Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - DYAX CORP | Financial_Report.xls |

| EX-32 - EXHIBIT 32 - DYAX CORP | a680939ex32.htm |

| EX-31.2 - EXHIBIT 31.2 - DYAX CORP | a680939ex31-2.htm |

| EX-10.1 - EXHIBIT 10.1 - DYAX CORP | a680939ex10-1.htm |

| EX-31.1 - EXHIBIT 31.1 - DYAX CORP | a680939ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| ý | Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

For the quarterly period ended June 30, 2011

|

|||

|

Or

|

|||

| o | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

For the transition period from to .

|

|||

Commission File No. 000-24537

|

DYAX CORP.

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

DELAWARE

|

04-3053198

|

|

|

(State of Incorporation)

|

(I.R.S. Employer Identification Number)

|

|

300 TECHNOLOGY SQUARE, CAMBRIDGE, MA 02139

|

|

(Address of Principal Executive Offices)

|

|

(617) 225-2500

|

|

(Registrant’s Telephone Number, including Area Code)

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES ý NO o

Indicate by check mark whether the registrant has submitted electronically and posted on it corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files).

YES ý NO o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "accelerated filer", "large accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer ý Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES o NO ý

Number of shares outstanding of Dyax Corp.’s Common Stock, par value $0.01, as of July 27, 2011: 98,748,086

DYAX CORP.

TABLE OF CONTENTS

|

Page

|

|||

|

3

|

|||

| 3 | |||

| 4 | |||

| 5 | |||

| 6 | |||

| 22 | |||

| 34 | |||

| 34 | |||

| 35 | |||

| 54 | |||

| 55 | |||

| 56 | |||

2

Dyax Corp. and Subsidiaries

|

June 30,

2011

|

December 31,

2010

|

|||||||

|

(In thousands, except share data)

|

||||||||

|

ASSETS

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 7,906 | $ | 18,601 | ||||

|

Short-term investments

|

47,655 | 58,783 | ||||||

|

Accounts receivable, net of allowances for doubtful accounts of $45 at June 30, 2011 and December 31, 2010, respectively

|

10,673 | 5,315 | ||||||

|

Inventory

|

6,945 | 1,696 | ||||||

|

Current portion of restricted cash

|

1,266 | 922 | ||||||

|

Other current assets

|

3,076 | 3,248 | ||||||

|

Total current assets

|

77,521 | 88,565 | ||||||

|

Fixed assets, net

|

1,673 | 2,178 | ||||||

|

Restricted cash

|

— | 1,266 | ||||||

|

Other assets

|

753 | 422 | ||||||

|

Total assets

|

$ | 79,947 | $ | 92,431 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT)

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable and accrued expenses

|

$ | 12,526 | $ | 10,672 | ||||

|

Current portion of deferred revenue

|

6,597 | 8,738 | ||||||

|

Current portion of long-term obligations

|

263 | 586 | ||||||

|

Other current liabilities

|

— | 700 | ||||||

|

Total current liabilities

|

19,386 | 20,696 | ||||||

|

Deferred revenue

|

11,144 | 12,598 | ||||||

|

Note payable

|

55,400 | 56,406 | ||||||

|

Long-term obligations

|

— | 68 | ||||||

|

Deferred rent and other long-term liabilities

|

— | 30 | ||||||

|

Total liabilities

|

85,930 | 89,798 | ||||||

|

Commitments and contingencies (Notes 7 and 9)

|

||||||||

|

Stockholders' equity (deficit):

|

||||||||

|

Preferred stock, $0.01 par value; 1,000,000 shares authorized; 0 shares issued and outstanding

|

— | — | ||||||

|

Common stock, $0.01 par value; 200,000,000 shares authorized;

98,748,086 and 98,508,487 shares issued and outstanding at June 30, 2011 and December 31, 2010, respectively

|

987 | 985 | ||||||

|

Additional paid-in capital

|

446,640 | 443,926 | ||||||

|

Accumulated deficit

|

(453,663 | ) | (442,322 | ) | ||||

|

Accumulated other comprehensive income

|

53 | 44 | ||||||

|

Total stockholders' equity (deficit)

|

(5,983 | ) | 2,633 | |||||

|

Total liabilities and stockholders' equity (deficit)

|

$ | 79,947 | $ | 92,431 | ||||

The accompanying notes are an integral part of the unaudited consolidated financial statements.

3

|

Three Months Ended

June 30,

|

Six Months Ended

June 30,

|

|||||||||||||||

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||

|

(In thousands, except share and per share data)

|

||||||||||||||||

|

Revenues:

|

||||||||||||||||

|

Product sales, net

|

$ | 5,184 | $ | 1,931 | $ | 9,291 | $ | 3,174 | ||||||||

|

Development and license fee revenues

|

16,691 | 13,211 | 20,798 | 32,016 | ||||||||||||

|

Total revenues, net

|

21,875 | 15,142 | 30,089 | 35,190 | ||||||||||||

|

Costs and expenses:

|

||||||||||||||||

|

Cost of product sales

|

282 | 92 | 521 | 128 | ||||||||||||

|

Research and development expenses

|

10,084 | 8,034 | 17,579 | 15,803 | ||||||||||||

|

Selling, general and administrative expenses

|

9,081 | 8,372 | 18,330 | 16,951 | ||||||||||||

|

Total costs and expenses

|

19,447 | 16,498 | 36,430 | 32,882 | ||||||||||||

|

Income (loss) from operations

|

2,428 | (1,356 | ) | (6,341 | ) | 2,308 | ||||||||||

|

Other income (expense):

|

||||||||||||||||

|

Interest income

|

68 | 48 | 162 | 75 | ||||||||||||

|

Interest and other expenses

|

(2,572 | ) | (3,953 | ) | (5,162 | ) | (6,690 | ) | ||||||||

|

Total other expense

|

(2,504 | ) | (3,905 | ) | (5,000 | ) | (6,615 | ) | ||||||||

|

Net loss

|

(76 | ) | (5,261 | ) | (11,341 | ) | (4,307 | ) | ||||||||

|

Other comprehensive income (loss):

|

||||||||||||||||

|

Unrealized gain on investments

|

1 | 34 | 9 | 34 | ||||||||||||

|

Comprehensive loss

|

$ | (75 | ) | $ | (5,227 | ) | $ | (11,332 | ) | $ | (4,273 | ) | ||||

|

Basic and diluted net loss per share

|

$ | (0.00 | ) | $ | (0.05 | ) | $ | (0.11 | ) | $ | (0.05 | ) | ||||

|

Shares used in computing basic and diluted net loss per share

|

98,721,889 | 97,568,409 | 98,705,931 | 87,995,184 | ||||||||||||

The accompanying notes are an integral part of the unaudited consolidated financial statements.

