your investment.

The PRC government imposes controls on the convertibility of the RMB into foreign currencies and, in certain cases, the remittance of currency out of China. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from the SAFE by complying with certain procedural requirements. But approval from appropriate government authorities is required where RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. Under our current corporate structure, the primary source of our income at the holding company level is dividend payments from our PRC subsidiary. Shortages in the availability of foreign currency may restrict the ability of our PRC subsidiary and our consolidated affiliated entities to remit sufficient foreign currency to pay dividends or other payments to us, or otherwise satisfy their foreign currency denominated obligations. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency needs, we may not be able to pay dividends in foreign currencies to our shareholders.

20

Our global income or the dividends we receive from our PRC subsidiary may be subject to PRC tax under the EIT Law, which could have a material adverse effect on our results of operations.

Under the PRC Enterprise Income Tax Law, or the EIT Law, an enterprise established outside of the PRC with “de facto management bodies” within the PRC is considered a resident enterprise and will be subject to the EIT at the rate of 25% on its worldwide income. The Implementation Rules of the EIT Law, or the Implementation Rules, define the term “de facto management bodies” as “establishments that carry out substantial and overall management and control over the manufacturing and business operations, personnel, accounting, properties, etc. of an enterprise.” The State Administration of Taxation issued the Notice Regarding the Determination of Chinese-Controlled Overseas Incorporated Enterprises as PRC Tax Resident Enterprises on the Basis of De Facto Management Bodies, or SAT Circular 82, on April 22, 2009. SAT Circular 82 provides certain specific criteria, only applicable to overseas registered enterprises controlled by PRC enterprises, not to those controlled by PRC individuals, for determining whether the “de facto management body” of a Chinese-controlled overseas-incorporated enterprise is located in China. However, it’s uncertain whether the State Administration of Taxation would make such criteria set forth in Circular 82 in the future generally applicable to determination of the tax resident status of offshore enterprises, regardless of whether they are controlled by PRC enterprises or individuals. If we are deemed a resident enterprise, we may be subject to the EIT at 25% on our global income, except that the dividends we receive from our PRC subsidiary will be exempt from the EIT to the extent such dividends are deemed as “dividends among qualified PRC resident enterprise.” If we are considered a resident enterprise and earn income other than dividends from our PRC subsidiary, a 25% EIT on our global income could significantly increase our tax burden and materially and adversely affect our cash flow and profitability.

Under the applicable PRC tax laws in effect before January 1, 2008, dividend payments to foreign investors made by foreign-invested enterprises in China, were exempt from PRC withholding tax. Pursuant to the EIT Law and the Implementation Rules, however, dividends payable by a foreign-invested enterprise in China to its foreign investors will be subject to a 10% withholding tax, unless any such foreign investor’s jurisdiction of incorporation has a tax treaty with China that provides for a different withholding arrangement. Hong Kong, where our wholly-owned subsidiary and the 100% shareholder of CU WFOE is incorporated, has such tax treaty with China. Under the EIT Law and the Implementation Rules, if we are regarded as a resident enterprise, the dividends we receive from our PRC subsidiary will be exempt from the EIT, because such dividend income and other distributions with respect to equity interests derived by a PRC resident enterprise from direct investment in another PRC resident enterprise is exempted under the EIT Law. If, however, we are not regarded as a resident enterprise, our PRC subsidiary will be required to pay a 5% withholding tax for any dividends they pay to us subject to applicable PRC laws and regulations. As a result, the amount of fund available to us to meet our cash requirements, including the payment of dividends to our shareholders, could be materially reduced.

Under the EIT Law, dividends payable by us and gains on the disposition of our shares could be subject to PRC taxation.

Because there remains uncertainty regarding the interpretation and implementation of the EIT Law and its Implementation Rules, it is uncertain whether any dividends to be distributed by us, if we are regarded as a PRC resident enterprise, to our non-PRC corporate shareholders would be subject to any PRC withholding tax. If we are required under the EIT Law to withhold PRC income tax on our dividends payable to our non-PRC corporate shareholders, or if gains on the disposition of our shares are subject to the PRC EIT, your investment in our ordinary shares may be materially and adversely affected.

