Attached files

Table of Contents

As filed with the Securities and Exchange Commission on August 5, 2011

Registration No. 333-175126

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

BLUEARC CORPORATION

(Exact name of Registrant as specified in its charter)

| Delaware | 3572 | 77-0526726 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

50 Rio Robles

San Jose, California 95134

(408) 576-6600

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Michael B. Gustafson

President and Chief Executive Officer

BlueArc Corporation

50 Rio Robles

San Jose, California 95134

(408) 576-6600

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Copies to:

| Michael J. Danaher, Esq. Julia Reigel, Esq. Wilson Sonsini Goodrich & Rosati Professional Corporation 650 Page Mill Road Palo Alto, California 94304 (650) 493-9300 |

Martin A. Wellington, Esq. Davis Polk & Wardwell LLP 1600 El Camino Real Menlo Park, California 94025 (650) 752-2000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | |||

| Non-accelerated filer x | (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

The Registrant hereby amends this Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a) may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated August 5, 2011

shares

Common stock

This is the initial public offering of our common stock of BlueArc Corporation. We are offering shares of common stock.

Prior to this offering, there has been no public market for our common stock. We expect the initial public offering price of our common stock will be between $ and $ per share. We expect to apply to list our common stock on either The NASDAQ Global Market or The New York Stock Exchange under the symbol “BLRC.”

Investing in our common stock involves risks. See “Risk Factors ” beginning on page 12.

| Price to public | Underwriting discounts and commissions |

Proceeds to BlueArc Corporation |

||||||||||

| Per Share |

$ | $ | $ | |||||||||

| Total |

$ | $ | $ | |||||||||

|

|

||||||||||||

The underwriters have an option to purchase up to additional shares of common stock from us to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on , 2011.

| J.P. Morgan | BofA Merrill Lynch | Credit Suisse | ||

| William Blair & Company | ||||

| Pacific Crest Securities | ThinkEquity LLC | |||

The date of this prospectus is , 2011.

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 7 | ||||

| 9 | ||||

| 12 | ||||

| Special note regarding forward-looking statements and industry data |

40 | |||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 44 | ||||

| 46 | ||||

| Management’s discussion and analysis of financial condition and results of operations |

49 | |||

| 80 | ||||

| 101 | ||||

| 111 | ||||

| 135 | ||||

| 143 | ||||

| 146 | ||||

| 151 | ||||

| Material United States federal income tax and estate tax consequences to non-U.S. holders |

154 | |||

| 158 | ||||

| 168 | ||||

| 168 | ||||

| 168 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus or to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

-i-

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all the information you should consider in making your investment decision. You should read this summary together with the more detailed information, including our consolidated financial statements and the related notes, elsewhere in this prospectus. You should carefully consider, among other things, the matters discussed in “Risk factors” beginning on page 12. Unless the context otherwise requires, we use the terms “BlueArc,” “we,” “us” and “our” in this prospectus to refer to BlueArc Corporation and its subsidiaries.

Overview

We are a leading provider of high performance, highly scalable networked storage systems for businesses of all sizes. Our storage systems deliver the levels of performance, scalability, versatility and simplicity required to cost effectively manage the rapid growth of unstructured data, such as email,business documents, web pages, digital images, audio and video, making them particularly suited for data-intensive applications such as server and desktop virtualization and cloud-based computing. Document retention and access requirements of regulatory compliance are also driving rapid growth of unstructured data. The need to manage and access unstructured data at scale has resulted in the demand for next-generation storage systems that minimize the complexities and overcome the performance limitations of existing storage systems. Our storage systems leverage our proprietary file system and flexible architecture to meet the needs of today’s most demanding applications and to manage unstructured data at scale. We enable our customers to more effectively explore, discover, research, create, process and innovate in performance sensitive and data intensive environments.

Our storage systems minimize the complexities and overcome the performance limitations of existing networked storage systems. We enable our customers to address storage bottlenecks and accelerate processes to achieve their critical business goals, such as enhanced revenue generation and improved service offerings. Our massively parallel architecture is highly scalable and delivers sustained performance under increased workloads, unlike competing storage systems. Our storage systems combine our servers with our advanced, proprietary software suite, and use standard interfaces and multiple tiers of efficient enterprise-class storage devices to provide a wide variety of system configurations to our customers. We also sell our servers independently as a gateway solution that can be deployed in storage environments to enable file services for easier data sharing, simplified management, server and desktop virtualization and improved functionality. Our storage systems are deployed throughout a wide range of organizations, from global businesses to small organizations with a single location. Our diverse customer base includes organizations in industries such as media and entertainment, electronic discovery for litigation, or e-Discovery, energy, the federal government, life sciences, Internet and cloud hosted service providers and other enterprises. As of April 30, 2011, over 750 customers worldwide have deployed over 2,000 of our storage systems.

According to IDC, an independent research firm, the network attached storage, or NAS, and Internet small computer system interface storage area network, or iSCSI SAN, markets are expected to grow from $8.1 billion in 2010 to $12.0 billion in 2014, representing a 10.2% compound annual growth rate, or CAGR. We believe that our networked storage systems address multiple end markets in light of the proliferation of unstructured data, the growing need to

-1-

Table of Contents

manage it at scale and the continuing shift to Internet Protocol networking. In addition, we believe that the Fibre Channel connectivity of our platform enables us to address the migration and transition away from Fibre Channel to next-generation storage systems that are optimized for unstructured data and file-based applications. We sell our storage systems through multiple channels; which include our direct sales force, our extensive network of channel partners and a global original equipment manufacturer, or OEM, agreement with Hitachi Data Systems Corporation, or HDS.

In fiscal 2009, fiscal 2010, fiscal 2011 and the three months ended April 30, 2011, we had total revenue of $74.2 million, $65.9 million, $85.6 million and $24.7 million, respectively. In fiscal 2009, fiscal 2010, fiscal 2011 and the three months ended April 30, 2011, we incurred net losses of $19.6 million, $15.8 million, $9.4 million and $4.3 million, respectively.

Industry background

The amount of data used by businesses of all sizes globally is growing rapidly. IDC predicts that between 2009 and 2020, the amount of digital data in customer sites will grow to 44 times what it was in 2010—growing to 35 billion terabytes. Businesses are focusing on leveraging highly scalable, high performance file systems and related storage infrastructure that seamlessly scale as they seek to organize, manage, access and analyze growing amounts of data. In recent years, unstructured data has become increasingly critical to businesses. In addition, system capabilities such as high scalability and parallel processing, once required only for specific high performance computing, or HPC, applications such as genomics, have become increasingly common for a wide variety of businesses. The growth in unstructured data, combined with advanced networking capabilities, increased disk capacities, improved computer processing capabilities and server and desktop virtualization have resulted in the need for next-generation data center technologies uniquely architected to meet the needs of today’s most demanding applications.