4

|

Six Months Ended June 30,

|

|||||||

|

2011

|

2010 | ||||||

|

(In thousands)

|

|||||||

|

Cash flows from operating activities:

|

|||||||

|

Net loss

|

$ | (11,341 | ) | $ | (4,307 | ) | |

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|||||||

|

Amortization of purchased premium/discount

|

137 | (3 | ) | ||||

|

Depreciation and amortization of fixed assets and intangible assets

|

657 | 772 | |||||

|

Non-cash interest expense

|

123 | 1,100 | |||||

|

Compensation expenses associated with stock-based compensation plans

|

2,220 | 1,964 | |||||

|

Loss on disposal of fixed assets

|

-- | 51 | |||||

|

Provision for doubtful accounts

|

-- | (15 | ) | ||||

|

Changes in operating assets and liabilities:

|

|||||||

|

Accounts receivable

|

(5,358 | ) | (1,567 | ) | |||

|

Prepaid research and development and other current assets

|

172 | (380 | ) | ||||

|

Inventory

|

(5,187 | ) | (461 | ) | |||

|

Other long-term assets

|

(332 | ) | 86 | ||||

|

Accounts payable and accrued expenses

|

1,153 | (3,090 | ) | ||||

|

Deferred revenue

|

(3,595 | ) | (11,613 | ) | |||

|

Long-term deferred rent

|

(30 | ) | (129 | ) | |||

|

Other long-term liabilities

|

-- | 11 | |||||

|

Net cash used in operating activities

|

(21,381 | ) | (17,581 | ) | |||

|

Cash flows from investing activities:

|

|||||||

|

Purchase of investments

|

-- | (36,590 | ) | ||||

|

Proceeds from maturity of investments

|

11,000 | 11,000 | |||||

|

Purchase of fixed assets

|

(198 | ) | (101 | ) | |||

|

Proceeds from sale of fixed assets

|

-- | 29 | |||||

|

Restricted cash

|

922 | 700 | |||||

|

Net cash provided by (used in) investing activities

|

11,724 | (24,962 | ) | ||||

|

Cash flows from financing activities:

|

|||||||

|

Net proceeds from common stock offerings

|

323 | 61,133 | |||||

|

Repayment of long-term obligations

|

(1,520 | ) | (2,407 | ) | |||

|

Proceeds from the issuance of common stock under employee stock purchase plan and exercise of stock options

|

159 | 167 | |||||

|

Net cash provided by (used in) financing activities

|

(1,038 | ) | 58,893 | ||||

|

Net increase (decrease) in cash and cash equivalents

|

(10,695 | ) | 16,350 | ||||

|

Cash and cash equivalents at beginning of the period

|

18,601 | 29,386 | |||||

|

Cash and cash equivalents at end of the period

|

$ | 7,906 | $ | 45,736 | |||

|

Supplemental disclosure of cash flow information:

|

|||||||

|

Interest paid

|

$ | 5,883 | $ | 6,859 | |||

The accompanying notes are an integral part of the unaudited consolidated financial statements.

5

DYAX CORP.

1. BUSINESS OVERVIEW

Dyax Corp. (Dyax or the Company) is a biopharmaceutical company focused on the discovery, development and commercialization of novel biotherapeutics for unmet medical needs. The Company began commercializing KALBITOR® (ecallantide) for treatment of acute attacks of hereditary angioedema (HAE) in patients 16 years of age and older in February 2010. Dyax currently has three major business components:

|

·

|

Dyax commercializes KALBITOR (ecallantide) on its own in the United States for treatment of acute attacks of HAE and is also developing KALBITOR for use in other indications. Outside of the United States, Dyax has established partnerships to obtain regulatory approval for and commercialize KALBITOR in other major markets and is evaluating opportunities in additional territories.

|

|

·

|

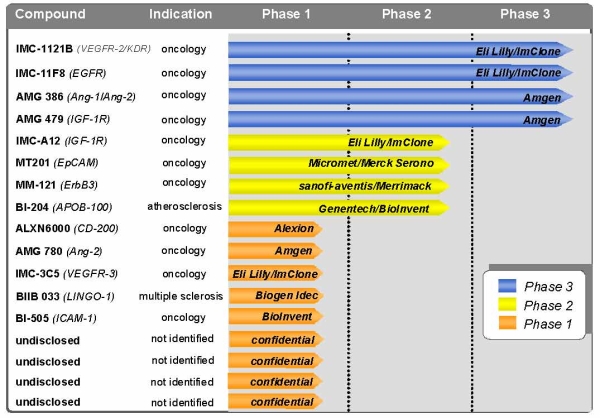

Dyax leverages its proprietary phage display technology through its Licensing and Funded Research Program, or LFRP. This program has resulted in a portfolio of product candidates being developed by its licensees, which currently includes 17 product candidates in clinical devlopment. The LFRP generated $26 million in revenue in 2010, and to the extent that one or more of these product candidates are commercialized according to published timelines, milestone and royalty revenues under the LFRP are expected to experience significant growth over the next several years.

|

|

·

|

Dyax uses its phage display technology to identify new drug candidates for its own preclinical pipeline.

|

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited interim consolidated financial statements have been prepared by the Company in accordance with accounting principles generally accepted in the United States of America (GAAP) for interim financial information and in accordance with instructions to the Quarterly Report on Form 10-Q. It is management’s opinion that the accompanying unaudited interim consolidated financial statements reflect all adjustments (which are normal and recurring) necessary for a fair statement of the results for the interim periods. The financial statements should be read in conjunction with the consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2010. The accompanying December 31, 2010 consolidated balance sheet was derived from audited financial statements, but does not include all disclosures required by GAAP.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect (i) the reported amounts of assets and liabilities, (ii) disclosure of contingent assets and liabilities at the dates of the financial statements and (iii) the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from those estimates. The results of operations for the three and six months ended June 30, 2011 are not necessarily indicative of the results that may be expected for the year ending December 31, 2011.

Basis of Consolidation

The accompanying consolidated financial statements include the accounts of the Company and the Company's European subsidiaries Dyax S.A. and Dyax BV. All inter-company accounts and transactions have been eliminated.

6

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make certain estimates and assumptions that affect the amounts of assets and liabilities reported and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenue and expenses during the reporting periods. The significant estimates and assumptions in these financial statements include revenue recognition, product sales allowances, useful lives with respect to long lived assets, valuation of stock options, accrued expenses and tax valuation reserves. Actual results could differ from those estimates.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash, cash equivalents, short-term investments and trade accounts receivable. At June 30, 2011 and December 31, 2010, approximately 95% and 98% of the Company's cash, cash equivalents and short-term investments were invested in money market funds backed by U.S. Treasury obligations, U.S. Treasury notes and bills, and obligations of United States government agencies held by one financial institution. The Company maintains balances in various operating accounts in excess of federally insured limits.

The Company provides most of its services and licenses its technology to pharmaceutical and biomedical companies worldwide, and makes all product sales to its exclusive distributor. Concentrations of credit risk with respect to trade receivable balances are usually limited on an ongoing basis, due to the diverse number of licensees and collaborators comprising the Company's customer base. As of June 30, 2011, two customers accounted for 70% and 23% of the accounts receivable balance. Three customers accounted for approximately 35%, 28% and 24%, of the Company's accounts receivable balance as of December 31, 2010, all of which were collected in the first quarter of 2011.

Cash and Cash Equivalents

All highly liquid investments purchased with an original maturity of ninety days or less are considered to be cash equivalents. Cash and cash equivalents consist principally of cash and U.S. Treasury funds.

Investments

Short-term investments primarily consist of investments with original maturities greater than ninety days and remaining maturities less than one year at quarter end. The Company has also classified its investments with maturities beyond one year as short-term, based on their highly liquid nature and because such marketable securities represent the investment of cash that is available for current operations. The Company considers its investment portfolio of investments available-for-sale. Accordingly, these investments are recorded at fair value, which is based on quoted market prices. As of June 30, 2011, the Company's investments consisted of U.S. Treasury notes and bills with an amortized cost and estimated fair value of $52.8 million, and an unrealized gain of $53,000, which is recorded in other comprehensive income on the accompanying consolidated balance sheet. As of December 31, 2010, the Company's investments consisted of United States Treasury notes and bills with an amortized cost of $58.7 million, an estimated fair value of $58.8 million, and had an unrealized gain of $44,000, which is recorded in other comprehensive income on the accompanying consolidated balance sheet.

