Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SunCoke Energy, Inc. | d8k.htm |

| EX-99.1 - PRESS RELEASE - SunCoke Energy, Inc. | dex991.htm |

Q2 ‘11

Earnings Conference Call August 3, 2011

Exhibit 99.2 |

Safe Harbor

Statement This slide presentation should be reviewed in conjunction with

SunCoke’s Second Quarter 2011 earnings conference call held on August

3, 2011 at 5:00 p.m. ET. You may listen to the audio portion of the conference call by phone or on the website and an

audio recording will be available after the call’s completion by calling

1-888-843-7419 and entering conference ID 30289205#. This slide

presentation should also be reviewed together with SunCoke’s Form 10-Q for the quarter ended June 30, 2011 filed

with the Securities and Exchange Commission today.

Statements in this presentation that are not historical facts are

forward-looking statements intended to be covered by the safe harbor

provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These

forward-looking statements are based upon assumptions by SunCoke concerning

future conditions, any or all of which ultimately may prove to be

inaccurate, and upon the current knowledge, beliefs and expectations of SunCoke management. These forward-

looking statements are not guarantees of future performance.

Forward looking statements are inherently uncertain and involve significant risks

and uncertainties that could cause actual results to differ materially from

those described during this presentation. Such risks and uncertainties include economic, business,

competitive and/or regulatory factors affecting SunCoke’s business, as well as

uncertainties related to the outcomes of pending or future

litigation.

In

accordance

with

the

safe

harbor

provisions

of

the

Private

Securities

Litigation

Reform

Act

of

1995,

SunCoke

has included in its filings with the Securities and Exchange Commission, cautionary

language identifying important factors (though not necessarily all such

factors) that could cause future outcomes to differ materially from those set forth in the forward looking

statements. For more information concerning these factors, see SunCoke's Securities

and Exchange Commission filings. SunCoke expressly disclaims any obligation

to update or alter its forward looking statements, whether as a result of new

information, future events or otherwise. For more information concerning these

factors, see SunCoke's Securities and Exchange Commission filings, available

on SunCoke's website at www.suncoke.com in the

Investor Relations section. This presentation includes certain non-GAAP

financial measures intended to supplement, not substitute for, comparable GAAP

measures. Reconciliations of non-GAAP financial measures to GAAP financial

measures are provided in the Appendix at the end of the presentation.

Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those

measures provided in the Appendix, or on our website at www.suncoke.com.

Second Quarter 2011 Earnings Conference Call

1 |

Separation

Update •

Completed Initial Public Offering (NYSE: SXC)

•

Issued $700 million aggregate of Long-Term Debt and entered into a

$150 million Revolving Credit Facility

•

$400 million Senior Notes

•

$300 million Secured Term Loan Credit Facility

•

Repaid intercompany payable to Sunoco of $575 million with

balance of the net proceeds retained for general corporate purposes

•

$150 million Revolver currently undrawn

•

Established Executive Management Team and Three Independent

Board Members

•

Sunoco intends to distribute SunCoke shares to Sunoco

shareholders on or before 12 months from IPO

Second Quarter 2011 Earnings Conference Call

2 |

Second Quarter

Overview (1) For a reconciliation of Adjusted EBITDA to net income and

operating income, please see the appendix. •

Continue to advance domestic and international growth opportunities

Second Quarter 2011 Earnings Conference Call

3

Q2 ‘11 vs. Q2 ’10

•

Year-over-year quarterly results reflect unfavorable impact of

ArcelorMittal settlement, and relocation and public company readiness

costs •

Net Income Attributable to Net Parent Investment of $22.4 million in Q2 ‘11

vs. $44.3 million in Q2 ’10

•

Adjusted EBITDA

(1)

of $37.6 million in Q2 ‘11 vs. $68.7 million in Q2 ’10

•

Improvement over Q1 ‘11 driven by stronger Indiana Harbor performance

and better utilization rates across all Coke Operations

•

Adjusted EBITDA

(1)

of $37.6 million in Q2 ‘11 vs. $26.6 million in Q1 ’11

Q2

‘11

vs.