Key trends affecting growing data center environments

Proliferation of unstructured data. The long-term storage and management of unstructured data poses a significant challenge for businesses as the amount of unstructured data has grown exponentially, the commercial value of that data has increased and the need to store and access it for long periods continues. IDC estimates that worldwide enterprise storage capacity shipped for traditional unstructured data is expected to grow from 3,924 petabytes in 2010 to 22,930 petabytes in 2014, representing a CAGR of 55.5%. Unlike structured data, which is typically stored in databases, unstructured data is stored in file systems. The proliferation of unstructured data is driving a need for next-generation file systems and the related storage infrastructure that are high performance, flexible and scalable to manage, move, protect and deliver growing amounts of unstructured data for businesses and consumers.

Growing performance demands. Mainstream businesses and organizations are increasingly requiring high performance, highly scalable storage systems that were previously only needed for HPC environments. At the same time, the storage system requirements to support HPC applications continue to increase. Growing performance burdens on storage infrastructure also result from greater numbers of files, concurrent users, demands for faster response times, increased sharing of data and the proliferation of server and desktop virtualization.

-2-

Table of Contents

Focusing on reduced complexity and leveraging existing infrastructure. Many organizations have deployed multiple disparate storage systems over time as their data needs have grown. This has resulted in overly complex infrastructure that is difficult and expensive to manage. To address these difficulties, businesses increasingly demand solutions that provide open architectures, are highly scalable and are interoperable with their existing data center deployments, enabling them to leverage significant existing infrastructure investments.

Increasing use of virtualization technologies. Increased adoption of server and desktop virtualization technologies has resulted in data center environments with dynamic storage requirements. Server virtualization technologies enable an administrator to use a software application to divide one physical server into multiple virtual servers, enabling multiple operating systems to run simultaneously on the same computer. Desktop virtualization environments provide multiple users with desktop, processing and storage capabilities on a remote central server instead of on a local computer. Adoption of server virtualization technologies and consolidation of data center resources has resulted in independent storage resources becoming siloed. This drives demand for solutions that enable the consolidation and centralization of these siloed storage pools. Increased use of server and desktop virtualization technologies within data centers has also resulted in an exponential increase in requirements for high input output operations per second, or IOPs, to support simultaneous operations of a large number of virtual desktops, such as having multiple users log in at the same time, and highly unpredictable traffic patterns within data centers.

Accelerating adoption of cloud-based architectures. The proliferation of cloud-based architectures, or architectures that enable the delivery of hosted on-demand services over the Internet, and data has resulted in the rapid growth of large data centers that require highly scalable networked storage with centralized management. The requirements of on-demand storage in cloud-based architectures are driving the need for storage technologies that deliver high efficiency across the storage infrastructure. To increase cost efficiency, storage architectures are increasingly incorporating tiering, which automatically routes and stores data in different storage media based on administrator-defined policies. Using cloud-based storage as one tier of the architecture reduces the cost of storing data. Many existing data center deployments are not optimized for current volumes of data and traffic or for the interoperability to offload data to a cloud-based tier of storage, making them difficult to scale and operate cost effectively.

Increasing focus on minimizing total cost of ownership. To stay competitive, businesses have increasingly focused on lowering their operating costs, particularly information technology infrastructure costs. Managing information technology infrastructure costs has also become increasingly complex as the rapid adoption of applications has competed with the need to manage mixed workloads across a shared network infrastructure environment.

We believe that existing storage systems do not fully address key requirements of businesses in today’s environment because they were not originally architected to address the scale of and broad prevalence of unstructured data. Existing storage systems lack the performance and scalability to address the diversity of applications and the size of data sets that are now being generated across distributed storage resources.

Our networked storage systems

We provide industry leading storage systems that leverage our proprietary file system, SiliconFS, and flexible architecture to deliver intelligent data management functionality for our customers.

-3-

Table of Contents

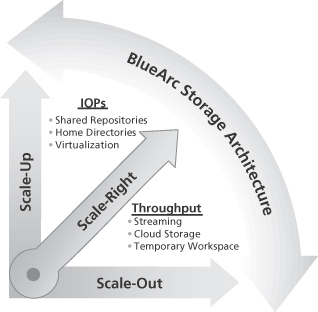

Our massively parallel architecture is designed to overcome the data network bottlenecks created by existing storage systems and deliver superior performance across diverse workloads without sacrificing scalability, storage bandwidth, functionality, or overall capacity. Through our intelligent file system architecture, we enable our customers to scale their infrastructure up, or enable higher performance out of a single storage system, and scale their infrastructure out, or enable multiple servers to be deployed seamlessly across data centers to meet continually changing business and application requirements. Our intelligent file system architecture enables our customers to scale-right, or scale each of these attributes independently to their specific needs, and to run intensive data management applications seamlessly without burdening the performance of overall storage infrastructure.

Our massively parallel architecture and highly scalable storage systems leverage a combination of standard field programmable gate arrays, or FPGAs, as an offload engine for high speed data transfer and multi-core processors for intensive data management functions. This architecture, combined with SiliconFS, allows us to deliver the following benefits to customers:

Management of unstructured data at scale. Our storage systems allow for the intelligent management of applications in data intensive environments and allow our customers to add storage systems, applications and data management features seamlessly without sacrificing performance or functionality. We believe our storage systems provide the most scalable solution in our product class, with the highest performance, as measured in IOPs, storage capacity up to 16 petabytes in a single system, throughput up to 1.5 gigabytes per second and the ability to configure clusters of up to eight servers. We also enable our customers to scale each of these attributes independently, significantly reducing the potential for underutilization of resources.

Ability to reduce complexity. Our storage systems are often deployed as a consolidation platform for networked storage environments, reducing complexity and cost by eliminating excess storage systems. Our storage systems serve as an ideal platform for the consolidation of applications, such as email, databases and home directories, as well as SAN and NAS on the same storage system and allow different users, applications, protocols and performance requirements to share storage resources. Our storage systems also enable traditionally siloed pools of storage to be viewed and managed through our single cluster namespace, which enables a user to view clusters of multiple servers and file systems as if they are a single coherent unit. We architected our storage systems to be easily integrated into our customers’ data centers to simplify the integration and management of our storage systems.

Optimized for virtual environments. Our architecture is ideally suited for large scale virtualized server and desktop environments because it delivers high levels of predictable performance for unpredictable workloads. In addition, our proprietary technology provides the ability to instantly create space-efficient, writeable copies of files for use in a wide variety of environments and run multiple simulations with large-scale data sets. This allows administrators to quickly deploy many new virtual machines without consuming additional disk storage space.