Inventories

Inventories are stated at the lower of cost or market with cost determined under the first-in, first-out, or FIFO, basis. The Company evaluates inventory levels and would write-down inventory that is expected to expire prior to being sold, inventory that has a cost basis in excess of its expected net realizable value, inventory in excess of expected sales requirements, or inventory that fails to meet commercial sale specifications, through a charge to cost of product sales. Included in the cost of inventory are employee stock-based compensation costs capitalized under Accounting Standards Codification (ASC) 718.

7

Fixed Assets

Property and equipment are recorded at cost and depreciated over the estimated useful lives of the related assets using the straight-line method. Laboratory and production equipment, furniture and office equipment are depreciated over a three to seven year period. Leasehold improvements are stated at cost and are amortized over the lesser of the non-cancelable term of the related lease or their estimated useful lives. Leased equipment is amortized over the lesser of the life of the lease or their estimated useful lives. Maintenance and repairs are charged to expense as incurred. When assets are retired or otherwise disposed of, the cost of these assets and related accumulated depreciation and amortization are eliminated from the balance sheet and any resulting gains or losses are included in operations in the period of disposal.

Impairment of Long-Lived Assets

The Company reviews its long-lived assets for impairment whenever events or changes in business circumstances indicate that the carrying amount of assets may not be fully recoverable or that the useful lives of these assets are no longer appropriate. Each impairment test is based on a comparison of the undiscounted cash flow to the recorded value of the asset. If impairment is indicated, the asset is written down to its estimated fair value on a discounted cash flow basis.

Revenue Recognition

The Company’s principal sources of revenue are product sales of KALBITOR, license fees, funding for research and development, and milestones and royalties derived from collaboration and license agreements. In all instances, revenue is recognized only when the price is fixed or determinable, persuasive evidence of an arrangement exists, delivery has occurred or services have been rendered, collectability of the resulting receivable is reasonably assured and the Company has no further performance obligations.

Product Sales and Allowances

Product Sales. All product sales are generated from the sale of KALBITOR to ASD Specialty Healthcare Inc. (ASD), the Company’s exclusive wholesale distributor, and US Bioservices Corporation (US Bio), its exclusive specialty pharmacy, both of which are wholly-owned subsidiaries of AmerisourceBergen Specialty Group, Inc. (ABSG). Product sales are recorded upon delivery to ASD and US Bio. These sales are recorded net of applicable reserves for trade prompt pay discounts, government rebates, a patient assistance program, product returns and other applicable allowances.

Product Sales Allowances. The Company establishes reserves for trade prompt pay discounts, government rebates, a patient assistance program, product returns and other applicable allowances. Reserves established for these discounts and allowances are classified as a reduction of accounts receivable (if the amount is payable to the customer) or a liability (if the amount is payable to a party other than the customer).

Allowances against receivable balances primarily relate to prompt payment discounts and are recorded at the time of sale, resulting in a reduction in product sales revenue. Accruals related to government rebates, the patient financial assistance program, product returns and other applicable allowances are recognized at the time of sale, resulting in a reduction in product sales revenue and the recording of an increase in accrued expenses.

The Company maintains a service contract with US Bio for patient service initiatives. Accounting standards related to consideration given by a vendor to a customer, including a reseller of a vendor’s product, specify that each consideration given by a vendor to a customer is presumed to be a reduction of the selling price. Consideration should be characterized as a cost if the company receives, or will receive, an identifiable benefit in exchange for the consideration, and fair value of the benefit can be reasonably estimated. The Company has established that the services are at fair value and represent a separate and identifiable benefit related to these services and, accordingly, has classified them as selling, general and administrative expense.

8

Prompt Payment Discounts. The Company offers a prompt payment discount to its customers ASD and US Bio. Since the Company expects their customers will take advantage of this discount, the Company accrues 100% of the prompt payment discount that is based on the gross amount of each invoice, at the time of sale. The accrual is adjusted quarterly to reflect actual earned discounts.

Government Rebates and Chargebacks. The Company estimates reductions to product sales for Medicaid and Veterans' Administration (VA) programs and the Medicare Part D Coverage Gap Program, as well as with respect to certain other qualifying federal and state government programs. The Company estimates the amount of these reductions based on KALBITOR patient data, actual sales data and market research data related to payer mix. These allowances are adjusted each period based on actual experience.

Medicaid rebate reserves relate to the Company’s estimated obligations to states under the established reimbursement arrangements of each applicable state. Rebate accruals are recorded during the same period in which the related product sales are recognized. Actual rebate amounts are determined at the time of claim by the state, and the Company will generally make cash payments for such amounts after receiving billings from the state.

VA rebates or chargeback reserves represent the Company’s estimated obligations resulting from contractual commitments to sell products to qualified healthcare providers at a price lower than the list price charged to the Company’s distributor. The distributor will charge the Company for the difference between what the distributor pays for the product and the ultimate selling price to the qualified healthcare provider. Rebate accruals are established during the same period in which the related product sales are recognized. Actual chargeback amounts for Public Health Service are determined at the time of resale to the qualified healthcare provider from the distributor, and the Company will generally issue credits for such amounts after receiving notification from the distributor.

The Company offers a financial assistance program, which involves the use of a patient voucher, for qualified KALBITOR patients in order to aid a patient’s access to KALBITOR. The Company estimates its liability from this voucher program based on actual redemption rates.

Although allowances and accruals are recorded at the time of product sale, certain rebates are typically paid out, on average, up to six months or longer after the sale. Reserve estimates are evaluated quarterly and if necessary, adjusted to reflect actual results. Any such adjustments will be reflected in the Company’s operating results in the period of the adjustment.

Product Returns. Allowances for product returns are recorded during the period in which the related product sales are recognized, resulting in a reduction to product revenue. The Company does not provide its customers with a general right of product return. It permits returns if the product is damaged or defective when received by its customers or if the product has expired. The Company estimates product returns based upon historical trends in the pharmaceutical industry and trends for similar products sold by others.

During the three and six months ended June 30, 2011 and 2010, provisions for product sales allowances reduced gross product sales as follows (in thousands):

9

|

Three months ended June 30,

|

Six months ended June 30,

|

|||||||||||||||

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||

|

Total gross product sales

|

$ | 5,411 | $ | 2,035 | $ | 9,704 | $ | 3,347 | ||||||||

|

Prompt pay and other discounts

|

$ | (149 | ) | $ | (64 | ) | $ | (255 | ) | $ | (90 | ) | ||||

|

Government rebates and chargebacks

|

(58 | ) | (40 | ) | (144 | ) | (73 | ) | ||||||||

|

Returns

|

(20 | ) | -- | (14 | ) | (10 | ) | |||||||||

|

Product sales allowances

|

$ | (227 | ) | $ | (104 | ) | $ | (413 | ) | $ | (173 | ) | ||||

|

Total product sales, net

|

$ | 5,184 | $ | 1,931 | $ | 9,291 | $ | 3,174 | ||||||||

|

Total product sales allowances as a percent of

gross product sales

|

4 | % | 6 | % | 4 | % | 6 | % | ||||||||

Development and License Fee Revenues

In January 2011, the Company adopted a new U.S. GAAP accounting standard which amends existing revenue recognition accounting guidance to provide accounting principles and application guidance on whether multiple deliverables exist, whether and how the deliverables should be separated, and the consideration allocated. The new guidance eliminates the requirement to establish objective evidence of fair value of undelivered products and services and instead provides for separate revenue recognition based upon management’s best estimate of selling price for an undelivered item when there is no other means to determine the fair value of that undelivered item. The adoption of this standardwill be applied to all new or materially amended agreements which include multiple deliverables in 2011. During the second quarter of 2011, the Company applied the amended revenue guidance to two revenue arrangements entered into during the period, including one amendment which was determined to be a material modification to an existing agreement (see Note 3, Significant Transactions – Sigma-Tau).