Q1

’11 |

Q2 ‘11

Financial Results ($ in millions)

Q2 '11

Q2 '10

Q1 '11

Q2 '11 vs.

Q2 '10

Q2 '11 vs.

Q1 '11

Revenue

$378.0

$349.3

$333.3

$28.7

$44.7

Operating Income

$21.4

$57.9

$4.3

($36.5)

$17.1

Net Income Attributable to

Net Parent Investment

$22.4

$44.3

$11.8

($21.9)

$10.6

Adjusted EBITDA

(1)

$37.6

$68.7

$26.6

($31.1)

$11.0

Coke Sales Volumes

927

909

872

18

55

Coal Sales Volumes

334

314

386

20

(52)

(1) For a reconciliation of Adjusted EBITDA to net income and operating income,

please see the appendix. Second Quarter 2011 Earnings Conference Call

4 |

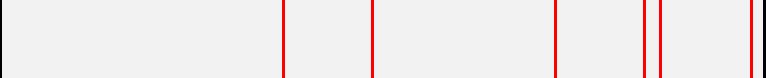

Q2 2010 to Q2

2011 Adjusted EBITDA Reconciliation

(1)

Excluding settlement impact, Adjusted EBITDA improvement from Haverhill and Granite City was

offset by operational issues at Indiana Harbor and Coal Mining and relocation and public

company readiness costs ($ in millions)

(1) For a reconciliation of Adjusted EBITDA to net income and operating income,

please see the appendix. Second Quarter 2011 Earnings Conference Call

5

$68.7

$37.6

$5.2

$2.5

($19.3)

($5.9)

($3.8)

($7.9)

($1.9)

$0

$10

$20

$30

$40

$50

$60

$70

Q2 2010A

Adjusted

EBITDA

ArcelorMittal

Settlement Impact

Indiana Harbor

Performance

(Costs and Yield)

Haverhill Operating

Cost Recovery and

Lower Operating

Expenses

Granite City

Improvement

(Steam Sales)

Coal Mining

(Excluding Transfer

Pricing Increase)