Support for cloud-based environments. Our storage systems allow our customers to easily scale their storage solutions, applications and data management features without sacrificing performance, making our storage systems optimal for cloud-based environments. In addition, our customers benefit from our storage systems’ predictable performance across a variety of complex workloads such as those associated with hosted security, storage and software models. Our open

-4-

Table of Contents

architecture provides and supports interoperability with cloud-based tiers of storage, allowing customers to seamlessly offload noncritical data to locations hosted offsite in public and private clouds.

Low total cost of ownership. We believe our storage systems enable our customers to achieve higher usable capacity per server and lower overall total cost of ownership. Our customers are able to realize cost savings and higher efficiencies from using fewer servers, smaller physical data center space, less power and fewer administrators. In addition, our platform is based on our open architecture, which supports interoperability within data center environments, enabling our customers to leverage their significant investments in existing infrastructure to achieve higher returns on investment and faster payback periods.

Our strategy

Our objective is to be the leading networked storage system vendor providing solutions to solve the challenges businesses face in managing unstructured data at scale. Key elements of our strategy include:

| • | Extending our technology leadership and product breadth by leveraging our massively parallel architecture and file system; |

| • | Continuing to deepen and expand our customer relationships and vertical market penetration through leveraging our proven high performance technology and our diverse routes to market; |

| • | Continuing to expand our routes to market, including direct and channel distribution, to maximize our reach to customers; and |

| • | Broadening our technology partnerships with infrastructure vendors, application vendors and storage suppliers by leveraging our existing platform. |

Risk factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described in “Risk Factors” below together with all the other information contained in this prospectus, including the following:

| • | We have a history of losses, and we may not be able to achieve or sustain consistent profitability in the future. |

| • | We must continue to expand our routes to market and maintain adequate support for our partners and customers. If we fail to do so, our revenue may suffer, our relationships with our partners could be harmed and sales of our storage systems could decline. |

| • | If we do not timely develop and introduce new products and technologies, we may be unable to grow our customer base and our business. |

| • | We have experienced rapid growth in recent periods and we may not be able to sustain or manage any future growth effectively. If we fail to manage our growth effectively, we may be unable to execute our business plan, sell our storage systems and services successfully and adequately address competitive challenges. As a result, our financial performance may suffer. |

-5-

Table of Contents

| • | We are dependent on our relationship with HDS for a substantial portion of our revenue, and any disruption in this relationship, including competition from HDS, could adversely affect our ability to sell our storage systems and achieve our revenue forecasts and we may be unable to sell excess inventory that was intended to be sold to HDS. |

| • | If we are unable to maintain or extend our relationships with our current customers, establish new customer relationships and additional strategic partners or to increase the diversification of our current customer base and strategic partners, our growth may be limited and our revenue could decline. |

| • | The market for our storage systems is highly competitive and dominated by larger companies with significantly greater resources than us. If we are unable to compete effectively, we may experience decreased sales or pricing pressure, which would adversely impact our operating results. |

Corporate information

We were founded in 1998 in Bracknell, England. In 1999, we relocated our corporate headquarters to San Jose, California and incorporated as a Delaware corporation under the name Synaxia Networks Inc. We changed our name to BlueArc Corporation in January 2001. Our principal executive offices are located at 50 Rio Robles, San Jose, California 95134. Our telephone number is (408) 576-6600. Our website address is www.bluearc.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus.

“BlueArc,” “Titan,” “Mercury,” “SiliconFS,” “JetCenter,” “JetClone,” “Data Migrator,” our logo and other trademarks or service marks of BlueArc appearing in this prospectus are the property of BlueArc Corporation. This prospectus contains additional trade names, trademarks and service marks of other companies. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

-6-

Table of Contents

| Common stock offered by BlueArc |

shares |

| Over-allotment option |

shares |

| Common stock to be outstanding after this offering |

shares |

| Use of proceeds |

We intend to use the net proceeds from this offering for working capital and other general corporate purposes including research and development and the expansion of our storage systems to serve other high growth data intensive markets. We may also use part of the net proceeds to develop technology partnerships and to acquire other businesses, products or technologies. However, we do not have agreements or commitments for any specific partnerships or acquisitions at this time. |

| Proposed symbol |

BLRC |

The number of shares of our common stock to be outstanding following this offering is based on 43,366,170 shares of our common stock outstanding as of July 30, 2011, which excludes:

| • | 9,071,435 shares of common stock issuable upon exercise of options outstanding as of July 30, 2011 at a weighted average exercise price of $1.71 per share; |

| • | 749,845 shares of common stock reserved as of July 30, 2011 for future grant under our 2000 Stock Plan, or our 2000 Plan; |

| • | shares of common stock reserved for future issuance under our 2011 Equity Incentive Plan, or our 2011 Plan, that will become effective on the effective date of the registration statement of which this prospectus is a part; |

| • | 1,073,447 shares of common stock reserved for issuance upon the exercise of outstanding warrants as of July 30, 2011, at a weighted average exercise price of $2.68 per share; and |

| • | 320,393 shares of common stock reserved for issuance upon the exercise of outstanding warrants as of July 30, 2011, at a weighted average exercise price of $2.53 per share that will be net exercised for shares of common stock, based on an assumed initial public offering price of $ per share, which is the midpoint of the range of the initial public offering price listed on the cover page of this prospectus. |

Unless otherwise indicated, this prospectus reflects and assumes the following:

| • | the automatic conversion of each outstanding share of our preferred stock into one share of common stock (excluding conversion of our Series CC and Series EE preferred stock) upon the closing of the offering; |

-7-

Table of Contents

| • | the automatic conversion of each outstanding share of our Series CC preferred stock into 11.80684 shares of common stock upon the closing of the offering; |

| • | the automatic conversion of each outstanding share of our Series EE preferred stock into 1.02268 shares of common stock upon the closing of the offering; |

| • | the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws immediately prior to the closing of this offering; and |

| • | no exercise of the underwriters’ over-allotment option. |

-8-

Table of Contents

Summary condensed consolidated financial data

We derived the summary condensed consolidated statements of operations data for the fiscal years ended January 31, 2009, January 30, 2010 and January 29, 2011 from our audited consolidated financial statements and related notes included elsewhere in this prospectus. The condensed consolidated statements of operations data for the three months ended May 1, 2010 and April 30, 2011 and the condensed consolidated balance sheet data as of April 30, 2011, are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The unaudited consolidated financial statements have been prepared on the same basis as the audited consolidated financial statements and include, in our opinion, all adjustments, which include only normal recurring adjustments, that we consider necessary for the fair presentation of the financial information set forth in those financial statements. Historical results are not necessarily indicative of future results. The summary of our consolidated financial data set forth below should be read together with our consolidated financial statements and the accompanying notes to those statements, as well as “Selected consolidated financial data” and “Management’s discussion and analysis of financial condition and results of operations,” appearing elsewhere in this prospectus.