Collaboration Agreements. The Company enters into collaboration agreements with other companies for the research and development of therapeutic, diagnostic and separations products. The terms of the agreements may include non-refundable signing and licensing fees, funding for research and development, payments related to manufacturing services, milestone payments and royalties on any product sales derived from collaborations. These multiple element arrangements are analyzed to determine how the deliverables, which often include license and performance obligations such as research, steering committee and manufacturing services, are separated into units of accounting.

Before January 1, 2011, we evaluated license arrangements with multiple elements in accordance with Accounting Standards Codification, or ASC, 605-25 Revenue Recognition – Multiple-Element Arrangements. In October 2009, the Financial Accounting Standards Board, or FASB, issued ASU 2009-13 Revenue Arrangements with Multiple Deliverables, or ASU 2009-13, which amended the accounting standards for certain multiple element arrangements to :

|

|

·

|

Provide updated guidance on whether multiple elements exist, how the elements in an arrangement should be separated and how the arrangement considerations should be allocated to the separate elements;

|

|

|

·

|

Require an entity to allocate arrangement consideration to each element based on a selling price hierarchy, also called the relative selling price method, where the selling price for an element is based on vendor-specific objective evidence (VSOE), if available, vendor objective evidence (VOE), if available and VSOE is not available; or the best estimate of selling price (BESP), if neither VSOE or VOE are available;

|

|

|

·

|

Eliminate the use of the residual method and require an entity to allocate arrangement consideration using the selling price hierarchy.

|

The Company evaluates all deliverables within an arrangement to determine whether or not they provide value to the licensee on a stand-alone basis. Based on this evaluation, the deliverables are separated into units of accounting. If VSOE or VOE is not available to determine the fair value of a deliverable, the Company determines the best estimate of selling price associated with the deliverable. The arrangement consideration, including upfront license fees and funding for research and development is allocated to the separate units based on relative fair value.

10

VSOE is based on the price charged when an element is sold separately and represents the actual price charged for that deliverable. For more advanced stage development licensing agreements, these arrangements are unique in nature and therefore the Company generally cannot establish VSOE for the elements within the arrangement. For earlier stage funded research agreements, the Company can establish the fair value of the elements based on VSOE. This type of agreement is less unique from licensee to licensee and the Company has more history of entering funded research agreements.

When VSOE cannot be established, we attempt to establish the selling price of the elements of a license arrangement based on VOE. VOE is determined based on third party evidence for similar deliverables when sold separately. In circumstances when the Company charges a licensee for pass-through costs paid to external vendors for development services, these costs represent VOE.

When we are unable to establish the selling price of an element using VSOE or VOE, management determines BESP for that element. The objective of BESP is to determine the price at which we would transact a sale if the element within the license agreement was sold on a stand-alone basis. Our process for establishing BESP involves management’s judgment and considers multiple factors including discounted cash flows, estimated direct expenses and other costs and available data.

Based on the value allocated to each unit of accounting within an arrangement, upfront fees and other guaranteed payments are allocated to each unit based on relative fair value. The appropriate revenue recognition method is applied to each unit and revenue is accordingly recognized as each unit is delivered.

For agreements entered into prior to 2011, revenue related to upfront license fees was spread over the full period of performance under the agreement, unless the license was determined to provide value to the licensee on a stand-alone basis and the fair value of the undelivered performance obligations, typically including research/or steering committee services were determined.

Steering committee services that were not inconsequential or perfunctory and were determined to be performance obligations were combined with other research services or performance obligations required under an arrangement, if any, to determine the level of effort required in an arrangement and the period over which the Company expected to complete its aggregate performance obligations.

Whenever the Company determined that an arrangement should be accounted for as a single unit of accounting, it determined the period over which the performance obligations would be performed for revenue recognized. Revenue is recognized using either a proportional performance or straight-line method. The Company recognizes revenue using the proportional performance method when the level of effort required to complete its performance obligations under an arrangement can be reasonably estimated and such performance obligations are provided on a best-efforts basis. Direct labor hours or full-time equivalents are typically used as the measurement of performance.

If the Company cannot reasonably estimate the level of effort to complete its performance obligations under an arrangement, then revenue under the arrangement is recognized on a straight-line basis over the period the Company is expected to complete its performance obligations.

Many of the Company's collaboration agreements entitle it to additional payments upon the achievement of performance-based milestones. If the achievement of a milestone is considered probable at the inception of the collaboration, the related milestone payment is included with other collaboration consideration, such as up-front fees and research funding, in the Company's revenue model. Milestones that involve substantial effort on the Company's part and the achievement of which are not considered probable at the inception of the collaboration are considered "substantive milestones." All milestones achieved after January 1, 2011 which are determined to be substantive milestones are recognized as revenue in the period in which they are met in accordance with Accounting Standards Update (ASU) No. 2010-17, Revenue Recognition – Milestone Method. For all milestones achieved prior to 2011, substantive milestones were included in the Company's revenue model when achievement of the milestone was considered probable. Milestones that are tied to regulatory approval are not considered probable of being achieved until such approval is received. Milestones tied to counter-party performance are not included in the Company's revenue model until the performance conditions are met.

Royalty revenue is recognized upon the sale of the related products provided the Company has no remaining performance obligations under the arrangement.

Costs of revenues related to product development and license fees are classified as research and development in the consolidated statements of operations and comprehensive loss.

Patent Licenses. The Company generally licenses its patent rights covering phage display on a non-exclusive basis to third parties for use in connection with the research and development of therapeutic, diagnostic, and other products.

Standard terms of the patent rights agreements generally include non-refundable signing fees, non-refundable license maintenance fees, development milestone payments and royalties on product sales. Signing fees and maintenance fees are generally recognized on a straight line basis over the term of the agreement. Perpetual patent licenses are recognized immediately if the Company has no future obligations and the payments are upfront.

11

Library Licenses. Standard terms of the proprietary phage display library agreements generally include non-refundable signing fees, license maintenance fees, development milestone payments, product license payments and royalties on product sales. Signing fees and maintenance fees are generally recognized on a straight line basis over the term of the agreement as deliverables within these arrangements are determined to not provide the licensee with value on a stand-alone basis and therefore are accounted for as a single unit of accounting. As milestones are achieved under a phage display library license, a portion of the milestone payment, equal to the percentage of the performance period completed when the milestone is achieved, multiplied by the amount of the milestone payment, will be recognized. The remaining portion of the milestone will be recognized over the remaining performance period on a straight-line basis. Milestone payments under these license arrangements are recognized when the milestone is achieved if the Company has no future obligations under the license. Product license payments, which are optional to the licensee, are substantive and therefore are excluded from the initial allocation of the arrangement consideration. These payments are recognized as revenue when the license is issued upon exercise of the licensee’s option, if the Company has no future obligations under the agreement. If there are future obligations under the agreement, product license payments are recognized as revenue only to the extent of the fair value of the license. Amounts paid in excess of fair value are recognized in a manner similar to milestone payments. Royalty revenue is recognized upon the sale of the related products provided the Company has no remaining performance obligations under the arrangement.

Payments received that have not met the appropriate criteria for revenue recognition are recorded as deferred revenue.

Cost of Product Sales

Cost of product sales includes costs to procure, manufacture and distribute KALBITOR and manufacturing royalties. Costs associated with the manufacture of KALBITOR prior to regulatory approval were expensed when incurred as a research and development cost and accordingly, KALBITOR units sold during the three and six months ended June 30, 2011 and 2010 do not reflect the full cost of drug manufacturing.