Higher Corp. Costs

for Relocation and

Public Company

Readiness

Other Items

Q2 2011A

Adjusted

EBITDA |

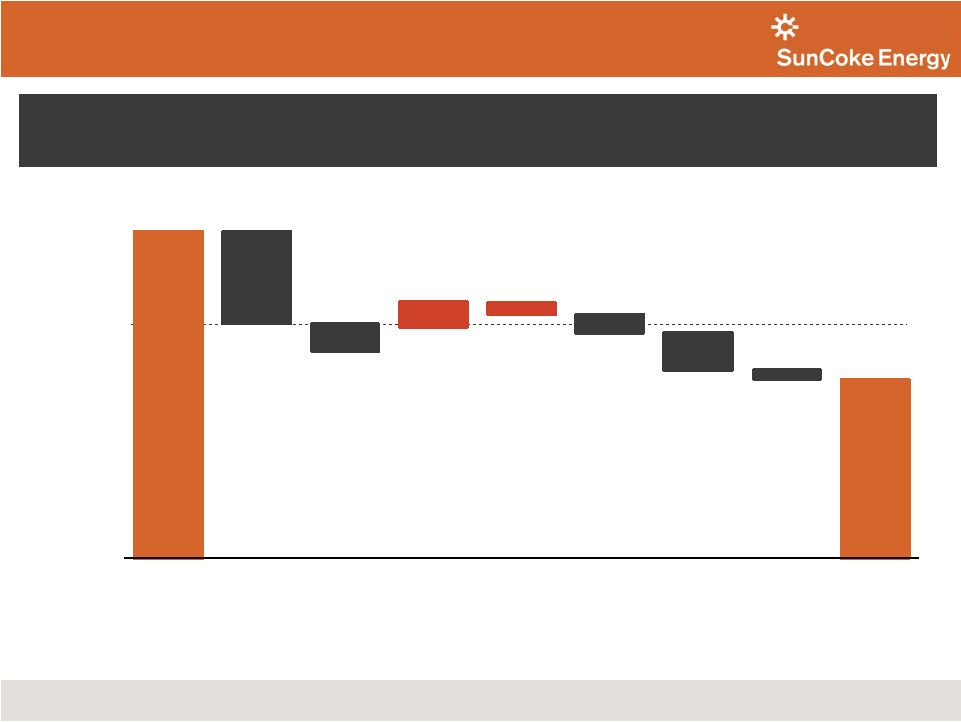

Q1 2011 to Q2

2011 Adjusted EBITDA Reconciliation

(1)

Adjusted EBITDA improvement driven by the absence of coke cover loss and improvements at Indiana

Harbor and Haverhill, partially offset by higher relocation and public company readiness

costs ($ in millions)

(1) For a reconciliation of Adjusted EBITDA to net income and operating income,

please see the appendix. Second Quarter 2011 Earnings Conference Call

6

$26.6

$37.6

$11.4

$3.9

$2.0

($5.5)

($0.8)

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$50

Q1 2011A

Adjusted

EBITDA

Coke Cover and Inventory

Loss at Indiana Harbor

Other Indiana Harbor

Improvements

Haverhill

Improvements

Higher Corp

Costs

Other Items

Q2 2011A

Adjusted

EBITDA |

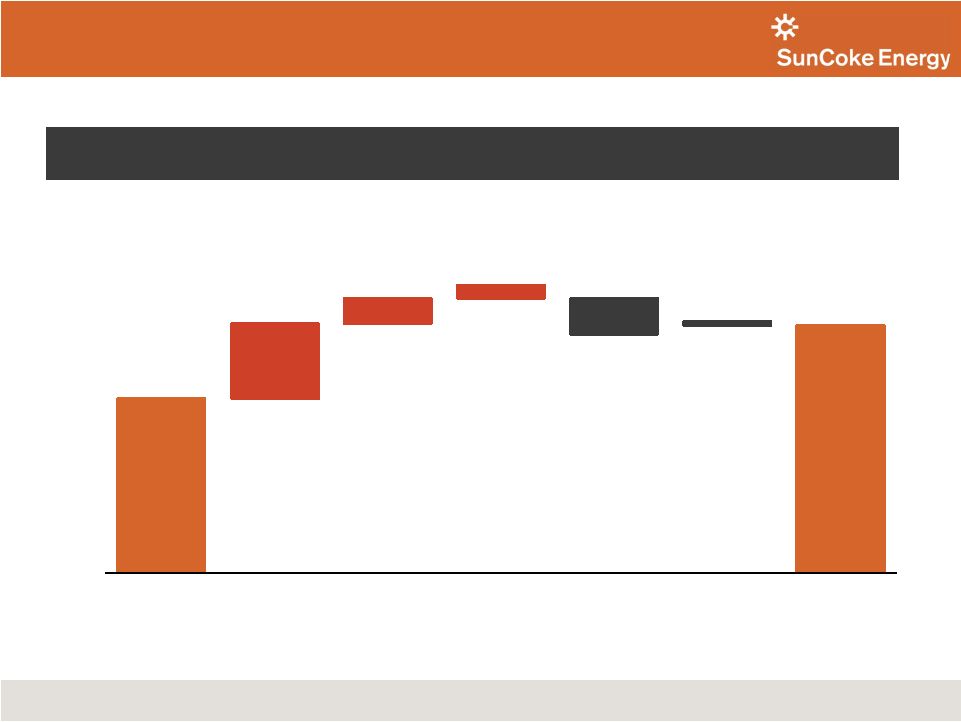

178

174

177

280

256

301

272

266

276

153

165

168

Q2 '10

Q1 '11

Q2 '11

Jewell

Indiana Harbor

Haverhill

Granite City

Domestic Coke Financial Summary

(Jewell Coke & Other Domestic Coke)