| Year ended | Three months ended | |||||||||||||||||||

| January 31, 2009 |

January 30, 2010 |

January 29, 2011 |

May 1, 2010 |

April 30, 2011 |

||||||||||||||||

|

|

||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Consolidated statements of operations data: |

||||||||||||||||||||

| Product revenue |

$ | 59,864 | $ | 49,523 | $ | 66,550 | $ | 14,103 | $ | 19,596 | ||||||||||

| Support revenue |

14,366 | 16,352 | 19,039 | 4,511 | 5,116 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenue |

74,230 | 65,875 | 85,589 | 18,614 | 24,712 | |||||||||||||||

| Cost of product revenue |

32,179 | 29,709 | 34,627 | 7,546 | 9,938 | |||||||||||||||

| Cost of support revenue |

3,483 | 4,570 | 6,184 | 1,395 | 1,815 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total cost of revenue(1) |

35,662 | 34,279 | 40,811 | 8,941 | 11,753 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

38,568 | 31,596 | 44,778 | 9,673 | 12,959 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Sales and marketing(1) |

33,759 | 28,540 | 32,068 | 7,868 | 9,327 | |||||||||||||||

| Research and development(1) |

18,274 | 13,783 | 16,410 | 3,775 | 4,966 | |||||||||||||||

| General and administrative(1) |

5,659 | 4,868 | 5,277 | 1,464 | 1,614 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

57,692 | 47,191 | 53,755 | 13,107 | 15,907 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(19,124 | ) | (15,595 | ) | (8,977 | ) | (3,434 | ) | (2,948 | ) | ||||||||||

| Interest income |

260 | 24 | 15 | — | 2 | |||||||||||||||

| Interest expense |

(237 | ) | (1,065 | ) | (1,317 | ) | (339 | ) | (284 | ) | ||||||||||

| Other expense, net |

(1,359 | ) | (389 | ) | (566 | ) | (136 | ) | (1,552 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before income taxes |

(20,460 | ) | (17,025 | ) | (10,845 | ) | (3,909 | ) | (4,782 | ) | ||||||||||

| Benefit from income taxes |

882 | 1,272 | 1,420 | 324 | 453 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (19,578 | ) | $ | (15,753 | ) | $ | (9,425 | ) | $ | (3,585 | ) | $ | (4,329 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

||||||||||||||||||||

-9-

Table of Contents

| Year ended | Three months ended | |||||||||||||||||||

| January 31, 2009 |

January 30, 2010 |

January 29, 2011 |

May 1, 2010 |

April 30, 2011 |

||||||||||||||||

|

|

||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Deemed dividend on exchange of preferred stock |

— | — | (940 | ) | — | — | ||||||||||||||

| Net loss attributable to common stockholders |

$ | (19,578 | ) | $ | (15,753 | ) | $ | (10,365 | ) | $ | (3,585 | ) | $ | (4,329 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss per share attributable to common stockholders, basic and diluted |

$ | (8.74 | ) | $ | (6.55 | ) | $ | (3.54 | ) | $ | (1.47 | ) | $ | (1.25 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Shares used in computing net loss per share attributable to common stockholders, basic and diluted |

2,241 | 2,404 | 2,930 | 2,438 | 3,465 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pro forma net loss per share, basic and diluted (unaudited)(2) |

$ | (0.24 | ) | $ | (0.06 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Shares used in computing pro forma net loss per share attributable to common stockholders, basic and diluted (unaudited)(2) |

39,363 | 43,284 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Year ended | Three months ended | |||||||||||||||||||

| January 31, 2009 |

January 30, 2010 |

January 29, 2011 |

May 1, 2010 |

April 30, 2011 |

||||||||||||||||

| (in thousands, unaudited) | ||||||||||||||||||||

| Other financial data: |

||||||||||||||||||||

| Adjusted EBITDA(3) |

$ | (14,875 | ) | $ | (10,739 | ) | $ | (5,146 | ) | $ | (2,514 | ) | $ | (1,546 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| As of April 30, 2011 | ||||||||||||

| Actual | Pro forma(4) | Pro forma as adjusted(5)(6) |

||||||||||

|

|

||||||||||||

| (in thousands, unaudited) | ||||||||||||

| Consolidated balance sheet data: |

||||||||||||

| Cash and cash equivalents |

$ | 16,084 | $ | 16,084 | $ | |||||||

| Working capital |

12,187 | 12,187 | ||||||||||

| Total assets |

57,646 | 57,646 | ||||||||||

| Total debt and capital lease obligations |

7,481 | 7,481 | ||||||||||

| Total liabilities |

48,022 | 44,420 | ||||||||||

| Convertible preferred stock |

121,699 | — | ||||||||||

| Common stock and additional paid-in-capital |

117,094 | 242,395 | ||||||||||

| Total stockholders’ equity (deficit) |

(112,075 | ) | 13,226 | |||||||||

|

|

||||||||||||

| (1) | Includes stock-based compensation expense as follows: |

| Year ended | Three months ended | |||||||||||||||||||

| January 31, 2009 |

January 30, 2010 |

January 29, 2011 |

May 1, 2010 |

April 30, 2011 |

||||||||||||||||

|

|

||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Cost of revenue |

$ | 51 | $ | 67 | $ | 44 | $ | 9 | $ | 11 | ||||||||||

| Sales and marketing |

498 | 610 | 476 | 86 | 116 | |||||||||||||||

| Research and development |

282 | 366 | 254 | 69 | 62 | |||||||||||||||

| General and administrative |

387 | 366 | 343 | 115 | 132 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total stock-based compensation expense |

$ | 1,218 | $ | 1,409 | $ | 1,117 | $ | 279 | $ | 321 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

||||||||||||||||||||

| (2) | Pro forma weighted average shares outstanding reflects the conversion of our convertible preferred stock (using the if-converted method) into common stock as though the conversion had occurred at the beginning of the period or original date of issuance, if later. |

-10-

Table of Contents

| (3) | We present Adjusted EBITDA, which we define as net loss excluding: |

| • | benefit from income taxes; |

| • | other income (expense), net; |

| • | interest expense; |

| • | interest income; |

| • | stock-based compensation; and |

| • | depreciation and amortization. |

Adjusted EBITDA is a financial measure that is not calculated in accordance with generally accepted accounting principles, or GAAP. We exclude other income (expense), net from Adjusted EBITDA as it largely consists of mark to market and other expenses related to our warrants and foreign currency gain or losses. Gains from nonrecurring engineering projects included in other income (expense), net are all excluded from other income (expense), net when calculating Adjusted EBITDA. We have provided a reconciliation of Adjusted EBITDA, a non-GAAP financial measure, to net loss, the most directly comparable financial measure calculated and presented in accordance with GAAP. Adjusted EBITDA should not be considered as an alternative to net loss, operating income or any other measure of financial performance calculated and presented in accordance with GAAP. Our Adjusted EBITDA may not be comparable to similarly titled measures of other organizations because other organizations may not calculate Adjusted EBITDA in the same manner as we do. We have included Adjusted EBITDA in this prospectus because it is a basis upon which our management assesses financial performance and it eliminates the impact of items that we do not consider indicative of our core operating performance. In evaluating Adjusted EBITDA, you should be aware that in the future we will incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or nonrecurring items.