Research and Development

Research and development costs include all direct costs, including salaries and benefits for research and development personnel, outside consultants, costs of clinical trials, sponsored research, clinical trials insurance, other outside costs, depreciation and facility costs related to the development of drug candidates.

Income Taxes

The Company utilizes the asset and liability method of accounting for income taxes in accordance with ASC 740. Under this method, deferred tax assets and liabilities are recognized for the expected future tax consequences of temporary differences between the carrying amounts and the tax basis of assets and liabilities using the current statutory tax rates. At June 30, 2011 and December 31, 2010, there were no unrecognized tax benefits.

The Company accounts for uncertain tax positions using a "more-likely-than-not" threshold for recognizing and resolving uncertain tax positions. The evaluation of uncertain tax positions is based on factors that include, but are not limited to, changes in tax law, the measurement of tax positions taken or expected to be taken in tax returns, the effective settlement of matters subject to audit, new audit activity and changes in facts or circumstances related to a tax position. The Company evaluates uncertain tax positions on a quarterly basis and adjusts the level of the liability to reflect any subsequent changes in the relevant facts surrounding the uncertain positions.

12

Translation of Foreign Currencies

Assets and liabilities of the Company's foreign subsidiaries are translated at period end exchange rates. Amounts included in the statements of operations are translated at the average exchange rate for the period. All currency translation adjustments are recorded to other income (expense) in the consolidated statement of operations. For the three and six months ending June 30, 2011 the Company recorded other income of $12,000 and other expense of $47,000, respectively, for the translation of foreign currency. For the three and six months ending June 30, 2010 the Company recorded other expenses of $54,000 and $94,000, respectively, for the translation of foreign currency.

Share-Based Compensation

The Company’s share-based compensation program consists of share-based awards granted to employees in the form of stock options, as well as its 1998 Employee Stock Purchase Plan, as amended (the Purchase Plan). The Company’s share-based compensation expense is recorded in accordance with ASC 718.

Income or Loss Per Share

The Company presents two earnings or loss per share (EPS) amounts, basic and diluted in accordance with ASC 260. Basic earnings or loss per share is computed using the weighted average number of shares of common stock outstanding. Diluted net loss per share does not differ from basic net loss per share since potential common shares from the exercise of stock options, warrants or rights under the Purchase Plan are anti-dilutive for the period ended June 30, 2011 and, therefore, are excluded from the calculation of diluted net loss per share.

Stock options and warrants to purchase a total of 11,656,386 and 10,368,180 shares of common stock were outstanding at June 30, 2011 and 2010, respectively.

Comprehensive Income (Loss)

The Company accounts for comprehensive income (loss) under ASC 220, Comprehensive Income, which established standards for reporting and displaying comprehensive income (loss) and its components in a full set of general purpose financial statements. The statement required that all components of comprehensive income (loss) be reported in a financial statement that is displayed with the same prominence as other financial statements.

Business Segments

The Company discloses business segments under ASC 280, Segment Reporting. The statement established standards for reporting information about operating segments and disclosures about products and services, geographic areas and major customers. The Company operates as one business segment within predominantly one geographic area.

Recent Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (FASB) or other standard setting bodies, which are adopted by the Company as of the specified effective date. Unless otherwise discussed, the Company believes that the impact of recently issued standards that are not yet effective will not have a material impact on its financial position or results of operations upon adoption.

In May 2011, the FASB issued ASU No. 2011-04, “Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs” (ASU 2011-04). This newly issued accounting standard clarifies the application of certain existing fair value measurement guidance and expands the disclosures for fair value measurements that are estimated using significant unobservable (Level 3) inputs. This ASU is effective on a prospective basis for

13

annual and interim reporting periods beginning on or after December 15, 2011, which for Dyax will be January 1, 2012. We do not expect that adoption of this standard will have a material impact on our financial position or results of operations.

In June 2011, the FASB issued Accounting Standards Update (ASU) No. 2011-05, “Comprehensive Income (Topic 220)” (ASU 2011-05). This newly issued accounting standard (1) eliminates the option to present the components of other comprehensive income as part of the statement of changes in stockholders’ equity; (2) requires the consecutive presentation of the statement of net income and other comprehensive income; and (3) requires an entity to present reclassification adjustments on the face of the financial statements from other comprehensive income to net income. The amendments in this ASU do not change the items that must be reported in other comprehensive income or when an item of other comprehensive income must be reclassified to net income nor do the amendments affect how earnings per share is calculated or presented. This ASU is required to be applied retrospectively and is effective for fiscal years and interim periods within those years beginning after December 15, 2011, which for Dyax will be January 1, 2012. As this accounting standard only requires enhanced disclosure, the adoption of this standard will not impact our financial position or results of operations.

3. SIGNIFICANT TRANSACTIONS

Sigma-Tau

In June 2010, the Company entered into a strategic partnership agreement with Defiante Farmaceutica S.A., a subsidiary of the pharmaceutical company Sigma-Tau SpA (Sigma-Tau) to develop and commercialize subcutaneous ecallantide for the treatment of HAE and other therapeutic indications throughout Europe, North Africa, the Middle East and Russia. In December 2010, the original agreement was amended to expand the partnership to commercialize KALBITOR for the treatment of HAE in Australia and New Zealand (the first amendment). In May 2011, the Company further amended its agreement with Sigma-Tau to include development and commercialization rights in Latin America (excluding Mexico), the Caribbean, Taiwan, Singapore and South Korea (the second amendment).

Under the terms of the original agreement, Sigma-Tau made a $2.5 million upfront payment. In addition, Sigma-Tau purchased 636,132 shares of the Company's common stock at a price of $3.93 per share, which represented a 50% premium over the 20-day average closing price through June 17, 2010, for an aggregate purchase price of $2.5 million.

Under the terms of the first amendment, Sigma-Tau made an additional $500,000 upfront payment to the Company and also purchased 151,515 shares of the Company's common stock at a price of $3.30 per share, which represented a 50% premium over the 20-day average closing price through December 20, 2010, for an aggregate purchase price of $500,000. Both payments were received in January 2011.

Under the terms of the second amendment, Sigma-Tau is required to make an additional $7.0 million in non-refundable upfront payments to the Company during 2011, of which $4.0 million was received in July 2011.

The Company is also eligible to receive over $115 million in development and sales milestones related to ecallantide and royalties equal to 41% of net sales of product, as adjusted for product costs. Sigma-Tau will pay costs associated with regulatory approval and commercialization in the licensed territories. In addition, the Company and Sigma-Tau will share equally the costs for all development activities for optional future indications developed in partnership with Sigma-Tau in the territories covered under the initial Sigma-Tau agreement. The partnership agreement may be terminated by Sigma-Tau, at will, upon 6 months’ prior written notice. Either party may terminate the partnership agreement in the event of an uncured material breach or declaration or filing of bankruptcy by the other party.

14

Prior to the second amendment in May 2011, revenue related to this multiple element arrangement was being recognized in accordance with ASC 605. The Company evaluated the terms of the second amendment relative to the entire arrangement and determined the amendment to be a material modification to the existing agreement for financial reporting purposes. As a result, the Company evaluated the entire arrangement under the guidance of ASU 2009-13 which was adopted in 2011.