Domestic Coke Production

Domestic

Coke

Pro

Forma

Adjusted

EBITDA

(1)

,

Pro

Forma

for

ArcelorMittal Settlement and Coal Transfer Price

(Tons in thousands)

($ in millions, except per ton amounts)

883

861

922

$37

$19

$36

Pro Forma Adjusted EBITDA / ton

(1) For a reconciliation of ProForma Adjusted EBITDA to operating income, please

see the appendix.

Second Quarter 2011 Earnings Conference Call

7

$14

$11

$11

$23

$8

$25

$ 41/ton

$ 22/ton

$ 39/ton

Q2 '10

Q1 '11

Q2 '11

Jewell Coke Segment

Other Domestic Coke Segment

Other

Domestic

Coke:

705

Other

Domestic

Coke:

687

Other

Domestic

Coke:

745 |

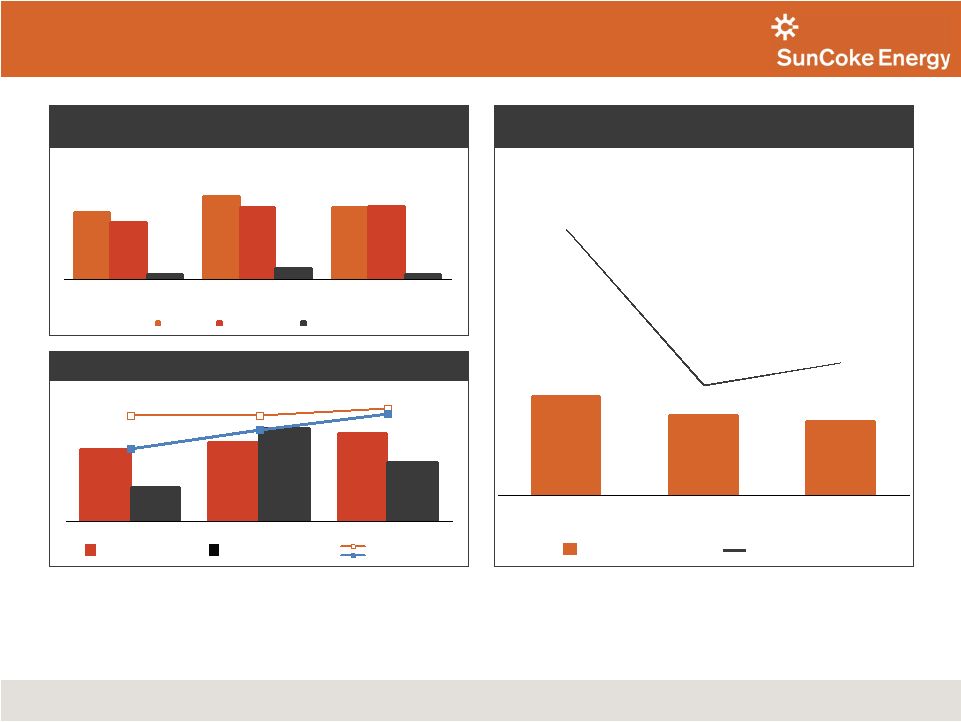

$104

$114

$126

$49

$133

$85

$152

$152

$162

$104

$131

$155

Q2 '10

Q1 '11

Q2 '11

Proforma Sales Price (2)

Average Sales Price

314

386

334

265

335

340

23

51

24

Q2 '10

Q1 '11

Q2 '11

Coal sales

Coal production

Coal purchases

Coal Mining Financial Summary

Coal Sales, Production and Purchases

Avg.