We reconcile net loss to Adjusted EBITDA as follows:

| Year ended | Three months ended | |||||||||||||||||||

| January 31, 2009 |

January 30, 2010 |

January 29, 2011 |

May 1, 2010 |

April 30, 2010 |

||||||||||||||||

|

|

||||||||||||||||||||

| (in thousands, unaudited) | ||||||||||||||||||||

| Net loss |

$ | (19,578 | ) | $ | (15,753 | ) | $ | (9,425 | ) | $ | (3,585 | ) | $ | (4,329 | ) | |||||

| Benefit from income taxes |

(882 | ) | (1,272 | ) | (1,420 | ) | (324 | ) | (453 | ) | ||||||||||

| Other expense, net |

1,359 | 389 | 566 | 136 | 1,832 | |||||||||||||||

| Interest expense |

237 | 1,065 | 1,317 | 339 | 284 | |||||||||||||||

| Interest income |

(260 | ) | (24 | ) | (15 | ) | — | (2 | ) | |||||||||||

| Stock-based compensation |

1,218 | 1,409 | 1,117 | 279 | 321 | |||||||||||||||

| Depreciation and amortization |

3,031 | 3,447 | 2,714 | 641 | 801 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | (14,875 | ) | $ | (10,739 | ) | $ | (5,146 | ) | $ | (2,514 | ) | $ | (1,546 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

||||||||||||||||||||

| (4) | The pro forma consolidated balance sheet data in the table above gives effect to the automatic conversion of all of our outstanding convertible preferred stock into common stock upon the closing of this offering, assuming that our Series CC preferred stock converts at a ratio of one for 11.80684 and our Series EE preferred stock converts at a ratio of one for 1.02268. In addition, it assumes the reclassification of the convertible preferred stock warrant liability to additional paid-in capital. |

| (5) | The pro forma as adjusted consolidated balance sheet data in the table above gives effect to our receipt of the estimated net proceeds from this offering at an assumed initial public offering price of $ per share, after deducting underwriting discounts and commission and estimated offering expenses payable by us. |

| (6) | A $1.00 increase (decrease) in the assumed initial public offering price of $ per share of our common stock in this offering would increase (decrease) each of cash and cash equivalents, working capital, total assets and total stockholders’ equity (deficit) by $ , assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

-11-

Table of Contents

An investment in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below together with all the other information contained in this prospectus, including our consolidated financial statements and the related notes, before deciding whether to invest.

Risks related to our business and industry

We have a history of losses, and we may not be able to achieve or sustain consistent profitability in the future.

Since our formation, we have recorded a net loss in every fiscal year and we expect to continue to record net losses. We had a net loss of $9.4 million in fiscal 2011 and $4.3 million in the three months ended April 30, 2011. As of April 30, 2011, our accumulated deficit was $230.3 million. We anticipate spending significantly to develop our storage systems and expand our business, including expenditures for additional personnel in sales and marketing and research and development. As a public company, we will also incur significant legal, accounting and other expenses as a result of regulatory requirements that did not apply to us as a private company. We may encounter unforeseen difficulties, complications and delays and other unknown factors that require additional expenditures. Due to these increased expenditures, we will have to generate and sustain substantially higher revenue in order to achieve and maintain profitability. Our revenue growth trend since the first quarter of fiscal 2010 may not be sustainable, and we may not generate revenue in excess of our anticipated expenditures to achieve or maintain profitability. Failure to achieve and sustain consistent profitability may require us to raise additional capital, which may not be available on terms acceptable to us, or at all. In addition, our expense levels are based in part on our expectations as to future sales and a significant percentage of our expenses are fixed. If sales are below expectations, our operating expenses would be disproportionately high relative to revenue, which would adversely impact our ability to become profitable. Although we achieved Adjusted EBITDA profitability during the three months ended January 29, 2011, we expect that our Adjusted EBITDA will continue to be negative on a quarterly basis.

We must continue to expand our routes to market and maintain adequate support for our partners and customers. If we fail to do so, our revenue may suffer, our relationships with our partners could be harmed and sales of our storage systems could decline.

We may not continue to experience revenue growth unless we gain market share by expanding our routes to market, including our relationships with OEMs, value added resellers, or VARs, and other distribution partners, as well as our internal sales force. Expanding our relationships with new OEMs, VARs and other distribution partners requires significant time and resources from many of our key personnel. Expanding our internal sales force is a lengthy process that involves substantial training of new sales personnel and competing with our competitors for qualified talent. If we are not successful in expanding our routes to market, our ability to generate future growth could be impaired. In addition, we may be unsuccessful in establishing these new relationships or hiring new sales personnel if our competitors offer incentives or other terms that we are unable to match or exceed. Consequently, our revenue could suffer, our relationships with our existing OEM partner, VARs and other distribution partners could be harmed and our ability to adequately grow or retain our internal sales force could be impaired.

-12-

Table of Contents

We must also continue to scale and improve our processes and procedures that support our partners and sales personnel, including investments in systems and training. These processes and procedures may become increasingly complex and difficult to manage. If we fail to adequately develop these processes and procedures, our partners and sales personnel may not adequately market and sell our storage systems or accurately educate our potential customers regarding the benefits of our storage systems.

If we do not timely develop and introduce new products and technologies, we may be unable to grow our customer base and our business.

We must timely develop and introduce new products and technologies that allow us to increase our business with our existing customers, broaden our customer base and expand our business both domestically and internationally. We must also deepen our relationships with our existing customers by penetrating their organizations more deeply with our existing products. Successful marketing and selling of our storage systems depends on us identifying appropriate customers, educating them about the benefits of our storage systems and overcoming any concerns they may have about working with a small, independent storage system vendor with whom they may not have a business relationship. If our storage systems do not continue to achieve market adoption, our ability to grow our business will be materially and adversely affected.

If we are unable to establish and maintain relationships with strategic partners, our revenue could decline and we could lose customers.