Under the terms of the original agreement and first amendment, the Company analyzed this multiple element arrangement in accordance with ASC 605 and evaluated whether the performance obligations under this agreement, including the product license and development, steering committee, and manufacturing services should be accounted for as a single unit or multiple units of accounting. The Company determined that there were two units of accounting. The first unit of accounting included the product license, the committed future development services and the steering committee involvement. These deliverables were grouped into one unit of accounting due to the lack of objective and reliable evidence of fair value. The second unit of accounting related to the manufacturing services, and was determined to meet all of the criteria to be a separate unit of accounting. The Company had the ability to estimate the scope and timing of its involvement in the future development of the program as the Company's obligations under the development period are clearly defined. Therefore, the Company recognized revenue related to the first unit of accounting utilizing a proportional performance model based on the actual effort performed in proportion to the total estimated level of effort. Under this model, the Company estimated the level of effort to be expended over the term of the agreement and recognized revenue based on the lesser of the amount calculated based on proportional performance of total expected revenue or the amount of non-refundable payments earned. As of the date of the second amendment, $4.8 million of revenue was recognized for the first unit of accounting. To date, no revenue has been recognized related to manufacturing services as none have been provided.

As the second amendment represented a material modification to the existing agreement the Company re-evaluated the entire arrangement under ASU 2009-13 and the Company determined all undelivered items under the agreement and divided them into separate units of accounting based on whether the deliverable provided stand-alone value to the licensee. These units of accounting consist of (i) the license to develop and commercialize ecallantide for the treatment of HAE and other therapeutic indications in the territories granted under the second amendment, (ii) steering committee services and (iii) committed future development services. The Company then determined the best estimate selling price (BESP) for the license and steering committee services and the fair value of committed future development services was determined using vendor objective evidence. The Company’s process for determining BESP involves management’s judgment and includes factors such as discounted cash flows, estimated direct expenses and other costs and available data.

Based on the change in revenue guidance applied to this arrangement, previously deferred revenue of $3.4 million was recognized during the second quarter of 2011. This amount represents the existing deferred revenue balance and guaranteed payments less the total of BESP for the undelivered units of accounting.

As the license granted under the second amendment was delivered during the quarter, revenue related to this unit of $5.8 million was also recognized in the second quarter of 2011. Revenue related to steering committee services of $190,000 was deferred and is being recognized under the proportional performance model as meetings are held through the estimated development period of ecallantide in the Sigma-Tau Territories. Revenues associated with future committed development services will be recognized as incurred and billed to Sigma-Tau for reimbursement. As future milestones are achieved and to the extent they involve substantial effort on the Company’s part, revenue will be recognized in the period in which the milestone is achieved. The manufacturing services were determined to represent a contingent deliverable and, as such, have been excluded from the current revenue model.

15

The Company recognized revenue of approximately $10.7 million and $11.9 million related to this agreement for the three and six months ended June 30, 2011, respectively. Revenue for the three and six months ending June 30, 2011 would have been $5.0 million and $6.2 million, respectively, if revenue had been recognized under the previous revenue recognition model, prior to adoption of ASU 2009-13.

As of June 30, 2011 and December 31, 2010, the Company has deferred $190,000 and $3.1 million, respectively, of revenue related to this arrangement, which is recorded in deferred revenue on the accompanying consolidated balance sheets at such dates. The deferred revenue balance at June 30, 2011, relates to the joint steering committee obligation which is estimated to go through 2012. The Company recorded a receivable of $7.0 million as of June 30, 2011 for payments due in 2011 under the second amendment, of which $4.0 million was collected in July 2011. Additionally, the Company recorded receivables for reimbursement of costs associated with regulatory approval of $456,000 and $1.4 million as of June 30, 2011 and December 31, 2010, respectively.

CMIC

In September 2010, the Company entered into an agreement with CMIC Co., Ltd, (CMIC) to develop and commercialize subcutaneous ecallantide for the treatment of HAE and other angioedema indications in Japan.

Under the terms of the agreement, the Company received a $4.0 million upfront payment. The Company is also eligible to receive up to $102 million in development and sales milestones for ecallantide in HAE and other angioedema indications and royalties of 20%-24% of net product sales. CMIC is solely responsible for all costs associated with development, regulatory activities, and commercialization of ecallantide for all angioedema indications in Japan. CMIC will purchase drug product from the Company on a cost-plus basis for clinical and commercial supply.

The Company analyzed this multiple element arrangement in accordance with ASC 605 and evaluated whether the performance obligations under this agreement, including the product license, development of ecallantide for the treatment of HAE and other angioedema indications in Japan, steering committee, and manufacturing services should be accounted for as a single unit or multiple units of accounting. The Company determined that there were two units of accounting. The first unit of accounting includes the product license, the committed future development services and the steering committee involvement. The second unit of accounting relates to the manufacturing services. At this time the scope and timing of the future development of ecallantide for the treatment of HAE and other indications in the CMIC territory are the joint responsibility of the Company and CMIC and therefore, the Company cannot reasonably estimate the level of effort required to fulfill its obligations under the first unit of accounting. As a result, the Company is recognizing revenue under the first unit of accounting on a straight-lined basis over the estimated development period of ecallantide for the treatment of HAE and other indications in the CMIC territory of approximately seven years.

The Company recognized revenue of approximately $148,000 and $296,000 related to this agreement for the three and six months ended June 30, 2011, respectively. As of June 30, 2011 and December 31, 2010, the Company has deferred approximately $3.6 million and $3.9 million, respectively, of revenue related to this arrangement, which is recorded in deferred revenue on the accompanying consolidated balance sheets.

Sale of Xyntha Royalty Rights

In April 2010, the Company sold its rights to royalties and other payments related to the commercialization of the product Xyntha®, which was developed by one of the Company's licensees under the Company's phage display LFRP. Under the terms of this sale, the Company received an upfront cash payment of $9.8 million and earned an additional $1.5 million milestone payment based on 2010 product

16

sales. The Company is also eligible to receive an additional $500,000 milestone payment based on 2011 product sales. A portion of the cash payments received were required to be applied to the Company's loan with Cowen Healthcare (see Note 7 – Note Payable), totaling a $2.2 million principal reduction and interest expense of $1.4 million. The Company has determined that it has no substantive future obligations under the arrangement.

Cubist Pharmaceuticals Inc.

In 2008, the Company entered into an exclusive license and collaboration agreement with Cubist Pharmaceuticals, Inc. (Cubist), for the development and commercialization in North America and Europe of the intravenous formulation of ecallantide for the reduction of blood loss during surgery. Under this agreement, Cubist assumed responsibility for all further development and costs associated with ecallantide in the licensed indications in the Cubist territory. The Company received $17.5 million in license and milestone fees in 2008 as a result of the Cubist agreement. Additionally, the Company received $3.6 million for drug product supply and reimbursement of costs incurred in 2008 related to the conduct of the Phase 2 clinical trial.

On March 31, 2010, Cubist announced its plan to stop investing in the clinical development of ecallantide as a therapy to reduce blood loss during surgery and its intention to terminate the 2008 agreement with the Company. Based upon Cubist's decision, $13.8 million of deferred revenue was recognized as revenue during the three months ended March 31, 2010, as the development period had ended.