Sales

Price/Ton

(1)

and

Cost/Ton

Coal Mining Pro Forma Adjusted EBITDA

(5)

, Pro Forma for

Coal Transfer Price Impact

(Tons in thousands)

($ in millions, except per ton amounts)

Pro Forma Adjusted EBITDA

Pro Forma Adjusted EBITDA / ton

Coal

cash

cost

(3)

($ per ton)

(1)

Average Sales Price is the weighted average sales price for all coal sales volumes, includes

sales to affiliates and sales to Jewell Coke established via a transfer pricing

agreement. The transfer price per ton to Jewell Coke was $103.86, $133.57 and $156.12

for Q2 ‘10, Q1 ‘11 and Q2 ‘11,respectively. (2)

Pro

Forma

Sales

Price

is

the

Average

Sales

Price

adjusted

to

set

the

internal

transfer

price

on

Jewell

Coke

coal purchase volumes equal to the Jewell Coke coal component contract price. The per ton coal

cost component

included

in

the

Jewell

Coke

contract

was

approximately

$162,

$165

and

$165

for

Q2

‘10,

Q1 ‘11

and Q2 ‘11, respectively.

(3)

Mining and preparation costs, excluding depreciation, depletion and amortization, divided by

coal production volume.

(4)

Costs of purchased raw coal divided by purchased coal volume.

Second Quarter 2011 Earnings Conference Call

8

$15

$12

$11

$49/ton

$32/ton

$34/ton

Q2 '10

Q1 '11

Q2 '11

(5) For a reconciliation of ProForma Adjusted EBITDA to operating income, please

see the appendix.

Purchased coal cost

(4) |

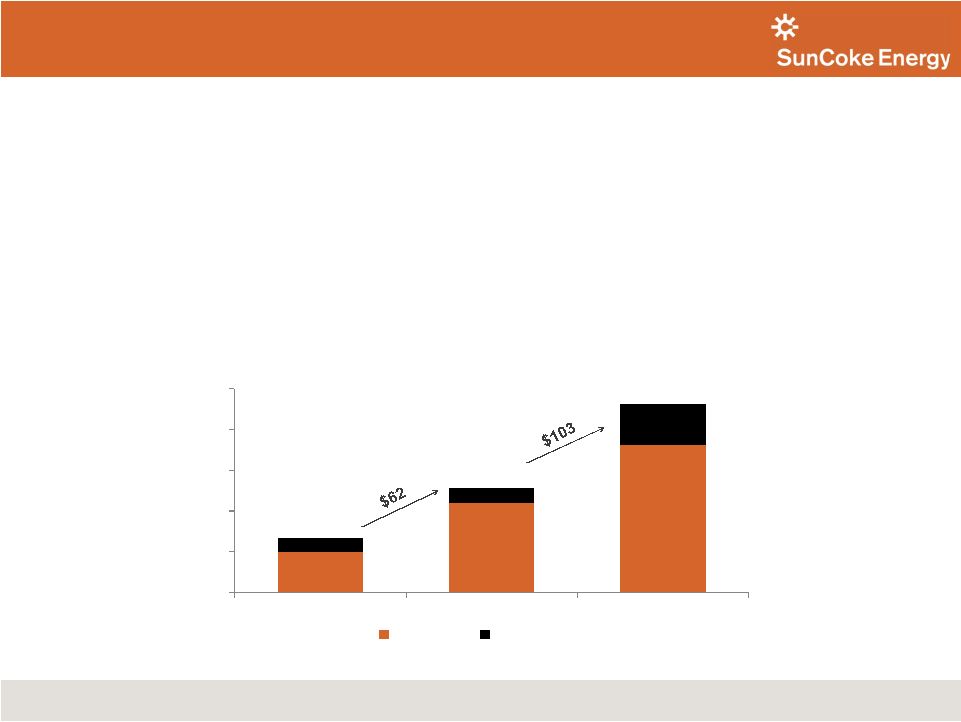

$49

$110

$181

$17

$18

$50

$0

$50

$100

$150

$200

$250

First Half '10

First Half '11

Full Year '11E

Capital Expenditures

Expansion

Ongoing

Capital Expenditures

($ in millions)