One of our key strategies is to partner with major third party software and hardware vendors to integrate our storage systems into their products and also co-market our storage systems with the vendors. We have significant partner relationships with database, business application, backup management and server virtualization companies, including VMware, Inc. A number of these strategic partners are industry leaders that offer us expanded access to segments of the storage and data management market. There is intense competition for strategic partners, and even if we can establish relationships with these or other partners, these partnerships may not generate significant revenue or may not continue to be in effect for any specific period of time. If these relationships are not maintained or fail to materialize as expected, our revenue could be adversely affected and we could suffer delays in product development or experience other operational difficulties.

Our contracts with our partners do not prohibit them from offering products or services that compete with ours. These partners may choose to discontinue offering our storage systems and services or may not devote sufficient attention and resources to selling our storage systems and services. Our competitors may provide more favorable terms or more lucrative sales incentives to our existing and potential partners to use or purchase their products and services or to prevent or reduce sales of our storage systems and services. If our distribution and strategic partners do not effectively promote and sell our storage systems or if we lose the services of certain of our key distribution and strategic partners, we would have to develop additional relationships with other third parties or devote more resources to directly marketing and selling our storage systems, either of which could reduce our revenue or cause us to lose customers.

-13-

Table of Contents

We have experienced rapid growth in recent periods and we may not be able to sustain or manage any future growth effectively. If we fail to manage our growth effectively, we may be unable to execute our business plan, sell our storage systems and services successfully and adequately address competitive challenges. As a result, our financial performance may suffer.

In recent periods we have significantly expanded the size and scope of our business, and our future operating results depend to a large extent on our ability to successfully manage any future expansion and growth. Continued growth in our business will place significant demands on our managerial, administrative, operational, financial and other resources. Successful management of any future growth will require substantial management attention with respect to, among other things:

| • | recruiting, hiring, integrating and retaining highly skilled and motivated individuals, including research and development and sales personnel; |

| • | maintaining and expanding our indirect sales channels and educating and supporting the sales forces of those channel partners; |

| • | expanding and broadening product development processes; |

| • | accurately forecasting revenue and controlling costs; |

| • | enhancing and expanding our infrastructure; |

| • | managing inventory levels; |

| • | expanding our international operations and managing increasingly dispersed geographic locations and facilities; and |

| • | implementing and improving our company-wide processes and procedures to address human resource, financial reporting and financial management matters. |

If we are unable to execute our growth strategy effectively or to manage any future growth we may experience, we may not be able to take advantage of market opportunities, execute our business plan or remain competitive. In addition, our failure to effectively sustain or manage any future growth we do experience could result in a reduction of revenue, an inability to maintain customer relationships or attract new customers and our business and financial results could be materially and adversely affected.

We are dependent on our relationship with HDS for a substantial portion of our revenue, and any disruption in this relationship could adversely affect our ability to sell our storage systems and achieve our revenue forecasts and we may be unable to sell excess inventory that was intended to be sold to HDS.

We sell our SiliconFS file system and license additional software applications to HDS, which resells them in combination with its storage arrays. HDS accounted for 22%, 30%, 41% and 45% of our revenue in fiscal 2009, fiscal 2010, fiscal 2011 and the three months ended April 30, 2011, respectively. Although we have experienced high rates of growth from HDS in recent periods, we do not expect the rate of revenue growth to continue at the level we experienced in fiscal 2011 and the three months ended April 30, 2011. We expect that our relationship with HDS will continue to account for a substantial portion of our revenue for the foreseeable future. We rely upon HDS’ sales force to continue to prioritize the sale of the HDS products into which our SiliconFS file system is incorporated. HDS’ sales personnel may decide to focus on selling other HDS products due to changes in sales incentives, the lengthy sales cycle for our products or HDS

-14-

Table of Contents

internal directives to push other products into the market. If these sales personnel reduced their efforts to actively sell the storage systems containing our SiliconFS file system, our revenue would decline and our relationship with HDS and our operating results could be negatively affected. Although our OEM agreement with HDS has one-year automatic renewals of its term, either party can terminate the agreement for any reason by providing the other party with written notice at least 60 days prior to the end of the next renewal period, which for the current term is in July 2013. A termination of our agreement with HDS, decreased purchases by HDS, whether under the OEM agreement or otherwise, or any other disruption in our relationship with HDS, could adversely affect our ability to sell our storage systems and achieve our revenue forecasts.

After September 30, 2011, HDS will no longer have any minimum purchase commitments under the OEM agreement. Although HDS has agreed to provide us with rolling forecasts of potential orders under the agreement, the forecasts are nonbinding. The nonbinding nature of the forecasts and the elimination of HDS’ minimum purchase obligations may make it difficult for us to accurately predict HDS sales of our products during any given period. Our long lead time for manufacturing, coupled with this uncertainty in predicting the requirements of HDS, could result in an inventory shortage and force us to make difficult decisions regarding the allocation of our available inventory among HDS and our other customers. If we are unable to fully satisfy purchase orders of HDS on a timely basis, our relationship with HDS could be damaged. Alternatively, if we overestimate the number of units that HDS may purchase in any period, we could have an excess inventory of products that we may or may not be able to sell to other customers.

If HDS began competing in our markets or engaging our customers, our sales to HDS and to our direct customers could suffer and prices for our products may decline.

Our agreement with HDS does not prohibit us or HDS from competing in each other’s respective markets or from approaching the other party’s customer prospects for future business. If we and HDS engage with the same customers, there may be customer confusion and prices for our products may decline due to competition between us and HDS. Although we support HDS’ selling activities, we and HDS do not coordinate our sales and channel conflicts may arise. In addition, if HDS or another OEM partner required us to allow them to rebrand or sell our storage systems as white box storage systems, we may not build the brand recognition we need to grow our business because customers purchasing these storage systems may not realize they are storage systems we developed and sell independently.

Our agreement does not preclude HDS or its affiliates from developing competing products or technologies internally and focusing the activities of its sales force on selling and marketing those internal products and technologies. HDS currently has internally developed NAS storage systems in its product portfolio that do not address the same markets as our storage systems. In the future HDS or its affiliates may enhance these existing storage systems or develop new storage systems or technologies to directly compete with our storage systems. If HDS or its affiliates were to do so, HDS may opt to reduce or eliminate purchases from us in order to promote its internally developed solution, regardless of the relative quality or functionality of its solutions compared to ours, which would cause our sales to HDS and to our direct customers to suffer.

If we are unable to maintain or extend our relationships with our current customers, establish new customer relationships or to increase the diversification of our current customer base, our growth may be limited and our revenue could decline.

We have historically derived a large percentage of our revenue from repeat sales to our existing customers. We may be unable to secure future orders from these customers as they build out

-15-

Table of Contents

their storage networks and, even if we do, our current customers may reach saturation once they complete their storage networks. We cannot provide any assurance that we will be able to sustain our revenue from our existing customers. Our customers typically buy storage systems on a purchase order basis and do not enter into long-term contracts or minimum purchase commitments that would obligate them to continue to buy additional storage systems or services from us in the future. Although we continuously seek to grow our customer base through the addition of new customers, there is no assurance that we will be successful in doing so. If we are unable to generate repeat business from our existing customers or to generate revenue from new customers or expand into broader enterprise markets, we may be unable to maintain or expand our growth and our sales would be adversely affected.