4. FAIR VALUE MEASUREMENTS

The following tables present information about the Company's financial assets that have been measured at fair value as of June 30, 2011 and December 31, 2010 and indicate the fair value hierarchy of the valuation inputs utilized to determine such fair value. In general, fair values determined by Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities. Fair values determined by Level 2 inputs utilize observable inputs other than Level 1 prices, such as quoted prices, for similar assets or liabilities, quoted prices in markets that are not active or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the related assets or liabilities. Fair values determined by Level 3 inputs are unobservable data points for the asset or liability, and includes situations where there is little, if any, market activity for the asset or liability.

|

Description (in thousands)

|

June 30,

2011

|

Quoted

Prices in

Active

Markets

(Level 1)

|

Significant

Other

Observable

Inputs

(Level 2)

|

Significant

Unobservable

Inputs

(Level 3)

|

||||||||||||

|

Assets:

|

||||||||||||||||

|

Cash equivalents

|

$ | 5,151 | $ | 5,151 | $ | — | $ | — | ||||||||

|

Marketable debt securities

|

47,655 | 47,655 | — | — | ||||||||||||

|

Total

|

$ | 52,806 | $ | 52,806 | $ | — | $ | — | ||||||||

|

Description (in thousands)

|

December

31,

2010

|

Quoted

Prices in

Active

Markets

(Level 1)

|

Significant

Other

Observable

Inputs

(Level 2)

|

Significant

Unobservable

Inputs

(Level 3)

|

||||||||||||

|

Assets:

|

||||||||||||||||

|

Cash equivalents

|

$ | 16,931 | $ | 16,931 | $ | — | $ | — | ||||||||

|

Marketable debt securities

|

58,783 | 58,783 | — | — | ||||||||||||

|

Total

|

$ | 75,714 | $ | 75,714 | $ | — | $ | — | ||||||||

17

As of June 30, 2011 and December 31, 2010, the Company's investments consisted of U.S. Treasury notes and bills which are categorized as Level 1. The fair values of cash equivalents and marketable debt securities are determined through market, observable and corroborated sources. The carrying amounts reflected in the consolidated balance sheets for cash, cash equivalents, accounts receivable, other current assets, accounts payable and accrued expenses and other current liabilities approximate fair value due to their short-term maturities.

5. INVENTORY

In December 2009, the Company received marketing approval of KALBITOR from the FDA. Costs associated with the manufacture of KALBITOR prior to regulatory approval were expensed when incurred, and therefore were not capitalized as inventory. As a result, the Company’s finished goods inventory does not include all costs of manufacturing drug substance currently being sold. Subsequent to FDA approval, all costs associated with the manufacture of KALBITOR have been recorded as inventory, which consists of the following (in thousands):

|

June 30,

2011

|

December 31,

2010

|

|||||||

|

Raw Materials

|

$ | 1,333 | $ | 766 | ||||

|

Work in Progress

|

5,336 | 723 | ||||||

|

Finished Goods

|

276 | 207 | ||||||

|

Total

|

$ | 6,945 | $ | 1,696 | ||||

6. ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Accounts payable and accrued expenses consist of the following (in thousands):

|

June 30,

2011

|

December 31,

2010

|

|||||||

|

Accounts payable

|

$ | 5,141 | $ | 1,398 | ||||

|

Accrued employee compensation and related taxes

|

3,164 | 4,847 | ||||||

|

Accrued external research and development and contract manufacturing

|

1,886 | 1,180 | ||||||

|

Accrued legal

|

608 | 500 | ||||||

|

Other accrued liabilities

|

1,727 | 2,747 | ||||||

|

Total

|

$ | 12,526 | $ | 10,672 | ||||

7. NOTE PAYABLE

In 2008, the Company entered into an agreement with Cowen Healthcare Royalty Partners, LP (Cowen Healthcare) for a $50.0 million loan secured by the Company's phage display LFRP (Tranche A loan). The Company used $35.1 million from the proceeds of the Tranche A loan to pay off its remaining obligation under a then existing agreement with Paul Royalty Fund Holdings II, LP. In March 2009, the Company amended and restated the loan agreement with Cowen Healthcare to include a Tranche B loan of $15.0 million.

The Tranche A and Tranche B loans (collectively, the Loan) mature in August 2016. The Tranche A portion bears interest at an annual rate of 16%, payable quarterly, and the Tranche B portion bears interest at an annual rate of 21.5%, payable quarterly. The Loan may be prepaid without penalty, in whole or in part, beginning in August 2012. In connection with the Loan, the Company has entered into a security agreement granting Cowen Healthcare a security interest in the intellectual property related to the LFRP, and the revenues generated by the Company through the license of the intellectual property related to the LFRP. The security agreement does not apply to the Company's internal drug development or to any of the Company's co-development programs.

18

Under the terms of the loan agreement, the Company is required to repay the Loan based on the annual net LFRP receipts. Until June 30, 2013, required payments are tiered as follows: 75% of the first $10.0 million in specified annual LFRP receipts, 50% of the next $5.0 million and 25% of annual included LFRP receipts over $15.0 million. After June 30, 2013, and until the maturity date or the complete amortization of the Loan, Cowen Healthcare will receive 90% of all included LFRP receipts. If the Cowen Healthcare portion of LFRP receipts for any quarter exceeds the interest for that quarter, then the principal balance will be reduced. Any unpaid principal will be due upon the maturity of the Loan. If the Cowen Healthcare portion of LFRP revenues for any quarterly period is insufficient to cover the cash interest due for that period, the deficiency may be added to the outstanding principal or paid in cash by the Company. After five years from the date of funding of each tranche of the loan, the Company must repay to Cowen Healthcare all additional accumulated principal above the original $50.0 million and $15.0 million loan amounts of Tranche A and Tranche B, respectively.

In addition, under the terms of the loan agreement, the Company is permitted to sell or otherwise transfer collateral generating cash proceeds of up to $25.0 million. Twenty percent of these cash proceeds will be applied to principal and accrued interest on the Loan plus any applicable prepayment premium and an additional 5.0% of such proceeds will be paid to Cowen Healthcare as a cash premium. In 2010, the Company sold its rights to royalties and other payments related to the commercialization of a product developed by one of the Company’s licensees under the LFRP. Under the terms of the sale, the Company has received $11.3 million and is eligible to receive an additional $500,000 based on 2011 product sales (see Note 3, Significant Transactions - Sale of Xyntha Royalty Rights).

In connection with the Tranche A loan, the Company issued to Cowen Healthcare a warrant to purchase 250,000 shares of the Company's common stock at an exercise price of $5.50 per share. The warrant expires in August 2016 and became exercisable on August 5, 2009. The Company estimated the relative fair value of the warrant to be $853,000 on the date of issuance, using the Black-Scholes valuation model, assuming a volatility factor of 83.64%, risk-free interest rate of 4.07%, an eight-year expected term and an expected dividend yield of zero. In conjunction with the Tranche B loan, the Company issued to Cowen Healthcare a warrant to purchase 250,000 shares of the Company’s common stock at an exercise price of $2.87 per share. The warrant expires in August 2016 and became exercisable on March 27, 2010. The Company estimated the relative fair value of the warrant to be $477,000 on the date of issuance, using the Black-Scholes valuation model, assuming a volatility factor of 85.98%, risk-free interest rate of 2.77%, a seven-year, four-month expected term and an expected dividend yield of zero. The relative fair values of the warrants are recorded in additional paid-in capital on the Company's consolidated balance sheets.

The cash proceeds from the Loan were recorded as a note payable on the Company's consolidated balance sheet. The note payable balance was reduced by $1.3 million for the fair value of the Tranche A and Tranche B warrants, and by $580,000 for payment of Cowen Healthcare’s legal fees in conjunction with the Loan. Each of these amounts is being accreted over the life of the note.

The following table reflects the activity on the Loan for financial reporting purposes for the six months ended June 30, 2011 and the year ended December 31, 2010 (in thousands):

|

June 30,

|

December 31,

|

|||||||

|

2011

|

2010

|

|||||||

|

Beginning balance

|

$ | 56,406 | $ | 58,096 | ||||

|

Accretion on warrants and discount

|

123 | 246 | ||||||

|

Loan activity:

|

||||||||

|

Interest expense

|

5,008 | 11,420 | ||||||

|

Payments applied to principal

|

(1,129 | ) | (1,935 | ) | ||||

|

Payments applied to interest

|

(5,008 | ) | (10,721 | ) | ||||

|

Accrued interest payable

|

-- | (700 | ) | |||||

|

Ending balance

|

$ | 55,400 | $ | 56,406 | ||||

19

The Loan principal balance at June 30, 2011, and December 31, 2010 was $56.7 million and $57.8 million, respectively.The estimated fair value of the note payable was $52.4 million at June 30, 2011.