•

Capital Expenditures increased $62M from first half of 2010, primarily related

to

Middletown Operations

-

Capital Expenditures for Q1 ‘11 and Q2 ’11 were $59.5M and $68.5M,

respectively -

Middletown facility, $165 million in 2011

-

Coal expansion project, $16 million in 2011

$231

$128

$66

Second Quarter 2011 Earnings Conference Call

10

•

Estimated 2011 Capital Expenditures of approximately $231 million

-

2011 Expansion Capital Expenditures: |

Cash Flows and

Financial Position •

Issued $700M in debt in the form of $300M Term

Loan and $400M Senior Notes

Capital Structure

•

Sufficient liquidity (cash and undrawn revolver) to

support growth strategy and allow opportunistic

acquisitions

Liquidity

•

Will continue to invest operating cash flows into

expansion projects

Growth Funding

•

Dividends or share buybacks not considered at this

time

Dividend Policy

Second Quarter 2011 Earnings Conference Call

10 |

Key Drivers of

Near Term Growth (2012/2013) Second Quarter 2011 Earnings Conference

Call 11

Middletown

•

Plant is approximately 95% complete and 90% staffed and is on track

to commence operations in Q4

Indiana Harbor

•

No anticipated contractual production shortfall in 2012/2013

•

$50M –

$100M estimated spending to support contract extension

•

Contract renewal negotiations in process

Coal Expansion

•

Expect to reach 350K tons annualized rate in 2012 and 500K

annualized rate by mid-2013

•

Executed contract mining agreement with Revelation Energy, LLC to

mine approximately 1.3 million tons of surface reserves over 3 years

|

Key Drivers of

Longer Term Growth (2013 and Beyond)

•

International

–

Brazil,

China

and

India

•

Steel is growing in emerging economies, led by China and India

•

India is attractive for us given expected growth in primary coke

demand and coke supply/demand balance

•

Signed Memorandum of Understanding with Global Coke

•

Next U.S. Coke Plant

•

Permitting process in Kentucky underway

•

Also assessing alternative sites in other states

•

Expect plant to be 1.1 million tons in capacity with portion reserved for

market coke sales

•

Engineering design targeting CAPEX/ton reductions over Middletown

Second Quarter 2011 Earnings Conference Call

12 |

Questions

Second Quarter 2011 Earnings Conference Call

13 |

Appendix

Second Quarter 2011 Earnings Conference Call

14 |

Management

Team Name

Position

Years of industry

experience

Previous experience

Fritz Henderson

Chief Executive Officer

26

General Motors

Michael Thomson

President and Chief Operating Officer

28

Public Service Enterprise Group, Corning

Mark Newman

Senior Vice President and Chief Financial

Officer

25

Ally Financial, General Motors

Denise Cade

Senior Vice President, General Counsel

and Corporate Secretary

21

PPG Industries, Shaw Pittman LLP

Matthew McGrath

Senior Vice President, Corporate Strategy

and Business Development

21

Public Service Enterprise Group

Michael White

Senior Vice President, Operations

30

Sunoco, Lyondell-Equistar, Exxon

Jim Mullins

Vice President, Coal Operations

35

Arch Coal, Island Creek Coal

Fay West

Vice President and Controller

19

United Continental, PepsiAmericas

Ryan Osterholm

Director, Finance and Investor Relations

13

Public Service Enterprise Group

SunCoke’s management team represents a combination of deep industry knowledge,

international experience and broad management/technical skills

Second Quarter 2011 Earnings Conference Call

15 |

Board of

Directors Name

Affiliation

Employment History

Board affiliations

Fritz Henderson

SunCoke Energy

SunCoke Energy, Inc; General Motors

Compuware Corp.