21

We rely principally on dividends and other distributions on equity paid by our subsidiary to fund any cash and financing requirements we may have, and any limitation on the ability of our subsidiary to make payments to us could have a material adverse effect on our ability to conduct our business.

We are a holding company, and we rely principally on dividends from our PRC subsidiary in China and service, license and other fees paid to our PRC subsidiary by our consolidated affiliated entities for our cash requirements, including any debt we may incur. Current PRC regulations permit our PRC subsidiary to pay dividends to us only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, our PRC subsidiary is required to set aside at least 10% of its after-tax profits each year as reported in its PRC statutory financial statements, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital, and our PRC subsidiary that is considered foreign-invested enterprises is required to further set aside a portion of its after-tax profits as reported in its PRC statutory financial statements to fund the employee welfare fund at the discretion of the board. These reserves are not distributable as cash dividends. Furthermore, if our PRC subsidiary and consolidated affiliated entities in China incur debt on their own behalf in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments to us. In addition, the PRC tax authorities may require us to adjust our taxable income under the contractual arrangements we currently have in place in a manner that would materially and adversely affect our subsidiary’s ability to pay dividends and other distributions to us. Any limitation on the ability of our subsidiary and consolidated affiliated entities to distribute dividends or other payments to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our businesses, pay dividends, or otherwise fund and conduct our business.

Fluctuation in the value of the RMB may have a material adverse effect on your investment.

The value of the RMB against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions. On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the RMB to the U.S. dollar. Under the new policy, the RMB is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy has resulted in an approximately 19.5% appreciation of the RMB against the U.S. dollar between July 21, 2005 and April 15, 2011. However, under the current global financial and economic conditions, it is impossible to predict with any certainty how the RMB will move vis-à-vis the U.S. dollar in the near future.

Our revenues and costs are mostly denominated in the RMB, and a significant portion of our financial assets are also denominated in RMB. We rely entirely on dividends and other fees paid to us by our subsidiary and consolidated affiliated entities in China. Any significant appreciation or depreciation of the RMB against the U.S. dollar may affect our cash flows, revenues, earnings and financial position, and the value of, and any dividends payable on, our ordinary shares in U.S. dollars. For example, a further appreciation of the RMB against the U.S. dollar would make any new RMB-denominated investments or expenditures more costly to us, to the extent that we need to convert U.S. dollars into the RMB for such purposes. An appreciation of the RMB against the U.S. dollar would also result in foreign currency translation losses for financial reporting purposes when we translate our U.S. dollar denominated financial assets into the RMB, as the RMB is our reporting currency. Conversely, a significant depreciation of the RMB against the U.S. dollar may significantly reduce the U.S. dollar equivalent of our reported earnings, and may adversely affect the price of our shares.

22

The PRC Labor Contract Law and its implementing rules may adversely affect our business and results of operations.

On June 29, 2007, the Standing Committee of the National People’s Congress of China promulgated the Labor Contract Law, which became effective on January 1, 2008. On September 18, 2008, the State Council promulgated the implementing rules for the Labor Contract Law, which became effective upon adoption. This new labor law and its implementing rules have reinforced the protection for employees, who, under the existing PRC Labor Law, already have certain rights, such as the right to have written labor contracts, the right to enter into labor contracts with indefinite terms under specific circumstances, the right to receive overtime wages when working overtime, and the right to terminate in the labor contracts. In addition, the Labor Contract Law and its implementing rules have made some amendments to the existing PRC Labor Law and added some clauses that could increase cost of labor to employers. As the Labor Contract Law and its implementing rules are relatively new, there remains significant uncertainty as to their interpretation and application by the PRC government authorities. In the event that we decide to significantly reduce our workforce, the Labor Contract Law and its implementing rules could adversely affect our ability to effect these changes cost-effectively or in the manner we desire, which could lead to a negative impact on our business and results of operations.

We may have difficulty establishing adequate management, legal and financial controls in the people’s republic of China.