8. STOCKHOLDER’S EQUITY (DEFICIT) AND STOCK-BASED COMPENSATION

Common Stock

In January 2011, the Company issued 151,515 shares of its common stock for an aggregate purchase price of $500,000 in connection with an amendment to a strategic partnership (see Note 3, Significant Transactions - Sigma Tau).

In May 2011, the Company’s stockholders approved an amendment to Dyax’s Restated Certificate of Incorporation to increase the number of authorized shares of common stock to 200,000,000 shares.

Equity Incentive Plan

The Company's 1995 Equity Incentive Plan (the Equity Plan), as amended, is an equity plan under which equity awards, including awards of restricted stock and incentive and nonqualified stock options to purchase shares of common stock may be granted to employees, consultants and directors of the Company by action of the Compensation Committee of the Board of Directors. Options are generally granted at the current fair market value on the date of grant, generally vest ratably over a 48-month period, and expire within ten years from date of grant. The Equity Plan is intended to attract and retain employees and to provide an incentive for employees, consultants and directors to assist the Company to achieve long-range performance goals and to enable them to participate in the long-term growth of the Company. At June 30, 2011, a total of 3,416,123 shares were available for future grants under the Equity Plan.

Employee Stock Purchase Plan

The Company's Purchase Plan allows employees to purchase shares of the Company's common stock at a discount from fair market value. Under this Plan, eligible employees may purchase shares during six-month offering periods commencing on June 1 and December 1 of each year at a price per share of 85% of the lower of the fair market value price per share on the first or last day of each six-month offering period. Participating employees may elect to have up to 10% of their base pay withheld and applied toward the purchase of such shares, subject to the limitation of 875 shares per participant per quarter. The rights of participating employees under the Purchase Plan terminate upon voluntary withdrawal from the Purchase Plan at any time or upon termination of employment. The compensation expense in connection with the Plan for the three and six months ended June 30, 2011 was approximately $12,000 and $24,000, respectively, and $5,000 and $31,000, respectively, for the three and six months ended June 30, 2010. There were 87,188 and 49,972 shares purchased under the Plan during the six months ended June 30, 2011 and 2010, respectively. At June 30, 2011, a total of 506,892 shares were reserved and available for issuance under this Plan.

Stock-Based Compensation Expense

The Company measures compensation cost for all stock awards at fair value on date of grant and recognition of compensation over the service period for awards expected to vest. The fair value of stock options is determined using the Black-Scholes valuation model. Such value is recognized as expense over the service period, net of estimated forfeitures and adjusted for actual forfeitures. The estimation of stock options that will ultimately vest requires significant judgment. The Company considers many factors when estimating expected forfeitures, including historical experience. Actual results and future changes in estimates may differ substantially from the Company's current estimates.

20

The following table reflects stock compensation expense recorded, net of amounts capitalized into inventory, during the three and six months ended June 30, 2011 and 2010 (in thousands):

| Three Months Ended | Six Months Ended | |||||||||||||||

|

June 30,

|

June 30,

|

|||||||||||||||

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||

|

Compensation expense related to:

|

||||||||||||||||

|

Equity Incentive Plan

|

$ | 1,204 | $ | 1,017 | $ | 2,196 | $ | 1,933 | ||||||||

|

Employee Stock Purchase Plan

|

12 | 5 | 24 | 31 | ||||||||||||

| $ | 1,216 | $ | 1,022 | $ | 2,220 | $ | 1,964 | |||||||||

|

Stock-based compensation expense charged to:

|

||||||||||||||||

|

Research and development expenses

|

$ | 313 | $ | 376 | $ | 624 | $ | 719 | ||||||||

|

Selling, general and administrative expenses

|

$ | 903 | $ | 646 | $ | 1,596 | $ | 1,245 | ||||||||

Stock-based compensation of $15,000 and $17,000 was capitalized into inventory for the six months ended June 30, 2011 and 2010, respectively. Capitalized stock-based compensation is recognized into cost of product sales when the related product is sold.

9. INCOME TAXES

Deferred tax assets and deferred tax liabilities are recognized based on temporary differences between the financial reporting and tax basis of assets and liabilities using future expected enacted rates. A valuation allowance is recorded against deferred tax assets if it is more likely than not that some or all of the deferred tax assets will not be realized. The Company has recorded a deferred tax asset of approximately $1.8 million at December 31, 2010 reflecting the benefit of deductions from the exercise of stock options which is fully reserved until it is more likely than not that the benefit will be realized. The benefit from this deferred tax asset will be recorded as a credit to additional paid-in capital if and when realized through a reduction of cash taxes.

As required by ASC 740, the Company's management has evaluated the positive and negative evidence bearing upon the realizability of its deferred tax assets, and has determined that it is not "more likely than not" that the Company will recognize the benefits of the deferred tax assets. Accordingly, a valuation allowance of approximately $187.7 million was in place at December 31, 2010.

The Company accounts for uncertain tax positions using a "more-likely-than-not" threshold for recognizing and resolving uncertain tax positions. The evaluation of uncertain tax positions is based on factors that include, but are not limited to, changes in tax law, the measurement of tax positions taken or expected to be taken in tax returns, the effective settlement of matters subject to audit, new audit activity and changes in facts or circumstances related to a tax position. The Company evaluates uncertain tax positions on a quarterly basis and adjusts the level of the liability to reflect any subsequent changes in the relevant facts surrounding the uncertain positions. As of June 30, 2011, the Company had no unrecognized tax benefits.

The tax years 1996 through 2010 remain open to examination by major taxing jurisdictions to which the Company is subject, which are primarily in the United States, as carryforward attributes generated in years past may still be adjusted upon examination by the Internal Revenue Service or state tax authorities if they have or will be used in a future period. The Company is currently not under examination in any jurisdictions for any tax years.

21

10. SUBSEQUENT EVENT

On July 14, 2011, the Company entered into a lease agreement for new premises located in Burlington, Massachusetts. The premises, consisting of approximately 44,500 rentable square feet of office and laboratory facilities, will be used as the Company’s principal offices and corporate headquarters. The Company intends to relocate all of its operations presently conducted in Cambridge, Massachusetts to the new facility in January 2012. The term of the new lease is ten years, and the Company has rights to extend the term for an additional five years at fair market value subject to specified terms and conditions. The aggregate minimum lease commitment over the ten year term of the new lease is approximately $15.0 million. The Company has provided the landlord a letter of credit of $1.1 million to secure its obligations under the lease. The landlord has provided the Company with a tenant improvement allowance of up to $1.9 million.

In connection with this relocation, the Company intends to exercise its rights to terminate the lease agreement for the Company’s current headquarters in Cambridge, Massachusetts to coincide approximately with the commencement of its new lease.

Note Regarding Forward-Looking Statements

This quarterly report on Form 10-Q contains forward-looking statements that have been made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on current expectations, estimates and projections about our industry, management’s beliefs, and certain assumptions made by our management and may include, but are not limited to, statements about:

|

●

|

the potential benefits and commercial potential of KALBITOR (ecallantide) for its approved indication and any additional indications;

|

|

●

|

our commercialization of KALBITOR, including revenues and cost of product sales;

|

|

●

|