Our operating results may fluctuate significantly as a result of factors that may be outside of our control, which may make it difficult to rely on our quarterly comparisons as an indicator of future performance.

Our operating results may fluctuate due to a variety of factors, many of which are outside of our control. As a result, comparing our operating results on a period to period basis may not be meaningful. You should not rely on our past results as an indication of our future performance. Our sales cycles can be long and unpredictable and our sales efforts require substantial time and expense. Our revenue is difficult to predict and may vary substantially from quarter to quarter, which may cause our operating results to fluctuate significantly. We ship the vast majority of our storage systems in the same quarter in which they are ordered, and as a result do not enter new quarters with any significant backlog. Our revenue each quarter depends on our ability to receive purchase orders and ship our products in that quarter. In addition, a significant percentage of our sales typically occurs near the end of the quarter. Small delays in receipt of purchase orders and shipment of products could result in our failure to achieve our internal forecasts or stock market expectations. Our customers also often purchase our storage systems as part of larger storage installations and the timing of negotiations for those purchases may cause the timing of our orders with customers to fluctuate. In addition, some of the orders we receive may include conditions, such as customer acceptance criteria, in which case we cannot immediately recognize revenue for those orders, if at all. These conditions make it difficult to determine when orders will translate to revenue and to accurately predict future operating results. If our revenue or operating results fall below the expectations of investors or the securities analysts that follow us, the price of our common stock may decline.

In any quarter, our revenue may be largely attributable to the timing of our customers’ orders. We expect our gross margins to fluctuate over time depending on product configuration and channel mix shifts, as well as quarter to quarter volatility caused by large implementations of our storage systems. For these reasons, comparisons of our operating results on a period to period basis may not be meaningful. You should not rely on our past results as an indication of our future performance.

Factors that are difficult to predict and that may affect our operating results include:

| • | the timing and magnitude of shipments of our storage systems in each quarter; |

| • | the gain or loss of one or more of our significant customers; |

| • | reductions in customers’ budgets for storage system purchases or delays in their purchasing cycles; |

-16-

Table of Contents

| • | our ability to timely develop new technologies, products and enhancements that meet customer requirements; |

| • | deferments of customer storage system purchases in anticipation of new products or updates from us or our competitors or products used in combination with ours; |

| • | production delays as a result of manufacturing or supplier capacity or quality issues; |

| • | the extent to which and the timing of when our customers renew their support contracts with us; |

| • | increases in the costs or lack of availability of the components we use in our storage systems; |

| • | the timing of product releases or upgrades or announcements by us or our competitors; |

| • | unanticipated warranty expenses or charges for excess or obsolete inventory; |

| • | fluctuations in demand and prices for our storage systems; |

| • | changes in industry standards in the storage industry; |

| • | any change in the competitive landscape of our industry, including further consolidation or the entrance of new competitors; |

| • | general economic conditions in the markets in which we operate; and |

| • | other factors outside our control. |

Our sales cycles can be long and unpredictable, and our sales efforts often require a substantial amount of time and expenses. As a result, the timing of our sales is difficult to predict and could vary substantially from quarter to quarter, which may cause our operating results to fluctuate significantly.

Our sales efforts involve educating our current and prospective customers about the use and benefits of our storage systems, including their technical merits and potential cost savings to the customers as compared to storage solutions currently used by them or other storage solutions that are available. Customers often undertake a significant evaluation and testing process that can result in a lengthy sales cycle that typically averages six months, but has, in some cases, exceeded 12 months. We spend substantial time and resources on our sales efforts without any assurance that our efforts will produce any sales. In addition, purchases by our current and prospective customers are frequently subject to budget constraints, multiple approvals and a variety of unpredictable administrative, processing and other delays. Purchases of our storage systems may also occur in connection with a larger data center scale out. The effect of these factors tends to be magnified even greater in the case of large orders.

Our sales to HDS can also involve a substantial amount of time. HDS incorporates our solutions into its products, which can require a lengthy evaluation and testing process before our product is approved for inclusion in one of its storage systems. From time to time HDS may also require us to customize our SiliconFS file systems and related software to ensure that they interoperate with new products or product enhancements of HDS. This customization process could lengthen our normal sales cycle and make us vulnerable to the risk of delays if we encounter manufacturing or supplier capacity issues. Sales cycles to customers of HDS may be longer than our normal sales cycle because our product may be a part of a larger storage solution. Our extended sales cycle with HDS’ customers makes us vulnerable to the risk of delays or termination of orders if the end

-17-

Table of Contents

customers decide to delay or withdraw their purchases, which could occur for various reasons, including global economic cycles and capital market fluctuations. These delays or termination of orders could negatively impact the revenue we realize from sales to HDS.

Our lengthy and uncertain sales cycles make it difficult for us to predict when customers may purchase and accept products from us, may prevent us from recognizing revenue in a particular quarter and ultimately may not produce any sales. As a result, our operating results may vary significantly from quarter to quarter.

The market for our storage systems is highly competitive and dominated by larger companies with significantly greater resources than us. If we are unable to compete effectively, we may experience decreased sales or pricing pressure, which would adversely impact our operating results.

The market for our storage systems is highly competitive and we expect competition to intensify in the future. Currently, we face competition from a number of established companies, including EMC Corporation, or EMC, Hewlett Packard Company, or HP, International Business Machines Corporation, or IBM, and NetApp, Inc., or NetApp. We also face competition from smaller, privately held companies and could face competition from new market entrants, whether from new ventures or from established companies moving into our industry. We also compete against internally developed storage systems as well as combined third party software and hardware systems. A number of new, privately held companies are currently attempting to enter our market, some of which may become significant competitors in the future. All of our well established competitors, as well as some of our other current and potential competitors, have longer operating histories, greater brand awareness, more employees, a larger customer base, more established customer relationships and significantly greater financial, technical, sales, marketing and other resources than we have. As a result of their established presence in the industry, some of our competitors have substantial control and influence over future trends in the industry, including acceptance of a particular industry standard or competing technology. In addition, many of our competitors benefit from long-standing relationships with key decision makers at many of our current and prospective customers. Our competitors may be able to leverage these existing relationships to persuade our current and potential customers to purchase our competitors’ products, regardless of the performance or features of our storage systems. Our competitors may also be able to devote greater resources to the development, promotion and sale of products, which could allow them to introduce new technologies and products to the market faster than we can.