Alvin Bledsoe

Independent

PricewaterhouseCoopers LLP

Crestwood Midstream Partners

Robert Darnall

Independent

Inland Steel Industries; Ispat North America, Inc.

Stacy Fox

Sunoco

Sunoco, Inc.; Roxbury Group; Collins & Aikman

Corporation

Peter Hamilton

Independent

Brunswick Corporation

Spectra Energy Corp.

Michael Hennigan

Sunoco

Sunoco Logistics Partners L.P.; Sunoco, Inc.

Brian MacDonald

Sunoco

Sunoco, Inc.; Dell, Inc.

Sunoco Logistics and American

Red Cross (Southeastern, PA

chapter)

Charmian Uy

Sunoco

Sunoco, Inc.; American Express; General Motors

Dennis Zeleny

Sunoco

Sunoco, Inc.; Sunoco Logistics Partners L.P.;

Caremark RX, LLC

Second Quarter 2011 Earnings Conference Call

16 |

Definitions

•

Adjusted

EBITDA

represents

earnings

before

interest,

taxes,

depreciation,

depletion

and

amortization

(“EBITDA”)

adjusted for sales discounts and the deduction of income attributable to

non-controlling interests in our Indiana Harbor cokemaking

operations.

EBITDA

reflects

sales

discounts

included

as

a

reduction

in

sales

and

other

operating

revenue.

The sales discounts represent the sharing with our customers of a portion of

nonconventional fuels tax credits, which reduce our income tax expense.

However, we believe that our Adjusted EBITDA would be inappropriately penalized if

these

discounts

were

treated

as

a

reduction

of

EBITDA

since

they

represent

sharing

of

a

tax

benefit

which

is

not

included

in EBITDA. Accordingly, in computing Adjusted EBITDA, we have added back these

sales discounts. Our Adjusted EBITDA also reflects the deduction of income

attributable to noncontrolling interest in our Indiana Harbor cokemaking

operations. EBITDA and Adjusted EBITDA do not represent and should not be

considered alternatives to net income or operating income under GAAP and may

not be comparable to other similarly titled measures of other businesses.

Management believes Adjusted EBITDA is an important measure of the operating

performance of the company’s assets and is indicative of the

Company’s ability to generate cash from operations. •

Pro

Forma

Adjusted

EBITDA

represents

Adjusted

EBITDA

adjusted

for

the

ArcelorMittal

settlement

impact

and

coal

transfer price impacts. The Jewell Coke and Coal Mining results have been adjusted

to set the internal transfer price to equal the coal component contract

price in Jewell Coke’s coke sales price for coal sales volumes sold to Jewell Coke

under the transfer pricing agreement. Management believes Pro Forma Adjusted

EBITDA provides transparency into the underlying profitability of

these respective segments for the periods presented. Second Quarter 2011

Earnings Conference Call 17 |

EBITDA

Reconciliation, $MM For The Three Months Ended June 30, 2011

Second Quarter 2011 Earnings Conference Call

18

Jewell Coke

Other

Domestic

Coke

International

Coke

Coal Mining

Corporate

and Other

Total

Net Income

$23,993

Add: depreciation, depletion and amortization

14,605

Subtract: interest income (primarily from affiliates)

(5,763)

Add:

interest

cost

-

affiliate

1,723

Subtract: capitalized interest

(399)

Add (Subtract): income tax expense (benefit)

1,881

EBITDA

$12,892

$23,695

$843

$9,144

($10,534)

$36,040

Add: sales discounts provided to customers due to sharing of nonconventional fuels tax

credits 3,174

3,174

(1,573)

(1,573)

Adjusted EBITDA

$12,892

$25,296

$843

$9,144

($10,534)

$37,641

Add (Subtract): coal transfer price impact

(2,334)

2,334

-

Pro Forma Adjusted EBITDA without ArcelorMittal settlement and coal transfer price impacts

$10,558

$25,296

$843

$11,478

($10,534)

$37,641

Sales Volumes (thousands of tons)