Because many of our competitors have greater resources than we do and are able to offer a more diversified and comprehensive bundle of products and services, these competitors may be able to adopt more aggressive pricing policies than we can adopt, through which they could deliver competitive products or technologies at a lower price than our storage systems. If our competitors are able to undercut our prices, we may be unable to remain competitive in the industry or be forced to reduce our selling prices. This could result in reduced gross margins, increased sales and marketing expenses or our failure to increase, or our loss of, market share, any of which could seriously harm our business, operating results and financial condition.

Our ability to compete effectively depends on a number of factors, including:

| • | our ability to effectively respond to aggressive business tactics by our competitors, including selling at a discount or asserting intellectual property rights irrespective of the validity of the claims; |

-18-

Table of Contents

| • | our storage systems’ scalability, performance, quality, ease of use and cost effectiveness relative to that of our competitors’ products; |

| • | our storage systems’ interoperability with various operating systems, software applications, data access protocols and other storage systems; |

| • | our success in developing and using new and proprietary technologies to offer products and features previously not available in the marketplace; |

| • | our ability to attract and retain other VARs and OEMs; |

| • | our success in identifying new markets, applications and technologies; |

| • | our ability to continue to establish greater name recognition and build upon our reputation in the industry; |

| • | our ability to recruit and retain development engineers and sales and marketing personnel; and |

| • | our ability to protect our intellectual property. |

We may not be able to address one or more of the factors listed above, which could hurt our ability to effectively compete in our industry and adversely affect our operating results and financial condition.

Consolidation in the storage industry has increased the competitive pressures that we face and could materially and adversely affect our prices, our revenue and our ability to achieve profitability.

The storage industry has consolidated over the past several years as the result of a series of acquisitions, including recent acquisitions by EMC, HP and IBM. For example, Isilon Systems, Inc. was acquired by EMC in December 2010, 3Par Inc. was acquired by HP in September 2010 and Data Domain, Inc. was acquired by EMC in July 2009. The consolidation in the storage industry has resulted in a few large companies controlling a substantial portion of the market share, which may make it difficult for us to compete effectively. These large competitors may seek to further consolidate the industry by acquiring components, technologies and resources of suppliers in the industry, which may make it difficult for us to obtain components for our storage systems at competitive prices or in sufficient quantities. For example, NetApp recently acquired Engenio, the external storage systems business of LSI Corporation, which is one of our component suppliers. Although we historically competed with targeted sales forces of independent competitors, we now compete with the larger sales forces of integrated storage providers. In addition, current and potential competitors have established, or may establish, strategic alliances among themselves or with third parties, including some of our partners. Through these alliances our competitors could acquire additional market share and further strengthen their positions in the industry. Continued consolidation of our industry or establishment of strategic alliances by our competitors could increase the competitive pressures that we face and materially and adversely affect our prices, our revenue and our ability to achieve profitability.

If we are unsuccessful in developing and selling new storage systems, services and product enhancements that achieve market acceptance, our ability to attract and retain customers could be impaired, our competitive position could be harmed and our revenue could be reduced.

We compete in a market characterized by rapid technological change, frequent new product introductions, evolving industry standards and changing customer needs. Improvements in

-19-

Table of Contents

existing technologies and applications, including desktop and server virtualization, to accelerate storage performance or reduce storage costs may reduce the need for our storage systems. Improvements in other emerging technologies, other application protocols or network protocols such as the Transmission Control Protocol could have a similar effect. Our future growth depends on our ability to anticipate future market needs and to successfully design, develop, market and sell new file systems and software products that provide increasingly higher levels of performance, functionality, capacity and reliability and that meet the cost expectations of our customers. Developing our storage systems is expensive and the investment in product development may involve a long payback cycle. In fiscal 2009, fiscal 2010, fiscal 2011 and the three months ended April 30, 2011, our research and development expenses were $18.3 million, $13.8 million, $16.4 million and $5.0 million, respectively. We believe that we must continue to dedicate a significant amount of resources to our research and development efforts to maintain and extend our competitive position.

Due to the complexity of storage systems, the new storage systems that we develop are subject to significant technical risks that may impact our ability to introduce these storage systems successfully. Our new storage systems must address technological changes and evolving industry standards and may not achieve market acceptance. In addition, in the event that new storage systems require features for which we have not developed or otherwise acquired technology, we will be required to develop or obtain such technology through purchase, license or other arrangements. If the required technology is not available on commercially reasonable terms, or at all, we may incur additional expenses in an effort to internally develop the required technology.

Despite our efforts to develop new and successful storage systems and technologies, our competitors, many of whom have greater financial and engineering resources than we do, may be able to introduce new storage systems or develop new technologies more quickly than we can. If our investments in our research and development do not provide the desired returns in a timely manner or if the new storage systems and technologies we develop do not achieve market acceptance, our ability to attract and retain customers could be impaired, our competitive position could be harmed and our revenue could be reduced.

If we are unable to reduce or adequately control our total costs of revenue, our gross margins could decrease and we may be unable to achieve profitability.

If we are unable to reduce or maintain a sufficiently low level of costs for manufacturing and selling our storage systems relative to their selling prices, our operating results, gross margins and business could be materially and adversely impacted. The largest component of our cost of product revenue is disk drives and disk arrays that we integrate into and sell with our storage systems. We have made, and will be required to make, significant efforts to reduce the cost of products, including but not limited to disk drives and disk arrays. The consolidation that has occurred among suppliers of a variety of components, including but not limited to disk drives, makes it difficult for us to control the cost of the components we use in our storage systems. As compared to our larger competitors, we typically do not purchase a sufficiently high volume of components to obtain the discounts that our larger competitors are often able to obtain from their component suppliers. Some of our larger competitors, such as NetApp, have also acquired component suppliers, which provides them with advantages in obtaining lower cost components and may negatively affect our ability to reduce our cost of product revenue as we will be negotiating pricing with our competitors. We expect this consolidation of the component suppliers to continue in the future. Further consolidation would continue to make it difficult for

-20-

Table of Contents

us to reduce or control the costs of manufacturing our storage systems due to a lack of alternative suppliers.

If the average selling prices of our storage systems decrease, our revenue and gross margins could decline.

We anticipate that we will be forced to make price reductions in the future. Because of the resources available to many of our large, established competitors, reductions in average selling prices throughout our industry could have a more adverse effect on our business than on the business of these large competitors. In addition, if we decide to target the lower end of our market, we may sell our storage systems at prices that are lower than those of our storage systems that address the mid-range and high-end of the market. If we are unsuccessful in offsetting price reductions in our storage systems by increasing our sales volumes or reducing our cost of goods, our revenue and operating results could suffer. If the average selling prices of our existing products decline and if we are unable to introduce and generate significant demand for higher margin storage systems or additional software applications, we may be unable to maintain our current gross margins.