170

757

412

334

Pro Forma Adjusted EBITDA per Ton

$62

$33

$34

Operating Income

$11,559

$14,059

$788

$5,964

($10,935)

$21,435

Depreciation

Expense

1,333

9,636

55

3,180

401

14,605

EBITDA

$12,892

$23,695

$843

$9,144

($10,534)

$36,040

Domestic Coke Weighted

Average = $39

Add (Subtract): net (income) loss attributable to noncontrolling interests

|

EBITDA

Reconciliation, $MM For The Three Months Ended June 30, 2010

Second Quarter 2011 Earnings Conference Call

19

Domestic Coke Weighted

Average = $41

Jewell Coke

Other

Domestic

Coke

International

Coke

Coal Mining

Corporate

and Other

Total

Net Income

$47,550

Add: depreciation, depletion and amortization

11,107

Subtract: interest income (primarily from affiliates)

(6,039)

Add: interest cost -

affiliate

1,701

Subtract: capitalized interest

(127)

Add (Subtract): income tax expense (benefit)

14,774

EBITDA

$53,044

$18,716

$7

$107

($2,908)

$68,966

Add: sales discounts provided to customers due to sharing of nonconventional fuels tax

credits 2,980

2,980

(3,256)

(3,256)

Adjusted EBITDA

$53,044

$18,440

$7

$107

($2,908)

$68,690

(23,600)

4,300

(19,300)

Add (Subtract): coal transfer price impact

(15,219)

15,219

-

Pro Forma Adjusted EBITDA without ArcelorMittal settlement and coal transfer price impacts

$14,225

$22,740

$7

$15,326

($2,908)

$49,390

Sales Volumes (thousands of tons)

191

718

422

314

Pro Forma Adjusted EBITDA per Ton

$74

$32

$49

Operating Income

$51,945

$10,793

($18)

($1,818)

($3,043)

$57,859

Depreciation Expense

1,099

7,923

25

1,925

135

11,107

EBITDA

$53,044

$18,716

$7

$107

($2,908)

$68,966

Add (Subtract): net (income) loss attributable to noncontrolling interests

Add (Subtract): pro forma impact of ArcelorMittal settlement |

EBITDA

Reconciliation, $MM For The Three Months Ended March 31, 2011

Second Quarter 2011 Earnings Conference Call

20

Jewell Coke

Other

Domestic

Coke

International

Coke

Coal Mining

Corporate

and Other

Total

Net Income

$5,655

Add: Depreciation, depletion and amortization

13,020

Subtract: interest income (primarily from affiliates)

(5,717)

Add: interest cost - affiliate

1,500

Subtract: capitalized interest

(312)

Add (Subtract): income tax expense (benefit)

3,139

EBITDA

$19,054

($857)

$988

$4,296

($6,196)

$17,285

Add: sales discounts provided to customers due to sharing of nonconventional fuels tax

credits

3,125

3,125

Add (Subtract): Net (income) loss attributable to noncontrolling interests

6,171

6,171

Adjusted EBITDA

$19,054

$8,439

$988

$4,296

($6,196)

$26,581

Add (Subtract): coal transfer price impact

(8,042)

8,042

-

Proforma Adjusted EBITDA without ArcelorMittal settlement and coal

transfer price impacts $11,012

$8,439

$988

$12,338

($6,196)

$26,581

Sales Volumes (thousands of tons)

175

697

362

386

Proforma Adjusted EBITDA per Ton

$63

$12

$32

Operating Income

$17,953

($9,472)

$935

$1,577

($6,728)

$4,265

Depreciation Expense

1,101

8,615

53

2,719

532

13,020

EBITDA

$19,054

($857)

$988

$4,296

($6,196)

$17,285

Domestic Coke Weighted

Average = $22 |

Media releases and SEC filings are available

on our website at www.suncoke.com

Contact Investor Relations for more information: 630-824-1907

Second Quarter 2011 Earnings Conference Call

21 |